SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2014

OR

o Transition report pursuant to Section 13 of 15(d) of the Securities Exchange Act of 1934

For the transition period from ______ to ______

Commission File Number: 000-23329

Charles & Colvard, Ltd.

(Exact name of registrant as specified in its charter)

|

North Carolina

|

|

56-1928817

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

170 Southport Drive

Morrisville, North Carolina

|

|

27560

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(919) 468-0399

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

|

|

|

|

Non-accelerated filer

|

o (Do not check if a smaller reporting company)

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 4, 2014, there were 20,357,333 shares of the registrant’s common stock, no par value per share, outstanding.

CHARLES & COLVARD, LTD.

FORM 10-Q

For the Quarterly Period Ended June 30, 2014

|

|

|

Page

Number

|

|

PART I – FINANCIAL INFORMATION

|

|

Item 1.

|

|

|

|

|

|

3

|

|

|

|

4

|

|

|

|

5

|

|

|

|

6

|

|

Item 2.

|

|

17

|

|

Item 3.

|

|

30

|

|

Item 4.

|

|

30

|

|

|

|

PART II – OTHER INFORMATION

|

|

Item 1.

|

|

31

|

|

Item 1A.

|

|

31

|

|

Item 6.

|

|

31

|

|

|

|

32

|

PART I – FINANCIAL INFORMATION

| Item 1. |

Financial Statements |

CHARLES & COLVARD, LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

June 30, 2014

(unaudited)

|

|

|

December 31,

2013

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

3,362,813

|

|

|

$

|

2,573,405

|

|

|

Accounts receivable, net

|

|

|

7,816,710

|

|

|

|

10,244,732

|

|

|

Inventory, net

|

|

|

12,419,064

|

|

|

|

13,074,428

|

|

|

Prepaid expenses and other assets

|

|

|

1,055,610

|

|

|

|

951,635

|

|

|

Deferred income taxes

|

|

|

-

|

|

|

|

1,197,832

|

|

|

Total current assets

|

|

|

24,654,197

|

|

|

|

28,042,032

|

|

|

Long-term assets:

|

|

|

|

|

|

|

|

|

|

Inventory, net

|

|

|

29,055,044

|

|

|

|

29,337,674

|

|

|

Property and equipment, net

|

|

|

2,163,187

|

|

|

|

1,717,692

|

|

|

Intangible assets, net

|

|

|

305,955

|

|

|

|

325,867

|

|

|

Deferred income taxes

|

|

|

-

|

|

|

|

2,841,891

|

|

|

Other assets

|

|

|

349,466

|

|

|

|

58,696

|

|

|

Total long-term assets

|

|

|

31,873,652

|

|

|

|

34,281,820

|

|

|

TOTAL ASSETS

|

|

$

|

56,527,849

|

|

|

$

|

62,323,852

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

3,659,900

|

|

|

$

|

3,670,551

|

|

|

Accrued cooperative advertising

|

|

|

196,000

|

|

|

|

188,000

|

|

|

Accrued expenses and other liabilities

|

|

|

713,860

|

|

|

|

642,186

|

|

|

Total current liabilities

|

|

|

4,569,760

|

|

|

|

4,500,737

|

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

Accrued rent

|

|

|

575,907

|

|

|

|

-

|

|

|

Accrued income taxes

|

|

|

401,496

|

|

|

|

395,442

|

|

|

Total long-term liabilities

|

|

|

977,403

|

|

|

|

395,442

|

|

|

Total liabilities

|

|

|

5,547,163

|

|

|

|

4,896,179

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock, no par value

|

|

|

53,949,001

|

|

|

|

53,949,001

|

|

|

Additional paid-in capital – stock-based compensation

|

|

|

10,751,470

|

|

|

|

9,940,980

|

|

|

Accumulated deficit

|

|

|

(13,719,785

|

)

|

|

|

(6,462,308

|

)

|

|

Total shareholders’ equity

|

|

|

50,980,686

|

|

|

|

57,427,673

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

$

|

56,527,849

|

|

|

$

|

62,323,852

|

|

See Notes to Condensed Consolidated Financial Statements.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

|

Net sales

|

|

$

|

7,841,647

|

|

|

$

|

6,512,500

|

|

|

$

|

13,909,200

|

|

|

$

|

13,017,574

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

5,324,981

|

|

|

|

3,389,315

|

|

|

|

8,988,023

|

|

|

|

6,271,293

|

|

|

Sales and marketing

|

|

|

2,171,614

|

|

|

|

2,532,995

|

|

|

|

4,366,225

|

|

|

|

4,779,204

|

|

|

General and administrative

|

|

|

2,376,466

|

|

|

|

1,344,408

|

|

|

|

3,752,681

|

|

|

|

2,193,785

|

|

|

Research and development

|

|

|

9,514

|

|

|

|

9,041

|

|

|

|

11,501

|

|

|

|

15,024

|

|

|

Loss on abandonment of assets

|

|

|

-

|

|

|

|

95,052

|

|

|

|

2,201

|

|

|

|

95,052

|

|

|

Total costs and expenses

|

|

|

9,882,575

|

|

|

|

7,370,811

|

|

|

|

17,120,631

|

|

|

|

13,354,358

|

|

|

Loss from operations

|

|

|

(2,040,928

|

)

|

|

|

(858,311

|

)

|

|

|

(3,211,431

|

)

|

|

|

(336,784

|

)

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

20

|

|

|

|

6,972

|

|

|

|

49

|

|

|

|

14,474

|

|

|

Interest expense

|

|

|

(188

|

)

|

|

|

(234

|

)

|

|

|

(318

|

)

|

|

|

(974

|

)

|

|

Total other (expense) income, net

|

|

|

(168

|

)

|

|

|

6,738

|

|

|

|

(269

|

)

|

|

|

13,500

|

|

|

Loss before income taxes

|

|

|

(2,041,096

|

)

|

|

|

(851,573

|

)

|

|

|

(3,211,700

|

)

|

|

|

(323,284

|

)

|

|

Income tax net (expense) benefit

|

|

|

(4,152,987

|

)

|

|

|

359,988

|

|

|

|

(4,045,777

|

)

|

|

|

137,972

|

|

|

Net loss

|

|

$

|

(6,194,083

|

)

|

|

$

|

(491,585

|

)

|

|

$

|

(7,257,477

|

)

|

|

$

|

(185,312

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.31

|

)

|

|

$

|

(0.02

|

)

|

|

$

|

(0.36

|

)

|

|

$

|

(0.01

|

)

|

|

Diluted

|

|

$

|

(0.31

|

)

|

|

$

|

(0.02

|

)

|

|

$

|

(0.36

|

)

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in computing net loss per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

20,262,299

|

|

|

|

19,812,397

|

|

|

|

20,229,979

|

|

|

|

19,736,068

|

|

|

Diluted

|

|

|

20,262,299

|

|

|

|

19,812,397

|

|

|

|

20,229,979

|

|

|

|

19,736,068

|

|

See Notes to Condensed Consolidated Financial Statements.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2014

|

|

|

2013

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(7,257,477

|

)

|

|

$

|

(185,312

|

)

|

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

588,745

|

|

|

|

384,749

|

|

|

Amortization of bond premium

|

|

|

-

|

|

|

|

2,706

|

|

|

Stock-based compensation

|

|

|

810,490

|

|

|

|

743,633

|

|

|

Provision for uncollectible accounts

|

|

|

682,725

|

|

|

|

(60,805

|

)

|

|

Provision for sales returns

|

|

|

(845,000

|

)

|

|

|

(135,000

|

)

|

|

Provision for inventory reserves

|

|

|

69,000

|

|

|

|

75,000

|

|

|

Provision (benefit) for deferred income taxes

|

|

|

4,039,723

|

|

|

|

(150,832

|

)

|

|

Loss on abandonment of assets

|

|

|

2,201

|

|

|

|

95,052

|

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

2,590,297

|

|

|

|

476,974

|

|

|

Interest receivable

|

|

|

-

|

|

|

|

(891

|

)

|

|

Inventory

|

|

|

868,994

|

|

|

|

(3,664,506

|

)

|

|

Prepaid expenses and other assets, net

|

|

|

(394,745

|

)

|

|

|

(392,819

|

)

|

|

Accounts payable

|

|

|

(10,651

|

)

|

|

|

430,126

|

|

|

Accrued cooperative advertising

|

|

|

8,000

|

|

|

|

108,000

|

|

|

Accrued income taxes

|

|

|

6,054

|

|

|

|

5,810

|

|

|

Other accrued liabilities

|

|

|

647,581

|

|

|

|

(40,620

|

)

|

|

Net cash provided by (used in) operating activities

|

|

|

1,805,937

|

|

|

|

(2,308,735

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(956,666

|

)

|

|

|

(202,610

|

)

|

|

Patent, license rights, and trademark costs

|

|

|

(59,863

|

)

|

|

|

(91,678

|

)

|

|

Net cash used in investing activities

|

|

|

(1,016,529

|

)

|

|

|

(294,288

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Stock option exercises

|

|

|

-

|

|

|

|

13,400

|

|

|

Net cash provided by financing activities

|

|

|

-

|

|

|

|

13,400

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

|

|

789,408

|

|

|

|

(2,589,623

|

)

|

|

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD

|

|

|

2,573,405

|

|

|

|

11,860,842

|

|

|

CASH AND CASH EQUIVALENTS, END OF PERIOD

|

|

$

|

3,362,813

|

|

|

$

|

9,271,219

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for interest

|

|

$

|

318

|

|

|

$

|

974

|

|

|

Cash paid during the period for income taxes

|

|

$

|

-

|

|

|

$

|

7,050

|

|

See Notes to Condensed Consolidated Financial Statements.

CHARLES & COLVARD, LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

| 1. |

DESCRIPTION OF BUSINESS |

Charles & Colvard, Ltd. (the “Company”), a North Carolina corporation founded in 1995, manufactures, markets, and distributes Charles & Colvard Created Moissanite® jewels (hereinafter referred to as moissanite or moissanite jewels), finished jewelry featuring moissanite, and fashion finished jewelry for sale in the worldwide jewelry market. Moissanite, also known by its chemical name of silicon carbide (“SiC”), is a rare mineral first discovered in a meteor crater. Because naturally occurring SiC crystals are too small for commercial use, larger crystals must be grown in a laboratory. Leveraging its advantage of being the sole source worldwide of created moissanite jewels, the Company’s strategy is to establish itself with reputable, high-quality, and sophisticated brands and to position moissanite as an affordable, luxurious alternative to other gems, such as diamond. The Company believes this is possible due to moissanite’s exceptional brilliance, fire, luster, durability, and rarity like no other jewel available on the market. The Company sells loose moissanite jewels and finished jewelry at wholesale to distributors, manufacturers, and retailers and at retail to end consumers through its wholly owned operating subsidiaries Moissanite.com, LLC and Charles & Colvard Direct, LLC.

| 2. |

BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation and Principles of Consolidation - The accompanying unaudited condensed consolidated financial statements included in this Quarterly Report on Form 10-Q have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information. However, certain information or footnote disclosures normally included in complete financial statements prepared in accordance with U.S. GAAP have been condensed, or omitted, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). In the opinion of the Company’s management, the unaudited statements in this Quarterly Report on Form 10-Q include all normal and recurring adjustments necessary for the fair statement of the results for the interim periods presented. The results for the three and six months ended June 30, 2014 are not necessarily indicative of the results to be expected for the fiscal year ending December 31, 2014.

The condensed consolidated financial statements as of and for the three and six months ended June 30, 2014 and 2013 included in this Quarterly Report on Form 10-Q are unaudited. The balance sheet as of December 31, 2013 is derived from the audited financial statements as of that date. The accompanying statements should be read in conjunction with the audited financial statements and related notes, together with Management’s Discussion and Analysis of Financial Condition and Results of Operations, contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 filed with the SEC on March 27, 2014 (the “2013 Annual Report”).

The accompanying condensed consolidated financial statements as of and for the three and six months ended June 30, 2014 and 2013 include the accounts of the Company and its wholly owned subsidiaries Moissanite.com, LLC, formed in 2011; Charles & Colvard Direct, LLC, formed in 2011; and Charles & Colvard (HK) Ltd., the Company’s Hong Kong subsidiary that became a dormant entity in the second quarter of 2009 and the operations of which ceased in 2008. All intercompany accounts have been eliminated.

Significant Accounting Policies - In the opinion of the Company’s management, the significant accounting policies used for the three and six months ended June 30, 2014 are consistent with those used for the year ended December 31, 2013. Accordingly, please refer to the 2013 Annual Report for the Company’s significant accounting policies.

Use of Estimates - The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. The most significant estimates impacting the Company’s condensed consolidated financial statements relate to valuation and classification of inventories, accounts receivable reserves, deferred tax assets, uncertain tax positions, stock compensation expense, and cooperative advertising. Actual results could differ materially from those estimates.

Reclassifications - Certain amounts in the prior year’s condensed consolidated financial statements have been reclassified to conform to the current year presentation.

Recently Adopted/Issued Accounting Pronouncements - In May 2014, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (ASU 2014-09), which supersedes nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration to which an entity expects to be entitled for those goods or services. ASU 2014-09 defines a five step process to achieve this core principle and, in doing so, more judgment and estimates may be required within the revenue recognition process than are required under existing U.S. GAAP.

The standard is effective for annual periods beginning after December 15, 2016, and interim periods therein, using either of the following transition methods: (i) a full retrospective approach reflecting the application of the standard in each prior reporting period with the option to elect certain practical expedients, or (ii) a retrospective approach with the cumulative effect of initially adopting ASU 2014-09 recognized at the date of adoption (which includes additional footnote disclosures). The Company is currently evaluating the impact of the pending adoption of ASU 2014-09 on its consolidated financial statements and has not yet determined the method by which the Company will adopt the standard in 2017.

| 3. |

SEGMENT INFORMATION AND GEOGRAPHIC DATA |

The Company reports segment information based on the “management” approach. The management approach designates the internal reporting used by management for making operating decisions and assessing performance as the source of the Company’s operating and reportable segments.

The Company manages its business primarily by its two distribution channels that it uses to sell its product lines, loose jewels and finished jewelry. Accordingly, the Company determined its two operating and reporting segments to be wholesale distribution transacted through the parent entity and direct-to-consumer distribution transacted through the Company’s wholly owned operating subsidiaries, Moissanite.com, LLC and Charles & Colvard Direct, LLC. The accounting policies for these segments are the same as those described in Note 2, “Basis of Presentation and Significant Accounting Policies,” of this Quarterly Report on Form 10-Q and in the Notes to Consolidated Financial Statements in the 2013 Annual Report.

The Company evaluates the financial performance of its segments based on net sales; product line gross profit, or the excess of product line sales over product line cost of goods sold; and operating income (loss). The Company’s inventories are maintained in the parent entity’s wholesale distribution segment and are transferred without intercompany markup to the operating subsidiaries as product line cost of goods sold when sold to the end consumer. Product line cost of goods sold is defined as product cost of goods sold in each of the Company’s wholesale distribution and direct-to-consumer distribution operating segments excluding non-capitalized expenses from the Company’s manufacturing and production control departments, comprising personnel costs, depreciation, rent, utilities, and corporate overhead allocations; freight out; inventory valuation allowance adjustments; and other inventory adjustments, comprising costs of quality issues, damaged goods, and inventory write-offs.

The Company allocates certain general and administrative and information technology-related expenses from its parent entity to its two direct-to-consumer operating subsidiaries primarily based on net sales and headcount, respectively. Unallocated expenses, which also include interest and taxes, remain in the parent entity’s wholesale distribution segment.

Summary financial information by reporting segment is as follows:

|

|

|

Three Months Ended June 30,

|

|

|

|

|

2014

|

|

|

2013

|

|

|

|

|

Wholesale

|

|

|

Direct-to-

Consumer

|

|

|

Total

|

|

|

Wholesale

|

|

|

Direct-to-

Consumer

|

|

|

Total

|

|

|

Net sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loose jewels

|

|

$

|

3,837,012

|

|

|

$

|

173,327

|

|

|

$

|

4,010,339

|

|

|

$

|

3,984,058

|

|

|

$

|

91,238

|

|

|

$

|

4,075,296

|

|

|

Finished jewelry

|

|

|

3,012,372

|

|

|

|

818,936

|

|

|

|

3,831,308

|

|

|

|

1,905,430

|

|

|

|

531,774

|

|

|

|

2,437,204

|

|

|

Total

|

|

$

|

6,849,384

|

|

|

$

|

992,263

|

|

|

$

|

7,841,647

|

|

|

$

|

5,889,488

|

|

|

$

|

623,012

|

|

|

$

|

6,512,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product line cost of goods sold

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loose jewels

|

|

$

|

2,040,944

|

|

|

$

|

25,346

|

|

|

$

|

2,066,290

|

|

|

$

|

1,334,472

|

|

|

$

|

11,795

|

|

|

$

|

1,346,267

|

|

|

Finished jewelry

|

|

|

2,377,715

|

|

|

|

369,649

|

|

|

|

2,747,364

|

|

|

|

1,330,109

|

|

|

|

290,816

|

|

|

|

1,620,925

|

|

|

Total

|

|

$

|

4,418,659

|

|

|

$

|

394,995

|

|

|

$

|

4,813,654

|

|

|

$

|

2,664,581

|

|

|

$

|

302,611

|

|

|

$

|

2,967,192

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product line gross profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loose jewels

|

|

$

|

1,796,068

|

|

|

$

|

147,981

|

|

|

$

|

1,944,049

|

|

|

$

|

2,649,586

|

|

|

$

|

79,443

|

|

|

$

|

2,729,029

|

|

|

Finished jewelry

|

|

|

634,657

|

|

|

|

449,287

|

|

|

|

1,083,944

|

|

|

|

575,321

|

|

|

|

240,958

|

|

|

|

816,279

|

|

|

Total

|

|

$

|

2,430,725

|

|

|

$

|

597,268

|

|

|

$

|

3,027,993

|

|

|

$

|

3,224,907

|

|

|

$

|

320,401

|

|

|

$

|

3,545,308

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income

|

|

$

|

(1,008,146

|

)

|

|

$

|

(1,032,782

|

)

|

|

$

|

(2,040,928

|

)

|

|

$

|

624,419

|

|

|

$

|

(1,482,730

|

)

|

|

$

|

(858,311

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

$

|

214,021

|

|

|

$

|

96,926

|

|

|

$

|

310,947

|

|

|

$

|

101,876

|

|

|

$

|

90,486

|

|

|

$

|

192,362

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

$

|

928,341

|

|

|

$

|

-

|

|

|

$

|

928,341

|

|

|

$

|

108,645

|

|

|

$

|

5,968

|

|

|

$

|

114,613

|

|

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2014

|

|

|

2013

|

|

|

|

|

Wholesale

|

|

|

Direct-to-

Consumer

|

|

|

Total

|

|

|

Wholesale

|

|

|

Direct-to-

Consumer

|

|

|

Total

|

|

|

Net sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loose jewels

|

|

$

|

7,370,756

|

|

|

$

|

320,269

|

|

|

$

|

7,691,025

|

|

|

$

|

8,278,212

|

|

|

$

|

144,998

|

|

|

$

|

8,423,210

|

|

|

Finished jewelry

|

|

|

4,632,243

|

|

|

|

1,585,932

|

|

|

|

6,218,175

|

|

|

|

3,634,153

|

|

|

|

960,211

|

|

|

|

4,594,364

|

|

|

Total

|

|

$

|

12,002,999

|

|

|

$

|

1,906,201

|

|

|

$

|

13,909,200

|

|

|

$

|

11,912,365

|

|

|

$

|

1,105,209

|

|

|

$

|

13,017,574

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product line cost of goods sold

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loose jewels

|

|

$

|

3,816,079

|

|

|

$

|

47,619

|

|

|

$

|

3,863,698

|

|

|

$

|

3,050,412

|

|

|

$

|

18,542

|

|

|

$

|

3,068,954

|

|

|

Finished jewelry

|

|

|

3,657,816

|

|

|

|

727,796

|

|

|

|

4,385,612

|

|

|

|

1,931,079

|

|

|

|

473,467

|

|

|

|

2,404,546

|

|

|

Total

|

|

$

|

7,473,895

|

|

|

$

|

775,415

|

|

|

$

|

8,249,310

|

|

|

$

|

4,981,491

|

|

|

$

|

492,009

|

|

|

$

|

5,473,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product line gross profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loose jewels

|

|

$

|

3,554,677

|

|

|

$

|

272,650

|

|

|

$

|

3,827,327

|

|

|

$

|

5,227,800

|

|

|

$

|

126,456

|

|

|

$

|

5,354,256

|

|

|

Finished jewelry

|

|

|

974,427

|

|

|

|

858,136

|

|

|

|

1,832,563

|

|

|

|

1,703,074

|

|

|

|

486,744

|

|

|

|

2,189,818

|

|

|

Total

|

|

$

|

4,529,104

|

|

|

$

|

1,130,786

|

|

|

$

|

5,659,890

|

|

|

$

|

6,930,874

|

|

|

$

|

613,200

|

|

|

$

|

7,544,074

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income

|

|

$

|

(1,133,003

|

)

|

|

$

|

(2,078,428

|

)

|

|

$

|

(3,211,431

|

)

|

|

$

|

2,264,325

|

|

|

$

|

(2,601,109

|

)

|

|

$

|

(336,784

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

$

|

393,693

|

|

|

$

|

195,052

|

|

|

$

|

588,745

|

|

|

$

|

192,855

|

|

|

$

|

191,894

|

|

|

$

|

384,749

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

$

|

956,666

|

|

|

$

|

-

|

|

|

$

|

956,666

|

|

|

$

|

189,316

|

|

|

$

|

13,294

|

|

|

$

|

202,610

|

|

|

|

June 30, 2014

|

|

December 31, 2013

|

|

|

|

Wholesale

|

|

Direct-to-

Consumer

|

|

Total

|

|

Wholesale

|

|

Direct-to-

Consumer

|

|

Total

|

|

|

Total assets

|

|

$

|

55,724,771

|

|

|

$

|

803,078

|

|

|

$

|

56,527,849

|

|

|

$

|

61,702,449

|

|

|

$

|

621,403

|

|

|

$

|

62,323,852

|

|

A reconciliation of the Company’s product line cost of goods sold to cost of goods sold as reported in the condensed consolidated financial statements is as follows:

|

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

|

Product line cost of goods sold

|

|

$

|

4,813,654

|

|

|

$

|

2,967,192

|

|

|

$

|

8,249,310

|

|

|

$

|

5,473,500

|

|

|

Non-capitalized manufacturing and production control expenses

|

|

|

256,144

|

|

|

|

208,389

|

|

|

|

411,167

|

|

|

|

608,640

|

|

|

Freight out

|

|

|

76,077

|

|

|

|

51,453

|

|

|

|

135,976

|

|

|

|

87,962

|

|

|

Inventory valuation allowances

|

|

|

45,000

|

|

|

|

94,000

|

|

|

|

69,000

|

|

|

|

75,000

|

|

|

Other inventory adjustments

|

|

|

134,106

|

|

|

|

68,281

|

|

|

|

122,570

|

|

|

|

26,191

|

|

|

Cost of goods sold

|

|

$

|

5,324,981

|

|

|

$

|

3,389,315

|

|

|

$

|

8,988,023

|

|

|

$

|

6,271,293

|

|

The Company’s net inventories by product line maintained in the parent entity’s wholesale distribution segment are as follows:

|

|

|

June 30,

2014

|

|

|

December 31,

2013

|

|

|

Loose jewels

|

|

|

|

|

|

|

|

Raw materials

|

|

$

|

5,110,412

|

|

|

$

|

3,311,375

|

|

|

Work-in-process

|

|

|

6,486,882

|

|

|

|

9,526,769

|

|

|

Finished goods

|

|

|

21,671,343

|

|

|

|

20,002,881

|

|

|

Finished goods on consignment

|

|

|

149,142

|

|

|

|

32,948

|

|

|

Total

|

|

$

|

33,417,779

|

|

|

$

|

32,873,973

|

|

|

|

|

|

|

|

|

|

|

|

|

Finished jewelry

|

|

|

|

|

|

|

|

|

|

Raw materials

|

|

$

|

283,378

|

|

|

$

|

270,043

|

|

|

Work-in-process

|

|

|

562,916

|

|

|

|

764,355

|

|

|

Finished goods

|

|

|

6,781,866

|

|

|

|

8,117,035

|

|

|

Finished goods on consignment

|

|

|

355,735

|

|

|

|

299,514

|

|

|

Total

|

|

$

|

7,983,895

|

|

|

$

|

9,450,947

|

|

Supplies inventories of approximately $72,000 and $87,000 at June 30, 2014 and December 31, 2013, respectively, included in finished goods inventories in the condensed consolidated financial statements are omitted from inventories by product line because they are used in both product lines and are not maintained separately.

The Company recognizes sales by geographic area based on the country in which the customer is based. A portion of the Company’s international wholesale distribution segment sales represents products sold internationally that may be re-imported to United States (“U.S.”) retailers. Sales to international end consumers made by the Company’s direct-to-consumer distribution segment are included in U.S. sales because products are shipped and invoiced to a U.S.-based intermediary party that assumes all international shipping and credit risks. The following presents certain data by geographic area:

|

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

|

Net sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

$

|

7,267,441

|

|

|

$

|

5,373,178

|

|

|

$

|

12,976,474

|

|

|

$

|

10,485,467

|

|

|

International

|

|

|

574,206

|

|

|

|

1,139,322

|

|

|

|

932,726

|

|

|

|

2,532,107

|

|

|

Total

|

|

$

|

7,841,647

|

|

|

$

|

6,512,500

|

|

|

$

|

13,909,200

|

|

|

$

|

13,017,574

|

|

|

|

|

June 30,

2014

|

|

|

December 31,

2013

|

|

|

Property and equipment, net

|

|

|

|

|

|

|

|

United States

|

|

$

|

2,163,187

|

|

|

$

|

1,717,692

|

|

|

International

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

$

|

2,163,187

|

|

|

$

|

1,717,692

|

|

|

|

|

June 30,

2014

|

|

|

December 31,

2013

|

|

|

Intangible assets, net

|

|

|

|

|

|

|

|

United States

|

|

$

|

54,090

|

|

|

$

|

70,830

|

|

|

International

|

|

|

251,865

|

|

|

|

255,037

|

|

|

Total

|

|

$

|

305,955

|

|

|

$

|

325,867

|

|

| 4. |

FAIR VALUE MEASUREMENTS |

Under U.S. GAAP, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are obtained from independent sources and can be validated by a third party, whereas unobservable inputs reflect assumptions regarding what a third party would use in pricing an asset or liability. The fair value hierarchy consists of three levels based on the reliability of inputs, as follows:

|

● |

Level 1 - quoted prices in active markets for identical assets and liabilities |

|

● |

Level 2 - inputs other than Level 1 quoted prices that are directly or indirectly observable |

|

● |

Level 3 - unobservable inputs that are not corroborated by market data |

The Company evaluates assets and liabilities subject to fair value measurements on a recurring and non-recurring basis to determine the appropriate level to classify them for each reporting period. This determination requires significant judgments to be made by management of the Company. The instruments identified as subject to fair value measurements on a recurring basis are cash and cash equivalents, trade accounts receivable, trade accounts payable, and accrued expenses. All instruments are reflected in the consolidated balance sheets at carrying value, which approximates fair value due to the short-term nature of these instruments.

Assets that are measured at fair value on a non-recurring basis include property and equipment, leasehold improvements, and intangible assets, comprising patents, license rights, and trademarks. These items are recognized at fair value when they are considered to be impaired. Level 3 inputs are primarily based on the estimated future cash flows of the asset determined by market inquiries to establish fair market value of used machinery or future revenue expected to be generated with the assistance of patents, license rights, and trademarks.

The Company’s total inventories, net of reserves, consisted of the following as of June 30, 2014 and December 31, 2013:

|

|

|

June 30,

2013

|

|

|

December 31,

2013

|

|

|

Raw materials

|

|

$

|

5,393,790

|

|

|

$

|

3,581,418

|

|

|

Work-in-process

|

|

|

7,049,798

|

|

|

|

10,291,124

|

|

|

Finished goods

|

|

|

29,185,643

|

|

|

|

28,771,098

|

|

|

Finished goods on consignment

|

|

|

552,877

|

|

|

|

407,462

|

|

|

Less inventory reserves

|

|

|

(708,000

|

)

|

|

|

(639,000

|

)

|

|

Total

|

|

$

|

41,474,108

|

|

|

$

|

42,412,102

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion

|

|

$

|

12,419,064

|

|

|

$

|

13,074,428

|

|

|

Long-term portion

|

|

|

29,055,044

|

|

|

|

29,337,674

|

|

|

Total

|

|

$

|

41,474,108

|

|

|

$

|

42,412,102

|

|

Inventories are stated at the lower of cost or market on an average cost basis. Inventory costs include direct material and labor, inbound freight, purchasing and receiving costs, inspection costs, and warehousing costs. Any inventory on hand at the measurement date in excess of the Company’s current requirements based on historical and anticipated levels of sales is classified as long-term on the Company’s consolidated balance sheets. The Company’s classification of long-term inventory requires it to estimate the portion of on-hand inventory that can be realized over the next 12 months and does not include precious metal, labor, and other inventory purchases expected to be both purchased and realized over the next 12 months.

The Company’s work-in-process inventories include raw SiC crystals on which processing costs, such as labor and sawing, have been incurred; and components, such as metal castings and finished good moissanite jewels, that have been issued to jobs in the manufacture of finished jewelry. The Company’s moissanite jewel manufacturing process involves the production of intermediary shapes, called “preforms,” that vary depending upon the size and shape of the finished jewel. To maximize manufacturing efficiencies, preforms may be made in advance of current finished inventory needs but remain in work-in-process inventories. As of June 30, 2014 and December 31, 2013, work-in-process inventories issued to active production jobs approximated $2.11 million and $4.09 million, respectively.

The Company’s jewels do not degrade in quality over time and inventory generally consists of the shapes and sizes most commonly used in the jewelry industry. In addition, the majority of jewel inventory is not mounted in finished jewelry settings and is therefore not subject to fashion trends nor is obsolescence a significant factor. The Company has very small market penetration in the worldwide jewelry market, and the Company has the exclusive right in the U.S. through mid-2015 and in many other countries through mid-2016 to produce and sell created SiC for use in jewelry applications. In view of the foregoing factors, management has concluded that no excess or obsolete loose jewel inventory reserve requirements existed as of June 30, 2014.

In 2010, the Company began manufacturing finished jewelry featuring moissanite. Relative to loose moissanite jewels, finished jewelry is more fashion oriented and subject to styling trends that could render certain designs obsolete. The majority of the Company’s finished jewelry featuring moissanite is held in inventory for resale and consists of such basic designs as stud earrings, solitaire and three-stone rings, pendants, and bracelets that tend not to be subject to significant obsolescence risk due to their classic styling. In addition, the Company manufactures small individual quantities of designer-inspired moissanite fashion jewelry as part of its sample line that are used in the selling process to its wholesale customers.

In 2011, the Company began purchasing fashion finished jewelry comprised of base metals and non-precious gemstones for sale through Lulu Avenue®, the direct-to-consumer home party division of the Company’s wholly owned operating subsidiary, Charles & Colvard Direct, LLC. This finished jewelry is fashion oriented and subject to styling trends that may change with each catalog season, of which there are several each year. Typically in the jewelry industry, slow-moving or discontinued lines are sold as closeouts or liquidated in alternative sales channels. The Company reviews the finished jewelry inventory on an ongoing basis for any lower of cost or market and obsolescence issues. The Company identified certain fashion finished jewelry inventory that could not be sold due to damage or branding issues and established an obsolescence reserve of $128,000 as of June 30, 2014 and December 31, 2013, for the carrying costs in excess of any estimated scrap values. As of June 30, 2014, the Company identified certain finished jewelry featuring moissanite that was obsolete and established an obsolescence reserve of $30,000 for the carrying costs in excess of any estimated scrap values.

Periodically, the Company ships finished goods inventory to wholesale customers on consignment terms. Under these terms, the customer assumes the risk of loss and has an absolute right of return for a specified period. Finished goods on consignment at June 30, 2014 and December 31, 2013 are net of shrinkage reserves of $48,000 and $75,000, respectively, to allow for certain loose jewels and finished jewelry on consignment with wholesale customers that may not be returned or may be returned in a condition that does not meet the Company’s current grading or quality standards.

Total net loose jewel inventories at June 30, 2014 and December 31, 2013, including inventory on consignment net of reserves, were $33.42 million and $32.87 million, respectively. The loose jewel inventories at June 30, 2014 and December 31, 2013 include shrinkage reserves of $1,000 and $2,000, respectively, with no shrinkage reserves on inventory on consignment. Loose jewel inventories at June 30, 2014 and December 31, 2013 also include recuts reserves of $197,000 and $172,000, respectively.

Total net jewelry inventories at June 30, 2014 and December 31, 2013, including inventory on consignment net of reserves, finished jewelry featuring moissanite manufactured by the Company since entering the finished jewelry business in 2010, and fashion finished jewelry purchased by the Company for sale through Lulu Avenue®, were $7.98 million and $9.45 million, respectively. Jewelry inventories consist primarily of finished goods, a portion of which the Company acquired as part of a January 2009 settlement agreement with a former manufacturer customer to reduce the outstanding receivable to the Company. Due to the lack of a plan to market this inventory at that time, a jewelry inventory reserve was established to reduce the majority of the acquired jewelry inventory value to scrap value, or the amount the Company would expect to obtain by melting the gold in the jewelry and returning to loose-jewel finished goods inventory those jewels that meet grading standards. The scrap reserve established for this acquired inventory at the time of the agreement is adjusted at each reporting period for the market price of gold and has generally declined as the associated jewelry is sold down. At June 30, 2014, the balance increased to $114,000 from $106,000 at December 31, 2013 as a result of a sales return, offset in part by sell down of the inventory during the quarter. Because the finished jewelry the Company began manufacturing in 2010 after it entered that business was made pursuant to an operational plan to market and sell the inventory, it is not subject to this reserve. The finished jewelry inventories at June 30, 2014 and December 31, 2013 also include shrinkage reserves of $160,000 and $180,000, respectively, including shrinkage reserves of $48,000 and $75,000 on inventory on consignment, respectively; and finished jewelry inventories at June 30, 2014 and December 31, 2013 include a repairs reserve of $78,000 and $51,000, respectively.

The need for adjustments to inventory reserves is evaluated on a period-by-period basis.

The Company recognized an income tax net expense of approximately $4.15 million for the three months ended June 30, 2014 compared to an income tax net benefit of approximately $360,000 for the three months ended June 30, 2013. The Company recognized an income tax net expense of $4.05 million for the six months ended June 30, 2014 compared to an income tax net benefit of $138,000 for the six months ended June 30, 2013.

As of each reporting date, the Company’s management considers new evidence, both positive and negative, that could impact its view with regard to future realization of deferred tax assets. The Company’s management determined that sufficient positive evidence existed as of March 31, 2014 and December 31, 2013 to conclude that it is more likely than not that deferred tax assets of $4.15 million and $4.04 million, respectively, were realizable. A valuation allowance remained at March 31, 2014 and December 31, 2013 against certain deferred tax assets relating to state net operating loss carryforwards from the Company’s e-commerce and home party operating subsidiaries due to the timing uncertainty of when the subsidiaries will generate cumulative positive taxable income to utilize the associated deferred tax assets. A valuation allowance also remained at March 31, 2014 and December 31, 2013 against certain deferred tax assets relating to investment loss carryforwards because the Company does not anticipate it will generate sufficient investment income to utilize the carryforwards. The Company also previously considered various strategic alternatives, resulting in management determining that a valuation allowance was not necessary at that time. During the three months ended June 30, 2014, the Company’s management determined that such alternatives were no longer in the best interest of the Company. Accordingly, the Company’s management concluded that the positive evidence was no longer sufficient to offset available negative evidence, primarily as a result of the pre-tax operating loss for the three and six months ended June 30, 2014. As a result, management concluded that it was uncertain that the Company would have sufficient future taxable income to utilize its deferred tax assets, and therefore, the Company established a valuation allowance against its deferred tax assets, resulting in a tax expense of $4.15 million and $4.05 million for the three and six months ended June 30, 2014, respectively. During the three and six months ended June 30, 2014, the Company also recognized approximately $6,000 of income tax expense for estimated tax, penalties, and interest associated with uncertain tax positions.

For the three months ended June 30, 2013, the Company recognized $358,000 of current period income tax benefit, offsetting an income tax expense recorded in the first quarter of 2013 of approximately $211,000. The resulting income tax net benefit of $147,000 for the six months ended June 30, 2013 represents an effective tax rate of 45.4% on the year-to-date pre-tax book loss. The effective tax rate for the six months ended June 30, 2013 differs from the federal statutory rate of 34.0% primarily due to the impact of state income taxes, stock-based compensation expense that is not deductible for tax purposes, and other book-to-tax reconciling items. This effective tax rate increased from December 31, 2012 due to anticipation of higher taxable income in 2013, and an additional $7,000 of income tax expense was accrued and paid in the first quarter of 2013 related to the prior tax year, primarily for adjustment of the federal alternative minimum tax. Additionally, the Company recorded approximately $4,000 of income tax benefit for a discrete permanent tax deduction difference during the three and six months ended June 30, 2013 and approximately $2,000 and $6,000 of income tax expense for estimated tax, penalties, and interest associated with uncertain tax positions during the three and six months ended June 30, 2013, respectively.

| 7. |

COMMITMENTS AND CONTINGENCIES |

Lease Commitments

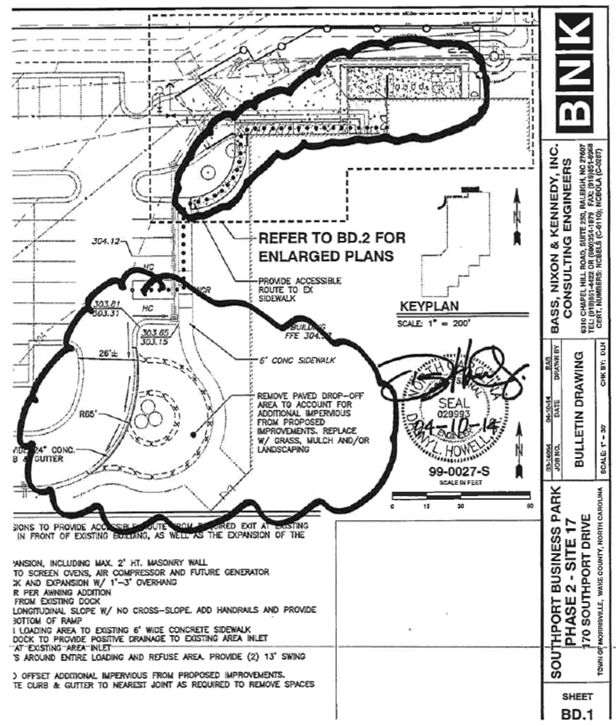

In March 2004, the Company entered into a seven-year lease, beginning in August 2004, for approximately 16,500 square feet of mixed-use space from an unaffiliated third party at a base cost with escalations throughout the lease term plus additional common-area expenses based on the Company’s proportionate share of the lessor’s operating costs. The lease provided for two rent holidays, during which no rent was payable, and a moving allowance. In January 2011, the Company amended the lease effective January 1, 2011 to extend the term through January 2017 in exchange for a reduced rental rate and 50% rent abatement in the first 12 months of the extended term. The amended lease includes 3% annual rent escalations and a one-time option to terminate the lease effective as of July 31, 2014. The Company exercised this right to terminate the lease by giving notice to the lessor prior to October 31, 2013. The cost to terminate the lease effective July 31, 2014 was approximately $112,000, which the Company paid at the time notice was given to terminate the lease. This amount reflects all unamortized lease transaction costs, including, without limitation, all rent abated since January 1, 2011, plus two months’ rent at the current rental rate. On December 9, 2013, the Company entered into a Lease Agreement, as amended on December 23, 2013 and April 15, 2014 (the “Lease Agreement”), for a new corporate headquarters, which occupies approximately 36,350 square feet of office, storage, and light manufacturing space. The Company took possession of the leased property on May 23, 2014 once certain improvements to the leased space were completed. These improvements and other lease signing and moving incentives offered by the landlord totaled approximately $550,000 and $73,000, respectively, which will be amortized over the life of the lease. Included in the Lease Agreement is a seven-month rent abatement period expected to begin June 2014 through December 2014.

The Company recognizes rent expense on a straight-line basis, giving consideration to the rent holidays and escalations, the lease signing and moving allowance to be paid to the Company, and the rent abatement.

As of June 30, 2014, the Company’s future minimum payments under the operating leases were as follows:

|

2014

|

|

$

|

-

|

|

|

2015

|

|

|

553,905

|

|

|

2016

|

|

|

569,138

|

|

|

2017

|

|

|

584,789

|

|

|

2018

|

|

|

600,871

|

|

|

Thereafter

|

|

|

1,793,725

|

|

|

Total

|

|

$

|

4,102,428

|

|

Rent expense for the three months ended June 30, 2014 and 2013 was approximately $84,000 and $77,000, respectively. Rent expense for the six months ended June 30, 2014 and 2013 was approximately $115,000 and $133,000, respectively.

Purchase Commitments

On June 6, 1997, the Company entered into an amended and restated exclusive supply agreement with Cree, Inc. (“Cree”). The exclusive supply agreement had an initial term of ten years that was extended in January 2005 to July 2015. In connection with the amended and restated exclusive supply agreement, the Company has committed to purchase from Cree a minimum of 50%, by dollar volume, of its raw material SiC crystal requirements. If the Company’s orders require Cree to expand beyond specified production levels, the Company must commit to purchase certain minimum quantities. Effective February 8, 2013, the Company entered into an amendment to a prior letter agreement with Cree, which provides a framework for the Company’s purchases of SiC crystals under the amended and restated exclusive supply agreement. Pursuant to this amendment, the Company agreed to purchase at least $4.00 million of SiC crystals in an initial new order. After the initial new order, the Company has agreed to issue non-cancellable, quarterly orders that must equal or exceed a set minimum order quantity. The total purchase commitment under the amendment until July 2015, including the initial new order, is dependent upon the grade of the material and ranges between approximately $7.64 million and approximately $18.56 million. During the six months ended June 30, 2014 and 2013, the Company purchased approximately $3.58 million and $4.99 million, respectively, of SiC crystals under the exclusive supply agreement.

On September 20, 2013, the Company obtained a $10,000,000 revolving line of credit (the “Line of Credit”) from PNC Bank, National Association (“PNC Bank”) for general corporate and working capital purposes. The Line of Credit was evidenced by a Committed Line of Credit Note, dated September 20, 2013 (the “Note”), which was set to mature on June 15, 2015. The interest rate under the Note was the one-month LIBOR rate (adjusted daily) plus 1.50%, calculated on an actual/360 basis.

The Line of Credit was also governed by a loan agreement, dated September 20, 2013 (the “Loan Agreement”) and was guaranteed by Charles & Colvard Direct, LLC, and Moissanite.com, LLC. The Line of Credit was secured by a lien on substantially all assets of the Company and its subsidiaries.

Effective June 25, 2014, the Line of Credit was terminated concurrent with the Company entering into a new banking relationship with Wells Fargo Bank, National Association (“Wells Fargo”). The Company had not utilized the Line of Credit. The Company recognized the remaining $19,000 of deferred legal expenses associated with this Line of Credit upon termination.

On June 25, 2014, the Company and its wholly owned subsidiaries, Charles & Colvard Direct, LLC, and Moissanite.com, LLC (collectively, the “Borrowers”), obtained a $10,000,000 asset-based revolving credit facility (the “Credit Facility”) from Wells Fargo. The Credit Facility will be used for general corporate and working capital purposes, including transaction fees and expenses incurred in connection therewith and the issuance of letters of credit up to a $1,000,000 sublimit. The Credit Facility will mature on June 25, 2017.

The Credit Facility includes a $5,000,000 sublimit for advances that are supported by a 90% guaranty provided by the U.S. Export-Import Bank. Advances under the Credit Facility are limited to a borrowing base, which is computed by applying specified advance rates to the value of the Borrowers’ eligible accounts and inventory, less reserves. Advances against inventory are further subject to an initial $3,000,000 maximum. The Borrowers must maintain a minimum of $1,000,000 in excess availability at all times. There are no other financial covenants.

Each advance accrues interest at a rate equal to Wells Fargo’s 3-month LIBOR rate plus 2.50%, calculated on an actual/360 basis and payable monthly in arrears. Principal outstanding during an event of default accrues interest at a rate of 3% in excess of the above rate. Any advance may be prepaid in whole or in part at any time. In addition, the maximum line amount may be reduced by the Company in whole or part at any time, subject to a fee equal to 2% of any reduction in the first year after closing, 1% of any reduction in the second year after closing, and 0% thereafter. There are no mandatory prepayments or line reductions.

The Credit Facility is secured by a lien on substantially all assets of the Borrowers, each of which is jointly and severally liable for all obligations thereunder.

The Credit Facility is evidenced by a credit and security agreement, dated as of June 25, 2014 (the “Credit Agreement”), and customary ancillary documents. The Credit Agreement contains customary covenants, representations and cash dominion provisions, including a financial reporting covenant and limitations on dividends, distributions, debt, contingent obligations, liens, loans, investments, mergers, acquisitions, divestitures, subsidiaries, affiliate transactions, and changes in control.

Events of default under the Credit Facility include, without limitation, (1) any impairment of the Export-Import Bank guaranty, unless the guaranteed advances are repaid within two business days, (2) an event of default under any other indebtedness of the Borrowers in excess of $200,000, and (3) a material adverse change in the ability of the Borrowers to perform their obligations under the Credit Agreement or in the Borrowers’ assets, liabilities, businesses or prospects, or other circumstances that Wells Fargo believes may impair the prospect of repayment. If an event of default occurs, Wells Fargo is entitled to take enforcement action, including acceleration of amounts due under the Credit Agreement and foreclosure upon collateral.

The Credit Agreement contains other customary terms, including indemnity, expense reimbursement, yield protection, and confidentiality provisions. Wells Fargo is permitted to assign the Credit Facility.

As of June 30, 2014, the Company had not borrowed against the Credit Facility.

| 9. |

STOCK-BASED COMPENSATION |

The following table summarizes the components of the Company’s stock-based compensation included in net loss:

|

|

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

|

Employee stock options

|

|

$

|

209,698

|

|

|

$

|

161,227

|

|

|

$

|

392,422

|

|

|

$

|

300,497

|

|

|

Restricted stock awards

|

|

|

224,281

|

|

|

|

335,740

|

|

|

|

418,068

|

|

|

|

443,136

|

|

|

Income tax benefit

|

|

|

(78,349

|

)

|

|

|

(162,247

|

)

|

|

|

(146,046

|

)

|

|

|

(201,184

|

)

|

|

Totals

|

|

$

|

355,630

|

|

|

$

|

334,720

|

|

|

$

|

664,444

|

|

|

$

|

542,449

|

|

No stock-based compensation was capitalized as a cost of inventory during the three and six months ended June 30, 2014 and 2013.

Stock Options - The following is a summary of the stock option activity for the six months ended June 30, 2014:

|

|

|

Shares

|

|

|

Weighted

Average

Exercise Price

|

|

|

Outstanding, December 31, 2013

|

|

|

1,204,297

|

|

|

$

|

3.14

|

|

|

Granted

|

|

|

215,000

|

|

|

$

|

2.89

|

|

|

Exercised

|

|

|

-

|

|

|

$

|

-

|

|

|

Forfeited