Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

For the fiscal year ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

Commission File No. 1-11859

PEGASYSTEMS INC.

(Exact name of Registrant as specified in its charter)

Massachusetts

(State or other jurisdiction of incorporation or organization)

(IRS Employer Identification No. 04-2787865)

| 101 Main Street Cambridge, MA |

02142-1590 | |

| (Address of principal executive offices) | (zip code) |

(617) 374-9600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant based on the closing price (as reported by NASDAQ) of such common stock on the last business day of the Registrant’s most recently completed second fiscal quarter (June 30, 2011) was approximately $783 million.

There were 37,716,783 shares of the Registrant’s common stock, $0.01 par value per share, outstanding on February 20, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement related to its 2012 annual meeting of stockholders to be filed subsequently are incorporated by reference into Part III of this report.

Table of Contents

| Item |

Page | |||||

| PART I | ||||||

| 1 |

3 | |||||

| 1A |

10 | |||||

| 1B |

15 | |||||

| 2 |

15 | |||||

| 3 |

15 | |||||

| 4 |

15 | |||||

| PART II | ||||||

| 5 |

16 | |||||

| 6 |

18 | |||||

| 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||

| 7A |

41 | |||||

| 8 |

42 | |||||

| 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

77 | ||||

| 9A |

77 | |||||

| 9B |

79 | |||||

| PART III | ||||||

| 10 |

79 | |||||

| 11 |

80 | |||||

| 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

80 | ||||

| 13 |

Certain Relationships and Related Transactions, and Director Independence |

83 | ||||

| 14 |

83 | |||||

| PART IV | ||||||

| 15 |

83 | |||||

| 84 | ||||||

2

Table of Contents

PART I

Forward-looking statements

This Annual Report on Form 10-K contains or incorporates forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s beliefs and assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “estimate,” “may,” “target,” “project,” or variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. We have identified certain risk factors included in Item 1A of this Annual Report on Form 10-K that we believe could cause our actual results to differ materially from the forward-looking statements we make. We do not intend to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

| ITEM 1. | Business |

Pegasystems Inc. was incorporated in Massachusetts in 1983. Our stock is traded on the NASDAQ Global Select Market under the symbol PEGA. Our Website address is www.pega.com. We are not including the information contained on our Website as part of, or incorporating it by reference into, this Annual Report on Form 10-K. Unless the context otherwise requires, references in this Annual Report on Form 10-K to “the Company,” “we,” “us” or “our” refer to Pegasystems Inc. and its subsidiaries.

Our business

We develop, market, and license software. We also provide implementation, consulting, training, and technical support services to help our customers maximize the business value they obtain from the use of our software.

Our PegaRULES Process Commander ® (“PRPC”) software provides a unified platform that includes all the necessary elements and technologies to build enterprise applications in a fraction of the time it would take using the disjointed architectures offered by our competitors. This allows organizations to build, deploy, and change enterprise applications easily and quickly. It also eliminates the time and expense required to create lengthy policy manuals and system specifications by unifying business rules with business processes in the software and automating the creation of system documentation. Our software delivers multi-channel, cross silo capabilities that bridge front and back-office, and is often used to rejuvenate legacy technology. Our customers use our software to improve their customer service and the customer experience, generate new business, and enhance productivity and profitability.

Our unified technology also allows customers to leverage existing technology investments and create and/or deploy their PRPC applications on premise or through an internet-based cloud computing model, using our Pega Cloud service offerings.

PRPC is complemented by software solutions that we refer to as frameworks. These frameworks provide purpose or industry-specific functionality that allows our customers to quickly implement and easily customize our software to suit their unique requirement.

The integrated capabilities of PRPC and our frameworks make us the leader in the Business Process Management (“BPM”) software market as well as a leader in Customer Relationship Management (“CRM”), Dynamic Case Management, and Decision Management software markets. We focus our sales efforts on target accounts, which are large companies or divisions within companies, and typically leaders in their industry. Our

3

Table of Contents

strategy is to sell initial licenses that are focused on a specific purpose or area of operations, rather than selling large enterprise licenses. A primary objective of this strategy is to have our customers quickly realize business value from our software. Once a customer has realized this initial value, we work with that customer to identify opportunities for follow-on sales. The sales process for follow-on sales is often shorter as a result of our established relationship with the customer. We invest resources in professional services, customer support, and customer and partner enablement to help our customers achieve success.

Our partners

We maintain alliances with global systems integrators and technology consulting firms that also provide consulting services to our customers. Strategic partnerships with technology consulting firms and systems integrators are important to our sales efforts because they influence buying decisions, help us to identify sales opportunities, and complement our software with their domain expertise and services capabilities. These partners may deliver strategic business planning, consulting, project management, and implementation services to our customers. Currently, our partners include well respected, major firms such as Accenture Ltd., Capgemini SA, Cognizant Technology Solutions Inc., Infosys Technologies Limited, Mahindra Satyam, Tata Consultancy Services Limited, International Business Machines Corporation (“IBM”), PricewaterhouseCoopers LLP, Virtusa Corporation, and Wipro Ltd.

Our products

Our primary software solutions are as follows:

PegaRULES Process Commander

PRPC provides a unified platform that includes all the necessary elements and technologies to build enterprise applications in a fraction of the time it would take using our competitors’ products. These elements, which include the direct capture of business objectives, automating programming, reporting, predictive analytics and decisioning, dynamic case management, mobile device access, dynamically generated user interface, process automation, business rules, social media technologies and automating work, are all part of our integrated architecture. This allows organizations to build, deploy, and change enterprise applications easily and quickly. It also eliminates the time and expense required to create lengthy policy manuals and system specifications by unifying business rules with business processes in the software and automating the creation of system documentation. Our software is standards-based and can leverage existing technology investments to create new business applications that cross technology silos. Our customers use our software and services to improve their customer service and experience, generate new business, and enhance organizational effectiveness and productivity, which can optionally be created and/or deployed on the cloud using our Pega Cloud service offerings.

Solution Frameworks

We also offer purpose or industry-specific solution frameworks built on the capabilities of our PRPC software. These frameworks allow organizations to quickly implement new customer-facing practices and processes, bring new offerings to market, and provide customized or specialized processing to meet the needs of different customers, departments, geographies or regulatory requirements

Pega CRM

Pega CRM software offers a process-driven, customer-centric business solution in order to optimize the customer experience while reducing costs. The capabilities within Pega CRM automate customer service

4

Table of Contents

inquiries and marketing and apply analytics to predict and adapt customer service processes, which result in the delivery of a personalized customer interaction.

Pega Decision Management

Our decision management products and capabilities are designed to manage processes so that all actions optimize the outcome based on business objectives. Pega Decision Strategy Manager and Next-Best-Action Advisor support cross-channel decision-making for offer management, risk, and other marketing and customer management solutions that optimize customer lifetime value. Our Pega frameworks for cross-sell/up-sell, retention, and collections help marketing professionals build and deploy decision making solutions quickly, while predictive and adaptive analytics support creation and improvement of decision models for outstanding operational performance.

Pega Cloud ®

Pega Cloud is Pegasystems’ service offering that allows customers to create and/or run Pega applications using an Internet-based infrastructure. This offering enables our customers to rapidly build, test, and deploy their applications in a secure cloud environment, while minimizing their infrastructure and hardware costs.

Our services and support

We offer services and support through our professional services group, customer support group, and our training services group. We also utilize third party contractors to assist us in providing services.

Professional services

Our professional services group helps companies and partners implement our software. This enables us to guide our customers through deployment of our software. Many of our customers choose to engage our professional services group for augmentation and expert services to expand their use of our software to additional business or product lines or automate additional processes within existing solutions. In addition, systems integrators and consulting firms, with which we have alliances, also help our customers deploy our products.

Customer support

Our customer support group is responsible for support of our software deployed at customer sites when customer support has been purchased. Support services include automated problem tracking, prioritization and escalation procedures, periodic preventive maintenance, documentation updates, and new software releases.

Training services

The success of our sales strategy for multiple follow-on sales to target customers depends on our ability to train a larger number of partners and customers to implement our technology. We offer training for our staff, customers, and partners. Training is offered at our regional training facilities in Cambridge, Massachusetts, Bedford, New Hampshire, Reading, England, Hyderabad, India, Sydney, Australia, at third party facilities in numerous other locations, and at customer sites. Beginning in 2012, we will also be offering training online through Pega Academy, which will present new ways to learn our software quickly and easily. We expect that the online training will help expand the number of trained experts at a faster pace. Our courses are designed to meet the specific requirements of process architects, system architects, and system administrators.

5

Table of Contents

Our markets and representative customers

Our target customers are large, industry-leading organizations faced with managing transaction intensive, complex and changing processes that seek the agility needed for growth, productivity, customer retention, and compliance. Our customers have typically been large companies in the financial services, healthcare, insurance, government, and communications and media markets. We are expanding our customer base to a broader range of companies within those markets as well as to a broader range of industries, such as manufacturing, energy, travel and entertainment.

Financial services

Financial services organizations require software to improve the quality, accuracy, and efficiency of customer interactions and transactions processing. Pegasystems’ customer process and exceptions management products allow customers to be responsive to changing business requirements. Representative financial services customers of ours include: American Express Company, BBVA Bancomer S.A., BNP Paribas, Citigroup Inc., Charles Schwab Corporation, HSBC Holdings Plc, ING Bank, JP Morgan Chase, MasterCard Worldwide, National Australia Bank Limited, RBC Financial Group, and Toronto-Dominion Bank.

Healthcare

Healthcare organizations seek products that integrate their front and back office initiatives and help drive customer service, efficiency, and productivity. Representative healthcare customers of ours include: Aetna Inc., Amerigroup Corporation, more than 60 percent of the members of the Blue Cross Blue Shield network, Highmark, Medco Health Solutions, Inc., Tenet Healthcare Corporation, United Healthcare Services, Inc., and ViPS/WebMD.

Insurance

Insurance companies, whether competing globally or nationally for customers and channels, need software to automate the key activities of policy rating, quoting, customization, underwriting, and servicing as well as products that improve customer service and the overall customer experience. Representative insurance industry customers of ours include: American National Insurance Group, CARDIF, Chartis, Farmers Insurance Group of Companies, John Hancock Life Insurance Co., Wesfarmers, and Zurich North America.

Communications and Media

Communications and media organizations need to address high levels of customer churn, growing pressure to increase revenue and an ability to respond quickly to changing market conditions. Pega’s unique ability to put the power of innovation into the hands of the business enables organizations to reshape the way they interact with customers, streamline operations and bring new services and products to market. Representative communications and media customers of ours include: Vodafone, Orange, O2, Deutsche Telekom and Cox Communications.

Government

Government agencies need to modernize legacy systems and processes to meet the growing demands for improved constituent service, lower costs and greater levels of transparency. Pegasystems offers a proven, economical and highly effective solution that delivers advanced capabilities to streamline application development and delivery. Representative public sector clients include the State of Texas, ViPS, the FDIC, the Centers for Medicare and Medicaid Services (CMS), and CSC.

6

Table of Contents

Other industries

PRPC offers solutions to a broad range of companies and industries. For example, we sell our BPM technology to customers in energy, life sciences, manufacturing, and travel services. Customers include: Baxter International Inc., Bristol Myers Squibb, ConEdison, Carnival Cruise Lines, GE Energy, Jabil, Novartis International AG, and The British Airport Authority.

Competition

We compete in the BPM, Case Management, CRM, and Decision Management software markets. These markets are intensely competitive, rapidly changing, and highly fragmented, as current competitors expand their product offerings and new companies enter the market. Competitors vary in size and in the scope and breadth of the products and services offered. We encounter competition from:

| • | BPM vendors including Service-Oriented Architecture (“SOA”) middleware vendors IBM, Oracle Corporation, Software AG, and Tibco Software Inc., and other BPM vendors such as Appian Corporation and the Savvion division of Progress Software; |

| • | Case Management vendors such as the Documentum division of EMC Corporation, the FileNet division of IBM’s Information Management Group, and the BPM/Case Management division of OpenText (following its acquisition of Metastorm and Global 360); |

| • | CRM application vendors such as the Siebel division of Oracle, the Microsoft Dynamics CRM division of Microsoft, and Salesforce.com; |

| • | Decision Management vendors including Business Rules Engine vendors such as the ILOG division of IBM, and the Blaze division of FICO, and vendors of solutions that leverage predictive analytics in managing customer relationships including the Unica Division of IBM; |

| • | Companies that provide application specific software for the financial services, healthcare, insurance and other specific markets such as Guidewire Software, Inc., the Detica NetReveal Division of BAE, SmartStream Technologies Ltd., SunGard, SAP, and The TriZetto Group, Inc.; and |

| • | Current customers’ information technology departments, which may seek to modify their existing systems or develop their own proprietary systems. |

We have been most successful competing for customers whose businesses are characterized by a high degree of change, complexity, and size. We believe that the principal competitive factors within our market include:

| • | Product adaptability, scalability, functionality, and performance; |

| • | Proven success in delivering cost-savings and efficiency improvements; |

| • | Ease-of-use for developers, business units, and end-users; |

| • | Timely development and introduction of new products and product enhancements; |

| • | Establishment of a significant base of reference customers; |

| • | Ability to integrate with other products and technologies; |

| • | Customer service and support; |

| • | Product price; |

7

Table of Contents

| • | Vendor reputation; and |

| • | Relationships with systems integrators. |

We believe we compete favorably with our competitors on the basis of these competitive factors as our unified Build for Change® technology allows both client business and IT staff, using a single, browser-based user interface, to build enterprise applications in a fraction of the time it would take with the types of disjointed architectures and tools offered by our competitors. We believe we also compete favorably due to our expertise in our target industries and our long-standing customer relationships. We believe we compete less favorably on the basis of some of these factors with respect to our larger competitors, many of which have greater sales, marketing and financial resources, more extensive geographical presence and greater name recognition than we do. In addition, we may be at a disadvantage with respect to our ability to provide expertise outside our target industries.

Sales and marketing

We market our software and services primarily through a direct sales force. Strategic partnerships with consultants and systems integrators are important to our sales efforts because they influence buying decisions, help us to identify sales opportunities, and complement our software with their domain expertise and professional services capabilities.

To support our sales efforts, we conduct a broad range of marketing programs, including targeted solution campaigns, industry trade shows, including our PegaWORLD user conference, solution seminars, industry analyst and press relations, Web marketing, community development, social media, and other direct and indirect marketing efforts. Our consulting staff, business partners, and other third parties also conduct joint and separate campaigns that generate sales leads.

Sales by geography

In 2011, 2010, and 2009, sales to customers based outside of the United States of America (“U.S.”) represented approximately 48%, 41%, and 34%, respectively, of our total revenue. We currently operate in one operating segment — Business Process Solutions. We derive substantially all of our operating revenue from the sale and support of one group of similar products and services. Substantially all of our assets are located within the U.S. See Note 18 “Geographic Information and Major Customers” included in the notes to the accompanying audited consolidated financial statements for further detail.

Research and development

Our development organization is responsible for product architecture, core technology development, product testing, and quality assurance. Our product development priority is to continue expanding the capabilities of our integrator technology. We intend to maintain and extend the support of our existing solution frameworks, and we may choose to invest in additional frameworks which incorporate the latest business innovations. We also intend to maintain and extend the support of popular hardware platforms, operating systems, databases, and connectivity options to facilitate easy and rapid deployment in diverse information technology infrastructures. Our goal with all of our products is to enhance product capabilities, ease of implementation, long-term flexibility, and the ability to provide improved customer service.

During 2011, 2010, and 2009, research and development expenses were approximately $65.3 million, $55.2 million, and $38.9 million, respectively. We expect that we will continue to commit significant resources to our product research and development in the future to maintain our leadership position.

8

Table of Contents

Employees

As of January 31, 2012, we had 1,858 employees worldwide, of which 1,104 were based in the U.S., 346 were based in Europe, 316 were based in India, 33 were based in Australia, 30 were based in Canada and 29 were based in Asia. Our total headcount includes 633 consulting and customer support employees, 474 sales and marketing employees, 537 research and development employees, and 214 administrative employees. In addition, we augmented our research and development and professional services employees with approximately 230 contractors.

Backlog of license, maintenance, and professional services

As of December 31, 2011, we had software license, maintenance, and professional services agreements with customers expected to result in approximately $359.8 million of future revenue, of which we expect approximately $184.8 million to be recognized in 2012. As of December 31, 2010, we had backlog of software license, maintenance, and professional services agreements with customers of approximately $232.1 million. Under some of these agreements, we must fulfill certain conditions prior to recognizing revenue, and there can be no assurance when, if ever, we will be able to satisfy all such conditions in each instance. Business conditions could change and, therefore, backlog may not be a reliable indicator of future financial performance.

Available Information

We make available free of charge through our Website www.pegasystems.com our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”). The SEC maintains a Website that contains reports, proxy, and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. We make available on our Website reports filed by our executive officers and Directors on Forms 3, 4, and 5 regarding their ownership of our securities. Our Code of Conduct, and any amendments to our Code of Conduct, is also available on our Website.

9

Table of Contents

| ITEM 1A. | RISK FACTORS |

The following important factors could cause our actual business and financial results to differ materially from those contained in forward-looking statements made in this Annual Report on Form 10-K or elsewhere by management from time to time.

Factors relating to our financial results

The number of our license arrangements has been increasing, and we may not be able to sustain this growth unless we and our partners can provide sufficient high quality professional services, training, and maintenance resources to enable our customers to realize significant business value from our software. Our customers typically request professional services and training to assist them in implementing our products. Our customers also purchase maintenance on our products in almost all cases. As a result, an increase in the number of license arrangements is likely to increase demand for professional services, training, and maintenance relating to our products. Given that the number of our license arrangements has been increasing, we will need to provide our customers with more professional services, training, and maintenance to enable our customers to realize significant business value from our software. Accordingly, we have been hiring additional personnel in these areas and improving our “on-boarding” process to ramp up new personnel in a shorter period of time. We have also been increasingly enabling our partners and customers through training to create an expanded universe of people that are skilled in the implementation of our products. However, if we and our partners are unable to provide sufficient high quality professional services, training, or maintenance resources to our customers, our customers may not realize sufficient business value from our products to justify follow-on sales, which could impact our future financial performance. In addition, the growth required to meet the increased demand for our professional services could strain our ability to deliver our services engagements at desired levels of profitability, thereby impacting our overall profitability and financial results.

We frequently enter into limited scope initial licenses with new customers, which could adversely affect our financial performance if we are not successful in obtaining follow-on business from these customers. We frequently enter into initial licenses with our new customers that are focused on a specific purpose or area of operations, rather than selling large enterprise licenses, to allow these new customers to realize business value from our software quickly and for a limited initial investment. Once a customer has realized this initial value, we work with the customer to identify opportunities for follow-on sales. However, we may not be successful in demonstrating this initial value to some customers, for reasons relating to the performance of our products, the quality of the services and support we provide for our products, or external reasons. For these customers, we may not obtain follow-on sales or the follow-on sales may be delayed, and our license revenue will be limited to the smaller initial sale. This could lower the total value of all transactions and adversely affect our financial performance.

Our professional services revenue is dependent to a significant extent on closing new license transactions with customers. We derive a substantial portion of our professional services revenue from implementation of new software licenses with our customers. Accordingly, it is imperative that we close more license transactions with our customers if we are to maintain or grow our services revenue.

If we are unable to maintain vendor specific objective evidence (“VSOE”) of fair value of our professional services arrangements, we may be required to delay a portion of our revenue to future periods. We have established VSOE of fair value of our professional services in North America and Europe, other than Spain, based on the price charged when these services are sold separately. The weakened economy and significant competition within our industry have created pricing pressure on professional services provided by technology companies. If we elect to discount our professional services pricing or otherwise introduce variability in our professional services arrangements to attract or retain customers, this could lead to an insufficient number of consistently priced professional services arrangements for us to maintain VSOE. If we do not have VSOE of fair value of our professional services, we may be required to recognize all revenue for these professional

10

Table of Contents

services arrangements, including any related license, maintenance, and other services revenue if the professional services are bundled in an arrangement, ratably over the longer of the software maintenance period or the service period.

The timing of our license revenue is difficult to predict accurately, which may cause our quarterly operating results to vary considerably. A change in the number or size of high value license arrangements, or a change in the mix between perpetual licenses, term licenses, and Pega Cloud subscriptions can cause our revenues to fluctuate materially from quarter to quarter. Our decision to enter into term licenses and Pega Cloud subscriptions that require the revenue to be recognized over the license term may adversely affect our profitability in any period due to sales commissions being paid at the time of signing and the corresponding revenue being recognized over time. We budget for our selling and marketing, product development, and other expenses based on anticipated future revenue. If the timing or amount of revenue fails to meet our expectations in any given quarter, our financial performance is likely to be adversely affected because only small portions of expenses vary with revenue. As a result, period-to-period comparisons of our operating results are not necessarily meaningful and should not be relied upon to predict future performance.

Our financial results may be adversely affected if we are required to change certain estimates, judgments, and positions relative to our income taxes. In the ordinary course of conducting a global business enterprise, there are many transactions and calculations undertaken whose ultimate tax outcome cannot be certain. Some of these uncertainties arise as a consequence of positions we have taken regarding valuation of deferred tax assets, transfer pricing for transactions with our subsidiaries, and potential challenges to nexus and tax credit estimates. We estimate our exposure to unfavorable outcomes related to these uncertainties and estimate the probability for such outcomes. Future realization of our deferred tax assets ultimately depends on the existence of sufficient taxable income within the available carryback or carryforward periods. We record a valuation allowance to reduce our deferred tax assets to an amount we believe is more likely than not to be realized. If our taxable income is not consistent with our expectations or the timing of income is not within the applicable carryforward period, we may be required to establish a valuation allowance on all or a portion of these deferred tax assets. Changes in our valuation allowance impact income tax expense in the period of adjustment. Although we believe our estimates are reasonable, no assurance can be given that the final tax outcome of these matters or our current estimates regarding these matters will not be different from what is reflected in our historical income tax provisions, returns, and accruals. Such differences, or changes in estimates relating to potential differences, could have a material impact, unfavorable or favorable, on our income tax provisions, require us to change the recorded value of deferred tax assets, and adversely affect our financial results.

We are investing heavily in sales and marketing and professional services in anticipation of a continued increase in license arrangements, and we may experience decreased profitability or losses if we are unsuccessful in increasing the value of our license arrangements in the future. We have been increasing our investment in sales and marketing to meet increasing demand for our software by hiring additional sales and marketing personnel. We anticipate that we will need to provide our customers with more professional services, training, and maintenance as a result of this increase in demand, and have been hiring additional personnel in these areas. These investments have resulted in increased fixed costs that do not vary with the level of revenue. If the increased demand for our products does not continue, we could experience decreased profitability or losses as a result of these increased fixed costs.

Factors relating to our products and markets

The continued weakness in the U.S and international economies may negatively impact our sales to, and the collection of receivables from, our financial services and insurance customers and possibly our customers in other industries. Our sales to, and our collection of receivables from, our customers may be impacted by adverse changes in global economic conditions, especially in the U.S., Europe and Asia Pacific. In the past few years, these regions have experienced instability in financial markets, tightening credit, and weak overall economic conditions, which has impacted the financial services and insurance industries in particular. These trends could

11

Table of Contents

impact the ability and willingness of our financial services and insurance customers, and possibly our customers in other industries, to make investments in technology, which may delay or reduce the amount of purchases of our software and professional services. These factors could also impact the ability and willingness of these customers to pay their trade obligations and honor their contractual commitments under their non-cancellable term licenses. These customers may also become subject to increasingly restrictive regulatory requirements, which could limit or delay their ability to proceed with new technology purchases. Our financial services and insurance customers as a group represent a significant amount of our revenues and receivables. Accordingly, their potential financial instability could negatively impact our business, operating results, and financial condition.

We will need to acquire or develop new products, evolve existing ones, and adapt to technology change. Technical developments, customer requirements, programming languages, and industry standards change frequently in our markets. As a result, success in current markets and new markets will depend upon our ability to enhance current products, to acquire or develop and introduce new products that meet customer needs, keep pace with technology changes, respond to competitive products, and achieve market acceptance. Product development requires substantial investments for research, refinement, and testing. There can be no assurance that we will have sufficient resources to make necessary product development investments. We may experience difficulties that will delay or prevent the successful development, introduction, or implementation of new or enhanced products. Inability to introduce or implement new or enhanced products in a timely manner would adversely affect future financial performance.

The market for our offerings is intensely and increasingly competitive, rapidly changing, and highly fragmented. The market for BPM software and related implementation, consulting, and training services is intensely competitive, rapidly changing and highly fragmented. We currently encounter significant competition from internal information systems departments of potential or existing customers that develop custom software. We also compete with large technology companies such as IBM, Oracle and SAP, companies that target the customer interaction and workflow markets, companies focused on business rules engines or enterprise application integration, “pure play” BPM companies, industry-specific application vendors, and professional service organizations that develop custom software in conjunction with rendering consulting services. Competition for market share and pressure to reduce prices and make sales concessions are likely to increase. Many competitors have far greater resources and may be able to respond more quickly and efficiently to new or emerging technologies, programming languages or standards or to changes in customer requirements or preferences. Competitors may also be able to devote greater managerial and financial resources to develop, promote, and distribute products and provide related consulting and training services. There has been recent consolidation in the BPM market whereby larger companies such as IBM, Oracle, OpenText and Progress Software have acquired companies that provide BPM software, which we expect will further increase competition. There can be no assurance that we will be able to compete successfully against current or future competitors or that the competitive pressures faced by us will not materially adversely affect our business, operating results, and financial condition.

We have historically sold to the financial services, insurance and healthcare markets, and rapid changes or consolidation in these markets could affect the level of demand for our products. We have historically derived a significant portion of our revenue from customers in the financial services, insurance, and healthcare markets, and sales to these markets are important for our future growth. Competitive pressures, industry consolidation, decreasing operating margins, regulatory changes, and privacy concerns affect the financial condition of our customers and their willingness to buy. In addition, customers’ purchasing patterns in these industries for large technology projects are somewhat discretionary. The financial services and insurance markets are undergoing intense domestic and international consolidation and financial turmoil, and consolidation has been occurring in the healthcare market. Consolidation may interrupt normal buying behaviors and increase the volatility of our operating results. In recent years, several of our customers have been merged or consolidated, and we expect this to continue in the near future. Future mergers or consolidations may cause a decline in revenues and adversely affect our future financial performance. All of these factors affect the level of demand for our products from customers in these industries, and could adversely affect our business, operating results and financial condition.

12

Table of Contents

We rely on certain third-party relationships. We have a number of relationships with third parties that are significant to sales, marketing and support activities, and product development efforts. We rely on software and hardware vendors, large system integrators, and technology consulting firms to provide marketing and sales opportunities for the direct sales force and to strengthen our products through the use of industry-standard tools and utilities. We also have relationships with third parties that distribute our products. There can be no assurance that these companies, most of which have significantly greater financial and marketing resources, will not develop or market products that compete with ours in the future or will not otherwise end or limit their relationships with us.

We face risks from operations and customers based outside of the U.S. Sales to customers located outside of the U.S. represented approximately 48% of our total revenue in 2011, 41% of our total revenue in 2010, and 34% of our total revenue in 2009. We, in part through our wholly owned subsidiaries, market products and render consulting and training services to customers based outside of the U.S. including, for example, customers based in Canada, the United Kingdom, France, Germany, Spain, Italy, the Netherlands, Belgium, Switzerland, Austria, Ireland, Finland, Hungary, Poland, Sweden, Turkey, Russia, Mexico, Australia, China, Hong Kong, and Singapore. We have established offices in Canada, Europe, Asia and Australia. We believe that growth will necessitate expanded international operations, requiring a diversion of managerial attention and increased costs. We anticipate hiring additional personnel to accommodate international growth, and we may also enter into agreements with local distributors, representatives, or resellers. If we are unable to do one or more of these things in a timely manner, our growth, if any, in our foreign operations may be restricted, and our business, operating results, and financial condition could be materially and adversely affected.

In addition, there can be no assurance that we will be able to maintain or increase international market demand for our products. Several of our international sales are denominated in U.S. dollars. Accordingly, any appreciation of the value of the U.S. dollar relative to the currencies of those countries in which we sell our products may place us at a competitive disadvantage by effectively making our products more expensive as compared to those of our competitors. Additional risks inherent in our international business activities generally include unexpected changes in regulatory requirements, increased tariffs and other trade barriers, the costs of localizing products for local markets and complying with local business customs, longer accounts receivable patterns and difficulties in collecting foreign accounts receivable, difficulties in enforcing contractual and intellectual property rights, heightened risks of political and economic instability, the possibility of nationalization or expropriation of industries or properties, difficulties in managing international operations, potentially adverse tax consequences (including restrictions on repatriating earnings and the threat of “double taxation”), increased accounting and internal control expenses, and the burden of complying with a wide variety of foreign laws. There can be no assurance that one or more of these factors will not have a material adverse effect on our foreign operations, and, consequentially, our business, operating results, and financial condition.

We are exposed to fluctuations in currency exchange rates that could negatively impact our financial results and cash flows. Because a significant portion of our business is conducted outside the U.S., we face exposure to adverse movements in foreign currency exchange rates. These exposures may change over time as business practices evolve, and they could have a material adverse impact on our financial results and cash flows. Our international sales have increasingly become denominated in foreign currencies. The operating expenses of our foreign operations are primarily denominated in foreign currencies, which partially offset our foreign currency exposure. Our U.S. operating company invoices most of our foreign customers in foreign currencies, so it holds cash and receivables valued in these foreign currencies, which are subject to foreign currency transaction gains or losses. A decrease in the value of foreign currencies, particularly the British pound and the Euro relative to the U.S. dollar, could adversely impact our financial results and cash flows.

13

Table of Contents

Factors relating to our internal operations and potential liabilities

We depend on certain key personnel, and must be able to attract and retain qualified personnel in the future. The business is dependent on a number of key, highly skilled technical, managerial, consulting, sales, and marketing personnel, including our Chief Executive Officer. The loss of key personnel could adversely affect financial performance. We do not have any significant key-man life insurance on any officers or employees and do not plan to obtain any. Our success will depend in large part on the ability to hire and retain qualified personnel. The number of potential employees who have the extensive knowledge of computer hardware and operating systems needed to develop, sell, and maintain our products is limited, and competition for their services is intense, and there can be no assurance that we will be able to attract and retain such personnel. If we are unable to do so, our business, operating results, and financial condition could be materially adversely affected.

We may experience significant errors or security flaws in our product and services, and could face privacy, product liability and warranty claims as a result. Despite testing prior to their release, software products frequently contain errors or security flaws, especially when first introduced or when new versions are released. Errors in our software products could affect the ability of our products to work with other hardware or software products, or could delay the development or release of new products or new versions of products. The detection and correction of any security flaws can be time consuming and costly. Errors or security flaws in our software could result in the inadvertent disclosure of confidential information or personal data relating to our customers, employees, or third parties. Software product errors and security flaws in our products or services could expose us to privacy, product liability and warranty claims as well as harm our reputation, which could impact our future sales of products and services. Our license agreements typically contain provisions intended to limit the nature and extent of our risk of product liability and warranty claims. There is a risk that a court might interpret these terms in a limited way or could hold part or all of these terms to be unenforceable. Also, there is a risk that these contract terms might not bind a party other than the direct customer. Furthermore, some of our licenses with our customers are governed by non-U.S. law, and there is a risk that foreign law might give us less or different protection. Although we have not experienced any material product liability claims to date, a product liability suit or action claiming a breach of warranty, whether or not meritorious, could result in substantial costs and a diversion of management’s attention and our resources.

We face risks related to intellectual property claims or appropriation of our intellectual property rights. We rely primarily on a combination of copyright, trademark and trade secrets laws, as well as confidentiality agreements to protect our proprietary rights. We have obtained patents from the U.S. Patent and Trademark Office relating to the architecture of our systems. We cannot assure that such patents will not be invalidated or circumvented or that rights granted thereunder or the claims contained therein will provide us with competitive advantages. Moreover, despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or to obtain the use of information that we regard as proprietary. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the U.S. There can be no assurance that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar technology.

There can be no assurance that third parties will not claim infringement by us with respect to current or future products. Although we attempt to limit the amount and type of our contractual liability for infringement of the proprietary rights of third parties, these limitations often contain certain exclusions, and we cannot be assured that these limitations will be applicable and enforceable in all cases. Even if these limitations are found to be applicable and enforceable, our liability to our customers for these types of claims could be material in amount given the size of certain of our transactions. We expect that software product developers will increasingly be subject to infringement claims as the number of products and competitors in our industry segment grows and the functionality of products in different industry segments overlaps. Any such claims, with or without merit, could be time-consuming, result in costly litigation, cause product shipment delays, or require us to enter into royalty or licensing agreements. Such royalty or licensing agreements, if required, may not be available on terms acceptable to us or at all, which could have a material adverse effect upon our business, operating results, and financial condition.

14

Table of Contents

If our security measures are breached and/or unauthorized access is obtained to a customer’s confidential information from our cloud computing service offering, we may be exposed to significant legal and financial liabilities. Our cloud computing service offering allows customers to create and run PRPC-based applications using an internet-based infrastructure. This offering involves the hosting of customers’ applications which may contain confidential information, including personal and financial data regarding their end customers on the servers of a third-party technology provider. We also rely on third party systems including encryption, virtualized infrastructure and support. Because we do not control the transmissions between our customers and our third-party infrastructure providers, the processing of data on the servers of the third-party technology providers, or the internal controls maintained by the third-party technology providers that could prevent unauthorized access and provide appropriate data encryption, we cannot ensure the complete integrity or security of such transmissions, data or processing. Our security measures may be breached as a result of third-party action, including intentional misconduct by computer hackers, system error, human error or otherwise. Because the techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. While we have invested in the protection of our customers’ data to reduce these risks, there can be no assurance that our efforts will prevent breaches in our systems. Security breaches could expose us and our customers to a risk of loss or misuse of this information. Any security breach could result in a loss of confidence in the security of our service, damage our reputation, disrupt our business, lead to legal liability and negatively impact our future sales. We carry data breach insurance coverage to potentially mitigate the financial impact of such potential legal liability.

The acquisition of other businesses and technologies may present new risks. We have undertaken a significant acquisition during the past two years and may continue to evaluate and consider other potential strategic transactions, including acquisitions of businesses, technologies, services, products and other assets in the future. These acquisitions, if undertaken, may involve significant new risks and uncertainties, including distraction of management attention away from our current business operations, insufficient new revenue to offset expenses, inadequate return on capital, integration challenges, new regulatory requirements, and issues not discovered in our due diligence process. No assurance can be given that such acquisitions will be successful and will not adversely affect our profitability or operations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | Properties |

Our principal administrative, sales, marketing, support, and research and development operations are located at 101 Main Street, Cambridge, Massachusetts in an approximately 105,000 square foot leased facility. The lease for this facility expires in 2013. We expect all of these functions will move to One Charles Park and One Rogers Street, Cambridge, Massachusetts, in the second half of 2012, where our leases for approximately 163,000 square feet expire in 2023, subject to our option to extend for two additional five-year periods. We also lease space for our other offices in the U.S., Australia, Canada, India, the United Kingdom and in other European and Asian countries under leases that expire at various dates through 2020. We believe that additional or alternative space will be available as needed in the future on commercially reasonable terms.

| ITEM 3. | Legal Proceedings |

None.

| ITEM 4. | Mine Safety Disclosures |

Not applicable.

15

Table of Contents

PART II

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

Our common stock is quoted on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “PEGA.” The following table sets forth the range of high and low sales prices of our common stock on NASDAQ for each quarter in the years ended December 31:

| Common Stock Price | ||||||||||||||||

| 2011 | 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 41.15 | $ | 30.82 | $ | 39.65 | $ | 32.25 | ||||||||

| Second Quarter |

$ | 47.14 | $ | 34.30 | $ | 39.66 | $ | 26.33 | ||||||||

| Third Quarter |

$ | 47.55 | $ | 30.54 | $ | 33.94 | $ | 20.36 | ||||||||

| Fourth Quarter |

$ | 40.67 | $ | 26.87 | $ | 37.81 | $ | 23.92 | ||||||||

Holders

As of February 10, 2012, we had approximately 36 stockholders of record and approximately 29,200 beneficial owners of our common stock.

Dividends

In July 2006, we began paying a quarterly cash dividend of $0.03 per share of common stock. Quarterly cash dividends are expected to continue at $0.03 per share to stockholders of record as of the first trading day of each quarter, subject to change or elimination at any time by our Board of Directors.

Issuer Purchases of Equity Securities

The following table sets forth information regarding our repurchases of our common stock during the fourth quarter of 2011.

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Share Repurchase Program (1) |

Approximate Dollar Value of Shares That May Yet Be Purchased Under Publicly Announced Share Repurchased Programs (1) (in thousands) |

||||||||||||

| 10/1/11 – 10/31/11 |

7,405 | $ | 32.54 | 7,405 | $ | 9,454 | ||||||||||

| 11/1/11 – 11/30/11 |

24,904 | 29.57 | 24,904 | 14,308 | ||||||||||||

| 12/1/11 – 12/31/11 |

11,624 | 29.74 | 11,624 | 13,963 | ||||||||||||

|

|

|

|||||||||||||||

| Total |

43,933 | $ | 30.12 | |||||||||||||

|

|

|

|||||||||||||||

| (1) | Since 2004, our Board of Directors has approved stock repurchase programs that have authorized the repurchase, in the aggregate, up to $86.3 million of our common stock. On November 9, 2011, we announced that our Board of Directors approved a $5.6 million increase in the remaining funds available under the program expiring on December 31, 2011, and an extension of the expiration date to December 31, 2012. Under this program, purchases may be made from time to time on the open market or in privately |

16

Table of Contents

| negotiated transactions. Shares may be repurchased in such amounts as market conditions warrant, subject to regulatory and other considerations. We have established a pre-arranged stock repurchase plan, intended to comply with the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, and of Rule 10b-18 of the Exchange Act (the “10b5-1 Plan”). All share repurchases under the Current Program during closed trading window periods will be made pursuant to the 10b5-1 Plan. |

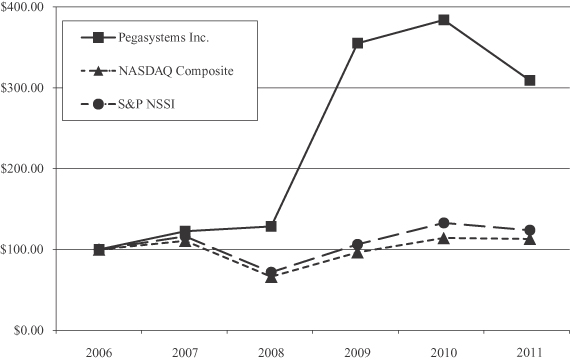

Stock Performance Graph and Cumulative Total Stockholder Return

The following performance graph represents a comparison of the cumulative total stockholder return (assuming the reinvestment of dividends) for a $100 investment on December 31, 2006 in our common stock, the Total Return Index for the NASDAQ Composite (“NASDAQ Composite”), a broad market index, and the Standard & Poors (“S&P”) North Software-Software Index™ (“S&P NSSI”), a published industry index. We paid dividends of $0.12 per share during 2011, 2010, 2009, 2008, and 2007. The graph lines merely connect measurement dates and do not reflect fluctuations between those dates.

| 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | |||||||||||||||||||

|

Pegasystems Inc. |

$ | 100.00 | $ | 122.60 | $ | 128.33 | $ | 354.64 | $ | 383.50 | $ | 308.81 | ||||||||||||

| NASDAQ Composite |

$ | 100.00 | $ | 110.65 | $ | 66.42 | $96.54 | $ | 114.06 | $ | 113.16 | |||||||||||||

| S&P NSSI |

$ | 100.00 | $ | 116.24 | $ | 71.83 | $106.24 | $ | 132.96 | $ | 123.85 | |||||||||||||

17

Table of Contents

| ITEM 6. | Selected Financial Data |

The selected financial data presented below has been derived from our audited consolidated financial statements. This data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, the consolidated financial statements and accompanying notes.

| Year Ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Total revenue |

$ | 416,675 | $ | 336,599 | $ | 264,013 | $ | 211,647 | $ | 161,949 | ||||||||||

| Income (loss) from operations |

10,494 | (2,580 | ) | 41,819 | 14,479 | 1,951 | ||||||||||||||

| Income (loss) before provision (benefit) for income taxes |

10,813 | (6,197 | ) | 47,415 | 15,672 | 9,942 | ||||||||||||||

| Net income (loss) |

10,108 | (5,891 | ) | 32,212 | 10,977 | 6,595 | ||||||||||||||

| Net earnings (loss) per share: |

||||||||||||||||||||

| Basic |

$ | 0.27 | $ | (0.16 | ) | $ | 0.89 | $ | 0.30 | $ | 0.18 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | 0.26 | $ | (0.16 | ) | $ | 0.85 | $ | 0.29 | $ | 0.18 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash dividends declared per common share |

$ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.12 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||

| Total cash, cash equivalents, and marketable securities |

$ | 111,432 | $ | 87,251 | $ | 202,653 | $ | 167,229 | $ | 149,981 | ||||||||||

| Working capital |

89,716 | 73,606 | 188,552 | 159,080 | 159,547 | |||||||||||||||

| Long-term license installments, net of unearned interest income |

— | 1,223 | 2,976 | 5,413 | 8,267 | |||||||||||||||

| Intangible assets, net of accumulated amortization |

69,369 | 80,684 | 336 | 479 | — | |||||||||||||||

| Goodwill |

20,451 | 20,451 | 2,391 | 2,141 | 1,933 | |||||||||||||||

| Total assets |

381,711 | 337,475 | 279,585 | 245,850 | 243,307 | |||||||||||||||

| Stockholders’ equity |

208,756 | 195,670 | 205,219 | 173,114 | 172,944 | |||||||||||||||

The following items impact the comparability of our consolidated financial data:

| • | Our acquisition of Chordiant in April 2010. During the first quarter of 2011, the Company recorded adjustments to the purchase price allocation of its acquisition of Chordiant. As required by applicable business combination accounting rules, these adjustments were applied retrospectively. Therefore, other current assets, long-term other assets, goodwill, accrued expenses, and deferred tax assets were revised as of December 31, 2010 to reflect these adjustments. These revisions did not have any impact on the Company’s previously reported results of operations or cash flows. See Note 9 “Acquisition, Goodwill, and Other Intangible Assets” for further discussion of these adjustments. |

| • | Foreign currency transaction (losses) gains of $(0.9) million, $(5.6) million, $2.1 million, $(4.5) million, and $0.3 million, during the years ended December 31, 2011, 2010, 2009, 2008, and 2007, respectively. See Item 7A. “Quantitative and Qualitative Disclosure about Market Risk” for further discussion of our foreign currency exchange risk. |

18

Table of Contents

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Business overview

We develop, market, license, and support software, which allows organizations to build, deploy, and change enterprise applications easily and quickly. Our unified software platform includes all the necessary elements and technologies to build enterprise applications in a fraction of the time it would take with competitive disjointed architectures, by directly capturing business objectives, automating programming, and automating work. Our customers use our software to improve their customer service and the customer experience, generate new business, and enhance productivity and profitability. We also provide professional services, maintenance, and training related to our software.

We focus our sales efforts on target accounts, which are large companies or divisions within companies and typically leaders in their industry. We also focus our sales efforts on existing and targeted new industries. Our strategy is to sell initial licenses that are focused on a specific purpose or area of operations, rather than selling large enterprise licenses. Once a customer has realized the value of our software, we work with the customer to identify opportunities for follow-on sales.

Our license revenue is primarily derived from sales of our PRPC software and related solution frameworks. PRPC is a comprehensive platform for building and managing BPM applications that unifies business rules and business processes. Our solution frameworks, built on the capabilities of PRPC, are purpose or industry-specific collections of best practice functionality, which allow organizations to quickly implement new customer-facing practices and processes, bring new offerings to market, and provide customized or specialized processing. Our products are simpler, easier to use and often result in shorter implementation periods than competitive enterprise software products. PRPC and related solution frameworks can be used by a broad range of customers within financial services, insurance, healthcare, communications and government markets, as well as other markets such as energy and media.

We develop and license CRM software, which enables unified predictive decisioning and analytics and optimizes the overall customer experience. Our decision management products and capabilities are designed to manage processes so that all actions optimize the outcome based on business objectives. We continue to invest in the development of new products and intend to remain a leader in BPM, CRM, and decision management. We also offer Pega Cloud, a service offering that allows customers to optionally create and/or run Pega applications using an Internet-based infrastructure. This offering enables our customers to immediately build, test, and deploy their applications in a secure cloud environment while minimizing their infrastructure and hardware costs. Revenue from our Pega Cloud offering is included in consulting services revenue.

We offer training for our staff, customers, and partners at our regional training facilities, at third party facilities in numerous other locations, and at customer sites. Beginning in 2012, we will also be offering training online through Pega Academy, which will provide new ways to learn our software quickly and easily. We expect that this online training will help expand the number of trained experts at a faster pace. Our online training may result in lower training revenues.

Our total revenue increased 24% in 2011 compared to 2010 and reflects revenue growth in each of software license, maintenance, and professional services revenue. Maintenance revenue increased 40% primarily due to the increase in the aggregate value of the installed base of our software and a full year of maintenance revenue attributed to license arrangements executed by Chordiant prior to the acquisition. In 2011, we generated approximately $39.8 million in cash from operations, primarily driven by our net income, and ended the year with $111.4 million in cash, cash equivalents, and marketable securities.

We believe our growth and success in 2011 were due to:

| • | Our disciplined and focused global sales strategy to targeted customers; |

19

Table of Contents

| • | The return on investment our clients achieve from the use of Pega technology leading to repeat purchases; |

| • | Expansion of our customer base through sales to customers within new industries; |

| • | Demand for our industry-leading software solutions and services; |

| • | Investment in making our products faster and easier to use; |

| • | Expansion of our solutions frameworks offerings; and |

| • | Collaboration and continued development of our partner alliances. |

We believe that the ongoing challenges for our business include our ability to drive revenue growth, expand our expertise in new and existing industries, remain a leader in CRM and the decision management markets, and maintain our leadership position in the BPM market.

To support our growth and successfully address these challenges through 2012 we plan to:

| • | Expand our expertise across targeted industries; |

| • | Improve the end user experience with enhanced user interface; |

| • | Maintain our focused global sales strategy to targeted customers; |

| • | Invest in our research and development by significantly increasing headcount; |

| • | Hire additional sales and marketing professionals; |

| • | Invest in self-study enablement to expand the Pega ecosystem; |

| • | Further develop our partner alliances; and |

| • | Develop and increase our solutions frameworks. |

RESULTS OF OPERATIONS

2011 Compared to 2010

| (Dollars in thousands) | Year Ended December 31, | Increase (Decrease) | ||||||||||||||

| 2011 | 2010 | |||||||||||||||

| Total revenue |

$ | 416,675 | $ | 336,599 | $ | 80,076 | 24 | % | ||||||||

| Gross profit |

251,877 | 207,865 | 44,012 | 21 | % | |||||||||||

| Acquisition-related costs |

482 | 5,924 | (5,442) | (92) | % | |||||||||||

| Restructuring costs |

(62) | 8,064 | (8,126) | n/m | ||||||||||||

| Other operating expenses |

240,963 | 196,457 | 44,506 | 23 | % | |||||||||||

| Total operating expenses |

241,383 | 210,445 | 30,938 | 15 | % | |||||||||||

| Income (loss) before provision (benefit) for income taxes |

10,813 | (6,197) | 17,010 | n/m | ||||||||||||

n/m – not meaningful

The aggregate value of license arrangements executed in 2011 was significantly higher than in 2010 or in any prior year. We believe the continued demand for our software products and related services is due to the strong value proposition, short implementation period, and variety of licensing models we offer our customers. In addition, our significant investment in hiring sales personnel has generated license sales to customers in new and existing industries and geographies.

20

Table of Contents

The increase in gross profit was primarily due to the increase in maintenance revenue and to a lesser extent the increase in license revenue.

The increase in operating expenses was primarily due to the increase in selling and marketing expenses associated with higher headcount and higher sales commissions related to the increase in the value of license arrangements executed.

The increase in income (loss) before provision (benefit) for income taxes was primarily due to the increase in maintenance and license gross profit and the decrease in foreign exchange losses in 2011 compared to 2010, partially offset by the increase in total operating expenses.

Revenue

| (Dollars in thousands) | Year Ended December 31, |

Increase |

||||||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||||||

| License revenue |

||||||||||||||||||||||||

| Perpetual licenses |

$ | 94,129 | 68 | % | $ | 79,041 | 66 | % | $ | 15,088 | 19 | % | ||||||||||||

| Term licenses |

34,453 | 25 | % | 31,940 | 27 | % | 2,513 | 8 | % | |||||||||||||||

| Subscription |

10,225 | 7 | % | 8,858 | 7 | % | 1,367 | 15 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total license revenue |

$ | 138,807 | 100 | % | $ | 119,839 | 100 | % | $ | 18,968 | 16 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

The aggregate value of license arrangements executed in 2011 was significantly higher than in 2010 or any prior year. The aggregate value of license agreements executed in the fourth quarter of 2011 set a quarterly record for the Company primarily due to a significant increase in the value of term license arrangements executed. A change in the mix between perpetual and term license arrangements executed in a period varies based on customer needs, which may cause our revenues to vary materially quarter to quarter. If we continue to execute a higher proportion of term license arrangements, our license revenue may be recognized over longer periods.

The increase in perpetual license revenue was primarily due to an increase in the aggregate value of perpetual license arrangements executed. Many of our perpetual license arrangements include extended payment terms and/or additional rights of use that delay the recognition of revenue to future periods. The aggregate value of payments due under these licenses was $48.4 million as of December 31, 2011 compared to $32.8 million as of December 31, 2010. See the table of future cash receipts by year from these perpetual licenses and certain subscription licenses on page 33.

We recognize revenue for our term license arrangements over the term of the agreement as payments become due or earlier if prepaid. The increase in our term license revenue was primarily due to revenue from the increased aggregate value of term license arrangements executed during 2011, partially offset by higher prepayments in 2010. Prepayments can cause our term license revenue to vary quarter to quarter. Total future payments due under term licenses increased to $161.4 million as of December 31, 2011 compared to $90.9 million as of December 31, 2010 and includes approximately $37.7 million of term license payments that we expect to recognize as revenue in 2012. Our term license revenue in 2012 could be higher than $37.7 million as we complete new term license agreements in 2012 or if we receive prepayments from existing term license agreements. See the table of future cash receipts by year from these term licenses on page 33.

21

Table of Contents

Subscription revenue primarily consists of the ratable recognition of license, maintenance and bundled services revenue on perpetual license arrangements that include a right to unspecified future products. Subscription revenue does not include revenue from our Pega Cloud offerings. The timing of scheduled payments under customer arrangements determines the amount of revenue that can be recognized in a reporting period. Consequently, our subscription revenue may vary quarter to quarter.

| (Dollars in thousands) | Year Ended December 31, | Increase | ||||||||||||||

| 2011 | 2010 | |||||||||||||||

| Maintenance revenue |

||||||||||||||||

| Maintenance |

$ | 117,110 | $ | 83,878 | $ | 33,232 | 40 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

The increase in maintenance revenue was primarily due the continued increase in the aggregate value of the installed base of our software and a full year of maintenance revenue attributed to license arrangements executed by Chordiant prior to the acquisition.

| (Dollars in thousands) | Year Ended December 31, | Increase | ||||||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||||||

| Professional services revenue |

||||||||||||||||||||||||

| Consulting services |

$ | 153,919 | 96 | % | $ | 126,283 | 95 | % | $ | 27,636 | 22 | % | ||||||||||||

| Training |

6,839 | 4 | % | 6,599 | 5 | % | 240 | 4 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Professional services |

$ | 160,758 | 100 | % | $ | 132,882 | 100 | % | $ | 27,876 | 21 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Professional services are primarily consulting services related to new license implementations. The increase in consulting services revenue was primarily due to higher demand for these services as a result of the significant increase in the number of license arrangements executed in the fourth quarter of 2010 and in 2011.

| (Dollars in thousands) | Year Ended December 31, | Increase (Decrease) | ||||||||||||||

| 2011 | 2010 | |||||||||||||||

| Gross Profit |

||||||||||||||||

| Software license |

$ | 132,114 | $ | 115,536 | $ | 16,578 | 14 | % | ||||||||

| Maintenance |

104,033 | 72,837 | 31,196 | 43 | % | |||||||||||

| Professional services |

15,730 | 19,492 | (3,762 | ) | (19 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total gross profit |

$ | 251,877 | $ | 207,865 | $ | 44,012 | 21 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Total gross profit percent |

60 | % | 62 | % | ||||||||||||

| Software license gross profit percent |

95 | % | 96 | % | ||||||||||||

| Maintenance gross profit percent |

89 | % | 87 | % | ||||||||||||

| Professional services gross profit percent |

10 | % | 15 | % | ||||||||||||

The decrease in software license gross profit percent was primarily due to the full year of amortization expense in 2011 for the technology intangibles we acquired as part of the Chordiant acquisition in April 2010.