UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-K

____________________________

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 | |||||

For the fiscal year ended December 31 , 2023

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 | |||||

Commission File No. 1-11859

____________________

(Exact name of Registrant as specified in its charter)

____________________

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | ||||||||||||||||||||||

(Address of principal executive offices, including zip code)

(617 ) 374-9600

(Registrant’s telephone number, including area code)

____________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

____________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging company,” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. □

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). □

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s common stock held by non-affiliates, based upon the closing price of the Registrant’s common stock on the NASDAQ Global Select Market of $49.30, on June 30, 2023 was approximately $2.1 billion.

There were 83,905,034 shares of the Registrant’s common stock, $0.01 par value per share, outstanding on February 6, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement related to its 2024 annual meeting of stockholders to be filed subsequently are incorporated by reference into Part III of this report.

PEGASYSTEMS INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| Item | Page | |||||||

| PART I | ||||||||

| 1 | Business | |||||||

| 1A | Risk Factors | |||||||

| 1B | Unresolved Staff Comments | |||||||

1C | Cybersecurity | |||||||

| 2 | Properties | |||||||

| 3 | Legal Proceedings | |||||||

| 4 | Mine Safety Disclosures | |||||||

| PART II | ||||||||

| 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||||||

| 6 | [Reserved] | |||||||

| 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| 7A | Quantitative and Qualitative Disclosures about Market Risk | |||||||

| 8 | Financial Statements and Supplementary Data | |||||||

| 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||||

| 9A | Controls and Procedures | |||||||

| 9B | Other Information | |||||||

9C | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |||||||

| PART III | ||||||||

| 10 | Directors, Executive Officers and Corporate Governance | |||||||

| 11 | Executive Compensation | |||||||

| 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

| 13 | Certain Relationships and Related Transactions, and Director Independence | |||||||

| 14 | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| 15 | Exhibits and Financial Statement Schedules | |||||||

| 16 | Form 10-K Summary | |||||||

| Signatures | ||||||||

2

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”), including without limitation, “Item 1. Business,” “Item 1A. Risk Factors,” “Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities,” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” along with other reports that we have filed with the Securities and Exchange Commission (“SEC”), external documents, and oral presentations, contains or incorporates forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as expects, anticipates, intends, plans, believes, will, could, should, estimates, may, targets, strategies, intends to, projects, forecasts, guidance, likely, and usually or variations of such words and other similar expressions, identify forward-looking statements, which represent our views only as of the date the statement was made and are based on current expectations and assumptions.

Forward-looking statements deal with future events and are subject to risks and uncertainties that are difficult to predict, including, but not limited to:

•our future financial performance and business plans;

•the adequacy of our liquidity and capital resources;

•the continued payment of our quarterly dividends;

•the timing of revenue recognition;

•variation in demand for our products and services, including among clients in the public sector;

•reliance on key personnel;

•reliance on third-party service providers, including hosting providers;

•compliance with our debt obligations and covenants;

•the potential impact of our convertible senior notes and capped call transactions;

•foreign currency exchange rates;

•the potential legal and financial liabilities and damage to our reputation due to cyber-attacks;

•security breaches and security flaws;

•our ability to protect our intellectual property rights, costs associated with defending such rights, intellectual property rights claims, and other related claims by third parties against us, including related costs, damages, and other relief that may be granted against us;

•our ongoing litigation with Appian Corp.;

•our client retention rate; and

•management of our growth.

These risks and others that may cause actual results to differ materially from those expressed in such forward-looking statements are described further in “Item 1A. Risk Factors” of this Annual Report and other filings we make with the SEC.

Investors are cautioned not to place undue reliance on such forward-looking statements, and there are no assurances that the results included in such statements will be achieved. Although subsequent events may cause our view to change, except as required by applicable law, we do not undertake and expressly disclaim any obligation to publicly update or revise these forward-looking statements, whether as the result of new information, future events, or otherwise. The forward-looking statements in this Annual Report represent our views as of February 14, 2024.

3

ITEM 1. BUSINESS

Our Business

We develop, market, license, host, and support enterprise software that helps organizations build agility into their business so they can adapt to change. Our powerful, low-code platform for workflow automation and artificial intelligence-powered decisioning enables the world’s leading brands and government agencies to hyper-personalize customer experiences, streamline customer service, and automate mission-critical business processes and workflows. With Pega, our clients can leverage our artificial intelligence (“AI”) technology and scalable architecture to accelerate their digital transformation. In addition, our client success teams, world-class partners, and clients leverage our Pega Express™ methodology to design and deploy mission-critical applications quickly and collaboratively.

To grow our business, we intend to:

•Increase market share by developing and delivering a low-code platform for workflow automation and AI-powered decisioning for buyers in marketing, sales, service, operations, and IT that can work together seamlessly with maximum competitive differentiation;

•Deepen and expand our relationships with existing clients;

•Establish relationships with new clients; and

•Continue to scale our marketing efforts to support how today’s buyers discover, evaluate, and choose products and services.

Whether we are successful depends, in part, on our ability to:

•Execute our marketing and sales strategies;

•Manage our expenses appropriately as we grow our organization;

•Develop new products and enhance our existing products; and

•Incorporate acquired technologies into our solutions and the unified Pega Platform™.

Our Products

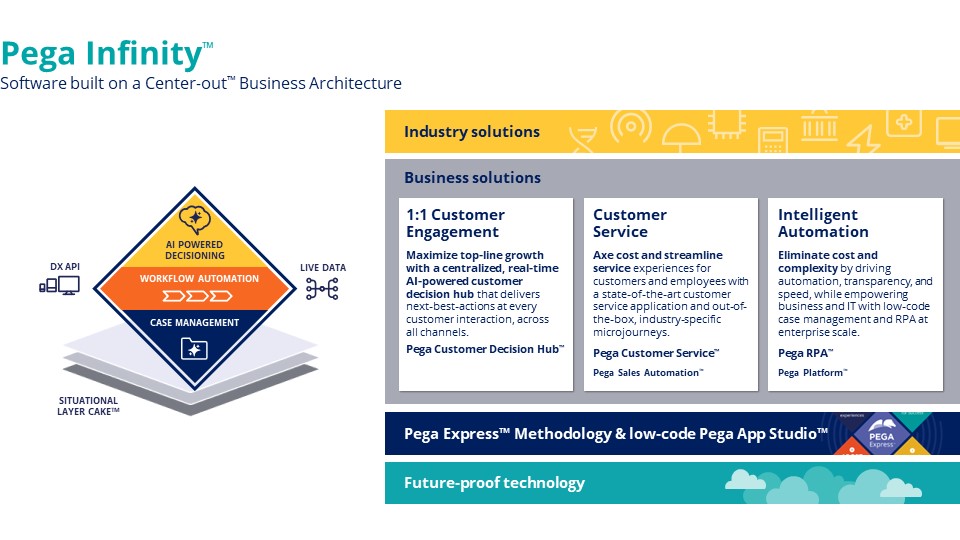

Pega Infinity

Pega Infinity™, the latest version of our software portfolio, helps build agility into our clients’ organizations so they can work smarter, unify experiences, and adapt to meet changing requirements.

4

Our applications and low-code platform intersect with and encompass several software markets, including:

•Customer Engagement, including Customer Relationship Management (“CRM”);

•Digital Process Automation (“DPA”), including Business Process Management (“BPM”), Workflow, and Dynamic Case Management (“DCM”);

•Low-code application development platforms (“LCAP”), including Multi-experience Development Platforms (“MXDP”);

•Robotic Process Automation (“RPA”);

•Business Rules Management Systems (“BRMS”);

•Decision Management, including predictive and adaptive analytics; and

•the Vertical-Specific Software (“VSS”) market of industry solutions and packaged applications.

1:1 Customer Engagement

Our omnichannel customer engagement applications are designed to maximize the lifetime value of customers and help reduce the costs of serving customers while ensuring a consistent, unified, and personalized customer experience. At the center of our customer engagement applications is the Pega Customer Decision Hub™, our real-time, AI-powered decision engine, which can predict a customer’s behavior and recommend the “next best action” to take across channels in real-time. It is designed to enable enterprises to improve customer acquisition and experience across inbound, outbound, and paid media channels. It incorporates artificial intelligence (“AI”) in the form of predictive and machine-learning analytics and business rules and executes these decisions in real-time to evaluate the context of each customer interaction and dynamically deliver the most relevant action, offer, content, and channel.

Customer Service

The Pega Customer Service™ application simplifies customer service. It is designed to anticipate customer needs, connect customers to the right people and systems, automate or intelligently guide customer interactions, rapidly and continuously evolve the customer service experience, and allow enterprises to deliver consistent interactions across channels and improve employee productivity. The application consists of a contact center desktop, case management for customer service, chat, knowledge management, mobile field service, omnichannel self-service, AI-powered virtual assistants, and industry-specific processes (“Microjourney®”) and data models. For clients who want to extend intelligence and automation into the early stages of the customer journey, Pega Sales Automation™ automates and manages the entire sales process, from prospecting to product fulfillment. It allows enterprises to capture best practices and leverage AI to guide sales teams through the sales and customer onboarding processes.

Intelligent Automation

Pega Platform, our software for Intelligent Automation, boosts the efficiency of our clients’ processes and workflows. This technology allows organizations to take an end-to-end approach to transformation by using intelligence and design thinking to streamline processes and create better customer and employee experiences. Intelligent automation goes beyond traditional Business Process Management (BPM) to unify technologies such as Robotic Process Automation (“RPA”) and AI and enable organization-wide digital transformation. With its Intelligent Automation capabilities, the Pega Platform allows clients to break down silos, improve customer-centricity, add agility to legacy technology, and provide end-to-end automation to support the needs of customers and employees.

Our Capabilities

We drive better business outcomes for our clients in three ways:

•1:1 Customer Engagement: we enable clients to hyper-personalize interactions with their customers using our AI-powered decision engine, resulting in higher customer lifetime value.

•Customer Service: we enable clients to streamline customer service and deliver better service experiences for their customers and employees, resulting in higher customer satisfaction and loyalty with reduced costs.

•Intelligent Automation: we enable clients to automate mission-critical workflows, resulting in improved operational efficiency, faster time to value, and lower cost.

We deliver our solution through our Center-out Business™ Architecture, enabling clients to transcend channels and internal data silos to achieve quick wins and long-term transformation. This approach insulates business logic from back-end and front-end complexity, delivering consistent customer experiences and agility to the business.

The key aspects of this architecture are:

Centrally-managed AI-powered decisioning

Pega’s centrally-managed AI-powered decisioning ensures AI and business rules operate across all channels. Applications built on Pega’s low-code Platform leverage predictive and adaptive analytics to deliver personalized customer experiences and maximize business objectives. For example, Pega Customer Decision Hub, a centralized, always-on “customer brain,” unleashes the power of predictive analytics, machine learning, and real-time decisioning across our clients’ data, systems, and touchpoints — orchestrating engagement across customer interaction channels and optimizing processes for better efficiency.

5

End-to-end workflow automation aligned with business outcomes

We combine human-assisted robotic desktop automation and unattended robotic process automation with our unified workflow automation and case management capabilities. This combination provides our platform and applications the differentiated ability to automate customer-facing and back-office operational processes from “end to end,” connecting across organizational and system silos to connect customers and employees to outcomes seamlessly and easily.

Consistent omnichannel experiences

With centrally defined business and process logic, Pega provides dynamic, open APIs to align front-end channels and business logic for consistent customer experiences. By leveraging innovative user interface (UI) technology, Pega-powered processes and decisions can be easily embedded into existing front ends or used as the basis for new employee-facing applications.

Insulation of back-end complexity

Pega’s architecture insulates case and decision logic from the complexity of back-end systems. Our data virtualization automatically pulls in needed data in a common structure, regardless of source. This capability allows clients the agility to build new experiences on existing systems, modernizing legacy systems without breaking existing processes.

A layered approach to managing variation

Pega’s Situational Layer Cake™ organizes logic into layers that map to the unique dimensions of a client’s business – customer types, lines of business, geographies, etc. This layered approach lets organizations manage variations of their businesses without duplicating logic. This capability allows initial deployments into a single department or region to seamlessly scale to manage the complexity of a global, multi-line enterprise.

In addition to our Center-out Business Architecture, Pega technology has been designed to be deployed rapidly, be easily changed, and scale across changing architecture needs.

Pega Express™ Methodology and low code

Our solutions are designed to quickly improve targeted customer outcomes with out-of-the-box functionality that connects enterprise data and systems to customer experience channels. From there, organizations can scale one customer experience at a time to realize greater value while delivering increasingly consistent and personalized customer experiences. We prescribe a “Microjourney” approach to delivery that breaks customer journeys into discrete processes that drive meaningful outcomes, such as “inquiring about a bill” or “updating an insurance policy,” allowing us to combine design-thinking and out-of-the-box functionality to deliver rapid results and ensure the ability to enhance applications in the future.

Our approach leverages low-code to improve business and IT collaboration and bypass the error-prone and time-consuming process of manually translating requirements into code. Users design software in low-code visual models that reflect the needs of the business. The software application is created and optimized automatically and directly from the model, helping to close the costly gap between vision and execution. Changes to the code are made by altering the model, and application documentation is generated directly from the model.

Cloud choice

Pega Cloud® allows clients to develop, test, and deploy, on an accelerated basis, our applications and the Pega Platform using a secure, flexible internet-based infrastructure, minimizing cost while focusing on core revenue-generating competencies.

Clients can also manage the Pega deployment themselves using the cloud architecture they prefer. This multi-cloud approach of both Pega Cloud and client-managed cloud gives our clients the ability to select and change, as needed, the best cloud architecture for the security, data access, speed-to-market, and budget requirements of each application they deploy.

Our Services and Support

We offer services and support through our Global Client Success, Global Service Assurance and Client Support, and Pega Academy groups. We also use third-party contractors to assist us in providing these services.

•Global Client Success – Global Client Success guides our clients to maximize their investment in our technology and realize the business outcomes they are targeting. Within Global Client Success, our Client Innovation team helps clients transform and prototype their customer journeys through our Pega Catalyst™ offering, our Success team ensures our clients receive the maximum business value from their Pega investments, and our Pega Consulting team provides planning, design, implementation, and assurance services.

•Global Service Assurance and Client Support – Global Service Assurance addresses risks to client success because of technical concerns. By providing technical staff dedicated to client success, we reduce the time to resolve technical issues, eliminate lengthy deliberations of technical resource logistics, and increase clients’ confidence in our technology and client service. Global Client Support provides technical support for our products and services. Support services include cloud service reliability management, online support community management, self-service knowledge, proactive problem prevention through information and knowledge sharing, problem tracking, prioritization, escalation, diagnosis, and resolution.

6

•Pega Academy – Pega Academy offers enablement content for all Pega product implementations to ensure the success of our Clients and Partners. We have increased our ability to train partners and clients to implement our technology and made it easier for individuals to stay current as it evolves. We offer many mediums, including instructor-led and online training to our employees, clients, and partners so individuals can learn in the way that best suits them. We have also partnered with universities to provide our courseware as part of the student curriculum to expand our ecosystem of enablement content. In addition, we have robust and comprehensive documentation on our documentation portal, so people have the information at their fingertips in the moment of need. Lastly, engagement is an important part of our strategy to create a broad ecosystem passionate about Pega technology to further increase our advocates across our clients and other key stakeholders.

Our Partners

We collaborate with global systems integrators and technology consulting firms that provide consulting services to our clients, as well as Independent Software Vendors (“ISVs”) and technology partners that extend clients’ investments with integrated solutions. In addition, Authorized Training Partners (“ATPs”) support Pega customers in local languages, while our Workforce Development Partners let clients outsource their recruiting. Strategic partnerships with these firms are important to our sales efforts because they influence buying decisions, identify sales opportunities, and complement our software with their domain expertise, solutions, and service capabilities. These partners may deliver strategic business planning, consulting, project management, training, and implementation services to our clients.

Our partners include well-respected major firms, such as Accenture PLC, Amazon.com, Inc., Areteans, Capgemini SA, Coforge, Cognizant Technology Solutions Corporation, EY, Google, HCL Infosys, Merkle, PwC, Tata Consultancy Services Limited, Tech Mahindra Limited, Virtusa Corporation, and Wipro Limited.

Our Markets

Target Clients

Our target clients are Global 2000 organizations and government agencies that require solutions to distinguish themselves in the markets they serve. Our solutions achieve and facilitate differentiation by increasing business agility, driving growth, improving productivity, attracting and retaining customers, and reducing risk. Along with our partners, we deliver solutions tailored to the specific industry needs of our clients.

Our clients represent many industries, including:

•Financial services – Pega’s software for AI-powered decisioning and workflow automation is used by financial services organizations for Customer Engagement, Onboarding and KYC, Lending, Customer Service, Payment Exceptions, Bank Operations, and Managing Financial Crime. Our platform enables clients to increase loyalty and wallet share, reduce time and effort to close loans and open accounts, address compliance more effectively while simplifying customer experiences, resolve service requests across channels more quickly with less effort, and boost the efficiency of various back-office processes with fewer human touches.

•Government – Pega’s software for AI-powered decisioning and workflow automation is used by government agencies for Enterprise Modernization, Licensing, Investigative Case Management, Grants and Financial Management, Acquisition and Supply Chain Modernization, and Citizen Service. Our platform enables clients to modernize legacy systems and processes to meet the growing demands for improved constituent service, lower costs, reduced fraud, and greater transparency.

•Healthcare – Pega’s software for AI-powered decisioning and workflow automation is used by healthcare organizations for Consumer Engagement, Onboarding and Enrollment, Customer Service, Care Management Services and Claims/Core Admin. Our platform enables clients to improve member and patient outcomes, loyalty, and retention, simplify experiences with reduced time and effort, resolve service requests faster and easier across channels, advance efficient flexible healthcare coordination, and deliver streamlined, modern experiences for members, providers, and employees.

•Communications and media – Pega’s software for AI-powered decisioning and workflow automation is used by communications and media organizations for Customer Engagement, Order Management, Customer Service, Service Assurance, Network Operations, and Shared Services. Our platform enables clients to increase loyalty and wallet share, simplify experiences while accelerating revenues and processes, resolve service requests across channels more quickly with less effort, drive a faster, simpler repair experience, and boost the efficiency of 5G, fiber, and cloud processes.

•Insurance – Pega’s software for AI-powered decisioning and workflow automation is used by insurance companies for Customer Engagement, Sales, Distribution, Underwriting, Policy Holder Service, and Claims. Our platform enables clients to nurture and grow their book of business, increase agent sales effectiveness, power better partner performance and loyalty, automate application intake and processing with intelligence, personalize seamless policy lifecycle experiences, and improve claims handling efficiencies with more modern customer and employee experiences.

•Consumer services – Pega’s software for AI-powered decisioning and workflow automation is used by consumer services organizations for Customer Engagement, Supplier Onboarding, Customer Service, and Enterprise Operations in industries such as transportation, utilities, internet providers, retail, hospitality, and entertainment. Our platform enables clients to enable more personalized real-time next best action, accelerate onboarding with simplified experiences, automate the resolution of customer requests across channels with increased digital self-servicing, and streamline operations to rapidly reduce cost, time, and risks while increasing customer satisfaction.

7

•Manufacturing and high tech – Pega’s software for AI-powered decisioning and workflow automation is used by manufacturers to streamline their complex global operations and create more value for their customers, dealers, distributors, and suppliers while directly managing the performance, uptime, and impact of their connected products, equipment, and experiences. Our platform enables clients to reduce the complexity of enterprise operations in domains like supply chain, order management, quality management, shared services, customer service, and aftermarket services, including warranty management and captive finance, while minimizing the constraints on digital transformation caused by legacy systems.

Competition

The markets for our offerings are intensely competitive, rapidly changing, and highly fragmented as current competitors expand their product offerings and new companies enter the market.

We compete in the CRM, including marketing, sales, and customer service, and DPA, including BPM, case management, decision management, robotic automation, co-browsing, social engagement, low-code application development, and mobile application development platform software markets, as well as in markets for the vertical applications we provide (e.g., Pega Know Your CustomerTM for Financial Services, Pega Care Management™).

We also compete with clients’ internal information systems departments that seek to modify their existing systems or develop their own proprietary systems and professional service organizations that develop their own products or create custom software in conjunction with rendering consulting services.

Competitors vary in size, scope, and breadth of the products and services they offer and include some of the world’s largest companies, including International Business Machines Corporation (“IBM”), Microsoft Corporation, Oracle Corporation, Salesforce.com, SAP SE, and ServiceNow.

We have been most successful in competing for clients whose businesses are characterized by a high degree of change, complexity, and/or regulation.

We believe we are competitively differentiated because our unified Pega Platform is designed to allow client business and IT staff, using a single, intuitive user interface, to build and evolve enterprise applications in a fraction of the time it would take with disjointed architectures and tools offered by many of our competitors. In addition, our applications, built on the Pega Platform, provide the same flexibility and ability to adapt to our clients’ needs as the Pega Platform. We believe we compete favorably due to our expertise in our target industries and our long-standing client relationships. We believe we compete less favorably on some of the above factors against our larger competitors, many of which have greater sales, marketing, and financial resources, a more extensive geographical presence, and greater name recognition. In addition, we may be at a competitive disadvantage against our larger competitors with respect to our ability to provide expertise outside our target industries.

For additional information, see risk factor "The market for our offerings is intensely and increasingly competitive, rapidly changing, and fragmented" in Item 1A of this Annual Report.

Intellectual Property

We rely primarily on a combination of copyright, patent, trademark, and trade secrets laws, as well as confidentiality procedures and contractual provisions to protect our intellectual property rights and our brand. We have obtained patents relating to our system architecture and products in strategic global markets. We enter into confidentiality, intellectual property ownership, and license agreements with our employees, partners, clients, and other third parties. To protect our proprietary rights, we also control access to and ownership of software, services, documentation, and other information. We also purchase or license technology that we incorporate into our products and services.

Sales and Marketing

We encourage our direct sales force and outside partners to co-market, pursue joint sales initiatives, and drive broader adoption of our technology, helping us grow our business more efficiently and focus our resources on continued innovation and enhancement of our solutions. In addition, strategic partnerships with management consulting firms and major systems integrators are important to our sales efforts because they influence buying decisions, help us identify sales opportunities, and complement our software and services with their domain expertise and consulting capabilities. We also partner with technology providers and application developers.

To support our sales efforts, we conduct a broad range of marketing programs, including awareness advertising, client and industry-targeted solution campaigns, trade shows, including our PegaWorld® iNspire user conference, solution seminars and webinars, industry analyst and press relations, web and digital marketing, community development, social media presence, and other direct and indirect marketing efforts. In addition, our consulting employees, business partners, and other third parties also conduct joint and separate marketing campaigns that generate sales leads. Our sales and marketing efforts are premised on the strength of our products, both as they exist currently and as they will continue to develop in the future through our research and development efforts.

8

Research and Development

Our research and development organization is responsible for product architecture, core technology development, product testing, and quality assurance. Our product development priority is to continue expanding our technology’s capabilities and ensure we deliver superior cloud-native solutions. We intend to maintain and extend the support of our existing applications, and we may choose to invest in additional strategic applications that incorporate the latest business innovations. We also intend to maintain and extend the support for popular public and private cloud platforms, and integration options to facilitate easy and rapid deployment in diverse IT infrastructures. Our goal with all products is to enhance product capabilities, implementation ease, long-term flexibility, and improve client service.

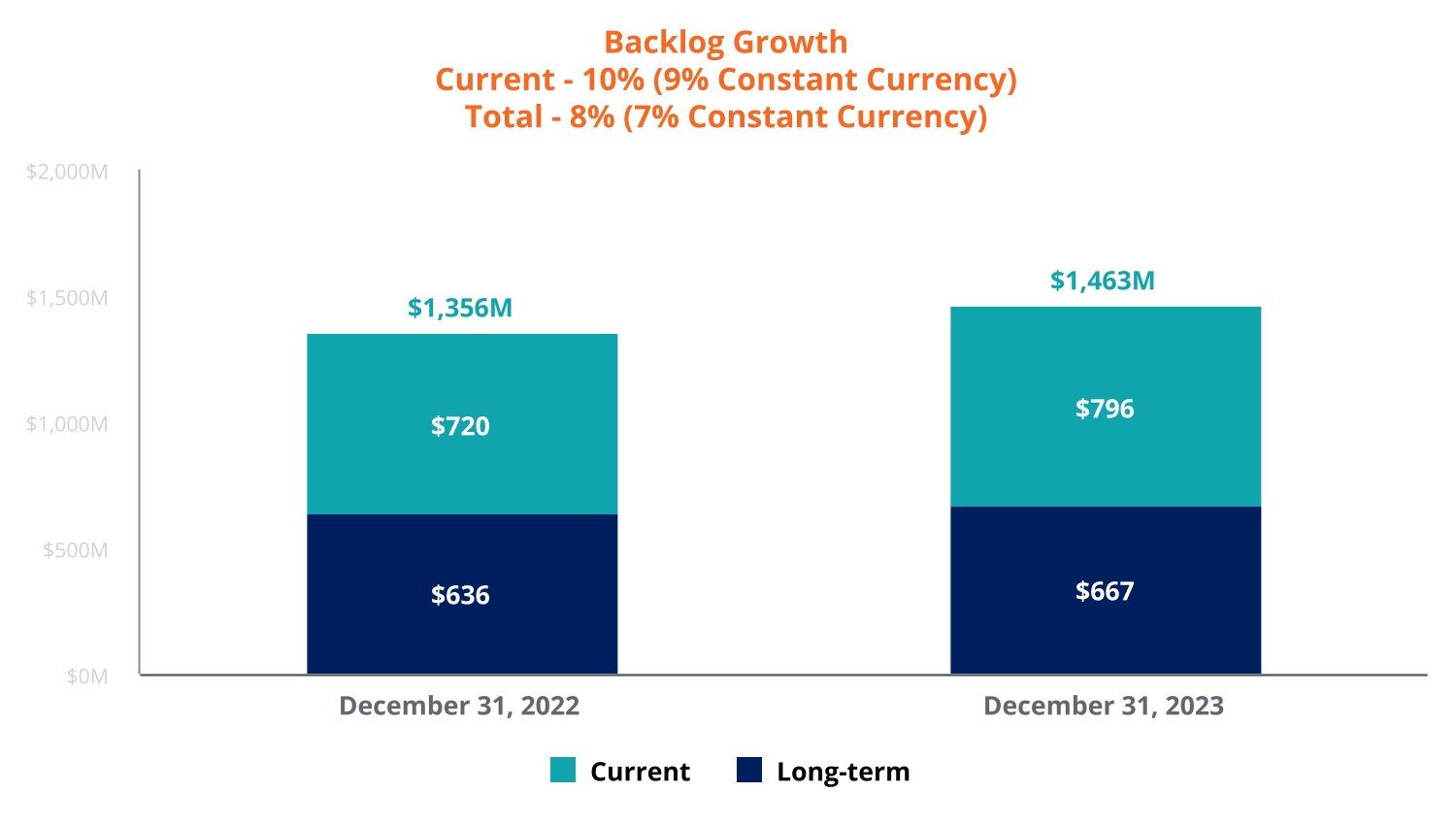

Backlog

As of December 31, 2023, we expected to recognize $1.5 billion in revenue from backlog on existing contracts in future periods. For additional information, see "Remaining Performance Obligations ("Backlog")" in Item 7 of this Annual Report.

Our People

As of January 31, 2024, we had 5,406 employees, of which 1,998 were based in the Americas, 1,224 were based in Europe, 1,873 were based in India, and 311 were based elsewhere in Asia-Pacific.

Our people are critical to our success. We strive to be a place where people build their career in an inclusive, equitable, and diverse culture. We believe cultivating our talent is at the heart of engaging, motivating, and retaining our workforce to support our clients, partners, and business.

We evolve our corporate culture through various initiatives, including global equity, inclusion, and belonging initiatives, employee engagement, pay equity, and employee development.

Diversity, Equity, Inclusion, and Belonging (“DEIB”)

We celebrate, welcome, and foster diverse perspectives at Pega because we believe this will accelerate our ability to deliver innovative products and services to our clients. It is critical for us to create an environment where all individuals are respected, valued, and supported, have access to opportunities, and feel that they belong. Our commitment to DEIB includes inclusion and allyship programs, amongst other investments. We are continuously expanding our sponsorship of formal employee resource groups and are proud to share our support for the following communities: women, veterans, Black, LGBTQIA+, Asian, LatinX, and persons with disabilities.

Employee Engagement, Health, and Well-Being

Our efforts to retain and attract employees include providing competitive reward packages and encouraging active and transparent communication throughout the Company. We regularly seek feedback to better understand and improve our employee experience, and we are committed to fostering an environment where everyone feels connected at Pega.

We share the responsibility to preserve, strengthen, and evolve our culture while continuously reviewing the way we do things to propel us forward together. In addition to our employee engagement survey and continuous feedback tools, we host regular sessions led by the executive leadership team where any employee can ask questions.

We are committed to fostering an environment that supports our employees’ health and overall well-being, with an emphasis on physical, emotional, financial, and personal wellness. PegaUp!, our employee wellness program, includes awareness campaigns, fitness classes, guided meditation, and health and wellness offerings. In 2022, we also implemented global Wellness Days, where we encourage our people to take a break to recharge.

Pay Equity

We compensate our employees for what they do and how they do it, regardless of their gender, race, or other characteristics. To deliver on that commitment, we benchmark and set pay ranges based on market data and consider individual factors, such as an employee’s role and experience, location, and performance. We regularly review our compensation practices, in terms of our overall workforce and individual employees, to ensure our pay is fair and equitable against local markets.

Talent Cultivation

Talent Cultivation is at the foundation of our people strategy. It is an ongoing, dynamic process that encourages our employees to focus on performance and development goals, receive continuous feedback, and drive their future path for growth. We invest in our employees’ career growth and progression by providing a wide range of opportunities, including formal and informal development, mentoring, sponsorship, and coaching. Pega Academy helps employees, clients, and partners gain and rapidly advance Pega software skills. A series of leadership and management development programs equip our managers with the skills and knowledge to successfully build a culture of engagement and high performance.

Additionally, we provide educational resources and classes, career training, and education reimbursement programs.

Corporate Information

Pegasystems Inc. was incorporated in Massachusetts in 1983. Our stock is traded on the NASDAQ Global Select Market under the symbol “PEGA.” Our website is at www.pega.com, and our investor relations website is at www.pega.com/about/investors.

9

Available Information

We make available our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports, free of charge, through our website as soon as reasonably practicable after we electronically file such material with or furnish such material to the SEC. We also make available on our website reports filed by our executive officers and directors on Forms 3, 4, and 5 regarding their ownership of our securities. Our Code of Conduct is available on our website in the “Governance” section.

The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

ITEM 1A. RISK FACTORS

The risks and uncertainties described below are not the only ones we face. Events that we do not currently anticipate, or expect to be immaterial, may also materially adversely affect our results of operations, cash flows, and financial condition.

Risks Related to Our Business and Industry

If we fail to operate our subscription-based business model successfully, our results of operations and/or cash flows could be negatively impacted.

We have substantially completed our transition to a more subscription-based business model, in which clients have the right to access our software in a hosted environment or use downloaded software for a specified subscription period. The shift of our clients’ preference to subscription-based offerings requires a scalable organization and a considerable investment of technical, financial, legal, managerial, and sales resources.

Continued growth of our subscription-based offerings will depend on our ability to continue to:

•innovate and include new functionality and improve the usability of our products in a manner that addresses our clients’ needs and requirements; and

•optimally price our products considering marketplace conditions, competition, our costs, and client demand.

Our cloud-based subscription model also requires that we rely on third parties to host our software for our clients. We incur significant recurring third-party hosting expenses to deliver our Pega Cloud offering that we do not incur for our perpetual and term license products. These expenses may cause the gross margin we realize from our Pega Cloud sales to be lower than the gross margin we realize from our perpetual and term license products. If we are unable to meet these challenges effectively, our operating results and financial condition could be materially adversely affected.

We may not achieve the key elements of our strategy and grow our business as anticipated.

We currently intend to grow our business by pursuing strategic initiatives consistent with becoming a Rule of 40 company, meaning a company with combined Annual Contract Value (“ACV”) growth rate and free cash flow margin of at least 40%. Key elements of our strategy include increasing our market share by developing and delivering robust solutions that can work together seamlessly with maximum differentiation and minimal customization, offering versatility in the Pega Platform and application deployment and licensing options to meet the specific needs of our clients, growing our network of partner alliances, and developing the talent and organizational structure capable of supporting our revenue and earnings growth targets. We may not achieve one or more of our key initiatives. Our success depends on our ability to manage our expenses as we appropriately grow our organization, successfully execute our marketing and sales strategies, successfully incorporate acquired technologies into our unified Pega Platform, and develop new products or product enhancements. If we are not able to execute these actions, our business may not grow as we anticipate, and our operating results and financial condition could be materially adversely affected.

We depend on key personnel, including our Chief Executive Officer, and must attract and retain qualified personnel in the future.

Our business is dependent on key, highly skilled technical, managerial, consulting, sales, and marketing personnel, including our Chief Executive Officer, who is also our founder and largest stockholder.

The loss of key personnel could be disruptive to our operations and materially adversely affect our financial performance. We do not carry, nor do we currently intend to obtain, significant key-person life insurance on officers or other employees. Our success will depend on attracting and retaining qualified personnel and rapidly replacing and developing new management, as needed. The number of potential employees who have the extensive knowledge needed to develop, sell, and maintain our offerings is limited, and competition for their services is intense. There can be no guarantee that we will be able to attract and retain such personnel. If we are unable to do so, our business, operating results, and financial condition could be materially adversely affected. We have from time to time in the past experienced, and we expect to continue to experience in the future, difficulty in hiring and difficulty in retaining highly skilled employees with appropriate qualifications.

In addition, we believe our corporate culture has been a key contributor to our success. If we fail to maintain and enhance our corporate culture within an environment of hybrid work, our ability to retain and recruit personnel essential to our success may be negatively affected.

10

The timing of our license and Pega Cloud revenue is difficult to predict, which may cause our operating results to vary considerably.

A change in the size or volume of license and Pega Cloud arrangements, or a change in the mix between perpetual licenses, subscription licenses, and Pega Cloud arrangements, can cause our revenues and cash flows to fluctuate materially between periods. Revenue from subscription service arrangements, which includes Pega Cloud and maintenance, is typically recognized over the contract term, while revenue from license sales is recognized when the license rights become effective, typically upfront. Subscription licenses and services are typically billed and collected over the contract term, while perpetual licenses are generally billed and collected upfront when the license rights become effective.

Factors that may influence the predictability of our license and Pega Cloud revenue include:

•changes in clients’ budgets and decision-making processes that could affect both the timing and size of transactions;

•the timing of the execution of an agreement or our ability to deliver the products or services;

•changes in our business model; and

•our ability to execute our marketing and sales strategies.

We budget for our selling and marketing, product development, and other expenses based upon anticipated future bookings and revenue. If the timing or amount of revenue fails to meet our expectations, our financial performance is likely to be materially adversely affected because only a small portion of our expenses vary with revenue. Other factors that may cause our operating results to vary include changes in foreign currency exchange rates, income tax effects, and the impact of new accounting pronouncements.

As a result, period-to-period comparisons of our operating results are not necessarily meaningful and should not be relied upon to predict future performance. If our revenues and operating results do not meet the expectations of our investors or securities analysts or fall below guidance we may provide to the market, or due to other factors discussed elsewhere in this section, the price of our common stock may decline.

The number and value of license and Pega Cloud arrangements has been increasing, and we may not be able to sustain this growth unless our partners and we can provide sufficient high-quality consulting, training, and maintenance resources to enable our clients to realize significant business value from our software.

Our clients typically request consulting and training to assist them in implementing our license and Pega Cloud offerings. Our clients also usually purchase maintenance on our perpetual and term licenses. As a result, an increase in the number and value of license and Pega Cloud arrangements is likely to increase demand for consulting, training, and maintenance related to our offerings. Given that the number and value of our license and Pega Cloud arrangements has been growing, we will need to provide our clients with more consulting, training, and maintenance to enable them to realize significant business value from our software. We have been increasing our partner and client enablement through training to create an expanded ecosystem of people that are skilled in the implementation of our solutions. However, if our partners and we are unable to provide sufficient high-quality consulting, training, and maintenance resources, our clients may not realize sufficient business value from our offerings to justify follow-on sales, which could impact our future financial performance.

Further, some of our client engagements have high public visibility. If our partners or we encounter problems in helping these clients implement our license and Pega Cloud offerings or if there is negative publicity regarding these engagements (even if unrelated to our services or offerings), our reputation could be harmed and our future financial performance could be negatively impacted. Finally, the investments required to meet the increased demand for our consulting services could strain our ability to deliver our consulting engagements at desired profitability, thereby impacting our overall profitability and financial results.

We may not be able to maintain our retention rate for our subscription clients.

The majority of our revenue is derived from our subscription offerings. Our clients have no obligation to renew their subscriptions, although historically, most have elected to do so. If our retention rate for those clients decreases, our business, operating results, and financial condition could be materially affected.

Investments we are making to continue to grow license and Pega Cloud arrangements may result in decreased profitability or losses and reduced or negative cash flow if we do not continue to increase the value of our license and Pega Cloud arrangements to balance our growth in expenses.

We expect to provide our clients with more cloud and maintenance support as our business grows and have been investing significantly in research and development to expand and improve the Pega Platform and applications. These investments have resulted in increased fixed costs that do not vary with the level of revenue. If the increased demand for our offerings does not continue, we could experience decreased profitability or losses and reduced or negative cash flow because of these increased fixed costs. Conversely, if we are unable to achieve an appropriate balance of sales and marketing personnel to meet future demand or research and development personnel to enhance our current products or develop new products, we may not be able to achieve our sales and profitability targets.

11

We rely on third-party relationships.

We have a number of relationships with third parties that are significant to our sales, marketing, support, and product development efforts, including hosting facilities for our Pega Cloud offering. We rely on software and hardware vendors, large system integrators, and technology consulting firms to supply marketing and sales opportunities for our direct sales force and to strengthen our offerings using industry-standard tools and utilities. We also have relationships with third parties that distribute our products. There can be no assurance that these companies, many of which have far greater financial and marketing resources than us, will not develop or market offerings that compete with ours in the future or will not otherwise end or limit their relationships with us. Further, the use of third-party hosting facilities requires us to rely on the functionality and availability of the third parties’ services, as well as their data security, which despite our due diligence, may be or become inadequate, as further discussed below under the risk factor “We rely on third-party hosting providers to deliver our offerings, and any disruption or interference with our use of these services could adversely affect our business.”

We face risks from operations and clients based outside of the United States.

We market our products and services to clients based outside of the U.S., representing 43% of our revenue over the last three years. We have established offices in the Americas, Europe, Asia, and Australia. We anticipate hiring personnel to accommodate increased international demand, and we may also enter into agreements with local distributors, representatives, or resellers. If we are unable to do one or more of these things in a timely and effective manner, the growth, if any, of our international operations may be restricted, and our business, operating results, and financial condition could be materially adversely affected.

Additional risks inherent in our international business activities include:

•laws and business practices favoring local competitors;

•compliance with multiple, conflicting, and changing governmental laws and regulations, including employment, tax, privacy, and data privacy and protection;

•increased tariffs and other trade barriers;

•the costs of localizing offerings for local markets, including translation into foreign languages and associated expenses;

•longer payment cycles and credit and collectability risk on our foreign trade receivables;

•difficulties in enforcing contractual and intellectual property rights;

•heightened fraud and bribery risks;

•treatment of revenue from international sources and changes to tax codes, including being subject to foreign tax laws, being liable for paying withholding, income or other taxes in foreign jurisdictions, and other potentially adverse tax consequences (including restrictions on repatriating earnings and the threat of “double taxation”);

•management of our international operations, including increased administrative and compliance expenses;

•heightened risks of political and economic instability; and

•foreign currency exchange rate fluctuations and controls.

There can be no assurance that one or more of these factors will not have a material adverse effect on our international operations and, consequently, on our business, operating results, and financial condition.

Our consulting revenue is significantly dependent upon our consulting personnel implementing new license and Pega Cloud arrangements.

We derive a substantial portion of our consulting revenue from implementations of new license and Pega Cloud arrangements managed by our consulting personnel and consulting for partner and client-led implementation efforts. Our strategy is to support and encourage partner-led and client-led implementations to increase the breadth, capability, and depth of market capacity to deliver implementation services to our clients. Accordingly, if our consulting personnel’s involvement in future implementations decreases, this could materially adversely affect our consulting revenue.

We frequently enter into a series of license or Pega Cloud arrangements that each focus on a specific purpose or area of operations. If we are not successful in obtaining follow-on business from these clients, our financial performance could be materially adversely affected.

Once a client has realized the value of our software, we work with the client to identify opportunities for follow-on sales. However, we may not be successful in demonstrating this value for several reasons, including the performance of our products, the quality of the services and support provided by our partners and us, or external factors. Also, some of our smaller clients may have limited additional sales opportunities available. We may not obtain follow-on sales, or the follow-on sales may be delayed, and our future revenue could be limited.

12

We will need to acquire or develop new products, evolve existing ones, address defects or errors, and adapt to technology changes.

Technical developments, client requirements, programming languages, industry standards, and regulatory requirements frequently change in the markets in which we operate. The introduction of third-party solutions embodying new technologies, including generative AI and the emergence of new industry standards could make our existing and future software solutions obsolete and unmarketable. As a result, our success will depend upon our ability to enhance current products, address any product defects or errors, acquire or develop and introduce new products that meet client needs, keep pace with technology and regulatory changes, respond to competitive products, and achieve market acceptance. Product development requires substantial investments for research, refinement, and testing. We may not have sufficient resources to make the necessary product development investments. We may experience technical or other difficulties that will delay or prevent the successful development, introduction, or implementation of new or enhanced products. We may also experience technical or other challenges integrating acquired technologies into our existing platform and applications. Inability to introduce or implement new or enhanced products in a timely manner could result in loss of market share if competitors are able to provide solutions to meet client needs before we do, give rise to unanticipated expenses related to further development or modification of acquired technologies, and materially adversely affect our financial performance. We may also fail to anticipate adequately and prepare for the development of new markets and applications for our technology and the commercialization of emerging technologies such as generative AI and thereby fail to take advantage of new market opportunities or fall behind early movers in those markets.

The market for our offerings is intensely and increasingly competitive, rapidly changing, and fragmented.

We encounter significant competition from:

•customer engagement vendors, including Customer Relationship Management application vendors;

•Digital Process Automation vendors and platforms, including Business Process Management vendors, low-code application development platforms, and service-oriented architecture middleware vendors;

•case management vendors;

•decision management, data science, and Artificial Intelligence vendors, as well as vendors of solutions that leverage decision making and data science in managing customer relationships and marketing;

•robotic automation and workforce intelligence software providers;

•companies that provide application-specific software for financial services, healthcare, insurance, and other specific markets;

•mobile application platform vendors;

•co-browsing software providers;

•social listening, text analytics, and natural language processing vendors;

•commercialized open-source vendors;

•professional services organizations that develop their own products or create custom software in conjunction with rendering consulting services; and

•clients’ in-house information technology departments, which may seek to modify their existing systems or develop their own proprietary systems.

Many of our competitors, such as International Business Machines Corporation (“IBM”), Microsoft Corporation, Oracle Corporation, Salesforce.com, SAP SE, and ServiceNow, have far greater resources than we do and may be able to respond more quickly and efficiently to new or emerging technologies, programming languages or standards, or changes in client requirements or preferences. Competitors may also be able to devote greater managerial and financial resources to develop, promote, and distribute products and to provide related consulting and training services.

We believe the principal competitive factors within our market include:

•product adaptability, scalability, functionality, and performance;

•proven success in delivering cost-savings and efficiency improvements;

•proven success in enabling improved customer interactions;

•ease-of-use for developers, business units, and end-users;

•timely development and introduction of new products and product enhancements;

•establishment of a significant base of reference clients;

•ability to integrate with other products and technologies;

•customer service and support;

•product price;

•vendor reputation; and

•relationships with systems integrators.

13

Competition for market share and pressure to reduce prices and make sales concessions is likely to increase. There can be no assurance that we will be able to compete successfully against current or future competitors or that the competitive pressures we face will not materially adversely affect our business, operating results, and financial condition.

For additional information, see "Item 1. Business" of this Annual Report.

Our Chief Executive Officer is our largest stockholder and can exert significant influence over matters submitted to our stockholders, which could materially adversely affect our other stockholders.

As of December 31, 2023, our Chief Executive Officer beneficially owned approximately 47 percent of our outstanding common stock. As a result, he has the ability to exert significant influence over all matters submitted to our stockholders for approval, including the election and removal of directors and any merger, consolidation, or sale of our assets. Under Massachusetts law and our governing documents, approval of a merger, share exchange or sale of all or substantially all of our assets requires approval of two-thirds of all shares entitled to vote. As a result, this concentration of ownership may delay or prevent a change in control, impede a merger, consolidation, takeover, or other business combination involving us, discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, or result in actions that may be opposed by other stockholders.

If we are unsuccessful in the appeal of the trial court judgment in our litigation with Appian Corp., our operating results and financial condition would be adversely impacted.

We are currently party to litigation with Appian Corp. — see Part I, Item 3 “Legal Proceedings” and "Note 20. Commitments And Contingencies" in the “Notes to Consolidated Financial Statements” included in Part II, Item 8 of this Annual Report. On September 15, 2022, the circuit court of Fairfax County entered judgment for Appian in the amount of $2,060,479,287 and awarding post-judgment interest. The Company filed a notice of appeal from the judgment the same day with the Court of Appeals of Virginia. On September 29, 2022, the circuit court approved the $25,000,000 letter of credit obtained by the Company to secure the judgment and suspended the judgment during the pendency of the Company’s appeal. On November 15, 2023, the Court of Appeals of Virginia heard oral arguments in the appeal. After the Court issues an opinion, the non-prevailing party or, depending on the ruling of the court, parties may file a petition for rehearing with the Court of Appeals of Virginia and/or file a petition for appeal with the Supreme Court of Virginia. Although it is not possible to predict timing, this appeals process could potentially take years to complete.

We believe we have strong grounds to overturn the result in the trial court. But if we are ultimately unsuccessful in prevailing in the matter in its entirety or in substantially reducing any judgment, we may be required to incur additional debt or otherwise engage in capital markets transactions, which may include a public offering or private placement of our equity securities or a sale or license of assets. See below under the risk factor, “We may require additional capital in the future.” In addition, if we do not satisfy the judgment within 60 days following the expiration of the right to appeal, there may be an acceleration of liabilities under our Convertible Senior Notes due 2025 (the “Notes”) and our Credit Facility. We believe that we have the financial strength to pay these amounts if it ever becomes necessary, but it is possible that we may not be able to engage in financing activities on desirable terms, which could have a material adverse effect on our business, financial condition, and operating results. Further discussion of these risks is contained below under the heading “Risks Related to Our Financial Obligations and Indebtedness.”

Risks Related to Information Technology Resilience and Security

We face risks related to outages, data losses, and disruptions of our online services if we fail to maintain an adequate operations infrastructure.

The increasing user traffic for our Pega Cloud offering demands more computing power. It requires that we maintain an internet connectivity infrastructure that is robust and reliable within competitive and regulatory constraints that continue to evolve. Inefficiencies or operational failures, including temporary or permanent loss of client data, power outages, or telecommunications infrastructure outages, by our third-party service providers or us, could diminish the quality of our user experience resulting in contractual liability, claims by clients and others, damage to our reputation, loss of current and potential clients, and negatively impact our operating results and financial condition.

Security of our systems and global client data is a growing challenge. Cyber-attacks and security breaches may expose us to significant legal and financial liabilities.

High-profile security breaches at other companies have increased in recent years. Security industry experts and government officials have warned about the risks of hackers and cyber-attackers targeting information technology products and businesses. Threats to IT security can take a variety of forms. Individual hackers, groups of hackers, and sophisticated organizations, including state-sponsored organizations, or nation-states themselves, may take steps that threaten our clients, suppliers, third-party technology providers, and us.

14

Although we are not aware of having experienced any prior material data breaches, regulatory non-compliance incidents or cyber security incidents, we may in the future be impacted by such an event, exposing our clients and us to a risk of someone obtaining access to our information, to information of our clients or their customers, or to our intellectual property, disabling or degrading service, or sabotaging systems or information. Any such security breach could result in a loss of confidence in the security of our services, damage our reputation, disrupt our business, require us to incur significant costs of investigation, remediation and/or payment of a ransom, lead to legal liability, negatively impact our future sales, and result in a substantial financial loss. Additionally, our Pega Cloud offering provides provisioned, monitored, and maintained environments for individual clients to create and deploy Pega-based applications using an Internet-based infrastructure. These services involve storing and transmitting client data and other confidential information.

Our security measures, those of our suppliers, third-party technology providers, and our clients may be breached because of third-party actions or those of employees, consultants, clients, or others, including intentional misconduct by computer hackers, system errors, human errors, technical flaws in our products, or otherwise. Because we do not control the configuration of Pega applications by our clients, the transmissions between our clients and our third-party technology providers, the processing of data on the servers at third-party technology providers, or the internal controls maintained by our clients and third-party technology providers that could prevent unauthorized access or provide appropriate data encryption, we cannot fully ensure the complete integrity or security of such transmissions processing or controls. In addition, privacy, security, and data transmission concerns in some parts of the world may inhibit demand for our Pega Cloud offering or lead to requirements to provide our products or services in configurations that may increase the cost of serving such markets. The techniques used to obtain unauthorized access or sabotage systems change frequently and are generally only recognized once launched against a target. While we have invested in protecting our data and systems and clients' data to reduce these risks and actively monitor for risks of data breaches, regulatory non-compliance incidents and cyber security incidents, there can be no assurance that our efforts will prevent breaches. Moreover, like most software companies, we incorporate open-source code into our software products and services, which also creates a potential risk. We deal with security issues regularly and have experienced security incidents from time to time. We have a standing Compliance and Risk Governing Committee composed of senior representatives across the Company that reports to and assists the Audit Committee and the Board as a whole in the oversight of compliance and risk management programs, including cybersecurity measures. In addition, we have a standing Security Steering Group, whose members include our Chief Information Security Officer, Chief Product Officer and Chief Technical Systems Officer, and which is charged with providing strategic direction for the implementation and ongoing operation of our cyber security program. Even with the efforts the Company has undertaken, there is a risk that a security breach will be successful, and such an event will be material. We carry data breach insurance coverage to mitigate the financial impact of a security breach, though this may prove insufficient in the event of a breach.

Our Pega Cloud offering involves hosting client applications on the servers of third-party technology providers. We also rely on third-party systems and technology, including encryption, virtualized infrastructure, and support, and employ a shared security model with our clients and third-party technology providers.

To defend against security threats, we need to continuously engineer products and services with enhanced security and reliability features, improve the deployment of software updates to address security vulnerabilities, apply technologies that mitigate the risk of attacks, and maintain a digital security infrastructure that protects the integrity of our network, products, and services. The cost of these steps could negatively impact our operating results. While we actively work to improve vulnerability scanning, patching, threat intelligence, security event detection, security event alerting and forensics, it is possible that security breaches, whether due to unpatched vulnerabilities or otherwise, occur and may be undetected when they occur. Any such security breach could result in a loss of confidence in the security of our services, damage our reputation, disrupt our business, require us to incur significant costs of investigation, remediation and/or payment of a ransom, lead to legal liability, negatively impact our future sales, and result in a substantial financial loss.

We rely on third-party hosting providers to deliver our offerings, and any disruption or interference with our use of these services could adversely affect our business.

Our use of third-party hosting facilities requires us to rely on the functionality and availability of the third-party services and their data security, which, despite our due diligence, may be or become inadequate. Our continued growth depends in part on the ability of our existing and potential customers to use and access our cloud services or our website to download our software within an acceptable amount of time. We use third-party service providers for key infrastructure components, particularly when developing and delivering our cloud-based products. These service providers give us greater flexibility in efficiently delivering a more tailored, scalable customer experience and expose us to additional risks and vulnerabilities. Third-party service providers operate platforms we access and which are vulnerable to service interruptions. We may experience interruptions, delays, and outages in service and availability due to problems with our third-party service providers’ infrastructure. This infrastructure’s lack of availability could be due to many potential causes, including technical failures, power shortages, natural disasters, fraud, terrorism, or security attacks that we cannot predict or prevent. Such outages could trigger our service level agreements and the issuance of credits to our clients, which may impact our business and consolidated financial statements.

If we are unable to renew our agreements with our cloud service providers on commercially reasonable terms, an agreement is prematurely terminated, or we need to add new cloud services providers to increase capacity and uptime, we could experience interruptions, downtime, delays, and additional expenses related to transferring to and providing support for these new platforms. Any of the above circumstances or events may harm our reputation and brand, reduce our platforms’ availability or usage, and impair our ability to attract new users, which could adversely affect our business, financial condition, and results of operations.

15

We may experience significant errors or security flaws in our products and services and could face privacy, product liability, and warranty claims.

Despite quality testing each release, our software frequently contains errors or security flaws, especially when first introduced or when new versions are released. Errors in our software could affect its ability to work with hardware or other software or delay the development or release of new products or new versions of our software. Additionally, detecting and correcting any security flaws, including those introduced by our use of open-source, can be time-consuming and costly. Errors or security flaws in our software could result in the inadvertent disclosure of confidential information or personal data relating to our clients, employees, or third parties. Software errors and security flaws in our products or services could expose us to privacy, product liability, or warranty claims and harm our reputation, which could impact our future sales of products and services. Typically, we enter into license agreements that contain provisions intended to limit the nature and extent of our risk of product liability and warranty claims. A court might interpret these terms in a limited way or hold part or all of them unenforceable. Also, there is a risk that these contract terms might not bind a party other than the direct client. Furthermore, some of our licenses with our clients are governed by non-U.S. law, and there is a risk that foreign law might give us less or different protection. Although we have not experienced any material product liability claims to date, a product liability suit or action claiming a breach of warranty, whether meritorious, could result in substantial costs and a diversion of management’s attention and our resources.

Risks Related to Our Financial Obligations and Indebtedness

We have significant debt which may limit our business flexibility, access to capital, and/or increase our borrowing costs, which may adversely affect our operations and financial results.

As of December 31, 2023, we had $502.27 million in aggregate principal indebtedness under our Notes and have outstanding letters of credit under our credit facility, including a $25 million letter of credit obtained to secure the judgment in our litigation with Appian.

Our indebtedness may:

•limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions, or other general business purposes;

•limit our ability to use our cash flow or obtain additional financing for future working capital, capital expenditures, acquisitions, or other general business purposes;

•require us to use a substantial portion of our cash flow from operations to make debt service payments;

•limit our flexibility to plan for, or react to, changes in our business and industry;

•place us at a competitive disadvantage compared to less leveraged competitors;

•dilute existing stockholders from the issuance of common stock if the Notes are converted; and

•increase our vulnerability to the impact of adverse economic and industry conditions.

Our ability to pay our debt when due or refinance our indebtedness, including the Notes, depends on our future performance, which is subject to economic, financial, competitive, and other factors beyond our control. Our business may not generate sufficient cash flow from operations to service our debt and make necessary investments in our business. Our ability to refinance our indebtedness will depend on the capital market conditions and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations. In turn, this could result in that and our other indebtedness becoming immediately payable in full which could materially adversely affect our financial condition, results of operation or cost of borrowing.

We may require additional capital in the future.

We may require additional capital in the future to finance our operations. If we raise funds through future issuance of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our common stock. Any future debt financing could involve restrictive covenants relating to our capital raising activities and other financial and operations matters, which may increase the risks related to our business and our ability to service and repay our indebtedness.

16

The conditional conversion feature of the Notes, if triggered, may adversely affect our financial condition and operating results.