UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

| |

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended

| |

Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number:

FACTSET RESEARCH SYSTEMS INC.

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive office, including zip code)

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbols(s) |

Name of each exchange on which registered |

| |

|

NASDAQ Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Accelerated filer ☐ |

| Non-accelerated filer ☐ |

Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant based upon the closing price of a share of the registrant’s common stock on February 28, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, as reported by the New York Stock Exchange on that date, was $

The number of shares outstanding of the registrant’s common stock, as of October 24, 2019, was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement dated October 30, 2019, for the 2019 Annual Meeting of Stockholders to be held on December 17, 2019, are incorporated by reference into Part III of this Report on Form 10-K where indicated.

FACTSET RESEARCH SYSTEMS INC.

FORM 10-K

For The Fiscal Year Ended August 31, 2019

| Page |

||

| PART I |

||

| ITEM 1. |

Business |

3 |

| ITEM 1A. |

Risk Factors |

11 |

| ITEM 1B. |

Unresolved Staff Comments |

16 |

| ITEM 2. |

Properties |

16 |

| ITEM 3. |

Legal Proceedings |

18 |

| ITEM 4. |

Mine Safety Disclosures |

18 |

| PART II |

||

| ITEM 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

19 |

| ITEM 6. |

Selected Financial Data |

21 |

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

| ITEM 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

46 |

| ITEM 8. |

Financial Statements and Supplementary Data |

49 |

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

97 |

| ITEM 9A. |

Controls and Procedures |

97 |

| ITEM 9B. |

Other Information |

97 |

| PART III |

||

| ITEM 10. |

Directors, Executive Officers and Corporate Governance |

98 |

| ITEM 11. |

Executive Compensation |

98 |

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

98 |

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

99 |

| ITEM 14. |

Principal Accounting Fees and Services |

99 |

| PART IV |

||

| ITEM 15. |

Exhibits, Financial Statement Schedules |

100 |

| ITEM 16. | Form 10-K Summary | 101 |

| Signatures |

102 |

Part I

ITEM 1. BUSINESS

Business Overview

FactSet Research Systems Inc. (the “Company” or “FactSet”) is a global provider of integrated financial information, analytical applications and industry-leading services for the investment and corporate communities. For over 40 years, global financial professionals have utilized our content and multi-asset class solutions across each stage of the investment process. Our goal is to provide a seamless user experience spanning idea generation, research, portfolio construction, trade execution, performance measurement, risk management, reporting, and portfolio analysis, in which we serve the front, middle, and back offices to drive productivity and improved performance. Our flexible, open data and technology solutions can be implemented both across the investment portfolio lifecycle or as standalone components serving different workflows in the organization. We are focused on growing our business throughout each of our three segments, the U.S., Europe, and Asia Pacific. We primarily deliver insight and information through the workflow solutions of Research, Analytics and Trading, Content and Technology Solutions and Wealth.

We currently serve financial professionals, which include portfolio managers, investment research professionals, investment bankers, risk and performance analysts, wealth advisors, and corporate clients. We provide both insights on global market trends and intelligence on companies and industries, as well as capabilities to monitor portfolio risk and performance and to execute trades. We combine dedicated client service with open and flexible technology offerings, such as a comprehensive data marketplace, a configurable mobile and desktop platform, digital portals and application programming interface (“APIs”). Our revenue is primarily derived from subscriptions to products and services such as workstations, analytics, enterprise data, research management, and trade execution.

Corporate History

FactSet was founded in 1978 and has been publicly held since 1996. We are dual listed on the New York Stock Exchange (“NYSE”) and the NASDAQ Stock Market (“NASDAQ”) under the symbol “FDS.” Fiscal 2019 marked our 41st year of operations and while much has changed in the market and in technology, our focus has always been to provide best-in-class products and exceptional client service.

The following timeline depicts the Company’s history since our founding in 1978:

Business Strategy

As a premier financial solutions provider for the global financial community, we provide workflow solutions and leading analytical applications across the investment lifecycle to create an open and scalable platform. We bring the front, middle and back offices together to drive productivity and performance throughout the portfolio lifecycle. Our strategy is focused on growing our business throughout each of our three segments, the U.S., Europe, and Asia Pacific. We believe this geographical strategy alignment helps us better manage our resources and concentrate on markets that demand our products. To execute on our strategy of broad-based growth across each geographical segment, we continue to look at ways to create value for our clients by offering data, products and analytical applications within our workflow solutions of Research, Analytics and Trading, Wealth, and Content and Technology Solutions.

Research Solutions

Our Research Solutions workflow (“Research”) focuses on company analysis, idea generation, and research management. The tools within Research provide solutions to analyze public and private companies, generate ideas and discover opportunities with our proprietary data. Research also allows users to monitor the global markets, to gain industry and market insights, and to collaborate on and share information across teams. FactSet combines the global coverage, deep history, and transparency with over 1,000 FactSet-sourced and third-party databases integrated in one flexible platform.

Analytics and Trading Solutions

Our Analytics and Trading Solutions workflow (“Analytics and Trading”) addresses processes around portfolio analytics, risk management and performance measurement and attribution. Analytics and Trading also focuses on client reporting, portfolio construction, trade execution and order management. The applications within Analytics and Trading are modularized and deployed to fulfill both targeted and holistic needs in the front and middle offices. Analytics and Trading integrates our clients’ proprietary data along with FactSet and third-party content to bring actionable insights to the portfolio management process. Analytics and Trading tools are accessible through a variety of mediums, including the FactSet workstation and application programming interfaces.

Wealth Solutions

Our Wealth Solutions workflow (“Wealth”) is specific to the wealth management industry and creates offerings that enable wealth professionals across an entire enterprise, including home office, advisory, and client engagement. Wealth empowers wealth managers to demonstrate value to clients and prospects while protecting and growing their assets with FactSet’s combined solution set of portfolio analytics, market monitoring tools, multi-asset class research and customized client facing digital solutions. Our Research Management Solutions products enable our wealth management clients to increase collaboration and communication between Home Office and Advisory functions within the firm and deliver consistent and scalable messaging to the clients of the advisor.

Content and Technology Solutions

Our Content and Technology Solutions workflow (“CTS”) is focused on delivering value to our clients in the way they want to consume it. Our goal is to reduce the number of customizations by standardizing and bundling our proprietary data into data feeds. Whether a client needs market, company, or alternative data, our data delivery services provide normalized data through APIs and a direct delivery of local copies of standard data feeds. Our symbology links and aggregates a variety of content sources to ensure consistency, transparency, and data integrity across a client’s business.

FactSet Clients

Buy-side

As buy-side clients continue to shift towards multi-asset class investment strategies, we are positioned to be a partner in the space, given our ability to provide enterprise-wide solutions across their entire workflow. We provide solutions across asset classes and at nearly every stage of the investment process by utilizing our workstations, analytics, proprietary content, data feeds and portfolio services. Buy-side clients include portfolio managers, analysts, traders, wealth managers, performance teams and risk and compliance teams at a variety of firms, such as traditional asset managers, wealth advisors, corporations, hedge funds, insurance companies, plan sponsors and fund of funds.

The buy-side annual subscription value (“ASV”) growth rate for fiscal 2019 was 4.8%. Buy-side clients accounted for 83.7% of ASV as of August 31, 2019.

Sell-side

FactSet delivers comprehensive solutions to sell-side clients including workstation, proprietary and third-party content, productivity tools for Microsoft® Office, FactSet Web and Mobile, and FactSet Partners for research authoring and publishing. Our focus remains on expanding the depth of content offered and increasing workflow efficiency for investment banking, private equity, corporate and research firms.

The sell-side ASV growth rate for fiscal 2019 was 6.3%. Sell-side clients accounted for 16.3% of ASV as of August 31, 2019.

Client Subscription Growth

During fiscal 2019, we added 432 net new clients, increasing the number of clients by 8.4% over the prior year. In the first quarter of fiscal 2019, we changed our client count definition to include clients from the April 2017 acquisition of FDSG. The prior year client count was not restated to reflect this change. We added 34,925 net new users during fiscal 2019, leading to a healthy progression in the number of users in both our buy-side and sell-side clients.

ASV Growth

ASV at any given point in time represents the forward-looking revenue for the next twelve months from all subscription services currently being supplied to clients and excludes professional service fees, which are not subscription-based. Organic ASV excludes ASV from acquisitions and dispositions completed within the last 12 months, and the effects of foreign currency, and professional services fees.

As of August 31, 2019, ASV was $1.46 billion, up from $1.39 billion a year ago. As of August 31, 2019, organic ASV was $1.46 billion, up $70.2 million or 5.0% from a year ago. This increase in organic ASV was due to growth across all of our geographic segments with the majority of growth in the U.S., followed by Asia Pacific and Europe. ASV growth from our workflow solutions was primarily driven by Analytics and Trading, CTS and Wealth.

The following chart provides a snapshot of FactSet’s historic ASV growth:

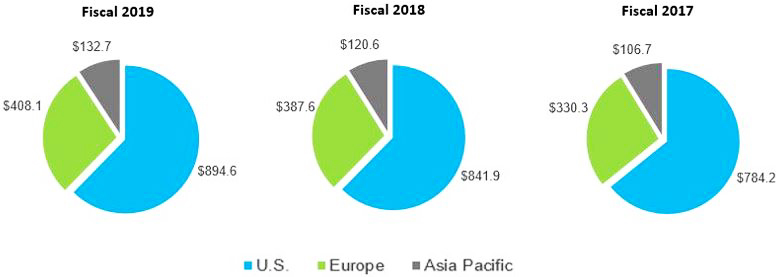

Financial Information on Geographic Areas

Operating segments are defined as components of an enterprise that have the following characteristics: (i) it engages in business activities from which it may earn revenues and incur expenses, (ii) its operating results are regularly reviewed by the company’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance, and (iii) its discrete financial information is available. Executive management, along with the CEO, constitute our chief operating decision making group (“CODMG”). Executive management consists of certain executives who directly report to the CEO, consisting of the Chief Financial Officer, Chief Technology and Product Officer, Global Head of Sales and Client Solutions, General Counsel, Chief Human Resources Officer and Head of Analytics and Trading. The CODMG reviews financial information at the operating segment level and is responsible for making decisions about resources allocated amongst the operating segments based on actual results.

Our operating segments are aligned with how the Company, including its CODMG, manages the business and the demographic markets in which it serves. Our internal financial reporting structure is based on three segments: the U.S., Europe and Asia Pacific. We believe this alignment helps to better manage the business and serve client needs, as each segment requires financial and economic information specific to their respective markets. Our primary functional groups within the U.S., Europe, and Asia Pacific segments include sales, consulting, data collection, product development and software engineering, which provide global financial and economic information to investment managers, investment banks and other financial services professionals.

The U.S. segment serves investment professionals, including financial institutions throughout the Americas. The Europe and Asia Pacific segments serve investment professionals located throughout Europe and Asia Pacific, respectively. Financial information, including revenues, operating income and long-lived assets related to our operations in each geographic area are presented in Note 8, Segment Information, and in the Notes to the Company’s Consolidated Financial Statements included in Item 8.

The U.S. segment has offices in 15 locations, within 13 states throughout the U.S., including our corporate headquarters in Norwalk, Connecticut, as well as two additional offices located in Brazil and Canada. The European segment maintains office locations in Bulgaria, UAE (Dubai), England, France, Germany, Italy, Latvia, Luxembourg, the Netherlands, South Africa, Spain, and Switzerland. The Asia Pacific segment has office locations in Australia, Hong Kong, China, India, Japan, the Philippines, and Singapore. Segment revenue reflects direct sales to clients based in their respective geographic locations. Each segment records compensation expense (including stock-based compensation), amortization of intangible assets, depreciation of furniture and fixtures, amortization of leasehold improvements, communication costs, professional fees, rent expense, travel, office and other direct expenses.

Expenditures associated with our data centers, third-party data costs and corporate headquarters charges are recorded by the U.S. segment and are not allocated to the other segments. The content collection centers, located in India, the Philippines, and Latvia, benefit all our operating segments, and thus the expenses incurred at these locations are allocated to each segment based on a percentage of revenue.

The following charts depict revenue related to our reportable segments.

Talent

We have built a collaborative culture that recognizes and rewards innovation and offers employees a variety of opportunities and experiences. Our employees are critical to our success and are the reason we continue to execute at a high level. We believe our continued focus on making employee engagement a top priority will help us provide high quality insights and information to clients globally.

As of August 31, 2019, our employee headcount was 9,681, an increase of 1.1% in the last twelve months. Of our total employees, 2,351 are in the U.S., 1,282 in Europe and 6,048 in the Asia Pacific segment. In order to optimize productivity, we have invested in expanding our footprint and talent pool in India and the Philippines, where we now have a combined workforce of approximately 5,800 people. As of August 31, 2019, approximately 430 FactSet employees within certain French and German subsidiaries were represented by mandatory works councils, an amount consistent with fiscal 2018. No other employees are represented by collective bargaining agreements.

In December 2018, we appointed Daniel Viens as Chief Human Resources Officer. In May 2019, we announced that John W. Wiseman, the Company’s Global Head of Sales and Client Solutions, would step down from his position on June 1, 2019, remaining at the company until August 31, 2019 to assist during the transition. In the same announcement, effective June 1, 2019, we appointed Franck A.R. Gossieaux as the Company's new Global Head of Sales and Client Solutions.

Third-Party Content

We aggregate content from over 1,000 third-party data suppliers, news sources, exchanges, brokers and contributors into our own dedicated single online service, which the client accesses to perform their analysis. We license content from premier providers of major global exchanges and data providers. We seek to maintain contractual relationships with a minimum of two content providers for each major type of financial data, though certain data sets on which we rely have a limited number of suppliers. We make every effort to assure that, where reasonable, alternative sources are available. We are not dependent on any one third-party data supplier in order to meet the needs of our clients. We have entered into third-party content agreements of varying lengths, which in some cases can be terminated on one year’s notice, at predefined dates, and in other cases on shorter notice. No single vendor or data supplier represented more than 10% of FactSet's total data costs during fiscal 2019, with the exception for one vendor, which is a supplier of risk models and portfolio optimizer data to FactSet and represented 11% of FactSet’s data costs in fiscal 2019.

Data Centers

Our business is dependent on our ability to process substantial volumes of data and transactions rapidly and efficiently on our networks and systems. Our global technology infrastructure supports our operations and is designed to facilitate the reliable and efficient processing and delivery of data and analytics to our clients. Our data centers contain multiple layers of redundancy to enhance system performance, including maintaining, processing and storing data at multiple data centers. User connections are load balanced between data centers. In the event of a site failure, equipment problem or localized disaster, the remaining centers have the capacity to handle the additional load. We continue to be focused on maintaining a global technological infrastructure that allows us to support our growing business.

We are embarking on a set of programs that will increasingly move our systems and applications to cloud computing platforms. We continue to operate fully redundant data centers in both Virginia and New Jersey in the U.S. that can handle our entire client capacity. In addition, select workloads are migrating to diverse cloud computing regions utilizing premier, market-leading Cloud providers.

The Competitive Landscape

We are a part of the financial information services industry, providing accurate financial information and workflow solutions to the global investment community. This extremely competitive market is comprised of both large, well-capitalized companies and smaller, niche firms including market data suppliers, news and information providers and many of the content providers that supply us with financial information included in the FactSet workstation. Our largest competitors are Bloomberg L.P., Refinitiv (formerly part of Thomson Reuters), and S&P Global Market Intelligence. Other competitors and competitive products include online database suppliers and integrators and their applications, such as MSCI Inc., Morningstar Inc., BlackRock Solutions and RIMES Technologies Corporation. Many of these firms offer products or services which are similar to those we sell. Our development of robust sets of proprietary content combined with our news and quotes offering have resulted in more direct competition with the largest financial data providers.

Despite competing products and services, we enjoy high barriers to entry and believe it would be difficult for another vendor to quickly replicate the extensive databases we currently offer. Through our in-depth analytics and client service, we believe we can offer clients a more comprehensive solution with one of the broadest sets of functionalities, through a desktop or mobile user interface or through a standardized or bespoke data feed. In addition, our applications, including our client support and service offerings, are entrenched in the workflow of many financial professionals given the downloading functions and portfolio analysis/screening capabilities offered. We are entrusted with significant amounts of our clients' own proprietary data, including portfolio holdings. As a result, our products have become central to our clients’ investment analysis and decision-making.

Intellectual Property

We have registered trademarks and copyrights for many of our products and services and will continue to evaluate the registration of additional trademarks and copyrights as appropriate. We enter into confidentiality agreements with our employees, clients, data suppliers and vendors. We seek to protect our workflow solutions, documentation and other written materials under trade secret, copyright and patent laws. While we do not believe we are dependent on any one of our intellectual property rights, we do rely on the combination of intellectual property rights and other measures to protect our proprietary rights. Despite these efforts, existing intellectual property laws may afford only limited protection.

Research and Product Development Costs

A key aspect of our growth strategy is to enhance our existing products and applications by making them faster with more reliable data. We strive to rapidly adopt new technology that can improve our products and services. At FactSet we do not have a separate research and product development department, but rather our product development and engineering departments work closely with our strategists, product managers, sales and other client-facing specialists to identify areas of improvement to provide increased value to our clients. Research and product development costs relate to the salary and benefits for our product development, software engineering and technical support staff. These costs are expensed as incurred within our cost of services as employee compensation. We intend to continue to invest in the development of new products and enhancements that will allow us to respond quickly to market changes and efficiently meet the needs of our clients. We incurred research and product development costs of $214.7 million, $217.1 million and $215.0 million during fiscal years 2019, 2018 and 2017, respectively.

Government Regulation

FactSet is subject to reporting requirements, disclosure obligations and other recordkeeping requirements of the Securities and Exchange Commission (“SEC”) and the various local authorities that regulate each location in which we operate. The Company’s P.A.N. Securities, LP, is a member of the Financial Industry Regulatory Authority, Inc. and is a registered broker-dealer under Section 15 of the Securities Exchange Act of 1934. P.A.N. Securities, LP, as a registered broker-dealer, is subject to Rule 15c3-1 under the Securities Exchange Act of 1934, which requires that the Company maintain minimum net capital requirements. The Company claims exemption under Rule 15c3-3(k)(2)(i).

Corporate Contact Information

FactSet was founded as a Delaware corporation in 1978, and its principal executive office is in Norwalk, Connecticut.

Mailing address of the Company’s headquarters: 601 Merritt 7, Norwalk, CT 06851 prior to January 1, 2020, and 45 Glover Avenue Norwalk, CT 06850, thereafter

Telephone number: +1 (203) 810-1000

Website address: www.factset.com

Available Information

Through the Investor Relations section of FactSet’s website (https://investor.factset.com), we make available the following filings as soon as practicable after they are electronically filed with, or furnished to, the SEC: the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements for the annual stockholder meetings, Reports on Forms 3, 4 and 5, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. All such filings are available free of charge.

Additionally, we broadcast live our quarterly earnings calls via the investor relations section of our website. We also provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases, and blogs as part of our investor relations website. The contents of this website section are not intended to be incorporated by reference into this Report on Form 10-K or in any other report or document the Company files and any reference to this section of our website is intended to be inactive textual references only.

In addition, the FactSet Code of Business Conduct and Ethics is posted in the Investor Relations section of the Company’s website. The same information is available in print to any stockholder who submits a written request to the Company’s Investor Relations department. Any amendments to or waivers of such code that are required to be publicly disclosed by the applicable exchange rules or the SEC will be posted on our website. The Corporate Governance Guidelines and the charters of each of the committees of the Company’s Board of Directors, including the Audit Committee, Compensation and Talent Committee, and Nominating and Corporate Governance Committee are available on the Investor Relations section of our website. The same information is available in print, free of charge, to any stockholder who submits a written request to our Investor Relations department.

Executive Officers of the Registrant

The following table shows FactSet’s current executive officers:

| Name of Officer |

Age |

Office Held with the Company |

Officer Since |

| F. Philip Snow |

55 |

Chief Executive Officer |

2014 |

| Helen L. Shan |

52 |

Executive Vice President and Chief Financial Officer |

2018 |

| Franck A.R. Gossieaux |

49 |

Executive Vice President, Global Head of Sales and Client Solutions |

2019 |

| Rachel R. Stern |

54 |

Executive Vice President, General Counsel and Secretary |

2009 |

| Gene D. Fernandez |

52 |

Executive Vice President, Chief Technology and Product Officer |

2017 |

| Robert J. Robie |

41 |

Executive Vice President, Head of Analytics and Trading |

2018 |

| Daniel Viens |

62 |

Senior Vice President, Chief Human Resources Officer |

2018 |

F. Philip Snow – Chief Executive Officer. Mr. Snow was named Chief Executive Officer effective July 1, 2015. Prior to that, Mr. Snow held the title of President. He began his career at FactSet in 1996 as a Consultant, before moving to Asia to hold positions in the Tokyo and Sydney offices. Following his move back to the U.S. in 2000, Mr. Snow held various sales leadership roles prior to assuming the role of Senior Vice President, Director of U.S. Investment Management Sales in 2013. Mr. Snow received a Bachelor of Arts in Chemistry from the University of California at Berkeley and a Master of International Management from the Thunderbird School of Global Management. He has earned the right to use the Chartered Financial Analyst designation.

Helen L. Shan – Executive Vice President and Chief Financial Officer. Ms. Shan joined FactSet in September 2018 from Marsh and McLennan Companies, where she was CFO for Mercer, a professional services firm. During her time at Mercer, Ms. Shan was responsible for global financial reporting and performance, operational finance, investments, and corporate strategy, leading a team of finance professionals supporting clients in over 130 countries. Preceding her tenure as the CFO for Mercer, Ms. Shan also served as the Vice President and Treasurer for Marsh and McLennan Companies, with additional prior experience in the same position with Pitney Bowes Inc. and served as a Managing Director at J.P. Morgan. In September 2018, Ms. Shan joined the Board of Directors of EPAM Systems Inc., a global provider of digital platform engineering and software development services. Ms. Shan holds dual degrees with a Bachelor of Science and a Bachelor of Applied Science from the University of Pennsylvania’s Wharton School of Business and School of Applied Science and Engineering. Ms. Shan also has a Master of Business Administration from Cornell University’s SC Johnson College of Business.

Frank A.R. Gossieaux – Executive Vice President, Global Head of Sales and Client Solutions. Mr. Gossieaux joined FactSet in September 2004. Mr. Gossieaux held multiple senior leadership roles at FactSet in both Europe and North America including Senior Vice President of Americas Sales, Senior Vice President of EMEA Sales, and Senior Vice President of International Investment Management. Mr. Gossieaux received a Bachelor of Science in Economics from the University Pantheon-Assas (Sorbonne-Assas) in Paris.

Rachel R. Stern – Executive Vice President, Strategic Resources and General Counsel. Ms. Stern joined FactSet in January 2001 as General Counsel. In addition to her role in the Legal Department, Ms. Stern is also responsible for Compliance, Facilities and Real Estate Planning, and the administration of our offices in Hyderabad, Manila and Riga. Ms. Stern is admitted to practice in New York, Washington D.C., and as House Counsel in Connecticut. Ms. Stern received a Bachelor of Arts from Yale University, a Master of Arts from the University of London and a Juris Doctor from the University of Pennsylvania Law School.

Gene D. Fernandez – Executive Vice President, Chief Technology and Product Officer. Mr. Fernandez joined FactSet in November 2017 from J.P. Morgan, where he served as the Chief Technology Officer, New Product Development. In this role, he developed the strategy and built the engineering function responsible for new product innovation. During a decade at J.P. Morgan, Mr. Fernandez held various other roles, including Chief Technology Officer for Client Technology and Research and Banking Information Technology. Prior to J.P. Morgan, he worked at Credit Suisse and Merrill Lynch. Mr. Fernandez received a Bachelor of Science in Computer Science and Economics from Rutgers University.

Robert J. Robie – Executive Vice President, Head of Analytics and Trading Solutions. Mr. Robie joined FactSet in July 2000 as a Product Sales Specialist. During his tenure at FactSet, Mr. Robie has held several positions of increasing responsibility, including Senior Director of Analytics and Director of Global Fixed Income and Analytics, where he led sales and support efforts for FactSet’s fixed income product offering. Although Mr. Robie joined FactSet in 2000, he did work at BTN Partners from 2004 through 2005 in their quantitative portfolio management and performance division, before returning to continue his career with FactSet. Mr. Robie holds a Bachelor of Arts in Economics from Beloit College.

Daniel Viens – Senior Vice President, Chief Human Resources Officer. Mr. Viens joined FactSet in September 1998 as a Vice President, Director of Human Resources and has held several leadership positions of increased responsibility in Human Resources. Prior to joining FactSet, Mr. Viens was a Director of Human Resources for First Data Solutions and Donnelly Marketing (a former company of Dun & Bradstreet), where he developed significant Human Resources acumen. Mr. Viens graduated from Boston University, and holds both a Master's Degree from Eastern Illinois University in Clinical Psychology, and a Master of Business Administration from Columbia University.

Additional Information

Additional information with respect to FactSet’s business is included in the following pages and is incorporated herein by reference:

| Page(s) |

|

| Five-Year Summary of Selected Financial Data |

21 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

| Quantitative and Qualitative Disclosures about Market Risk |

46 |

| Note 1 to Consolidated Financial Statements entitled Organization and Nature of Business |

59 |

| Note 8 to Consolidated Financial Statements entitled Segment Information |

72 |

ITEM 1A. RISK FACTORS

The following risks could materially and adversely affect our business, financial condition, cash flows, results of operations and as a result, the trading price of our common stock could decline. These risk factors do not identify all risks that we face; our operations could also be affected by factors that are not presently known to us or that we currently consider to be immaterial to our operations. Due to risks and uncertainties, known and unknown, our past financial results may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. Investors should also refer to the other information set forth in this Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements including the related notes. Investors should carefully consider all risks, including those disclosed, before making an investment decision.

Loss, corruption and misappropriation of data and information relating to clients and others

Many of our products, as well as our internal systems and processes, involve the storage and transmission of our own, as well as supplier and customer proprietary information and sensitive or confidential data. This includes data from client portfolios and strategies. Breaches of this confidentiality, should they occur, could result in the loss of clients and termination of arrangements with suppliers for the use of their data. If we fail to maintain the adequacy of our internal controls, unauthorized access or misappropriation of client or supplier data by an employee or an external third-party could occur. Additionally, the maintenance and enhancement of our systems may not be completely effective in preventing loss, unauthorized access or misappropriation. Data misappropriation, unauthorized access or data loss could instill a lack of confidence in our products and systems and damage our brand, reputation and business. Breaches of security measures could expose us, our clients or the individuals affected to a risk of loss or misuse of this information, potentially resulting in litigation and liability for us, as well as the loss of existing or potential clients. Many jurisdictions in which we operate have laws and regulations relating to data privacy and protection of personal information, including the European Union General Data Protection Regulation which became effective May 25, 2018, and California's Consumer Privacy Act, effective January 1, 2020. Both require companies to satisfy requirements regarding the handling of personal and sensitive data, including our use, protection and the ability of persons whose data is stored to correct or delete such data about themselves. The law in this area continues to develop and the changing nature of privacy laws could impact our processing of personal and sensitive information related to our content, operations, employees, clients, and suppliers, and may expose us to claims of violations.

Successful cyber-attacks and the failure of cyber-security systems and procedures

In providing our digital-enabled services to clients, we rely on information technology infrastructure that is primarily managed internally, along with some reliance placed on third-party service providers. We and these third-party service providers are subject to the risks of system failures and security breaches, including cyber-attacks, such as phishing scams, viruses and denials of service attacks, as well as employee errors or malfeasance. Our protective systems and procedures and those of third parties to which we are connected, such as cloud computing providers, may not be effective against these threats. We could suffer significant damage to our brand and reputation: if a cyber-attack or other security incident were to allow unauthorized access to, or modification of, clients’ or suppliers’ data, other external data, internal data or information technology systems; if the services provided to clients were disrupted; or if products or services were perceived as having security vulnerabilities. The costs we would incur to address and resolve these security incidents would increase our expenses. These types of security incidents could also lead to lawsuits, regulatory investigations and claims, loss of business and increased legal liability. We also make acquisitions periodically. While significant effort is placed on addressing information technology security issues with respect to the acquired companies, we may inherit such risks when these acquisitions are integrated into our infrastructure.

A prolonged or recurring outage at our data centers and other business continuity disruptions at facilities could result in reduced service and the loss of clients

Our clients rely on us for the delivery of time-sensitive, up-to-date data and applications. Our business is dependent on our ability to process substantial volumes of data and transactions rapidly and efficiently on our computer-based networks and systems. Our computer operations, as well as our other business centers, and those of our suppliers and clients are vulnerable to interruption by fire, natural disaster, power loss, telecommunications failures, terrorist attacks, acts of war, civil unrest, Internet failures, computer viruses, security breaches, and other events beyond our reasonable control. We maintain back-up facilities and certain other redundancies for each of our major data centers to minimize the risk that any such event will disrupt those operations. However, a loss of our services involving our significant facilities may materially disrupt our business and may induce our clients to seek alternative data suppliers. Any such losses or damages we incur could have a material adverse effect on our business. Although we seek to minimize these risks through security measures, controls, back-up data centers and emergency planning, there can be no assurance that such efforts will be successful or effective.

Competition in our industry may cause price reductions or loss of market share

We continue to experience intense competition across all markets for our products with competitors ranging in size from smaller, highly specialized, single-product businesses to multi-billion-dollar companies. While we believe the breadth and depth of our suite of products and applications offer benefits to our clients that are a competitive advantage, our competitors may offer price incentives to attract new business. Future competitive pricing pressures may result in decreased sales volumes and price reductions, resulting in lower revenue. Weak economic conditions may also result in clients seeking to utilize lower-cost information that is available from alternative sources. The impact of cost-cutting pressures across the industries we serve could lower demand for our products. Clients within the financial services industry that strive to reduce their operating costs may seek to reduce their spending on financial market data and related services, such as ours. If our clients consolidate their spending with fewer suppliers, by selecting suppliers with lower-cost offerings or by self-sourcing their needs for financial market data, our business could be negatively affected.

The continued shift from active to passive investing could negatively impact user count growth and revenue

The predominant investment strategy today is still active investing, which attempts to outperform the market. The main advantage of active management is the expectation that the investment managers will be able to outperform market indices. They make informed investment decisions based on their experiences, insights, knowledge and ability to identify opportunities that can translate into superior performance. The main advantage of passive investing is that it closely matches the performance of market indices. Passive investing requires little decision-making by investment managers and low operating costs which result in lower fees for the investor. A continued shift to passive investing, resulting in an increased outflow to passively managed index funds, could reduce demand for the services of active investment managers and consequently, the demand of our clients for our services.

A decline in equity and/or fixed income returns may impact the buying power of investment management clients

Approximately 83.7% of our ASV is derived from our investment management clients. The profitability and management fees of these clients are tied to assets under management. An equity market decline not only depresses the value of assets under management but also could cause a significant increase in redemption requests from our clients’ customers, further reducing their assets under management. Reduced client profits and management fees may cause our clients to cut costs. Moreover, extended declines in the equity and fixed income markets may reduce new fund or client creation. Each of these developments may result in lower demand from investment managers for our services and workstations, which could negatively affect our business.

Failure to develop and market new products and enhancements that maintain our technological and competitive position and failure to anticipate and respond to changes in the marketplace for our products

The market for our products is characterized by rapid technological change, including methods and speed of delivery, changes in client demands, development of new investment instruments and evolving industry standards. The direction of these trends can render our existing products less competitive, obsolete or unmarketable. As a result, our future success will continue to depend upon our ability to identify and develop new products and enhancements that address the future needs of our target markets and to respond to their changing standards and practices. We may not be successful in developing, introducing, marketing, licensing and implementing new products and enhancements on a timely and cost-effective basis or without impacting the stability and efficiency of existing products and customer systems. Further, any new products and enhancements may not adequately meet the requirements of the marketplace or achieve market acceptance. Our failure or inability to anticipate and respond to changes in the marketplace, including competitor and supplier developments, may also adversely affect our business, operations and growth.

Uncertainty, consolidation and business failures in the global investment banking industry may cause us to lose clients and users

Our investment banking clients that perform mergers and acquisitions ("M&A") advisory work, capital markets services and equity research, account for approximately 16.3% of our ASV. A significant portion of these revenues relate to services deployed by the largest banks. Consolidation or contraction in this industry directly impacts the number of prospective clients and users within the sector. Thus, economic uncertainty for our global investment banking clients, consolidation and business failures in this sector could adversely affect our financial results and future growth.

Volatility in the financial markets may delay the spending pattern of clients and reduce future ASV growth

The decision on the part of large institutional clients to purchase our services often requires management-level sponsorship and typically depends upon the size of the client, with larger clients having more complex and time-consuming purchasing processes. The process is also influenced by market volatility. These characteristics often lead us to engage in relatively lengthy sales efforts. Purchases (and incremental ASV) may therefore be delayed as uncertainties in the financial markets may cause clients to remain cautious about capital and data content expenditures, particularly in uncertain economic environments.

Additional cost due to tax assessments resulting from ongoing and future audits by tax authorities as well as changes in tax laws

In the ordinary course of business, we are subject to tax examinations by various governmental tax authorities. The global and diverse nature of our business means that there could be additional examinations by governmental tax authorities and the resolution of ongoing and other probable audits which could impose a future risk to the results of our business. In August 2019, FactSet received a Notice of Intent to Assess (the “Notice”) additional sales taxes, interest and underpayment penalties from the Commonwealth of Massachusetts Department of Revenue relating to prior tax periods. The Notice follows FactSet’s previously disclosed response to a letter from the Commonwealth requesting additional sales information. Based upon a preliminary review of the Notice, the Company believes the Commonwealth may assess sales tax, interest and underpayment penalties on previously recorded sales transactions. The Company intends to contest any such assessment, if assessed, and continues to cooperate with the Commonwealth’s inquiry. Due to uncertainty surrounding the assessment process, the Company is unable to reasonably estimate the ultimate outcome of this matter and, as such, has not recorded a liability as of August 31, 2019. While FactSet believes that it will ultimately prevail if the Company is presented with a formal assessment; if FactSet does not prevail, the amount could have a material impact on the Company’s consolidated financial position, cash flows and results of operations.

Changes in tax laws or the terms of tax treaties in a jurisdiction where we are subject to tax could increase our taxes payable. On December 22, 2017, the U.S. Tax Cuts and Jobs Act, ("TCJA") was signed into law. The TCJA enacted broad changes to the U.S. Internal Revenue code, including reducing the federal corporate income tax rate from 35% to 21%, amongst many other complex provisions. The ultimate impact of such tax reform may differ from our current estimate due to changes in interpretations and assumptions made by us as well as the issuance of further regulations or guidance.

Failure to identify, integrate, or realize anticipated benefits of acquisitions and strains on resources as a result of growth

There can be no assurance that we will be able to identify suitable candidates for successful acquisition at acceptable prices. Additionally, there may be integration risks or other risks resulting from acquired businesses. Our ability to achieve the expected returns and synergies from past and future acquisitions and alliances depends in part upon our ability to integrate the offerings, technology, sales, administrative functions and personnel of these businesses effectively into our core business. We cannot guarantee that our acquired businesses will perform at the levels anticipated. In addition, past and future acquisitions may subject us to unanticipated risks or liabilities or disrupt operations.

Growth, such as the addition of new clients and acquisitions, puts demands on our resources, including our internal systems and infrastructure. These may require improvements or replacement to meet the additional demands of a larger organization. Further, the addition of new clients and the implementation of such improvements would require additional management time and resources. These needs may result in increased costs that could negatively impact results of operations. Failure to implement needed improvements, such as improved scalability, could result in a deterioration in the performance of our internal systems and negatively impact the performance of our business.

Failure to enter into or renew contracts supplying new and existing data sets or products on competitive terms

We collect and aggregate third-party content from thousands of data suppliers, news sources, exchanges, brokers and contributors into our own dedicated online service, which clients access to perform their analyses. Clients have access to the data and content found within our databases. These databases are important to our operations as they provide clients with key information. We have entered into third-party content agreements of varying lengths, which in some cases can be terminated on one year’s notice at predefined dates, and in other cases on shorter notice. Some of our content provider agreements are with competitors, who may attempt to make renewals difficult or expensive. We seek to maintain favorable contractual relationships with our data suppliers, including those that are also competitors. We also make efforts, when reasonable, to locate alternative sources to ensure we are not dependent on any one third-party data supplier. We believe we are not dependent on any one significant third-party data supplier. Our failure to be able to maintain these relationships or the failure of our suppliers to deliver accurate data or in a timely manner could adversely affect our business.

Inability to hire and retain key qualified personnel

Our business is based on successfully attracting, motivating and retaining talented employees. Competition for talent, especially engineering personnel, is strong. We need technical resources such as engineers to help develop new products and enhance existing services. We rely upon sales personnel to sell our products and services and maintain healthy business relationships. If we are unsuccessful in our recruiting efforts, or if we are unable to retain key employees, our ability to develop and deliver successful products and services may be adversely affected and could have a material, adverse effect on our business.

Increased accessibility to free or relatively inexpensive information sources may reduce demand for our products

Each year, an increasing amount of free or relatively inexpensive information becomes available, particularly through the Internet, and this trend may continue. The availability of free or relatively inexpensive information may reduce demand for our products. While we believe our service offering is distinguished by such factors as customization, timeliness, accuracy, ease-of-use, completeness and other value-added factors, if users choose to obtain the information they need from public or other sources, our business and results of operations could be adversely affected.

Third parties may claim we infringe upon their intellectual property rights or may infringe upon our intellectual property rights

We may receive notice from others claiming that we have infringed upon their intellectual property rights. Responding to these claims may require us to enter into royalty and licensing agreements on unfavorable terms, incur litigation costs, enter into settlements, stop selling or redesign affected products, or pay damages and satisfy indemnification commitments with our clients or suppliers under contractual provisions of various license arrangements. Additionally, third parties may copy, infringe or otherwise profit from the unauthorized use of our intellectual property rights requiring us to litigate to protect our rights. Certain countries may not offer adequate protection of proprietary rights. If we are required to defend ourselves or assert our rights or take such actions mentioned, our operating margins may decline as a result. We have incurred, and expect to continue to incur, expenditures to acquire the use of technology and intellectual property rights as part of our strategy to manage this risk.

Operations outside the U.S. involve additional requirements and burdens that we may not be able to control or manage successfully

In fiscal 2019, approximately 38% of our revenue related to operations located outside the U.S. In addition, a significant number of our employees, approximately 76%, are located in offices outside the U.S. We expect our growth to continue outside the U.S., with non-U.S. revenues accounting for an increased portion of total revenue in the future. Our non-U.S. operations involve risks that differ from or are in addition to those faced by our U.S. operations. These risks include difficulties in developing products, services and technology tailored to the needs of non-U.S. clients, including in emerging markets; different employment laws and rules; rising labor costs in low-wage countries; difficulties in staffing and managing personnel that are located outside the U.S.; different regulatory, legal and compliance requirements, including in the areas of privacy and data protection, anti-bribery and anti-corruption, trade sanctions and currency controls, marketing and sales and other barriers to conducting business; social and cultural differences, such as languages; diverse or less stable political, operating and economic environments and market fluctuations; civil disturbances or other catastrophic events that reduce business activity; limited recognition of our brand and intellectual property protection; differing accounting principles and standards; restrictions on or adverse tax consequences from entity management efforts; and changes in U.S. or foreign tax laws. If we are not able to adapt efficiently or manage the business effectively in markets outside the U.S., our business prospects and operating results could be materially and adversely affected.

Exposure to fluctuations in currency exchange rates and the failure of hedging arrangements

Due to the global nature of our operations, we conduct business outside the U.S. in several currencies including the Euro, Indian Rupee, Philippine Peso, British Pound Sterling, and Japanese Yen. To the extent our international activities increase in the future, our exposure to fluctuations in currency exchange rates may increase as well. To manage this exposure, we utilize derivative instruments (such as foreign currency forward contracts). By their nature, all derivative instruments involve elements of market and credit risk. The market risk associated with these instruments resulting from currency exchange movements is expected to offset the market risk of the underlying transactions, assets and liabilities being hedged. Credit risk is managed through the continuous monitoring of exposure to the counterparties associated with these instruments. Our primary objective in holding derivatives is to reduce the volatility of earnings with changes in foreign currency. Although we believe that our foreign exchange hedging policies are reasonable and prudent under the circumstances, our attempt to hedge against these risks may not be successful, which could cause an adverse impact on our results of operations.

Legislative and regulatory changes in the environments in which we and our clients operate

Many of our clients operate within a highly regulated environment and must comply with governmental legislation and regulations. The U.S. regulators have increased their focus on the regulation of the financial services industry. Increased regulation of our clients may increase their expenses, causing them to seek to limit or reduce their costs from outside services such as ours. Additionally, if our clients are subjected to investigations or legal proceedings they may be adversely impacted, possibly leading to their liquidation, bankruptcy, receivership, reduction in assets under management, or diminished operations, which would adversely affect our revenue. In the European Union, the new version of the Markets in Financial Instruments Directive (recast), also known as “MiFID II” became effective in January 2018. We believe that compliance with MiFID II requirements is time-consuming and costly for the investment managers who are subject to it and will cause clients to adapt their pricing models and business practices significantly. These increased costs may impact our clients’ spending and may cause some investment managers to lose business or withdraw from the market, which may adversely affect demand for our services. However, MiFID II may also present us with new business opportunities for new service offerings. In addition to the MiFID II requirements, we further believe the proposed withdrawal of the U.K. from the European Union (also known as Brexit) on terms still being negotiated, has created economic uncertainty among our client base. This uncertainty may have an impact on our clients’ expansion or spending plans, which may in turn negatively impact our revenue or growth.

As a business, we are also subject to numerous laws and regulations in the U.S. and in the other countries in which we operate. These laws, rules, and regulations, and their interpretations, may change in the future, and compliance with these changes may increase our costs or cause us to make changes in or otherwise limit our business practices. In addition, the global nature and scope of our business operations make it more difficult to monitor areas that may be subject to regulatory and compliance risk. If we fail to comply with any applicable law, rule, or regulation, we could be subject to claims and fines and suffer reputational damage.

Adverse resolution of litigation or governmental investigations

We are party to lawsuits in the normal course of business. Litigation and governmental investigations can be expensive, lengthy and disruptive to normal business operations. Moreover, the results of complex legal proceedings are difficult to predict. Unfavorable resolution of lawsuits could have a material adverse effect on our business, operating results or financial condition. For additional information regarding legal matters, see Item 3, Legal Proceedings, contained in Part I of this Report on Form 10-K.

Failure to maintain reputation

We enjoy a positive reputation in the marketplace. Our ability to attract and retain clients and employees is affected by external perceptions of our brand and reputation. Reputational damage from negative perceptions or publicity could affect our ability to attract and retain clients and employees and our ability to maintain our pricing for our products. Although we monitor developments for areas of potential risk to our reputation and brand, negative perceptions or publicity could have a material adverse effect on our business and financial results.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

As of August 31, 2019, we leased approximately 202,000 square feet of office space at our headquarters in Norwalk, Connecticut. On February 14, 2018, we entered into a new lease agreement to relocate our corporate headquarters to 45 Glover Avenue in Norwalk, Connecticut. The new location will comprise approximately 173,000 square feet of office space. We took possession of the newly leased property on January 1, 2019, for fit-out purposes. We will continue to occupy our existing headquarters space until the new headquarters is ready for occupancy, currently estimated to be in the second quarter of fiscal 2020.

We have data content collection offices located in India, the Philippines and Latvia, which benefit all our operating segments. Additionally, we have data centers that support our technological infrastructure located in New Jersey and Virginia. The other locations listed in the table below are leased office space. The leases expire on various dates through 2035. We believe the amount of leased space as of August 31, 2019 is adequate for our current needs and that additional space can be available to meet any future needs.

Including new lease agreements executed during fiscal 2019, our Company’s worldwide leased space increased to approximately 1,860,000 square feet as of August 31, 2019, up 110,000 square feet, or 6.3%, from August 31, 2018 and includes properties at the following locations:

| Segment |

Leased Location |

| United States |

Atlanta, Georgia |

| Austin, Texas |

|

| Boston, Massachusetts |

|

| Chicago, Illinois |

|

| Jackson, Wyoming |

|

| Los Angeles, California |

|

| Manchester, New Hampshire |

|

| Minneapolis, Minnesota |

|

| New York, New York |

|

| Norwalk, Connecticut |

|

| Piscataway, New Jersey |

|

| Reston, Virginia |

|

| San Francisco, California |

|

| Sao Paulo, Brazil |

|

| Toronto, Canada |

|

| Youngstown, Ohio |

|

| Europe |

Avon, France |

| Amsterdam, the Netherlands |

|

| Cologne, Germany |

|

| Dubai, United Arab Emirates |

|

| Frankfurt, Germany |

|

| Gloucester, England |

|

| Johannesburg, South Africa |

|

| London, England |

|

| Luxembourg City, Luxembourg |

|

| Madrid, Spain |

|

| Milan, Italy |

|

| Paris, France |

|

| Riga, Latvia |

|

| Sofia, Bulgaria |

|

| Zurich, Switzerland |

|

| Asia Pacific |

Chennai, India |

| Hong Kong, China |

|

| Hyderabad, India |

|

| Manila, the Philippines |

|

| Melbourne, Australia |

|

| Mumbai, India |

|

| Shanghai, China |

|

| Singapore |

|

| Sydney, Australia |

|

| Tokyo, Japan |

ITEM 3. LEGAL PROCEEDINGS

From time to time, the Company is subject to legal proceedings, claims and litigation arising in the ordinary course of business, including intellectual property litigation. Based on currently available information, the Company’s management does not believe that the ultimate outcome of these unresolved matters against FactSet, individually or in the aggregate, is likely to have a material adverse effect on the Company's consolidated financial position, its annual results of operations or its annual cash flows. However, these matters are subject to inherent uncertainties and management’s view of these matters may change in the future.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

Part II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

| (a) |

Market Information, Holders and Dividends |

Market Information – Our common stock is listed on the New York Stock Exchange (“NYSE”) and the NASDAQ Stock Market under the symbol FDS. The following table sets forth, for each fiscal period indicated, the high and low sales prices per share of our common stock as reported on the NYSE:

| First |

Second |

Third |

Fourth |

|||||||||||||

| 2019 |

||||||||||||||||

| High |

$ | 237.29 | $ | 237.95 | $ | 284.32 | $ | 305.38 | ||||||||

| Low |

$ | 210.11 | $ | 188.31 | $ | 228.43 | $ | 266.06 | ||||||||

| 2018 |

||||||||||||||||

| High |

$ | 200.31 | $ | 209.02 | $ | 217.36 | $ | 229.98 | ||||||||

| Low |

$ | 155.88 | $ | 183.89 | $ | 184.48 | $ | 195.69 | ||||||||

Holders of Record – As of October 24, 2019, we had approximately 199,571 holders of record of our common stock. However, because many of our shares of common stock are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders. The closing price of our common stock on October 24, 2019, was $253.22 per share as reported on the NYSE.

Dividends - During fiscal years 2019 and 2018, our Board of Directors declared the following dividends on our common stock:

| Year Ended |

Dividends per Share of Common Stock |

Record Date |

Total $ Amount (in thousands) |

Payment Date |

||||||||

| Fiscal 2019 |

||||||||||||

| First Quarter |

$ | 0.64 | November 30, 2018 |

$ | 24,372 | December 18, 2018 |

||||||

| Second Quarter |

$ | 0.64 | February 28, 2019 |

$ | 24,385 | March 19, 2019 |

||||||

| Third Quarter |

$ | 0.72 | May 31, 2019 |

$ | 27,506 | June 18, 2019 |

||||||

| Fourth Quarter |

$ | 0.72 | August 30, 2019 |

$ | 27,445 | September 19, 2019 |

||||||

| Fiscal 2018 |

||||||||||||

| First Quarter |

$ | 0.56 | November 30, 2017 |

$ | 21,902 | December 19, 2017 |

||||||

| Second Quarter |

$ | 0.56 | February 28, 2018 |

$ | 21,799 | March 20, 2018 |

||||||

| Third Quarter |

$ | 0.64 | May 31, 2018 |

$ | 24,566 | June 19, 2018 |

||||||

| Fourth Quarter |

$ | 0.64 | August 31, 2018 |

$ | 24,443 | September 18, 2018 |

||||||

All the above cash dividends were paid from existing cash resources on a quarterly basis. Future dividend payments will depend on our earnings, capital requirements, financial condition and other factors considered relevant by us, and is subject to final determination by our Board of Directors.

| (b) |

Recent Sales of Unregistered Securities |

There were no sales of unregistered equity securities during fiscal 2019.

| (c) |

Issuer Purchases of Equity Securities |

The following table provides a month-to-month summary of the share repurchase activity under the current stock repurchase program during the three months ended August 31, 2019:

(in thousands, except per share data)

| Period |

Total number of shares purchased(1) |

Average price paid per share |

Total number of shares purchased as part of publicly announced plans or programs |

Maximum number of shares (or approximate dollar value) that may yet be purchased under the plans or programs(2) |

||||||||||||

| June 2019 |

28,421 | $ | 285.92 | 25,000 | $ | 292,465 | (3) | |||||||||

| July 2019 |

102,629 | $ | 283.86 | 102,500 | $ | 263,370 | ||||||||||

| August 2019 |

90,242 | $ | 275.02 | 90,000 | $ | 238,619 | ||||||||||

| 221,292 | 217,500 | |||||||||||||||

| (1) |

Includes 217,500 shares purchased under the existing stock repurchase program, as well as 3,792 shares repurchased from employees to cover their cost of taxes upon vesting of restricted stock. |

| (2) |

Repurchases may be made from time to time in the open market and privately negotiated transactions, subject to market conditions. There is no defined number of shares to be repurchased over a specified timeframe through the life of the share repurchase program. It is expected that share repurchases will be paid using existing and future cash generated by operations. |

| (3) |

The amount included in the Maximum number of shares that may yet be purchased under the plans or programs column for June 2019, includes a $210.0 million expansion of the existing share repurchase program as approved by the Board of Directors of FactSet on June 24, 2019. |

Securities Authorized for Issuance under Equity Compensation Plans – see Part III of this Report on Form 10-K

Stock Performance Graph

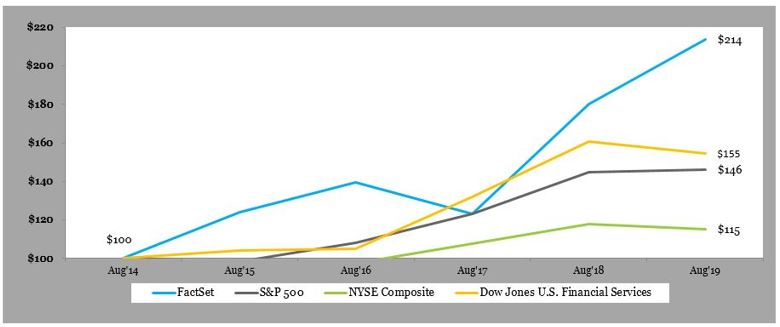

The annual changes for the five-year period shown in the graph below assume $100 had been invested in our common stock, the Standard & Poor’s 500 Index, the NYSE Composite Index and the Dow Jones U.S. Financial Services Index on August 31, 2014. The total cumulative dollar returns shown on the graph represent the value that such investments would have had on August 31, 2019. Stockholder returns over the indicated period are based on historical data and should not be considered indicative of future stockholder returns.

| 2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|||||||||||||||||||

| FactSet Research Systems Inc. |

$ | 100 | $ | 124 | $ | 140 | $ | 123 | $ | 180 | $ | 214 | ||||||||||||

| S&P 500 Index |

$ | 100 | $ | 98 | $ | 108 | $ | 123 | $ | 145 | $ | 146 | ||||||||||||

| NYSE Composite Index |

$ | 100 | $ | 92 | $ | 97 | $ | 108 | $ | 118 | $ | 115 | ||||||||||||

| Dow Jones U.S. Financial Services Index |

$ | 100 | $ | 104 | $ | 105 | $ | 132 | $ | 161 | $ | 155 | ||||||||||||

The information contained in the above graph shall not be deemed to be soliciting material or filed or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that FactSet specifically incorporates it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data has been derived from our consolidated financial statements. This financial data should be read in conjunction with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8, Financial Statements and Supplementary Data, of this Report on Form 10-K.

Consolidated Statements of Income Data

| For the year ended August 31, |

||||||||||||||||||||

| (in thousands, except per share data) |

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

| Revenue |

$ | 1,435,351 | $ | 1,350,145 | $ | 1,221,179 | $ | 1,127,092 | $ | 1,006,768 | ||||||||||

| Operating income |

$ | 438,035 | (1) | $ | 366,204 | (4) | $ | 352,135 | (7) | $ | 349,676 | (10) | $ | 331,918 | (13) | |||||

| Provision for income taxes |

$ | 69,175 | $ | 84,753 | $ | 86,053 | $ | 122,178 | $ | 92,703 | ||||||||||

| Net income |

$ | 352,790 | (2) | $ | 267,085 | (5) | $ | 258,259 | (8) | $ | 338,815 | (11) | $ | 241,051 | (14) | |||||

| Diluted earnings per common share |

$ | 9.08 | (3) | $ | 6.78 | (6) | $ | 6.51 | (9) | $ | 8.19 | (12) | $ | 5.71 | (15) | |||||

| Weighted average common shares (diluted) |

38,873 | 39,377 | 39,642 | 41,365 | 42,235 | |||||||||||||||

| Cash dividends declared per common share |

$ | 2.72 | $ | 2.40 | $ | 2.12 | $ | 1.88 | $ | 1.66 | ||||||||||

Consolidated Balance Sheets Data

| As of August 31, |

||||||||||||||||||||

| (in thousands) |

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

| Cash and cash equivalents |

$ | 359,799 | $ | 208,623 | $ | 194,731 | $ | 228,407 | $ | 158,914 | ||||||||||

| Accounts receivable, net of reserves |

$ | 146,309 | $ | 156,639 | $ | 148,331 | $ | 97,797 | $ | 95,064 | ||||||||||

| Goodwill and intangible assets, net |

$ | 806,280 | $ | 850,768 | $ | 881,103 | $ | 546,076 | $ | 348,339 | ||||||||||

| Total assets |

$ | 1,560,130 | $ | 1,419,447 | $ | 1,413,315 | $ | 1,019,161 | $ | 736,671 | ||||||||||

| Non-current liabilities |

$ | 668,951 | $ | 672,413 | $ | 652,485 | $ | 343,570 | $ | 65,307 | ||||||||||

| Total stockholders’ equity |

$ | 672,256 | $ | 525,900 | $ | 559,691 | $ | 517,381 | $ | 531,584 | ||||||||||

| (1) |

Operating income in fiscal 2019 included pre-tax charges of $8.0 million, primarily related to $4.3 million in severance costs, $8.7 million related to other corporate actions including stock-based compensation acceleration, professional fees related to infrastructure upgrade activities and a one-time adjustment related to data costs and occupancy costs, partially offset by $5.0 million in non-core transaction related revenue. |

| (2) |

Net income in fiscal 2019 included $6.3 million (after-tax) expenses, primarily related to $3.5 million (after-tax) in severance costs, $6.8 million (after-tax) related to other corporate actions including stock-based compensation acceleration, professional fees related to infrastructure upgrade activities and a one-time adjustment related to data costs and occupancy costs, partially offset by $4.0 million (after-tax) in non-core transaction related revenue. |

| (3) |

Diluted earnings per share (“EPS”) in fiscal 2019 was reduced by $0.15 per share, primarily related to $0.09 in severance costs, $0.16 related to other corporate actions including stock-based compensation acceleration, professional fees related to infrastructure upgrade activities and a one-time adjustment related to data costs and occupancy costs, partially offset by $0.10 in non-core transaction related revenue. |

| (4) |

Operating income in fiscal 2018 included pre-tax charges of $17.4 million from restructuring actions, $4.7 million related to other corporate actions including stock-based compensation acceleration and $4.9 million in legal matters. |

| (5) |

Net income in fiscal 2018 included $13.8 million (after-tax) expense related to restructuring actions, $3.8 million (after-tax) expense related to other corporate actions including stock-based compensation acceleration, $3.4 million (after-tax) expense related to legal matters and $21.3 million of tax charges primarily related to the one-time deemed repatriation tax on foreign earnings. |

| (6) |

Diluted earnings per share (“EPS”) in fiscal 2018 included a $0.35 decrease in diluted EPS from restructuring actions, a $0.10 detriment due to other corporate actions including stock-based compensation, a $0.09 decrease from legal matters and a $0.53 decrease from tax charges primarily related to the one-time deemed repatriation tax on foreign earnings. |

| (7) |

Operating income in fiscal 2017 included pre-tax charges of $5.6 million related to modifications of certain share-based compensation grants, $5.0 million related to restructuring actions and $7.4 million in acquisition-related expenses. |

| (8) |

Net income in fiscal 2017 included $4.2 million (after-tax) related to modifications of certain share-based compensation grants, $3.7 million (after-tax) related to restructuring actions and $5.5 million (after-tax) of acquisition-related expenses. Fiscal 2017 net income also included a loss of $0.9 million (after-tax) from a final working capital adjustment related to the sale of FactSet’s Market Metrics business in the fourth quarter of fiscal 2016. These charges were offset by income tax benefits of $1.9 million related primarily to finalizing prior year tax returns and other discrete items. |

| (9) |

Diluted EPS in fiscal 2017 included a $0.11 decrease in diluted EPS from the modifications of certain share-based compensation grants, a $0.09 decrease from the restructuring actions, a $0.13 decrease from acquisition-related expenses and $0.02 decrease from the working capital adjustment, partially offset by a $0.05 increase in diluted EPS from the income tax benefits. |

| (10) |