UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant |

| ☐ | Filed by a Party other than the Registrant |

CHECK THE APPROPRIATE BOX:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY):

| ☑ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

April 10, 2024

Dear Stockholders:

It is my pleasure to invite you to join us at the Annual Meeting of Stockholders of TTEC Holdings, Inc. The meeting will be held on Wednesday, May 22, 2024, at 10:00 a.m., Mountain Daylight Time, and will be conducted virtually. You will be able to attend the Annual Meeting, vote and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/TTEC2024 and entering the 16-digit control number included in our notice of internet availability within the proxy materials, on your proxy card, or in the instructions that accompanied your proxy materials. As permitted by the Securities and Exchange Commission (SEC), we are making our proxy materials available to our stockholders electronically via the internet. In our business, we are focused on improving the engagement between our clients and their customers. Our aspirations with respect to our stockholders are no different. We believe electronic delivery expedites your receipt of materials, reduces the environmental impact of our Annual Stockholders Meeting, reduces costs significantly, and enhances our stockholders’ experience in accessing our information, understanding our business, and the way in which TTEC is governed and managed.

For additional information about the Annual Meeting, please see the Important Information About the Proxy Materials and Voting Your Shares section of this Proxy Statement.

PLEASE VOTE

Your vote is important. Whether or not you plan to attend the Annual Meeting via the webcast, we encourage you to read these materials carefully and promptly vote your shares. There are several ways you can vote: via the internet, by telephone, by mailing the enclosed proxy or by attending our Annual Stockholders Meeting virtually. Please vote as soon as possible to ensure that your vote is recorded promptly. If you hold shares in a brokerage account, your broker will not be able to vote your shares on most matters unless you provide your voting instructions.

On behalf of the Board of Directors and over 60,000 TTEC employees, thank you for your continued confidence in TTEC and our business.

Very truly yours,

KENNETH D. TUCHMAN

Chairman and Chief Executive Officer

Denver Center for Experience and Innovation (DCXI)

6312 S. Fiddler’s Green Circle, Suite 100N

Greenwood Village, CO 80111

Notice of 2024 Annual Meeting of Stockholders

Wednesday, May 22, 2024

10:00 a.m. Mountain Daylight Time

Join the webcast at www.virtualshareholdermeeting.com/TTEC2024.

ITEMS OF BUSINESS:

At the meeting, our stockholders will be asked to:

| ● | Elect eight directors named in the Proxy Statement, for a term of one year; |

| ● | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2024; |

| ● | Approve an amendment to the TTEC 2020 Equity Incentive Plan; and |

| ● | Transact such other business, including stockholder proposals, as may properly come before the meeting. |

The meeting will also include a report on our financial results for fiscal year 2023, an overview of our 2023 Impact & Sustainability initiatives, and our outlook for the remainder of 2024.

RECORD DATE:

Only stockholders of record at the close of business on April 3, 2024, will be entitled to receive notice of, and to vote at, the 2024 Annual Stockholders Meeting. Our total shares outstanding on the Record Date are 47,448,910.

| By Order of the Board of Directors |

Margaret B. McLean

General Counsel and Chief Risk Officer

Greenwood Village, Colorado

April 10, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 22, 2024: This Notice of Annual Meeting and Proxy Statement and the 2023 Annual Report are available at ttec.com.

|

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:

| |||||

|

VIA INTERNET

Visit the website listed on your proxy card.

|

|

BY MAIL

Sign, date and return your proxy card in the enclosed envelope.

| ||

|

BY TELEPHONE

Call the telephone number on your proxy card.

|

|

AT THE VIRTUAL MEETING

Attend the Annual Meeting virtually and vote using the URL provided above.

| ||

|

ELECTION TO RECEIVE ELECTRONIC DELIVERY OF FUTURE ANNUAL MEETING MATERIALS. You can expedite delivery and avoid costly mailings by confirming in advance your preference for electronic delivery.

| |||||

Table of Contents

6312 S. Fiddler’s Green Circle, Suite 100N

Greenwood Village, CO 80111

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT EXECUTIVE SUMMARY

This summary highlights only selected information contained in this Proxy Statement. We encourage you to read the entire Proxy Statement and TTEC’s 2023 Annual Report on Form 10-K for the period ended December 31, 2023, and any subsequent financial filings, before voting your shares.

MATTERS TO BE VOTED ON AT THE 2024 ANNUAL MEETING

| Proposal | Board Recommendation |

For more detail, see page: | |

| 1. Election of Directors | FOR each Nominee | 60 | |

| 2. Ratification of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for fiscal year 2024 | FOR | 68 | |

| 3. Approval of an Amendment to the TTEC 2020 Equity Incentive Plan | FOR | 70 |

On or about April 10, 2024, we will begin distributing to each stockholder entitled to vote at the Annual Meeting either (1) this Proxy Statement, a proxy card or voting instruction form, and our 2023 Annual Report to Stockholders, which we collectively refer to as the “proxy materials,” or (2) an email or notice of internet availability of proxy materials, in each case with instructions on how to access electronic copies of our proxy materials.

1

OUR COMPANY

Founded in 1982, TTEC Holdings, Inc. (“TTEC”, “the Company”, “we”, “our”, or “us”; pronounced “T-TEC”) is a global customer experience (CX) outsourcing partner for marquis and disruptive brands and public sector clients. The Company designs, builds, and operates technology-enabled customer experiences across digital and live interaction channels to help clients increase customer loyalty, revenue, and profitability. By combining digital solutions with data-driven service capabilities, we help clients improve their customer satisfaction while lowering their total cost to serve. As of December 31, 2023, TTEC served over 750 clients across targeted industry verticals including financial services, healthcare, public sector, telecom, technology, media, travel and hospitality, automotive, and retail.

TTEC operates through two business segments.

| ● | TTEC Digital is one of the largest CX technology providers and is focused exclusively on the intersection of Contact Center As a Service (CCaaS), Customer Relationship Management (CRM), and Artificial Intelligence (AI) and Analytics. A professional services organization comprised of software engineers, systems architects, data scientists, and CX strategists; this segment creates and implements strategic CX transformation roadmaps; sells, operates, and provides managed services for cloud platforms and premise-based CX technologies including Amazon Web Services, Cisco, Genesys, Google, and Microsoft; and creates proprietary IP to support industry specific and custom client needs. TTEC Digital serves clients across Enterprise and Small & Medium Sized Business (SMB) segments and has a dedicated unit with government technology certifications serving the public sector. |

| ● | TTEC Engage provides the digitally enabled CX operational and managed services to support large, complex enterprise clients’ end-to-end customer interactions at scale. Tailored to meet industry specific and business needs, this segment delivers data-driven omnichannel customer care, customer acquisition, growth, and retention services, tech support, trust and safety, and back-office solutions. The segment’s technology-enabled delivery model covers the entire associate lifecycle including recruitment, onboarding, training, delivery, workforce management, and quality assurance. |

TTEC demonstrates its market leadership through strategic collaboration across TTEC Digital and TTEC Engage when there is client demand and fit for our integrated solutions. This partnership is central to our ability to deliver comprehensive and transformational customer experience solutions to our clients, including integrated delivery, go-to-market, and innovation for truly differentiated, market-leading CX solutions.

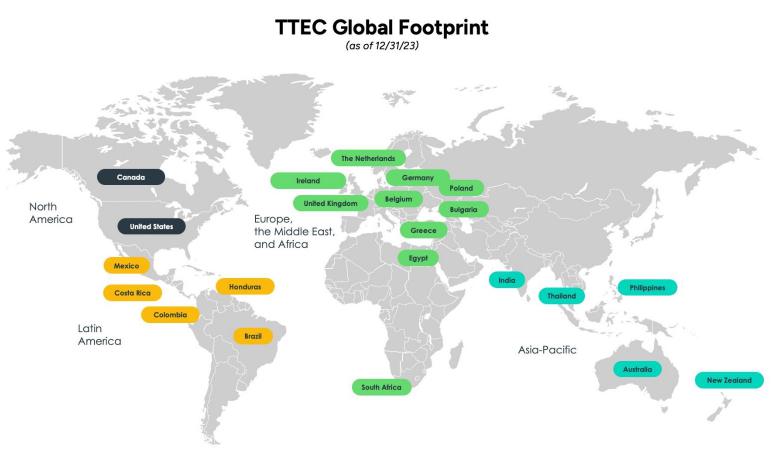

During 2023, the combined TTEC Digital and TTEC Engage global operating platform delivered onshore, nearshore, and offshore services in 22 countries on six continents -- the United States, Australia, Belgium, Brazil, Bulgaria, Canada, Colombia, Costa Rica, Egypt, Germany, Greece, Honduras, India, Ireland, Mexico, the Netherlands, New Zealand, the Philippines, Poland, South Africa, Thailand, and the United Kingdom – with the help of over 60,000 customer care associates, consultants, technologists, and CX professionals.

Our revenue for fiscal 2023 was $2.463 billion, approximately $487 million, or 20%, of which came from our TTEC Digital segment and $1.976 billion, or 80%, of which came from our TTEC Engage segment.

To improve our competitive position in a rapidly changing market and to lead our clients with emerging CX methodologies, we continue to invest in innovation and service offerings for both mainstream and high-growth disruptive businesses, diversifying and strengthening our core customer care services with technology-enabled, outcomes-focused services, data analytics, insights, and consulting.

AI-including generative AI-is and will continue to fundamentally transform how customer experience (CX) business is done and how brands connect with their customers. TTEC has embraced the responsible use of AI technologies for internal use in our business and in our client offerings under principles of accountability, responsibility, and transparency aligned with TTEC’s Values and our AI Use Policy.

TTEC partners with select market leaders to adopt generative AI CX solutions and analytics to meet the needs of industries we serve with the purpose of enhancing the CX experience to deliver a better, faster customer interaction and to generate increased revenue. How TTEC uses generative AI tools and applications in the business is subject to review and approval of the Responsible AI Council, a special-purpose multi-disciplinary team of subject matter experts who review and analyze the use of generative AI technologies before they are deployed in the business to assure that they meet our AI use standards and our Values.

2

We also invest to broaden our product and service capabilities, increase our global client base and industry expertise, tailor our geographic footprint to the needs of our clients, and further scale our end-to-end integrated solutions platform. To this end we were acquisitive in the last several years, including our acquisition in April 2022 of certain public sector assets of Faneuil, Inc. that included healthcare exchange and transportation services contracts. We also completed an acquisition in the second quarter of 2021 of a provider of Genesys and Microsoft cloud contact center services, which followed an acquisition in the second half of 2020 of a preferred Amazon Connect cloud contact center service and implementation provider.

We have extensive expertise in the healthcare, automotive, public sector, financial services, communications, technology, travel and logistics, media and entertainment, e-tail/retail, and transportation industries. We serve more than 750 diverse clients globally, including many of the world’s iconic brands, Fortune 1000 companies, public sector clients, and disruptive hypergrowth companies.

2023 PERFORMANCE HIGHLIGHTS

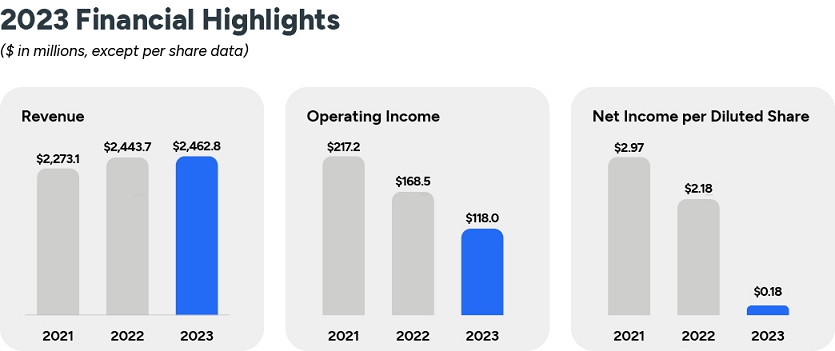

Our 2023 performance is summarized below:

| ● | Our revenue was $2.46 billion, an increase of 0.8% over the prior year. |

| ● | Our income from operations was $118.0 million, or 4.8% of revenue, a 30.0% decrease year over year. Income from operations on a non-GAAP basis1 was $200.4 million, or 8.1% of revenue, compared to 10.2% in the prior year. |

| ● | Our net cash provided by operating activities was $144.8 million compared to $137.0 million in the prior year. |

| ● | Our diluted earnings per share were $0.18 compared to $2.18 in the prior year, and $2.181 compared to $3.59 in the prior year on a non-GAAP basis. |

| ● | We paid a total of $49.2 million in cash dividends to our shareholders. |

| 1. | TTEC presents company performance metrics on a non-GAAP basis to more accurately convey the performance of the business, which adjusts for non-operating items including, but not limited to, asset impairment, restructuring charges, cybersecurity incident-related costs, equity-based compensation expense, depreciation and amortization expense, changes in acquisition contingent consideration, changes in tax valuation allowances, return to provision adjustments, and one-time non-recurring items. For additional information, please review GAAP to Non-GAAP Reconciliation of Performance Metrics on page 59 of this Proxy Statement. |

3

CORPORATE GOVERNANCE HIGHLIGHTS

Our Board follows sound governance practices.

| Independence |

● In 2023, seven out of our eight Board members were independent directors pursuant to the standards set forth in the NASDAQ Stock Market Rules, which is the standard used by the Company to determine Board member independence. ● All Board Committees, except a limited purpose Executive Committee of the Board, are comprised exclusively of independent directors. ● In 2024, subject to TTEC stockholders voting in favor of the directors nominated by the Board, our independent and executive director mix will continue to be the same as in the prior year.

|

| Executive Sessions |

● The independent directors regularly meet in executive sessions without management. ● They also regularly meet with the independent auditor and independent compensation consultants in executive sessions without management, as well as with senior executives in internal audit, finance, IT, cybersecurity, compliance, legal, human resources, and compensation functions.

|

| Board Oversight of Risk Management |

● Our Board understands, oversees, and regularly reviews risks inherent in TTEC’s business with emphasis on the oversight of the appropriateness of the Company’s risk management strategy, long- and short-range risk mitigation planning, and the effectiveness of our risk strategy execution. In 2023, the Board was particularly focused on the evolving risks specific to the use of artificial intelligence in TTEC’s business and the impact and opportunities it is likely to have, over time, on the Company’s offerings and its industry. ● The Audit Committee of the Board reviews our overall enterprise risk management policies and practices, is actively involved in the oversight of our Enterprise Risk Management (ERM) program, and reviews risks inherent in our internal controls over financial reporting; risks specific to our geographic footprint and its expansion and concentration; risks specific to our complex regulatory compliance framework around the world; risks arising from macro- and microeconomic volatility and the related impact on TTEC clients’ and our business outlook; risks specific to our cost structure; and our financial and liquidity risks. ● The Compensation Committee of the Board evaluates: risks associated with TTEC’s management and employee compensation plans; the structure of and risks specific to our employees’ and senior management incentive programs; risks specific to TTEC employment practices including the Company’s commitment to diversity, equality, and inclusion in the TTEC workforce; and risks inherent in hiring, retention, and development of our people. ● The Nominating and Governance Committee of the Board is focused on: risks inherent in our governance, senior management, and board succession planning; risks specific to crisis management and crisis response; and climate risks specific to our business. ● The Security and Technology Committee of the Board oversees and reviews: risks inherent in TTEC’s IT resilience, including TTEC’s cybersecurity initiatives designed to protect TTEC’s IT infrastructure and data, which include the data of the Company’s clients, their customers, and TTEC employees; risks specific to our data governance, including how we collect, store, use, transfer, and protect information; the Company’s incident response and business continuity and disaster recovery practices; and the evolving risks specific to the use of artificial intelligence in TTEC’s business and client offerings.

|

| Board Oversight of Cybersecurity | ● Although the Board relies on its Security & Technology Committee to oversee technology resilience and cybersecurity at TTEC, the full Board retains the overarching responsibility for cyber-related risk management oversight and business continuity practices. As part of that oversight, the Board routinely seeks information from and offers input to management about the ongoing cybersecurity maturity evolution at the Company, and monitors how TTEC performs against its cybersecurity risk management plans designed to protect TTEC’s IT infrastructure, safeguard the interface between TTEC’s and TTEC clients’ IT environments, and protect TTEC and its clients’ data from unauthorized access. The Board also monitors the evolution of and improvements in the Company’s incident response and business continuity and disaster recovery practices. |

| Board Oversight of Environmental, Social and Governance (ESG) Initiatives and the Impact and Sustainability Report |

● Our Board supports and regularly reviews TTEC’s ongoing commitment to ESG initiatives. ● The Nominating and Governance Committee of the Board is tasked with the oversight of ESG at TTEC, including the establishment of climate stewardship and social responsibility priorities for the Company, the identification and implementation of appropriate disclosure and reporting standards, and awareness and training initiatives. ● The Compensation Committee of the Board is tasked with the oversight of diversity, equity and inclusion programs as part of the Company’s impact and sustainability initiative, and challenges management to focus the Company’s employee and philanthropy programs on its social responsibility. ● The Security & Technology Committee of the Board leverages its oversight of global data privacy, technology reliance and business continuity planning to support good governance at TTEC.

|

4

● The Audit Committee of the Board is focused on financial governance and on the accuracy of auditable ESG-related disclosures, including positioning the Company to be ready to comply with the upcoming SEC climate risk disclosure requirements. ● During 2023, the Board oversaw the publishing of the Company’s Environmental, Social, and Governance report for fiscal year 2022 and guided the Company in its transition from ESG-focused reporting to a broader focus reflected in the Company’s 2023 Impact and Sustainability Report. This Report evolved to expand its climate stewardship activities by disclosing its Scope 1 and Scope 2 greenhouse gas emissions and aligning its disclosures to the Task Force on Climate-related Financial Disclosures (TCFD) framework and to the relevant United Nations Sustainable Development Goals (UNSDG), in addition to the previously reported alignment with the Sustainability Accounting Standards Board (SASB) framework.

| |

| Stock Ownership Requirements |

● TTEC Board members have committed to hold 5x of their annual cash retainer in TTEC common stock and to attain this level of holdings within five (5) years of joining our Board. ● Our Chief Executive Officer and the Chief Executive Officers of TTEC’s business segments must, within five (5) years of attaining their respective positions, hold TTEC common stock valued at 4x their annual base salary. ● Our Chief Financial Officer is expected, within five (5) years of attaining the position, to hold TTEC common stock valued at 3x the officer’s annual base salary. ● Our other executives at the executive vice president level must, within five (5) years of attaining their respective positions, hold TTEC common stock valued at 2.5x their annual base salary. ● Our senior vice president level executives, within five (5) years of attaining the position, must hold TTEC common stock valued at 1x their base annual salary.

|

| Board Practices |

● Our Board annually reviews its overall effectiveness utilizing confidential self-assessment surveys that cover topics generally recommended by the National Association of Corporate Directors (NACD) and public company governance experts or engaging third-party specialists for such evaluations. The Board committees conduct similar assessments on the cadence consistent with NASDAQ stock market requirements. The assessment findings are reviewed by the Nominating and Governance Committee of the Board with necessary changes in board practices adopted from time to time to address the insights and feedback developed through such annual evaluations. ● Board nomination priorities are adjusted annually to ensure that our Board, as a whole, continues to reflect the appropriate mix of skills, experience, and competencies necessary to support TTEC’s business strategy. ● Our Board and its committees have access to independent advisors at their sole discretion. ● The Nominating and Governance Committee of the Board maintains and enforces TTEC’s Corporate Governance Guidelines, which include business conduct, conflicts of interest, board qualification, and over-boarding guidelines. ● Our Board also engages in ongoing education and our directors take ethics training consistent with best practices.

|

| Accountability |

● All directors stand for election annually. ● Our Chairman of the Board and Chief Executive Officer is the controlling stockholder of TTEC. He controls 58.7% of our common stock. ● Although certain listing rules of the NASDAQ stock market are permitted not to be mandatory for controlled companies like TTEC, TTEC does not avail itself of these exceptions and its governance is consistent with best practices of NASDAQ-listed companies that are not controlled companies. |

5

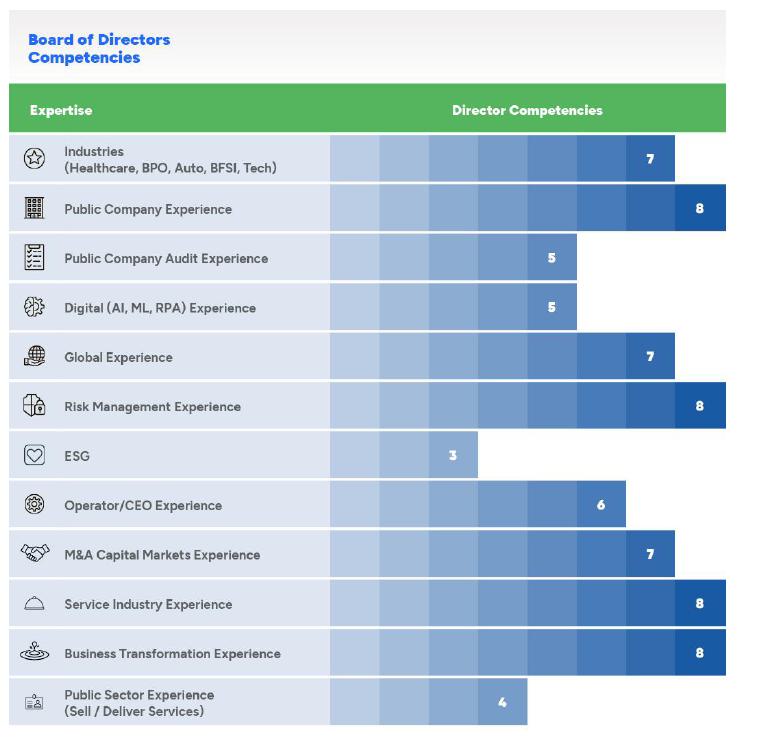

DIRECTOR EXPERIENCE

The Board and our Nominating and Governance Committee of the Board believe that diversity in experience and perspectives is important to achieving sound decisions and driving stockholder value. The following chart reflects the experience of our Board members and nominees:

Our Board includes two women and two ethnically diverse directors who we believe further enhance the quality of deliberations and ultimately the decision-making processes of our Board (see, Board Diversity Matrix on page 67).

6

IMPACT AND SUSTAINABILITY (ESG): LIVING OUR VALUES

TTEC’s dedication to sustainable growth traces back to our inception over 40 years ago. We continuously refine our impact and sustainability priorities to align with our business strategy, aiming to maximize shareholder value while prioritizing investments in our people and the communities where we operate. Our impact and sustainability focus is synonymous with living our values.

TTEC’s 2023 Impact and Sustainability Report showcases our progress on the journey towards sustainable and socially responsible growth. Specifically, it highlights advancements in three key areas refined from our 2023 Impact materiality assessment: investments in our employees and communities, commitment to good governance, and our contribution to climate stewardship. These focus areas laid the foundation for the significant strides made toward creating a positive impact, contributing to a more diverse, fair, sustainable, and ethical future.

Our 2023 highlights include: the launch of global Scope 1 and Scope 2 carbon emissions reporting, establishment of a foundation for Scope 3 reporting and emission-reduction targets, implementation of our Impact Strategy Practice to foster economic vibrancy worldwide, adoption of transparency initiatives such as the Task Force on Climate-related Financial Disclosures (TFCD) and United Nations Sustainable Development Goals (UNSDG), and alignment with the Sustainability Accounting Standards Board (SASB) framework. Additionally, we formed a Responsible AI Council to oversee the ethical use of artificial intelligence, refined our Diversity

Council’s charter, expanded Diversity, Equity, and Inclusion (DE&I) initiatives globally, and enhanced our Health and Safety program by launching a cross-disciplinary working group to ensure a safe and productive work environment for all employees. To ensure our values are ever-present, we upgraded our supplier onboarding processes to ensure that our suppliers share our principles, expanded our Modern Slavery Statements from regional commitments to a global policy that covers all our operations, and formalized our long-standing environmental stewardship commitment through the new Climate Change and Environmental Responsibility policy.

Looking ahead, we see ample opportunity to continue making a positive impact by maximizing shareholder value through investments in our people, our services, and the communities we serve. TTEC’s 2023 Impact and Sustainability Report (not incorporated into these Proxy materials by reference) can be found at https://www.ttec.com/about-us/impact-and-sustainability-report.

7

2024 BOARD NOMINEES

| Director | Age | Director Since |

Independent | Qualifications |

| Kenneth D. Tuchman | 64 | 1994 |

● Business Transformation Experience ● Capital Markets or M&A Experience ● Global Experience ● Industry Experience ● Operator or CEO Experience ● Public Company CEO and Board Experience ● Risk Management Experience ● Service Industry Experience ● Technology/Digital Sector Experience ● TTEC Founder

| |

| Steven J. Anenen | 71 | 2016 | ✓ |

● Business Transformation Experience ● Capital Markets or M&A Experience ● Global Experience ● Industry Experience ● Operator or CEO Experience ● Public Company CEO and Board Experience ● Risk Management Experience ● Service Industry Experience

|

| Tracy L. Bahl | 62 | 2013 | ✓ |

● Business Transformation Experience ● Capital Markets or M&A Experience ● Industry Experience ● Operator or CEO Experience ● Public Company Audit Experience ● Public Company Board Experience ● Risk Management Experience ● Service Industry Experience

|

| Gregory A. Conley | 69 | 2012 | ✓ |

● Business Transformation Experience ● Capital Markets or M&A Experience ● Global Experience ● Industry Experience ● Operator or CEO Experience ● Public Company Audit Experience ● Public Company Board Experience ● Risk Management Experience ● Service Industry Experience ● Technology/Digital Sector Experience

|

| Robert N. Frerichs | 72 | 2012 | ✓ |

● Business Transformation Experience ● Capital Markets or M&A Experience ● Global Experience ● Industry Experience ● Operator or CEO Experience ● Public Company Audit Experience ● Public Company Board Experience ● Public Sector Experience ● Risk Management Experience ● Service Industry Experience ● Technology/Digital Sector Experience

|

| Marc L. Holtzman | 64 | 2014 | ✓ |

● Business Transformation Experience ● Capital Markets or M&A Experience ● ESG Experience ● Global Experience ● Industry Experience ● Operator or CEO Experience ● Public Company Board Experience ● Public Company Audit Experience ● Public Sector Experience ● Risk Management Experience ● Service Industry Experience

|

8

| Gina L. Loften | 58 | 2021 | ✓ |

● Business Transformation Experience ● Capital Markets or M&A Experience ● ESG Experience ● Global Experience ● Industry Experience ● Public Sector Experience ● Public Company Board Experience ● Risk Management Experience ● Service Industry Experience ● Technology/Digital Sector Experience

|

| Ekta Singh-Bushell | 52 | 2017 | ✓ |

● Business Transformation Experience ● ESG Experience ● Global Experience ● Public Company Audit Experience ● Public Company Board Experience ● Public Sector Experience ● Risk Management Experience ● Service Industry Experience ● Technology/Digital Sector Experience

|

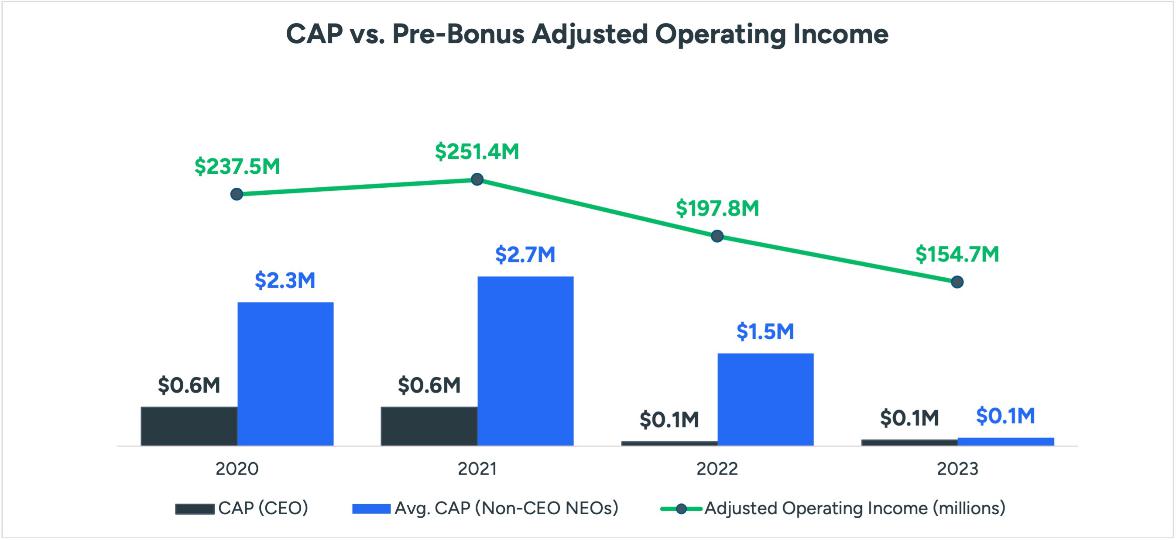

2023 EXECUTIVE COMPENSATION HIGHLIGHTS

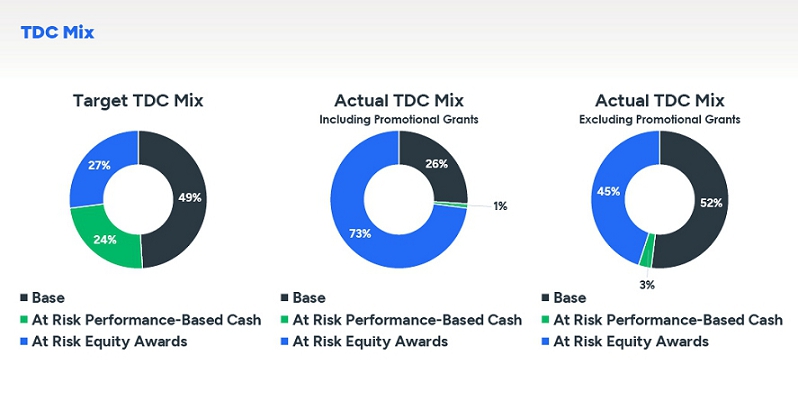

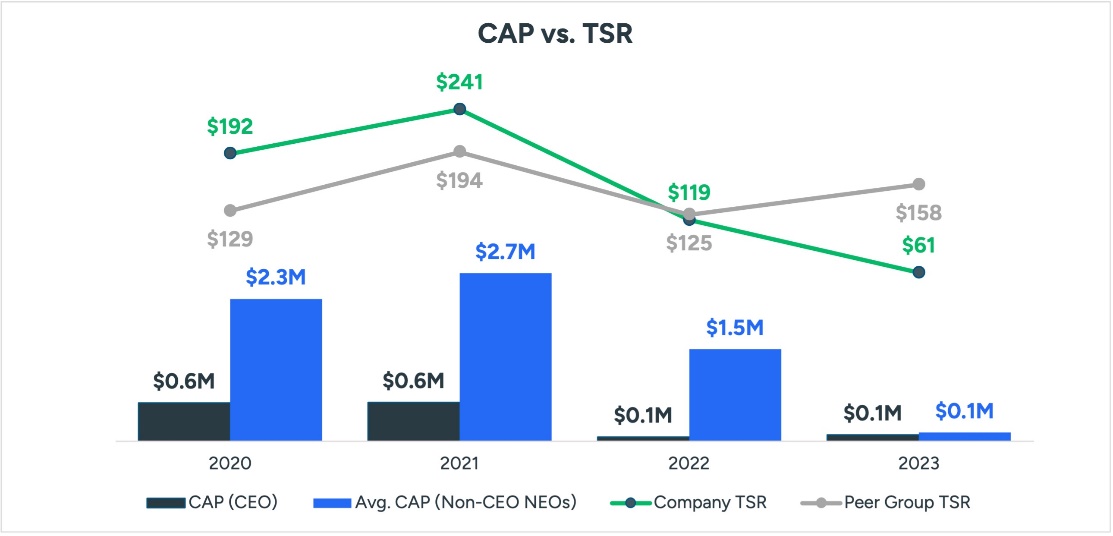

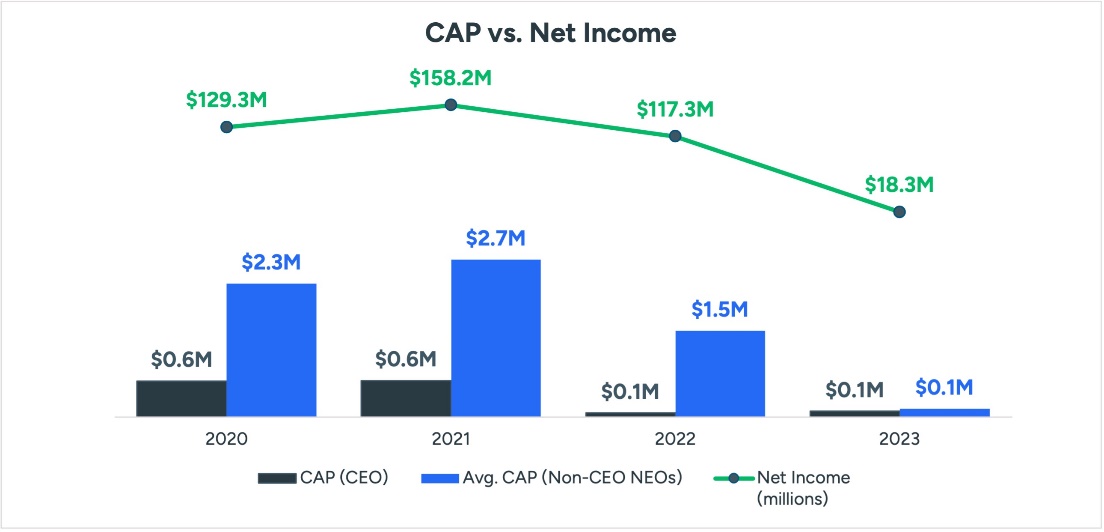

Our executive compensation program:

| ● | Rewards financial results and effective strategic leadership, which we believe are key to building sustainable value for our stockholders. |

| ● | Utilizes a mix of base salary and short- and long-term incentives to attract and retain highly qualified executives and maintain a strong relationship between executive pay and company performance. |

| ● | Places significant weight on ethical and responsible conduct in pursuit of TTEC’s strategic goals. Our incentive recoupment (clawback) policy requires our Board of Directors to recoup cash and equity incentive compensation from senior executives in the event of a financial restatement as a result of material noncompliance with accounting standards, or in the event a senior executive’s detrimental conduct causes damage to TTEC in other material respects. |

| ● | Places a meaningful portion of compensation “at risk” by aligning cash incentive payments to performance and by granting equity that vests over three-, four- and five-year periods to ensure that the actual compensation realized by executives aligns with stockholder value over the long term. |

| ● | Ensures that our rewards are affordable by aligning them to the Company’s annual business plan. |

| ● | Includes two components: one that rewards the prior year’s performance but vests over time, and another that is forward looking and rewards growth of key performance indicators like Revenue and Adjusted EBITDA over a three-year period. By emphasizing a longer-term view in equity performance incentives, the Company aligns our Named Executive Officers’ and other executives’ interests with the interests of and value creation for our stockholders. |

| ● | Aligns executive officers’ interests with stockholders with stock holding requirements. |

| ● | Considers stockholder views. At our 2023 Annual Meeting of Stockholders, we asked our stockholders to provide an advisory, non-binding vote of support of our executive officer compensation, commonly known as a “Say on Pay” proposal. Stockholders indicated strong support with 99% voting in favor of the program. The stockholders will again consider our executive compensation on an advisory basis as part of the 2026 Annual Stockholder Meeting. |

| ● | In addition, at our 2023 Annual Meeting of Stockholders, we asked our stockholders to provide an advisory, non-binding vote on the frequency with which they should provide an advisory vote on executive compensation. The stockholders indicated strong support for our existing practices, with 71% voting in favor of executive compensation being considered on an advisory basis once every three years. Stockholders will again consider the frequency with which they should provide an advisory vote on executive compensation as part of the 2029 Annual Stockholder Meeting. |

9

The following table reflects the compensation decisions made by the Compensation Committee of the Board for TTEC’s Named Executive Officers (NEOs).

In 2023, we paid the following to our Named Executive Officers:

| Named Executive Officers | Actual Total Direct (TDC) Compensation 1 |

Market TDC at 25th | Market TDC at 50th | Market TDC at 75th | Percentile |

| Kenneth D. Tuchman 2 | $1 | $5,850,000 | $7,208,000 | $9,370,000 | <25th |

| Michelle “Shelly” R. Swanback 3 | $5,947,110 | $1,937,000 | $2,984,000 | $4,363,000 | >75th |

| Francois Bourret 4 | $917,947 | $382,932 | $505,880 | $811,451 | >75th |

| Dustin J. Semach 5 | $159,615 | $2,148,000 | $2,735,000 | $3,327,000 | - |

| David J. Seybold | $937,507 | $934,000 | $1,912,000 | $3,350,000 | <50th |

| Margaret B. McLean | $686,536 | $746,000 | $1,235,000 | $1,643,000 | <25th |

| 1. | Actual TDC represents base salary earned in 2023, bonus paid in 2023 for 2022 performance, retention bonuses paid in 2023, fair market value (FMV) of RSU equity grants awarded in 2023, and fair market value (FMV) of performance-based grants, at target achievement, awarded under the 2023 annual long-term incentive plan. |

| 2. | At Mr. Tuchman’s request, the Compensation Committee approved Mr. Tuchman’s base salary to be $1 per year. |

| 3. | Ms. Swanback’s actual TDC includes a one-time $2 million RSU equity grant, vesting in equal installments over a five-year period, and a $2 million performance-based equity grant, subject to a 3-year cliff vesting period, both issued in connection with her promotion to President, TTEC Holdings, Inc |

| 4. | The market data presented for Mr. Bourret corresponds with his primary role as Chief Accounting Officer. |

| 5. | Due to Mr. Semach’s limited tenure during 2023, we have not compared his 2023 actual TDC against the market benchmarks. |

GENERAL INFORMATION

This proxy statement (Proxy Statement) is issued in connection with the solicitation of proxies by the Company’s Board of Directors for use at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 22, 2024, at 10:00 a.m. Mountain Daylight Time, completely “virtually” as further covered in this Proxy Statement, and at any adjournment or postponement thereof.

On or about April 10, 2024, we will begin distributing to each stockholder entitled to vote at the Annual Meeting either (1) this Proxy Statement, a proxy card or voting instruction form, and our 2023 Annual Report to Stockholders, which we collectively refer to as the “proxy materials,” or (2) an email or notice of internet availability of proxy materials, in each case with instructions on how to access electronic copies of our proxy materials.

This Proxy Statement contains important information regarding the Annual Meeting, the proposals on which you are being asked to vote, information about our voting procedures, and information you may find useful in determining how to vote.

IMPORTANT INFORMATION ABOUT THE PROXY MATERIALS AND VOTING YOUR SHARES

Why am I receiving these proxy materials?

The Company is soliciting your proxy in connection with the Annual Meeting. As a stockholder, you are requested to vote on the items of business discussed in this Proxy Statement.

How can I vote my shares electronically and participate in the Annual Meeting?

This year’s Annual Meeting will be held entirely online. Stockholders may participate in the virtual Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/TTEC2024. To participate in the virtual Annual Meeting, you will need the 16-digit control number included on your notice of internet availability of proxy materials (Notice of Internet Availability), on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the stockholder of record may be voted electronically during the virtual Annual Meeting. Shares for which you are the beneficial owner but not the stockholder of record also may be voted electronically during the virtual Annual Meeting. However, even if you plan to attend the virtual Annual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the virtual Annual Meeting.

10

In our desire to ensure that the virtual Annual Meeting provides stockholders with a meaningful opportunity to participate, our stockholders will be able to ask questions to the Board of Directors and management both at the time of registration and during the Annual Meeting. Stockholders may submit questions during the Annual Meeting by typing questions in the question/chat section of the meeting screen. Questions relevant to meeting matters will be answered during the Annual Meeting, subject to time constraints and in accordance with the rules of conduct which will be posted on ttec.com under the “Investors” tab. We will also post on our Investors page responses to questions relevant to meeting matters that are not answered during the Annual Meeting due to time constraints.

How can I vote my shares without attending the virtual Annual Meeting?

To vote your shares without attending the virtual Annual Meeting, please follow the instructions for internet or telephone voting on the Notice of Internet Availability. If you request printed copies of the proxy materials by mail, you may also vote by signing and submitting your proxy card and returning it by mail, if you are the stockholder of record, or by signing the voter instruction form provided by your bank or broker and returning it by mail, if you are the beneficial owner but not the stockholder of record. This way your shares will be represented whether or not you are able to attend the virtual meeting.

What will I need in order to attend the virtual Annual Meeting?

You are entitled to attend the virtual Annual Meeting only if you were a stockholder as of the Record Date for the Annual Meeting, or April 3, 2024 (the “Record Date”), or you hold a valid proxy for the Annual Meeting. You may attend the virtual Annual Meeting, vote, and submit a question during the Annual Meeting by visiting www.virtualshareholdermeeting.com/TTEC2024 and using your 16-digit control number to enter the meeting. If you do not comply with the procedures outlined above, you will not be admitted to the virtual Annual Meeting.

Why did I receive a Notice of Internet Availability of proxy materials?

Under the rules of the SEC, we are using the internet as the primary means of furnishing proxy materials to our stockholders. Most of our stockholders will not receive printed copies of the proxy materials unless they request them. Accordingly, if you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials, unless you request one as instructed in that notice. Instead, the Notice of Internet Availability will instruct you on how you may access and review the proxy materials on the internet, free of charge. This approach to distribution of proxy materials reduces the environmental impact of our Annual Meeting, expedites stockholders’ receipt of our proxy materials, and lowers our costs. The Notice of Internet Availability also includes instructions allowing stockholders to request to receive future proxy materials in printed form by mail or electronically by email.

For your information, voting via the internet is the least expensive to us, followed by telephone voting, with voting by mail being the most expensive. Also, you may help to save us the expense of a second mailing if you vote promptly.

What are the matters to be voted on at the Annual Meeting?

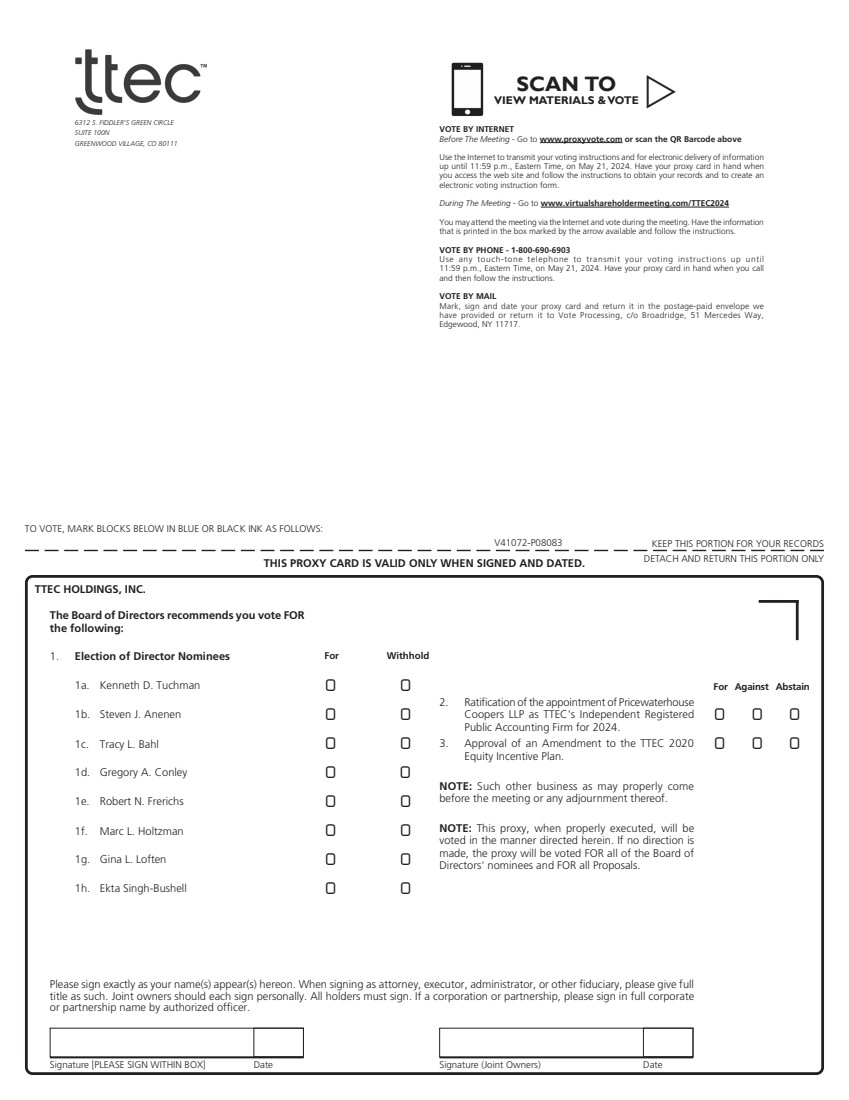

The items of business scheduled to be voted on at the Annual Meeting are:

| ● | Proposal No. 1: | The election of eight directors (see, page 60); |

| ● | Proposal No. 2: | The ratification of the appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting firm for 2024 (see, page 68); and |

| ● | Proposal No. 3: | The approval of an amendment to the TTEC 2020 Equity Incentive Plan (see, page 70). |

We will also consider other business that properly comes before the Annual Meeting.

What are my voting choices?

For the election of directors (Proposal No. 1), you may vote “FOR” or “WITHHOLD” with respect to each nominee. Cumulative voting is not permitted in the election of directors. For ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024 (Proposal No. 2), you may vote “FOR”, “AGAINST” or “ABSTAIN”. For the approval of an amendment to the TTEC 2020 Equity Incentive Plan (Proposal No. 3), you may vote “FOR”, “AGAINST” or “ABSTAIN.

11

How does the Board recommend that I vote?

Our Board recommends that you vote your shares:

| ● | “FOR” each of the nominees to our Board; |

| ● | “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting for 2024; and |

| ● | “FOR” the approval of an amendment to the TTEC 2020 Equity Incentive Plan. |

Kenneth D. Tuchman, our Chairman and Chief Executive Officer and the beneficial owner of 58.7% of the issued and outstanding shares of common stock as of the Record Date (58.7% of the shares entitled to vote, excluding stock options) has indicated that he intends to vote:

| ● | “FOR” each of the nominees to our Board; |

| ● | “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024; and |

| ● | “FOR” the approval of an amendment to the TTEC 2020 Equity Incentive Plan. |

How will my shares be voted by proxy?

Valid proxies provided to the Company by telephone, over the internet, or by a mailed proxy card will be voted at the Annual Meeting as directed by you unless revoked in accordance with the instructions. If you properly execute and submit your proxy, but do not indicate how you want your shares voted, the persons named as your proxies will vote your shares in accordance with the recommendations of our Board of Directors. These recommendations are:

| ● | “FOR” each of the nominees to our Board; |

| ● | “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting for 2024; and |

| ● | “FOR” the approval of an amendment to the TTEC 2020 Equity Incentive Plan. |

How can I revoke my proxy or change my vote?

You may revoke your proxy or change your vote at any time prior to the taking of the vote at the Annual Meeting. If you are the stockholder of record, you may change your vote by:

| ● | Voting again through the internet, by telephone, or by completing, signing, dating, and returning a new proxy card with a later date, all of which automatically revoke the earlier proxy so long as completed prior to the applicable deadline for each method; |

| ● | Providing a written notice of revocation to our Corporate Secretary at TTEC Holdings, Inc., 6312 S. Fiddler’s Green Circle, Suite 100N, Greenwood Village, CO 80111, prior to your shares being voted; or |

| ● | Attending the virtual Annual Meeting and voting during the meeting. Your virtual attendance at the Annual Meeting alone will not cause your previously granted proxy to be revoked unless you specifically so request before the taking of the vote. |

For shares you hold beneficially in “street name”, you may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the virtual Annual Meeting and voting during the meeting.

Will shares I hold in my brokerage account be voted if I do not provide timely voting instructions?

If your shares are held through a brokerage firm, they will be voted as you instruct on the voting instruction card provided by your broker. If you sign and return your card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board of Directors.

If you do not provide timely instructions as to how your brokerage shares are to be voted, your broker will have the authority to vote them only on the ratification of our independent registered public accounting firm. Your broker will be prohibited from voting your shares on the election of directors and the amendment to the TTEC 2020 Equity Incentive Plan. These “broker non-votes” will be counted only for the purpose of determining whether a quorum is present at the meeting and not as votes cast. As a result, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

12

Will shares that I own as a stockholder of record be voted if I do not return my proxy card in a timely manner?

Shares that you own as a stockholder of record will be voted as you instruct on your proxy card. If you sign and return your proxy card without giving specific instructions, they will be voted in accordance with the recommendations of our Board of Directors. If you do not return your proxy card in a timely manner or provide voting instructions through the internet or by phone, your shares will not be voted unless you or your proxy holder attend the virtual Annual Meeting and vote during the meeting.

What is required to conduct the business of the Annual Meeting?

In order to conduct business at the Annual Meeting, a quorum of a majority of the outstanding shares of common stock entitled to vote as of the Record Date must be present in person or represented by proxy. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

How many votes are required to approve each proposal?

Directors are elected by a plurality of the votes cast. This means that the eight individuals nominated for election to the Board who receive the most “FOR” votes will be elected.

The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy at the meeting and entitled to vote is required to approve the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy at the meeting and entitled to vote is required to approve the amendment to the TTEC 2020 Equity Incentive Plan.

As of the Record Date, there were 47,448,910 shares of common stock outstanding and entitled to vote. Each share of common stock entitles the holder thereof to one vote on each proposal.

How are votes counted?

Votes cast by proxy prior to the Annual Meeting will be tabulated by an automatic system administered by Broadridge Financial Solutions, Inc. Votes cast by proxy or in person at the Annual Meeting will be counted by the persons we appoint to act as election inspectors for the Annual Meeting.

Votes withheld from a director nominee will have no effect on the election of the director from whom votes are withheld. Abstentions will be treated as shares that are present and entitled to vote and will consequently have the effect of a vote “AGAINST” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm and the approval of an amendment to the TTEC 2020 Equity Incentive Plan.

If a broker indicates on the proxy card that it does not have discretionary authority to vote certain shares on a particular matter, it is referred to as a “broker non-vote.” Broker non-votes will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum but will not be considered as voted for the purpose of determining the approval of the particular matter.

If I share an address with another stockholder, how will we receive our proxy materials?

For stockholders of record, we have adopted a procedure called “householding”, which the SEC has approved. Under this procedure, we are delivering a single copy of the Notice of Internet Availability and, if applicable, this Proxy Statement and the 2023 Annual Report to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs and the impact of printing and mailing these materials on the environment. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or verbal request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, this Proxy Statement and the 2023 Annual Report to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy of the Notice of Internet Availability and, if applicable, this Proxy Statement, the 2023 Annual Report, or to request delivery of a single copy of these materials if multiple copies are currently being delivered, stockholders may contact us at TTEC Holdings, Inc., 6312 S. Fiddler’s Green Circle, Suite 100N, Greenwood Village, CO 80111, Attention: Investor Relations, or send an email to investor.relations@ttec.com.

Stockholders who hold shares in “street name” (as described above) may contact their brokerage firm, bank, broker- dealer, or other similar organization to request information about householding.

13

How can I see the list of stockholders entitled to vote?

A complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose germane to the meeting, at the Annual Meeting by means of a link to be made available on the meeting screen and at our principal office located at 6312 S. Fiddler’s Green Circle, Suite 100N, Greenwood Village, CO 80111, during normal business hours for a period of at least 10 days prior to the Annual Meeting.

What happens if additional items of business are presented at the Annual Meeting?

We are not aware of any items that may be voted on at the Annual Meeting that are not described in this Proxy Statement. However, the holders of the proxies that we are soliciting will have the discretion to vote them in accordance with their best judgment on any additional matters that may be voted on, including matters incidental to the conduct of the Annual Meeting.

Is my vote confidential?

Stockholders may elect that their identity and individual vote be held confidential by marking the appropriate box on their proxy card or ballot. Confidentiality will not apply to the extent that voting disclosure is required by law or is necessary or appropriate to assert or defend any claim relating to voting. Confidentiality also will not apply with respect to any matter for which votes are solicited in opposition to the director nominees or voting recommendations of our Board of Directors, unless the persons engaging in the opposing solicitation provide stockholders with voting confidentiality comparable to that which we provide.

Where can I find the voting results?

We expect to announce preliminary voting results at the Annual Meeting and to publish final results in a Current Report on Form 8-K that we will file with the SEC within four business days following the meeting. The report will be available on our website at ttec.com under the “Investors” and “SEC Filings” tabs.

How may I obtain financial and other information about TTEC?

Additional financial and other information about the Company is included in our Annual Report on Form 10-K, which we file with the SEC, and which is available on our website at ttec.com under the “Investors” and “SEC Filings” tabs. We will also furnish a copy of our 2023 Annual Report (excluding exhibits), except those that are specifically requested, without charge to any stockholder who so requests by contacting our Investor Relations department at TTEC Holdings, Inc., 6312 S. Fiddler’s Green Circle, Suite 100N, Greenwood Village, CO 80111, Attention: Investor Relations, or send an email to investor.relations@ttec.com.

You can also obtain, without charge, a copy of our bylaws, codes of conduct and Board committee charters by contacting the Investor Relations department, or you can view these materials on the internet by accessing our website at ttec.com and clicking on the “Investors” tab, then clicking on the “Corporate Governance” tab.

Who will conduct and pay for the cost of this proxy solicitation?

We will bear all costs of soliciting proxies, including reimbursement of banks, brokerage firms, custodians, nominees, and fiduciaries for reasonable expenses they incur. Proxies may be solicited personally, by mail, by telephone, or via internet; by our directors, officers, or other regular employees without remuneration other than regular compensation. We will request brokers and other fiduciaries to forward proxy materials to the beneficial owners of shares of common stock that are held of record by such brokers and fiduciaries and will reimburse such persons for their reasonable out-of-pocket expenses.

14

CORPORATE GOVERNANCE

TTEC is committed to best practices in corporate governance. The Company is governed by our Board of Directors. The role of the Board and the Board committees include:

| ● | Oversight of the Company’s management; |

| ● | Appointment of the Chief Executive Officer; |

| ● | Goal setting for and overseeing performance of the Company’s executive management team; |

| ● | Management succession planning; |

| ● | Oversight of effective corporate governance, including selecting and recommending for stockholders’ approval nominees for the Board of Directors; |

| ● | Annual assessment of Board performance; |

| ● | Board succession planning; |

| ● | Forming and staffing Board Committees; |

| ● | Review and oversight of the development and implementation of the Company’s annual strategic, financial, and operational plans and budgets; |

| ● | Oversight of the Company’s impact and sustainability (aka ESG) practices, including the progress that it makes against its environmental stewardship and diversity, equity and inclusion commitments; |

| ● | Assessment and monitoring of Company’s risk and risk management practices; |

| ● | Oversight of TTEC’s cybersecurity programs and protection of TTEC data and data of TTEC clients, their customers, and the Company’s employees; |

| ● | Review and approval of significant corporate actions; |

| ● | Monitoring of processes designed to assure TTEC’s integrity and transparency to its stakeholders, including financial reporting, compliance with legal and regulatory obligations, maintenance of confidential channels to report concerns about violations of laws and policies, and protection against reprisals for those who report such violations; and |

| ● | Oversight of the relationship between the Company and its stockholders. |

Board Leadership Structure

Our Board is led by TTEC’s founder, Kenneth D. Tuchman, who serves as the Chairman of the Board. Mr. Tuchman is also TTEC’s Chief Executive Officer. The Board retains the flexibility to determine from time to time whether the position of the Chief Executive Officer and the Chairman of the Board should be combined or separated, whether an independent director should serve as Chairman of the Board, and whether to appoint a lead independent director to serve as a liaison between independent directors and the Chairman.

At present, the Board believes that the Company is best served by having Mr. Tuchman serve as both the Chairman of the Board and Chief Executive Officer of TTEC. The Board’s view is based on the facts that Mr. Tuchman beneficially owns 58.7% of the outstanding equity in the Company, has a unique insight into the Company’s CX solutions strategy as an industry innovator and the Company founder, and is intimately involved in the day-to-day strategic direction of the Company.

Since the size of the Company’s Board is relatively small and each independent director has unrestricted access to Mr. Tuchman and the Company’s management, the independent members of the Board do not currently perceive the need for an appointment of a lead independent director. Our Board also believes that appointing a lead independent director may serve to create a potential conflict among the directors and interfere with the current collaborative environment in the boardroom that permits the Board to leverage the knowledge and experience of each Board member to drive strategic initiatives necessary to support the Company’s transformation from a business process outsourcing service provider to an integrated customer engagement technology and digital solutions provider.

With the exception of Mr. Tuchman, all of TTEC’s other directors are independent. In addition, there are no family relationships among any director, executive officer, or any person nominated or chosen by us to become a director.

15

The Board is aware of the potential conflicts that may arise in having Mr. Tuchman, the Company’s largest and controlling stockholder, serve as the Chairman of the Board, but believes that there are adequate governance safeguards in place to mitigate such risks. Such safeguards include, but are not limited to:

| ● | The Board and Board committees hold executive sessions comprised entirely of the independent directors. |

| ● | During 2023, seven of our eight directors were independent on our Board. |

| ● | Our Compensation Committee of the Board, comprised entirely of independent directors, makes all executive management compensation determinations based on the individual manager’s performance and input from independent compensation consultants. |

| ● | Our Compensation Committee of the Board retains an independent compensation consultant when it deems it appropriate. |

| ● | Our Board members have unrestricted access to independent consultants, including legal counsel. |

| ● | Our Board members and executives have a shareholding guideline consistent with industry best practices. |

| ● | Our Board performs an annual self-assessment and acts on the findings. |

| ● | Our Board committees perform periodic self-assessments and act on the findings. |

| ● | Our Board published Corporate Governance Guidelines to communicate to the stockholders and other stakeholders how the Company is governed. |

Although we qualify as a “controlled company” under the listing rules of the NASDAQ stock market, the Company elects not to avail itself of governance exceptions available to “controlled companies” under these rules. Specifically, a majority of our Board of Directors is independent and our Nominating and Governance Committee of the Board and Compensation Committee of the Board are comprised solely of independent directors, even though the Company is exempt from these corporate governance requirements as a controlled company.

Lastly, our Board has demonstrated the independence necessary to address potential conflicts of interest through the use of special ad hoc committees to address specific matters when they arise or requesting that the Chairman abstain from deliberations and voting on certain decisions that may represent a conflict with his controlling stockholdings in the Company.

| Board Participation in 2023 |

| ● 7 Board meetings held in 2023 |

| ● Each director attended 100% of all Board and committee meetings where the director is a member, either in person or virtually |

| ● All directors attended our Annual Meeting of Stockholders in 2023. Although the Company does not require the directors to always attend the Annual Meeting of Stockholders, the directors are encouraged to do so; and most attend the Meetings regularly. |

Board Risk Oversight

While our executive officers are responsible for day-to-day management of risk at TTEC, our Board oversees and monitors our Enterprise Risk Management (ERM), regulatory compliance, impact and sustainability (aka ESG) initiatives, technology resilience and cybersecurity, business continuity, and financial disclosure practices, in the course of its ongoing review of the Company’s strategy, business plans, risk management, and financial reporting programs. The Board recognizes that certain risk-taking is essential for any company to stay competitive. It is the view of the Board, however, that the risk-taking must be reasoned and measured, and must be evaluated and mitigated appropriately.

16

In 2023, the Board’s ERM oversight primarily focused on, but was not limited to, the following areas (i) the Company’s strategy and long-term growth plans; (ii) technology resilience and stability of TTEC information technology platforms; (iii) cybersecurity preparedness and incident response; (iv) risks inherent in our work from home service delivery; (v) crisis management, business continuity planning, emergency preparedness, critical incident response, and disaster recovery planning and execution; (vi) risks arising from the complexities of the regulatory compliance framework that affects TTEC’s regulated business around the globe; (vii) the service delivery effectiveness of the Company’s business segments; (viii) anticipating and planning for the rapidly evolving micro- and macro-economic conditions in the market place, how such conditions may impact our clients and, therefore, have an indirect impact on our business volumes and liquidity; and (ix) our ongoing effort to embed AI into our solutions so that our offerings are at the forefront of offerings that leverage these technological disruptors. The responsibility for managing each of these high-priority risk areas, as identified by the ERM process, was assigned to one or more members of the Company’s executive leadership team. The Board has delegated the oversight of certain categories of risk management to designated Board committees, which periodically report to the Board on matters related to the specific areas of risk they oversee.

| Board/Committee | Primary Areas of Risk Oversight |

| Full Board | Enterprise risk management structure; strategic risk associated with TTEC’s business plan; litigation that may have material financial or reputational impact on the Company; significant capital transactions, including M&A, technology investment and divestitures; capital structure risks; cybersecurity and cybersecurity incident response; risks specific to the use of artificial intelligence; service delivery effectiveness; and CEO succession planning. |

| Audit Committee | Risks related to financial reporting, disclosure, and related controls; risks specific to our geographic footprint; major financial exposure risks; risks inherent in the Company’s regulatory compliance framework around the world; risks arising from macro- and micro-economic volatility; currency exposure risks; risks specific to our cost structure; and liquidity risks. |

| Compensation Committee | Executive recruiting, retention, and succession planning; compensation policies and practices, including incentive compensation; and health and welfare benefits programs. Assessment of the risks associated with compensation policies and practices applicable to TTEC’s employees to determine if such policies and practices are reasonably likely to have a material adverse effect on TTEC. Employee engagement and turnover risks and the Company’s commitment to diversity, equality, and inclusion in the workforce. |

| Nominating and Governance Committee | Corporate governance risks; effectiveness of the Board’s and its committees’ performance; senior management and Board succession planning; conflicts of interest; director independence and competencies; executive management succession; risks specific to crisis management and response; climate risks specific to our business; and impact and sustainability (aka ESG) . |

| Security and Technology Committee | Risk management oversight of the Company’s technology resilience, including cybersecurity initiatives designed to protect the Company’s IT infrastructure and data; practices and stability of our technology platforms used to support our business and services delivered to our clients; data governance risks; the Company’s incident response and continuity and disaster recovery practices; and risks specific to the evolving use of artificial intelligence in the Company’s business. |

The Board and its committees periodically request and receive comprehensive reports from Digital and Engage business segments and key Company functions (including finance, treasury, tax, legal and regulatory compliance, information security, human capital, risk management, and the Company’s ESG leadership team including its Diversity Council), and have the opportunity to assess risk exposures to the business in these specific functional areas. In addition to the Company’s ERM and internal audit processes, the Board and the Audit Committee monitor and oversee the Company’s periodic assessment of the effectiveness of its internal controls over financial reporting.

To ensure that the Company’s compensation practices and policies do not have a material adverse effect on the Company and its business, the Compensation Committee of the Board annually reviews TTEC’s executive compensation programs for inherent risks and alignment with the Company’s objectives. The Committee receives periodic reports from the Company’s people and culture and legal departments on steps that TTEC takes to anticipate and mitigate any potential risks in long- and short-term incentive and performance-based compensation programs. The Compensation Committee of the Board believes that executive compensation should be contingent on performance relative to targets and business plans. It expects TTEC senior executives to achieve these targets in a manner consistent with TTEC’s values, ethical standards, and policies. The Board engages in periodic discussions with management on how to maximize executives’ performance through compensation incentives without creating unreasonable risks to the business. For additional information on TTEC compensation program risks, please review section titled “Compensation Discussion and Analysis” in these proxy materials.

17

Communications with The Board

The Board established a process for stockholders and other interested parties to communicate with the Board or any directors by requesting that all communication be sent via email to corporatesecretary@ttec.com or to the following address:

Board of Directors

c/o Corporate Secretary

TTEC Holdings, Inc.

6312 S. Fiddler’s Green Circle, Suite 100N

Greenwood Village, CO 80111

Since most members of the TTEC leadership team, including the Corporate Secretary, work hybrid schedules where they attend meetings and plenary sessions in the offices while performing most of their day-to-day functions remotely working from home, communication via email through the corporatesecretary@ttec.com dedicated mailbox may be a more reliable method to connect with our Board of Directors as there can be no assurance that physical mail delivery would be monitored on a daily basis. The Corporate Secretary reviews all communications addressed to the Board and shares them with the Board Chair and the Chair of the Nominating and Governance Committee of the Board, as long as they are not offensive or inappropriate. Offensive and inappropriate communications, if any, are mentioned as received at the regularly scheduled Nominating and Governance Committee of the Board meetings but are not distributed to directors, unless the Chair of the Nominating and Governance Committee of the Board specifically directs for them to be distributed.

Board Committees

The following table outlines the composition of each of our Board committees during 2023:

| Director | Audit Committee |

Compensation Committee |

Nominating and Governance Committee |

Security and Technology Committee |

Executive Committee |

| Kenneth D. Tuchman | Chair | ||||

| Steven J. Anenen | ✓ | ✓ | ✓ | ||

| Tracy L. Bahl | Chair | ✓ | |||

| Gregory A. Conley | Chair | ✓ | ✓ | ||

| Robert N. Frerichs | ✓ | ✓ | Chair | ||

| Marc L. Holtzman | ✓ | ||||

| Gina L. Loften | ✓ | ✓ | |||

| Ekta Singh-Bushell | ✓ | ✓ | Chair |

The Nominating and Governance Committee of the Board, with input from the Board Chairman, periodically reviews Committee membership and chairmanships and makes adjustments as needed to address the needs of the business, appropriately leverage Board members’ expertise, and provide important development opportunities to Board members as part of its longer-term succession planning for the Board.

18

Audit Committee

The Audit Committee of the Board operates under the Audit Committee charter adopted by our Board and available at ttec.com/investors/corporate-governance/ (“Corporate Governance” under the “Investors” tab on our public website ttec.com). It is responsible for, among other things:

| ● | Assisting the Board in its oversight of the integrity of TTEC’s financial statements including any critical audit matters; |

| ● | Overseeing the adequacy of internal controls over our financial reporting and disclosure processes; |

| ● | Selecting, evaluating, and appointing the independent registered public accounting firm, including assessing the registered public accounting firm’s independence and qualifications; |

| ● | Reviewing and approving all non-audit services performed by the independent registered public accounting firm; |

| ● | Overseeing the activities and processes of the TTEC internal audit department; |

| ● | Overseeing TTEC’s ethics program and its confidential hotline process, including reviewing the establishment of and compliance by employees and executives with the Company’s employee code of conduct, Code of Ethics: How TTEC Does Business and the Company’s Ethics Code for Executive and Financial Officers; |

| ● | Overseeing investigations into any matters within the Audit Committee’s scope of responsibility; |

| ● | Overseeing the Company’s enterprise business risk process; |

| ● | Reviewing and approving all related-party transactions; and |

| ● | Overseeing business continuity and disaster recovery plans and practices of the Company. |

In 2023, the members of the Audit Committee of the Board included Gregory A. Conley (Chair), Robert N. Frerichs, Ekta Singh-Bushell, and Steven J. Anenen. Throughout 2023, each Committee member was “independent” in accordance with the NASDAQ Stock Market Rules and Rule 10A-3(b)(1) under the U.S. Securities Exchange Act of 1934.

Our Board determined that Mr. Conley, Mr. Frerichs, Ms. Singh-Bushell, and Mr. Anenen each qualify as an “audit committee financial expert” within the meaning of the SEC rules. Mr. Conley’s relevant experience includes his experience as a chief executive officer and director of several public and private companies, and his tenure as the chair of the TTEC Audit Committee of the Board since May 2014. Mr. Frerichs’ relevant experience includes his CPA credentials, his role as chair of one of the largest public consultancies in the world, his career in audit and risk management, and his tenure on the audit committees of several companies. Ms. Singh-Bushell’s relevant experience includes her CPA credentials, her tenure as a member of several audit committees for public companies, and her two decades of experience working for a global public accounting and consultancy firm. Mr. Anenen’s relevant experience includes his experience as a chief executive officer and director of several public and private companies, and his tenure as a member of the TTEC Audit Committee of the Board.

The Audit Committee of the Board oversees TTEC’s disclosure processes. These processes are established to ensure accurate and complete financial reporting and to identify timely any potential issues that could impact TTEC’s accounting, financial reporting, and effectiveness of its internal controls. The Committee also established procedures for, and oversees receipt and treatment of, confidential (including anonymous) submissions by TTEC employees of concerns about the Company’s accounting, internal control, and auditing practices. The Audit Committee of the Board reviews and assesses the matters raised through these reporting channels and monitors management’s response to these reports, engaging when warranted.

The Audit Committee of the Board evaluates the independence, qualifications, and performance of TTEC’s internal audit function and annually approves the Company’s internal audit plan. The Committee also discusses with management TTEC’s risk assessment and management practices; the Company’s major financial, operational, and regulatory risk exposures; and the steps management has taken to monitor and mitigate such exposures to be within the Company’s risk tolerance levels.

During 2023, the Audit Committee of the Board held four regularly scheduled meetings and four special meetings. The Committee also approved one matter through unanimous written consent. The Audit Committee of the Board reviews and assesses the adequacy of its charter, and revises it, if appropriate, on an annual basis.

19

Compensation Committee

The Compensation Committee of the Board operates under the Compensation Committee charter adopted by our Board and available at ttec.com/investors/corporate-governance/ (“Corporate Governance” under the “Investors” tab on our public website ttec.com). It is responsible for, among other things:

| ● | Reviewing performance goals and approving the annual salary, incentives, and all other compensation for each executive officer, including any employment arrangements and change in control agreements with such officers; |

| ● | Reviewing and approving compensation programs for independent Board members; |

| ● | Reviewing and approving material employee benefit plans (and changes to such plans); |

| ● | Reviewing and evaluating risks associated with our compensation programs; |

| ● | Adopting and administering various equity-based incentive plans; and |

| ● | Overseeing the company’s diversity, equality and inclusion programs. |

In 2023, the members of the Compensation Committee of the Board included Tracy L. Bahl (Chair), Gregory A. Conley, Robert N. Frerichs, and Gina L. Loften. Throughout 2023, each member of the Committee was “independent” (as defined under the NASDAQ Stock Market Rules and the SEC’s Rule 10C-1(b)(1)) and a “non-employee director” (as defined under SEC’s Rule 16b-3).

During 2023, the Compensation Committee of the Board held four regularly scheduled meetings and three special meetings and approved one matter through unanimous written consent process. The Compensation Committee of the Board reviews and assesses the adequacy of its charter, and revises it, if appropriate, on an annual basis.

Nominating and Governance Committee

The Nominating and Governance Committee of the Board operates under the Nominating and Governance Committee charter adopted by our Board and available at ttec.com/investors/corporate-governance/ (“Corporate Governance” under the “Investors” tab on our public website ttec.com). It is responsible for, among other things:

| ● | Overseeing and managing the Board of Directors’ overall governance practices; |

| ● | Identifying and recommending to our Board qualified candidates to stand for election to the Board (or be appointed pending the election at the Annual Stockholders Meeting); |

| ● | Overseeing development and succession planning for executive officers and the Board of Directors of the Company; |

| ● | Overseeing TTEC’s corporate governance, including the evaluation of the Board and its committees’ performance and processes, and assignment and rotation of Board members to various committees; and |

| ● | Overseeing TTEC’s ESG initiatives and reporting. |

During 2023, the members of the Nominating and Governance Committee of the Board included Robert N. Frerichs (Chair), Ekta Singh-Bushell, Steven J. Anenen, and Marc L. Holtzman. Each Committee member was “independent” in accordance with the NASDAQ Stock Market Rules.

During 2023, the Nominating and Governance Committee of the Board held four regularly scheduled meetings, no special meetings, and approved no matters through unanimous written consent. The Nominating and Governance Committee of the Board reviews and assesses the adequacy of its charter, and revises it, if appropriate, on an annual basis.

20

Security and Technology Committee

The Security and Technology Committee of the Board operates under the Security and Technology Committee charter adopted by our Board and available at ttec.com/investors/corporate-governance/ (“Corporate Governance” under the “Investors” tab on our public website ttec.com). It is responsible for, among other things:

| ● | Overseeing the risk management of the Company’s security practices, resiliency capabilities, and strategic plans of the Company’s technology used to support its business and deliver services to its clients; |

| ● | Overseeing the practices and controls that management uses to identify, manage and mitigate risks related to cybersecurity, disaster recovery, cyber event management and response, fraud and physical security, and data governance; |

| ● | Reviewing management’s crisis preparedness, incident response and business continuity plans, and the Company’s disaster recovery plans, capabilities, and testing practices; |

| ● | Reviewing the outcomes of the Company’s internal and third-party security compliance audits; |

| ● | Reviewing evolving risks specific to the use of artificial intelligence in the Company’s business and client offerings; |