UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

GLASSBRIDGE ENTERPRISES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. |

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

GLASSBRIDGE ENTERPRISES, INC.

510 Madison Avenue, 9th Floor

New York, NY 10022

July 2, 2019

Dear GlassBridge Enterprises, Inc. Stockholders:

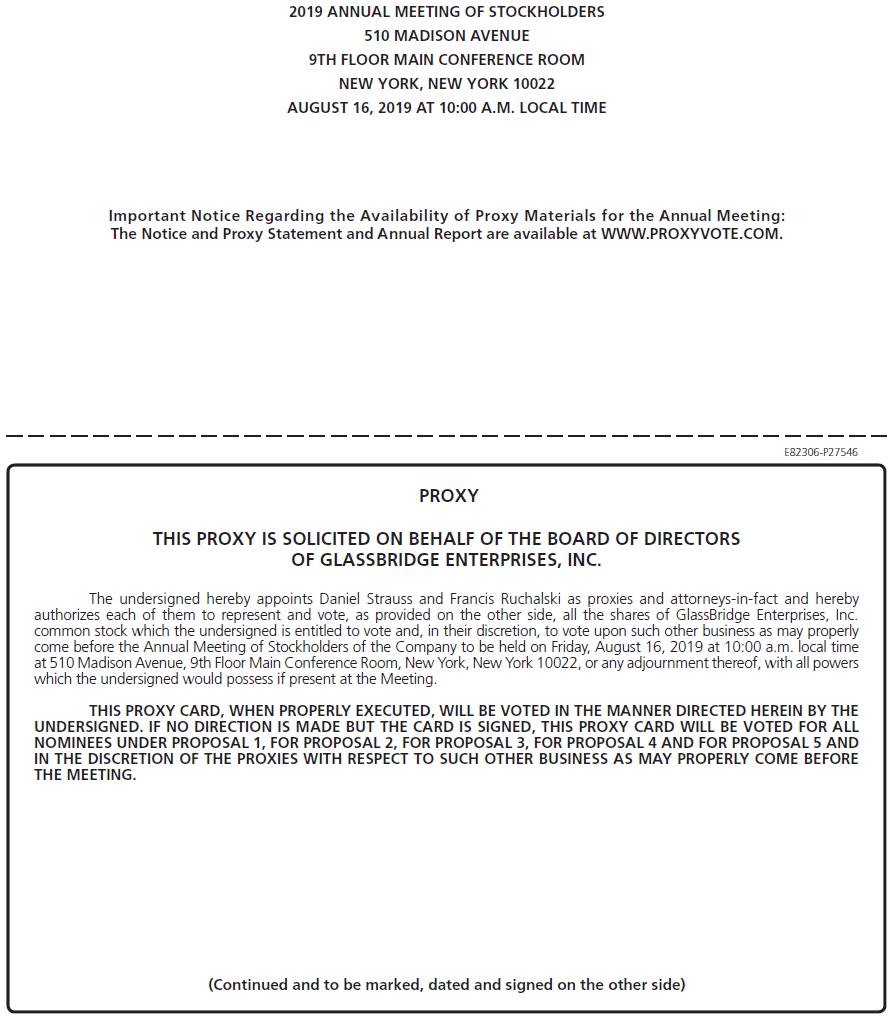

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of GlassBridge Enterprises, Inc. (the “Annual Meeting”). We will hold the Annual Meeting on August 16, 2019, at 10:00 a.m., local time, at 510 Madison Avenue, 9th Floor Main Conference Room, New York, NY 10022. The record date for the Annual Meeting is June 25, 2019. If you held our common stock as of the close of business on that date, you are entitled to vote at the Annual Meeting. During the meeting, we will discuss each item of business described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Whether or not you expect to attend, please vote your shares either by telephone, Internet or mail so your shares will be represented at the Annual Meeting. Instructions on voting your shares are on the Notice of Internet Availability of Proxy Materials or proxy card you received for the Annual Meeting.

| Sincerely, | |

| /s/ Daniel Strauss | |

| Daniel Strauss | |

| Chief Executive Officer and | |

| Chief Operating Officer |

GLASSBRIDGE ENTERPRISES, INC.

510

Madison Avenue, 9th

Floor New York, NY 10022

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on August 16, 2019

To the Stockholders of GlassBridge Enterprises, Inc.:

The 2019 Annual Meeting of Stockholders of GlassBridge Enterprises, Inc. (the “Annual Meeting”) will be held on August 16, 2019, at 10:00 a.m., local time, at 510 Madison Avenue, 9th Floor Main Conference Room, New York, NY 10022. At the Annual Meeting, you will be asked to consider and vote upon the following proposals:

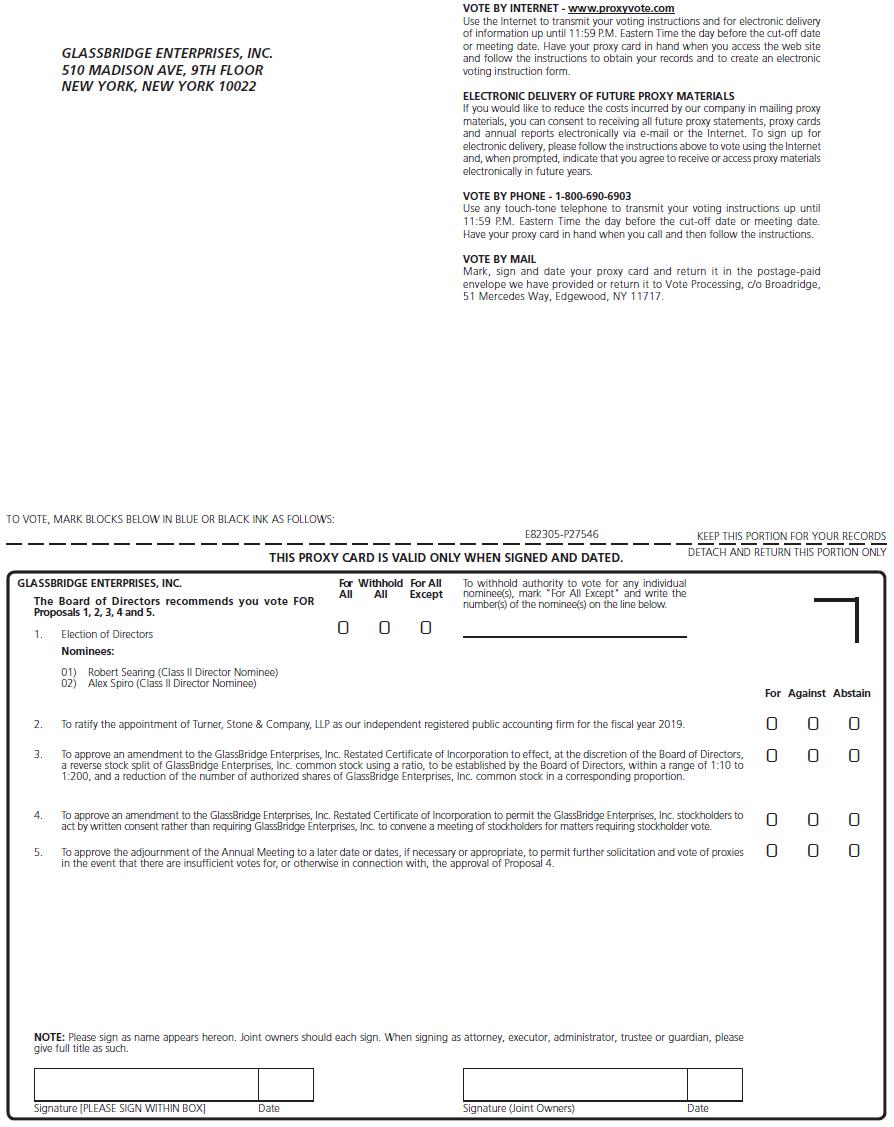

| 1. | To elect Robert Searing and Alex Spiro as Class II directors, with terms expiring at our 2020 Annual Meeting of Stockholders. | |

| 2. | To ratify the appointment of Turner, Stone & Company L.L.P. (“Turner”) as our independent registered public accounting firm for the fiscal year 2019. | |

| 3. | To approve an amendment to the GlassBridge Enterprises, Inc. (“GlassBridge”) Restated Certification of Incorporation to effect, at the discretion of the Board of Directors (the “Board”) and at any time prior to , 2019, (i) a reverse stock split of GlassBridge’s common stock using a ratio, to be established by the Board in its sole discretion, within a range of 1:10 to 1:200 and (ii) a reduction of the number of authorized shares of GlassBridge’s common stock in a corresponding proportion (the “Reverse Stock Split Proposal”). | |

| 4. | To approve an amendment to the GlassBridge Enterprises, Inc. (“GlassBridge”) Restated Certification of Incorporation to permit the GlassBridge stockholders to act by written consent rather than requiring GlassBridge to convene a meeting of stockholders for matters requiring stockholder approval (the “Written Consent Proposal”). | |

| 5. | To approve the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of Proposal 4. | |

| 6. | To transact such other business that may properly come before the Annual Meeting or any postponements or adjournments thereof. |

The record date for the Annual Meeting is June 25, 2019. If you held our common stock as of the close of business on that date, you are entitled to vote at the Annual Meeting.

The accompanying proxy statement contains important information about the Annual Meeting and the proposals. Please read it carefully and vote your shares at the meeting.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” PROPOSALS 1, 2, 3, 4 AND 5.

| By Order of the Board of Directors, | |

| /s/ Daniel Strauss | |

| Daniel Strauss | |

| Chief Executive Officer and Chief Operating Officer |

New York, New York

July 2, 2019

Whether or not you expect to attend, please vote your shares either by telephone, Internet or mail so your shares will be represented at the Annual Meeting. Instructions on voting your shares are on the Notice of Internet Availability of Proxy Materials or proxy card you received for the Annual Meeting.

IF YOU SUBMIT YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED “FOR” PROPOSALS 1, 2, 3, 4 AND 5.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 16, 2019 |

TABLE OF CONTENTS

| i |

GLASSBRIDGE ENTERPRISES, INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 16, 2019

INFORMATION CONCERNING SOLICITATION AND VOTING

We are providing this proxy statement in connection with the solicitation of proxies by the Board of Directors of GlassBridge Enterprises, Inc. (the “Company,” “GlassBridge,” “we,” “our” or “us”) for use at our Annual Meeting of Stockholders on August 16, 2019 and at all postponements or adjournments thereof (the “Annual Meeting”). The record date for the Annual Meeting is June 25, 2019. If you held our common stock as of the close of business on that date, you are entitled to vote at the Annual Meeting. As of June 25, 2019, there were approximately 5,687,789 shares of our common stock, $0.01 par value, outstanding. You have one vote for each share of common stock you hold, and there is no cumulative voting. The shares of common stock we hold in our treasury will not be voted and will not be counted at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote.

We first made this proxy statement available to our stockholders on or about July 2, 2019. Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent to most of our stockholders the Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our 2018 Annual Report online. Stockholders who have received the Notice will not be sent a printed copy of our proxy materials in the mail, unless they request to receive one.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 16, 2019 |

To vote your shares, please follow the instructions on the Notice you received for our Annual Meeting of Stockholders. If you received paper copies of our proxy materials, we have enclosed a proxy card for you to use to vote your shares. In order to register your vote, complete, date and sign the proxy card and return it in the enclosed envelope or vote your proxy by telephone or Internet in accordance with the voting instructions on the proxy card.

You have several choices on each item to be voted upon at the Annual Meeting.

For the election of Robert Searing and Alex Spiro as Class II directors, with terms expiring at our 2020 Annual Meeting of Stockholders, you can:

| ● | vote “FOR” the nominated directors; | |

| ● | vote “AGAINST” the nominated director; or | |

| ● | “ABSTAIN” from voting for the nominated director. |

| 1 |

Directors are elected by the majority of the votes cast with respect to such director at the Annual Meeting. A majority of the votes cast means that the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” that director. In a contested election, a situation in which the number of nominees exceeds the number of directors to be elected (a situation we do not anticipate), the standard for election of directors will be a plurality of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on the election of directors. A plurality means that the nominees receiving the highest number of votes cast will be elected.

For the ratification of the appointment of the independent registered accounting firm, you can:

| ● | vote “FOR” ratification; | |

| ● | vote “AGAINST” ratification; or | |

| ● | “ABSTAIN” from voting on ratification. |

The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote at the Annual Meeting is required for ratification of the appointment of the independent registered public accounting firm.

For the approval of the Reverse Stock Split Proposal you can:

| ● | vote “FOR” the Reverse Stock Split Proposal; | |

| ● | vote “AGAINST” the Reverse Stock Split Proposal; or | |

| ● | “ABSTAIN” from voting on the Reverse Stock Split Proposal. |

Approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote thereon.

For the approval of the Written Consent Proposal you can:

| ● | vote “FOR” the Reverse Stock Split Proposal; | |

| ● | vote “AGAINST” the Reverse Stock Split Proposal; or | |

| ● | “ABSTAIN” from voting on the Reverse Stock Split Proposal. |

Approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote thereon.

For the approval of the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Reverse Stock Split Proposal (the “Adjournment Proposal”), you can:

| ● | vote “FOR” the approval of the Adjournment Proposal; | |

| ● | vote “AGAINST” the approval of the Adjournment Proposal; or | |

| ● | “ABSTAIN” from voting on the approval of the Adjournment Proposal. |

Approval of the Adjournment Proposal requires the vote of the holders of a majority of the votes cast at the Annual Meeting either in person or by proxy. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

If you do not specify on your proxy card (or when giving your proxy on the Internet) how you want to vote your shares, your shares will be voted “FOR” the election of all directors as nominated, “FOR” the ratification of the independent registered accounting firm, “AGAINST” the Reverse Stock Split Proposal, “AGAINST” the Written Consent Proposal and “FOR” the Adjournment Proposal.

| 2 |

If you change your mind after you vote your shares, you can revoke your proxy at any time before it is actually voted at the Annual Meeting by:

| ● | sending written notice of revocation to our Corporate Secretary; | |

| ● | submitting a signed proxy with a later date; | |

| ● | voting by telephone or the internet on a date after your prior telephone or internet vote; or | |

| ● | attending the meeting and withdrawing your proxy. |

You can also be represented by another person present at the meeting by executing a proxy designating that person to act on your behalf.

If you “abstain” on any matter, your shares will be considered present at the meeting for purposes of determining a quorum and for purposes of calculating the vote but will not be considered to have been voted on the matter. Therefore, abstentions will have the same effect as a vote “against”. If you hold shares in “street name” and you do not provide voting instructions to your broker, your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker does not have discretionary authority to vote. In that case, your shares will be considered present at the meeting for purposes of determining a quorum but will not be considered to be represented at the meeting for purposes of calculating the vote on that proposal. Your broker does not have discretionary authority to vote your shares on any of the proposals.

You may also vote in person at the meeting. If you are a stockholder of record with shares registered in your name, simply come to the Annual Meeting and we will provide you a ballot. If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you must obtain a valid proxy from your broker, bank or other agent to vote in person at the meeting. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

If you would like to consent to receive our proxy materials and annual reports electronically in the future, please follow the instructions on your proxy card.

We will pay the costs of preparing, printing and mailing the Notice of Annual Meeting of Stockholders and this proxy statement, including the reimbursement to banks, brokers and other custodians, nominees and fiduciaries for their costs in sending the proxy materials to the beneficial owners. In addition to the use of the mail, proxies may be solicited personally, via the Internet, by telephone or facsimile by our regular employees without additional compensation.

Security Ownership of Certain Beneficial Owners

The table below shows the number of shares of our outstanding common stock as of June 25, 2019 held by each person that we know owns beneficially (as defined by the SEC for proxy statement purposes) more than 5% of any class of our voting stock. The beneficial ownership percentages listed below are based on 5,687,789 shares of common stock outstanding as of June 25, 2019.

| 3 |

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

| George

Hall 510 Madison Avenue, 9th Floor New York, NY 10022 | 1,466,170 | (1) | 25.78 | % | ||||

| Ariel

Investments, LLC 200 East Randolph Street, Suite 2900 Chicago, IL 60601 | 639,070 | (2) | 11.24 | % | ||||

| Wells

Fargo Capital Management Incorporated 420 Montgomery Street San Francisco, CA 94104 | 523,584 | (3) | 9.21 | % | ||||

| (1) | Information reported is based on a Schedule 13D/A filed with the SEC on March 30, 2017 by Clinton Group, Inc., George Hall and Joseph A. De Perio. Mr. Hall reported beneficial ownership of 1,494,894 shares of our common stock. Of such shares, Mr. Hall reported that he had sole voting power and sole dispositive power with respect to 1,296,529 and shared voting power and shared dispositive power with respect to 198,365 shares. A Form 4 was filed with the SEC on May 17, 2017 by George E. Hall and Clinton Group, Inc. reporting beneficial ownership of 1,466,170 shares of our common stock. Information reported is | |

| (2) | Information reported is based on a Schedule 13G/A filed with the SEC on December 31, 2018 by Ariel Investments, LLC (“Ariel”), an investment advisor, reporting beneficial ownership of 639,070 shares of our common stock. Of such shares, Ariel reported that it had sole voting power with respect to 604,040 shares and sole dispositive power with respect to 639,070 shares. | |

| (3) | Information reported is based on a Schedule 13G/A filed with the SEC on January 14, 2019 by Wells Fargo & Company (“Wells Fargo”) on its own behalf and on behalf of its subsidiaries Wells Capital Management Incorporated (investment advisor) (“Wells Capital”), Wells Fargo Funds Management, LLC (investment advisor) (“Wells Fargo Funds”), Wells Fargo Clearing Services, LLC (broker dealer) and Wells Fargo Bank, National Association (bank). Wells Fargo reported beneficial ownership of 522,532 shares of our common stock, over which it has shared voting power with respect to 305,421 shares, shared dispositive power with respect to 305,670 shares and sole voting power and sole dispositive power with respect to 0 shares. Wells Capital beneficially owns 522,532 shares of our common stock, over which it has shared voting power with respect to 0 shares, shared dispositive power with respect to 522,532 shares and sole voting and sole dispositive power with respect to 0 shares. Wells Fargo Funds beneficially owns 305,670 shares of our common stock, over with it has shared voting power and shared dispositive power. |

| 4 |

Security Ownership of Management

The table below shows the number of shares of our common stock beneficially owned as of June 25, 2019 by each director, each nominated director, each officer named in the Summary Compensation Table in this proxy statement and all directors and executive officers as a group. Except as otherwise indicated, the named person has sole voting and investment powers with respect to the shares held by that person, and the shares are not subject to any pledge. The beneficial ownership percentages listed below are based on 5,687,789 shares of common stock outstanding as of June 25, 2019.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

| Daniel Strauss | ||||||||

| (Chief Executive Officer and Chief Operating Officer) | 0 | - | ||||||

| Francis Ruchalski | ||||||||

| (Chief Financial Officer) | 0 | - | ||||||

| Joseph De Perio | ||||||||

| (Chairman and Principal Executive Officer) | 124,693 | 2.43 | % | |||||

| Robert

Searing (Director) | 40,371 | 0.79 | % | |||||

| Alex

Spiro (Director) | 71,480 | 1.39 | % | |||||

| Robert

G. Torricelli (Director) | 66,095 | 1.29 | % | |||||

| All Directors and Officers as a Group (6 Persons) | 302,639 | 5.89 | % | |||||

* Indicates ownership of less than 1%.

Section Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our directors and executive officers to file reports of ownership and changes in ownership of our common stock with the SEC. We are required to identify any of those individuals who did not file such reports on a timely basis. We believe that during 2018 all of our directors and executive officers complied with their Section 16(a) filing requirements.

Related Person Transactions and Related Person Transaction Policy

On August 30, 2018, the Compensation Committee of the Board of Directors approved a one-time bonus award of $230,000 to Danny Zheng, the Company’s former Chief Financial Officer and former interim Chief Executive Officer. The bonus was awarded to Mr. Zheng for his chief executive role in leading the Nexsan Group businesses (“Nexsan”) beginning in November 2017 and executing the divestiture of Nexsan in August 2018 as described in a Current Report on Form 8-K filed with the Securities and Exchange commission on August 21, 2018. The Board and Mr. Zheng agreed that at the onset of his tenure leading Nexsan, he would defer all compensation until Nexsan was sold, and as such, no additional compensation was paid to Mr. Zheng during his tenure with Nexsan. The Company did not pay a customary investment banking fee in connection with the Nexsan sale.

| 5 |

Subsequent Events

On March 29, 2019, the Board appointed Daniel Strauss to serve as the CEO of the Company in addition to his role as COO of the Company, and appointed Francis Ruchalski to serve as CFO of the Company effective April 5, 2019. Mr. Strauss has been the COO of the Company since 2017 and is a Portfolio Manager at Clinton Group, Inc. (“Clinton”) and will continue in such role following his appointment. Mr. Ruchalski is currently the CFO of Clinton and has been employed by Clinton since 1997. Clinton is an investment adviser registered with the SEC, and is a stockholder of the Company. Mr. Strauss and Mr. Ruchalski will serve pursuant to the terms of an Amended and Restated Services Agreement (the “Amended MSA”) which amended and replaced the Services Agreement previously disclosed by the Company on March 6, 2017. The Amended MSA provides that Clinton will make available certain of its employees to provide services to the Company, including CEO services, to be provided by Mr. Strauss, COO services, to be provided by Mr. Strauss, and CFO services, to be provided by Mr. Ruchalski. In addition, pursuant to the Amended RSA, Clinton agreed to make available other employees of Clinton as necessary to manage certain business functions as deemed necessary in the sole discretion of Clinton to provide other management services. In consideration for the services provided under the Amended MSA, the Company shall provide to Clinton a rate of $243,750 for the initial term, such initial term being the first three (3) months following the execution date of the Amended MSA, and shall automatically renew for successive renewal terms of three (3) calendar months, the fee for each renewal term being $243,750. Each of the Company or Clinton may terminate the Amended MSA, for any reason, by transmitting five (5) days’ prior notice to the other party.

On March 29, Mr. Zheng submitted his resignation from his positions with the Company. In connection with the resignation, the Company and Mr. Zheng entered into a separation agreement, whereby Mr. Zheng received a one-time cash severance payment of $57,000, and Mr. Zheng executed a general release on behalf of the Company, and waived any other entitlements or benefits due and payable to Mr. Zheng by the Company, including those described in Mr. Zheng’s employment agreement with the Company dated April 26, 2016.

Related Person Transaction Policy

On February 6, 2007, the Audit and Finance Committee of the Board of Directors adopted a written policy regarding transactions with related persons. On November 4, 2016, the Audit and Finance Committee adopted a new written policy regarding transactions with related persons to replace the prior 2007 version. In accordance with the policy, our Chief Financial Officer and the Audit and Finance Committee are responsible for the review and approval of all transactions with related persons that are required to be disclosed under the rules of the SEC. Under the policy, a “related person” includes any of our directors or executive officers, certain of our stockholders and any of their respective immediate family members. The policy applies to transactions in which GlassBridge is a participant, the amount involved exceeds $120,000 and a related person has a direct or indirect material interest. A related person’s material interest in a transaction is to be determined based on the significance of the information to investors in light of all the circumstances. Under the policy, key management meets quarterly to review the list of related parties and to discuss related party transactions. The Audit and Finance Committee also reviews each new, existing or proposed related party transaction, including the terms of the transaction, the business purpose of the transaction, and the benefits to GlassBridge and to the relevant related party. In determining whether to approve a related party transaction, the Audit and Finance Committee will consider the factors it deems relevant to the related party transaction, including, among other things, whether the terms of the related party transaction are fair to GlassBridge on the same basis as would apply if the transaction did not involve a related party.

| 6 |

Corporate Governance Guidelines

Our Board of Directors is committed to sound and effective corporate governance practices. Our Board of Directors has adopted Corporate Governance Guidelines (“Guidelines”) which describe the Board’s governance principles and procedures. The Guidelines cover director qualifications and retirement policy, director responsibilities, Board committees, director access to officers and employees, director compensation, director orientation and continuing education, Chief Executive Officer evaluation and management succession, and the annual performance evaluation of the Board. You may request a copy of the Guidelines which will be provided at no cost to you by contacting GlassBridge Enterprises, Inc., c/o Corporate Secretary, 510 Madison Avenue, 9th Floor New York, NY 10022.

Code of Ethics

We adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, and all of our other employees. If we make any amendments to our code of ethics other than technical, administrative or other non-substantive amendments, or grant any waiver, including any implicit waiver, from a provision of the code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions requiring disclosure under applicable SEC rules, we intend to disclose the nature of such amendment or waiver on the SEC’s website. The information on the SEC’s website is not incorporated by reference into this proxy statement. You may request a copy of the code of ethics which will be provided at no cost to you by contacting GlassBridge Enterprises, Inc., c/o Corporate Secretary, 510 Madison Avenue, 9th Floor New York, NY 10022.

Annual Meeting Attendance Policy

Directors are expected to attend our Annual Meeting. All four of our then current directors attended our 2018 Annual Meeting of Stockholders.

Communications with the Board

Our Board of Directors has a process in place for interested parties to communicate directly with our directors. If any interested party wants to make concerns known to our Board of Directors, communication can be sent to the Board of Directors, GlassBridge Enterprises, Inc., c/o Corporate Secretary, 510 Madison Avenue, 9th Floor New York, NY 10022. Communications sent to the mailing address will be sent to our Corporate Secretary who will then circulate the communications to the Board members as appropriate.

Director Independence and Determination of Audit Committee Financial Expert

Our Board of Directors concluded its review of the independence of our directors and nominees under the applicable rules of the OTCQX marketplace (“OTCQX”) in 2019. The Board made this review to determine whether any of the relationships or transactions described below, if existing, were inconsistent with a determination that the director or nominee is independent. During this review, our Board reviewed:

| ● | whether there were any transactions or relationships between each director, nominee or any member of his or her immediate family and us and our subsidiaries and affiliates; and | |

| ● | whether there were any relationships between the directors or nominees and senior management and between directors or nominees and our independent registered public accounting firm. |

None of the directors or nominees except Mr. De Perio had any material relationship with us that would interfere with their independence from management. Therefore, the Board affirmatively determined that all of the directors and nominees except Mr. De Perio are independent.

| 7 |

In 2019, the Board also reviewed whether the Audit and Finance Committee had an audit committee financial expert as defined in the SEC rules and the OTCQX rules. The Board reviewed the skills and experience required under the rules and determined that Mr. Searing qualifies as an audit committee financial expert as defined under those rules.

Meetings of the Board and Board Committees

Meetings of the Board

During 2018, the Board of Directors held a total of 4 meetings, and the various standing committees of the Board met a total of 4 times. Each incumbent director attended at least 75% or more of the total meetings of the Board of Directors and the Board committees on which such director served.

Committees of the Board

The standing committees of the Board of Directors are the Audit and Finance Committee, Compensation Committee and Nominating and Governance Committee. Each of the Board committees has adopted a written charter which describes the functions and responsibilities of the committee. You may request a copy of the charters for our Audit and Finance Committee, Compensation Committee and Nominating and Governance Committee, which will be provided at no cost to you by contacting GlassBridge Enterprises, Inc., c/o Corporate Secretary, 510 Madison Avenue, 9th Floor New York, NY 10022. The Board also established ad hoc committees or subcommittees from time to time to review particular issues such as material merger and acquisition activity.

Audit and Finance Committee

| Members: | Two non-employee directors: |

| Messrs. Searing (Chair) and Torricelli. Mr. Putnam served on the Audit and Finance Committee until his resignation from the Board of Directors in March 2018. During his term served, each of the current members of the Audit and Finance Committee has been an independent director as defined under the OTCQX rules and the rules of the SEC. |

Number of meetings in 2018: 4

Functions:

| ● | Reviews our consolidated financial statements, including accounting principles and practices | |

| ● | Appoints or replaces our independent registered public accounting firm and approves the scope of its audit services and fees | |

| ● | Reviews and approves non-audit services performed by and fees of our independent registered public accounting firm | |

| ● | Reviews our compliance procedures and scope of internal controls | |

| ● | Reports to the Board of Directors on the adequacy of financial statement disclosures and adherence to accounting principles | |

| ● | Reviews financial policies which may impact our financial statements | |

| ● | Oversees our internal audit function with the Manager of Internal Audit reporting directly to the Audit and Finance Committee | |

| ● | Monitors compliance with financing agreements | |

| ● | Monitors the functions of our Pension and Retirement Committee | |

| ● | Reviews and approves any related person transactions under our related person transaction policy |

| 8 |

Under our Guidelines, no director may serve on a total of more than three public company audit committees. All of our directors are in compliance with that provision of our Guidelines.

Compensation Committee

| Members: | Two non-employee directors: |

| Messrs. Searing (Chair) and Spiro. Ms. McKibben served on the Compensation Committee until her resignation from the Board of Directors in March 2018. During his term of service, each of the current members of the Compensation Committee has been an independent director as defined under the OTCQX rules. |

Number of meetings in 2018:4

Functions:

| ● | Reviews and approves compensation and benefits programs for our executive officers and key employees | |

| ● | Oversees executive evaluation process and approves compensation for executives other than the Chief Executive Officer | |

| ● | Reviews and recommends Chief Executive Officer compensation to the independent directors | |

| ● | Reviews executive stock ownership guidelines and progress in meeting the guidelines | |

| ● | Oversees implementation of certain stock and compensation plans |

The processes and procedures followed by our Compensation Committee in considering and determining compensation are described below under the heading “Compensation Process.” In addition, the Compensation Committee may form and delegate authority to subcommittees when appropriate.

Nominating and Governance Committee

| Members: | Two non-employee directors: Mr. Spiro (Chair) and Mr. Searing. Mr. Putnam served on the Nominating and Governance Committee until his resignation from the Board of Directors in March 2018. During his term served, each of the current members of the Nominating and Governance Committee has been an independent director as defined under the OTCQX rules. |

Number of meetings in 2018: 4

Functions:

| ● | Advises and makes recommendations to the Board on all matters concerning directors (such as independence evaluations, committee assignments, director compensation and director stock ownership guidelines) and corporate governance matters | |

| ● | Advises and makes recommendations to the Board on the selection of candidates as nominees for election as directors | |

| ● | Reports to the Board on succession planning, including succession in the event of retirement of the Chief Executive Officer | |

| ● | Oversees the evaluation of the Chief Executive Officer |

Our Board has responsibility for risk oversight, focusing on our overall risk management strategy, our degree of tolerance for risk, and the steps management is taking to manage our risks. Management reports on its risk management process on a quarterly basis to the Board of Directors. The Audit and Finance Committee also receives quarterly reports on key financial risks that could affect us.

| 9 |

The Board of Directors oversees our risk management process and our management is responsible for day-to-day risk assessment and mitigation activities. We believe this division of responsibilities provides an effective approach for addressing our risks and that our Board leadership structure (with the separation of the Chairman of the Board from the Chief Executive Officer to strengthen the Board of Directors general oversight role) is aligned with this approach.

The Nominating and Governance Committee will consider qualified candidates for Board membership submitted by stockholders. A candidate for election to the Board needs the ability to apply good business judgment and must be in a position to properly exercise his or her duties of loyalty and care in his or her representation of the interests of stockholders. Candidates should also exhibit proven leadership capabilities, high integrity and experience with a high level of responsibilities within their chosen fields, and have the ability to quickly grasp complex principles of business, finance and international transactions and those regarding our industry. In general, candidates will be preferred who hold an established executive level position and have extensive experience in business, finance, law, education, research or government. The Nominating and Governance Committee also reviews the current composition of the Board to determine the needs of the Board in terms of diversity of candidates including diversity of skills, experience, race, national origin or gender, but the Nominating and Governance Committee does not have a specific policy with regard to the consideration of diversity. The Nominating and Governance Committee will consider all these criteria for nominees identified by the Nominating and Governance Committee, by stockholders or through some other source. The Nominating and Governance Committee also uses external search firms to assist it in locating candidates that meet the criteria for qualified candidates. When current Board members are considered for nomination for re-election, the Nominating and Governance Committee will also take into consideration their prior Board contributions, performance and meeting attendance records.

Stockholders who want to submit a qualified candidate for Board membership can do so by sending the following information to the Nominating and Governance Committee (through our Corporate Secretary at 510 Madison Avenue, 9th Floor New York, NY 10022):

| ● | name of the candidate and a brief biographical sketch and resume; | |

| ● | contact information for the candidate and a document evidencing the candidate’s willingness to serve as a director if elected; and | |

| ● | a signed statement as to the submitting stockholder’s current status as a stockholder and the number of shares currently held. |

The Nominating and Governance Committee will conduct a process of making a preliminary assessment of each proposed nominee based upon his or her resume and biographical information, an indication of the individual’s willingness to serve and other relevant information. This information will be evaluated against the criteria set forth above and our specific needs at that time. Based upon a preliminary assessment of the candidate(s), those who appear best suited to meet our needs may be subject to a background investigation and may be invited to participate in a series of interviews, which are used as a further means of evaluating potential candidates. On the basis of information learned during this process, the Nominating and Governance Committee will determine which nominee(s) to recommend to the Board to submit for election at the next annual meeting. The Nominating and Governance Committee will use the same process for evaluating all nominees, regardless of the original source of the nomination. Any nominations for director to be made at an annual meeting of stockholders must be made in accordance with the requirements described in the section entitled “Stockholder Proposals for 2020 Annual Meeting.”

Non-employee directors receive the following compensation for service on our Board:

| ● | Annual Retainer: $20,000 | |

| ● | Committee Chairperson Fee: |

| 10 |

| ● | $10,000 per year for serving as chair of the Audit and Finance Committee |

| ● | Chairman Fee: $50,000 (in addition to the Annual Retainer received by all Directors, for a total of $70,000) | |

| ● | Equity Grants: Directors receive an initial equity grant of restricted stock on the date a person becomes a director and an additional annual equity grant of restricted stock on the date of the annual meeting of stockholders each year. The annual equity grant is a dollar value of $10,000 in restricted stock, at a price-per-share of $5.00, entitling each director to an aggregate of 2,000 shares of common stock. The Chairman receives an additional $10,000 in restricted stock. The restricted stock vests in one year but may accelerate under certain circumstances such as death, disability, retirement and change of control of GlassBridge, as defined under the 2005 Director Program, as amended. In order to alleviate dilution to stockholders, in August 2017 the Board approved the settlement of 1/3 of the 2018 equity grant in cash, paid quarterly. Directors joining during the year receive a prorated annual equity grant. The initial equity grant for a director or Chairperson who is first elected at a time other than the annual meeting of stockholders is prorated based on the dollar value of the equity grant to directors or the Chairman at the time of the preceding annual meeting of stockholders. | |

| ● | Continuing Education Program Reimbursement: We encourage our directors to attend continuing education programs for directors and reimburse any director who chooses to attend such programs for the cost of attending the program, including travel and lodging, at the maximum rate of one program per year. | |

| ● | Travel Reimbursement: We reimburse directors for travel costs of attending Board meetings, other meetings with management and interviews of Board candidates. |

The Nominating and Governance Committee reviews Board compensation every year.

In lieu of cash, non-employee directors may elect to receive all or part of their Annual Retainer, Chairman fee, Committee Chairperson fee and meeting fees in shares of common stock or in restricted stock units equivalent to shares of common stock.

Director Compensation for Fiscal Year 2018

| Name | Fees Earned or Paid in Cash ($) | Stock Awards($) | All Other Compensation ($)(1) | Total($) | ||||||||||||

| Joseph A. De Perio | 166,667 | 57,926 | 40,000 | 264,592 | (1) | |||||||||||

| Robert Searing | 110,000 | 28,028 | 138,028 | |||||||||||||

| Alex Spiro | 105,000 | 39,239 | 144,239 | |||||||||||||

| Robert Torricelli | 79,245 | 28,028 | 107,273 | |||||||||||||

| (1) | Includes $40,000 in consideration for Mr. De Perio acting as a member of the board of directors of NXSN Acquisition Corporation, a Delaware corporation and former subsidiary of the Company, during 2018. |

| 11 |

The Board has adopted a retirement policy that provides that:

| ● | non-employee directors cannot be nominated for re-election as a director at the next annual meeting of stockholders following either 15 years of service as a director or reaching the age of 70, whichever comes first; | |

| ● | a director who is also our Chief Executive Officer must submit his or her resignation from the Board when he or she ceases to be the Chief Executive Officer; and | |

| ● | any other director who is an employee must retire from the Board (i) at the time of a reduction in his or her duties or responsibilities as an officer unless the Board at its sole discretion determines the officer continues to be qualified to act as a director, (ii) upon termination of his or her active service as an employee or (iii) upon attaining the age of 65, whichever is earliest. |

It is our policy to indemnify directors and officers against any costs, expenses and other liabilities to which they may become subject by reason of their service to us and to insure our directors and officers against such liabilities to the extent permitted by applicable law. Our bylaws provide for indemnification of our directors, officers and employees against those costs, expenses and other liabilities as long as the director, officer or employee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests. We also enter into indemnity agreements with each of our directors pursuant to which we agree to indemnify each director to the full extent provided by applicable law and our bylaws as currently in effect.

| 12 |

ELECTION OF DIRECTORS

Our Board of Directors is currently composed of four directors divided into two classes. The members of each class are generally elected to serve three-year terms with the term of office of each class ending in successive years. Messrs. Searing and Spiro are the two directors serving in Class II with terms expiring at the Annual Meeting. Pursuant to our certificate of incorporation, our directors must be divided into three classes with as nearly equal in number of directors as possible. Therefore Messrs. Searing and Spiro have been nominated by the Board of Directors for re-election as Class II Directors at the Annual Meeting. Each nominee standing for election has indicated a willingness to serve, if elected. However, if the nominee becomes unable to serve before the election, the shares represented by proxy may be voted for a substitute designated by the Board.

Each Class II nominee elected will hold office until the annual meeting of stockholders to be held in 2022, or until his successor has been duly elected and qualified, unless prior to such meeting the director resigns or his or her directorship becomes vacant due to his death or removal.

Information Concerning Directors

All of our directors meet the expectations described in the section entitled “Director Nominations.” In addition, each director has a particular area of expertise that is of value to GlassBridge and has led to the creation of a well-rounded Board of Directors. Included at the end of each director’s biography is a description of the particular experience, qualifications, attributes or skills that led the Board to conclude that each of our directors should serve as a director of GlassBridge.

Board Members Continuing in Off ice — Class II (Term Ending 2022)

| Robert Searing | Robert Searing, age 69, joined our Board on August 26, 2015. Mr. Searing has been the Chief Operating Officer and the Chief Financial Officer of BH Asset Management, LLC, a Registered Investment Advisory firm, since January 2010. From 2003 to 2009, he was the Chief Operating Officer of Schottenfeld Group, LLC, an investment advisory and broker dealer firm. Mr. Searing is also a Certified Public Accountant. |

| Mr. Searing brings to our Board his experience as a financial leader with significant depth and breadth of knowledge in dealing with complex financial and accounting matters as well as broad managerial expertise. | |

| Alex Spiro | Alex Spiro, age 35, joined our Board on August 26, 2015. Mr. Spiro has been a partner at Quinn Emanuel Urquhart & Sullivan LLP since October 2017. Prior to that, Mr. Spiro had been an attorney at Brafman and Associates in New York City since July 2013. In that position,Mr. Spiro has handled an array of complex litigation and investigations. Prior to his joining Brafman and Associates, from September 2008 to July 2013, Mr. Spiro worked as a Manhattan prosecutor. Mr. Spiro formerly was the director of an autism children’s program at McLean Hospital, Harvard’s psychiatric hospital. Mr. Spiro is a graduate of the Harvard Law School where he remains on the adjunct faculty. He has lectured and written on a variety of subjects related to psychology and the law. |

| Mr. Spiro brings to our Board his significant analytical and overall business leadership skills. |

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” THE ELECTION OF ROBERT SEARING AND ALEX SPIRO AS II MEMBERS OF OUR BOARD OF DIRECTORS.

Assuming the presence of a quorum, directors in uncontested elections are elected by the majority of the votes cast with respect to such director at the Annual Meeting. A majority of the votes cast means that the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” that director. In a contested election, a situation in which the number of nominees exceeds the number of directors to be elected (a situation we do not anticipate), the standard for election of directors will be a plurality of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on the election of directors. A plurality means that the nominees receiving the highest number of votes cast will be elected.

If a nominee who is serving as a director is not elected at the Annual Meeting, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under our bylaws, any director who fails to be elected must offer to tender his or her resignation to the Board of Directors. The Nominating and Governance Committee will then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors will act on the Nominating and Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. The director who tenders his or her resignation will not participate in the Board’s decision.

| 13 |

AUDIT AND FINANCE COMMITTEE REPORT

The Audit and Finance Committee of the Board of Directors (the “Committee”) is composed of non-employee directors, each of whom is independent as defined under the OTCQX rules and the rules of the SEC. The Committee operates under a written charter adopted by the Board of Directors which is available on our website. The Committee has taken the following actions with respect to GlassBridge’s audited financial statements for the year ended December 31, 2018:

| ● | The Committee has reviewed and discussed the audited financial statements with GlassBridge’s management. | |

| ● | The Committee has discussed with Turner, GlassBridge’s independent registered public accounting firm, the matters required to be discussed by Auditing Standard No. 61, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board. | |

| ● | The Committee has received the written disclosures and the letter from Turner required by applicable requirements of the Public Company Accounting Oversight Board regarding Turner communications with the Committee concerning independence and has discussed with Turner its independence from GlassBridge. In connection with its review of Turner’s independence, the Committee also considered whether Turner’s provision of non-audit services during the 2017 fiscal year was compatible with the maintenance of its independence and determined that it was. | |

| ● | Based on the review and discussions described above, the Committee has recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, for filing with the SEC. |

| AUDIT AND FINANCE COMMITTEE | |

| Robert Searing, Chairman | |

| Robert G. Torricelli |

The material in this report of the Audit Committee is not “soliciting material,” is furnished to, but not deemed “filed” with, the SEC and is not deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

| 14 |

AUDIT AND OTHER FEES AND AUDIT AND

FINANCE COMMITTEE PRE-APPROVAL POLICY

Below is a listing of the services provided by type and amount charged to us by our independent registered public accounting firms for fiscal years 2018 and 2017. On October 23, 2018, the Audit and Finance Committee engaged Turner as our independent registered public accounting firm for the year ending December 31, 2018. Effective October 22, 2018, Marcum LLP (“Marcum”) was dismissed as our independent registered public accounting firm.

The reports of Marcum on the Company’s consolidated financial statements as of and for the years ended December 31, 2017 and 2016 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principle.

During the Company’s fiscal years ended December 31, 2017 and December 31, 2016 and through June 30, 2018, the interim period, (i) there were no disagreements between the Company and Marcum on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum, would have caused Marcum to make reference to the matter in their reports on the Company’s financial statements for the such years and (ii) there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

The listing below reflects this change in our independent registered public accounting firms in fiscal years 2018 and 2017.

| Fiscal Year | Fiscal Year | |||||||

| 2018 (1) | 2017 | |||||||

Audit Fees: | ||||||||

| GAAP and statutory audits | $ | 363,552 | $ | 302,552 | ||||

| Audit-Related Fees: | ||||||||

| Services related to business transactions | $ | $ | 0 | |||||

| Employee benefit plan audits | $ | $ | 0 | |||||

| Attest services and other | $ | $ | 0 | |||||

| Total Audit-Related Fees | $ | 363,552 | $ | 302,552 | ||||

| Tax Fees (tax preparation, advice and consulting) | $ | 9,806 | $ | 20,188 | ||||

| All Other Fees: | ||||||||

| Other Business Consulting Fees | $ | $ | 12,128 | |||||

| Financial training materials | $ | $ | 0 | |||||

(1) Including audit fee of $335,373 and tax fees of $9,806 to the former auditor - Marcum LLP

Audit and Finance Committee Pre-Approval Policy of Audit and Permissible Non-Audit Services

All the services provided by our independent registered public accounting firm are subject to pre-approval by the Audit and Finance Committee. The Audit and Finance Committee has authorized the Chairman of the Audit and Finance Committee to approve services by our independent registered public accounting firm in the event there is a need for approval prior to the next full Audit and Finance Committee meeting. The Chairman reports any pre-approval decisions to the Audit and Finance Committee at its next scheduled meeting.

With respect to each proposed pre-approved service, our independent registered public accounting firm provides back-up documentation as requested, including estimated fees regarding the specific services to be provided. The Audit and Finance Committee (or Chairman, as applicable) reviews the services and the estimated fees and considers whether approval of the proposed services will have a detrimental impact on our independent registered public accounting firm’s independence prior to approving any service. At least annually, a member of our management reports to the Audit and Finance Committee all audit and non-audit services performed during the previous twelve months and all fees billed by our independent registered public accounting firm for those services.

In fiscal year 2018 and 2017, all audit services, audit-related services, tax services and those items described above under all other fees were pre-approved by the Audit and Finance Committee or the Chairman.

| 15 |

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit and Finance Committee has appointed Turner as our independent registered public accounting firm to audit our consolidated financial statements for 2019. Turner has audited our financial statements since 2018. Representatives of Turner will attend the Annual Meeting in-person or by telephonic conference and will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions.

Stockholder ratification of the appointment of Turner as our independent registered public accounting firm is not required by our bylaws or otherwise. However, the Board of Directors is submitting the appointment of Turner to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment, the Audit and Finance Committee will reconsider whether or not to retain Turner. Even if the appointment is ratified, the Audit and Finance Committee, which is solely responsible for appointing and terminating our independent registered public accounting firm, may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that a change would be in our best interest and in the best interest of our stockholders.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote at the Annual Meeting is required for ratification of the appointment of the independent registered public accounting firm.

| 16 |

COMPENSATION OF NAMED EXECUTIVE OFFICERS

We are a “smaller reporting company” as such term is defined in Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and Item 10 of Regulation S-K. Accordingly, and in accordance with relevant SEC rules and guidance, we have elected, with respect to the disclosures required by Item 402 of Regulation S-K, to comply with the disclosure requirements applicable to smaller reporting companies.

Executive Officers of the Company

Our current executive officers as of June 25, 2019 are as follows:

| ● | Joseph A. De Perio, Chairman and principal executive officer | |

| ● | Daniel A. Strauss, Chief Executive Officer and Chief Operating Officer | |

| ● | Francis Ruchalski, Chief Financial Officer |

Joseph A. De Perio, age 40, is our Chairman and principal executive officer. Mr. De Perio joined our Board on May 20, 2015. On March 22, 2017, the Board appointed Joseph De Perio to serve as its Chairman and as the Company’s principal executive officer, effective on the same day. Previously, Mr. De Perio served as the Board’s Non-Executive Chairman. Mr. De Perio has served as a Senior Portfolio Manager of Clinton since October 2010; he also served in a similar capacity from 2006 until December 2007. From December 2007 until October 2010, Mr. De Perio was a Vice President at Millennium Management, L.L.C., a global investment management firm. Mr. De Perio was a Private Equity Associate at Trimaran Capital Partners, a private investment firm, from 2004 until 2006 and an analyst and associate in the mergers and acquisitions department at CIBC Oppenheimer, a national investment boutique, from 2000 until 2004. Mr. De Perio also served on the board of directors of Viking Systems, Inc., a leading worldwide developer, manufacturer and marketer of 3D and 2D visualization solutions for complex minimally invasive surgery, from June 2011 until its sale to Conmed Corporation in October 2012, and Overland Storage, Inc. (f/k/a Overland Data, Inc.), a provider of data protection appliances, from April 2011 until its sale to Sphere 3D Corporation in December 2014. Mr. De Perio also served on the board of directors of EveryWare Global, Inc., a provider of tabletop and food preparation products for the consumer and foodservice markets, from May 2013 until April 2015 when the company filed for protection under Chapter 11 of the United States Bankruptcy Code pursuant to a pre-packaged plan of reorganization. Mr. De Perio received a B.A. in business economics and organizational behavior management with honors from Brown University. Mr. De Perio brings to our Board his over 15 years’ experience in corporate finance, including over 10 years as an investment analyst and portfolio manager in private equity and public equity, and his experience as a director of public companies.

Daniel A. Strauss, age 34, is our Chief Executive Officer and Chief Operating Officer. Mr. Strauss has been a Portfolio Manager at Clinton since 2010. Mr. Strauss has over ten years of experience in corporate finance as a portfolio manager and investment analyst in private and public equity through which he has developed a deep understanding of corporate finance and strategic planning activities. At Clinton, Mr. Strauss is responsible for evaluating and executing private equity transactions across a range of industries. Post-investment, Mr. Strauss is responsible for the ongoing management and oversight of Clinton’s portfolio investments. From 2008 to 2010, he worked for Angelo, Gordon & Co. as a member of the firm’s private equity and special situations area. Mr. Strauss was previously with Houlihan Lokey, where he focused on mergers and acquisitions from 2006 to 2008. Mr. Strauss has served on the boards of directors of Pacific Mercantile Bancorp (NASDAQ: PMBC) from August 2011 until December 2015 and Community Financial Shares, Inc. (OTC: CFIS) from December 2012 until its sale to Wintrust Financial Corporation in July 2015. Mr. Strauss received a Bachelor of Science in Finance and International Business from the Stern School of Business at New York University.

Francis Ruchalski, age 55, is our Chief Financial officer. Mr. Ruchalski is currently the Chief Financial Officer of Clinton, and has been employed by Clinton since 1997. Prior to joining Clinton, Mr. Ruchalski was an audit manager with Anchin, Block & Anchin, LLP, a certified public accounting firm, from 1986 to 1997. Mr. Ruchalski’s responsibilities while with Anchin, Block & Anchin LLP included client auditing and financial and taxation planning. Mr. Ruchalski holds a bachelor of science in accounting from St. John’s University.

| 17 |

Summary Compensation Table for 2018

The table below shows compensation for the last two fiscal years for our named executive officers for 2017.

| Name

and principal position |

Year | Salary ($) | Bonus ($) | Bonus

Stock Awards (in $) |

Option

Awards ($) |

Stock Awards ($) |

Change in Pension Value and Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation | Total | |||||||||||||||||||||||||||

| Daniel Strauss(2) | 2018 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||||||||||||

| (Chief Executive Officer and Chief Operating Officer) | 2017 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||||||||||||

| Danny Zheng(3) | 2018 | $ | 315,000 | $ | 230,000 | (1) | $ | $ | - | $ | 110,250 | $ | 900 | $ |

|

656,150 | ||||||||||||||||||||

| (Former Interim Chief Executive Officer and Chief Financial Officer) | 2017 | $ | 303,750 | $ | $ | 316,360 | $ | - | $ | 181,625 | $ | 900 | $ | 7,174 | 809,815 | |||||||||||||||||||||

| Francis Ruchalski(4) | 2018 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | - | ||||||||||||||||||||

| (Chief Financial Officer) | 2017 | $ | - | - | $ | - | $ | - | $ | - | $ | - | $ | - | - | |||||||||||||||||||||

| Joseph De Perio(5) | 2018 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | 0 | ||||||||||||||||||||

| (Chairman and Principal Executive Officer) | 2017 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | 0 | ||||||||||||||||||||

| (1) | Represents a one-time cash bonus received in consideration for outstanding services rendered in connection with the Company’s sale of its Nexsan business. | |

| (2) | Mr. Strauss serves as our Chief Executive officer and Chief Operating Officer pursuant to the terms of a services agreement entered into between the Company and Clinton Group. Please see “Related Person Transactions.” | |

| (3) | Mr. Zheng resigned as an executive officer of the company effective March 29, 2019. | |

| (4) | Mr. Ruchalski was named the Company’s Chief Financial Officer effective March 29, 2019. He received no compensation from the Company for the years ended 2018 or 2017. | |

| (5) | Mr. De Perio is the principal executive officer of the Company. He is an employee of Clinton Group. He receives no salary for his role as principal executive officer of the Company. |

As has been previously disclosed, we have undergone a period of significant changes. Beginning with the proxy contest in connection with the 2015 Annual Meeting of Stockholders and continuing until February 2017, we underwent a restructuring plan led by our management, our Board of Directors and its Strategic Alternatives Committee. Since that proxy contest, our evolution has included a re-composition of the Board of Directors and changes in the compensation structures of the Board of Directors and management. These compensation changes included initiatives to suspend temporarily cash bonus compensation for certain executive officers and long-term incentive compensation not tied to performance- based vesting requirements. In early 2017, the Compensation Committee approved a new compensation framework designed to condition the payment of substantial portions of management’s potential compensation on companywide and individual performance metrics. The new framework includes annual and long-term incentive programs for management that are based on individualized performance goals and are designed to incentivize performance aligned with our strategic plan, including the development of our asset management business and cash position, and increasing stockholder value.

| 18 |

Supplemental All Other Compensation Table

Name and principal position | Year | Perks and Other Personal Benefits ($) | Registrant Contributions to 401(k) and Non-Qualified Pension Plans ($) | Severance Payment (in $) | ||||||||||||

| Daniel Strauss | 2018 | $ | 0 | $ | 0 | $ | 0 | |||||||||

| (Chief Executive Officer and Chief Operating Officer) | 2017 | $ | 0 | $ | 0 | $ | 0 | |||||||||

| Danny Zheng | 2018 | $ | 0 | $ | 0 | $ | 0 | |||||||||

| (Former Interim Chief Executive Officer and Chief Financial Officer) | 2017 | $ | 0 | $ | 0 | $ | 0 | |||||||||

| Francis Ruchalski | 2018 | $ | 0 | $ | 0 | $ | 0 | |||||||||

| (Chief Financial Officer) | 2017 | $ | 0 | 0 | $ | 0 | ||||||||||

| Joseph De Perio | 2018 | $ | 0 | $ | 0 | $ | 0 | |||||||||

| (Chairman and Principal Executive Officer) | 2017 | $ | 0 | $ | 0 | $ | 0 | |||||||||

Outstanding Equity Awards at 2018 Fiscal Year-End

The following table summarizes the total outstanding equity awards as of December 31, 2018 for each of the named executive officers in the Summary Compensation Table.

| Option Awards | | | Stock Awards | ||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock Held That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(1) | |||||||

| Danny Zheng | 335 | (2) | — | 57.90 | 05/01/2022 | | | ||||||

| 395 | (2) | — | 96.50 | 05/03/2021 | | | |||||||

| 162 | (2) | — | 106.10 | 05/04/2020 | | | |||||||

| 106 | (2) | — | 101.90 | 05/05/2019 | | | |||||||

| | | | 45,000 | (3) | 41,850 | ||||||||

| David Strauss (no awards) | | | | | | | |||||||

| Francis Ruchalski (no awards) | | | | | | | |||||||

| Joseph De Perio (no awards) | |||||||||||||

| 19 |

Compensation Under Retirement Plans

Name and principal position | Plan Name | Number of Years Credited Service ($) | Present Value of Accumulated Benefit ($) | Payments During Latest Fiscal Year (in $) | |||||||||||

| Daniel Strauss | Pension Plan | $ | - | $ | - | $ | 0 | ||||||||

| (Chief Executive Officer and Chief Operating Officer) | Non-qualified pension plan | $ | - | $ | - | $ | 0 | ||||||||

| Danny Zheng | - | $ | 2 | $ | 28,848 | $ | - | ||||||||

| (Former Interim Chief Executive Officer and Chief Financial Officer) | - | $ | 9 | $ | 1,286 | $ | - | ||||||||

| Francis Ruchalski | - | $ | - | $ | - | $ | - | ||||||||

| (Chief Financial Officer) | - | $ | - | - | $ | - | |||||||||

| Joseph De Perio | - | $ | - | $ | - | $ | - | ||||||||

| (Chairman and Principal Executive Officer) | - | $ | - | $ | - | $ | - | ||||||||

| 20 |

Compensation Under Severance Plans

| Name and principal position | Base Salary ($) | Accrued Unused PTO ($) | Annual Bonus ($) | Total (in $) | ||||||||||||

| Daniel Strauss | 0 | $ | $ | 0 | $ | 0 | ||||||||||

| (Chief Executive Officer and Chief Operating Officer) | ||||||||||||||||

| Danny Zheng | 157,500 | $ | 36,043 | $ | 110,250 | $ | 303,7931 | |||||||||

| (Former Interim Chief Executive Officer and Chief Financial Officer) | ||||||||||||||||

| Francis Ruchalski | 0 | $ | $ | 0 | $ | 0 | ||||||||||

| (Chief Financial Officer) | ||||||||||||||||

| Joseph De Perio | 0 | $ | $ | 0 | $ | 0 | ||||||||||

| (Chairman and Principal Executive Officer) | ||||||||||||||||

Our Cash Balance Pension Plan, a tax-qualified defined benefit pension plan under the Code (the “Pension Plan”), was “frozen” as to new participants effective December 31, 2009; this means no employees hired or rehired after December 31, 2009 are eligible to participate in the Pension Plan. In addition, the Pension Plan was later amended to “freeze” the benefits of participants in the Pension Plan effective December 31, 2010. This means no participants in the Pension Plan will receive credit for new benefit accruals (referred to as “pay credits” under the Pension Plan) after December 31, 2010; their accrued benefits as December 31, 2010 will continue to receive annual interest credits (equal to the average yield on 30-year U.S. Treasury Bonds for November of the previous year) until they receive a distribution. For the 2017 Pension Plan year, the interest-crediting rate was 3.03%. Effective December 31, 2010, we also “froze” the additional benefits that had been provided each year under our Pension Plan to certain eligible former 3M Company employees who had accrued additional benefits in our Pension Plan since our spin-off in 1996.

Beginning in September 2018, the Company entered into discussions with the U.S. Pension Benefit Guaranty Corporation (the “PBGC”), a United States government agency established by Title IV of the Employee Retirement Income Security Act of 1974 (“ERISA”) which insures certain pension plans., for the purpose of obtaining certain relief from the Company’s obligations under the Pension Plan. On April 16, 2019, the Company received notice from the PBGC, that the Company’s application for termination of the Pension Plan had been approved by the PBGC, with the termination date of the Pension Plan to occur on April 30, 2019, the PBGC finding that (i) the Pension Plan did not meet the minimum funding standard required under section 412 of the Internal Revenue Code; (ii) the Pension Plan would be unable to pay benefits when due and (iii) the Pension Plan should be terminated in order to protect the interests of the Pension Plan participants (the “Notice of Determination”). Pursuant to the Notice of Determination, any settlement reached by the Company with the PBGC may be accomplished by an agreement between the Company and the PBGC. Together with the Notice of Determination, the PBGC furnished to the Company an Agreement for Appointment of Trustee and Termination of Plan (the “Appointment Agreement Agreement”). The Pension Plan was terminated effective April 30, 2019 and the PBGC was appointed trustee of the Plan (the “PBGC Arrangement”).

| 21 |

THE REVERSE STOCK SPLIT PROPOSAL

Our Board has unanimously approved and is submitting for stockholder approval an amendment to our Restated Certificate of Incorporation (the “Reverse Split Amendment”) to effect, at the discretion of the Board and at any time prior to December 15, 2019, (i) a reverse stock split of GlassBridge’s common stock using a ratio, to be established by the Board in its sole discretion, within a range of 1:10 to 1:200 and (ii) a reduction of the number of authorized shares of GlassBridge’s common stock in a corresponding proportion.

Background of the Reverse Stock Split

Pursuant to the DGCL, any amendment of our Restated Certificate of Incorporation must be approved by our Board and submitted to our stockholders for approval.

Our Board reserves the right to abandon the Reverse Stock Split, and corresponding proportionate reduction of authorized shares of common stock, even if approved by stockholders. By voting in favor of the Reverse Stock Split Proposal, you are also expressly authorizing our Board to determine not to proceed with, and to abandon, the Reverse Stock Split in its sole discretion.

The form of the proposed Reverse Split Amendment is attached to this Proxy Statement as Annex A. The Reverse Stock Split Amendment will effect a Reverse Stock Split of our common stock using a ratio, to be established by our Board in its sole discretion, within a range of 1:10 to 1:200 following stockholder approval. We believe that the availability of the range of reverse split ratios will provide the Company with the flexibility to implement the Reverse Stock Split in a manner designed to maximize the anticipated benefits for us and our stockholders. In determining which reverse stock split ratio to implement, if any, following the receipt of stockholder approval, our Board may consider, among other things:

| ● | our ability to comply with stock exchange listing requirements; | |

| ● | the historical trading price and trading volume of our common stock; | |

| ● | the then prevailing trading price and trading volume of our common stock and the anticipated impact of the Reverse Stock Split on the trading market for our common stock; | |

| ● | which reverse split ratio would result in the greatest overall reduction in our administrative costs; and | |

| ● | prevailing general market and economic conditions. |

The Reverse Stock Split will affect all holders of GlassBridge’s common stock uniformly and will not affect any stockholder’s percentage ownership interest in GlassBridge, except to the extent that the Reverse Stock Split would result in any holder of GlassBridge’s common stock receiving fractional shares. GlassBridge will not issue any fractional shares. Stockholders who would otherwise hold fractional shares as a result of the Reverse Stock Split will receive a cash payment in lieu of the issuance of any such fractional share in an amount per share equal to the closing price per share on the OTCQB on the trading day immediately preceding the effective date of the Reverse Stock Split (as adjusted to give effect to the Reverse Stock Split), without interest. The Reverse Stock Split will not impact the market value of GlassBridge as a whole, although the market value of GlassBridge’s common stock may move up or down once the Reverse Stock Split is effective.

The actual number of shares outstanding after giving effect to the Reverse Stock Split will depend on the reverse split ratio that is ultimately established by our Board. The table below illustrates certain, but not all, possible reverse stock split ratios, together with (i) the implied number of authorized shares of common stock resulting from a reduction of the number of authorized shares of common stock by a corresponding proportion, based on 10,000,000 shares of common stock currently authorized under our Restated Certificate of Incorporation, (ii) the implied number of issued and outstanding shares of our common stock resulting from the Reverse Stock Split in accordance with such ratio, based on 5,687,789 shares of our common stock outstanding as of June 25, 2019 and (iii) the implied approximate number of holders of common stock following the Reverse Stock Split.

| 22 |

| Sample Ratios within Delegated Range of Ratios | Implied Number of Authorized Shares of Common Stock Following the Reverse Stock Split | Implied Approximate Number of Issued and Outstanding Shares of Common Stock Following the Reverse Stock Split* | Implied Approximate Number of Holders of Common Stock Following the Reverse Stock Split** | |||||||||

| 1:10 | 1,000,000 | 568,778 | 2,362 | |||||||||

| 1:25 | 500,000 | 227,511 | 1,183 | |||||||||

| 1:50 | 200,000 | 113,755 | 692 | |||||||||

| 1:100 | 100,000 | 56,877 | 461 | |||||||||

| 1:200 | 50,000 | 28,438 | 342 | |||||||||

| * | Excludes the effect of cashout payments in lieu of the creation of fractional shares. |

| ** | Excludes the holders of any fractional shares following the Reverse Stock Split. |

We do not expect the Reverse Stock Split itself to have any economic effect on our stockholders, debt holders or holders of options or restricted stock, except to the extent the Reverse Stock Split will result in cashout payments in lieu of the creation of fractional shares.

Reasons for the Reverse Stock Split Proposal

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. Other factors, however, such as our financial results, market conditions, the market perception of our business and other risks, including those set forth in our Annual Report on Form 10-K for the year ended December 31, 2018, may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split or that the market price of our common stock will not decrease at any time after the Reverse Stock Split is effected.

On June 25, 2019, the Company’s common stock had a closing price equal to $0.31 per share. The Company’s Board of Directors authorized the Reverse Stock Split with the goal of, among other things, increasing the price of the Company’s common stock. Further, the broad range of the Reverse Stock Split was chosen to allow the Company’s Board of Directors the greatest flexibility possible to effect the Reverse Stock Split at a ratio which best fit the needs of the Company. Factors which would influence the Board of Directors’ determination of the Reverse Stock Split ratio include: (i) meeting the continued listing requirements of the OTCQB, and any initial listing requirements of a stock exchange; (ii) appeal to a broader range of investors, including both retail and institutional investors and (iii) improve the perception of the Company’s common stock as an investment security.