Exhibit 99.2

ALMADEN MINERALS LTD.

MANAGEMENT’S DISCUSSION AND ANALYSIS

March 31, 2020

INTRODUCTION

This Management’s Discussion and Analysis (“MD&A”) for Almaden Minerals Ltd. (“Almaden” or the “Company”) has been prepared based on information known to management as of May 14, 2020. This MD&A is intended to help the reader understand, and should be read in conjunction with, the condensed consolidated interim financial statements of Almaden for the financial period ended March 31, 2020 and supporting notes. The financial statements have been prepared in accordance and compliance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Management is responsible for the preparation and integrity of the Company’s condensed consolidated interim financial statements, including the maintenance of appropriate information systems, procedures and internal controls. The audit committee of the board of directors of the Company (the “Board”) meets with management regularly to review the Company’s condensed consolidated interim financial statements and MD&A, and to discuss other financial, operating and internal control matters.

All currency amounts used in this MD&A are expressed in Canadian dollars unless otherwise noted.

The Company’s common stock is quoted on the NYSE American stock exchange under the trading symbol “AAU” and on the Toronto Stock Exchange under the symbol “AMM”.

FORWARD LOOKING STATEMENTS

This MD&A contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law. Forward looking statements include, but are not limited to, the feasibility of the Ixtaca project; our forecasts and expected cash flows; our projected capital and operating costs; our expectations regarding mining and metallurgical recoveries; mine life and production rates; disclosure regarding the permitting review process for the Ixtaca project; the outcome of legal actions in Mexico including the outcome of the Amparo (as defined below) proceedings; the outcome of the challenge by the Company to the applicable Mexican authorities’ currently position that the Original Concessions (as defined below) are active and owned by Almaden and the New Concessions (as defined below) are left without effect; the outcome of the Company’s formal request for SEMARNAT to reinstate its review of the MIA (as defined below), the Company’s belief that Ixtaca will, long after final closure, make meaningful and enduring positive contributions to surrounding communities and beyond, the Company’s expectation that the project would employ over 400 people over an 11-year mine life and would also provide updated infrastructure to the region, the impact of the project's proposed dry-stack tailing facilities, the Company’s belief that the Ixtaca deposit can be an economically robust project that could provide the basis for further investment in the area. In certain cases, in preparing the forward looking statements in this MD&A, the Company has applied several material assumptions, including, but not limited to with respect to: the Government of Mexico continuing to take the same positions with respect to mineral tenure in any appeal as it did before the Puebla lower court; both Almaden’s and the applicable Mexican authorities’ legal positions; the permitting and legal regimes in Mexico; economic and political conditions; success of exploration, development and environmental protection and remediation activities; stability and predictability in Mexico’s mineral tenure, mining, environmental and agrarian laws and regulations, as well as their application and judicial decisions thereon; continued respect for the rule of law in Mexico; prices for gold, silver and base metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds; capital, decommissioning and reclamation estimates; mineral reserve and resource estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour-related disruptions; all necessary permits, licenses and regulatory approvals being received in a timely manner; the ability to secure and maintain title and ownership to properties and the surface rights necessary for operations; community support in the Ixtaca project; and the ability to comply with environmental, health and safety laws. Forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward looking statements. Such risks and other factors include, among others, risks related to; political risk in Mexico, crime and violence in Mexico; corruption; environmental risks, including environmental matters under Mexican rules and regulations; impact of environmental impact assessment requirements on the Company’s planned exploration and development activities on the Ixtaca project; certainty of mineral title and the outcome of litigation; community relations; governmental regulations and the ability to obtain necessary licences and permits; risks related to mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title; changes in environmental laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may increase costs of doing business and restrict operations; as well as those factors discussed the section entitled "Risk Factors" in Almaden's Annual Information Form and Almaden's latest Form 20-F on file with the United States Securities and Exchange Commission in Washington, D.C. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events or results to differ materially from those described in forward looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements.

1

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

The United States Securities and Exchange Commission (the “SEC”) permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Almaden uses certain terms such as “measured”, “indicated”, “inferred”, and “mineral resources,” which the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC.

ADDITIONAL INFORMATION

The Company’s financial statements, MD&A and additional information relevant to the Company, including the Company’s Form 20-F for the year ended December 31, 2019 which is filed as an Annual Information Form, can be found on SEDAR at www.sedar.com, on the EDGAR section of the SEC’s website at www.sec.gov, and/or on the Company’s website at www.almadenminerals.com.

QUARTERLY HIGHLIGHTS

The Company’s efforts during this quarter were primarily focused on resolving the Mexican authorities’ suspension of their review of the Company’s environmental permit (“MIA”) application for the Ixtaca project. This suspension was announced by the Company on October 29, 2019. The Company has filed a formal request to SEMARNAT to revisit its decision, on the basis that SEMARNAT’s authority is limited to the regulation of environmental matters, that SEMARNAT is not a party to the Amparo and that SEMARNAT has no legal basis to link its administrative review of the MIA to the Amparo. On February 4, 2020, Almaden’s Mexican subsidiary also filed an “incident” before the lower court regarding the SEMARNAT suspension of the MIA review, and this “incident” has been accepted for study and resolution. During the quarter, the Company also clarified the status of the Ixtaca project mineral claims and the Amparo (as defined below), on February 27, 2020. Please refer below under the heading “Risks and Uncertainties” for additional information.

2

On March 9, 2020 the Company announced that it had partnered with a local community group focused on irrigation development, and together with them coordinated with the Federal Government water authority (“CONAGUA”), to co-fund a new water reservoir in Zacatepec, a community located nearby the proposed Ixtaca mine development. This project was identified through the formal process the Company initiated at Ixtaca in 2017, known as a “Trámite Evaluación de Impacto Social”, or “EVIS”. The EVIS formalized the Company’s long history of consultation at Ixtaca prior to 2017, was conducted by an independent expert group, and had the primary objective of helping the Company to understand areas of concern that can be mitigated in mine development, and also identify opportunities which can be leveraged in mine planning. The Zacatepec reservoir was one of the projects identified which could bring immediate benefits to the local area even prior to Ixtaca development, and the first step of this project was completed during the quarter with the construction of the reservoir. Next steps will involve adding new pipelines, tanks, and other structures to enhance the irrigation potential in support of local agricultural production.

During the quarter, the Company also completed a non-brokered private placement, with the issuance of 5,509,658 units (“Units”) at $0.37 per Unit. Each Unit consisted of one common share of the Company and one non-transferable Common Share purchase warrant, with each warrant allowing the holder to purchase one Common Share at a price of $0.50 until March 27, 2023.

Finally, as announced on May 14, 2019, Almaden has entered into a secured gold loan agreement (“Gold Loan”) with Almadex Minerals Ltd. (“Almadex”) pursuant to which Almadex agreed to loan up to 1,597 ounces of gold to Almaden. As at March 31, 2020, the Company has borrowed 1,200 ounces of gold bullion under this facility.

Subsequent to the end of the quarter, on April 1, 2020, the Company announced that the Mexican federal government had mandated that all non-essential businesses, including mining and exploration, temporarily suspend operations until April 30 due to the COVID-19 virus. This suspension was subsequently extended to May 30, 2020, however on May 14, 2020, the Mexican government added mining activity to the list of essential businesses, allowing such businesses to resume operations. In respect of the Amparo lawsuit (as defined below), it has been determined that Courts could resume their work on a provisional basis, only on cases considered to be urgent. While there is some discretion amongst the Judges as to which cases should be considered to be urgent, the Company’s Mexican legal advice is that the Amparo Lawsuit (as defined below) is not likely to be considered to be urgent, and therefore the Company does not anticipate any movement on this lawsuit or other administrative procedures in which it is involved during the suspension period.

The Company is working with state and municipal government to purchase and distribute personal protection equipment to local people, and will continue to explore ways it can contribute to efforts to limit the impact of COVID-19 in the region.

OVERALL PERFORMANCE

Overview

Company Mission and Focus

The Company’s goal is to advance its wholly-owned Ixtaca gold-silver deposit to become a low-cost, modern mine which makes a positive social difference.

Qualified Person

Morgan Poliquin, P.Eng., a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the President, Chief Executive Officer and a director of Almaden, has reviewed and approved the scientific and technical information in this MD&A. Much of the scientific and technical contents in this MD&A are derived from the feasibility study (“FS”). The independent Qualified Persons responsible for preparing the FS are set out below under the heading, “Qualified Persons, Sample Preparation, Analyses, Quality Control and Assurance”.

Use of the Terms “Mineral Resources” and “Mineral Reserves”

All capitalized terms used but not defined in this MD&A have the meanings given to them in NI 43-101 and the CIM definitions Standards on Mineral Resources and Reserves (the “CIM Standards”).

Any reference in this MD&A to Mineral Resources does not mean Mineral Reserves.

3

Under NI 43-101, a Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

Mineral Resources are sub-divided, in order of increasing geologic confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource, and may only be converted to a Probable Mineral Reserve.

A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

The terms “Mineral Reserve,” “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1933, as amended. Under SEC Industry Guide 7, a reserve is defined as part of a mineral deposit which could be economically and legally extracted or produced at the time the reserve determination is made. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms “Mineral Resource,” “Measured Mineral Resource,” “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Indicated Mineral Resource” and “Inferred Mineral Resource” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an Indicated Mineral Resource or Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of Feasibility Studies or Pre-Feasibility Studies, except in rare cases. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this MD&A or incorporated by reference herein contains descriptions of the Company’s mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under United States federal securities laws and the rules and regulations promulgated thereunder.

4

Ixtaca (Tuligtic) – Mexico

The following is a brief description of the principal mineral property owned by the Company. Additional information can be obtained from Almaden’s website at www.almadenminerals.com and in the FS, which is available under the Company’s SEDAR profile at www.sedar.com.

Location and Ownership

The Ixtaca project is 100% owned by the Company, subject to a 2% net smelter return (“NSR”) royalty held by Almadex Minerals Ltd. (“Almadex”). The Ixtaca project lies within the Trans Mexican Volcanic Belt about 120 kilometres southeast of the Pachuca gold/silver deposit, which has reported historic production of 1.4 billion ounces of silver and 7 million ounces of gold. The Tuligtic property, located in Puebla State, was acquired by staking in 2001 following prospecting work carried out by the Company in the area. Since that time, Almaden has had agreements to develop the property with three separate parties, all of whom relinquished all rights to the property and none of whom conducted work on the Ixtaca zone. The Ixtaca zone is located along a trend of shallowly eroded epithermal systems that Almaden has identified in eastern Mexico.

Recent Updates

Feasibility Study and Updated Resource Estimate

On December 11, 2018, Almaden announced the results of an independent Feasibility Study titled “Ixtaca Gold-Silver Project, Puebla State, Mexico NI 43-101 Technical Report on the Feasibility Study”, which was prepared in accordance with National Instrument 43-101 (“NI 43-101”). The FS was subsequently filed on SEDAR on January 24, 2019. An update to the FS was filed on SEDAR on October 3, 2019.

HIGHLIGHTS

(All values shown are in $US. Base case uses $1275/oz gold and $17/oz silver prices. Gold and silver equivalency calculations assume 75:1 ratio).

| • | Average annual production of 108,500 ounces gold and 7.06 million ounces silver (203,000 gold equivalent ounces, or 15.2 million silver equivalent ounces) over first 6 years; |

| • | After-tax IRR of 42% and after-tax payback period of 1.9 years; |

| • | After-tax NPV of $310 million at a 5% discount rate; |

| • | Initial Capital of $174 million; |

| • | Conventional open pit mining with a Proven and Probable Mineral Reserve of 1.39 million ounces of gold and 85.2 million ounces of silver; |

| • | Pre-concentration uses ore sorting to produce a total of 48 million tonnes of mill feed averaging 0.77 g/t gold and 47.9 g/t silver (2.03 g/t gold equivalent over first 6 years, 1.41 g/t gold equivalent over life of mine); |

| • | Average LOM annual production of 90,800 ounces gold and 6.14 million ounces silver (173,000 gold equivalent ounces, or 12.9 million silver equivalent ounces); |

| • | Operating cost $716 per gold equivalent ounce, or $9.55 per silver equivalent ounce; |

| • | All-in Sustaining Costs (“AISC”), including operating costs, sustaining capital, expansion capital, private and public royalties, refining and transport of $850 per gold equivalent ounce, or $11.30 per silver equivalent ounce; |

5

| • | Elimination of tailings dam by using filtered tailings significantly reduces the project footprint and water usage. |

Feasibility Study Summary

Almaden engaged a team of consultants led by Moose Mountain Technical Services (“MMTS”) to undertake this FS. MMTS was responsible for mining, metallurgy, processing, infrastructure and the economic evaluation, APEX Geoscience Ltd. for exploration and drill data QA/QC, Giroux Consultants for the resources estimation, and SRK Consulting (U.S.), Inc. (“SRK”) for aspects related to geotechnical, tailings and water management.

Table 1 – Summary of the Economics of the Ixtaca Feasibility Study

| Amount | ||

| Pre-Tax NPV (5%) | $ 470 million | |

| Pre-Tax IRR | 57% | |

| Pre-Tax Payback | 1.6 Years | |

| Post-Tax NPV (5%) | $310 million | |

| Post-Tax IRR | 42 % | |

| Post-Tax Payback | 1.9 Years | |

| Initial Capital | $ 174 million | |

| Life of Mine | 11 Years | |

| Waste/ ROM ore ratio | 4.5:1 | |

| Years 1 - 6 | Life of Mine (LOM) | |

| Cash Operating Cost ($/AuEq oz.) | 667 | 716 |

| AISC ($/AuEq oz.) | 810 | 850 |

| Annual Gold production (000's oz.) | 108 | 90 |

| Annual Silver production (000's oz.) | 7,071 | 6,160 |

| Annual Gold equivalent production (000's oz.) | 202 | 173 |

| Average mill feed grade (g/t) Au | 1.10 | 0.77 |

| Average mill feed grade (g/t) Ag | 69.3 | 47.9 |

| Average mill feed grade (g/t) AuEq | 2.03 | 1.41 |

Economics assume a Gold Price of $1275/Oz and Silver Price of $17/Oz and are estimated on a 100% equity basis.

Geology and Mineral Resource Estimate

The Ixtaca deposit is an epithermal gold-silver deposit, mostly occurring as anastomosing (branching and re-connecting) vein zones hosted by limestone and shale basement rocks with a minor component of disseminated mineralisation hosted in overlying volcanic rocks. The wireframe models constructed to define the overall vein zones therefore contain interspersed irregular zones of barren limestone dilution. In this FS the limestone unit hosts 75% of the metal produced, the volcanic unit hosts 12% and the black shale unit hosts 13% on a gold-equivalent basis. The Mineral Resources for Ixtaca are presented in Table 2.

6

Table 2- Summary of Ixtaca Mineral Resources

| MEASURED RESOURCE | |||||||

| AuEq Cut-off | Tonnes > Cut-off | Grade>Cut-off | Contained Metal x 1,000 | ||||

| (g/t) | (tonnes) | Au (g/t) | Ag (g/t) | AuEq (g/t) | Au (ozs) | Ag (ozs) | AuEq (ozs) |

| 0.30 | 43,380,000 | 0.62 | 36.27 | 1.14 | 862 | 50,590 | 1,591 |

| 0.50 | 32,530,000 | 0.75 | 44.27 | 1.39 | 788 | 46,300 | 1,454 |

| 0.70 | 25,080,000 | 0.88 | 51.71 | 1.63 | 711 | 41,700 | 1,312 |

| 1.00 | 17,870,000 | 1.06 | 61.69 | 1.95 | 608 | 35,440 | 1,118 |

| INDICATED RESOURCE | |||||||

| AuEq Cut-off | Tonnes > Cut-off | Grade>Cut-off | Contained Metal x 1,000 | ||||

| (g/t) | (tonnes) | Au (g/t) | Ag (g/t) | AuEq (g/t) | Au (ozs) | Ag (ozs) | AuEq (ozs) |

| 0.30 | 80,760,000 | 0.44 | 22.67 | 0.77 | 1,145 | 58,870 | 1,994 |

| 0.50 | 48,220,000 | 0.59 | 30.13 | 1.02 | 913 | 46,710 | 1,586 |

| 0.70 | 29,980,000 | 0.74 | 37.79 | 1.29 | 715 | 36,430 | 1,240 |

| 1.00 | 16,730,000 | 0.96 | 47.94 | 1.65 | 516 | 25,790 | 888 |

| INFERRED RESOURCE | |||||||

| AuEq Cut-off | Tonnes > Cut-off | Grade>Cut-off | Contained Metal x 1,000 | ||||

| (g/t) | (tonnes) | Au (g/t) | Ag (g/t) | AuEq (g/t) | Au (ozs) | Ag (ozs) | AuEq (ozs) |

| 0.30 | 40,410,000 | 0.32 | 16.83 | 0.56 | 412 | 21,870 | 726 |

| 0.50 | 16,920,000 | 0.44 | 25.43 | 0.80 | 237 | 13,830 | 436 |

| 0.70 | 7,760,000 | 0.57 | 33.80 | 1.06 | 142 | 8,430 | 264 |

| 1.00 | 3,040,000 | 0.79 | 43.64 | 1.42 | 77 | 4,270 | 139 |

| 1. | Ixtaca Mineral Resources Estimate have an effective date of 8 July 2018. The Qualified person for the estimate is Gary Giroux, P.Eng. |

| 2. | Base Case 0.3 g/t AuEq Cut-Off grade is highlighted. Also shown are the 0.5, 0.7 and 1.0 g/t AuEq cut-off results. AuEq calculation based average prices of $1250/oz gold and $18/oz silver. The Base Case cut-off grade includes consideration of the open pit mining method, 90% metallurgical recovery, mining costs of $1.82/t, average processing costs of $11.7, G&A costs of $1.81/t |

| 3. | Mineral Resources are reported inclusive of those Mineral Resources that have been converted to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 4. | The estimate of Mineral Resources may be materially affected by environmental, permitting, legal or other relevant issues. The Mineral Resources have been classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves in effect as of December 11, 2018. |

| 5. | All figures were rounded to reflect the relative accuracy of the estimates and may result in summation differences. |

Mine Plan

The Ixtaca gold-silver project is planned as a typical open pit mining operation using contractor mining. Initial production will ramp up to a mill feed rate of 7,650 tonnes per day followed by an expansion to 15,300 tonnes per day from Year 5 onwards.

An ore control system is planned to provide field control for the loading equipment to selectively mine ore grade material separately from the waste.

Mining operations will be based on 365 operating days per year with three 8 hour shifts per day.

7

Processing

The FS reflects the Rock Creek process plant which has been purchased by Almaden. Run of mine ore will be crushed in a three-stage crushing circuit to -9 mm.

The FS also incorporates ore sorting, test work for which has shown the ability to separate barren or low grade limestone host rock encountered within the vein swarm from vein and veined material (see Almaden news release of July 16th 2018). Product from the secondary crusher will be screened in to coarse (+20mm), mid-size (12 to 20 mm), and fine (-12mm) fractions. Coarse and mid-size ore will be sorted by an XRT ore sort machine to eject waste rock. Fine ore will bypass the ore sorting and is sent directly to the mill.

Ore sort waste from Limestone and Black Shale is below waste/ore cutoff grade and is placed in the waste rock dump. Ore sort ‘waste’ from the Volcanic unit is low grade ore and will be stockpiled for processing later in the mine life. Ore sorting pre-concentration increases the mill feed gold and silver grades by 32% and 31% respectively compared to run of mine (ROM) grades. Table 3 shows ROM grades with ore sort waste removed from the ROM, and the resulting mill feed.

Table 3 Ore Sort Mill Feed grade improvement

| ROM | Ore sort | Mill | ||

| Ore | Waste | Feed | ||

| Limestone | million tonnes | 51.5 | 18.8 | 32.7 |

| Au g/t | 0.572 | 0.24 | 0.763 | |

| Ag g/t | 37.5 | 12.0 | 52.2 | |

| Black Shale | million tonnes | 12.2 | 6.3 | 5.8 |

| Au g/t | 0.517 | 0.25 | 0.806 | |

| Ag g/t | 44.4 | 20.0 | 70.8 | |

| Volcanic | million tonnes | 9.4 | - | 9.4 |

| Au g/t | 0.790 | - | 0.790 | |

| Ag g/t | 18.6 | - | 18.6 | |

| TOTAL | million tonnes | 73.1 | 25.1 | 48.0 |

| Au g/t | 0.591 | 0.24 | 0.773 | |

| Ag g/t | 36.3 | 14.0 | 47.9 |

Crushed ore is transported to the grinding circuit by an over land conveyor. Grinding to 75 microns is carried out with ball milling in a closed circuit with cyclones. Cyclone underflow is screened and the screen undersize is treated in semi-batch centrifugal gravity separators to produce a gravity concentrate.

The gravity concentrate will be treated in an intensive leach unit with gold and silver recovered from electrowinning cells.

The cyclone overflow will be treated in a flotation unit to produce a flotation concentrate. After regrinding the flotation concentrate leaching will be carried out in 2 stages. CIL leaching for 24 hours will complete gold extraction, followed by agitated tank leaching to complete silver leaching. A carbon desorption process will recover gold and silver from the CIL loaded carbon, and a Merrill Crowe process will recover gold and silver from pregnant solution from the agitated leach circuit.

Cyanide destruction on leach residue is carried out using the SO2/Air process. Final tailings are thickened and filtered then dry stacked and co-disposed with mine waste rock.

Average process recoveries from mill feed to final product over the life of mine are summarized in Table 4 for each ore type.

8

Table 4 Average Life of Mine Process Recoveries from Mill Feed

| Gold | Silver | |

| Limestone | 88.5% | 86.8% |

| Volcanic | 64.4% | 76.3% |

| Black Shale | 54.5% | 84.7% |

Water and Waste Management

One of Almaden’s top priorities at Ixtaca is water quality and a mine plan that provides a permanent and consistent long-term supply of water for residents. The plan outlined in the FS has evolved through the open dialogue between the Company and residents over the past number of years and as part of the Social Investment Plan consultation (see section below on “Community”).

Rainfall in the Ixtaca vicinity falls primarily during a relatively short rainy season. With no local water storage facilities, the flash flows of water are currently lost to the communities. Under the FS, rainwater will be captured during the rainy season in the water storage reservoir and slowly released during the dry season, for use by both the mining operation and local residents.

Extensive geochemical studies have evaluated the potential for acid rock drainage and metal leaching from the waste rock and tailings using globally accepted standardised methods of laboratory testing and in compliance with Mexican regulations. Most of the waste rock at Ixtaca is limestone, and the studies of both waste rock and tailings have consistently shown that there is more than enough neutralising potential present in the waste rock to neutralise any acid generated. Testing to date also indicates low potential for metal leaching. These results along with the excellent access to potential markets in the growing industrial state of Puebla, indicate the potential for rock waste and tailings from the Ixtaca deposit to be secondary resources such as aggregate and cement feedstock.

In consideration of these findings and the hydrologic conditions at Ixtaca, Almaden and its consultants reviewed Best Available Technology and Best Applicable Practice in the design and planning of tailings management at Ixtaca, which resulted in selecting a dry-stack tailings facility which would include co-disposal of waste with filtered tailings, use much less water than traditional slurry facilities, reduce the mine footprint, allow for better dust control, and enable earlier rehabilitation of the tailings and waste disposal areas.

Mineral Reserve Estimate

Mineral Reserves in Table 5, have been developed by MMTS with an effective date of November 30, 2018, and are classified using the 2014 CIM Definition Standards. The Mineral Reserves are based on an engineered open pit mine plan.

Table 5 – Mineral Reserves

| Tonnes | Diluted Average Grades | Contained Metal | |||

| (millions) | Au (g/t) | Ag (g/t) | Au - '000 ozs | Ag - '000 ozs | |

| Proven | 31.6 | 0.70 | 43.5 | 714 | 44,273 |

| Probable | 41.4 | 0.51 | 30.7 | 673 | 40,887 |

| TOTAL | 73.1 | 0.59 | 36.3 | 1,387 | 85,159 |

| • | Mineral Reserves have an effective date of November 30, 2018. The qualified person responsible for the Mineral Reserves is Jesse Aarsen, P.Eng of Moose Mountain Technical Services. |

| • | The cut-off grade used for ore/waste determination is NSR>=$14/t |

9

| • | All Mineral Reserves in this table are Proven and Probable Mineral Reserves. The Mineral Reserves are not in addition to the Mineral Resources but are a subset thereof. All Mineral Reserves stated above account for mining loss and dilution. |

| • | Associated metallurgical recoveries (gold and silver, respectively) have been estimated as 90% and 90% for limestone, 50% and 90% for volcanic, 50% and 90% for black shale. |

| • | Reserves are based on a US$1,300/oz gold price, US$17/oz silver price and an exchange rate of US$1.00:MXP20.00. |

| • | Reserves are converted from resources through the process of pit optimization, pit design, production schedule and supported by a positive cash flow model. |

| • | Rounding as required by reporting guidelines may result in summation differences. |

Legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Reserves are provided in this MD&A under the heading “Forward-Looking Statements”.

Capital and Operating Costs

Initial capital cost for the Ixtaca gold-silver project is $174 million and sustaining capital (including expansion capital) is $111 million over the LOM. The estimated expansion capital of $64.5 million will be funded from cashflow in Year 4 for the throughput ramp-up in Year 5. Estimated LOM operating costs are $26.8 per tonne mill feed. The following tables summarize the cost components:

Table 6 – Initial Capital Costs ($ millions)

| Mining | $22.2 |

| Process | $80.2 |

| Onsite Infrastructure | $24.3 |

| Offsite Infrastructure | $7.5 |

| Indirects, EPCM, Contingency and Owner’s Costs | $39.9 |

| Total | $174.2 |

Table 7 – Expansion Capital Costs ($ millions)

| Mining | $1.2 |

| Process | $56.9 |

| Infrastructure | $1.5 |

| Indirects, EPCM, Contingency and Owner’s Costs | $5.0 |

| Total | $64.5 |

Table 8 – LOM Average Operating Costs ($)

| Mining costs | $/tonne milled | $15.2 |

| Processing | $/tonne milled | $10.5 |

| G&A | $/tonne milled | $1.1 |

| Total | $/tonne milled | $26.8 |

Economic Results and Sensitivities

A summary of financial outcomes comparing base case metal prices to alternative metal price conditions are presented below. The FS base case prices are derived from current common peer usage, while the alternate cases consider the project’s economic outcomes at varying prices witnessed at some point over the three years prior to the effective date of the FS.

10

Table 9 - Summary of Ixtaca Economic Sensitivity to Precious Metal Prices (Base Case is Bold)

| Gold Price ($/oz) | 1125 | 1200 | 1275 | 1350 | 1425 |

| Silver Price ($/oz) | 14 | 15.5 | 17 | 18.5 | 20 |

| Pre-Tax NPV 5% ($million) | 229 | 349 | 470 | 591 | 712 |

| Pre-Tax IRR (%) | 35% | 46% | 57% | 67% | 77% |

| Pre-Tax Payback (years) | 2.0 | 1.8 | 1.6 | 1.4 | 1.3 |

| After-Tax NPV 5% ($million) | 151 | 233 | 310 | 388 | 466 |

| After-Tax IRR (%) | 25% | 34% | 42% | 49% | 57% |

| After-Tax Payback (years) | 2.6 | 2.1 | 1.9 | 1.7 | 1.5 |

Community Consultations

Almaden has a long history of engagement with communities in the region around the Ixtaca project. Amongst many other initiatives, the Company has trained and employed drillers and driller helpers from the local area, held nine large-scale community meetings totalling over 4,100 people, taken 480 local adults on tours of operating mines in Mexico, and held monthly technical meetings on a diverse range of aspects relating to the mining industry and the Ixtaca project. On December 9, 2018, Almaden hosted the most recent large-scale community meeting which was attended by over 800 people, including representatives of the new Federal Government in Mexico.

In 2017, Almaden engaged a third-party consultant to lead a community consultation and impact assessment at the Ixtaca project. In Mexico, only the energy industry requires completion of such an assessment (known in Mexico as a Trámite Evaluación de Impacto Social, or “EVIS”) as part of the permitting process. The purpose of these studies is to identify the people in the area of influence of a project (“Focus Area”), and assess the potential positive and negative consequences of project development to assist in the development of mitigation measures and the formation of social investment plans. To Almaden’s knowledge, this is the first time a formal EVIS has been completed in the minerals industry in Mexico, and as such reflects the Company’s commitment to best national and international standards in Ixtaca project development.

The EVIS and subsequent work on the development of a Social Investment Plan were conducted according to Mexican and international standards such as the Guiding Principles on Business and Human Rights, the Equator Principles, and the OECD Guidelines for Multinational Enterprises and Due Diligence Guidance for Meaningful Stakeholder Engagement in the Extractive Sector.

Fieldwork for the EVIS was conducted by an interdisciplinary group of nine anthropologists, ethnologists and sociologists graduated from various universities, who lived in community homes within the Ixtaca Focus Area during the FS to allow for ethnographic immersion and an appreciation for the local customs and way of life. This third-party consultation sought voluntary participation from broad, diverse population groups, with specific attention to approximately one thousand persons in the Focus Area.

This extensive consultation resulted in changes to some elements of the mine design, including the planned construction of a permanent water reservoir to serve the local area long after mine closure, and the shift to dry-stack filtered waste management. The Company looks forward to advancing further elements of the community Social Investment Plan as mine permitting and construction advance when the suspension of the MIA permit review by SEMARNAT is resolved.

11

Economic Contributions

The FS anticipates that approximately 600 direct jobs will be created during the peak of construction, and 420 jobs will be generated during operations. Assuming base case metal prices, under this FS, Ixtaca is anticipated to generate approximately US$130 million in Federal taxes, US$50 million in State taxes and US$30 million in Municipal taxes.

Closure and Reclamation

Mine waste areas will be reclaimed and re-vegetated at the end of mining activity. At closure, all buildings will be removed and remaining facilities, except for the water storage dam (WSD), will be reclaimed and re-vegetated. The WSD and the availability of this water to the local communities will remain after closure.

Opportunities

Several opportunities excluded from the base case economics have been identified in the FS.

| · | Results from the ore sorting tests identified several opportunities to increase the ore sort efficiency and could result in a further increase in mill feed grades. These opportunities will be investigated with future test work. |

| · | Gold extraction recoveries in the minor black shale unit are currently impeded by the presence of carbonaceous material. Recent test work including carbon pre-flotation and ultra-fine gravity separation has demonstrated that the carbon can be liberated and removed with a significant improvement in gold recovery. This test work is ongoing and is expected to improve the black shale gold recovery. |

| · | Test work carried out on Ixtaca limestone waste rock samples concluded that Ixtaca limestone waste rock is suitable for many types of concrete use and other applications such as shotcrete, subgrade, asphalt aggregate or railroad ballast with little effort and processing. Concrete produced with tests on Ixtaca limestone aggregate performed very well, achieving the 28-day design compressive strength of 30 MPa already at 7 days, and more than 40 MPa at 28 and 56 days. |

Ixtaca is connected by 60 km of paved road to the industrial city Apizaco, 120 km of paved road to the state capital of Puebla, and 170 km of paved road to Mexico City.

The sale of limestone ore sort rejects (a waste product) as an aggregate presents a very significant potential source of revenue to the project at no additional capital or operating cost to the project. There is also potential to sell some of the ROM waste rock as an aggregate.

| · | Fine aggregate from crushing and grinding operations is also expected to perform in a similar way to the coarse aggregate. Chemical analysis of the fine aggregate indicates that it is also suitable as a raw material for the production of lime cement or Portland cement if properly processed and blended with suitable silica aluminates. |

Next Engineering and Development Steps

The Company has submitted its environmental permit application to Mexican authorities. As noted in our press release of October 29, 2019, the environmental permit review has been suspended by Mexican environmental authorities.

A NI 43-101 technical report for the FS was filed on SEDAR on January 24, 2019. An update to the FS was filed on SEDAR on October 3, 2019.

12

Qualified Persons, Sample Preparation, Analyses, Quality Control and Assurance

The independent qualified persons responsible for preparing the FS are: Jesse Aarsen, P.Eng. and Tracey Meintjes, P.Eng. of MMTS; Edward Wellman PE, PG, CEG and Clara Balasko, P.E. of SRK; Kris Raffle, P.Geo. of APEX Geoscience Ltd.; and Gary Giroux, M.A.Sc., P.Eng. of Giroux Consultants Ltd.; all of whom act as independent consultants to the Company, are Qualified Persons as defined by National Instrument 43-101 ("NI 43-101").

The analyses used in the preparation of the mineral resource statement were carried out at ALS Chemex Laboratories of North Vancouver (“ALS”) using industry standard analytical techniques. All strongly altered or epithermal-mineralized intervals of core have been sampled. Almaden employs a maximum sample length of 2 to 3m in unmineralized lithologies, and a maximum sample length of 1m in mineralized lithologies. During the years 2010 and 2011, Almaden employed a minimum sample length of 20cm. The minimum sample length was increased to 50cm from 2012 onwards to ensure the availability of sufficient material for replicate analysis. Drill core is half-sawn using industry standard diamond core saws. After cutting, half the core is placed in a new plastic sample bag and half is placed back in the core box. Sample numbers are written on the outside of the sample bags and a numbered tag placed inside the bag. Sample bags are sealed using a plastic cable tie. Sample numbers are checked against the numbers on the core box and the sample book.

ALS sends its own trucks to the Ixtaca project to take custody of the samples at the Santa Maria core facility and transports them to its sample preparation facility in Guadalajara or Zacatecas, Mexico. Prepared sample pulps are then forwarded by ALS personnel to the ALS North Vancouver, British Columbia laboratory, which is ISO/IEC 17025:2017 and ISO 9001: 2015 certified, for analysis.

For gold, samples are first analysed by fire assay and atomic absorption spectroscopy (“AAS”). Samples that return values greater than 10 g/t gold using this technique are then re-analysed by fire assay but with a gravimetric finish. Silver is first analysed by Inductively Coupled Plasma - Atomic Emission Spectroscopy (“ICP-AES”). Samples that return values greater than 100 g/t silver by ICP-AES are then re analysed by HF-HNO3-HCLO4 digestion with HCL leach and ICP-AES finish. Of these samples those that return silver values greater than 1,500 g/t are further analysed by fire assay with a gravimetric finish. Blanks, field duplicates and certified standards were inserted into the sample stream as part of Almaden’s quality assurance and control program which complies with National Instrument 43-101 requirements. In addition to the in-house QAQC measures employed by Almaden, Kris Raffle, P.Geo. of APEX Geoscience Ltd., completed an independent review of blank, field duplicate and certified standard analyses. All QAQC values falling outside the limits of expected variability were flagged and followed through to ensure completion of appropriate reanalyses. No discrepancies were noted within the drill hole database, and all QAQC failures were dealt with and handled with appropriate reanalyses.

The mineral resource estimate referenced in this document was prepared by Gary Giroux, P.Eng., an independent Qualified Person as defined by NI 43-101.

Exploration Opportunities

The Ixtaca deposit is one of several exploration targets on the Company’s mineral claims, which cover an area of high level epithermal clay alteration. The project area is partially covered by volcanic ash deposits which mask underlying alteration, potential vein zones and associated soil responses. In areas devoid of this covering ash, soil sampling has defined several distinct zones of elevated gold and silver values and trace elements typically associated with epithermal vein systems. The Ixtaca zone is one of the largest areas of gold/silver soil response but it is also one of the areas with the least ash cover on the project. Management believes that the other altered and geochemically anomalous areas could represent additional zones of underlying quartz-carbonate epithermal veining like the Ixtaca zone.

The potential quantity and grade of these exploration targets is conceptual in nature. There has been insufficient exploration and/or study to define these exploration targets as a Mineral Resource. It is uncertain if additional exploration will result in these exploration targets being delineated as a Mineral Resource. The potential quantity and grade of these exploration targets has not been used in this FS.

13

Outlook

Almaden has access to sufficient funding to conduct its anticipated work program for the next fiscal year at Ixtaca. Continuing work on Ixtaca will be focused on resolving the suspension of the MIA permit review by SEMARNAT.

RISKS AND UNCERTAINTIES

Below are some of the risks and uncertainties that the Company faces. For a full list of risk factors, please refer to the Company’s Form 20-F for the year ended December 31, 2019, as filed on SEDAR on March 26, 2020, under the heading “Annual Information Form”.

Industry

The Company is engaged in the exploration and development of mineral properties, an inherently risky business. There is no assurance that a mineral deposit will ever be discovered, developed and economically produced. Few exploration projects result in the discovery of commercially mineable ore deposits. If market conditions make financings difficult, it may be difficult for the Company to find joint venture partners or to finance development of its projects. The Company may be unsuccessful in identifying and acquiring projects of merit.

Mineral resource estimates

The estimation of resources and mineralization is a subjective process and the accuracy of any such estimates is a function of the quality of available data and of engineering and geological interpretation and judgment. No assurances can be given that the volume and grade of resources recovered and rates of production will not be less than anticipated in the FS, the Mineral Resource Estimate, the Mineral Reserve Estimate, or otherwise.

The prices of gold, silver and other metals

The price of gold is affected by numerous factors including central bank sales or purchases, producer hedging activities, the relative exchange rate of the U.S. dollar with other major currencies, supply and demand, political, economic conditions and production levels. In addition, the price of gold has been volatile over short periods of time due to speculative activities.

The price of silver is affected by similar factors and, in addition, is affected by having more industrial uses than gold, as well as sometimes being produced as a by-product of mining for other metals with its production thus being more dependent on demand for the main mine product than supply and demand for silver. The prices of other metals and mineral products that the Company may explore for have the same or similar price risk factors.

Cash flows and additional funding requirements

The Company currently has no revenue from operations. Additional capital would be required to continue with advancement and development of its properties. The sources of funds currently available to the Company are equity capital or the offering of an interest in its projects to another party. The Company believes it currently has sufficient financial resources to undertake all of its currently planned programs.

14

Exchange rate fluctuations

Fluctuations in currency exchange rates, principally the Canadian/U.S. Dollar and the Canadian/MXN exchange rates, can impact cash flows. The exchange rates have varied substantially over time. Most of the Company’s expenses in Mexico are denominated in U.S. Dollars and MXN. Fluctuations in exchange rates may give rise to foreign currency exposure, either favourable or unfavourable, which will impact financial results. The Company does not engage in currency hedging to offset any risk of exchange rate fluctuation.

Environmental

The Company’s exploration and development activities are subject to extensive laws and regulations governing environment protection. The Company is also subject to various reclamation-related conditions. Reclamation requirements are designed to minimize long-term effects of mining exploitation and exploration disturbance by requiring the operating company to control possible deleterious effluents and to re-establish to some degree pre-disturbance land forms and vegetation. The Company is subject to such requirements in connection with its activities at Ixtaca. Any significant environmental issues that may arise, however, could lead to increased reclamation expenditures and could have a material adverse impact on the Company’s financial resources.

There can also be no assurance that closure estimates prove to be accurate. The amounts recorded for reclamation costs are estimates unique to a property based on estimates provided by independent consulting engineers and the Company’s assessment of the anticipated timing of future reclamation and remediation work required to comply with existing laws and regulations. Actual costs incurred in future periods could differ from amounts estimated. Additionally, future changes to environmental laws and regulations could affect the extent of reclamation and remediation work required to be performed by the Company. Any such changes in future costs could materially impact the amounts charged to operations for reclamation and remediation.

Although the Company closely follows and believes it is operating in compliance with all applicable environmental regulations, there can be no assurance that all future requirements will be obtainable on reasonable terms. Failure to comply may result in enforcement actions causing operations to cease or be curtailed and may include corrective measures requiring capital expenditures. Intense lobbying over environmental concerns by NGOs opposed to mining has caused some governments to cancel or restrict development of mining projects. Current publicized concern over climate change may lead to carbon taxes, requirements for carbon offset purchases or new regulation. The costs or likelihood of such potential issues to the Company cannot be estimated at this time.

Laws and regulations

The Company’s exploration activities are subject to extensive federal, provincial, state and local laws and regulations governing prospecting, development, production, exports, taxes, labour standards, occupational health and safety, mine safety and other matters in all the jurisdictions in which it operates. These laws and regulations are subject to change, can become more stringent and compliance can therefore become more costly. These factors may affect both the Company’s ability to undertake exploration and development activities in respect of future properties in the manner contemplated, as well as its ability to continue to explore, develop and operate those properties in which it currently has an interest or in respect of which it has obtained exploration and development rights to date. The Company applies the expertise of its management, advisors, employees and contractors to ensure compliance with current laws and relies on its land men and legal counsel in both Mexico and Canada.

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining, curtailing or closing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in the Company incurring significant expenditures. The Company may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or a more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of our operations and delays in the exploration and development of Ixtaca.

15

Political, economic and social environment

The Company’s mineral properties may be adversely affected by political, economic and social uncertainties which could have a material adverse effect on the Company’s results of operations and financial condition. Areas in which the Company holds or may acquire properties may experience local political unrest and disruption which could potentially affect the Company’s projects or interests. Changes in leadership, social or political disruption or unforeseen circumstances affecting political, economic and social structure could adversely affect the Company’s property interests or restrict its operations. The Company’s mineral exploration and development activities may be affected by changes in government regulations relating to the mining industry and may include regulations on production, price controls, labour, export controls, income taxes, expropriation of property, environmental legislation and safety factors.

Any shifts in political attitudes or changes in laws that may result in, among other things, significant changes to mining laws or any other national legal body of regulations or policies are beyond the control of the Company and may adversely affect its business. The Company faces the risk that governments may adopt substantially different policies, which might extend to the expropriation of assets or increased government participation in the mining sector. In addition, changes in resource development or investment policies, increases in taxation rates, higher mining fees and royalty payments, revocation or cancellation of mining concession rights or shifts in political attitudes in Mexico may adversely affect the Company’s business.

The Company’s relationship with communities in which it operates is critical to the development of the Ixtaca project. Local communities may be influenced by external entities, groups or organizations opposed to mining activities. In recent years, anti-mining NGO activity in Mexico has increased. These NGOs have taken such actions as road closures, work stoppages and law suits for damages. These actions relate not only to current activities but often in respect to the mining activities by prior owners of mining properties. Such actions by NGOs may have a material adverse effect on the Company’s operations at the Ixtaca project and on its financial position, cash flow and results of operations.

Risks related to International Labour Organization (“ILO”) Convention 169 Compliance

The Company may, or may in the future, operate in areas presently or previously inhabited or used by indigenous peoples. As a result, the Company’s operations are subject to national and international laws, codes, resolutions, conventions, guidelines and other similar rules respecting the rights of indigenous peoples, including the provisions of ILO Convention 169. ILO Convention 169 mandates, among other things, that governments consult with indigenous peoples who may be impacted by mining projects prior to granting rights, permits or approvals in respect of such projects.

ILO Convention 169 has been ratified by Mexico. It is possible however that Mexico may not (i) have implemented procedures to ensure their compliance with ILO Convention 169 or (ii) have complied with the requirements of ILO Convention 169 despite implementing such procedures.

Government compliance with ILO Convention 169 can result in delays and significant additional expenses to the Company arising from the consultation process with indigenous peoples in relation to the Company’s exploration, mining or development projects. Moreover, any actual or perceived past contraventions, or potential future actual or perceived contraventions, of ILO Convention 169 by ratifying governments in the countries in which the Company operates create a risk that the permits, rights, approvals, and other governmental authorizations that the Company has relied upon, or may in the future rely upon, to carry out its operations or plans in such countries could be challenged by or on behalf of indigenous peoples in such countries.

16

Such challenges may result in, without limitation, additional expenses with respect to the Company’s operations, the suspension, revocation or amendment of the Company’s rights or mining, environmental or export permits, a delay or stoppage of the Company’s development, exploration or mining operations, the refusal by governmental authorities to grant new permits or approvals required for the Company’s continuing operations until the settlement of such challenges, or the requirement for the responsible government to undertake the requisite consultation process in accordance with ILO Convention 169.

As a result of the inherent uncertainty in respect of such proceedings, the Company is unable to predict what the results of any such challenges would be; however, any ILO Convention 169 proceedings relating to the Company’s operations in Mexico may have a material adverse effect on the business, operations, and financial condition of the Company.

As a result of social media and other web-based applications, companies today are at much greater risk of losing control over how they are perceived

Damage to the Company’s reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. Although the Company places a great emphasis on protecting its image and reputation, it does not ultimately have direct control over how it is perceived by others. Reputation loss may lead to increased challenges in developing and maintaining community relations, decreased investor confidence and act as an impediment to the Company’s overall ability to advance its projects, thereby having a material adverse impact on the Company’s business, financial condition or results of operations.

The Company may be subject to legal proceedings that arise in the ordinary course of business

Due to the nature of its business, the Company may be subject to regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of its business. The Company’s operations are subject to the risk of legal claims by employees, unions, contractors, lenders, suppliers, joint venture partners, shareholders, governmental agencies or others through private actions, class actions, administrative proceedings, regulatory actions or other litigation. Plaintiffs may seek recovery of very large or indeterminate amounts, and the magnitude of the potential loss relating to such lawsuits may remain unknown for substantial periods of time. Defense and settlement costs can be substantial, even with respect to claims that have no merit. The results of these legal proceedings cannot be predicted with certainty due to the uncertainty inherent in litigation, including the effects of discovery of new evidence or advancement of new legal theories, the difficulty of predicting decisions of judges and juries and the possibility that decisions may be reversed on appeal. The litigation process could, as a result, take away from the time and effort of the Company’s management and could force the Company to pay substantial legal fees or penalties. There can be no assurances that the resolutions of any such matters will not have a material adverse effect on the Company’s business, financial condition and results of operations.

Title to mineral properties

While the Company has investigated title to its mineral properties, this should not be construed as a guarantee of title. The properties may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. Title to Almaden’s mining concessions may also be adversely affected by the Amparo as discussed below.

There is a risk that title to the mining concessions, the surface rights and access rights comprising Ixtaca and the necessary infrastructure, may be deficient or subject to additional disputes. The procurement or enforcement of such rights, or any dispute with respect to such rights, can be costly and time consuming. In areas where there are local populations or land owners, it may be necessary, as a practical matter, to negotiate surface access. Despite having the legal right to access the surface and carry on construction and mining activities, the Company may not be able to negotiate satisfactory agreements with existing landowners/occupiers for such access, and therefore it may be unable to carry out activities as planned. In addition, in circumstances where such access is denied, or no agreement can be reached, this could have a material adverse effect on the Company and the Company may need to rely on the assistance of local officials or the courts in such jurisdictions or pursue other alternatives, which may suspend, delay or impact mining activities as planned.

17

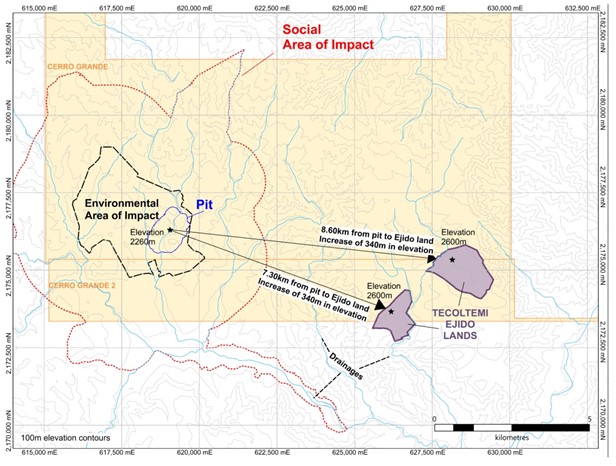

There is also a risk that the Company’s exploration, development and mining authorizations and surface rights may be challenged or impugned by third parties. In addition, there is a risk that the Company will not be able to renew some or all its licenses in the future. Inability to renew a license could result in the loss of any project located within that license. As noted in our press releases dated April 15, 2019 and February 27, 2020, the Company’s Original Concessions (as defined below) are subject to legal proceedings (the “Amparo”, or “Mineral Title Lawsuit”). On April 7, 2015, the Ejido Tecoltemi filed the Amparo against Mexican mining authorities claiming that Mexico’s mineral title system is unconstitutional because indigenous consultation is not required before the granting of mineral title. Almaden’s two original mining concessions covering the Ixtaca project (the “Original Concessions”) (Figure 1) are the subject matter of the Amparo. The Original Concessions cover Almaden’s Ixtaca project and certain endowed lands of the Ejido (the “Ejido Lands”). The Ejido Lands overlap approximately 330 Ha of the far south-eastern corner of the Original Concessions and are not considered material to Almaden.

On April 15, 2019, the lower court in Puebla State ruled that Mexico’s mineral title system is unconstitutional. The Original Concessions were ruled to be illegal, but the mineral rights over that land were ordered to be held for Almaden until such time as indigenous consultation can be completed.

Under Mexican law, any decisions in the Amparo, such as the April 15, 2019 lower court ruling, are granted in a provisional manner and only become final once the decisions are no longer subject to further appeal. The Superior Court has accepted the appeals of each of the Mexican Congress, Senate, Secretary of Economy and mining authorities, as well as Almaden as an interested party, against the April 15, 2019 provisional lower court decision in the Amparo, and these appeals are in the process of being studied for resolution.

Figure 1: Original Concessions. Ixtaca environmental and social impact areas, and Ejido Lands

Shortly after the Amparo was filed, the lower court ordered the suspension of Almaden from conducting exploration and exploitation work over those portions of the Original Concessions which overlap with the Ejido Lands.

18

Mineral tenure over the Ejido Lands is not material to Almaden. The Ejido Lands do not overlap the Ixtaca project or its environmental or social area of impact. Almaden has never tried to negotiate access to the Ejido Lands, never conducted exploration work on the Ejido Lands, and has no interest in conducting any future exploration or development work over the Ejido Lands. The Ejido Lands are in a different drainage basin than the Ixtaca project and the Company does not need to travel though the Ejido Lands to access the Ixtaca project.

In the event the provisional lower court Amparo decision becomes final, this would result in amendments to Mexican mining law and could suggest that all mineral claims granted in Mexico since 2001 are unconstitutional. In Almaden’s case, the Original Concessions (see Figure 1) would be deemed to be illegal but the mineral rights over that land would be held for Almaden until such time as indigenous consultation can be completed. However, given that Almaden has no interest in conducting work on the Ejido Lands, it is unclear over what area indigenous consultation would occur. We note that none of the communities located within the New Concessions (see Figure 3 below) or within the Ixtaca project’s area of social impact are party to the Amparo. Moreover, the surface area of the proposed Ixtaca project is covered by private property.

Claim Reduction Efforts

In 2015, after learning about the Amparo, Almaden commenced a process to voluntarily cancel approximately 7,000 Ha of its Original Concessions, including the area covering the Ejido Lands, to assure the Ejido that Almaden would not interfere with the Ejido Lands, and to reduce Almaden’s land holding costs.

Almaden divided the Original Concessions into nine smaller concessions, which included two smaller mining concessions which overlapped the Ejido Lands (the “Overlapping Concessions”) (see Figure 2) and then voluntarily cancelled the Overlapping Concessions (see Figure 3 – which shows only the “New Concessions”). The applicable Mexican mining authorities issued the New Concessions and accepted the abandonment of the Overlapping Concessions in May and June of 2017 after the issuance of a Court Order.

|  | |

| Figure 2: New and overlapping concessions | Figure 3: New Concessions. |

In June 2017, the Ejido Tecoltemi, the complainant in the Amparo, filed a legal complaint about the court order leading to the New Concessions, and on February 1, 2018, the court reviewing the complaint ruled the Ejido’s complaint was founded, and sent the ruling to the court hearing the Amparo.

On December 21, 2018, the General Directorate of Mines issued a resolution that the New Concessions are left without effect, and the Original Concessions are in full force and effect (the “December Communication”).

19

On February 13, 2019, the General Directorate of Mines delivered, to the court hearing the Amparo, mining certificates stating that the Original Concessions are valid, and the New Concessions are cancelled.

On June 10, 2019, Almaden’s subsidiary appealed the December Communication, and subsequent cancellation of the New Concessions. On September 26, 2019, the lower court refused to hear the appeal, but on October 14, 2019, a higher court agreed to hear the appeal.

In communications with the lower court and mineral title certificates issued by the General Directorate of Mines directly to Almaden on December 16, 2019 (the “December 2019 Certificates”), the applicable Mexican records currently reflect the position that the Original Concessions (the subject matter of the Amparo) are active and owned by Almaden (through its Mexican subsidiary) and the New Concessions are left without effect. It should be noted that the Mexican mining authorities also have indicated in the December 2019 Certificates that their position is subject to the final resolution of the Amparo.

On January 21, 2020, the Company filed an administrative challenge against the Mexican mining authorities’ issuance of the December 2019 Certificates, which represented the first time that Almaden had been directly notified of any changes in its mineral tenure.

Almaden believes that the December Communication from the Mexican mining authorities is the basis for the recorded change in its mineral tenure. The Company’s Mexican counsel has advised it that the December Communication has no legal effect as it was only provided to the lower court, was never officially served on the Company and was not issued by an official possessing the necessary legal authority. While the December Communication is dated December 21, 2018, the Company first became aware of it in May, 2019 through a review of court documents.

Currently, applicable Mexican mining authority records show the Original Concessions as Almaden’s sole mineral claims to the Ixtaca project. As noted above those claims are subject to the Amparo.

Although the Company is challenging this change to its mineral tenure, the Original Concessions provide Almaden with the same exploration and mining rights over the Company’s Ixtaca project as the New Concessions.

Almaden’s two appeals to this change in mineral tenure are based on Mexican legal advice that it cannot be forced to own mineral rights it has formally dropped. The Mexican legal advice is that the New Concessions remain in full force and effect. Almaden continues to file taxes and assessment reports on the New Concessions, which have been accepted by the Mexican mining authorities, and Almaden has not received any notifications from the Mexican mining authorities regarding unpaid taxes on the Original Concessions. Almaden believes that it has a strong legal basis for its appeals.

Possible dilution to present and prospective shareholders

The Company’s plan of operation, in part, contemplates the financing of its business by the issuance of securities and possibly, incurring debt. Any transaction involving the issuance of previously authorized but unissued shares of common stock, or securities convertible into common stock, would result in dilution, possibly substantial, to present and prospective holders of common stock. Likewise, any debt, royalty, or streaming transaction would result in dilution, possibly substantial, to existing shareholders’ exposure to the potential cash flows generated from the Company’s projects.

Material risk of dilution presented by large number of outstanding share purchase options and warrants

At May 14, 2020, there were 11,382,000 stock options and 15,851,008 Warrants (including 192,450 finders’ warrants) outstanding. Directors and officers hold 9,287,000 of the options and 2,095,000 are held by employees and consultants of the Company. Directors and officers hold 608,703 of the Warrants.

20

Trading volume

The relatively low trading volume of the Common Shares reduces the liquidity of an investment in the Common Shares.

Volatility of share price

Market prices for shares of early stage companies are often volatile. Factors such as announcements of mineral discoveries or discouraging exploration results, changes in financial results, and other factors could have a significant effect on share price.

Competition

There is competition from other mining companies with operations similar to Almaden. Many of the companies with which it competes have operations and financial strength greater than the Company.

Dependence on management

The Company depends heavily on the business and technical expertise of its management.

Conflict of interest

Some of the Company’s directors and officers are directors and officers of other natural resource or mining-related companies. These associations may give rise from time to time to conflicts of interest. As a result of such conflict, the Company may miss the opportunity to participate in certain transactions.

Impairment of Exploration and Evaluation Assets

The Company assesses its exploration and evaluation assets quarterly to determine whether any indication of impairment exists. Common indications of impairment, which is often subjective, include but are not limited to, that the right to explore the assets has expired or will soon expire and is not expected to be renewed, that substantive expenditure of further exploration is not planned, or that results are not compelling enough to warrant further exploration by the Company.

At March 31, 2020, the Company concluded that no impairment indicators existed with respect to its exploration and evaluation assets and no impairment of exploration and evaluation assets was recognized.

SUMMARY OF QUARTERLY RESULTS

The following tables provide selected financial information for the Company’s eight most recently completed fiscal quarters, stated in Canadian dollars in accordance with IFRS:

| Quarter Ended Mar 31, 2020 ($) |

Quarter Ended Dec 31, 2019 ($) |

Quarter Ended Sep 30, 2019 ($) |

Quarter Ended Jun 30, 2019 ($) | |

| Revenue | Nil | Nil | Nil | Nil |

| Other income (loss) | 158,222 | (338,263) | 352,249 | 432,895 |

| Comprehensive loss | (945,350) | (1,119,575) | (1,099,401) | (596,300) |

| Basic & diluted net income (loss) per share | (0.01) | (0.01) | (0.01) | (0.00) |

| Total assets | 75,723,275 | 74,063,855 | 75,302,179 | 75,488,119 |

| Total long term liabilities | 4,919,498 | 4,577,916 | 4,561,492 | 4,466,555 |

| Cash dividends declared | Nil | Nil | Nil | Nil |

21

| Quarter Ended Mar 31, 2019 ($) |

Quarter Ended Dec 31, 2018 ($) |

Quarter Ended Sep 30, 2018 ($) |

Quarter Ended Jun 30, 2018 ($) | |

| Revenue | Nil | Nil | Nil | Nil |

| Other income | 231,073 | 428,422 | 216,268 | 269,376 |

| Comprehensive loss | (947,799) | (823,501) | (631,041) | (1,174,705) |

| Basic & diluted net income (loss) per share | (0.01) | (0.01) | (0.00) | (0.01) |

| Total assets | 73,042,598 | 73,928,394 | 74,384,213 | 75,353,555 |

| Total long term liabilities | 1,727,561 | 1,434,882 | 1,434,882 | 1,434,882 |

| Cash dividends declared | Nil | Nil | Nil | Nil |

Quarterly variances in other income are dependent on the interest income earned from various levels of cash balances, financing activities related to the gold loan and cost recoveries from administrative services earned from Azucar Minerals Ltd. (“Azucar”) and Almadex. The main changes in comprehensive loss include share-based payments relating to the fair values of stock options granted, salaries and benefits relating to various levels of staffing requirements during the suspension of the development stage activities, and foreign exchange gain (loss) from foreign exchange rate fluctuations. Further details are discussed in Review of Operations and Financial Results section below.

Review of Operations and Financial Results

Results of Operations for the three months ended March 31, 2020 compared to the three months ended March 31, 2019

For the three months ended March 31, 2020, the Company recorded a comprehensive loss of $945,350, or $0.01 per common share, compared to a comprehensive loss of $947,799, or $0.01 per common share, for the three months ended March 31, 2019. The decrease in comprehensive loss of $2,449 was primarily a result of a $72,851 decrease in other income offset by a $75,300 decrease in operating expenses.

Because the Company is an exploration company, it has no revenue from mining operations. Other income of $158,222 (2019 - $231,073) during the quarter ended March 31, 2020 relates primarily to administrative services fees earned from Azucar of $243,640 (2019 - $151,914), and from Almadex of $122,112 (2019 - $76,522). The Company has an administrative services agreement with these two companies whereby overhead and salaries expenses are proportionally allocated as described under the heading “Transactions with Related Parties”. The decrease of $72,851 in other income (loss) relates to a decrease in interest income from lower levels of cash balances and an increase in finance expenses related to the gold loan as it did not exist in Q1 2019.

Operating expenses were $1,103,572 during the three months ended March 31, 2020 (2019 - $1,178,872). Certain operating expenses were reported on a gross basis and recovered through other income from the administrative services agreements with Azucar and Almadex. The decrease in operating expenses of $75,300 are mainly the result of a decrease in salaries and benefits of $73,994 due to the lack of work during the development delay. Directors fees were also deferred in Q1 2020 until the financial conditions in the capital markets improved. The decrease in operation expenses were offset by an increase in finance costs on gold loan payable of $93,039.

LIQUIDITY AND CAPITAL RESOURCES