UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07619

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Equity Funds

For investors seeking long-term capital appreciation.

Annual Report

June 30, 2013

| Share Class / Ticker Symbol | ||||||||||||

| Fund Name | Class A | Class B | Class C | Class R3 | Class R6 | Class I | ||||||

| Nuveen Large Cap Value Fund (formerly Nuveen Multi-Manager Large-Cap Value Fund) |

NNGAX | NNGBX | NNGCX | NMMTX | — | NNGRX | ||||||

| Nuveen NWQ Multi-Cap Value Fund |

NQVAX | NQVBX | NQVCX | NMCTX | — | NQVRX | ||||||

| Nuveen NWQ Large-Cap Value Fund |

NQCAX | — | NQCCX | NQCQX | — | NQCRX | ||||||

| Nuveen NWQ Small/Mid-Cap Value Fund |

NSMAX | — | NSMCX | NSQRX | — | NSMRX | ||||||

| Nuveen NWQ Small-Cap Value Fund |

NSCAX | — | NSCCX | NSCOX | NSCFX | NSCRX | ||||||

| Nuveen Tradewinds Value Opportunities Fund |

NVOAX | NVOBX | NVOCX | NTVTX | — | NVORX | ||||||

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

| Must be preceded by or accompanied by a prospectus. | NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 4 | ||||

| 5 | ||||

| 21 | ||||

| 34 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 62 | ||||

| 74 | ||||

| 87 | ||||

| 91 | ||||

| 98 | ||||

| 99 | ||||

Letter to Shareholders

| 4 | Nuveen Investments |

Nuveen Large Cap Value Fund (formerly Nuveen Multi-Manager Large-Cap Value Fund)

Nuveen NWQ Multi-Cap Value Fund

Nuveen NWQ Large-Cap Value Fund

Nuveen NWQ Small/Mid-Cap Value Fund

Nuveen NWQ Small-Cap Value Fund

Nuveen Tradewinds Value Opportunities Fund

The Nuveen Large Cap Value Fund is co-managed by Institutional Capital LLC (ICAP), Nuveen Asset Management, LLC, and Symphony Asset Management LLC (Symphony). Nuveen Asset Management and Symphony are affiliates of Nuveen Investments. Jerrold Sensor, CFA, and Thomas Wenzel, CFA, oversee the portion of the Fund’s assets managed by ICAP, while Keith Hembre, CFA and Walter French oversee the Fund’s assets managed by Nuveen Asset Management. Gunther Stein and Ross Sakamoto oversee the portion of the Fund’s assets managed by Symphony. On August 1, 2012, Thomas Cole, CFA was named portfolio manager for the portion of the Fund’s assets managed by ICAP and Joel Drescher was named portfolio manager for the portion of the Fund’s assets managed by Symphony.

Effective June 24, 2013, the Nuveen Multi-Manager Large-Cap Value was renamed the Nuveen Large Cap Value Fund. In addition, ICAP and Symphony no longer serve as sub-advisers to the Fund. Nuveen Asset Management became the Fund’s sole sub-adviser and Robert Doll, CFA, replaced the existing portfolio managers. The Fund’s principal investment strategies also changed and the Fund’s primary benchmark changed from the S&P 500 Index to the Russell 1000 Value Index. Please see the Fund’s most recent prospectus for more information.

The Nuveen NWQ Multi-Cap Value Fund, Nuveen NWQ Large-Cap Value Fund, Nuveen NWQ Small/Mid-Cap Value Fund and Nuveen NWQ Small-Cap Value Fund feature equity management by NWQ Investment Management Company, LLC (NWQ), an affiliate of Nuveen Investments. Jon Bosse is the Chief Investment Officer of NWQ and manages the Nuveen NWQ Multi-Cap Value and Large-Cap Value Funds. Phyllis Thomas manages the Nuveen NWQ Small/Mid-Cap Value and Small-Cap Value Funds.

The Nuveen Tradewinds Value Opportunities Fund features portfolio management by Tradewinds Global Investors, LLC (Tradewinds), an affiliate of Nuveen Investments. Joann Barry, CFA and F. Rowe Michels, CFA serve as portfolio managers of the Fund.

What factors affected the U.S. economy and equity markets during the twelve-month period ended June 30, 2013?

During this reporting period, the U.S. economy’s progress toward recovery from recession continued at a moderate pace. The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. The Fed also continued its monthly purchases of $40 billion of mortgage-backed securities and $45 billion of longer-term Treasury securities in an open-ended effort to bolster growth. However, at its June 2013 meeting, the Central Bank indicated that downside risks to the economy had diminished since the fall of 2012. Although the Fed made no changes to its highly accommodative monetary policies at the June meeting, Chairman Bernanke’s remarks afterward indicated the Central Bank could slow the pace of its bond buying program later this year if the economy continues to improve.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

| Nuveen Investments | 5 |

As measured by gross domestic product (GDP), the U.S. economy grew at an estimated annualized rate of 1.7% in the second quarter of 2013, compared with 1.1% for the first quarter, continuing the pattern of positive economic growth for the 16th consecutive quarter. The Consumer Price Index (CPI) rose 1.8% year-over-year as of June 2013, while the core CPI (which excludes food and energy) increased 1.6% during the period, staying within the Fed’s unofficial objective of 2.0% or lower for this inflation measure. Meanwhile, labor market conditions continued to slowly show signs of improvement, although unemployment remained above the Central Bank’s 6.5% target. As of June 2013, the national unemployment rate was 7.6%, down from 8.2% a year ago. The housing market, long a major weak spot in the U.S. economic recovery, also delivered some good news as the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 12.2% for the twelve months ended May 2013 (most recent data available at the time this report was prepared). This marked the largest twelve-month percentage gain for the index since March 2006. However, the outlook for the U.S. economy continued to be clouded by uncertainty about global financial markets and the outcome of the “fiscal cliff.” The tax consequences of the fiscal cliff situation, which had been scheduled to become effective in January 2013, were averted through a last minute deal that raised payroll taxes, but left in place a number of tax breaks. However, lawmakers postponed and then failed to reach a resolution on $1.2 trillion in spending cuts intended to address the federal budget deficit. As a result, automatic spending cuts (or sequestration) affecting both defense and non-defense programs (excluding Social Security and Medicaid) took effect March 1, 2013, with potential implications for U.S. economic growth over the next decade. In late March 2013, Congress passed legislation that established federal funding levels for the remainder of fiscal 2013, which ends on September 30, 2013, preventing a federal government shutdown. The proposed federal budget for fiscal 2014 remains under debate.

With the fairly benign macro environment and ongoing low interest rates, U.S. investors continued to move out the risk spectrum, resulting in robust flows into U.S. equity funds. Leading U.S. stock market indexes, including the S&P 500® Index, the Dow Jones Industrial Average and the Russell 2000® Index, each hit new all-time highs during the period, with the S&P 500® Index gaining 20.60% over the twelve-month time frame. Sluggish global growth, muted inflation globally and ongoing fiscal drag provided a backdrop for continued monetary policy actions outside the United States as well, which drove very strong equity market advances globally. In Japan, new Prime Minister Shinzo Abe articulated policies to the market designed to re-invigorate Japan’s weak economy. Widespread optimism for his strategies led to a massive rally in the Japanese equity market. Elsewhere, the European Central Bank signaled an extended period of low rates while the U.K’s Bank of England pursued its most aggressive monetary policy of all time. Returns for developed markets outside the United States were very strong, as evidenced by the MSCI EAFE Index’s advance of 18.62% for the reporting period. In emerging market countries, which are more dependent on global growth and commodity prices, stock market returns significantly lagged developed markets over the period.

How did the Funds perform during the twelve-month reporting period ended June 30, 2013?

The tables in the Fund Performance and Expense Ratios section of this report provide Class A Share total returns for the Funds for the one-year, five-year, ten-year and/or since inception periods ended June 30, 2013. Each Funds’ Class A Share total returns at net asset value (NAV) are compared with the performance of their corresponding market indexes and peer group averages. A more detailed account of each Fund’s performance is provided later in this report.

What strategies were used to manage the Funds during the twelve-month reporting period ended June 30, 2013? How did these strategies influence performance?

Nuveen Large Cap Value Fund (formerly Nuveen Multi-Manager Large-Cap Value Fund)

The Nuveen Large Cap Value Fund’s Class A Shares at NAV outperformed the S&P 500® Index but underperformed the Russell 1000® Value Index and the comparative Lipper classification average over the twelve-month period ended June 30, 2013.

| 6 | Nuveen Investments |

During the period, the Fund used three separate sub-advisers to seek large capitalization value stocks with the potential for long-term capital appreciation. ICAP uses a value-oriented investment strategy that attempts to identify stocks offering the best relative value and stable to rising earnings from a universe of large and mid-sized companies. It then selects a portion of those stocks that are identified to have a catalyst for change and monitors these holdings closely to determine if circumstances change. For the Nuveen Asset Management portion of the Fund, we create proprietary models to help establish quantitative links between economic/market variables, investment factors and equity market returns. Our proprietary models analyze macroeconomic and market data and other statistics to determine what we believe will be the key drivers of performance in the current economy. We also use historical analysis of these drivers to estimate equity market return and the relative contribution to market returns for a comprehensive list of investment factors. We evaluate each stock in the investable universe to determine its sensitivity to the expected returns for each factor and estimate a potential contribution for each stock. The Fund’s portfolio will include stocks that we believe target the highest expected returns within the established risk budget. Symphony seeks to deliver consistent returns through an investment process that combines quantitative screens and fundamental research. The portfolio construction process utilizes a proprietary optimizer designed to potentially generate an optimal risk reward balance versus the stated benchmark.

In the portion of the portfolio managed by ICAP, security selection detracted from the Fund’s performance in relative terms, while sector allocation was a corresponding positive. Specifically, stock picking in the basic industries, energy and communications sectors were sources of underperformance relative to the Russell Index, while security selection in the consumer services, capital spending and retail sectors contributed positively. In terms of sector allocation, the portfolio benefited the most from limiting exposure to the underperforming utilities group, which we had deemphasized because of our view that the sector was generally overvalued. Underweighting the financials sector, however, detracted from relative performance.

Throughout the reporting period, we consistently followed our bottom-up stock-selection investment process. In other words, we chose investments one-by-one, based on our view of their valuation and opportunities for price improvement in relation to other stocks. We purchased or increased our exposure to stocks we believed offered good value along with a potential catalyst for a rising stock price. In contrast, we sold or cut the Fund’s weighting in securities whose appreciation prospects we believed were limited.

As we consistently pursued this approach, we also responded to evolving market conditions by taking advantage of opportunities to buy and sell stocks when we believed we could add value by doing so. In health care, for example, we sold the portfolio’s shares of pharmaceutical maker Merck after it reached our target price. In both cases, we believed these stocks provided better performance prospects. Elsewhere, we eliminated positions in Procter & Gamble, a maker of household and personal care products; and oil and gas producer Occidental Petroleum, while establishing new positions in oilfield services company Halliburton, regional bank PNC Financial and drug retailer CVS Caremark.

On an individual basis, the Fund’s portfolio’s three largest relative detractors were Canadian gold miner Barrick Gold, U.K.-based wireless communications provider Vodafone and Microsoft. Barrick Gold detracted, as the firm’s results were hindered by higher-than-expected costs associated with mine development and production. We sold this position because we were concerned this risk would likely be ongoing. Vodafone’s businesses in Southern Europe weighed on the company’s financial results, although we also note the company’s strong performance in the United States and emerging markets. At period end, we believed the stock was attractively valued and saw opportunities for the company to return cash to shareholders, in light of the potential for continued dividends from Verizon Wireless, of which Vodafone owns a 45% stake. Of final note, Microsoft detracted, in part because it was premature to determine how the recently launched Windows 8 operating system would affect the company’s results.

On the positive side, the Fund’s top contributors to relative performance were media company Time Warner, diversified financial services firm Citigroup and diversified industrial company Honeywell International. In addition to continuing its

| Nuveen Investments | 7 |

successful business operation, Time Warner returned cash to shareholders by increasing dividends and stock buybacks and also provided investors with expectations for better growth in affiliate-fee revenue. In the financials sector, Citigroup’s financial results improved, as ongoing efforts to increase efficiency and operating leverage began to pay off. The company also benefited from a more-favorable interest rate environment and increased level of capital. Honeywell’s restructuring and initiatives to improve productivity yielded increased profit margins, which in turn improved the firm’s financial results.

The portion of the portfolio managed by Nuveen Asset Management both overweights sectors where we anticipate stronger performance and selects the names within the sectors that appear to have the strongest prospects. Over the year, the Fund benefitted from our selection of stocks, but the timing of our sector emphases reduced the benefit.

On average, the Fund was overweighted information technology and financials during the period, and underweighted energy, materials, industrials, and consumer discretionary names. The largest single sector overweight was in information technology. The overweighting did not correspond to the periods of the sector’s highest returns, causing a slight drag from the weights, but this was more than compensated by selections within the sector that outperformed the benchmark’s names. Financials contributed very strongly from our selection and also from the timing of our over weight.

Over the year, the largest average sector underweight was to materials. This sector was a weak performer over the year, and our selection also added value, making this an even stronger contributor to the Fund’s relative performance versus the index. Overall, sector weightings were a negative to the Fund’s relative performance versus the index.

Performance attributable to the individual stock holdings within sectors was a net positive for the Fund during the reporting period, with the stock picks within the financials sector having the largest positive impact. The holdings within the information technology, energy and materials sectors were also a positive for the Fund. Holdings within the staples and industrials sectors resulted in negative relative performance for the Fund.

For the portion of the portfolio managed by Symphony, we continued to be invested in companies with relatively strong fundamentals. Stock selection in the materials and energy sectors were the largest contributors to relative performance. Overweight positions in LyondellBasell Industries and Marathon Petroleum Corporation benefited performance over the period. Selection within the consumer discretionary and consumer staples sectors detracted from performance over the period. In particular, overweight exposures to International Game Technology and Altria Group had negative impacts on returns.

As mentioned previously, effective June 24, 2013, Nuveen Asset Management became the Fund’s sole sub-adviser and Robert (Bob) Doll replaced the teams that managed the Fund for the majority of this reporting period. Mr. Doll, a CFA with 33 years of financial industry experience, is chief equity strategist and a senior portfolio manager at Nuveen Asset Management. In addition, the Fund’s primary benchmark changed from the S&P 500® Index to the Russell 1000® Value Index and its principal investment strategies were modified. As a result, Mr. Doll made significant changes to transition the Fund’s portfolio to the new approach in the final week of the reporting period. He employed his disciplined approach for managing large cap equity strategies that combines a balance of fundamental analysis and quantitative techniques. He identified potential holdings for the Fund’s portfolio based on security rankings provided by Nuveen’s multi-factor quantitative models combined with fundamental analysis by the firm’s team of 17 sector-specific analysts. Mr. Doll then applied his own extensive industry insights and fundamental research to select Fund holdings from among those candidates. Using this approach, he significantly reduced the number of holdings in the Fund from around 300 to slightly less than 100 as of June 30, 2013. Shareholders can expect the Fund’s portfolio to retain this more concentrated approach going forward with approximately 90-125 holdings. In addition, Mr. Doll structured the Fund’s portfolio to include a broader capitalization range, shifting it from nearly all large- and mega-cap companies to include more mid-cap holdings. This has lowered the Fund’s average weighted market capitalization from around $87 billion to approximately $65 billion

| 8 | Nuveen Investments |

as of period end. Now that the transition is complete, the Fund’s turnover going forward is expected to remain in line with or slightly below its historical average of around 100% per year.

Nuveen NWQ Multi-Cap Value Fund

Class A Shares at NAV for the Nuveen NWQ Multi-Cap Value Fund underperformed both the Russell 3000® Value Index and its Lipper classification average for the twelve-month period ended June 30, 2013.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with large, medium and small market capitalizations that are selected on an opportunistic basis. Generally, the Fund’s manager looks for undervalued companies where catalysts exist that may help unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

The Fund’s foreign holdings detracted from relative performance for the year, attributable mostly to sharp declines in gold mining stocks AngloGold Ashanti and Barrick Gold. A small position in AuRico Gold was eliminated from the Fund in December. Most of the Fund’s remaining foreign holdings appreciated during the period, including a significant position in pharmaceutical manufacturer, Sanofi. Foreign holdings in the energy sector, Canadian Natural and Talisman Energy, both contributed modest gains.

Most of our financial holdings outperformed on the strength of improving fundamentals, including stronger capital positions, ongoing cost cutting initiatives, and a steady recovery in the housing market. The Fund’s insurance holdings rose sharply during the period and were driven by continued strong fundamentals, improving capital positions and company specific initiatives. Higher interest rates over the last several months and a broader shift in sentiment have also helped life insurance valuations move higher.

Hartford Financial’s significant outperformance was driven by continued execution of its strategic plan, improving fundamentals in its runoff life insurance business combined with steady returns in its property-casualty insurance division. In 2013, Hartford took advantage of strong equity markets in Japan and a weakening yen to fully hedge its Japan variable annuity block. In addition, the performance of its runoff life insurance unit, Talcott Resolution, has been better than expected and the unit has become capital self-sufficient earlier than originally expected. As a result, Hartford’s excess capital position improved and the company recently announced an increase in its share buyback authorization as well as a 50% increase in its annual common dividend.

American International Group (AIG) continues its transformation and the de-risking of its balance sheet. The company’s ongoing execution of its strategic plan combined with higher interest rates drove the outperformance of the shares. With the sale of a number of assets over the past year, AIG is focused on improving its overall return on equity (ROE) through better underwriting, expense management, and claims management in its core businesses, Chartis and SunAmerica. We have now seen several quarters of improving fundamentals at Chartis and the company remains committed to disposing of International Lease Finance Corp. and returning excess capital to shareholders over the next several years.

Unum Group appreciated as investors began to recognize that the company was earning its cost of capital while trading at a significant discount to its book value. In addition, Unum has been returning a substantial part of its earnings to shareholders in the form of dividends and share repurchases. Unum’s underwriting discipline combined with active capital management and higher interest rates have brought the stock’s valuation more in line with the company’s solid fundamentals. The company’s disability benefits business has consistently performed better than its peers struggling with rising incidence and lower claims recoveries. Unum continues to have one of the strongest balance sheets in the industry, and an ongoing employee benefits business that is generating ROEs in the low double digits. Unum will continue to deploy about $500 million toward share buybacks in each of the next two years.

| Nuveen Investments | 9 |

For Reinsurance Group of America (RGA), inconsistent mortality experience across several geographies and issues in the company’s group business in Australia drove choppy stock price performance during most of the year. More recently, the stock’s performance has been helped by rising interest rates and a continued strong pipeline of accretive reinsurance transactions as primary insurers look to offload closed blocks of business.

The insurance brokers have enjoyed meaningful stock price appreciation over the last year as they focus on generating solid organic growth despite a peak in commercial lines pricing and a lackluster macro environment. AON Plc continues to make progress on its revenue enhancing initiatives in its insurance brokerage business and improving margins in the consulting business post its acquisition of Hewitt. More consistent earnings performance, improving cash flows driven by revenue enhancing initiatives, and greater accretion from its relocation to the UK drove nearly 40% upside in the stock.

Willis Group Holdings’ new CEO has already made great strides at the company in 2013, replacing the head of its challenged North American business and almost immediately simplifying accounting and reporting at the company. The CEO’s strategic overview, increased transparency, and the advent of a simpler story have resulted in more positive sentiment toward Willis from the investment community.

General Motors also benefited as fears of a renewed recession in the U.S. have diminished, while the economic slowdown in Europe appears to be near the bottom. The company’s large pickup truck is well positioned to benefit from a recovery in the U.S. housing market with its new GM K2XX truck expected to boost profits in 2013 and more significantly in 2014. A management shakeup at Opel Europe and current restructuring initiatives are also likely to significantly lower losses at that division in 2013.

Our gold mining stocks AngloGold Ashanti and Barrick Gold performed poorly for the year. The recent environment for gold prices has been challenging for the Fund’s gold miners, Barrick Gold and AngloGold. Recent noise regarding the Fed tapering of quantitative easing, higher interest rates, and Japanese stimulus have all led to strength in the dollar and gold weakness. Current gold prices are roughly equivalent to the true full cost of mining for many producers. We believe that there remains a case for gold in an uncertain world as the economy has yet to prove traction without massive amounts of monetary stimulus. Should the economy weaken in the face of less Fed action, stimulus would likely resume and gold prices would react favorably. Gold companies have also been negatively impacted by project cost overruns, sovereign (host country) renegotiation over the past several years, in addition to the recent decline in the gold price. More recently, heightened labor strife in South Africa has been a concern. We have trimmed the Fund’s gold holdings during the past year, and have maintained exposure to the stocks given potential positive catalysts, including the sell or spin-off of assets, as well as new projects that, once completed, should result in a significant ramp up in free cash flow.

Also detracting from performance was Mattson Technology, which produces semiconductor equipment for the manufacture of memory chips. As the global economy slowed, the semiconductor industry pulled back on orders for new equipment, particularly in China as several memory chip foundries pushed out their spending intentions. When orders didn’t materialize, Mattson was stuck with elevated inventory levels and operating expenses that could not be offset. We ultimately exited the position as we became concerned that liquidity issues could emerge if the company was unable to sell assets, or faced a protracted downturn that consumed all of their remaining cash.

New holdings added to the Fund during the year include Harman International Industries, LSI Corp, McDermott International, Microsoft, Tyson Foods, PennyMac Financial Services, Vodafone Group Plc, and Willis Group. We also increased our stakes in several existing positions during the period.

Low interest rates have been a major headwind for bank and insurance company earnings the past few years, and we would expect profitability for these companies to improve from a steeper yield curve and higher returns on their investment portfolios. We believe several other of the Fund’s holdings would also react positively to a steady and measured rise in interest rates from current levels. If the rise in rates is gradual and accompanied by an improvement in the labor market, it would be viewed as a vote of confidence for the economy and bullish for equities in general. In such

| 10 | Nuveen Investments |

an environment, we would expect the Fund’s more cyclical holdings in the energy, materials, technology, and consumer discretionary (auto, advertising/media) sectors to perform well given an uptick in economic activity and attractive valuations. Furthermore, pension liabilities for companies with pension obligations, such as General Motors, would also be lower in a higher interest rate environment. We would add that increased interest rates will likely be a negative for more defensive sectors of the market such as utilities and consumer staples where dividend yields are usually higher and valuations less attractive. These are areas where the Fund is underweight versus the benchmark.

Nuveen NWQ Large-Cap Value Fund

The Fund’s Class A Shares at NAV underperformed both the comparative Lipper classification average and the Russell 1000® Value Index for the twelve-month period ended June 30, 2013.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with large market capitalizations that are selected on an opportunistic basis. Generally, the Fund’s manager looks for undervalued companies where catalysts exist that may help unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

During the reporting period, the strength of holdings in the consumer discretionary, finance and producer durables goods sectors contributed to the Fund’s performance. Finance was the best performing sector of the market during the past year, and we opportunistically increased our positions in this sector in the third quarter of 2012 with increased stakes in American International Group, Capital One, and Hartford Financial. We also opportunistically added to various positions in the energy and technology sectors, two sectors of the market that have lagged.

The Fund’s foreign holdings detracted relative performance for the year, attributable mostly to sharp declines in gold mining stocks AngloGold Ashanti and Barrick Gold. Most of the Fund’s remaining foreign holdings appreciated during the period, including a significant position in pharmaceutical manufacturer, Sanofi. Foreign holdings in the energy sector, Canadian Natural and Talisman Energy, both contributed modest gains.

Most of our financial holdings outperformed on the strength of improving fundamentals, including stronger capital positions, ongoing cost cutting initiatives, and a steady recovery in the housing market. Two notable investments in the sector included Citigroup and Hartford Financial. New management at Citigroup continued to prune assets in its Citi Holdings segment and has sold/closed overseas operations that were not earning their cost of capital.

The Fund’s insurance holdings rose sharply during the period and were driven by continued strong fundamentals, improving capital positions, and company specific initiatives. Higher interest rates over the last several months and a broader shift in sentiment have also helped life insurance valuations move higher.

Hartford Financial’s significant outperformance was driven by continued execution of its strategic plan, improving fundamentals in its runoff life insurance business combined with steady returns in its property-casualty insurance division. In 2013, Hartford took advantage of strong equity markets in Japan and a weakening Yen to fully hedge its Japan variable annuity block. In addition, the performance of its runoff life insurance unit, Talcott Resolution, has been better than expected and the unit has become capital self-sufficient earlier than originally expected. As a result, Hartford’s excess capital position improved and the company recently announced an increase in its share buyback authorization as well as a 50% increase in its annual common dividend.

American International Group (AIG) continues its transformation and the de-risking of its balance sheet. The company’s ongoing execution of its strategic plan combined with higher interest rates drove the outperformance of the shares. With the sale of a number of assets over the past year, AIG is focused on improving its overall return on equity (ROE) through better underwriting, expense management, and claims management in its core businesses, Chartis and SunAmerica. We have now seen several quarters of improving fundamentals at Chartis and the company remains committed to disposing of International Lease Finance Corp. and returning excess capital to shareholders over the next several years.

| Nuveen Investments | 11 |

MetLife and Unum Group both outperformed, primarily reflecting higher interest rates and the resulting better sentiment towards the life insurance group in general. MetLife is a leading life insurer with a strong franchise generating a tangible ROE in the mid-teens whose absolute valuation remains attractive. While it appears that MetLife will be named a non-bank systemically important financial institution (SIFI) and its return of capital to shareholders has been delayed for over a year now, management recently raised the common dividend after successfully de-banking and is focused on growing its international business as evidenced by its recent accretive acquisition of BBVA’s Chilean pension business. Unum Group appreciated as investors began to recognize that the company was earning its cost of capital while trading at a significant discount to its book value. In addition, Unum has been returning a substantial part of its earnings to shareholders in the form of dividends and share repurchases.

Unum’s underwriting discipline combined with active capital management and higher interest rates have brought the stock’s valuation more in line with the company’s solid fundamentals. The company’s disability benefits business has consistently performed better than its peers struggling with rising incidence and lower claims recoveries. Unum continues to have one of the strongest balance sheets in the industry, and an ongoing employee benefits business that is generating ROEs in the low double digits. Unum will continue to deploy about $500 million toward share buybacks in each of the next two years.

The insurance brokers have enjoyed meaningful stock price appreciation over the last year as they focus on generating solid organic growth despite a peak in commercial lines pricing and a lackluster macro environment. AON Plc continues to make progress on its revenue enhancing initiatives in its insurance brokerage business and improving margins in the consulting business post its acquisition of Hewitt. More consistent earnings performance, improving cash flows driven by revenue enhancing initiatives, and greater accretion from its relocation to the UK drove nearly 40% upside in the stock.

Lastly, Time Warner appreciated given improving long-term fundamentals along with near term catalysts that are driving earnings. The company is experiencing good ratings momentum across most of its cable networks given a successful mix of new and returning shows at both TBS and TNT networks. Ninety percent of Turner Broadcasting’s affiliate fee deals are renewable between 2014 through 2016, and the improved ratings provide management with increased bargaining power.

Our gold mining stocks AngloGold Ashanti and Barrick Gold performed poorly for the year. The recent environment for gold prices has been challenging for the Fund’s gold miners, Barrick Gold and AngloGold. Recent noise regarding the Fed tapering of quantitative easing, higher interest rates, and Japanese stimulus have all led to strength in the dollar and gold weakness. Current gold prices are roughly equivalent to the true full cost of mining for many producers. We believe that there remains a case for gold in an uncertain world as the economy has yet to prove traction without massive amounts of monetary stimulus. Should the economy weaken in the face of less Fed action, stimulus would likely resume and gold prices would react favorably. Gold companies have also been negatively impacted by project cost overruns, sovereign (host country) renegotiation over the past several years, in addition to the recent decline in the gold price. More recently, heightened labor strife in South Africa has been a concern. We have trimmed the Fund’s gold holdings during the past year, and have maintained exposure to the stocks given potential positive catalysts, including the sell or spin-off of assets, as well as new projects that, once completed, should result in a significant ramp up in free cash flow.

Our investment in Hewlett-Packard also declined as management struggled to turn around the company and prove earnings sustainability to the market. A catalyst for the underperformance was disappointing third quarter earnings that revealed inventory issues in its PC and printer divisions, and the write-down of its software division. We eliminated this position from the Fund in November.

New holdings added to the Fund during the year include Applied Materials, CenturyLink and Vodafone Group Plc. We also increased our stakes in several existing positions during the period.

| 12 | Nuveen Investments |

During the reporting period, we eliminated Best Buy, Hewlett-Packard, Lincoln National, Noble Energy, and Pitney Bowes from the portfolio. Lincoln National, Merck, Noble Energy and Pitney Bowes were eliminated as the stocks had reached our estimation of fair value.

Low interest rates have been a major headwind for bank and insurance company earnings the past few years, and we would expect profitability for these companies to improve from a steeper yield curve and higher returns on their investment portfolios. We believe several other of the Fund’s holdings would also react positively to a steady and measured rise in interest rates from current levels. If the rise in rates is gradual and accompanied by an improvement in the labor market, it would be viewed as a vote of confidence for the economy and bullish for equities in general. In such an environment, we would expect the Fund’s more cyclical holdings in the energy, materials, technology, and consumer discretionary (auto, advertising/media) sectors to perform well given an uptick in economic activity and attractive valuations. Furthermore, pension liabilities for companies with pension obligations such as Fund holding General Motors would also be lower in a higher interest rate environment. We would add that increased interest rates will likely be a negative for more defensive sectors of the market such as utilities and consumer staples where dividend yields are usually higher and valuations less attractive. These are areas where the Fund is underweight versus the benchmark.

Nuveen NWQ Small/Mid-Cap Value Fund

The Fund’s Class A Shares at NAV underperformed the Russell 2500® Value Index, but outperformed its Lipper classification average for the twelve-month period ended June 30, 2013.

The Fund continued to follow its disciplined investment approach, which seeks long-term capital appreciation by investing in equity securities of companies with small- to mid-market capitalizations selected using an analyst-driven, value-oriented process. The portfolio manager looks for undervalued companies where catalysts exist to unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

For the twelve-month reporting period, positive stock selection in the financial services and producer durables sectors was offset by weakness in the consumer discretionary, consumer staples and materials and processing sectors. In the broader market, value stocks performed better than growth stocks across all capitalizations.

Several positions contributed to the Fund’s positive returns for the period. Forestar Real Estate Group Inc. rose sharply during the period as the real estate market continued to show signs of improvement. Investors also warmed to Forestar’s recent acquisition of oil and gas producer Credo Petroleum as oil and gas prices rose. The acquisition is expected to more than double Forestar’s existing oil and gas production and, in our view, will provide Forestar a stream of recurring cash flows while it remains focused on monetizing its real estate acreage and mineral rights. We remain positive on the shares and believe the risk/reward is quite attractive.

TriMas Corporation also outperformed during the period. TriMas Corporation designs, manufactures and distributes various products for commercial, industrial and consumer markets worldwide. TriMas reported positive third quarter earnings as strong organic sales growth offset operating margin compression brought on by increased marketing spending and increased costs related to expanding manufacturing capacity. We believe management remains focused on improving operating margins and deleveraging the balance sheet.

Inter Parfums was also a leading contributor to performance. Shares rose sharply during the second quarter of 2013, after the company released first quarter results that exceeded expectations on stronger than expected sales of Burberry fragrances in that line’s final quarter with Inter Parfums (the license was sold back to the parent Burberry company). Significantly, sales of continuing brands Jimmy Choo and Montblanc fragrances also rose 50% and 39% respectively. We continue to find the stock attractive given the strong momentum behind Inter Parfums’ licensed fragrances and the potential for additional upside through acquisitions given the company’s strong cash position.

| Nuveen Investments | 13 |

Several positions detracted from the Fund’s performance. AuRico Gold was a leading detractor from performance and was eliminated from the portfolio during the period. Gold miners have struggled to meet earnings expectations as the decline in spot prices and structural cost inflation has squeezed margins. The decline in gold is due largely to an improving economic outlook, combined with a stronger U.S. dollar and continued low domestic inflation expectations. While AuRico remains on-track with the ramping of production at its Young Davidson mine, spot gold prices at current levels, in our view, limit the company’s earning potential. Our remaining position was eliminated during the period in light of the less compelling risk/reward.

Shares of Mistras Group also fell sharply during the period. Challenging macro-environments in many of the company’s growing markets have led customers to delay large projects and resulted in a higher percentage of lower-margin, maintenance-oriented bookings for Mistras. While pricing remains strong for the company’s premium offerings, competitors have shown a willingness to compete aggressively on price in commodity-type service offerings. As a result, organic growth has slowed and margins have compressed. We trimmed our position late in the period in light of, in our view, a lack of visibility into near term results given the limited catalyst for a rebound in margins and growth.

Salix Pharmaceuticals also detracted from performance during the period. Shares traded off in the wake of the company unexpectedly receiving a complete response letter (CLR) from the Federal Drug Administration (FDA) following its review of an injectable form of Relistor for opioid-induced constipation in chronic pain patients. The contents and implications of the CLR were not immediately disclosed but it raised concerns regarding the FDA’s review of an oral form of Relistor, which has a much larger market opportunity. As a result, we eliminated the position.

Lastly, McDermott International declined after the company reported disappointing first quarter 2013 results and lowered margin expectations for the second and third fiscal quarters. While the company still expects to achieve its 2013 full year margin guidance, margins during the second and third quarters may remain weak as the company works through temporary cost overruns and execution issues in its Atlantic and Middle Eastern regions. We added to our position on weakness in the share price. In our view, the company’s operational issues are transitory rather than structural and profitability should improve as the company works through lower margin projects. Trading at close to book value as of quarter end, we view the risk/reward as attractive given the company’s strong pipeline of projects in the offshore energy sector.

Several new positions were added to the Fund’s portfolio during the period including audio products supplier Harman International Industries. The company has dominant market share in the luxury infotainment and professional audio equipment markets and is the long-standing supplier of fully integrated systems for luxury car makers such as BMW, Audi, and Mercedes. Strong bookings of new business in recent years have supported double digit organic growth as the company continues to gain market share and content in the auto segment with its higher profit margin modular systems. We believe Harman shares offer attractive risk/reward given the company’s improving profitability, growing market share and management’s focus on improving shareholder returns via share buyback and dividend increases. Jazz Pharmaceuticals was added to the portfolio during the period. Jazz is a specialty biopharmaceutical company which focuses on the identification, development and commercialization of pharmaceutical products. The company has a diverse portfolio of products in the areas of narcolepsy, oncology, pain and psychiatry. We took advantage of a rare bit of weakness in the company’s shares and initiated a position after the company reported first quarter earnings. The share weakness was the results of management’s comments that the FDA might be seeking to approve a generic version of Xyrem. Jazz derives more than 60% of its sales from Xyrem, a controlled substance for narcolepsy. We are comfortable with Jazz’s patent protection on Xyrem, believe that Jazz’s leukemia drug Erwinaze is growing nicely, and note that Jazz has a second generation Xyrem in the clinic. While the stock has bounced back rapidly, we remain constructive on the future for Jazz.

| 14 | Nuveen Investments |

Nuveen NWQ Small-Cap Value Fund

The Fund’s Class A Shares at NAV outperformed the Russell 2000® Value Index and its Lipper classification average for the twelve-month period ended June 30, 2013.

During the reporting period, the Fund continued to follow its disciplined investment approach. The Fund seeks long-term capital appreciation by investing in equity securities of companies with small market capitalizations selected using an analyst-driven, value-oriented process. NWQ seeks to provide superior risk-adjusted returns through an analyst-driven, value-oriented process. Portfolio managers look for undervalued companies where catalysts exist to unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

Superior stock selection in the producer durables and financial services sectors drove performance, which was partially offset by weakness in the materials and processing and consumer discretionary. In the broader market, value stocks performed better than growth stocks across all capitalizations.

Several positions contributed to the Fund’s positive returns for the period. Albany International was a leading contributor to performance rising significantly during the year. Albany’s engineered composites segment is the sole source supplier for the composite cold-section fan blades and fan case for the family of jet engines which have been selected to power the majority of next generation single-aisle airplanes. During the period the company entered into a non-binding letter of intent to sell a 10% equity interest in its engineered composite segment to Safran for $28 million. Shares reacted positively to the announcement as it provided validation of the technology and clarity to the valuation of the segment. In our view, Albany’s engineered composites should be the driver of growth for the company over the long-term, and the company’s Machine Clothing segment should continue to generate solid cash flows. We continue to find the stock attractive.

Forestar Real Estate Group Inc. rose sharply during the period as the real estate market continued to show signs of improvement. Investors also warmed to Forestar’s recent acquisition of oil and gas producer Credo Petroleum as oil and gas prices rose. The acquisition is expected to more than double Forestar’s existing oil and gas production and, in our view, will provide Forestar a stream of recurring cash flows while it remains focused on monetizing its real estate acreage and mineral rights. We remain positive on the shares and believe the risk/reward is quite attractive.

TriMas Corporation also outperformed during the period. TriMas Corporation designs, manufactures and distributes various products for commercial, industrial and consumer markets worldwide. TriMas reported positive third quarter earnings as strong organic sales growth offset operating margin compression brought on by increased marketing spend and increased costs related to expanding manufacturing capacity. We believe management remains focused on improving operating margins and deleveraging the balance sheet.

Lastly, shares of Methode Electronics also rose sharply during the period. The stock appreciated over 100% since June 30, 2012. In April, Methode began shipping the center console for GM’s new K2XX truck platform; a contract that could earn the company as much as $200 million in annual revenues by 2015. The first shipments, in our view, gave investors additional confidence in the company’s ability to ramp production to meet the demands of the company’s growing backlog. Additionally, the successful launch could lead to significant additional business from GM. We continue to find the shares attractive.

Several positions detracted from the Fund’s performance. AuRico Gold was a leading detractor from performance and was eliminated from the portfolio during the period. Gold miners have struggled to meet earnings expectations as the decline in spot prices and structural cost inflation has squeezed margins. The decline in gold is due largely to an improving economic outlook, combined with a stronger U.S. dollar and continued low domestic inflation expectations. While AuRico remains on-track with the ramping of production at its Young Davidson mine, spot gold prices at current levels, in our view, limit the company’s earning potential. Our remaining position was eliminated during the period in light of the less compelling risk/reward.

| Nuveen Investments | 15 |

Shares of Mistras Group also fell sharply during the period. Challenging macro-environments in many of the company’s growing markets have led customers to delay large projects and resulted in a higher percentage of lower-margin, maintenance-oriented bookings for Mistras. While pricing remains strong for the company’s premium offerings, competitors have shown a willingness to compete aggressively on price in commodity-type service offerings. As a result, organic growth has slowed and margins have compressed. We trimmed our position late in the period in light of, in our view, a lack of visibility into near term results given the limited catalyst for a rebound in margins and growth.

True Religion also declined during the period after reporting disappointing earnings results. The company had skewed its women’s fashion offering to a ‘cleaner’ look (less stitching and embellishments on the pockets), and we believe the strategy clearly backfired, resulting in same store sales slowing precipitously. Management was forced to clear the excess inventory through lower margin sales to off channel retailers and its own outlet stores. Additionally, international sales also declined during the period primarily due to a slowdown in South Korea and Canada. We eliminated the position during the first quarter of 2013. While the company’s shares rose sharply after the company reported fourth quarter earnings that beat expectations, the position was eliminated in light of less favorable risk/reward.

Lastly, McDermott International declined after the company reported disappointing first quarter 2013 results and lowered margin expectations for the second and third fiscal quarters. While the company still expects to achieve its 2013 full year margin guidance, margins during the second and third quarters may remain weak as the company works through temporary cost overruns and execution issues in its Atlantic and Middle Eastern regions. We added to our position on weakness in the share price. In our view, the company’s operational issues are transitory rather than structural and profitability should improve as the company works through lower margin projects. Trading at close to book value as of quarter end, we view the risk/reward as attractive given the company’s strong pipeline of projects in the offshore energy sector.

Several new positions were added to the Fund’s portfolio during the period including audio products supplier Harman International Industries. The company has dominant market share in the luxury infotainment and professional audio equipment markets and is the long-standing supplier of fully integrated systems for luxury car makers such as BMW, Audi, and Mercedes. Strong bookings of new business in recent years have supported double digit organic growth as the company continues to gain market share and content in the auto segment with its higher profit margin modular systems. We believe Harman shares offer attractive risk/reward given the company’s improving profitability, growing market share and management’s focus on improving shareholder returns via share buyback and dividend increases.

Astronics Corp. was also added to the portfolio during the period. Astronics designs and manufactures power management and performance lighting systems for the aerospace and defense industry. Specifically, the company has over 80% market share in the in-seat power systems market—which routes power to outlets in airplane seats and to in-flight entertainment systems. Shares rose sharply after we initiated a position in late March of 2013 on the heels of a key carrier announcement, a positive earnings surprise, and an acquisition that significantly expands the company’s content on commercial airliners. In April, a leading carrier awarded Astronics a significant contract for seat back entertainment and in-seat power. In our view, this is the first of many orders for the company’s patented exclusive offering on narrowbody aircraft. Astronics shares continued to move higher following the release of first quarter earnings that exceeded expectations. The company continued to demonstrate strong organic growth and delivered strong operating margins. Finally, in May, Astronics announced the acquisition of PECO Manufacturing, which complements the company’s lighting and power offerings and gives the company significant content on Boeing aircraft. In our view, Boeing remains a key customer for the company as deliveries for Boeing’s next generation wide-body and narrow-body aircrafts are expected to ramp significantly in the coming years.

Nuveen Tradewinds Value Opportunities Fund

The Fund’s Class A Shares at NAV underperformed the Russell 3000® Value Index, but outperformed the Lipper classification average for the twelve-month period ended June 30, 2013. It should be noted that the Fund has held, and is

| 16 | Nuveen Investments |

expected to continue to hold, securities that are not included in the comparative index shown in this report. Due to the difference between the securities held by the Fund and the composition of the index, we would expect there to be some differences over time between the Fund and the index in terms of performance, composition, and/or risk profile.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with varying market capitalizations selected using an eclectic, value-oriented process. Our team assesses each company held in the Fund individually to determine its future prospects and intrinsic value. Attractive valuation is our number one criterion and is a prerequisite for investing in any company. Some other criteria that we look for are sustainable business models, meaningful barriers to entry, and the ability to meet basic needs.

Throughout the reporting period, we made meaningful reductions to our overall materials and processing exposure, primarily through selling down over time the shares of gold mining companies, as greater opportunities for return on a risk reward basis were found in other areas of the market. Specifically over the last year, we have found value in consumer discretionary, insurance, and health care companies.

We continue to have some exposure to the materials and processing sector as we find undervalued companies which own resources that meet some of the criteria we mention above, and their shares offer very attractive risk/reward opportunities. As of June 30, 2013, we have 3.83% of the Fund’s portfolio invested in the materials and processing sector as defined by the Russell Index.

A top performer during the reporting period included U.S. based American International Group (AIG), which has global life insurance, non-life insurance and aircraft leasing operations. With nearly all the company’s derivatives operations sold to the government, ring-fenced and wound-down, AIG has a transparent balance sheet with a clear capital structure and share count. As such, AIG can be valued on the merits of its market-leading insurance operations. Additionally, asset sales at attractive prices have built cash for share buybacks which increased AIG’s book-value-per-share. We believe the market is well aware of the improved capital position of AIG overall, but we also believe the market is underestimating the overcapitalization of AIG’s non-life subsidiaries. During the second quarter of 2013, Standard & Poor’s Ratings Services upgraded the long-term counterparty credit and financial strength ratings for these subsidiaries from “A” to A+”. This event provided headroom for AIG to increase the premiums charged by these businesses. Its improved balance sheet will allow AIG to embark on further stock buybacks. We believe the company still has further gains to provide to investors, and this position remains among our top holdings.

General Motors Co. (GM) the second-largest global automaker, was another top performer. The company has benefited from the winding down of the U.S. Treasury Department’s stake, which was a legacy of bailouts provided during the tumult of 2008. We believe this outstanding ownership stake has acted as a key overhang for the stock, and its eventual removal will create room for further appreciation. The company received a stock price boost on better than expected earnings during the first quarter and the announcement that it would replace H.J. Heinz Co. in the S&P 100® and 500® indexes during the second quarter. GM continues to reinvent itself, with plans to refresh a third of its product lines in 2013, one of the most sweeping refresh plans in an industry that is experiencing recovery.

Aetna Inc., a major health care benefits company, was another top contributor. We believe U.S. health care regulatory uncertainty is becoming less of an overhang for the company, as details regarding the impact of new laws became more concrete. During the fourth quarter, the company passed several important shareholder and regulatory milestones in its strategic acquisition of health care benefits firm Coventry Health Care Inc. Generating high levels of cash flow, Aetna announced a 14.3% dividend increase in late November on increased revenues and earnings. We believed shares became fairly valued and sold out of this name.

Major global gold producers Barrick Gold Corp. and Newmont Corp. were detractors during the reporting period. Though development and input costs have been a concern, we find these companies continue to cut expenses as they complete new mines and shelve low priority projects. Nonetheless, these constructive moves have been overwhelmed by

| Nuveen Investments | 17 |

pessimism toward gold price prospects. Central bank rhetoric and perceived deflationary forces drove a gold commodity price slump of approximately 25% during the second quarter of 2013. Investors have tended to view attenuating monetary stimulus, and the rising interest rates and dollar strength that accompany such a move, as negative for the price of gold and gold miners. We found meaningful value in other companies and decided to sell out of these gold stocks during the second quarter.

Biopharmaceutical firm Dendreon Corp. was another detractor during the reporting period. The shares declined on investor concerns regarding shortfalls in sales of the company’s metastatic prostate cancer drug, Provenge. The management team faced challenges with an inexperienced sales force, resulting in weaker than expected sales, post-launch. We decided to sell our shares in this company during the second quarter as we found more attractive valuation elsewhere.

Risk Considerations

Nuveen Large Cap Value Fund (formerly Nuveen Multi-Manager Large-Cap Value Fund)

Mutual fund investing involves risk; principal loss is possible. Prices of equity securities may decline significantly over short or extended periods of time. These and other risk considerations, such as futures contract, large cap stock, and value stock risks, are described in detail in the Fund’s most recent prospectus.

Nuveen NWQ Multi-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the Fund, are subject to market risk and common stock risk. Investments in small- and mid-cap companies are subject to greater volatility. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets.

Nuveen NWQ Large-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the Fund, are subject to market risk and common stock risk. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets.

Nuveen NWQ Small/Mid-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the Fund, are subject to market risk and common stock risk. Investments in small and mid-cap companies are subject to greater volatility. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets.

Nuveen NWQ Small-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the Fund, are subject to market risk and common stock risk. Investments in small-cap companies are subject to greater volatility. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets.

| 18 | Nuveen Investments |

Nuveen Tradewinds Value Opportunities Fund

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the Fund, are subject to market risk and common stock risk. Investments in small- and mid-cap companies are subject to greater volatility. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets.

| Nuveen Investments | 19 |

[THIS PAGE INTENTIONALLY LEFT BLANK]

| 20 | Nuveen Investments |

Fund Performance and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown on the following twelve pages.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waivers and/or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

| Nuveen Investments | 21 |

Fund Performance and Expense Ratios (continued)

Nuveen Large Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2013

| Average Annual | ||||||||||||

| 1-Year | 5-Year | 10-Year* | ||||||||||

| Class A Shares at NAV |

23.09% | 5.11% | 7.55% | |||||||||

| Class A Shares at maximum Offering Price |

16.02% | 3.88% | 6.91% | |||||||||

| Russell 1000® Value Index** |

25.32% | 6.67% | 7.79% | |||||||||

| S&P 500® Index** |

20.60% | 7.01% | 7.30% | |||||||||

| Lipper Large-Cap Value Funds Classification Average** |

24.12% | 5.73% | 6.92% | |||||||||

| Class B Shares w/o CDSC |

22.12% | 4.32% | 6.90% | |||||||||

| Class B Shares w/CDSC |

18.12% | 4.15% | 6.90% | |||||||||

| Class C Shares |

22.10% | 4.33% | 6.74% | |||||||||

| Class R3 Shares |

22.72% | 4.83% | 7.25% | |||||||||

| Class I Shares |

23.39% | 5.37% | 7.81% | |||||||||

Performance prior to June 24, 2013, reflects the Fund’s performance under the management of multiple sub-advisers using investment strategies that differed significantly from those currently in place.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Expense Ratios | ||

| Class A Shares |

1.15% | |

| Class B Shares |

1.90% | |

| Class C Shares |

1.90% | |

| Class R3 Shares |

1.40% | |

| Class I Shares |

0.90% | |

| * | The returns for Class A, B, C and I Shares are actual. The returns for Class R3 Shares are actual for the periods since class inception on 8/04/08; returns prior to class inception are Class I Share returns adjusted for differences in sales charges and expenses, which are primarily differences in distribution and service fees. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| 22 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2013 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 23 |

Fund Performance and Expense Ratios (continued)

Nuveen NWQ Multi-Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2013

| Average Annual | ||||||||||||

| 1-Year | 5-Year* | 10-Year* | ||||||||||

| Class A Shares at NAV |

22.78% | 3.95% | 6.03% | |||||||||

| Class A Shares at maximum Offering Price |

15.70% | 2.73% | 5.40% | |||||||||

| S&P 500® Index** |

20.60% | 7.01% | 7.30% | |||||||||

| Russell 3000® Value Index** |

25.28% | 6.83% | 7.90% | |||||||||

| Lipper Multi-Cap Value Funds Classification Average** |

24.96% | 6.88% | 7.44% | |||||||||

| Class B Shares w/o CDSC |

21.81% | 3.17% | 5.40% | |||||||||

| Class B Shares w/CDSC |

17.81% | 2.99% | 5.40% | |||||||||

| Class C Shares |

21.81% | 3.17% | 5.23% | |||||||||

| Class R3 Shares |

22.43% | 3.69% | 5.73% | |||||||||

| Class I Shares |

23.01% | 4.21% | 6.29% | |||||||||

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Expense Ratios |

||||

| Class A Shares |

1.31% | |||

| Class B Shares |

2.06% | |||

| Class C Shares |

2.05% | |||

| Class R3 Shares |

1.56% | |||

| Class I Shares |

1.06% | |||

| * | The returns for Class A, B, C and I Shares are actual. The returns for Class R3 Shares are actual for the periods since class inception on 8/04/08; returns prior to class inception are Class I Share returns adjusted for differences in sales charges and expense, which are primarily differences in distribution and service fees. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| 24 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2013 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 25 |

Fund Performance and Expense Ratios (continued)

Nuveen NWQ Large-Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2013

| Average Annual | ||||||||||||

| 1-Year | 5-Year | Since Inception* |

||||||||||

| Class A Shares at NAV |

22.04% | 3.82% | 0.81% | |||||||||

| Class A Shares at maximum Offering Price |

15.01% | 2.60% | -0.10% | |||||||||

| Russell 1000® Value Index** |

25.32% | 6.67% | 2.71% | |||||||||

| Lipper Large-Cap Value Funds Classification Average** |

24.12% | 5.73% | 2.44% | |||||||||

| Class C Shares |

21.08% | 3.03% | 0.06% | |||||||||

| Class R3 Shares |

21.68% | 3.56% | 0.55% | |||||||||

| Class I Shares |

22.31% | 4.08% | 1.06% | |||||||||

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Expense Ratios |

||||

| Class A Shares |

1.11% | |||

| Class C Shares |

1.86% | |||

| Class R3 Shares |

1.36% | |||

| Class I Shares |

0.85% | |||

| * | Since inception returns for Class A, C and I Shares, and the comparative index and Lipper classification average, are from 12/15/06. The returns for Class A, C and I Shares are actual. The returns for Class R3 Shares are actual for the periods since class inception on 9/29/09; returns prior to class inception are Class I Share returns adjusted for differences in sales charges and expense, which are primarily differences in distribution and service fees. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

| 26 | Nuveen Investments |

Growth of an Assumed $10,000 Investment as of June 30, 2013 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 27 |

Fund Performance and Expense Ratios (continued)

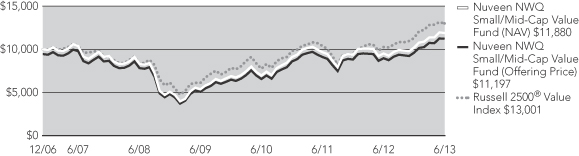

Nuveen NWQ Small/Mid-Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of June 30, 2013

| Average Annual | ||||||||||||