| FILED PURSUANT TO RULE 424(b)(5) | |

| REGISTRATION STATEMENT NO.: 333-172143-03 |

PROSPECTUS SUPPLEMENT

(to Prospectus dated March 1, 2012)

(to Prospectus dated March 1, 2012)

$829,492,000 (Approximate)

COMM 2012-LC4

Commercial Mortgage Pass-Through Certificates

German American Capital Corporation

Ladder Capital Finance LLC

Guggenheim Life and Annuity Company

Sponsors and Mortgage Loan Sellers

Deutsche Mortgage & Asset Receiving Corporation

Depositor

COMM 2012-LC4 Mortgage Trust

Issuing Entity

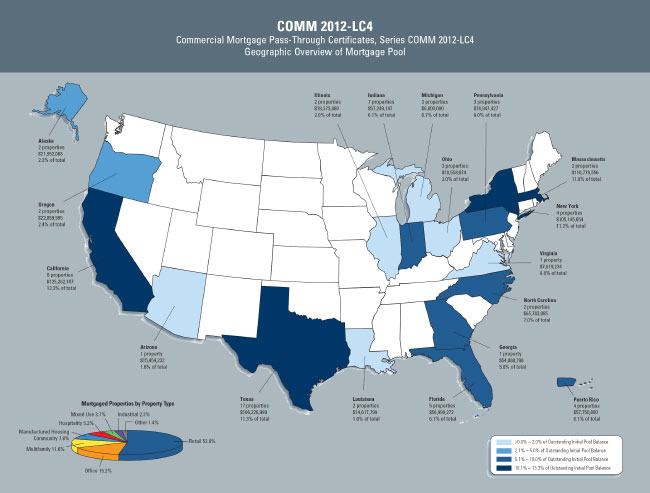

The COMM 2012-LC4 Commercial Mortgage Pass-Through Certificates will represent beneficial ownership interests in the issuing entity, COMM 2012-LC4 Mortgage Trust. The issuing entity’s assets will primarily be 43 fixed-rate mortgage loans, secured by first liens on 67 commercial, multifamily and manufactured housing community properties. The COMM 2012-LC4 Commercial Mortgage Pass-Through Certificates will represent interests in the issuing entity only and will not represent the obligations of Deutsche Bank AG, Deutsche Mortgage & Asset Receiving Corporation, the sponsors or any of their respective affiliates, and neither the certificates nor the underlying mortgage loans are insured or guaranteed by any governmental agency.

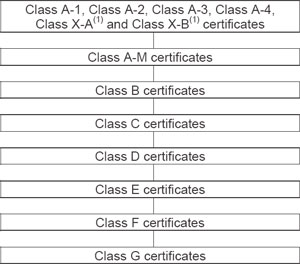

Each class of certificates offered hereby will receive distributions of interest, principal or both on the fourth business day following the sixth day of each month or the following business day, commencing in April 2012. Credit enhancement will be provided by certain classes of subordinate certificates that will be subordinate to certain classes of senior certificates as described in this prospectus supplement under “Description of the Offered Certificates—Subordination.”

Certain characteristics of the certificates offered by this prospectus supplement include:

|

Class

|

Initial Certificate Balance or Notional Balance(1)

|

Approximate Initial

Pass-Through Rate |

Assumed Final

Distribution Date(2) |

||||

|

Class A-1

|

$48,958,000

|

1.156%

|

July 2016

|

||||

|

Class A-2

|

$77,841,000

|

2.256%

|

March 2017

|

||||

|

Class A-3

|

$115,586,000

|

3.069%

|

July 2021

|

||||

|

Class A-4

|

$416,502,000

|

3.288%

|

January 2022

|

||||

|

Class A-M

|

$92,950,000

|

4.063%

|

February 2022

|

||||

|

Class B

|

$44,711,000

|

4.934%(3)

|

February 2022

|

||||

|

Class C

|

$32,944,000

|

5.825%(4)

|

February 2022

|

||||

(Footnotes to table to begin on page xii)

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined that this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Investing in the certificates offered in this prospectus supplement involves risks. See “Risk Factors” beginning on page S-35 of this prospectus supplement and page 11 of the prospectus.

With respect to this offering, Deutsche Bank Securities Inc. is acting as the sole bookrunner and lead manager with respect to each class of offered certificates. Ladder Capital Securities LLC, Guggenheim Securities, LLC, Morgan Stanley & Co. LLC and RBS Securities Inc. are acting as co-managers. The underwriters will offer the certificates offered by this prospectus supplement, in the amounts set forth in this prospectus supplement, to the public in negotiated transactions or otherwise at varying prices to be determined at the time of sale.

Deutsche Bank Securities Inc., Ladder Capital Securities LLC, Guggenheim Securities, LLC, Morgan Stanley & Co. LLC and RBS Securities Inc. are required to purchase the certificates offered by this prospectus supplement (in the amounts to be set forth under “Method of Distribution (Underwriter Conflicts of Interest)” in this prospectus supplement) from Deutsche Mortgage & Asset Receiving Corporation, subject to certain conditions. Deutsche Mortgage & Asset Receiving Corporation expects to receive from the sale of the offered certificates approximately 100.78% of the initial aggregate certificate balance of the offered certificates, plus accrued interest, before deducting expenses payable by it. The underwriters expect to deliver the certificates offered in this prospectus supplement to purchasers on or about March 20, 2012.

Deutsche Bank Securities

Sole Bookrunner and Lead Manager

| Ladder Capital Securities | Guggenheim Securities | ||

| Morgan Stanley | RBS |

Co-Managers

March 1, 2012

TABLE OF CONTENTS

|

EXECUTIVE SUMMARY

|

xii

|

Some Mortgaged Properties May Not

|

||||

|

SUMMARY

|

S-1

|

Be Readily Convertible to

|

||||

|

RISK FACTORS

|

S-35

|

Alternative Uses

|

S-43

|

|||

|

General Risks

|

S-35

|

Limitations of Appraisals

|

S-43

|

|||

|

The Offered Certificates May Not

|

Property Value May Be Adversely

|

|||||

|

Be a Suitable Investment for

|

Affected Even When Current

|

|||||

|

You

|

S-35

|

Operating Income Is Not

|

S-44

|

|||

|

Risks Related to Market Conditions

|

S-35

|

Risks Related to Tenants

|

S-44

|

|||

|

The Credit Crisis and Downturn in

|

Tenant Concentration Entails Risk .

|

S-44

|

||||

|

the Real Estate Market Have

|

Mortgaged Properties Leased to

|

|||||

|

Adversely Affected the Value of

|

Multiple Tenants Also Have

|

|||||

|

Commercial Mortgage-Backed

|

Risks

|

S-45

|

||||

|

Securities

|

S-35

|

Mortgaged Properties Leased to

|

||||

|

The Volatile Economy and Credit

|

Borrowers or Borrower Affiliated

|

|||||

|

Crisis May Increase Loan

|

Entities Also Have Risks

|

S-45

|

||||

|

Defaults and Affect the Value

|

Certain Additional Risks Related to

|

|||||

|

and Liquidity of Your

|

Tenants

|

S-46

|

||||

|

Investment

|

S-36

|

Tenant Bankruptcy Entails Risks

|

S-48

|

|||

|

Heightened Underwriting Standards

|

Risks Related to Mortgage Loan

|

|||||

|

May Contribute to Losses on

|

Concentration

|

S-48

|

||||

|

Commercial Loans

|

S-36

|

Risks Related to Borrower

|

||||

|

Global Market Disruptions and

|

Concentration

|

S-49

|

||||

|

Recent U.S. Legislation May

|

Risks Relating to Property Type

|

|||||

|

Adversely Affect the Availability

|

Concentration

|

S-49

|

||||

|

of Credit for Commercial Real

|

Geographic Concentration Exposes

|

|||||

|

Estate

|

S-37

|

Investors to Greater Risk of Default

|

||||

|

General Conditions in the

|

and Loss

|

S-50

|

||||

|

Commercial Real Estate

|

Certain Mortgage Loans Were Not

|

|||||

|

Mortgage Markets May

|

Specifically Originated for

|

|||||

|

Adversely Affect the

|

Securitization

|

S-51

|

||||

|

Performance of the Offered

|

Seasoned Mortgage Loans Present

|

|||||

|

Certificates

|

S-38

|

Additional Risks of Repayment

|

S-52

|

|||

|

RISKS RELATED TO THE MORTGAGE

|

Retail Properties Have Special Risks

|

S-52

|

||||

|

LOANS

|

S-39

|

The Presence or Absence of an

|

||||

|

Mortgage Loans Are Nonrecourse and

|

“Anchor Tenant” May Adversely

|

|||||

|

Are Not Insured or Guaranteed

|

S-39

|

Affect the Economic

|

||||

|

The Offered Certificates Are Limited

|

Performance of a Retail

|

|||||

|

Obligations and Payments Will Be

|

Property

|

S-52

|

||||

|

Primarily Derived from the Mortgage

|

Current Levels of Property Income

|

|||||

|

Loans

|

S-39

|

May Not Be Maintained Due to

|

||||

|

Commercial Lending Is Dependent upon

|

Varying Tenant Occupancy

|

S-54

|

||||

|

Net Operating Income

|

S-40

|

Competition May Adversely Affect

|

||||

|

Mortgage Loans Have Not Been

|

the Performance of the

|

|||||

|

Reunderwritten Since Origination

|

S-42

|

Mortgaged Property

|

S-54

|

|||

|

The Prospective Performance of the

|

Certain Risks of Restaurant

|

|||||

|

Commercial and Multifamily

|

Tenants

|

S-55

|

||||

|

Mortgage Loans Included in the

|

Certain Risks of Health Club or

|

|||||

|

Issuing Entity Should Be Evaluated

|

Exercise Studio Space Tenants

|

S-55 | ||||

|

Separately from the Performance of

|

Certain Risks of Movie Theater

|

|||||

|

the Mortgage Loans in Any of the

|

Tenants

|

S-56

|

||||

|

Depositor’s Other Trusts

|

S-42

|

Office Properties Have Special Risks

|

S-56

|

|||

|

Multifamily Properties Have Special

|

||||||

|

Risks

|

S-57

|

iii

|

State Regulations and Government

|

Maturity Date or Anticipated

|

|||||

|

Subsidies May Affect a

|

Repayment Date

|

S-71

|

||||

|

Borrower’s Ability To Repay a

|

Risks Relating to Borrower Organization

|

|||||

|

Multifamily Mortgage Loan

|

S-58

|

or Structure

|

S-72

|

|||

|

Manufactured Housing Community

|

Delaware Statutory Trusts May Hinder

|

|||||

|

Properties Have Special Risks

|

S-59

|

Recovery

|

S-73

|

|||

|

Hospitality Properties Have Special

|

Risks Related to Additional Debt

|

S-73

|

||||

|

Risks

|

S-59

|

Bankruptcy Proceedings Entail Certain

|

||||

|

The Seasonality of Business May

|

Risks

|

S-74

|

||||

|

Create Shortfalls in Hospitality

|

Risks Related to Loan Sponsor

|

|||||

|

Revenue

|

S-60

|

Guaranties

|

S-75

|

|||

|

The Inability to Maintain a Liquor

|

Lack of Skillful Property Management

|

|||||

|

License May Adversely Impact

|

Entail Risks

|

S-76

|

||||

|

Hospitality Revenue

|

S-61

|

Risks of Inspections Relating to

|

||||

|

The Performance of a Hospitality

|

Property

|

S-76

|

||||

|

Property Depends in Part on

|

World Events and Natural (or Other)

|

|||||

|

the Performance of Its

|

Disasters Could Have an Adverse

|

|||||

|

Management Company

|

S-61

|

Impact on the Mortgaged Properties

|

||||

|

Industrial Properties Have Special Risks

|

S-62 |

and Could Reduce the Cash Flow

|

||||

|

Risks Related to Loans Secured by

|

Available To Make Payments on the

|

|||||

|

Mortgaged Properties Located in

|

Certificates

|

S-76

|

||||

|

Puerto Rico

|

S-62

|

Inadequate Property Insurance

|

||||

|

Risks of Co-Tenancy and Other Early

|

Coverage Could Have an Adverse

|

|||||

|

Termination Provisions in Retail and

|

Impact on the Mortgaged Properties

|

S-77 | ||||

|

Office Leases

|

S-63

|

Certain Risks Are Not Covered

|

||||

|

Condominium Properties Have Special

|

under Standard Insurance

|

|||||

|

Risks

|

S-65

|

Policies

|

S-77

|

|||

|

Risks Related to Construction,

|

Standard Insurance May Be

|

|||||

|

Development, Redevelopment,

|

Inadequate Even for Types of

|

|||||

|

Renovation and Repairs at

|

Losses That Are Insured

|

|||||

|

Mortgaged Properties

|

S-66

|

Against

|

S-78

|

|||

|

Options and Other Purchase Rights May

|

There Is No Assurance That

|

|||||

|

Affect Value or Hinder Recovery

|

Required Insurance Will Be

|

|||||

|

with Respect to the Mortgaged

|

Maintained

|

S-78

|

||||

|

Properties

|

S-67

|

Risks Associated with Blanket Insurance

|

||||

|

The Sellers of the Mortgage Loans Are

|

Policies or Self-Insurance

|

S-79

|

||||

|

Subject to Bankruptcy or Insolvency

|

Availability of Terrorism Insurance

|

S-79

|

||||

|

Laws That May Affect the Issuing

|

Certain Mortgage Loans Limit the

|

|||||

|

Entity’s Ownership of the Mortgage

|

Borrower’s Obligation to Obtain

|

|||||

|

Loans

|

S-67

|

Terrorism Insurance

|

S-80

|

|||

|

Environmental Issues at the Mortgaged

|

There Is No Assurance That

|

|||||

|

Properties May Adversely Affect

|

Required Terrorism Insurance

|

|||||

|

Payments on Your Certificates

|

S-68

|

Will Be Maintained

|

S-81

|

|||

|

Certain Environmental Laws May

|

Appraisals and Market Studies Have

|

|||||

|

Negatively Impact a Borrower’s

|

Certain Limitations

|

S-81

|

||||

|

Ability to Repay a Mortgage

|

Increases in Real Estate Taxes Due to

|

|||||

|

Loan

|

S-68

|

Termination of a PILOT Program or

|

||||

|

A Borrower May Be Required to

|

Other Tax Abatement Arrangements

|

|||||

|

Take Remedial Steps with

|

May Reduce Payments to

|

|||||

|

Respect to Environmental

|

Certificateholders

|

S-81

|

||||

|

Hazards at a Property

|

S-69

|

Risks Related to Enforceability

|

S-82

|

|||

|

Potential Issuing Entity Liability Related

|

Risks Related to Enforceability of

|

|||||

|

to a Materially Adverse

|

Prepayment Premiums, Yield

|

|||||

|

Environmental Condition

|

S-69

|

Maintenance Charges and

|

||||

|

Borrower May Be Unable To Repay the

|

Defeasance Provisions

|

S-82

|

||||

|

Remaining Principal Balance on the

|

iv

|

The Master Servicer or the Special

|

RISKS RELATED TO THE OFFERED

|

|||||

|

Servicer May Experience Difficulty

|

CERTIFICATES

|

S-98

|

||||

|

in Collecting Rents upon the Default

|

Legal and Regulatory Provisions

|

|||||

|

and/or Bankruptcy of a Borrower

|

S-82

|

Affecting Investors Could Adversely

|

||||

|

Risks Related to Mortgage Loans

|

Affect the Liquidity of the Offered

|

|||||

|

Secured by Multiple Properties

|

S-83

|

Certificates

|

S-98

|

|||

|

State Law Limitations Entail Certain

|

Risks Related to Prepayments and

|

|||||

|

Risks

|

S-84

|

Repurchases of Mortgage Loans

|

S-99

|

|||

|

Leased Fee Properties Entail Risks that

|

Limited Obligations

|

S-101

|

||||

|

May Adversely Affect Payments on

|

Yield Considerations

|

S-101

|

||||

|

Your Certificates

|

S-84

|

Optional Early Termination of the

|

||||

|

Mortgage Loans Secured by Leasehold

|

Issuing Entity May Result in an

|

|||||

|

Interests May Expose Investors to

|

Adverse Impact on Your Yield or

|

|||||

|

Greater Risks of Default and Loss

|

S-85

|

May Result in a Loss

|

S-102

|

|||

|

Potential Absence of Attornment

|

A Mortgage Loan Seller May Not Be

|

|||||

|

Provisions Entails Risks

|

S-88

|

Able to Make a Required

|

||||

|

Risks Related to Zoning Laws

|

S-88

|

Repurchase or Substitution of a

|

||||

|

Risks Related to Litigation and

|

Defective Mortgage Loan

|

S-102

|

||||

|

Condemnation

|

S-89

|

Any Loss of Value Payment Made by a

|

||||

|

Prior Bankruptcies, Defaults or Other

|

Mortgage Loan Seller May Prove to

|

|||||

|

Proceedings May Be Relevant to

|

Be Insufficient to Cover All Losses

|

|||||

|

Future Performance

|

S-90

|

on a Defective Mortgage Loan

|

S-102

|

|||

|

Risks Relating to Costs of Compliance

|

Risks Related to Borrower Default

|

S-103

|

||||

|

with Applicable Laws and

|

Risks Related to Modification of

|

|||||

|

Regulations

|

S-90

|

Mortgage Loans with Balloon

|

||||

|

RISKS RELATED TO CONFLICTS OF

|

Payments

|

S-103

|

||||

|

INTEREST

|

S-91

|

Risks Related to Certain Payments

|

S-104

|

|||

|

Potential Conflicts of Interest of the

|

Risks of Limited Liquidity and Market

|

|||||

|

Master Servicer and the Special

|

Value

|

S-104

|

||||

|

Servicer

|

S-91

|

The Limited Nature of Ongoing

|

||||

|

Special Servicer May Be Directed to

|

Information May Make It Difficult for

|

|||||

|

Take Actions

|

S-91

|

You To Resell Your Certificates

|

S-104

|

|||

|

Potential Conflicts of Interest of the

|

Risks Related to Factors Unrelated to

|

|||||

|

Operating Advisor

|

S-92

|

the Performance of the Certificates

|

||||

|

Potential Conflicts of Interest of the

|

and the Mortgage Loans, Such as

|

|||||

|

Underwriters and Their Affiliates

|

S-93

|

Fluctuations in Interest Rates and

|

||||

|

Potential Conflicts of Interest in the

|

the Supply and Demand of CMBS

|

|||||

|

Selection of the Underlying

|

Generally

|

S-105

|

||||

|

Mortgage Loans

|

S-94

|

Credit Support May Not Cover All Types

|

||||

|

Related Parties May Acquire Certificates

|

of Losses

|

S-105

|

||||

|

or Experience Other Conflicts

|

S-95

|

Disproportionate Benefits May Be Given

|

||||

|

Related Parties’ Ownership of

|

to Certain Classes

|

S-105

|

||||

|

Certificates May Impact the

|

The Amount of Credit Support Will Be

|

|||||

|

Servicing of the Mortgage

|

Limited

|

S-106

|

||||

|

Loans and Affect Payments

|

REMIC Status

|

S-106

|

||||

|

under the Certificates

|

S-95

|

State and Local Tax Considerations

|

S-106

|

|||

|

Conflicts of Interest May Arise in

|

Certain Federal Tax Consideration

|

|||||

|

the Ordinary Course of the

|

Regarding Original Issue Discount

|

S-107

|

||||

|

Servicers’ Businesses in

|

Tax Considerations Related to

|

|||||

|

Servicing the Mortgage Loans

|

S-95

|

Foreclosure

|

S-107

|

|||

|

Conflicts of Interest May Arise Due

|

Changes in REMIC Restrictions on Loan

|

|||||

|

to the Activities of the Sponsors

|

S-96 |

Modifications May Impact an

|

||||

|

Conflicts Between Property Managers

|

Investment in the Certificates

|

S-107

|

||||

|

and the Borrowers

|

S-97

|

Risk of Limited Assets

|

S-108

|

|||

|

Other Potential Conflicts of Interest

|

S-97

|

v

|

Risks Relating to Lack of

|

Security for the Mortgage Loans

|

S-152

|

||||

|

Certificateholder Control over the

|

Significant Mortgage Loans and

|

|||||

|

Issuing Entity

|

S-108

|

Significant Obligors

|

S-153

|

|||

|

Different Timing of Mortgage Loan

|

Certain Underwriting Matters

|

S-155

|

||||

|

Amortization Poses Certain Risks

|

S-108

|

Split Loan Structures

|

S-159

|

|||

|

Ratings of the Offered Certificates

|

S-109

|

The Pooled Component and the

|

||||

|

THE SPONSORS, MORTGAGE LOAN

|

Non-Pooled Component of the

|

|||||

|

SELLERS AND ORIGINATORS

|

S-111

|

Hartman Portfolio Mortgage

|

||||

|

German American Capital Corporation

|

S-111 |

Loan

|

S-159

|

|||

|

General

|

S-111

|

Additional Mortgage Loan Information

|

S-165

|

|||

|

GACC’s Securitization Program

|

S-111

|

Certain Terms and Conditions of the

|

||||

|

Review of GACC Mortgage Loans

|

S-112

|

Mortgage Loans

|

S-170

|

|||

|

GACC’s Underwriting Standards

|

S-114

|

Changes in Mortgage Pool

|

||||

|

Compliance with Rule 15Ga-1

|

Characteristics

|

S-184

|

||||

|

under the Exchange Act

|

S-117

|

DESCRIPTION OF THE OFFERED

|

||||

|

Ladder Capital Finance LLC

|

S-118

|

CERTIFICATES

|

S-185

|

|||

|

General

|

S-118

|

General

|

S-185

|

|||

|

Ladder Capital Group’s

|

Distributions

|

S-186

|

||||

|

Securitization Program

|

S-118

|

Fees and Expenses

|

S-192

|

|||

|

Review of LCF Mortgage Loans

|

S-119

|

Distributions of the Alamance

|

||||

|

Ladder Capital Group’s

|

Crossing Interest Strip

|

S-199

|

||||

|

Underwriting Guidelines and

|

Distribution of Excess Interest

|

S-199

|

||||

|

Processes

|

S-121

|

Prepayment Premiums and Yield

|

||||

|

Compliance with Rule 15Ga-1

|

Maintenance Charges

|

S-199

|

||||

|

under the Exchange Act

|

S-126

|

Application Priority of Mortgage

|

||||

|

Guggenheim Life and Annuity Company

|

S-126 |

Loan Collections

|

S-200

|

|||

|

General

|

S-126

|

Assumed Final Distribution Date

|

S-202

|

|||

|

GLAC’s Loan Origination and

|

Realized Losses

|

S-203

|

||||

|

Acquisition History

|

S-127

|

Prepayment Interest Shortfalls

|

S-204

|

|||

|

Review of GLAC Mortgage Loans

|

S-127

|

Subordination

|

S-206

|

|||

|

GLAC’s Underwriting Standards

|

S-129

|

Appraisal Reductions

|

S-206

|

|||

|

Compliance with Rule 15Ga-1

|

Delivery, Form and Denomination

|

S-210

|

||||

|

under the Exchange Act

|

S-134

|

Book-Entry Registration

|

S-211

|

|||

|

THE DEPOSITOR

|

S-134

|

Definitive Certificates

|

S-213

|

|||

|

THE ISSUING ENTITY

|

S-135

|

Certificateholder Communication

|

S-213

|

|||

|

THE SERVICERS

|

S-136

|

Access to Certificateholders’

|

||||

|

Generally

|

S-136

|

Names and Addresses

|

S-213

|

|||

|

The Master Servicer

|

S-136

|

Special Notices

|

S-213

|

|||

|

The Special Servicer

|

S-140

|

Retention of Certain Certificates by

|

||||

|

Replacement of the Special Servicer

|

S-142

|

Affiliates of Transaction Parties

|

S-214

|

|||

|

THE TRUSTEE

|

S-144

|

YIELD AND MATURITY

|

||||

|

Certain Matters Regarding the Trustee

|

S-145

|

CONSIDERATIONS

|

S-214

|

|||

|

Resignation and Removal of the Trustee

|

S-146

|

Yield Considerations

|

S-214

|

|||

|

THE CERTIFICATE ADMINISTRATOR

|

Weighted Average Life

|

S-216

|

||||

|

AND CUSTODIAN

|

S-146

|

Certain Price/Yield Tables

|

S-218

|

|||

|

Trustee and Certificate Administrator

|

THE POOLING AND SERVICING

|

|||||

|

Fee

|

S-148

|

AGREEMENT

|

S-220

|

|||

|

PAYING AGENT, CERTIFICATE

|

General

|

S-220

|

||||

|

REGISTRAR, CUSTODIAN AND

|

Servicing of the Mortgage Loans;

|

|||||

|

AUTHENTICATING AGENT

|

S-148

|

Collection of Payments

|

S-220

|

|||

|

THE OPERATING ADVISOR

|

S-149

|

The Directing Holder

|

S-222

|

|||

|

CERTAIN RELATIONSHIPS AND

|

Limitation on Liability of Directing Holder

|

S-226

|

||||

|

RELATED TRANSACTIONS

|

S-150

|

The Operating Advisor

|

S-227

|

|||

|

DESCRIPTION OF THE MORTGAGE

|

General

|

S-227

|

||||

|

POOL

|

S-151

|

|||||

|

General

|

S-151

|

vi

|

Role of Operating Advisor When No

|

CERTAIN FEDERAL INCOME TAX

|

|||||||

|

Control Termination Event Has

|

CONSEQUENCES

|

S-275

|

||||||

|

Occurred and Is Continuing

|

S-227

|

General

|

S-275

|

|||||

|

Role of Operating Advisor Only

|

Tax Status of Offered Certificates

|

S-276

|

||||||

|

While a Control Termination

|

Taxation of Offered Certificates

|

S-276

|

||||||

|

Event Has Occurred and Is

|

Further Information; Taxation of Foreign

|

|||||||

|

Continuing

|

S-227

|

Investors

|

S-277

|

|||||

|

Annual Report

|

S-229

|

CERTAIN STATE AND LOCAL TAX

|

||||||

|

Replacement of the Special

|

CONSIDERATIONS

|

S-278

|

||||||

|

Servicer

|

S-230

|

ERISA CONSIDERATIONS

|

S-278

|

|||||

|

Operating Advisor Termination

|

METHOD OF DISTRIBUTION

|

|||||||

|

Events

|

S-230

|

(UNDERWRITER CONFLICTS OF

|

||||||

|

Rights upon Operating Advisor

|

INTEREST)

|

S-280

|

||||||

|

Termination Event

|

S-231

|

LEGAL INVESTMENT

|

S-281

|

|||||

|

Termination of the Operating

|

LEGAL MATTERS

|

S-282

|

||||||

|

Advisor Without Cause

|

S-231

|

RATINGS

|

S-282

|

|||||

|

Operating Advisor Compensation

|

S-232

|

LEGAL ASPECTS OF MORTGAGE

|

||||||

|

Advances

|

S-232

|

LOANS IN CALIFORNIA,

|

||||||

|

Accounts

|

S-236

|

MASSACHUSETTS, TEXAS, NEW

|

||||||

|

Enforcement of “Due-On-Sale” and

|

YORK AND PUERTO RICO

|

S-283

|

||||||

|

“Due-On-Encumbrance” Clauses

|

S-238

|

INDEX OF DEFINED TERMS

|

S-287

|

|||||

|

Inspections

|

S-239

|

|||||||

|

Insurance Policies

|

S-239

|

ANNEX A-1

|

– |

CERTAIN

|

||||

|

Assignment of the Mortgage Loans

|

S-242

|

CHARACTERISTICS

|

||||||

|

Representations and Warranties;

|

OF THE MORTGAGE

|

|||||||

|

Repurchase; Substitution

|

S-242

|

LOANS

|

A-1-1

|

|||||

|

Certain Matters Regarding the

|

ANNEX A-2

|

– |

CERTAIN POOL

|

|||||

|

Depositor, the Master Servicer, the

|

CHARACTERISTICS

|

|||||||

|

Special Servicer and the Operating

|

OF THE MORTGAGE

|

|||||||

|

Advisor

|

S-244

|

LOANS AND

|

||||||

|

Events of Default

|

S-246

|

MORTGAGED

|

||||||

|

Rights upon Event of Default

|

S-247

|

PROPERTIES

|

A-2-1

|

|||||

|

Waivers of Events of Default

|

S-249

|

ANNEX B

|

– |

DESCRIPTION OF THE

|

||||

|

Amendment

|

S-249

|

TOP 20 MORTGAGE

|

||||||

|

No Downgrade Confirmation

|

S-250

|

LOANS OR GROUPS

|

||||||

|

Evidence of Compliance

|

S-252

|

OF CROSS-

|

||||||

|

Voting Rights

|

S-252

|

COLLATERALIZED

|

||||||

|

Realization Upon Mortgage Loans

|

S-252

|

MORTGAGE LOANS

|

B-1

|

|||||

|

Sale of Defaulted Mortgage Loans and

|

ANNEX C

|

– |

GLOBAL CLEARANCE,

|

|||||

|

REO Properties

|

S-254

|

SETTLEMENT AND

|

||||||

|

Modifications

|

S-255

|

TAX DOCUMENTATION

|

||||||

|

Optional Termination

|

S-257

|

PROCEDURES

|

C-1

|

|||||

|

Servicing Compensation and Payment

|

ANNEX D

|

– |

DECREMENT TABLES

|

D 1

|

||||

|

of Expenses

|

S-258

|

ANNEX E

|

– |

PRICE/YIELD TABLES

|

E 1

|

|||

|

Special Servicing

|

S-259

|

ANNEX F

|

– |

MORTGAGE LOAN

|

||||

|

Master Servicer and Special

|

SELLER

|

|||||||

|

Servicer Permitted To Buy

|

REPRESENTATIONS

|

|||||||

|

Certificates

|

S-265

|

AND WARRANTIES

|

F-1

|

|||||

|

Reports to Certificateholders; Available

|

ANNEX G

|

– |

EXCEPTIONS TO

|

|||||

|

Information

|

S-265

|

MORTGAGE LOAN

|

||||||

|

Certificate Administrator Reports

|

S-265 |

SELLER

|

||||||

|

Information Available Electronically

|

S-268 |

REPRESENTATIONS

|

||||||

|

Other Information

|

S-273

|

AND WARRANTIES

|

G-1

|

|||||

|

Master Servicer’s Reports

|

S-273

|

|||||||

|

Exchange Act Filings

|

S-274

|

|||||||

|

USE OF PROCEEDS

|

S-275

|

|||||||

vii

IMPORTANT NOTICE ABOUT INFORMATION

PRESENTED IN PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

Information about the certificates offered in this prospectus supplement is contained in two separate documents that progressively provide more detail: (a) the accompanying prospectus, which provides general information, some of which may not apply to the offered certificates; and (b) this prospectus supplement, which describes the specific terms of the offered certificates. The Annexes to this prospectus supplement are incorporated into and are a part of this prospectus supplement. References in the accompanying prospectus to the prospectus supplement for the offered certificates should be interpreted to mean this prospectus supplement.

In addition, we have filed with the Securities and Exchange Commission a registration statement under the Securities Act of 1933, as amended, with respect to the offered certificates. This prospectus supplement and the accompanying prospectus form a part of that registration statement. However, this prospectus supplement and the accompanying prospectus do not contain all of the information contained in our registration statement. For further information regarding the documents referred to in this prospectus supplement and the accompanying prospectus, you should refer to our registration statement and the exhibits to it. Our registration statement and the exhibits to it can be inspected and copied at prescribed rates at the public reference facilities maintained by the Securities and Exchange Commission (the “SEC”) at its public reference room, 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Copies of these materials can also be obtained electronically through the SEC’s internet website (http://www.sec.gov).

This prospectus supplement is not an offer to sell or a solicitation of an offer to buy these securities in any state where such offer, solicitation or sale is not permitted.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information that is different from that contained in this prospectus supplement. The information in this prospectus supplement is accurate only as of the date of this prospectus supplement.

This prospectus supplement and the accompanying prospectus include cross references to sections in these materials where you can find further related discussions. The tables of contents in this prospectus supplement and the accompanying prospectus identify the pages where these sections are located.

Certain capitalized terms are defined and used in this prospectus supplement and the accompanying prospectus to assist you in understanding the terms of the offered certificates. The capitalized terms used in this prospectus supplement are defined on the pages indicated under the caption “Index of Defined Terms” beginning on page S-287 in this prospectus supplement.

In this prospectus supplement:

|

●

|

the terms “Depositor,” “we,” “us” and “our” refer to Deutsche Mortgage & Asset Receiving Corporation.

|

|

●

|

references to “lender” with respect to the mortgage loans generally should be construed to mean, subsequent to the issuance of the offered certificates, the trustee on behalf of the issuing entity as the holder of record title to the mortgage loans or the master servicer or the special servicer, as applicable, with respect to the obligations and rights of the lender as described under “The Pooling and Servicing Agreement” in this prospectus supplement.

|

THE OFFERED CERTIFICATES DO NOT REPRESENT AN INTEREST IN OR OBLIGATION OF THE DEPOSITOR, THE SPONSORS, THE MORTGAGE LOAN SELLERS, THE MASTER SERVICER, THE SPECIAL SERVICER, THE TRUSTEE, THE CERTIFICATE ADMINISTRATOR, THE OPERATING

viii

ADVISOR, THE INITIAL DIRECTING HOLDER, THE UNDERWRITERS OR ANY OF THEIR RESPECTIVE AFFILIATES. NEITHER THE OFFERED CERTIFICATES NOR THE MORTGAGE LOANS ARE INSURED OR GUARANTEED BY ANY GOVERNMENTAL AGENCY OR INSTRUMENTALITY OR PRIVATE INSURER.

THERE IS CURRENTLY NO SECONDARY MARKET FOR THE OFFERED CERTIFICATES. WE CANNOT ASSURE YOU THAT A SECONDARY MARKET WILL DEVELOP OR, IF A SECONDARY MARKET DOES DEVELOP, THAT IT WILL PROVIDE HOLDERS OF THE OFFERED CERTIFICATES WITH LIQUIDITY OF INVESTMENT OR THAT IT WILL CONTINUE FOR THE TERM OF THE OFFERED CERTIFICATES. THE UNDERWRITERS CURRENTLY INTEND TO MAKE A MARKET IN THE OFFERED CERTIFICATES BUT ARE UNDER NO OBLIGATION TO DO SO. ACCORDINGLY, PURCHASERS MUST BE PREPARED TO BEAR THE RISKS OF THEIR INVESTMENTS FOR AN INDEFINITE PERIOD. SEE “RISK FACTORS—RISKS RELATED TO THE OFFERED CERTIFICATES—RISKS OF LIMITED LIQUIDITY AND MARKET VALUE” IN THIS PROSPECTUS SUPPLEMENT.

ix

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus contain certain forward-looking statements. If and when included in this prospectus supplement, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties, which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this prospectus supplement are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

NOTICE TO RESIDENTS OF THE UNITED KINGDOM

The issuing entity described in this prospectus supplement may constitute a “collective investment scheme” as defined by Section 235 of the Financial Services and Markets Act 2000 (the “FSMA”) that is not a “recognised collective investment scheme” for the purposes of the FSMA and that has not been authorized or otherwise approved. As an unregulated scheme, the certificates cannot be marketed in the United Kingdom to the general public, except in accordance with the FSMA.

The distribution of this prospectus supplement (A) if made by a person who is not an authorized person under the FSMA, is being made only to, or directed only at, persons who (i) are outside the United Kingdom, or (ii) have professional experience in matters relating to investments and qualify as investment professionals in accordance with Article 19(5) of the FSMA (Financial Promotion) Order 2001 (the “Financial Promotion Order”), or (iii) are persons falling within Article 49(2)(a) through (d) (“high net worth companies, unincorporated associations, etc.”) of the Financial Promotion Order 2001 (all such persons together being referred to as “FPO Persons”); and (B) if made by a person who is an authorized person under the FSMA, is being made only to, or directed only at, persons who (i) are outside the United Kingdom, or (ii) have professional experience in participating in unregulated collective investment schemes and qualify as investment professionals in accordance with Article 14(3) of the FSMA (Promotion of Collective Investment Schemes)(Exemptions) Order 2001 (the “Promotion of Collective Investment Schemes Exemptions Order”), or (iii) are persons falling within Article 22(2)(a) through (d) (“high net worth companies, unincorporated associations, etc.”) of the Promotion of Collective Investment Schemes Exemptions Order (all such persons together being referred to as “PCIS Persons” and, together with the FPO Persons, the “Relevant Persons”). This prospectus supplement must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this prospectus supplement relates, including the offered certificates, is available only to Relevant Persons and will be engaged in only with Relevant Persons. Any persons other than Relevant Persons should not rely on this prospectus supplement.

Potential investors in the United Kingdom are advised that all, or most, of the protections afforded by the United Kingdom regulatory system will not apply to an investment in the certificates and that compensation will not be available under the United Kingdom Financial Services Compensation Scheme.

EUROPEAN ECONOMIC AREA

THIS PROSPECTUS SUPPLEMENT HAS BEEN PREPARED ON THE BASIS THAT ANY OFFER OF CERTIFICATES (AS DEFINED HEREIN) IN ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA WHICH HAS IMPLEMENTED THE PROSPECTUS DIRECTIVE (EACH, A “RELEVANT MEMBER STATE”) WILL BE MADE PURSUANT TO AN EXEMPTION UNDER THE PROSPECTUS DIRECTIVE (AS DEFINED BELOW) FROM THE REQUIREMENT TO PUBLISH A PROSPECTUS FOR OFFERS OF CERTIFICATES. ACCORDINGLY, ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN THAT RELEVANT MEMBER STATE OF CERTIFICATES WHICH

x

ARE THE SUBJECT OF AN OFFERING CONTEMPLATED IN THIS PROSPECTUS SUPPLEMENT AS COMPLETED BY FINAL TERMS IN RELATION TO THE OFFER OF THOSE CERTIFICATES MAY ONLY DO SO IN CIRCUMSTANCES IN WHICH NO OBLIGATION ARISES FOR THE ISSUING ENTITY, THE DEPOSITOR OR AN UNDERWRITER TO PUBLISH A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE IN RELATION TO SUCH OFFER.

NONE OF THE ISSUING ENTITY, THE DEPOSITOR AND THE UNDERWRITERS HAS AUTHORISED, NOR DOES ANY OF THEM AUTHORISE, THE MAKING OF ANY OFFER OF CERTIFICATES IN CIRCUMSTANCES IN WHICH AN OBLIGATION ARISES FOR THE ISSUING ENTITY, THE DEPOSITOR OR AN UNDERWRITER TO PUBLISH OR SUPPLEMENT A PROSPECTUS FOR SUCH OFFER.

FOR THE PURPOSES OF THE DISCUSSION IN THIS SECTION ENTITLED “EUROPEAN ECONOMIC AREA”, THE EXPRESSION “PROSPECTUS DIRECTIVE” MEANS DIRECTIVE 2003/71/EC (AND AMENDMENTS THERETO, INCLUDING THE 2010 PD AMENDING DIRECTIVE, TO THE EXTENT IMPLEMENTED IN THE RELEVANT MEMBER STATE), AND INCLUDES ANY RELEVANT IMPLEMENTING MEASURE IN THE RELEVANT MEMBER STATE AND THE EXPRESSION “2010 PD AMENDING DIRECTIVE” MEANS DIRECTIVE 2010/73/EU.

In relation to each Relevant Member State, each underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) it has not made and will not make an offer of certificates to the public in that Relevant Member State other than:

(a) to any legal entity which is a “qualified investor” as defined in the Prospectus Directive;

(b) to fewer than 100 or, if the Relevant Member State has implemented the relevant provisions of the 2010 PD Amending Directive, 150 natural or legal persons (other than “qualified investors” as defined in the Prospectus Directive) subject to obtaining the prior consent of the relevant underwriters nominated by the depositor for any such offer; or

(c) in any other circumstances falling within Article 3(2) of the Prospectus Directive;

provided no such offer of certificates referred to in (a) to (c) above shall require the issuing entity, the depositor or any of the underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this provision, the expression an “offer of certificates to the public” in relation to any certificates in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the certificates to be offered so as to enable an investor to decide to purchase or subscribe the certificates, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State.

xi

EXECUTIVE SUMMARY

This Executive Summary does not include all of the information you need to consider in making your investment decision. You are advised to carefully read, and should rely solely on, the detailed information appearing elsewhere in this prospectus supplement relating to the certificates offered by this free writing supplement and the underlying mortgage loans.

CERTIFICATES

|

Class

|

Initial Certificate Balance or Notional Balance(1)

|

Approximate Initial Credit Support(5)

|

Description

of Pass-

Through

Rate

|

Assumed Final Distribution

Date(2)

|

Approximate

Initial

Pass-Through

Rate

|

Weighted Average Life

(Yrs.)(6)

|

Principal Window (Mos.)(6)

|

|||||||

|

Offered Certificates

|

||||||||||||||

|

A-1

|

$48,958,000

|

30.000%(7)

|

Fixed

|

July 2016

|

1.156%

|

2.29

|

1-52

|

|||||||

|

A-2

|

$77,841,000

|

30.000%(7)

|

Fixed

|

March 2017

|

2.256%

|

4.64

|

52-60

|

|||||||

|

A-3

|

$115,586,000

|

30.000%(7)

|

Fixed

|

July 2021

|

3.069%

|

6.86

|

60-112

|

|||||||

|

A-4

|

$416,502,000

|

30.000%(7)

|

Fixed

|

January 2022

|

3.288%

|

9.60

|

112-118

|

|||||||

|

A-M

|

$92,950,000

|

20.125%

|

Fixed

|

February 2022

|

4.063%

|

9.82

|

118-119

|

|||||||

|

B

|

$44,711,000

|

15.375%

|

Fixed(3)

|

February 2022

|

4.934%

|

9.89

|

119-119

|

|||||||

|

C

|

$32,944,000

|

11.875%

|

WAC(4)

|

February 2022

|

5.825%

|

9.89

|

119-119

|

|||||||

|

Non-Offered Certificates(8)

|

||||||||||||||

|

X-A(9)

|

$751,837,000

|

N/A

|

Variable(9)

|

N/A

|

2.720%

|

N/A

|

N/A

|

|||||||

|

X-B(9)

|

$189,431,016

|

N/A

|

Variable(9)

|

N/A

|

0.699%

|

N/A

|

N/A

|

|||||||

|

D

|

$52,946,000

|

6.250%

|

WAC(4)

|

March 2022

|

5.825%

|

9.96

|

119-120

|

|||||||

|

E

|

$15,296,000

|

4.625%

|

Fixed

|

March 2022

|

4.250%

|

9.97

|

120-120

|

|||||||

|

F

|

$11,766,000

|

3.375%

|

Fixed

|

March 2022

|

4.250%

|

9.97

|

120-120

|

|||||||

|

G

|

$31,768,016

|

0.000%

|

Fixed

|

March 2022

|

4.250%

|

9.97

|

120-120

|

|||||||

|

HP(10)

|

$10,000,000

|

0.000%

|

Fixed(11)

|

October 2018

|

6.486%

|

6.26

|

1-79

|

|||||||

| X-ALA(12) |

$50,454,121

|

N/A

|

Fixed

|

N/A

|

0.980% |

N/A

|

N/A

|

|||||||

|

V(13)

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|||||||

|

R(14)

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|||||||

|

LR(14)

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|||||||

|

(1)

|

Approximate; subject to a variance of plus or minus 5.0%.

|

|

(2)

|

The assumed final distribution date with respect to any class of certificates is the distribution date on which the final distribution would occur for that class of certificates based upon the assumption that no mortgage loan is prepaid prior to its stated maturity date or anticipated repayment date, as applicable, and otherwise based on modeling assumptions described in this prospectus supplement. The actual performance and experience of the mortgage loans will likely differ from such assumptions. See “Yield and Maturity Considerations” in this prospectus supplement.

|

|

(3)

|

For any distribution date, the pass-through rate on the Class B certificates will equal a per annum rate equal to the lesser of (i) the weighted average of the net mortgage rates on the mortgage loans (in the case of the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to this prospectus supplement as Hartman Portfolio, taking into account the interest rate and principal balance of the pooled component only) (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which such distribution date occurs and (ii) 4.934%.

|

|

(4)

|

For any distribution date, the pass-through rates on the Class C and Class D certificates will equal a per annum rate equal to the weighted average of the net mortgage rates on the mortgage loans (in the case of the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to this prospectus supplement as Hartman Portfolio, taking into account the interest rate and principal balance of the pooled component only) (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which such distribution date occurs.

|

|

(5)

|

The credit support for each class of certificates presented in the table does not include the non-pooled component of the mortgage loan (referenced in this prospectus supplement as the Hartman Portfolio mortgage loan) secured by the portfolio of mortgaged properties identified on Annex A-1 to this prospectus supplement as Hartman Portfolio.

|

|

(6)

|

The weighted average life and principal window during which distributions of principal would be received as set forth in the table with respect to each class of certificates is based on (i) modeling assumptions and prepayment assumptions described in this prospectus supplement, (ii) assumptions that there are no prepayments or losses on the mortgage loans and (iii) assumptions that there are no extensions of maturity dates and that mortgage loans with anticipated repayment dates are repaid on their respective anticipated repayment dates.

|

|

(7)

|

Represents the approximate credit support for the Class A-1, Class A-2, Class A-3 and Class A-4 certificates, in the aggregate.

|

|

(8)

|

None of the classes of certificates set forth below in this table are offered by this prospectus supplement.

|

|

(9)

|

The Class X-A and Class X-B certificates will not have certificate balances. None of the Class X-A or Class X-B certificates are entitled to distributions of principal. The Class X-A and Class X-B certificates will accrue interest on their related notional balance and at the related pass-through rate as described in this prospectus supplement under “Description of the Offered Certificates—General” and “—Distributions.”

|

|

(10)

|

The Class HP certificates will only receive distributions from, and will only incur losses with respect to, the non-pooled component of the Hartman Portfolio mortgage loan.

|

|

(11)

|

For any distribution date, the pass-through rate on the Class HP certificates will be the net mortgage rate of the non-pooled component of the Hartman Portfolio mortgage loan.

|

|

(12)

|

The Class X-ALA certificates will not have a certificate balance or assumed final distribution date. The Class X-ALA certificates will not be entitled to distributions in respect of principal. The Class X-ALA certificates will be entitled to distributions of the Alamance Crossing Interest Strip, which strip is equal to the amount of interest accrued on a notional balance equal to the stated principal balance of the Alamance Crossing mortgage loan at a rate equal to the pass-through rate of the Class X-ALA certificates and calculated on the basis of the actual number of days elapsed in each interest accrual period and a 360-day year, as described in this prospectus supplement under “Description of the Offered Certificates—General” and “—Distributions of the Alamance Crossing Interest Strip.”

|

xii

|

(13)

|

The Class V certificates will not have a certificate balance, notional balance, pass-through rate or assumed final distribution date. The Class V certificates represent undivided interests in the excess interest, as further described in this prospectus supplement. The Class V certificates will not be entitled to distributions in respect of interest other than excess interest.

|

|

(14)

|

The Class R and Class LR certificates will each not have a certificate balance, notional balance, pass-through rate or assumed final distribution date. The Class R and Class LR certificates represent the residual interests in each Trust REMIC, as further described in this prospectus supplement. The Class R and Class LR certificates will not be entitled to distributions of principal or interest.

|

xiii

The following table shows information regarding the mortgage loans and the mortgaged properties as of the cut-off date. All weighted averages set forth below are based on the principal balances of the mortgage loans as of such date.

The Mortgage Pool(1)

|

Outstanding Pool Balance as of the Cut-off Date(2)

|

$941,268,017

|

|

Number of Mortgage Loans

|

43

|

|

Number of Mortgaged Properties

|

67

|

|

Average Cut-off Date Mortgage Loan Balance

|

$21,889,954

|

|

Weighted Average Mortgage Rate

|

5.810%

|

|

Weighted Average Cut-off Date Remaining Term to

Maturity (in months) (3) |

110

|

|

Weighted Average Cut-off Date Debt Service Coverage Ratio

|

1.78x

|

|

Weighted Average Cut-off Date Loan-to-Value Ratio

|

59.2%

|

|

Cut-off Date U/W NOI Debt Yield

|

12.8%

|

|

(1)

|

Statistical information in this table does not include the non-pooled component of the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to this prospectus supplement as Hartman Portfolio.

|

|

(2)

|

Subject to a permitted variance of plus or minus 5.0%.

|

|

(3)

|

Calculated with respect to an anticipated repayment date for 1 mortgage loan, representing 1.6% of the outstanding pool balance as of the cut-off date.

|

xiv

|

SUMMARY

|

|||

|

This summary highlights selected information from this prospectus supplement and does not include all of the relevant information you need to consider in making your investment decision. You are advised to carefully read, and should rely solely on, the detailed information appearing elsewhere in this prospectus supplement and in the accompanying prospectus.

|

|||

|

Title of Certificates

|

COMM 2012-LC4 Commercial Mortgage Pass-Through Certificates.

|

||

|

RELEVANT PARTIES AND DATES

|

|||

|

Issuing Entity

|

The issuing entity is COMM 2012-LC4 Mortgage Trust, a common law trust fund to be formed on the closing date under the laws of the State of New York pursuant to a pooling and servicing agreement by and among the depositor, the trustee, the certificate administrator, the operating advisor, the master servicer and the special servicer. See “The Issuing Entity” in this prospectus supplement.

|

||

|

Depositor

|

Deutsche Mortgage & Asset Receiving Corporation, a Delaware corporation. Our principal offices are located at 60 Wall Street, New York, New York 10005. Our telephone number is (212) 250-2500. See “The Depositor” in this prospectus supplement and “The Depositor” in the prospectus.

|

||

|

Sponsors

|

German American Capital Corporation, Ladder Capital Finance LLC and Guggenheim Life and Annuity Company each have acted as a sponsor with respect to the issuance of the certificates. The sponsors are the entities that will organize and initiate the issuance of the certificates by transferring or causing the transfer of the mortgage loans to the depositor. The depositor in turn will transfer the mortgage loans to the issuing entity and the issuing entity will issue the certificates. See “The Sponsors, Mortgage Loan Sellers and Originators” in this prospectus supplement and “The Sponsor” in the prospectus.

|

||

|

Mortgage Loan Sellers

|

German American Capital Corporation, a sponsor and an affiliate of Deutsche Bank Securities Inc., an underwriter, and of Deutsche Mortgage & Asset Receiving Corporation, the depositor.

|

||

|

Ladder Capital Finance LLC, a sponsor and an affiliate of Ladder Capital Securities LLC, an underwriter.

|

|||

|

Guggenheim Life and Annuity Company, a sponsor and an affiliate of Guggenheim Securities, LLC, an underwriter.

|

|||

|

See “The Sponsors, Mortgage Loan Sellers and Originators” in this prospectus supplement.

|

|||

S-1

|

The number and total cut-off date principal balance of the mortgage loans that will be transferred to the depositor by the respective mortgage loan sellers are as follows:

|

|||||||||||

|

Mortgage Loan Seller

|

Number

of

Mortgage

Loans

|

Total Cut-off

Date Principal

Balance

|

% of Initial

Outstanding

Pool

Balance

|

||||||||

|

German American Capital Corporation(1)

|

13

|

$418,332,854

|

44.4%

|

||||||||

|

Ladder Capital Finance LLC

|

23

|

$393,439,607

|

41.8%

|

||||||||

|

Guggenheim Life and Annuity Company

|

7

|

$129,495,555

|

13.8%

|

||||||||

|

Total

|

43

|

$941,268,017

|

100.0%

|

||||||||

|

(1)

|

Does not include the non-pooled component of the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to this prospectus supplement as Hartman Portfolio.

|

||||||||||

|

Originators

|

Except as indicated in the following sentences, each mortgage loan seller or one of its affiliates originated each of the mortgage loans as to which it is acting as mortgage loan seller.

|

||||||||||

|

The mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to this prospectus supplement as Hartman Portfolio, representing 6.0% of the outstanding pool balance as of the cut-off date and as to which German American Capital Corporation is acting as mortgage loan seller, is a mortgage loan that was originated by an affiliate of J.P. Morgan Investment Management Inc. and acquired by German American Capital Corporation.

|

|||||||||||

|

The mortgage loan secured by the mortgaged property identified on Annex A-1 to this prospectus supplement as Alamance Crossing, representing 5.4% of the outstanding pool balance as of the cut-off date and as to which Guggenheim Life and Annuity Company is acting as mortgage loan seller, was originated by Regions Bank and acquired by Guggenheim Life and Annuity Company.

|

|||||||||||

|

See “The Sponsors, Mortgage Loan Sellers and Originators” in this prospectus supplement.

|

|||||||||||

|

Master Servicer

|

Wells Fargo Bank, National Association, a national banking association, will act as master servicer with respect to all of the mortgage loans sold to the depositor. See “The Servicers—The Master Servicer” in this prospectus supplement. The master servicer will be primarily responsible for servicing and administering, directly or through sub-servicers or primary servicers, the mortgage loans: (a) as to which there is no default or reasonably foreseeable default that would give rise to a transfer of servicing to the special servicer; and (b) as to which any such default or reasonably foreseeable default has been corrected, including as part of a workout. In addition, the master servicer will be the primary party responsible for making principal and interest advances and property advances under the pooling and servicing agreement with respect to the mortgage loans that it is servicing, subject in each case to a nonrecoverability determination. The fee of the master servicer with respect to the mortgage loans will be

|

||||||||||

S-2

|

payable monthly from amounts received in respect of interest on each mortgage loan serviced by the master servicer (prior to application of such interest payments to make payments on the certificates), and will equal a rate per annum equal to the administrative fee rate set forth on Annex A-1 of this prospectus supplement for each mortgage loan (net of the trustee/certificate administrator fee rate and operating advisor fee rate) multiplied by the stated principal balance of the related mortgage loan. The master servicer will also be entitled to receive income from investment of funds in certain accounts and certain fees paid by the borrowers. See “The Servicers—The Master Servicer” and “The Pooling and Servicing Agreement—Servicing Compensation and Payment of Expenses” in this prospectus supplement.

|

|||

|

The principal west coast commercial mortgage master servicing offices of Wells Fargo Bank, National Association are located at 1901 Harrison Street, Oakland, California 94612. The principal east coast commercial mortgage master servicing offices of Wells Fargo Bank, National Association are located at Duke Energy Center, 550 South Tryon Street, 14th Floor, MAC D1086-120, Charlotte, North Carolina 28202.

|

|||

|

Special Servicer

|

CWCapital Asset Management LLC, a Massachusetts limited liability company, will be responsible for the servicing and administration of the specially serviced loans and REO properties. See “The Servicers—The Special Servicer” and “The Pooling and Servicing Agreement—Special Servicing” in this prospectus supplement. CWCapital Asset Management LLC was appointed to be the special servicer by CPUSI Co-Investment SS Securities, LLC, which is expected to be the initial directing holder (other than with respect to the mortgage loans that are part of a split loan structure) and, on the closing date, is expected to purchase the Class E, Class F and Class G certificates. The principal servicing office of CWCapital Asset Management LLC is located at 7501 Wisconsin Avenue, Suite 500 West, Bethesda, Maryland 20814, and its telephone number is (202) 715-9500.

|

||

|

The principal compensation to be paid to the special servicer in respect of its special servicing activities will be the special servicing fee, the workout fee and the liquidation fee.

|

|||

|

The special servicing fee will equal 0.25% per annum of the stated principal balance of the related specially serviced loan (including the non-pooled component of the Hartman Portfolio mortgage loan) or REO loan (or mortgage loan as to which the related mortgaged property has become an REO property), and will be payable monthly. The special servicing fee for each specially serviced loan will accrue on the same basis as interest accrues on such specially serviced loan.

|

|||

|

The workout fee will generally be payable with respect to each specially serviced loan (including the non-pooled component of the Hartman Portfolio mortgage loan) which has become a “corrected mortgage loan” (which will occur (i) with respect to a specially serviced loan as to which there has been a payment default, when the borrower has brought the mortgage loan current and thereafter made three consecutive full and timely monthly payments,

|

S-3

|

including pursuant to any workout and (ii) with respect to any other specially serviced loan, when the related default is cured or the other circumstances pursuant to which it became a specially serviced loan cease to exist in the good faith judgment of the special servicer). The workout fee will be payable out of each collection of interest and principal (including scheduled payments, prepayments, balloon payments, and payments at maturity) received on the related mortgage loan for so long as it remains a corrected mortgage loan, in an amount equal to the lesser of (1) 1.0% of each such collection of interest and principal and (2) $1,000,000 in the aggregate with respect to any particular workout of a specially serviced loan.

|

|||

|

A liquidation fee will generally be payable with respect to each specially serviced loan (including the non-pooled component of the Hartman Portfolio mortgage loan) as to which the special servicer obtains a full or discounted payoff from the related borrower or which is repurchased by the related mortgage loan seller outside the applicable cure period and, except as otherwise described in this prospectus supplement, with respect to any specially serviced loan or REO property as to which the special servicer receives any liquidation proceeds. The liquidation fee for each specially serviced loan will be payable from the related payment or proceeds in an amount equal to the lesser of (1) 1.0% of such payment or proceeds and (2) $1,000,000.

|

|||

|

Workout fees and liquidation fees paid by the issuing entity with respect to each mortgage loan will be subject to an aggregate cap per mortgage loan of $1,000,000 as described in “The Pooling and Servicing Agreement—Special Servicing—Special Servicing Compensation” in this prospectus supplement. Any workout fees or liquidation fees paid to a predecessor or successor special servicer will not be taken into account in determining the cap.

|

|||

|

The special servicer will also be entitled to receive income from investment of funds in certain accounts and certain fees paid by the borrowers.

|

|||

|

The foregoing compensation to the special servicer will be paid from the applicable distributions on the mortgage loans prior to application of such distributions to make payments on the certificates, and may result in shortfalls in payments to certificateholders. See “The Servicers—The Special Servicer” and “The Pooling and Servicing Agreement—Special Servicing—Special Servicing Compensation” in this prospectus supplement.

|

|||

|

Trustee

|

U.S. Bank National Association, a national banking association. The corporate trust offices of U.S. Bank National Association are located at 190 South LaSalle Street, 7th floor, Chicago, Illinois 60603. Following the transfer of the underlying mortgage loans into the issuing entity, the trustee, on behalf of the issuing entity, will become the mortgagee of record with respect to each mortgage loan transferred to the issuing entity. In addition (subject to the terms of the pooling and servicing agreement), the trustee will be primarily responsible for back-up advancing. See “The Trustee” in this prospectus supplement.

|

||

S-4

|

Certificate Administrator

and Custodian |

Deutsche Bank Trust Company Americas, a New York banking corporation, located at 1761 East St. Andrew Place, Santa Ana, California 92705-4934, Attention: Trust Administration-DB12L4, and its telephone number is (714) 247-6000. |

|||

|

The certificate administrator will be responsible for: (a) distributing payments to certificateholders, (b) delivering or otherwise making available certain reports to certificateholders and (c), in its capacity as 17g-5 information provider, making available certain information to rating agencies in accordance with Rule 17g-5 under the Securities Exchange Act of 1934, as amended. In addition, the certificate administrator will have additional duties with respect to tax administration. See “The Certificate Administrator and Custodian” in this prospectus supplement.

|

||||

|

The fees of the trustee, custodian and certificate administrator and custodian will be payable monthly from amounts received in respect of interest on each mortgage loan (prior to application of such interest payments to make payments on the certificates), and will be equal to, in the aggregate, 0.002% per annum of the stated principal balance of the related mortgage loan. The certificate administrator will also be entitled to receive income from investment of funds in certain accounts maintained on behalf of the issuing entity.

|

||||

|

Operating Advisor

|

Park Bridge Lender Services LLC, a New York limited liability company and an affiliate of Park Bridge Financial LLC.

|

|||

|

With respect to each mortgage loan, at any time during the period when a “Control Termination Event,” as described under “The Pooling and Servicing Agreement—The Directing Holder” in this prospectus supplement, has occurred and is continuing:

|

||||

|

(i)

|

the special servicer will be required to consult with the operating advisor with regard to certain major decisions with respect to the mortgage loans to the extent described in this prospectus supplement and the pooling and servicing agreement;

|

|||

|

(ii)

|

the operating advisor will be required to review certain operational activities related to specially serviced loans in general on a platform level basis; and

|

|||

|

(iii)

|

based on the operating advisor’s review of certain information described in this prospectus supplement, the operating advisor will be required to prepare an annual report to be provided to the trustee, the rating agencies and the certificate administrator (and made available through the certificate administrator’s website) setting forth its assessment of the special servicer’s performance of its duties under the pooling and servicing agreement on a platform-level basis with respect to the resolution and liquidation of specially serviced loans.

|

|||

S-5

|

With respect to each mortgage loan, after the occurrence and continuance of a “Consultation Termination Event,” as described under “The Pooling and Servicing Agreement—The Directing Holder” in this prospectus supplement, if the operating advisor determines the special servicer is not performing its duties as required under the pooling and servicing agreement or is otherwise not acting in accordance with the servicing standard, the operating advisor may recommend the replacement of the special servicer as described under “The Servicers—Replacement of the Special Servicer” in this prospectus supplement.

|

|||

|