UNITED STATES

SECURITIES AND EXCHANGE COMMISION

Washington, D.C. 20549

FORM 20-F

| ( ) | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| (X) | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 |

OR

| ( ) | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ( ) | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from _____________________ to ____________________

Commission file number 001-32702

ALMADEN MINERALS LTD.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

1333 Johnston Street, #210, Vancouver, British Columbia V6H 3R9

(Address of principal executive offices)

Korm Trieu, ktrieu@almadenminerals.com, 1333 Johnston Street, #210, Vancouver, BC V6H 3R9

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Name of each exchange on which registered | |||

| Common Stock without Par Value | NYSE MKT |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

102,199,625

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

( ) Yes ( X ) No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

( ) Yes ( X ) No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

( X ) Yes ( ) No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

( ) Yes ( ) No

As a foreign private issuer that prepares its financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), the Registrant has not previously been required to submit to the SEC and post on its corporate website Interactive Data Files (as defined by Item 11 of Regulation S-T) pursuant to Rule 405 of Regulation S-T. This requirement will now apply to the Company for this its first annual report for a fiscal period ending on or after December 15, 2017.

Indicate by check mark weather the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ( ) | Accelerated filer (X) | Non-accelerated filer ( ) | Emerging Growth Company (X) |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ( )

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ( ) | International Financial Reporting Standards as issued (X) | Other ( ) |

| by the International Accounting Standards Board |

| 2 |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

( ) Item 17 ( ) Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

( ) Yes ( X ) No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

( ) Yes ( ) No

| 3 |

TABLE OF CONTENTS

| 4 |

Glossary of Geologic and Mining Terms

Adularia: A colourless, moderate to low-temperature variety of orthoclase feldspar typically with a relatively high barium content. It is a prominent constituent of low sulphidation epithermal veins.

Alkalic Intrusive: An igneous rock emplaced below ground level in which the feldspar is dominantly sodic and or potassic.

Alkalinity: The chemical nature of solutions characterized by a high concentration of hydroxyl ions.

Alteration: Usually referring to chemical reactions in a rock mass resulting from the passage of hydrothermal fluids.

Andesite: A dark-coloured, fine-grained extrusive rock that, when porphyritic, contains phenocrysts composed primarily of zoned sodic plagioclase (esp. andesine) and one or more of the mafic minerals (eg. Biotite, horn-blende, pyroxene), with a ground-mass composed generally of the same minerals as the phenocrysts; the extrusive equivalent of diorite. Andesite grades into latite with increasing alkali feldspar content, and into dacite with more alkali feldspar and quartz. It was named by Buch in 1826 from the Andes Mountains, South America.

Anomalous: A geological feature, often subsurface, distinguished by geological, geochemical or geophysical means, which is detectably different than the general surroundings and is often of potential economic value.

Anomaly: Any concentration of metal noticeably above or below the average background concentration.

Argillic: A form of alteration characterized by the alteration of original minerals to clays.

Arsenopyrite: A sulphide of arsenic and iron with the chemical composition FeAsS.

Assay: An analysis to determine the presence, absence or quantity of one or more components.

Axis: An imaginary hinge line about which the fold limbs are bent. The axis of a fold can be at the top or bottom of the fold, can be tilted or horizontal.

Batholith: An intrusion, usually granitic, which has a large exposed surface area and no observable bottom. Usually associated with orogenic belts.

Breccia: Rock consisting of more or less angular fragments in a matrix of finer-grained material or cementing material.

Brecciated: Rock broken up by geological forces.

Bulk sample: A very large sample, the kind of sample to take from broken rock or of gravels and sands when testing placer deposits.

Calc-silicate: Calcium-bearing silicate minerals. These minerals are commonly formed as a result of the interaction of molten rock and its derived, hot hydrothermal fluids with very chemically reactive calcium carbonate (limestone). Calc-silicate minerals include garnet, pyroxene, amphibole and epidote. These minerals are commonly described as skarn and are genetically and spatially associated with a wide range of metals

Chert: A very fine grained siliceous rock. Many limestones contain nodules and thin lenses of chert.

Chip sample: A sample composed of discontinuous chips taken along a surface across a given line.

Claim: That portion of public mineral lands, which a party has staked or marked out in accordance with provincial or state mining laws, to acquire the right to explore for the minerals under the surface.

| 5 |

Clastic: Consisting of rock material that has been mechanically derived, transported, and deposited. Such material is also called detrital.

Cleavage: The tendency of a crystal to split, or break, along planes of structural weakness.

Concordant Bodies: Intrusive igneous bodies whose contacts are parallel to the bedding of the intruded rock.

Conglomerate: Rock composed of mostly rounded fragments which are of gravel size or larger in a finer grained matrix.

Craton: A central stable region common to nearly all continents and composed chiefly of highly metamorphosed Precambrian rocks.

Cretaceous: Geological time period between 136 and 64 million years ago.

Crystalline: Means the specimen is made up of one or more groups of crystals.

Cut-off grade: The minimum grade of mineralization used to establish quantitative and qualitative estimates of total mineralization.

Dacite: A fine grained acid volcanic rock, similar to rhyolite in which the feldspar is predominantly plagioclase.

Degradation: The ongoing process of erosion in a stream.

Diagenesis: The changes that occur in a sediment during and after lithification. These changes include compaction, cementation, replacement, and recrystallization.

Diamond drill: A type of rotary drill in which the cutting is done by abrasion using diamonds embedded in a matrix rather than by percussion. The drill cuts a core of rock which is recovered in long cylindrical sections.

Dilution: Results from the mixing in of unwanted gangue or waste rock with the ore during mining.

Dip: Geological measurement of the angle of maximum slope of planar elements in rocks. Can be applied to beddings, jointing, fault planes, etc.

Discordant Bodies: Intrusive igneous bodies whose contacts cut across the bedding, or other pre-existing structures, to the intruded rock.

Disseminated deposit: Deposit in which the mineralization is scattered through a large volume of host rock, sometimes as separate mineral grains, or sometimes along joint or fault surfaces.

Dyke: A tabular, discordant, intrusive igneous body.

Earn in: The right to acquire an interest in a property pursuant to an Option Agreement.

Ejecta: Pyroclastic material thrown out or ejected by a volcano. It includes ash, volcanic bombs, and lapilli.

Epithermal: Epithermal deposits are a class of ore deposits that form generally less than 1 km from surface. These deposits, which can host economic quantities of gold, silver, copper, lead and zinc are formed as a result of the precipitation of ore minerals from up-welling hydrothermal fluids. There are several classes of epithermal deposits that are defined on the basis of fluid chemistry and resulting alteration and ore mineralogy. Fluid chemistry is largely controlled by the proximity to igneous intrusive rocks and as a result igneous fluid content.

Extrusive Rock: Igneous rock that has solidified on the earth’s surface from volcanic action.

Fault: A fracture in a rock where there had been displacement of the two sides.

| 6 |

Faults: Breaks in rocks with noticeable movement or displacement of the rocks on either side of the break.

Feldspar: A group of aluminum silicate minerals closely related in chemical composition and physical properties. There are two major chemical varieties of feldspar: the potassium aluminum, or potash, feldspars and the sodium-calcium-aluminum, or plagioclase, feldspars. The feldspars possess a tetrahedral framework of silicon and oxygen, with the partial substitution of aluminum for the silicon. They make up about 60 percent of the earth’s crust.

Felsic: Light colored silicate minerals, mainly quartz and feldspar, or an igneous rock comprised largely of felsic minerals (granite, rhyolite).

Fluid inclusion: Fluid inclusions are "bubbles" of fluid trapped within the host mineral during its deposition from its parent hydrothermal fluid. They are tiny remnants of the exact fluid from which the host mineral and its associated ore minerals deposited and they provide direct information about the fluid composition, temperature and pressure at which the hydrothermal deposit formed.

Folds: Are flexures in bedded or layered rocks. They are formed when forces are applied gradually to rocks over a long period of time.

Fracture: Breaks in a rock, usually due to intensive folding or faulting.

Gangue: Term used to describe worthless minerals or rock waste mixed in with the valuable minerals.

Geochemical Anomaly: An area of elevated values of a particular element in soil or rock samples collected during the preliminary reconnaissance search for locating favourable metal concentrations that could indicate the presence of surface or drill targets.

Geochemistry: The study of the chemistry of rocks, minerals, and mineral deposits.

Geophysics: The study of the physical properties of rocks, minerals, and mineral deposits.

Gouge: The finely ground rock that results from the abrasion along a fault surface.

Grade: The concentration of each ore metal in a rock sample, usually given as weight percent. Where extremely low concentrations are involved, the concentration may be given in grams per tonne (g/t) or ounces per ton (oz/t). The grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from throughout the deposit.

Granite: A coarse grained, plutonic igneous rock that is normally pale pink, pale pink-brown, or pale grey, and composed of quartz, alkali feldspar, micas and accessory minerals.

Granodiorite: A course grained, plutonic igneous rock that is normally pale grey, and composed of quartz, calc-alkali feldspar, micas and accessory minerals.

Grid: A network composed of two sets of uniformly spaced parallel lines, usually intersecting at right angles and forming squares, superimposed on a map, chart, or aerial photograph, to permit identification of ground locations by means of a system or coordinates and to facilitate computation of direction and distance and size of geologic, geochemical or geophysical features.

Hectare: A square of 100 meters on each side.

Host rock: The rock within which the ore deposit occurs.

Hydrothermal: Of or pertaining to hot water, to the action of hot water, or to the products of this action, such as a mineral deposit precipitated from a hot aqueous solution; also, said of the solution itself. “Hydrothermal” is generally used for any hot water, but has been restricted by some to water of magmatic origin.

| 7 |

Igneous: Means a rock formed by the cooling of molten silicate material.

Induced polarization (I.P.) method: The method used to measure various electrical responses to the passage of alternating currents of different frequencies through near-surface rocks or to the passage of pulses of electricity.

Intermediate: An igneous rock made up of both felsic and mafic minerals (diorite).

Intrusion: General term for a body of igneous rock formed below the surface.

Intrusive Rock: Any igneous rock solidified from magma beneath the earth’s surface.

Joint venture agreement: An agreement where the parties agree to the terms on which a property will be jointly explored, developed, and mined. (See also “Option agreement” and “Earn in”).

Jurassic: Geological time period between 195 and 136 million years ago.

Kriging: (a) A statistical technique employed in calculating grade and tonnage of ore reserves from sampling data. The data are handled by computer. (b) A technique for interpolating which honors data points exactly. An output point is calculated as a linear combination of known data points. Kriging attempts to produce the best linear unbiased estimate. Used to interpolate between drill holes.

K-silicate: Potassium-bearing silicates. Potassium silicates are very common rock-forming minerals, however they are also formed by the interaction of hydrothermal fluids derived from the cooling intrusive rocks that are genetically and spatially associated with porphyry and epithermal deposits. Potassium feldspar (orthoclase) and potassium mica (biotite) are both commonly closely associated with copper-molybdenum ore in porphyry copper deposits.

K-spar: Potassium feldspar.

Lava: Means an igneous rock formed by the cooling of molten silicate material which escapes to the earth’s surface or pours out onto the sea floor.

Limestone: Sedimentary rock that is composed mostly of carbonates, the two most common of which are calcium and magnesium carbonates.

Lithosphere: The crust and upper mantle, located above the asthenosphere and composing the rigid plates.

Mafic: A general term used to describe ferromagnesian minerals. Rocks composed mainly of ferromagnesian minerals are correctly termed melanocratic.

Magma: Naturally occurring molten rock material, generated within the earth and capable of intrusion and extrusion, from which igneous rocks have been derived through solidification and related processes. It may or may not contain suspended solids (such as crystals and rock fragments) and/or gas phases.

Massive: Implies large mass. Applied in the context of hand specimens of, for example, sulphide ores, it usually means the specimen is composed essentially of sulphides with few, if any, other constituents.

Metamorphic: Means any rock which is altered within the earth’s crust by the effects of heat and/or pressure and/or chemical reactions. Pertains to the process of metamorphism or to its results.

Metasediment: A sediment or sedimentary rock that shows evidence of having been subjected to metamorphism.

Metavolcanic: An informal term for volcanic rocks that show evidence of having been subject to metamorphism.

Mineral claim: A legal entitlement to minerals in a certain defined area of ground.

| 8 |

Mineral Deposit or Mineralized Material: A mineralized underground body which has been intersected by sufficient closely spaced drill holes and/or underground sampling to support sufficient tonnage and average grade of metal(s) to warrant further exploration-development work. This deposit does not qualify as a commercially mineable ore body (Reserves), as prescribed under Commission standards, until a final and comprehensive economic, technical, and legal feasibility study based upon the test results is concluded.

Mineral: A naturally occurring, inorganic, solid element or compound that possesses an orderly internal arrangement of atoms and a unique set of physical and chemical properties.

Mineralization: Usually implies minerals of value occurring in rocks.

National Instrument 43-101 or NI 43-101: A rule developed by the Canadian Securities Administrators and administered by the provincial securities commissions that govern how issuers disclose scientific and technical information about their mineral projects to the public. It covers oral statements as well as written documents and websites. It requires that all disclosure be based on advice by a “qualified person” and in some circumstances that the person be independent of the issuer and the property.

Net profits interest: A contractual granted right to some portion of the profits after deduction of expenses sometimes expressed as a form of royalty.

Net smelter returns: Means the amount actually paid to the mine or mill owner from the sale of ore, minerals and other materials or concentrates mined and removed from mineral properties. A royalty based on net smelter returns usually provides cash flow that is free of any operating or capital costs and environmental liabilities.

Option agreement: An agreement where the optionee can exercise certain options to acquire or increase an interest in a property by making periodic payments or share issuances or both to the optionor or by exploring, developing or producing from the optionor’s property or both. Usually upon the acquisition of such interest, unless it is a 100% interest, all operations thereafter are on a joint venture basis.

Ordinary kriging: The basic technique of kriging and uses a weighted average of neighboring samples to estimate the 'unknown' value at a given location. Weights are optimized using the semi-variogram model, the location of the samples and all the relevant inter-relationships between known and unknown values. The technique also provides a "standard error" which may be used to quantify confidence levels.

Ore: A natural aggregate of one or more minerals which may be mined and sold at a profit, or from which some part may be profitably separated.

Ore reserve: The measured quantity and grade of all or part of a mineralized body in a mine or undeveloped mineral deposit for which the mineralization is sufficiently defined and measured on three sides to form the basis of at least a preliminary mine production plan for economically viable mining.

Orogeny: The process of forming mountains by folding and thrusting.

Outcrop: An in situ exposure of bedrock.

Overburden: A general term for any material covering or obscuring rocks from view.

oz/t or opt: Ounces per ton.

Paleozoic: An era of geologic time, from the end of the Precambrian to the beginning of the Mesozoic, or from about 570 to about 225 million years ago.

Phenocrysts: An unusually large crystal in a relatively finer grained matrix.

Pluton: Term for an igneous intrusion, usually formed from magma.

Porphyry: An igneous rock composed of larger crystals set within a finer ground mass.

| 9 |

Pyroclastic rock: A rock of volcanic origin consisting of highly variable mixture of rock fragments, cinders and ashes and bits of crystals and glass.

Quartz monzonite: A course grained, plutonic igneous rock that is normally pale pink, and composed of quartz, alkali feldspar, micas and accessory minerals.

Rare Earth: A group of rare metallic chemical elements with consecutive atomic numbers of 57 to 71.

Reclamation bond: A bond usually required by governmental mining regulations when mechanized work on a property is contemplated. Proceeds of the bond are used to reclaim any workings or put right any damage if reclamation undertaken does not satisfy the requirements of the regulations.

Reserve: That part of a mineral deposit which could be economically extracted or produced at the time of the reserve determination.

Reserves: A natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit, or from which some part may be profitably separated.

Reverse circulation drill: A rotary percussion drill in which the drilling mud and cuttings return to the surface through the drill pipe.

Rhyolite: The fine grained equivalent of granite.

Royalty interest: A royalty, the calculation and payment of which is tied to some production unit such as ton of concentrate or ounce of gold or silver produced. A common form of royalty interest is based on the net smelter return.

Sample: Small amount of material that is supposed to be absolutely typical or representative of the object being sampled.

Sandstone: Composed of sand-sized fragments cemented together. As a rule the fragments contain a high percentage of quartz.

Sedimentary: A rock formed from cemented or compacted sediments.

Sediments: Are composed of the debris resulting from the weathering and breakup of other rocks that have been deposited by or carried to the oceans by rivers, or left over from glacial erosion or sometimes from wind action.

Selvage: A marginal zone, as in a dyke or vein, having some distinctive feature of fabric or composition.

Sericite: A fine-grained variety of mica occurring in small scales, especially in schists.

Shale: An argillaceous rock consisting of silt or clay-sized particles cemented together. Most shales are quite soft, because they contain large amounts of clay minerals.

Silicate: Most rocks are made up of a small number of silicate minerals ranging from quartz (SiO2) to more complex minerals such as orthoclase feldspar (KAlSi3O8) or hornblende (Ca2Na(Mg,Fe)4(Al,Fe,Ti)Si8)22(OH)2).

Sill: Tabular intrusion which is sandwiched between layers in the host rock.

Skarn: A thermally altered impure limestone in which material has been added to the original rock. Skarns are generally characterized by the presence of calcium and silica rich minerals. Many skarns contain sulphide minerals which in some cases can be of economic value.

| 10 |

Stock: An igneous intrusive body of unknown depth with a surface exposure of less than 104 square kilometres. The sides, or contacts, of a stock, like those of a batholith, are usually steep and broaden with depth.

Stockwork: A mineral deposit consisting of a three-dimensional network of closely spaced planar or irregular veinlets.

Strike: The bearing, or magnetic compass direction, of an imaginary line formed by the intersection of a horizontal plane with any planar surface, most commonly with bedding planes or foliation planes in rocks.

Sulphide minerals: A mineral compound characterized by the linkage of sulfur with a metal or semimetal; e.g., galena.

Syncline: A fold in which the bed has been forced down in the middle or up on the sides to form a trough.

Tailings: Material rejected from a mill after recoverable valuable minerals have been extracted.

Tailings pond: A pond where tailings are disposed of.

Tonne: Metric ton – 1,000 kilograms – equivalent to 1.1023 tons.

Triassic: Geological time period between 225 and 195 million years ago.

Tuff: A finer grained pyroclastic rock made up mostly of ash and other fine grained volcanic material.

Veins: The mineral deposits that are found filling openings in rocks created by faults or replacing rocks on either side of faults.

Vuggy silica: In a high sulphidation epithermal environment, the highly acidic waters have dissolved everything but silica resulting in a highly porous and pox marker rock which is a good host for gold deposition. It is an indicator mineralization typical of epithermal rocks.

Waste: Rock which is not ore. Usually referred to that rock which has to be removed during the normal course of mining in order to get at the ore.

Glossary of Abbreviations

Ag: Silver

Ag g/t: Silver grade measured in grams per metric ton

Converts to ounces per ton by dividing by 34.286

Au: Gold

Au g/t: Gold grade measured in grams per metric ton

Converts to ounces per ton by dividing by 34.286

Cu: Copper

g/t: grams per tonne

IP: Induced Polarization geophysical survey

masl: meters above sea level

NSR: net smelter returns royalty

Oz: Troy ounce

QA/QC: Quality Assurance/Quality Control

tpd: Tonnes per day

ton: Short ton (2,000 pounds)

tonne: Metric ton (1000 kilograms - 2204.62 pounds)

| 11 |

NOTES CONCERNING TERMINOLOGY RELATED TO RESOURCES AND RESERVES

Please see “CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES,” below.

The terms "mineral resource", "measured mineral resource", "indicated mineral resource", "inferred mineral resource", “mineral reserve”, “probable mineral reserve” and “proven mineral reserve” used in this Annual Report are Canadian mining terms as defined in accordance with National Instrument 43-101 (“NI 43-101”), Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council. On November 14, 2004, November 27, 2010 and May 10, 2014, CIM Council adopted an update to the CIM Definition Standards to reflect the more detailed guidance available and effect certain editorial changes required to maintain consistency with current regulations. This version of the CIM Definition Standards includes further editorial changes required to maintain compatibility with the new version of National Instrument 43-101 which became Canadian law in 2011. The CIM Definition Standards can be viewed on the CIM website at www.cim.org. In accordance with Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, issued by the U. S. Securities and Exchange Commission (the “Commission”), a reserve is termed a “mineral deposit”.

Definitions

Qualified Person

Mineral Resource and Mineral Reserve estimates and resulting technical reports under NI 43-101 must be prepared by or under the direction of, and dated and signed by, a Qualified Person. A “Qualified Person” means an individual who is an engineer or geoscientist with a university degree, or equivalent accreditation, with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association. The Qualified Person(s) should be clearly satisfied that they could face their peers and demonstrate competence and relevant experience in the commodity, type of deposit and situation under consideration. If doubt exists, the person must either seek or obtain opinions from other colleagues or demonstrate that he or she has obtained assistance from experts in areas where he or she lacked the necessary expertise. Determination of what constitutes relevant experience can be a difficult area and common sense has to be exercised. For example, in estimating Mineral Resources for vein gold mineralization, experience in a high-nugget, vein-type mineralization such as tin, uranium etc. should be relevant whereas experience in massive base metal deposits may not be. As a second example, for a person to qualify as a Qualified Person in the estimation of Mineral Reserves for alluvial gold deposits, he or she would need to have relevant experience in the evaluation and extraction of such deposits. Experience with placer deposits containing minerals other than gold, may not necessarily provide appropriate relevant experience for gold. In addition to experience in the style of mineralization, a Qualified Person preparing or taking responsibility for Mineral Resource estimates must have sufficient experience in the sampling, assaying, or other property testing techniques that are relevant to the deposit under consideration in order to be aware of problems that could affect the reliability of the data. Some appreciation of extraction and processing techniques applicable to that deposit type might also be important.

Estimation of Mineral Resources is often a team effort, for example, involving one person or team collecting the data and another person or team preparing the Mineral Resource estimate. Within this team, geologists usually occupy the pivotal role. Estimation of Mineral Reserves is almost always a team effort involving a number of technical disciplines, and within this team mining engineers have an important role. Documentation for a Mineral Resource and Mineral Reserve estimate must be compiled by, or under the supervision of, a Qualified Person(s), whether a geologist, mining engineer or member of another discipline. It is recommended that, where there is a clear division of responsibilities within a team, each Qualified Person should accept responsibility for his or her particular contribution. For example, one Qualified Person could accept responsibility for the collection of Mineral Resource data, another for the Mineral Reserve estimation process, another for the mining study, and the project leader could accept responsibility for the overall document. It is important that the Qualified Person accepting overall responsibility for a Mineral Resource and/or Mineral Reserve estimate and supporting documentation, which has been prepared in whole or in part by others, is satisfied that the other contributors are Qualified Persons with respect to the work for which they are taking responsibility and that such persons are provided adequate documentation.

| 12 |

Preliminary Economic Assessment (PEA)

A study, other than a Pre-Feasibility or Feasibility Study, that includes an economic analysis of the potential viability of mineral resources.

Preliminary Feasibility Study (Pre-Feasibility Study)

The CIM Definition Standards requires the completion of a Preliminary Feasibility Study as the minimum prerequisite for the conversion of Mineral Resources to Mineral Reserves.

A Preliminary Feasibility Study is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on mining, processing, metallurgical, economic, marketing, legal, environmental, social and governmental considerations and the evaluation of any other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve.

Feasibility Study

A Feasibility Study is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of realistically assumed mining, processing, metallurgical, economic, marketing, legal, environmental, social and governmental considerations together with any other relevant operational factors and detailed financial analysis, that are necessary to demonstrate at the time of reporting that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a Pre-Feasibility Study.

Exploration Information

Exploration information means geological, geophysical, geochemical, sampling, drilling, trenching, analytical testing, assaying, mineralogical, metallurgical and other similar information concerning a particular property that is derived from activities undertaken to locate, investigate, define or delineate a mineral prospect or mineral deposit. It is recognized that in the review and compilation of data on a project or property, previous or historical estimates of tonnage and grade, not meeting the minimum requirement for classification as Mineral Resource, may be encountered. If a Qualified Person reports Exploration Information in the form of tonnage and grade, it must be clearly stated that these estimates are conceptual or order of magnitude and that they do not meet the criteria of a Mineral Resource.

Mineral Resource

Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource. A Mineral Resource is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. The term Mineral Resource covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which Mineral Reserves may subsequently be defined by the consideration and application of technical, economic, legal, environmental, socio-economic and governmental factors. The phrase “reasonable prospects for economic extraction” implies a judgment by the Qualified Person in respect of the technical and economic factors likely to influence the prospect of economic extraction. A Mineral Resource is an inventory of mineralization that under realistically assumed and justifiable technical and economic conditions might become economically extractable. These assumptions must be presented explicitly in both public and technical reports.

| 13 |

Inferred Mineral Resource

An “Inferred Mineral Resource” is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. Due to the uncertainty that may be attached to Inferred Mineral Resources, it cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. Confidence in the estimate is insufficient to allow the meaningful application of technical and economic parameters or to enable an evaluation of economic viability worthy of public disclosure. Inferred Mineral Resources must be excluded from estimates forming the basis of feasibility or other economic studies.

Indicated Mineral Resource

An “Indicated Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. Mineralization may be classified as an Indicated Mineral Resource by the Qualified Person when the nature, quality, quantity and distribution of data are such as to allow confident interpretation of the geological framework and to reasonably assume the continuity of mineralization. The Qualified Person must recognize the importance of the Indicated Mineral Resource category to the advancement of the feasibility of the project. An Indicated Mineral Resource estimate is of sufficient quality to support a Preliminary Feasibility Study which can serve as the basis for major development decisions.

Measured Mineral Resource

A “Measured Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. Mineralization or other natural material of economic interest may be classified as a Measured Mineral Resource by the Qualified Person when the nature, quality, quantity and distribution of data are such that the tonnage and grade of the mineralization can be estimated to within close limits and that variation from the estimate would not significantly affect potential economic viability. This category requires a high level of confidence in, and understanding of, the geology and controls of the mineral deposit.

Mineral Reserve

Mineral Reserves are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. A Probable Mineral Reserve has a lower level of confidence than a Proven Mineral Reserve.

A Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. Mineral Reserves are those parts of Mineral Resources which, after the application of all mining factors, result in an estimated tonnage and grade which, in the opinion of the Qualified Person(s) making the estimates, is the basis of an economically viable project after taking account of all relevant processing, metallurgical, economic, marketing, legal, environment, socio-economic and government factors. Mineral Reserves are inclusive of diluting material that will be mined in conjunction with the Mineral Reserves and delivered to the treatment plant or equivalent facility. The term “Mineral Reserve” need not necessarily signify that extraction facilities are in place or operative or that all governmental approvals have been received. It does signify that there are reasonable expectations of such approvals.

| 14 |

Probable Mineral Reserve

A “Probable Mineral Reserve” is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

Proven Mineral Reserve

A “Proven Mineral Reserve” is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. Application of the Proven Mineral Reserve category implies that the Qualified Person has the highest degree of confidence in the estimate with the consequent expectation in the minds of the readers of the report. The term should be restricted to that part of the deposit where production planning is taking place and for which any variation in the estimate would not significantly affect potential economic viability.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

As used in this Annual Report on Form 20-F, the terms “Mineral Reserve,” “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms defined in accordance with NI 43-101 and the CIM Standards. These definitions differ from the definitions in SEC Industry Guide 7 under the U.S. Securities Act. Under SEC Industry Guide 7, a reserve is defined as that part of a mineral deposit which could be economically and legally extracted or produced at the time the reserve determination is made. The terms “Mineral Resource,” “Measured Mineral Resource,” “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be used by NI 43-101. However, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all, or any part, of a mineral deposit in these categories will ever be converted into reserves. “Indicated Mineral Resource” and “Inferred Mineral Resource” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an Indicated Mineral Resource or an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of Feasibility or Preliminary Feasibility studies, except in rare cases. Investors are cautioned not to assume that all, or any part, of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations. However, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this Annual Report on Form 20-F and the exhibits filed herewith or incorporated by reference herein contain descriptions of mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under U.S. federal securities laws and the rules and regulations promulgated thereunder. Further, the term “mineralized material” as used in this Annual Report on Form 20-F does not indicate “reserves” by SEC standards. We cannot be certain that mineralized material will ever be confirmed or converted into SEC Industry Guide 7 compliant "reserves". Investors are cautioned not to assume that mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

Conversion Table

Metric / Imperial

1.0 millimeter (mm) = 0.039 inches (in)

1.0 meter (m) = 3.28 feet (ft)

1.0 kilometer (km) = 0.621 miles (mi)

1.0 hectare (ha) = 2.471 acres (ac)

1.0 gram (g) = 0.032 troy ounces (oz)

1.0 metric tonne (t) = 1.102 short tons (ton)

1.0 g/t = 0.029 oz/ton

Unless otherwise indicated, all dollar ($) amounts referred to herein are in Canadian dollars.

| 15 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this Annual Report on Form 20-F of the Registrant, Almaden Minerals Ltd. (“Almaden” or the “Company”), and the exhibits attached hereto that are not historical facts are forward-looking statements within the meaning of U.S. and Canadian securities legislation and the U.S. Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. Such forward-looking statements include, but are not limited to, statements with respect to anticipated results and developments in the Company’s operations, planned exploration and development of the Company’s properties, plans related to the Company’s business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Statements concerning Mineral Reserve and Mineral Resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if a property is developed, and in the case of Mineral Reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” (or the negative and grammatical variations of any of these terms and similar expressions) be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements and forward-looking information are based, in part, on assumptions and factors that may change and are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results, performance or achievements of the Company to differ materially from those expressed or implied by the forward-looking statements and forward-looking information. Some of the important risks, uncertainties and other factors that could affect forward-looking statements and forward-looking information include, but are not limited to, those described further in the sections entitled “ITEM 3. KEY INFORMATION - Risk Factors”, “ITEM 4. INFORMATION ON THE COMPANY - Business Overview”, “ITEM 4. INFORMATION ON THE COMPANY – Principal Property Interests” and “ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS” and in the exhibits attached to this Annual Report on Form 20-F. Should one or more of these risks, uncertainties and other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the Company’s forward-looking statements or forward-looking information. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and information. The forward-looking statements and forward-looking information are based on beliefs, expectations and opinions of the Company’s management on the date of this Annual Report on Form 20-F and speak only as of the date hereof and the Company does not undertake any obligation to publicly update forward-looking statements or forward-looking information contained herein to reflect events or circumstances after the date hereof, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Forward-looking statements and other information contained herein concerning the mining industry and the Company’s expectations concerning the mining industry are based on estimates prepared by the Company using data from publicly available sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which the Company believes to be reasonable. However, this data is inherently imprecise, although generally indicative of relative market positions, market shares and performance characteristics. While the Company is not aware of any misstatements regarding any mining industry data presented herein, the industry involves risks and uncertainties and is subject to change based on various factors.

Certain historical and forward-looking information contained in this Annual Report on Form 20-F has been provided by, or derived from information provided by, certain persons other than the Company. Although the Company does not have any knowledge that would indicate that any such information is untrue or incomplete, the Company assumes no responsibility for the accuracy and completeness of such information or the failure by such other persons to disclose events which may have occurred or may affect the completeness or accuracy of such information, but which is unknown to the Company.

Please consult the Company’s public filings at www.sec.gov for further, more detailed information concerning these matters.

| 16 |

PART I

Item 1. Identity of Directors, Senior Management and Advisors

Not applicable

Item 2. Offer Statistics and Expected Timetable

Not applicable

The following selected financial data of the Company for Fiscal 2017, Fiscal 2016 and Fiscal 2015 ended December 31st was derived from the consolidated financial statements of the Company included elsewhere in this 20-F Annual Report. The selected financial data set forth for Fiscal 2014 and Fiscal 2013 ended December 31st are derived from the Company's audited consolidated financial statements, not included herein. The selected financial data should be read in conjunction with the consolidated financial statements and other information included immediately following the text of this Annual Report.

The consolidated financial statements of the Company have been prepared in accordance and compliance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

The basis of preparation is described in Note 3 of the consolidated financial statements.

Table No. 1

Selected Financial Data

International Financial Reporting Standards (“IFRS”)

(expressed in thousands of Canadian dollars, except share and per share data)

| Year | Year | Year | Year | Year | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| 12/31/2017 | 12/31/2016 | 12/31/2015 | 12/31/2014 | 12/31/2013 | ||||||||||||||||

| Revenues | $ | - | $ | - | $ | - | $ | - | $ | 220 | ||||||||||

| Other Income (loss) | 468 | 444 | 2,711 | (9,496 | ) | - | ||||||||||||||

| Net loss and comprehensive loss | (5,231 | ) | (4,024 | ) | (1,145 | ) | (14,701 | ) | (6,357 | ) | ||||||||||

| Basic net (loss) income per common share | (0.05 | ) | (0.05 | ) | (0.02 | ) | (0.23 | ) | (0.10 | ) | ||||||||||

| Diluted net (loss) income per common share | (0.05 | ) | (0.05 | ) | (0.02 | ) | (0.23 | ) | (0.10 | ) | ||||||||||

| Weighted average shares (000) | 95,873 | 82,323 | 73,249 | 66,331 | 62,055 | |||||||||||||||

| Working capital | 16,065 | 9,293 | 5,808 | 9,172 | 12,676 | |||||||||||||||

| Exploration and evaluation assets | 44,804 | 35,985 | 30,538 | 28,645 | 24,447 | |||||||||||||||

| Net assets | 64,730 | 45,221 | 35,983 | 39,637 | 47,891 | |||||||||||||||

| Total assets | 66,803 | 47,514 | 38,215 | 42,019 | 48,988 | |||||||||||||||

| Capital stock | 118,054 | 95,290 | 83,758 | 87,084 | 81,151 | |||||||||||||||

| Dividends declared per share | - | - | - | - | - | |||||||||||||||

Canadian/U.S. Dollar Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian dollars (CDN$).

| 17 |

Table No. 2 sets forth the exchange rate for the Canadian dollars at the end of the five most recent fiscal periods ended at December 31st, the average rates for the period, the range of high and low rates and the close for the period. Table No. 3 sets forth the range of high and low rates for each month during the previous six months. For purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The table sets forth the number of Canadian Dollars required under that formula to buy one U.S. Dollar. The average rate means the average of the exchange rates on the last day of each month during the period.

Table No. 2

Canadian Dollar/U.S. Dollar Exchange Rates for Five Most Recent Financial Years

| Average | High | Low | Close | |||||||||||||

| Fiscal Year Ended 12/31/2017 | $ | 1.30 | $ | 1.37 | $ | 1.21 | $ | 1.25 | ||||||||

| Fiscal Year Ended 12/31/2016 | 1.32 | 1.46 | 1.25 | 1.34 | ||||||||||||

| Fiscal Year Ended 12/31/2015 | 1.28 | 1.40 | 1.17 | 1.38 | ||||||||||||

| Fiscal Year Ended 12/31/2014 | 1.10 | 1.16 | 1.06 | 1.16 | ||||||||||||

| Fiscal Year Ended 12/31/2013 | 1.03 | 1.07 | 0.98 | 1.06 | ||||||||||||

Table No. 3

Canadian Dollar/U.S. Dollar Exchange Rates for Previous Six Months

| September 2017 | October 2017 | November 2017 | December 2017 | January 2018 | February 2018 | |||||||||||||||||||

| High | $ | 1.25 | $ | 1.29 | $ | 1.29 | $ | 1.29 | $ | 1.25 | $ | 1.28 | ||||||||||||

| Low | 1.21 | 1.25 | 1.27 | 1.25 | 1.23 | 1.23 | ||||||||||||||||||

The exchange rate was CDN$1.29/US$1.00 on March 28, 2018.

Risk Factors

General Risk Factors Attendant to Resource Exploration and Development

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environment protection, the combination of which factors may result in the Company not receiving an adequate return on investment capital.

Presently, the Company is in the exploration and development stage and there is no assurance that a commercially viable ore deposit (a reserve) exists in any of its properties or prospects until further work is done and a comprehensive economic evaluation based upon that work is concluded. The Company has financed its operations principally through the sale of equity securities, entering into joint venture arrangements and the sale of its inventory of gold. The recoverability of mineral properties is dependent on the establishment of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete development and ultimately upon future profitable production or the realization of proceeds from the disposition of the properties.

Uncertainty in Discovering Commercially Mineable Ore Deposits

There is no certainty that the expenditures to be made by the Company in the exploration of its properties as described herein will result in discoveries of mineralized material in commercial quantities. Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of recovery of ore reserves will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short term factors relating to ore reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. There can be no assurance that minerals recovered in small-scale tests will be duplicated in large-scale tests under on-site conditions or in production scale. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

| 18 |

History of Net Losses, Lack of Cash Flow and Assurance of Profitability

The Company had net losses in a number of years since its date of incorporation. Due to the nature of the Company’s business, there can be no assurance that the Company will be profitable. The Company had net losses of $5,231,295 in Fiscal 2017, $4,023,504 in Fiscal 2016, and $1,144,525 in Fiscal 2015.

The Company currently has no revenues from operations as all of its properties and prospects are in the exploration stage. There is no assurance that the Company will receive revenues from operations at any time in the near future. During Fiscal 2017, 2016 and Fiscal 2015, the Company earned interest income and other income from Administrative service fees charged to Almadex Minerals Limited (“Almadex”).

The Company has not paid dividends on its shares since incorporation and the Company does not anticipate doing so in the foreseeable future.

Uncertainty of Obtaining Additional Funding Requirements

If the Company’s exploration and development programs are successful, additional capital will be required for the further development of an economic ore body and to place it in commercial production. The only material sources of future funds presently available to the Company are the sale of its equity capital, the incurring of debt, or the offering by the Company of an interest in its properties and prospects to be earned by another party or parties carrying out further development thereof.

Failure to obtain additional financing on a timely basis could cause the Company to forfeit its interest in such properties, dilute its interests in the properties and/or reduce or terminate its operations.

Possible Dilution to Present and Prospective Shareholders

The Company’s plan of operation, in part, contemplates the financing of the conduct of its business by the issuance, for cash, of equity securities of the Company or incurring debt, or a combination of the two. Any transaction involving the issuance of previously authorized but unissued shares of common stock, or securities convertible into common stock, would result in dilution, possibly substantial, to present and prospective holders of common stock. The Company could also seek joint venture partners or funding sources such as royalties or streaming transactions. These approaches would dilute the Company’s interest in properties it has acquired.

Mineral Prices May Not Support Corporate Profit

The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of mineral resources are developed, a profitable market will exist for the sale of same. Factors beyond the control of the Company may affect the marketability of any substances discovered. The price of minerals is volatile over short periods of time, and is affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining techniques. Material changes in mineral prices may affect the economic viability of any project.

Environmental Regulations

The current and anticipated future operations of the Company, including development activities and commencement of production on its properties, require permits from various federal, territorial and local governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs, and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There can be no assurance, however, that all permits which the Company may require for construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that such laws and regulations, or that new legislation or modifications to existing legislation, would not have an adverse effect on any exploration or mining project which the Company might undertake.

| 19 |

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in exploration and mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations.

The enactment of new laws or amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Environmental

The Company’s exploration and development activities are subject to extensive laws and regulations governing environment protection. The Company is also subject to various reclamation-related conditions. Although the Company closely follows and believes it is operating in compliance with all applicable environmental regulations, there can be no assurance that all future requirements will be obtainable on reasonable terms. Failure to comply may result in enforcement actions causing operations to cease or be curtailed and may include corrective measures requiring capital expenditures. Intense lobbying over environmental concerns by NGOs opposed to mining has caused some governments to cancel or restrict development of mining projects. Current publicized concern over climate change may lead to carbon taxes, requirements for carbon offset purchases or new regulation. The costs or likelihood of such potential issues to the Company cannot be estimated at this time.

No Guarantee of Title to Mineral Properties

While the Company has investigated title to all of its mineral properties and prospects, and, to the best of its knowledge, title to all of its properties and prospects in which it has the right to acquire or earn an interest are in good standing as of the date of this Annual Report, this should not be construed as a guarantee of title. The properties and prospects may be subject to prior unregistered agreements or transfers unknown to the Company and title may be affected by undetected defects, e.g. defects in staking or acquisition process.

If title is disputed, the Company will have to defend its ownership through the courts, which would likely be an expensive and protracted process and have a negative effect on the Company’s operations and financial condition. In the event of an adverse judgment, the Company could lose its property rights.

Volatility of Share Price

Market prices for shares of early stage companies are often volatile. Factors such as announcements of mineral discoveries, exploration and financial results, and other factors could have a significant effect on the price of the Company’s shares.

Material Risk of Dilution Presented by Large Number of Outstanding Share Purchase Options and Warrants

As of March 28, 2018, there were share purchase options outstanding allowing the holders of these options to purchase 9,590,000 shares of common stock and warrants allowing the holders of these warrants to purchase 8,132,262 shares of common stock. Directors and officers of the Company hold 8,112,000 of these share purchase options and 50,000 of these warrants. An additional 1,478,000 share purchase options are held by employees and consultants of the Company. Given the fact that as of March 28, 2018 there were 102,199,625 shares of common stock outstanding, the exercise of all of the existing share purchase options and warrants would result in dilution to the existing shareholders and could depress the price of the Company’s shares. The exercise of all outstanding share purchase options and warrants would cause the number of issued and outstanding common shares to rise 15%.

| 20 |

No Proven Reserves

The properties and prospects in which the Company has an interest or the properties in which the Company has the right to earn an interest are in the exploration and development stage only, are without a known body of economically viable ore and are not in commercial production. If the Company does not ultimately find a body of economically recoverable ore, it would either have to acquire additional exploration projects, or terminate its operations.

Uncertainty of Reserves and Mineralization Estimates

There are numerous uncertainties inherent in estimating proven and probable reserves and mineralization, including many factors beyond the control of the Company. The estimation of reserves and mineralization is a subjective process and the accuracy of any such estimates is a function of the quality of available data and of engineering and geological interpretation and judgment. Results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may justify revision of such estimates. No assurances can be given that the volume and grade of reserves recovered and rates of production will not be less than anticipated. Assumptions about prices are subject to greater uncertainty and metals prices have fluctuated widely in the past. Declines in the market price of base or precious metals also may render reserves or mineralization containing relatively lower grades of ore uneconomic to exploit. Changes in operating and capital costs and other factors including, but not limited to, short-term operating factors such as the need for sequential development of ore bodies and the processing of new or different ore grades, may materially and adversely affect reserves.

Changes to Mexican Mining Taxes

In October 2013, the Mexican Congress approved a package of tax reforms which included significant changes to the country’s mining royalties and tax structure. These new laws had an effective date of January 1, 2014. The changes include a 7.5% special mining royalty on earnings before interest, taxes, depreciation and amortization (“EBITDA”) and an additional 0.5% royalty on gross revenues from precious metal production. The new law also increases annual taxes on certain inactive exploration concessions by 50% to 100%. These changes may result in increased holding costs to the Company for its existing mineral concessions. The new taxes and royalties may also materially and adversely affect the potential to define economic reserves on any Mexican properties and result in the Company’s Mexican properties being less attractive to potential optionees or joint-venture partners.

Foreign Incorporation and Civil Liabilities

The Company was created under amalgamation under the laws of the Province of British Columbia, Canada. All of the Company’s directors and officers are residents of Canada and all of the Company’s assets and its subsidiaries are located outside the U.S. Consequently, it may be difficult for U.S. investors to affect service of process in the U.S. upon those directors and officers who are not residents of the U.S., or to realize in the U.S. upon judgments of U.S. courts predicated upon civil liabilities under applicable U.S. laws.

Conflict of Interest

Some of the Company’s directors and officers are directors and officers of other natural resource or mining-related companies. Duane Poliquin, Morgan Poliquin, John McCleary, Mark Brown, William Worrall, Douglas McDonald, and Korm Trieu also serve as directors and/or officers of Almadex Minerals Limited. Gerald Carlson also serves a director and as the President and CEO of Pacific Ridge Exploration Ltd. and director of New Point Exploration Corp. Mark Brown also serves as the President, CEO and director of Big Sky Petroleum Corporation, and Mountain Boy Minerals Ltd. He also serves as Executive Chairman of Alianza Minerals Ltd., and director and/or officer of Avrupa Minerals Ltd., Strategem Capital Corp., Paget Minerals Corp, Sutter Gold Mining Ltd., Affinor Growers Ltd., Redstar Gold Corp., Orestone Mining Corp. and Adamera Minerals Corp. David Strang also serves as a director, CEO and President of Ero Copper Corporation. Elaine Ellingham also serves as a director of Aurania Resources Ltd. And Wallbridge Mining Company Ltd. These associations may give rise from time to time to conflicts of interest, as a result of which, the Company may miss the opportunity to participate in certain transactions.

Foreign Operations

The Company currently has exploration projects located in Mexico. The Company’s foreign activities are subject to the risk normally associated with conducting business in foreign countries, including exchange controls and currency fluctuations, foreign taxation, laws or policies of particular countries, labor practices and disputes, and uncertain political and economic environments, as well as risks of war and civil disturbances, or other risk that could cause exploration or development difficulties or stoppages, restrict the movement of funds or result in the deprivation or loss of contract rights or the taking of property by nationalization or expropriation without fair compensation. Foreign operations could also be adversely impacted by laws and policies of the U.S. affecting foreign trade, investment and taxation.

| 21 |

Foreign Currency Fluctuations

At the present time, some of the Company’s activities are carried on outside of Canada. Accordingly, it is subject to risks associated with fluctuations of the rate of exchange between the Canadian dollar and foreign currencies.

The Company is currently not engaged in currency hedging to offset any risk of exchange rate fluctuation and currently has no plans to engage in currency hedging.

Operating Hazards and Risks Associated with the Mining Industry

Mining operations generally involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Hazards such as unusual or unexpected geological formations and other conditions are involved. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of minerals, any of which could result in work stoppages, damage to or destruction of mines and other producing facilities, damage to or loss of life and property, environmental damage and possible legal liability for any or all damage or loss. The Company may become subject to liability for cave-ins and other hazards for which it cannot insure or against which it may elect not to insure where premium costs are disproportionate to the Company’s perception of the relevant risks. The payment of such insurance premiums and the incurring of such liabilities would reduce the funds available for exploration activities.

The Ability to Manage Growth

Should the Company be successful in its efforts to develop its mineral properties or to raise capital for such development or for the development of other mining ventures it will experience significant growth in operations. If this occurs management anticipates that additional expansion will be required in order to continue development. Any expansion of the Company’s business would place further demands on its management, operational capacity and financial resources. The Company anticipates that it will need to recruit qualified personnel in all areas of its operations. There can be no assurance that the Company will be effective in retaining its current personnel or attracting and retaining additional qualified personnel, expanding its operational capacity or otherwise managing growth. The failure to manage growth effectively could have a material adverse effect on the Company's business, financial condition and results of operations.

Lack of a Dividend Policy

The Company does not intend to pay cash dividends in the foreseeable future, as any earnings are expected to be retained for use in developing and expanding its business. However, the actual amount of dividends which the Company may pay will remain subject to the discretion of the Company’s Board of Directors and will depend on results of operations, cash requirements and future prospects of the Company and other factors.

Competition

There is competition from other mining exploration companies with operations similar to those of the Company's. Many of the mining companies with which the Company competes have operations and financial strength many times greater than that of the Company. Such competitors could outbid the Company for such projects, equipment or personnel, or produce minerals at a lower cost which would have a negative effect on the Company’s operations and financial condition.

Dependence on Key Personnel

The Company depends highly on the business and technical expertise of its management and key personnel, in particular, Duane Poliquin and Morgan Poliquin. There is little possibility that this dependence will decrease in the near term. As the Company’s operations expand, additional general management resources may be required. The Company maintains no “Key Man” insurance coverage, and the loss or unavailability of any of its key personnel could have a negative effect on the Company’s ability to operate effectively.

| 22 |

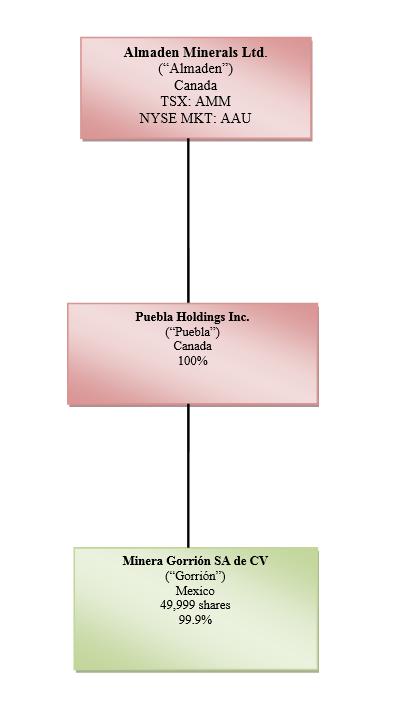

Cybersecurity Risks