| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-260277-02 | ||

| FIVE 2023-V1 |

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-260277) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by emailing: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us. This free writing prospectus does not contain all information that is required to be included in the prospectus. |

| STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION |

| This material is for your information, and none of Deutsche Bank Securities Inc., Citigroup Global Markets Inc., Barclays Capital Inc., BMO Capital Markets Corp., Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC or any other underwriter, (collectively, the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. |

| Neither this document nor anything contained herein shall form the basis for any contract or commitment whatsoever. The information contained herein is preliminary as of the date hereof. These materials are subject to change, completion or amendment from time to time. The information contained herein will be superseded by similar information delivered to you as part of the preliminary prospectus relating to the FIVE 2023-V1 Mortgage Trust Commercial Mortgage Pass-Through Certificates, Series 2023-V1 (the "Offering Document"). The information contained herein supersedes any such information previously delivered and should be reviewed only in conjunction with the entire Offering Document. All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense. |

| The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Underwriters or any of their respective affiliates makes any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. |

| This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth herein. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of the dates thereof, the depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Individuals should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the issuer’s view only as of the date hereof. |

| IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS |

| Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system. |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | % of Initial Pool Balance | % of Loan Balance | Mortgage Loan Originator | Mortgage Loan Seller | Related Group | Crossed Group |

| 9 | ||||||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 9.8% | 100.0% | GSBI, MSBNA, BMO, DBRI | BMO, GACC, GSMC | NAP | NAP |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | 9.8% | BCREI, BANA, WFBNA, CREFI | Barclays, CREFI | NAP | NAP | |

| 2.01 | Property | 1 | 401-405 Colorado | 2.5% | 25.6% | |||||

| 2.02 | Property | 1 | 1900 Market | 2.5% | 25.2% | |||||

| 2.03 | Property | 1 | The Bulletin Building | 2.0% | 20.2% | |||||

| 2.04 | Property | 1 | Four Points Centre 3 | 0.9% | 9.4% | |||||

| 2.05 | Property | 1 | 500 North Gulph | 0.6% | 6.6% | |||||

| 2.06 | Property | 1 | Metroplex – PA | 0.6% | 6.6% | |||||

| 2.07 | Property | 1 | 933 First Avenue | 0.6% | 6.5% | |||||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | 8.7% | 100.0% | CREFI | CREFI | NAP | NAP |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 8.4% | 100.0% | GACC | GACC | NAP | NAP |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 7.4% | 100.0% | BCREI | Barclays | NAP | NAP |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 6.8% | 100.0% | DBRI | GACC | NAP | NAP |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | 5.9% | 100.0% | BMO | BMO | NAP | NAP |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 4.9% | 100.0% | CREFI, SGFC | CREFI | NAP | NAP |

| 9 | Loan | 11 | 2 | Clifton Industrial | 3.6% | DBRI | GACC | NAP | NAP | |

| 9.01 | Property | 1 | 10 Clifton Boulevard | 1.9% | 51.5% | |||||

| 9.02 | Property | 1 | 200 Clifton Boulevard | 1.8% | 48.5% | |||||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | 3.6% | BMO | BMO | NAP | NAP | |

| 10.01 | Property | 1 | 237 East 34th Street | 2.7% | 73.6% | |||||

| 10.02 | Property | 1 | 114 West 86th Street | 1.0% | 26.4% | |||||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | 3.3% | 100.0% | CREFI | CREFI | NAP | NAP |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | 3.3% | 100.0% | GACC, AREF | GACC | NAP | NAP |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | 3.1% | 100.0% | DBRI | GACC | NAP | NAP |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | 2.6% | DBRI | GACC | NAP | NAP | |

| 14.01 | Property | 1 | Center Point of Hamilton | 1.3% | 49.3% | |||||

| 14.02 | Property | 1 | Center Point on Centennial | 0.6% | 24.2% | |||||

| 14.03 | Property | 1 | Center Point on Manning | 0.4% | 16.3% | |||||

| 14.04 | Property | 1 | Center Point on Russell | 0.2% | 7.1% | |||||

| 14.05 | Property | 1 | Center Point on Field House | 0.1% | 3.0% | |||||

| 14.06 | Property | 1 | Center Point 212 | 0.0% | 0.1% | |||||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | 2.5% | 100.0% | BCREI | Barclays | NAP | NAP |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | 2.2% | 100.0% | DBRI | GACC | NAP | NAP |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | 2.2% | 100.0% | CREFI | CREFI | NAP | NAP |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | 2.1% | 100.0% | GSBI | GSMC | NAP | NAP |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | 2.0% | 100.0% | GSBI, MSBNA | GSMC | NAP | NAP |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | 1.3% | 100.0% | DBRI | GACC | NAP | NAP |

| 21 | Loan | 18 | 1 | Rockwell Chicago | 1.3% | 100.0% | DBRI | GACC | NAP | NAP |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | 1.3% | 100.0% | DBRI | GACC | NAP | NAP |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | 1.3% | DBRI | GACC | NAP | NAP | |

| 23.01 | Property | 1 | 2959 West 47th Street | 0.5% | 35.8% | |||||

| 23.02 | Property | 1 | 4725 South Talman Avenue | 0.4% | 28.5% | |||||

| 23.03 | Property | 1 | 4030 South Archer Avenue | 0.3% | 26.5% | |||||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | 0.1% | 5.3% | |||||

| 23.05 | Property | 1 | 4013 South Archer Avenue | 0.1% | 4.0% | |||||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | 1.2% | 100.0% | CREFI | CREFI | NAP | NAP |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | 0.8% | 100.0% | SMC, BMO, CREFI | BMO | NAP | NAP |

| 26 | Loan | 1 | Cityline Kangaroo Storage | 0.7% | 100.0% | CREFI | CREFI | NAP | NAP |

| A-1-1 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Address | City | County | State | Zip Code |

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 2034 Green Acres Road | Valley Stream | Nassau | New York | 11581 |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | Various | Various | Various | Various | Various |

| 2.01 | Property | 1 | 401-405 Colorado | 401-405 Colorado Street | Austin | Travis | Texas | 78701 | |

| 2.02 | Property | 1 | 1900 Market | 1900 Market Street | Philadelphia | Philadelphia | Pennsylvania | 19103 | |

| 2.03 | Property | 1 | The Bulletin Building | 3025 Market Street | Philadelphia | Philadelphia | Pennsylvania | 19104 | |

| 2.04 | Property | 1 | Four Points Centre 3 | 11120 Four Points Drive | Austin | Travis | Texas | 78726 | |

| 2.05 | Property | 1 | 500 North Gulph | 500 North Gulph Road | King of Prussia | Montgomery | Pennsylvania | 19406 | |

| 2.06 | Property | 1 | Metroplex – PA | 4000 Chemical Road | Plymouth Meeting | Montgomery | Pennsylvania | 19462 | |

| 2.07 | Property | 1 | 933 First Avenue | 933 First Avenue | King of Prussia | Montgomery | Pennsylvania | 19406 | |

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | 333 South Spruce Street | Manteno | Kankakee | Illinois | 60950 |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 1050 1st Street Northeast | Washington | District of Columbia | District of Columbia | 20002 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 6600-6708 Lonetree Boulevard | Rocklin | Placer | California | 95765 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 428-430 North Rodeo Drive | Beverly Hills | Los Angeles | California | 90210 |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | 2000 South Main Street | Belle Glade | Palm Beach | Florida | 33430 |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 575 Broadway | New York | New York | New York | 10012 |

| 9 | Loan | 11 | 2 | Clifton Industrial | Various | Clifton | Passaic | New Jersey | 07011 |

| 9.01 | Property | 1 | 10 Clifton Boulevard | 10 Clifton Boulevard | Clifton | Passaic | New Jersey | 07011 | |

| 9.02 | Property | 1 | 200 Clifton Boulevard | 200 Clifton Boulevard | Clifton | Passaic | New Jersey | 07011 | |

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | Various | New York | New York | New York | Various |

| 10.01 | Property | 1 | 237 East 34th Street | 237 East 34th Street | New York | New York | New York | 10016 | |

| 10.02 | Property | 1 | 114 West 86th Street | 114 West 86th Street | New York | New York | New York | 10024 | |

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | 225 East Coastline Drive | Jacksonville | Duval | Florida | 32202 |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | 3530 Wilshire Boulevard | Los Angeles | Los Angeles | California | 90010 |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | 2855 East Guasti Road | Ontario | San Bernardino | California | 91761 |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | Various | High Point | Guilford | North Carolina | 27260 |

| 14.01 | Property | 1 | Center Point of Hamilton | 309 Russell Avenue, 401-421 and 416 South Hamilton Street | High Point | Guilford | North Carolina | 27260 | |

| 14.02 | Property | 1 | Center Point on Centennial | 400-418 East Russell Avenue, 403-445 South Centennial and 404-432 Tate Drive | High Point | Guilford | North Carolina | 27260 | |

| 14.03 | Property | 1 | Center Point on Manning | 324 East Russell Avenue | High Point | Guilford | North Carolina | 27260 | |

| 14.04 | Property | 1 | Center Point on Russell | 319 South Centennial Street | High Point | Guilford | North Carolina | 27260 | |

| 14.05 | Property | 1 | Center Point on Field House | 411 Manning Street | High Point | Guilford | North Carolina | 27260 | |

| 14.06 | Property | 1 | Center Point 212 | 212 East Russell Avenue | High Point | Guilford | North Carolina | 27260 | |

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | 27422 and 27442 Portola Parkway | Lake Forest | Orange | California | 92610 |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | 2189 and 2203 Cornell Road | Cleveland | Cuyahoga | Ohio | 44106 |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | 1800 East Spring Street | Long Beach | Los Angeles | California | 90755 |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | 5250 and 5253 Prue Road | San Antonio | Bexar | Texas | 78240 |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | 175 Delancey Street | New York | New York | New York | 10002 |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | 1400 Milwaukee Avenue, 215 and 235 Parkway Drive | Lincolnshire | Lake | Illinois | 60069 |

| 21 | Loan | 18 | 1 | Rockwell Chicago | 3001 North Rockwell Street and 2950 North Campbell Avenue | Chicago | Cook | Illinois | 60618 |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | 8244 Orion Avenue | Van Nuys | Los Angeles | California | 91406 |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | Various | Chicago | Cook | Illinois | Various |

| 23.01 | Property | 1 | 2959 West 47th Street | 2959 West 47th Street | Chicago | Cook | Illinois | 60632 | |

| 23.02 | Property | 1 | 4725 South Talman Avenue | 4725 South Talman Avenue | Chicago | Cook | Illinois | 60632 | |

| 23.03 | Property | 1 | 4030 South Archer Avenue | 4030 South Archer Avenue | Chicago | Cook | Illinois | 60632 | |

| 23.04 | Property | 1 | 2525 South Artesian Avenue | 2525 South Artesian Avenue | Chicago | Cook | Illinois | 60608 | |

| 23.05 | Property | 1 | 4013 South Archer Avenue | 4013 South Archer Avenue | Chicago | Cook | Illinois | 60632 | |

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | 617 West Expressway 83 | McAllen | Hidalgo | Texas | 78503 |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | 784, 788 and 792 Columbus Avenue | New York | New York | New York | 10025 |

| 26 | Loan | 1 | Cityline Kangaroo Storage | 308 Southwest Drive | Cheyenne | Laramie | Wyoming | 82007 |

| A-1-2 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | General Property Type | Detailed Property Type | Year Built | Year Renovated | Number of Units | Unit of Measure | Loan Per Unit ($) | Original Balance ($) |

| 13 | 12, 21 | 10, 12, 21 | 11 | |||||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | Retail | Regional Mall | 1956, 2016 | 1982, 2006, 2007 | 2,081,286 | SF | 177.77 | 75,000,000 |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | Office | Various | Various | Various | 1,443,002 | SF | 169.78 | 75,000,000 |

| 2.01 | Property | 1 | 401-405 Colorado | Office | CBD | 2021 | NAP | 205,803 | SF | 19,190,204 | ||

| 2.02 | Property | 1 | 1900 Market | Office | CBD | 1981 | 2015 | 456,922 | SF | 18,888,673 | ||

| 2.03 | Property | 1 | The Bulletin Building | Office | CBD | 1953 | 2018-2020 | 282,709 | SF | 15,131,327 | ||

| 2.04 | Property | 1 | Four Points Centre 3 | Office | Suburban | 2019 | NAP | 164,818 | SF | 7,054,286 | ||

| 2.05 | Property | 1 | 500 North Gulph | Office | Suburban | 1979 | 2019 | 100,820 | SF | 4,935,000 | ||

| 2.06 | Property | 1 | Metroplex – PA | Office | Suburban | 2007 | NAP | 120,877 | SF | 4,914,796 | ||

| 2.07 | Property | 1 | 933 First Avenue | Office | Suburban | 2017 | NAP | 111,053 | SF | 4,885,714 | ||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | Industrial | Warehouse/Distribution | 1991 | NAP | 1,546,575 | SF | 43.30 | 67,000,000 |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | Office | CBD | 2013 | NAP | 283,915 | SF | 366.31 | 64,000,000 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | Retail | Anchored | 2006 | NAP | 366,732 | SF | 154.06 | 56,500,000 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | Retail | Anchored | 1953 | 2021 | 9,368 | SF | 5,550.81 | 52,000,000 |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | Multifamily | Garden | 1989 | 2021-2022 | 384 | Units | 117,187.50 | 45,000,000 |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | Mixed Use | Retail/Office | 1882 | 2015 | 176,648 | SF | 719.86 | 37,700,000 |

| 9 | Loan | 11 | 2 | Clifton Industrial | Industrial | Warehouse/Distribution | 1925 | Various | 288,686 | SF | 96.64 | 27,900,000 |

| 9.01 | Property | 1 | 10 Clifton Boulevard | Industrial | Warehouse/Distribution | 1925 | 2004 | 144,222 | SF | 14,376,000 | ||

| 9.02 | Property | 1 | 200 Clifton Boulevard | Industrial | Warehouse/Distribution | 1925 | 2005 | 144,464 | SF | 13,524,000 | ||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | Multifamily | High Rise | Various | NAP | 153 | Units | 364,379.08 | 27,750,000 |

| 10.01 | Property | 1 | 237 East 34th Street | Multifamily | High Rise | 2015 | NAP | 105 | Units | 20,419,251 | ||

| 10.02 | Property | 1 | 114 West 86th Street | Multifamily | High Rise | 1928 | NAP | 48 | Units | 7,330,749 | ||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | Hospitality | Full Service | 2001 | 2005, 2015, 2018, 2021 | 951 | Rooms | 78,864.35 | 25,000,000 |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | Office | CBD | 1985 | NAP | 419,804 | SF | 128.63 | 25,000,000 |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | Office | Suburban | 2008 | NAP | 147,732 | SF | 159.95 | 23,630,000 |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | Mixed Use | Industrial/Retail | Various | Various | 482,216 | SF | 61.47 | 20,000,000 |

| 14.01 | Property | 1 | Center Point of Hamilton | Mixed Use | Industrial/Retail | 1896, 1970 | 1995 | 237,803 | SF | 9,862,924 | ||

| 14.02 | Property | 1 | Center Point on Centennial | Mixed Use | Industrial/Retail | 1952 | 2001 | 116,471 | SF | 4,830,657 | ||

| 14.03 | Property | 1 | Center Point on Manning | Mixed Use | Industrial/Retail | 1966 | 2002 | 78,829 | SF | 3,269,448 | ||

| 14.04 | Property | 1 | Center Point on Russell | Mixed Use | Industrial/Retail | 1932 | 1999 | 34,215 | SF | 1,419,074 | ||

| 14.05 | Property | 1 | Center Point on Field House | Mixed Use | Industrial/Retail | 1966 | 2006 | 14,400 | SF | 597,243 | ||

| 14.06 | Property | 1 | Center Point 212 | Mixed Use | Industrial/Retail | 1950 | NAP | 498 | SF | 20,655 | ||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | Office | Suburban | 2001 | 2019 | 210,902 | SF | 89.62 | 18,900,000 |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | Multifamily | Garden | 1900 | 2022 | 51 | Units | 328,431.37 | 16,750,000 |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | Retail | Other | 1991 | 2021 | 33,412 | SF | 493.83 | 16,500,000 |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | Office | Suburban | 2008 | NAP | 143,831 | SF | 110.72 | 15,925,000 |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | Mixed Use | Office/Retail | 2016 | NAP | 60,365 | SF | 674.07 | 15,690,000 |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | Mixed Use | Hospitality/Retail | 1998 | 2020 | 117 | Rooms | 85,470.09 | 10,000,000 |

| 21 | Loan | 18 | 1 | Rockwell Chicago | Industrial | Manufacturing/Warehouse | 1965, 1985 | NAP | 195,467 | SF | 51.16 | 10,000,000 |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | Hospitality | Limited Service | 1967 | 2012 | 130 | Rooms | 76,923.08 | 10,000,000 |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | Various | Various | Various | NAP | 296,989 | SF | 32.54 | 9,664,000 |

| 23.01 | Property | 1 | 2959 West 47th Street | Mixed Use | Industrial/Other | 1935 | NAP | 194,414 | SF | 3,456,000 | ||

| 23.02 | Property | 1 | 4725 South Talman Avenue | Industrial | Cold Storage | 1947 | NAP | 26,716 | SF | 2,752,000 | ||

| 23.03 | Property | 1 | 4030 South Archer Avenue | Retail | Anchored | 1954 | NAP | 30,000 | SF | 2,560,000 | ||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | Other | Parking | NAP | NAP | 32,206 | SF | 512,000 | ||

| 23.05 | Property | 1 | 4013 South Archer Avenue | Retail | Single Tenant | 1973 | NAP | 13,653 | SF | 384,000 | ||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | Hospitality | Select Service | 2000 | 2018 | 104 | Rooms | 87,450.64 | 9,100,000 |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | Multifamily | High Rise | 1950, 1958, 1963 | 2014 | 850 | Units | 220,588.24 | 6,500,000 |

| 26 | Loan | 1 | Cityline Kangaroo Storage | Self Storage | Self Storage | 1973 - 1996 | NAP | 88,300 | SF | 57.76 | 5,100,000 |

| A-1-3 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Cut-off Date Balance ($) | Maturity/ARD Balance ($) | Interest Rate % | Administrative Fee Rate % | Net Mortgage Rate % | Monthly Debt Service (P&I) ($) | Monthly Debt Service (IO) ($) | Annual Debt Service (P&I) ($) | Annual Debt Service (IO) ($) |

| 11 | 14 | 1, 14 | 2, 15 | 15 | 2, 15 | 15 | |||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 75,000,000 | 75,000,000 | 5.89900% | 0.01738% | 5.88162% | NAP | 373,808.16 | NAP | 4,485,697.92 |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | 75,000,000 | 75,000,000 | 5.87500% | 0.01738% | 5.85762% | NAP | 372,287.33 | NAP | 4,467,447.96 |

| 2.01 | Property | 1 | 401-405 Colorado | 19,190,204 | 19,190,204 | ||||||||

| 2.02 | Property | 1 | 1900 Market | 18,888,673 | 18,888,673 | ||||||||

| 2.03 | Property | 1 | The Bulletin Building | 15,131,327 | 15,131,327 | ||||||||

| 2.04 | Property | 1 | Four Points Centre 3 | 7,054,286 | 7,054,286 | ||||||||

| 2.05 | Property | 1 | 500 North Gulph | 4,935,000 | 4,935,000 | ||||||||

| 2.06 | Property | 1 | Metroplex – PA | 4,914,796 | 4,914,796 | ||||||||

| 2.07 | Property | 1 | 933 First Avenue | 4,885,714 | 4,885,714 | ||||||||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | 66,964,706 | 63,847,526 | 7.54000% | 0.01738% | 7.52262% | 470,310.22 | NAP | 5,643,722.64 | NAP |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 64,000,000 | 64,000,000 | 6.05000% | 0.01738% | 6.03262% | NAP | 327,148.15 | NAP | 3,925,777.80 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 56,500,000 | 56,500,000 | 6.99000% | 0.01738% | 6.97262% | NAP | 333,683.51 | NAP | 4,004,202.12 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 52,000,000 | 52,000,000 | 6.23500% | 0.01738% | 6.21762% | NAP | 273,935.88 | NAP | 3,287,230.56 |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | 45,000,000 | 45,000,000 | 6.68500% | 0.01738% | 6.66762% | NAP | 254,169.27 | NAP | 3,050,031.24 |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 37,629,373 | 34,817,492 | 7.49000% | 0.01738% | 7.47262% | 278,354.50 | NAP | 3,340,254.00 | NAP |

| 9 | Loan | 11 | 2 | Clifton Industrial | 27,900,000 | 27,900,000 | 5.83000% | 0.01738% | 5.81262% | NAP | 137,430.10 | NAP | 1,649,161.20 |

| 9.01 | Property | 1 | 10 Clifton Boulevard | 14,376,000 | 14,376,000 | ||||||||

| 9.02 | Property | 1 | 200 Clifton Boulevard | 13,524,000 | 13,524,000 | ||||||||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | 27,750,000 | 27,750,000 | 4.3381166% | 0.01738% | 4.3207366% | NAP | 101,712.27 | NAP | 1,220,547.24 |

| 10.01 | Property | 1 | 237 East 34th Street | 20,419,251 | 20,419,251 | ||||||||

| 10.02 | Property | 1 | 114 West 86th Street | 7,330,749 | 7,330,749 | ||||||||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | 25,000,000 | 24,239,924 | 6.86813% | 0.02738% | 6.84075% | 164,117.46 | 145,073.35 | 1,969,409.52 | 1,740,880.20 |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | 25,000,000 | 25,000,000 | 6.72350% | 0.01738% | 6.70612% | NAP | 142,018.37 | NAP | 1,704,220.44 |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | 23,630,000 | 23,630,000 | 6.08100% | 0.01738% | 6.06362% | NAP | 121,408.15 | NAP | 1,456,897.80 |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | 20,000,000 | 19,466,437 | 6.50000% | 0.01738% | 6.48262% | 126,413.60 | 109,837.96 | 1,516,963.20 | 1,318,055.52 |

| 14.01 | Property | 1 | Center Point of Hamilton | 9,862,924 | 9,599,800 | ||||||||

| 14.02 | Property | 1 | Center Point on Centennial | 4,830,657 | 4,701,784 | ||||||||

| 14.03 | Property | 1 | Center Point on Manning | 3,269,448 | 3,182,225 | ||||||||

| 14.04 | Property | 1 | Center Point on Russell | 1,419,074 | 1,381,216 | ||||||||

| 14.05 | Property | 1 | Center Point on Field House | 597,243 | 581,309 | ||||||||

| 14.06 | Property | 1 | Center Point 212 | 20,655 | 20,104 | ||||||||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | 18,900,000 | 18,900,000 | 6.66000% | 0.01738% | 6.64262% | NAP | 106,351.88 | NAP | 1,276,222.56 |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | 16,750,000 | 16,750,000 | 6.41650% | 0.06613% | 6.35037% | NAP | 90,807.59 | NAP | 1,089,691.08 |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | 16,500,000 | 16,500,000 | 6.82000% | 0.01738% | 6.80262% | NAP | 95,077.43 | NAP | 1,140,929.16 |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | 15,925,000 | 15,925,000 | 6.80000% | 0.04738% | 6.75262% | NAP | 91,495.02 | NAP | 1,097,940.24 |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | 15,690,000 | 15,690,000 | 6.87000% | 0.01738% | 6.85262% | NAP | 91,072.82 | NAP | 1,092,873.84 |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | 10,000,000 | 10,000,000 | 6.57000% | 0.01738% | 6.55262% | NAP | 55,510.42 | NAP | 666,125.04 |

| 21 | Loan | 18 | 1 | Rockwell Chicago | 10,000,000 | 10,000,000 | 6.28600% | 0.01738% | 6.26862% | NAP | 53,110.88 | NAP | 637,330.56 |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | 10,000,000 | 10,000,000 | 6.47000% | 0.01738% | 6.45262% | NAP | 54,665.51 | NAP | 655,986.12 |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | 9,664,000 | 8,761,171 | 6.18300% | 0.01738% | 6.16562% | 63,350.80 | NAP | 760,209.60 | NAP |

| 23.01 | Property | 1 | 2959 West 47th Street | 3,456,000 | 3,133,134 | ||||||||

| 23.02 | Property | 1 | 4725 South Talman Avenue | 2,752,000 | 2,494,903 | ||||||||

| 23.03 | Property | 1 | 4030 South Archer Avenue | 2,560,000 | 2,320,840 | ||||||||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | 512,000 | 464,168 | ||||||||

| 23.05 | Property | 1 | 4013 South Archer Avenue | 384,000 | 348,126 | ||||||||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | 9,094,866 | 8,651,760 | 7.33000% | 0.01738% | 7.31262% | 62,572.59 | NAP | 750,871.08 | NAP |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | 6,500,000 | 6,500,000 | 4.65000% | 0.01738% | 4.63262% | NAP | 25,537.33 | NAP | 306,447.96 |

| 26 | Loan | 1 | Cityline Kangaroo Storage | 5,100,000 | 5,100,000 | 6.43000% | 0.01738% | 6.41262% | NAP | 27,707.05 | NAP | 332,484.60 |

| A-1-4 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Amortization Type | ARD Loan (Yes / No) | Interest Accrual Method | Original Interest-Only Period (Mos.) | Remaining Interest-Only Period (Mos.) | Original Term To Maturity / ARD (Mos.) | Remaining Term To Maturity / ARD (Mos.) | Original Amortization Term (Mos.) |

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | Interest Only | No | Actual/360 | 60 | 60 | 60 | 60 | 0 |

| 2.01 | Property | 1 | 401-405 Colorado | |||||||||

| 2.02 | Property | 1 | 1900 Market | |||||||||

| 2.03 | Property | 1 | The Bulletin Building | |||||||||

| 2.04 | Property | 1 | Four Points Centre 3 | |||||||||

| 2.05 | Property | 1 | 500 North Gulph | |||||||||

| 2.06 | Property | 1 | Metroplex – PA | |||||||||

| 2.07 | Property | 1 | 933 First Avenue | |||||||||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | Amortizing Balloon | No | Actual/360 | 0 | 0 | 60 | 59 | 360 |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | Interest Only | No | Actual/360 | 60 | 58 | 60 | 58 | 0 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | Interest Only | No | Actual/360 | 60 | 60 | 60 | 60 | 0 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | Interest Only | No | Actual/360 | 60 | 60 | 60 | 60 | 0 |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | Amortizing Balloon | No | Actual/360 | 0 | 0 | 60 | 58 | 300 |

| 9 | Loan | 11 | 2 | Clifton Industrial | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 9.01 | Property | 1 | 10 Clifton Boulevard | |||||||||

| 9.02 | Property | 1 | 200 Clifton Boulevard | |||||||||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 10.01 | Property | 1 | 237 East 34th Street | |||||||||

| 10.02 | Property | 1 | 114 West 86th Street | |||||||||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | Interest Only, Amortizing Balloon | No | Actual/360 | 24 | 20 | 60 | 56 | 360 |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | Interest Only, Amortizing Balloon | No | Actual/360 | 30 | 30 | 60 | 60 | 360 |

| 14.01 | Property | 1 | Center Point of Hamilton | |||||||||

| 14.02 | Property | 1 | Center Point on Centennial | |||||||||

| 14.03 | Property | 1 | Center Point on Manning | |||||||||

| 14.04 | Property | 1 | Center Point on Russell | |||||||||

| 14.05 | Property | 1 | Center Point on Field House | |||||||||

| 14.06 | Property | 1 | Center Point 212 | |||||||||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | Interest Only | No | Actual/360 | 60 | 60 | 60 | 60 | 0 |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| 21 | Loan | 18 | 1 | Rockwell Chicago | Interest Only | No | Actual/360 | 60 | 57 | 60 | 57 | 0 |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | Interest Only | No | Actual/360 | 60 | 60 | 60 | 60 | 0 |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | Amortizing Balloon | No | Actual/360 | 0 | 0 | 60 | 60 | 300 |

| 23.01 | Property | 1 | 2959 West 47th Street | |||||||||

| 23.02 | Property | 1 | 4725 South Talman Avenue | |||||||||

| 23.03 | Property | 1 | 4030 South Archer Avenue | |||||||||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | |||||||||

| 23.05 | Property | 1 | 4013 South Archer Avenue | |||||||||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | Amortizing Balloon | No | Actual/360 | 0 | 0 | 60 | 59 | 360 |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | Interest Only | No | Actual/360 | 60 | 54 | 60 | 54 | 0 |

| 26 | Loan | 1 | Cityline Kangaroo Storage | Interest Only | No | Actual/360 | 60 | 59 | 60 | 59 | 0 |

| A-1-5 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Remaining Amortization Term (Mos.) | Origination Date | Seasoning (Mos.) | Payment Due Date | First Payment Date | First P&I Payment Date | Maturity Date or Anticipated Repayment Date | Final Maturity Date | Grace Period - Late Fee (Days) | Grace Period - Default (Days) |

| 19 | 19 | |||||||||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 0 | 1/3/2023 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 5 | 0 |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | 0 | 1/19/2023 | 0 | 6 | 3/6/2023 | NAP | 2/6/2028 | NAP | 0 | 0 |

| 2.01 | Property | 1 | 401-405 Colorado | |||||||||||

| 2.02 | Property | 1 | 1900 Market | |||||||||||

| 2.03 | Property | 1 | The Bulletin Building | |||||||||||

| 2.04 | Property | 1 | Four Points Centre 3 | |||||||||||

| 2.05 | Property | 1 | 500 North Gulph | |||||||||||

| 2.06 | Property | 1 | Metroplex – PA | |||||||||||

| 2.07 | Property | 1 | 933 First Avenue | |||||||||||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | 359 | 12/29/2022 | 1 | 6 | 2/6/2023 | 2/6/2023 | 1/6/2028 | NAP | 0 | 0 |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 0 | 11/18/2022 | 2 | 6 | 1/6/2023 | NAP | 12/6/2027 | NAP | 0 | 0 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 0 | 1/19/2023 | 0 | 6 | 3/6/2023 | NAP | 2/6/2028 | NAP | 0 | 0 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 0 | 1/10/2023 | 0 | 6 | 3/6/2023 | NAP | 2/6/2028 | NAP | 0 | 0 |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | 0 | 12/13/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 298 | 11/29/2022 | 2 | 6 | 1/6/2023 | 1/6/2023 | 12/6/2027 | NAP | 0 | 0 |

| 9 | Loan | 11 | 2 | Clifton Industrial | 0 | 12/13/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 9.01 | Property | 1 | 10 Clifton Boulevard | |||||||||||

| 9.02 | Property | 1 | 200 Clifton Boulevard | |||||||||||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | 0 | 12/20/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 10.01 | Property | 1 | 237 East 34th Street | |||||||||||

| 10.02 | Property | 1 | 114 West 86th Street | |||||||||||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | 360 | 9/9/2022 | 4 | 6 | 11/6/2022 | 11/6/2024 | 10/6/2027 | NAP | 0 | 0 |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | 0 | 1/6/2023 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 5 | 0 |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | 0 | 12/21/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | 360 | 1/9/2023 | 0 | 6 | 3/6/2023 | 9/6/2025 | 2/6/2028 | NAP | 0 | 0 |

| 14.01 | Property | 1 | Center Point of Hamilton | |||||||||||

| 14.02 | Property | 1 | Center Point on Centennial | |||||||||||

| 14.03 | Property | 1 | Center Point on Manning | |||||||||||

| 14.04 | Property | 1 | Center Point on Russell | |||||||||||

| 14.05 | Property | 1 | Center Point on Field House | |||||||||||

| 14.06 | Property | 1 | Center Point 212 | |||||||||||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | 0 | 1/5/2023 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | 0 | 12/19/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | 0 | 1/30/2023 | 0 | 6 | 3/6/2023 | NAP | 2/6/2028 | NAP | 0 | 0 |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | 0 | 12/22/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | 0 | 12/23/2022 | 1 | 1 | 2/1/2023 | NAP | 1/1/2028 | NAP | 0 | 0 |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | 0 | 12/15/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| 21 | Loan | 18 | 1 | Rockwell Chicago | 0 | 10/7/2022 | 3 | 6 | 12/6/2022 | NAP | 11/6/2027 | NAP | 0 | 0 |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | 0 | 1/20/2023 | 0 | 6 | 3/6/2023 | NAP | 2/6/2028 | NAP | 0 | 0 |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | 300 | 1/30/2023 | 0 | 6 | 3/6/2023 | 3/6/2023 | 2/6/2028 | NAP | 0 | 0 |

| 23.01 | Property | 1 | 2959 West 47th Street | |||||||||||

| 23.02 | Property | 1 | 4725 South Talman Avenue | |||||||||||

| 23.03 | Property | 1 | 4030 South Archer Avenue | |||||||||||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | |||||||||||

| 23.05 | Property | 1 | 4013 South Archer Avenue | |||||||||||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | 359 | 12/23/2022 | 1 | 6 | 2/6/2023 | 2/6/2023 | 1/6/2028 | NAP | 0 | 0 |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | 0 | 8/3/2022 | 6 | 6 | 9/6/2022 | NAP | 8/6/2027 | NAP | 0 | 0 |

| 26 | Loan | 1 | Cityline Kangaroo Storage | 0 | 12/7/2022 | 1 | 6 | 2/6/2023 | NAP | 1/6/2028 | NAP | 0 | 0 |

| A-1-6 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Prepayment Provision | Most Recent EGI ($) | Most Recent Expenses ($) | Most Recent NOI ($) | Most Recent NOI Date | Most Recent Description | Second Most Recent EGI ($) | Second Most Recent Expenses ($) |

| 3, 22, 23 | 18 | |||||||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | L(25),YM1(30),O(5) | 76,986,549 | 31,812,161 | 45,174,388 | 9/30/2022 | T-12 | 76,903,875 | 30,285,085 |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | L(25),YM1(28),O(7) | 49,769,720 | 20,248,022 | 29,521,698 | 11/30/2022 | T-12 | 43,807,043 | 16,229,423 |

| 2.01 | Property | 1 | 401-405 Colorado | 3,738,970 | 4,440,497 | (701,527) | 11/30/2022 | T-12 | 334,988 | 1,044,046 | ||

| 2.02 | Property | 1 | 1900 Market | 16,201,107 | 5,715,454 | 10,485,653 | 11/30/2022 | T-12 | 16,060,971 | 5,847,186 | ||

| 2.03 | Property | 1 | The Bulletin Building | 11,128,461 | 4,692,277 | 6,436,184 | 11/30/2022 | T-12 | 9,842,342 | 3,944,036 | ||

| 2.04 | Property | 1 | Four Points Centre 3 | 6,874,281 | 2,427,666 | 4,446,615 | 11/30/2022 | T-12 | 6,908,123 | 2,447,144 | ||

| 2.05 | Property | 1 | 500 North Gulph | 3,727,029 | 672,649 | 3,054,380 | 11/30/2022 | T-12 | 3,656,774 | 664,903 | ||

| 2.06 | Property | 1 | Metroplex – PA | 4,147,046 | 1,396,958 | 2,750,088 | 11/30/2022 | T-12 | 3,089,488 | 1,406,185 | ||

| 2.07 | Property | 1 | 933 First Avenue | 3,952,826 | 902,521 | 3,050,305 | 11/30/2022 | T-12 | 3,914,357 | 875,923 | ||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | L(3),YM1(50),O(7) | NAV | NAV | NAV | NAV | NAV | NAV | NAV |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | L(26),D(21),O(13) | 14,938,491 | 5,298,404 | 9,640,088 | 9/30/2022 | T-12 | 14,712,258 | 5,415,296 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | L(24),YM1(29),O(7) | 7,353,079 | 1,907,596 | 5,445,483 | 11/30/2022 | T-12 | 7,145,535 | 2,167,463 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | L(23),YM1(30),O(7) | 3,332,723 | 284,305 | 3,048,419 | 5/31/2022 | T-12 | 2,826,295 | 306,532 |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | L(25),D(30),O(5) | NAV | NAV | NAV | NAV | NAV | NAV | NAV |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | L(26),D(28),O(6) | 34,792,051 | 11,050,658 | 23,741,393 | 6/30/2022 | T-12 | 32,527,216 | 10,808,852 |

| 9 | Loan | 11 | 2 | Clifton Industrial | L(25),D(28),O(7) | 3,653,537 | 1,342,949 | 2,310,588 | 10/31/2022 | T-12 | 3,300,520 | 1,387,320 |

| 9.01 | Property | 1 | 10 Clifton Boulevard | 1,879,658 | 610,808 | 1,268,850 | 10/31/2022 | T-12 | 1,866,846 | 652,867 | ||

| 9.02 | Property | 1 | 200 Clifton Boulevard | 1,773,879 | 595,730 | 1,178,149 | 10/31/2022 | T-12 | 1,433,674 | 734,453 | ||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | L(25),D(31),O(4) | 8,654,206 | 2,814,082 | 5,840,124 | 9/30/2022 | T-12 | 7,301,221 | 3,026,795 |

| 10.01 | Property | 1 | 237 East 34th Street | 6,801,752 | 2,163,123 | 4,638,629 | 9/30/2022 | T-12 | 5,622,737 | 2,385,249 | ||

| 10.02 | Property | 1 | 114 West 86th Street | 1,852,454 | 650,959 | 1,201,496 | 9/30/2022 | T-12 | 1,678,483 | 641,545 | ||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | L(28),D(28),O(4) | 43,804,567 | 30,356,486 | 13,448,081 | 6/30/2022 | T-12 | 35,038,634 | 24,691,698 |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | L(12),YM1(13),DorYM1(30),O(5) | 9,222,846 | 3,110,138 | 6,112,708 | 9/30/2022 | T-12 | 10,696,105 | 3,145,704 |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | L(25),D(30),O(5) | 4,530,098 | 1,875,048 | 2,655,050 | 9/30/2022 | T-12 | 4,227,688 | 1,692,461 |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | L(24),D(32),O(4) | 6,935,942 | 2,214,415 | 4,721,527 | 7/31/2022 | T-12 | 5,994,552 | 2,112,554 |

| 14.01 | Property | 1 | Center Point of Hamilton | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 14.02 | Property | 1 | Center Point on Centennial | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 14.03 | Property | 1 | Center Point on Manning | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 14.04 | Property | 1 | Center Point on Russell | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 14.05 | Property | 1 | Center Point on Field House | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 14.06 | Property | 1 | Center Point 212 | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | L(25),D(31),O(4) | 4,956,989 | 2,357,882 | 2,599,107 | 11/30/2022 | T-12 | 4,922,601 | 2,193,862 |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | L(25),D(28),O(7) | 717,175 | 320,007 | 397,169 | 10/31/2022 | T-12 | NAV | NAV |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | L(24),D(32),O(4) | NAV | NAV | NAV | NAV | NAV | NAV | NAV |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | L(25),D(32),O(3) | 2,226,928 | 814,749 | 1,412,178 | 11/30/2022 | T-12 | 1,992,575 | 768,957 |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | L(25),D(28),O(7) | 4,514,207 | 1,215,150 | 3,299,057 | 8/31/2022 | T-12 | 4,455,086 | 1,231,423 |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | L(25),D(22),O(13) | 3,225,953 | 1,535,371 | 1,690,582 | 10/31/2022 | T-12 | 2,080,356 | 1,060,347 |

| 21 | Loan | 18 | 1 | Rockwell Chicago | L(27),D(28),O(5) | 1,393,274 | 386,042 | 1,007,232 | 7/31/2022 | T-12 | 1,361,888 | 369,460 |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | L(24),YM2(32),O(4) | 4,647,400 | 2,501,913 | 2,145,487 | 11/30/2022 | T-12 | 3,693,365 | 2,589,638 |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | L(24),D(32),O(4) | NAV | NAV | NAV | NAV | NAV | NAV | NAV |

| 23.01 | Property | 1 | 2959 West 47th Street | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 23.02 | Property | 1 | 4725 South Talman Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 23.03 | Property | 1 | 4030 South Archer Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 23.05 | Property | 1 | 4013 South Archer Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | ||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | L(25),D(31),O(4) | 3,393,138 | 1,883,995 | 1,509,143 | 11/30/2022 | T-12 | 3,061,343 | 1,699,677 |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | L(30),D(25),O(5) | 25,035,638 | 9,544,221 | 15,491,417 | 5/31/2022 | T-12 | 22,682,409 | 9,325,401 |

| 26 | Loan | 1 | Cityline Kangaroo Storage | L(25),D(31),O(4) | 672,568 | 165,146 | 507,421 | 10/31/2022 | T-12 | 683,356 | 207,375 |

| A-1-7 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Second Most Recent NOI ($) | Second Most Recent NOI Date | Second Most Recent Description | Third Most Recent EGI ($) | Third Most Recent Expenses ($) | Third Most Recent NOI ($) | Third Most Recent NOI Date | Third Most Recent Description | Underwritten Economic Occupancy (%) |

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 46,618,790 | 12/31/2021 | T-12 | 69,008,722 | 28,007,136 | 41,001,586 | 12/31/2020 | T-12 | 96.2% |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | 27,577,620 | 12/31/2021 | T-12 | 37,846,335 | 14,397,273 | 23,449,062 | 12/31/2020 | T-12 | 98.2% |

| 2.01 | Property | 1 | 401-405 Colorado | (709,058) | 12/31/2021 | T-12 | 0 | 10,841 | (10,841) | 12/31/2020 | T-12 | 97.1% | |

| 2.02 | Property | 1 | 1900 Market | 10,213,785 | 12/31/2021 | T-12 | 14,737,420 | 5,692,038 | 9,045,382 | 12/31/2020 | T-12 | 100.0% | |

| 2.03 | Property | 1 | The Bulletin Building | 5,898,306 | 12/31/2021 | T-12 | 7,868,770 | 3,455,632 | 4,413,138 | 12/31/2020 | T-12 | 97.0% | |

| 2.04 | Property | 1 | Four Points Centre 3 | 4,460,979 | 12/31/2021 | T-12 | 6,282,086 | 2,482,361 | 3,799,725 | 12/31/2020 | T-12 | 100.0% | |

| 2.05 | Property | 1 | 500 North Gulph | 2,991,871 | 12/31/2021 | T-12 | 3,564,005 | 635,340 | 2,928,665 | 12/31/2020 | T-12 | 100.0% | |

| 2.06 | Property | 1 | Metroplex – PA | 1,683,303 | 12/31/2021 | T-12 | 1,676,397 | 1,321,752 | 354,645 | 12/31/2020 | T-12 | 92.7% | |

| 2.07 | Property | 1 | 933 First Avenue | 3,038,434 | 12/31/2021 | T-12 | 3,717,657 | 799,309 | 2,918,348 | 12/31/2020 | T-12 | 100.0% | |

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | 95.0% |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 9,296,962 | 12/31/2021 | T-12 | 13,218,587 | 5,245,590 | 7,972,997 | 12/31/2020 | T-12 | 95.0% |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 4,978,072 | 12/31/2021 | T-12 | 7,406,831 | 2,111,524 | 5,295,307 | 12/31/2020 | T-12 | 95.0% |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 2,519,764 | 12/31/2021 | T-12 | 4,365,715 | 247,078 | 4,118,637 | 12/31/2020 | T-12 | 96.6% |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | 91.1% |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 21,718,364 | 12/31/2021 | T-12 | 29,676,032 | 10,308,321 | 19,367,711 | 12/31/2020 | T-12 | 93.4% |

| 9 | Loan | 11 | 2 | Clifton Industrial | 1,913,200 | 12/31/2021 | T-12 | 3,012,715 | 1,106,074 | 1,906,641 | 12/31/2020 | T-12 | 89.9% |

| 9.01 | Property | 1 | 10 Clifton Boulevard | 1,213,979 | 12/31/2021 | T-12 | 1,784,864 | 571,249 | 1,213,615 | 12/31/2020 | T-12 | 95.0% | |

| 9.02 | Property | 1 | 200 Clifton Boulevard | 699,221 | 12/31/2021 | T-12 | 1,227,851 | 534,825 | 693,026 | 12/31/2020 | T-12 | 79.5% | |

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | 4,274,426 | 12/31/2021 | T-12 | 7,515,165 | 2,910,192 | 4,604,973 | 12/31/2020 | T-12 | 98.0% |

| 10.01 | Property | 1 | 237 East 34th Street | 3,237,488 | 12/31/2021 | T-12 | 5,785,642 | 2,268,343 | 3,517,299 | 12/31/2020 | T-12 | 99.0% | |

| 10.02 | Property | 1 | 114 West 86th Street | 1,036,938 | 12/31/2021 | T-12 | 1,729,524 | 641,849 | 1,087,675 | 12/31/2020 | T-12 | 94.5% | |

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | 10,346,936 | 12/31/2021 | T-12 | 54,526,196 | 39,952,555 | 14,573,641 | 2/28/2020 | T-12 | 66.1% |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | 7,550,401 | 12/31/2021 | T-12 | 12,069,467 | 3,425,309 | 8,644,158 | 12/31/2020 | T-12 | 69.8% |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | 2,535,227 | 12/31/2021 | T-12 | 4,023,354 | 1,630,132 | 2,393,222 | 12/31/2020 | T-12 | 88.5% |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | 3,881,998 | 12/31/2021 | T-12 | 4,805,172 | 1,901,233 | 2,903,939 | 12/31/2020 | T-12 | 95.0% |

| 14.01 | Property | 1 | Center Point of Hamilton | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 14.02 | Property | 1 | Center Point on Centennial | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 14.03 | Property | 1 | Center Point on Manning | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 14.04 | Property | 1 | Center Point on Russell | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 14.05 | Property | 1 | Center Point on Field House | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 14.06 | Property | 1 | Center Point 212 | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | 2,728,739 | 12/31/2021 | T-12 | 4,901,121 | 2,127,738 | 2,773,383 | 12/31/2020 | T-12 | 84.4% |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | 92.7% |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | 95.0% |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | 1,223,618 | 12/31/2021 | T-12 | 1,883,147 | 864,429 | 1,018,718 | 12/31/2020 | T-12 | 85.0% |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | 3,223,663 | 12/31/2021 | T-12 | 4,214,299 | 1,213,334 | 3,000,965 | 12/31/2020 | T-12 | 96.8% |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | 1,020,009 | 12/31/2021 | T-12 | 1,092,008 | 926,155 | 165,853 | 12/31/2020 | T-12 | 64.4% |

| 21 | Loan | 18 | 1 | Rockwell Chicago | 992,429 | 12/31/2021 | T-12 | 1,258,606 | 290,938 | 967,668 | 12/31/2020 | T-12 | 95.0% |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | 1,103,727 | 12/31/2021 | T-12 | 2,667,113 | 2,278,216 | 388,897 | 12/31/2020 | T-12 | 57.0% |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | 93.9% |

| 23.01 | Property | 1 | 2959 West 47th Street | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 23.02 | Property | 1 | 4725 South Talman Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 23.03 | Property | 1 | 4030 South Archer Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 23.04 | Property | 1 | 2525 South Artesian Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 23.05 | Property | 1 | 4013 South Archer Avenue | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | NAV | |

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | 1,361,666 | 12/31/2021 | T-12 | 1,714,114 | 1,259,222 | 454,892 | 12/31/2020 | T-12 | 73.6% |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | 13,357,008 | 12/31/2021 | T-12 | 23,638,812 | 9,046,781 | 14,592,031 | 12/31/2020 | T-12 | 91.3% |

| 26 | Loan | 1 | Cityline Kangaroo Storage | 475,981 | 12/31/2021 | T-12 | 646,445 | 200,901 | 445,545 | 12/31/2020 | T-12 | 88.5% |

| A-1-8 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Underwritten EGI ($) | Underwritten Expenses ($) | Underwritten Net Operating Income ($) | Underwritten Replacement / FF&E Reserve ($) | Underwritten TI / LC ($) | Underwritten Net Cash Flow ($) | Underwritten NOI DSCR (x) | Underwritten NCF DSCR (x) | Underwritten NOI Debt Yield (%) |

| 18 | 4, 10, 15 | 4, 10, 15 | 10 | ||||||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 83,514,884 | 35,580,356 | 47,934,528 | 455,855 | 1,113,906 | 46,364,767 | 2.17 | 2.10 | 13.0% |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | 67,944,892 | 23,839,304 | 44,105,588 | 360,751 | 2,886,004 | 40,858,833 | 3.02 | 2.80 | 18.0% |

| 2.01 | Property | 1 | 401-405 Colorado | 16,629,112 | 6,396,629 | 10,232,483 | 51,451 | 411,606 | 9,769,426 | ||||

| 2.02 | Property | 1 | 1900 Market | 17,764,762 | 6,002,663 | 11,762,099 | 114,231 | 913,844 | 10,734,025 | ||||

| 2.03 | Property | 1 | The Bulletin Building | 13,875,082 | 5,904,172 | 7,970,910 | 70,677 | 565,418 | 7,334,815 | ||||

| 2.04 | Property | 1 | Four Points Centre 3 | 7,138,490 | 2,518,642 | 4,619,849 | 41,205 | 329,636 | 4,249,008 | ||||

| 2.05 | Property | 1 | 500 North Gulph | 4,006,303 | 690,550 | 3,315,752 | 25,205 | 201,640 | 3,088,907 | ||||

| 2.06 | Property | 1 | Metroplex – PA | 4,423,155 | 1,446,241 | 2,976,914 | 30,219 | 241,754 | 2,704,941 | ||||

| 2.07 | Property | 1 | 933 First Avenue | 4,107,987 | 880,407 | 3,227,580 | 27,763 | 222,106 | 2,977,711 | ||||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | 10,256,144 | 2,753,751 | 7,502,393 | 154,658 | 154,658 | 7,193,078 | 1.33 | 1.27 | 11.2% |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 15,239,748 | 5,781,977 | 9,457,771 | 56,783 | 0 | 9,400,988 | 1.48 | 1.47 | 9.1% |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 8,437,918 | 2,094,582 | 6,343,337 | 55,010 | 456,748 | 5,831,579 | 1.58 | 1.46 | 11.2% |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 7,169,883 | 990,883 | 6,179,000 | 1,874 | 0 | 6,177,126 | 1.88 | 1.88 | 11.9% |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | 6,184,793 | 1,907,911 | 4,276,882 | 76,800 | 0 | 4,200,082 | 1.40 | 1.38 | 11.4% |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 27,803,795 | 11,776,167 | 16,027,627 | 35,330 | 441,620 | 15,550,678 | 1.42 | 1.38 | 12.6% |

| 9 | Loan | 11 | 2 | Clifton Industrial | 3,826,877 | 1,315,071 | 2,511,806 | 53,407 | 0 | 2,458,399 | 1.52 | 1.49 | 9.0% |

| 9.01 | Property | 1 | 10 Clifton Boulevard | 2,162,054 | 674,499 | 1,487,555 | 30,259 | 0 | 1,457,296 | ||||

| 9.02 | Property | 1 | 200 Clifton Boulevard | 1,664,823 | 640,573 | 1,024,250 | 23,148 | 0 | 1,001,102 | ||||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | 9,607,348 | 3,194,304 | 6,413,044 | 0 | 5,996 | 6,407,048 | 2.62 | 2.61 | 11.5% |

| 10.01 | Property | 1 | 237 East 34th Street | 7,657,375 | 2,499,137 | 5,158,238 | 0 | 5,996 | 5,152,242 | ||||

| 10.02 | Property | 1 | 114 West 86th Street | 1,949,973 | 695,167 | 1,254,806 | 0 | 0 | 1,254,806 | ||||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | 54,315,058 | 39,033,557 | 15,281,501 | 2,172,602 | 0 | 13,108,899 | 2.59 | 2.22 | 20.4% |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | 10,018,053 | 3,244,801 | 6,773,252 | 117,545 | 294,804 | 6,360,903 | 1.84 | 1.73 | 12.5% |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | 4,653,812 | 1,726,887 | 2,926,925 | 36,933 | 147,732 | 2,742,260 | 2.01 | 1.88 | 12.4% |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | 7,357,012 | 2,476,362 | 4,880,650 | 101,265 | 206,108 | 4,573,276 | 2.17 | 2.03 | 16.5% |

| 14.01 | Property | 1 | Center Point of Hamilton | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 14.02 | Property | 1 | Center Point on Centennial | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 14.03 | Property | 1 | Center Point on Manning | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 14.04 | Property | 1 | Center Point on Russell | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 14.05 | Property | 1 | Center Point on Field House | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 14.06 | Property | 1 | Center Point 212 | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | 5,728,704 | 2,074,937 | 3,653,767 | 42,180 | 488,371 | 3,123,216 | 2.86 | 2.45 | 19.3% |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | 1,552,371 | 292,406 | 1,259,965 | 12,750 | 0 | 1,247,215 | 1.16 | 1.14 | 7.5% |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | 2,141,824 | 312,609 | 1,829,215 | 12,889 | 26,949 | 1,789,378 | 1.60 | 1.57 | 11.1% |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | 2,948,312 | 1,006,106 | 1,942,206 | 37,396 | 117,835 | 1,786,974 | 1.77 | 1.63 | 12.2% |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | 5,010,828 | 1,233,644 | 3,777,184 | 9,055 | 19,586 | 3,748,543 | 1.33 | 1.32 | 9.3% |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | 3,327,547 | 1,563,078 | 1,764,470 | 133,102 | 0 | 1,631,368 | 2.65 | 2.45 | 17.6% |

| 21 | Loan | 18 | 1 | Rockwell Chicago | 1,564,757 | 391,230 | 1,173,527 | 19,547 | 0 | 1,153,980 | 1.84 | 1.81 | 11.7% |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | 4,650,951 | 2,945,870 | 1,705,081 | 186,038 | 0 | 1,519,043 | 2.60 | 2.32 | 17.1% |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | 1,897,546 | 717,484 | 1,180,062 | 41,116 | 63,969 | 1,074,976 | 1.55 | 1.41 | 12.2% |

| 23.01 | Property | 1 | 2959 West 47th Street | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 23.02 | Property | 1 | 4725 South Talman Avenue | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 23.03 | Property | 1 | 4030 South Archer Avenue | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 23.05 | Property | 1 | 4013 South Archer Avenue | NAV | NAV | NAV | NAV | NAV | NAV | ||||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | 3,393,138 | 1,929,670 | 1,463,468 | 135,726 | 0 | 1,327,742 | 1.95 | 1.77 | 16.1% |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | 32,787,176 | 9,786,898 | 23,000,278 | 0 | 0 | 23,000,278 | 2.60 | 2.60 | 12.3% |

| 26 | Loan | 1 | Cityline Kangaroo Storage | 682,468 | 162,756 | 519,712 | 0 | 0 | 519,712 | 1.56 | 1.56 | 10.2% |

| A-1-9 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Underwritten NCF Debt Yield (%) | Appraised Value ($) | Appraised Value Type | Appraisal Date | Cut-off Date LTV Ratio (%) | LTV Ratio at Maturity / ARD (%) | Leased Occupancy (%) | Occupancy Date |

| 10 | 20 | 20 | 10, 20 | 10, 20 | 5, 12, 25, 28 | |||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 12.5% | 679,000,000 | As Is | 10/30/2022 | 54.5% | 54.5% | 97.7% | 12/12/2022 |

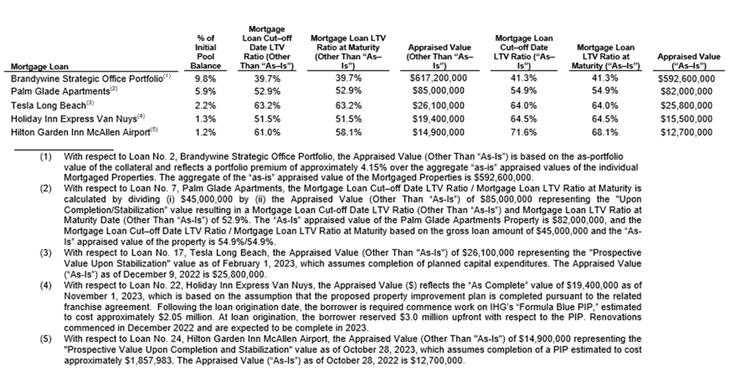

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | 16.7% | 617,200,000 | As Is Portfolio | Various | 39.7% | 39.7% | 98.1% | |

| 2.01 | Property | 1 | 401-405 Colorado | 138,000,000 | As Is | 11/3/2022 | 96.0% | 12/21/2022 | ||||

| 2.02 | Property | 1 | 1900 Market | 159,100,000 | As Is | 11/2/2022 | 100.0% | 12/21/2022 | ||||

| 2.03 | Property | 1 | The Bulletin Building | 113,100,000 | As Is | 11/2/2022 | 97.3% | 12/21/2022 | ||||

| 2.04 | Property | 1 | Four Points Centre 3 | 67,800,000 | As Is | 11/3/2022 | 100.0% | 2/6/2023 | ||||

| 2.05 | Property | 1 | 500 North Gulph | 38,100,000 | As Is | 11/4/2022 | 100.0% | 2/6/2023 | ||||

| 2.06 | Property | 1 | Metroplex – PA | 38,600,000 | As Is | 11/4/2022 | 90.1% | 12/21/2022 | ||||

| 2.07 | Property | 1 | 933 First Avenue | 37,900,000 | As Is | 11/4/2022 | 100.0% | 2/6/2023 | ||||

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | 10.7% | 134,000,000 | As Is | 11/22/2022 | 50.0% | 47.6% | 100.0% | 2/6/2023 |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 9.0% | 167,000,000 | As Is | 9/22/2022 | 62.3% | 62.3% | 93.7% | 12/31/2022 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 10.3% | 84,000,000 | As Is | 12/21/2022 | 67.3% | 67.3% | 97.0% | 1/3/2023 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 11.9% | 153,000,000 | As Is | 11/8/2022 | 34.0% | 34.0% | 100.0% | 9/7/2022 |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | 11.2% | 85,000,000 | Upon Completion/Stabilization | 4/1/2023 | 52.9% | 52.9% | 91.1% | 11/1/2022 |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 12.2% | 215,000,000 | As Is | 9/7/2022 | 59.1% | 54.7% | 88.1% | 7/1/2022 |

| 9 | Loan | 11 | 2 | Clifton Industrial | 8.8% | 59,100,000 | As Is | 11/7/2022 | 47.2% | 47.2% | 89.0% | |

| 9.01 | Property | 1 | 10 Clifton Boulevard | 30,400,000 | As Is | 11/7/2022 | 100.0% | 12/6/2022 | ||||

| 9.02 | Property | 1 | 200 Clifton Boulevard | 28,700,000 | As Is | 11/7/2022 | 78.0% | 12/6/2022 | ||||

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | 11.5% | 141,000,000 | As Is | 10/28/2022 | 39.5% | 39.5% | 98.7% | |

| 10.01 | Property | 1 | 237 East 34th Street | 106,300,000 | As Is | 10/28/2022 | 99.0% | 11/1/2022 | ||||

| 10.02 | Property | 1 | 114 West 86th Street | 34,700,000 | As Is | 10/28/2022 | 97.9% | 11/1/2022 | ||||

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | 17.5% | 164,000,000 | As Is | 8/8/2022 | 45.7% | 44.3% | 52.5% | 6/30/2022 |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | 11.8% | 104,000,000 | As Is | 10/10/2022 | 51.9% | 51.9% | 65.9% | 1/1/2023 |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | 11.6% | 40,300,000 | As Is | 9/14/2022 | 58.6% | 58.6% | 84.2% | 12/9/2022 |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | 15.4% | 44,100,000 | As Is | 10/12/2022 | 67.2% | 65.4% | 98.1% | |

| 14.01 | Property | 1 | Center Point of Hamilton | 21,747,748 | As Is | 10/12/2022 | 99.2% | 12/13/2022 | ||||

| 14.02 | Property | 1 | Center Point on Centennial | 10,651,598 | As Is | 10/12/2022 | 100.0% | 12/13/2022 | ||||

| 14.03 | Property | 1 | Center Point on Manning | 7,209,133 | As Is | 10/12/2022 | 100.0% | 12/13/2022 | ||||

| 14.04 | Property | 1 | Center Point on Russell | 3,129,058 | As Is | 10/12/2022 | 99.1% | 12/13/2022 | ||||

| 14.05 | Property | 1 | Center Point on Field House | 1,316,920 | As Is | 10/12/2022 | 50.0% | 12/13/2022 | ||||

| 14.06 | Property | 1 | Center Point 212 | 45,543 | As Is | 10/12/2022 | 100.0% | 12/13/2022 | ||||

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | 16.5% | 32,250,000 | As Is | 11/30/2022 | 58.6% | 58.6% | 89.9% | 1/5/2023 |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | 7.4% | 23,400,000 | As Is | 11/22/2022 | 71.6% | 71.6% | 94.1% | 11/22/2022 |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | 10.8% | 26,100,000 | Upon Stabilization | 2/1/2023 | 63.2% | 63.2% | 100.0% | 1/1/2023 |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | 11.2% | 23,500,000 | As Is | 12/7/2022 | 67.8% | 67.8% | 84.9% | 12/31/2022 |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | 9.2% | 62,600,000 | As Is | 10/18/2022 | 65.0% | 65.0% | 100.0% | 12/16/2022 |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | 16.3% | 26,000,000 | As Is | 10/18/2022 | 38.5% | 38.5% | 62.7% | 10/31/2022 |

| 21 | Loan | 18 | 1 | Rockwell Chicago | 11.5% | 21,900,000 | As Is | 8/25/2022 | 45.7% | 45.7% | 100.0% | 2/6/2023 |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | 15.2% | 19,400,000 | As Complete | 11/1/2023 | 51.5% | 51.5% | 57.0% | 11/30/2022 |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | 11.1% | 15,100,000 | As Is | 10/26/2022 | 64.0% | 58.0% | 100.0% | |

| 23.01 | Property | 1 | 2959 West 47th Street | 5,400,000 | As Is | 10/26/2022 | 100.0% | 12/1/2022 | ||||

| 23.02 | Property | 1 | 4725 South Talman Avenue | 4,300,000 | As Is | 10/26/2022 | 100.0% | 12/1/2022 | ||||

| 23.03 | Property | 1 | 4030 South Archer Avenue | 4,000,000 | As Is | 10/26/2022 | 100.0% | 12/1/2022 | ||||

| 23.04 | Property | 1 | 2525 South Artesian Avenue | 800,000 | As Is | 10/26/2022 | 100.0% | 12/1/2022 | ||||

| 23.05 | Property | 1 | 4013 South Archer Avenue | 600,000 | As Is | 10/26/2022 | 100.0% | 2/6/2023 | ||||

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | 14.6% | 14,900,000 | Upon Completion/Stabilization | 10/28/2023 | 61.0% | 58.1% | 73.6% | 11/30/2022 |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | 12.3% | 575,000,000 | As Is | 1/20/2022 | 32.6% | 32.6% | 94.7% | 7/22/2022 |

| 26 | Loan | 1 | Cityline Kangaroo Storage | 10.2% | 8,975,000 | As Is | 11/1/2022 | 56.8% | 56.8% | 90.6% | 9/30/2022 |

| A-1-10 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Single Tenant (Y/N) | Largest Tenant | Largest Tenant SF | Largest Tenant % of NRA | Largest Tenant Lease Expiration Date | Second Largest Tenant |

| 21, 26, 27 | 26, 27 | 26, 27 | 6, 26, 27 | 26, 27 | ||||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | No | Macy's | 390,503 | 18.8% | 8/18/2026 | Walmart |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | ||||||

| 2.01 | Property | 1 | 401-405 Colorado | No | Bain & Company, Inc. | 50,423 | 24.5% | 11/30/2034 | JPMorgan Chase Bank, National Association | |

| 2.02 | Property | 1 | 1900 Market | No | Independence Blue Cross, LLC | 227,974 | 49.9% | 4/16/2034 | 1900 Market Street Tenant LLC dba WeWork | |

| 2.03 | Property | 1 | The Bulletin Building | No | Spark Therapeutics, Inc. | 183,208 | 64.8% | 12/31/2033 | Drexel University | |

| 2.04 | Property | 1 | Four Points Centre 3 | Yes | SailPoint Technologies, Inc. | 164,818 | 100.0% | 4/30/2029 | NAP | |

| 2.05 | Property | 1 | 500 North Gulph | Yes | CSL Behring L.L.C. | 100,820 | 100.0% | 1/31/2031 | NAP | |

| 2.06 | Property | 1 | Metroplex – PA | No | Bill Me Later, Inc. | 99,512 | 82.3% | 1/31/2031 | United HealthCare Services, Inc. | |

| 2.07 | Property | 1 | 933 First Avenue | Yes | Worldwide Insurance Services, LLC | 111,053 | 100.0% | 5/31/2029 | NAP | |

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | Yes | Transform Manteno Warehouse Operations, LLC. | 1,546,575 | 100.0% | 12/31/2037 | NAP |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | No | Government of the DC | 164,642 | 58.0% | 2/28/2029 | GSA-Federal Election Commission |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | No | Century Theaters | 57,372 | 15.6% | 12/18/2025 | Sportsman's Warehouse |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | No | Alexander McQueen | 6,262 | 66.8% | 7/31/2034 | Jaeger-LeCoultre |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | NAP | NAP | NAP | NAP | NAP | NAP |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | No | Estee Lauder | 64,122 | 36.3% | 3/31/2025 | Prada USA Corp. |

| 9 | Loan | 11 | 2 | Clifton Industrial | ||||||

| 9.01 | Property | 1 | 10 Clifton Boulevard | No | Polymer Technologies | 85,976 | 59.6% | 12/31/2026 | Stanley Steamer | |

| 9.02 | Property | 1 | 200 Clifton Boulevard | No | Dempsey Uniform | 47,300 | 32.7% | 11/30/2033 | Gotham Cleaners | |

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | ||||||

| 10.01 | Property | 1 | 237 East 34th Street | NAP | NAP | NAP | NAP | NAP | NAP | |

| 10.02 | Property | 1 | 114 West 86th Street | NAP | NAP | NAP | NAP | NAP | NAP | |

| 11 | Loan | 10, 18, 36 | 1 | Hyatt Regency Jacksonville | NAP | NAP | NAP | NAP | NAP | NAP |

| 12 | Loan | 9, 10, 18, 19, 22, 27, 28 | 1 | Metroplex | No | County of Los Angeles | 66,644 | 15.9% | 2/3/2025 | New York Life Insurance Company |

| 13 | Loan | 18, 27, 29 | 1 | Ontario Airport Tower | No | West Coast University | 66,172 | 44.8% | 1/31/2029 | CU Direct Corp |

| 14 | Loan | 10, 11, 12, 22, 31, 35 | 6 | Centers of High Point | ||||||

| 14.01 | Property | 1 | Center Point of Hamilton | No | Hillsdale Furniture | 34,408 | 14.5% | 10/1/2023 | Behold Home | |

| 14.02 | Property | 1 | Center Point on Centennial | No | Jonathan Louis | 34,907 | 30.0% | 4/1/2025 | International Furniture Direct | |

| 14.03 | Property | 1 | Center Point on Manning | No | Liberty Furniture | 77,930 | 98.9% | 10/1/2028 | NAP | |

| 14.04 | Property | 1 | Center Point on Russell | No | Vogue | 19,618 | 57.3% | 10/1/2024 | Alan White Manufacturing | |

| 14.05 | Property | 1 | Center Point on Field House | No | Pelican Reef | 7,200 | 50.0% | 10/1/2024 | NAP | |

| 14.06 | Property | 1 | Center Point 212 | Yes | Planned Furniture Promotions | 498 | 100.0% | 4/1/2024 | NAP | |

| 15 | Loan | 13, 18, 28, 29 | 1 | Foothill Plaza | No | Kaiser Aluminum & Chemical | 36,338 | 17.2% | 12/31/2024 | US Real Estate Svc |

| 16 | Loan | 18, 24, 35 | 1 | Baricelli Little Italy | NAP | NAP | NAP | NAP | NAP | NAP |

| 17 | Loan | 20, 35 | 1 | Tesla Long Beach | No | Tesla, Inc | 33,092 | 99.0% | 1/31/2032 | EV Certified Auto Sales |

| 18 | Loan | 18, 26, 27 | 1 | Network Crossing | No | Chenega Corporation | 45,220 | 31.4% | Various | LHC Group Inc |

| 19 | Loan | 9, 10, 12, 18, 22 | 1 | Essex Crossing | No | NYU Hospital Center | 55,845 | 92.5% | 1/31/2034 | Wells Fargo Bank, N.A. |

| 20 | Loan | 12 | 1 | ECD Lincolnshire | NAP | Wildfire | 8,733 | 60.7% | 6/30/2029 | Big Bowl |

| 21 | Loan | 18 | 1 | Rockwell Chicago | Yes | Cenveo Corporation | 195,467 | 100.0% | 12/31/2026 | NAP |

| 22 | Loan | 20, 24, 30 | 1 | Holiday Inn Express Van Nuys | NAP | NAP | NAP | NAP | NAP | NAP |

| 23 | Loan | 11, 21, 26, 32 | 5 | Sequoia Portfolio | ||||||

| 23.01 | Property | 1 | 2959 West 47th Street | No | ING Logistics | 108,900 | 56.0% | 9/30/2026 | America Mattress Group, Inc | |

| 23.02 | Property | 1 | 4725 South Talman Avenue | No | Qasri Hills, Inc. | 10,625 | 39.8% | 11/30/2032 | Madina Traders | |

| 23.03 | Property | 1 | 4030 South Archer Avenue | No | Villegas Furniture II, Inc. | 15,000 | 50.0% | 4/30/2029 | Bright Wash and Detail, Inc | |

| 23.04 | Property | 1 | 2525 South Artesian Avenue | No | American Business College, Inc | 25,000 | 77.6% | 2/28/2029 | Sky Express, Inc. | |

| 23.05 | Property | 1 | 4013 South Archer Avenue | Yes | Mitch Auto Sales | 13,653 | 100.0% | 4/30/2024 | NAP | |

| 24 | Loan | 20, 30 | 1 | Hilton Garden Inn McAllen Airport | NAP | NAP | NAP | NAP | NAP | NAP |

| 25 | Loan | 9, 10, 12, 18, 22, 29, 30, 31, 33 | 1 | Park West Village | NAP | NAP | NAP | NAP | NAP | NAP |

| 26 | Loan | 1 | Cityline Kangaroo Storage | NAP | NAP | NAP | NAP | NAP | NAP |

| A-1-11 |

FIVE 2023-V1 Annex A-1

| Loan ID Number | Loan / Property Flag | Footnotes (for Loan and Property Information) | # of Properties | Property Name | Second Largest Tenant SF | Second Largest Tenant % of NRA | Second Largest Tenant Lease Expiration Date | Third Largest Tenant | Third Largest Tenant SF | Third Largest Tenant % of NRA | Third Largest Tenant Lease Expiration Date |

| 26, 27 | 26, 27 | 6, 26, 27 | 26, 27 | 26, 27 | 26, 27 | 6, 26, 27 | |||||

| 1 | Loan | 9, 10, 13, 16, 19, 22, 23, 24, 26, 28, 30, 32, 34, 36 | 1 | Green Acres | 173,450 | 8.3% | 8/31/2028 | SEARS | 144,537 | 6.9% | 10/31/2028 |

| 2 | Loan | 9, 10, 11, 18, 20, 23, 24, 27, 28, 31, 32 | 7 | Brandywine Strategic Office Portfolio | |||||||

| 2.01 | Property | 1 | 401-405 Colorado | 45,100 | 21.9% | 12/31/2032 | Snap Inc. | 18,739 | 9.1% | 5/31/2033 | |

| 2.02 | Property | 1 | 1900 Market | 56,050 | 12.3% | 11/30/2037 | Pennoni Associates Inc. | 55,846 | 12.2% | 3/31/2029 | |

| 2.03 | Property | 1 | The Bulletin Building | 57,461 | 20.3% | 10/31/2027 | BDN SY Hospitality, LLC | 13,163 | 4.7% | 11/30/2031 | |

| 2.04 | Property | 1 | Four Points Centre 3 | NAP | NAP | NAP | NAP | NAP | NAP | NAP | |

| 2.05 | Property | 1 | 500 North Gulph | NAP | NAP | NAP | NAP | NAP | NAP | NAP | |

| 2.06 | Property | 1 | Metroplex – PA | 9,431 | 7.8% | 6/30/2026 | NAP | NAP | NAP | NAP | |

| 2.07 | Property | 1 | 933 First Avenue | NAP | NAP | NAP | NAP | NAP | NAP | NAP | |

| 3 | Loan | 25, 30, 34, 35 | 1 | 3PL Distribution Center | NAP | NAP | NAP | NAP | NAP | NAP | NAP |

| 4 | Loan | 10, 22 | 1 | Sentinel Square II | 99,677 | 35.1% | 11/30/2032 | LA LUXE DENTAL, PLLC | 1,575 | 0.6% | 5/31/2031 |

| 5 | Loan | 13, 18, 23, 30 | 1 | Blue Oaks Town Center | 56,698 | 15.5% | 11/30/2026 | Hobby Lobby | 51,257 | 14.0% | 7/31/2032 |

| 6 | Loan | 18, 27, 28, 30 | 1 | 428-430 North Rodeo | 3,106 | 33.2% | 8/31/2031 | NAP | NAP | NAP | NAP |

| 7 | Loan | 20, 30, 35, 36 | 1 | Palm Glade Apartments | NAP | NAP | NAP | NAP | NAP | NAP | NAP |

| 8 | Loan | 9, 10, 12, 13, 22, 24, 27, 28, 30 | 1 | 575 Broadway | 30,079 | 17.0% | 1/31/2035 | Valor Management LLC | 12,990 | 7.4% | 8/31/2033 |

| 9 | Loan | 11 | 2 | Clifton Industrial | |||||||

| 9.01 | Property | 1 | 10 Clifton Boulevard | 20,162 | 14.0% | 3/31/2027 | Precise Components | 13,695 | 9.5% | 5/31/2027 | |

| 9.02 | Property | 1 | 200 Clifton Boulevard | 27,787 | 19.2% | 6/30/2031 | Sunbelt Rentals | 23,000 | 15.9% | 11/30/2028 | |

| 10 | Loan | 10, 11, 12, 22, 23, 30, 36 | 2 | Gilardian NYC Portfolio | |||||||

| 10.01 | Property | 1 | 237 East 34th Street | NAP | NAP | NAP | NAP | NAP | NAP | NAP | |