UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material under §240.14a-12

|

GLASSBRIDGE ENTERPRISES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required.

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

|

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

GLASSBRIDGE ENTERPRISES, INC.

411 East 57th Street, Suite 1-A

New York NY 10022

November 10, 2020

Dear GlassBridge Enterprises, Inc. Stockholders:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of GlassBridge Enterprises, Inc. (the “Annual Meeting”). We will hold the Annual Meeting on December 22, 2020, at 10:00

a.m., New York City time. You may attend the meeting online, only, by logging in at www.virtualshareholdermeeting.com/GLAE2020; there will be no physical attendance. The record date for the Annual Meeting is October 30, 2020. If you held our

common stock as of the close of business on that date, you are entitled to vote at the Annual Meeting. During the meeting, we will discuss each item of business described in the accompanying Notice of Annual Meeting of Stockholders and Proxy

Statement.

Whether or not you expect to attend, please vote your shares either by telephone, Internet or mail so your shares will be represented at the Annual Meeting. Instructions on voting your shares are

on the Notice of Internet Availability of Proxy Materials or proxy card you received for the Annual Meeting.

|

Sincerely,

|

|

|

/s/ Daniel Strauss

|

|

|

Daniel Strauss

|

|

|

Chief Executive Officer

|

GLASSBRIDGE ENTERPRISES, INC.

411 East 57th Street, Suite 1-A New York, NY 10022

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 22, 2020

To the Stockholders of GlassBridge Enterprises, Inc.:

The 2020 Annual Meeting of Stockholders of GlassBridge Enterprises, Inc. (the “Annual Meeting”) will be held on December 22, 2020, at 10:00 a.m., New York City time. You may attend the meeting

online, only, by logging in at www.virtualshareholdermeeting.com/GLAE2020; there will be no physical attendance. At the Annual Meeting, you will be asked to consider and vote upon the following proposals:

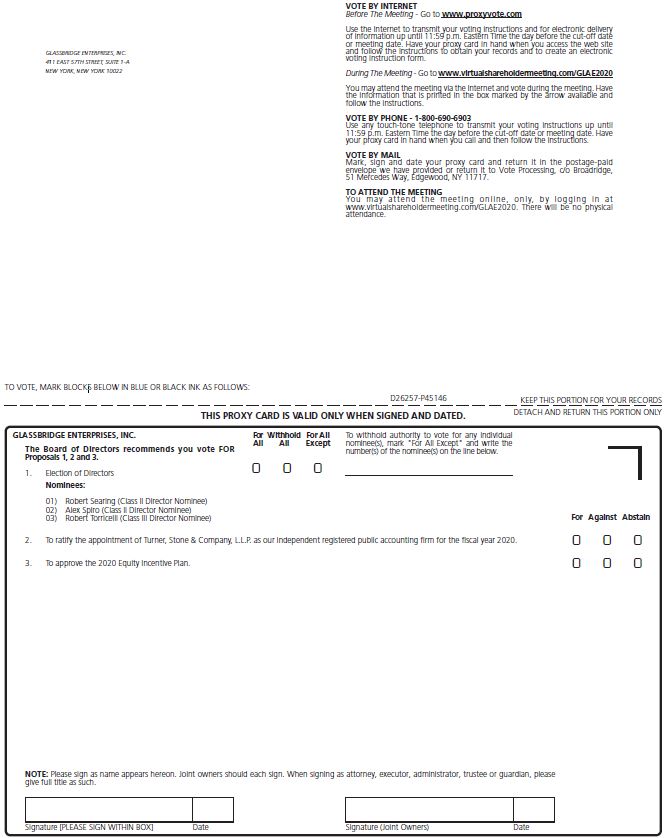

| 1. |

To elect Robert Searing and Alex Spiro, as Class II directors, with terms expiring at our 2022 Annual Meeting of Stockholders and Robert Torricelli, as a Class III director, with a term expiring at our 2023 Annual Meeting of

Stockholders.

|

| 2. |

To ratify the appointment of Turner, Stone & Company, L.L.P. (“Turner”) as our independent registered public accounting firm for 2020.

|

| 3. |

To approve the GlassBridge Enterprises, Inc. 2020 Equity Incentive Plan.

|

| 4. |

To transact such other business that may properly come before the Annual Meeting or any postponements or adjournments thereof.

|

The record date for the Annual Meeting is October 30, 2020. If you held our common stock as of the close of business on that date, you are entitled to vote at the Annual Meeting.

The accompanying proxy statement contains important information about the Annual Meeting and the proposals. Please read it carefully and vote your shares at the meeting.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” PROPOSALS 1, 2, AND 3.

|

By Order of the Board of Directors,

|

|

|

/s/ Daniel Strauss

|

|

|

Daniel Strauss

|

|

|

Chief Executive Officer

|

New York, New York

November 10, 2020

Whether or not you expect to attend, please vote your shares either by telephone, Internet or mail so your shares will be represented at the Annual Meeting. Instructions on voting your shares are

on the Notice of Internet Availability of Proxy Materials or proxy card you received for the Annual Meeting.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 22, 2020

This notice of meeting and the accompanying proxy statement are available at www.proxyvote.com

|

IF YOU SUBMIT YOUR SIGNED, DATED PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED “FOR” PROPOSALS 1, 2, AND 3.

|

Page

|

|

|

1

|

|

|

1

|

|

|

2

|

|

|

3

|

|

|

5

|

|

|

5

|

|

|

7

|

|

|

7

|

|

|

8

|

|

|

10

|

|

|

10

|

|

|

11

|

|

|

11

|

|

|

11

|

|

|

12

|

|

|

13

|

|

|

13

|

|

|

13

|

|

| 15 | |

| 16 | |

| 16 | |

| 16 | |

| 17 | |

| 18 | |

| 18 | |

|

22

|

|

| 22 | |

|

22

|

|

| 22 |

GLASSBRIDGE ENTERPRISES, INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 22, 2020

We are providing this proxy statement in connection with the solicitation of proxies by the Board of Directors of GlassBridge Enterprises, Inc. (the “Company,” “GlassBridge,” “we,” “our” or “us”)

for use at our Annual Meeting of Stockholders on December 22, 2020 and at all postponements or adjournments thereof (the “Annual Meeting”). The record date for the Annual Meeting is October 30, 2020. If you held our common stock as of the close

of business on that date, you are entitled to vote at the Annual Meeting. As of October 30, 2020, there were approximately 25,170 shares of our common stock, $0.01 par value, outstanding. You have one vote for each share of common stock you hold,

and there is no cumulative voting. The shares of common stock we hold in our treasury will not be voted and will not be counted at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote.

We first made this proxy statement available to our stockholders on or about November 10, 2020. Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have

elected to provide access to our proxy materials over the Internet. Accordingly, we have sent to most of our stockholders the Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy

statement and our 2019 Annual Report online. Stockholders who have received the Notice will not be sent a printed copy of our proxy materials in the mail, unless they request to receive one.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 22, 2020

This proxy statement and our 2019 Annual Report are available at www.proxyvote.com

|

To vote your shares, please follow the instructions on the Notice you received for our Annual Meeting of Stockholders. If you received paper copies of our proxy materials, we have enclosed a

proxy card for you to use to vote your shares. Please complete, date and sign the proxy card, and return it in the enclosed envelope, or vote your proxy by telephone or Internet in accordance with the voting instructions on the proxy card.

You have several choices on each item to be voted upon at the Annual Meeting.

For the election of Robert Searing and Alex Spiro, as Class II directors, with terms expiring at our 2022 Annual Meeting of Stockholders, or for Robert Torricelli, as a Class III director, with a

term expiring at our, 2023 Annual Meeting of Stockholders you may:

| ● |

vote “FOR” all or any of the nominated directors;

|

| ● |

vote “AGAINST” all or any of the nominated directors; or

|

| ● |

“ABSTAIN” from voting for all or any of the nominated directors.

|

Directors are elected by the majority of the votes cast with respect to such director at the Annual Meeting. A majority of the votes cast means that the number of shares voted “FOR” a director

must exceed the number of votes cast “AGAINST” that director. In a contested election, a situation in which the number of nominees exceeds the number of directors to be elected (a situation we do not anticipate), the standard for election of

directors will be a plurality of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on the election of directors. A plurality means that the nominees receiving the highest number of votes cast will be elected.

For the ratification of the appointment of the independent registered accounting firm, you may:

| ● |

vote “FOR” ratification;

|

| ● |

vote “AGAINST” ratification; or

|

| ● |

“ABSTAIN” from voting on ratification.

|

The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote at the Annual Meeting is required for ratification of the

appointment of the independent registered public accounting firm.

For approval of the 2020 Equity Incentive Plan (“Plan”), you may:

| ● |

vote “FOR” approval of the Plan;

|

| ● |

vote “AGAINST” approval of the Plan; or

|

| ● |

“ABSTAIN” from voting on approval of the Plan.

|

The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote at the Annual Meeting is required for approval of the Plan.

If you do not specify on your proxy card (or when giving your proxy on the Internet) how you want to vote your shares, your shares will be voted “FOR” the election of all directors as nominated,

“FOR” the ratification of the independent registered accounting firm, “and “FOR” the approval of the Plan.

If you change your mind after you vote your shares, you can revoke your proxy at any time before it is actually voted at the Annual Meeting by:

| ● |

sending written notice of revocation to our Corporate Secretary;

|

| ● |

submitting a signed proxy with a later date; or

|

| ● |

voting by telephone or the Internet on a date after your prior telephone or Internet vote.

|

If you “abstain” on any matter, your shares will be considered present at the meeting for purposes of determining a quorum and for purposes of calculating the vote but will not be considered to

have been voted on the matter. Therefore, abstentions will have the same effect as a vote “against.” If you hold shares in “street name,” and you do not provide voting instructions to your broker, your shares will be considered to be “broker

non-votes” and will not be voted on any proposal on which your broker does not have discretionary authority to vote. In that case, your shares will be considered present at the meeting for purposes of determining a quorum but will not be

considered to be represented at the meeting for purposes of calculating the vote on that proposal. Your broker has discretionary authority to vote your shares only on the proposal to ratify the appointment of the independent registered accounting

firm.

If you would like to consent to receive our proxy materials and annual reports electronically, in the future, please follow the instructions on your proxy card.

We will pay the costs of preparing, printing and mailing the Notice of Annual Meeting of Stockholders and this proxy statement, including the reimbursement to banks, brokers and other custodians,

nominees and fiduciaries for their costs in sending the proxy materials to the beneficial owners. In addition to the use of the mail, proxies may be solicited personally, via the Internet, or by telephone or facsimile, by our regular employees

without additional compensation.

BENEFICIAL OWNERS AND MANAGEMENT

The table below shows the number of shares of our outstanding common stock, as of October 30, 2020, held by each person that we know owns beneficially (as defined by the SEC for proxy statement

purposes) more than 5% of any class of our voting stock. The beneficial ownership percentages listed below are based on 25,170 shares of common stock outstanding as of October 30, 2020.

|

Name of Beneficial Owner

|

Amount and

Nature of

Beneficial

Ownership

|

Percent

of

Class

|

||||||

|

George Hall

80 West River Road

Rumson NJ 07760

|

7,328

|

29.1

|

||||||

|

Ariel Investments, LLC(1)

200 East Randolph Street, Suite 2900

Chicago IL 60601

|

2,351

|

9.3

|

||||||

|

Wells Fargo & Company(2)

420 Montgomery Street

San Francisco CA 94163

|

2,610

|

10.4

|

||||||

(1) Information relating to this beneficial owner is based on Amendment 10 to Schedule 13G, filed July 10, 2020.

(2) Information relating to this beneficial owner is based on Amendment 1 to Schedule 13G, filed February 4, 2020, on behalf of its subsidiaries, Wells Fargo Funds Management, LLC, Wells Capital Management

Incorporated, and Wells Fargo Clearing Services, LLC. The beneficial owner has sole voting power and investment power as to one share, shared voting power as to 696 shares, and shared investment power as to 2,609 shares.

The table below shows the number of shares of our common stock beneficially owned, as of October 30, 2020, by each director, each nominated director, each current executive officer named in the

Summary Compensation Table in this proxy statement, and all directors and executive officers as a group. Except as otherwise indicated, the named person has sole voting and investment power with respect to the shares held by that person, and the

shares are not subject to any pledge. The beneficial ownership percentages listed below are based on 25,170 shares of common stock outstanding as of October 30, 2020.

|

Name of Beneficial Owner

|

Amount and

Nature of

Beneficial

Ownership

|

Percent of Class

|

|||||

|

Daniel Strauss

(Chief Executive Officer)

|

620(1)

|

2.4

|

|||||

|

Francis Ruchalski

(Chief Financial Officer)

|

0

|

-

|

|||||

|

Joseph De Perio

(Chairman and Principal Executive Officer)

|

693(2)

|

2.8

|

|||||

|

Robert Searing

(Director)

|

262(3)

|

1

|

|||||

|

Alex Spiro

(Director)

|

418(3)

|

1.7

|

|||||

|

Robert G. Torricelli

(Director)

|

391(3)

|

1.6

|

|||||

|

All Directors and Executive Officers as a Group (6 Persons)

|

2,384(4)

|

9.2

|

|||||

| (1) |

Includes 620 shares issuable pursuant to a currently exercisable option.

|

| (2) |

Includes 70 shares issuable pursuant to a currently exercisable option.

|

| (3) |

Includes 61 shares issuable pursuant to a currently exercisable option.

|

| (4) |

Includes 873 shares issuable pursuant to currently exercisable options.

|

Our Board of Directors is currently composed of four directors divided into three classes. The members of each class are elected to serve three-year terms, with the term of office of each class

ending in successive years. The Board has nominated Messrs. Robert Searing and Alex Spiro for election as Class II directors, with terms expiring at the 2023 annual meeting of stockholders, and Mr. Robert G. Torricelli for election as a Class III

director, with a term expiring at the 2022 annual meeting. If a nominee becomes unable to serve before the election, the shares represented by proxy may be voted for a substitute designated by the Board.

All of our directors meet the expectations described in the section entitled, Nominating and Governance Committee. In addition, each director has a

particular area of expertise that is of value to GlassBridge. Included at the end of each director’s biography is a description of the particular experience, qualifications, attributes or skills that led the Board to conclude that each of our

directors should serve as a director of GlassBridge.

Class III Board Member — (Term Ending 2023)

|

Robert G. Torricelli

|

Robert G. Torricelli, age 69. joined our Board on February 27, 2017. Mr. Torricelli served in the U.S. House of Representatives from the Ninth District of New Jersey from 1982 until his

election to the U.S. Senate in 1996, where he served until 2003. During his tenure in the Senate, Mr. Torricelli was a member of the Senate Finance, Governmental Affairs, Foreign Relations, Judiciary and Rules Committees and also served

as Chair of the Democratic Senatorial Campaign Committee. Upon retiring from the Senate, Mr. Torricelli established a national and international business strategy firm, Rosemont Associates LLC, and created a real estate development

business, Woodrose Properties LLC. Mr. Torricelli brings to our board extensive leadership and strategic business experience.

|

Class II Board Members — (Term Ending 2022)

|

Robert Searing

|

Robert Searing, age71, joined our Board on August 26, 2015. Mr. Searing has been the Chief Operating Officer and the Chief Financial Officer of BH Asset Management, LLC, a Registered Investment Advisory firm, since January 2010. From

2003 to 2009, he was the Chief Operating Officer of Schottenfeld Group, LLC, an investment advisory and broker dealer firm. Mr. Searing is also a Certified Public Accountant.

Mr. Searing brings to our Board his experience as a financial leader with significant depth and breadth of knowledge in dealing with complex financial and accounting matters as well as broad managerial

expertise.

|

|

Alex Spiro

|

Alex Spiro, age 38, joined our Board on August 26, 2015. Mr. Spiro has been a partner at Quinn Emanuel Urquhart & Sullivan LLP since October 2017. Prior to that, Mr. Spiro had been

an attorney at Brafman and Associates in New York City since July 2013. In that position, Mr. Spiro has handled an array of complex litigation and investigations. Prior to his joining Brafman and Associates, from September 2008 to July

2013, Mr. Spiro worked as a Manhattan prosecutor. Mr. Spiro formerly was the director of an autism children’s program at McLean Hospital, Harvard’s psychiatric hospital. Mr. Spiro is a graduate of the Harvard Law School where he remains

on the adjunct faculty. Mr. Spiro serves on the board of ARRIVE, the venture capital arm of Roc Nation. He has lectured and written on a variety of subjects related to psychology and the law. Mr. Spiro brings to our Board his significant

analytical and overall business leadership skills.

|

Class I Board Member, Continuing in Office— (Term Ending 2021)

|

Joseph A. De Perio

|

Joseph A. De Perio, age 42, is our Chairman and principal executive officer. Mr. De Perio joined our Board on May 20, 2015. On March 22, 2017, the Board appointed Joseph De Perio to serve as its Chairman and as

the Company’s principal executive officer, effective on the same day. Previously, Mr. De Perio served as the Board’s Non-Executive Chairman. Mr. De Perio is the Co-Founder of Sport-BLX, Inc. since January 2019. Earlier, Mr. De Perio

served as a Senior Portfolio Manager of Clinton since October 2010. Mr. De Perio also served on the Board of directors of Viking Systems, Inc., a leading worldwide developer, manufacturer, and marketer of 3D and 2D visualization solutions

for complex minimally invasive surgery, from June 2011 until its sale to Conmed Corporation in October 2012, and Overland Storage, Inc. (f/k/a Overland Data, Inc.), a provider of data protection appliances, from April 2011 until its sale

to Sphere 3D Corporation in December 2014. Mr. De Perio received a B.A. in business economics and organizational behavior management with honors from Brown.

niversity.

|

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” THE ELECTION OF ROBERT SEARING AND ALEX SPIRO, AS CLASS II MEMBERS, AND ROBERT G. TORRICELLI, AS A CLASS I MEMBER, OF OUR BOARD

OF DIRECTORS.

Assuming the presence of a quorum, directors in uncontested elections are elected by the majority of the votes cast with respect to such director at the Annual Meeting. A majority of the votes

cast means that the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” that director. In a contested election, a situation in which the number of nominees exceeds the number of directors to be elected (a

situation we do not anticipate), the standard for election of directors will be a plurality of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on the election of directors. A plurality means that the

nominees receiving the highest number of votes cast will be elected.

If a nominee who is serving as a director is not elected at the Annual Meeting, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under our

bylaws, any director who fails to be elected must offer to tender his or her resignation to the Board of Directors. The Nominating and Governance Committee will then make a recommendation to the Board whether to accept or reject the resignation

or whether other action should be taken. The Board of Directors will act on the Nominating and Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results

are certified. The director who tenders his or her resignation will not participate in the Board’s decision.

Corporate Governance Guidelines

Our Board of Directors is committed to sound and effective corporate governance practices. Our Board of Directors has adopted Corporate Governance Guidelines (“Guidelines”) which describe the

Board’s governance principles and procedures. The Guidelines cover director qualifications and retirement policy, director responsibilities, Board committees, director access to officers and employees, director compensation, director orientation

and continuing education, Chief Executive Officer evaluation and management succession, and the annual performance evaluation of the Board. You may request a copy of the Guidelines, which will be provided at no cost to you, by contacting

GlassBridge Enterprises, Inc., c/o Corporate Secretary, 411 East 57th Street, Suite 1-A, New York NY 10022.

Code of Ethics

We adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, and

all of our other employees. If we make any amendments to our code of ethics other than technical, administrative or other non-substantive amendments, or grant any waiver, including any implicit waiver, from a provision of the code of ethics

applicable to our principal executive officer, principal financial officer, principal accounting officer, or controller or persons performing similar functions requiring disclosure under applicable SEC rules, we intend to disclose the nature of

such amendment or waiver on Form 8-K, Item 5.05. You may request a copy of the code of ethics, which will be provided at no cost to you by contacting GlassBridge Enterprises, Inc., c/o Corporate Secretary, 411 East 57th Street, Suite 1-A, New

York NY 10022.

Annual Meeting Attendance Policy

Directors are expected to attend our Annual Meeting. All four of our directors attended our 2019 Annual Meeting of Stockholders.

Communications with the Board

Our Board of Directors has a process in place for interested parties to communicate directly with our directors. If any interested party wants to make concerns known to our Board of Directors,

communication can be sent to the Board of Directors, GlassBridge Enterprises, Inc., c/o Corporate Secretary, 411 East 57th Street, Suite 1-A, New York NY 10022. Communications sent to the mailing address will be sent to our Corporate Secretary

who will then circulate the communications to the Board members as appropriate.

Risk Oversight

Our Board has responsibility for risk oversight, focusing on our overall risk management strategy, our degree of tolerance for risk, and the steps management is taking to manage our risks.

Management reports on its risk management process to the Board of Directors, quarterly. The Audit and Finance Committee also receives quarterly reports on key financial risks that could affect us. Our Compensation Committee assesses and monitors

whether any of our compensation policies and programs have the potential to encourage excessive risk-taking.

The Board of Directors oversees our risk management process, and our management is responsible for day-to-day risk assessment and mitigation activities. We believe this division of

responsibilities provides an effective approach for addressing our risks and that our Board leadership structure (with the separation of the Chairman of the Board from the Chief Executive Officer, to strengthen the Board of Directors general

oversight role) is aligned with this approach.

Our Board of Directors has reviewed whether our directors and nominees are “independent.” Our Board considers to not be independent any person having a relationship that would interfere with the

exercise of independent judgment in carrying out the person’s responsibilities as a director. The following persons will be considered not independent:

| • |

a director who is, or at any time during the past three years was, an executive officer or employee of the Company;

|

| • |

a director who accepted or has a family member who accepted any compensation from the Company exceeding $120,000 during any fiscal year within the three years preceding the determination of independence, other than compensation for

board or board committee service; compensation paid to a family member who is an employee (other than an executive officer) of the Company; or benefits under a tax-qualified retirement plan or nondiscretionary compensation; or

|

| • |

a director who is a family member of a person who is, or at any time during the past three years was, employed by the Company as an executive officer.

|

“Family member” means a person’s spouse, parents, children, and siblings, whether by birth, marriage, or adoption, or anyone residing in that person’s home.

None of the directors or nominees, except Mr. De Perio, had a relationship with the Company that the Board considers would interfere with the director’s or nominee’s independence or would not be

independent under the enumerated criteria. Therefore, the Board determined that each of the directors and nominees, except Mr. De Perio, is independent.

Meetings of the Board

During 2019, the Board of Directors held a total of 16 meetings. Each director attended at least 75% of the total meetings of the Board of Directors and

the Board committees on which the director served.

Committees of the Board

The standing committees of the Board of Directors include the Audit and Finance Committee, the Compensation Committee, and the Nominating and Governance Committee. Each of the Board committees

has adopted a written charter that describes the functions and responsibilities of the committee. You may request a copy of the charters for our Audit and Finance Committee, Compensation Committee and Nominating and Governance Committee, which

will be provided at no cost to you by contacting GlassBridge Enterprises, Inc., c/o Corporate Secretary, 411 East 57th Street, Suite 1-A, New York NY 10022. The Board also established ad hoc committees or subcommittees from time to time to

review particular issues such as material merger and acquisition activity.

Audit and Finance Committee

Members: Messrs. Searing (Chair) and Torricelli. The Board has determined that each member of the Audit and Finance Committee is independent, and that Mr. Searing qualifies as an audit

committee financial expert, as defined under SEC rules.

Number of meetings in 2019: 4

Functions:

| ● |

Reviews our consolidated financial statements, including accounting principles and practices

|

| ● |

Appoints or replaces our independent registered public accounting firm and approves the scope of its audit services and fees

|

| ● |

Reviews and approves non-audit services performed by and fees of our independent registered public accounting firm

|

| ● |

Reviews our compliance procedures and scope of internal controls

|

| ● |

Reports to the Board of Directors on the adequacy of financial statement disclosures and adherence to accounting principles

|

| ● |

Reviews financial policies that may impact our financial statements

|

| ● |

Oversees our internal audit function with the Manager of Internal Audit reporting directly to the Audit and Finance Committee

|

| ● |

Monitors compliance with financing agreements

|

| ● |

Monitors the functions of our Pension and Retirement Committee

|

| ● |

Reviews and approves any related person transactions under our related person transaction policy

|

Under our Guidelines, no director may serve on a total of more than three public company audit committees. All of our directors are in compliance with that provision of our Guidelines.

The Audit and Finance Committee has taken the following actions with respect to GlassBridge’s audited financial statements for the year ended December

31, 2019:

| ● |

The Audit and Finance Committee has reviewed and discussed the audited financial statements with GlassBridge’s management.

|

| ● |

The Audit and Finance Committee has discussed with Turner, Stone & Company, L.L.P., GlassBridge’s independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the Public

Company Accounting Oversight Board (“PCAOB”).

|

| ● |

The Audit and Finance Committee has received the written disclosures and the letter from Turner, Stone required by applicable requirements of the PCAOB regarding Turner, Stone’s communications with the Audit and Finance Committee

concerning independence and has discussed with Turner, Stone its independence from GlassBridge. In connection with its review of Turner’s independence.

|

| ● |

Based on the review and discussions described above, the Audit and Finance Committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December

31, 2019, for filing with the SEC.

|

|

|

AUDIT AND FINANCE COMMITTEE

Robert Searing, Chairman Robert G. Torricelli

|

The material in this report of the Audit Committee is not “soliciting material,” is furnished to, but not deemed “filed” with, the SEC and is not deemed to

be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Compensation Committee

Members: Messrs. Searing (Chair) and Spiro

Number of meetings in 2019: As a result of the numerous meetings held by the Board during 2019, the Board, a majority of whom are independent, also administered matters

ordinarily handled by the Compensation Committee, which, accordingly, did not meet, formally, during 2019.

Functions:

| ● |

Reviews and approves compensation and benefits programs for our executive officers and key employees

|

| ● |

Oversees executive evaluation process and approves compensation for executives other than the Chief Executive Officer

|

| ● |

Reviews and recommends Chief Executive Officer compensation to the independent directors

|

| ● |

Reviews executive stock ownership guidelines and progress in meeting the guidelines

|

| ● |

Oversees implementation of certain stock and compensation plans

|

Nominating and Governance Committee

Members: Messrs. Spiro (Chair) and Mr. Searing.

Number of meetings in 2019: As a result of the numerous meetings held by the Board during 2019, the Board, a majority of whom are independent, also administered matters

ordinarily handled by the Nominating and Governance Committee, which, accordingly, did not meet, formally, during 2019.

Functions:

| ● |

Advises and makes recommendations to the Board on all matters concerning directors (such as independence evaluations, committee assignments, director compensation and director stock ownership guidelines) and corporate governance

matters

|

| ● |

Advises and makes recommendations to the Board on the selection of candidates as nominees for election as directors

|

| ● |

Reports to the Board on succession planning, including succession in the event of retirement of the Chief Executive Officer

|

| ● |

Oversees the evaluation of the Chief Executive Officer

|

The Nominating and Governance Committee will consider qualified candidates for Board membership submitted by stockholders. A candidate for election to the Board needs the

ability to apply good business judgment and must be in a position to properly exercise his or her duties of loyalty and care in his or her representation of the interests of stockholders. Candidates should also exhibit proven leadership

capabilities, high integrity and experience with a high level of responsibilities within their chosen fields, and have the ability to quickly grasp complex principles of business, finance and international transactions and those regarding our

industry. In general, candidates will be preferred who hold an established executive level position and have extensive experience in business, finance, law, education, research or government. The Nominating and Governance Committee also reviews

the current composition of the Board to determine the needs of the Board in terms of diversity of candidates including diversity of skills and experience, but the Nominating and Governance Committee does not have a specific policy with regard to

the consideration of diversity. The Nominating and Governance Committee will consider all these criteria for nominees identified by the Nominating and Governance Committee, by stockholders or through some other source. The Nominating and

Governance Committee also uses external search firms to assist it in locating candidates that meet the criteria for qualified candidates. When current Board members are considered for nomination for re-election, the Nominating and Governance

Committee will also take into consideration their prior Board contributions, performance and meeting attendance records.

Stockholders who want to submit a qualified candidate for Board membership can do so by sending the following information to the Nominating and Governance Committee (c/o

Corporate Secretary, 411 East 57th Street, Suite 1-A, New York NY 10022):

| ● |

name of the candidate and a brief biographical sketch and resume;

|

| ● |

contact information for the candidate and a document evidencing the candidate’s willingness to serve as a director if elected; and

|

| ● |

a signed statement as to the submitting stockholder’s current status as a stockholder and the number of shares currently held.

|

The Nominating and Governance Committee will conduct a process of making a preliminary assessment of each proposed nominee based upon his or her resume and biographical

information, an indication of the individual’s willingness to serve, and other relevant information. This information will be evaluated against the criteria set forth above and our specific needs at that time. Based upon a preliminary assessment

of the candidate(s), those who appear best suited to meet our needs may be subject to a background investigation and may be invited to participate in a series of interviews, which are used as a further means of evaluating potential candidates. On

the basis of information learned during this process, the Nominating and Governance Committee will determine which nominee(s) to recommend to the Board to submit for election at the next annual meeting. The Nominating and Governance Committee

will use the same process for evaluating all nominees, regardless of the original source of the nomination. Any nominations for director to be made at an annual meeting of stockholders must be made in accordance with the requirements set forth

under the caption, Stockholder Proposals for 2021 Annual Meeting.

We are a “smaller reporting company,” as such term is defined in Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and Item 10 of Regulation S-K. Accordingly, and in

accordance with relevant SEC rules and guidance, we have elected, with respect to the disclosures required by Item 402 of Regulation S-K, to comply with the disclosure requirements applicable to smaller reporting companies.

During 2019, non-employee directors were compensated for Board service in accordance with the following:

| ● |

Annual Retainer: $21,250

|

| ● |

Committee Chairperson Fee: $10,000 per year for serving as chair of the Audit and Finance Committee

|

| ● |

Chairman Fee: $67,500 (in addition to the Annual Retainer received by all Directors, for a total of $88,750)

|

The Nominating and Governance Committee reviews Board compensation every year.

In lieu of cash, non-employee directors may elect to receive all or part of their fees in shares of common stock or in restricted stock units equivalent to shares of common stock.

The table below provides information relating to compensation of our directors for 2019.

|

Name

|

Fees Earned

or Paid in

Cash ($)

|

Stock

Awards($)

|

Option

Awards($)(1)

|

All

Other

Compensation

($)(2)

|

Total($)

|

|||||||||||||||

|

Joseph A. De Perio

|

88,750

|

0

|

0

|

90,000

|

178,750

|

|||||||||||||||

|

Robert Searing

|

31,250

|

0

|

0

|

10,000

|

41,250

|

|||||||||||||||

|

Alex Spiro

|

21,250

|

0

|

0

|

10,000

|

31,250

|

|||||||||||||||

|

Robert Torricelli

|

21,250

|

0

|

0

|

10,000

|

31,250

|

|||||||||||||||

| (1) |

In 2019, Messrs. De Perio and Messrs. Searing, Spiro and Torricelli were each awarded a stock option to purchase 165 shares and 145 shares, respectively. The aggregate number of outstanding stock options held by each director as of

the last day of the fiscal year 2019 was the number of the shares awarded to such director in 2019.

|

| (2) |

Comprises additional compensation paid in connection with transactions with Orix PTP Holdings, LLC and settlement of claims resulting from levies on the sale of optical media in France and The Netherlands.

|

In August 2020, the Board increased the annual fee for each director to $60,000, the additional annual fee for the chairman of the Audit and Finance Committee to $75,000, and the Chairman’s additional annual fee to

$90,000.

It is our policy to indemnify directors and officers against any costs, expenses and other liabilities to which they may become subject by reason of their service to us and to insure our

directors and officers against such liabilities to the extent permitted by applicable law. Our bylaws provide for indemnification of our directors, officers and employees against those costs, expenses and other liabilities as long as the

director, officer or employee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests. We also enter into indemnity agreements with each of our directors pursuant to which we agree to

indemnify each director to the full extent provided by applicable law and our bylaws as currently in effect.

Executive Officers of the Company

Our current executive officers as of October 30, 2020 are as follows:

| ● |

Joseph A. De Perio, Chairman and principal executive officer

|

| ● |

Daniel A. Strauss, Chief Executive Officer

|

| ● |

Francis Ruchalski, Chief Financial Officer

|

Information regarding Mr. De Perio’s business experience is described under the caption PROPOSAL I, Election of Directors—Information about Directors.

Daniel A. Strauss, age 36, has served as our Chief Executive Officer since March 2019. Mr. Strauss served as our Chief Operating Officer from March 2017 through December 2019. Mr. Strauss was a

Portfolio Manager at Clinton from 2010 until 2019. Mr. Strauss is currently the Chief Executive Office of our subsidiary Adara Enterprises Corp. (“Adara”) and is a member of the board of directors of Adara and its subsidiary Sport-BLX, Inc.

(“SportBLX”). Mr. Strauss also serves on the Board of ARRIVE, the venture capital arm of Roc Nation. Mr. Strauss has over ten years of experience in corporate finance as a portfolio manager and investment analyst in private and public equity. At

Clinton, Mr. Strauss was responsible for evaluating and executing private equity transactions across a range of industries. Post-investment, Mr. Strauss was responsible for the ongoing management and oversight of Clinton’s portfolio investments.

From 2008 to 2010, he worked for Angelo, Gordon & Co., as a member of the firm’s private equity and special situations area. Mr. Strauss was previously with Houlihan Lokey, where he focused on mergers and acquisitions from 2006 to 2008. Mr.

Strauss has served on the boards of directors of Pacific Mercantile Bancorp (NASDAQ: PMBC) from August 2011 until December 2015 and Community Financial Shares, Inc. (OTC: CFIS) from December 2012 until its sale to Wintrust Financial Corporation

in July 2015. Mr. Strauss received a Bachelor of Science in Finance and International Business from the Stern School of Business at New York University.

Francis Ruchalski, age 56, is our Chief Financial officer. Mr. Ruchalski is also the Chief Financial Officer of Clinton and a member of its board of directors. He has been employed by Clinton

since 1997. In addition, Mr. Ruchalski is the Chief Financial Officer of SportBLX, a member of its board of directors, and a member of the board of directors of Adara. Prior to joining Clinton, Mr. Ruchalski was an audit manager with Anchin,

Block & Anchin, LLP, a certified public accounting firm, from 1986 to 1997. Mr. Ruchalski’s responsibilities while with Anchin, Block & Anchin LLP included client auditing and financial and taxation planning. Mr. Ruchalski holds a

bachelor of science in accounting from St. John’s University.

The table below summarizes compensation of our named executive officers for 2019 and 2018.

|

Name and principal

position

|

Year

|

Salary ($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Stock Awards ($)

|

Change in Pension

Value and

Non-

Qualified

Deferred

Compensation

Earnings ($)

|

All Other Compen-

sation

|

Total

|

|||||||||||||||||||||||||

|

Joseph De Perio(1)

(Chairman and Principal Executive Officer)

|

2019

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|||||||||||||||||||||||||

|

2018

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||||||||||||||||||

|

Daniel Strauss(2)

(Chief Executive Officer and Former Chief Operating Officer)

|

2019

|

53,030

|

0

|

0

|

0

|

0

|

0

|

312,000

|

365,530

|

|||||||||||||||||||||||||

|

2018

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||||||||||||||||||

|

Danny Zheng(3)

(Former Interim Chief Executive Officer and Chief Financial Officer)

|

2019

|

83,393

|

110,250

|

0

|

0

|

1,500

|

0

|

102,325

|

297,469

|

|||||||||||||||||||||||||

|

2018

|

315,000

|

230,000

|

0

|

0

|

110,250

|

900

|

0

|

656,150

|

||||||||||||||||||||||||||

|

Francis Ruchalski(4)

(Chief Financial Officer)

|

2019

|

14,583

|

0

|

0

|

0

|

0

|

0

|

80,000

|

94,583

|

|||||||||||||||||||||||||

|

2018

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||||||||||||||||||

| (1) |

Mr. De Perio receives no salary as principal executive officer of the Company. See, Director Compensation for 2019, for Mr. De Perio’s compensation as a director and Chairman.

|

| (2) |

2019 All Other Compensation consists of additional compensation paid in connection with transactions with Orix PTP Holdings, LLC and settlement of claims resulting from levies on the sale of optical media in France and The

Netherlands.. Mr. Strauss serves as our Chief Executive Officer pursuant to the terms of an employment agreement with the Company dated December 18, 2019. Prior to entering into the employment agreement, Mr. Strauss served as our Chief

Executive Officer and Chief Operating Officer pursuant to an Amended and Restated Services Agreement, between the Company and Clinton. See, “Related Party Transactions.” On December 18, 2019, Mr. Strauss amended his employment agreement

with the Company’s subsidiary Adara, to provide for at-will employment at a salary of $200,000 per year. Mr. Strauss received no compensation from the Company for 2018.

|

| (3) |

2019 All Other Compensation consists of severance pay and unused vacation pay. Mr. Zheng resigned as an executive officer of the company effective March 29, 2019.

|

| (4) |

2019 All Other Compensation consists of additional compensation paid in connection with transactions with Orix PTP Holdings, LLC and settlement of claims resulting from levies on the sale of optical media in France and The Netherlands.

Mr. Ruchalski was named the Company’s Chief Financial Officer effective March 29, 2019. Previously, he served as Chief Financial Officer pursuant to the Amended and Restated Services Agreement referred to in Note (2). Mr. Ruchalski

received no compensation from the Company for 2018.

|

On December 18, 2019, Mr. Strauss entered into an employment agreement with the Company as the Company’s Chief Executive Officer and amended his employment agreement with Adara. Previously, Mr. Strauss served as the

Company’s Chief Executive Officer and Chief Operating Officer pursuant to the Services Agreement.

The material terms of the employment agreement with the Company:

| ● |

Mr. Strauss will be an at-will employee with an annual salary of $200,000; and

|

| ● |

Mr. Strauss is eligible to participate in the compensation and benefit programs generally available to the Company’s executive officers.

|

The material terms of the employment agreement with Adara, are as follows:

| ● |

Mr. Strauss will be an at-will employee with an annual salary of $200,000; and

|

| ● |

Mr. Strauss is eligible to participate in the compensation and benefit programs generally available to the Company’s executive officers.

|

In connection with transactions consummated July 21, 2020, referred to under the caption, Related Person Transactions, the Board authorized a $425,000 bonus to Mr. Strauss.

In August 2020, Adara approved a one-time payment of $37,500 to each member of the board of directors of AEC. Mr. Strauss and Francis Ruchalski are members of the Adara board.

The following table summarizes the total outstanding equity awards as of December 31, 2019, for each of the named executive officers in the Summary Compensation Table.

|

Option Awards

|

Stock

Awards

|

|||||||||||||||||||

|

Name

|

Number of

securities

underlying

unexercised

options (#) exercisable

|

Number of

securities

underlying

unexercised

options (#)

un-

exercisable

|

Option

exercise

price ($)

|

Option

expiration

date

|

||||||||||||||||

|

Joseph De Perio(1)

|

14

|

151

|

106

|

09/06/2029

|

0

|

|||||||||||||||

|

Daniel Strauss(2)

|

428

|

332

|

106

|

09/06/2029

|

0

|

|||||||||||||||

|

Francis Ruchalski

|

0

|

0

|

--

|

--

|

0

|

|||||||||||||||

| (1) |

Mr. De Perio’s stock option vests in 12 quarterly installments beginning January 1, 2020.

|

| (2) |

One-half of Mr. Strauss’s stock option vested on date of grant, and the remainder vests in 24 quarterly installments beginning October 1, 2019.

|

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our directors and executive officers to file reports of ownership and changes in ownership of our

common stock with the SEC. We are required to identify any of those individuals who did not file such reports on a timely basis. We believe that during 2019 all of our directors and executive officers complied with their Section 16(a) filing

requirements, except that Messrs. Strauss, De Perio, Searing, Spiro, and Torricelli each filed, late, a Form 4 regarding the grant of a stock option.

On January 1, 2019, the Company and Clinton, which is controlled by Mr. George Hall, beneficial owner of 29.1% of our common stock (“Clinton”), entered into a management service agreement (the

“Management Service Agreement”), pursuant to which Clinton agreed to provide certain services to the Company. Prior to being appointed our Chief Executive Officer and Chief Financial Officer, respectively, Mr. Strauss served as our Chief

Executive Officer and Chief Operating Officer, and Mr. Ruchalski served as our Chief Financial Officer, pursuant to the terms of the Amended and Restated Services Agreement we entered into with Clinton on March 29, 2019 (the “Amended Services

Agreement”), replacing in its entirety the Services Agreement we entered into with Clinton on March 2, 2017. Clinton also made available other employees of Clinton as necessary to manage certain business functions, as deemed necessary in the

sole discretion of Clinton to provide other management services. On December 18, 2019, Clinton and the Company terminated the Management Service Agreement and Amended Services Agreement, effective March 20, 2020. Under these agreements, for

2019, through the effective date of termination, and for 2018, the Company paid Clinton $1,400,000, and $500,000, respectively. In connection with the terminations, the Company and Mr. Strauss entered into, and the Company’s subsidiary Adara and

Mr. Strauss amended, the employment agreements described following the table under the caption, Summary Compensation Table for 2019.

In January 2019, for total consideration of $1,000,000, Sport-BLX Inc. issued to the Company shares of SportBLX common stock, constituting 9.0% of the common stock outstanding after giving effect

to the transaction. Immediately before the transaction, Mr. Hall, SportBLX’s Executive Chairman and CEO, held 65.6% of SportBLX’s outstanding shares; certain other directors and executive officers of SportBLX are also directors or executive

officers of the Company.

In September 2019, the Company paid success fees to Clinton totaling approximately $3,983,000 in connection with the completion of a transaction between Adara and Orix PTP Holdings, LLC (“Orix”)

and settlement of claims against the Company by the Pension Benefit Guaranty Corporation, in addition to a payment, in May 2019, of $250,000, in consideration of Clinton’s efforts regarding the settlement.

In November 2019, the Company and Clinton Special Opportunities Fund LLC (“CSO”), wholly owned by Mr. Hall, entered into a Credit Facility Letter Agreement pursuant to which the Company extended to CSO a one-year

revolving credit facility in the aggregate principal amount up to $1,000,000, bearing 10% interest. CSO’s obligations were secured by security interests in all of CSO’s assets, including all of CSO’s Company common stock, and guaranteed by Mr.

Hall. In July 2020, the facility was terminated, and the Fund’s obligation of $520,000 principal amount and accrued interest thereunder were set off against the Company’s interest obligations under the promissory note to Mr. Hall referred to in

the next paragraph.

In December 2019, the Company purchased from Mr. Hall shares of SportBLX common stock representing 28.1% of the outstanding shares, in exchange for $1,346,302 in cash and a $12,116,718 principal

amount promissory note bearing interest at a 5% annual rate, due December 12, 2022. On the same date, the Company purchased from Joseph A. De Perio shares of SportBLX common stock representing 12.6% of the outstanding shares, in exchange for

$606,198 in cash and a $5,455,782 principal amount promissory note bearing 5% interest, due December 12, 2022. Interest under the notes is payable in arrears on the first day of each calendar quarter in cash, or, at the Company’s option, in

shares of common stock of the Company, at a price reflecting market value. Mr. De Perio owns 2.47% of the Company’s common stock, is Company’s Chairman and principal executive officer and SportBLX’s president.

In June 2020, SportBLX entered into a subscription agreement with Sport-BLX Securities, Inc. (“Securities”) for SportBLX’s proprietary sports-based alternative asset trading platform (the

“Platform”) via which the customer, Securities, may issue sports-related securities that are tradeable by investors. Mr. Hall and Mr. De Perio own 65.5% and 28.1% of Securities, respectively. As consideration for the subscription, SportBLX

received a one-time up-front subscription fee of $150,000 and will receive a monthly subscription fee of $100,000 during the first year of the contract. The fee increases to $137,500, monthly, for the remaining year of the initial term.

Thereafter, upon renewal, SportBLX may increase the fee by an amount not to exceed five percent of the previous year’s fee. The agreement also provides fees of $75,000 for each new tradable asset listed by the customer on the Platform. The

subscription is effective for a two year term and automatically renews for consecutive one-year renewal terms unless either party provides notice to the other party of its intention not to renew prior to the end of the initial or renewal term.

Either party may terminate the agreement for convenience upon 30 days’ notice to the other party. As of October 31, 2020, SportBLX had received $550,000.00 in fees under the subscription.

In June 2020, SportBLX borrowed $150,000 from CSO, $40,000 from Mr. De Perio, and $213,800 from Securities. Each loan bears interest at an 8% annual rate and matures on July 1, 2021 or earlier

demand.

In July 2020, as part of a series of related transactions (the “July 2020 Transactions”), the Company purchased from GEH Capital, LLC, wholly owned by George Hall, certain of that company’s

quantitative trading software, for $1,750,000. Thereafter, the Company sold to GEH Sport LLC, wholly owned by Mr. Hall, for $1.00, all outstanding membership interests in Adara Asset Management, LLC

(“AAM”), and AAM incurred a $13,000,000 obligation to Orix. At the time, AAM’s only assets were its ownership of the general partner interest in The Sports & Entertainment Fund, L.P., which holds a $17.8 million investment, the related

commodities pool operator registration, and $1,790,000, in cash.

In connection with the closing of transactions referred to in the previous paragraph, the Company paid a $250,000 consulting fee to George Hall and a $200,000 consulting fee to a third party. Alex Spiro, a Company

director who introduced the consultant to the Company, received $120,000 of the consulting fee.

In accordance with our policy regarding transactions with related persons, our Chief Financial Officer and the Audit and Finance Committee are responsible for the review and approval of all

transactions with related persons that are required to be disclosed under the rules of the SEC. Under the policy, a “related person” includes any of our directors or executive officers, certain of our stockholders and any of their respective

immediate family members. The policy applies to transactions in which the Company is a participant, the amount involved exceeds $120,000, and a related person has a direct or indirect material interest. A related person’s material interest in a

transaction is to be determined based on the significance of the information to investors in light of all the circumstances. Under the policy, key management meets quarterly to review the list of related parties and to discuss related party

transactions. The Audit and Finance Committee also reviews each new, existing or proposed related party transaction, including the terms of the transaction, the business purpose of the transaction, and the benefits to GlassBridge and to the

relevant related party. In determining whether to approve a related party transaction, the Audit and Finance Committee will consider the factors it deems relevant to the related party transaction, including, among other things, whether the terms

of the related party transaction are fair to the Company on the same basis as would apply if the transaction did not involve a related party.

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED

The Audit and Finance Committee has appointed Turner, Stone & Company, L.L.P., as our independent registered public accounting firm to audit our

consolidated financial statements for 2020. Turner has audited our financial statements since 2018. Representatives of Turner will attend the Annual Meeting and will have an opportunity to make a statement if they desire and will be available to

respond to appropriate questions.

Stockholder ratification of the appointment of Turner as our independent registered public accounting firm is not required by our bylaws or otherwise.

However, the Board of Directors is submitting the appointment of Turner to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment, the Audit and Finance Committee will

reconsider whether to retain Turner. Even if the appointment is ratified, the Audit and Finance Committee, which is solely responsible for appointing and terminating our independent registered public accounting firm, may, in its discretion,

direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that a change would be in our best interest and in the best interest of our stockholders.

During 2018, the Company dismissed Marcum LLP (“Marcum”) as our independent registered public accounting firm. The dismissal was approved by the Board

of Directors and Audit and Finance Committee.

The reports of Marcum on the Company’s consolidated financial statements as of and for 2017 and 2016 did not contain an adverse opinion or a disclaimer

of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle.

During the Company’s fiscal years ended December 31, 2017 and December 31, 2016 and through June 30, 2018, the interim period, (i) there were no

disagreements between the Company and Marcum on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum, would have

caused Marcum to make reference to the matter in their reports on the Company’s financial statements for the such years and (ii) there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

Below is a listing of the services provided by type and amount charged to us by our independent registered public accounting firms for 2019 and 2018.

|

2019

|

2018(1)

|

|||||||

|

Audit Fees:

GAAP and statutory audits

|

$

|

89,000

|

$

|

363,552

|

||||

|

Audit-Related Fees:

Services related to business transactions

|

$

|

0

|

$

|

0

|

||||

|

Total Audit-Related Fees

|

$

|

89,000

|

$

|

363,552

|

||||

|

Tax Fees (tax preparation, advice and consulting)

|

$

|

0

|

$

|

9,806

|

||||

|

All Other Fees:

Other Business Consulting Fees

|

$

|

0

|

$

|

12,128

|

||||

(1) Including audit fee of $335,373 and tax fees of $9,806 to Marcum.

All the services provided by our independent registered public accounting firm are subject to pre-approval by the Audit and Finance Committee. The Audit

and Finance Committee has authorized the Chairman of the Audit and Finance Committee to approve services by our independent registered public accounting firm if there is a need for approval prior to the next full Audit and Finance Committee

meeting. The Chairman reports any pre-approval decisions to the Audit and Finance Committee at its next scheduled meeting.

With respect to each proposed pre-approved service, our independent registered public accounting firm provides back-up documentation as requested,

including estimated fees regarding the specific services to be provided. The Audit and Finance Committee (or Chairman, as applicable) reviews the services and the estimated fees and considers whether approval of the proposed services will have a

detrimental impact on our independent registered public accounting firm’s independence prior to approving any service. At least annually, a member of our management reports to the Audit and Finance Committee all audit and non-audit services

performed during the previous twelve months and all fees billed by our independent registered public accounting firm for those services.

In 2019 and 2018, all audit services, audit-related services, tax services and those items described above, under “All Other Fees,” were pre-approved by

the Audit and Finance Committee or the Chairman.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM. The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote at the Annual Meeting is required for ratification of the appointment of the independent

registered public accounting firm.

APPROVAL OF 2020 EQUITY INCENTIVE PLAN

Our Board of Directors has adopted and approved the GlassBridge Enterprises, Inc. 2020 Equity Incentive Plan (the “Plan”). The Plan will become effective on October 30, 2020, the date Board adopted the Plan, and is a comprehensive incentive

compensation plan under which we can grant equity-based and other incentive awards to officers, employees and directors of, and consultants and advisers to, the Company and its subsidiaries. The purpose of the Plan is to help us attract,

motivate and retain such persons and thereby enhance stockholder value.

Administration. The Plan will be administered by the Compensation Committee of the Board of Directors (the “Plan Committee”) consisting of persons who, upon completion of this offering, will each be

(i) “non-employee directors” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act,” and such directors, “Non-Employee Directors,”) and (ii) “independent” for purposes of any applicable listing

requirements. If a member of the Plan Committee is eligible to receive an award under the Plan, such Plan Committee member shall have no authority hereunder with respect to his or her own award. Among other things, the Plan Committee has

complete discretion, subject to the terms of the Plan, to determine the employees, non-employee directors and non-employee consultants to be granted awards under the Plan, the type of awards to be granted, the number of shares subject to each

award, the exercise price under each option and the base price for each stock appreciation right (“SAR”), the term of each award, the vesting schedule for an award, whether to accelerate vesting, the value of the shares underlying the award, and

the required withholdings, if any. The Plan Committee is also authorized to construe the award agreements, and may prescribe rules relating to the Plan.

Grant of Awards; Common Stock Available for Awards. The Plan provides for the grant of awards that are incentive stock options (“ISOs”), non-qualified stock options (“NQSOs”), unrestricted shares,

restricted shares, restricted stock units, performance stock, performance units, SARs, tandem stock appreciation rights, distribution equivalent rights, or any combination of the foregoing, to key management employees, non-employee directors, and

non-employee consultants of the Company or any of its subsidiaries (each a “participant”); however, solely Company employees or employees of the Company’s subsidiaries are eligible to receive ISOs. We have reserved a total of 2,900 shares for

issuance as or under awards to be made under the Plan. To the extent that an award lapses, expires, is canceled, is terminated unexercised or ceases to be exercisable for any reason, or the rights of its participant terminate, any shares subject

to such award shall again be available for the grant of a new award. The Plan shall continue in effect, unless sooner terminated, until the 10th anniversary of the date on which it is adopted by the Board of Directors (except as to awards

outstanding on that date). The Board of Directors in its discretion may terminate the Plan at any time with respect to any shares for which awards have not theretofore been granted; provided, however, that the Plan’s termination shall not

materially and adversely impair the rights of a participant, without the consent of the participant, with respect to any award previously granted. The number of shares for which awards which are options or SARs may be granted to a participant

under the Plan during any calendar year is limited to 160.

Future new hires, non-employee directors and additional non-employee consultants are eligible to participate in the Plan as well. The number of awards to be granted to officers, non-employee directors, employees and non-employee consultants

cannot be determined at this time as the grant of awards is dependent upon various factors such as hiring requirements and job performance.

Options. The term of each stock option shall be as specified in the option agreement; provided, however, that except for ISOs granted to an employee who owns or is deemed to own (by reason of the

attribution rules applicable under Code Section 424(d)) more than 10% of the total combined voting power of all classes of shares of the Company or of any parent corporation or subsidiary corporation thereof (both as defined in Section 424 of the

Code), within the meaning of Section 422(b)(6) of the Code (a “ten percent stockholder”), no option shall be exercisable after the expiration of ten years from the date of its grant (five years for an employee who is a ten percent stockholder).

The price at which a share may be purchased upon exercise of a stock option shall be determined by the Plan Committee; provided, however, that such option price (i) shall not be less than the fair market value of a share of common stock on the

date such stock option is granted, and (ii) shall be subject to adjustment as provided in the Plan. The Plan Committee or the Board of Directors shall determine the time or times at which, or the circumstances under which, a stock option may be

exercised in whole or in part, the methods by which such exercise price may be paid or deemed to be paid, the form of such payment, and the methods by or forms in which shares will be delivered or deemed to be delivered to participants who

exercise stock options.

ISOs will comply in all respects with Section 422 of the Code. The exercise price of an ISO granted to a ten percent stockholder (to the extent required by the Code at the time of grant) shall be no less than 110% of the fair market value of

a share on the date such ISO is granted. ISOs may only be granted to employees of the Company or the Company’s subsidiaries. In addition, the aggregate fair market value of the shares subject to an ISO (determined at the time of grant) that are

exercisable for the first time by an employee during any calendar year under all plans of the Company and any parent corporation or subsidiary corporation thereof (both as defined in Section 424 of the Code) may not exceed $100,000. Any Option

specifying that it is not intended to qualify as an ISO or that fails to meet the ISO requirements at any point in time will automatically be treated as a NQSO.

Unrestricted Stock Awards. An unrestricted stock award is an award or sale of shares to an employee, non-employee director, or non-employee consultant that is not subject to transfer restrictions in

consideration for past services rendered to the Company (or any of its subsidiaries) or for other consideration.

Restricted Stock Awards. A restricted stock award is a grant or sale of shares to the participant, subject to such restrictions on transferability, risk of forfeiture and other restrictions, if any, as

the Plan Committee or the Board of Directors may impose, which restrictions may lapse separately or in combination at such times, under such circumstances (including based on achievement of performance goals and/or future service requirements),

in such installments or otherwise, as the Plan Committee or the Board of Directors may determine at the date of grant or purchase or thereafter. If provided for under the restricted stock award agreement, a participant who is granted or has

purchased restricted stock shall have all of the rights of a stockholder, including the right to vote the restricted stock and the right to receive dividends thereon (subject to any mandatory reinvestment or other requirement imposed by the Plan

Committee or the Board of Directors or in the award agreement). During the restricted period applicable to the restricted stock, subject to certain exceptions, the restricted stock may not be sold, transferred, pledged, exchanged, hypothecated,

or otherwise disposed of.

Restricted Stock Unit Awards. A restricted stock unit award provides for a grant of shares or a cash payment to be made to the participant upon the satisfaction of predetermined individual

service-related vesting requirements, based on the number of units awarded to the participant. The Plan Committee sets forth in the applicable restricted stock unit award agreement the individual service-based vesting requirements which the

participant would be required to satisfy before the participant would become entitled to payment and the number of units awarded to the participant. At the time of such award, the Plan Committee may, in its sole discretion, prescribe additional

terms and conditions or restrictions. The holder of a restricted stock unit is entitled to receive a cash payment equal to the fair market value of a share, or one share, as determined in the sole discretion of the Plan Committee and as set

forth in the restricted stock unit award agreement, for each restricted stock unit subject to such restricted stock unit award, if and to the extent the participant satisfies the applicable vesting requirements. The payment or distribution is

made no later than by the 15th day of the third calendar month following the year in which the restricted stock unit first becomes vested, unless otherwise structured to comply with Code Section 409A.

Performance Stock Awards. A performance stock award provides for the distribution of shares (or cash equal to the fair market value of shares) to the participant upon the satisfaction of predetermined

individual and/or Company goals or objectives. The Plan Committee sets forth in the applicable performance stock award agreement the performance goals and objectives (and the period of time to which the goals and objectives apply), which the

participant and/or Company would be required to satisfy before the participant would become entitled to the receipt of shares (or cash equal to the fair market value of hares) pursuant to the participant’s performance stock award and the number

of shares of shares subject to the performance stock award. The vesting restrictions under any performance stock award shall constitute a “substantial risk of forfeiture” under Section 409A of the Code and, if the goals and objectives are

achieved, the distribution of the shares is made no later than by the 15th day of the third month following the year to which the goals and objectives relate, unless otherwise structured to comply with Code Section 409A. At the time of the

award, the Plan Committee may, in its sole discretion, prescribe additional terms and conditions or restrictions. The participant of a performance stock award has no rights as a stockholder until such time, if any, as the participant actually

receives shares pursuant to the performance stock award.