Exhibit 99.1

ALMADEN MINERALS LTD.

(the “Company”)

Form 51-102F6

Statement of Executive Compensation

Compensation Discussion and Analysis

The compensation of the Company’s Named Executive Officers (“Named Executive Officers” or “NEOs”) and directors is determined by the Company’s Board of Directors (the “Board”) upon the recommendations of the Board’s Compensation Committee (the “Committee”). The Committee is composed of four directors from the Board, John McCleary, Gerald Carlson, William J. Worrall and Mark Brown, all of whom are independent directors within the meaning of section 1.4 of National Instrument 52- 110 – Audit Committees (“NI 52-110”). All of the members of the Committee have experience setting compensation for executives in companies of similar size to the Company.

The Company does not have a formal compensation program. However, the Committee meets to discuss and determine the recommendations that it will make to the Board regarding management compensation, without reference to formal objectives, criteria or analysis. The general objectives of the Company’s compensation strategy are to (a) compensate management in a manner that encourages and rewards a high level of performance and outstanding results with a view to increasing long-term shareholder value; (b) align management’s interests with the long-term interests of shareholders; (c) provide a compensation package that is commensurate with other peer group companies to enable the Company to attract and retain talent; and (d) ensure that the total compensation package is designed in a manner that takes into account the constraints that the Company is under by virtue of the fact that it is a mineral exploration company without a history of earnings.

The Committee considers and evaluates executive compensation levels on an annual basis against available information for similar companies to ensure that the Company’s executive compensation levels are within the range of comparable norms. In selecting similar companies, the Company primarily looks for public companies that are comparable in terms of business and size.

The Committee’s NEO compensation program is designed to provide competitive levels of compensation, a significant portion of which is dependent upon individual and corporate performance and contribution to increasing shareholder value. The Committee recognizes the need to provide a total compensation package that will attract and retain qualified and experienced executives as well as align the compensation level of each executive to that executive’s level of responsibility.

Currently, the principal components of the Company’s executive compensation packages are base remuneration, long-term incentive in the form of stock options, and a discretionary annual incentive cash bonus. The compensation package is determined by gathering competitive salary information on comparable companies within the industry from a variety of sources.

While the Committee believes that it is important to use comparable data to assist it in determining appropriate ranges for executive compensation, it also considers other factors when awarding executive compensation, such as the overall financial strength of the Company, its exploration successes and equity financing success.

Base remuneration is used to provide the Named Executive Officers a set amount of money during the year with the expectation that each Named Executive Officer will perform his responsibilities to the best of his ability and in the best interests of the Company.

The granting of incentive stock options provides a link between management compensation and the Company’s share price. It also rewards management for achieving results that improve Company performance and thereby increase shareholder value. Stock options are generally awarded to executive officers at the commencement of employment and periodically thereafter. In making a determination as to whether a grant of long-term incentive stock options is appropriate, and if so, the number of options that should be granted, consideration is given to: the number and terms of outstanding incentive stock options held by the Named Executive Officer; current and expected future performance of the Named Executive Officer; the potential dilution to shareholders and the cost to the Company; general industry standards and the limits imposed by the terms of the Company’s stock option plan (the “Plan”) and the Toronto Stock Exchange (the “TSX”). The Company considers the granting of incentive stock options to be a particularly important element of compensation as it allows the Company to reward each Named Executive Officer’s efforts to increase value for shareholders without requiring the Company to use cash from its treasury. The terms and conditions of the Company’s stock option grants, including vesting provisions and exercise prices, are governed by the terms of the Plan, which is described under the heading “Securities Authorized for Issue Under Equity Compensation Plans” in the Company’s Management Information Circular as at and dated May 17, 2019 in respect of the Company’s 2019 Annual General Meeting (the “Information Circular”).

Finally, the Committee will consider whether it is appropriate and in the best interests of the Company to award a discretionary cash bonus to the Named Executive Officers, and if so, in what amount. A cash bonus may be awarded to reward extraordinary performance that has led to increase value for shareholders through strategic corporate transactions, property acquisitions or divestitures, the formation of new strategic or joint venture relationships and/or capital raising efforts. Demonstrations of extraordinary personal commitment to the Company’s interests, the community and the industry may also be rewarded through a cash bonus.

The Committee considers the implications and risks of the Company’s compensation policies and practices as a factor in assisting the Board in approving and monitoring guidelines and practices regarding the compensation and benefits of officers. In particular, the Committee considers the impact on NEOs and other senior executives to ensure that they do not take undue risks. The Committee has not identified any risks in the Company’s existing compensation policies and practices that it believes would be reasonably likely to have a material adverse effect on the Company.

The Company has a formal policy that does not permit a NEO or director to purchase or sell call or put options or other derivatives in respect of the Company’s securities.

In 2018, annual director’s fees of $12,000 were paid, payable or accrued for payment to each non-executive director. Also in 2018, the Chairs of the Audit and Compensation Committees were paid an additional $5,000 each.

In 2018 Duane Poliquin received compensation by way of an annual salary and the grant of stock options. No year-end bonus was paid. This compensation was based on his executive compensation contract with the objective to retain his services, motivate a high level of performance and reward him for his achievements and loyalty. All elements of compensation were approved by the Board. Mr. D. Poliquin’s annual remuneration is based on industry standards and, when paid or granted, his year-end bonus and the number of stock options granted to him reflect his responsibilities to the Company relative to all other bonus or option recipients. Please refer to the “Summary Compensation Table” below.

In 2018, Morgan Poliquin received compensation by way of an annual salary, bonus and the grant of stock options. This compensation was based on his executive employment contract with the objective to retain his services, motivate a high level of performance and reward him for his achievements and loyalty. All elements of compensation were approved by the Board. Mr. M. Poliquin’s annual salary is based on industry standards and, when paid or granted, his year-end bonus and the number of stock options granted to him reflect his responsibilities to the Company relative to all other bonus or option recipients.

2

In 2018, Korm Trieu received compensation by way of an annual salary, bonus and the grant of stock options. This compensation was based on his executive employment contract with the objective to retain his services, motivate a high level of performance and reward him for his achievements and loyalty. All elements of compensation were approved by the Board. Mr. Trieu’s annual salary is based on industry standards and when paid or granted, his year-end bonus and the number of stock options granted to him reflect his responsibilities to the Company relative to all other bonus or option recipients.

In 2018, Douglas McDonald received compensation by way of an annual salary, bonus and the grant of stock options. This compensation was based on his executive employment contract with the objective to retain his services, motivate a high level of performance and reward him for his achievements and loyalty. All elements of compensation were approved by the Board. Mr. McDonald’s annual salary is based on industry standards and, when paid or granted, his year-end bonus and the number of stock options granted to him reflect his responsibilities to the Company relative to all other bonus or option recipients.

In 2018, Laurence Morris received compensation by way of an annual fee and the grant of stock options. This compensation was based on his independent contractor agreement with the objective to retain his services, motivate a high level of performance and reward him for his achievements and loyalty. All elements of compensation were approved by the Board. Mr. Morris’s annual fee is based on industry standards and, when paid or granted, his year-end bonus and the number of stock options granted to him reflect his responsibilities to the Company relative to all other bonus or option recipients.

Summary Compensation Table

Named Executive Officers

The following table contains information about the compensation paid or payable to, or earned by, those who were, at December 31, 2018, (a) the Company’s Chairman; (b) the Company’s Chief Executive Officer; (c) the Company’s Chief Financial Officer; (d) each of the three other most highly compensated executive officers of the Company, including any of its subsidiaries, (except those whose total compensation does not, individually, exceed $150,000) and (e) any additional individuals who would be included in (d) but for the fact the individual was neither an executive officer of the Company or any of its subsidiaries, nor acting in a similar capacity, at December 31, 2018. The Company presently has five (5) Named Executive Officers, namely Duane Poliquin, Chairman, Morgan Poliquin, President and Chief Executive Officer (“CEO”), Korm Trieu, Chief Financial Officer (“CFO”), Douglas McDonald, Vice President, Corporate Development. and Laurence Morris, Vice President Operations & Projects.

3

Set out below is a summary of compensation paid during the three years ended December 31, 2018 to the Company’s Named Executive Officers.

|

Non-Equity Incentive Plan Compensation ($) |

|||||||||

| Name and Principal Position |

Year* |

Salary(a) ($) |

Share-Based Awards ($) |

Option-Based Awards(b) ($) |

Annual Incentive Plans |

Long-Term Incentive Plans |

Pension Value ($) |

All other Compensation(a) ($) |

Total Compensation(a) ($) |

|

Duane Poliquin Chairman |

2018 | 138,194 | N/A | 181,500(3)(4)(5) | N/A | N/A | N/A | Nil | 319,694 |

| 2017 | 168,000 | N/A | 397,200(6)(7)(10)(12) | N/A | N/A | N/A | Nil | 565,200 | |

| 2016 | 168,000 | N/A | 345,000(13)(14) | N/A | N/A | N/A | Nil | 513,000 | |

|

Morgan Poliquin President & CEO |

2018 | 192,895 | N/A | 275,000(3)(5) | 66,250 | N/A | N/A | Nil | 534,145 |

| 2017 | 213,500 | N/A | 739,200(6)(10)(11)(12) | 85,400 | N/A | N/A | Nil | 1,038,100 | |

| 2016 | 185,500 | N/A | 434,000(13) | 92,750 | N/A | N/A | Nil | 712,250 | |

|

Korm Trieu CFO |

2018 | 129,556 | N/A | 73,950(2)(3)(5) | 27,750 | N/A | N/A | Nil | 231,256 |

| 2017 | 142,450 | N/A | 164,450(9)(10)(12) | 35,613 | N/A | N/A | Nil | 342,513 | |

| 2016 | 129,500 | N/A | 93,000(13) | 38,850 | N/A | N/A | Nil | 261,350 | |

|

Douglas McDonald VP, Corporate Development |

2018 | 122,071 | N/A | 49,000(3)(5) | 28,875 | N/A | N/A | Nil | 199,946 |

| 2017 | 134,750 | N/A | 155,000(8)(10)(12) | 33,688 | N/A | N/A | Nil | 323,438 | |

| 2016 | 122,500 | N/A | 97,900(13)(15) | 18,375 | N/A | N/A | Nil | 238,775 | |

|

Laurence Morris VP, Operations & Projects(16) |

2018 | 246,488 | N/A | 144,000(1) | N/A | N/A | N/A | Nil | 390,488 |

|

|||||||||

| * | Ended December 31. | |

| (a) | Under an Administrative Services Agreement dated May 15, 2015, as amended December 16, 2015, between Azucar Minerals Ltd. (“Azucar”) and the Company (the “Azucar Agreement”), the Company provides management services to Azucar and Azucar compensates the Company 30% of any shared personnel remuneration and office overhead expenses. With the exception of Laurence Morris, in respect of whom there was no recovery, the above table reflects only the compensation for each individual paid by the Company after recovery of such 30% from Azucar. The Azucar Agreement includes a Change of Control clause - see ** below. |

Under an Administrative Services Agreement dated March 29, 2018, between Almadex Minerals Ltd. (“Almadex”) and the Company (the “Almadex Agreement”), the Company provides management services to Almadex and Almadex compensates the Company 20% of any shared personnel remuneration and office overhead expenses. With the exception of Laurence Morris, in respect of whom there was no recovery, the above table reflects only the compensation for each individual paid by the Company after recovery of such 20% from Almadex. The Almadex Agreement includes a Change of Control clause - see ** below.

| (b) | Comprised of options granted pursuant to the Company’s Stock Option Plan. All options vested upon grant. | |

| (1) | The value of option-based awards is based on the fair value of the awards ($0.48) calculated at the February 7, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.99%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 64.14% and an estimated option life of 3 years. |

| (2) | The value of option-based awards is based on the fair value of the awards ($0.31) calculated at the April 10, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.85%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 55.18% and an estimated option life of 2 years. |

| (3) | The value of option-based awards is based on the fair value of the awards ($0.29) calculated at the June 18, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.85%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 51.53% and an estimated option life of 2 years. |

| (4) | The value of option-based awards is based on the fair value of the awards ($0.25) calculated at the September 26, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 2.19%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 47.93% and an estimated option life of 2 years. |

4

| (5) | The value of option-based awards is based on the fair value of the awards ($0.24) calculated at the December 13, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.89%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 49.38% and an estimated option life of 2 years. |

| (6) | The value of option-based awards is based on the fair value of the awards ($0.54) calculated at the January 11, 2017 grant date using the Black-Scholes model assuming a weighted average risk free rate of 0.75%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 68.94% and an estimated option life of 2 years. |

| (7) | The value of option-based awards is based on the fair value of the awards ($0.63) calculated at the May 4, 2017 grant date using the Black-Scholes model assuming a weighted average risk free rate of 0.71%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 65.77% and an estimated option life of 2 years. |

| (8) | The value of option-based awards is based on the fair value of the awards ($0.60) calculated at the May 19, 2017 grant date using the Black-Scholes model assuming a weighted average risk free rate of 0.72%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 65.65% and an estimated option life of 2 years. |

| (9) | The value of option-based awards is based on the fair value of the awards ($0.63) calculated at the June 12, 2017 grant date using the Black-Scholes model assuming a weighted average risk free rate of 0.88%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 65.95% and an estimated option life of 2 years. |

| (10) | The value of option-based awards is based on the fair value of the awards ($0.48) calculated at the August 25, 2017 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.24%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 62.80% and an estimated option life of 2 years. |

| (11) | The value of option-based awards is based on the fair value of the awards ($0.55) calculated at the September 12, 2017 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.59%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 63.12% and an estimated option life of 2.5 years. |

| (12) | The value of option-based awards is based on the fair value of the awards ($0.62) calculated at the December 22, 2017 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.71%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 65.20% and an estimated option life of 3 years. |

| (13) | The value of option-based awards is based on the fair value of the awards ($0.62) calculated at the June 8, 2016 grant date using the Black-Scholes model assuming a weighted average risk free rate of 0.54%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 64.68% and an estimated option life of 2 years. |

| (14) | The value of option-based awards is based on the fair value of the awards ($0.70) calculated at the September 15, 2016 grant date using the Black-Scholes model assuming a weighted average risk free rate of 0.58%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 68.08% and an estimated option life of 2 years. |

| (15) | The value of option-based awards is based on the fair value of the awards ($0.57) calculated at the October 6, 2016 grant date using the Black-Scholes model assuming a weighted average risk free rate of 0.60%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 68.47% and an estimated option life of 2 years. |

| (16) | Laurence Morris was appointed Vice President, Operations & Projects on April 30, 2018. |

The Company has in place an executive employment contract, as amended, (the “DP Contract”), with its Chairman, Duane Poliquin, whereby the Company has agreed to pay an annual base salary (currently $240,000 – see ** below) to Mr. D. Poliquin for providing management and technical services to the Company. Under the DP Contract, Mr. D. Poliquin is entitled to receive certain benefits if terminated by the Company without cause or by Mr. D. Poliquin for Good Reason (see “Termination and Change of Control Benefits” below).

The Company has in place an executive employment contract, as amended, (the “MP Contract”), with its President and CEO, Morgan Poliquin, whereby the Company has agreed to pay an annual base salary (currently $335,000 – see ** below) to Mr. M. Poliquin for providing management and technical services to the Company. Under the MP Contract, Mr. M. Poliquin is entitled to receive certain benefits if terminated by the Company without cause or by Mr. M. Poliquin for Good Reason (see “Termination and Change of Control Benefits” below).

The Company has in place an executive employment contract, as amended, (the “KT Contract”) with its CFO, Korm Trieu, whereby the Company has agreed to pay an annual base salary (currently $225,000 – see ** below) to Mr. Trieu for providing financial, administrative and executive services to the Company. Under the KT Contract, Mr. Trieu is entitled to receive certain benefits if terminated by the Company without cause or by Mr. Trieu for Good Reason (see “Termination and Change of Control Benefits” below).

The Company has in place an executive employment contract, as amended, (the “DM Contract”) with its Vice President, Corporate Development, Douglas McDonald, whereby the Company has agreed to pay an annual base salary (currently $212,000 – see ** below) to Mr. McDonald for providing executive services to the Company. Under the DM Contract, Mr. McDonald is entitled to receive certain benefits if terminated by the Company without cause or by Mr. McDonald for Good Reason (see “Termination and Change of Control Benefits” below).

5

The Company has in place an independent contractor agreement (the “LM Agreement”) with its Vice President, Operations & Projects, Laurence Morris, whereby the Company has agreed to pay an annual fee (currently US$250,000) to Mr. Morris for providing operations and projects mining services to the Company. Under the LM Agreement, Mr. Morris is entitled to receive certain benefits if, following a Change of Control, the engagement of Mr. Morris under the LM Agreement is terminated by the Company without cause or by Mr. Morris upon notice (see “Termination and Change of Control Benefits” below).

**Under the Azucar Agreement, the Company provides management services to Azucar and Azucar compensates the Company 30% of any shared personnel remuneration and office overhead expenses. The Azucar Agreement has an initial five year term, subject to automatic renewal annually thereafter (unless six months’ advance notice of intent to terminate is given). The Azucar Agreement includes a Change of Control clause. If either Azucar or the Company is subject to a Change of Control during the term of the Azucar Agreement, the Azucar Agreement shall automatically terminate within 48 hours of the Change of Control unless agreed to in writing by both parties. The target of the Change of Control shall then pay the other party $2 million as compensation for the unplanned termination of the Company’s engagement and significant disruption to Azucar’s business. “Change of Control” means the date upon which, without the written concurrence of the target of the Change of Control, any person (as that term is defined in the Securities Act (British Columbia) makes and does not withdraw a take-over bid (as that term is defined in the Securities Act (British Columbia)) or acquires, directly or indirectly, that number of common shares of the target which equals or exceeds twenty percent (20%) of the then issued common shares of the target.

**Under the Almadex Agreement, the Company provides management services to Almadex and Almadex compensates the Company 20% of any shared personnel remuneration and office overhead expenses. The Almadex Agreement has an initial five year term, subject to automatic renewal annually thereafter (unless six months’ advance notice of intent to terminate is given). The Almadex Agreement includes a Change of Control clause. If either Almadex or the Company is subject to a Change of Control during the term of the Almadex Agreement, the Almadex Agreement shall automatically terminate within 48 hours of the Change of Control unless agreed to in writing by both parties. The target of the Change of Control shall then pay the other party $2 million as compensation for the unplanned termination of the Company’s engagement and significant disruption to Almadex’s business. “Change of Control” means the date upon which, without the written concurrence of the target of the Change of Control, any person (as that term is defined in the Securities Act (British Columbia) makes and does not withdraw a take-over bid (as that term is defined in the Securities Act (British Columbia)) or acquires, directly or indirectly, that number of common shares of the target which equals or exceeds twenty percent (20%) of the then issued common shares of the target.

There have been no re-pricing or other significant changes to the terms of any share-based or option-based award program during the most recently completed year.

6

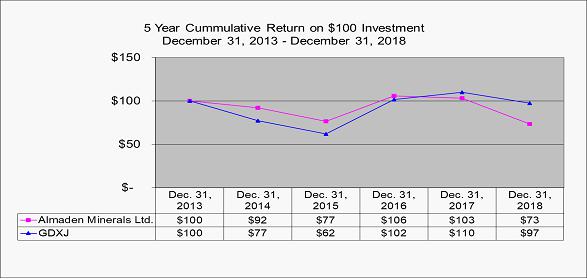

Performance Graph

The following graph compares the total cumulative shareholder return for $100 invested in the Company’s common shares since December 31, 2013, with the cumulative total return of the VanEck Vectors Junior Gold Miners ETF Index (“GDXJ”) for the five most recently completed fiscal years of the Company.

There is little correlation between the compensation of Named Executive Officers and the stock price of the Company. Stock prices are affected by many external factors in the mineral exploration industry and the retention and compensation of senior executives to manage the Company cannot be directly related to stock price. There are two factors that are important in consideration of the stock price as compared to executive compensation: (1) the senior executives of the Company are significant shareholders of the Company so that changes in the stock price do affect them directly, and (2) the Stock Option Plan is the one part of the compensation that is related directly to the compensation of the Named Executive Officers.

Option-Based Awards

The Company currently has in place the Stock Option Plan more particularly described in the Information Circular under the heading “Securities Authorized for Issue Under Equity Compensation Plans” for the purpose of attracting and motivating directors, officers, employees and consultants of the Company and advancing the interests of the Company by affording such persons with the opportunity to acquire an equity interest in the Company through rights granted under the Stock Option Plan to purchase shares of the Company. Recommendations for stock option grants are made initially by the Compensation Committee, and subsequently reviewed and determined by the Board. One of the factors considered when setting new option-based awards is the number of option-based awards previously granted to each individual.

The purpose of granting such stock options is to assist the Company in compensating, attracting, retaining and motivating the officers, directors and employees of the Company and to closely align the personal interest of such persons to the interest of the shareholders.

7

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth, for each Named Executive Officer, all share-based awards and option-based awards outstanding at December 31, 2018.

| Option-Based Awards | Share-Based Awards | ||||||

|

Name |

Number of Securities Underlying Unexercised Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Value of Unexercised In-the-Money Options(1) ($) |

Number of Incentives that have not Vested (#) |

Market or Payout Value of Incentives that have not Vested ($) |

Market or Payout Value of Vested Share-based Awards not paid out or distributed ($) |

|

Duane Poliquin Chairman |

100,000 | 1.99 | May 4, 2019 | Nil |

N/A |

N/A |

N/A |

| 300,000 | 1.34 | July 2, 2019 | Nil | ||||

| 165,000 | 1.40 | September 19, 2019 | Nil | ||||

| 500,000 | 0.98 | June 8, 2020 | Nil | ||||

| 150,000 | 1.25 | September 30, 2020 | Nil | ||||

| 50,000 | 0.79 | September 30, 2020 | 6,000 | ||||

| 100,000 | 0.86 | December 13, 2020 | 5,000 | ||||

|

Morgan Poliquin President & CEO |

250,000 | 1.04 | January 2, 2019 | Nil |

N/A |

N/A |

N/A |

| 150,000 | 1.32 | July 2, 2019 | Nil | ||||

| 350,000 | 1.34 | July 2, 2019 | Nil | ||||

| 315,000 | 1.40 | September 19, 2019 | Nil | ||||

| 500,000 | 1.53 | April 30, 2020 | Nil | ||||

| 700,000 | 0.98 | June 8, 2020 | Nil | ||||

| 200,000 | 1.25 | September 30, 2020 | Nil | ||||

| 300,000 | 0.86 | December 13, 2020 | 15,000 | ||||

|

Korm Trieu CFO |

50,000 | 1.04 | January 2, 2019 | Nil |

N/A |

N/A |

N/A |

| 75,000 | 1.89 | June 12, 2019 | Nil | ||||

| 115,000 | 1.40 | September 19, 2019 | Nil | ||||

| 75,000 | 1.03 | April 10, 2020 | Nil | ||||

| 150,000 | 0.98 | June 8, 2020 | Nil | ||||

| 100,000 | 1.25 | September 30, 2020 | Nil | ||||

| 30,000 | 0.86 | December 13, 2020 | 1,500 | ||||

|

Douglas McDonald VP, Corporate Development

|

75,000 | 1.84 | May 19, 2019 | Nil |

N/A |

N/A |

N/A |

| 100,000 | 1.40 | September 19, 2019 | Nil | ||||

| 20,000 | 0.98 | June 8, 2020 | Nil | ||||

| 100,000 | 1.25 | September 30, 2020 | Nil | ||||

| 180,000 | 0.86 | December 13, 2020 | 9,000 | ||||

|

Laurence Morris VP, Operations & Projects |

300,000 | 1.11 | February 7, 2021 | Nil | |||

| N/A | N/A | N/A | |||||

| (1) | Calculated based on the difference between the market value of the shares underlying the options as at December 31, 2018 ($0.91) and the exercise price of the options. |

8

Incentive Plan Awards – Value Vested or Earned During the Year

The following table outlines, for each Named Executive Officer, the value of option-based awards and share-based awards which vested during the year ended December 31, 2018 and the value of non-equity incentive plan compensation earned during the year ended December 31, 2018.

|

Name |

Option-Based Awards-Value Vested During the Year $ |

Share-Based-Awards-Value Vested During the Year $ |

Non-Equity Incentive Plan Compensation – Value Earned During the Year $ |

|

Duane Poliquin Chairman |

2,000(1) | N/A | N/A |

| (1) | Calculated based on the difference between the market value of the shares underlying the options as at September 20, 2018 ($0.83) and the exercise price of the options ($0.79). |

For a full description of the Company’s Stock Option Plan, see “SECURITIES AUTHORIZED FOR ISSUE UNDER EQUITY COMPENSATION PLANS” in the Information Circular.

PENSION PLAN BENEFITS

No pension plan or retirement benefit plans have been instituted by the Company and none are proposed at this time.

Termination and Change of Control Benefits

Except as otherwise disclosed below, there are no compensatory plans, contracts, agreements or arrangements in place that provide for payments to the Named Executive Officers at, following or in connection with any termination of employment (whether voluntary, involuntary or constructive), resignation, retirement or a change in the Named Executive Officer’s responsibilities following a change in control.

The Company has in place the DP Contract with its Chairman, Duane Poliquin which is for an indefinite term and provides that Mr. D. Poliquin is entitled to receive the following benefits if terminated otherwise than for cause:

| (a) | without cause, payment of an amount equal to 2 times Mr. D. Poliquin’s then current base salary; |

| (b) | by death or disability, payment of an amount equal to 6 months of Mr. D. Poliquin’s then current base salary; |

| (c) | by the Company without cause following a Change in Control or by Mr. D. Poliquin for Good Reason, payment of an amount equal to 3 times Mr. D. Poliquin’s then current base salary; and |

| (d) | if (c) applies, employment search assistance for up to 12 months. |

The right to receive the aforementioned payment and benefits under (c) and (d) is expressly contingent upon the signing of a waiver and release satisfactory to the Company which releases the Company and its affiliates from all claims and liabilities arising out of Mr. D. Poliquin’s employment and termination thereof and including confidentiality provisions, which waiver and release is satisfactory to the Company with respect to form, substance and timeliness.

9

The Company has in place the MP Contract with its President and CEO, Morgan Poliquin, which is for an indefinite term and provides that Mr. M. Poliquin is entitled to receive the following benefits if terminated otherwise than for cause:

| (a) | without cause, payment of an amount equal to 2 times Mr. M. Poliquin’s then current base salary; |

| (b) | by death or disability, payment of an amount equal to 6 months of Mr. M. Poliquin’s then current base salary; |

| (c) | by the Company without cause following a Change in Control or by Mr. M. Poliquin for Good Reason, payment of an amount equal to 3 times Mr. M. Poliquin’s then current base salary; and |

| (d) | if (c) applies, employment search assistance for up to 12 months. |

The right to receive the payment and benefits under (c) and (d) is expressly contingent upon the signing of a waiver and release satisfactory to the Company which releases the Company and its affiliates from all claims and liabilities arising out of Mr. M. Poliquin’s employment and termination thereof and including confidentiality provisions, which waiver and release is satisfactory to the Company with respect to form, substance and timeliness.

The Company has in place the KT Contract with its CFO, Korm Trieu, which is for an indefinite term and provides that Mr. Trieu is entitled to receive the following benefits if terminated otherwise than for cause:

| (a) | without cause, payment of an amount equal to 1 times Mr. Trieu’s then current base salary; and |

| (b) | by the Company without cause following a Change in Control or by Mr. Trieu for Good Reason, payment of an amount equal to 2 times Mr. Trieu’s then current base salary. |

The right to receive the payment and benefits under (b) is expressly contingent upon the signing of a waiver and release satisfactory to the Company which releases the Company and its affiliates from all claims and liabilities arising out of Mr. Trieu’s employment and termination thereof and including confidentiality provisions, which waiver and release is satisfactory to the Company with respect to form, substance and timeliness.

The Company has in place the DM Contract with its Vice President, Corporate Development, Douglas McDonald, which is for an indefinite term and provides that Mr. McDonald is entitled to receive the following benefits if terminated otherwise than for cause:

| (a) | without cause, payment of an amount equal to 1 times the then current base salary; and |

| (b) | by the Company without cause following a Change in Control or by Mr. McDonald, payment of an amount equal to 2 times Mr. McDonald’s then current base salary. |

10

The right to receive the payment and benefits under (b) is expressly contingent upon the signing of a waiver and release satisfactory to the Company which releases the Company and its affiliates from all claims and liabilities arising out of Mr. McDonald’s employment and termination thereof and including confidentiality provisions, which waiver and release is satisfactory to the Company with respect to form, substance and timeliness. For purposes of each of the DP Contract, the MP Contract, the KT Contract and the DM Contract (collectively, the “Contracts”):

“Change in Control” shall be deemed to have occurred if:

(i) any person or any person and such person’s associates or affiliates, as such terms are defined in the Securities Act (British Columbia) (the “Act”), makes a tender, take-over or exchange offer, circulates a proxy to shareholders or takes other steps to effect a takeover of the control of the Company, whether by way of a reverse take-over, take over bid, causing the election or appointment of a majority of directors of the Company or otherwise in any manner whatsoever; or

(ii) during any period of eighteen (18) consecutive months (not including any period prior to the effective date of an employee’s Contract), individuals who at the beginning of such period constituted the Board of Directors of the Company and any new directors, whose appointment by the Board of Directors or nomination for election by the Company’s shareholders was approved by a vote of at least three quarters (3/4) of the Board of Directors then still in office who either were directors at the beginning of the period or whose appointment or nomination for election was previously so approved, cease for any reason to constitute a majority of the Board of Directors of the Company; or

(iii) the acquisition by any person or by any person and such person’s affiliates or associates, as such terms are defined in the Act, and whether directly or indirectly, of common shares of the Company at the time held by such person and such person’s affiliates and associates, totals for the first time, twenty percent (20%) or more of the outstanding common shares of the Company; or

(iv) the business or businesses of the Company, for which the employee’s services are principally performed, are disposed of by the Company pursuant to a partial or complete liquidation, dissolution, consolidation or merger of the Company, or a sale or transfer of all or a significant portion of the Company’s assets.

Notwithstanding any other provisions in the Contracts regarding termination, if any of the events described above constituting a Change in Control shall have occurred during the course of the employee’s Contract, upon the termination of the employee’s employment thereunder (unless such termination is because of the employee’s death or disability, by the Company for cause or by the employee other than for “Good Reason”, as defined below) the employee shall be entitled to and will receive no later than the fifteenth (15th) day following the date of termination a lump sum severance payment in the amount set forth above.

“Good Reason” shall mean, without the employee’s express written consent, any of the following:

(i) the assignment to the employee of any duties inconsistent with the status or authority of the employee’s office, or the employee’s removal from such position, or a substantial alteration in the nature or status of the employee’s authorities or responsibilities from those in effect immediately prior to the Change in Control;

(ii) a reduction by the Company in the employee’s then current base salary, or a failure by the Company to increase the employee’s base salary as provided in the employee’s Contract or at a rate commensurate with that of other key employees of the Company;

(iii) the relocation of the office of the Company where the employee is employed at the time of the Change in Control (the “CIC Location”) to a location more than fifty (50) miles away from the CIC Location, or the Company’s requiring the employee to be based more than fifty (50) miles away from the CIC Location (except for requiring travel on the Company’s business to an extent substantially consistent with the employee’s business travel obligations prior to the Change in Control);

11

(iv) the failure by the Company to continue to provide the employee with benefits at least as favourable as those enjoyed by the employee prior to the Change in Control, the taking of any action by the Company which would directly or indirectly materially reduce any of such benefits or deprive the employee of any material benefit under the employee’s Contract enjoyed by the employee at the time of the Change in Control, or the failure by the Company to provide the employee with the number of entitled vacation days as provided in the employee’s Contract; or

(v) the failure of the Company to obtain a satisfactory agreement from any successor to assume and agree to perform the employee’s Contract or, if the business of the Company for which the employee’s services are principally performed is sold or transferred, the purchaser or transferee of such business shall fail to agree to provide the employee with the same or a comparable position, duties, salary and benefits as provided to the employee by the Company immediately prior to the Change in Control.

Following a Change in Control during the course of the employee’s Contract, the employee shall be entitled to terminate the employee’s employment for Good Reason.

The Company has in place the LM Agreement with its Vice President, Operations & Projects, Laurence Morris, which is for an indefinite term and provides that if, following a Change of Control, Mr. Morris’ engagement under the LM Agreement is terminated by the Company without cause or Mr. Morris elects to terminate his engagement thereunder by notifying the Company of such election in writing within 10 days after the occurrence of a Change of Control, Mr. Morris’ engagement shall immediately terminate and Mr. Morris will be entitled to receive a payment equal to 2 times Mr. Morris’ then current annual fee, payable, at the Company’s discretion, either in one lump sum within five business days from the effective date of termination of Mr. Morris’ engagement under the LM Agreement or in two or more equal instalments over the three months period commencing on the effective date of termination of Mr. Morris’ engagement, with the first such instalment payable within five business days from such effective date. Absent a Change of Control, Mr. Morris’ engagement under the LM Agreement may be terminated by the Company or by Mr. Morris, respectively, without cause, upon 90 days written notice to Mr. Morris or the Company, as the case may be.

For purposes of the LM Agreement, “Change of Control” means the occurrence of any of the following events: (a) any Person acquiring fifty percent (50%) or more of the issued and outstanding shares of the Company; or (b) any Person acquiring all or substantially all of the assets of the Company, provided that for the purposes of the definition of Change of Control in the LM Agreement, “Person” means a third party that is operating at arm's length from Mr. Morris. For greater certainty, “Person” shall not include any person, partnership, corporation or other entity with which Mr. Morris is involved directly or indirectly as principal, agent, shareholder of more than 2% of such entity’s voting securities, officer, employee or in any other manner whatsoever.

12

DIRECTOR COMPENSATION

Director Compensation Table

Other than compensation paid to the Named Executive Officers, and except as noted below, no compensation was paid to directors in their capacity as directors of the Company or its subsidiaries, in their capacity as members of a committee of the Board or of a committee of the board of directors of its subsidiaries, or as consultants or experts, during the year ended December 31, 2018.

|

Name |

Fees Earned ($) |

Share-Based Awards ($) |

Option-Based Awards ($)(3) |

Non-Equity Incentive Plan Compensation ($) |

Pension Value ($) |

All other Compensation ($) |

Total ($)

|

| John (Jack) McCleary | 17,000(1)(2) | Nil | 55,780(5)(6)(7) | Nil | Nil | Nil | 72,780 |

| Gerald G. Carlson | 12,000(1) | Nil | 44,280(5)(7)(8) | Nil | Nil | Nil | 56,280 |

| Mark T. Brown | 17,000(1)(2) | Nil | 18,280(5)(6) | Nil | Nil | Nil | 35,280 |

| William J. Worrall | 12,000(1) | Nil | 80,750(5)(6)(8) | Nil | Nil | Nil | 92,750 |

| Elaine Ellingham | 12,000(1) | Nil | 168,000(4) | Nil | Nil | Nil | 180,000 |

| (1) | Director’s fees. |

| (2) | Audit and Compensation Committee Chair fee. |

| (3) | Comprised of options granted pursuant to the Company’s Stock Option Plan. All options vested upon grant. |

| (4) | The value of option-based awards is based on the fair value of the awards ($0.42) calculated at the March 29, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.94%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 55.10% and an estimated option life of 3 years. |

| (5) | The value of option-based awards is based on the fair value of the awards ($0.29) calculated at the June 18, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.85%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 51.53% and an estimated option life of 2 years. |

| (6) | The value of option-based awards is based on the fair value of the awards ($0.21) calculated at the August 15, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 2.09%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 48.39% and an estimated option life of 2 years. |

| (7) | The value of option-based awards is based on the fair value of the awards ($0.25) calculated at the September 26, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 2.19%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 47.93% and an estimated option life of 2 years. |

| (8) | The value of option-based awards is based on the fair value of the awards ($0.24) calculated at the December 13, 2018 grant date using the Black-Scholes model assuming a weighted average risk free rate of 1.89%, a dividend yield of 0%, a weighted average volatility of the Company’s share price of 49.38% and an estimated option life of 2 years. |

13

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth for each of the directors of the Company, other than directors who are also Named Executive Officers, all option-based awards and share-based awards outstanding at December 31, 2018.

| Option-Based Awards | Share-Based Awards | ||||||

|

Name |

Number of Securities Underlying Unexercised Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Value of Unexercised In-the-Money Options(1) ($) |

Number of Incentives that have not Vested (#) |

Market or Payout Value of Incentives that have not Vested ($) |

Market or Payout Value of Vested Share-based awards not paid out or distributed ($) |

| John (Jack) McCleary | 207,000 | 1.35 | March 17, 2019 | Nil | |||

| 25,000 | 1.99 | May 4, 2019 | Nil | ||||

| 100,000 | 0.98 | June 8, 2020 | Nil | N/A | N/A | N/A | |

| 100,000 | 1.25 | September 30, 2020 | Nil | ||||

| 68,000 | 0.83 | September 30, 2020 | 5,440 | ||||

| 50,000 | 0.79 | September 30, 2020 | 6,000 | ||||

| Gerald G. Carlson | 50,000 | 1.04 | January 2, 2019 | Nil | |||

| 50,000 | 1.34 | July 2, 2019 | Nil | ||||

| 25,000 | 1.99 | May 4, 2019 | Nil | N/A | N/A | N/A | |

| 115,000 | 1.40 | September 19, 2019 | Nil | ||||

| 50,000 | 0.98 | June 8, 2020 | Nil | ||||

| 100,000 | 1.25 | September 30, 2020 | Nil | ||||

| 50,000 | 0.79 | September 30, 2020 | 6,000 | ||||

| 72,000 | 0.86 | December 13, 2020 | 3,600 | ||||

| Mark T. Brown | 25,000 | 1.04 | January 2, 2019 | Nil | |||

| 25,000 | 1.99 | May 4, 2019 | Nil | ||||

| 117,000 | 1.34 | July 2, 2019 | Nil | N/A | N/A | N/A | |

| 115,000 | 1.40 | September 19, 2019 | Nil | ||||

| 100,000 | 1.14 | April 30, 2020 | Nil | ||||

| 50,000 | 0.98 | June 8, 2020 | Nil | ||||

| 100,000 | 1.25 | September 30, 2020 | Nil | ||||

| 18,000 | 0.83 | September 30, 2020 | 1,440 | ||||

| William J. Worrall | 115,000 | 1.40 | September 19, 2019 | Nil | |||

| 250,000 | 0.98 | June 8, 2020 | Nil | ||||

| 100,000 | 1.25 | September 30, 2020 | Nil | N/A | N/A | N/A | |

| 5,000 | 0.83 | September 30, 2020 | 400 | ||||

| 30,000 | 0.86 | December 13, 2020 | 1,500 | ||||

| Elaine Ellingham | 400,000 | 1.08 | March 29, 2021 | Nil | N/A | N/A | N/A |

(1) Calculated based on the difference between the market value of the shares underlying the options as at December 31, 2018 ($0.91) and the exercise price of the options.

14

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth for each director of the Company, other than directors who are also Named Executive Officers, the value of option-based awards and share-based awards which vested during the year ended December 31, 2018 and the value of non-equity incentive plan compensation earned during the most recently completed financial year.

|

Name |

Option-Based Awards-Value Vested During the Year $ |

Share-Based-Awards-Value Vested During the Year $ |

Non-Equity Incentive Plan Compensation–Value Earned During the Year $ |

| John (Jack) McCleary | 2,000(1) | N/A | N/A |

| Gerald G. Carlson | 2,000(1) | N/A | N/A |

| Mark T. Brown | Nil | N/A | N/A |

| William J. Worrall | Nil | N/A | N/A |

| Elaine Ellingham | Nil | N/A | N/A |

| (1) | Calculated based on the difference between the market value of the shares underlying the options as at September 26, 2018 ($0.83) and the exercise price of the options ($0.79). |

15