| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-206705-13 | ||

May 1, 2018

FREE WRITING PROSPECTUS

STRUCTURAL AND COLLATERAL TERM SHEET

$1,006,082,811

(Approximate Total Mortgage Pool Balance)

$861,458,000

(Approximate Offered Certificates)

|

COMM 2018-COR3 |

Deutsche Mortgage & Asset Receiving Corporation

Depositor

German American Capital Corporation

LoanCore Capital Markets LLC

Citi Real Estate Funding Inc.

JPMorgan Chase Bank, National Association

Sponsors and Mortgage Loan Sellers

|

|

|

|

Co-Lead Managers and Joint Bookrunners | ||

| Jefferies | Academy Securities | |

|

Co-Manager | ||

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-206705) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission website at www.sec.gov. Alternatively, the depositor or Deutsche Bank Securities Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-503-4611 or by emailing: prospectus.cpdg@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us. This free writing prospectus does not contain all information that is required to be included in the prospectus.

|

COMM 2018-COR3 Mortgage Trust

Capitalized terms used but not defined herein have the meanings assigned to them in the Preliminary Prospectus expected to be dated April 30, 2018 relating to the offered certificates (hereinafter referred to as the “Preliminary Prospectus”).

|

| KEY FEATURES OF SECURITIZATION |

| Offering Terms: | |

| Co-Lead Managers and Joint Bookrunners: | Deutsche Bank Securities Inc., Citigroup Global Markets Inc. and J.P. Morgan Securities LLC |

| Co-Manager: | Jefferies LLC and Academy Securities, Inc. |

| Mortgage Loan Sellers: | German American Capital Corporation* (“GACC”) (22.4%), LoanCore Capital Markets LLC (“LCM”) (64.0%), Citi Real Estate Funding Inc. (“CREFI”) (8.1%) and JPMorgan Chase Bank, National Association (“JPMCB”) (5.5%) and *An indirect wholly owned subsidiary of Deutsche Bank AG |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association (“Midland Loan Services”) |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| Special Servicer: | Midland Loan Services |

| Certificate Administrator: | Wells Fargo Bank, National Association (“Wells Fargo”) |

| Trustee: | Wilmington Trust, National Association |

| Rating Agencies: | Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, Inc. (“KBRA”) |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements are being satisfied by LCM, as retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. Note that this securitization transaction is not structured to satisfy the EU risk retention and due diligence requirements. |

| Determination Date: | 6th day of each month, or if such 6th day is not a business day, the immediately following business day, commencing in June 2018. |

| Distribution Date: | 4th business day following the Determination Date in each month, commencing in June 2018. |

| Cut-off Date: | With respect to each mortgage loan, the later of the related payment date of such mortgage loan in May 2018 (or, in the case of any mortgage loan that has its first due date subsequent to May 2018, the date that would have been its due date in May 2018 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) and the date of origination of such mortgage loan. Unless otherwise noted, all mortgage loan statistics are based on balances as of the Cut-off Date. |

| Closing Date: | On or about May 22, 2018 |

| Settlement Terms: | DTC, Euroclear and Clearstream, same day funds, with accrued interest. |

| ERISA Eligible: | All of the Offered Certificates are expected to be ERISA eligible. |

| SMMEA Eligible: | None of the Offered Certificates will be SMMEA eligible. |

| Day Count: | 30/360 |

| Tax Treatment: | REMIC |

| Rated Final Distribution Date: | May 2051 |

| Minimum Denominations: | $10,000 (for offered principal balance certificates) and $100,000 (for Class X-A Certificates) and in each case in multiples of $1 thereafter. |

| Clean-up Call: | 1% (with certain exceptions described under “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus) |

| Distribution of Collateral by Property Type |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

COMM 2018-COR3 Mortgage Trust

|

| TRANSACTION HIGHLIGHTS |

| Mortgage Loan Sellers | Number of Mortgage Loans |

Number of Mortgaged Properties |

Aggregate Cut-off Date Balance |

%

of Initial Pool Balance |

| LoanCore Capital Markets LLC | 24 | 27 | $572,718,334 | 56.9% |

| German American Capital Corporation | 4 | 4 | $154,194,472 | 15.3% |

| LoanCore Capital Markets LLC/German American Capital Corporation | 2 | 2 | $142,000,000 | 14.1% |

| Citi Real Estate Funding Inc. | 8 | 8 | $81,810,094 | 8.1% |

| JPMorgan Chase Bank, National Association | 3 | 3 | $55,359,912 | 5.5% |

| Total: | 41 | 44 | $1,006,082,811 | 100.0% |

|

Pooled Collateral Facts: |

|

| Initial Outstanding Pool Balance: | $1,006,082,811 |

| Number of Mortgage Loans: | 41 |

| Number of Mortgaged Properties: | 44 |

| Average Mortgage Loan Cut-off Date Balance: | $24,538,605 |

| Average Mortgaged Property Cut-off Date Balance: | $22,865,518 |

| Weighted Average Mortgage Rate: | 4.5764% |

| Weighted Average Mortgage Loan Original Term to Maturity Date or ARD (months)(1): | 121 |

| Weighted Average Mortgage Loan Remaining Term to Maturity Date or ARD (months)(1): | 117 |

| Weighted Average Mortgage Loan Seasoning (months): | 4 |

| % of Mortgaged Properties Leased to a Single Tenant: | 29.5% |

Credit Statistics(2): |

|

| Weighted Average Mortgage Loan U/W NCF DSCR: | 2.05x |

| Weighted Average Mortgage Loan Cut-off Date LTV(3): | 56.9% |

| Weighted Average Mortgage Loan Maturity Date or ARD LTV(1)(3): | 55.0% |

| Weighted Average U/W NOI Debt Yield: | 10.5% |

Amortization Overview: |

|

| % Mortgage Loans which pay Interest Only through Maturity Date or ARD(1): | 80.3% |

| % Mortgage Loans which pay Interest Only followed by Amortization through Maturity Date or ARD(1): | 10.6% |

| % Mortgage Loans with Amortization through Maturity Date or ARD(1): | 9.1% |

| Weighted Average Remaining Amortization Term (months)(4): | 359 |

Loan Structural Features: |

|

| % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 72.1% |

| % Mortgage Loans with Upfront or Ongoing Replacement Reserves(5): | 64.7% |

| % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 51.4% |

| % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(6): | 84.7% |

| % Mortgage Loans with Upfront Engineering Reserves: | 32.6% |

| % Mortgage Loans with Upfront or Ongoing Other Reserves: | 45.8% |

| % Mortgage Loans with In Place Hard Lockboxes: | 78.7% |

| % Mortgage Loans with Cash Traps Triggered at Debt Yield ≥ 5.6%: | 59.7% |

| % Mortgage Loans with Cash Traps Triggered at DSCR Levels ≥ 1.10x: | 35.8% |

| % Mortgage Loans with Defeasance Only After a Lockout Period and Prior to an Open Period: | 99.1% |

| % Mortgage Loans with Prepayment Only After a Lockout Period and Prior to an Open Period with a Yield Maintenance Charge: | 0.9% |

| (1) | With respect to the 1001 North Shoreline Boulevard Mortgage Loan (the “ARD Loan”), the Original Term to Maturity Date or ARD, Remaining Term to Maturity Date or ARD and Maturity Date or ARD LTV are calculated through the related anticipated repayment date. |

| (2) | The LTV, DSCR and Debt Yield calculations include any related pari passu companion loan(s) and exclude any related subordinate companion loan(s) and/or mezzanine loan(s). |

| (3) | With respect to four Mortgage Loans, in aggregate, representing approximately 12.3% of the Initial Outstanding Pool Balance (including 1001 North Shoreline Boulevard, Shoreline Center, Fairfield Inn Charleston Airport and Maple Ridge Plaza), the Cut-off Date LTV and Maturity Date or ARD LTV has been calculated based on other than “As Is” appraised values. For additional information please see the footnotes to Annex A-1 in the Preliminary Prospectus. |

| (4) | Excludes mortgage loans which are interest only for the full loan term. |

| (5) | Includes FF&E reserves. |

| (6) | Represents the percent of the allocated Initial Outstanding Pool Balance of office, retail, mixed use and industrial properties only. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

OFFERED CERTIFICATES

| Class(1) | Ratings (Moody’s/Fitch/KBRA) |

Initial Certificate Balance or Notional |

Initial |

Weighted Average Life (years)(3) |

Principal Window (months)(3) |

Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |||||||||

| Class A-1 | Aaa(sf)/AAAsf/AAA(sf) | $11,703,000 | 30.000%(7) | 2.88 | 1 – 61 | 39.8% | 15.0% | |||||||||

| Class A-SB | Aaa(sf)/AAAsf/AAA(sf) | $17,303,000 | 30.000%(7) | 7.36 | 61 – 115 | 39.8% | 15.0% | |||||||||

| Class A-2 | Aaa(sf)/AAAsf/AAA(sf) | (6) | 30.000%(7) | (6) | (6) | 39.8% | 15.0% | |||||||||

| Class A-3 | Aaa(sf)/AAAsf/AAA(sf) | (6) | 30.000%(7) | (6) | (6) | 39.8% | 15.0% | |||||||||

| Class X-A(8) | Aa1(sf)/AAAsf/AAA(sf) | $760,850,000 | (9) | N/A | N/A | N/A | N/A | N/A | ||||||||

| Class A-M | Aa2(sf)/AAAsf/AAA(sf) | $56,593,000 | 24.375% | 9.88 | 119 – 119 | 43.0% | 13.9% | |||||||||

| Class B | NR/AA-sf/AA(sf) | $51,561,000 | 19.250% | 9.88 | 119 – 119 | 45.9% | 13.0% | |||||||||

| Class C | NR/A-sf/A-(sf) | $49,047,000 | 14.375% | 9.88 | 119 – 119 | 48.7% | 12.3% | |||||||||

NON-OFFERED CERTIFICATES

| Class(1) | Ratings (Moody’s/Fitch/KBRA) |

Initial Certificate Balance or Notional Amount(2) |

Initial Subordination |

Weighted Average Life (years)(3) |

Principal Window (months)(3) |

Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |||||||||

| Class X-B(8) | NR/AA-sf/AAA(sf) | $51,561,000 | (9) | N/A | N/A | N/A | N/A | N/A | ||||||||

| Class X-D(8) | NR/BBB-sf/BBB-(sf) | $47,340,000 | (9) | N/A | N/A | N/A | N/A | N/A | ||||||||

| Class D | NR/BBB-sf/BBB-(sf) | $47,340,000 | (10) | 9.670% | 9.93 | 119 – 120 | 51.4% | 11.6% | ||||||||

| Class E-RR(11) | NR/BBB-sf/BBB-(sf) | $11,767,000 | (10) | 8.500% | 9.97 | 120 – 120 | 52.1% | 11.5% | ||||||||

| Class F-RR(11) | NR/BBsf/BB-(sf) | $20,122,000 | 6.500% | 9.97 | 120 – 120 | 53.2% | 11.2% | |||||||||

| Class G-RR(11) | NR/B-sf/B-(sf) | $18,864,000 | 4.625% | 9.97 | 120 – 120 | 54.3% | 11.0% | |||||||||

| Class H-RR(11) | NR/NR/NR | $46,531,811 | 0.000% | 9.97 | 120 – 120 | 56.9% | 10.5% | |||||||||

| (1) | The pass-through rates applicable to the Class A-1, Class A-SB, Class A-2, Class A-3, Class A-M, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates (the “Principal Balance Certificates”) will equal one of: (i) a fixed per annum rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related Distribution Date occurs (the “WAC” Rate”), (iii) a rate equal to the lesser of a specified pass-through rate and the WAC Rate or (iv) the WAC Rate less a specified rate. |

| (2) | Approximate; subject to a permitted variance of plus or minus 5%. |

| (3) | The weighted average life and principal window during which distributions of principal would be received as set forth in the table with respect to each class of Principal Balance Certificates is based on (i) modeling assumptions described in the Preliminary Prospectus, (ii) assumptions that there are no prepayments, delinquencies or losses on the mortgage loans and (iii) assumptions that there are no extensions of maturity dates and mortgage loans with anticipated repayment dates, if any, are repaid on the respective anticipated repayment dates. |

| (4) | “Certificate Principal to Value Ratio” for any class of Principal Balance Certificates is calculated as the product of (a) the weighted average mortgage loan Cut-off Date LTV of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of the related class of Principal Balance Certificates and all other classes of Principal Balance Certificates, if any, that are senior to such class, and the denominator of which is the total initial Certificate Balance of all classes of Principal Balance Certificates. The Certificate Principal to Value Ratios of the Class A-1, Class A-SB, Class A-2 and Class A-3 certificates are calculated in the aggregate for those classes as if they were a single class. |

| (5) | “Underwritten NOI Debt Yield” for any class of Principal Balance Certificates is calculated as the product of (a) the weighted average Underwritten NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance of the such class of Principal Balance Certificates and all other classes of Principal Balance Certificates, if any, that are senior to such class. The Underwritten NOI Debt Yields of the Class A-1, Class A-SB, Class A-2 and Class A-3 certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | The exact initial Certificate Balances of the Class A-2 and Class A-3 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial Certificate Balances, weighted average lives and principal windows of the Class A-2 and Class A-3 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-2 and Class A-3 certificates is expected to be approximately $675,251,000, subject to a variance of plus or minus 5.0%. |

| Class of Certificates | Expected Range of Initial Certificate Balance | Expected Range of Weighted Avg. Life (years) | Principal Window (months) |

| Class A-2 | $100,000,000 - $303,000,000 | 9.20 - 9.42 | 109 - 113 / 109 - 117 |

| Class A-3 | $372,251,000 - $575,251,000 | 9.83 - 9.73 | 117 - 119 / 113 - 119 |

| (7) | The initial subordination levels for the Class A-1, Class A-SB, Class A-2 and Class A-3 certificates are represented in the aggregate. |

| (8) | As further described in the Preliminary Prospectus, the pass-through rate applicable to the Class X-A, Class X-B and Class X-D certificates (collectively, the “Class X Certificates” and, together with the Principal Balance Certificates, the “Regular Certificates”) for each Distribution Date will generally be equal to the excess of (i) the WAC Rate over (ii)(A) with respect to the Class X-A certificates, the weighted average of the pass-through rates of the Class A-1, Class A-SB, Class A-2, Class A-3 and Class A-M certificates (based on their Certificate Balances), (B) with respect to the Class X-B certificates, the pass-through rate of the Class B certificates and (C) with respect to the Class X-D certificates, the pass-through rate of the Class D certificates. |

| (9) | The Class X Certificates will not have Certificate Balances. None of the Class X Certificates will be entitled to distributions of principal. The interest accrual amounts on the Class X-A certificates will be calculated by reference to a notional amount equal to the sum of the Certificate Balances of each of the Class A-1, Class A-SB, Class A-2, Class A-3 and Class A-M certificates. The interest accrual amounts on the Class X-B certificates will be calculated by reference to a notional amount equal to the Certificate Balance of the Class B certificates. The interest accrual amounts on the Class X-D certificates will be calculated by reference to a notional amount equal to the Certificate Balance of the Class D certificates. The notional amount of each class of the Class X Certificates is subject to change depending upon the final pricing of the Principal Balance Certificates, as follows: (1) if as a result of such pricing the pass-through rate of any class of Principal Balance Certificates whose Certificate Balance comprises such notional amount is equal to the WAC Rate, the Certificate Balance of such class of Principal Balance Certificates may not be part of, and will reduce accordingly, such notional amount of the related Class X Certificates (or, if as a result of such pricing the pass-through rate of the related Class X Certificates is equal to zero, such Class X Certificates may not be issued on the Closing Date), and/or (2) if as a result of such pricing the pass-through rate of any class of Principal Balance Certificates that does not comprise such notional amount of the related Class X Certificates is equal to less than the WAC Rate, such class of Principal Balance Certificates may become a part of, and will increase accordingly, such notional amount of the related Class X Certificates. |

| (10) | The approximate initial Certificate Balance of each of the Class D and Class E-RR certificates is subject to change based on final pricing of all classes of Principal Balance Certificates and Class X Certificates, with the ultimate initial Certificate Balance of the Class D and Class E-RR certificates determined such that, upon initial issuance the aggregate fair value of the RR Certificates (as defined below) will equal at least 5% of the fair value of all classes of Principal Balance Certificates and Class X Certificates. |

| (11) | The Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates (collectively, the “RR Certificates”) are expected to be retained by LoanCore Capital Markets LLC, as “retaining sponsor”, or its “majority-owned affiliate” (in each case as defined in the credit risk retention rules) in accordance with the credit risk retention rules applicable to this securitization transaction. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the RR Certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

| Principal Payments: |

Payments in respect of principal on the certificates will be distributed, first, to the Class A-SB certificates, until the Certificate Balance of such class is reduced to the planned principal balance for the related Distribution Date set forth on Annex G to the Preliminary Prospectus, then, to the Class A-1, Class A-2, Class A-3, Class A-SB, Class A-M, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates, in that order, until the Certificate Balance of each such class is reduced to zero. Notwithstanding the foregoing, if the total Certificate Balance of the Class A-M, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates have been reduced to zero as a result of loss allocation, payments in respect of principal of the certificates will be distributed, first, to the Class A-1, Class A-SB, Class A-2 and Class A-3 certificates, on a pro rata basis, based on the Certificate Balance of each such class, then, to the extent of any recoveries on realized losses, to the Class A-M, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates, in that order, in each case until the Certificate Balance of each such class is reduced to zero (or previously allocated realized losses have been fully reimbursed).

Each class of Class X Certificates will not be entitled to receive distributions of principal; however, (i) the notional amount of the Class X-A certificates will be reduced by the aggregate amount of principal distributions and realized losses allocated to the Class A-1, Class A-SB, Class A-2, Class A-3 and Class A-M certificates; (ii) the notional amount of the Class X-B certificates will be reduced by the principal distributions and realized losses allocated to the Class B certificates; and (iii) the notional amount of the Class X-D certificates will be reduced by the principal distributions and realized losses allocated to the Class D certificates.

|

|

| Interest Payments: |

On each Distribution Date, interest accrued for each class of certificates at the applicable pass-through rate will be distributed in the following order of priority, to the extent of available funds (exclusive of any portion thereof that represents (i) any yield maintenance charges and prepayment premiums and/or (ii) any excess interest accrued after the related anticipated repayment date on any mortgage loan with an anticipated repayment date): first, to the Class A-1, Class A-SB, Class A-2, Class A-3, Class X-A, Class X-B and Class X-D certificates, on a pro rata basis, based on the accrued and unpaid interest on each such class and then, to the Class A-M, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates, in that order, in each case until the interest payable to each such class is paid in full.

The pass-through rates applicable to the Class A-1, Class A-SB, Class A-2, Class A-3, Class A-M, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates for each Distribution Date will equal one of: (i) a fixed per annum rate, (ii) the WAC Rate, (iii) a rate equal to the lesser of a specified pass-through rate and the WAC Rate or (iv) the WAC Rate less a specified rate.

As further described in the Preliminary Prospectus, the pass-through rates applicable to the Class X Certificates for each Distribution Date will generally be equal to the excess of (i) the WAC Rate over (ii) (A) with respect to the Class X-A certificates, the weighted average of the pass-through rates of the Class A-1, Class A-SB, Class A-2, Class A-3 and Class A-M certificates (based on their Certificate Balances immediately prior to that Distribution Date), (B) with respect to the Class X-B certificates, the pass-through rate of the Class B certificates and (C) with respect to the Class X-D certificates, the pass-through rate of the Class D certificates.

|

|

| Prepayment Interest Shortfalls: |

Prepayment interest shortfalls will be allocated pro rata based on interest entitlements, in reduction of the interest otherwise payable with respect to each of the interest-bearing classes of certificates.

|

|

| Loss Allocation: |

Losses will be allocated to each class of the Principal Balance Certificates in reverse alphabetical order starting with Class H-RR through and including Class A-M and then to Class A-1, Class A-SB, Class A-2 and Class A-3 certificates on a pro rata basis based on the Certificate Balance of each such class. The notional amount of any class of Class X Certificates will be reduced by the aggregate amount of realized losses allocated to the class(es) of certificates that are component(s) of the notional amount of such class of Class X Certificates. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

|

Prepayment Premiums:

|

All prepayment premiums (either fixed prepayment premiums or yield maintenance amounts) collected on the Mortgage Loans will be allocated to each of the Class A-1, Class A-SB, Class A-2, Class A-3, Class A-M, Class B, Class C and Class D certificates (the “YM P&I Certificates”) then entitled to principal distributions, which percentage will be equal to the product of (a) a fraction, not greater than one, the numerator of which is the amount of principal distributed to such class on such Distribution Date and the denominator of which is the total amount of principal distributed to the holders of the Class A-1, Class A-SB, Class A-2, Class A-3, Class A-M, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates on such Distribution Date, and (b) a fraction (expressed as a percentage which can be no greater than 100% nor less than 0%), the numerator of which is the excess of the pass-through rate of each such class of certificates currently receiving principal over the relevant Discount Rate, and the denominator of which is the excess of the Mortgage Rate of the related Mortgage Loan over the relevant Discount Rate.

Prepayment Premium Allocation Percentage for all YM P&I Certificates = |

|

(Pass-Through Rate - Discount Rate) |

X |

The percentage of the principal distribution amount to such class as described in (a) above | |

| (Mortgage Rate - Discount Rate) |

|

The remaining percentage of the prepayment premiums will be allocated to the Class X-A, Class X-B and Class X-D certificates in the manner described in the Preliminary Prospectus. In general, this formula provides for an increase in the percentage of prepayment premiums allocated to the YM P&I Certificates then entitled to principal distributions relative to the Class X-A, Class X-B and Class X-D certificates as Discount Rates decrease and a decrease in the percentage allocated to such classes as Discount Rates rise.

|

||

| Whole Loans: |

The mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as 1001 North Shoreline Boulevard, Grand Hyatt Seattle, 315 West 36th Street, Atlantic Times Square and Lehigh Valley Mall each secure both a mortgage loan to be included in the trust fund and one or more other companion loans that will not be included in the trust fund, each of which will be pari passu and/or subordinate in right of payment with the mortgage loan included in the trust fund. We refer to each such group of related loans as a “whole loan”.

As of the Closing Date, the pari passu companion loans and the subordinate companion loans are expected to be held by the party identified below under “Companion Loan Summary”.

|

|

| Control Rights and Directing Certificateholder: |

Controlling Class Certificateholders will generally have certain control rights over servicing matters with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans (other than the 1001 North Shoreline Boulevard Mortgage Loan, the Atlantic Times Square Mortgage Loan and the related Companion Loans). The majority owner or appointed representative of the class of Control Eligible Certificates that is the Controlling Class will be entitled to direct the Special Servicer to take, or refrain from taking certain actions with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans (other than 1001 North Shoreline Boulevard Mortgage Loan, the Atlantic Times Square Mortgage Loan and the related Companion Loans), and the holder of the controlling note of the Atlantic Times Square Whole Loan will be entitled to direct the Special Servicer to take, or refrain from taking certain actions with respect to such Whole Loan (such holder, together with the majority owner or appointed representative of the Controlling Class, the “Directing Certificateholder”). Furthermore, the Directing Certificateholder will also have the right to receive notice and consent to certain material actions that the Master Servicer and the Special Servicer proposes to take with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans.

It is expected that LoanCore Capital Markets LLC or its affiliate will be the initial Directing Certificateholder with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans (other than 1001 North Shoreline Boulevard Mortgage Loan, the Atlantic Times Square Mortgage Loan and the related Serviced Companion Loans). It is expected that DBNY will be the initial Directing Certificateholder with respect to the 1001 North Shoreline Boulevard Mortgage Loan. It is expected that JPMCB will be the initial Directing Certificateholder with respect to the Atlantic Times Square Mortgage Loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

| For a description of the directing holder for each Non-Serviced Whole Loan, see “Description of the Mortgage Pool—The Whole Loans” and “Pooling and Servicing Agreement—The Directing Certificateholder” in the Preliminary Prospectus.

|

||

| Control Eligible Certificates: |

Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates.

|

|

| Controlling Class: |

The Controlling Class will be the most subordinate class of Control Eligible Certificates then outstanding that has an aggregate Certificate Balance, as notionally reduced by any appraisal reduction amounts and any collateral deficiency amounts allocable to such class, equal to at least 25% of the initial Certificate Balance of such class; provided that if at any time the Certificate Balances of all Control Eligible Certificates, as notionally reduced by any appraisal reduction amounts (but without regard to any collateral deficiency amounts) allocable to such classes, have been reduced to zero, then the “Controlling Class” will be the most subordinate class of Control Eligible Certificates that has an aggregate principal balance greater than zero; provided, further that if at any time the Certificate Balances of the Class A-1, Class A-SB, Class A-2, Class A-3, Class A-M, Class B, Class C and Class D certificates have been reduced to zero as a result of the allocation of principal payments on the Mortgage Loans, then the “Controlling Class” will be the most subordinate class of Control Eligible Certificates that has an aggregate Certificate Balance greater than zero (without regard to the application of appraisal reduction amounts or any collateral deficiency amounts to notionally reduce the Certificate Balance of such class).

The Controlling Class as of the Closing Date will be the Class H-RR certificates.

|

|

| Appraised-Out Class: |

Any class of Control Eligible Certificates that has been determined, as a result of appraisal reductions amounts and collateral deficiency amounts allocable to such class, to no longer be the Controlling Class.

|

|

| Remedies Available to Holders of an Appraised-Out Class: |

Holders of the majority of any class of Control Eligible Certificates that is determined at any time of determination to no longer be the Controlling Class as a result of an allocation of appraisal reduction amounts and collateral deficiency amounts in respect of such class will have the right, at their sole expense, to require the Special Servicer to order a second appraisal for any Serviced Mortgage Loan for which an appraisal reduction event has occurred or as to which there exists a collateral deficiency amount. Upon receipt of the second appraisal, the Special Servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of the second appraisal, a recalculation of the appraisal reduction amount or collateral deficiency amount is warranted. If warranted, the Special Servicer will direct the Master Servicer to recalculate the appraisal reduction amount or collateral deficiency amount based on the second appraisal, and if required by such recalculation, the Special Servicer will reinstate the Appraised-Out Class as the Controlling Class. The Holders of an Appraised-Out Class requesting a second appraisal will not be entitled to exercise any rights of the Controlling Class until such time, if any, as the class is reinstated as the Controlling Class.

|

|

| Control Termination Event: |

Will occur (other than with respect to the 1001 North Shoreline Boulevard Mortgage Loan or the Atlantic Times Square Mortgage Loan) when (i) the Class E-RR certificates have a Certificate Balance (taking into account the application of any appraisal reduction amounts and collateral deficiency amounts to notionally reduce the Certificate Balance of such class) of less than 25% of the initial Certificate Balance of that class or (ii) a holder of the Class E-RR certificates is the majority Controlling Class Certificateholder and has irrevocably waived its right, in writing, to exercise any of the rights of the Controlling Class Certificateholder and such rights have not been reinstated to a successor Controlling Class Certificateholder (subject to “—Controlling Class” above).

Upon the occurrence and the continuance of a Control Termination Event, the Directing Certificateholder will no longer have any control rights. The Directing Certificateholder will no longer have the right to direct certain actions of the Special Servicer and will no longer have consent rights with respect to certain material actions that the Master Servicer or Special Servicer proposes to take with respect to a Serviced Mortgage Loan and any related Serviced Companion Loans.

Upon the occurrence and continuation of a Control Termination Event, the Directing Certificateholder will retain non-binding consultation rights with respect to certain material actions that the Special Servicer proposes to take with respect to a Serviced Mortgage Loan |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

|

and any related Serviced Companion Loans. Such consultation rights will continue until the occurrence of a Consultation Termination Event.

|

||

| Consultation Termination Event: |

Will occur (other than with respect to the 1001 North Shoreline Boulevard Mortgage Loan or the Atlantic Times Square Mortgage Loan) when (i) there is no class of Control Eligible Certificates that has a then-outstanding Certificate Balance at least equal to 25% of the initial Certificate Balance of such class, in each case, without regard to the application of any appraisal reduction amounts and collateral deficiency amounts; or (ii) a holder of the Class E-RR certificates is the majority Controlling Class Certificateholder and has irrevocably waived its right, in writing, to exercise any of the rights of the Controlling Class Certificateholder and such rights have not been reinstated to a successor Controlling Class Certificateholder (subject to “—Controlling Class” above).

Upon the occurrence and continuance of a Consultation Termination Event, the Directing Certificateholder will have no rights under the PSA other than those rights that all Certificateholders have.

|

|

| Appointment and Replacement of Special Servicer: |

The Directing Certificateholder will appoint the initial Special Servicer with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans as of the Closing Date. Prior to the occurrence and continuance of a Control Termination Event, the Directing Certificateholder generally may replace the Special Servicer with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans with or without cause at any time.

Upon the occurrence and during the continuance of a Control Termination Event, the Directing Certificateholder will no longer have the right to replace the Special Servicer and such replacement (other than with respect to the Non-Serviced Whole Loans) will occur based on a vote of holders of all voting eligible classes of certificates as described below. See “Description of the Mortgage Pool—The Whole Loans” and “Pooling and Servicing Agreement” in the Preliminary Prospectus for a description of the special servicer appointment and replacement rights with respect to Non-Serviced Whole Loans.

|

|

| Replacement of Special Servicer by Vote of Certificateholders: |

Other than with respect to Non-Serviced Whole Loans, if a Control Termination Event has occurred and is continuing, upon (i) the written direction of holders of certificates evidencing not less than 25% of the voting rights of all classes of certificates entitled to principal (taking into account the application of appraisal reduction amounts to notionally reduce the Certificate Balances of classes to which such appraisal reduction amounts are allocable) requesting a vote to replace the Special Servicer with a replacement special servicer, (ii) payment by such requesting holders to the Certificate Administrator of all reasonable fees and expenses to be incurred by the Certificate Administrator in connection with administering such vote and (iii) delivery by such holders to the Certificate Administrator and Trustee of written confirmations from each Rating Agency that the appointment of the replacement Special Servicer will not result in a downgrade of the certificates, the Certificate Administrator will be required to promptly post notice of such request on the Certificate Administrator’s website and concurrently provide written notice of such request by mail to all Certificateholders of such request and conduct the solicitation of votes of all certificates in such regard. Upon the written direction (within 180 days) of (i) Holders of at least 66-2/3% of a Certificateholder Quorum or (ii) Holders of at least 50% of the voting rights of all classes of certificates entitled to principal, the Trustee will immediately replace the Special Servicer with the replacement Special Servicer (other than with respect to Non-Serviced Whole Loans).

“Certificateholder Quorum” means, in connection with any solicitation of votes in connection with the replacement of the Special Servicer as described above or the Asset Representations Reviewer as described below, the holders of certificates evidencing at least 50% of the aggregate voting rights (taking into account Realized Losses and, other than with respect to the termination of the Asset Representations Reviewer, the application of any appraisal reduction amounts to notionally reduce the Certificate Balance of the certificates) of all classes of Principal Balance Certificates, on an aggregate basis.

In addition, if at any time the Operating Advisor determines, in its sole discretion exercised in good faith, that (1) the Special Servicer is not performing its duties as required under the PSA or is otherwise not acting in accordance with the Servicing Standard and (2) the replacement of the Special Servicer would be in the best interest of the Certificateholders as a collective whole, then the Operating Advisor will have the right to recommend the replacement of the Special |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

Servicer. The Operating Advisor’s recommendation to replace the Special Servicer (other than with respect Non-Serviced Whole Loans) must be confirmed by a majority of the aggregate voting rights of all Principal Balance Certificates on an aggregate basis (taking into account the application of appraisal reduction amounts to notionally reduce the Certificate Balances of classes to which such appraisal reduction amounts are allocable) within 180 days from the time such recommendation is posted to the Certificate Administrator website and is subject to the receipt of written confirmations from each Rating Agency that the appointment of the replacement Special Servicer will not result in a downgrade of the certificates.

See “Description of the Mortgage Pool—The Whole Loans” and “Pooling and Servicing Agreement” in the Preliminary Prospectus for a description of the special servicer appointment and replacement rights with respect to Non-Serviced Whole Loans.

|

||

| Cap on Workout and Liquidation Fees: |

The workout fees and liquidation fees payable to a Special Servicer under the PSA will be an amount equal to the lesser of: (1) 1.0% of each collection of interest and principal following a workout or liquidation and (2) $1,000,000 per workout or liquidation. All Modification Fees actually paid to the Special Servicer in connection with a workout or liquidation or in connection with any prior workout or partial liquidation that occurred within the prior 18 months will be deducted from the total workout fee and/or liquidation fees payable (other than Modification Fees earned while the Mortgage Loan was not in special servicing). In addition, the total amount of workout and liquidation fees actually payable by the Trust under the PSA will be capped in the aggregate at $1,000,000 for each related Mortgage Loan. If a new special servicer begins servicing the related Mortgage Loan, all amounts paid to the prior special servicer will be disregarded for purposes of calculating the cap.

|

|

| Special Servicer Compensation: |

The special servicing fee will equal 0.25% per annum of the stated principal balance of the related specially serviced loan or REO property, as applicable. The Special Servicer and its affiliates will be prohibited from receiving or retaining any compensation or any other remuneration under the PSA (including, without limitation, in the form of commissions, brokerage fees, rebates, or as a result of any other fee-sharing arrangement) from any person (including, without limitation, the issuing entity, any borrower, any manager, any guarantor or indemnitor in respect of a Serviced Mortgage Loan and any related Serviced Companion Loans, if any, and any purchaser of any Serviced Mortgage Loan and any related Serviced Companion Loan or REO Property) in connection with the disposition, workout or foreclosure of any Serviced Mortgage Loan and any related Serviced Companion Loans, the management or disposition of any REO Property, or the performance of any other special servicing duties under the PSA, other than as expressly permitted in the PSA and other than commercially reasonable treasury management fees, banking fees, customary title agent fees and insurance commissions or fees received or retained by the Special Servicer or any of its Affiliates in connection with any services performed by such party with respect to any Mortgage Loan. Subject to certain limited exceptions, the Special Servicer will also be required to report any compensation or other remuneration the Special Servicer or its affiliates have received from any person and such information will be disclosed in the Certificateholders’ monthly distribution date statement.

|

|

| Operating Advisor: |

With respect to the Serviced Mortgage Loans and any related Serviced Companion Loans the Operating Advisor will have access to any final asset status report and all information available with respect to the transaction on the Certificate Administrator’s website and will have certain monitoring responsibilities on behalf of the entire trust. After the occurrence and during the continuance of an Operating Advisor Consultation Event, the Operating Advisor will have consultation rights with respect to certain major decisions.

The Operating Advisor will be subject to termination if holders of at least 15% of the aggregate voting rights of the certificates (in connection with termination and replacement relating to the Mortgage Loans) vote to terminate and replace the Operating Advisor and such vote is approved by holders of more than 50% of the applicable voting rights that exercise their right to vote (in the case of each of such vote and approval, taking into account Realized Losses and the application of any appraisal reduction amounts to notionally reduce the Certificate Balance of the certificates), provided that holders of at least 50% of the applicable voting rights have exercised their right to vote. The holders initiating such vote will be responsible for the fees and expenses in connection with the vote and replacement.

The Operating Advisor will not have consultation rights in respect of Non-Serviced Mortgage Loans. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

| Asset Representations Reviewer: |

The Asset Representations Reviewer will be required to review certain delinquent Mortgage Loans after a specified delinquency threshold has been exceeded and the required percentage of Certificateholders vote to direct a review of such delinquent Mortgage Loans. An asset review will occur when either (1) Mortgage Loans with an aggregate outstanding principal balance of 25% or more of the aggregate outstanding principal balance of all of the Mortgage Loans (including any REO loans (or a portion of any REO loan in the case of a whole loan)) held by the issuing entity as of the end of the applicable collection period are delinquent loans or (2)(A) prior to and including the second anniversary of the Closing Date, at least 10 Mortgage Loans are delinquent loans as of the end of the applicable collection period and the outstanding principal balance of such delinquent loans in the aggregate constitutes at least 15% of the aggregate outstanding principal balance of all of the Mortgage Loans (including any REO loans (or a portion of any REO loan in the case of a whole loan)) held by the issuing entity as of the end of the applicable collection period, or (B) after the second anniversary of the Closing Date, at least 15 Mortgage Loans are delinquent loans as of the end of the applicable collection period and the outstanding principal balance of such delinquent loans in the aggregate constitutes at least 20% of the aggregate outstanding principal balance of all of the Mortgage Loans (including any REO loans (or a portion of any REO loan in the case of a whole loan)) held by the issuing entity as of the end of the applicable collection period.

The Asset Representations Reviewer may be terminated and replaced without cause. Upon (i) the written direction of Certificateholders evidencing not less than 25% of the voting rights (taking into account Realized Losses, but without regard to the application of any appraisal reduction amounts to notionally reduce the Certificate Balance of the certificates) requesting a vote to terminate and replace the Asset Representations Reviewer with a proposed successor asset representations reviewer that is an eligible asset representations reviewer, and (ii) payment by such holders to the Certificate Administrator of the reasonable fees and expenses to be incurred by the Certificate Administrator in connection with administering such vote, the Certificate Administrator will promptly provide notice to all Certificateholders and the Asset Representations Reviewer of such request by posting such notice on its internet website, and by mailing such notice to all Certificateholders and the Asset Representations Reviewer. Upon the written direction of Certificateholders evidencing at least 75% of a Certificateholder Quorum, the Trustee will terminate all of the rights and obligations of the Asset Representations Reviewer under the PSA by written notice to the Asset Representations Reviewer, and the proposed successor Asset Representations Reviewer will be appointed. See “Pooling and Servicing Agreement—The Asset Representations Reviewer” in the Preliminary Prospectus. |

|

| Dispute Resolution Provisions: |

Each Mortgage Loan Seller will be subject to the dispute resolution provisions set forth in the PSA to the extent those provisions are triggered with respect to any Mortgage Loan sold to the depositor by such Mortgage Loan Seller and such Mortgage Loan Seller will be obligated under the related mortgage loan purchase agreement to comply with all applicable provisions and to take part in any mediation or arbitration proceedings that may result.

Generally, in the event that a repurchase request as described in the Preliminary Prospectus is not “Resolved” within 180 days after the related Mortgage Loan Seller receives such Repurchase Request, then the enforcing servicer will be required to send a notice to the initial requesting Certificateholder (if any) indicating the enforcing servicer’s intended course of action with respect to the Repurchase Request. If (a) the enforcing servicer’s intended course of action with respect to the Repurchase Request does not involve pursuing further action to exercise rights against the related Mortgage Loan Seller with respect to the Repurchase Request and the initial requesting Certificateholder, if any, or any other Certificateholder or Certificate Owner wishes to exercise its right to refer the matter to mediation (including nonbinding arbitration) or arbitration, or (b) the enforcing servicer’s intended course of action is to pursue further action to exercise rights against the related Mortgage Loan Seller with respect to the Repurchase Request but the initial requesting Certificateholder, if any, or any other Certificateholder or Certificate Owner does not agree with the dispute resolution method selected by the enforcing servicer, then the initial requesting Certificateholder, if any, or such other Certificateholder or Certificate Owner may deliver a written notice to the enforcing servicer indicating its intent to exercise its right to refer the matter to either mediation or arbitration.

“Resolved” means, with respect to a Repurchase Request, (i) that the related material defect has been cured, (ii) the related Mortgage Loan has been repurchased in accordance with the related mortgage loan purchase agreement, (iii) a mortgage loan has been substituted for the related Mortgage Loan in accordance with the related mortgage loan purchase agreement, (iv) the applicable Mortgage Loan Seller made the loss of value payment, (v) a contractually binding |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

|

COMM 2018-COR3 Mortgage Trust

|

| STRUCTURE OVERVIEW |

agreement is entered into between the enforcing servicer, on behalf of the issuing entity, and the related Mortgage Loan Seller that settles the related Mortgage Loan Seller’s obligations under the related mortgage loan purchase agreement, or (vi) the related Mortgage Loan is no longer property of the issuing entity as a result of a sale or other disposition in accordance with the PSA. See “Pooling and Servicing Agreement—Dispute Resolution Provisions” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

|

COMM 2018-COR3 Mortgage Trust

|

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Distribution of Cut-off Date Balances(1) | |||||||||||

| Range of Cut-off Date Balances | Number of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Pool |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| $4,030,000 | - | $7,499,999 | 7 | $39,256,012 | 3.9% | 4.7194% | 118 | 1.74x | 64.3% | 58.1% | |

| $7,500,000 | - | $14,999,999 | 15 | $164,101,828 | 16.3% | 4.8355% | 117 | 2.17x | 58.1% | 53.5% | |

| $15,000,000 | - | $24,999,999 | 6 | $119,230,500 | 11.9% | 4.7192% | 116 | 1.62x | 65.8% | 63.3% | |

| $25,000,000 | - | $49,999,999 | 7 | $262,544,472 | 26.1% | 4.5119% | 116 | 1.78x | 59.7% | 57.3% | |

| $50,000,000 | - | $100,000,000 | 6 | $420,950,000 | 41.8% | 4.4617% | 118 | 2.32x | 51.4% | 51.4% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

| Distribution of Mortgage Rates(1) | |||||||||||

| Range of Mortgage Rates | Number of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| 3.4649% | - | 3.9999% | 1 | $64,450,000 | 6.4% | 3.4649% | 119 | 3.52x | 37.7% | 37.7% | |

| 4.0000% | - | 4.2499% | 3 | $171,744,472 | 17.1% | 4.1337% | 117 | 2.40x | 51.7% | 50.1% | |

| 4.2500% | - | 4.4999% | 5 | $98,900,000 | 9.8% | 4.3672% | 116 | 2.05x | 63.6% | 62.5% | |

| 4.5000% | - | 4.7499% | 14 | $292,356,068 | 29.1% | 4.6384% | 116 | 1.93x | 55.1% | 53.1% | |

| 4.7500% | - | 4.9999% | 10 | $230,308,122 | 22.9% | 4.8711% | 119 | 1.89x | 59.6% | 57.7% | |

| 5.0000% | - | 5.3680% | 8 | $148,324,150 | 14.7% | 5.1312% | 118 | 1.48x | 65.9% | 62.5% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

| Property Type Distribution(1) | ||||||||||||

| Property Type | Number of Mortgaged Properties |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Number

of Rooms/Units/NRA /Spaces |

Weighted Averages | |||||||

Cut-off

Date Rooms/Units/ NRA/Space |

Mortgage Rate |

Stated Term |

Occupancy | U/W

NCF DSCR |

Cut-off Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | ||||||

| Retail | 14 | $198,837,285 | 19.8% | 1,347,437 | $529 | 4.5436% | 115 | 95.7% | 1.67x | 61.4% | 56.6% | |

| Anchored(5) | 14 | $198,837,285 | 19.8% | 1,347,437 | $529 | 4.5436% | 115 | 95.7% | 1.67x | 61.4% | 56.6% | |

| Office | 8 | $197,909,912 | 19.7% | 690,491 | $443 | 4.2382% | 118 | 97.9% | 2.34x | 54.6% | 53.2% | |

| Suburban | 4 | $126,300,000 | 12.6% | 374,616 | $435 | 4.0178% | 118 | 99.3% | 2.79x | 50.8% | 49.4% | |

| CBD | 3 | $68,309,912 | 6.8% | 305,663 | $460 | 4.6306% | 118 | 95.1% | 1.52x | 61.5% | 60.2% | |

| Medical | 1 | $3,300,000 | 0.3% | 10,212 | $378 | 4.5540% | 112 | 100.0% | 2.16x | 55.4% | 55.4% | |

| Hospitality | 6 | $191,985,848 | 19.1% | 1,507 | $206,398 | 4.8629% | 116 | 85.3% | 2.44x | 50.9% | 50.2% | |

| Full Service | 5 | $179,500,000 | 17.8% | 1,405 | $212,240 | 4.8311% | 116 | 85.8% | 2.49x | 49.8% | 49.8% | |

| Limited Service | 1 | $12,485,848 | 1.2% | 102 | $122,410 | 5.3200% | 119 | 78.1% | 1.61x | 66.4% | 55.2% | |

| Mixed Use | 8 | $189,480,000 | 18.8% | 901,043 | $349 | 4.8496% | 118 | 97.2% | 1.67x | 63.6% | 63.0% | |

| Office/Retail/Parking | 1 | $65,500,000 | 6.5% | 130,218 | $503 | 5.0660% | 117 | 100.0% | 1.29x | 68.9% | 68.9% | |

| Retail/Multifamily | 1 | $40,000,000 | 4.0% | 379,376 | $258 | 4.8450% | 119 | 96.9% | 1.86x | 59.8% | 59.8% | |

| Office/Retail/Multifamily | 2 | $38,450,000 | 3.8% | 204,287 | $281 | 4.7727% | 117 | 93.7% | 1.70x | 65.4% | 62.8% | |

| Office/Retail | 2 | $28,500,000 | 2.8% | 100,558 | $284 | 4.5459% | 119 | 100.0% | 1.94x | 56.2% | 56.2% | |

| Medical Office/Retail | 1 | $13,000,000 | 1.3% | 47,381 | $274 | 4.7200% | 119 | 87.3% | 2.00x | 63.1% | 63.1% | |

| Industrial/Office | 1 | $4,030,000 | 0.4% | 39,223 | $103 | 4.6800% | 119 | 100.0% | 2.53x | 51.0% | 51.0% | |

| Industrial | 3 | $138,800,000 | 13.8% | 798,425 | $251 | 4.3164% | 118 | 97.9% | 2.45x | 57.4% | 54.6% | |

| Warehouse/Distribution | 1 | $100,000,000 | 9.9% | 315,644 | $317 | 4.1660% | 120 | 100.0% | 2.83x | 51.3% | 51.3% | |

| Flex | 1 | $34,000,000 | 3.4% | 411,631 | $83 | 4.7300% | 114 | 91.5% | 1.44x | 74.6% | 64.1% | |

| Warehouse/Flex | 1 | $4,800,000 | 0.5% | 71,150 | $67 | 4.5210% | 116 | 100.0% | 1.62x | 64.0% | 54.7% | |

| Multifamily | 2 | $67,394,766 | 6.7% | 199 | $344,500 | 4.6609% | 119 | 85.8% | 1.59x | 44.9% | 44.1% | |

| High-Rise | 1 | $63,000,000 | 6.3% | 178 | $353,933 | 4.6335% | 119 | 84.8% | 1.60x | 43.2% | 43.2% | |

| Mid-Rise | 1 | $4,394,766 | 0.4% | 21 | $209,275 | 5.0540% | 119 | 100.0% | 1.40x | 69.2% | 57.1% | |

| Other | 3 | $21,675,000 | 2.2% | 268 | $80,877 | 4.4382% | 113 | 100.0% | 1.65x | 63.6% | 63.6% | |

| Total/Weighted Average | 44 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 94.2% | 2.05x | 56.9% | 55.0% | |||

| Geographic Distribution(1)(4) | |||||||||

| State/Location | Number

of Properties |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||

| New York | 13 | $386,584,912 | 38.4% | 4.5246% | 118 | 1.86x | 56.8% | 56.4% | |

| New York City | 10 | $366,595,000 | 36.4% | 4.5126% | 118 | 1.86x | 56.4% | 56.4% | |

| New York State | 3 | $19,989,912 | 2.0% | 4.7451% | 115 | 1.78x | 64.7% | 55.8% | |

| California | 6 | $217,850,000 | 21.7% | 4.3693% | 118 | 2.38x | 53.8% | 53.8% | |

| Northern(6) | 3 | $123,950,000 | 12.3% | 3.9813% | 118 | 2.82x | 50.0% | 50.0% | |

| Southern(6) | 3 | $93,900,000 | 9.3% | 4.8814% | 118 | 1.80x | 58.8% | 58.8% | |

| Washington | 3 | $135,170,000 | 13.4% | 4.7891% | 115 | 2.19x | 53.4% | 53.4% | |

| Florida | 5 | $49,525,000 | 4.9% | 4.5288% | 116 | 3.23x | 48.4% | 45.5% | |

| Texas | 1 | $34,000,000 | 3.4% | 4.7300% | 114 | 1.44x | 74.6% | 64.1% | |

| Other | 16 | $182,952,899 | 18.2% | 4.7595% | 117 | 1.75x | 62.0% | 55.3% | |

| Total/Weighted Average | 44 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

|

COMM 2018-COR3 Mortgage Trust

|

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Distribution of Cut-off Date LTV Ratios(1)(3) | |||||||||||

| Range of Cut-off Date LTV Ratios | Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| 16.7% | - | 54.9% | 12 | $462,094,472 | 45.9% | 4.3979% | 118 | 2.55x | 47.4% | 46.8% | |

| 55.0% | - | 59.9% | 5 | $118,550,000 | 11.8% | 4.5627% | 116 | 1.77x | 58.4% | 57.9% | |

| 60.0% | - | 64.9% | 9 | $189,684,912 | 18.9% | 4.5847% | 117 | 1.74x | 62.8% | 62.0% | |

| 65.0% | - | 69.9% | 9 | $154,729,182 | 15.4% | 4.9505% | 117 | 1.50x | 68.5% | 65.0% | |

| 70.0% | - | 74.6% | 6 | $81,024,246 | 8.1% | 4.8798% | 116 | 1.40x | 72.6% | 61.4% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

| Distribution of Maturity Date or ARD LTV Ratios(1)(2)(3) | |||||||||||

| Range of Maturity Date or ARD LTV Ratios | Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| 16.7% | - | 49.9% | 5 | $177,194,472 | 17.6% | 4.1078% | 118 | 2.79x | 38.8% | 37.3% | |

| 50.0% | - | 54.9% | 10 | $310,689,912 | 30.9% | 4.5985% | 118 | 2.35x | 53.4% | 52.8% | |

| 55.0% | - | 59.9% | 10 | $159,410,928 | 15.8% | 4.6751% | 117 | 1.66x | 61.9% | 57.8% | |

| 60.0% | - | 68.9% | 16 | $358,787,500 | 35.7% | 4.7447% | 117 | 1.60x | 66.5% | 64.3% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

| Distribution of Underwritten NCF Debt Service Coverage Ratios(1) | |||||||||||

| Range of Underwritten NCF Debt Service Coverage Ratios | Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| 1.25x | - | 1.44x | 10 | $206,119,012 | 20.5% | 4.8767% | 117 | 1.36x | 68.4% | 63.5% | |

| 1.45x | - | 1.49x | 1 | $9,006,068 | 0.9% | 4.5500% | 112 | 1.45x | 68.2% | 55.8% | |

| 1.50x | - | 1.74x | 11 | $245,398,348 | 24.4% | 4.6540% | 117 | 1.62x | 57.7% | 56.6% | |

| 1.75x | - | 1.99x | 5 | $109,025,000 | 10.8% | 4.8406% | 118 | 1.88x | 60.1% | 58.6% | |

| 2.00x | - | 2.49x | 9 | $248,054,383 | 24.7% | 4.5854% | 116 | 2.18x | 54.9% | 53.5% | |

| 2.50x | - | 3.49x | 2 | $104,030,000 | 10.3% | 4.1859% | 120 | 2.82x | 51.3% | 51.3% | |

| 3.50x | - | 6.07x | 3 | $84,450,000 | 8.4% | 3.7339% | 119 | 3.94x | 33.4% | 33.4% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

| Original Terms to Maturity or ARD(1)(2) | |||||||||||

| Range

of Original Terms to Maturity or ARD |

Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| 120 | 38 | $815,082,811 | 81.0% | 4.5367% | 117 | 2.06x | 58.4% | 56.1% | |||

| 121 | 1 | $50,000,000 | 5.0% | 4.7400% | 109 | 2.12x | 54.9% | 54.9% | |||

| 129 | - | 131 | 2 | $141,000,000 | 14.0% | 4.7477% | 119 | 1.96x | 48.3% | 48.3% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

| Distribution of Remaining Terms to Maturity or ARD(1)(2) | |||||||||||

| Range

of Remaining Terms to Maturity or ARD |

Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| 109 | - | 114 | 8 | $204,375,540 | 20.3% | 4.4590% | 112 | 1.79x | 59.4% | 55.4% | |

| 115 | - | 120 | 33 | $801,707,272 | 79.7% | 4.6063% | 118 | 2.12x | 56.2% | 54.8% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

|

COMM 2018-COR3 Mortgage Trust

|

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Distribution of Underwritten NOI Debt Yields(1) | |||||||||||

| Range of Underwritten NOI Debt Yields | Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||||

| 6.8% | - | 8.9% | 10 | $324,867,500 | 32.3% | 4.6607% | 117 | 1.52x | 59.6% | 59.6% | |

| 9.0% | - | 9.9% | 12 | $165,527,080 | 16.5% | 4.7808% | 117 | 1.68x | 65.5% | 60.3% | |

| 10.0% | - | 12.4% | 12 | $358,473,848 | 35.6% | 4.3858% | 117 | 2.48x | 53.8% | 52.1% | |

| 12.5% | - | 14.9% | 5 | $137,214,383 | 13.6% | 4.6241% | 117 | 2.15x | 53.4% | 50.1% | |

| 15.0% | - | 34.9% | 2 | $20,000,000 | 2.0% | 4.6010% | 118 | 5.29x | 19.7% | 19.7% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |||

| Amortization Types(1) | |||||||||

| Amortization Type | Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

%

of Initial Outstanding Pool Balance |

Weighted Averages | |||||

| Mortgage Rate | Stated Remaining Term (Mos.)(2) |

U/W

NCF DSCR |

Cut-off

Date LTV Ratio(3) |

Maturity

Date LTV(2)(3) | |||||

| Interest Only | 24 | $743,637,500 | 73.9% | 4.6227% | 117 | 2.04x | 56.2% | 56.2% | |

| Interest Only, then Amortizing | 8 | $106,400,000 | 10.6% | 4.8463% | 115 | 1.55x | 69.7% | 61.3% | |

| Amortizing Balloon | 8 | $91,595,311 | 9.1% | 4.6687% | 117 | 1.71x | 60.6% | 49.6% | |

| Interest Only, ARD | 1 | $64,450,000 | 6.4% | 3.4649% | 119 | 3.52x | 37.7% | 37.7% | |

| Total/Weighted Average | 41 | $1,006,082,811 | 100.0% | 4.5764% | 117 | 2.05x | 56.9% | 55.0% | |

Footnotes:

| (1) | The U/W NCF DSCR, Cut-off Date LTV Ratio, Maturity Date or ARD LTV, Underwritten NOI Debt Yield and Cut-off Date Balance per Room/Unit/NRA/Space calculations include any related pari passu companion loan(s) and exclude any related subordinate companion loan(s) and/or mezzanine loan(s). |

| (2) | With respect to the ARD Loan, the Original Term to Maturity or ARD, Remaining Term to Maturity or ARD, LTV Ratio at Maturity or ARD, Stated Remaining Term (Mos.) and Maturity Date or ARD LTV are calculated through the related anticipated repayment date. |

| (3) | With respect to the four Mortgage Loans, in aggregate, representing approximately 12.3% of the Initial Outstanding Pool Balance (including 1001 North Shoreline Boulevard, Shoreline Center, Fairfield Inn Charleston Airport and Maple Ridge Plaza), the Cut-off Date LTV and Maturity Date or ARD LTV has been calculated based on other than “As Is” appraised values. For additional information please see the footnotes to Annex A-1 in the Preliminary Prospectus. |

| (4) | Reflects allocated loan amount for properties securing multi-property Mortgage Loans. |

| (5) | Anchored retail also includes single tenant, super regional mall and shadow anchored retail properties. |

| (6) | Northern California properties have a zip code greater than 93600. Southern California properties have a zip code less than or equal to 93600. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

|

COMM 2018-COR3 Mortgage Trust

|

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Ten Largest Mortgage Loans | |||||||||

| Mortgage Loan | Mortgage Loan Seller |

City, State | Property Type | Cut-off

Date Balance |

% of Initial Outstanding Pool Balance |

Cut-off

Date Balance per Room/NRA/Unit(1) |

Cut-off

Date Ratio(1)(2) |

U/W NCF DSCR after IO(1) |

U/W NOI Debt Yield(1) |

| 930 Flushing | LCM/GACC | Brooklyn, NY | Industrial | $100,000,000 | 9.9% | $317 | 51.3% | 2.83x | 12.3% |

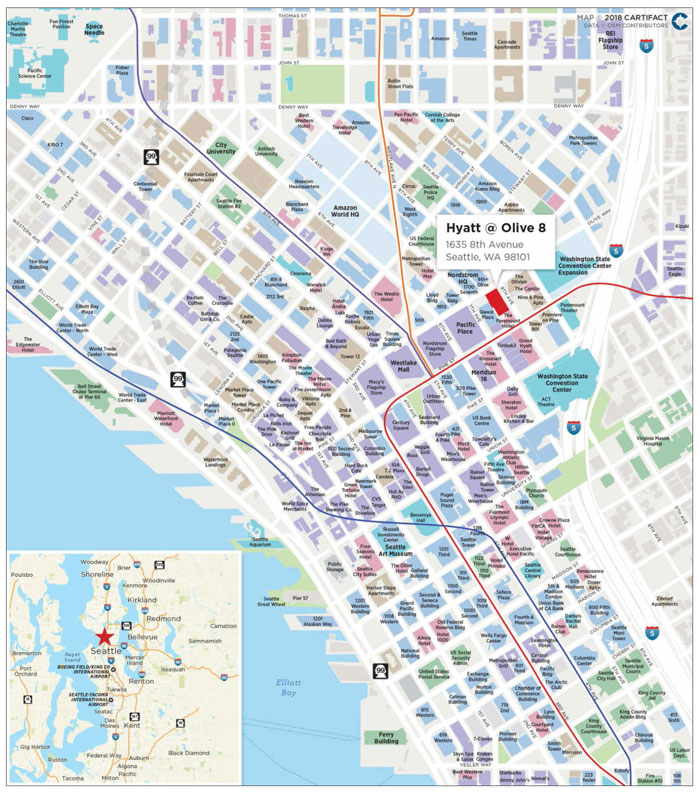

| Hyatt @ Olive 8 | LCM | Seattle, WA | Hospitality | $78,000,000 | 7.8% | $225,434 | 52.5% | 2.25x | 13.3% |

| Kingswood Center | LCM | Brooklyn, NY | Mixed Use | $65,500,000 | 6.5% | $503 | 68.9% | 1.29x | 6.9% |

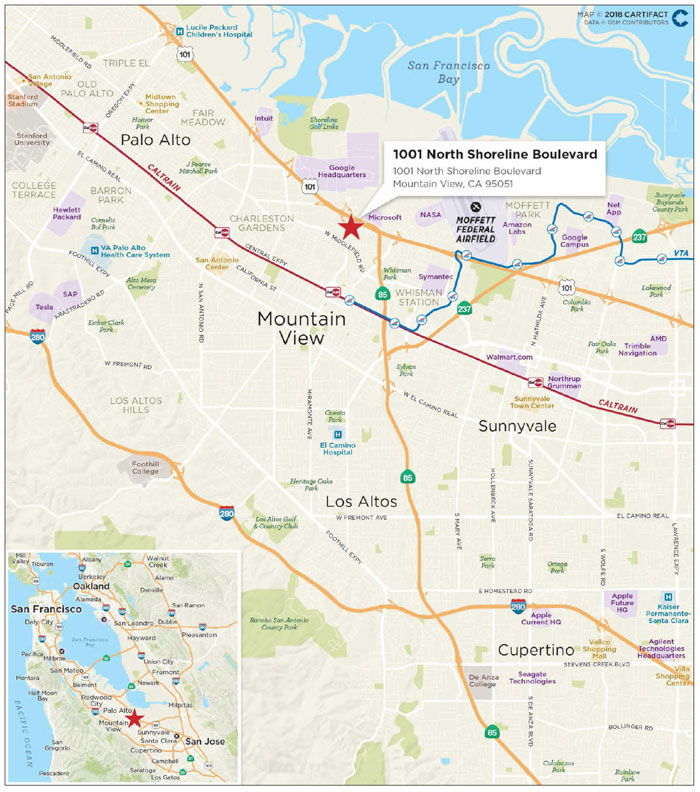

| 1001 North Shoreline Boulevard | GACC | Mountain View, CA | Office | $64,450,000 | 6.4% | $522 | 37.7% | 3.52x | 12.4% |

| Beekman Tower | LCM | New York, NY | Multifamily | $63,000,000 | 6.3% | $353,933 | 43.2% | 1.60x | 7.6% |

| Grand Hyatt Seattle | LCM | Seattle, WA | Hospitality | $50,000,000 | 5.0% | $291,028 | 54.9% | 2.12x | 11.8% |

| 315 West 36th Street | GACC | New York, NY | Office | $47,000,000 | 4.7% | $537 | 60.6% | 1.39x | 6.8% |

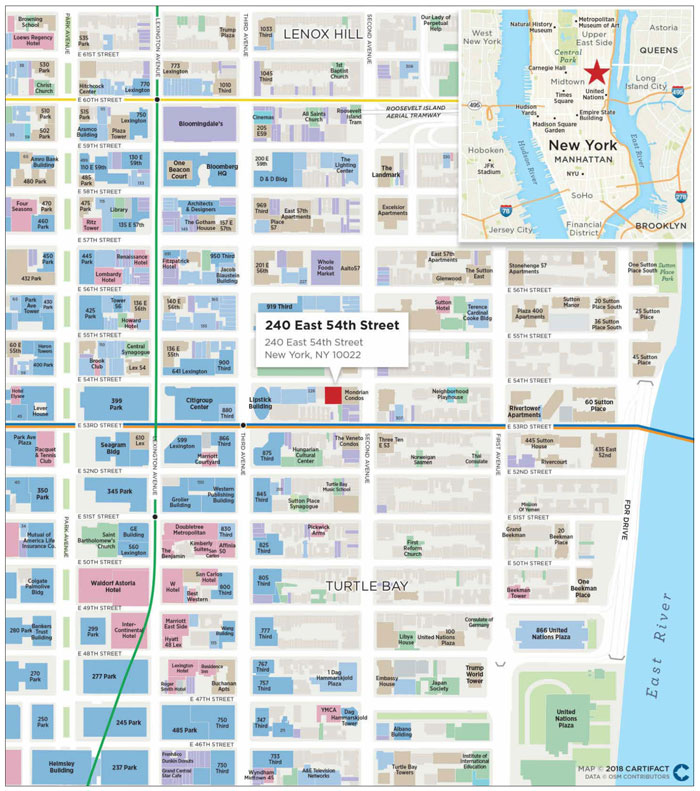

| 240 East 54th Street | LCM/GACC | New York, NY | Retail | $42,000,000 | 4.2% | $1,402 | 57.5% | 1.63x | 6.8% |

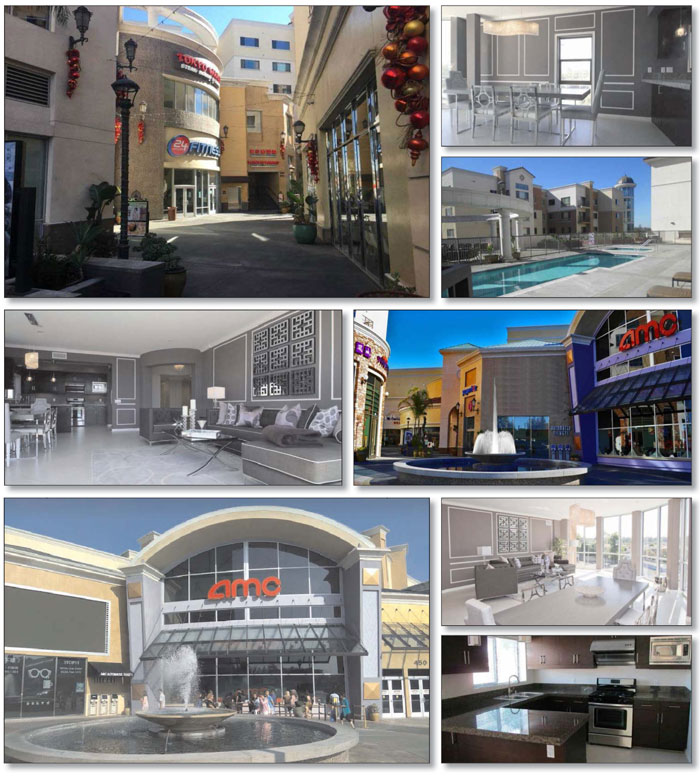

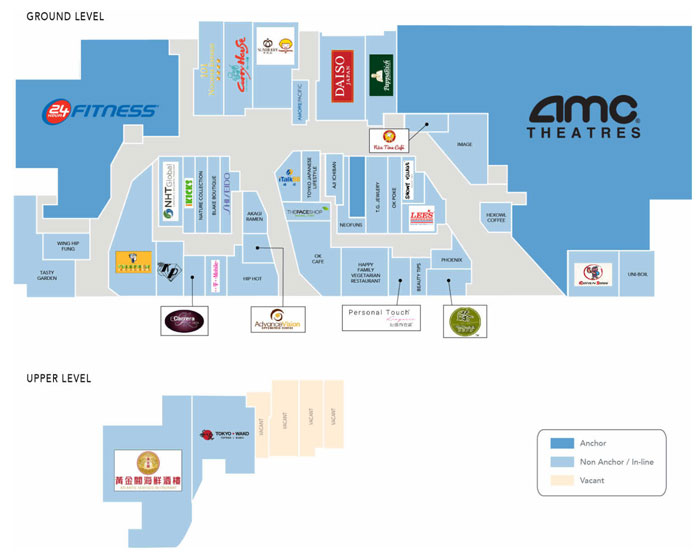

| Atlantic Times Square | JPMCB | Monterey Park, CA | Mixed Use | $40,000,000 | 4.0% | $258 | 59.8% | 1.86x | 9.5% |

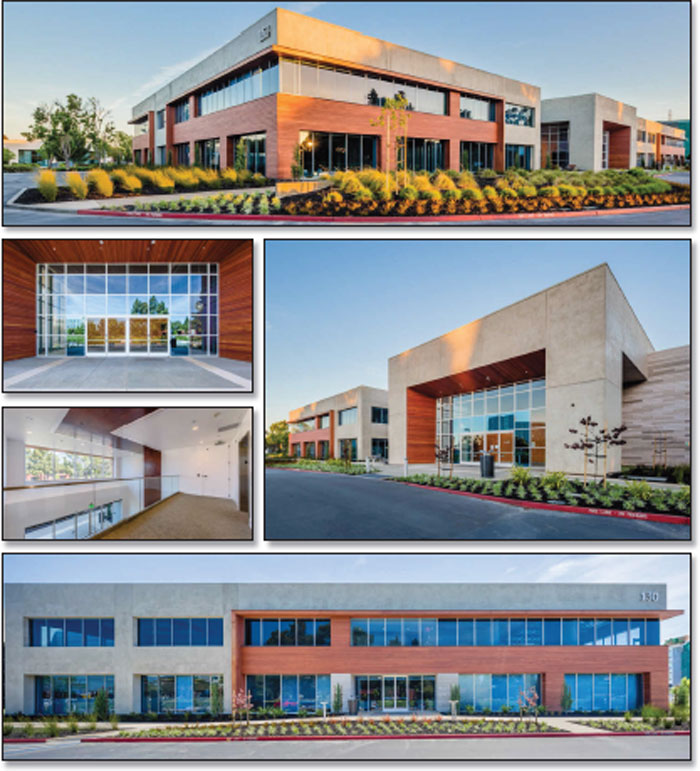

| Shoreline Center | LCM | Redwood City, CA | Office | $38,300,000 | 3.8% | $470 | 63.8% | 2.32x | 10.6% |

| Total/Weighted Average | $588,250,000 | 58.5% | 53.9% | 2.17x | 10.2% | ||||

| (1) | The Cut-off Date Balance per Room/NRA/Unit, Cut-off Date LTV Ratio, U/W NCF DSCR after IO and U/W NOI Debt Yield calculations include any related pari passu companion loan(s) and exclude any related subordinate companion loan(s) and/or mezzanine loan(s). |

| (2) | With respect to 1001 North Shoreline Boulevard and Shoreline Center, the Cut-off Date LTV Ratio has been calculated based on the appraised values other than “As Is” respectively. For additional information please see the footnotes to Annex A-1 in the Preliminary Prospectus. |

| Existing Mezzanine Debt Summary | ||||||||

| Mortgage Loan |

Mortgage Loan Cut-off Date Balance |

Mezzanine

Debt Cut-off Date Balance |

Trust U/W NCF DSCR |

Total

Debt U/W NCF DSCR |

Trust

Cut-off Date LTV Ratio |

Total

Debt Cut-off Date LTV Ratio |

Trust U/W NOI Debt Yield |

Total

Debt U/W NOI Debt Yield |

| NYC Parking Portfolio | $21,675,000 | $1,825,000 | 1.65x | 1.44x | 63.6% | 68.9% | 7.5% | 6.9% |

| Subordinate Debt Summary | ||||||||

| Mortgage Loan | Mortgage Loan Cut-off Date Balance |

Subordinate

Debt Cut-off Date Balance |

Trust U/W NCF DSCR |

Total

Debt U/W NCF DSCR(1) |

Trust

Cut-off Date LTV Ratio |

Total

Debt Cut-off Date LTV Ratio(1) |

Trust U/W NOI Debt Yield |

Total

Debt U/W NOI Debt Yield(1) |

| 1001 North Shoreline Boulevard | $64,450,000 | $46,050,000 | 3.52x | 1.65x | 37.7% | 64.6% | 12.4% | 7.2% |

(1) |

Total Debt U/W NCF DSCR, Total Debt Cut-off Date LTV Ratio and Total Debt U/W NOI Debt Yield calculations include any related subordinate companion loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

|

COMM 2018-COR3 Mortgage Trust

|

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Companion Loan Summary | ||||||||

| Loan No. | Mortgage Loan | Note(s) | Original Balance ($) |

Cut-off Date Balance ($) | Holder of Note | Lead Servicer for Whole Loan (Y/N) | Master Servicer Under Lead Securitization | Special Servicer Under Lead Securitization |

| 4 | 1001 North Shoreline Boulevard(1) | A | $64,450,000 | $64,450,000 | COMM 2018-COR3 | No | Midland Loan Services | Midland Loan Services |

| B | $46,050,000 | $46,050,000 | DBNY | Yes | ||||

| Total | $110,500,000 | $110,500,000 | ||||||

| 6 | Grand Hyatt Seattle | A-1 | $50,000,000 | $50,000,000 | COMM 2017-COR2 | Yes | Midland Loan Services | Midland Loan Services |

| A-2 | $50,000,000 | $50,000,000 | COMM 2018-COR3 | No | ||||

| A-3 | $33,000,000 | $33,000,000 | LCM | No | ||||

| Total | $133,000,000 | $133,000,000 | ||||||

| 7 | 315 West 36th Street | A-1, A-3 | $47,000,000 | $47,000,000 | COMM 2018-COR3 | Yes | Midland Loan Services | Midland Loan Services |

| A-2 | $30,000,000 | $30,000,000 | Benchmark 2018-B3 | No | ||||

| Total | $77,000,000 | $77,000,000 | ||||||

| 9 | Atlantic Times Square(2) | A-1 | $40,000,000 | $40,000,000 | JPMCB | Yes | Midland Loan Services | Midland Loan Services |

| A-2 | $40,000,000 | $40,000,000 | COMM 2018-COR3 | No | ||||

| A-3 | $18,000,000 | $18,000,000 | JPMCB | No | ||||

| Total | $98,000,000 | $98,000,000 | ||||||

| 13 | Lehigh Valley Mall | A-1-A | $42,000,000 | $41,642,260 | Benchmark 2018-B1 | Yes | Wells Fargo Bank, National Association | Midland Loan Services |

| A-1-B | $50,000,000 | $49,574,119 | CSAIL 2017-CX10 | No | ||||

| A-2-A | $35,500,000 | $35,197,625 | Benchmark 2018-B2 | No | ||||

| A-2-B | $27,500,000 | $27,265,766 | CSAIL 2018-CX11 | No | ||||

| A-1-C, A-2-C-2 | $30,000,000 | $29,744,472 | COMM 2018-COR3 | No | ||||

| A-2-C-1 | $15,000,000 | $14,872,236 | DBNY | No | ||||

| Total | $200,000,000 | $198,296,477 | ||||||

| (1) | The related whole loan will be serviced pursuant to the COMM 2018-COR3 pooling and servicing agreement. However, so long as no “control appraisal period” (or similar term) has occurred and is continuing, the holder of Note B will be the controlling noteholder and will have the right to approve certain modifications and consent to certain actions taken with respect to the related whole loan. If a control appraisal period has occurred and is continuing, the holder of Note A will be the controlling noteholder, which rights may be exercised by the controlling class certificateholder (or its representative or any party assigned to exercise the rights of the controlling noteholder under the COMM 2018-COR3 pooling and servicing agreement). |

| (2) | Prior to the applicable servicing shift securitization date, the related whole loans will be serviced under the pooling and servicing agreement for this transaction. From and after the related servicing shift securitization date, the related servicing shift whole loan will be serviced under the related servicing shift pooling and servicing agreement. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

(THIS PAGE INTENTIONALLY LEFT BLANK)

17

930 Flushing Avenue Brooklyn, NY 11206 |

Collateral Asset Summary – Loan No. 1 930 Flushing |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$100,000,000 51.3% 2.83x 12.3% |