UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year ended | ||||||||

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition period from to . | ||||||||

Commission file No. 001-15891

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices) | (Zip Code) | |||||||

(609 ) 524-4500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Exchange on Which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | |||||||||||||||||||||

| Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of the last business day of the most recently completed second fiscal quarter, the aggregate market value of the common stock of the registrant held by non-affiliates was approximately $6,941,658,699 based on the closing sale price of $32.56 as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date.

| Class | Outstanding at March 1, 2021 | |||||||

| Common Stock, par value $0.01 per share | ||||||||

Documents Incorporated by Reference:

Portions of the Registrant's definitive Proxy Statement relating to its 2021 Annual Meeting of Stockholders

are incorporated by reference into Part III of this Annual Report on Form 10-K

1

TABLE OF CONTENTS

2

Glossary of Terms

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| 2023 Term Loan Facility | The Company's term loan facility due 2023, a component of the Senior Credit Facility, which was repaid during the second quarter of 2019 | |||||||

| ACE | Affordable Clean Energy | |||||||

| Adjusted EBITDA | Adjusted earnings before interest, taxes, depreciation and amortization | |||||||

| ARO | Asset Retirement Obligation | |||||||

| ASC | The FASB Accounting Standards Codification, which the FASB established as the source of authoritative GAAP | |||||||

| ASU | Accounting Standards Updates – updates to the ASC | |||||||

| AUC | Alberta Utilities Commission | |||||||

| Average realized prices | Volume-weighted average power prices, net of average fuel costs and reflecting the impact of settled hedges | |||||||

| Bankruptcy Code | Chapter 11 of Title 11 of the U.S. Bankruptcy Code | |||||||

| Bankruptcy Court | United States Bankruptcy Court for the Southern District of Texas, Houston Division | |||||||

| Baseload | Units expected to satisfy minimum baseload requirements of the system and produce electricity at an essentially constant rate and run continuously | |||||||

| BETM | Boston Energy Trading and Marketing LLC | |||||||

| BTU | British Thermal Unit | |||||||

| Business Solutions | NRG's business solutions group, which includes demand response, commodity sales, energy efficiency and energy management services | |||||||

| CAA | Clean Air Act | |||||||

| CAISO | California Independent System Operator | |||||||

| California Bankruptcy Court | United States Bankruptcy Court for the Northern District of California, San Francisco Division | |||||||

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act | |||||||

| Carlsbad | Carlsbad Energy Center, a 528 MW natural gas-fired project located in Carlsbad, CA | |||||||

| CCR | Coal Combustion Residuals | |||||||

| CDD | Cooling Degree Day | |||||||

| CFTC | U.S. Commodity Futures Trading Commission | |||||||

| Chapter 11 Cases | Voluntary cases commenced by the GenOn Entities under the Bankruptcy Code in the Bankruptcy Court | |||||||

| C&I | Commercial, industrial and governmental/institutional | |||||||

| CES | Clean Energy Standard | |||||||

| Cleco | Cleco Corporate Holdings LLC | |||||||

CO2 | Carbon Dioxide | |||||||

CO2e | Carbon Dioxide Equivalents | |||||||

| ComEd | Commonwealth Edison | |||||||

| Company | NRG Energy, Inc. | |||||||

| Convertible Senior Notes | As of December 31, 2020, consists of NRG’s $575 million unsecured 2.75% Convertible Senior Notes due 2048 | |||||||

| Cottonwood | Cottonwood Generating Station, a 1,153 MW natural gas-fueled plant | |||||||

| COVID-19 | Coronavirus Disease 2019 | |||||||

| CPP | Clean Power Plan | |||||||

| CPUC | California Public Utilities Commission | |||||||

| CWA | Clean Water Act | |||||||

| D.C. Circuit | U.S. Court of Appeals for the District of Columbia Circuit | |||||||

| Distributed Solar | Solar power projects that primarily sell power to customers for usage on site, or are interconnected to sell power into a local distribution grid | |||||||

| DSI | Dry Sorbent Injection | |||||||

3

| DSU | Deferred Stock Unit | |||||||

| Economic gross margin | Sum of energy revenue, capacity revenue, retail revenue and other revenue, less cost of fuels and other cost of sales | |||||||

| EGU | Electric Generating Unit | |||||||

| EME | Edison Mission Energy | |||||||

| Energy Plus Holdings | Energy Plus Holdings LLC | |||||||

| EPA | U.S. Environmental Protection Agency | |||||||

| EPC | Engineering, Procurement and Construction | |||||||

| ERCOT | Electric Reliability Council of Texas, the Independent System Operator and the regional reliability coordinator of the various electricity systems within Texas | |||||||

| ESCO | Energy Service Companies | |||||||

| ESP | Electrostatic Precipitator | |||||||

| ESPP | NRG Energy, Inc. Amended and Restated Employee Stock Purchase Plan | |||||||

| Exchange Act | The Securities Exchange Act of 1934, as amended | |||||||

| FASB | Financial Accounting Standards Board | |||||||

| FERC | Federal Energy Regulatory Commission | |||||||

| FGD | Flue gas desulfurization | |||||||

| FPA | Federal Power Act | |||||||

| FTRs | Financial Transmission Rights | |||||||

| GAAP | Generally accepted accounting principles in the U.S. | |||||||

| GenConn | GenConn Energy LLC | |||||||

| GenOn | GenOn Energy, Inc. | |||||||

| GenOn Americas Generation | GenOn Americas Generation, LLC | |||||||

| GenOn Entities | GenOn and certain of its wholly owned subsidiaries, including GenOn Americas Generation, that filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code in the Bankruptcy Court on June 14, 2017 | |||||||

| GenOn Mid-Atlantic | GenOn Mid-Atlantic, LLC and, except where the context indicates otherwise, its subsidiaries, which include the coal generation units at two generating facilities under operating leases | |||||||

| GHG | Greenhouse Gas | |||||||

| GIP | Global Infrastructure Partners | |||||||

| Green Mountain Energy | Green Mountain Energy Company | |||||||

| Guam | NRG's wholly owned subsidiary NRG Solar Guam, LLC that was sold during the first quarter of 2019 | |||||||

| GW | Gigawatt | |||||||

| GWh | Gigawatt Hour | |||||||

| HDD | Heating Degree Day | |||||||

| Heat Rate | A measure of thermal efficiency computed by dividing the total BTU content of the fuel burned by the resulting kWhs generated. Heat rates can be expressed as either gross or net heat rates, depending whether the electricity output measured is gross or net generation and is generally expressed as BTU per net kWh | |||||||

| HLBV | Hypothetical Liquidation at Book Value | |||||||

| HLW | High-level radioactive waste | |||||||

| IPPNY | Independent Power Producers of New York | |||||||

| ICE | Intercontinental Exchange | |||||||

| ISO | Independent System Operator, also referred to as RTOs | |||||||

| ISO-NE | ISO New England Inc. | |||||||

| Ivanpah | Ivanpah Solar Electric Generation Station, a 393 MW solar thermal power plant located in California's Mojave Desert in which NRG owns 54.5% interest | |||||||

| kWh | Kilowatt-hour | |||||||

4

| LaGen | Louisiana Generating LLC | |||||||

| LIBOR | London Inter-Bank Offered Rate | |||||||

| LSE | Load Serving Entities | |||||||

| LTIPs | Collectively, the NRG LTIP and the NRG GenOn LTIP | |||||||

| Mass Market | Residential and small commercial customers | |||||||

| MATS | Mercury and Air Toxics Standards promulgated by the EPA | |||||||

| MDth | Thousand Dekatherms | |||||||

| Merger | The merger completed on December 14, 2012 by NRG and GenOn pursuant to the Merger Agreement | |||||||

| Midwest Generation | Midwest Generation, LLC | |||||||

| MISO | Midcontinent Independent System Operator, Inc. | |||||||

| MMBtu | Million British Thermal Units | |||||||

| MMDth | Million Dekatherms | |||||||

| MSU | Market Stock Unit | |||||||

| MW | Megawatts | |||||||

| MWe | Megawatt equivalent | |||||||

| MWh | Saleable megawatt hour net of internal/parasitic load megawatt-hour | |||||||

| NAAQS | National Ambient Air Quality Standards | |||||||

| NEIL | Nuclear Electric Insurance Limited | |||||||

| NEPOOL | New England Power Pool | |||||||

| NERC | North American Electric Reliability Corporation | |||||||

| Net Capacity Factor | The net amount of electricity that a generating unit produces over a period of time divided by the net amount of electricity it could have produced if it had run at full power over that time period. The net amount of electricity produced is the total amount of electricity generated minus the amount of electricity used during generation | |||||||

| Net Exposure | Counterparty credit exposure to NRG, net of collateral | |||||||

| Net Generation | The net amount of electricity produced, expressed in kWhs or MWhs, that is the total amount of electricity generated (gross) minus the amount of electricity used during generation | |||||||

| Net Revenue Rate | Sum of retail revenues less TDSP transportation charges | |||||||

| NJBPU | New Jersey Board of Public Utilities | |||||||

| NOL | Net Operating Loss | |||||||

NOx | Nitrogen Oxides | |||||||

| NPNS | Normal Purchase Normal Sale | |||||||

| NQSO | Non-Qualified Stock Option | |||||||

| NRC | U.S. Nuclear Regulatory Commission | |||||||

| NRG | NRG Energy, Inc. | |||||||

| NRG GenOn LTIP | NRG 2010 Stock Plan for GenOn Employees (formerly the GenOn Energy, Inc. 2010 Omnibus Incentive Plan, which was assumed by NRG in connection with the Merger) | |||||||

| NRG LTIP | NRG Energy, Inc. Amended and Restated Long-Term Incentive Plan | |||||||

| NRG Yield, Inc. | NRG Yield, Inc., which changed its name to Clearway energy, Inc. following the sale by NRG or NRG Yield and the Renewables Platform to GIP | |||||||

| Nuclear Decommissioning Trust Fund | NRG's nuclear decommissioning trust fund assets, which are for the Company's portion of the decommissioning of the STP, units 1 & 2 | |||||||

| Nuclear Waste Policy Act | U.S. Nuclear Waste Policy Act of 1982 | |||||||

| NYISO | New York Independent System Operator | |||||||

| NYMEX | New York Mercantile Exchange | |||||||

| NYSDEC | New York State Department of Environmental Conservation | |||||||

| NYSPSC | New York State Public Service Commission | |||||||

| OCI/OCL | Other Comprehensive Income/(Loss) | |||||||

5

| ORDC | Operating Reserve Demand Curve | |||||||

| Peaking | Units expected to satisfy demand requirements during the periods of greatest or peak load on the system | |||||||

| PER | Peak Energy Rent | |||||||

| Petra Nova | Petra Nova Parish Holdings, LLC | |||||||

| PG&E | PG&E Corporation (NYSE: PCG) and its primary operating subsidiary, Pacific Gas and Electric Company | |||||||

| Pipeline | Projects that range from identified lead to shortlisted with an offtake, and represents a lower level of execution certainty | |||||||

| PJM | PJM Interconnection, LLC | |||||||

| PM2.5 | Particulate Matter that has a diameter of less than 2.5 micrometers | |||||||

| PPA | Power Purchase Agreement | |||||||

| PPM | Parts per million | |||||||

| PSU | Performance Stock Unit | |||||||

| PTC | Production Tax Credit | |||||||

| PUCT | Public Utility Commission of Texas | |||||||

| RCE | Residential Customer Equivalent is a unit of measure used by the energy industry to denote the typical annual commodity consumption by a single-family residential customer. 1 RCE represents 1,000 therms of natural gas or 10,000 kWh of electricity | |||||||

| RCRA | Resource Conservation and Recovery Act of 1976 | |||||||

| RECs | Renewable Energy Certificates | |||||||

| REMA | NRG REMA LLC, which leases a 100% interest in the Shawville generating facility and 16.7% and 16.5% interests in the Keystone and Conemaugh generating facilities, respectively | |||||||

| Renewables | Consists of the following projects in which NRG has an ownership interest: Agua Caliente, Ivanpah, and solar generating stations located at various NFL Stadiums | |||||||

| Renewables Platform | The renewable operating and development platform sold to GIP with NRG's interest in NRG Yield. | |||||||

| Restructuring Support Agreement | Restructuring Support and Lock-Up Agreement, dated as of June 12, 2017 and as amended on October 2, 2017, by and among GenOn Energy, Inc., GenOn Americas Generation, LLC, and subsidiaries signatory thereto, NRG Energy, Inc. and the noteholders signatory thereto | |||||||

| Revolving Credit Facility | The Company's $2.6 billion revolving credit facility as of December 31, 2020, a component of the Senior Credit Facility, due 2024 was amended on May 28, 2019 and August 20, 2020 | |||||||

| RGGI | Regional Greenhouse Gas Initiative | |||||||

| RMR | Reliability Must-Run | |||||||

| RPM | Reliability Pricing Model | |||||||

| RPS | Renewable Portfolio Standards | |||||||

| RPSU | Relative Performance Stock Unit | |||||||

| RSU | Restricted Stock Unit | |||||||

| RTO | Regional Transmission Organization | |||||||

| SCE | Southern California Edison Company | |||||||

| SCR | Selective Catalytic Reduction Control System | |||||||

| SDG&E | San Diego Gas & Electric | |||||||

| SEC | U.S. Securities and Exchange Commission | |||||||

| Securities Act | The Securities Act of 1933, as amended | |||||||

| Senior Credit Facility | NRG's senior secured credit facility, comprised of the Revolving Credit Facility and the 2023 Term Loan Facility. The 2023 Term Loan Facility was repaid in the second quarter of 2019 | |||||||

6

| Senior Notes | As of December 31, 2020, NRG's $5.3 billion outstanding unsecured senior notes consisting of $1.0 billion of the 7.25% senior notes due 2026, $1.23 billion of the 6.625% senior notes due 2027, $821 million of 5.75% senior notes due 2028, $733 million of the 5.25% senior notes due 2029, $500 million of the 3.375% senior notes due 2029, and $1.0 billion of the 3.625% senior notes due 2031 | |||||||

| Senior Secured Notes | As of December 31, 2020, NRG’s $2.5 billion outstanding Senior Secured First Lien Notes consists of $600 million of the 3.75% Senior Secured First Lien Notes due 2024, $500 million of the 2.0% Senior Secured First Lien Notes due 2025, $900 million of the 2.45% Senior Secured First Lien Notes due 2027, and $500 million of the 4.45% Senior Secured First Lien Notes due 2029 | |||||||

| Services Agreement | NRG provided GenOn with various management, personnel and other services, which include human resources, regulatory and public affairs, accounting, tax, legal, information systems, treasury, risk management, commercial operations, and asset management, as set forth in the services agreement with GenOn | |||||||

| Settlement Agreement | A settlement agreement and any other documents necessary to effectuate the settlement among NRG, GenOn, and certain holders of senior unsecured notes of GenOn Americas Generations and GenOn, and certain of GenOn's direct and indirect subsidiaries | |||||||

| SNF | Spent Nuclear Fuel | |||||||

SO2 | Sulfur Dioxide | |||||||

| South Central Portfolio | NRG's South Central Portfolio, which owned and operated a portfolio of generation assets consisting of Bayou Cove, Big Cajun-I, Big Cajun-II, Cottonwood and Sterlington, was sold on February 4, 2019. NRG is leasing back the Cottonwood facility through May 2025 | |||||||

| S&P | Standard & Poor's | |||||||

| STP | South Texas Project — nuclear generating facility located near Bay City, Texas in which NRG owns a 44% interest | |||||||

| STPNOC | South Texas Project Nuclear Operating Company | |||||||

| Tax Act | The Tax Cuts and Jobs Act of 2017 | |||||||

| TDSP | Transmission/distribution service provider | |||||||

| Texas Genco | Texas Genco LLC | |||||||

| Transformation Plan | NRG's three-year plan announced in 2017 that included targets related to operations and excellence, portfolio optimization, and capital structure and allocation enhancement and was completed as of December 31, 2020 | |||||||

| TSA | Transportation Services Agreement | |||||||

| TSR | Total Shareholder Return | |||||||

| TWCC | Texas Westmoreland Coal Co. | |||||||

| TWh | Terawatt Hour | |||||||

| UPMC | University of Pittsburgh Medical Center | |||||||

| U.S. | United States of America | |||||||

| U.S. DOE | U.S. Department of Energy | |||||||

| Utility-Scale Solar | Solar power projects, typically 20 MW or greater in size (on an alternating current basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level | |||||||

| VaR | Value at Risk | |||||||

| VIE | Variable Interest Entity | |||||||

| WECC | Western Electricity Coordinating Council | |||||||

7

PART I

Item 1 — Business

General

NRG Energy, Inc., or NRG or the Company, is an integrated power company built on dynamic retail brands with diverse generation assets. NRG brings the power of energy to customers by producing and selling energy and related products and services, in major competitive power and gas markets in the U.S. and Canada in a manner that delivers value to all of NRG's stakeholders. NRG is a customer-centric business focused on perfecting the integrated model by balancing retail load with generation supply within its deregulated markets. As of December 31, 2020, the Company sold energy, services, and innovative, sustainable products and services directly to retail customers under the brand names NRG, Reliant, Green Mountain Energy, Stream, and XOOM Energy, as well as other brand names owned by NRG, supported by approximately 23,000 MW of generation.

NRG also conducts business under the brand name of Direct Energy as a result of the Company's acquisition of Direct Energy, a North American subsidiary of Centrica plc, on January 5, 2021. Direct Energy is a leading retail provider of electricity, natural gas, and home and business energy related products and services in North America, with operations in all 50 U.S. states and 8 Canadian provinces. In addition, Direct Energy is a participant in the wholesale gas and power markets in the United States and Canada. See Item 15 — Note 4, Acquisitions, Discontinued Operations and Dispositions, to the Consolidated Financial Statements for further discussion of the acquisition of Direct Energy.

On February 28, 2021, the Company entered into a definitive purchase agreement with Generation Bridge, an affiliate of ArcLight Capital Partners, to sell approximately 4,850 MWs of fossil generating assets from its East and West regions of operations for total proceeds of $760 million, subject to standard purchase price adjustments and certain other indemnifications. As part of the transaction, NRG is entering into a tolling agreement for its 866 MW Arthur Kill plant in New York City through April 2025. The transaction is expected to close in the fourth quarter of 2021, and is subject to various closing conditions, approvals and consents, including FERC, NYSPSC, and antitrust review under Hart-Scott-Rodino.

The Company has achieved the targets related to operations and cost excellence, portfolio optimization, and capital structure and allocation enhancement, as set out by the Transformation Plan. See Item 7 - Management's Discussion and Analysis of Financial Conditions and Results of Operations for further discussion.

Strategy

NRG's strategy is to maximize stakeholder value through the safe production and sale of reliable power and gas to its customers in the markets it serves, while positioning the Company to provide innovative solutions to the end-use energy customer. This strategy is intended to enable the Company to optimize its integrated model to generate stable and predictable cash flow, significantly strengthen earnings and cost competitiveness, and lower risk and volatility.

To effectuate the Company’s strategy, NRG is focused on: (i) serving the energy needs of end-use residential, commercial and industrial, and wholesale customers in competitive markets through multiple brands and channels; (ii) offering a variety of energy products and services, including renewable energy solutions, that are differentiated by innovative features, premium service, sustainability, and loyalty/affinity programs; (iii) excellence in operating performance of its existing assets; (iv) optimal hedging of NRG's portfolio; and (v) engaging in disciplined and transparent capital allocation.

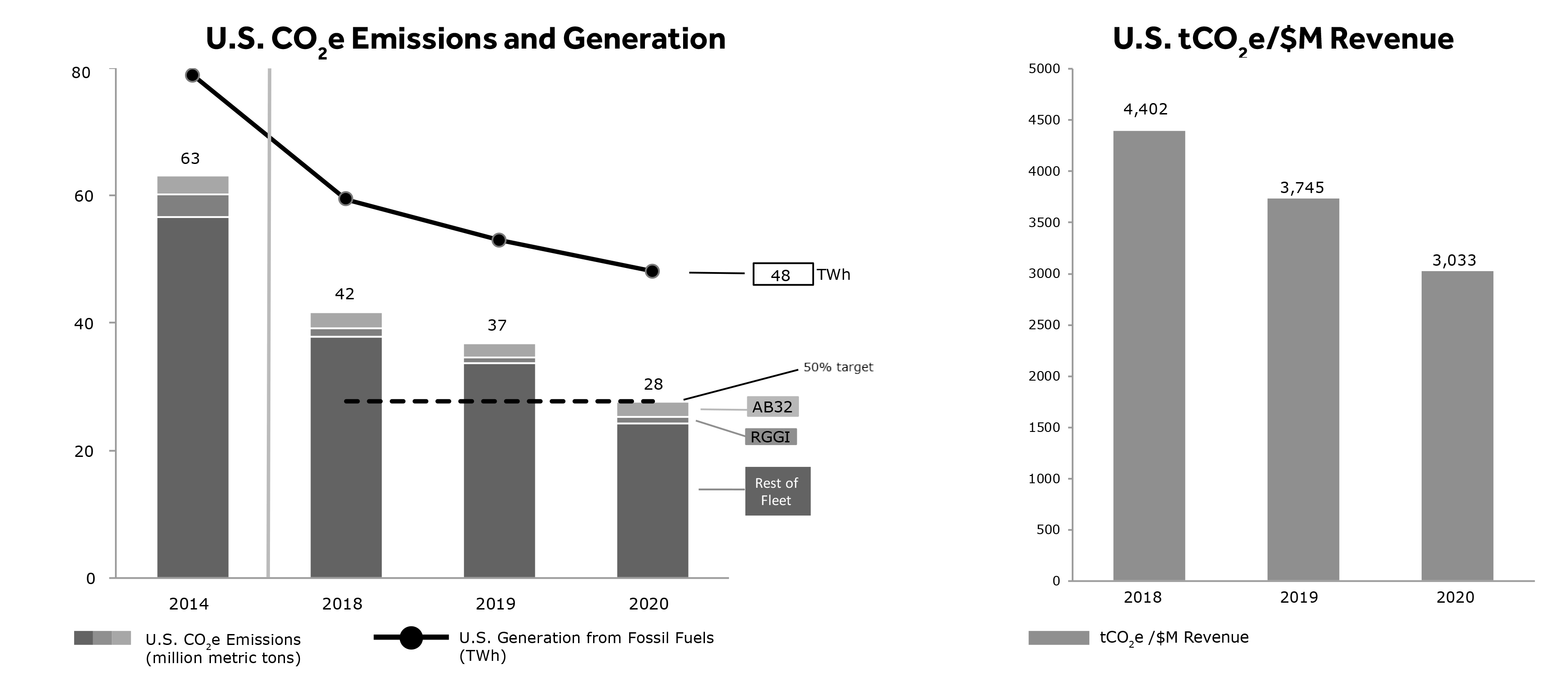

Sustainability is an integral piece of NRG's strategy and ties directly to business success, reduced risks and brand value. In 2019, NRG announced the acceleration of its science-based GHG emissions reduction goals to align with prevailing climate science, limiting global warming in the post-industrial era to 1.5 degree Celsius. Under its new GHG emissions reduction timeline, NRG is targeting a 50% reduction by 2025, from its current 2014 baseline, and net-zero emissions by 2050. The Company is on track to meet its 2025 goal.

Business Overview

The Company’s core business is the sale of electricity and natural gas to residential, commercial and industrial customers, supported by the Company's wholesale generation.

As part of perfecting the integrated model, in which the majority of the Company’s generation serves its retail customers, the Company began managing its operations based on the combined results of the retail and wholesale generation businesses with a geographical focus in 2020. As a result, the Company changed its business segments from Retail and Generation to Texas, East and West/Other beginning in the first quarter of 2020. The Company's updated segment structure reflects how management makes financial decisions and allocates resources.

The Company's business is segregated as follows:

•Texas, which includes all activity related to customer, plant and market operations in Texas;

8

•East, which includes the remaining activity related to customer operations and all activity related to plant and market operations in the East;

•West/Other, which includes the following assets and activities: (i) all activity related to plant and market operations in the West, (ii) activity related to the Cottonwood power plant that was sold to Cleco on February 4, 2019 and is being leased back until 2025, (iii) the remaining renewables activity, including the Company’s equity method investments in Ivanpah Master Holdings, LLC and Agua Caliente (which was sold on February 3, 2021) and the NFL stadium solar generating assets, and (iv) activity related to the Company’s equity method investment for the Gladstone power plant in Australia; and

•Corporate activities.

As of December 31, 2020, the vast majority of the Company’s business was in Texas, where the Company’s generation supply is fully integrated with its retail load. In the East, the Company’s retail load is more dispersed throughout the region and not fully integrated with the Company’s generation supply due to the locations of its power plants in that region. In the West, the Company’s business is primarily generation supply. The acquisition of Direct Energy broadens the Company's presence in the Northeast and into states and locales where it did not previously operate, supporting NRG's objective to diversify its business.

The acquired operations of Direct Energy will be integrated into the existing NRG segment structure. Domestic customer and market operations will be combined into the corresponding geographical segments of Texas, East and West/Other. The East segment will also include the deregulated customer and market operations of Canada. The West/Other segment will also include activity related to the regulated operations in Alberta, Canada and the services businesses.

The Company’s integrated model consists of three core functions: Customer Operations, Market Operations and Plant Operations, which directly support each other in each geographic region. The Company’s integrated model provides the advantage of being able to supply the Company’s retail customers with electricity from the Company’s assets, which reduces the need to sell electricity to and buy electricity from other institutions and intermediaries, resulting in stable earnings and cash flows, lower transaction costs and less credit exposure. The integrated model also results in a reduction in actual and contingent collateral through offsetting transactions, thereby minimizing transactions with third parties.

NRG provides energy and related services to residential, industrial and commercial, and wholesale customers at either fixed, indexed or month-to-month prices through various brands and sales channels across the U.S. and Canada. Residential and small commercial ("Mass market") customers typically contract for terms ranging from one month to five years, while industrial and large commercial ("C&I") contracts are often between one year and five years in length. NRG sold approximately 68.2 TWhs of electricity and 23.5 MMDth of natural gas in 2020 and served approximately 3.6 million customers as of December 31, 2020, making it one of the largest competitive energy retailers in the U.S. In any given year, the quantity of TWhs and MMDth sold can be affected by weather, economic conditions and competition. As of the end of 2020, NRG had recurring electricity and/or natural gas sales in 19 U.S. states, the District of Columbia, and 2 provinces in Canada. Following the acquisition of Direct Energy, NRG has recurring electricity and/or natural gas sales in 24 U.S. states, the District of Columbia, and 8 provinces in Canada. NRG's retail brands, collectively, have the largest share of competitively served residential electric customers in Texas and nationwide.

9

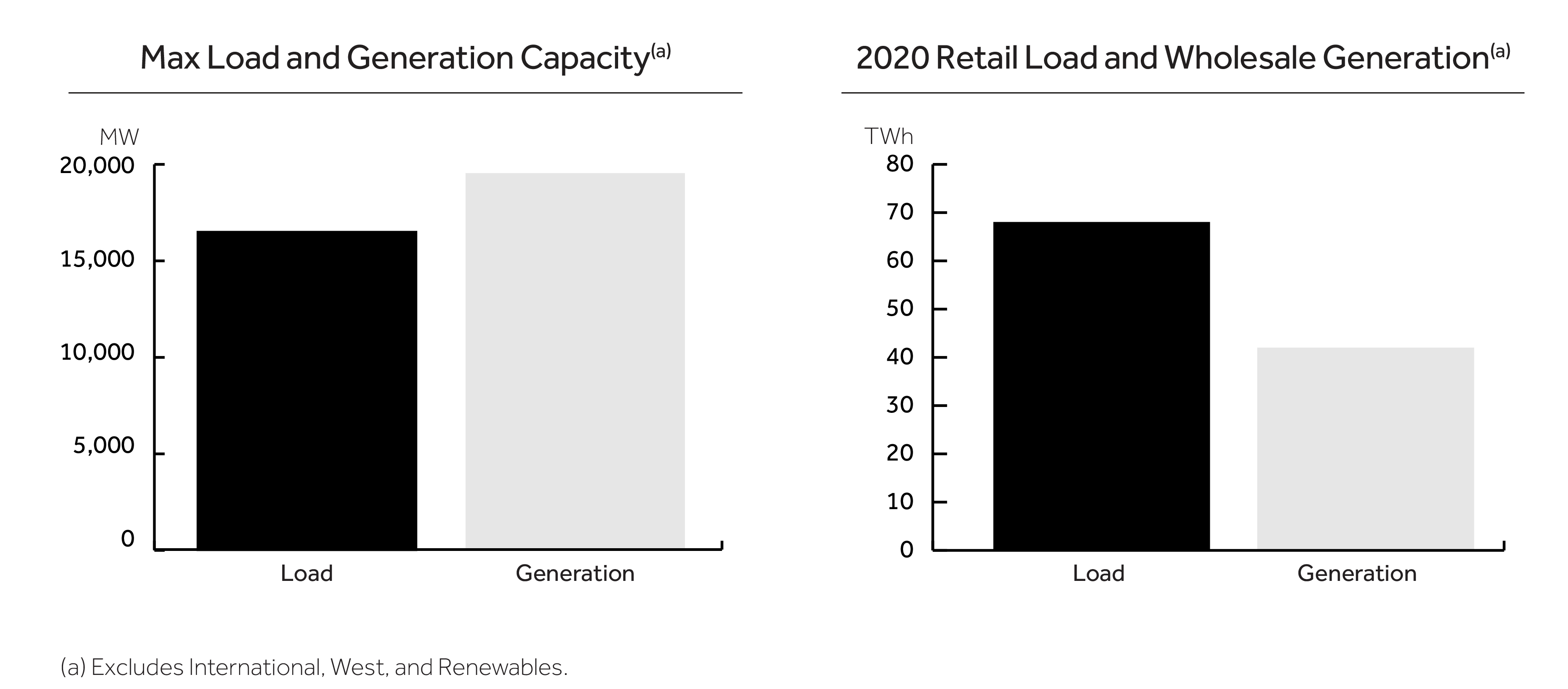

The charts below illustrate NRG's U.S. retail capabilities, power generation and net capacity as of and for the year ended December 31, 2020:

Extreme Weather Event in Texas During February 2021

During February 2021, Texas experienced unprecedented cold temperatures for a prolonged duration, resulting in a power emergency, blackouts, and an estimated all-time peak demand of 77 GWs (without load shed). Ahead of the event, NRG launched residential customer communications calling for conservation across all of its brands, and initiated residential and commercial and industrial demand response programs to curtail customer load. The Company maximized available generating capacity and brought in additional resources to supplement in-state staff with technical and operating experts from the rest of its U.S. fleet. NRG is committed to working with all necessary stakeholders on a comprehensive, objective, and exhaustive root cause analysis of the entirety of the energy system.

The estimated financial impact is still preliminary, due to customer meter and settlement data not being finalized, as well as potential customer and counterparty risk and expected ERCOT default allocations. Based on a preliminary analysis, Winter Storm Uri's financial impact is not expected to be adverse to NRG's financial results. The Company separately stress-tested assumptions and although at a lower probability, this stress-test analysis indicated a potential plus or minus $100 million to income from continuing operations in 2021. NRG's integrated platform continues to deliver stable results through unprecedented events.

COVID-19

In March 2020, the World Health Organization categorized COVID-19 as a pandemic and the President of the United States declared the COVID-19 outbreak a national emergency. Electricity was deemed a ‘critical and essential business operation’ under various state and federal governmental COVID-19 mandates.

NRG has been and continues to remain focused on protecting the health and well-being of its employees, while supporting its customers and the communities in which it operates and assuring the continuity of its operations. During 2020, NRG contributed $2 million to COVID-19 relief efforts, including funding for urgently needed safety equipment supporting first responders, as well as funds that aided local communities and teachers. The Company also allocated funding to the NRG Employee Relief Fund to assist employees adversely impacted by natural disasters and other extraordinary events.

NRG activated its Crisis Management Team ("CMT") in January 2020, which proactively began managing the Company's response to the impacts of COVID-19. The CMT implemented the business continuity plans for the Company and had taken a variety of measures to ensure the ongoing availability of the Company's services, while maintaining the Company's commitment to its core values of health and safety. Pursuant to the Company's Infectious Disease & Pandemic Policy, in March 2020, NRG implemented restrictions on business travel and face-to-face sales channels, instituted remote work practices and enhanced cleaning and hygiene protocols in all of its offices and facilities.

In order to effectively serve the Company’s customers, select essential employees and contractors continued to report to plant and certain office locations. In June 2020, summer-critical office employees also returned to the offices.

10

The Company requires pre-entry screening, including temperature checks, separation of work crews, additional personal protective equipment for employees and contractors when social distancing cannot be maintained, and a ban on all non-essential visitors. As a result of these business continuity measures, the Company has not experienced any material disruptions in its ability to continue its business operations to date. The first COVID-19 vaccine became available in the United States in December 2020. NRG continues to advocate alongside state and federal trade groups for the high prioritization of essential electric industry personnel for inoculation against COVID-19. States are receiving weekly doses of vaccines and allocating those doses to frontline healthcare workers, elderly populations and high risk individuals. NRG continues to monitor state information as well as dosage and allocation numbers to anticipate the latest timing of vaccine distribution to our essential employees. The Company will continue to evaluate additional return to normal work operations on a location-by-location basis as COVID-19 conditions evolve.

The Company continues to utilize the communication protocol established in January 2020, including a central information hub on its intranet. The Company has provided additional wellness programs to support employees through the pandemic, including no-cost access to telehealth services, a mindfulness and meditation program, center or home-based backup child and elder care, and access to the Company's Emergency Relief Fund for financially impacted employees.

Following the President's declaration of COVID-19 outbreak as a national emergency in March 2020, the Governors of the majority of states in which the Company operates issued executive orders that every person should, except where necessary to provide or obtain essential services, minimize social gatherings and minimize in-person contact with people who are not in the same household. The impact of these orders affected energy loads due to closed schools, restaurants and bars, except in certain cases for takeout, and other non-essential businesses. As state restrictions have been eased or lifted, loads have begun to recover in those markets in which the Company operates. The rebound in demand has varied across the Company's market footprint, as restrictions vary regionally. During 2020, the Company experienced increased demand from its residential portfolio as many people remained at home, while the load for small businesses and C&I customers decreased due to reduced economic activity. The Company expects similar demand trends to continue in the near future. These restrictions have also created limitations to the Company's face-to-face sales channels and are expected to negatively impact the Company's customer count primarily in the East region. As the COVID-19 vaccine is distributed and the spread of transmission decreases, the Company would anticipate changes to the previously disclosed restrictions.

In Texas, the PUCT adopted the COVID-19 Electricity Relief Program (“ERP”) to mitigate the impact of COVID-19 on Texas retail electric customers experiencing economic hardship as a result of the pandemic. The COVID-19 ERP provided temporary disconnection protection for eligible customers and established funds to offset some of the costs incurred by retail electric providers that continued service to those customers. The COVID-19 ERP disconnection protection and benefits ended on September 30, 2020. Consistent with the PUCT's orders, NRG is continuing to offer deferred payment plans to all residential and small commercial customers while the declaration of emergency in Texas is in place.

While the pandemic presented risks, as further described in Part II, Item 1A — Risk Factors of this Form 10-K, to the Company’s business, there was not a material adverse impact on the Company’s results of operations for the year ended December 31, 2020. NRG believes it has sufficient liquidity on hand to continue business operations in light of current circumstances posed by the pandemic. As disclosed in the Liquidity and Capital Resources section, the Company has total available liquidity of $7.0 billion as of December 31, 2020, consisting of cash on hand, its Revolving Credit Facility and additional facilities.

The situation surrounding COVID-19 remains fluid and the potential for a material adverse impact on the Company exists as long as the virus impacts the level of economic activity in the United States and abroad. The Company expects the risk to decrease in the future as vaccinations are administered. NRG cannot reasonably estimate with any degree of certainty the full impact COVID-19, and any resurgence of COVID-19, may have on the Company’s future results of operations, financial position, and liquidity. The extent to which the COVID-19 pandemic may impact the Company’s business, operating results, financial condition, risk exposure or liquidity will depend on future developments, including the duration of the pandemic, travel restrictions, business and workforce disruptions, any resurgence of the pandemic and the effectiveness of actions taken to contain, mitigate and treat the disease. See Part I, Item 1A — Risk Factors of this Form 10-K.

Customer Operations

Customer Operations is responsible for growing and retaining the customer base and delivering an outstanding customer experience. This includes acquisition and retention of all of NRG’s residential, small commercial, government and commercial & industrial customers. NRG employs a multi-brand strategy that leverages a wide array of sales and partnership channels, direct face-to-face sales channels, call centers, websites, and brokers. Go-to-market activities include market strategy planning and development, product innovation, offer design, campaign execution, marketing and creative services, and selling. Customer portfolio maintenance and retention activities include fulfillment, billing, payment processing, collections, customer service, issue resolution, and contract renewals. Throughout all Customer Operations activities, the customer experience is kept at the forefront to inform decision-making and optimize retention, while creating supporters and advocates for NRG’s brands in the

11

market. Following the expansion of the customer base with the acquisition of Direct Energy, Customer Operations now comprises three end-use customer facing teams: NRG Home, which serves Mass Market customers, NRG Business, which serves medium and large business customers, and NRG Services, which primarily includes the services businesses acquired.

Product Offerings

NRG sells a variety of products to residential and small commercial customers, including retail electricity and energy management, natural gas, home security, line and surge protection products, HVAC installation, repair and maintenance, home warranty and protection products, carbon offsets, back-up power stations, portable power, portable solar and portable lighting. Mass market customers make purchase decisions based on a variety of factors, including price, incentive, customer service, brand, innovative offers/features and referrals from friends and family. Through its broad range of service offerings and value propositions, NRG is able to attract, retain, and increase the value of its customer relationships. NRG's brands are recognized for exemplary customer service, innovative smart energy and technology product offerings, and environmentally-friendly solutions.

The Company provides power and natural gas to the business-to-business markets in North America, as well as retail services, including demand response, commodity sales, energy efficiency and energy management solutions to C&I customers. The Company is an integrated provider of supply and distributed energy resources and focuses on distributed products and services as businesses seek greater reliability, cleaner power and/or other benefits that they cannot obtain from the grid. These solutions include system power, distributed generation, renewable products, carbon management and specialty services, backup generation, storage and distributed solar, demand response, and energy efficiency and advisory services. In providing on-site energy solutions, the Company often benefits from its ability to supply energy products from its wholesale generation portfolio to C&I customers. In 2020, the Company sold approximately 20 TWhs of electricity to C&I customers and managed approximately 1,750 MWs of demand response positions across its portfolio.

Market Operations

Market Operations has two primary objectives: (i) to supply energy to our customers in the most cost-efficient manner; and (ii) to maximize the value of the Company's assets after satisfying its customer load requirements. These objectives are intended to reduce supply costs and maximize earnings with predictable cash flows.

To meet these objectives, NRG enters into supply, power and gas sales and hedging arrangements via a wide range of products and contracts, including (i) renewable PPAs, (ii) capacity auctions and other contracted revenue sources, (iii) fuel supply and transportation contracts, and (iv) physical and financial natural gas derivative instruments and other financial instruments.

In addition, because changes in power prices in the markets where NRG operates are generally correlated to changes in natural gas prices, NRG uses hedging strategies that may include power and natural gas forward purchases and sales contracts to manage the commodity price risk.

Renewable PPAs

During 2019, NRG began procuring mid to long-term renewable generation through power purchase agreements. As of December 31, 2020, NRG has entered into PPAs in Texas totaling approximately 1,800 MWs with third-party project developers and other counterparties. The tenor of these agreements is an average between eleven and twelve years. The Company expects to continue evaluating and executing agreements, such as these, that support the needs of the business.

Capacity and Other Contracted Revenue Sources

NRG's revenues and cash flows, primarily in the East and West, benefit from capacity/demand payments and other contracted revenue sources, originating from market clearing capacity prices, resource adequacy contracts, tolling arrangements and other long-term contractual arrangements.

The Company's largest sources of capacity revenues are capacity auctions in PJM, ISO-NE and NYISO. Both PJM and ISO-NE operate a pay-for-performance model where capacity payments are modified based on real-time performance and NRG's actual revenues will be the combination of revenues based on the cleared auction MWs plus the net of any over- and under-performance of NRG's respective generation assets. The Company primarily sells physical and financial capacity forward through bilateral contracts for our New York state assets. To the extent NRG is not able to enter into physical bilateral contracts, NRG will sell the remaining capacity into the NYISO six month strip, monthly or spot auctions.

•2024/2025 ISO-NE Auction Results - On February 11, 2020 ISO-NE announced the results of its 2024/2025 forward capacity auction. NRG cleared 1,518 MW of capacity. NRG's expected capacity revenues from the auction for the 2024/2025 delivery year are approximately $48 million.

12

•PJM Auction Results —PJM announced during 2019 it was suspending all auction deadlines relating to Base Residual Auctions for 2022/2023 and 2023/2024 delivery year, consistent with FERC’s July 25, 2019 Order. The auctions are now set to resume in 2021. Refer to the Capacity Market Reforms Filing discussion within the Regional Regulatory Developments section below for further discussion.

In California, there is a resource adequacy requirement that is primarily satisfied through bilateral contracts. Such bilateral contracts are typically short-term resource adequacy contracts. When bilateral contracting does not satisfy the resource adequacy need, such shortfalls can be addressed through procurement tools administered by the CAISO, including the capacity procurement mechanism or reliability must-run contracts.

Fuel Supply and Transportation

NRG's fuel requirements consist of various forms of fossil fuel and nuclear fuel. The prices of fossil fuels can be volatile. The Company obtains its fossil fuels from multiple suppliers and through multiple transporters. Although availability is generally not an issue, localized shortages, transportation availability, delays arising from extreme weather conditions and supplier financial stability issues can and do occur. The preceding factors related to the sources and availability of raw materials are fairly uniform across the Company's business and fuel products used. NRG's primary fuel requirements consist of the following:

Natural Gas — NRG operates a fleet of mid-merit and peaking natural gas plants across all its U.S. wholesale regions. Fuel needs are managed on a spot basis, especially for peaking assets, as the Company does not believe it is prudent to forward purchase natural gas for these types of units as the dispatch is highly unpredictable. The Company contracts for natural gas storage services, as well as natural gas transportation services to deliver natural gas when needed.

Coal — The Company believes it is adequately hedged, using forward coal supply agreements, for its domestic coal consumption for 2021. NRG actively manages its coal requirements based on forecasted generation, market volatility and its inventory on site. As of December 31, 2020, NRG had purchased forward contracts to provide fuel for approximately 50% of the Company's expected requirements for 2021 and 2022 . NRG purchased approximately 11 million tons of coal in 2020, almost all of which was Powder River Basin coal. For fuel transport, NRG has entered into various rail transportation and rail car lease agreements with varying tenures that will provide for most of the Company's transportation requirements of Powder River Basin coal for the next 2 years.

Nuclear Fuel — STP's owners, including NRG, satisfy their fuel supply requirements by: (i) acquiring uranium concentrates and contracting for conversion of the uranium concentrates into uranium hexafluoride; (ii) contracting for enrichment of uranium hexafluoride; and (iii) contracting for fabrication of nuclear fuel assemblies. Through its proportionate participation in STPNOC, which is the NRC-licensed operator of STP that is responsible for all aspects of fuel procurement, NRG is party to a number of long-term forward purchase contracts with many of the world's largest suppliers covering STP's requirements for uranium concentrates with only approximately 25% of STP's requirements outstanding for the duration of the original operating license. Similarly, NRG is party to long-term contracts to procure STP's requirements for conversion and enrichment services and fuel fabrication for the life of the operating license. Since the operating license was renewed for another 20 years in 2017, STPNOC has begun to review a second phase of fuel purchasing.

Derivative Instruments and Other Financial Instruments

NRG also trades electric power, natural gas and related commodities, environmental products, weather products and financial products, including forwards, futures, options and swaps. NRG enters into these instruments for many reasons, including to manage price and delivery risk, optimize physical and contractual assets in the portfolio, manage working capital requirements, reduce the carbon exposure in its business and comply with regulations and laws.

Plant Operations

The Company owns a diversified power generation portfolio with approximately 23,000 MW of fossil fuel, nuclear and renewable generation capacity at 33 plants as of December 31, 2020. The Company's power generation assets are diversified by fuel-type, dispatch level and region, which helps mitigate the risks associated with fuel price volatility and market demand cycles. NRG continually evaluates its generation portfolio to focus on asset optimization opportunities and the locational value of its generation assets in each of the markets where the Company participates, as well as opportunities for the development of new generation.

13

The following table summarizes NRG's generation portfolio as of December 31, 2020:

(In MW)(a) | ||||||||||||||||||||||||||

| Type | Texas | East | West/Other | Total | ||||||||||||||||||||||

| Natural gas | 4,774 | 2,742 | 2,308 | 9,824 | ||||||||||||||||||||||

| Coal | 4,174 | 3,140 | 605 | 7,919 | ||||||||||||||||||||||

| Oil | — | 3,600 | — | 3,600 | ||||||||||||||||||||||

| Nuclear | 1,132 | — | — | 1,132 | ||||||||||||||||||||||

| Utility Scale Solar | — | — | 321 | 321 | ||||||||||||||||||||||

Battery Storage(b) | 2 | — | — | 2 | ||||||||||||||||||||||

| Total generation capacity | 10,082 | 9,482 | 3,234 | 22,798 | ||||||||||||||||||||||

(a)All Utility Scale Solar are described in MW on an alternating current basis. MW figures provided represent nominal summer net MW capacity of power generated as adjusted for the Company's owned or leased interest excluding capacity from inactive/mothballed units

(b)The Distributed Solar figure includes the aggregate production capacity of installed and activated residential solar energy systems

Plant Operations is responsible for operating the Company's generation facilities at the highest standards of safety and reliability, and includes (i) operations and maintenance, (ii) asset management, and (iii) development, engineering and construction.

Operations & Maintenance

NRG operates and maintains its generation portfolio, as well as approximately 7,243 MW of additional coal and natural gas generation capacity at 11 plants operated on behalf of third parties as of December 31, 2020 using prudent industry practices for the safe, reliable and economic generation of electricity in compliance with all local, state and federal requirements. The Company follows a consistent set of operating requirements, including a solid base of training, required adherence to specific safety and environmental limits, procedure and checklist usage, and the implementation of continuous process improvement through incident investigations.

NRG uses best-in-class maintenance practices for preventive, predictive, and corrective maintenance planning. The Company’s strategic planning process evaluates equipment condition, performance, and obsolescence to support the development of a comprehensive work scope and schedule for long-term performance.

Asset Management

NRG manages all aspects of its generation portfolio to optimize the lifecycle value of the assets, consistent with the Company’s goals. The Company evaluates capital projects required for continued operation and strategic enhancement of the assets, provides quality assurance on capital outlays, and assesses the impact of rules, regulations, and laws on business profitability. In addition, the Company manages its long-term contracts, power purchase agreements, and real estate holdings and provides third party asset management services.

Development, Engineering & Construction

NRG develops, engineers and executes major plant modifications, “new build” generation and energy storage projects that enhance the value of its generation portfolio and provide options to meet generation growth needs in the retail markets we serve, in accordance with the Company’s strategic goals. Projects have included gas-fired generation development and construction, coal to gas conversions, grid scale energy storage development, grid scale renewable construction, and asset demolition, remediation and reclamation work.

14

Operational Statistics

The following statistics represent the Company's retail customer count, load and contract mix:

| Years ended December 31, | |||||||||||||||||

| 2020 | 2019 | 2018 | |||||||||||||||

Sales volumes (in GWh) | |||||||||||||||||

| Mass Market electricity - Texas | 38,473 | 38,958 | 37,846 | ||||||||||||||

| Mass Market electricity - East | 10,221 | 9,918 | 7,968 | ||||||||||||||

| C&I electricity - Texas | 17,928 | 18,976 | 20,192 | ||||||||||||||

| C&I electricity - East | 1,596 | 1,214 | 984 | ||||||||||||||

| Total Load | 68,218 | 69,066 | 66,990 | ||||||||||||||

Customer count - Electricity (in thousands) | |||||||||||||||||

Mass Market - Texas (a) | |||||||||||||||||

| Average retail | 2,449 | 2,358 | 2,209 | ||||||||||||||

| Ending retail | 2,451 | 2,450 | 2,318 | ||||||||||||||

Mass Market - East | |||||||||||||||||

| Average retail | 1,019 | 990 | 790 | ||||||||||||||

| Ending retail | 970 | 1,070 | 903 | ||||||||||||||

(a) Includes customers of non-electric services | |||||||||||||||||

Customer count - Natural gas - East (in thousands) | |||||||||||||||||

| Average retail Mass Market | 156 | 122 | 64 | ||||||||||||||

| Ending retail Mass Market | 166 | 158 | 99 | ||||||||||||||

| Customer contract mix | |||||||||||||||||

| Fixed | 69 | % | 67 | % | 65 | % | |||||||||||

| Month-to-month | 23 | % | 24 | % | 25 | % | |||||||||||

| Indexed | 8 | % | 9 | % | 10 | % | |||||||||||

| 100 | % | 100 | % | 100 | % | ||||||||||||

The following are industry statistics for the Company's fossil and nuclear plants, as defined by the NERC, and are more fully described below:

Annual Equivalent Availability Factor, or EAF — Measures the percentage of maximum generation available over time as the fraction of net maximum generation that could be provided over a defined period of time after all types of outages and deratings, including seasonal deratings, are taken into account.

Net Heat Rate — The net heat rate represents the total amount of fuel in BTU required to generate one net kWh provided.

Net Capacity Factor — The net amount of electricity that a generating unit produces over a period of time divided by the net amount of electricity it could have produced if it had run at full power over that time period. The net amount of electricity produced is the total amount of electricity generated minus the amount of electricity used during generation.

15

The tables below present these performance metrics for the Company's generation portfolio, including leased facilities and those accounted for as equity method investments, for the years ended December 31, 2020 and 2019:

| Year Ended December 31, 2020 | |||||||||||||||||||||||||||||

Fossil and Nuclear Plants (a) | |||||||||||||||||||||||||||||

Net Owned Capacity (MW) | Net Generation (In thousands of MWh) (a) | Annual Equivalent Availability Factor | Average Net Heat Rate BTU/kWh | Net Capacity Factor | |||||||||||||||||||||||||

| Texas | 10,082 | 31,385 | 76.0 | % | 7,704 | 35.9 | % | ||||||||||||||||||||||

| East | 9,482 | 4,102 | 81.7 | % | 12,329 | 4.8 | % | ||||||||||||||||||||||

West/Other (b)(c) | 3,234 | 9,171 | 88.0 | % | 7,338 | 52.3 | % | ||||||||||||||||||||||

| Year Ended December 31, 2019 | |||||||||||||||||||||||||||||

Fossil and Nuclear Plants (a) | |||||||||||||||||||||||||||||

Net Owned Capacity (MW) | Net Generation (In thousands of MWh) (a) | Annual Equivalent Availability Factor | Average Net Heat Rate BTU/kWh | Net Capacity Factor | |||||||||||||||||||||||||

| Texas | 10,061 | 37,995 | 83.3 | % | 10,542 | 43.2 | % | ||||||||||||||||||||||

| East | 9,426 | 6,913 | 81.7 | % | 11,917 | 8.3 | % | ||||||||||||||||||||||

West/Other (b)(c) | 3,294 | 9,462 | 79.9 | % | 6,751 | 51.4 | % | ||||||||||||||||||||||

(a)Net generation excludes equity method investments

(b)Includes the Sherbino and Guam facilities that were sold in 2019

(c)Includes the aggregate production capacity of installed and activated residential solar energy systems

The generation performance by region for the three years ended December 31, 2020, 2019 and 2018 is shown below:

| Net Generation | |||||||||||||||||

| (In thousands of MWh) | 2020 | 2019 | 2018 | ||||||||||||||

| Texas | |||||||||||||||||

| Coal | 15,701 | 21,985 | 24,781 | ||||||||||||||

| Gas | 6,006 | 6,315 | 4,415 | ||||||||||||||

Nuclear (a) | 9,678 | 9,695 | 9,018 | ||||||||||||||

| Total Texas | 31,385 | 37,995 | 38,214 | ||||||||||||||

| East | |||||||||||||||||

| Coal | 1,888 | 4,435 | 7,965 | ||||||||||||||

| Oil | 322 | 209 | 544 | ||||||||||||||

| Gas | 1,892 | 2,269 | 1,610 | ||||||||||||||

| Total East | 4,102 | 6,913 | 10,119 | ||||||||||||||

| West/Other | |||||||||||||||||

| Gas | 9,165 | 9,450 | 10,187 | ||||||||||||||

| Renewables | 6 | 12 | 783 | ||||||||||||||

| Total West/Other | 9,171 | 9,462 | 10,970 | ||||||||||||||

(a)Reflects the Company's undivided interest in total MWh generated by STP

Competition

While there has been consolidation in the competitive retail space over the past few years, there is still considerable competition for customers. In Texas, there is healthy competition in deregulated areas and customers can choose providers based on the most appealing offers. Outside of Texas, electricity retailers compete with the incumbent utilities, in addition to other retail electric providers, which can inhibit competition, depending on the market rules of the state. There is a high degree of fragmentation, with both large and small competitors offering a range of value propositions, including value, rewards, and sustainability.

Wholesale generation is highly fragmented and diverse in terms of industry structure by region. As such, there is a wide variation in terms of the capabilities, resources, nature and identities of the Company’s competitors depending on the market. Competitors include regulated utilities, municipalities, cooperatives, other independent power producers, and power marketers or trading companies, including those owned by financial institutions.

16

Seasonality and Price Volatility

The sale of electric power to retail customers is a seasonal business with the demand for power generally peaking during the summer months. In connection with the acquisition of Direct Energy, the Company acquired a large natural gas customer portfolio, which generally experiences peak demand during the winter months. As a result, net working capital requirements for the Company's retail operations generally increase during summer and winter months along with the higher revenues, and then decline during off-peak months. Weather may impact operating results and extreme weather conditions could have a material impact. The rates charged to retail customers may be impacted by fluctuations in total power prices and market dynamics, such as the price of natural gas, transmission constraints, competitor actions, and changes in market heat rates.

Annual and quarterly operating results of the Company's generation portfolio can be significantly affected by weather and energy commodity price volatility. Significant other events, such as the demand for natural gas, interruptions in fuel supply infrastructure and relative levels of hydroelectric capacity can increase seasonal fuel and power price volatility. The preceding factors related to seasonality and price volatility are fairly uniform across the regions in which the Company operates.

Market Framework

NRG sells electricity, natural gas and related products and services to customers throughout the U.S. and Canada. In most of the states and regions that have introduced retail consumer choice, NRG competitively offers electricity, natural gas, portable power and other value-enhancing services to customers. Each retail consumer choice state or province establishes its own retail competition laws and regulations, and the specific operational, licensing, and compliance requirements vary by state or province. Regulated terms and conditions of default service, as well as any movement to replace default service with competitive services, as is done in ERCOT, can affect customer participation in retail competition. In Canada, NRG sells energy and related services to residential and commercial customers in the province of Alberta pursuant both to a regulated rate service governed by provincial regulations as well as a competitive service with rates set by market forces. Sales of energy to commercial customers take place in other provinces as well. The attractiveness of NRG's retail offerings may be impacted by the rules, regulations, market structure and communication requirements from public utility commissions in each state and province.

NRG's fleet operates in organized energy markets, known as RTOs or ISOs. Each organized market administers day-ahead and real-time centralized bid-based energy and ancillary services markets pursuant to tariffs approved by FERC, or in the case of ERCOT, market rules approved by the PUCT. These tariffs and rules dictate how the energy markets operate, how market participants make bilateral sales with one another, and how entities with market-based rates are compensated. Established prices reflect the value of energy at the specific location and time it is delivered, which is known as the Locational Marginal Price. Each market is subject to market mitigation measures designed to limit the exercise of locational market power. These market structures facilitate NRG's sale of power and capacity products at market-based rates.

Other than ERCOT, each of the ISO regions also operates a capacity or resource adequacy market that provides an opportunity for generating and demand response resources to earn revenues to offset their fixed costs that are not recovered in the energy and ancillary services markets. The ISOs are also responsible for transmission planning and operations.

Texas

NRG's business in Texas is subject to standards and regulations adopted by the PUCT and ERCOT(a), including the requirement for retailers to be certified by the PUCT in order to contract with end-users to sell electricity. The ERCOT market is one of the nation's largest and, historically, fastest growing power markets. ERCOT is an energy-only market and has implemented market rule changes referred to as the Operating Reserve Demand Curve (ORDC) to provide pricing more reflective of higher energy value when operating reserves are scarce or constrained. The PUCT directed the implementation of the ORDC in 2014 to act as the primary scarcity pricing mechanism, with subsequent amendments made in 2019 and 2020. The majority of the retail load in the ERCOT market region is served by competitive retail suppliers, except certain areas that have not opted into competitive consumer choice and are served by municipal utilities and electric cooperatives.

East

While most of the states in the East region have introduced some level of retail consumer choice for electricity and/or natural gas, the incumbent utilities currently provide default service in most of the states and as a result typically serve the majority of residential customers. NRG’s retail activities in the East are subject to standards and regulations adopted by the ISOs and state public utility commissions, including the requirement for retailers to be certified in each state in order to contract with end-users to sell electricity.

(a)The Cottonwood facility is located in Deweyville, Texas, but operates in the MISO market

17

NRG's power plants and demand response assets located in the East region of the U.S. are within the control areas of ISO-NE, MISO, NYISO and PJM. Each of the market regions in the East region provides for robust competition in the day-ahead and real-time energy and ancillary services markets. Additionally, the East region receives a significant portion of its revenues from capacity markets. PJM and ISO-NE use a three-year forward capacity auction, while NYISO uses a month-ahead capacity auction. MISO has an annual auction, known as the Planning Resource Auction. Capacity market prices are sensitive to design parameters, as well as additions of new capacity. Both ISO-NE and PJM operate a pay-for-performance model where capacity payments are modified based on real-time generator performance. In such markets, NRG’s actual capacity revenues will be the combination of cleared auction prices times the quantity of MWs cleared, plus the net of any over-performance "bonus payments" and any under-performance charges. Additionally, bidding rules allow for the incorporation of a risk premium into generator bids.

West

In the West region of the U.S., NRG operates a fleet of natural gas-fired power plants located entirely within the CAISO footprint. The CAISO operates day-ahead and real-time locational markets for energy and ancillary services, while managing congestion primarily through nodal prices. The CAISO system facilitates NRG's sale of power, ancillary services and capacity products at market-based rates, either within the CAISO's centralized energy and ancillary service markets or bilaterally pursuant to tolling arrangements or other capacity sales with California's LSEs. The CPUC also determines capacity requirements for LSEs and for specified local areas utilizing inputs from the CAISO. Both the CAISO and CPUC rules require LSEs to contract with sufficient generation resources in order to maintain minimum levels of generation within defined local areas. Additionally, the CAISO has independent authority to contract with needed resources under certain circumstances, typically either when LSEs have failed to procure sufficient resources, or system conditions change unexpectedly.

Canada

In Canada, NRG sells to residential and commercial retail customers in Alberta under both regulated rates approved by the AUC as well as through competitive service with rates set by the market. The Company's regulated rates are approved through periodic rate applications that establish rates for power and gas sales as well as for recovery of other costs associated with operating the regulated business. In addition, the Company conducts retail sales of energy to commercial customers in other provinces. All sales and operations are subject to applicable federal and provincial laws, regulations and licensing requirements.

Regulatory Matters

As participants in wholesale and retail energy markets and owners and operators of power plants, certain NRG entities are subject to regulation by various federal and state government agencies. These include the CFTC, FERC, NRC and the PUCT, as well as other public utility commissions in certain states where NRG's generation or distributed generation assets are located. In addition, NRG is subject to the market rules, procedures and protocols of the various ISO and RTO markets in which it participates. Likewise, certain NRG entities participating in the retail markets are subject to rules and regulations established by the states and provinces in which NRG entities are licensed to sell at retail. NRG must also comply with the mandatory reliability requirements imposed by NERC and the regional reliability entities in the regions where NRG operates.

Since entering office in January 2021, the President has signed a package of executive orders which, amongst other things, intends to boost the federal government's response to COVID-19, as well as elevate climate change across all levels and jurisdictions of the federal government. The administration has requested all agencies delay submitting rules to the Federal Register or posting their effective date for 60 days if not already effective, until they can be reviewed by appointees of the current administration. NRG is closely monitoring agency action as the orders will likely result in the promulgation of new regulations, where applicable.

NRG's operations within the ERCOT footprint are not subject to rate regulation by FERC, as they are deemed to operate solely within the ERCOT market and not in interstate commerce. These operations are subject to regulation by the PUCT, as well as to regulation by the NRC with respect to NRG's ownership interest in STP.

Federal Energy Regulation

D.C. Circuit Ruling on FERC's Use of Tolling Orders — On June 30, 2020, the U.S. Court of Appeals for the D.C. Circuit issued a decision stating that FERC's ability to "toll" actions on rehearing beyond the statutory 30-day period is unlawful. On September 17, 2020, FERC staff explained that in Federal Power Act cases, it will no longer issue tolling orders but instead will issue either a Notice of Denial of Rehearing by Operation of Law or a Notice of Denial of Rehearing by Operation of Law and Providing for Further Consideration. The first indicates that FERC would not intend to issue a merits order and the second indicates that FERC intends to issue further action. This decision impacts an array of appeals related to the PJM MOPR order and will impact how rehearings are decided and appeals filed.

18

State and Provincial Energy Regulation

State Proceedings Regarding States’ Participation in the Wholesale Market — Various states, including Connecticut, New Jersey, and New York as well as the District of Columbia have initiated proceedings to investigate resource adequacy alternatives and to consider its participation in the regional wholesale electricity market constructs, specifically withdrawal from the regional market or implementing a Fixed Resource Requirement Regime. Any actions taken by the states could affect market design and market prices in the respective regional markets.

Regional Regulatory Developments

NRG is affected by rule/tariff changes that occur in the ISO regions. For further discussion on regulatory developments see Item 15 — Note 25, Regulatory Matters, to the Consolidated Financial Statements.

East/West

PJM

Capacity Market Reforms Filing — On December 19, 2019, FERC issued an order on the pending proposals to reform the PJM market to mitigate subsidized resources in the capacity market. FERC directed PJM to apply the Minimum Offer Price Rule, or MOPR, to new and existing resources receiving state subsidies and subject them to default offer floor prices in their capacity bids. The Order provided for various category specific exemptions to the MOPR, as well as a unit specific exemption, which permits any resource that can justify an offer lower than the default offer price floor to submit such capacity bids to PJM for review. After subsequent filings and orders, on November 13, 2020, PJM submitted its third compliance filing, including a timeline to hold the next Base Residual Auction for Delivery Year 2022-2023 on May 19-25, 2021, which was accepted by FERC. Multiple parties filed appeals in this matter, which have been consolidated at the Seventh Circuit Court of Appeals. Subjecting subsidized resources to default offer floors in the capacity market should protect the market from further price suppression. The impact of these changes on capacity market outcomes depends on, among other factors, bidding behavior, load forecast changes, new resource entry, and existing resource exit.

Indiana Municipal Power Agency and City of Lawrenceburg, Indiana Complaint on Station Power — On September 17, 2020, FERC issued an order in response to a complaint and request for declaratory judgement challenging the station power wholesale netting provisions in PJM's tariff. FERC found that it does not have jurisdiction over the supply of station power and the provision of station power is a retail sale subject to state jurisdiction. The order established a Section 206 proceeding and required PJM to submit a filing within 60 days to show why the station service netting provisions of its tariff are just and reasonable. Lawrenceburg Power, LLC filed for rehearing, which was denied by operation of law on November 19, 2020 and they subsequently appealed to the United States Court of Appeals for the District of Columbia Circuit. The matter is pending. On November 23, 2020, PJM submitted its station power compliance filing to FERC. Multiple parties filed comments and protests to PJM's compliance filing. This decision could affect the rates that plants pay for station power.

PJM's ORDC Filing and Compliance Directives — On March 29, 2019, PJM proposed energy and reserve market reforms to enhance price formation in reserve markets, which includes modifying its ORDC and aligning market-based reserve product in Day-Ahead and Real-Time markets. On May 21, 2020, FERC approved PJM's proposed energy and reserve market reforms. FERC also directed PJM to implement a forward-looking Energy and Ancillary Services Offset to be used in PJM's capacity markets. PJM submitted a compliance filing to revise its tariff on August 5, 2020. On November 12, 2020, FERC approved two PJM compliance filings regarding PJM's reserve markets and the forward-looking Energy and Ancillary Services Offset and subsequently issued a timeline to hold the Base Residual Auction as noted above. PJM will implement the forward-looking Energy and Ancillary Services Offset for the 2022/2023 Base Residual Auction.

New England

ISO-NE Inventoried Energy Compensation Proposal — FERC approved ISO-NE's proposed interim measure to address near-term fuel security concerns by operation of law. After an appeal to the Court of Appeals and a remand back to FERC, FERC issued an order accepting Inventoried Energy Compensation Proposal and by operation of law denied requests for rehearing on August 20, 2020. Multiple parties filed amended petitions for review to include FERC's order on remand. ISO-NE's proposal will affect future capacity market prices and the compensation that fuel secure units receive.

Mystic's Complaint on Transmission Reliability Review — On June 10, 2020, Constellation Mystic Power LLC filed a complaint at FERC against ISO-NE alleging that ISO-NE violated its Tariff in its addition of language to its planning procedure and in its conduct in carrying out a competitive transmission REP to address the retirements of Mystic Units 8 and 9. On August 17, 2020, FERC issued an order denying the complaint. After a rehearing that was denied by operation of law, on January 4, 2021, Constellation Mystic Power LLC filed an appeal to the D.C. Circuit. The outcome of this proceeding affects the retirement of the Mystic Units 8 and 9, thereby affecting capacity prices in ISO-NE.

19

Paper Hearing on ISO-NE's New Entrant Rule — On July 1, 2020, FERC issued an order establishing a Section 206 hearing initiated by FERC's preliminary finding that the "new entrant rules" may be unjust and unreasonable, specifically as it relates to the seven-year price-lock rule as a result of the D.C. Circuit Court's remand on a FERC Order. The price-lock mechanism permits qualified new resources that clear the auction to receive their first-year clearing price for seven years. On December 1, 2020, FERC issued an order eliminating the seven-year price lock rule beginning in Forward Capacity Auction 16. The elimination of the seven-year price lock rule could affect future capacity prices in ISO-NE.

Competitive Auctions with Sponsored Resources Proposal (CASPR) — On January 8, 2018, ISO-NE filed the CASPR proposal which attempts to accommodate state sponsored resources while maintaining competitive market pricing. On November 19, 2020, FERC upheld the order approving CASPR. Multiple parties filed an appeal to the D.C. Circuit. The outcome of this proceeding will potentially affect future capacity market prices.

New York

New York State Public Service Commission Retail Energy Market Proceedings — On February 23, 2016, the NYSPSC issued an order referred to as the Retail Reset Order. Among other things, the Retail Reset Order placed a price cap on energy supply offers and imposed burdensome new regulations on ESCO's. Various parties have challenged the NYSPSC's authority to regulate prices charged by competitive suppliers. On May 9, 2019 the New York Court of Appeals, the state’s highest tribunal, issued a decision affirming the NYSPSC’s authority to regulate ESCO’s prices as a condition of access to the utilities’ infrastructure. On December 12, 2019, the NYSPSC issued an order limiting ESCO's offers for electric and natural gas to three compliant products: guaranteed savings from the utility default rate, a fixed term capped at 5% of the rolling 12-month average utility default rate, or NY-sourced renewable energy that is at least 50% greater than the prevailing NY Renewable Energy Standard for load serving entities. The Order effectively limited ESCO offers to natural gas customers to only the guaranteed savings and capped fixed term compliant products because no equivalent renewable energy product exists for natural gas. The Order also establishes new ESCO eligibility criteria and certification process, as well as re-certification of current ESCOs. Multiple parties filed for rehearing, which were denied. After extension requests, the NYSPSC ordered compliance effective April 16, 2021. On January 21, 2021, the NYSPSC issued an Order setting a timeline to evaluate additional compliant energy-related value-added products and also provided for a limited one-year waiver whereby ESCOs, including NRG's Green Mountain Energy and XOOM Energy, which currently offer green gas products, could continue to serve existing customers. The limited offerings imposed by the Order, as issued, may impact the Company's retail sales to Mass Market customers in New York, although the Company is currently in the process of moving existing customers to compliant products.