UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

| BioScrip, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on Tuesday, May 7, 2013

To the Stockholders of BioScrip, Inc.:

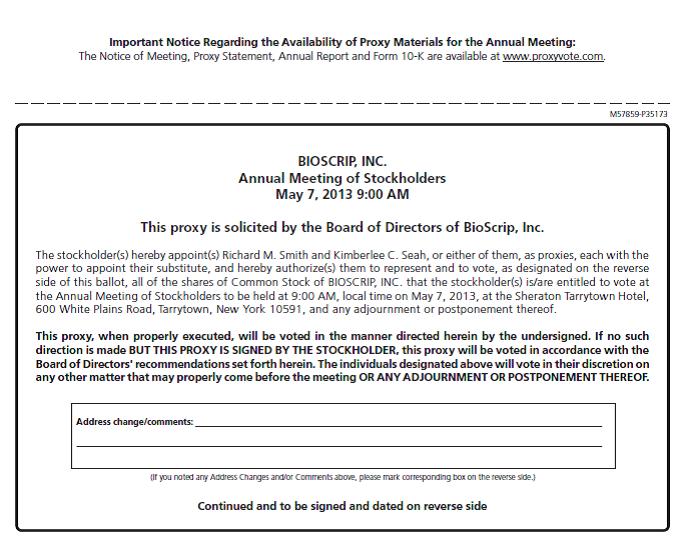

Notice is hereby given that the 2013 Annual Meeting of Stockholders (the “Annual Meeting”) of BioScrip, Inc., a Delaware corporation (the “Company”), will be held at the Sheraton Tarrytown Hotel, 600 White Plains Road, Tarrytown, New York 10591 on Tuesday, May 7, 2013 at 9:00 a.m., local time, for the following purposes:

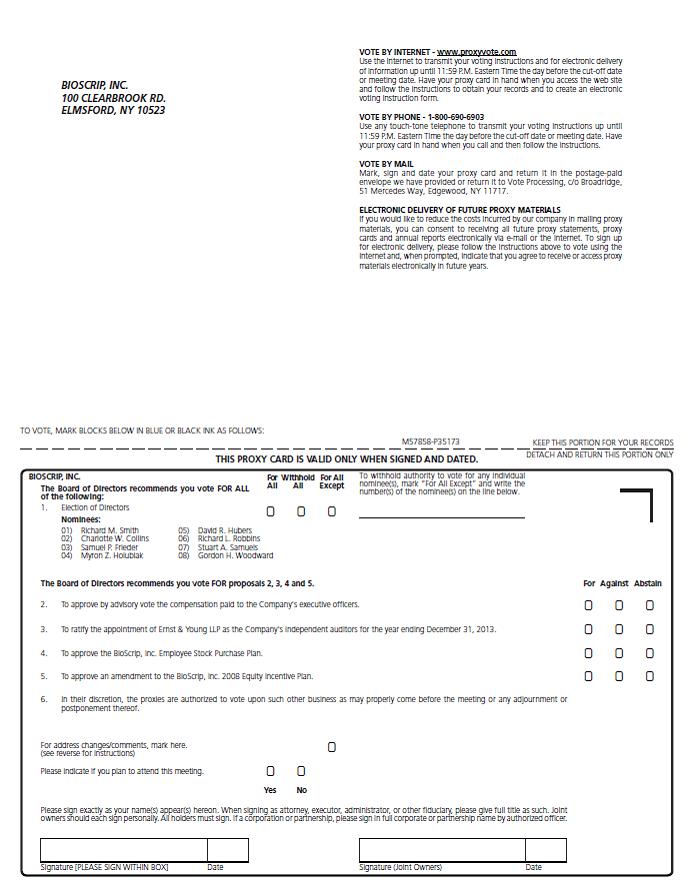

1. To elect eight directors to the Board of Directors of the Company, each to hold office for a term of one year or until their respective successors shall have been duly elected and shall have qualified.

2. To vote on a non-binding advisory resolution to approve the Company’s executive compensation.

3. To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the year ending December 31, 2013.

4. To approve the BioScrip, Inc. Employee Stock Purchase Plan.

5. To approve an amendment to the BioScrip, Inc. 2008 Equity Incentive Plan.

6. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The foregoing items of business, including information regarding the Company’s current directors and those persons nominated for election as directors of the Company, are more fully described in the Proxy Statement which is attached to and made a part of this notice.

The Board of Directors has fixed the close of business on March 12, 2013 as the record date for determining stockholders of the Company entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you plan to attend the Annual Meeting in person, please mark, sign, date and mail the enclosed proxy card as promptly as possible in the enclosed postage-prepaid envelope to ensure your representation and the presence of a quorum at the Annual Meeting. Alternatively, you may vote by toll-free telephone call or electronically via the Internet by following the instructions on the enclosed proxy card. If you send in your proxy card, vote by telephone or via the Internet and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable as set forth in the Proxy Statement.

By order of the Board of Directors,

-s- Kimberlee C. Seah

Kimberlee C. Seah,

Senior Vice President, Secretary and General Counsel

Elmsford, New York

April 2, 2013

Important notice regarding availability of proxy materials for the Annual Meeting of Stockholders to be held on Tuesday, May 7, 2013 or any adjournments of that meeting: This Proxy Statement, Proxy Card and the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 are also available for viewing at www.proxyvote.com.

| i |

BIOSCRIP, INC.

100 Clearbrook Road

Elmsford, New York 10523

(914) 460 – 1600

PROXY STATEMENT

Meeting Time and Date

This Proxy Statement is being furnished to the stockholders of BioScrip, Inc., a Delaware corporation (“BioScrip” or the “Company”), in connection with the solicitation by the Board of Directors of the Company (the “Board” or the “Board of Directors”) of proxies in the enclosed form for use in voting at the Company’s 2013 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, May 7, 2013 at 9:00 a.m., local time, at the Sheraton Tarrytown Hotel, 600 White Plains Road, Tarrytown, New York 10591 and at any adjournments or postponements thereof. The shares of BioScrip’s common stock, par value $.0001 per share (the “Common Stock”), represented by the proxies received, properly marked, dated, executed and not revoked will be voted at the Annual Meeting.

This Proxy Statement and the accompanying proxy card, which are furnished in connection with the solicitation of proxies by the Company’s Board of Directors, are being mailed and made available electronically to stockholders on or about April 2, 2013. This Proxy Statement contains information on matters to be voted upon at the annual meeting or any adjournments of that meeting.

Instead of submitting your proxy with the paper proxy card, you may vote by telephone or electronically via the Internet. If you vote by telephone or via the Internet it is not necessary to return your proxy card. Please note that there are separate telephone and Internet voting arrangements depending upon whether your shares of Common Stock are registered in your name or in the name of a broker or bank. You should follow the instructions on the proxy card you receive.

Record Date and Shares Outstanding

The close of business on March 12, 2013 has been fixed by the Board of Directors as the record date (the “Record Date”) for determining stockholders of the Company entitled to notice of and to vote at the Annual Meeting. The only outstanding voting securities of the Company are shares of Common Stock. As of the close of business on the Record Date, the Company had 57,038,458 shares of Common Stock issued and outstanding and held of record by approximately 208 holders (in addition to approximately 8,132 stockholders whose shares were held in nominee name).

Matters to be Voted on at the Annual Meeting

The following matters will be presented for stockholder consideration and voting at the 2013 Annual Meeting:

| · | Proposal 1: Election of Directors — the election of the eight directors nominated to serve on the Board of Directors of the Company, each to hold office until their respective successors shall have been duly elected and shall have qualified. |

| · | Proposal 2: Vote on a Resolution to Approve the Compensation Paid to the Company’s Executive Officers — a non-binding vote on a resolution to approve the compensation paid to the Company’s executive officers, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion. |

| · | Proposal 3: Ratification of the Appointment of Independent Auditors — the ratification of the appointment of Ernst & Young LLP as BioScrip’s independent auditor for the year ending December 31, 2013. |

| · | Proposal 4: Approval of the BioScrip, Inc. Employee Stock Purchase Plan (the “ESPP”) — the approval of the Employee Stock Purchase Plan, which is attached as Exhibit A to the Proxy Statement and which has been adopted by the Board of Directors, subject to the approval of the stockholders. |

| · | Proposal 5: Approval of an amendment to the BioScrip, Inc. 2008 Equity Incentive Plan (the “2008 Plan”) – the approval of an amendment to the 2008 Plan to increase the number of shares of common stock in the aggregate that may be subject to awards granted to directors by 300,000 shares, from 500,000 to 800,000 shares, which amendment is attached as Exhibit B to the Proxy Statement and has been adopted by the Board of Directors, subject to the approval of the stockholders. |

| 1 |

The Board of Directors recommends that you vote FOR each of the directors nominated under Proposal 1 and FOR Proposals 2, 3, 4 and 5.

The Board is not aware of any matters to be presented for a vote at the 2013 Annual Meeting other than those described in this Proxy Statement. If any other matters properly arise at the meeting, your proxy, together with the other proxies received, will be voted at the discretion of the proxy holders designated on the proxy card.

Voting and Solicitation

Each stockholder entitled to vote at the Annual Meeting may cast one vote in person or by proxy for each share of Common Stock held by such stockholder. To vote in person, a stockholder should attend the Annual Meeting with a completed proxy or, alternatively, the Company will give you a ballot to complete upon arrival at the Annual Meeting. To vote by mail using a proxy card, a stockholder should mark, sign, date and mail the enclosed proxy card as promptly as possible in the enclosed postage-prepaid envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. To vote by telephone, dial toll-free (800) 690-6903 using a touch-tone phone and follow the recorded instructions. To vote via the Internet, a stockholder must go to www.proxyvote.com and complete an electronic proxy card. When voting over the telephone or via the Internet, a stockholder will be asked to provide the company number and account number contained on the enclosed proxy card.

If on the Record Date a stockholder’s shares of Common Stock were held in an account maintained at a brokerage firm, bank, dealer, or other similar organization, then that stockholder is considered to be the beneficial owner of shares held in “street name” and these proxy materials are being forwarded by that organization, which is considered the stockholder of record for purposes of voting at the Annual Meeting. A stockholder who is a beneficial owner has the right to direct his or her broker or other agent on how to vote the shares of Common Stock in his or her account. Beneficial owners of the Company’s Common Stock are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, he or she may not vote in person at the Annual Meeting unless he or she requests and obtains a valid proxy from his or her broker or other agent.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Election at the Annual Meeting. The Inspector of Election will also determine whether or not a quorum is present. The holders of a majority of the shares of Common Stock issued and outstanding as of the Record Date are required to be present at the Annual Meeting, either in person or by proxy, in order to constitute a quorum. Shares of Common Stock represented at the Annual Meeting in person or by proxy but not voted will be counted for purposes of determining a quorum. Accordingly, abstentions and broker “non-votes” (generally shares as to which a broker or nominee has indicated that it has not received voting instructions from the beneficial owner and lacks discretionary authority to vote) on a particular matter, including the election of directors, will be treated as shares that are present and entitled to vote at the Annual Meeting for purposes of determining the presence of a quorum.

Pursuant to the rules of the U.S. Securities and Exchange Commission and the NASDAQ Global Market broker-dealers are prohibited from voting on the election of directors, executive compensation, or any other significant matter, all of which are considered “non-routine”, unless instructed by the beneficial owner of the shares. Certain matters submitted to a vote of stockholders are considered to be “routine” items upon which brokerage firms may vote in their discretion on behalf of their customers if such customers have not furnished voting instructions within a specified period of time prior to the Annual Meeting. On those matters determined to be “non-routine,” brokerage firms that have not received instructions from their customers would not have discretion to vote. Proposals 1, 2, 4 and 5 are likely to be considered “non-routine” matters, and Proposal 3 is likely to be considered a “routine” matter. Accordingly, if your broker holds shares that you own in “street name,” the broker may not vote your shares on either Proposal 1, 2, 4 or 5 without receiving instructions from you, and your shares will not be voted (i.e., broker “non-vote”). If you do not vote in person or vote via the Internet or by telephone, or sign and return a proxy, your shares will not be counted as “FOR” votes or “AGAINST” votes and will not affect the outcome of any of the Proposals.

In the election of directors, Proposal 1, the eight nominees who receive the greatest number of affirmative votes will be elected to the Board of Directors. Votes to withhold and broker non-votes will not affect the outcome of the vote on Proposal 1.

The vote on Proposal 2 to approve on a non-binding, advisory basis, the compensation paid to the Company’s executive officers is advisory and so the results will not be binding on the Compensation Committee. The Compensation Committee will, however, take into account the outcome of the vote when considering future compensation arrangements. Abstentions and broker non-votes will not affect the outcome of the vote on Proposal 2.

In order to approve Proposal 3, the proposal to ratify the appointment of Ernst & Young LLP, requires the affirmative “FOR” vote of the holders of a majority of the shares of Common Stock represented in person or by proxy at the Annual Meeting. Abstentions will have the same effect as a vote “AGAINST” on Proposal 3. Broker non-votes will likely not affect the outcome of the vote on Proposal 3 because they will likely be deemed a “routine” matter upon which brokers may vote without specific direction.

In order to approve Proposal 4, the proposal to approve the BioScrip, Inc. Employee Stock Purchase Plan; and Proposal 5, the proposal to amend the BioScrip, Inc. 2008 Equity Incentive Plan, requires the affirmative “FOR” vote of the holders of a majority of the shares of Common Stock represented in person or by proxy at the Annual Meeting. Abstentions and broker non-votes will have the same effect as a vote “AGAINST” on Proposals 4 and 5.

| 2 |

Proxies in the accompanying form that are properly executed, duly returned to the Company and not revoked, or proxies that are submitted by telephone or via the Internet and not revoked, will be voted in accordance with the instructions contained therein. If, as a stockholder of record, you do not specify how your shares are to be voted, the proxies will vote your shares FOR Proposals 1, 2, 3, 4 and 5. No proposal is currently expected to be considered at the Annual Meeting other than the proposals set forth in the accompanying Notice of Annual Meeting. If any other proposals are properly brought before the Annual Meeting for action it is intended that the persons named in the proxy and acting thereunder will vote in accordance with their discretion on such proposals.

The solicitation of proxies will be conducted by mail and the Company will bear all associated costs of the solicitation process. These costs include the expenses of preparing and mailing proxy solicitation materials for the Annual Meeting and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding such materials to beneficial owners of shares of Common Stock. The Company may conduct further solicitations personally, telephonically or by facsimile through its officers, directors and employees, none of whom will receive additional compensation for assisting with any such solicitations.

Revocation of Proxies

The presence of a stockholder at the Annual Meeting will not revoke such stockholder’s proxy. However, a proxy may be revoked at any time before it is voted.

Shareholders of Record. If you are a shareholder of record, you may revoke your proxy card (i) by delivering to the Secretary of the Company (at the principal executive offices of the Company) a written notice of revocation, (ii) by executing and delivering a later dated proxy, or (iii) by attending the Annual Meeting and voting in person. Stockholders voting by telephone or via the Internet may also revoke their proxy by attending the Annual Meeting and voting in person, by submitting the proxy in accordance with the instructions thereon or by voting again, at a later time, by telephone or via the Internet (a stockholder’s latest telephone or Internet vote, as applicable, will be counted and all earlier votes will be disregarded). However, once voting on a particular proposal is completed at the Annual Meeting, a stockholder will not be able to revoke his or her proxy or change his or her vote as to any proposal or proposals on which voting has been completed.

Beneficial Owners. If you are a beneficial owner, you will need to revoke or resubmit your proxy through your nominee and in accordance with its procedures. In order to attend the annual meeting and vote in person, you will need to obtain a proxy from your nominee, the shareholder of record

Adjournments and Postponements

Adjournments or postponements of the Annual Meeting may be made for the purpose of, among other things, soliciting additional proxies. Any adjournment or postponement may be made from time to time by approval of the holders of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting (whether or not a quorum exists) without further notice other than by an announcement made at the Annual Meeting. The Company does not currently intend to seek an adjournment or postponement of the Annual Meeting, but no assurance can be given that one will not be sought at that time.

| 3 |

COMMON STOCK OWNERSHIP BY CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 12, 2013, certain information concerning the beneficial shareholdings of (i) each person who is a director of the Company and each director nominee; (ii) each of the Company’s executive officers named in the Summary Compensation Table set forth below; (iii) all directors and executive officers of the Company as a group; and (iv) each person who is known by the Company to beneficially own more than five percent of the Company’s Common Stock (based on 57,038,458 shares of common stock outstanding as of March 12, 2013). To our knowledge, except as set forth in the footnotes to this table and subject to applicable community property laws, each person named in the table has sole voting and investment power with respect to the shares set forth opposite such person’s name.

| Name and Address of Beneficial Owner (1) | Number of Shares Beneficially Owned (2)(3) | Percent of Class (3) | ||||||||||

| Holders of 5% or more of our common stock (excluding Directors and NEOs) | Footnote # | |||||||||||

| Kohlberg Management V, L.L.C. 111 Radio Circle Mt. Kisco, New York 10549 | (4) | 15,686,149 | 26.12 | % | ||||||||

| FMR LLC 82 Devonshire Street Boston, MA 02109 | (5) | 4,096,771 | 7.18 | % | ||||||||

| 2012 Directors and Named Executive Officers | Footnote # | |||||||||||

| Richard M. Smith | (6) | 810,001 | 1.40 | % | ||||||||

| Charlotte W. Collins | (7) | 78,800 | * | |||||||||

| Samuel P. Frieder | (8) | 30,000 | * | |||||||||

| Myron Z. Holubiak | (9) | 56,200 | * | |||||||||

| David R. Hubers | (10) | 188,100 | * | |||||||||

| Richard L. Robbins | (11) | 118,500 | * | |||||||||

| Stuart A. Samuels | (12) | 82,700 | * | |||||||||

| Gordon H. Woodward | (8) | 30,000 | * | |||||||||

| Hai Tran | (13) | — | * | |||||||||

| Mary Jane Graves | (14) | 86,425 | * | |||||||||

| David Evans | (15) | 144,540 | * | |||||||||

| Vito Ponzio, Jr. | (16) | 133,334 | * | |||||||||

| Russel J. Corvese | (17) | 402,422 | * | |||||||||

| Patricia Bogusz | (18) | 134,470 | * | |||||||||

| All Directors and Executive Officers as a group (17 persons) | 2,536,299 | (19) | 4.3 | % | ||||||||

| * | Percentage less than 1% of class. |

| (1) | Except as otherwise indicated, all addresses are c/o BioScrip, Inc., 100 Clearbrook Road, Elmsford, NY 10523. |

| (2) | The inclusion in this table of any shares of Common Stock as “beneficially owned” does not constitute an admission by the holder of beneficial ownership of those shares. Except as otherwise indicated, each person has sole voting power and sole investment power with respect to all such shares beneficially owned by such person. |

| (3) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and generally includes voting or investment power over securities. The table above includes the number of shares underlying options and warrants that are currently exercisable or are exercisable within 60 days of March 12, 2013. With respect to each person, beneficial ownership is therefore based on 57,038,458 shares of common stock outstanding as of March 12, 2013, plus the number of options or warrants held by such person which are currently exercisable or are exercisable within 60 days of March 12, 2013. Shares of Common Stock subject to options and warrants that are currently exercisable or are exercisable within 60 days of March 12, 2013 are considered outstanding and beneficially owned by the person holding the options or warrants for the purposes of computing beneficial ownership of that person and of the directors and executive officers as a group, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| 4 |

| (4) | Based on information contained in Schedule 13D filed with the Securities and Exchange Commission on October 24, 2011 on behalf of the following: (i) Kohlberg Management V, L.L.C., a Delaware limited liability company (“Fund V”) beneficially owns 15,686,149 shares of which it has shared voting power with respect to 15,686,149 shares and shared dispositive power with respect to 14,889,510 shares; (ii) Kohlberg Investors V, L.P., a Delaware limited partnership (“Investors”) beneficially owns 8,654,951 shares of which it has shared voting power with respect to 8,654,951 shares and shared dispositive power with respect to 7,858,312; (iii) Kohlberg Partners V, L.P., a Delaware limited partnership (“Partners”) beneficially owns 442,499 shares for which it has shared voting power and shared dispositive power; (iv) Kohlberg Offshore Investors V, L.P., a Delaware limited partnership (“Offshore”) beneficially owns 526,390 shares for which it has shared voting power and shared dispositive power, (v) Kohlberg TE Investors V, L.P., a Delaware limited partnership (“TE”) beneficially owns 5,715,246 shares for which is has shared voting power and shared dispositive power, and (vi) KOCO Investors V, L.P., a Delaware limited partnership (“KOCO” and collectively with Investors, Partners, Offshore and TE, the “Funds”) beneficially owns 347,063 for which it has shared voting power and shared dispositive power. Fund V is the general partner of the Funds. Includes warrants to acquire up to an aggregate of 3,004,887 shares of the Company’s common stock and 796,639 shares of common stock held in escrow to satisfy the indemnification obligations of the Funds in connection with the acquisition of Critical Homecare Solutions Holdings, Inc. (“CHS”) by the Company in March 2010. Each reporting person expressly disclaims beneficial ownership of any of these securities except to the extent such reporting person actually exercises voting or dispositive power with respect to such securities. |

| (5) | Based on information contained in Schedule 13G filed with the Commission on February 14, 2013 by FMR, LLC, referred to herein as “FMR.” FMR advises that it is a parent holding company. FMR reports that of the 4,096,771 shares that it beneficially owns, it has the sole power to vote or direct 308,141. FMR indicates that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Common Stock of BioScrip, Inc. and no one person’s interest in the Common Stock of BioScrip, Inc. is more than five percent (5%) of the total outstanding Common Stock. |

| (6) | Includes 680,001 shares issuable upon exercise of options held by Mr. Smith. Excludes 374,999 shares subject to options held by Mr. Smith that will not be vested within 60 days of March 12, 2013. |

| (7) | Includes 35,000 shares issuable upon exercise of options to purchase Common Stock held by Ms. Collins. |

| (8) | In connection with the acquisition of CHS in March 2010, the Company entered into a stockholders’ agreement with Kohlberg Investors V, L.P., as stockholders’ representative, the stockholders of CHS and an optionholder of CHS. Among other things, the stockholders’ agreement grants to the stockholder representative the right to designate up to two directors (based on specified ownership percentages of the Company’s common stock) to be nominated for election to the Company’s board of directors. The stockholders’ representative designated Messrs. Samuel P. Frieder and Gordon H. Woodward as its representatives for nomination to the Board in accordance with the stockholders’ agreement and they were appointed to the Company’s Board upon the closing of the acquisition of CHS. Pursuant to the terms of an Assignment and Transfer Agreement entered into on July 7, 2010, Messrs. Samuel P. Frieder and Gordon H. Woodward transferred his pecuniary interest in their shares to Kohlberg & Co., LLC, but have retained all voting and dispositive power with respect to such shares. Messrs. Samuel P. Frieder and Gordon H. Woodward disclaim beneficial ownership of such shares except to the extent of his pecuniary interest therein. |

| (9) | Includes 36,200 shares issuable upon exercise of options held by Mr. Holubiak. |

| (10) | Includes 36,200 shares issuable upon exercise of the vested portion of options held by Mr. Hubers. Also includes 15,762 shares of Common Stock held by the David R. Hubers Revocable Trust; 11,200 shares of Common Stock held by the David R. Hubers Grantor Retained Annuity Trust; 36,978 shares of Common Stock held by the Hubers Grandchildren’s Trust; and 26,600 shares of Common Stock held by the David R. Hubers 2010 GRAT no. 1 U/A/D 07/29/2010. Mr. Hubers is a trustee of these trusts, other than the Hubers Grandchildren’s Trust, of which Mr. Hubers’ spouse is the trustee. |

| (11) | Includes 25,000 shares issuable upon exercise of options held by Mr. Robbins. |

| (12) | Includes 36,200 shares issuable upon exercise of options held by Mr. Samuels. |

| (13) | Excludes 200,000 shares subject to options held by Mr. Tran that will not be vested within 60 days of March 12, 2013. |

| (14) | Includes warrants to acquire up to 66,446 shares of the Company’s common stock and 1,214 shares of common stock held in escrow to satisfy the indemnification obligations in connection with the acquisition of Critical Homecare Solutions Holdings, Inc. by the Company in March 2010. |

| (15) | Includes 140,001 shares issuable upon exercise of options held by Mr. Evans. Excludes 99,999 shares subject to options held by Mr. Evans that will not be vested within 60 days of March 12, 2013. |

| (16) | Includes 133,334 shares issuable upon exercise of options held by Mr. Ponzio. Excludes 91,666 shares subject to options held by Mr. Ponzio that will not be vested within 60 days of March 12, 2013. |

| 5 |

| (17) | Includes 366,976 shares issuable upon exercise of options held by Mr. Corvese. Excludes 93,332 shares subject to options held by Mr. Corvese that will not be vested within 60 days of March 12, 2013. |

| (18) | Includes 126,354 shares issuable upon exercise of options held by Ms. Bogusz. Excludes 93,333 shares subject to options held by Ms. Bogusz that will not be vested within 60 days of March 12, 2013. |

| (19) | Includes 1,841,247 shares issuable upon exercise of options and 66,446 shares issuable upon exercise of warrants. Excludes 1,060,995 shares subject to options that will not be vested within 60 days of March 12, 2013. |

* * * * *

Equity Compensation Plan Information

The following table sets forth information relating to equity securities authorized for issuance under the Company’s equity compensation plans as of December 31, 2012.

| Number of | |||||||||||

| securities | |||||||||||

| remaining | |||||||||||

| available for | |||||||||||

| future | |||||||||||

| Number of | Weighted- | issuance under | |||||||||

| securities | average | equity | |||||||||

| to be issued upon | exercise price | compensation | |||||||||

| exercise of | of | plans | |||||||||

| outstanding | outstanding | (excluding | |||||||||

| options, | options, | securities | |||||||||

| warrants and | warrants and | reflected in | |||||||||

| rights | rights | column (a)) | |||||||||

| Plan Category | (a) | (b) | (c) | ||||||||

| Equity compensation plans approved by security holders (1) | 4,955,215 | $ | 5.88 | 3,748,254 | |||||||

| Equity compensation plans not approved by security holders | — | — | — | ||||||||

| Total | 4,955,215 | $ | 5.88 | 3,748,254 | |||||||

| (1) | This includes the BioScrip, Inc. 2008 Plan and the CHS Plan. In connection with the Company’s acquisition of CHS in March 2010, the Company assumed and adopted the BioScrip/CHS 2006 Equity Incentive Plan (the “CHS Plan”) and certain options issued under the under CHS Plan were converted into the right to purchase 716,086 shares of the Company’s Common Stock and all other options issued under the CHS Plan were either cashed out or cancelled. There are 1,719,528 shares of common stock remaining available under the CHS Plan for grant to current employees of the Company who are former employees of CHS and to employees of the Company hired after the date of the acquisition of CHS. |

* * * * *

The following table sets forth information relating to the number of stock options and shares of restricted stock granted by the Company in fiscal years 2012, 2011 and 2010:

|

Fiscal Year |

Stock Options Granted (#) |

Restricted Stock Granted (#) |

|||||

| 2012 | 2,106,500 | 70,000 | |||||

| 2011 | 1,523,500 | 90,000 | |||||

| 2010 | 1,722,250 | 80,000 |

* * * * *

| 6 |

PROPOSAL 1.

ELECTION OF DIRECTORS

General

In accordance with the Company’s By-Laws, the Board of Directors shall be comprised of such number of directors as is designated from time to time by resolution of the Board of Directors. Directors shall hold office until the next annual meeting of stockholders or until their respective successors are duly elected and qualified, or until any such director’s earlier death, resignation or removal. Vacancies on the Board of Directors and newly created directorships will generally be filled by the vote of a majority of the directors then in office, and any directors so chosen will hold office until the next annual meeting of stockholders. In voting for directors, each stockholder is entitled to cast one vote for each share of Common Stock held by such stockholder for each nominee. Stockholders are not entitled to cumulative voting in the election of directors. If a quorum is present, the eight nominees who receive the greatest number of votes will be elected to the Board of Directors. In the unanticipated event that one or more of such nominees becomes unavailable as a candidate for director, the persons named in the accompanying proxy will vote for another candidate nominated by the Board. Each person nominated for election has agreed to serve if elected. We have no reason to believe that any nominee will be unable to serve.

In connection with the acquisition of CHS in March 2010, the Company entered into a stockholders’ agreement with Kohlberg Investors V, L.P., as stockholders’ representative, the stockholders of CHS and an optionholder of CHS. Among other things, the stockholders’ agreement grants to the stockholders’ representative the right to designate up to two directors (based on specified ownership percentages of the Company’s common stock) to be nominated for election to the Company’s board of directors. The stockholders’ representative designated Messrs. Samuel P. Frieder and Gordon H. Woodward as its representatives for nomination to the Board in accordance with the stockholders’ agreement and they were appointed to the Company’s Board upon the closing of the acquisition of CHS. For as long as the stockholders’ representative has the right to designate one or more directors to the Board, at least one of those directors will be entitled to representation on the Audit, Management Development and Compensation and Corporate Strategy committees, so long as such designee meets the requirements of the NASDAQ listing standards for such committee.

Based on the recommendation of the Governance and Nominating Committee, the following eight persons have been nominated for election to the Board of Directors at the 2013 Annual Meeting: Charlotte W. Collins, Samuel P. Frieder, Myron Z. Holubiak, David R. Hubers, Richard L. Robbins, Stuart A. Samuels, Richard M. Smith, and Gordon H. Woodward. All of the nominees for election to the Board of Directors currently serve as directors of the Company.

The following table and narrative description sets forth, as of March 7, 2013, the age, principal occupation and employment, position with us, directorships in other public corporations, and year first elected as one of our directors, of each of the eight individuals nominated for election as director. Unless otherwise indicated, each nominee has been engaged in the principal occupation or occupations described below for more than the past five years.

| Name | Age | Director Since | Present Position with BioScrip | |||

| Myron Z. Holubiak | 66 | 2005 | Chairman of the Board | |||

| Richard M. Smith | 53 | 2009 | Director, President and CEO | |||

| Charlotte W. Collins | 60 | 2003 | Director | |||

| Samuel P. Frieder | 48 | 2010 | Director | |||

| David R. Hubers | 70 | 2005 | Director | |||

| Richard L. Robbins | 72 | 2005 | Director | |||

| Stuart A. Samuels | 71 | 2005 | Director | |||

| Gordon H. Woodward | 44 | 2010 | Director |

The Company’s directors have backgrounds that, when combined, provide a portfolio of experience and knowledge that serve the Company’s governance and strategic needs. Director nominees are considered on the basis of a range of criteria including broad-based business knowledge and relationships, prominence and reputations in their primary fields of endeavor, as well as a commitment to good corporate citizenship. They must have demonstrated experience and ability that is relevant to the board’s oversight role with respect to the Company’s business and affairs and have expertise and knowledge in various disciplines relevant to the Company’s business and/or operations. Each director’s biography set forth below includes the particular experience and qualifications that led the Board to conclude that the director should serve on the Board of Directors.

| 7 |

Current Directors and Nominees for Director

The following biographies set forth certain information with respect to each current director and each nominee for election as a director, including biographical data for at least the last five years:

Richard M. Smith, 53, President and Chief Executive Officer. Mr. Smith joined the Company as its President and Chief Operating Officer in January 2009 and was appointed a director of the Company in September 2009. On January 1, 2011, Mr. Smith became the Company’s Chief Executive Officer. Prior to joining the Company, from June 2006 to December 2008, Mr. Smith was Chief Executive Officer and a director of Byram Healthcare Centers, Inc., a provider of medical supplies and pharmacy items to long-term chronic patients. From May 2003 to May 2006, Mr. Smith was the President and Chief Operating Officer of Option Care, Inc., a home infusion and specialty pharmaceutical company.

Charlotte W. Collins, Esq., 60, has been a director of the Company since April 2003. Since January 2008, she has been a senior executive for the Asthma and Allergy Foundation of America. From 2003 to 2007, she was Associate Professor of Health Services Management and Leadership, and Health Policy at the George Washington University School of Public Health and Health Services. From January 2002 to June 2003, she was an Associate Research Professor of Health Policy at the same university. She served a four year term on the National Allergy and Infectious Diseases Advisory Council of the National Institutes of Health beginning in 2001. From September 1996 to November 2004, Ms. Collins was Of Counsel in the health policy practice of the law firm of Powell, Goldstein LLP in its Washington DC office. She served as General Counsel of the Regional Medical Center at Memphis for ten years until 1996 and served as interim General Counsel for the District of Columbia Health and Hospitals Public Benefit Corporation in 1998. In 1993, Ms. Collins co-founded a managed care plan and served on its board of directors through 1996. She has also served on the boards of two primary care centers, a Medicare Part A intermediary company, and as a leadership coach for the Robert Wood Johnson Foundation’s Health Policy Fellows program. In 2006, Modern Healthcare magazine named her one of the top 25 most influential minority healthcare executives.

Samuel P. Frieder, 48, was appointed a director of the Company in connection with the Company’s acquisition of CHS in March 2010. Mr. Frieder is the Managing Partner of Kohlberg & Co., L.L.C. (“Kohlberg”) and a member of Kohlberg’s Investment Committee. Mr. Frieder joined Kohlberg in 1989, became a principal in 1995 and named Managing Partner in 2006. He is a member of the board of directors of AGY Holdings Corporation, Aurora Casket Company, Bauer Performance Sports, Chronos Life Group, Concrete Technologies Worldwide, e+CancerCare, Katy Industries, Kellermeyer Bergensons Services, Nielsen & Bainbridge, Packaging Dynamics Corporation, Pittsburgh Glass Works, Phillips-Medisize Corporation, Sabre Industries, Inc., SouthernCare, Stanadyne Corporation, SVP Holdings and Trico Products. Mr. Frieder received an A.B. from Harvard College.

Myron Z. Holubiak, 66, has been a director of the Company since March 2005 and was appointed Chairman of the Board of the Company on April 18, 2012. Prior to being appointed a director of the Company he had served as a director of Chronimed since September 2002. Mr. Holubiak is the former President of Roche Laboratories, Inc. He held this position from December 1998 to August 2001. Currently, Mr. Holubiak is the President and a member of the board of directors of 1-800-Doctors, Inc., a medical referral company that provides consumers access to physicians and hospitals. Mr. Holubiak has been serving as a member of the board of directors of IntelliCell Biosciences, Inc. since October 2012 and as a member the board of Ventrus Biosciences, Inc. since July 2010.

David R. Hubers, 70, has been a director of the Company since March 2005. Prior to being appointed a director of the Company he had served as a director of Chronimed since November 2000. Mr. Hubers was Chairman of American Express Financial Advisors, Inc. prior to his retirement. He joined American Express Financial Advisors Inc. in 1965 and held various positions, including Senior Vice President of Finance and Chief Financial Officer until being appointed President and Chief Executive Officer in August 1993. He served in that capacity until June 2001. Mr. Hubers served on the boards of directors of the Carlson School of Management at the University of Minnesota and Lawson Software.

Richard L. Robbins, 72, has been a director of the Company since March 2005. From October 2003 through March 2006, Mr. Robbins was Senior Vice President, Financial Reporting and Control and Principal Financial Officer of Footstar, Inc., a nationwide retailer of footwear. From July 2002 to October 2003, Mr. Robbins was a partner of Robbins Consulting LLP, a financial, strategic and management consulting firm. From 1978 to 2002, Mr. Robbins was a partner of Arthur Andersen LLP. From December 2002 to March 2003, Mr. Robbins served on the board of directors of Bionx Corp., a medical products company. From May 2003 to October 2008, Mr. Robbins served on the board of directors of Vital Signs, Inc., a medical products company. From August 2007 to February 2008, Mr. Robbins served on the board of directors of American Banknote Holographics, Inc. From August 2007 to April 2009, Mr. Robbins served on the board of directors of Empire Resorts, Inc. Since January 2012, Mr. Robbins has served on the audit committee of Resorts Casino Hotel.

Stuart A. Samuels, 71, has been a director of the Company since March 2005. Prior to being appointed a director of the Company he had served as a director of Chronimed since November 2000. Since 1990, Mr. Samuels has been a management consultant, specializing in business management, strategic sales and marketing and business development for several companies, specifically in the pharmaceutical and healthcare industries. Mr. Samuels served on the board of directors of Target Rx, Inc. from 2000-2011, and the board of Infomedics, Inc. from 2005-2012. He currently serves as a Business Monitor for the Federal Trade Commission.

| 8 |

Gordon H. Woodward, 44, was appointed a director of the Company in connection with the Company’s acquisition of CHS in March 2010. Mr. Woodward is a Partner and Chief Investment Officer of Kohlberg & Co, L.L.C. (“Kohlberg”) and a member of Kohlberg’s Investment Committee. Mr. Woodward joined Kohlberg in 1996, became a Partner in 2001 and Chief Investment Officer in 2010. He is a member of the board of directors of Aurora Casket Company, Bauer Performance Sports, Chronos Life Group, e+CancerCare, Kellermeyer Bergensons Services, Nielsen & Bainbridge, Packaging Dynamics Corporation, Pittsburgh Glass Works, Phillips-Medisize Corporation, Sabre Industries, SouthernCare, Stanadyne Corporation and Standard Parking Corporation. Prior to joining Kohlberg, Mr. Woodward was with James D. Wolfensohn Incorporated. Mr. Woodward received an A.B. from Harvard College.

Additional Director Information

From 1998 to 2007, Mr. Frieder served as a director of Holley Performance Products, Inc. (“Holley”), a leading designer, manufacturer and distributor of high performance automotive products headquartered in Bowling Green, Kentucky. In February 2008, Holley filed a voluntary petition for reorganization under Chapter 11 of the federal bankruptcy laws in the U.S. Bankruptcy Court and emerged from bankruptcy in June 2010.

From October 2003 through March 2006, Mr. Robbins was Senior Vice President, Financial Reporting and Control and Principal Financial Officer of Footstar, Inc., a nationwide retailer of footwear. Footstar, Inc. filed for bankruptcy protection in March 2004 and emerged from bankruptcy in February 2006.

During the past ten years none of the persons currently serving as executive officers and/or directors of the Company has been the subject matter of any of the following legal proceedings that are required to be disclosed pursuant to Item 401(f) of Regulation S-K including: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (b) any criminal convictions; (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (d) any finding by a court, the Securities and Exchange Commission or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud; or (e) any sanction or order of any self-regulatory organization or registered entity or equivalent exchange, association or entity. Further, no such legal proceedings are believed to be contemplated by governmental authorities against any director or executive officer.

There is no family relationship among any of the directors or executive officers of the Company.

Vote Required and Recommendation of the Board of Directors

If a quorum is present and voting, the eight nominees receiving the highest number of votes duly cast at the Annual Meeting will be elected to the Board of Directors. Proxies cannot be voted for a greater number of persons than the number of nominees.

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE “FOR” EACH OF THE ABOVE-NAMED NOMINEES.

| 9 |

PROPOSAL 2.

APPROVAL, BY ADVISORY VOTE, OF THE COMPENSATION PAID TO THE

COMPANY’S EXECUTIVE OFFICERS

The Board of Directors recommends that you vote FOR this proposal:

“RESOLVED, that the compensation paid to the Company’s executive officers, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

This proposal will give stockholders the opportunity to endorse the Company’s executive compensation programs and policies and the resulting compensation for the executive officers, as described in this Proxy Statement on pages 33-49. The Company is providing this vote as required pursuant to section 14A of the Securities Exchange Act. Because the vote on this Proposal is advisory, the results will not be binding on the Management Development and Compensation Committee (“Compensation Committee”) and it will not affect, limit, or augment any existing compensation or awards. The Compensation Committee will, however, take into account the outcome of the vote when considering future compensation arrangements.

The Compensation Committee of the Board of Directors of the Company believes that the following design features are key to the program’s success and promotion of stockholders’ interests:

| · | Paying for performance: Other than base salaries, all other components of compensation are variable and dependent on achievement of business and/or financial performance; |

| · | Aligning executives’ interests with those of stockholders: Most incentive compensation is equity-based, and executives are encouraged to meet stock ownership guidelines; |

| · | Encouraging long-term decision-making: Stock options vest over three years and may normally be exercised over ten years; |

| · | Rewarding achievement of the Company’s business and financial performance: Amounts available for annual incentive awards are based on Company performance compared to its Business Plan; individual awards take account of business unit and individual executive performance relative to their goals; and |

| · | Avoiding incentives that might cause executives to take excessive risk: The Company makes discretionary rather than formulaic awards and uses Adjusted EBITDA as a key performance indicator. As an example, the Company also incentivizes management to achieve revenues at appropriate gross profit percentage levels and not simply revenues at any gross profit percentage level. |

At the same time, the Company’s executive compensation programs exclude practices that would be contrary to the Company’s compensation philosophy and contrary to stockholders’ interests. For example, the Company’s executive compensation program:

| · | does not provide executives with guaranteed bonuses; and |

| · | does not provide contractual change-in-control cash severance pay beyond two times base salary for triggering acceleration upon a change of control under the Company’s equity plans. |

The compensation of the executive officers reflects the Compensation Committee’s independent evaluation of these accomplishments, as well as their individual accomplishments.

The Compensation Committee and Board of Directors believes that the Company’s compensation programs and policies, and the compensation of the executive officers, as described above and on pages 33-49 of this Proxy Statement, promote the Company’s business objectives with appropriate compensation delivered in appropriate forms.

At the 2011 annual meeting of shareholders, the Company’s shareholders voted in favor of holding future advisory votes every year, and the Company’s Board of Directors subsequently adopted this as its official position. Accordingly, this Proposal 2 is being submitted to you to obtain the advisory vote of the shareholders in accordance with the Dodd-Frank Act, Section 14A of the Securities Exchange Act and the SEC’s rules. After this annual meeting the Company expects that the next shareholder advisory vote on the Company’s executive compensation program will occur at the 2014 annual meeting of shareholders.

Vote Required and Recommendation of the Board of Directors

Because the vote on this Proposal is advisory, the results will not be binding on the Compensation Committee and it will not affect, limit, or augment any existing compensation or awards. The Compensation Committee will, however, take into account the outcome of the vote when considering future compensation arrangements as it deems appropriate.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL, BY ADVISORY VOTE, OF THE COMPENSATION PAID TO THE COMPANY’S EXECUTIVE OFFICERS.

| 10 |

PROPOSAL 3.

RATIFICATION OF ERNST & YOUNG LLP

AS THE COMPANY’S INDEPENDENT

AUDITORS FOR THE YEAR ENDING DECEMBER 31, 2013.

Ernst & Young LLP served as the Company’s independent auditors for the year ended December 31, 2012 and the Audit Committee has appointed Ernst & Young LLP as the Company’s independent auditors for the year ending December 31, 2013. The Board of Directors is asking that stockholders ratify the appointment of Ernst & Young LLP as the Company’s independent auditors. While the Company’s By-Laws do not require stockholder ratification, the Company is asking its stockholders to ratify this appointment because it believes such a proposal is a matter of good corporate practice. If the stockholders do not ratify the appointment of Ernst & Young LLP, the Audit Committee will reconsider whether or not to retain Ernst & Young LLP as the Company’s independent auditors, but may determine to do so nonetheless. Even if the appointment of Ernst & Young LLP is ratified by the stockholders, the Audit Committee may change the appointment at any time during the year if it determines that a change would be in the best interests of the Company and its stockholders.

A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement, if he or she desires to do so, and to be available to respond to appropriate questions from stockholders.

Independent Auditors Fees

The following table shows the aggregate fees billed to the Company by Ernst & Young LLP for services rendered during the years ended December 31, 2011 and 2012:

| Years Ended December 31, | |||||

|

Description of Fees |

2011 | 2012 | |||

| Audit Fees | 1,277,586 | 1,076,179 | |||

| Audit Related Fees | — | 156,272 | |||

| Tax Fees (1) | — | 20,000 | |||

| All Other Fees | 1,995 | — | |||

| Total Fees | 1,279,581 | 1,252,451 | |||

| (1) | In 2012, Ernst & Young LLP provided tax planning services in connection with corporate structure. All other 2012 tax compliance, tax advice, or tax planning services were provided by PriceWaterhouseCoopers LLP and Grant Thornton. In 2011 Ernst & Young LLP did not provide any tax compliance, tax advice or tax planning services, all of which services were provided by PriceWaterhouseCoopers LLP. |

Audit Fees

Audit fees consist of the aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of the Company’s financial statements as of and for the years ended December 31, 2011 and 2012, its audit of our internal control over financial reporting as of December 31, 2011 and 2012, and its reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q and Annual Report on Form 10-K for 2011 and 2012.

Audit Related Fees

Audit-related fees consist of the aggregate fees for professional services rendered by Ernst & Young LLP for transaction due diligence in connection with the Company’s acquisition of InfuScience, Inc. in 2012.

Tax Fees

Tax fees consist of the aggregate fees billed for professional services rendered for tax compliance, tax advice, and tax planning.

All Other Fees

All other fees consist of the aggregate fees for professional services rendered by Ernst & Young LLP for permitted advisory services.

| 11 |

Pre-Approval of Audit and Non-Audit Services

In accordance with the provisions of the Audit Committee charter, the Audit Committee must pre-approve all audit and non-audit services, and the related fees, provided to the Company by its independent auditors, or subsequently approve non-audit services in those circumstances where a subsequent approval is necessary and permissible under the Exchange Act or the rules of the Commission. Accordingly, the Audit Committee pre-approved all services and fees provided by Ernst & Young LLP during the year ended December 31, 2012 and has concluded that the provision of these services is compatible with the accountant’s independence.

During the year ended December 31, 2012, none of the total hours expended on the audit of the Company’s financial statements by Ernst & Young LLP were provided by persons other than full time employees of Ernst & Young LLP.

Vote Required and Recommendation of the Board of Directors

Approval of the ratification of the appointment of Ernst & Young LLP, requires the affirmative “FOR” vote of the holders of a majority of the shares of Common Stock represented in person or by proxy at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

RATIFICATION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT AUDITORS

FOR THE YEAR ENDING DECEMBER 31, 2013.

* * * * *

| 12 |

PROPOSAL 4.

APPROVAL OF BIOSCRIP, INC. EMPLOYEE STOCK PURCHASE PLAN.

The Board of Directors has approved and unanimously recommends that the stockholders approve the Company’s Employee Stock Purchase Place (the “ESPP”), covering the issuance of 750,000 shares of Common Stock. The primary purpose of the ESPP is to provide all employees of the Company and its subsidiaries with the opportunity to acquire a proprietary interest in the Company, thereby increasing their interest in their employer’s welfare, and encouraging them to remain in the employ of their employer.

The following discussion summarizes the material terms of the ESPP. This discussion is not intended to be complete and is qualified in its entirety by reference to the full text of the ESPP, a copy of which is attached to this proxy statement as Exhibit A.

Administration

The ESPP will be administered by the Management Development & Compensation Committee (the “Compensation Committee”), or such other committee appointed by the Board of Directors, which shall consist of at least two or more members of the Company’s Board of Directors. Each director, while serving as a member of the Compensation Committee, must satisfy the requirements for a “non-employee director” under Rule 16b-3 of the Securities Exchange Act of 1934 (the “Exchange Act”) and an “outside director” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent not inconsistent with applicable law, including Section 162(m) of the Code, or the rules and regulations of the principal securities exchange on which the Common Stock is traded or listed, the Compensation Committee may allocate among one or more of its members, or may delegate to one or more of its agents, such duties and responsibilities as it determines.

Each participating subsidiary of the Company that intends to participate in the plan will adopt the ESPP as its own ESPP, effective upon the adoption by (1) official action of its board of directors, or by other similar action, (2) execution of an instrument making such subsidiary a signatory to the ESPP, and (3) by obtaining the consent of the Board of Directors of the Company.

Coverage Eligibility and Offering Period

The ESPP is to be provided to all eligible employees of the Company. An eligible employee will be each employee of the Company or any subsidiary (if the subsidiary has adopted the ESPP) except that the Compensation Committee in its sole discretion may exclude:

(a) any employee who has accrued less than a minimum period of continuous service established by the Compensation Committee (but not to exceed two (2) years).

(b) any employee whose customary employment is twenty (20) hours or less per week;

(c) any employee whose customary employment is for not more than five (5) months in any calendar year;

(d) any employee who would directly or indirectly owns or holds (applying the rules of Section 424(d) of the Code to determine stock ownership) immediately following of a grant an aggregate of five percent (5%) or more of the total combined voting power or value of all outstanding shares of all classes of stock of the Company or any subsidiary; and

(e) any employee who is a highly compensated employee of the Company or subsidiary within the meaning of Section 414(q) of the Code.

Any period of service described in the preceding sentence may be decreased in the discretion of the Compensation Committee.

In addition, to be eligible to participate, a person will be an employee of the Company or subsidiary on the first business day of the offering period. An offering period will be the period determined by the Compensation Committee as the period employees are offered the opportunity to purchase stock under the ESPP, generally the twelve (12) calendar months beginning on January 1 and ending on December 31 of each year (the “Plan Year”), unless and until changed by the Compensation Committee in its sole and absolute discretion.

Participation, Payroll Deduction Authorization, Change and Carry Forward/Withdrawal

An eligible employee may become a participant by filing a written election to participate with the Compensation Committee that authorizes payroll deductions during the offering period (a “Participant Election Form”). An eligible employee may elect to participate for less than the maximum number of shares which he has been offered the opportunity to purchase, by authorizing a payroll deduction of a percentage of compensation less than the percentage determined by the Board of Directors of the Company. Compensation will not include commissions based on sales, bonuses or overtime pay.

| 13 |

An eligible employee may waive the right to participate for any offering period by declining to authorize a payroll deduction. Such declination must be filed in writing with the Compensation Committee. The filing of a written declination will apply for only the applicable offering period and not any future offering period and will be irrevocable. Failure to timely authorize payroll deductions for an offering period will not be treated as if the participant declined to authorize deductions, but instead will be treated as a zero percent (0%) election.

Each eligible employee who elects to participate in the ESPP will authorize the making of payroll deductions to fund the purchase of the stock by completing and returning a Participant Election Form. Deductions will be made pro rata for the applicable payroll periods. A participant may authorize payroll deductions in an amount of either (i) zero percent (0%) or (ii) not less than one percent (1%) nor more than ten percent (10%) (in multiples of one percent (1%)) of the employee’s compensation for the Plan Year. A participant who authorizes a payroll deduction of zero percent (0%) will not be deemed to have waived participation.

Unless a participant’s employment is terminated, a participant may not vary the amount of the participant’s payroll deduction during any offering period. However, a participant may (i) elect to stop the payroll deductions effective with the first payroll occurring thirty (30) days after the Compensation Committee’s receipt of the participant’s written election to stop the payroll deductions, and (ii) with at least thirty (30) days advance written notice to the Compensation Committee, elect to decrease the participant’s payroll deduction rate, within the limits specified above. Such notice to stop or decrease deductions will be effective on the first day of the calendar quarter next following the date of the notice. A participant’s election to stop the payroll deductions will be treated as a waiver of participation for the remainder of the offering period in which the cessation occurs. A participant’s election to decrease the payroll deduction rate to zero percent (0%) will not be deemed to be a waiver of participation.

Any amounts remaining credited to a participant’s payroll deduction account on the last day of the Plan Year, after taking into account the amount of stock purchased by the participant, will be carried forward to the subsequent offering period, or, may be refunded to the participant upon the Compensation Committee’s receipt of waiver of participation by the participant.

Shares Reserved for Issuance Under the ESPP

Subject to adjustment as described below, there shall be 750,000 shares of Common Stock authorized for issuance under the ESPP. Any shares issued under the ESPP may consist, in whole or in part, of authorized and unissued shares of Common Stock, treasury shares of Common Stock or shares of Common Stock purchased in the open market or otherwise.

Stock Grants and Limits

For each offering period during the term of the ESPP, unless the Board determines otherwise, an offering will be made under which all eligible employees are granted the opportunity to purchase stock. All grants will be deemed to have been made on the same date, which date will be the first day of the offering period, on which date the maximum amount of stock that can be purchased under the grant and the minimum purchase price for the stock will be fixed or determinable. Each eligible employee will be granted an opportunity to purchase up to that number of whole shares of stock which could be purchased at the price, with an amount equal to such percentage, not to exceed ten percent (10%), as the Board determines, of an eligible employee’s compensation.

Limitations on Stock. Unless otherwise amended by the Board of Directors of the Company and approved by the stockholders of the Company to the extent required by law, a maximum number of 750,000 shares of Stock of the Company (or such number as may result following any adjustment) shall be reserved and available for grant under the ESPP. The maximum number of shares of stock that may be granted to any participant during an offering period will not exceed a maximum annual accrual of $25,000 provided that:

| (a) | the maximum number of shares of stock that may be purchased during any offering period may be increased or decreased as determined by the Compensation Committee prior to the first day of any such offering period; and |

| (b) | notwithstanding the directly preceding or any other provision in the ESPP to the contrary, if during an offering period more than fifty percent (50%) of the shares of stock which are available for issuance will otherwise be purchased under the ESPP by participants during the offering period, the Compensation Committee may further limit the number of shares of Stock that can be purchased by all participants during such offering period by establishing a lower fixed number of shares of stock that can be purchased during such offering period by all participants but only to the extent necessary to ensure that such fifty percent (50%) limit is not exceeded. |

Either authorized and unissued shares or issued shares heretofore or hereafter reacquired by the employer of the employee may be made subject to purchase under the ESPP, in the sole and absolute discretion of the Compensation Committee. Further, except if the participant purchases more than the maximum number of shares of stock permitted, if for any reason any purchase of stock under the ESPP is not consummated, shares subject to such purchase agreement may be subjected to a new purchase agreement under the ESPP.

| 14 |

Limitations on Grants. No eligible employee will be given the opportunity to purchase stock under the ESPP if, immediately following the grant of the right to purchase stock, such eligible employee owns stock, including the stock he has been granted the opportunity to purchase under the ESPP, possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or any parent or subsidiary thereof, computed in accordance with section 423(b)(3) of the Code.

No eligible employee will be granted the opportunity to purchase stock which permits the employee’s rights to purchase stock under this ESPP and under all other employee stock purchase plans of the employer or any corporation which is the parent or a subsidiary company of the employer to accrue at a rate which exceeds $25,000 (or such other rate as may be prescribed from time to time by the Code) of the fair market value of stock (determined as of the first day of the offering period) for each calendar year in which such eligible employee is participating under the ESPP, in accordance with the provisions of section 423(b)(8) of the Code.

Stock Purchase

Stock Price. A participant may acquire stock under the ESPP at a cost of eighty five percent (85%) of the lower of (i) the fair market value of the stock on the first day of the Plan Year in which the stock is purchased, or (ii) the fair market value of the stock on the last day of the Plan Year in which the stock is purchased. For these purposes, the fair market value of the stock on any given date shall be the closing price of the stock on the relevant date, as reported on the composite tape or by NASDAQ or the most recent preceding day for which such quotations are reported, as the case may be.

Purchase of Stock by Participant While Employed. At any time during the Plan Year, a participant, only if allowed by the Compensation Committee in its sole discretion and subject to such terms and conditions as it may in its sole discretion impose, may elect to purchase that amount of stock that the participant has been given the opportunity to purchase under the ESPP, by delivering written notice of election to purchase such stock and a payroll deduction authorization to the Compensation Committee. If a participant elects to purchase only a part of the stock that the participant has been given the opportunity to purchase, the remainder of that grant shall continue to the end of the Plan Year and may be exercised as provided in the next paragraph. If a participant files a written notice of election not to purchase with the Compensation Committee, the balance credited to the participant’s payroll deduction account will be paid to the participant in cash, and the participant will not be entitled to participate again in the ESPP for the remainder of the Plan Year.

If, on the last day of the Plan Year, a participant has not made an election to purchase, in whole or in part, and has not filed a written notice of election not to purchase with the Compensation Committee, such participant will be deemed to have elected to purchase the amount of stock which the participant can purchase with the money in the participant’s payroll deduction account on such last date.

The balance credited to a participant payroll deduction account, after paying for the participant’s stock, shall be paid to the participant in cash; provided, however, that if such a balance occurs during an offering period, it shall be carried over during the offering period and be credited to the participant’s payroll deduction account as if contributed during that offering period.

Purchase of Stock by Participant After Termination of Employment. If a participant’s employment terminates for any reason other than death, disability, or retirement, the participant’s right to purchase stock under the ESPP will immediately terminate and become void, and the amount credited to such participant’s payroll deduction account will be paid to such participant in cash.

Purchase of Stock by a Retired or Disabled Participant. If a participant’s employment terminates on account of the participant’s disability or retirement, such participant will have the right to complete paying for the stock agreed to purchase by making a cash contribution to the participant’s payroll deduction account during the period beginning on the date such employee’s employment terminates and ending ninety (90) days following such date. In the event that such a contribution is not made, the participant’s right to purchase the stock will immediately terminate and become void, and the amount credited to such participant’s payroll deduction account will be paid to him in cash. A participant will be considered to have retired if its employment terminates by reason of his retirement after attaining age sixty-five (65) and with the consent of the employer.

Purchase of Stock by a Participant’s Representative. In the event a participant’s employment terminates on account of the death of the participant, his heirs, legatees, distributees or personal representatives will have the right to complete paying for the stock agreed to purchase by making a cash contribution to his payroll deduction account during the period beginning on the date of his death and ending ninety (90) days following date of death. In the event that such a contribution is not made, the right to purchase stock will immediately terminate and become void, and the amount credited to such participant’s payroll deduction account will be paid to his heirs, legatees, distributees or personal representatives in cash.

| 15 |

Notwithstanding anything to the contrary in the ESPP, in no event will stock be purchasable under the ESPP after the expiration of 27 months from the date such stock first become purchasable under the terms of the ESPP.

Payment. Upon the election to participate, and agreement to purchase shares, the shares of stock will be paid for in full by the making of payroll deductions and, at the end of the Plan Year, the transfer of the purchase price from the amount credited to the participant to an account of the employer of the employee. Any balance credited to such participant in excess of the purchase price at the end of the Plan Year will be paid to the participant in cash. If for any reason, the balance credited to the participant at the end of the Plan Year is not sufficient to pay for the stock purchased, the participant, his legatees, or distributees may, at such time and in such manner as the Compensation Committee shall prescribe, contribute cash, which will be credited to the participant’s payroll deduction account in order to pay for the full number of shares for which the participant has elected to participate, or the participant, his personal representative heirs, legatees or distributes may purchase that part of the number of full shares which the balance credited to the participant’s payroll deduction account is sufficient to purchase and shall receive the balance credited to such account and not used to purchase stock in cash. Notwithstanding the foregoing, a participant will not be permitted, except in the event of retirement, disability or death, to contribute additional cash to the participant’s payroll deduction account in excess of amounts withheld from the participant’s compensation.

Stock Certificate. The shares of the stock purchased by a participant will be issued or transferred to the participant on the books of the Company as of the last day of the Plan Year in which the purchase was made. Stock certificates will be delivered to the participant as soon as practicable after such time, and the participant will receive and be the transferee of substantially all the rights of ownership of such stock, in accordance with Treasury Regulations Section 1.421-1(f) as currently in effect or any successor to such Treasury Regulations. Such rights of ownership shall include the right to vote, the right to receive declared dividends, the right to share in the assets of the Company in the event of liquidation, the right to inspect the Company’s books, and the right to pledge or sell such stock, subject to the restrictions on such rights in this ESPP and the restrictions on such rights imposed by applicable law. Until delivery of certificates for the stock to the participant, the participant will have none of the rights and privileges of a stockholder in the Company with respect to shares of stock purchased. Notwithstanding anything to the contrary herein, the Company will not be obligated to issue stock under the ESPP if, in the opinion of counsel for the Company, such issuance would constitute a violation of Federal or state securities laws.

Adjustment for Change in Capitalization or Merger

Notwithstanding the foregoing provision, if the shares of stock subject to purchase under the ESPP are increased, decreased, changed into, or exchanged for a different number or kind of shares or securities of the Company through reorganization, merger, recapitalization, reclassification, stock split up or similar event, an appropriate and proportionate adjustment shall be made in the number and kind of shares as to which purchases are or may be made under the ESPP. A corresponding adjustment changing the number or kind of shares allocated to unpurchased stock shall likewise be made. Any such adjustment, however, in the stock shall be made without change in the total price applicable to the portion of the stock purchased under the ESPP which has not been fully paid for, but with a corresponding adjustment, if appropriate, in the price for each share of stock.

Further, if the Company is reorganized, merged or consolidated with another corporation while stock is subject to a purchase agreement under the ESPP, or, solely for purposes of (ii) below, if the Company is dissolved or liquidated, the Company shall either (i) substitute for such shares an appropriate number of shares of each class of stock or other securities of the reorganized or merged or consolidated corporation which were distributed to the shareholders of the Company with respect to such shares, or (ii) permit each participant to immediately complete making payment for the stock such participant agreed to purchase, without regard to the payroll deduction provisions, by making a cash contribution to the participant’s payroll deduction account during the thirty (30) day period next preceding the effective date of any such reorganization, merger or consolidation or of any dissolution or liquidation of the Company.

Transferability and Satisfaction of All Claims

No rights granted under the ESPP, including, but not limited to, payroll deductions credited to a participant and rights with regard to the exercise of an opportunity to purchase stock granted, may be transferred except by will or the laws of descent and distribution and, during the lifetime of the participant to whom granted, may be exercised only by such participant.

Any payment or any issuance or transfer of shares of stock to any participant, or to a participant’s legal representative, heir, legatee or distributee, in accordance with the provisions of the ESPP, will to the extent thereof be in full satisfaction of all claims thereunder against the ESPP. The Compensation Committee may require such participant, legal representative, heir, legatee or distributee, as a condition precedent to such payment, to execute a receipt and release in such form as it will determine.

| 16 |

Amendments to the ESPP

The Company will have the right to amend the ESPP in any manner it deems necessary or advisable to qualify the ESPP under the provisions of section 423 of the Code and to amend the ESPP in any other manner, however, no amendment to the ESPP which either (i) increases the aggregate number of shares of stock which may be sold thereunder or (ii) changes the designation of corporations whose employees are eligible to participate will become effective unless such amendment is approved by the shareholders of the Company within twelve (12) months before or after the date such amendment is adopted by the Board of Directors of the Company. Such shareholder approval will not be required to designate corporations that have become the Company’s parent or subsidiary corporations after the adoption and approval date of the ESPP.