UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07619

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: August 31

Date of reporting period: August 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| ||

| Mutual Funds |

| Nuveen Asset Allocation

Funds |

|

|

Annual Report August 31, 2014 |

| Share Class / Ticker Symbol | ||||||||||||||

| Fund Name | Class A | Class C | Class R3 | Class I | ||||||||||

|

| ||||||||||||||

| Nuveen Intelligent Risk Conservative Allocation Fund |

NICAX | NICCX | NICRX | NICIX | ||||||||||

| Nuveen Intelligent Risk Growth Allocation Fund |

NIGAX | NIGCX | NIGRX | NIGIX | ||||||||||

| Nuveen Intelligent Risk Moderate Allocation Fund |

NIDAX | NIMCX | NIMRX | NIMIX | ||||||||||

|

|

||||||||||||

|

|

||||||||||||

| NUVEEN INVESTMENTS ACQUIRED BY TIAA-CREF | ||||||||||||

| On October 1, 2014, TIAA-CREF completed its previously announced acquisition of Nuveen Investments, Inc., the parent company of your fund’s investment adviser, Nuveen Fund Advisors, LLC (“NFAL”) and the Nuveen affiliates that act as sub-advisers to the majority of the Nuveen Funds. TIAA-CREF is a national financial services organization with approximately $613 billion in assets under management as of June 30, 2014 and is a leading provider of retirement services in the academic, research, medical and cultural fields. Nuveen expects to operate as a separate subsidiary within TIAA-CREF’s asset management business. Nuveen’s existing leadership and key investment teams have remained in place following the transaction.

Your fund investment will not change as a result of Nuveen’s change of ownership. You will still own the same fund shares and the underlying value of those shares will not change as a result of the transaction. NFAL and your fund’s sub-adviser(s) will continue to manage your fund according to the same objectives and policies as before, and we do not anticipate any changes to your fund’s operations. |

||||||||||||

|

Must be preceded by or accompanied by a prospectus.

NOT FDIC INSURED MAY LOSE VALUE |

||||||||||||

|

|

||||||||||||

of Contents

| 4 | ||||

| 5 | ||||

| 10 | ||||

| 11 | ||||

| 18 | ||||

| 21 | ||||

| 23 | ||||

| 25 | ||||

| 26 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 34 | ||||

| 40 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 57 | ||||

| Nuveen Investments | 3 |

to Shareholders

| 4 | Nuveen Investments |

Comments

Nuveen Intelligent Risk Conservative Allocation Fund

Nuveen Intelligent Risk Growth Allocation Fund

Nuveen Intelligent Risk Moderate Allocation Fund

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments, Inc. Portfolio manager James A. Colon, CFA, has been a portfolio manager of the Funds since their inception in May 2012. Effective December 31, 2013, David R. Wilson, CFA, replaced Derek B. Bloom, CFA, as a portfolio manager to the Funds.

Here the management team discusses economic and market conditions, key investment strategies and the Funds’ performance during the twelve-month reporting period ended August 31, 2014.

What factors affected the U.S. economy and equity markets during the twelve-month reporting period ended August 31, 2014?

During this reporting period, the U.S. economy continued its advance toward recovery from recession. The Federal Reserve (Fed) maintained efforts to bolster growth and promote progress toward its mandates of maximum employment and price stability by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. Based on its view that the underlying strength in the broader economy was enough to support ongoing improvement in the labor market, the Fed began to reduce or taper its monthly asset purchases in $10 billion increments over the course of seven consecutive meetings (December 2013 through September 2014). As of October 2014 (subsequent to the close of this reporting period), the Fed’s monthly purchases comprise $5 billion in mortgage-backed securities (versus the original $40 billion per month) and $10 billion in longer-term Treasury securities (versus $45 billion). Following its September 2014 meeting (subsequent to the close of this reporting period), the Fed stated that, if upcoming data supports ongoing improvements in the labor markets and inflation rates, it would end its current program of asset purchases at its next meeting in October 2014. The Fed also reiterated that it would continue to look at a wide range of factors, including labor market conditions, indicators of inflationary pressures and readings on financial developments, in determining future actions, saying that it would likely maintain the current target range for the fed funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Fed’s 2% longer-run goal.

In the second quarter of 2014, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew 4.6%, rebounding strongly from the -2.1% posted in the first quarter of 2014, the economy’s weakest quarter since the recession officially ended in June 2009. Second-quarter growth was attributed in part to improved consumer spending, particularly on durable goods and increased domestic investment. The Consumer Price Index (CPI) rose 1.7% year-over-year as of August 2014, while the core CPI (which excludes food and energy) also increased 1.7% during the same period, below the Fed’s unofficial longer term objective of 2.0% for this inflation measure. As of August 2014, the national unemployment rate was 6.1%, down from the 7.2% reported in August 2013, but still above levels that would provide consistent support for optimal GDP growth. The housing market continued to post gains, as the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 6.7% for the twelve months ended July 2014 (most recent data available at the time this report was prepared), raising home prices to their spring 2005 levels.

Several events touched off increased volatility in the financial markets during the first part of this reporting period. Widespread uncertainty about the next step for the Fed’s quantitative easing program, including the start date for tapering its asset purchase program, had an impact on the markets as well as the overall economy. Meanwhile, Congress failed to reach an agreement on the federal budget for Fiscal 2014. On October 1, 2013, the start date for Fiscal 2014, the federal government shut down for 16 days

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

| Nuveen Investments | 5 |

Portfolio Managers’ Comments (continued)

until an interim appropriations bill was signed into law. (Consensus on a $1.1 trillion federal spending bill was ultimately reached in January 2014 and in February 2014, members of Congress agreed to suspend the $16.7 trillion debt ceiling until March 2015.) As calendar year 2014 began, the market environment stabilized and the markets improved.

The period was particularly strong for the U.S. stock market, but also meaningfully so for overseas equities. U.S. equities entered their sixth year of the current bull market boosted by improving macroeconomic data, solid earnings growth and continued accommodative policies from the Fed. The U.S. market did experience a negative sentiment shift and drop in market prices from mid-March through the end of April that was not driven by a significant change in fundamentals. Subsequent to the brief sell-off, larger-cap U.S. equities recovered all of their lost ground and the S&P 500 Index reached record highs in July and August. Over the twelve-month reporting period ended August 31, 2014, this bellwether U.S. market gauge returned 25.25%. Several times throughout the reporting period, investors rotated fairly aggressively away from smaller-cap stocks and into larger-cap stocks and those that pay a dividend. Small caps underperformed their larger-cap brethren during this reporting period, gaining 17.68% as measured by the Russell 2000® Index.

International developed markets performed well over the first half of the reporting period, rounding out a strong 2013, while emerging markets stumbled due to weakness in global growth and commodity prices combined with credit and liquidity concerns. In the early months of 2014, investors rotated aggressively away from stocks that had performed so well in 2013, most notably growth-oriented stocks in the biotechnology and internet-related areas and back to value-oriented stocks. The very bullish expectations carried over from fourth quarter 2013 were dampened by cold weather conditions in the U.S., the political crisis over Russia’s military action in the Ukraine, commentary from new Fed chair Janet Yellen suggesting the potential for a sooner-than-expected rate hike and heightened volatility in Japan as corporates unwound equity positions. China-related concerns also lingered due to poor export data as well as the first yuan-denominated debt default. In the final months of the reporting period, investors returned to their risk-taking ways after the Fed made comments indicating greater flexibility toward maintaining accommodative interest rate levels and the European Central Bank (ECB) announced the adoption of negative interest rates as a strategy to limit deflation risks. IPOs and secondary offerings continued unabated with mixed price results, while the merger and acquisition (M&A) boom continued. The process of inversion, which involves re-domiciling in a non-U.S. tax jurisdiction through M&A transactions with a foreign entity, gained traction as companies looked for ways to access liquidity trapped overseas and potentially lower taxes. While the latter half of the reporting period in particular had times of volatility, the markets continued to grind steadily higher in the face of both positive and negative news. While violence flared up in Iraq and tensions continued in Ukraine, these geopolitical events seemed to do little to rile markets; they mostly manifested in energy sector appreciation on rising oil prices. The performance strength and accompanying valuation premiums of U.S. equities compared with international equities continued, although markets were largely strong across the globe. The MSCI EAFE Index reported a 16.92% return for the reporting period ended August 31, 2014, while the MSCI Emerging Markets Index gained 20.40%.

Overall for the reporting period, fixed income spread sectors produced favorable results as investors worked through a high degree of uncertainty surrounding Fed monetary policy, uneven economic growth and the direction of interest rates. At the beginning of the reporting period, fixed income markets were stressed by the Fed’s discussions surrounding the tapering of its monthly security purchases as a step toward slowly normalizing U.S. monetary policy. The uncertainty roiled fixed income investors, leading to increased risk aversion and significant investor flows out of the bond market, which resulted in sharply higher interest rates, declines in risk assets and stress among emerging markets. For calendar year 2013, investors withdrew more money out of bond funds than they put in for the first time in nearly a decade. After months of “taper talk,” the Fed finally made it official in December, announcing it would begin reducing asset purchases by $10 billion a month starting in January 2014. Policymakers cited improving economic numbers, particularly lower unemployment figures, as the impetus behind the move. At the same time, the Central Bank calmed market fears by reiterating that tapering did not equate to tightening, making a clear commitment to keep short-term interest rates at their current very low levels until at least 2015. Fixed income markets showed stabilization as 2014 got under way, even as concerns were raised about economic slowdowns in the United States due mostly to weather-related issues and in China due to policy shifts to slow the country’s credit growth. Demand for domestic fixed income assets resumed in part due to geopolitical concerns stemming from Russia’s military action in Ukraine and concerns about emerging market growth and stability. The second half of the reporting period largely saw improvements in fundamental and market conditions as investor inflows continued into fixed income markets, yields were generally lower and spreads tightened for risk assets. Markets were further supported by actions taken by policymakers around the globe including various emerging market countries, the Chinese government and the European Central Bank (ECB). The period

| 6 | Nuveen Investments |

ended with U.S. economic growth rebounding nicely from its extremely weak first quarter as employment numbers steadily improved, consumer spending picked up and manufacturing increased. With the backdrop of improved U.S. data and reduced policy uncertainty, fixed income markets ended the reporting period with market volatility declining to historically low levels, prompting some concern from market analysts and policymakers who believed that investors may be growing overly complacent. The Barclays Aggregate Bond Index posted a return of 5.66% for the reporting period ended August 31, 2014.

How did the Funds perform during the twelve-month reporting period ended August 31, 2014?

The tables in the Fund Performance and Expense Ratios section of this report provide Class A Share total return performance information for the one-year and since inception periods ended August 31, 2014. Each Fund’s Class A Share total returns at net asset value (NAV) are compared with the performance of the appropriate Morningstar Index and Lipper classification average.

What strategies were used to manage the Funds during the reporting period ended August 31, 2014 and how did these strategies influence performance?

We manage each of the three risk categories of our Intelligent Risk Funds (Conservative, Growth and Moderate) using the same investment process. Our goal with each Fund is to provide investors with a stable level of risk that matches their risk tolerance through changing market conditions. Therefore, each Fund targets its own explicit daily volatility range that we believe to be appropriate for its risk category:

| Fund | Daily Volatility Target (Annualized) | |||

| Nuveen Intelligent Risk Conservative Allocation Fund |

3.5% to 7% | |||

| Nuveen Intelligent Risk Growth Allocation Fund |

12% to 18% | |||

| Nuveen Intelligent Risk Moderate Allocation Fund |

7% to 12% | |||

To keep each Fund’s volatility within its target range, we use our proprietary risk forecasting models to forecast future volatility across asset classes, and in turn, use that information to construct a risk-targeted portfolio. Risk forecasting and portfolio construction processes attempt to limit fluctuations in each portfolio’s volatility primarily by having exposure to a variety of different asset classes and dynamically adjusting exposure to these asset classes. To gain exposure to the various asset classes, the Funds are currently invested in a diverse blend of exchange-traded funds (ETFs) with broad exposures in equities, fixed income, real estate, commodities and cash.

Each Fund’s wide range investable universe gives us the flexibility to reduce exposure to risky assets during periods of high volatility and increase exposure to risky assets during periods of low volatility, while maintaining a stable risk profile. This strategy offers the potential to meet each Fund’s investment objective in a range of economic environments by capitalizing on market upswings, while mitigating risk in down markets. Our goal is to proactively anticipate market volatility to protect investors from unintentionally taking on risk that is inconsistent with each Fund’s respective risk tolerance.

What was the overall volatility environment during the twelve-month reporting period?

Aside from a few instances of increased volatility during reporting period, volatility remained extremely low and stable across asset classes. U.S. equity volatility stayed below 15% annualized for the overwhelming majority of the reporting period. Historically, U.S. equity volatility has averaged 19%, which illustrates the relative calm that U.S. markets felt throughout the reporting period. By the end of August 2014, U.S. equity volatility had fallen below 9%, and investors saw very little fluctuations in the value of their U.S. equity investments.

While many investors prepared for increasing yields, either by selling fixed income investments or shortening duration, the belief that yields would soon be increasing had little impact on price fluctuations in Treasuries. For example, 20+ Year U.S. Treasuries experienced very little volatility during the reporting period and trended lower throughout the year. At the end of August 2014, 20+ Year U.S. Treasury volatility was less than 7%, or nearly half the historical average.

In other markets, gold volatility modestly increased above its historical average during the fourth quarter of 2013 due to concerns over reductions in the Fed’s asset purchase program. However, by the end of the first quarter of 2014, gold volatility had fallen well below its historical average of 18%. Even emerging market equities, which historically tend to exhibit high levels of volatility, finished in single digits (7.8% annualized) and below the volatility of U.S. equities.

| Nuveen Investments | 7 |

Portfolio Managers’ Comments (continued)

How did the Funds perform and what changes were made to their portfolio allocations during this reporting period ended August 31, 2014?

Nuveen Intelligent Risk Conservative Allocation Fund

During the reporting period, the Nuveen Intelligent Risk Conservative Allocation Fund stayed within its target volatility range 100% of the time. An overweight to more volatile asset classes helped keep volatility within the target range during the very low volatility environment.

The Fund’s Class A Shares at NAV underperformed the Morningstar index and Lipper average for the twelve-month reporting period ended August 31, 2014. The Morningstar index is heavily concentrated in U.S. equities with little diversification across real assets and fixed income. Consequently, when U.S. equities outperform most other markets, as they did during the reporting period, the Fund will tend to underperform the benchmark due to its enhanced diversification.

All equity and fixed income asset classes that our team tracks performed well during the reporting period; however, commodity-based investments continued to be a drag on the Fund’s performance. U.S. large-cap equities finished the reporting year up 25.25% as measured by the S&P 500® Index and emerging market equities gained 22.70%, according to the FTSE Emerging Markets Index. U.S. real estate advanced 25.25% during the reporting period, as measured by the MSCI U.S. REIT Index. Gold, however, fell throughout the year and ended the reporting period down more than 7%, according to Bloomberg. A diversified blend of commodities, as measured by the Bloomberg Commodity Index, fared slightly better than gold and finished with a -2.92% return during the reporting period. At the end of the reporting period, we continued to hold approximately 22% in commodity funds.

Due to the low volatility environment, we continued to emphasize risk assets in the Fund’s portfolio. Early in the year, we eliminated the Fund’s target allocation to short-duration U.S. Treasuries and significantly reduced its allocation to long-duration U.S. Treasuries. Proceeds from these portfolio moves were reallocated primarily to emerging market equities, real estate and commodities.

As of August 31, 2014, the Fund is positioned with overweights in equities and real assets and an underweight to fixed income relative to historical levels. However, the strategy still holds defensive positions in long-duration U.S. Treasuries and municipal fixed income that are intended to help mitigate declines in other areas of the Fund’s portfolio while providing yield.

Nuveen Intelligent Risk Growth Allocation Fund

During the reporting period, the Nuveen Intelligent Risk Growth Allocation Fund stayed within its target volatility range 34% of the time. However, if we were to extend the bottom of its 12% to 18% range to 10%, the Fund would have stayed in its volatility range 99% of the time. This indicates that when the Fund was outside of its target range, it was delivering volatility levels below its target range.

The Fund’s Class A Shares at NAV underperformed the Morningstar index and Lipper average for the twelve-month reporting period ended August 31, 2014. The Morningstar index is heavily concentrated in U.S. equities with little diversification across real assets and fixed income. Consequently, when U.S. equities outperform most other markets, as they did during the reporting period, the Fund will tend to underperform the benchmark due to its enhanced diversification.

Due to the persistently low volatility levels across asset classes, our team allocated the majority of the Fund’s assets to equities throughout the reporting period. Early in the reporting period, we sold out of its positions in gold, diversified commodities and real estate, allocating the proceeds primarily to small-cap U.S. equities, developed international equities and natural resources.

While small-cap U.S. equities underperformed large-cap U.S. equities during the reporting period, the asset class still produced favorable results for the Fund. Small caps gained 17.68% during the reporting period, as measured by the Russell 2000® Index. Meanwhile, developed international equities turned in similarly strong results, advancing 16.84% according to the FTSE Developed ex North America Index. Natural resources equities also generated favorable returns for investors, returning 22.93% as measured by the S&P North American Natural Resources Index during the reporting period.

Aside from a small and brief allocation to 20+ year U.S. Treasuries at the beginning of the reporting period, we do not hold any fixed income investments in the Fund. Our shift away from fixed income investments and into global equities had a positive impact on the Fund’s returns.

| 8 | Nuveen Investments |

As of August 31, 2014, the Fund is positioned with an overweight to equities and underweights to real assets and fixed income relative to historical levels. Until we see a meaningful increase in market volatility, our team expects to continue allocating a substantial amount of the Fund into global equities to capitalize on a supportive environment for higher risk investments.

Nuveen Intelligent Risk Moderate Allocation Fund

During the reporting period, the Nuveen Intelligent Risk Moderate Allocation Fund stayed within its target volatility range 92% of the time. An overweight to more volatile asset classes helped keep the Fund’s volatility within the target range.

The Fund’s Class A Shares at NAV underperformed the Morningstar index and Lipper average for the twelve-month reporting period ended August 31, 2014. The Morningstar index is heavily concentrated in U.S. equities with little diversification across real assets and fixed income. Consequently, when U.S. equities outperform most other markets, as they did during the reporting period, the Fund will tend to underperform the benchmark due to its enhanced diversification.

During the reporting period, our team maintained the Fund’s relatively large allocation to global equities and commodities and a reduced allocation to fixed income. By concentrating the Fund’s exposures in more volatile asset classes, we were able to keep volatility consistently within its target range.

Our substantial allocation to equities in the Fund significantly benefited investors. U.S. large-cap equities finished the reporting year up 25.25% as measured by the S&P 500® Index and emerging market equities gained 22.70%, according to the FTSE Emerging Markets Index. However, allocations to commodities, which we use to help diversify risk in the Fund, did prove to be a drag on performance. The commodities asset class finished the reporting period with a -2.92% return as measured by Bloomberg Commodity Index. At the end of the reporting period, we continued to hold approximately 22% in commodity funds.

Our team began reducing the Fund’s exposure to diversified commodities early in the reporting period. By the end of the reporting period, the Fund had a target allocation of less than 4% to diversified commodities, which minimized the impact of negative returns in the asset class. However, we generally maintained a meaningful level of exposure to gold, which we use to hedge against substantial global market declines, geopolitical events and unexpected inflation. Although we did vary the Fund’s exposure to gold, the asset class declined throughout most of the reporting period and ended down more than 7%, according to Bloomberg.

At the beginning of the reporting period, the Fund had a target allocation of 35% to fixed income asset classes. While we prefer to balance risk across the Fund’s asset classes, the low volatility environment suggested that riskier asset classes, such as equities, would perform well and help keep the Fund within its target volatility range of 7% to 12%. As of August 31, 2014, the Fund is positioned with overweights to equities and real assets and an underweight to fixed income relative to historical levels.

| Nuveen Investments | 9 |

and Dividend Information

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. There is no guarantee that the Funds will achieve their investment objectives and the portfolio managers’ asset allocation decisions may adversely affect Fund performance. Each Fund is exposed to the risks of the underlying derivative instruments, ETFs, municipal bonds, corporate bonds, foreign government bonds, equity securities, commodities, real estate, asset-backed securities, mortgage-backed securities, inflation-protected securities and short-term securities that may be held in the portfolio. These risks include market risk, frequent trading risk, index methodology risk, other investment companies risk, liquidity risk, interest rate risk, and credit risk. As interest rates rise, bond prices fall. The credit risk and liquidity risk is heightened for non-investment grade or high-yield securities. The use of derivatives involves substantial financial risks and transaction costs. Commodities may be highly volatile and foreign investments are subject to additional risks including currency fluctuations, and economic or political instability. These risks are magnified in emerging markets. In addition, each Fund will bear its proportionate share of any fees and expenses paid by the ETFs in which it invests.

Dividend Information

Nuveen Intelligent Risk Conservative Allocation Fund seeks to pay regular dividends out of its net investment income at a rate that reflects the Fund’s past performance and current net income performance. To permit the Fund to maintain a more stable dividend, it may pay dividends consisting only of net investment income at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If the Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if the Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. The Fund will, over time, pay all its net investment income as dividends to shareholders.

As of August 31, 2014, Nuveen Intelligent Risk Conservative Allocation Fund had a positive UNII balance for tax purposes and a negative UNII balance for financial reporting purposes.

All dividends paid by each Fund during the fiscal year ended August 31, 2014 were paid from net investment income. If a portion of a Fund’s distributions was sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, the Fund’s shareholders would have received a notice to that effect. The composition and per share amounts of each Fund’s dividends for the reporting period are presented in the Statement of Changes in Net Assets and Financial Highlights, respectively (for reporting purposes) and in Note 6—Income Tax Information within the accompany Notes to Financial Statements (for income tax purposes), later in this report.

| 10 | Nuveen Investments |

and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown within this section of the report.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement by the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Note 7—Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect total operating expenses (before fee waivers and/or expense reimbursements, if any) as shown in the most recent prospectus. The expense ratios include management fees and other fees and expenses.

| Nuveen Investments | 11 |

Fund Performance and Expense Ratios (continued)

Nuveen Intelligent Risk Conservative Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of August 31, 2014

| Average Annual | ||||||||

| 1-Year | Since Inception |

|||||||

| Class A Shares at NAV |

10.05% | 3.59% | ||||||

| Class A Shares at maximum Offering Price |

3.74% | 0.99% | ||||||

| Morningstar Moderately Conservative Target Risk Index |

11.10% | 7.98% | ||||||

| Lipper Mixed-Asset Target Allocation Conservative Funds Classification Average |

10.57% | 7.14% | ||||||

| Class C Shares |

9.23% | 2.81% | ||||||

| Class R3 Shares |

9.82% | 3.32% | ||||||

| Class I Shares |

10.31% | 3.83% | ||||||

Average Annual Total Returns as of September 30, 2014 (Most Recent Calendar Quarter)

| Average Annual | ||||||||

| 1-Year | Since Inception |

|||||||

| Class A Shares at NAV |

3.77% | 1.70% | ||||||

| Class A Shares at maximum Offering Price |

(2.18)% | (0.77)% | ||||||

| Class C Shares |

2.99% | 0.93% | ||||||

| Class R3 Shares |

3.55% | 1.43% | ||||||

| Class I Shares |

4.02% | 1.94% | ||||||

Since inception returns are from 5/04/12. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Share Class | ||||||||||||||||

| Class A | Class C | Class R3 | Class I | |||||||||||||

| Gross Expense Ratios* |

10.24% | 10.33% | 9.61% | 9.16% | ||||||||||||

| Net Expense Ratios* |

1.22% | 1.97% | 1.47% | 0.97% | ||||||||||||

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through December 31, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring December 31, 2014 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | The expense ratios include acquired fund fees and expenses of 0.29%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

| 12 | Nuveen Investments |

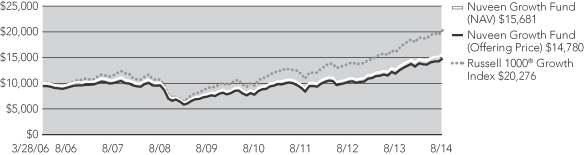

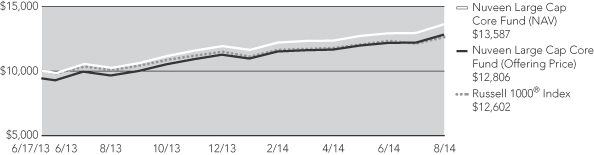

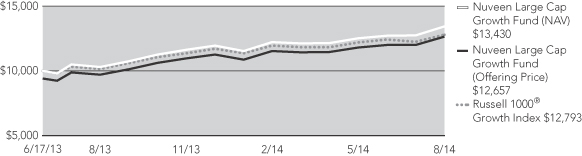

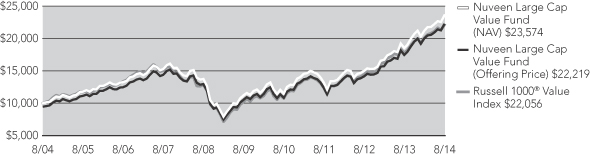

Growth of an Assumed $10,000 Investment as of August 31, 2014 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 13 |

Fund Performance and Expense Ratios (continued)

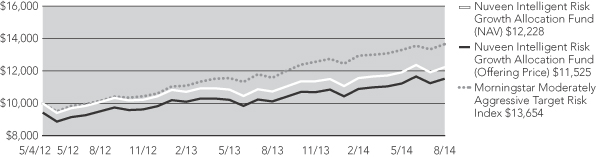

Nuveen Intelligent Risk Growth Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of August 31, 2014

| Average Annual | ||||||||

| 1-Year | Since Inception |

|||||||

| Class A Shares at NAV |

13.95% | 9.03% | ||||||

| Class A Shares at maximum Offering Price |

7.39% | 6.29% | ||||||

| Morningstar Moderately Aggressive Target Risk Index |

17.97% | 14.37% | ||||||

| Lipper Mixed-Asset Target Allocation Growth Funds Classification Average |

19.37% | 15.64% | ||||||

| Class C Shares |

13.06% | 8.20% | ||||||

| Class R3 Shares |

13.66% | 8.75% | ||||||

| Class I Shares |

14.21% | 9.28% | ||||||

Average Annual Total Returns as of September 30, 2014 (Most Recent Calendar Quarter)

| Average Annual | ||||||||

| 1-Year | Since Inception |

|||||||

| Class A Shares at NAV |

4.37% | 6.08% | ||||||

| Class A Shares at maximum Offering Price |

(1.65)% | 3.50% | ||||||

| Class C Shares |

3.64% | 5.30% | ||||||

| Class R3 Shares |

4.13% | 5.80% | ||||||

| Class I Shares |

4.61% | 6.33% | ||||||

Since inception returns are from 5/04/12. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Share Class | ||||||||||||||||

| Class A | Class C | Class R3 | Class I | |||||||||||||

| Gross Expense Ratios* |

7.78% | 8.59% | 8.48% | 7.84% | ||||||||||||

| Net Expense Ratios* |

1.32% | 2.07% | 1.57% | 1.07% | ||||||||||||

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through December 31, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring December 31, 2014 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | The expense ratios include acquired fund fees and expenses of 0.39%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

| 14 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of August 31, 2014 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 15 |

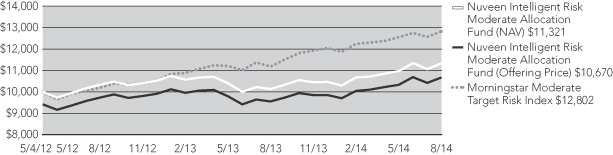

Fund Performance and Expense Ratios (continued)

Nuveen Intelligent Risk Moderate Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of August 31, 2014

| Average Annual | ||||||||

| 1-Year | Since Inception |

|||||||

| Class A Shares at NAV |

11.67% | 5.48% | ||||||

| Class A Shares at maximum Offering Price |

5.27% | 2.83% | ||||||

| Morningstar Moderate Target Risk Index |

14.69% | 11.24% | ||||||

| Lipper Mixed-Asset Target Allocation Moderate Funds Classification Average |

14.17% | 10.64% | ||||||

| Class C Shares |

10.84% | 4.68% | ||||||

| Class R3 Shares |

11.37% | 5.19% | ||||||

| Class I Shares |

11.94% | 5.72% | ||||||

Average Annual Total Returns as of September 30, 2014 (Most Recent Calendar Quarter)

| Average Annual | ||||||||

| 1-Year | Since Inception |

|||||||

| Class A Shares at NAV |

3.15% | 2.62% | ||||||

| Class A Shares at maximum Offering Price |

(2.79)% | 0.12% | ||||||

| Class C Shares |

2.36% | 1.85% | ||||||

| Class R3 Shares |

2.85% | 2.33% | ||||||

| Class I Shares |

3.40% | 2.85% | ||||||

Since inception returns are from 5/04/12. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Share Class | ||||||||||||||||

| Class A | Class C | Class R3 | Class I | |||||||||||||

| Gross Expense Ratios* |

7.11% | 8.14% | 7.45% | 7.09% | ||||||||||||

| Net Expense Ratios* |

1.29% | 2.04% | 1.54% | 1.04% | ||||||||||||

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through December 31, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring December 31, 2014 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | The expense ratios include acquired fund fees and expenses of 0.36%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

| 16 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of August 31, 2014 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 17 |

Summaries as of August 31, 2014

This data relates to the securities held in each Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings as subject to change.

A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov.

Nuveen Intelligent Risk Conservative Allocation Fund

| 18 | Nuveen Investments |

Nuveen Intelligent Risk Growth Allocation Fund

| Nuveen Investments | 19 |

Holding Summaries as of August 31, 2014 (continued)

Nuveen Intelligent Risk Moderate Allocation Fund

| 20 | Nuveen Investments |

Examples

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held through the period ended August 31, 2014.

The beginning of the period for the Funds is March 1, 2014.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

In addition to the fees and expenses which the Funds bear directly; the Funds indirectly bear a pro rata share of the fees and expenses of the exchange-traded funds in which the Funds invest. Because the exchange-traded funds have varied expenses and fee levels and the Funds may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Funds will vary. These exchange-traded fund fees and expenses are not included in the expenses shown in the table.

Nuveen Intelligent Risk Conservative Allocation Fund

| Share Class | ||||||||||||||||

| Class A | Class C | Class R3 | Class I | |||||||||||||

| Actual Performance |

||||||||||||||||

| Beginning Account Value |

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

| Ending Account Value |

$ | 1,048.10 | $ | 1,044.20 | $ | 1,046.70 | $ | 1,049.30 | ||||||||

| Expenses Incurred During Period |

$ | 4.75 | $ | 8.66 | $ | 6.09 | $ | 3.51 | ||||||||

| Hypothetical Performance (5% annualized return before expenses) |

||||||||||||||||

| Beginning Account Value |

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

| Ending Account Value |

$ | 1,020.57 | $ | 1,016.74 | $ | 1,019.26 | $ | 1,021.78 | ||||||||

| Expenses Incurred During Period |

$ | 4.69 | $ | 8.54 | $ | 6.01 | $ | 3.47 | ||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .92%, 1.68%, 1.18% and .68% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year peroid).

| Nuveen Investments | 21 |

Expense Examples (continued)

Nuveen Intelligent Risk Growth Allocation Fund

| Share Class | ||||||||||||||||

| Class A | Class C | Class R3 | Class I | |||||||||||||

| Actual Performance |

||||||||||||||||

| Beginning Account Value |

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

| Ending Account Value |

$ | 1,058.10 | $ | 1,053.40 | $ | 1,056.40 | $ | 1,058.50 | ||||||||

| Expenses Incurred During Period |

$ | 4.82 | $ | 8.70 | $ | 6.12 | $ | 3.53 | ||||||||

| Hypothetical Performance (5% annualized return before expenses) |

||||||||||||||||

| Beginning Account Value |

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

| Ending Account Value |

$ | 1,020.52 | $ | 1,016.74 | $ | 1,019.26 | $ | 1,021.78 | ||||||||

| Expenses Incurred During Period |

$ | 4.74 | $ | 8.54 | $ | 6.01 | $ | 3.47 | ||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .93%, 1.68%, 1.18% and .68% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year peroid).

Nuveen Intelligent Risk Moderate Allocation Fund

| Share Class | ||||||||||||||||

| Class A | Class C | Class R3 | Class I | |||||||||||||

| Actual Performance |

||||||||||||||||

| Beginning Account Value |

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

| Ending Account Value |

$ | 1,062.40 | $ | 1,058.20 | $ | 1,060.80 | $ | 1,063.10 | ||||||||

| Expenses Incurred During Period |

$ | 4.83 | $ | 8.72 | $ | 6.08 | $ | 3.54 | ||||||||

| Hypothetical Performance (5% annualized return before expenses) |

||||||||||||||||

| Beginning Account Value |

$ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||

| Ending Account Value |

$ | 1,020.52 | $ | 1,016.74 | $ | 1,019.31 | $ | 1,021.78 | ||||||||

| Expenses Incurred During Period |

$ | 4.74 | $ | 8.54 | $ | 5.96 | $ | 3.47 | ||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .93%, 1.68%, 1.17% and .68% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year peroid).

| 22 | Nuveen Investments |

A special shareholder meeting was held in the offices of Nuveen Investments on August 5, 2014 for Nuveen Intelligent Risk Conservative Allocation Fund, Nuveen Intelligent Risk Growth Allocation Fund and Nuveen Intelligent Risk Moderate Allocation Fund; at this meeting the shareholders were asked to vote to approve a new investment management agreement, to approve new sub-advisory agreements, to approve revisions to, or elimination of, certain fundamental investment policies and to elect Board Members.

| Nuveen Intelligent Risk Conservative Allocation Fund |

Nuveen Intelligent Risk Growth Allocation Fund |

Nuveen Intelligent Risk Moderate Allocation Fund |

||||||||||

| To approve a new investment management agreement between each Trust and Nuveen Advisors, LLC. |

||||||||||||

| For |

227,755 | 206,161 | 239,621 | |||||||||

| Against |

— | — | — | |||||||||

| Abstain |

— | — | — | |||||||||

| Broker Non-Votes |

9,998 | 36,952 | 34,467 | |||||||||

| Total |

237,753 | 243,113 | 274,088 | |||||||||

| To approve a new sub-advisory agreement between Nuveen Fund Advisors and each Fund’s sub-advisor(s) as follows: |

||||||||||||

| a. Nuveen Fund Advisors and Nuveen Asset Management, LLC |

||||||||||||

| For |

227,755 | 206,161 | 239,621 | |||||||||

| Against |

— | — | — | |||||||||

| Abstain |

— | — | — | |||||||||

| Broker Non-Votes |

9,998 | 36,952 | 34,467 | |||||||||

| Total |

237,753 | 243,113 | 274,088 | |||||||||

| To approve revisions to, or elimination of, certain fundamental investment policies: |

||||||||||||

| a. Revise the fundamental policy related to the purchase and sale of commodities. |

||||||||||||

| For |

227,755 | 206,161 | 239,621 | |||||||||

| Against |

— | — | — | |||||||||

| Abstain |

— | — | — | |||||||||

| Broker Non-Votes |

9,998 | 36,952 | 34,467 | |||||||||

| Total |

237,753 | 243,113 | 274,088 | |||||||||

| Approval of the Board Members was reached as follows: |

||||||||||||

| William Adams IV |

||||||||||||

| For |

49,378,636 | 49,378,636 | 49,378,636 | |||||||||

| Withhold |

1,137,131 | 1,137,131 | 1,137,131 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| Robert P. Bremner |

||||||||||||

| For |

49,351,001 | 49,351,001 | 49,351,001 | |||||||||

| Withhold |

1,164,766 | 1,164,766 | 1,164,766 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| Nuveen Investments | 23 |

Shareholder Meeting Report (continued)

| Nuveen Intelligent Risk Conservative Allocation Fund |

Nuveen Intelligent Risk Growth Allocation Fund |

Nuveen Intelligent Risk Moderate Allocation Fund |

||||||||||

| Jack B. Evans |

||||||||||||

| For |

49,395,570 | 49,395,570 | 49,395,570 | |||||||||

| Withhold |

1,120,197 | 1,120,197 | 1,120,197 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| William C. Hunter |

||||||||||||

| For |

49,387,571 | 49,387,571 | 49,387,571 | |||||||||

| Withhold |

1,128,196 | 1,128,196 | 1,128,196 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| David J. Kundert |

||||||||||||

| For |

49,367,384 | 49,367,384 | 49,367,384 | |||||||||

| Withhold |

1,148,383 | 1,148,383 | 1,148,383 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| John K. Nelson |

||||||||||||

| For |

49,384,058 | 49,384,058 | 49,384,058 | |||||||||

| Withhold |

1,131,709 | 1,131,709 | 1,131,709 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| William J. Schneider |

||||||||||||

| For |

49,378,386 | 49,378,386 | 49,378,386 | |||||||||

| Withhold |

1,137,381 | 1,137,381 | 1,137,381 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| Thomas S. Schreier, Jr. |

||||||||||||

| For |

49,374,764 | 49,374,764 | 49,374,764 | |||||||||

| Withhold |

1,141,003 | 1,141,003 | 1,141,003 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| Judith M. Stockdale |

||||||||||||

| For |

49,369,129 | 49,369,129 | 49,369,129 | |||||||||

| Withhold |

1,146,638 | 1,146,638 | 1,146,638 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| Carole E. Stone |

||||||||||||

| For |

49,368,193 | 49,368,193 | 49,368,193 | |||||||||

| Withhold |

1,147,574 | 1,147,574 | 1,147,574 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| Virginia L. Stringer |

||||||||||||

| For |

49,352,837 | 49,352,837 | 49,352,837 | |||||||||

| Withhold |

1,162,930 | 1,162,930 | 1,162,930 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| Terence J. Toth |

||||||||||||

| For |

49,380,576 | 49,380,576 | 49,380,576 | |||||||||

| Withhold |

1,135,191 | 1,135,191 | 1,135,191 | |||||||||

| Total |

50,515,767 | 50,515,767 | 50,515,767 | |||||||||

| 24 | Nuveen Investments |

Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Investment Trust:

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets, and the financial highlights present fairly, in all material respects, the financial position of Nuveen Intelligent Risk Conservative Allocation Fund, Nuveen Intelligent Risk Growth Allocation Fund and Nuveen Intelligent Risk Moderate Allocation Fund (each a series of the Nuveen Investment Trust, hereinafter referred to as the “Funds”) at August 31, 2014, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and the financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2014 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PRICEWATERHOUSECOOPERS LLP

Chicago, IL

October 28, 2014

| Nuveen Investments | 25 |

Nuveen Intelligent Risk Conservative Allocation Fund

| Portfolio of Investments | August 31, 2014 | |||

| Shares | Description (1), (2) | Value | ||||||||||||

| LONG-TERM INVESTMENTS – 100.7% |

||||||||||||||

| EXCHANGE-TRADED FUNDS – 100.7% |

||||||||||||||

| Commodity Funds – 22.2% | ||||||||||||||

| 8,193 | PowerShares DB Commodity Index Tracking Fund |

$ | 205,071 | |||||||||||

| 2,737 | PowerShares DB Gold Fund |

117,472 | ||||||||||||

| Total Commodity Funds |

322,543 | |||||||||||||

| Equity Funds – 37.0% | ||||||||||||||

| 1,008 | iShares® Russell 1000® Index Fund |

113,128 | ||||||||||||

| 674 | iShares® Russell 2000® Index Fund |

78,561 | ||||||||||||

| 935 | iShares® S&P North American Natural Resources Sector Index Fund |

46,058 | ||||||||||||

| 2,003 | Vanguard FTSE Developed Markets ETF |

83,505 | ||||||||||||

| 2,552 | Vanguard FTSE Emerging Markets ETF |

115,861 | ||||||||||||

| 1,320 | Vanguard REIT ETF |

101,878 | ||||||||||||

| Total Equity Funds |

538,991 | |||||||||||||

| Fixed Income Funds – 41.5% | ||||||||||||||

| 2,424 | iShares® Barclays 20+ Year Treasury Bond Fund |

288,577 | ||||||||||||

| 2,646 | iShares® National AMT-Free Municipal Bond Fund |

291,086 | ||||||||||||

| 615 | SPDR® Barclays Capital High Yield Bond Fund |

25,443 | ||||||||||||

| Total Fixed Income Funds |

605,106 | |||||||||||||

| Total Long-Term Investments (cost $1,308,231) |

1,466,640 | |||||||||||||

| Shares | Description (1) | Value | ||||||||||||

| SHORT-TERM INVESTMENTS – 2.1% |

||||||||||||||

| Money Market Funds – 2.1% | ||||||||||||||

| 30,846 | First American Treasury Obligations Fund, Class Z, 0.000%, (3) |

$ | 30,846 | |||||||||||

| Total Short-Term Investments (cost $30,846) |

30,846 | |||||||||||||

| Total Investments (cost $1,339,077) – 102.8% |

1,497,486 | |||||||||||||

| Other Assets Less Liabilities – (2.8)% |

(40,208 | ) | ||||||||||||

| Net Assets – 100% |

$ | 1,457,278 | ||||||||||||

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

| (3) | The rate shown is the annualized seven-day effective yield as of the end of the reporting period. |

| REIT | Real Estate Investment Trust. |

See accompanying notes to financial statements.

| 26 | Nuveen Investments |

Nuveen Intelligent Risk Growth Allocation Fund

| Portfolio of Investments | August 31, 2014 | |||

| Shares | Description (1), (2) | Value | ||||||||||||

| LONG-TERM INVESTMENTS – 100.8% |

||||||||||||||

| EXCHANGE-TRADED FUNDS – 100.8% |

||||||||||||||

| Equity Funds – 100.8% | ||||||||||||||

| 2,987 | iShares® Russell 1000® Index Fund |

$ | 335,231 | |||||||||||

| 6,128 | iShares® Russell 2000® Index Fund |

714,279 | ||||||||||||

| 16,172 | iShares® S&P North American Natural Resources Sector Index Fund |

796,633 | ||||||||||||

| 21,019 | Vanguard FTSE Developed Markets ETF |

876,282 | ||||||||||||

| 608 | Vanguard FTSE Emerging Markets ETF |

27,603 | ||||||||||||

| Total Long-Term Investments (cost $2,392,942) |

2,750,028 | |||||||||||||

| Shares | Description (1) | Value | ||||||||||||

| SHORT-TERM INVESTMENTS – 0.2% |

||||||||||||||

| Money Market Funds – 0.2% | ||||||||||||||

| 4,296 | First American Treasury Obligations Fund, Class Z, 0.000%, (3) |

$ | 4,296 | |||||||||||

| Total Short-Term Investments (cost $4,296) |

4,296 | |||||||||||||

| Total Investments (cost $2,397,238) – 101.0% |

2,754,324 | |||||||||||||

| Other Assets Less Liabilities – (1.0)% |

(27,623 | ) | ||||||||||||

| Net Assets – 100% |

$ | 2,726,701 | ||||||||||||

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

| (3) | The rate shown is the annualized seven-day effective yield as of the end of the reporting period. |

See accompanying notes to financial statements.

| Nuveen Investments | 27 |

Nuveen Intelligent Risk Moderate Allocation Fund

| Portfolio of Investments | August 31, 2014 | |||

| Shares | Description (1), (2) | Value | ||||||||||||

| LONG-TERM INVESTMENTS – 100.7% |

||||||||||||||

| EXCHANGE-TRADED FUNDS – 100.7% |

||||||||||||||

| Commodity Funds – 22.1% | ||||||||||||||

| 3,915 | PowerShares DB Commodity Index Tracking Fund |

$ | 97,992 | |||||||||||

| 10,935 | PowerShares DB Gold Fund |

469,331 | ||||||||||||

| Total Commodity Funds |

567,323 | |||||||||||||

| Equity Funds – 71.4% | ||||||||||||||

| 2,980 | iShares® Russell 1000® Index Fund |

334,445 | ||||||||||||

| 2,442 | iShares® Russell 2000® Index Fund |

284,640 | ||||||||||||

| 6,116 | iShares® S&P North American Natural Resources Sector Index Fund |

301,274 | ||||||||||||

| 7,883 | Vanguard FTSE Developed Markets ETF |

328,642 | ||||||||||||

| 7,362 | Vanguard FTSE Emerging Markets ETF |

334,235 | ||||||||||||

| 3,214 | Vanguard REIT ETF |

248,057 | ||||||||||||

| Total Equity Funds |

1,831,293 | |||||||||||||

| Fixed Income Funds – 7.2% | ||||||||||||||

| 1,546 | iShares® Barclays 20+ Year Treasury Bond Fund |

184,050 | ||||||||||||

| Total Long-Term Investments (cost $2,243,842) |

2,582,666 | |||||||||||||

| Shares | Description (1) | Value | ||||||||||||

| SHORT-TERM INVESTMENTS – 0.7% |

||||||||||||||

| Money Market Funds – 0.7% | ||||||||||||||

| 17,523 | First American Treasury Obligations Fund, Class Z, 0.000%, (3) |

$ | 17,523 | |||||||||||

| Total Short-Term Investments (cost $17,523) |

17,523 | |||||||||||||

| Total Investments (cost $2,261,365) – 101.4% |

2,600,189 | |||||||||||||

| Other Assets Less Liabilities – (1.4)% |

(35,749 | ) | ||||||||||||

| Net Assets – 100% |

$ | 2,564,440 | ||||||||||||

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

| (3) | The rate shown is the annualized seven-day effective yield as of the end of the reporting period. |

| REIT | Real Estate Investment Trust. |

See accompanying notes to financial statements.

| 28 | Nuveen Investments |

| Assets and Liabilities | August 31, 2014 |

| Intelligent Risk Conservative Allocation |

Intelligent Risk Growth Allocation |

Intelligent Risk Moderate Allocation |

||||||||||

| Assets |

||||||||||||

| Long-term investments, at value (cost $1,308,231, $2,392,942 and $2,243,842, respectively) |

$ | 1,466,640 | $ | 2,750,028 | $ | 2,582,666 | ||||||

| Short-term investments, at value (cost approximates value) |

30,846 | 4,296 | 17,523 | |||||||||

| Receivable for: |

||||||||||||

| Reimbursement from Adviser |

— | 5,340 | 1,625 | |||||||||

| Shares sold |

94 | — | — | |||||||||

| Other assets |

4,414 | 4,411 | 4,412 | |||||||||

| Total assets |

1,501,994 | 2,764,075 | 2,606,226 | |||||||||

| Liabilities |

||||||||||||

| Payable for: |

||||||||||||

| Dividends |

3,743 | — | — | |||||||||

| Shares redeemed |

146 | — | — | |||||||||

| Accrued expenses: |

||||||||||||

| Management fees |

10,079 | — | — | |||||||||

| Trustees fees |

53 | 68 | 65 | |||||||||

| 12b-1 distribution and service fees |

196 | 309 | 349 | |||||||||

| Professional fees |

20,555 | 20,562 | 20,558 | |||||||||

| Shareholder reporting expenses |

8,054 | 14,452 | 18,697 | |||||||||

| Other |

1,890 | 1,983 | 2,117 | |||||||||

| Total liabilities |

44,716 | 37,374 | 41,786 | |||||||||

| Net assets |

$ | 1,457,278 | $ | 2,726,701 | $ | 2,564,440 | ||||||

| Class A Shares |

||||||||||||

| Net assets |

$ | 310,401 | $ | 603,172 | $ | 367,265 | ||||||

| Shares outstanding |

14,861 | 25,106 | 16,607 | |||||||||

| Net asset value (“NAV”) per share |

$ | 20.89 | $ | 24.03 | $ | 22.12 | ||||||

| Offering price per share (NAV per share plus maximum sales charge of 5.75% of offering price) |

$ | 22.16 | $ | 25.50 | $ | 23.47 | ||||||

| Class C Shares |

||||||||||||

| Net assets |

$ | 135,752 | $ | 190,117 | $ | 309,326 | ||||||

| Shares outstanding |

6,505 | 7,957 | 14,080 | |||||||||

| NAV and offering price per share |

$ | 20.87 | $ | 23.89 | $ | 21.97 | ||||||

| Class R3 Shares |

||||||||||||

| Net assets |

$ | 52,195 | $ | 59,942 | $ | 55,179 | ||||||

| Shares outstanding |

2,500 | 2,500 | 2,500 | |||||||||

| NAV and offering price per share |

$ | 20.88 | $ | 23.98 | $ | 22.07 | ||||||

| Class I Shares |

||||||||||||

| Net assets |

$ | 958,930 | $ | 1,873,470 | $ | 1,832,670 | ||||||

| Shares outstanding |

45,911 | 77,859 | 82,786 | |||||||||

| NAV and offering price per share |

$ | 20.89 | $ | 24.06 | $ | 22.14 | ||||||

| Net assets consist of: |

||||||||||||

| Capital paid-in |

$ | 1,227,700 | $ | 2,221,775 | $ | 2,171,014 | ||||||

| Undistributed (Over-distribution of) net investment income |

(3,232 | ) | 39,245 | — | ||||||||

| Accumulated net realized gain (loss) |

74,401 | 108,595 | 54,602 | |||||||||

| Net unrealized appreciation (depreciation) |

158,409 | 357,086 | 338,824 | |||||||||

| Net assets |

$ | 1,457,278 | $ | 2,726,701 | $ | 2,564,440 | ||||||

| Authorized shares – per class |

Unlimited | Unlimited | Unlimited | |||||||||

| Par value per share |

$ | 0.01 | $ | 0.01 | $ | 0.01 | ||||||

See accompanying notes to financial statements.

| Nuveen Investments | 29 |

| Operations | Year Ended August 31, 2014 |

| Intelligent Risk Conservative Allocation |

Intelligent Risk Growth Allocation |

Intelligent Risk Moderate Allocation |

||||||||||

| Investment Income |

$ | 78,981 | $ | 91,460 | $ | 78,401 | ||||||

| Expenses |

||||||||||||

| Management fees |

26,963 | 35,393 | 35,112 | |||||||||

| 12b-1 service fees – Class A Shares |

747 | 1,084 | 1,032 | |||||||||

| 12b-1 distribution and service fees – Class C Shares |

1,060 | 2,002 | 2,711 | |||||||||

| 12b-1 distribution and service fees – Class R3 Shares |

250 | 285 | 262 | |||||||||

| Shareholder servicing agent fees and expenses |

1,324 | 1,912 | 2,040 | |||||||||

| Custodian fees and expenses |

8,647 | 8,590 | 8,936 | |||||||||

| Trustees fees and expenses |

100 | 135 | 129 | |||||||||

| Professional fees |

25,509 | 25,724 | 25,780 | |||||||||

| Shareholder reporting expenses |

8,754 | 25,378 | 25,207 | |||||||||

| Federal and state registration fees |

36,062 | 36,069 | 36,060 | |||||||||

| Other expenses |

3,359 | 3,363 | 3,370 | |||||||||

| Total expenses before fee waiver/expense reimbursement |

112,775 | 139,935 | 140,639 | |||||||||

| Fee waiver/expense reimbursement |

(86,897 | ) | (105,299 | ) | (105,618 | ) | ||||||

| Net expenses |

25,878 | 34,636 | 35,021 | |||||||||

| Net investment income (loss) |

53,103 | 56,824 | 43,380 | |||||||||

| Realized and Unrealized Gain (Loss) |

||||||||||||

| Net realized gain (loss) from investments |

102,287 | 145,674 | 150,881 | |||||||||

| Change in net unrealized appreciation (depreciation) of investments |

186,352 | 278,771 | 318,602 | |||||||||

| Net realized and unrealized gain (loss) |

288,639 | 424,445 | 469,483 | |||||||||

| Net increase (decrease) in net assets from operations |

$ | 341,742 | $ | 481,269 | $ | 512,863 | ||||||

See accompanying notes to financial statements.

| 30 | Nuveen Investments |

| Changes in Net Assets |

| Intelligent Risk Conservative Allocation | Intelligent Risk Growth Allocation | |||||||||||||||||

| Year Ended |

Year Ended 8/31/13 |

Year Ended |

Year Ended 8/31/13 |

|||||||||||||||

| Operations |

||||||||||||||||||

| Net investment income (loss) |

$ | 53,103 | $ | 21,118 | $ | 56,824 | $ | 16,026 | ||||||||||

| Net realized gain (loss) from investments |

102,287 | (26,121 | ) | 145,674 | (25,638 | ) | ||||||||||||

| Change in net unrealized appreciation (depreciation) of investments |

186,352 | (48,394 | ) | 278,771 | 58,357 | |||||||||||||

| Net increase (decrease) in net assets from operations |

341,742 | (53,397 | ) | 481,269 | 48,745 | |||||||||||||

| Distributions to Shareholders |

||||||||||||||||||

| From net investment income: |

||||||||||||||||||

| Class A |

(4,054 | ) | (3,661 | ) | (2,885 | ) | (436 | ) | ||||||||||

| Class C |

(616 | ) | (677 | ) | (363 | ) | (189 | ) | ||||||||||

| Class R3 |

(542 | ) | (788 | ) | (378 | ) | (353 | ) | ||||||||||

| Class I |

(48,098 | ) | (17,840 | ) | (20,312 | ) | (9,022 | ) | ||||||||||

| Return of capital: |

||||||||||||||||||

| Class A |

— | (481 | ) | — | — | |||||||||||||

| Class C |

— | (89 | ) | — | — | |||||||||||||

| Class R3 |

— | (103 | ) | — | — | |||||||||||||

| Class I |

— | (2,342 | ) | — | — | |||||||||||||

| Decrease in net assets from distributions to shareholders |

(53,310 | ) | (25,981 | ) | (23,938 | ) | (10,000 | ) | ||||||||||

| Fund Share Transactions |

||||||||||||||||||

| Proceeds from sale of shares |

3,562,195 | 363,762 | 3,757,395 | 1,326,303 | ||||||||||||||

| Proceeds from shares issued to shareholders due to reinvestment of distributions |

4,652 | 3,994 | 11,885 | 204 | ||||||||||||||

| 3,566,847 | 367,756 | 3,769,280 | 1,326,507 | |||||||||||||||

| Cost of shares redeemed |

(3,697,970 | ) | (40,604 | ) | (3,780,184 | ) | (93,503 | ) | ||||||||||

| Net increase (decrease) in net assets from Fund share transactions |

(131,123 | ) | 327,152 | (10,904 | ) | 1,233,004 | ||||||||||||

| Net increase (decrease) in net assets |

157,309 | 247,774 | 446,427 | 1,271,749 | ||||||||||||||

| Net assets at the beginning of period |

1,299,969 | 1,052,195 | 2,280,274 | 1,008,525 | ||||||||||||||

| Net assets at the end of period |

$ | 1,457,278 | $ | 1,299,969 | $ | 2,726,701 | $ | 2,280,274 | ||||||||||

| Undistributed (Over-distribution of) net investment income at the end of period |

$ | (3,232 | ) | $ | (1,852 | ) | $ | 39,245 | $ | 8,480 | ||||||||

See accompanying notes to financial statements.

| Nuveen Investments | 31 |

Statement of Changes in Net Assets (continued)

| Intelligent Risk Moderate Allocation | ||||||||

| Year Ended |

Year Ended 8/31/13 |

|||||||

| Operations |

||||||||

| Net investment income (loss) |

$ | 43,380 | $ | 22,163 | ||||

| Net realized gain (loss) from investments |

150,881 | (90,849 | ) | |||||

| Change in net unrealized appreciation (depreciation) of investments |

318,602 | (19,350 | ) | |||||

| Net increase (decrease) in net assets from operations |

512,863 | (88,036 | ) | |||||

| Distributions to Shareholders |

||||||||

| From net investment income: |

||||||||

| Class A |

(6,020 | ) | (1,319 | ) | ||||

| Class C |

(1,633 | ) | (412 | ) | ||||

| Class R3 |

(529 | ) | (464 | ) | ||||

| Class I |

(42,922 | ) | (13,123 | ) | ||||

| Return of capital: |

||||||||

| Class A |

— | — | ||||||

| Class C |

— | — | ||||||

| Class R3 |

— | — | ||||||

| Class I |

— | — | ||||||

| Decrease in net assets from distributions to shareholders |

(51,104 | ) | (15,318 | ) | ||||

| Fund Share Transactions |

||||||||

| Proceeds from sale of shares |

3,644,121 | 3,371,884 | ||||||

| Proceeds from shares issued to shareholders due to reinvestment of distributions |

18,350 | 2,763 | ||||||

| 3,662,471 | 3,374,647 | |||||||

| Cost of shares redeemed |

(4,110,875 | ) | (1,825,745 | ) | ||||

| Net increase (decrease) in net assets from Fund share transactions |

(448,404 | ) | 1,548,902 | |||||

| Net increase (decrease) in net assets |

13,355 | 1,445,548 | ||||||

| Net assets at the beginning of period |

2,551,085 | 1,105,537 | ||||||

| Net assets at the end of period |

$ | 2,564,440 | $ | 2,551,085 | ||||

| Undistributed (Over-distribution of) net investment income at the end of period |

$ | — | $ | 9,233 | ||||

See accompanying notes to financial statements.

| 32 | Nuveen Investments |

THIS PAGE INTENTIONALLY LEFT BLANK

| Nuveen Investments | 33 |

Highlights

Intelligent Risk Conservative Allocation

Selected data for a share outstanding throughout each period:

| Investment Operations | Less Distributions | |||||||||||||||||||||||||||||||||||||

| Class (Commencement Date)

Year Ended August 31, |

Beginning NAV |

Net Investment Income (Loss)(a) |

Net Realized/ Unrealized Gain (Loss) |

Total | From Net Invest ment Income |

From Accumulated Net Realized Gains |

Return Capital |

Total | Ending NAV |

|||||||||||||||||||||||||||||

| Class A (5/12) |

||||||||||||||||||||||||||||||||||||||

| 2014 |

$ | 19.24 | $ | 0.26 | $ | 1.66 | $ | 1.92 | $ | (0.27 | ) | $ | — | $ | — | $ | (0.27 | ) | $ | 20.89 | ||||||||||||||||||

| 2013 |

20.33 | 0.27 | (0.95 | ) | (0.68 | ) | (0.37 | ) | — | (0.04 | ) | (0.41 | ) | 19.24 | ||||||||||||||||||||||||

| 2012(d) |

20.00 | 0.10 | 0.33 | 0.43 | (0.10 | ) | — | — | (0.10 | ) | 20.33 | |||||||||||||||||||||||||||

| Class C (5/12) |

||||||||||||||||||||||||||||||||||||||

| 2014 |

19.22 | 0.12 | 1.65 | 1.77 | (0.12 | ) | — | — | (0.12 | ) | 20.87 | |||||||||||||||||||||||||||

| 2013 |

20.32 | 0.15 | (0.99 | ) | (0.84 | ) | (0.23 | ) | — | (0.03 | ) | (0.26 | ) | 19.22 | ||||||||||||||||||||||||

| 2012(d) |

20.00 | 0.05 | 0.34 | 0.39 | (0.07 | ) | — | — | (0.07 | ) | 20.32 | |||||||||||||||||||||||||||

| Class R3 (5/12) |

||||||||||||||||||||||||||||||||||||||

| 2014 |

19.22 | 0.21 | 1.67 | 1.88 | (0.22 | ) | — | — | (0.22 | ) | 20.88 | |||||||||||||||||||||||||||

| 2013 |

20.33 | 0.28 | (1.03 | ) | (0.75 | ) | (0.32 | ) | — | (0.04 | ) | (0.36 | ) | 19.22 | ||||||||||||||||||||||||

| 2012(d) |