UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-K

____________________________

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 | |||||

For the fiscal year ended December 31 , 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 | |||||

Commission File No. 1-11859

____________________

(Exact name of Registrant as specified in its charter)

____________________

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | ||||||||||||||||||||||

(Address of principal executive offices, including zip code)

(617 ) 374-9600

(Registrant’s telephone number, including area code)

____________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

____________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging company,” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s common stock held by non-affiliates, based upon the closing price of the Registrant’s common stock on the NASDAQ Global Select Market of $101.17, on June 30, 2020 was approximately $4.0 billion.

There were 80,900,637 shares of the Registrant’s common stock, $0.01 par value per share, outstanding on February 5, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

PEGASYSTEMS INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| Item | Page | |||||||

| PART I | ||||||||

| 1 | Business | |||||||

| 1A | Risk Factors | |||||||

| 1B | Unresolved Staff Comments | |||||||

| 2 | Properties | |||||||

| 3 | Legal Proceedings | |||||||

| 4 | Mine Safety Disclosures | |||||||

| PART II | ||||||||

| 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||||||

| 6 | Selected Financial Data | |||||||

| 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| 7A | Quantitative and Qualitative Disclosures about Market Risk | |||||||

| 8 | Financial Statements and Supplementary Data | |||||||

| 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||||

| 9A | Controls and Procedures | |||||||

| 9B | Other Information | |||||||

| PART III | ||||||||

| 10 | Directors, Executive Officers, and Corporate Governance | |||||||

| 11 | Executive Compensation | |||||||

| 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

| 13 | Certain Relationships and Related Transactions, and Director Independence | |||||||

| 14 | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| 15 | Exhibits and Financial Statement Schedules | |||||||

| 16 | Form 10-K Summary | |||||||

| Signatures | ||||||||

2

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”), including without limitation, “Item 1. Business,” “Item 1A. Risk Factors,” “Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities,” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” along with other reports that we have filed with the Securities and Exchange Commission (“SEC”), external documents and oral presentations, contains or incorporates forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as expects, anticipates, intends, plans, believes, will, could, should, estimates, may, targets, strategies, projects, forecasts, guidance, likely, and usually, or variations of such words and other similar expressions identify forward-looking statements, which are based on current expectations and assumptions.

These forward-looking statements deal with future events and are subject to various risks and uncertainties that are difficult to predict, including, but not limited to, statements about:

•our future financial performance and business plans;

•the adequacy of our liquidity and capital resources;

•the continued payment of quarterly dividends;

•the timing of revenue recognition;

•management of our transition to a more subscription-based business model;

•variation in demand for our products and services, including among clients in the public sector;

•the impact of actual or threatened public health emergencies, such as the Coronavirus (COVID-19);

•reliance on third-party service providers;

•compliance with our debt obligations and debt covenants;

•the potential impact of our convertible senior notes and related Capped Call Transactions;

•reliance on key personnel;

•the relocation of our corporate headquarters;

•the continued uncertainties in the global economy;

•foreign currency exchange rates;

•the potential legal and financial liabilities and reputation damage due to cyber-attacks;

•security breaches and security flaws;

•our ability to protect our intellectual property rights and costs associated with defending such rights;

•our client retention rate;

•management of our growth.

These risks and others that may cause actual results to differ materially from those expressed in such forward-looking statements are described further in “Item 1A. Risk Factors” of this Annual Report and other filings we make with the SEC. Except as required by applicable law, we do not undertake and expressly disclaim any obligation to publicly update or revise these forward-looking statements whether as the result of new information, future events, or otherwise.

The forward-looking statements contained in this Annual Report represent our views as of February 17, 2021.

3

ITEM 1. BUSINESS

Our Business

We develop, market, license, host, and support enterprise software applications that help organizations transform how they engage with their customers and process work. We also license our low code Pega Platform™ for rapid application development to clients that wish to build and extend their business applications. Our cloud-architected portfolio of customer engagement and digital process automation applications leverages artificial intelligence (“AI”), case management, and robotic automation technology, built on our unified low code Pega Platform, empowering businesses to quickly design, extend, and scale their enterprise applications to meet strategic business needs.

To grow our business, we intend to:

•increase market share by developing and delivering market-leading applications for marketing, sales, service, and operations that can work together seamlessly with maximum competitive differentiation;

•execute new-market growth initiatives, further expanding go-to-market coverage within the Global 3000; and

•continue to scale our marketing efforts to support the way today’s clients discover, evaluate, and buy products and services.

Whether we are successful depends, in part, on our ability to:

•execute our marketing and sales strategies;

•appropriately manage our expenses as we grow our organization;

•effectively develop new products and enhance our existing products; and

•incorporate acquired technologies into our applications and unified Pega Platform.

Cloud Transition

We are in the process of transitioning our business to sell software primarily through subscription arrangements, particularly Pega Cloud (“Cloud Transition”). Until we substantially complete our Cloud Transition, which we anticipate will occur in early 2023, we expect to continue to experience lower revenue growth and lower operating cash flow growth or negative cash flow. The actual mix of revenue and new arrangements in a given period can fluctuate based on client preferences.

See risk factor "If we fail to manage our transition to a more subscription-based business model successfully, our results of operations and/or cash flows could be negatively impacted." in Item 1A of this Annual Report for additional information.

Coronavirus (“COVID-19”)

As of December 31, 2020, COVID-19 has not had a material impact on our results of operations or financial condition.

COVID-19's ultimate impact on our operational and financial performance will depend on future developments, including the duration and spread of the outbreak and the impact of COVID-19 on our sales cycles, partners, vendors, and employees, all of which is uncertain and unpredictable. Our shift towards subscription-based revenue streams, the industry mix of our clients, the substantial size and available resources of our clients, and the critical nature of our products to our clients may reduce or delay the impact of COVID-19 on our business. However, it is not possible to estimate the ultimate impact that COVID-19 will have on our business at this time.

See “Coronavirus (“COVID-19”)” in Item 1A of this Annual Report for additional information.

Relocation of Corporate Headquarters

On February 12, 2021, we entered into an agreement with our landlord to vacate our Cambridge, Massachusetts corporate headquarters on October 1, 2021, in exchange for a one-time payment to us of $18 million. We expect to enter into a new lease agreement for a facility within the greater Boston area.

4

Our Products

Pega Infinity™, the latest version of our software portfolio, helps connect enterprises to their customers in real time across channels, streamline business operations, and adapt to meet changing requirements.

Our applications and platform intersect with and encompass several software markets, including:

•Customer Engagement, including Customer Relationship Management (“CRM”);

•Digital Process Automation (“DPA”), including Business Process Management (“BPM”) and Dynamic Case Management (“DCM”);

•Robotic Process Automation (“RPA”);

•Business Rules Management Systems (“BRMS”);

•Decision Management, including predictive and adaptive analytics;

•Low code application development platforms, including Multi-experience Development Platforms (“MXDP”); and

•Vertical-Specific Software (“VSS”) market of industry solutions and packaged applications.

1:1 Customer Engagement

Our omnichannel customer engagement applications are designed to maximize the lifetime value of customers and help reduce the costs of serving customers while ensuring a consistent, unified, and personalized customer experience. At the center of our customer engagement applications is the Pega Customer Decision Hub™, our real time AI engine, which can predict a customer’s behavior and recommend the “next best action” to take across channels in real time. It is designed to enable enterprises to improve customer acquisition and experiences across inbound, outbound, and paid media channels. It incorporates AI in the form of predictive and machine-learning analytics, as well as business rules, and executes these decisions in real time to evaluate the context of each customer interaction and dynamically deliver the most relevant action, offer, content, and channel.

Customer Service

The Pega Customer Service™ application simplifies customer service. It is designed to anticipate customer needs, connect customers to the right people and systems, and automate or intelligently guide customer interactions, to rapidly and continuously evolve the customer service experience, and to allow enterprises to deliver consistent interactions across channels and improve employee productivity. The application consists of a contact center desktop, case management for customer service, chat, knowledge management, mobile field service, omnichannel self-service, AI-powered virtual assistants, and industry-specific processes (“Microjourneys™”) and data models. For clients who want to extend intelligence and automation into the early stages of the customer journey, Pega Sales Automation™ automates and manages the entire sales process, from prospecting to product fulfillment. It allows enterprises to capture best practices and leverage AI to guide sales teams through the sales and customer onboarding processes.

5

Intelligent Automation

Our software for Intelligent Automation boosts the efficiency of our clients’ processes. This technology allows organizations to take an end-to-end approach to transformation by using intelligence and design thinking to streamline processes and create better experiences for their customers and employees. Intelligent automation goes beyond traditional Business Process Management (BPM) to unify technologies such as Robotic Process Automation (RPA) and Artificial Intelligence (AI) and enable organization-wide digital transformation. The Pega Platform, with its intelligent automation capabilities, allows clients to break down silos, improve customer-centricity, add agility to legacy technology, and provide end-to-end automation to support the needs of customers and employees.

Our Capabilities

We drive better business outcomes in two ways:

•Making decisions: delivering real time customer engagement, powered by real time, omnichannel AI.

•Getting work done: making customer and employee-facing processes more efficient through end-to-end automation and robotics.

We deliver our solution through our Center-out Business™ Architecture®, which enables clients to transcend channels and internal data silos to achieve both quick wins and long-term transformation. This approach insulates business logic from back-end and front-end complexity, delivering both consistent experiences to customers and agility to the business.

The key aspects of this architecture are:

Centrally-managed intelligence

Pega’s centrally-managed intelligence ensures AI and business rules operate across all channels. Applications built on the Pega Platform leverage predictive and adaptive analytics to deliver more personalized customer experiences and maximize business objectives. For example, Pega Customer Decision Hub, a centralized, always-on “customer brain,” unleashes the power of predictive analytics, machine learning, and real time decisioning across our clients’ data, systems, and touchpoints - orchestrating engagement across customer interaction channels.

End-to-end automation aligned with business outcomes

We bring together human-assisted robotic desktop automation and unattended robotic process automation with our unified process and case management capabilities. This provides our platform and applications the differentiated ability to automate both customer-facing and back-office operational processes from “end to end,” connecting across organizational and system silos to connect customers and employees to outcomes seamlessly and easily.

Consistent omni-channel experiences

With business and process logic centrally defined, Pega provides dynamic, open APIs to keep front-end channels and business logic operating in alignment for consistent customer experiences. By leveraging cutting-edge user interface (UI) technology, Pega-powered processes and decisions can be easily embedded into existing front-ends or used as the basis for new employee-facing applications.

Insulation of back-end complexity

Pega’s architecture insulates case and decision logic from the complexity of back-end systems. Our data virtualization automatically pulls in needed data in a common structure, regardless of source. This capability gives clients the agility to build new experiences on existing systems, modernizing legacy systems without breaking existing processes.

A Layered approach to managing variation

Pega’s Situational Layer Cake organizes logic into layers that map to the unique dimensions of a client’s business – customer types, lines of business, geographies, etc. This layered approach lets organizations manage variations of their business without duplicating logic. This capability allows initial deployments into a single department or region to seamlessly scale to manage the complexity of a global, multi-line enterprise.

In addition to our Center-out Business Architecture, Pega technology has been designed to be deployed rapidly, be changed easily, and scale across changing architecture needs.

Pega Express™ Methodology and low code

Our solutions are designed to quickly improve targeted customer outcomes and with out-of-the-box functionality that connects enterprise data and systems to customer experience channels. From there, organizations can scale, one customer experience at a time, to realize greater value while delivering increasingly consistent and personalized customer experiences. We prescribe a “Microjourney™” approach to delivery that breaks customer journeys into discrete processes that drive meaningful outcomes, such as “inquiring about a bill” or “updating an insurance policy.” This allows us to combine design-thinking and out-of-the-box functionality to deliver rapid results and ensure the ability to enhance the application going forward.

Our approach leverages low code to improve business and IT collaboration and bypass the error-prone and time-consuming process of manually translating requirements into code. Users design software in low code visual models that reflect the needs of the business. The software application is created and optimized automatically and directly from the model, helping to close the costly gap between vision and execution. Changes to the code are made by altering the model, and application documentation is generated directly from the model.

6

Cloud choice

Pega Cloud® allows clients to develop, test, and deploy, on an accelerated basis, our applications and the Pega Platform using a secure, flexible internet-based infrastructure, minimizing cost while focusing on core revenue-generating competencies.

Clients can also choose to manage the Pega deployment themselves (“client cloud”) using the cloud architecture they prefer. This multi-cloud approach of both Pega Cloud and client-managed cloud gives our clients the ability to select, and change as needed, the best cloud architecture for the security, data access, speed-to-market, and budget requirements of each application they deploy.

Our Services and Support

We offer services and support through our Global Client Success, Global Service Assurance, Global Client Support, and Pega Academy™ groups. We also use third-party contractors to assist us in providing these services.

•Global Client Success – Our Global Client Success group guides our clients on how to maximize their investment in our technology and realize the business outcomes they are targeting. This includes building implementation expertise and creating awareness of product features and capabilities.

•Global Service Assurance – Our Global Service Assurance group addresses risks to client success because of technical concerns. By providing technical staff dedicated to client success, we reduce the time to resolve technical issues, eliminate lengthy deliberations of technical resource logistics, and increase clients’ confidence in our technology and client service.

•Global Client Support – Our Global Client Support group provides technical support for our products and Pega Cloud services. Support services include cloud service reliability management, online support community management, self-service knowledge, proactive problem prevention through information and knowledge sharing, problem tracking, prioritization, escalation, diagnosis, and resolution.

•Pega Academy – The success of our sales strategy for repeat sales to target clients depends on enablement and ecosystem engagement. We have increased our ability to train a large number of partners and clients to implement our technology and made it easier for individuals to stay current with our technology as it evolves. We offer both instructor-led and online training to our employees, clients, and partners. We have also partnered with universities to provide our courseware as part of the student curriculum to expand our ecosystem. Engagement is an important part of our strategy to create a broad ecosystem that is passionate about Pega technology.

Our Partners

We collaborate with global systems integrators and technology consulting firms that provide consulting services to our clients, as well as Independent Software Vendors (“ISVs”) and technology partners that extend clients’ investments with integrated solutions. In addition, Authorized Training Partners (“ATPs”) support Pega customers in local languages, while our Workforce Development Partners let clients outsource their recruiting. Strategic partnerships with these firms are important to our sales efforts because they influence buying decisions, identify sales opportunities, and complement our software with their domain expertise, solutions, and services capabilities. These partners may deliver strategic business planning, consulting, project management, training, and implementation services to our clients.

Our partners include well-respected major firms, such as Accenture PLC, Amazon.com, Inc., Capgemini SA, Coforge, Cognizant Technology Solutions Corporation, EY, HCL Infosys, Merkle, PwC, Tata Consultancy Services Limited, Tech Mahindra Limited, Virtusa Corporation, and Wipro Limited.

Our Markets

Target Clients

Our target clients are Global 3000 organizations and government agencies that require applications to differentiate themselves in the markets they serve. Our applications achieve and facilitate differentiation by increasing business agility, driving growth, improving productivity, attracting and retaining customers, and reducing risk. We deliver applications tailored to our clients’ specific industry needs.

Our clients represent many industries, including:

•Financial services – Financial services organizations rely on software to market, onboard, cross-sell, retain, and service their customers, as well as automate the operations that support these customer interactions. Our intelligent automation, customer service, account onboarding, Know Your Customer (“KYC”), payment dispute and exception management, collections, and next best action solutions allow clients to improve the efficiency of their operations and provide better service to their customers.

•Life sciences – Life sciences organizations are looking for solutions to improve customer engagement, as well as increase efficiencies and transparency across the product development lifecycle. Our customer engagement, clinical, and pharmacovigilance applications are designed to deliver customer engagement, safety and risk management, and regulatory transparency.

•Healthcare – Healthcare organizations seek software that integrates their front and back-offices and helps them deliver personalized care and customer service while reducing costs, automating processes, and increasing operational efficiency. Our applications allow healthcare clients to address the sales, service, operational, financial, administrative, and regulatory requirements of healthcare consumerism and reform.

7

•Communications and media – Communications and media organizations need to address high levels of customer churn, growing pressure to increase revenue, and an ability to respond quickly to changing market conditions. Our applications enable organizations to reshape the way they engage with customers and increase customer lifetime value throughout the customer lifecycle by delivering omnichannel, personalized customer experiences. Our applications are designed to solve the most critical business issues, including acquiring more customers at a higher margin, increasing cross-sell/upsell, improving customer service efficiency and effectiveness, and streamlining sales and quoting.

•Government – Government agencies need to modernize legacy systems and processes to meet the growing demands for improved constituent service, lower costs, reduced fraud, and greater transparency. Our applications deliver advanced capabilities to help streamline operations and optimize service delivery through an agile, low risk approach.

•Insurance – Insurance companies, whether competing globally or nationally, need software to automate policyholder acquisition, cross sell/upsell, underwriting, claims, policy service, and retention activities across operations and channels of distribution. Insurers are also becoming increasingly sensitive to ways to improve customer service and the overall customer experience. Our applications for insurance carriers are designed to help increase business value by delivering customer-focused experiences and personalized interactions that help drive higher sales, lower expense ratios, and mitigate risk.

•Manufacturing and high tech – Manufacturers and high tech companies worldwide are transforming their businesses to engage customers and suppliers better, as well as to directly manage product performance throughout the product lifecycle. Our manufacturing applications address customer service and field service, manage warranties, recalls, repairs, returns, improve the performance of direct sales forces, and extend existing enterprise resource planning system capabilities.

•Consumer services – Consumer services organizations provide services to a range of consumers in industries such as transportation, utilities, internet providers, retail, hospitality, and entertainment. Our 1:1 customer engagement, customer service, and intelligent automation solutions help these organizations personalize their customer engagement to acquire more customers, drive revenue through cross-sell/upsell, and increase service efficiency while increasing customer satisfaction.

Competition

The markets for our offerings are intensely competitive, rapidly changing, and highly fragmented, as current competitors expand their product offerings and new companies enter the market.

We compete in the CRM, including marketing, sales, and customer service, and DPA, including BPM, case management, decision management, robotic automation, co-browsing, social engagement, and mobile application development platform software markets, as well as in markets for the vertical applications we provide (e.g., Pega KYC™ for Financial Services, Pega Underwriting™ for Insurance).

We also compete with clients’ internal information systems departments that seek to modify their existing systems or develop their own proprietary systems, and professional service organizations that develop their own products or create custom software in conjunction with rendering consulting services.

Competitors vary in size, scope, and breadth of the products and services they offer and include some of the world’s largest companies, including Salesforce.com, Microsoft Corporation, Oracle Corporation, SAP SE, ServiceNow, and International Business Machines Corporation (“IBM”).

We have been most successful in competing for clients whose businesses are characterized by a high degree of change, complexity, or regulation.

We believe we are competitively differentiated from our competitors because our unified Pega Platform is designed to allow client business and IT staff, using a single, intuitive user interface, to build and evolve enterprise applications in a fraction of the time it would take with disjointed architectures and tools offered by many of our competitors. In addition, our applications, built on the Pega Platform, provide the same level of flexibility and ability to adapt to our clients’ needs as our Pega Platform. We believe we compete favorably due to our expertise in our target industries and our long-standing client relationships. We believe we compete less favorably on some of the above factors against our larger competitors, many of which have greater sales, marketing, and financial resources, more extensive geographical presence, and greater name recognition than we do. In addition, we may be at a competitive disadvantage against our larger competitors with respect to our ability to provide expertise outside our target industries.

See risk factor "The market for our offerings is intensely and increasingly competitive, rapidly changing, and fragmented" in Item 1A of this Annual Report for additional information.

Intellectual Property

We rely primarily on a combination of copyright, patent, trademark, and trade secrets laws, as well as confidentiality and intellectual property agreements to protect our proprietary rights. We have obtained patents relating to our system architecture and products in strategic global markets. We enter into confidentiality, intellectual property ownership, and license agreements with our employees, partners, clients, and other third parties. We also control access to and ownership of software, services, documentation, and other information to protect our proprietary rights.

8

Sales and Marketing

We encourage our direct sales force and outside partners to co-market, pursue joint sales initiatives, and drive broader adoption of our technology, helping us grow our business more efficiently and focus our resources on continued innovation and enhancement of our solutions. In addition, strategic partnerships with management consulting firms and major systems integrators are important to our sales efforts because they influence buying decisions, help us identify sales opportunities and complement our software and services with their domain expertise and consulting capabilities. We also partner with technology providers and application developers.

To support our sales efforts, we conduct a broad range of marketing programs, including awareness advertising, client and industry-targeted solution campaigns, trade shows, including our PegaWorld® iNspire user conference, solution seminars and webinars, industry analyst and press relations, web and digital marketing, community development, social media presence, and other direct and indirect marketing efforts. Our consulting employees, business partners, and other third parties also conduct joint and separate marketing campaigns that generate sales leads for us.

Research and Development

Our research and development organization is responsible for product architecture, core technology development, product testing, and quality assurance. Our product development priority is to continue expanding our technology’s capabilities and ensure we deliver superior cloud-native solutions. We intend to maintain and extend the support of our existing applications, and we may choose to invest in additional strategic applications that incorporate the latest business innovations. We also intend to maintain and extend the support of popular hardware platforms, operating systems, databases, and connectivity options to facilitate easy and rapid deployment in diverse IT infrastructures. Our goal with all products is to enhance product capabilities, ease of implementation, long-term flexibility, and the ability to provide improved client service.

Backlog

As of December 31, 2020, we expected to recognize approximately $1.1 billion in revenue in future periods from backlog on existing contracts. See "Remaining performance obligations ("Backlog")" in Item 7 of this Annual Report for additional information.

Our People

As of January 31, 2021, we had 5,776 employees, of which 2,476 were based in the Americas, 1,306 were based in Europe, 1,668 were based in India, and 326 were based elsewhere in Asia-Pacific.

As a high technology company, our employees are critical to our success. We strive to be an employer of choice that can attract and retain exceptional talent. We aim to create a corporate culture that is equitable, inclusive, and diverse. We believe that encouraging employee development will help achieve our goal of developing, expanding, and retaining our workforce to support our business.

We build our corporate culture through a variety of initiatives, including global inclusion and diversity, employee engagement, pay equity, and employee development.

Global Inclusion and Diversity

An inclusive and diverse culture contributes to our ability to deliver innovative products and services, which is critical to our success. Our commitment to inclusion and diversity begins with a highly skilled and diverse board and includes our commitment to educate both managers and individual contributors about our corporate values. In 2020, we made significant investments in furthering our culture of inclusion, including hiring a Global Leader of Inclusion and Diversity and Diversity Talent Attraction Partner. We expanded our diversity recruiting efforts and delivered inclusivity workshops to leaders at all levels, among other efforts. We also currently sponsor formal resource groups for women, veterans, and members of the black and LGBTQIA+ communities, and plan to launch four additional resource groups in the first half of 2021.

Employee Engagement, Health, and Well-Being

Our efforts to recruit and retain diverse and passionate employees include providing competitive rewards packages and ensuring active communication throughout the Company. We regularly solicit and collect feedback to better understand and improve our employee experience and identify opportunities to strengthen our corporate culture. In 2020, in addition to our annual employee survey and continuous feedback tools, we hosted monthly check-in chats with our leadership team to directly address our employees’ questions and constructive feedback. We are committed to creating an environment that supports our employees’ health and overall well-being, focusing on physical, emotional, financial, and personal wellness. PegaUp!, our employee wellness program, includes such programs as awareness campaigns, fitness classes, guided meditation, and health, wellness, and financial seminars.

Pay Equity

We compensate our employees for what they do and how they do it, regardless of their gender, race, or other personal characteristics. To deliver on that commitment, we benchmark and set pay ranges based on market data and consider individual factors, such as an employee’s role and experience, job location, and job performance. We also regularly review our compensation practices, both in terms of our overall workforce and individual employees, to ensure our pay is fair and equitable.

9

Employee Development

Employee development underpins our efforts to execute our strategy and continue to create and sell innovative products and services. We continually invest in our employees’ career growth and provide employees with a wide range of development opportunities, including formal and informal learning, mentoring, and coaching. Pega Academy helps employees as well as clients and partners more rapidly gain and advance Pega software skills. To ensure our business’s long-term continuity, we actively manage the development of talent to fill the roles most critical to our success. To support our current and future leaders’ development, Pega currently offers five programs addressing the development of people managers and leaders in a cohort format comprised of all functions and geographies. We also provide educational resources and classes, career training, and education reimbursement programs. In 2020, more than 90% of our employees participated in a formal education program.

Corporate Information

Pegasystems Inc. was incorporated in Massachusetts in 1983. Our stock is traded on the NASDAQ Global Select Market under the symbol “PEGA.” Our website is located at www.pega.com, and our investor relations website is located at www.pega.com/about/investors.

Available Information

We make available our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports, free of charge through our website as soon as reasonably practicable after we electronically file such material with or furnish such material to the SEC. We also make available on our website reports filed by our executive officers and directors on Forms 3, 4, and 5 regarding their ownership of our securities. Our Code of Conduct is available on our website in the “Governance” section.

The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

ITEM 1A. RISK FACTORS

The risks and uncertainties described below are not the only ones we face. Events that we do not currently anticipate or that we currently expect to be immaterial may also affect our results of operations, cash flows, and financial condition.

Risks Related to Our Business and Industry

If we fail to manage our transition to a more subscription-based business model successfully, our results of operations and/or cash flows could be negatively impacted.

We are transitioning to a more subscription-based business model, which may have negative revenue and/or cash flow implications. The subscription model prices and delivers our software differently than a perpetual license model. These changes reflect a significant shift from perpetual license sales in favor of providing our clients the right to access our software in a hosted environment or use downloaded software for a specified subscription period. The potential shift of our clients’ preference to a cloud-based subscription model requires a considerable investment of technical, financial, legal, managerial and sales resources, and a scalable organization.

Market acceptance of our subscription-based offering will depend on our ability to continue to:

•innovate and include new functionality and improve the usability of our products in a manner that addresses our clients’ needs and requirements; and

•optimally price our products in light of marketplace conditions, competition, our costs, and client demand.

Our cloud-based subscription model also requires that we rely on third parties to host our products for our clients. We incur significant recurring third-party hosting expenses to deliver our Pega Cloud offering that we do not incur for our perpetual and term license products. These expenses may cause the gross margin we realize from our Pega Cloud sales to be lower than the gross margin we realize from our perpetual and term license products. If we are unable to meet these challenges effectively, our operating results and financial condition could be materially adversely affected.

The transition to a subscription-based business model gives rise to several risks, including the following:

•our revenues and cash flows may fluctuate more than anticipated in the near term;

•if the increased demand for our offerings does not continue, we could experience decreased profitability or losses and reduced or negative cash flow because of our continued significant investments in our Pega Cloud offering;

•if new or current clients desire only perpetual licenses, our subscription sales may lag behind our expectations;

•we may be unsuccessful in maintaining or implementing our target pricing or new pricing models, product adoption and projected renewal rates, or we may select a target price or new pricing model that is not optimal and could negatively affect our sales or earnings;

•if our clients do not renew their subscriptions, our revenue may decline, and our business may be materially adversely affected; and

•we may incur sales compensation costs at a higher than forecasted rate if the pace of our subscription transition is faster than anticipated.

The metrics our investors and we use to monitor our business model transition may evolve over the course of the transition as significant trends emerge. Therefore, it may be difficult to accurately determine the impact of this transition on our business on a contemporaneous basis or to clearly communicate the appropriate metrics to our investors.

10

We may not achieve the key elements of our strategy and grow our business as anticipated.

We currently intend to grow our business by pursuing strategic initiatives. Key elements of our strategy include growing our market share by developing and delivering robust applications that can work together seamlessly with maximum differentiation and minimal customization, offering versatility in our Pega Platform and application deployment and licensing options to meet the specific needs of our clients, growing our network of partner alliances, and developing the talent and organizational structure capable of supporting our revenue and earnings growth targets. We may not be able to achieve one or more of our key initiatives. Our success depends on our ability to manage our expenses as we grow our organization appropriately, successfully execute our marketing and sales strategies, successfully incorporate acquired technologies into our unified Pega Platform and develop new products or product enhancements. If we are not able to execute these actions, our business may not grow as we anticipate, and our operating results and financial condition could be materially adversely affected.

We depend on key personnel, including our Chief Executive Officer, and must be able to attract and retain qualified personnel in the future.

Our business is dependent on key, highly skilled technical, managerial, consulting, sales, and marketing personnel, including our Chief Executive Officer, who is also our founder and largest stockholder.

On February 12, 2021, we entered into an agreement with our landlord to vacate our Cambridge, Massachusetts facility on October 1, 2021 and expect to enter into a new lease agreement for a facility within the greater Boston area. Although we believe this relocation will help us attract and retain key personnel and provide a dynamic space to engage with our employees, competition for talent, delays in and costs associated with development and occupancy of the new facility and changes in commuting for our existing employees could impact our ability to realize the intended benefits of the move.

The loss of key personnel could be disruptive to our operations, and materially adversely affect financial performance. We do not have any significant key-person life insurance on any officers or employees and do not plan to obtain any. Our success will largely depend on the ability to attract and retain qualified personnel and rapidly replace and develop new management. The number of potential employees who have the extensive knowledge needed to develop, sell, and maintain our offerings is limited, and competition for their services is intense. There can be no assurance that we will be able to attract and retain such personnel. If we are unable to do so, our business, operating results, and financial condition could be materially adversely affected.

The timing of our license and Pega Cloud revenue is difficult to predict accurately, which may cause our operating results to vary considerably.

A change in the size or volume of license and Pega Cloud arrangements, or a change in the mix between perpetual licenses, term licenses, and Pega Cloud arrangements can cause our revenues and cash flows to fluctuate materially between periods. Revenue from Pega Cloud arrangements is typically recognized over the contract term. In contrast, revenue from license sales is generally recognized upfront when the license rights become effective. Pega Cloud and term license arrangements are generally billed and collected over the contract term while perpetual license arrangements are generally billed in full and collected upfront when the license rights become effective.

Factors that may influence the predictability of our license and Pega Cloud revenue include:

•changes in clients’ budgets and decision-making processes that could affect both the timing and size of transactions;

•deferral of license revenue to future periods due to the timing of the execution of an agreement or our ability to deliver the products or services;

•changes in our business model; and

•our ability to execute our marketing and sales strategies.

We budget for our selling and marketing, product development, and other expenses based upon anticipated future bookings and revenue. If the timing or amount of revenue fails to meet our expectations in a given period, our financial performance is likely to be materially adversely affected because only a small portion of our expenses vary with revenue. Other factors that may cause our operating results to vary considerably include changes in foreign currency exchange rates, income tax effects, and the impact of new accounting pronouncements.

As a result, period-to-period comparisons of our operating results are not necessarily meaningful and should not be relied upon to predict future performance. If our revenues and operating results do not meet the expectations of our investors or securities analysts or fall below guidance we may provide to the market, or due to other factors discussed elsewhere in this section, the price of our common stock may decline.

11

The number of license and Pega Cloud arrangements has been increasing, and we may not be able to sustain this growth unless our partners and we can provide sufficient high-quality consulting, training, and maintenance resources to enable our clients to realize significant business value from our software.

Our clients typically request consulting and training to assist them in implementing our license and Pega Cloud offerings. Our clients also typically purchase maintenance on our perpetual and term licenses. As a result, an increase in the number of license and Pega Cloud arrangements is likely to increase demand for consulting, training, and maintenance related to our offerings. Given that the number of our license and Pega Cloud arrangements has been growing, we will need to provide our clients with more consulting, training, and maintenance to enable them to realize significant business value from our software. We have been increasing our partner and client enablement through training to create an expanded ecosystem of people that are skilled in the implementation of our products. However, if our partners and we are unable to provide sufficient high-quality consulting, training, and maintenance resources, our clients may not realize sufficient business value from our offerings to justify follow-on sales, which could impact our future financial performance. Further, some of our client engagements have high public visibility. If our partners or we encounter problems in helping these clients implement our license and Pega Cloud offerings or if there is negative publicity regarding these engagements (even if unrelated to our services or offerings) our reputation could be harmed and our future financial performance could be negatively impacted. Finally, the investments required to meet the increased demand for our consulting services could strain our ability to deliver our consulting engagements at desired profitability, thereby impacting our overall profitability and financial results.

We may not be able to maintain our retention rate for Pega Cloud clients.

An increasing percentage of our revenue has been derived from our Pega Cloud offerings. Our clients have no obligation to renew their Pega Cloud subscriptions, although historically, most have elected to do so. If our retention rate for those clients decreases our business, operating results, and financial condition could be materially adversely affected.

We are investing heavily in sales and marketing, research and development, and support resources in anticipation of continued growth in license and Pega Cloud arrangements, and we may experience decreased profitability or losses and reduced or negative cash flow if we do not continue to increase the value of our license and Pega Cloud arrangements to balance our growth in expenses.

We have been expanding our sales and marketing capacity to meet the increasing demand for our software and to broaden our market coverage by hiring additional sales and marketing personnel. We anticipate that we will need to provide our clients with more maintenance support because of this increase in demand and have been hiring additional personnel in this area. We continue to invest significantly in research and development to expand and improve the Pega Platform and applications. These investments have resulted in increased fixed costs that do not vary with the level of revenue. If the increased demand for our offerings does not continue, we could experience decreased profitability or losses and reduced or negative cash flow because of these increased fixed costs. Conversely, if we are unable to hire sales and marketing personnel to meet future demand or research and development personnel to enhance our current products or develop new products, we may not be able to achieve our sales and profitability targets.

We face risks from operations and clients based outside of the U.S.

We market our products and services to clients based outside of the U.S., which represent 43% of our revenue over the last three years. We have established offices in the Americas, Europe, Asia, and Australia. We believe that growth will necessitate expanded international operations, resulting in increased managerial attention and costs. We anticipate hiring additional personnel to accommodate increased international market demand, and we may also enter into agreements with local distributors, representatives, or resellers. If we are unable to do one or more of these things in a timely and effective manner, the growth, if any, of our international operations may be restricted, and our business, operating results, and financial condition could be materially adversely affected.

Additional risks inherent in our international business activities generally include:

•laws and business practices favoring local competitors;

•compliance with multiple, conflicting, and changing governmental laws and regulations, including employment, tax, privacy and data privacy and protection, and increased tariffs and other trade barriers;

•the costs of localizing offerings for local markets, including translation into foreign languages and associated expenses;

•longer payment cycles and credit and collectability risk on our foreign trade receivables;

•difficulties in enforcing contractual and intellectual property rights;

•heightened fraud and bribery risks;

•treatment of revenue from international sources and changes to tax codes, including being subject to foreign tax laws, being liable for paying withholding, income or other taxes in foreign jurisdictions, and other potentially adverse tax consequences (including restrictions on repatriating earnings and the threat of “double taxation”);

•management of our international operations, including increased accounting, internal control, and compliance expenses;

•heightened risks of political and economic instability; and

•foreign currency exchange rate fluctuations and controls.

There can be no assurance that one or more of these factors will not have a material adverse effect on our international operations and, consequently, on our business, operating results, and financial condition.

12

We rely on third-party relationships.

We have a number of relationships with third parties that are significant to our sales, marketing, support, and product development efforts, including hosting facilities for our Pega Cloud offering. We rely on software and hardware vendors, large system integrators, and technology consulting firms to supply marketing and sales opportunities for our direct sales force and to strengthen our products using industry-standard tools and utilities. We also have relationships with third parties that distribute our products. There can be no assurance that these companies, many of which have far greater financial and marketing resources than us, will not develop or market offerings that compete with ours in the future or will not otherwise end or limit their relationships with us. Further, the use of third-party hosting facilities requires us to rely on the functionality and availability of the third parties’ services, as well as their data security, which despite our due diligence, may be or become inadequate.

We are exposed to fluctuations in currency exchange rates that could negatively impact our financial results and cash flows.

Because a significant portion of our business is conducted outside of the U.S., we face exposure to movements in foreign currency exchange rates. Our international sales are usually denominated in foreign currencies. The operating expenses of our foreign operations are also primarily denominated in foreign currencies, which partially offset our foreign currency exposure on our international sales. Our results of operations and cash flows are subject to fluctuations due to changes in foreign currency exchange rates, particularly changes in the U.S. dollar, the Euro, and the Australian dollar relative to the British Pound. These exposures may change over time as business practices evolve.

We have historically used but do not currently use foreign currency forward contracts to hedge our exposure to changes in foreign currency exchange rates associated with our foreign currency-denominated cash, accounts receivable, and intercompany receivables and payables held by our U.S. parent company and its U.K. subsidiary. We may enter into hedging contracts again in the future if we believe it is appropriate.

Our realized gain or loss for foreign currency fluctuations will generally depend on the size and type of cross-currency exposures that we enter into, the currency exchange rates associated with these exposures and changes in those rates, whether we have entered into forward contracts to offset these exposures and other factors. All of these factors could materially impact our operating results, financial condition, and cash flows.

Our consulting revenue is significantly dependent upon our consulting personnel implementing new license and Pega Cloud arrangements.

We derive a substantial portion of our consulting revenue from implementations of new license and Pega Cloud arrangements managed by our consulting personnel and consulting for partner and client-led implementation efforts. Our strategy is to support and encourage partner-led and client-led implementations to increase the breadth, capability, and depth of market capacity to deliver implementation services to our clients. Accordingly, if our consulting personnel’s involvement in future implementations decreases, this could materially adversely affect our consulting revenue.

We frequently enter into a series of license or Pega Cloud arrangements that are each focused on a specific purpose or area of operations. If we are not successful in obtaining follow-on business from these clients, our financial performance could be materially adversely affected.

Once a client has realized the value of our software, we work with the client to identify opportunities for follow-on sales. However, we may not be successful in demonstrating this value for several reasons, including the performance of our products, the quality of the services and support provided by our partners and us, or external factors. Also, some of our smaller clients may have limited additional sales opportunities available. We may not obtain follow-on sales, or the follow-on sales may be delayed, and our future revenue could be limited. This could lower the total value of all transactions, and materially adversely affect our financial performance.

We will need to acquire or develop new products, evolve existing ones, address any defects or errors, and adapt to technology changes.

Technical developments, client requirements, programming languages, industry standards, and regulatory requirements frequently change in the markets in which we operate. The introduction of third-party solutions embodying new technologies and the emergence of new industry standards could make our existing and future software solutions obsolete and unmarketable. As a result, our success will depend upon our ability to enhance current products, address any product defects or errors, acquire or develop and introduce new products that meet client needs, keep pace with technology and regulatory changes, respond to competitive products, and achieve market acceptance. Product development requires substantial investments for research, refinement, and testing. We may not have sufficient resources to make the necessary product development investments. We may experience technical or other difficulties that will delay or prevent the successful development, introduction, or implementation of new or enhanced products. We may also experience technical or other challenges in the integration of acquired technologies into our existing platform and applications. Inability to introduce or implement new or enhanced products in a timely manner could result in loss of market share if competitors are able to provide solutions to meet client needs before we do, give rise to unanticipated expenses related to further development or modification of acquired technologies, and materially adversely affect our financial performance. We may also fail to adequately anticipate and prepare for the development of new markets and applications for our technology and the commercialization of emerging technologies such as blockchain and thereby fail to take advantage of new market opportunities or fall behind early movers in those markets.

13

The market for our offerings is intensely and increasingly competitive, rapidly changing, and fragmented.

We encounter significant competition from:

•customer engagement vendors, including CRM application vendors;

•DPA vendors and platforms, including BPM vendors, low code application development platforms, and service-oriented architecture middleware vendors;

•case management vendors;

•decision management, data science, and AI vendors, as well as vendors of solutions that leverage decision making and data science in managing customer relationships and marketing;

•robotic automation and workforce intelligence software providers;

•companies that provide application-specific software for financial services, healthcare, insurance, and other specific markets;

•mobile application platform vendors;

•co-browsing software providers;

•social listening, text analytics, and natural language processing vendors;

•commercialized open-source vendors;

•professional service organizations that develop their own products or create custom software in conjunction with rendering consulting services; and

•clients’ in-house information technology departments, which may seek to modify their existing systems or develop their own proprietary systems.

Many of our competitors, such as Salesforce.com, Microsoft Corporation, Oracle Corporation, SAP SE, ServiceNow, and International Business Machines Corporation (“IBM”), have far greater resources than we do and may be able to respond more quickly and efficiently to new or emerging technologies, programming languages or standards, or changes in client requirements or preferences. Competitors may also be able to devote greater managerial and financial resources to develop, promote, and distribute products and to provide related consulting and training services.

We believe the principal competitive factors within our market include:

•product adaptability, scalability, functionality, and performance;

•proven success in delivering cost-savings and efficiency improvements;

•proven success in enabling improved customer interactions;

•ease-of-use for developers, business units, and end-users;

•timely development and introduction of new products and product enhancements;

•establishment of a significant base of reference clients;

•ability to integrate with other products and technologies;

•customer service and support;

•product price;

•vendor reputation; and

•relationships with systems integrators.

Competition for market share and pressure to reduce prices and make sales concessions is likely to increase. There can be no assurance that we will be able to compete successfully against current or future competitors or that the competitive pressures faced by us will not materially adversely affect our business, operating results, and financial condition.

See "Competition" in Item 1 of this Annual Report for additional information.

Our Chief Executive Officer is our largest stockholder and can exert significant influence over matters submitted to our stockholders, which could materially adversely affect our other stockholders.

As of December 31, 2020, our Chief Executive Officer beneficially owned 49% of our outstanding common stock. As a result, he has the ability to exert significant influence over all matters submitted to our stockholders for approval, including the election and removal of directors and any merger, consolidation, or sale of our assets. This concentration of ownership may delay or prevent a change in control, impede a merger, consolidation, takeover, or other business combination involving us, discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, or result in actions that may be opposed by other stockholders.

14

Risks Related to Information Technology Resilience and Security

We face risks related to outages, data losses, and disruptions of our online services if we fail to maintain an adequate operations infrastructure.

The increasing user traffic for our Pega Cloud offering demands more computing power. It requires that we maintain an internet connectivity infrastructure that is robust and reliable within competitive and regulatory constraints that continue to evolve. Inefficiencies or operational failures, including temporary or permanent loss of client data, power outages, or telecommunications infrastructure outages, by our third-party service providers or us, could diminish the quality of our user experience resulting in contractual liability, claims by clients and other third parties, damage to our reputation, loss of current and potential clients, and negatively impact our operating results and financial condition.

Security of our systems and global client data is a growing challenge on many fronts. Cyber-attacks and security breaches may expose us to significant legal and financial liabilities.

Security breaches could expose our clients and us to a risk of loss or misuse of this information. Any security breach could result in a loss of confidence in the security of our services, damage our reputation, disrupt our business, lead to legal liability, and negatively impact our future sales. High-profile security breaches at other companies have increased in recent years. Security industry experts and government officials have warned about the risks of hackers and cyber-attackers targeting information technology products and businesses. Threats to IT security can take a variety of forms. Individual hackers, groups of hackers, and sophisticated organizations, including state-sponsored organizations, or nation-states themselves, may take steps that threaten our clients and IT structure. Additionally, our Pega Cloud offering provides environments that are provisioned, monitored, and maintained for individual clients to create and deploy Pega-based applications using an Internet-based infrastructure. These services involve the storage and transmission of clients’ data and other confidential information.

Our security measures and those of our clients may be breached because of third-party actions or that of employees, consultants, or others, including intentional misconduct by computer hackers, system error, human error, technical flaws in our products, or otherwise. Because we do not control the configuration of Pega applications by our clients, the transmissions between our clients and our third-party technology providers, the processing of data on the servers at third-party technology providers, or the internal controls maintained by our clients and third-party technology providers that could prevent unauthorized access or provide appropriate data encryption, we cannot fully ensure the complete integrity or security of such transmissions processing or controls. In addition, privacy, security, and data transmission concerns in some parts of the world may inhibit demand for our Pega Cloud offering or lead to requirements to provide our products or services in configurations that may increase the cost of serving such markets. The techniques used to obtain unauthorized access or sabotage systems change frequently and are generally not recognized until launched against a target. While we have invested in protecting our data and systems and our clients’ data to reduce these risks, there can be no assurance that our efforts will prevent breaches. We carry data breach insurance coverage to mitigate the financial impact of a breach, though this may prove insufficient in the event of a breach.

Our Pega Cloud offering involves the hosting of clients’ applications on the servers of third-party technology providers. We also rely on third-party systems and technology, including encryption, virtualized infrastructure, and support, and we employ a shared security model with our clients and our third-party technology providers.

To defend against security threats, we need to continuously engineer products and services with enhanced security and reliability features, improve the deployment of software updates to address security vulnerabilities, apply technologies that mitigate the risk of attacks, and maintain a digital security infrastructure that protects the integrity of our network, products, and services. The cost of these steps could negatively impact our operating results.

We may experience significant errors or security flaws in our products and services and could face privacy, product liability, and warranty claims as a result.

Despite quality testing each release, our software frequently contains errors or security flaws, especially when first introduced or when new versions are released. Errors in our software could affect its ability to work with hardware or other software or delay the development or release of new products or new versions of our software. Additionally, the detection and correction of any security flaws can be time-consuming and costly. Errors or security flaws in our software could result in the inadvertent disclosure of confidential information or personal data relating to our clients, employees, or third parties. Software errors and security flaws in our products or services could expose us to privacy, product liability, and/or warranty claims as well as harm our reputation, which could impact our future sales of products and services. Typically, we enter into license agreements that contain provisions intended to limit the nature and extent of our risk of product liability and warranty claims. There is a risk that a court might interpret these terms in a limited way or could hold part or all of these terms to be unenforceable. Also, there is a risk that these contract terms might not bind a party other than the direct client. Furthermore, some of our licenses with our clients are governed by non-U.S. law, and there is a risk that foreign law might give us less or different protection. Although we have not experienced any material product liability claims to date, a product liability suit or action claiming a breach of warranty, whether meritorious, could result in substantial costs and a diversion of management’s attention and our resources.

15

Risks Related to Our Financial Obligations and Indebtedness

We have a significant amount of debt that may decrease our business flexibility, access to capital, and/or increase our borrowing costs, and we may still incur additional debt in the future, which may adversely affect our operations and financial results.

As of December 31, 2020, we had $600 million aggregate principal amount of indebtedness under our Convertible Senior Notes due 2025 (the “Notes”).

Our indebtedness may:

•limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions, or other business purposes;

•limit our ability to use our cash flow or obtain additional financing for future working capital, capital expenditures, acquisitions, or other general business purposes;

•require us to use a substantial portion of our cash flow from operations to make debt service payments;

•limit our flexibility to plan for, or react to, changes in our business and industry;

•place us at a competitive disadvantage compared to our less leveraged competitors;

•dilute the interests of our existing stockholders as a result of issuing shares of our common stock upon the conversion of the Notes; and

•increase our vulnerability to the impact of adverse economic and industry conditions.

Our ability to pay our debt when due or refinance our indebtedness, including the Notes, depends on our future performance, which is subject to economic, financial, competitive, and other factors beyond our control. Our business may not generate cash flow from operations in the future sufficient to service our debt and make necessary investments in our business. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations which could, in turn, result in that and our other indebtedness becoming immediately payable in full which could harm our financial condition, results of operation or cost of borrowing. In addition, we may incur additional debt to meet future financing needs. If we incur additional indebtedness, the risks related to our business and our ability to service or repay our indebtedness will increase.

The conditional conversion feature of the Notes, if triggered, may adversely affect our financial condition and operating results.

Under certain circumstances, the noteholders may convert their Notes at their option prior to the scheduled maturities. Upon conversion of the Notes, unless we elect to deliver solely shares of our common stock to settle such conversion, we will be obligated to make cash payments. In addition, holders of our Notes will have the right to require us to repurchase their Notes upon the occurrence of a fundamental change (as defined in the indenture, dated as of February 24, 2020, between U.S. Bank National Association, as trustee (the “Trustee”) and us (the “Indenture”)), at a repurchase price equal to 100% of the principal amount of the Notes to be repurchased, plus accrued and unpaid interest, if any, to, but not including, the fundamental change repurchase date. Although it is our intention and we currently expect to settle the conversion value of the Notes in cash up to the principal amount and any excess in shares, there is a risk that we may not have enough available cash or be able to obtain financing at the time we are required to make repurchases of Notes surrendered therefor or Notes being converted. In addition, our ability to make payments may be limited by law, by regulatory authority, or by agreements governing our future indebtedness. Our failure to repurchase Notes when the Indenture requires the repurchase or to pay any cash payable on the Notes’ future conversions as required by the Indenture would constitute a default under the Indenture. A default under the Indenture or the fundamental change itself could also lead to a default under agreements governing our future indebtedness. If the repayment of the related indebtedness were to be accelerated after any applicable notice or grace periods, we may not have sufficient funds to repay the indebtedness and repurchase the Notes or make cash payments upon conversions thereof. In addition, even if holders of Notes do not elect to convert their Notes, we could be required under applicable accounting rules to reclassify all or a portion of the outstanding principal of the Notes as a current rather than long-term liability, which would result in a material reduction of our net working capital.

The Capped Call Transactions may affect the value of the Notes and our common stock.

In connection with the Notes’ issuance, we entered into Capped Call Transactions with certain financial institutions (“option counterparties”). The Capped Call Transactions are generally expected to reduce the potential dilution to our common stock upon any conversion of the Notes and/or offset any cash payments we are required to make in excess of the principal amount of converted Notes, as the case may be, with such reduction and/or offset subject to a cap. From time to time, the option counterparties that are parties to the Capped Call Transactions or their respective affiliates may modify their hedge positions by entering into or unwinding various derivative transactions with respect to our common stock and/or purchasing or selling our common stock or other securities of ours in secondary market transactions before the maturity of the Notes. This activity could cause a decrease in the market price of our common stock.

16

We are exposed to counterparty risk for the Capped Call Transactions.

The option counterparties are financial institutions, and we are subject to the risk that one or more of the option counterparties may default or otherwise fail to perform, or may exercise certain rights to terminate, their obligations under the Capped Call Transactions. Our exposure to the credit risk of the option counterparties is not secured by any collateral. Recent global economic conditions have resulted in the actual or perceived failure or financial difficulties of many financial institutions. If an option counterparty becomes subject to insolvency proceedings, we will become an unsecured creditor in those proceedings with a claim equal to our exposure at the time under such transaction. Our exposure depends on many factors, but our exposure will generally increase if the market price or the volatility of our common stock increases. In addition, upon default or other failures to perform, or termination of obligations, by an option counterparty, we may suffer more dilution than we currently anticipate with respect to our common stock. We can provide no assurances as to the financial stability or viability of the option counterparties.

Provisions in the Notes’ Indenture may deter or prevent a business combination that may be favorable to our stockholders.

If a fundamental change occurs prior to the Notes’ maturity date, holders of the Notes will have the right, at their option, to require us to repurchase all or a portion of their Notes. In addition, if a “make-whole fundamental change” (as defined in the Indenture) occurs prior to the maturity date, we will in some cases be required to increase the conversion rate of the Notes for a holder that elects to convert its Notes in connection with such make-whole fundamental change.

Furthermore, the Indenture will prohibit us from engaging in certain mergers or acquisitions unless, among other things, the surviving entity assumes our obligations under the Notes. These and other provisions in the Indenture could deter or prevent a third party from acquiring us even when the acquisition may be favorable to our stockholders.

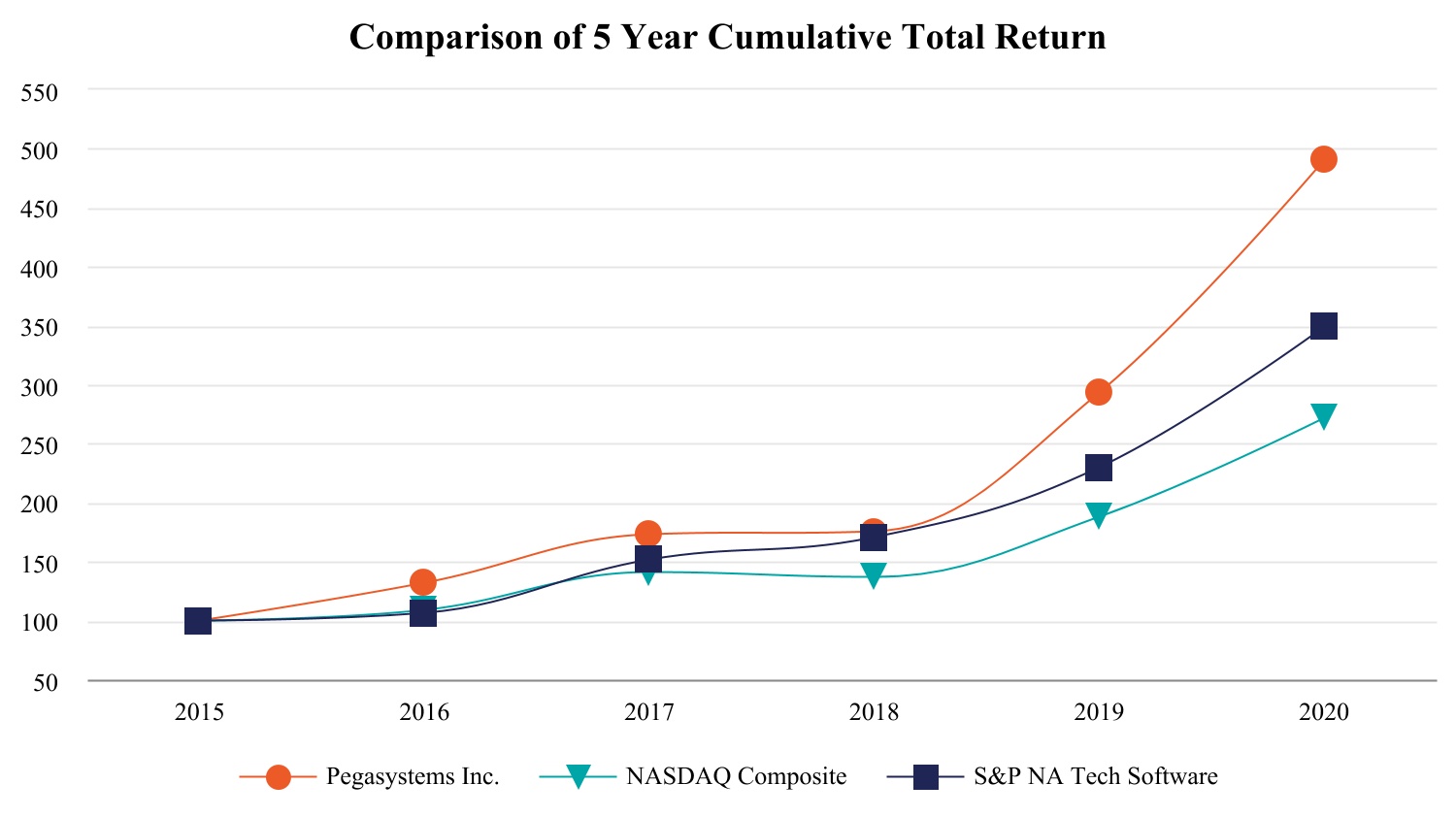

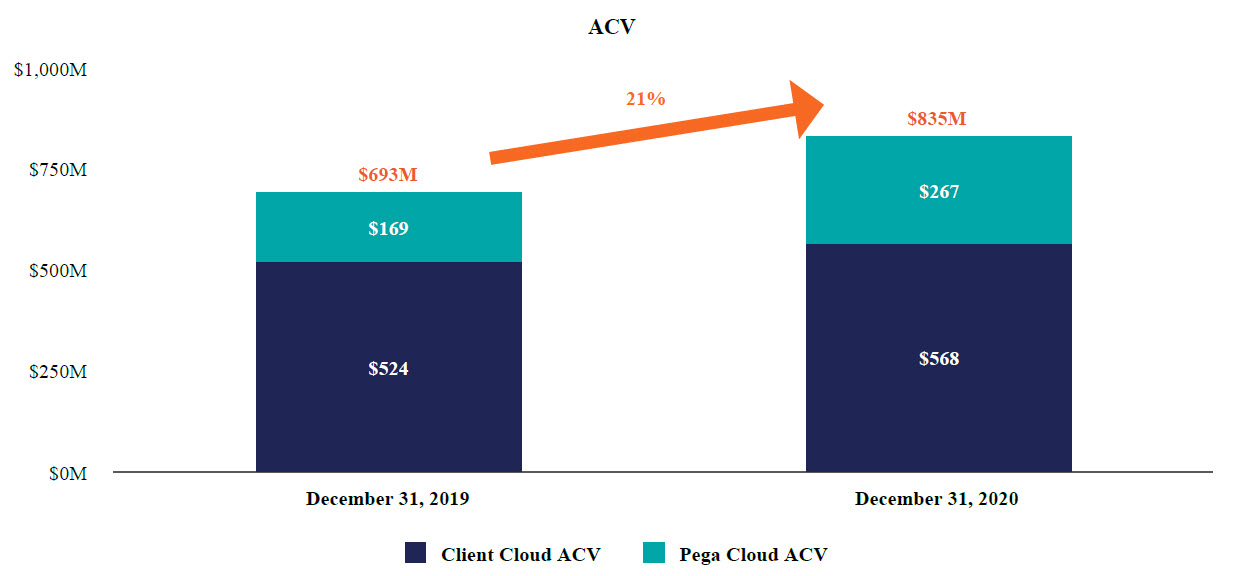

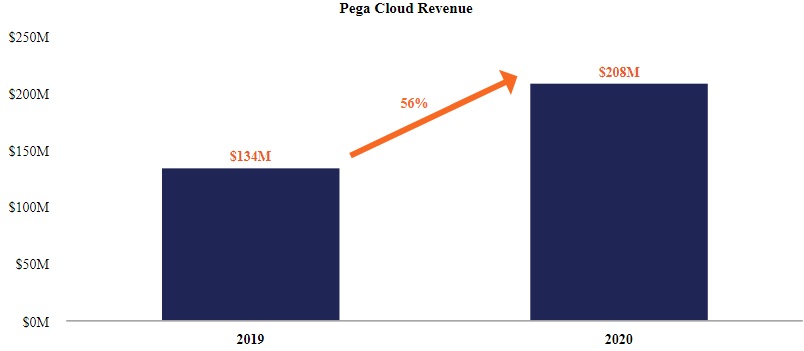

Conversion of the Notes may dilute the ownership interest of existing stockholders.