FOR IMMEDIATE RELEASE | October 16, 2014 | |

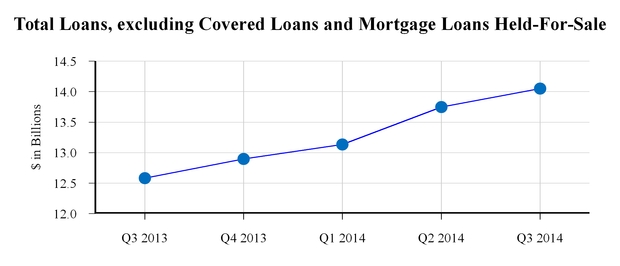

• | Total loans, excluding covered loans and mortgage loans held-for-sale, increased by $302 million, or 9% on annualized basis, to $14.1 billion |

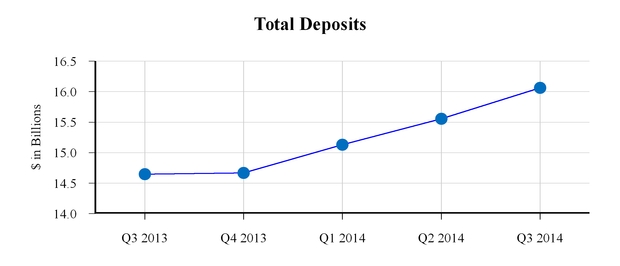

• | Total deposits increased by $509 million, or 13% on an annualized basis, to $16.1 billion |

• | Net interest income increased by $2.5 million to $151.7 million, however, net interest margin, on a fully-taxable equivalent basis, decreased by 16 basis points to 3.46% |

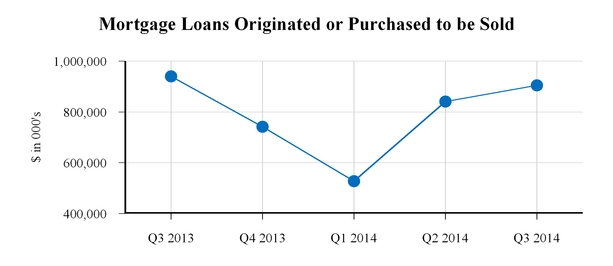

• | Mortgage banking revenue increased by $2.9 million to $26.7 million |

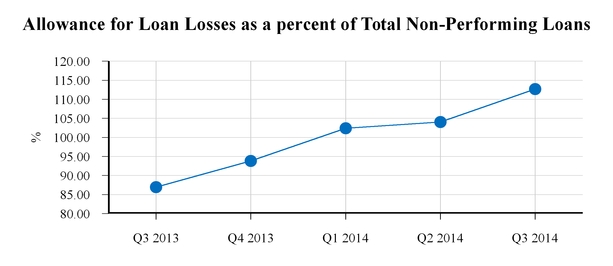

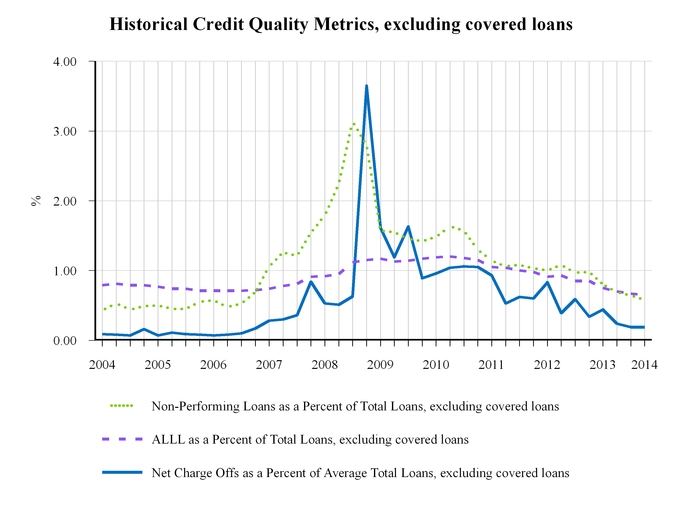

• | The allowance for loan losses as a percentage of total non-performing loans increased to 112% from 104% |

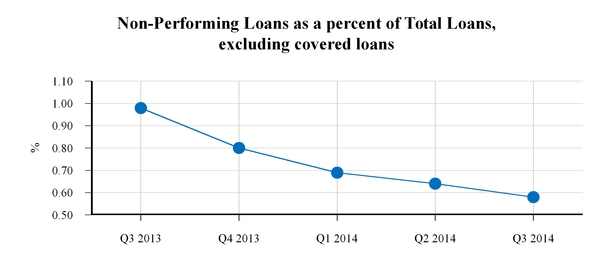

• | Non-performing loans as a percent of total loans, excluding covered loans, decreased to 0.58% from 0.64% |

• | Capital ratios remain strong with a tangible common equity ratio, assuming full conversion of preferred stock, of 8.6% |

• | Completed acquisition of 12 bank branches in Wisconsin through two separate branch transactions. |

% or(5) basis point (bp)change from 2nd Quarter 2014 | % or basis point (bp) change from 3rd Quarter 2013 | |||||||||||||||||||

Three Months Ended | ||||||||||||||||||||

(Dollars in thousands) | September 30, 2014 | June 30, 2014 | September 30, 2013 | |||||||||||||||||

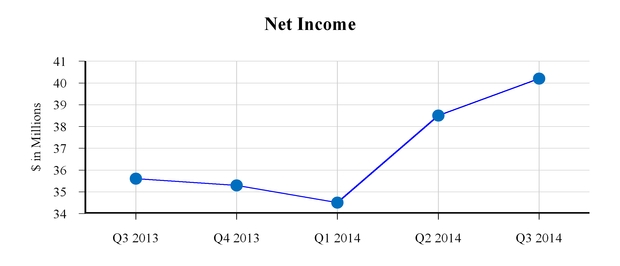

Net income | $ | 40,224 | $ | 38,541 | $ | 35,563 | 4 | % | 13 | % | ||||||||||

Net income per common share – diluted | $ | 0.79 | $ | 0.76 | $ | 0.71 | 4 | % | 11 | % | ||||||||||

Net revenue (1) | $ | 209,622 | $ | 203,282 | $ | 196,444 | 3 | % | 7 | % | ||||||||||

Net interest income | $ | 151,670 | $ | 149,180 | $ | 141,782 | 2 | % | 7 | % | ||||||||||

Net interest margin (2) | 3.46 | % | 3.62 | % | 3.57 | % | (16 | ) | bp | (11 | ) | bp | ||||||||

Net overhead ratio (2) (3) | 1.67 | % | 1.74 | % | 1.65 | % | (7 | ) | bp | 2 | bp | |||||||||

Efficiency ratio (2) (4) | 65.76 | % | 65.36 | % | 64.60 | % | 40 | bp | 116 | bp | ||||||||||

Return on average assets | 0.83 | % | 0.84 | % | 0.81 | % | (1 | ) | bp | 2 | bp | |||||||||

Return on average common equity | 8.09 | % | 8.03 | % | 7.85 | % | 6 | bp | 24 | bp | ||||||||||

Return on average tangible common equity | 10.59 | % | 10.43 | % | 10.27 | % | 16 | bp | 32 | bp | ||||||||||

At end of period | ||||||||||||||||||||

Total assets | $ | 19,169,345 | $ | 18,895,681 | $ | 17,682,548 | 6 | % | 8 | % | ||||||||||

Total loans, excluding loans held-for-sale, excluding covered loans | $ | 14,052,059 | $ | 13,749,996 | $ | 12,581,039 | 9 | % | 12 | % | ||||||||||

Total loans, including loans held-for-sale, excluding covered loans | $ | 14,415,362 | $ | 14,113,623 | $ | 12,915,384 | 8 | % | 12 | % | ||||||||||

Total deposits | $ | 16,065,246 | $ | 15,556,376 | $ | 14,647,446 | 13 | % | 10 | % | ||||||||||

Total shareholders’ equity | $ | 2,028,508 | $ | 1,998,235 | $ | 1,873,566 | 6 | % | 8 | % | ||||||||||

(1) | Net revenue is net interest income plus non-interest income. |

(2) | See “Supplemental Financial Measures/Ratios” for additional information on this performance measure/ratio. |

(3) | The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period's average total assets. A lower ratio indicates a higher degree of efficiency. |

(4) | The efficiency ratio is calculated by dividing total non-interest expense by tax-equivalent net revenue (less securities gains or losses). A lower ratio indicates more efficient revenue generation. |

(5) | Period-end balance sheet percentage changes are annualized. |

• | Net interest income increased $2.5 million in the third quarter of 2014 compared to the second quarter of 2014, due to: |

◦ | An increase in total interest income of $4.1 million in the third quarter of 2014 compared to the second quarter of 2014 resulting primarily from loan growth and one additional day in the quarter, partially offset by a decline in the yield on loans. |

◦ | Interest expense in the third quarter of 2014 compared to the second quarter of 2014 increased $1.6 million primarily as a result of the issuance of subordinated notes at the end of the second quarter of 2014 and one additional day in the quarter, partially offset by improvement in funding mix shown by a higher proportion of non-interest bearing deposits in the current quarter. |

• | Net interest income increased $9.9 million in the third quarter of 2014 compared to the third quarter of 2013, due to: |

◦ | Average loans, excluding covered loans, for the third quarter of 2014 increased by $1.2 billion compared to the third quarter of 2013. The growth in average loans, excluding covered loans, was partially offset by a 15 basis point decline in the yield on earning assets, resulting in an increase in total interest income of $9.5 million in the third quarter of 2014 compared to the prior year quarter. |

◦ | Funding mix improved as average demand deposits increased $681.8 million, average interest bearing deposits increased $878.1 million and average wholesale borrowings decreased by $146.1 million in the third quarter of 2014 compared to the third quarter of 2013. The change in funding mix, partially offset by the issuance of subordinated notes at the end of the second quarter of 2014, resulted in a four basis point decrease in the yield on average interest bearing liabilities which created a $380,000 decrease in interest expense. |

◦ | Combined, the increase in interest income of $9.5 million and the reduction of interest expense by $380,000 created the $9.9 million increase in net interest income in the third quarter of 2014 compared to the third quarter of 2013. |

• | Net interest income increased $36.5 million in the first nine months of 2014 compared to the first nine months of 2013, due to: |

◦ | Average earning assets for the first nine months of 2014 increased by $1.1 billion compared to the first nine months of 2013. This was primarily comprised of average loan growth, excluding covered loans, of $1.1 billion and an increase of $152.3 million in the average balance of liquidity management assets, partially offset by a decrease of $194.2 million in the average balance of covered loans. The growth in average total loans, excluding covered loans, included an increase of $541.2 million in commercial loans, $293.9 million in commercial real estate loans, $236.6 million in commercial premium finance receivables, $204.6 million in life insurance premium finance receivables and $4.7 million in home equity and other loans, partially offset by a decrease of $134.9 million in mortgage loans held-for-sale. |

◦ | The average earning asset growth of $1.1 billion in the first nine months of 2014, partially offset by a three basis point decrease in yield on earning assets, resulted in an increase in total interest income of $28.4 million in the first nine months of 2014 compared to the first nine months of 2013. |

◦ | Funding mix improved as average interest bearing deposits increased $555.6 million, average demand deposits increased $540.6 million and average wholesale borrowings decreased $112.5 million in the first nine months of 2014 compared to the first nine months of 2013. The change in the funding mix resulted in a 10 basis point decrease in the yield on average interest bearing liabilities which created a $8.1 million decrease in interest expense. |

◦ | Combined, the increase in interest income of $28.4 million and the reduction of interest expense by $8.1 million created the $36.5 million increase in net interest income in the first nine months of 2014 compared to the first nine months of 2013. |

Three Months Ended | Nine Months Ended | ||||||||||||||||||||

(In thousands, except per share data) | September 30, 2014 | June 30, 2014 | September 30, 2013 | September 30, 2014 | September 30, 2013 | ||||||||||||||||

Net income | $ | 40,224 | $ | 38,541 | $ | 35,563 | $ | 113,265 | $ | 101,922 | |||||||||||

Less: Preferred stock dividends and discount accretion | 1,581 | 1,581 | 1,581 | 4,743 | 6,814 | ||||||||||||||||

Net income applicable to common shares—Basic | (A) | 38,643 | 36,960 | 33,982 | 108,522 | 95,108 | |||||||||||||||

Add: Dividends on convertible preferred stock, if dilutive | 1,581 | 1,581 | 1,581 | 4,743 | 6,744 | ||||||||||||||||

Net income applicable to common shares—Diluted | (B) | 40,224 | 38,541 | 35,563 | 113,265 | 101,852 | |||||||||||||||

Weighted average common shares outstanding | (C) | 46,639 | 46,520 | 39,331 | 46,453 | 37,939 | |||||||||||||||

Effect of dilutive potential common shares: | |||||||||||||||||||||

Common stock equivalents | 1,166 | 1,327 | 7,346 | 1,274 | 7,263 | ||||||||||||||||

Convertible preferred stock, if dilutive | 3,075 | 3,075 | 3,477 | 3,075 | 4,500 | ||||||||||||||||

Weighted average common shares and effect of dilutive potential common shares | (D) | 50,880 | 50,922 | 50,154 | 50,802 | 49,702 | |||||||||||||||

Net income per common share: | |||||||||||||||||||||

Basic | (A/C) | $ | 0.83 | $ | 0.79 | $ | 0.86 | $ | 2.34 | $ | 2.51 | ||||||||||

Diluted | (B/D) | $ | 0.79 | $ | 0.76 | $ | 0.71 | $ | 2.23 | $ | 2.05 | ||||||||||

Three Months Ended | Nine Months Ended | |||||||||||||||||||

(Dollars in thousands, except per share data) | September 30, 2014 | June 30, 2014 | September 30, 2013 | September 30, 2014 | September 30, 2013 | |||||||||||||||

Selected Financial Condition Data (at end of period): | ||||||||||||||||||||

Total assets | $ | 19,169,345 | $ | 18,895,681 | $ | 17,682,548 | ||||||||||||||

Total loans, excluding loans held-for-sale and covered loans | 14,052,059 | 13,749,996 | 12,581,039 | |||||||||||||||||

Total deposits | 16,065,246 | 15,556,376 | 14,647,446 | |||||||||||||||||

Junior subordinated debentures | 249,493 | 249,493 | 249,493 | |||||||||||||||||

Total shareholders’ equity | 2,028,508 | 1,998,235 | 1,873,566 | |||||||||||||||||

Selected Statements of Income Data: | ||||||||||||||||||||

Net interest income | $ | 151,670 | $ | 149,180 | $ | 141,782 | $ | 444,856 | 408,319 | |||||||||||

Net revenue (1) | 209,622 | 203,282 | 196,444 | 602,439 | 584,355 | |||||||||||||||

Net income | 40,224 | 38,541 | 35,563 | 113,265 | 101,922 | |||||||||||||||

Net income per common share – Basic | $ | 0.83 | $ | 0.79 | $ | 0.86 | $ | 2.34 | $ | 2.51 | ||||||||||

Net income per common share – Diluted | $ | 0.79 | $ | 0.76 | $ | 0.71 | $ | 2.23 | $ | 2.05 | ||||||||||

Selected Financial Ratios and Other Data: | ||||||||||||||||||||

Performance Ratios: | ||||||||||||||||||||

Net interest margin (2) | 3.46 | % | 3.62 | % | 3.57 | % | 3.56 | % | 3.49 | % | ||||||||||

Non-interest income to average assets | 1.20 | % | 1.19 | % | 1.24 | % | 1.14 | % | 1.36 | % | ||||||||||

Non-interest expense to average assets | 2.87 | % | 2.93 | % | 2.89 | % | 2.92 | % | 2.89 | % | ||||||||||

Net overhead ratio (2) (3) | 1.67 | % | 1.74 | % | 1.65 | % | 1.78 | % | 1.54 | % | ||||||||||

Efficiency ratio (2) (4) | 65.76 | % | 65.36 | % | 64.60 | % | 66.65 | % | 64.12 | % | ||||||||||

Return on average assets | 0.83 | % | 0.84 | % | 0.81 | % | 0.82 | % | 0.79 | % | ||||||||||

Return on average common equity | 8.09 | % | 8.03 | % | 7.85 | % | 7.86 | % | 7.57 | % | ||||||||||

Return on average tangible common equity (2) | 10.59 | % | 10.43 | % | 10.27 | % | 10.25 | % | 9.93 | % | ||||||||||

Average total assets | $ | 19,127,346 | $ | 18,302,942 | $ | 17,489,571 | $ | 18,474,609 | $ | 17,344,319 | ||||||||||

Average total shareholders’ equity | 2,020,903 | 1,971,656 | 1,853,122 | 1,972,425 | 1,843,633 | |||||||||||||||

Average loans to average deposits ratio (excluding covered loans) | 90.1 | % | 90.4 | % | 91.3 | % | 90.0 | % | 88.9 | % | ||||||||||

Average loans to average deposits ratio (including covered loans) | 91.8 | % | 92.3 | % | 94.3 | % | 91.9 | % | 92.3 | % | ||||||||||

Common Share Data at end of period: | ||||||||||||||||||||

Market price per common share | $ | 44.67 | $ | 46.00 | $ | 41.07 | ||||||||||||||

Book value per common share (2) | $ | 40.74 | $ | 40.21 | $ | 38.09 | ||||||||||||||

Tangible common book value per share (2) | $ | 31.60 | $ | 31.64 | $ | 29.89 | ||||||||||||||

Common shares outstanding | 46,691,047 | 46,552,905 | 39,731,043 | |||||||||||||||||

Other Data at end of period:(8) | ||||||||||||||||||||

Leverage Ratio (5) | 10.0 | % | 10.5 | % | 10.5 | % | ||||||||||||||

Tier 1 capital to risk-weighted assets (5) | 11.5 | % | 11.7 | % | 12.3 | % | ||||||||||||||

Total capital to risk-weighted assets (5) | 12.9 | % | 13.2 | % | 13.1 | % | ||||||||||||||

Tangible common equity ratio (TCE) (2)(7) | 7.9 | % | 8.0 | % | 7.9 | % | ||||||||||||||

Tangible common equity ratio, assuming full conversion of preferred stock (2) (7) | 8.6 | % | 8.7 | % | 8.7 | % | ||||||||||||||

Allowance for credit losses (6) | $ | 91,841 | $ | 93,137 | $ | 108,455 | ||||||||||||||

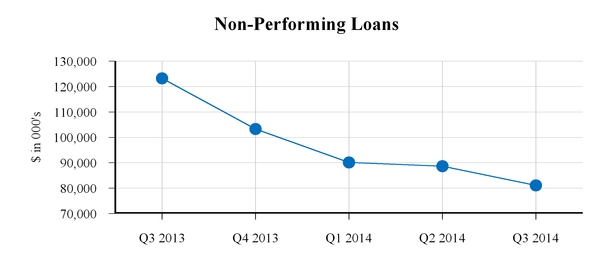

Non-performing loans | $ | 81,070 | $ | 88,650 | $ | 123,261 | ||||||||||||||

Allowance for credit losses to total loans (6) | 0.65 | % | 0.68 | % | 0.86 | % | ||||||||||||||

Non-performing loans to total loans | 0.58 | % | 0.64 | % | 0.98 | % | ||||||||||||||

Number of: | ||||||||||||||||||||

Bank subsidiaries | 15 | 15 | 15 | |||||||||||||||||

Banking offices | 139 | 127 | 119 | |||||||||||||||||

(1) | Net revenue includes net interest income and non-interest income |

(2) | See “Supplemental Financial Measures/Ratios” for additional information on this performance measure/ratio. |

(3) | The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s total average assets. A lower ratio indicates a higher degree of efficiency. |

(4) | The efficiency ratio is calculated by dividing total non-interest expense by tax-equivalent net revenue (less securities gains or losses). A lower ratio indicates more efficient revenue generation. |

(5) | Capital ratios for current quarter-end are estimated. |

(6) | The allowance for credit losses includes both the allowance for loan losses and the allowance for unfunded lending-related commitments, but excludes the allowance for covered loan losses. |

(7) | Total shareholders’ equity minus preferred stock and total intangible assets divided by total assets minus total intangible assets. |

(8) | Asset quality ratios exclude covered loans. |

(In thousands) | (Unaudited) September 30, 2014 | December 31, 2013 | (Unaudited) September 30, 2013 | |||||||||

Assets | ||||||||||||

Cash and due from banks | $ | 260,694 | $ | 253,408 | $ | 322,866 | ||||||

Federal funds sold and securities purchased under resale agreements | 26,722 | 10,456 | 7,771 | |||||||||

Interest bearing deposits with banks | 620,370 | 495,574 | 681,834 | |||||||||

Available-for-sale securities, at fair value | 1,782,648 | 2,176,290 | 1,781,883 | |||||||||

Trading account securities | 6,015 | 497 | 259 | |||||||||

Federal Home Loan Bank and Federal Reserve Bank stock | 80,951 | 79,261 | 76,755 | |||||||||

Brokerage customer receivables | 26,624 | 30,953 | 29,253 | |||||||||

Mortgage loans held-for-sale | 363,303 | 334,327 | 334,345 | |||||||||

Loans, net of unearned income, excluding covered loans | 14,052,059 | 12,896,602 | 12,581,039 | |||||||||

Covered loans | 254,605 | 346,431 | 415,988 | |||||||||

Total loans | 14,306,664 | 13,243,033 | 12,997,027 | |||||||||

Less: Allowance for loan losses | 91,019 | 96,922 | 107,188 | |||||||||

Less: Allowance for covered loan losses | 2,655 | 10,092 | 12,924 | |||||||||

Net loans | 14,212,990 | 13,136,019 | 12,876,915 | |||||||||

Premises and equipment, net | 555,241 | 531,947 | 517,942 | |||||||||

FDIC indemnification asset | 27,359 | 85,672 | 100,313 | |||||||||

Accrued interest receivable and other assets | 494,213 | 569,619 | 576,121 | |||||||||

Trade date securities receivable | 285,627 | — | — | |||||||||

Goodwill | 406,604 | 374,547 | 357,309 | |||||||||

Other intangible assets | 19,984 | 19,213 | 18,982 | |||||||||

Total assets | $ | 19,169,345 | $ | 18,097,783 | $ | 17,682,548 | ||||||

Liabilities and Shareholders’ Equity | ||||||||||||

Deposits: | ||||||||||||

Non-interest bearing | $ | 3,253,477 | $ | 2,721,771 | $ | 2,622,518 | ||||||

Interest bearing | 12,811,769 | 11,947,018 | 12,024,928 | |||||||||

Total deposits | 16,065,246 | 14,668,789 | 14,647,446 | |||||||||

Federal Home Loan Bank advances | 347,500 | 417,762 | 387,852 | |||||||||

Other borrowings | 51,483 | 255,104 | 248,416 | |||||||||

Subordinated notes | 140,000 | — | 10,000 | |||||||||

Junior subordinated debentures | 249,493 | 249,493 | 249,493 | |||||||||

Trade date securities payable | — | 303,088 | — | |||||||||

Accrued interest payable and other liabilities | 287,115 | 302,958 | 265,775 | |||||||||

Total liabilities | 17,140,837 | 16,197,194 | 15,808,982 | |||||||||

Shareholders’ Equity: | ||||||||||||

Preferred stock | 126,467 | 126,477 | 126,500 | |||||||||

Common stock | 46,766 | 46,181 | 39,992 | |||||||||

Surplus | 1,129,975 | 1,117,032 | 1,118,550 | |||||||||

Treasury stock | (3,519 | ) | (3,000 | ) | (8,290 | ) | ||||||

Retained earnings | 771,519 | 676,935 | 643,228 | |||||||||

Accumulated other comprehensive loss | (42,700 | ) | (63,036 | ) | (46,414 | ) | ||||||

Total shareholders’ equity | 2,028,508 | 1,900,589 | 1,873,566 | |||||||||

Total liabilities and shareholders’ equity | $ | 19,169,345 | $ | 18,097,783 | $ | 17,682,548 | ||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||||

(In thousands, except per share data) | September 30, 2014 | June 30, 2014 | September 30, 2013 | September 30, 2014 | September 30, 2013 | ||||||||||||||

Interest income | |||||||||||||||||||

Interest and fees on loans | $ | 156,534 | $ | 151,984 | $ | 150,810 | $ | 455,548 | $ | 438,907 | |||||||||

Interest bearing deposits with banks | 409 | 319 | 229 | 977 | 1,209 | ||||||||||||||

Federal funds sold and securities purchased under resale agreements | 12 | 6 | 4 | 22 | 23 | ||||||||||||||

Available-for-sale securities | 12,767 | 13,309 | 9,224 | 39,190 | 27,335 | ||||||||||||||

Trading account securities | 20 | 5 | 14 | 34 | 27 | ||||||||||||||

Federal Home Loan Bank and Federal Reserve Bank stock | 733 | 727 | 687 | 2,171 | 2,064 | ||||||||||||||

Brokerage customer receivables | 201 | 200 | 200 | 610 | 562 | ||||||||||||||

Total interest income | 170,676 | 166,550 | 161,168 | 498,552 | 470,127 | ||||||||||||||

Interest expense | |||||||||||||||||||

Interest on deposits | 12,298 | 11,759 | 12,524 | 35,980 | 40,703 | ||||||||||||||

Interest on Federal Home Loan Bank advances | 2,641 | 2,705 | 2,729 | 7,989 | 8,314 | ||||||||||||||

Interest on other borrowings | 200 | 510 | 910 | 1,460 | 3,196 | ||||||||||||||

Interest on subordinated notes | 1,776 | 354 | 40 | 2,130 | 151 | ||||||||||||||

Interest on junior subordinated debentures | 2,091 | 2,042 | 3,183 | 6,137 | 9,444 | ||||||||||||||

Total interest expense | 19,006 | 17,370 | 19,386 | 53,696 | 61,808 | ||||||||||||||

Net interest income | 151,670 | 149,180 | 141,782 | 444,856 | 408,319 | ||||||||||||||

Provision for credit losses | 5,864 | 6,660 | 11,114 | 14,404 | 42,183 | ||||||||||||||

Net interest income after provision for credit losses | 145,806 | 142,520 | 130,668 | 430,452 | 366,136 | ||||||||||||||

Non-interest income | |||||||||||||||||||

Wealth management | 17,659 | 18,222 | 16,057 | 52,694 | 46,777 | ||||||||||||||

Mortgage banking | 26,691 | 23,804 | 25,682 | 66,923 | 87,561 | ||||||||||||||

Service charges on deposit accounts | 6,084 | 5,688 | 5,308 | 17,118 | 15,136 | ||||||||||||||

(Losses) gains on available-for-sale securities, net | (153 | ) | (336 | ) | 75 | (522 | ) | 328 | |||||||||||

Fees from covered call options | 2,107 | 1,244 | 285 | 4,893 | 2,917 | ||||||||||||||

Trading gains (losses), net | 293 | (743 | ) | (1,655 | ) | (1,102 | ) | 1,170 | |||||||||||

Other | 5,271 | 6,223 | 8,910 | 17,579 | 22,147 | ||||||||||||||

Total non-interest income | 57,952 | 54,102 | 54,662 | 157,583 | 176,036 | ||||||||||||||

Non-interest expense | |||||||||||||||||||

Salaries and employee benefits | 85,976 | 81,963 | 78,007 | 247,873 | 234,745 | ||||||||||||||

Equipment | 7,570 | 7,223 | 6,593 | 22,196 | 19,190 | ||||||||||||||

Occupancy, net | 10,446 | 9,850 | 9,079 | 31,289 | 26,639 | ||||||||||||||

Data processing | 4,765 | 4,543 | 4,884 | 14,023 | 13,841 | ||||||||||||||

Advertising and marketing | 3,528 | 3,558 | 2,772 | 9,902 | 7,534 | ||||||||||||||

Professional fees | 4,035 | 4,046 | 3,378 | 11,535 | 10,790 | ||||||||||||||

Amortization of other intangible assets | 1,202 | 1,156 | 1,154 | 3,521 | 3,438 | ||||||||||||||

FDIC insurance | 3,211 | 3,196 | 3,245 | 9,358 | 9,692 | ||||||||||||||

OREO expense, net | 581 | 2,490 | 2,499 | 7,047 | 3,163 | ||||||||||||||

Other | 17,186 | 15,566 | 15,637 | 46,662 | 46,522 | ||||||||||||||

Total non-interest expense | 138,500 | 133,591 | 127,248 | 403,406 | 375,554 | ||||||||||||||

Income before taxes | 65,258 | 63,031 | 58,082 | 184,629 | 166,618 | ||||||||||||||

Income tax expense | 25,034 | 24,490 | 22,519 | 71,364 | 64,696 | ||||||||||||||

Net income | $ | 40,224 | $ | 38,541 | $ | 35,563 | $ | 113,265 | $ | 101,922 | |||||||||

Preferred stock dividends and discount accretion | 1,581 | 1,581 | 1,581 | 4,743 | 6,814 | ||||||||||||||

Net income applicable to common shares | $ | 38,643 | $ | 36,960 | $ | 33,982 | $ | 108,522 | $ | 95,108 | |||||||||

Net income per common share - Basic | $ | 0.83 | $ | 0.79 | $ | 0.86 | $ | 2.34 | $ | 2.51 | |||||||||

Net income per common share - Diluted | $ | 0.79 | $ | 0.76 | $ | 0.71 | $ | 2.23 | $ | 2.05 | |||||||||

Cash dividends declared per common share | $ | 0.10 | $ | 0.10 | $ | 0.09 | $ | 0.30 | $ | 0.18 | |||||||||

Weighted average common shares outstanding | 46,639 | 46,520 | 39,331 | 46,453 | 37,939 | ||||||||||||||

Dilutive potential common shares | 4,241 | 4,402 | 10,823 | 4,349 | 11,763 | ||||||||||||||

Average common shares and dilutive common shares | 50,880 | 50,922 | 50,154 | 50,802 | 49,702 | ||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||

September 30, | June 30, | March 31, | December 31, | September 30, | September 30, | September 30, | |||||||||||||||||||||

(Dollars and shares in thousands) | 2014 | 2014 | 2014 | 2013 | 2013 | 2014 | 2013 | ||||||||||||||||||||

Calculation of Net Interest Margin and Efficiency Ratio | |||||||||||||||||||||||||||

(A) Interest Income (GAAP) | $ | 170,676 | $ | 166,550 | $ | 161,326 | $ | 160,582 | $ | 161,168 | $ | 498,552 | $ | 470,127 | |||||||||||||

Taxable-equivalent adjustment: | |||||||||||||||||||||||||||

- Loans | 315 | 281 | 231 | 226 | 241 | 827 | 616 | ||||||||||||||||||||

- Liquidity Management Assets | 502 | 489 | 455 | 347 | 361 | 1,445 | 1,060 | ||||||||||||||||||||

- Other Earning Assets | 11 | 2 | 4 | (1 | ) | 7 | 17 | 12 | |||||||||||||||||||

Interest Income - FTE | $ | 171,504 | $ | 167,322 | $ | 162,016 | $ | 161,154 | $ | 161,777 | $ | 500,841 | $ | 471,815 | |||||||||||||

(B) Interest Expense (GAAP) | 19,006 | 17,370 | 17,320 | 18,274 | 19,386 | 53,696 | 61,808 | ||||||||||||||||||||

Net interest income - FTE | $ | 152,498 | $ | 149,952 | $ | 144,696 | $ | 142,880 | $ | 142,391 | $ | 447,145 | $ | 410,007 | |||||||||||||

(C) Net Interest Income (GAAP) (A minus B) | $ | 151,670 | $ | 149,180 | $ | 144,006 | $ | 142,308 | $ | 141,782 | $ | 444,856 | $ | 408,319 | |||||||||||||

(D) Net interest margin (GAAP) | 3.45 | % | 3.60 | % | 3.59 | % | 3.51 | % | 3.55 | % | 3.54 | % | 3.48 | % | |||||||||||||

Net interest margin - FTE | 3.46 | % | 3.62 | % | 3.61 | % | 3.53 | % | 3.57 | % | 3.56 | % | 3.49 | % | |||||||||||||

(E) Efficiency ratio (GAAP) | 66.02 | % | 65.61 | % | 69.27 | % | 66.15 | % | 64.80 | % | 66.90 | % | 64.30 | % | |||||||||||||

Efficiency ratio - FTE | 65.76 | % | 65.36 | % | 69.02 | % | 65.95 | % | 64.60 | % | 66.65 | % | 64.12 | % | |||||||||||||

(F) Net Overhead Ratio (GAAP) | 1.67 | % | 1.74 | % | 1.93 | % | 1.79 | % | 1.65 | % | 1.78 | % | 1.54 | % | |||||||||||||

Calculation of Tangible Common Equity ratio (at period end) | |||||||||||||||||||||||||||

Total shareholders’ equity | $ | 2,028,508 | $ | 1,998,235 | $ | 1,940,143 | $ | 1,900,589 | $ | 1,873,566 | |||||||||||||||||

(G) Less: Preferred stock | (126,467 | ) | (126,467 | ) | (126,477 | ) | (126,477 | ) | (126,500 | ) | |||||||||||||||||

Less: Intangible assets | (426,588 | ) | (398,615 | ) | (391,775 | ) | (393,760 | ) | (376,291 | ) | |||||||||||||||||

(H) Total tangible common shareholders’ equity | $ | 1,475,453 | $ | 1,473,153 | $ | 1,421,891 | $ | 1,380,352 | $ | 1,370,755 | |||||||||||||||||

Total assets | $ | 19,169,345 | $ | 18,895,681 | $ | 18,221,163 | $ | 18,097,783 | $ | 17,682,548 | |||||||||||||||||

Less: Intangible assets | (426,588 | ) | (398,615 | ) | (391,775 | ) | (393,760 | ) | (376,291 | ) | |||||||||||||||||

(I) Total tangible assets | $ | 18,742,757 | $ | 18,497,066 | $ | 17,829,388 | $ | 17,704,023 | $ | 17,306,257 | |||||||||||||||||

Tangible common equity ratio (H/I) | 7.9 | % | 8.0 | % | 8.0 | % | 7.8 | % | 7.9 | % | |||||||||||||||||

Tangible common equity ratio, assuming full conversion of preferred stock ((H-G)/I) | 8.6 | % | 8.7 | % | 8.7 | % | 8.5 | % | 8.7 | % | |||||||||||||||||

Calculation of book value per share | |||||||||||||||||||||||||||

Total shareholders’ equity | $ | 2,028,508 | $ | 1,998,235 | $ | 1,940,143 | $ | 1,900,589 | $ | 1,873,566 | |||||||||||||||||

Less: Preferred stock | (126,467 | ) | (126,467 | ) | (126,477 | ) | (126,477 | ) | (126,500 | ) | |||||||||||||||||

(J) Total common equity | $ | 1,902,041 | $ | 1,871,768 | $ | 1,813,666 | $ | 1,774,112 | $ | 1,747,066 | |||||||||||||||||

Actual common shares outstanding | 46,691 | 46,553 | 46,259 | 46,117 | 39,731 | ||||||||||||||||||||||

Add: TEU conversion shares | — | — | — | — | 6,133 | ||||||||||||||||||||||

(K) Common shares used for book value calculation | 46,691 | 46,553 | 46,259 | 46,117 | 45,864 | ||||||||||||||||||||||

Book value per share (J/K) | $ | 40.74 | $ | 40.21 | $ | 39.21 | $ | 38.47 | $ | 38.09 | |||||||||||||||||

Tangible common book value per share (H/K) | $ | 31.60 | $ | 31.64 | $ | 30.74 | $ | 29.93 | $ | 29.89 | |||||||||||||||||

Calculation of return on average common equity | |||||||||||||||||||||||||||

(L) Net income applicable to common shares | 38,643 | 36,960 | 32,919 | 33,707 | 33,982 | 108,522 | 95,108 | ||||||||||||||||||||

Add: After-tax intangible asset amortization | 739 | 708 | 712 | 726 | 705 | 2,159 | 2,102 | ||||||||||||||||||||

(M) Tangible net income applicable to common shares | 39,382 | 37,668 | 33,631 | 34,433 | 34,687 | 110,681 | 97,210 | ||||||||||||||||||||

Total average shareholders' equity | 2,020,903 | 1,971,656 | 1,923,649 | 1,895,498 | 1,853,122 | 1,972,425 | 1,843,633 | ||||||||||||||||||||

Less: Average preferred stock | (126,467 | ) | (126,473 | ) | (126,477 | ) | (126,484 | ) | (136,278 | ) | (126,472 | ) | (162,904 | ) | |||||||||||||

(N) Total average common shareholders' equity | 1,894,436 | 1,845,183 | 1,797,172 | 1,769,014 | 1,716,844 | 1,845,953 | 1,680,729 | ||||||||||||||||||||

Less: Average intangible assets | (419,125 | ) | (396,425 | ) | (392,703 | ) | (391,791 | ) | (376,667 | ) | (402,848 | ) | (371,697 | ) | |||||||||||||

(O) Total average tangible common shareholders’ equity | 1,475,311 | 1,448,758 | 1,404,469 | 1,377,223 | 1,340,177 | 1,443,105 | 1,309,032 | ||||||||||||||||||||

Return on average common equity, annualized (L/N) | 8.09 | % | 8.03 | % | 7.43 | % | 7.56 | % | 7.85 | % | 7.86 | % | 7.57 | % | |||||||||||||

Return on average tangible common equity, annualized (M/O) | 10.59 | % | 10.43 | % | 9.71 | % | 9.92 | % | 10.27 | % | 10.25 | % | 9.93 | % | |||||||||||||

% Growth | ||||||||||||||||||

(Dollars in thousands) | September 30, 2014 | December 31, 2013 | September 30, 2013 | From (1) December 31, 2013 | From September 30, 2013 | |||||||||||||

Balance: | ||||||||||||||||||

Commercial | $ | 3,689,671 | $ | 3,253,687 | $ | 3,109,121 | 18 | % | 19 | % | ||||||||

Commercial real-estate | 4,510,375 | 4,230,035 | 4,146,110 | 9 | 9 | |||||||||||||

Home equity | 720,058 | 719,137 | 736,620 | — | (2 | ) | ||||||||||||

Residential real-estate | 470,319 | 434,992 | 397,707 | 11 | 18 | |||||||||||||

Premium finance receivables - commercial | 2,377,892 | 2,167,565 | 2,150,481 | 13 | 11 | |||||||||||||

Premium finance receivables - life insurance | 2,134,405 | 1,923,698 | 1,869,739 | 15 | 14 | |||||||||||||

Consumer and other(2) | 149,339 | 167,488 | 171,261 | (14 | ) | (13 | ) | |||||||||||

Total loans, net of unearned income, excluding covered loans | $ | 14,052,059 | $ | 12,896,602 | $ | 12,581,039 | 12 | % | 12 | % | ||||||||

Covered loans | 254,605 | 346,431 | 415,988 | (35 | ) | (39 | ) | |||||||||||

Total loans, net of unearned income | $ | 14,306,664 | $ | 13,243,033 | $ | 12,997,027 | 11 | % | 10 | % | ||||||||

Mix: | ||||||||||||||||||

Commercial | 26 | % | 25 | % | 24 | % | ||||||||||||

Commercial real-estate | 31 | 32 | 32 | |||||||||||||||

Home equity | 5 | 5 | 6 | |||||||||||||||

Residential real-estate | 3 | 3 | 3 | |||||||||||||||

Premium finance receivables - commercial | 17 | 16 | 16 | |||||||||||||||

Premium finance receivables - life insurance | 15 | 15 | 14 | |||||||||||||||

Consumer and other(2) | 1 | 1 | 2 | |||||||||||||||

Total loans, net of unearned income, excluding covered loans | 98 | % | 97 | % | 97 | % | ||||||||||||

Covered loans | 2 | 3 | 3 | |||||||||||||||

Total loans, net of unearned income | 100 | % | 100 | % | 100 | % | ||||||||||||

(1) | Annualized |

(2) | Includes autos, boats, snowmobiles and other indirect consumer loans. |

As of September 30, 2014 | % of Total Balance | Nonaccrual | > 90 Days Past Due and Still Accruing | Allowance For Loan Losses Allocation | |||||||||||||||

(Dollars in thousands) | Balance | ||||||||||||||||||

Commercial: | |||||||||||||||||||

Commercial and industrial | $ | 2,070,827 | 25.3 | % | $ | 10,430 | $ | — | $ | 17,651 | |||||||||

Franchise | 238,300 | 2.9 | — | — | 1,989 | ||||||||||||||

Mortgage warehouse lines of credit | 121,585 | 1.5 | — | — | 1,042 | ||||||||||||||

Community Advantage - homeowner associations | 99,595 | 1.2 | — | — | 4 | ||||||||||||||

Aircraft | 6,146 | 0.1 | — | — | 7 | ||||||||||||||

Asset-based lending | 781,927 | 9.5 | 25 | — | 5,815 | ||||||||||||||

Tax exempt | 205,150 | 2.5 | — | — | 1,107 | ||||||||||||||

Leases | 145,439 | 1.8 | — | — | 13 | ||||||||||||||

Other | 11,403 | 0.1 | — | — | 95 | ||||||||||||||

PCI - commercial loans (1) | 9,299 | 0.1 | — | 863 | 189 | ||||||||||||||

Total commercial | $ | 3,689,671 | 45.0 | % | $ | 10,455 | $ | 863 | $ | 27,912 | |||||||||

Commercial Real-Estate: | |||||||||||||||||||

Residential construction | $ | 30,237 | 0.4 | % | $ | — | $ | — | $ | 522 | |||||||||

Commercial construction | 159,808 | 1.9 | 425 | — | 2,406 | ||||||||||||||

Land | 101,239 | 1.2 | 2,556 | — | 2,782 | ||||||||||||||

Office | 699,340 | 8.5 | 7,366 | — | 5,267 | ||||||||||||||

Industrial | 627,886 | 7.7 | 2,626 | — | 4,535 | ||||||||||||||

Retail | 725,890 | 8.9 | 6,205 | — | 5,990 | ||||||||||||||

Multi-family | 677,971 | 8.3 | 249 | — | 5,038 | ||||||||||||||

Mixed use and other | 1,427,386 | 17.4 | 7,936 | — | 12,112 | ||||||||||||||

PCI - commercial real-estate (1) | 60,618 | 0.7 | — | 14,294 | 7 | ||||||||||||||

Total commercial real-estate | $ | 4,510,375 | 55.0 | % | $ | 27,363 | $ | 14,294 | $ | 38,659 | |||||||||

Total commercial and commercial real-estate | $ | 8,200,046 | 100.0 | % | $ | 37,818 | $ | 15,157 | $ | 66,571 | |||||||||

Commercial real-estate - collateral location by state: | |||||||||||||||||||

Illinois | $ | 3,742,411 | 83.0 | % | |||||||||||||||

Wisconsin | 440,046 | 9.8 | |||||||||||||||||

Total primary markets | $ | 4,182,457 | 92.8 | % | |||||||||||||||

Florida | 82,577 | 1.8 | |||||||||||||||||

Arizona | 10,414 | 0.2 | |||||||||||||||||

Indiana | 89,254 | 2.0 | |||||||||||||||||

Other (no individual state greater than 0.5%) | 145,673 | 3.2 | |||||||||||||||||

Total | $ | 4,510,375 | 100.0 | % | |||||||||||||||

(1) | Purchased credit impaired ("PCI") loans represent loans acquired with evidence of credit quality deterioration since origination, in accordance with ASC 310-30. Loan agings are based upon contractually required payments. |

% Growth | ||||||||||||||||||

(Dollars in thousands) | September 30, 2014 | December 31, 2013 | September 30, 2013 | From (1) December 31, 2013 | From September 30, 2013 | |||||||||||||

Balance: | ||||||||||||||||||

Non-interest bearing | $ | 3,253,477 | $ | 2,721,771 | $ | 2,622,518 | 26 | % | 24 | % | ||||||||

NOW and interest bearing demand deposits | 2,086,099 | 1,953,882 | 1,922,906 | 9 | 8 | |||||||||||||

Wealth Management deposits (2) | 1,212,317 | 1,013,850 | 1,099,509 | 26 | 10 | |||||||||||||

Money Market | 3,744,682 | 3,359,999 | 3,423,413 | 15 | 9 | |||||||||||||

Savings | 1,465,250 | 1,392,575 | 1,318,147 | 7 | 11 | |||||||||||||

Time certificates of deposit | 4,303,421 | 4,226,712 | 4,260,953 | 2 | 1 | |||||||||||||

Total deposits | $ | 16,065,246 | $ | 14,668,789 | $ | 14,647,446 | 13 | % | 10 | % | ||||||||

Mix: | ||||||||||||||||||

Non-interest bearing | 20 | % | 19 | % | 18 | % | ||||||||||||

NOW and interest bearing demand deposits | 13 | 13 | 13 | |||||||||||||||

Wealth Management deposits (2) | 8 | 7 | 8 | |||||||||||||||

Money Market | 23 | 23 | 23 | |||||||||||||||

Savings | 9 | 9 | 9 | |||||||||||||||

Time certificates of deposit | 27 | 29 | 29 | |||||||||||||||

Total deposits | 100 | % | 100 | % | 100 | % | ||||||||||||

(1) | Annualized |

(2) | Represents deposit balances of the Company’s subsidiary banks from brokerage customers of Wayne Hummer Investments, trust and asset management customers of The Chicago Trust Company and brokerage customers from unaffiliated companies which have been placed into deposit accounts of the Banks. |

(Dollars in thousands) | CDARs & Brokered Certificates of Deposit (1) | MaxSafe Certificates of Deposit (1) | Variable Rate Certificates of Deposit (2) | Other Fixed Rate Certificates of Deposit (1) | Total Time Certificates of Deposit | Weighted-Average Rate of Maturing Time Certificates of Deposit (3) | |||||||||||||||||

1-3 months | $ | 80,052 | $ | 77,966 | $ | 156,916 | $ | 578,561 | $ | 893,495 | 0.45 | % | |||||||||||

4-6 months | 95,586 | 55,503 | — | 543,488 | 694,577 | 0.85 | % | ||||||||||||||||

7-9 months | 69,396 | 32,297 | — | 516,980 | 618,673 | 0.75 | % | ||||||||||||||||

10-12 months | 36,459 | 39,888 | — | 515,125 | 591,472 | 0.81 | % | ||||||||||||||||

13-18 months | 2,168 | 30,946 | — | 527,831 | 560,945 | 0.91 | % | ||||||||||||||||

19-24 months | 201,652 | 8,460 | — | 228,897 | 439,009 | 0.97 | % | ||||||||||||||||

24+ months | 41,000 | 19,535 | — | 444,715 | 505,250 | 1.19 | % | ||||||||||||||||

Total | $ | 526,313 | $ | 264,595 | $ | 156,916 | $ | 3,355,597 | $ | 4,303,421 | 0.81 | % | |||||||||||

(1) | This category of certificates of deposit is shown by contractual maturity date. |

(2) | This category includes variable rate certificates of deposit and savings certificates with the majority repricing on at least a monthly basis. |

(3) | Weighted-average rate excludes the impact of purchase accounting fair value adjustments. |

Average Balance for three months ended, | Interest for three months ended, | Yield/Rate for three months ended, | ||||||||||||||||||||||||||||||

(Dollars in thousands) | September 30, 2014 | June 30, 2014 | September 30, 2013 | September 30, 2014 | June 30, 2014 | September 30, 2013 | September 30, 2014 | June 30, 2014 | September 30, 2013 | |||||||||||||||||||||||

Liquidity management assets(1)(2)(7) | $ | 2,814,720 | $ | 2,607,980 | $ | 2,262,839 | $ | 14,423 | $ | 14,850 | $ | 10,504 | 2.03 | % | 2.28 | % | 1.84 | % | ||||||||||||||

Other earning assets(2)(3)(7) | 28,702 | 27,463 | 27,426 | 232 | 207 | 221 | 3.21 | 3.02 | 3.19 | |||||||||||||||||||||||

Loans, net of unearned income(2)(4)(7) | 14,359,467 | 13,710,535 | 13,113,138 | 151,540 | 145,169 | 142,085 | 4.19 | 4.25 | 4.30 | |||||||||||||||||||||||

Covered loans | 262,310 | 292,553 | 435,961 | 5,309 | 7,096 | 8,967 | 8.03 | 9.73 | 8.16 | |||||||||||||||||||||||

Total earning assets(7) | $ | 17,465,199 | $ | 16,638,531 | $ | 15,839,364 | $ | 171,504 | $ | 167,322 | $ | 161,777 | 3.90 | % | 4.03 | % | 4.05 | % | ||||||||||||||

Allowance for loan and covered loan losses | (96,463 | ) | (98,255 | ) | (126,164 | ) | ||||||||||||||||||||||||||

Cash and due from banks | 237,402 | 232,716 | 209,539 | |||||||||||||||||||||||||||||

Other assets | 1,521,208 | 1,529,950 | 1,566,832 | |||||||||||||||||||||||||||||

Total assets | $ | 19,127,346 | $ | 18,302,942 | $ | 17,489,571 | ||||||||||||||||||||||||||

Interest-bearing deposits | $ | 12,695,780 | $ | 12,284,444 | $ | 11,817,636 | $ | 12,298 | $ | 11,759 | $ | 12,524 | 0.38 | % | 0.38 | % | 0.42 | % | ||||||||||||||

Federal Home Loan Bank advances | 380,083 | 446,778 | 454,563 | 2,641 | 2,705 | 2,729 | 2.76 | 2.43 | 2.38 | |||||||||||||||||||||||

Other borrowings | 54,653 | 148,135 | 256,318 | 200 | 510 | 910 | 1.45 | 1.38 | 1.41 | |||||||||||||||||||||||

Subordinated notes | 140,000 | 27,692 | 10,000 | 1,776 | 354 | 40 | 5.07 | 5.06 | 1.57 | |||||||||||||||||||||||

Junior subordinated notes | 249,493 | 249,493 | 249,493 | 2,091 | 2,042 | 3,183 | 3.28 | 3.24 | 4.99 | |||||||||||||||||||||||

Total interest-bearing liabilities | $ | 13,520,009 | $ | 13,156,542 | $ | 12,788,010 | $ | 19,006 | $ | 17,370 | $ | 19,386 | 0.56 | % | 0.53 | % | 0.60 | % | ||||||||||||||

Non-interest bearing deposits | 3,233,937 | 2,880,501 | 2,552,182 | |||||||||||||||||||||||||||||

Other liabilities | 352,497 | 294,243 | 296,257 | |||||||||||||||||||||||||||||

Equity | 2,020,903 | 1,971,656 | 1,853,122 | |||||||||||||||||||||||||||||

Total liabilities and shareholders’ equity | $ | 19,127,346 | $ | 18,302,942 | $ | 17,489,571 | ||||||||||||||||||||||||||

Interest rate spread(5)(7) | 3.34 | % | 3.50 | % | 3.45 | % | ||||||||||||||||||||||||||

Net free funds/contribution(6) | $ | 3,945,190 | $ | 3,481,989 | $ | 3,051,354 | 0.12 | % | 0.12 | % | 0.12 | % | ||||||||||||||||||||

Net interest income/ margin(7) | $ | 152,498 | $ | 149,952 | $ | 142,391 | 3.46 | % | 3.62 | % | 3.57 | % | ||||||||||||||||||||

(1) | Liquidity management assets include available-for-sale securities, interest earning deposits with banks, federal funds sold and securities purchased under resale agreements. |

(2) | Interest income on tax-advantaged loans, trading securities and securities reflects a tax-equivalent adjustment based on a marginal federal corporate tax rate of 35%. The total adjustments for the three months ended September 30, 2014, June 30, 2014 and September 30, 2013 were $828,000, $772,000 and $609,000, respectively. |

(3) | Other earning assets include brokerage customer receivables and trading account securities. |

(4) | Loans, net of unearned income, include loans held-for-sale and non-accrual loans. |

(5) | Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities. |

(6) | Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities. |

(7) | See “Supplemental Financial Measures/Ratios” for additional information on this performance ratio. |

Average Balance for nine months ended, | Interest for nine months ended, | Yield/Rate for nine months ended, | |||||||||||||||||||

(Dollars in thousands) | September 30, 2014 | September 30, 2013 | September 30, 2014 | September 30, 2013 | September 30, 2014 | September 30, 2013 | |||||||||||||||

Liquidity management assets(1)(2)(7) | $ | 2,690,422 | $ | 2,538,131 | $ | 43,805 | $ | 31,690 | 2.18 | % | 1.67 | % | |||||||||

Other earning assets(2)(3)(7) | 28,363 | 25,815 | 661 | 602 | 3.12 | 3.12 | |||||||||||||||

Loans, net of unearned income(2)(4)(7) | 13,786,669 | 12,640,610 | 437,030 | 410,964 | 4.24 | 4.35 | |||||||||||||||

Covered loans | 293,349 | 487,581 | 19,345 | 28,559 | 8.82 | 7.83 | |||||||||||||||

Total earning assets(7) | $ | 16,798,803 | $ | 15,692,137 | $ | 500,841 | $ | 471,815 | 3.99 | % | 4.02 | % | |||||||||

Allowance for loan and covered loan losses | (101,624 | ) | (125,950 | ) | |||||||||||||||||

Cash and due from banks | 231,199 | 217,503 | |||||||||||||||||||

Other assets | 1,546,231 | 1,560,629 | |||||||||||||||||||

Total assets | $ | 18,474,609 | $ | 17,344,319 | |||||||||||||||||

Interest-bearing deposits | $ | 12,369,241 | $ | 11,813,674 | $ | 35,980 | $ | 40,703 | 0.39 | % | 0.46 | % | |||||||||

Federal Home Loan Bank advances | 405,246 | 434,557 | 7,989 | 8,314 | 2.64 | 2.56 | |||||||||||||||

Other borrowings | 148,549 | 275,425 | 1,460 | 3,196 | 1.31 | 1.55 | |||||||||||||||

Subordinated notes | 56,410 | 12,711 | 2,130 | 151 | 5.03 | 1.57 | |||||||||||||||

Junior subordinated notes | 249,493 | 249,493 | 6,137 | 9,444 | 3.24 | 4.99 | |||||||||||||||

Total interest-bearing liabilities | $ | 13,228,939 | $ | 12,785,860 | $ | 53,696 | $ | 61,808 | 0.54 | % | 0.64 | % | |||||||||

Non-interest bearing deposits | 2,948,961 | 2,408,365 | |||||||||||||||||||

Other liabilities | 324,284 | 306,461 | |||||||||||||||||||

Equity | 1,972,425 | 1,843,633 | |||||||||||||||||||

Total liabilities and shareholders’ equity | $ | 18,474,609 | $ | 17,344,319 | |||||||||||||||||

Interest rate spread(5)(7) | 3.45 | % | 3.38 | % | |||||||||||||||||

Net free funds/contribution(6) | $ | 3,569,864 | $ | 2,906,277 | 0.11 | % | 0.11 | % | |||||||||||||

Net interest income/ margin(7) | $ | 447,145 | $ | 410,007 | 3.56 | % | 3.49 | % | |||||||||||||

(1) | Liquidity management assets include available-for-sale securities, interest earning deposits with banks, federal funds sold and securities purchased under resale agreements. |

(2) | Interest income on tax-advantaged loans, trading securities and securities reflects a tax-equivalent adjustment based on a marginal federal corporate tax rate of 35%. The total adjustments for the nine months ended September 30, 2014, and September 30, 2013 were $2.3 million and $1.7 million, respectively. |

(3) | Other earning assets include brokerage customer receivables and trading account securities. |

(4) | Loans, net of unearned income, include loans held-for-sale and non-accrual loans. |

(5) | Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities. |

(6) | Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities. |

(7) | See “Supplemental Financial Measures/Ratios” for additional information on this performance ratio. |

Static Shock Scenarios | +200 Basis Points | +100 Basis Points | -100 Basis Points | ||||||

September 30, 2014 | 13.7 | % | 6.2 | % | (11.1 | )% | |||

December 31, 2013 | 13.0 | % | 5.7 | % | (12.9 | )% | |||

September 30, 2013 | 13.6 | % | 6.2 | % | (11.4 | )% | |||

Ramp Scenarios | +200 Basis Points | +100 Basis Points | -100 Basis Points | |||||

September 30, 2014 | 5.0 | % | 2.6 | % | (5.0 | )% | ||

December 31, 2013 | 5.0 | % | 2.4 | % | (5.0 | )% | ||

September 30, 2013 | 5.8 | % | 3.0 | % | (5.1 | )% | ||

Three Months Ended | ||||||||||||||||||||||||||

September 30, | June 30, | September 30, | Q3 2014 compared to Q2 2014 | Q3 2014 compared to Q3 2013 | ||||||||||||||||||||||

(Dollars in thousands) | 2014 | 2014 | 2013 | $ Change | % Change | $ Change | % Change | |||||||||||||||||||

Brokerage | $ | 7,185 | $ | 8,270 | $ | 7,388 | $ | (1,085 | ) | (13 | )% | $ | (203 | ) | (3 | )% | ||||||||||

Trust and asset management | 10,474 | 9,952 | 8,669 | 522 | 5 | 1,805 | 21 | |||||||||||||||||||

Total wealth management | 17,659 | 18,222 | 16,057 | (563 | ) | (3 | ) | 1,602 | 10 | |||||||||||||||||

Mortgage banking | 26,691 | 23,804 | 25,682 | 2,887 | 12 | 1,009 | 4 | |||||||||||||||||||

Service charges on deposit accounts | 6,084 | 5,688 | 5,308 | 396 | 7 | 776 | 15 | |||||||||||||||||||

(Losses) gains on available-for-sale securities, net | (153 | ) | (336 | ) | 75 | 183 | 54 | (228 | ) | NM | ||||||||||||||||

Fees from covered call options | 2,107 | 1,244 | 285 | 863 | 69 | 1,822 | NM | |||||||||||||||||||

Trading gains (losses), net | 293 | (743 | ) | (1,655 | ) | 1,036 | NM | 1,948 | NM | |||||||||||||||||

Other: | ||||||||||||||||||||||||||

Interest rate swap fees | 1,207 | 1,192 | 2,183 | 15 | 1 | (976 | ) | (45 | ) | |||||||||||||||||

Bank Owned Life Insurance | 652 | 675 | 625 | (23 | ) | (3 | ) | 27 | 4 | |||||||||||||||||

Administrative services | 990 | 938 | 943 | 52 | 6 | 47 | 5 | |||||||||||||||||||

Miscellaneous | 2,422 | 3,418 | 5,159 | (996 | ) | (29 | ) | (2,737 | ) | (53 | ) | |||||||||||||||

Total Other | 5,271 | 6,223 | 8,910 | (952 | ) | (15 | ) | (3,639 | ) | (41 | ) | |||||||||||||||

Total Non-Interest Income | $ | 57,952 | $ | 54,102 | $ | 54,662 | $ | 3,850 | 7 | % | $ | 3,290 | 6 | % | ||||||||||||

Nine months ended | $ Change | % Change | |||||||||||||

(Dollars in thousands) | September 30, 2014 | September 30, 2013 | |||||||||||||

Brokerage | $ | 22,546 | $ | 22,080 | $ | 466 | 2 | ||||||||

Trust and asset management | 30,148 | 24,697 | 5,451 | 22 | |||||||||||

Total wealth management | 52,694 | 46,777 | 5,917 | 13 | |||||||||||

Mortgage banking | 66,923 | 87,561 | (20,638 | ) | (24 | ) | |||||||||

Service charges on deposit accounts | 17,118 | 15,136 | 1,982 | 13 | |||||||||||

(Losses) gains on available-for-sale securities, net | (522 | ) | 328 | (850 | ) | NM | |||||||||

Fees from covered call options | 4,893 | 2,917 | 1,976 | 68 | |||||||||||

Trading (losses) gains, net | (1,102 | ) | 1,170 | (2,272 | ) | NM | |||||||||

Other: | |||||||||||||||

Interest rate swap fees | 3,350 | 6,092 | (2,742 | ) | (45 | ) | |||||||||

Bank Owned Life Insurance | 2,039 | 2,372 | (333 | ) | (14 | ) | |||||||||

Administrative services | 2,786 | 2,512 | 274 | 11 | |||||||||||

Miscellaneous | 9,404 | 11,171 | (1,767 | ) | (16 | ) | |||||||||

Total Other | 17,579 | 22,147 | (4,568 | ) | (21 | ) | |||||||||

Total Non-Interest Income | $ | 157,583 | $ | 176,036 | $ | (18,453 | ) | (10 | ) | ||||||

Three Months Ended | ||||||||

(Dollars in thousands) | September 30, 2014 | June 30, 2014 | September 30, 2013 | |||||

Mortgage loans serviced for others | 898,960 | 926,679 | 981,415 | |||||

Fair value of mortgage servicing rights (MSRs) | 8,137 | 8,227 | 8,608 | |||||

MSRs as a percentage of loans serviced | 0.91 | % | 0.89 | % | 0.88 | % | ||

Three Months Ended | ||||||||||||||||||||||||||

September 30, | June 30, | September 30, | Q3 2014 compared to Q2 2014 | Q3 2014 compared to Q3 2013 | ||||||||||||||||||||||

(Dollars in thousands) | 2014 | 2014 | 2013 | $ Change | % Change | $ Change | % Change | |||||||||||||||||||

Salaries and employee benefits: | ||||||||||||||||||||||||||

Salaries | $ | 45,471 | $ | 43,349 | $ | 42,789 | $ | 2,122 | 5 | % | $ | 2,682 | 6 | % | ||||||||||||

Commissions and incentive compensation | 27,885 | 25,398 | 23,409 | 2,487 | 10 | 4,476 | 19 | |||||||||||||||||||

Benefits | 12,620 | 13,216 | 11,809 | (596 | ) | (5 | ) | 811 | 7 | |||||||||||||||||

Total salaries and employee benefits | 85,976 | 81,963 | 78,007 | 4,013 | 5 | 7,969 | 10 | |||||||||||||||||||

Equipment | 7,570 | 7,223 | 6,593 | 347 | 5 | 977 | 15 | |||||||||||||||||||

Occupancy, net | 10,446 | 9,850 | 9,079 | 596 | 6 | 1,367 | 15 | |||||||||||||||||||

Data processing | 4,765 | 4,543 | 4,884 | 222 | 5 | (119 | ) | (2 | ) | |||||||||||||||||

Advertising and marketing | 3,528 | 3,558 | 2,772 | (30 | ) | (1 | ) | 756 | 27 | |||||||||||||||||

Professional fees | 4,035 | 4,046 | 3,378 | (11 | ) | — | 657 | 19 | ||||||||||||||||||

Amortization of other intangible assets | 1,202 | 1,156 | 1,154 | 46 | 4 | 48 | 4 | |||||||||||||||||||

FDIC insurance | 3,211 | 3,196 | 3,245 | 15 | — | (34 | ) | (1 | ) | |||||||||||||||||

OREO expense, net | 581 | 2,490 | 2,499 | (1,909 | ) | (77 | ) | (1,918 | ) | (77 | ) | |||||||||||||||

Other: | ||||||||||||||||||||||||||

Commissions - 3rd party brokers | 1,621 | 1,633 | 1,277 | (12 | ) | (1 | ) | 344 | 27 | |||||||||||||||||

Postage | 1,427 | 1,465 | 1,255 | (38 | ) | (3 | ) | 172 | 14 | |||||||||||||||||

Stationery and supplies | 899 | 894 | 1,009 | 5 | 1 | (110 | ) | (11 | ) | |||||||||||||||||

Miscellaneous | 13,239 | 11,574 | 12,096 | 1,665 | 14 | 1,143 | 9 | |||||||||||||||||||

Total other | 17,186 | 15,566 | 15,637 | 1,620 | 10 | 1,549 | 10 | |||||||||||||||||||

Total Non-Interest Expense | $ | 138,500 | $ | 133,591 | $ | 127,248 | $ | 4,909 | 4 | % | $ | 11,252 | 9 | % | ||||||||||||

Nine Months Ended | $ Change | % Change | |||||||||||||

(Dollars in thousands) | September 30, 2014 | September 30, 2013 | |||||||||||||

Salaries and employee benefits: | |||||||||||||||

Salaries | $ | 132,556 | $ | 126,291 | $ | 6,265 | 5 | % | |||||||

Commissions and incentive compensation | 74,816 | 69,828 | 4,988 | 7 | |||||||||||

Benefits | 40,501 | 38,626 | 1,875 | 5 | |||||||||||

Total salaries and employee benefits | 247,873 | 234,745 | 13,128 | 6 | |||||||||||

Equipment | 22,196 | 19,190 | 3,006 | 16 | |||||||||||

Occupancy, net | 31,289 | 26,639 | 4,650 | 17 | |||||||||||

Data processing | 14,023 | 13,841 | 182 | 1 | |||||||||||

Advertising and marketing | 9,902 | 7,534 | 2,368 | 31 | |||||||||||

Professional fees | 11,535 | 10,790 | 745 | 7 | |||||||||||

Amortization of other intangible assets | 3,521 | 3,438 | 83 | 2 | |||||||||||

FDIC insurance | 9,358 | 9,692 | (334 | ) | (3 | ) | |||||||||

OREO expense, net | 7,047 | 3,163 | 3,884 | NM | |||||||||||

Other: | |||||||||||||||

Commissions - 3rd party brokers | 4,911 | 3,639 | 1,272 | 35 | |||||||||||

Postage | 4,321 | 3,968 | 353 | 9 | |||||||||||

Stationery and supplies | 2,685 | 2,830 | (145 | ) | (5 | ) | |||||||||

Miscellaneous | 34,745 | 36,085 | (1,340 | ) | (4 | ) | |||||||||

Total other | 46,662 | 46,522 | 140 | — | |||||||||||

Total Non-Interest Expense | $ | 403,406 | $ | 375,554 | $ | 27,852 | 7 | % | |||||||

Three Months Ended | Nine Months Ended | |||||||||||||||||||

September 30, | June 30, | September 30, | September 30, | September 30, | ||||||||||||||||

(Dollars in thousands) | 2014 | 2014 | 2013 | 2014 | 2013 | |||||||||||||||

Allowance for loan losses at beginning of period | $ | 92,253 | $ | 92,275 | $ | 106,842 | $ | 96,922 | $ | 107,351 | ||||||||||

Provision for credit losses | 6,028 | 6,813 | 11,580 | 16,145 | 42,080 | |||||||||||||||

Other adjustments | (335 | ) | (105 | ) | (205 | ) | (588 | ) | (743 | ) | ||||||||||

Reclassification from (to) allowance for unfunded lending-related commitments | 62 | (146 | ) | 284 | (102 | ) | 136 | |||||||||||||

Charge-offs: | ||||||||||||||||||||

Commercial | 832 | 2,384 | 3,281 | 3,864 | 8,914 | |||||||||||||||

Commercial real estate | 4,510 | 2,351 | 6,982 | 11,354 | 25,228 | |||||||||||||||

Home equity | 748 | 730 | 711 | 3,745 | 4,893 | |||||||||||||||

Residential real estate | 205 | 689 | 328 | 1,120 | 2,573 | |||||||||||||||

Premium finance receivables - commercial | 1,557 | 1,492 | 1,294 | 4,259 | 3,668 | |||||||||||||||

Premium finance receivables - life insurance | — | — | 3 | — | 3 | |||||||||||||||

Consumer and other | 250 | 213 | 216 | 636 | 473 | |||||||||||||||

Total charge-offs | 8,102 | 7,859 | 12,815 | 24,978 | 45,752 | |||||||||||||||

Recoveries: | ||||||||||||||||||||

Commercial | 296 | 270 | 756 | 883 | 1,319 | |||||||||||||||

Commercial real estate | 275 | 342 | 272 | 762 | 1,224 | |||||||||||||||

Home equity | 99 | 122 | 43 | 478 | 376 | |||||||||||||||

Residential real estate | 111 | 74 | 64 | 316 | 87 | |||||||||||||||

Premium finance receivables - commercial | 289 | 312 | 314 | 920 | 878 | |||||||||||||||

Premium finance receivables - life insurance | 1 | 2 | 2 | 5 | 11 | |||||||||||||||

Consumer and other | 42 | 153 | 51 | 256 | 221 | |||||||||||||||

Total recoveries | 1,113 | 1,275 | 1,502 | 3,620 | 4,116 | |||||||||||||||

Net charge-offs | (6,989 | ) | (6,584 | ) | (11,313 | ) | (21,358 | ) | (41,636 | ) | ||||||||||

Allowance for loan losses at period end | $ | 91,019 | $ | 92,253 | $ | 107,188 | $ | 91,019 | $ | 107,188 | ||||||||||

Allowance for unfunded lending-related commitments at period end | 822 | 884 | 1,267 | 822 | 1,267 | |||||||||||||||

Allowance for credit losses at period end | $ | 91,841 | $ | 93,137 | $ | 108,455 | $ | 91,841 | $ | 108,455 | ||||||||||

Annualized net charge-offs by category as a percentage of its own respective category’s average: | ||||||||||||||||||||

Commercial | 0.06 | % | 0.24 | % | 0.32 | % | 0.11 | % | 0.34 | % | ||||||||||

Commercial real estate | 0.38 | 0.19 | 0.65 | 0.33 | 0.80 | |||||||||||||||

Home equity | 0.36 | 0.34 | 0.36 | 0.61 | 0.79 | |||||||||||||||

Residential real estate | 0.05 | 0.35 | 0.12 | 0.15 | 0.42 | |||||||||||||||

Premium finance receivables - commercial | 0.20 | 0.20 | 0.17 | 0.19 | 0.18 | |||||||||||||||

Premium finance receivables - life insurance | — | — | — | — | — | |||||||||||||||

Consumer and other | 0.49 | 0.14 | 0.35 | 0.30 | 0.18 | |||||||||||||||

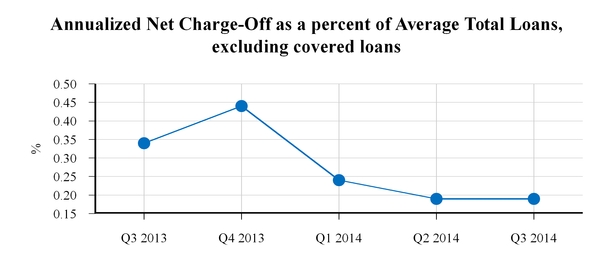

Total loans, net of unearned income, excluding covered loans | 0.19 | % | 0.19 | % | 0.34 | % | 0.21 | % | 0.44 | % | ||||||||||

Net charge-offs as a percentage of the provision for credit losses | 115.95 | % | 96.62 | % | 97.69 | % | 132.29 | % | 98.95 | % | ||||||||||

Loans at period-end, excluding covered loans | $ | 14,052,059 | $ | 13,749,996 | $ | 12,581,039 | ||||||||||||||

Allowance for loan losses as a percentage of loans at period end | 0.65 | % | 0.67 | % | 0.85 | % | ||||||||||||||

Allowance for credit losses as a percentage of loans at period end | 0.65 | % | 0.68 | % | 0.86 | % | ||||||||||||||

Three months ended | Nine months ended | |||||||||||||||||||

September 30, | June 30, | September 30, | September 30, | September 30, | ||||||||||||||||

(Dollars in thousands) | 2014 | 2014 | 2013 | 2014 | 2013 | |||||||||||||||

Provision for loan losses | $ | 6,090 | $ | 6,667 | $ | 11,864 | $ | 16,043 | $ | 42,216 | ||||||||||

Provision for unfunded lending-related commitments | (62 | ) | 146 | (284 | ) | 102 | (136 | ) | ||||||||||||

Provision for covered loan losses | (164 | ) | (153 | ) | (466 | ) | (1,741 | ) | 103 | |||||||||||

Provision for credit losses | $ | 5,864 | $ | 6,660 | $ | 11,114 | $ | 14,404 | $ | 42,183 | ||||||||||

Period End | ||||||||||||||||||||

September 30, | June 30, | September 30, | ||||||||||||||||||

2014 | 2014 | 2013 | ||||||||||||||||||

Allowance for loan losses | $ | 91,019 | $ | 92,253 | $ | 107,188 | ||||||||||||||

Allowance for unfunded lending-related commitments | 822 | 884 | 1,267 | |||||||||||||||||

Allowance for covered loan losses | 2,655 | 1,667 | 12,924 | |||||||||||||||||

Allowance for credit losses | $ | 94,496 | $ | 94,804 | $ | 121,379 | ||||||||||||||

As of September 30, 2014 | |||||||||||

Recorded | Calculated | As a percentage of its own respective | |||||||||

(Dollars in thousands) | Investment | Allowance | category’s balance | ||||||||

Commercial:(1) | |||||||||||

Commercial and industrial | $ | 2,022,939 | $ | 17,629 | 0.87 | % | |||||

Asset-based lending | 779,363 | 5,815 | 0.75 | ||||||||

Tax exempt | 204,963 | 1,107 | 0.54 | ||||||||

Leases | 145,361 | 13 | 0.01 | ||||||||

Other | 11,403 | 95 | 0.83 | ||||||||

Commercial real-estate:(1) | |||||||||||

Residential construction | 29,725 | 522 | 1.76 | ||||||||

Commercial construction | 155,687 | 2,406 | 1.55 | ||||||||

Land | 95,094 | 2,782 | 2.93 | ||||||||

Office | 671,914 | 5,235 | 0.78 | ||||||||

Industrial | 604,404 | 4,531 | 0.75 | ||||||||

Retail | 694,127 | 5,989 | 0.86 | ||||||||

Multi-family | 645,825 | 5,038 | 0.78 | ||||||||

Mixed use and other | 1,341,709 | 12,096 | 0.90 | ||||||||

Home equity(1) | 699,455 | 12,917 | 1.85 | ||||||||

Residential real-estate(1) | 441,940 | 4,028 | 0.91 | ||||||||

Total core loan portfolio | $ | 8,543,909 | $ | 80,203 | 0.94 | % | |||||

Commercial: | |||||||||||

Franchise | $ | 230,567 | $ | 1,989 | 0.86 | % | |||||

Mortgage warehouse lines of credit | 121,585 | 1,042 | 0.86 | ||||||||

Community Advantage - homeowner associations | 99,595 | 4 | — | ||||||||

Aircraft | 5,196 | 7 | 0.13 | ||||||||

Purchased non-covered commercial loans (2) | 68,699 | 211 | 0.31 | ||||||||

Commercial real-estate: | |||||||||||

Purchased non-covered commercial real-estate (2) | 271,890 | 60 | 0.02 | ||||||||

Purchased non-covered home equity (2) | 20,603 | 43 | 0.21 | ||||||||

Purchased non-covered residential real-estate (2) | 28,379 | 14 | 0.05 | ||||||||

Premium finance receivables | |||||||||||

U.S. commercial insurance loans | 2,071,396 | 5,091 | 0.25 | ||||||||

Canada commercial insurance loans (2) | 306,496 | 530 | 0.17 | ||||||||

Life insurance loans (1) | 1,726,803 | 646 | 0.04 | ||||||||

Purchased life insurance loans (2) | 407,602 | — | — | ||||||||

Consumer and other (1) | 144,745 | 1,143 | 0.79 | ||||||||

Purchased non-covered consumer and other (2) | 4,594 | 36 | 0.78 | ||||||||

Total consumer, niche and purchased loan portfolio | $ | 5,508,150 | $ | 10,816 | 0.20 | % | |||||

Total loans, net of unearned income, excluding covered loans | $ | 14,052,059 | $ | 91,019 | 0.65 | % | |||||

(1) | Excludes purchased loans reported in accordance with ASC 310-20 and ASC 310-30. |

(2) | Purchased loans represent loans reported in accordance with ASC 310-20 and ASC 310-30. |

As of June 30, 2014 | |||||||||||

Recorded | Calculated | As a percentage of its own respective | |||||||||

(Dollars in thousands) | Investment | Allowance | category’s balance | ||||||||

Commercial:(1) | |||||||||||

Commercial and industrial | $ | 1,988,656 | $ | 16,208 | 0.82 | % | |||||

Asset-based lending | 775,756 | 5,562 | 0.72 | ||||||||

Tax exempt | 208,787 | 1,017 | 0.49 | ||||||||

Leases | 144,310 | 6 | — | ||||||||

Other | 9,792 | 78 | 0.80 | ||||||||

Commercial real-estate:(1) | |||||||||||

Residential construction | 29,605 | 500 | 1.69 | ||||||||

Commercial construction | 154,266 | 2,184 | 1.42 | ||||||||

Land | 99,517 | 3,084 | 3.10 | ||||||||

Office | 654,424 | 7,406 | 1.13 | ||||||||

Industrial | 602,224 | 4,568 | 0.76 | ||||||||

Retail | 676,629 | 6,459 | 0.95 | ||||||||

Multi-family | 599,261 | 4,301 | 0.72 | ||||||||

Mixed use and other | 1,323,802 | 12,126 | 0.92 | ||||||||

Home equity(1) | 693,345 | 13,852 | 2.00 | ||||||||

Residential real-estate(1) | 425,918 | 3,667 | 0.86 | ||||||||

Total core loan portfolio | $ | 8,386,292 | $ | 81,018 | 0.97 | % | |||||

Commercial: | |||||||||||

Franchise | $ | 223,456 | $ | 1,888 | 0.84 | % | |||||

Mortgage warehouse lines of credit | 148,211 | 1,229 | 0.83 | ||||||||

Community Advantage - homeowner associations | 94,009 | — | — | ||||||||

Aircraft | 6,881 | 10 | 0.15 | ||||||||

Purchased non-covered commercial loans (2) | 40,572 | 40 | 0.10 | ||||||||

Commercial real-estate: | |||||||||||

Purchased non-covered commercial real-estate (2) | 213,744 | 74 | 0.03 | ||||||||

Purchased non-covered home equity (2) | 20,297 | 66 | 0.33 | ||||||||

Purchased non-covered residential real-estate (2) | 25,987 | 66 | 0.25 | ||||||||

Premium finance receivables | |||||||||||

U.S. commercial insurance loans | 2,085,483 | 5,129 | 0.25 | ||||||||

Canada commercial insurance loans (2) | 293,046 | 514 | 0.18 | ||||||||

Life insurance loans (1) | 1,641,885 | 666 | 0.04 | ||||||||

Purchased life insurance loans (2) | 409,760 | — | — | ||||||||

Consumer and other (1) | 157,268 | 1,539 | 0.98 | ||||||||

Purchased non-covered consumer and other (2) | 3,105 | 14 | 0.45 | ||||||||

Total consumer, niche and purchased loan portfolio | $ | 5,363,704 | $ | 11,235 | 0.21 | % | |||||

Total loans, net of unearned income, excluding covered loans | $ | 13,749,996 | $ | 92,253 | 0.67 | % | |||||

(1) | Excludes purchased loans reported in accordance with ASC 310-20 and ASC 310-30. |

(2) | Purchased loans represent loans reported in accordance with ASC 310-20 and ASC 310-30. |

90+ days | 60-89 | 30-59 | ||||||||||||||||||||||

As of September 30, 2014 | and still | days past | days past | |||||||||||||||||||||

(Dollars in thousands) | Nonaccrual | accruing | due | due | Current | Total Loans | ||||||||||||||||||

Loan Balances: | ||||||||||||||||||||||||

Commercial | ||||||||||||||||||||||||

Commercial and industrial | $ | 10,430 | $ | — | $ | 7,333 | $ | 8,559 | $ | 2,044,505 | $ | 2,070,827 | ||||||||||||

Franchise | — | — | — | 1,221 | 237,079 | 238,300 | ||||||||||||||||||

Mortgage warehouse lines of credit | — | — | — | — | 121,585 | 121,585 | ||||||||||||||||||

Community Advantage - homeowners association | — | — | — | — | 99,595 | 99,595 | ||||||||||||||||||

Aircraft | — | — | — | — | 6,146 | 6,146 | ||||||||||||||||||

Asset-based lending | 25 | — | 2,959 | 1,220 | 777,723 | 781,927 | ||||||||||||||||||

Tax exempt | — | — | — | — | 205,150 | 205,150 | ||||||||||||||||||

Leases | — | — | — | — | 145,439 | 145,439 | ||||||||||||||||||

Other | — | — | — | — | 11,403 | 11,403 | ||||||||||||||||||

PCI - commercial (1) | — | 863 | 64 | 137 | 8,235 | 9,299 | ||||||||||||||||||

Total commercial | 10,455 | 863 | 10,356 | 11,137 | 3,656,860 | 3,689,671 | ||||||||||||||||||

Commercial real-estate | ||||||||||||||||||||||||

Residential construction | — | — | — | — | 30,237 | 30,237 | ||||||||||||||||||

Commercial construction | 425 | — | — | — | 159,383 | 159,808 | ||||||||||||||||||

Land | 2,556 | — | 1,316 | 2,918 | 94,449 | 101,239 | ||||||||||||||||||

Office | 7,366 | — | 1,696 | 1,888 | 688,390 | 699,340 | ||||||||||||||||||

Industrial | 2,626 | — | 224 | 367 | 624,669 | 627,886 | ||||||||||||||||||

Retail | 6,205 | — | — | 4,117 | 715,568 | 725,890 | ||||||||||||||||||

Multi-family | 249 | — | 793 | 2,319 | 674,610 | 677,971 | ||||||||||||||||||

Mixed use and other | 7,936 | — | 1,468 | 10,323 | 1,407,659 | 1,427,386 | ||||||||||||||||||

PCI - commercial real-estate (1) | — | 14,294 | — | 5,807 | 40,517 | 60,618 | ||||||||||||||||||

Total commercial real-estate | 27,363 | 14,294 | 5,497 | 27,739 | 4,435,482 | 4,510,375 | ||||||||||||||||||

Home equity | 5,696 | — | 1,181 | 2,597 | 710,584 | 720,058 | ||||||||||||||||||

Residential real estate | 15,730 | — | 670 | 2,696 | 448,528 | 467,624 | ||||||||||||||||||

PCI - residential real estate (1) | — | 930 | 30 | — | 1,735 | 2,695 | ||||||||||||||||||

Premium finance receivables | ||||||||||||||||||||||||

Commercial insurance loans | 14,110 | 7,115 | 6,279 | 14,157 | 2,336,231 | 2,377,892 | ||||||||||||||||||

Life insurance loans | — | — | 7,533 | 6,942 | 1,712,328 | 1,726,803 | ||||||||||||||||||

PCI - life insurance loans (1) | — | — | — | — | 407,602 | 407,602 | ||||||||||||||||||

Consumer and other | 426 | 175 | 123 | 1,133 | 147,482 | 149,339 | ||||||||||||||||||

Total loans, net of unearned income, excluding covered loans | $ | 73,780 | $ | 23,377 | $ | 31,669 | $ | 66,401 | $ | 13,856,832 | $ | 14,052,059 | ||||||||||||

Covered loans | 6,042 | 26,170 | 4,289 | 5,655 | 212,449 | 254,605 | ||||||||||||||||||

Total loans, net of unearned income | $ | 79,822 | $ | 49,547 | $ | 35,958 | $ | 72,056 | $ | 14,069,281 | $ | 14,306,664 | ||||||||||||

(1) | Purchased credit impaired ("PCI") loans represent loans acquired with evidence of credit quality deterioration since origination, in accordance with ASC 310-30. Loan agings are based upon contractually required payments. |

Aging as a % of Loan Balance: | Nonaccrual | 90+ days and still accruing | 60-89 days past due | 30-59 days past due | Current | Total Loans | ||||||||||||

Commercial | ||||||||||||||||||

Commercial and industrial | 0.5 | % | — | % | 0.4 | % | 0.4 | % | 98.7 | % | 100.0 | % | ||||||

Franchise | — | — | — | 0.5 | 99.5 | 100.0 | ||||||||||||

Mortgage warehouse lines of credit | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Community Advantage - homeowners association | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Aircraft | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Asset-based lending | — | — | 0.4 | 0.2 | 99.4 | 100.0 | ||||||||||||

Tax exempt | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Leases | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Other | — | — | — | — | 100.0 | 100.0 | ||||||||||||

PCI - commercial(1) | — | 9.3 | 0.7 | 1.5 | 88.5 | 100.0 | ||||||||||||

Total commercial | 0.3 | — | 0.3 | 0.3 | 99.1 | 100.0 | ||||||||||||

Commercial real-estate | ||||||||||||||||||

Residential construction | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Commercial construction | 0.3 | — | — | — | 99.7 | 100.0 | ||||||||||||

Land | 2.5 | — | 1.3 | 2.9 | 93.3 | 100.0 | ||||||||||||

Office | 1.1 | — | 0.2 | 0.3 | 98.4 | 100.0 | ||||||||||||

Industrial | 0.4 | — | — | 0.1 | 99.5 | 100.0 | ||||||||||||

Retail | 0.9 | — | — | 0.6 | 98.5 | 100.0 | ||||||||||||

Multi-family | — | — | 0.1 | 0.3 | 99.6 | 100.0 | ||||||||||||

Mixed use and other | 0.6 | — | 0.1 | 0.7 | 98.6 | 100.0 | ||||||||||||

PCI - commercial real-estate (1) | — | 23.6 | — | 9.6 | 66.8 | 100.0 | ||||||||||||

Total commercial real-estate | 0.6 | 0.3 | 0.1 | 0.6 | 98.4 | 100.0 | ||||||||||||

Home equity | 0.8 | — | 0.2 | 0.4 | 98.6 | 100.0 | ||||||||||||

Residential real estate | 3.4 | — | 0.1 | 0.6 | 95.9 | 100.0 | ||||||||||||

PCI - residential real estate(1) | — | 34.5 | 1.1 | — | 64.4 | 100.0 | ||||||||||||

Premium finance receivables | ||||||||||||||||||

Commercial insurance loans | 0.6 | 0.3 | 0.3 | 0.6 | 98.2 | 100.0 | ||||||||||||

Life insurance loans | — | — | 0.4 | 0.4 | 99.2 | 100.0 | ||||||||||||

PCI - life insurance loans (1) | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Consumer and other | 0.3 | 0.1 | 0.1 | 0.8 | 98.7 | 100.0 | ||||||||||||

Total loans, net of unearned income, excluding covered loans | 0.5 | % | 0.2 | % | 0.2 | % | 0.5 | % | 98.6 | % | 100.0 | % | ||||||

Covered loans | 2.4 | 10.3 | 1.7 | 2.2 | 83.4 | 100.0 | ||||||||||||

Total loans, net of unearned income | 0.6 | % | 0.3 | % | 0.3 | % | 0.5 | % | 98.3 | % | 100.0 | % | ||||||

90+ days | 60-89 | 30-59 | ||||||||||||||||||||||

As of June 30, 2014 | and still | days past | days past | |||||||||||||||||||||

(Dollars in thousands) | Nonaccrual | accruing | due | due | Current | Total Loans | ||||||||||||||||||

Loan Balances: | ||||||||||||||||||||||||

Commercial | ||||||||||||||||||||||||

Commercial and industrial | $ | 6,216 | $ | — | $ | 4,165 | $ | 21,610 | $ | 1,980,489 | $ | 2,012,480 | ||||||||||||

Franchise | — | — | — | 549 | 222,907 | 223,456 | ||||||||||||||||||

Mortgage warehouse lines of credit | — | — | — | 1,680 | 146,531 | 148,211 | ||||||||||||||||||

Community Advantage - homeowners association | — | — | — | — | 94,009 | 94,009 | ||||||||||||||||||

Aircraft | — | — | — | — | 7,847 | 7,847 | ||||||||||||||||||

Asset-based lending | 295 | — | — | 6,047 | 772,002 | 778,344 | ||||||||||||||||||

Tax exempt | — | — | — | — | 208,913 | 208,913 | ||||||||||||||||||

Leases | — | — | — | 36 | 144,399 | 144,435 | ||||||||||||||||||

Other | — | — | — | — | 9,792 | 9,792 | ||||||||||||||||||

PCI - commercial(1) | — | 1,452 | — | 224 | 11,267 | 12,943 | ||||||||||||||||||

Total commercial | 6,511 | 1,452 | 4,165 | 30,146 | 3,598,156 | 3,640,430 | ||||||||||||||||||

Commercial real-estate | ||||||||||||||||||||||||

Residential construction | — | — | — | 18 | 29,941 | 29,959 | ||||||||||||||||||

Commercial construction | 839 | — | — | — | 154,220 | 155,059 | ||||||||||||||||||

Land | 2,367 | — | 614 | 4,502 | 98,444 | 105,927 | ||||||||||||||||||

Office | 10,950 | — | 999 | 3,911 | 652,057 | 667,917 | ||||||||||||||||||

Industrial | 5,097 | — | 899 | 690 | 610,954 | 617,640 | ||||||||||||||||||

Retail | 6,909 | — | 1,334 | 2,560 | 686,292 | 697,095 | ||||||||||||||||||

Multi-family | 689 | — | 244 | 4,717 | 630,519 | 636,169 | ||||||||||||||||||

Mixed use and other | 9,470 | 309 | 5,384 | 12,300 | 1,350,976 | 1,378,439 | ||||||||||||||||||

PCI - commercial real-estate (1) | — | 15,682 | 155 | 1,595 | 47,835 | 65,267 | ||||||||||||||||||

Total commercial real-estate | 36,321 | 15,991 | 9,629 | 30,293 | 4,261,238 | 4,353,472 | ||||||||||||||||||

Home equity | 5,804 | — | 1,392 | 3,324 | 703,122 | 713,642 | ||||||||||||||||||

Residential real estate | 15,294 | — | 1,487 | 1,978 | 430,364 | 449,123 | ||||||||||||||||||

PCI - residential real estate (1) | — | 988 | 111 | — | 1,683 | 2,782 | ||||||||||||||||||

Premium finance receivables | ||||||||||||||||||||||||

Commercial insurance loans | 12,298 | 10,275 | 12,335 | 14,672 | 2,328,949 | 2,378,529 | ||||||||||||||||||

Life insurance loans | — | 649 | 896 | 4,783 | 1,635,557 | 1,641,885 | ||||||||||||||||||

Purchased life insurance loans (1) | — | — | — | — | 409,760 | 409,760 | ||||||||||||||||||

Consumer and other | 1,116 | 73 | 562 | 600 | 158,022 | 160,373 | ||||||||||||||||||

Total loans, net of unearned income, excluding covered loans | $ | 77,344 | $ | 29,428 | $ | 30,577 | $ | 85,796 | $ | 13,526,851 | $ | 13,749,996 | ||||||||||||

Covered loans | 6,690 | 34,486 | 4,003 | 1,482 | 228,493 | 275,154 | ||||||||||||||||||

Total loans, net of unearned income | $ | 84,034 | $ | 63,914 | $ | 34,580 | $ | 87,278 | $ | 13,755,344 | $ | 14,025,150 | ||||||||||||

(1) | Purchased credit impaired ("PCI") loans represent loans acquired with evidence of credit quality deterioration since origination, in accordance with ASC 310-30. Loan agings are based upon contractually required payments. |

Aging as a % of Loan Balance: | Nonaccrual | 90+ days and still accruing | 60-89 days past due | 30-59 days past due | Current | Total Loans | ||||||||||||

Commercial | ||||||||||||||||||

Commercial and industrial | 0.3 | % | — | % | 0.2 | % | 1.1 | % | 98.4 | % | 100.0 | % | ||||||

Franchise | — | — | — | 0.2 | 99.8 | 100.0 | ||||||||||||

Mortgage warehouse lines of credit | — | — | — | 1.1 | 98.9 | 100.0 | ||||||||||||

Community Advantage - homeowners association | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Aircraft | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Asset-based lending | — | — | — | 0.8 | 99.2 | 100.0 | ||||||||||||

Tax exempt | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Leases | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Other | — | — | — | — | 100.0 | 100.0 | ||||||||||||

PCI - commercial(1) | — | 11.2 | — | 1.7 | 87.1 | 100.0 | ||||||||||||

Total commercial | 0.2 | — | 0.1 | 0.8 | 98.9 | 100.0 | ||||||||||||

Commercial real-estate | ||||||||||||||||||

Residential construction | — | — | — | 0.1 | 99.9 | 100.0 | ||||||||||||

Commercial construction | 0.5 | — | — | — | 99.5 | 100.0 | ||||||||||||

Land | 2.2 | — | 0.6 | 4.3 | 92.9 | 100.0 | ||||||||||||

Office | 1.6 | — | 0.1 | 0.6 | 97.7 | 100.0 | ||||||||||||

Industrial | 0.8 | — | 0.1 | 0.1 | 99.0 | 100.0 | ||||||||||||

Retail | 1.0 | — | 0.2 | 0.4 | 98.4 | 100.0 | ||||||||||||

Multi-family | 0.1 | — | — | 0.7 | 99.2 | 100.0 | ||||||||||||

Mixed use and other | 0.7 | — | 0.4 | 0.9 | 98.0 | 100.0 | ||||||||||||

PCI - commercial real-estate (1) | — | 24.0 | 0.2 | 2.4 | 73.4 | 100.0 | ||||||||||||

Total commercial real-estate | 0.8 | 0.4 | 0.2 | 0.7 | 97.9 | 100.0 | ||||||||||||

Home equity | 0.8 | — | 0.2 | 0.5 | 98.5 | 100.0 | ||||||||||||

Residential real estate | 3.4 | — | 0.3 | 0.4 | 95.9 | 100.0 | ||||||||||||

PCI - residential real estate (1) | — | 35.5 | 4.0 | — | 60.5 | 100.0 | ||||||||||||

Premium finance receivables | ||||||||||||||||||

Commercial insurance loans | 0.5 | 0.4 | 0.5 | 0.6 | 98.0 | 100.0 | ||||||||||||

Life insurance loans | — | — | 0.1 | 0.3 | 99.6 | 100.0 | ||||||||||||

Purchased life insurance loans (1) | — | — | — | — | 100.0 | 100.0 | ||||||||||||

Consumer and other | 0.7 | — | 0.4 | 0.4 | 98.5 | 100.0 | ||||||||||||

Total loans, net of unearned income, excluding covered loans | 0.6 | % | 0.2 | % | 0.2 | % | 0.6 | % | 98.4 | % | 100.0 | % | ||||||

Covered loans | 2.4 | 12.5 | 1.5 | 0.5 | 83.1 | 100.0 | ||||||||||||

Total loans, net of unearned income | 0.6 | % | 0.5 | % | 0.2 | % | 0.6 | % | 98.1 | % | 100.0 | % | ||||||

September 30, | June 30, | September 30, | ||||||||||

(Dollars in thousands) | 2014 | 2014 | 2013 | |||||||||

Loans past due greater than 90 days and still accruing(1): | ||||||||||||

Commercial | $ | — | $ | — | $ | 190 | ||||||

Commercial real-estate | — | 309 | 3,389 | |||||||||

Home equity | — | — | — | |||||||||

Residential real-estate | — | — | — | |||||||||

Premium finance receivables - commercial | 7,115 | 10,275 | 11,751 | |||||||||

Premium finance receivables - life insurance | — | 649 | 592 | |||||||||

Consumer and other | 175 | 73 | 100 | |||||||||

Total loans past due greater than 90 days and still accruing | 7,290 | 11,306 | 16,022 | |||||||||

Non-accrual loans(2): | ||||||||||||

Commercial | 10,455 | 6,511 | 17,647 | |||||||||

Commercial real-estate | 27,363 | 36,321 | 52,723 | |||||||||

Home equity | 5,696 | 5,804 | 10,926 | |||||||||

Residential real-estate | 15,730 | 15,294 | 14,126 | |||||||||

Premium finance receivables - commercial | 14,110 | 12,298 | 10,132 | |||||||||

Premium finance receivables - life insurance | — | — | 14 | |||||||||

Consumer and other | 426 | 1,116 | 1,671 | |||||||||

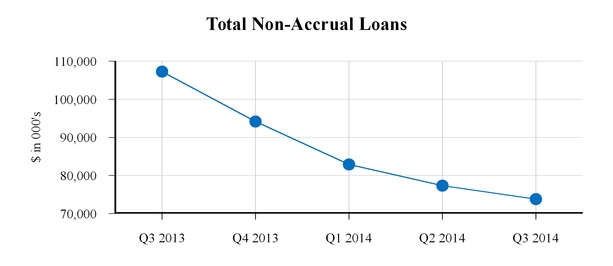

Total non-accrual loans | 73,780 | 77,344 | 107,239 | |||||||||

Total non-performing loans: | ||||||||||||

Commercial | 10,455 | 6,511 | 17,837 | |||||||||

Commercial real-estate | 27,363 | 36,630 | 56,112 | |||||||||

Home equity | 5,696 | 5,804 | 10,926 | |||||||||

Residential real-estate | 15,730 | 15,294 | 14,126 | |||||||||

Premium finance receivables - commercial | 21,225 | 22,573 | 21,883 | |||||||||

Premium finance receivables - life insurance | — | 649 | 606 | |||||||||

Consumer and other | 601 | 1,189 | 1,771 | |||||||||

Total non-performing loans | $ | 81,070 | $ | 88,650 | $ | 123,261 | ||||||

Other real estate owned | 41,506 | 51,673 | 45,947 | |||||||||

Other real estate owned - from acquisitions | 8,871 | 7,915 | 9,303 | |||||||||

Other repossessed assets | 292 | 311 | 446 | |||||||||

Total non-performing assets | $ | 131,739 | $ | 148,549 | $ | 178,957 | ||||||

TDRs performing under the contractual terms of the loan agreement | $ | 69,868 | $ | 72,199 | $ | 79,205 | ||||||

Total non-performing loans by category as a percent of its own respective category’s period-end balance: | ||||||||||||

Commercial | 0.28 | % | 0.18 | % | 0.57 | % | ||||||

Commercial real-estate | 0.61 | 0.84 | 1.35 | |||||||||

Home equity | 0.79 | 0.81 | 1.48 | |||||||||

Residential real-estate | 3.34 | 3.38 | 3.55 | |||||||||

Premium finance receivables - commercial | 0.89 | 0.95 | 1.02 | |||||||||

Premium finance receivables - life insurance | — | 0.03 | 0.03 | |||||||||

Consumer and other | 0.40 | 0.74 | 1.03 | |||||||||

Total loans, net of unearned income | 0.58 | % | 0.64 | % | 0.98 | % | ||||||

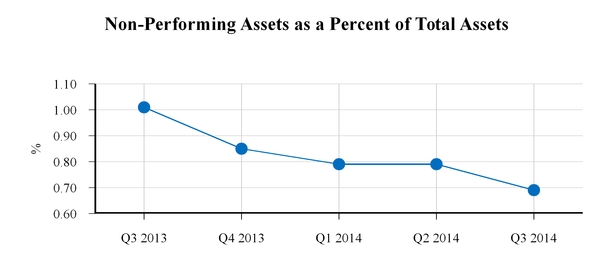

Total non-performing assets as a percentage of total assets | 0.69 | % | 0.79 | % | 1.01 | % | ||||||