Blueprint

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark

One)

[X]

ANNUAL REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

fiscal year ended December 31, 2017

[

]

TRANSITION REPORT

UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period __________ to

__________

Commission

file number 001-08675

UNITED STATES ANTIMONY CORPORATION

(Exact

name of registrant as specified in its charter)

|

Montana

|

|

81-0305822

|

|

(State

or other jurisdiction of incorporation or

organization)

|

|

(I.R.S.

Employer Identification No.)

|

|

P.O.

Box 643, Thompson Falls, Montana

|

59873

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant's

telephone number, including area code: (406) 827-3523

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par

value $.01 per share

Check

whether the issuer (1) filed all reports required to be filed by

Section 13 or 15(d) of the Exchange Act during the past 12 months

(or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Check

if there is no disclosure of delinquent filers in response to Item

405 of Regulation S-K contained in this form and will not be

contained, to the best of registrant's knowledge, in definitive

proxy or information statements incorporated by reference in Part

III of this Form 10-K or any amendment to this Form 10-K.

☑

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated

filer,” “accelerated filer” and “small

reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large Accelerated

Filer

|

☐

|

Accelerated

Filer

|

☐

|

|

Non-Accelerated

Filer

|

☐

|

Smaller reporting

company

|

☑

|

Indicate by check

mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act)

Yes ☐ No ☑

The

aggregate market value of the voting stock held by non-affiliates

of the registrant, based on the average bid price of such stock,

was $18,797,116 as of June 30, 2017.

At

April 2, 2018, the registrant had 67,488,153 outstanding shares of par value

$0.01 common stock.

UNITED STATES ANTIMONY CORPORATION

2017 ANNUAL REPORT

TABLE OF CONTENTS

|

PART I

|

|

|

|

|

|

|

ITEM 1.

|

DESCRIPTION OF BUSINESS

|

|

1

|

|

|

|

|

|

|

ITEM 1A.

|

RISK FACTORS

|

|

5

|

|

|

|

|

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

6

|

|

|

|

|

|

|

ITEM 2.

|

DESCRIPTION OF PROPERTIES

|

|

6

|

|

|

|

|

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

15

|

|

|

|

|

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

15

|

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

ITEM 5.

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

|

|

15

|

|

|

|

|

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

16

|

|

|

|

|

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF

OPERATIONS

|

|

16

|

|

|

|

|

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

|

|

22

|

|

|

|

|

|

|

ITEM 7B.

|

CRITICAL ACCOUNTING ESTIMATES

|

|

22

|

|

|

|

|

|

|

ITEM 8.

|

FINANCIAL STATEMENTS

|

|

22

|

|

|

|

|

|

| ITEM

9. |

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

|

|

22

|

|

|

|

|

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

|

22

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

| ITEM

10. |

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

AND COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE

ACT

|

|

23

|

|

|

|

|

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

|

26

|

|

|

|

|

|

| ITEM

12. |

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

|

|

27

|

|

|

|

|

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

|

29

|

|

|

|

|

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICE

|

|

29

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

ITEM 15.

|

EXHIBITS AND REPORTS ON FORM 8-K

|

|

30

|

|

|

|

|

|

|

SIGNATURES

|

|

33

|

|

|

|

|

|

CERTIFICATIONS

|

|

|

|

|

|

|

|

FINANCIAL STATEMENTS

|

|

F-1-F-22

|

PART I

General

Item 1. Description of Business

General

|

|

|

|

|

|

Explanatory Note: As used in this

report, the terms "we," "us" and "our" are used to refer to United

States Antimony Corporation and, as the context requires, its

management.

|

|

|

|

|

|

Some of

the information in this Form 10-K contains forward-looking

statements that involve substantial risks and uncertainties. You

can identify these statements by forward-looking words as "may,"

"will," "expect," "anticipate," "believe," "estimate" and

"continue," or similar words. You should read statements that

contain these words carefully because they:

●

discuss our future

expectations;

●

contain projections

of our future results of operations or of our financial condition;

and

●

state other

"forward-looking" information.

History

United

States Antimony Corporation, or USAC, was incorporated in Montana

in January 1970 to mine and produce antimony products. In December

1983, we suspended antimony mining operations but continued to

produce antimony products from domestic and foreign sources. In

April 1998, we formed United States Antimony SA de CV or USAMSA, to

mine and smelt antimony in Mexico. Bear River Zeolite Company or

BRZ, was incorporated in 2000, and it is mining and producing

zeolite in southeastern Idaho. On August 19, 2005, USAC formed

Antimonio de Mexico, S. A. de C. V. to explore and develop antimony

and silver deposits in Mexico. Our principal business is the

production and sale of antimony, silver, gold, and zeolite

products. On May 16, 2012, we started trading on the NYSE MKT (now

NYSE AMERICAN) under the symbol UAMY.

Antimony Division

Our

antimony smelter and precious metals plant is located in the Burns

Mining District of Sanders County, Montana, approximately 15 miles

west of Thompson Falls, MT. We hold 2 patented mill sites where the

plant is located. We have no "proven reserves" or "probable

reserves" of antimony, as these terms are defined by the Securities

and Exchange Commission. Environmental restrictions preclude mining

at this site.

Mining

was suspended in December 1983, because antimony could be purchased

more economically from foreign sources.

For

2017, and since 1983, we relied on foreign sources for raw

materials, and there are risks of interruption in procurement from

these sources and/or volatile changes in world market prices for

these materials that are not controllable by us. We have developed

sources of antimony in Mexico but we are still depending on foreign

companies for raw material in the future. We expect more raw

materials from our own properties for 2018 and later years. We

continue working with suppliers in North America, Central America,

Europe, Australia, and South America.

We

currently own 100% of the common stock, equipment, and the leases

on real property of United States Antimony, Mexico S.A. de C.V. or

“USAMSA”, which was formed in April 1998. We currently

own 100% of the stock in Antimony de Mexico SA de CV (AM) which

owns the San Miguel concession of the Los Juarez property. USAMSA

has three divisions (1) the Madero smelter in Coahuila, (2) the

Puerto Blanco flotation mill and oxide circuit in Guanajuato that

is ramping up for 2018, and (3) mining properties that include the

Los Juarez mineral deposit with concessions in Queretaro, the

Wadley mining concession in San Luis Potosi, the Soyatal deposits

in Queretaro, and the Guadalupe properties in

Zacatecas.

In our

existing operations in Montana, we produce antimony oxide, sodium

antimonate, antimony metal, and precious metals. Antimony oxide is

a fine, white powder that is used primarily in conjunction with a

halogen to form a synergistic flame retardant system for plastics,

rubber, fiberglass, textile goods, paints, coatings and paper.

Antimony oxide is also used as a color fastener in paint, as a

catalyst for production of polyester resins for fibers and film, as

a catalyst for production of polyethylene pthalate in plastic

bottles, as a phosphorescent agent in fluorescent light bulbs, and

as an opacifier for porcelains. Sodium antimonate is primarily used

as a fining agent (degasser) for glass in cathode ray tubes and as

a flame retardant. We also sell antimony metal for use in bearings,

storage batteries and ordnance.

We

estimate (but have not independently confirmed) that our present

share of the domestic market and international market for antimony

oxide products is approximately 4% and less than 1%, respectively.

We are the only significant U.S. producer of antimony products,

while China supplies 92% of the world antimony demand. We believe

we are competitive both domestically and world-wide due to the

following:

●

We have a

reputation for quality products delivered on a timely

basis.

●

We have two of the

three operating antimony smelters in North and Central

America.

●

We are the sole

domestic producer of antimony products.

●

We can ship on

short notice to domestic customers.

●

We are vertically

integrated, with raw materials from our own mines, mills, and

smelter in Mexico, along with the raw materials from exclusive

supply agreements we have with numerous ore and raw material

suppliers.

●

As a vertically

integrated company, we will have more control over our raw material

costs.

Following

is a five year schedule of our antimony sales:

Schedule of Antimony Sales

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

1,891,439

|

$7,588,470

|

$4.01

|

|

2016

|

2,936,880

|

$8,744,170

|

$2.98

|

|

2015

|

2,487,321

|

$9,863,933

|

$3.97

|

|

2014

|

1,727,804

|

$8,132,410

|

$4.71

|

|

2013

|

1,579,182

|

$8,375,158

|

$5.30

|

Concentration of

Sales:

During

the two years ended December 31, 2017, the following sales were

made to our three largest customers:

|

Sales to

|

|

|

Largest Customers

|

|

|

|

Mexichem

Specialty Compounds Inc.

|

$3,335,046

|

$2,108,998

|

|

East

Penn Manufacturing Inc

|

512,621

|

1,147,854

|

|

Kohler

Corporation

|

1,928,962

|

1,474,854

|

|

|

$5,776,629

|

$4,731,706

|

|

% of Total Revenues

|

56.50%

|

39.80%

|

While

the loss of one of our three largest customers would be a problem

in the short term, we have numerous requests from potential buyers

that we cannot fill, and we could quickly, in the present market

conditions, be able to replace the lost sales. Loss of all three of

our largest customers would be more serious and may affect our

profitability.

Marketing: We

employ full-time marketing personnel and have negotiated various

commission-based sales agreements with other chemical distribution

companies.

Antimony Price Fluctuations: Our operating results have been,

and will continue to be, related to the market prices of antimony

metal, which have fluctuated widely in recent years. The volatility

of prices is illustrated by the following table, which sets forth

the average prices of antimony metal per pound, as reported by

sources deemed reliable by us.

A five

year price range of prices for antimony oxide and antimony metal,

per pound, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

|

|

|

|

|

|

|

2017

|

$3.40

|

$3.41

|

$4.01

|

$3.77

|

$3.78

|

|

2016

|

$3.11

|

$2.62

|

$2.98

|

$2.99

|

$2.94

|

|

2015

|

$3.34

|

$3.71

|

$3.97

|

$3.41

|

$3.32

|

|

2014

|

$4.00

|

$4.18

|

$4.71

|

$4.40

|

$4.31

|

|

2013

|

$4.41

|

$4.69

|

$5.30

|

$4.73

|

$4.78

|

Antimony

metal prices are determined by a number of variables over which we

have no control. These include the availability and price of

imported metals, the quantity of new metal supply, and industrial

demand. If metal prices decline and remain depressed, our revenues

and profitability may be adversely affected.

We use

various antimony raw materials to produce our products. We

currently obtain antimony raw material from sources in Canada and

Mexico.

Zeolite Division

We own

100% of Bear River Zeolite Company, (BRZ), an Idaho corporation

that was incorporated on June 1, 2000. BRZ has a lease with Webster

Farm, L.L.C. that entitles BRZ to surface mine and process zeolite

on property located near Preston, Idaho, in exchange for a royalty

payment. In 2010 the royalty was adjusted to $10 per ton sold. The

current minimum annual royalty is $60,000. In addition, BRZ has

more zeolite on U.S. Bureau of Land Management land. A company

controlled by the estate of Al Dugan, a significant stockholder

and, as such, an affiliate of USAC, receives a payment equal to 3%

of net sales on zeolite products. William Raymond and Nancy Couse

are paid a royalty that varies from $1 to $5 per ton. On a combined

basis, royalties vary from 8%-13%. BRZ has constructed a processing

plant on the property and it has improved its productive capacity.

In addition to a large

amount of fully depreciated equipment that has been transferred

from the USAC division, we have spent approximately

$3,945,000 to purchase and

construct the processing plant as of December 31,

2017.

We have

no "proven reserves" or "probable reserves" of zeolite, as these

terms are defined by the Securities and Exchange

Commission.

"Zeolite"

refers to a group of industrial minerals that consist of hydrated

aluminosilicates that hold cations such as calcium, sodium,

ammonium, various heavy metals, and potassium in their crystal

lattice. Water is loosely held in cavities in the lattice. BRZ

zeolite is regarded as one of the best zeolites in the world due to

its high CEC of approximately 180-220 meq/100 gr., its hardness and

high clinoptilolite content, its absence of clay minerals, and its

low sodium content. BRZ's zeolite deposits’ characteristics

which make the mineral useful for a variety of purposes

including:

●

Soil Amendment and Fertilizer.

Zeolite has been successfully used to fertilize golf courses,

sports fields, parks and common areas, and high value agricultural

crops

●

Water Filtration. Zeolite is

used for particulate, heavy metal and ammonium removal in swimming

pools, municipal water systems, fisheries, fish farms, and

aquariums.

●

Sewage Treatment. Zeolite is

used in sewage treatment plants to remove nitrogen and as a carrier

for microorganisms.

●

Nuclear Waste and Other Environmental

Cleanup. Zeolite has shown a strong ability to selectively

remove strontium, cesium, radium, uranium, and various other

radioactive isotopes from solution. Zeolite can also be used for

the cleanup of soluble metals such as mercury, chromium, copper,

lead, zinc, arsenic, molybdenum, nickel, cobalt, antimony, calcium,

silver and uranium.

●

Odor Control. A major cause of

odor around cattle, hog, and poultry feed lots is the generation of

the ammonium in urea and manure. The ability of zeolite to absorb

ammonium prevents the formation of ammonia gas, which disperses the

odor.

●

Gas Separation. Zeolite has

been used for some time to separate gases, to re-oxygenate

downstream water from sewage plants, smelters, pulp and paper

plants, and fish ponds and tanks, and to remove carbon dioxide,

sulfur dioxide and hydrogen sulfide from methane generators as

organic waste, sanitary landfills, municipal sewage systems and

animal waste treatment facilities.

●

Animal Nutrition. Feeding up to

2% zeolite increases growth rates, decreases conversion rates,

prevents scours, and increases longevity.

●

Miscellaneous Uses. Other uses

include catalysts, petroleum refining, concrete, solar energy and

heat exchange, desiccants, pellet binding, horse and kitty litter,

floor cleaner and carriers for insecticides, pesticides and

herbicides.

Environmental Matters

Our

exploration, development and production programs conducted in the

United States are subject to local, state and federal regulations

regarding environmental protection. Some of our production and

mining activities are conducted on public lands. We believe that

our current discharge of waste materials from our processing

facilities is in material compliance with environmental regulations

and health and safety standards. The U.S. Forest Service

extensively regulates mining operations conducted in National

Forests. Department of Interior regulations cover mining operations

carried out on most other public lands. All operations by us

involving the exploration for or the production of minerals are

subject to existing laws and regulations relating to exploration

procedures, safety precautions, employee health and safety, air

quality standards, pollution of water sources, waste materials,

odor, noise, dust and other environmental protection requirements

adopted by federal, state and local governmental authorities. We

may be required to prepare and present data to these regulatory

authorities pertaining to the effect or impact that any proposed

exploration for, or production of, minerals may have upon the

environment. Any changes to our reclamation and remediation plans,

which may be required due to changes in state or federal

regulations, could have an adverse effect on our operations. The

range of reasonably possible loss in excess of the amounts accrued,

by site, cannot be reasonably estimated at this time.

We

accrue environmental liabilities when the occurrence of such

liabilities is probable and the costs are reasonably estimable. The

initial accruals for all our sites are based on comprehensive

remediation plans approved by the various regulatory agencies in

connection with permitting or bonding requirements. Our accruals

are further based on presently enacted regulatory requirements and

adjusted only when changes in requirements occur or when we revise

our estimate of costs to comply with existing requirements. As

remediation activity has physically commenced, we have been able to

refine and revise our estimates of costs required to fulfill future

environmental tasks based on contemporaneous cost information,

operating experience, and changes in regulatory requirements. In

instances where costs required to complete our remaining

environmental obligations are clearly determined to be in excess of

the existing accrual, we have adjusted the accrual accordingly.

When regulatory agencies require additional tasks to be performed

in connection with our environmental responsibilities, we evaluate

the costs required to perform those tasks and adjust our accrual

accordingly, as the information becomes available. In all cases,

however, our accrual at year-end is based on the best information

available at that time to develop estimates of environmental

liabilities.

Antimony Processing Site

We have

environmental remediation obligations at our antimony processing

site near Thompson Falls, Montana ("the Stibnite Hill Mine Site").

We are under the regulatory jurisdiction of the U.S. Forest Service

and subject to the operating permit requirements of the Montana

Department of Environmental Quality. At December 31, 2017 and 2016,

we have accrued $100,000 to fulfill our environmental

responsibilities.

BRZ

During

2001, we recorded a reclamation accrual for our BRZ subsidiary,

based on an analysis performed by us and reviewed and approved by

regulatory authorities for environmental bonding purposes. The

accrual of $7,500 represents our estimated costs of reclaiming, in

accordance with regulatory requirements, the acreage disturbed by

our zeolite operations, and remains unchanged at December 31,

2017.

General

Reclamation

activities at the Thompson Falls Antimony Plant have proceeded

under supervision of the U.S. Forest Service and Montana Department

of Environmental Quality. We have complied with regulators'

requirements and do not expect the imposition of substantial

additional requirements.

We have

posted cash performance bonds with a bank and the U.S. Forest

Service in connection with our reclamation activities.

We

believe we have accrued adequate reserves to fulfill our

environmental remediation responsibilities as of December 31, 2017.

We have made significant reclamation and remediation progress on

all our properties over thirty years and have complied with

regulatory requirements in our environmental remediation

efforts.

Employees

As of December 31, 2017, we employed 27 full-time employees in

Montana. In addition, we employed 16 people at our zeolite plant in

Idaho, and more than 60 employees at our mining, milling and

smelting operation in Mexico. The number of full-time employees may

vary seasonally. None of our employees are covered by any

collective bargaining agreement.

Other

We hold

no material patents, licenses, franchises or concessions. However,

we consider our antimony processing plants proprietary in

nature.

We are

subject to the requirements of the Federal Mining Safety and Health

Act of 1977, the Occupational Safety and Health Administration's

regulations, requirements of the state of Montana and the state of

Idaho, federal and state health and safety statutes and Sanders

County, Montana and Franklin County, Idaho health

ordinances.

Item 1A Risk Factors

There

may be events in the future that we are not able to accurately

predict or over which we have no control. The risk factors listed

below, as well as any cautionary language in this report, provide

examples of risks, uncertainties and events that may cause our

actual results to differ materially from the expectations we

describe in our forward-looking statements.

If we were liquidated, our common

stockholders could lose part, or all, of their

investment.

In the

event of our dissolution, the proceeds, if any, realized from the

liquidation of our assets will be distributed to our stockholders

only after the satisfaction of the claims of our creditors and

preferred stockholders. The ability of a purchaser of shares to

recover all, or any portion, of the purchase price for the shares,

in that event, will depend on the amount of funds realized and the

claims to be satisfied by those funds.

We may have un-asserted liabilities for environmental

reclamation.

Our

research, development, manufacturing and production processes

involve the controlled use of hazardous materials, and we are

subject to various environmental and occupational safety laws and

regulations governing the use, manufacture, storage, handling, and

disposal of hazardous materials and some waste products. The risk

of accidental contamination or injury from hazardous materials

cannot be completely eliminated. In the event of an accident, we

could be held liable for any damages that result and any liability

could exceed our financial resources. We also have one ongoing

environmental reclamation and remediation projects at our current

production facility in Montana. Adequate financial resources may

not be available to ultimately finish the reclamation activities if

changes in environmental laws and regulations occur, and these

changes could adversely affect our cash flow and profitability. We

do not have environmental liability insurance now, and we do not

expect to be able to obtain insurance at a reasonable cost. If we

incur liability for environmental damages while we are uninsured,

it could have a harmful effect on our financial condition and

results of operations. The range of reasonably possible losses from

our exposure to environmental liabilities in excess of amounts

accrued to date cannot be reasonably estimated at this

time.

We have accruals for asset retirement obligations and environmental

obligations.

We have

accruals totaling $271,572 on our balance sheet at December 31,

2017, for our environmental reclamation responsibilities and

estimated asset retirement obligations. If we are not able to

adequately perform these activities on a timely basis, we could be

subject to fines and penalties from regulatory

agencies.

Item 1B Unresolved Staff Comments

Not

Applicable

Item 2 Description of Properties

ANTIMONY DIVISION

Our

antimony smelter and precious metals plant is located in the Burns

Mining District, Sanders County, Montana, approximately 14 miles

west of Thompson Falls on Montana Highway 471. This highway is

asphalt, and the property is accessed by cars and trucks. The

property includes two five-acre patented mill sites that are owned

in fee-simple by us. The claims are U. S. Antimony Mill Site No. 1

(Mineral Survey 10953) and U. S. Antimony Mill Site No. 2 (Mineral

Survey 10953).

The U.

S. Antimony Mill Sites were used to run a flotation mill and

processing plant for antimony that we mined on adjacent claims that

have been sold. Presently, we run a smelter that includes furnaces

of a proprietary design to produce antimony metal, antimony oxide,

and various other products. We also run a precious metals plant.

The facility includes 6 buildings and our main office. There are no

plans to resume mining on the claims that have been sold or

abandoned, although the mineral rights have been retained on many

of the patented mining claims. The U. S. Forest Service and Montana

Department of Environmental Quality have told us that the

resumption of mining would require an Environmental Impact

Statement, massive cash bonding, and would be followed by years of

law suits. The mill site is serviced with three-phase electricity

from Northwest Power, and water is pumped from a well.

We

claim no reserves on any of these properties.

Antimony

mining and milling operations in the U.S. were curtailed during

1983 due to continued declines in the price of antimony. We are

currently purchasing foreign raw antimony materials and producing

our own raw materials from our properties in Mexico. We continue to

produce antimony metal, oxide, sodium antimonite, and precious

metals from our processing facility near Thompson Falls,

Montana.

ANTIMONY MINERAL PROPERTIES

Los Juarez Group

We hold

properties that are collectively called the “Los

Juarez” property, in Queretaro, as follows:

|

1.

|

San

Miguel I and II were purchased by a USAC subsidiary, Antimonio de

Mexico, S. A. de C. V (AM), for $1,480,500. As of December 31,

2017, we have paid for the property, and have incurred significant

permitting costs. The property consists of 40

hectares.

|

|

2.

|

San

Juan I and II are concessions owned by AM and include 466

hectares.

|

|

3.

|

San

Juan III is held by a lease agreement by AM in which we will pay a

10% royalty, based on the net smelter returns from another USAC

Mexican subsidiary, named United States Antimony Mexico, S. A. de

C. V. or USAMSA. It consists of 214 hectares.

|

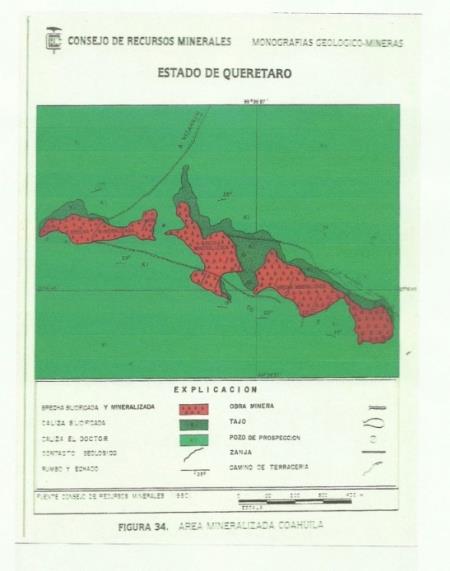

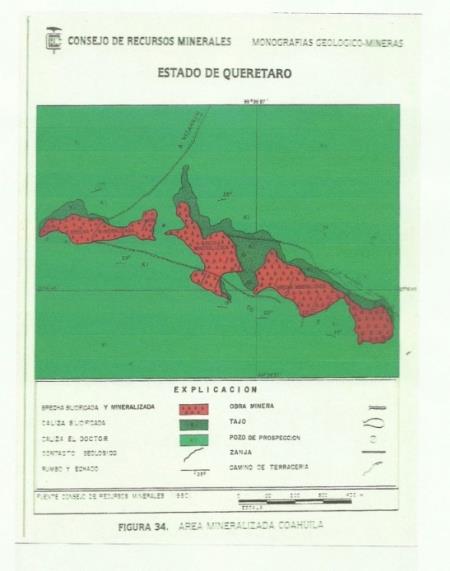

The

concessions collectively constitute 720 hectares. The claims are

accessed by roads that lead to highways.

Part of

the USAC Mexican property, including San Miguel I, II and part of

San Juan III, was originally drilled by the Penoles Company in

1970, when antimony metal prices were high. They did not proceed

with the property, due to the complex metallurgy of antimony.

Subsequently, the Mexican Government did additional work and

reported a deposit of mineralized material of 1,000,000 metric tons

(mt) grading 1.8% antimony and 8.1 ounces of silver per metric ton

(opmt) in Consejo de Recursos Minerales (Publicacion

M-4e). Such a report does not qualify as a comprehensive

evaluation, such as a final or bankable feasibility study that

concludes legal and technical viability, and economic feasibility.

The Securities and Exchange Commission does not recognize this

report, and we claim no reserves.

The

mineralized zone is a classic jasperoid-type deposit in the

Cretaceous El Doctor Limestone. The mineralization is confined to

silicified jasperiod pipes intruded upwards into limestone. The

zone strikes north 70 degrees west. The dimension of the deposit is

still conjectural. However, the strike length of the jasperoid is

more than 3,500 meters.

The

mineralization is typically very fine-grained stibnite with silver

and gold. It is primarily sulfide in nature due to its

encapsulation in silica. The mining for many years will be by open

pit methods. Eventually it will be by underground methods. At the

present time, mining has included hauling dump rock and rock from

mine faces.

Soyatal Mining District, Pinal De Amoles, Queretaro,

Mexico

Soyatal

Reportedly, the

Soyatal District was the third largest producer of antimony in

Mexico. U. S. Geological Survey Bulletin 960-B, 1948, Donald E.

White, Antimony Deposits of Soyatal District, State of Queretaro,

Mexico records the production from 1905-1943 at 25,600 tons of

antimony metal content. In 1942, the mines produced ore containing

1,737 tons of metal, and in 1943, they produced ore containing

1,864 tons of metal. This mining was performed primarily all by

hand labor, with no compressors or trammers, and the ore was

transported by mules, in sacks, to the railroad. Recoveries were

less than 40% of the values. Mining continued throughout World War

II.

Mr.

White remarks p. 84 and 85, “In the Soyatal Mines, as in

practically all antimony mines, it is difficult to estimate the

reserves, for the following reasons:

●

The individual

deposits are so extremely irregular in size, shape, and grade that

the amount of ore in any one of them is unknown until the ore has

been mined.

●

As only the

relatively high grade shipping ore is recovered, the ore bodies are

not systematically sampled and assayed…The total reserves are

thus unknown and cannot be estimated accurately, but they probably

would suffice to maintain a moderate degree of activity in the

district for at least 10 years. The mines may even contain enough

ore (mineralized deposit) to equal the total past

production.”

Minimal

ore, primarily through hand mining and sorting methods, has

continued at the Soyatal properties since 1943. We do not claim any

reserves at Soyatal as defined by the SEC.

USAMSA Puerto Blanco Flotation Mill, Guanajuato,

Mexico

The

flotation plant has a capacity of 140 metric tons per day. It

includes a 30” x 42” jaw crusher, a 4’x 8’

double-deck screen, a 36” cone crusher, an 8’x

36” Harding type ball mill, and eight No. 24 Denver sub A

type flotation machines, an 8’ disc filter, front end

loaders, tools and other equipment. The flotation circuit is used

for the processing of rock from Los Juarez, Guadalupe, and other

properties. We are in the process of installing a 400 metric ton

per day flotation mill that will be dedicated to processing ore

from our Los Juarez property. The crushing equipment currently in

place is adequate for both flotation mills. An oxide circuit was

added to the plant in 2013 and 2014 to mill oxide ores from Soyatal

and other properties. It includes a vertical shaft impactor, 3 ore

bins, 8 conveyors, a 4’ x 6’ high frequency screen,

jig, 8 standard concentrating tables, 5 pumps, sand screw and two

buildings. The capacity of the oxide circuit is 50 tons per day. We

are presently installing a cyanide leach circuit and settling pond

that will be used to recover precious metals from our Los Juarez

mine. During 2017 and 2016, less than 10% of the mill’s

capacity was utilized.

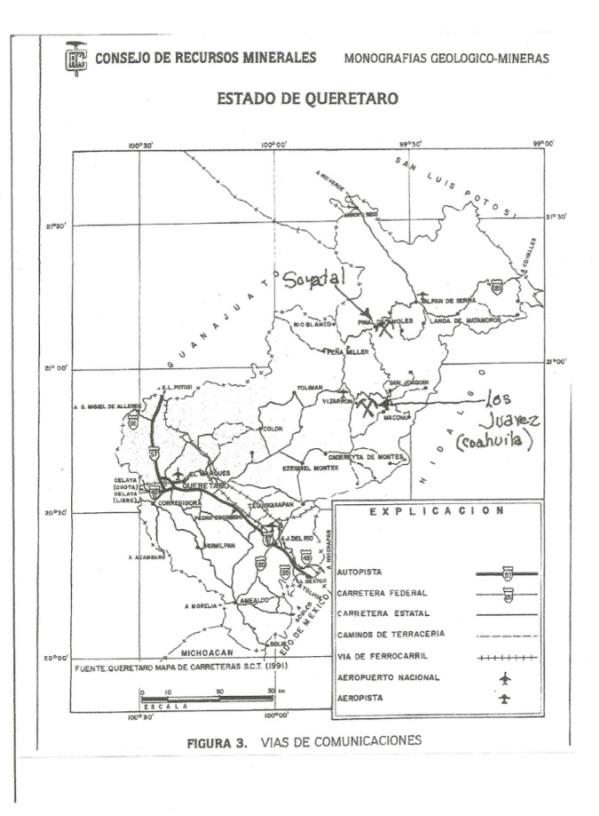

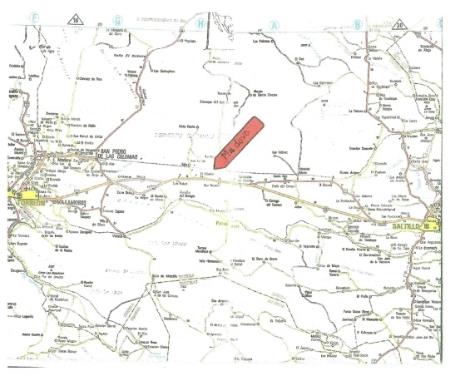

USAMSA Madero Smelter, Estacion Madero, Parras De La Fuente,

Coahuila, Mexico

USAC,

through its wholly owned subsidiary, USAMSA, owns and operates a

smelting facility at Estacion Madero, in the Municipio of Parras de

la Fuente, Coahuila, Mexico. The property includes 13.48 hectares.

Seventeen small rotating furnaces (SRF’s) and one large

rotating furnace (LRF) with an associated stack and scrubber were

permitted and installed by the end of 2015. Other equipment

includes cooling ducting, dust collectors, scrubber, laboratory,

warehouse, slag vault, stack, jaw crusher, screen, hammer mill, and

a 3.5’ x 8’ rod mill. The plant has a feed capacity of

five to six metric tons of direct shipping ore or concentrates per

day, depending on the quality of the feedstock. If the feedstock is

in the mid-range of 45% antimony, the smelter could produce

approximately 1.8 MM pounds of contained antimony annually.

Concentrates from our flotation plant, and hand-sorted ore from

Mexico sources and other areas, are being processed. During 2017,

we completed the installation of a leach circuit to process

concentrates from the Puerto Blanco cyanide leach plant containing

precious metals from our Los Juarez Mining property. The Madero

production is either sold or shipped to our Montana plant to

produce finished Antimony products and precious metals. Access to

the plant is by road and railroad. Set forth below are location

maps:

ZEOLITE DIVISION

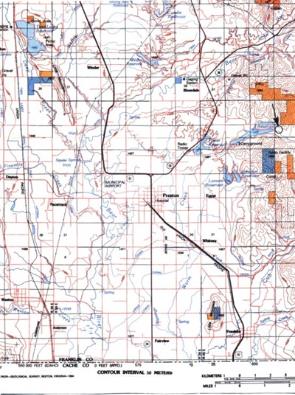

Location

This

property is located in the southeast corner of Idaho, approximately

seven miles east of Preston, Idaho, 34 miles north of Logan, Utah,

79 miles south of Pocatello, Idaho, and 100 miles north of

Salt Lake City, Utah.

The

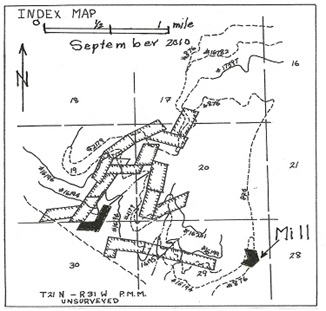

mine is located in the N ½ of section 10 and the W ½ of

section 2, section 3, and the E ½ section 4, Township 15,

Range 40 East of the Boise Meridian, Franklin County, Idaho. The

plant and the initial pit are located on the Webster Farm, L.L.C.,

which is private land.

Transportation

The

property is accessed by seven miles of paved road and about l mile

of gravel road from Preston, Idaho. Preston is near the major

north-south Interstate Highway 15 to Salt Lake City or

Pocatello.

Several

Union Pacific rail sidings may be available to the mine. Bonida is

approximately 25 miles west of the mine and includes acreage out of

town where bulk rock could be stored, possibly in existing silos or

on the ground. Three-phase power is installed at this abandoned

site. Finished goods can also be shipped from the

Franklin County Grain Growers feed mill in the town of Preston on

the Union Pacific Railroad.

The

Burlington Northern Railroad can be accessed at Logan,

Utah.

Location

Map

Property and Ownership

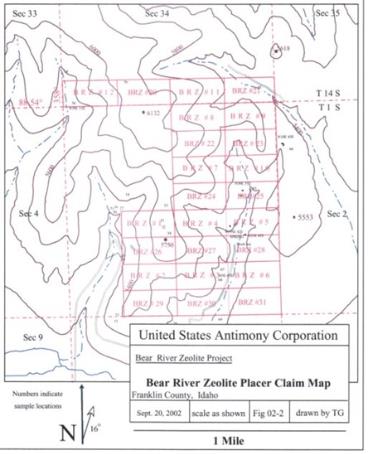

BRZ

leases 320 acres from the Webster Farm, L.L.C. The term of the

lease is 15 years and it began on March 1, 2010. This includes the

mill site and zeolite in the area of the open pit. The property is

the NW ¼ and W ½ of the SW ¼ of section 3 and the N

½ of the W ¼ of section 10, Township 15 South, Range 40

East of the Boise Meridian, Franklin County, Idaho. The lease

requires a payment of $10.00 per ton plus an additional annual

payment of $10,000 on March 1st of each year. In addition, there

are two other royalty holders. Nick Raymond and the estate of

George Desborough each have a graduated royalty of $1.00 per ton to

$5.00 per ton, depending on the sale price.

The

balance of the property is on Bureau of Land Management property

and includes 480 acres held by 24, 20-acre Placer claims. Should we

drop our lease with Webster Farms LLC., we will retain these placer

claims as follows:

|

BRZ

1 IMC

185308

BRZ

2 IMC

185309

BRZ

3 IMC

185310

BRZ

4 IMC

185311

BRZ

5 IMC

185312

BRZ

6 IMC

185313

BRZ

7 IMC

185314

BRZ

8 IMC

185315

BRZ

9 IMC

185316

BRZ

10 IMC 185317

BRZ

11 IMC 185318

BRZ

12 IMC 185319

|

BRZ

20 IMC 186183

BRZ

21 IMC 186184

BRZ

22 IMC 186185

BRZ

23 IMC 186186

BRZ

24 IMC 186187

BRZ

25 IMC 186188

BRZ

26 IMC 186189

BRZ

27 IMC 186190

BRZ

28 IMC 186191

BRZ

29 IMC 186192

BRZ

30 IMC 186193

BRZ

31 IMC 186194

|

Geology

The

deposit is a very thick, sedimentary deposit of zeolitized volcanic

ash of Tertiary age known as the Salt Lake Formation. The

sedimentary interval in which the clinoptilolite occurs is more

than 1000 feet thick in the area. Thick intervals of the zeolite

are separated by thin limestone and sandstone beds deposited in the

freshwater lake where the volcanic ash accumulated.

The

deposit includes an 800- foot mountain. Zeolite can be sampled over

a vertical extent of 800 feet and on more than 700 acres. The

current pit covers more than 3 acres. Despite the

apparent size of the deposit, we claim no

reserves.

Exploration, Development, and Mining

Exploration

has been limited to the examination and sampling of surface

outcrops and mine faces.

Mining Methods

Depending

on the location, the zeolite is overlain by 1 to 12 feet of

zeolite-rich soil. On the ridges, the cover is very little, and in

the draws the soil is thicker. The overburden is stripped using a

tractor dozer, currently a Caterpillar D-8K. It is moved to the toe

of the pit, and will eventually be dozed back over the pit for

reclamation.

Although

near-surface rock is easily ripped, it is more economical to drill

and blast it. Breakage is generally good. Initial benches were 20

to 30 foot, and each bench is accessed by a road.

Haulage

is over approximately 4,000 feet of road on an uphill grade of 2.5%

to the mill. On higher benches, the grade will eventually be

downhill. Caterpillar 769 B rock trucks are being used. They haul

18 to 20 tons per load, and the cycle time is about 30

minutes.

With

the trucks and the other existing equipment, the mine is capable of

producing 80 tons per hour.

MILLING

Primary Crusher

The

primary crushing circuit is a conventional closed circuit,

utilizing a Stephens-Adamson 42” x 12’ apron feeder,

Pioneer 30” x 42” jaw crusher, Nordberg standard

3’ cone crusher, a 5’ by 12’ double

deck Kohlberg screen, and has a self-cleaning dust collector. The

rock is crushed to minus 1 inch and the circuit has a rated

capacity of more than 50 tons per hour.

Dryer

There

are two dryer circuits, one for lines one and two, and one for the

Raymond mill. The dryer circuits include one 50 ton feed bin, and

each dryer has a conveyor bypass around each dryer, a bucket

elevator, and a dry rock bin. The dryers are 25 feet long, 5 feet

in diameter and are fired with propane burners rated at 750,000

BTUs. One self-cleaning bag house services both dryers. Depending

on the wetness of the feed rock, the capacity is in the range of 10

tons per hour per dryer. During most of the year, the dryers are

not run.

Coarse Products Circuit

There

are two lines to produce coarse products:

●

Line 1 is a

closed circuit with a 100 HP vertical shaft impactor and a 5 deck

Midwestern multivibe screen.

●

Line 2 includes a

Jeffries 30” by 24” 60 HP hammer mill in a closed

circuit with two 5’ x 12’ triple deck Midwestern Multi

Vibe high frequency screens. The circuits also include bucket

elevators, (3) 125 ton capacity product silos, a 6 ton capacity

Crust Buster blender, augers, Sweco screens, and dust

collectors.

Fine Products Circuit

The

fine products circuit is in one building and it includes (2)

3.5’ x 10.5’ Derrick 2 deck high frequency (3450 RPM)

screens and various bucket elevators, augers, bins, and Sweco

screens for handling product. Depending on the screening sizes, the

plants can generate approximately 150 tons of granules and 125 tons

of fines per 24-hour day.

Raymond Mill Circuit

The

Raymond mill circuit includes a 6058 high-side Raymond mill with a

double whizzer, dust collector, two 100 ton product silos, feed

bin, conveyors, air slide, bucket elevators, and control booth. The

Raymond mill has a rated capacity of more than 10 tons per

hour.

Item 3 Legal Proceedings

No

director, officer or affiliate of USAC and no owner of record or

beneficial owner of more than 5.0% of our securities or any

associate of any such director, officer or security holder is a

party adverse to USAC or has a material interest adverse to USAC in

reference to pending litigation.

Item 4 Mine Safety Disclosures

The

information concerning mine safety violations or other regulatory

matters required by section 1503(a) of the Dodd-Frank Wall Street

Reform and Consumer Protection Act and Item 104 of Regulation S-K

is included in Exhibit 95 to this Annual Report.

PART II

Item 5 Market for Common Equity and Related Stockholder

Matters

Currently,

our common stock is traded on the NYSE-AMERICAN under the symbol

UAMY. The following table sets forth the range of high and low bid

prices as reported for the periods indicated. The quotations were

taken from a website available to the public, and generally

believed to be accurate. The quoted prices may not necessarily

represent actual transactions.

|

2017

|

|

|

|

First

Quarter

|

$0.52

|

$0.34

|

|

Second

Quarter

|

0.43

|

0.31

|

|

Third

Quarter

|

0.29

|

0.21

|

|

Fourth

Quarter

|

0.36

|

0.31

|

|

|

|

|

|

2016

|

|

|

|

First

Quarter

|

$0.33

|

$0.17

|

|

Second

Quarter

|

0.31

|

0.20

|

|

Third

Quarter

|

0.60

|

0.20

|

|

Fourth

Quarter

|

0.47

|

0.22

|

The

approximate number of holders of record of our common stock at

April 2, 2018, is 2,500.

We have

not declared or paid any dividends to our stockholders during the

last five years and do not anticipate paying dividends on our

common stock in the foreseeable future. Instead, we expect to

retain earnings for the operation and expansion of our

business.

In

March of 2016 the Company issued the Board members 550,000 shares

of the Company’s common stock for services provided during

2015 with a value of $137,500.

In

December of 2016, the Company issued Daniel Parks, the

Company’s Chief Financial Officer, 200,000 shares of the

Company’s common stock valued at $54,000 to retain his

services for a two year period. As part of the agreement, Mr.

Parks’ hours worked and normal compensation was

reduced.

During

2016, the Company awarded, but did not issue, common stock with a

value at December 31, 2016, of $168,750 to its Board of Directors

as compensation for their services as directors. In connection with

the issuances, the Company recorded $168,750 in director

compensation expense. In March of 2017, at a price of $0.40 per

share, the directors were issued 421,875 shares for

2016.

During

2017, the Company awarded, but did not issue, common stock with a

value at December 31, 2017, of $175,000 to its Board of Directors

as compensation for their services as directors. In connection with

the issuances, the Company recorded $175,000 in director

compensation expense. As of April 2, 2018, the shares had not been

issued to the directors.

Item 6

Selected Financial Data

Not

Applicable.

Item 7

Management's Discussion and Analysis or Plan of

Operations

Certain

matters discussed are forward-looking statements that involve risks

and uncertainties, including the impact of antimony prices and

production volatility, changing market conditions and the

regulatory environment and other risks. Actual results may differ

materially from those projected. These forward-looking statements

represent our judgment as of the date of this filing. We disclaim,

however, any intent or obligation to update these forward-looking

statements.

Overview

Company-wide

For the

year ended December 31, 2017, we incurred a loss of $1,134,394 for

2017 after depreciation and amortization of $968,888, compared to a

loss of $1,309,200 for 2016 after depreciation and amortization of

$999,737, and an income tax provision of $298,138 for our Mexican

operations. Our company-wide EBITDA was a negative $165,506 for

2017, compared to a negative $11,325 for 2016.

Net

non-cash expense items totaled $1,275,000 for 2017 and included

$968,888 for depreciation and amortization, $93,450 for

amortization of debt discount, $175,000 for director compensation

and $37,662 for other items.

Net

non-cash expense items totaled $1,176,608 for 2016 and included

$999,737 for depreciation and amortization, $70,590 for

amortization of debt discount, $54,000 for stock-based

compensation, $168,750 for director compensation and ($116,469) for

other items.

Antimony Sales

During

2017, we saw our average sale price increase by $1.03 per pound to

$4.01 per pound from an average price of $2.98 per pound for 2016.

Due to the loss of our supply of antimony concentrates from

Australia, the volume of antimony sold (metal contained) decreased

from a record of 2,936,880 pounds sold in 2016 to 1,891,439 pounds

sold in 2017, a decrease of 1,045,441pounds. During 2017 our

production and sales from Mexican sources was approximately 530,000

pounds from our mines, and approximately 35,000 pounds from

Australian concentrates. During 2017, the loss of raw material from

Australia saw our gross sales of antimony decrease by $1,155,700

(13%). The antimony division had a negative EBIDTA of $1,094,579

for 2017, compared to a negative EBITDA of $1,131,971 for 2016. Our

loss from antimony decreased from a loss of $2,171,611 in 2016 to a

loss of $1,776,239 in 2017.

In

November of 2017, we renegotiated our sodium antimonite supply

agreement to recognize that antimony prices were in a world-wide

slump, and that our general and administrative costs were a larger

percent of our revenues than they were under the previous

agreement. The new price agreement was implemented in December of

2017, and will result in lower antimony production costs and an

improved cash flow for 2018 and the following years.

Zeolite Sales

Our

sales volume of zeolite in 2017 was 766 tons less than we sold in

2016, a decrease of 6%. Our average sales price decreased by

approximately $5 per ton, from $188 per ton in 2016 per ton to $183

per ton in 2017 (3%). During 2017, total sales of zeolite decreased

by $206,458 from 2016. The zeolite division had EBIDTA of $554,201

for 2017, compared to EBITDA of $447,775 for 2016. Net income

increased from $233,907 in 2016 to $331,472 in 2017, approximately

$98,000.

Precious Metals Sales

|

Precious Metals Sales

|

|

|

|

|

|

Silver/Gold

|

|

|

|

|

|

Montana

|

|

|

|

|

|

Ounces

Gold Shipped (Au)

|

64.77

|

89.12

|

108.10

|

107.00

|

|

Ounces

Silver Shipped (Ag)

|

29,480

|

30,421

|

38,123

|

32,021

|

|

Revenues

|

$461,083

|

$491,426

|

$556,650

|

$480,985

|

|

Australian - Hillgrove

|

|

|

|

|

|

Ounces

Gold Shipped (Au)

|

|

|

496.65

|

90.94

|

|

Revenues

- Gross

|

|

|

$597,309

|

$96,471

|

|

Revenues

to Hillgrove

|

|

|

(481,088)

|

(202,584)

|

|

Revenues

to USAC

|

|

|

$116,221

|

$(106,113)

|

|

Total Revenues

|

$461,083

|

$491,426

|

$672,871

|

$374,872

|

Results

of operations by division at December 31, 2017 and 2016 are as

follows:

|

Results of Operations by

Division

|

|

|

|

|

|

|

|

Antimony Division - United States:

|

|

|

|

Revenues

- Antimony (net of discount)

|

$7,588,470

|

$8,744,170

|

|

Domestic

cost of sales:

|

|

|

|

Production

costs

|

3,898,097

|

3,274,100

|

|

Depreciation

|

57,761

|

62,863

|

|

Freight

and delivery

|

321,282

|

419,256

|

|

Indirect

production costs

|

328,411

|

272,161

|

|

Direct

sales expense

|

65,652

|

65,652

|

|

Total

domestic antimony cost of sales

|

4,671,203

|

4,094,032

|

|

|

|

|

|

Cost

of sales - Mexico

|

|

|

|

Production

costs

|

2,223,663

|

3,480,252

|

|

Depreciation

and amortization

|

623,899

|

678,639

|

|

Freight

and delivery

|

45,461

|

113,412

|

|

Land

lease expense

|

190,116

|

261,154

|

|

Indirect

production costs

|

281,922

|

363,160

|

|

General

and administrative

|

109,582

|

178,048

|

|

Total

Mexico antimony cost of sales

|

3,474,643

|

5,074,665

|

|

|

|

|

|

Total

revenues - antimony

|

7,588,470

|

8,744,170

|

|

Total

cost of sales - antimony

|

8,145,846

|

9,168,697

|

|

Total

gross profit (loss) - antimony

|

(557,376)

|

(424,527)

|

|

|

|

|

|

Precious Metals Division:

|

|

|

|

Revenues

|

374,872

|

672,871

|

|

Cost

of sales:

|

|

|

|

Depreciation

|

64,499

|

44,367

|

|

Total

cost of sales

|

64,499

|

44,367

|

|

Gross

profit - precious metals

|

310,373

|

628,504

|

|

|

|

|

|

Zeolite Division:

|

|

|

|

Revenues

|

2,266,636

|

2,473,094

|

|

Cost

of sales:

|

|

|

|

Production

costs

|

919,876

|

1,210,832

|

|

Depreciation

|

222,729

|

213,868

|

|

Freight

and delivery

|

175,303

|

226,258

|

|

Indirect

production costs

|

176,566

|

178,881

|

|

Royalties

|

235,021

|

258,206

|

|

Direct

sales expense

|

128,738

|

52,375

|

|

Total

cost of sales

|

1,858,233

|

2,140,420

|

|

Gross

profit - zeolite

|

408,403

|

332,674

|

|

|

|

|

|

Total

revenues - combined

|

10,229,978

|

11,890,135

|

|

Total

cost of sales - combined

|

10,068,578

|

11,353,484

|

|

Total

gross profit - combined

|

$161,400

|

$536,651

|

|

Results of Operations by

Division

|

|

|

|

Antimony - Combined USA

|

|

|

|

and Mexico

|

|

|

|

Lbs

of Antimony Metal USA

|

1,326,659

|

1,422,957

|

|

Lbs

of Antimony Metal Mexico:

|

564,780

|

1,513,923

|

|

Total Lbs of Antimony Metal Sold

|

1,891,439

|

2,936,880

|

|

Average

Sales Price/Lb Metal

|

$4.01

|

$2.98

|

|

Net loss/Lb Metal

|

$(0.94)

|

$(0.74)

|

|

|

|

|

|

Gross

antimony revenue - net of discount

|

$7,588,470

|

$8,744,170

|

|

|

|

|

|

Cost

of sales - domestic

|

(4,671,202)

|

(4,094,032)

|

|

Cost

of sales - Mexico

|

(3,474,643)

|

(5,074,665)

|

|

Operating

expenses

|

(1,056,862)

|

(1,265,518)

|

|

Non-operating

expenses

|

(162,002)

|

(183,428)

|

|

Income

tax provision

|

-

|

(298,138)

|

|

|

(9,364,709)

|

(10,915,781)

|

|

|

|

|

|

Net loss - antimony

|

(1,776,239)

|

(2,171,611)

|

|

Depreciation,&

amortization

|

681,660

|

741,502

|

|

Income

taxes

|

-

|

298,138

|

|

EBITDA - antimony

|

$(1,094,579)

|

$(1,131,971)

|

|

|

|

|

|

Precious Metals

|

|

|

|

Ounces sold

|

|

|

|

Gold

|

107

|

108

|

|

Silver

|

32,021

|

38,123

|

|

|

|

|

|

Gross

precious metals revenue

|

$374,872

|

$672,871

|

|

Production

costs, royalties, and shipping costs

|

(64,499)

|

(44,367)

|

|

Net income - precious metals

|

310,373

|

628,504

|

|

Depreciation

|

64,499

|

44,367

|

|

EBITDA - precious metals

|

$374,872

|

$672,871

|

|

|

|

|

|

Zeolite

|

|

|

|

Tons sold

|

12,377

|

13,143

|

|

Average

Sales Price/Ton

|

$183.13

|

$188.17

|

|

Net income (Loss)/Ton

|

$26.78

|

$17.80

|

|

|

|

|

|

Gross

zeolite revenue

|

$2,266,636

|

$2,473,094

|

|

Cost

of sales

|

(1,858,234)

|

(2,140,420)

|

|

Operating

expenses

|

(64,237)

|

(87,655)

|

|

Non-operating

expenses

|

(12,693)

|

(11,112)

|

|

Net income - zeolite

|

331,472

|

233,907

|

|

Depreciation

|

222,729

|

213,868

|

|

EBITDA - zeolite

|

$554,201

|

$447,775

|

|

|

|

|

|

Company-wide

|

|

|

|

Gross

revenue

|

$10,229,978

|

$11,890,135

|

|

Production

costs

|

(10,068,578)

|

(11,353,484)

|

|

Operating

expenses

|

(1,121,099)

|

(1,353,173)

|

|

Non-operating

expenses

|

(174,695)

|

(194,540)

|

|

Income

tax provision

|

-

|

(298,138)

|

|

Net income (loss)

|

(1,134,394)

|

(1,309,200)

|

|

Depreciation,&

amortization

|

968,888

|

999,737

|

|

Income

taxes

|

-

|

298,138

|

|

EBITDA

|

$(165,506)

|

$(11,325)

|

During the two year period ended December 31,

2017, the most significant events affecting our financial

performance were the fluctuation of antimony prices and the

decrease in our sources of antimony raw material. During the first

half of 2016, the price for antimony hit a seven year low, but

recovered to approximately $4.00 per pound by the end of 2017. By

the end of 2016, we stopped the processing of antimony concentrate

for Hillgrove Mines, Ltd., of Australia and started production from

our own mines in Mexico. There was no production from our

own mines in Mexico, during 2016 due to the processing of

concentrates from Hillgrove. We produced approximately 530,000

pounds from our Mexican properties in 2017. The Puerto Blanco mill

circuits were utilized less than 10% of their capacity. Going

forward, the increased supply of raw material from Mexico and the

metal prices for both antimony and precious metals will be the most

significant factors influencing our operations. Included in antimony cost of

sales-Mexico are costs of approximately $276,000 and $358,000 for

2017 and 2016, respectively, relating to maintaining our mineral

properties which were idle for 2016 and for a portion of

2017.

The

following are highlights of the significant changes during 2017 and

the two year period then ended:

Antimony:

●

The sale of

antimony during 2017 was 1,891,439 pounds compared to 2,936,880

pounds in 2016, a decrease of 1,045,441 pounds (36%).

●

The average sales

price of antimony during 2016 was $2.98 per pound compared to $4.01

during 2017, an increase of $1.03 per pound (35%). During the

beginning of 2018, the Rotterdam price of antimony is approximately

$3.75 per pound.

●

The metallurgical

problem with the Los Juarez concentrates has been solved with

cyanide and caustic leach plants, and pilot mining, milling, and

smelting will resume. This will put the Puerto Blanco mill in

operation during 2018. During 2017 and 2016, the Puerto Blanco mill

was operating at less than 10% of capacity.

●

The net loss per

pound of antimony was $0.94 in 2017 even though the price increased

$1.03 per pound from 2016. The net loss per pound in 2016 was $0.74

per pound.

●

Our cost of goods sold for antimony decreased

from $9,168,697 in 2016 to $8,145,846 in 2017. This was primarily

due to the decrease in raw material from Australia.

For the years ended December 31, 2017

and 2016, costs of goods sold include operating and non-operating

production costs from Mexico operations.

●

Our cost of

production for the years ended December 31, 2017 and 2016 included

metallurgical testing at Puerto Blanco and Madero, Mexico, and to a

lesser degree, our plant in Thompson Falls, Montana.

●

We are producing

and buying raw materials, which will allow us to ensure a steady

flow of products for sale. Our smelter at Madero, Mexico, was

producing primarily from concentrates from Australia in 2016.

Production from Madero during 2017 was primarily from our own

Mexican properties, and we purchased a significant portion of the

raw materials for our smelter in Montana.

●

We are

proceeding with the testing of the Los Juarez ore in the 100 ton

per day mill at Puerto Blanco. A 400 ton per day flotation mill is

permitted and is partially installed. This mill will be dedicated

to processing rock from the Los Juarez mining property. We have

adequate crushing capacity in place to feed the 450 ton per day

mill and the existing mill.

●

Our principal

smelter, precious metals recovery operation, and our Company

headquarters remain in Montana.

Zeolite:

During

2017, BRZ sold 12,377 tons compared to 13,143 tons in 2016, down

766 tons (6%). BRZ realized a net income of $331,472 in 2017 after

depreciation of $222,729 compared to a net income of $233,907 in

2016 after depreciation of $213,868. Production efficiency at the

plant in Preston, Idaho, increased in 2017 due to repairs and new

equipment. Sales activity in the early part of 2018 includes a

number of new customers.

General

and administrative costs, as reported in our statement of

operations, include fees paid to directors through stock based

compensation, office expenses, and fees to the NYSE AMERICAN, and

other non-operating costs. The combined general and administrative

costs were 5.2%, and 5.7%, of sales for 2017 and 2016,

respectively.

The

decrease in professional fees for 2017 (approximately $91,000) was

primarily due to attorney fees of approximately $72,000 paid in

2016 related to our former Investor Relations representative. Our

accounting fees for 2017 related to our annual audit and our

quarterly SEC filings decreased by approximately $15,000 from the

prior year.

Factoring costs

increased in 2017 from approximately $35,000 in 2016 to

approximately $36,000 in 2017.

The

discounts we gave for early payments were approximately $110,000

for both 2017and 2016.

Subsidiaries

The

Company has a 100% investment in two subsidiaries in Mexico, USAMSA

and AM, whose mineral property carrying values were assessed at

December 31, 2017 and 2016 for impairment. Management’s

assessment of the subsidiaries’ fair value was based on their

future benefit to us.

Financial Condition and Liquidity

|

|

|

|

|

Current

assets

|

$1,562,270

|

$1,692,555

|

|

Current

liabilities

|

(3,934,726)

|

(3,382,123)

|

|

Net

Working Capital

|

$(2,372,456)

|

$(1,689,568)

|

|

|

|

|

|

Cash

provided by operations

|

$716,705

|

$425,837

|

|

Cash

used for capital outlay

|

(365,541)

|

(583,029)

|

|

Cash

provided (used) by financing:

|

|

|

|

Net

payments (to) from factor

|

(139,519)

|

136,617

|

|

Proceeds

from notes payable to bank

|

25,248

|

36,645

|

|

Principal

paid on long-term debt

|

(211,529)

|

(175,238)

|

|

Checks

issued and payable

|

(7,434)

|

35,682

|

|

Net

change in cash

|

$17,930

|

$(123,486)

|

Our net

working capital decreased for the year ended December 31, 2017,

from a negative amount of $1,689,568 at the beginning of the year

to a negative amount of $2,372,456 at the end of 2017. Our current

assets decreased primarily due to a decrease in our accounts

receivable, which was partially offset by an increase in our

inventories. Our current liabilities increased by approximately

$550,000 primarily due to an increase in our accounts payable and

the current portion of long-term debt, which were partially offset

by the decrease in our liability for factored accounts receivable.

Capital improvements were paid for with cash and debt.

For the

year ending December 31, 2018, we are planning to finance our

improvements with operating cash flow. Our 2018 improvements are

expected to include improvements related to completing the cyanide

leach circuit at Puerto Blanco.

The

current portion of our long term debt is serviceable from the cash

generated by operations.

Going Concern Consideration

At

December 31, 2017, the Company’s financial statements show

negative working capital of approximately $2.4 million and an

accumulated deficit of approximately $26.5 million. In

addition, the Company has incurred losses for the prior three

years. These factors indicate that there may be doubt

regarding the ability to continue as a going concern for the next

twelve months.

The

continuing losses are principally a result of the Company’s

antimony operations and in particular to the production costs

incurred in Mexico. The other two operating divisions, precious

metals and zeolite, had gross profits of $310,373 and $408,403,

respectively, in 2017.

Regarding the

antimony division, in 2016 the Company endured some of the lowest

prices for antimony in the past seven years, with an average sales

price of only $2.98 per pound of metal contained. Prices

improved during 2017 with an average sale price of $4.01. Through

March 2018, our average sale price for antimony is approximately

$4.10 per pound. Additionally, in November 2017, the Company

renegotiated its domestic sodium antimonite supply agreement

resulting in a lower cost for antimony per pound of approximately

$0.44. With the new supply agreement in place, most of the market

increase in antimony prices will result in increased Company cash

flow in 2018 from its antimony division.

In

2017, the Company reduced costs for labor at the Mexico locations

which has resulted in a lower overall production costs in Mexico

which will continue through 2018. The reduction was due to a large

reduction in the work force at the Madero smelter because of the

decrease in antimony concentrates from Hillgrove (see Note 10). In

the fourth quarter 2017, the Company also adjusted operating

approaches at Madero that will likely result in a decrease in

operating costs for fuel, natural gas, electricity, and reagents.

Although total production activity in Mexico decreased in 2017 due

to the lack of Hillgrove concentrates, the Company’s 2018

plan involves ramping up production at its own antimony properties

in Mexico. In addition, a new leach circuit expected to come on

line during 2018 in Mexico will result in more extraction of

precious metals.

In

2017, management implemented wage and other cost reductions at the

corporate level that will keep administrative costs stable in 2018.

The Company expects to continue paying a low cost for propane in

Montana, which in years past has been a major operating

cost.

Over

the past several years, the Company has been able to make required

principal payments on its debt from cash generated from operations

without the need for additional borrowings or selling shares of its

common stock. The Company plans to continue keeping current on its

debt payments in 2018 through cash flows from

operations.

Management believes

that the current circumstances and cost reduction actions taken

will enable the Company to be actively operating for the next

twelve months.

Critical Accounting Estimates

We

have, besides our estimates of the amount of depreciation on our

assets, two critical accounting estimates. The value of our

unprocessed ore in inventory is assessed on assays taken at the

time the ore is delivered, and may vary when the ore is processed

and final settlement is made. Also, the asset recovery obligation

on our balance sheet is based on an estimate of the future cost to

recover and remediate our properties as required by our permits

upon cessation of our operations, and may differ when we cease

operations.

●

The value of

unprocessed ore in our inventory at the Wadley mining concession

and Puerto Blanco mill is based on assays taken at the time the ore

is delivered, and may vary when the ore is processed and final

settlement is made. We assay the ore to estimate the amount of

antimony contained per metric ton, and then make a payment based on

the Rotterdam price of antimony and the % of antimony contained.

Our payment scale incorporates a penalty for ore with a low

percentage of antimony. It is reasonably likely that the initial

assay will differ from the amount of metal recovered from a given

lot. If the initial assay of a lot of ore on hand at the end of a

reporting period were different, it would cause a change in our

reported inventory and accounts payable amounts, but would not

change our reported cost of goods sold or net income amounts. At

December 31, 2017, if we had overestimated the per cent of antimony

in our total inventory of purchased ore by 2.5%, (a 10% correction

to the amount of antimony metal contained if we assayed 25.0%

antimony per metric ton), the amount of our inventory and accounts

payable would be smaller by approximately $1,500. Our net income

would not be affected. Direct shipping ore (DSO) purchased at our

Madero smelter is paid for at a fixed amount at the time of

delivery and assaying, and is not subject to accounting estimates.

The amount of the accounting estimate for purchased ore at our

Puerto Blanco mill is in a constant state of change because the

amount of purchased ore and the per cent of metal contained are

constantly changing. Due to the amount of ore on hand at the end of

a reporting period, as compared to the amount of total assets,

liabilities, equity, and the ore processed during a reporting