FREE WRITING PROSPECTUS

FILED PURSUANT TO RULE 433

REGISTRATION STATEMENT NO.:

333-130390

November 7, 2007

FREE WRITING PROSPECTUS

STRUCTURAL AND COLLATERAL TERM SHEET

$1,853,970,000

(Approximate Offered Certificates)

CD 2007–CD5

Commercial Mortgage Pass-Through Certificates

Deutsche Mortgage & Asset Receiving Corporation

Depositor

Citigroup Global Markets Realty Corp.

German American Capital Corporation

Artesia Mortgage Capital Corporation

Sponsors and Mortgage Loan Sellers

CWCapital LLC

SunTrust Bank

Mortgage Loan Sellers

|

|

| |||

|

|

| ||

| Initial Certificate or Notional Balance |

Anticipated Ratings Fitch/Moody’s/S&P |

Subordination Levels |

Expected WAL (yrs.) |

Principal Window |

Assumed Final Distribution Date | |||||||||

| Class A-1 | $ | 42,300,000 | AAA / Aaa / AAA | 30.000 | % | 3.09 | 12/07-07/12 | July 15, 2012 | ||||||

| Class A-2 | $ | 89,000,000 | AAA / Aaa / AAA | 30.000 | % | 4.66 | 07/12-10/12 | October 15, 2012 | ||||||

| Class A-3 | $ | 39,400,000 | AAA / Aaa / AAA | 30.000 | % | 6.81 | 09/14-11/14 | November 15, 2014 | ||||||

| Class A-AB | $ | 51,700,000 | AAA / Aaa / AAA | 30.000 | % | 6.92 | 10/12-10/16 | October 15, 2016 | ||||||

| Class A-4 | $ | 958,680,000 | AAA / Aaa / AAA | 30.000 | % | 9.62 | 10/16-08/17 | August 15, 2017 | ||||||

| Class A-1A | $ | 284,848,000 | AAA / Aaa / AAA | 30.000 | % | 8.03 | 12/07-09/17 | September 15, 2017 | ||||||

| Class AM-FX | $ | 167,726,000 | AAA / Aaa / AAA | 20.000 | % | 9.79 | 08/17-09/17 | September 15, 2017 | ||||||

| Class A-MA | $ | 40,693,000 | AAA / Aaa / AAA | 20.000 | % | 9.86 | 09/17-10/17 | October 15, 2017 | ||||||

| Class AJ-FX | $ | 110,780,000 | AAA / Aaa / AAA | 13.375 | % | 9.87 | 09/17-10/17 | October 15, 2017 | ||||||

| Class A-JA | $ | 26,959,000 | AAA / Aaa / AAA | 13.375 | % | 9.88 | 10/17-10/17 | October 15, 2017 | ||||||

| Class B | $ | 20,942,000 | AA+ / Aa1 / AA+ | 12.375 | % | 9.95 | 10/17-11/17 | November 15, 2017 | ||||||

| Class C | $ | 20,942,000 | AA / Aa2 / AA | 11.375 | % | 9.96 | 11/17-11/17 | November 15, 2017 | ||||||

| Deutsche Bank Securities Co-Lead and Joint Bookrunning Manager |

Citi Co-Lead and Joint Bookrunning Manager |

| SunTrust Robinson Humphrey | Credit Suisse | |

| Co-Manager | Co-Manager |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

KEY FEATURES OF SECURITIZATION

Distribution of Pool Collateral by Property Type

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

1

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

SUMMARY OF THE CERTIFICATES

| OFFERED CERTIFICATES |

| Class(1) | Initial Principal or Notional Amount(2) |

Subordination Levels |

Anticipated Ratings (Fitch/Moody’s/S&P) |

Expected Weighted Avg Life (years)(3) |

Principal Window (months) (3) |

Assumed Final Distribution Date(3)(4) | ||||||||

| Class A-1(4) | $ | 42,300,000 | 30.000 | %(6) | AAA/Aaa/AAA | 3.09 | 1–56 | July 15, 2012 | ||||||

| Class A-2(4) | $ | 89,000,000 | 30.000 | %(6) | AAA/Aaa/AAA | 4.66 | 56–59 | October 15, 2012 | ||||||

| Class A-3(4) | $ | 39,400,000 | 30.000 | %(6) | AAA/Aaa/AAA | 6.81 | 82–84 | November 15, 2014 | ||||||

| Class A-AB(4) | $ | 51,700,000 | 30.000 | %(6) | AAA/Aaa/AAA | 6.92 | 59–107 | October 15, 2016 | ||||||

| Class A-4(4) | $ | 958,680,000 | 30.000 | %(6) | AAA/Aaa/AAA | 9.62 | 107–117 | August 15, 2017 | ||||||

| Class A-1A(4) | $ | 284,848,000 | 30.000 | %(6) | AAA/Aaa/AAA | 8.03 | 1–118 | September 15, 2017 | ||||||

| Class AM-FX(4) | $ | 167,726,000 | 20.000 | %(7) | AAA/Aaa/AAA | 9.79 | 117–118 | September 15, 2017 | ||||||

| Class A-MA(4) | $ | 40,693,000 | 20.000 | %(7) | AAA/Aaa/AAA | 9.86 | 118–119 | October 15, 2017 | ||||||

| Class AJ-FX(4) | $ | 110,780,000 | 13.375 | %(8) | AAA/Aaa/AAA | 9.87 | 118–119 | October 15, 2017 | ||||||

| Class A-JA(4) | $ | 26,959,000 | 13.375 | %(8) | AAA/Aaa/AAA | 9.88 | 119–119 | October 15, 2017 | ||||||

| Class B | $ | 20,942,000 | 12.375 | % | AA+/Aa1/AA+ | 9.95 | 119–120 | November 15, 2017 | ||||||

| Class C | $ | 20,942,000 | 11.375 | % | AA/Aa2/AA | 9.96 | 120–120 | November 15, 2017 | ||||||

PRIVATE CERTIFICATES(5)

| Class(1) | Initial Principal or Notional Amount(2) |

Subordination Levels |

Anticipated Ratings (Fitch/Moody’s/S&P) |

Expected Weighted Avg |

Principal Window (months) (3) |

Assumed Final Distribution Date(3)(4) | ||||||||

| Class XP(9) | $ | TBD | N/A | AAA/Aaa/AAA | N/A | N/A | N/A | |||||||

| Class XS(9) | $ | 1,047,091,908 | N/A | AAA/Aaa/AAA | N/A | N/A | N/A | |||||||

| Class XW(9) | $ | 1,047,091,908 | N/A | AAA/Aaa/AAA | N/A | N/A | N/A | |||||||

| Class AM-FL(4)(10) | $ | 1,000,000 | 20.000 | %(7) | AAA/Aaa/AAA | 9.79 | 117–118 | September 15, 2017 | ||||||

| Class AJ-FL(4)(10) | $ | 1,000,000 | 13.375 | %(8) | AAA/Aaa/AAA | 9.87 | 118–119 | October 15, 2017 | ||||||

| Class D | $ | 20,942,000 | 10.375 | % | AA-/Aa3/AA- | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class E | $ | 18,324,000 | 9.500 | % | A+/A1/A+ | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class F | $ | 18,324,000 | 8.625 | % | A/A2/A | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class G | $ | 20,942,000 | 7.625 | % | A-/A3/A- | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class H | $ | 23,559,000 | 6.500 | % | BBB+/Baa1/BBB+ | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class J | $ | 23,560,000 | 5.375 | % | BBB/Baa2/BBB | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class K | $ | 20,942,000 | 4.375 | % | BBB-/Baa3/BBB- | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class L | $ | 26,177,000 | 3.125 | % | BB+/NR/BB+ | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class M | $ | 7,853,000 | 2.750 | % | BB/NR/BB | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class N | $ | 5,236,000 | 2.500 | % | BB-/NR/BB- | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class O | $ | 5,235,000 | 2.250 | % | B+/NR/B+ | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class P | $ | 5,236,000 | 2.000 | % | B/NR/B | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class Q | $ | 2,617,000 | 1.875 | % | B-/NR/B- | 9.96 | 120–120 | November 15, 2017 | ||||||

| Class S | $ | 39,266,816 | 0.000 | % | NR/NR/NR | 11.52 | 120–177 | August 15, 2022 | ||||||

| (1) | The pass-through rates applicable to the Class A-1, Class A-2, Class A-3, Class A-AB, Class A-4, Class A-1A, Class AM-FX, Class A-MA, Class AJ-FX, Class A-JA, Class B, Class C, Class D, Class E, Class F, Class G, Class H, Class J, Class K, Class L, Class M, Class N, Class O, Class P, Class Q and Class S Certificates, the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest will equal one of the following rates: (i) a fixed rate, (ii) a rate equal to the lesser of the initial pass-through rate for that class in the table above and the weighted average net mortgage pass through rate, (iii) a rate equal to the weighed average net mortgage pass through rate less a specified percentage or (iv) a rate equal to the weighted average net mortgage pass-through rate. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | Based on the structuring assumptions, assuming 0% CPR, described in the Prospectus Supplement. |

| (4) |

For purposes of making distributions to the Class A-1, Class A-2, Class A-3, Class A-AB, Class A-4, Class A-1A, Class AM-FX, Class A-MA, Class AJ-FX, and Class A-JA Certificates and the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest, the pool of mortgage loans will be deemed to consist of two distinct Loan Groups, Loan Group 1 and Loan Group 2. Loan Group 1 will consist of 135 mortgage loans, representing approximately 83.17% of the outstanding pool balance. Loan Group 2 will consist of 26 mortgage loans, representing approximately 16.83% of the outstanding pool balance. Loan Group 2 will include approximately 100.00% of all the mortgage loans secured by multifamily and manufactured housing properties. So long as funds are sufficient on any distribution date to make distributions of all interest on such distribution date to the Class A-1, Class A-2, Class A-3, Class A-AB, Class A-4, Class A-1A, Class AM-FX, Class A-MA, Class AJ-FX, Class A-JA, Class XP, Class XS and Class XW Certificates and the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest, interest distributions on the Class A-1, Class A-2, Class A-3, Class A-AB, Class A-4, Class AM-FX, Class AJ-FX Certificates and the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest will be based upon amounts available relating to mortgage loans in Loan Group 1 and interest distributions on the Class A-1A, Class A-MA and Class A-JA Certificates will be based upon amounts available relating to mortgage loans in Loan Group 2. In addition, generally, (i) the Class A-1, Class A-2, Class A-3, Class A-AB, Class A-4, Class AM-FX, Class AJ-FX Certificates and the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest will be entitled to receive distributions of principal collected or advanced in respect of mortgage loans in Loan Group 1, and after the certificate principal balance of the Class A-1A, Class A-MA and Class A-JA Certificates has been reduced to zero, Loan Group 2 and (ii) the Class A-1A, Class A-MA and Class A-JA Certificates will be entitled to receive distributions of principal collected or advanced in respect of mortgage loans in Loan Group 2 and after the certificate balance of the Class AJ-FX Certificates has been reduced to zero, from Loan Group 1. However, on and after any distribution date on which the certificate principal balances of the Class B through Class S Certificates have been reduced to zero, distributions of principal collected or advanced in respect of the pool of mortgage loans will be distributed to the Class A-1, Class A-2, Class A-3, Class A-AB, Class A-4 and Class A-1A Certificates, pro rata, then to the Class AM-FX and Class A-MA Certificates and the Class AM-FL Regular Interest, pro rata, and then to the Class AJ-FX and Class A-JA Certificates and the Class AJ-FL Regular Interest, pro rata. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

2

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

SUMMARY OF THE CERTIFICATES

| (5) | Certificates to be offered privately pursuant to Rule 144A and Regulation S. |

| (6) | Represents the approximate subordination level for the Class A-1, Class A-2, Class A-3, Class A-AB, Class A-4 and Class A-1A Certificates in the aggregate. |

| (7) | Represents the approximate subordination level for the Class AM-FX, Class AM-FL and Class A-MA Certificates in the aggregate. |

| (8) | Represents the approximate subordination level for the Class AJ-FX, Class AJ-FL and Class A-JA Certificates in the aggregate. |

| (9) | The Class XP, Class XS and Class XW Certificates will not have a certificate balance. The interest accrual amounts on the Class XP, Class XS and Class XW Certificates will be calculated by reference to a notional amount equal to the aggregate of the class principal balances of all of the classes of certificates (other than the Class AM-FL, Class AJ-FL, Class XP, Class XS, Class XW, Class T, Class R and Class LR Certificates) and the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest. The pass-through rates applicable to the Class XP, Class XS and Class XW Certificates for the initial distribution date will equal approximately [ ]%, [ ]% and [ ]%, respectively, per annum. The pass-through rate applicable to the Class XP, Class XS and Class XW Certificates for each distribution date subsequent to the initial distribution date generally will be equal in the aggregate to the difference between the weighted average net mortgage pass-through rate and the weighted average pass-through rate of the certificates (based on their certificate balances) other than the Class XP, Class XS, Class XW, Class T, Class R and Class LR certificates. |

| (10) | The Class AM-FL and Class AJ-FL Certificates will represent undivided interests in, among other things, the rights and obligations under the respective swap agreements, in each case, with a swap counterparty to be determined. The swap agreements will provide, among other things that fixed amounts payable by the Trust Fund as interest with respect to the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest will be exchanged for floating amounts at the applicable LIBOR-based rate. Under certain circumstances relating to an event of default under, or termination of, the related swap agreement, the pass-through rate applicable to the Class AM-FL Certificates or the Class AJ-FL Certificates, as applicable, may convert to the fixed pass-through rate applicable to the Class AM-FL Regular Interest or the Class AJ-FL Regular Interest, as applicable. Holders of the offered certificates will not own any interest in, or have any rights under, the swap agreements. |

The Class T, Class R and Class LR Certificates are not represented by this table.

Short-Term Certificate Principal Paydown Summary (1)

| Class |

Mortgage Loan Seller |

Property Name |

Property Type |

Aggregate Cut-off Date Balance |

Remaining Term to Maturity (Months) |

UW DSCR |

Cut-off Date LTV Ratio | ||||||||

| A-1 | GACC | Inverness Business Center North | Industrial | $ | 12,000,000 | 52 | 1.32x | 77.4% | |||||||

| A-1, A-2 | CGM | 130 Prince Street | Mixed Use | $ | 70,000,000 | 56 | 1.20x | 62.5% | |||||||

| A-2 | CGM | Exton Office | Office | $ | 5,400,000 | 57 | 1.30x | 64.3% | |||||||

| A-2 | Artesia | Cordes Professional Building | Office | $ | 1,735,000 | 58 | 1.20x | 73.2% | |||||||

| A-2 | GACC | Bent Tree Plaza I, II & III | Office | $ | 6,400,000 | 58 | 1.21x | 77.6% | |||||||

| A-2, A-AB | Artesia | Shoppes of Crabapple | Retail | $ | 2,660,000 | 59 | 1.19x | 69.1% | |||||||

| A-3, A-AB | Artesia | Town Center East Building 3 | Office | $ | 29,050,931 | 82 | 1.16x | 76.7% | |||||||

| A-3, A-AB | Artesia | Eastside Plaza 3 & 4 | Office | $ | 10,881,620 | 82 | 1.15x | 75.6% | |||||||

| A-3, A-AB | SunTrust | Whitney National Bank | Office | $ | 4,300,000 | 84 | 1.23x | 53.8% | |||||||

| A-4, A-AB | Artesia | Stapleton Square | Industrial | $ | 2,974,995 | 107 | 1.01x | 78.3% | |||||||

| (1) | This table identifies loans in Loan Group 1 with respective balloon payments due during the principal paydown window assuming 0% CPR and no losses for the indicated Certificates. Certain Mortgages may balloon during the principal paydown for more classes of the certificates. See “Yield and Maturity Considerations—Yield Considerations” in the Prospectus Supplement. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

3

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

STRUCTURE OVERVIEW

| Principal Payments: |

In general: (i) principal from Loan Group 1 will be distributed on each Distribution Date to the Class A-AB (until its balance reaches a scheduled balance) and, thereafter sequentially to the Class A-1, A-2, A-3, A-AB and A-4 Certificates, in that order, then pro rata, to the Class AM-FX Certificates and the Class AM-FL Regular Interest, and then pro rata, to the Class AJ-FX Certificates and Class AJ-FL Regular Interest, in that order, in each case until the balance of the subject class is reduced to zero; and (ii) principal from Loan Group 2 will be distributed on each Distribution Date to the Class A-1A, A-MA and A-JA Certificates in that order, in each case until the balance of the subject class is reduced to zero. However, the Class A-1, A-2, A-3, A-AB, A-4, AM-FX and AJ-FX Certificates and the Class AM-FL Regular Interest and Class AJ-FL Regular Interest (in the order described in clause (i) of the prior sentence) will be entitled to receive distributions of principal from Loan Group 2 after the total principal balance of the Class A-1A, A-MA and A-JA Certificates has been reduced to zero; and Class A-1A, A-MA and A-JA Certificates will be entitled to receive distributions of principal from Loan Group 1 after the total principal balance of the Class A-1, A-2, A-3, A-AB, A-4, AM-FX and AJ-FX Certificates and the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest have been reduced to zero. In addition, notwithstanding the foregoing, distributions of principal will be made first, with respect to the Class A-1, A-2, A-3, A-AB, A-4 and A-1A Certificates on a pro rata basis (by balance) and then to the Class AM-FX and Class A-MA Certificates and the Class AM-FL Regular Interest on a pro rata basis (by balance), and then to the Class AJ-FX and Class A-JA Certificates and the Class AJ-FL Regular Interest on a pro rata basis (by balance) if the total principal balance of the Classes B through S Certificates has been reduced to zero as a result of loss allocation. Thereafter, principal will be allocated sequentially (in alphabetical order of Class designation) starting with the Class B Certificates and ending with the Class S Certificates, in each case until retired. |

| Interest Payments: |

The Class XP, Class XS and Class XW Certificates will collectively accrue interest on the total principal balance of the Class A-1 through S Certificates at a rate generally equal to the excess, if any, of the weighted average net coupon for the Mortgage Loans over the weighted average pass-through rate for the Class A-1 through S Certificates. A separate free writing prospectus will describe the notional amounts on which, and the pass-through rates at which, the Class XP, Class XS and Class XW Certificates will individually accrue interest. The Class XP, Class XS and Class XW Certificates will receive payments of interest pari passu and pro rata (based on interest entitlements) with interest on the Class A-1, A-2, A-3, A-AB, A-4 and A-1A Certificates each month, except that interest payments on the Class A-1, A-2, A-3, A-AB and A-4 Certificates are generally to be made out of collections and advances on Loan Group 1 and interest payments on the Class A-1A Certificates are generally to be made out of collections and advances on Loan Group 2. Interest payments with respect to the Class AM-FL and AJ-FL certificates may be subject to reduction if the net WAC of the Mortgage Loans declines below the fixed rate per annum at which interest is payable by the trust to the swap counterparty. |

| Prepayment Interest Shortfalls: |

Net prepayment interest shortfalls will be allocated pro rata generally based on interest entitlements, in reduction of the interest otherwise payable with respect to each of the interestbearing certificate classes (except for this purpose, Class AM-FL and AJ-FL Certificates will be deemed to bear interest at the fixed/WAC/WAC Cap pass-through rate that would be payable thereon without regard to the related interest rate swap agreements). |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

4

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

STRUCTURE OVERVIEW

| Loss Allocation: |

Losses will be allocated to each Class of Certificates in reverse alphabetical order starting with Class S through and including Class B, and next to the Class AJ-FX Certificates and Class A-JA Certificates and the Class AJ-FL Regular Interest on a pro rata basis, and then to the Class AM-FX and A-MA Certificates and the Class AM-FL Regular Interest on a pro rata basis. Any remaining losses will be allocated to Classes A-1, A-2, A-3, A-AB, A-4, and A-1A Certificates on a pro rata basis. |

| Prepayment Premiums: |

Prepayment premiums collected with respect to each Loan Group will be allocated between the respective classes of Investment Grade P&I Certificates (i.e. Class A-1, A-2, A-3, A-AB, A-4, A-1A, AM-FX, A-MA, AJ-FX, A-JA, B, C, D, E, F, G, H, J and K Certificates and the Class AM-FL Regular Interest and the Class AJ-FL Regular Interest) then entitled to principal distributions with respect to such Loan Group and the Class XP, Class XS and Class XW Certificates as follows: A percentage of all prepayment premiums (either fixed prepayment premiums or yield maintenance amount) collected with respect to each Loan Group will be allocated to each class of the Investment Grade P&I Certificates then entitled to principal distributions with respect to such Loan Group, which percentage will be equal to the product of (a) the percentage of the principal distribution amount with respect to the relevant Loan Group that such Class receives, and (b) a fraction (expressed as a percentage which can be no greater than 100% nor less than 0%), the numerator of which is the excess of the pass-through rate of such Class of the Investment Grade P&I Certificates currently receiving principal (except for this purpose, the Class AM-FL and AJ-FL Certificates will be deemed to bear interest at the fixed/WAC/WAC Cap pass-through rate that would be payable thereon without regard to the related interest rate swap agreement) over the relevant discount rate, and the denominator of which is the excess of the mortgage rate of the related Mortgage Loan over the discount rate. However, as long as the related swap agreement is in effect and there is no continuing payment default thereunder, any prepayment premium allocable to Class AM-FL or AJ-FL Certificates will be payable to the related swap counterparty. |

| Prepayment Premium Allocation Percentage for all Investment Grade P&I Certificates collectively = |

| (Pass-Through Rate – Discount Rate) |

| (Mortgage Rate – Discount Rate) |

| The remaining percentage of the prepayment premiums will be allocated to the Class XP, Class XS and Class XW Certificates. In general, this formula provides for an increase in the percentage of prepayment premiums allocated to the Investment Grade P&I Certificates then entitled to principal distributions relative to the Class XP, Class XS and Class XW Certificates as discount rates decrease and a decrease in the percentage allocated to such Classes as discount rates rise. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

5

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS – ALL LOANS |

| Distribution of Pool Cut-Off Date Principal Balances(1)(2) | ||||||||||||||||||||||

| Range of Cut-Off Date Mortgage Loan Balances |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average |

||||||||||||||

| $ 1,000,000 — $ 4,999,999 | 70 | $ | 223,053,426 | 10.65 | % | 6.346 | % | 115 | 1.35 | x | 67.5 | % | 60.1 | % | ||||||||

| $ 5,000,000 — $ 9,999,999 | 45 | 308,503,783 | 14.73 | % | 6.259 | % | 115 | 1.30 | 70.1 | % | 63.7 | % | ||||||||||

| $ 10,000,000 — $ 19,999,999 | 19 | 273,333,202 | 13.05 | % | 6.175 | % | 113 | 1.26 | 70.1 | % | 64.6 | % | ||||||||||

| $ 20,000,000 — $ 34,999,999 | 17 | 460,705,325 | 22.00 | % | 6.272 | % | 116 | 1.27 | 71.0 | % | 66.2 | % | ||||||||||

| $ 35,000,000 — $ 49,999,999 | 4 | 162,124,331 | 7.74 | % | 6.522 | % | 117 | 1.61 | 57.8 | % | 52.2 | % | ||||||||||

| $ 50,000,000 — $ 99,999,999 | 3 | 204,000,000 | 9.74 | % | 5.984 | % | 77 | 1.41 | 59.7 | % | 59.7 | % | ||||||||||

| $100,000,000 — $149,999,999 | 1 | 145,000,000 | 6.92 | % | 5.606 | % | 116 | 1.33 | 73.0 | % | 73.0 | % | ||||||||||

| $150,000,000 — $160,000,000 | 2 | 317,463,751 | 15.16 | % | 6.198 | % | 116 | 1.45 | 68.2 | % | 68.2 | % | ||||||||||

| Total/Weighted Average | 161 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| Distribution of Mortgage Rates(1)(2) | ||||||||||||||||||||||

| Range of Mortgage Rates as of the Cut-Off Date |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| 5.068% — 5.999% | 36 | $ | 586,171,066 | 27.99 | % | 5.690 | % | 117 | 1.37 | x | 67.8 | % | 64.9 | % | ||||||||

| 6.000% — 6.249% | 22 | 391,100,483 | 18.68 | % | 6.064 | % | 105 | 1.44 | 62.9 | % | 60.2 | % | ||||||||||

| 6.250% — 6.499% | 53 | 652,901,902 | 31.18 | % | 6.357 | % | 108 | 1.33 | 72.0 | % | 67.7 | % | ||||||||||

| 6.500% — 6.749% | 39 | 314,979,677 | 15.04 | % | 6.617 | % | 116 | 1.32 | 66.9 | % | 61.2 | % | ||||||||||

| 6.750% — 7.160% | 11 | 149,030,688 | 7.12 | % | 6.987 | % | 112 | 1.19 | 66.7 | % | 60.5 | % | ||||||||||

| Total/Weighted Average | 161 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| Property Type Distribution(1)(2) | ||||||||||||||||||||||

| Property Type |

Number of Mortgaged Properties |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| Office | 42 | $ | 753,398,673 | 35.98 | % | 6.046 | % | 113 | 1.31 | x | 67.0 | % | 64.1 | % | ||||||||

| Retail | 54 | 349,622,379 | 16.69 | % | 6.204 | % | 117 | 1.29 | 70.0 | % | 65.8 | % | ||||||||||

| Anchored(3) | 31 | 268,053,880 | 12.80 | % | 6.148 | % | 118 | 1.30 | 70.3 | % | 67.0 | % | ||||||||||

| Unanchored | 23 | 81,568,500 | 3.90 | % | 6.390 | % | 116 | 1.25 | 68.8 | % | 62.1 | % | ||||||||||

| Multifamily | 24 | 299,000,754 | 14.28 | % | 6.149 | % | 100 | 1.35 | 67.1 | % | 63.4 | % | ||||||||||

| Industrial | 52 | 285,174,193 | 13.62 | % | 6.484 | % | 115 | 1.43 | 72.3 | % | 69.0 | % | ||||||||||

| Hotel | 69 | 175,723,586 | 8.39 | % | 6.487 | % | 124 | 1.42 | 68.4 | % | 57.6 | % | ||||||||||

| Full Service | 2 | 57,000,000 | 2.72 | % | 6.552 | % | 120 | 1.43 | 69.9 | % | 60.7 | % | ||||||||||

| Limited Service | 67 | 118,723,586 | 5.67 | % | 6.456 | % | 126 | 1.41 | 67.7 | % | 56.1 | % | ||||||||||

| Mixed Use | 11 | 133,483,535 | 6.37 | % | 6.184 | % | 85 | 1.24 | 65.6 | % | 62.7 | % | ||||||||||

| Manufactured Housing | 3 | 53,500,000 | 2.55 | % | 6.552 | % | 118 | 1.18 | 72.4 | % | 69.4 | % | ||||||||||

| Other | 1 | 35,000,000 | 1.67 | % | 5.695 | % | 114 | 2.39 | 43.4 | % | 40.5 | % | ||||||||||

| Land | 1 | 5,030,696 | 0.24 | % | 5.650 | % | 116 | 1.27 | 69.4 | % | 58.4 | % | ||||||||||

| Self Storage | 1 | 4,250,000 | 0.20 | % | 6.370 | % | 117 | 1.80 | 55.9 | % | 52.6 | % | ||||||||||

| Total/Weighted Average | 258 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| Geographic Distribution(1)(2) | ||||||||||||||||||||||

| State/Location |

Number of Mortgaged Properties |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| New York | 15 | $ | 293,895,072 | 14.03 | % | 6.320 | % | 103 | 1.24 | x | 64.9 | % | 61.8 | % | ||||||||

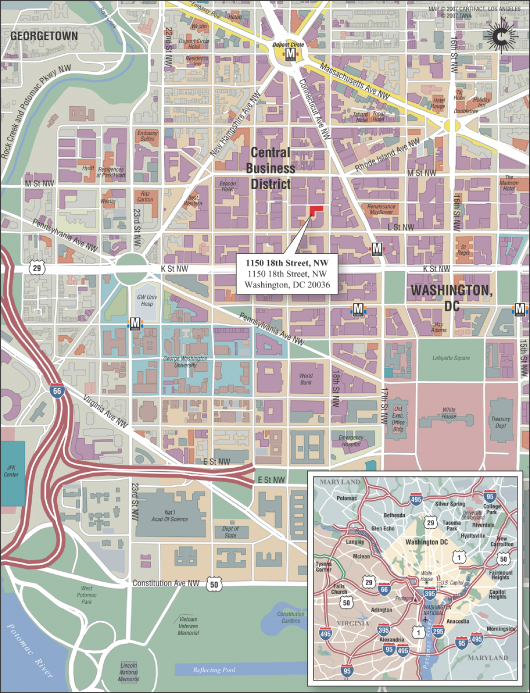

| District of Columbia DC | 3 | 210,625,161 | 10.06 | % | 6.247 | % | 116 | 1.24 | 63.3 | % | 62.3 | % | ||||||||||

| California(4) | 20 | 196,222,928 | 9.37 | % | 6.391 | % | 113 | 1.41 | 62.6 | % | 60.4 | % | ||||||||||

| Southern | 11 | 103,355,525 | 4.94 | % | 6.257 | % | 118 | 1.49 | 61.7 | % | 60.4 | % | ||||||||||

| Northern | 9 | 92,867,403 | 4.43 | % | 6.539 | % | 108 | 1.33 | 63.6 | % | 60.4 | % | ||||||||||

| Massachusetts | 6 | 178,536,527 | 8.53 | % | 5.658 | % | 116 | 1.31 | 72.9 | % | 72.4 | % | ||||||||||

| Texas | 23 | 120,760,662 | 5.77 | % | 6.059 | % | 112 | 1.36 | 71.8 | % | 66.5 | % | ||||||||||

| Washington | 11 | 107,855,492 | 5.15 | % | 6.129 | % | 101 | 1.60 | 63.3 | % | 57.8 | % | ||||||||||

| Georgia | 16 | 105,432,165 | 5.03 | % | 6.252 | % | 117 | 1.31 | 74.0 | % | 67.4 | % | ||||||||||

| Virginia | 12 | 85,310,926 | 4.07 | % | 6.336 | % | 117 | 1.26 | 76.3 | % | 71.0 | % | ||||||||||

| Maryland | 8 | 84,376,165 | 4.03 | % | 6.225 | % | 72 | 1.69 | 60.2 | % | 58.8 | % | ||||||||||

| North Carolina | 13 | 80,771,419 | 3.86 | % | 6.182 | % | 117 | 1.29 | 73.0 | % | 66.6 | % | ||||||||||

| Other | 131 | 630,397,301 | 30.10 | % | 6.232 | % | 117 | 1.37 | 69.6 | % | 63.9 | % | ||||||||||

| Total/Weighted Average | 258 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| (1) | With respect to the Lincoln Square loan, the USFS Industrial Distribution Portfolio loan, the Charles River Plaza North loan, the 85 Tenth Avenue loan, the Georgian Towers loan, the Seattle Space Needle loan and the CGM RRI Hotel Portfolio loan, LTV and DSCR calculations include related pari passu companion loans, and exclude the related, subordinate companion loan, if applicable. |

| (2) | With respect to 10 mortgage loans, collectively representing 8.51% of the outstanding pool balance as of the Cut-Off Date, the Cut-Off Date LTV, Maturity Date LTV and UW DSCR are calculated after netting out an escrow amount. With respect to 5 mortgage loans, collectively representing 0.67% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is calculated after netting out an escrow amount. With respect to 2 mortgage loans, collectively representing 2.32% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is equal to the DSCR level at which a sponsor guaranty will be released. For additional information regarding LTV and DSCR adjustments see the footnotes to Annex A-1 in the Prospectus Supplement. |

| (3) | Includes Shadow Anchored Properties. |

| (4) | Northern California properties have zip codes greater or equal to 93600. Southern California properties have zip codes less than 93600. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

6

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

OVERVIEW OF MORTGAGE POOL CHARACTERISTICS – ALL LOANS

| Distribution of Pool Cut-Off Date Loan-to-Value Ratios(1)(2) | ||||||||||||||||||||||

| Range of LTV Ratios as of the Cut-Off Date |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| 31.70% — 40.00% | 2 | $ | 5,500,000 | 0.26 | % | 6.467 | % | 118 | 2.58 | x | 34.1 | % | 33.8 | % | ||||||||

| 40.10% — 50.00% | 7 | 126,824,331 | 6.06 | % | 6.093 | % | 117 | 1.93 | 46.9 | % | 41.6 | % | ||||||||||

| 50.10% — 60.00% | 14 | 136,801,150 | 6.53 | % | 6.123 | % | 88 | 1.65 | 56.2 | % | 54.0 | % | ||||||||||

| 60.10% — 70.00% | 61 | 796,013,775 | 38.01 | % | 6.250 | % | 111 | 1.28 | 64.3 | % | 61.1 | % | ||||||||||

| 70.10% — 75.00% | 38 | 627,416,277 | 29.96 | % | 6.189 | % | 117 | 1.34 | 73.3 | % | 69.9 | % | ||||||||||

| 75.10% — 80.00% | 39 | 401,628,284 | 19.18 | % | 6.171 | % | 110 | 1.20 | 78.0 | % | 71.5 | % | ||||||||||

| Total/Weighted Average | 161 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| Distribution of Pooled Loan-to-Value Ratios at Maturity(1)(2) | ||||||||||||||||||||||

| Range of LTV Ratios as of the Maturity Date |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| 30.00% — 40.00% | 5 | $ | 32,030,000 | 1.53 | % | 6.218 | % | 144 | 1.74 | x | 45.4 | % | 35.1 | % | ||||||||

| 40.10% — 50.00% | 12 | 127,782,164 | 6.10 | % | 6.134 | % | 109 | 1.89 | 49.3 | % | 43.8 | % | ||||||||||

| 50.10% — 60.00% | 43 | 382,339,346 | 18.26 | % | 6.408 | % | 108 | 1.42 | 63.0 | % | 56.8 | % | ||||||||||

| 60.10% — 70.00% | 76 | 970,893,561 | 46.36 | % | 6.195 | % | 110 | 1.25 | 68.4 | % | 64.6 | % | ||||||||||

| 70.10% — 75.00% | 21 | 530,223,746 | 25.32 | % | 6.107 | % | 116 | 1.34 | 75.6 | % | 73.4 | % | ||||||||||

| 75.10% — 79.70% | 4 | 50,915,000 | 2.43 | % | 5.840 | % | 100 | 1.29 | 78.4 | % | 78.4 | % | ||||||||||

| Total/Weighted Average | 161 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| Distribution of Underwritten Debt Service Coverage Ratios(1)(2) | ||||||||||||||||||||||

| Range of Debt Service Coverage Ratios |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| 1.01x — 1.09x | 4 | $ | 84,834,995 | 4.05 | % | 6.687 | % | 118 | 1.04 | x | 72.5 | % | 67.6 | % | ||||||||

| 1.10x — 1.19x | 37 | 323,185,117 | 15.43 | % | 6.265 | % | 113 | 1.15 | 74.1 | % | 67.8 | % | ||||||||||

| 1.20x — 1.24x | 42 | 444,477,714 | 21.22 | % | 6.354 | % | 106 | 1.21 | 69.9 | % | 64.2 | % | ||||||||||

| 1.25x — 1.34x | 35 | 677,912,051 | 32.37 | % | 6.007 | % | 114 | 1.30 | 67.4 | % | 65.2 | % | ||||||||||

| 1.35x — 1.49x | 18 | 145,608,214 | 6.95 | % | 6.304 | % | 117 | 1.42 | 66.8 | % | 60.4 | % | ||||||||||

| 1.50x — 1.74x | 14 | 244,707,716 | 11.69 | % | 6.203 | % | 121 | 1.60 | 69.9 | % | 68.6 | % | ||||||||||

| 1.75x — 2.49x | 9 | 167,958,009 | 8.02 | % | 6.087 | % | 94 | 2.00 | 50.4 | % | 47.5 | % | ||||||||||

| 2.50x — 2.77x | 2 | 5,500,000 | 0.26 | % | 6.467 | % | 118 | 2.58 | 34.1 | % | 33.8 | % | ||||||||||

| Total/Weighted Average | 161 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| Distribution of Original Term to Maturity(1)(2) | ||||||||||||||||||||||

| Range of Original Term to Maturity |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| 60 — 83 | 9 | $ | 175,195,000 | 8.37 | % | 6.298 | % | 55 | 1.43 | x | 60.7 | % | 60.3 | % | ||||||||

| 84 — 119 | 5 | 68,082,552 | 3.25 | % | 6.158 | % | 92 | 1.20 | 75.8 | % | 69.5 | % | ||||||||||

| 120 — 180 | 147 | 1,850,906,265 | 88.38 | % | 6.192 | % | 118 | 1.35 | 68.4 | % | 64.2 | % | ||||||||||

| Total/Weighted Average | 161 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| Distribution of Remaining Term to Maturity(1)(2) | ||||||||||||||||||||||

| Range of Remaining Terms to Maturity |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| 52 — 60 | 9 | $ | 175,195,000 | 8.37 | % | 6.298 | % | 55 | 1.43 | x | 60.7 | % | 60.3 | % | ||||||||

| 61 — 84 | 3 | 44,232,552 | 2.11 | % | 6.377 | % | 82 | 1.16 | 74.2 | % | 66.3 | % | ||||||||||

| 85 — 177 | 149 | 1,874,756,265 | 89.52 | % | 6.186 | % | 118 | 1.35 | 68.5 | % | 64.3 | % | ||||||||||

| Total/Weighted Average | 161 | $ | 2,094,183,817 | 100.00 | % | 6.199 | % | 112 | 1.35 | x | 68.0 | % | 64.0 | % | ||||||||

| (1) | With respect to the Lincoln Square loan, the USFS Industrial Distribution Portfolio loan, the Charles River Plaza North loan, the 85 Tenth Avenue loan, the Georgian Towers loan, the Seattle Space Needle loan and the CGM RRI Hotel Portfolio loan, LTV and DSCR calculations include related pari passu companion loans, and exclude the related subordinate companion loan, if applicable. |

| (2) | With respect to 10 mortgage loans, collectively representing 8.51% of the outstanding pool balance as of the Cut-Off Date, the Cut-Off Date LTV, Maturity Date LTV and UW DSCR are calculated after netting out an escrow amount. With respect to 5 mortgage loans, collectively representing 0.67% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is calculated after netting out an escrow amount. With respect to 2 mortgage loans, collectively representing 2.32% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is equal to the DSCR level at which a sponsor guaranty will be released. For additional information regarding LTV and DSCR adjustments see the footnotes to Annex A-1 in the Prospectus Supplement. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

7

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

OVERVIEW OF MORTGAGE POOL CHARACTERISTICS – LOAN GROUP 1

Distribution of Cut-Off Date Principal Balances(1)(2)

| Range of Cut-Off Date Mortgage Loan Balances |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of

Cut-Off |

Weighted Avg Mortgage |

Weighted Avg Remaining Term (months) |

Weighted Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| $ 1,000,000 - $ 4,999,999 | 64 | $ | 202,975,719 | 11.65 | % | 6.340 | % | 115 | 1.36 | x | 67.2 | % | 59.8 | % | ||||||||

| $ 5,000,000 - $ 9,999,999 | 35 | 237,880,735 | 13.66 | % | 6.271 | % | 114 | 1.32 | 69.1 | % | 62.7 | % | ||||||||||

| $ 10,000,000 - $ 19,999,999 | 15 | 203,033,202 | 11.66 | % | 6.067 | % | 116 | 1.28 | 70.2 | % | 64.5 | % | ||||||||||

| $ 20,000,000 - $ 29,999,999 | 8 | 194,078,931 | 11.14 | % | 6.193 | % | 112 | 1.26 | 73.1 | % | 67.1 | % | ||||||||||

| $ 30,000,000 - $ 39,999,999 | 6 | 208,020,724 | 11.94 | % | 6.342 | % | 118 | 1.61 | 61.6 | % | 56.0 | % | ||||||||||

| $ 40,000,000 - $ 49,999,999 | 2 | 87,230,000 | 5.01 | % | 7.074 | % | 119 | 1.12 | 67.2 | % | 61.4 | % | ||||||||||

| $ 50,000,000 - $ 99,999,999 | 2 | 146,000,000 | 8.38 | % | 5.922 | % | 87 | 1.24 | 61.6 | % | 61.6 | % | ||||||||||

| $100,000,000 - $149,999,999 | 1 | 145,000,000 | 8.33 | % | 5.606 | % | 116 | 1.33 | 73.0 | % | 73.0 | % | ||||||||||

| $150,000,000 - $160,000,000 | 2 | 317,463,751 | 18.23 | % | 6.198 | % | 116 | 1.45 | 68.2 | % | 68.2 | % | ||||||||||

| Total/Weighted Average | 135 | $1,741,683,062 | 100.00% | 6.197 | % | 113 | 1.36 | x | 68.0 | % | 64.0 | % | ||||||||||

| Distribution of Mortgage Rates(1)(2) | ||||||||||||||||||||||

| Range of Mortgage Rates as of the Cut-Off Date |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| 5.068% — 5.999% | 27 | $ | 448,928,312 | 25.78 | % | 5.645 | % | 118 | 1.41 | x | 66.9 | % | 64.3 | % | ||||||||

| 6.000% — 6.249% | 21 | 333,100,483 | 19.13 | % | 6.050 | % | 114 | 1.37 | 64.3 | % | 61.1 | % | ||||||||||

| 6.250% — 6.499% | 47 | 589,883,902 | 33.87 | % | 6.354 | % | 107 | 1.35 | 71.5 | % | 67.5 | % | ||||||||||

| 6.500% — 6.749% | 32 | 259,039,677 | 14.87 | % | 6.629 | % | 116 | 1.34 | 66.6 | % | 60.3 | % | ||||||||||

| 6.750% — 7.160% | 8 | 110,730,688 | 6.36 | % | 7.034 | % | 119 | 1.17 | 68.0 | % | 61.3 | % | ||||||||||

| 135 | $ | 1,741,683,062 | 100.00 | % | 6.197 | % | 113 | 1.36 | x | 68.0 | % | 64.0 | % | |||||||||

| Property Type Distribution(1)(2) | ||||||||||||||||||||||

| Property Type |

Number of Mortgaged Properties |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| Office | 42 | $ | 753,398,673 | 43.26 | % | 6.046 | % | 113 | 1.31 | x | 67.0 | % | 64.1 | % | ||||||||

| Retail | 54 | 349,622,379 | 20.07 | % | 6.204 | % | 117 | 1.29 | 70.0 | % | 65.8 | % | ||||||||||

| Anchored(3) | 31 | 268,053,880 | 15.39 | % | 6.148 | % | 118 | 1.30 | 70.3 | % | 67.0 | % | ||||||||||

| Unanchored | 23 | 81,568,500 | 4.68 | % | 6.390 | % | 116 | 1.25 | 68.8 | % | 62.1 | % | ||||||||||

| Industrial | 52 | 285,174,193 | 16.37 | % | 6.484 | % | 115 | 1.43 | 72.3 | % | 69.0 | % | ||||||||||

| Hotel | 69 | 175,723,586 | 10.09 | % | 6.487 | % | 124 | 1.42 | 68.4 | % | 57.6 | % | ||||||||||

| Full Service | 2 | 57,000,000 | 3.27 | % | 6.552 | % | 120 | 1.43 | 69.9 | % | 60.7 | % | ||||||||||

| Limited Service | 67 | 118,723,586 | 6.82 | % | 6.456 | % | 126 | 1.41 | 67.7 | % | 56.1 | % | ||||||||||

| Mixed Use | 11 | 133,483,535 | 7.66 | % | 6.184 | % | 85 | 1.24 | 65.6 | % | 62.7 | % | ||||||||||

| Other | 1 | 35,000,000 | 2.01 | % | 5.695 | % | 114 | 2.39 | 43.4 | % | 40.5 | % | ||||||||||

| Land | 1 | 5,030,696 | 0.29 | % | 5.650 | % | 116 | 1.27 | 69.4 | % | 58.4 | % | ||||||||||

| Self Storage | 1 | 4,250,000 | 0.24 | % | 6.370 | % | 117 | 1.80 | 55.9 | % | 52.6 | % | ||||||||||

| Total/Weighted Average | 231 | $ | 1,741,683,062 | 100 | % | 6.197 | % | 113 | 1.36 | x | 68.0 | % | 64.0 | % | ||||||||

| Geographic Distribution(1)(2) | ||||||||||||||||||||||

| State/Location |

Number of Mortgaged Properties |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity |

||||||||||||||

| New York | 13 | $ | 283,210,072 | 16.26 | % | 6.311 | % | 103 | 1.24 | x | 64.8 | % | 61.6 | % | ||||||||

| District of Columbia | 3 | 210,625,161 | 12.09 | % | 6.247 | % | 116 | 1.24 | 63.3 | % | 62.3 | % | ||||||||||

| Massachusetts | 6 | 178,536,527 | 10.25 | % | 5.658 | % | 116 | 1.31 | 72.9 | % | 72.4 | % | ||||||||||

| California(4) | 16 | 117,722,928 | 6.76 | % | 6.429 | % | 119 | 1.49 | 63.9 | % | 60.7 | % | ||||||||||

| Southern | 9 | 68,355,525 | 3.92 | % | 6.440 | % | 119 | 1.53 | 62.1 | % | 60.5 | % | ||||||||||

| Northern | 7 | 49,367,403 | 2.83 | % | 6.414 | % | 118 | 1.42 | 66.5 | % | 61.0 | % | ||||||||||

| Texas | 21 | 105,760,662 | 6.07 | % | 6.096 | % | 112 | 1.35 | 72.5 | % | 66.9 | % | ||||||||||

| Washington | 9 | 104,355,492 | 5.99 | % | 6.114 | % | 103 | 1.61 | 63.3 | % | 57.6 | % | ||||||||||

| Virginia | 10 | 76,105,926 | 4.37 | % | 6.315 | % | 117 | 1.26 | 77.1 | % | 72.2 | % | ||||||||||

| Georgia | 14 | 69,314,165 | 3.98 | % | 6.441 | % | 116 | 1.38 | 71.4 | % | 64.3 | % | ||||||||||

| North Carolina | 11 | 55,301,371 | 3.18 | % | 6.165 | % | 117 | 1.34 | 72.0 | % | 65.6 | % | ||||||||||

| Oklahoma | 4 | 52,490,100 | 3.01 | % | 5.924 | % | 116 | 1.25 | 72.2 | % | 67.3 | % | ||||||||||

| Other | 124 | 488,260,660 | 28.03 | % | 6.271 | % | 117 | 1.42 | 68.3 | % | 62.7 | % | ||||||||||

| Total/Weighted Average | 231 | $ | 1,741,683,062 | 100.00 | % | 6.197 | % | 113 | 1.36 | x | 68.0 | % | 64.0 | % | ||||||||

| (1) | With respect to the Lincoln Square loan, the USFS Industrial Distribution Portfolio loan, the Charles River Plaza North loan, the 85 Tenth Avenue loan, the Georgian Towers loan, the Seattle Space Needle loan and the CGM RRI Hotel Portfolio loan, LTV and DSCR calculations include related pari passu companion loans and exclude the related subordinate companion loan, if applicable. |

| (2) | With respect to 7 mortgage loans, collectively representing 5.42% of the outstanding pool balance as of the Cut-Off Date, the Cut-Off Date LTV, Maturity Date LTV and UW DSCR are calculated after netting out an escrow amount. With respect to 4 mortgage loans, collectively representing 0.45% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is calculated after netting out an escrow amount. With respect to 1 mortgage loans, collectively representing 1.34% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is equal to the DSCR level at which a sponsor guaranty will be released. For additional information regarding LTV and DSCR adjustments see the footnotes to Annex A-1 in the Prospectus Supplement. |

| (3) | Includes Shadow Anchored Properties. |

| (4) | Northern California properties have zip codes greater or equal to 93600. Southern California properties have zip codes less than 93600. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

8

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

OVERVIEW OF MORTGAGE POOL CHARACTERISTICS – LOAN GROUP 1

| Distribution of Cut-Off Date Loan-to-Value Ratios(1)(2) | ||||||||||||||||||

| Range of LTV Ratios as of the Cut-Off Date |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten |

Weighted Average Cut-Off Date LTV |

Weighted Average LTV Ratio at | ||||||||||

| 31.70% — 50.00% | 8 | $ | 116,824,331 | 6.71% | 6.002% | 125 | 2.05 | x | 46.1% | 40.5% | ||||||||

| 50.10% — 60.00% | 10 | 41,446,150 | 2.38% | 6.392% | 114 | 1.57 | 55.8% | 49.0% | ||||||||||

| 60.10% — 65.00% | 27 | 442,630,507 | 25.41% | 6.081% | 106 | 1.28 | 62.2% | 60.6% | ||||||||||

| 65.10% — 70.00% | 28 | 283,598,268 | 16.28% | 6.505% | 117 | 1.30 | 67.4% | 61.0% | ||||||||||

| 70.10% — 75.00% | 31 | 559,098,277 | 32.10% | 6.156% | 117 | 1.36 | 73.3% | 70.3% | ||||||||||

| 75.10% — 80.00% | 31 | 298,085,530 | 17.11% | 6.205% | 109 | 1.21 | 77.7% | 71.3% | ||||||||||

| Total/Weighted Average |

135 | $ | 1,741,683,062 | 100.00% | 6.197% | 113 | 1.36 | x | 68.0% | 64.0% | ||||||||

| Distribution of Loan-to-Value Ratios at Maturity(1)(2) | ||||||||||||||||||

| Range of LTV Ratios as of the Maturity Date |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten |

Weighted Average Cut-Off Date LTV |

Weighted Average LTV Ratio at | ||||||||||

| 30.00% — 50.00% | 15 | $ | 142,957,164 | 8.21% | 6.066% | 122 | 1.93 | x | 48.5% | 41.5% | ||||||||

| 50.10% — 60.00% | 39 | 283,789,346 | 16.29% | 6.538% | 119 | 1.33 | 65.1% | 57.0% | ||||||||||

| 60.10% — 65.00% | 27 | 508,502,684 | 29.20% | 6.184% | 108 | 1.26 | 64.6% | 62.2% | ||||||||||

| 65.10% — 70.00% | 33 | 303,995,122 | 17.45% | 6.141% | 112 | 1.25 | 73.7% | 67.7% | ||||||||||

| 70.10% — 75.00% | 17 | 451,523,746 | 25.92% | 6.117% | 116 | 1.38 | 74.8% | 73.4% | ||||||||||

| 75.10% — 79.70% | 4 | 50,915,000 | 2.92% | 5.840% | 100 | 1.29 | 78.4% | 78.4% | ||||||||||

| Total/Weighted Average |

135 | $ | 1,741,683,062 | 100.00% | 6.197% | 113 | 1.36 | x | 68.0% | 64.0% | ||||||||

| Distribution of Underwritten Debt Service Coverage Ratios(1)(2) | ||||||||||||||||||

| Range of Debt Service |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten |

Weighted Average Cut-Off Date LTV |

Weighted Average LTV Ratio at | ||||||||||

| 1.01x — 1.09x | 4 | $ | 84,834,995 | 4.87% | 6.687% | 118 | 1.04 | x | 72.5% | 67.6% | ||||||||

| 1.10x — 1.19x | 28 | 208,027,410 | 11.94% | 6.306% | 110 | 1.15 | 72.4% | 66.0% | ||||||||||

| 1.20x — 1.34x | 64 | 982,546,717 | 56.41% | 6.115% | 111 | 1.27 | 68.4% | 64.9% | ||||||||||

| 1.35x — 1.49x | 16 | 112,108,214 | 6.44% | 6.443% | 119 | 1.42 | 69.0% | 60.6% | ||||||||||

| 1.50x — 1.74x | 13 | 238,707,716 | 13.71% | 6.211% | 121 | 1.60 | 70.3% | 68.9% | ||||||||||

| 1.75x — 2.49x | 8 | 109,958,009 | 6.31% | 6.059% | 117 | 2.09 | 47.8% | 43.5% | ||||||||||

| 2.50x — 2.77x | 2 | 5,500,000 | 0.32% | 6.467% | 118 | 2.58 | 34.1% | 33.8% | ||||||||||

| Total/Weighted Average |

135 | $ | 1,741,683,062 | 100.00% | 6.197% | 113 | 1.36 | x | 68.0% | 64.0% | ||||||||

| Distribution of Original Term to Maturity(1)(2) | ||||||||||||||||||

| Range of Original Term to Maturity |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity | ||||||||||

| 60 — 83 | 6 | $ | 98,195,000 | 5.64% | 6.285% | 56 | 1.22 | x | 65.8% | 65.3% | ||||||||

| 84 — 119 | 4 | 58,882,552 | 3.38% | 6.184% | 90 | 1.20 | 75.2% | 69.3% | ||||||||||

| 120 — 180 | 125 | 1,584,605,510 | 90.98% | 6.192% | 118 | 1.37 | 67.9% | 63.7% | ||||||||||

| Total/Weighted Average |

135 | $ | 1,741,683,062 | 100.00% | 6.197% | 113 | 1.36 | x | 68.0% | 64.0% | ||||||||

| Distribution of Remaining Term to Maturity/ARD(1)(2) | ||||||||||||||||||

| Range of Remaining Terms to Maturity |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten |

Weighted Average Cut-Off Date LTV |

Weighted Average LTV Ratio at | ||||||||||

| 52 — 60 | 6 | $ | 98,195,000 | 5.64% | 6.285% | 56 | 1.22 | x | 65.8% | 65.3% | ||||||||

| 61 — 84 | 3 | 44,232,552 | 2.54% | 6.377% | 82 | 1.16 | 74.2% | 66.3% | ||||||||||

| 85 — 177 | 126 | 1,599,255,510 | 91.82% | 6.187% | 118 | 1.37 | 68.0% | 63.8% | ||||||||||

| Total/Weighted Average |

135 | $ | 1,741,683,062 | 100.00% | 6.197% | 113 | 1.36 | x | 68.0% | 64.0% | ||||||||

| (1) | With respect to the Lincoln Square loan, the USFS Industrial Distribution Portfolio loan, the Charles River Plaza North loan, the 85 Tenth Avenue loan, the Georgian Towers loan, the Seattle Space Needle loan and the CGM RRI Hotel Portfolio loan, LTV and DSCR calculations include related pari passu companion loans, and exclude the related subordinate companion loan, if applicable. |

| (2) | With respect to 7 mortgage loans, collectively representing 5.42% of the outstanding pool balance as of the Cut-Off Date, the Cut-Off Date LTV, Maturity Date LTV and UW DSCR are calculated after netting out an escrow amount. With respect to 4 mortgage loans, collectively representing 0.45% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is calculated after netting out an escrow amount. With respect to 1 mortgage loans, collectively representing 1.34% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is equal to the DSCR level at which a sponsor guaranty will be released. For additional information regarding LTV and DSCR adjustments see the footnotes to Annex A-1 in the Prospectus Supplement. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

9

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

OVERVIEW OF MORTGAGE POOL CHARACTERISTICS – LOAN GROUP 2

Distribution of Cut-Off Date Principal Balances(1)(2)

| Range of Cut-Off Date Mortgage Loan Balances |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity | |||||||||

| $ 1,355,000 — $ 2,999,999 | 1 | $ | 1,355,000 | 0.38% | 6.500% | 120 | 1.20x | 56.5% | 48.6% | ||||||||

| $ 3,000,000 — $ 6,999,999 | 10 | 48,110,754 | 13.65% | 6.300% | 114 | 1.26 | 71.4% | 64.4% | |||||||||

| $ 7,000,000 — $ 9,999,999 | 5 | 41,235,000 | 11.70% | 6.208% | 115 | 1.18 | 74.7% | 68.0% | |||||||||

| $10,000,000 — $19,999,999 | 4 | 70,300,000 | 19.94% | 6.489% | 103 | 1.20 | 69.7% | 64.8% | |||||||||

| $20,000,000 — $29,999,999 | 3 | 72,500,000 | 20.57% | 6.294% | 117 | 1.20 | 69.2% | 67.2% | |||||||||

| $30,000,000 — $49,999,999 | 2 | 61,000,000 | 17.30% | 5.779% | 118 | 1.29 | 69.3% | 66.6% | |||||||||

| $50,000,000 — $58,000,000 | 1 | 58,000,000 | 16.45% | 6.140% | 52 | 1.83 | 55.1% | 55.1% | |||||||||

| Total/Weighted Average |

26 | $ | 352,500,754 | 100.00% | 6.210% | 103 | 1.33x | 67.9% | 64.3% | ||||||||

| Distribution of Mortgage Rates(1)(2) | |||||||||||||||||

| Range of Mortgage Rates as |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity | |||||||||

| 5.743% — 5.999% | 9 | $ | 137,242,754 | 38.93% | 5.836% | 115 | 1.26x | 70.6% | 66.9% | ||||||||

| 6.000% — 6.249% | 1 | 58,000,000 | 16.45% | 6.140% | 52 | 1.83 | 55.1% | 55.1% | |||||||||

| 6.250% — 6.499% | 6 | 63,018,000 | 17.88% | 6.387% | 118 | 1.17 | 76.4% | 69.7% | |||||||||

| 6.500% — 6.910% | 10 | 94,240,000 | 26.73% | 6.679% | 106 | 1.21 | 66.2% | 62.4% | |||||||||

| 26 | $ | 352,500,754 | 100.00% | 6.210% | 103 | 1.33x | 67.9% | 64.3% | |||||||||

Property Type Distribution(1)(2)

| Property Type |

Number of Mortgaged Properties |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity | |||||||||

| Multifamily | 24 | $ | 299,000,754 | 84.82% | 6.149% | 100 | 1.35x | 67.1% | 63.4% | ||||||||

| Manufactured Housing | 3 | 53,500,000 | 15.18% | 6.552% | 118 | 1.18 | 72.4% | 69.4% | |||||||||

| Total/Weighted Average |

27 | $ | 352,500,754 | 100.00% | 6.210% | 103 | 1.33x | 67.9% | 64.3% | ||||||||

Geographic Distribution(1)(2)

| State/Location |

Number of Mortgaged Properties |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted LTV Ratio | |||||||||

| California(3) | 4 | $ | 78,500,000 | 22.27% | 6.333% | 106 | 1.30x | 60.6% | 59.9% | ||||||||

| Southern |

2 | 35,000,000 | 9.93% | 5.900% | 117 | 1.40 | 60.8% | 60.2% | |||||||||

| Northern |

2 | 43,500,000 | 12.34% | 6.681% | 97 | 1.22 | 60.4% | 59.7% | |||||||||

| Maryland | 1 | 58,000,000 | 16.45% | 6.140% | 52 | 1.83 | 55.1% | 55.1% | |||||||||

| Georgia | 2 | 36,118,000 | 10.25% | 5.889% | 119 | 1.17 | 78.9% | 73.2% | |||||||||

| Louisiana | 2 | 25,800,000 | 7.32% | 6.683% | 118 | 1.22 | 74.3% | 66.5% | |||||||||

| North Carolina | 2 | 25,470,048 | 7.23% | 6.218% | 117 | 1.18 | 75.2% | 68.8% | |||||||||

| Nevada | 1 | 24,000,000 | 6.81% | 5.822% | 115 | 1.25 | 62.8% | 62.8% | |||||||||

| Illinois | 1 | 20,500,000 | 5.82% | 6.491% | 117 | 1.15 | 79.8% | 72.8% | |||||||||

| Tennessee | 1 | 18,000,000 | 5.11% | 5.978% | 113 | 1.15 | 80.0% | 74.8% | |||||||||

| Texas | 2 | 15,000,000 | 4.26% | 5.796% | 115 | 1.36 | 66.8% | 63.8% | |||||||||

| New York | 2 | 10,685,000 | 3.03% | 6.557% | 119 | 1.10 | 69.4% | 67.4% | |||||||||

| Other | 9 | 40,427,706 | 11.47% | 6.304% | 111 | 1.22 | 73.8% | 65.0% | |||||||||

| 27 | $ | 352,500,754 | 100.00% | 6.210% | 103 | 1.33x | 67.9% | 64.3% | |||||||||

| (1) | With respect to the Lincoln Square loan, the USFS Industrial Distribution Portfolio loan, the Charles River Plaza North loan, the 85 Tenth Avenue loan, the Georgian Towers loan, the Seattle Space Needle loan and the CGM RRI Hotel Portfolio loan, LTV and DSCR calculations include related pari passu companion loans, and exclude the related subordinate companion loan, if applicable. |

| (2) | With respect to 3 mortgage loans, collectively representing 3.09% of the outstanding pool balance as of the Cut-Off Date, the Cut-Off Date LTV, Maturity Date LTV and UW DSCR are calculated after netting out an escrow amount. With respect to 1 mortgage loans, collectively representing 0.22% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is calculated after netting out an escrow amount. With respect to 1 mortgage loans, collectively representing 0.98% of the outstanding pool balance as of the Cut-Off Date, the UW DSCR is equal to the DSCR level at which a sponsor guaranty will be released. For additional information regarding LTV and DSCR adjustments see the footnotes to Annex A-1 in the Prospectus Supplement. |

| (3) | Northern California properties have zip codes greater or equal to 93600. Southern California properties have zip codes less than 93600. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (SEC File No. 333-130390) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-503-4611 or by email to the following address: brian.trotta@db.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a ‘‘when, as and if issued’’ basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any ‘‘indications of interest’’ expressed by you, and any ‘‘soft circles’’ generated by us, will not create binding contractual obligations for you or us.

10

$1,853,970,000 (Approximate)

CD 2007-CD5 Mortgage Trust

OVERVIEW OF MORTGAGE POOL CHARACTERISTICS – LOAN GROUP 2

| Distribution of Cut-Off Date Loan-to-Value Ratios(1)(2) | ||||||||||||||||||

| Range of LTV Ratios as |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of Cut-Off Date Pool Balance |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity | ||||||||||

| 48.40% — 60.00% | 5 | $ | 110,855,000 | 31.45% | 6.133% | 74 | 1.62 | x | 55.2% | 54.8% | ||||||||

| 60.10% — 70.00% | 6 | 69,785,000 | 19.80% | 6.292% | 114 | 1.21 | 65.9% | 65.3% | ||||||||||

| 70.10% — 75.00% | 7 | 68,318,000 | 19.38% | 6.461% | 118 | 1.19 | 73.7% | 66.8% | ||||||||||

| 75.10% — 77.50% | 3 | 18,372,706 | 5.21% | 6.242% | 118 | 1.20 | 76.5% | 67.7% | ||||||||||

| 77.60% — 80.00% | 5 | 85,170,048 | 24.16% | 6.035% | 116 | 1.17 | 79.6% | 73.0% | ||||||||||

| 26 | $ | 352,500,754 | 100.00% | 6.210% | 103 | 1.33 | x | 67.9% | 64.3% | |||||||||

| Distribution of Loan-to-Value Ratios at Maturity(1)(2) | ||||||||||||||||||

| Range of LTV Ratios as |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity | ||||||||||

| 46.40% — 50.00% | 2 | $ | 16,855,000 | 4.78% | 6.877% | 63 | 1.26 | x | 49.1% | 46.6% | ||||||||

| 50.10% — 60.00% | 4 | 98,550,000 | 27.96% | 6.031% | 79 | 1.66 | 57.2% | 56.4% | ||||||||||

| 60.10% — 70.00% | 16 | 158,395,754 | 44.93% | 6.332% | 116 | 1.20 | 70.7% | 66.4% | ||||||||||

| 70.10% — 74.80% | 4 | 78,700,000 | 22.33% | 6.045% | 116 | 1.16 | 79.7% | 73.6% | ||||||||||

| 26 | $ | 352,500,754 | 100.00% | 6.210% | 103 | 1.33 | x | 67.9% | 64.3% | |||||||||

| Distribution of Underwritten Debt Service Coverage Ratios(1)(2) | ||||||||||||||||||

| Range of Debt Service |

Number of Mortgage Loans |

Aggregate Mortgage Loan Cut-Off Date Balance |

Percentage of |

Weighted Avg Mortgage Rate |

Weighted Avg Remaining Term (months) |

Weighted Avg Underwritten DSCR |

Weighted Average Cut-Off Date LTV Ratio |

Weighted Average LTV Ratio at Maturity | ||||||||||