00010132372023FYFALSEP3YP3Yhttp://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#AssetImpairmentChargeshttp://fasb.org/us-gaap/2023#AssetImpairmentCharges00010132372022-09-012023-08-310001013237exch:XNYS2022-09-012023-08-310001013237exch:XNAS2022-09-012023-08-3100010132372023-02-28iso4217:USD00010132372023-10-20xbrli:shares00010132372021-09-012022-08-3100010132372020-09-012021-08-31iso4217:USDxbrli:shares00010132372023-08-3100010132372022-08-3100010132372021-08-3100010132372020-08-310001013237us-gaap:CommonStockMember2020-08-310001013237us-gaap:AdditionalPaidInCapitalMember2020-08-310001013237us-gaap:TreasuryStockCommonMember2020-08-310001013237us-gaap:RetainedEarningsMember2020-08-310001013237us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-08-310001013237us-gaap:RetainedEarningsMember2020-09-012021-08-310001013237us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-012021-08-310001013237us-gaap:CommonStockMember2020-09-012021-08-310001013237us-gaap:AdditionalPaidInCapitalMember2020-09-012021-08-310001013237us-gaap:TreasuryStockCommonMember2020-09-012021-08-310001013237us-gaap:CommonStockMember2021-08-310001013237us-gaap:AdditionalPaidInCapitalMember2021-08-310001013237us-gaap:TreasuryStockCommonMember2021-08-310001013237us-gaap:RetainedEarningsMember2021-08-310001013237us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-08-310001013237us-gaap:RetainedEarningsMember2021-09-012022-08-310001013237us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-012022-08-310001013237us-gaap:CommonStockMember2021-09-012022-08-310001013237us-gaap:AdditionalPaidInCapitalMember2021-09-012022-08-310001013237us-gaap:TreasuryStockCommonMember2021-09-012022-08-310001013237us-gaap:CommonStockMember2022-08-310001013237us-gaap:AdditionalPaidInCapitalMember2022-08-310001013237us-gaap:TreasuryStockCommonMember2022-08-310001013237us-gaap:RetainedEarningsMember2022-08-310001013237us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-310001013237us-gaap:RetainedEarningsMember2022-09-012023-08-310001013237us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-012023-08-310001013237us-gaap:CommonStockMember2022-09-012023-08-310001013237us-gaap:AdditionalPaidInCapitalMember2022-09-012023-08-310001013237us-gaap:TreasuryStockCommonMember2022-09-012023-08-310001013237us-gaap:CommonStockMember2023-08-310001013237us-gaap:AdditionalPaidInCapitalMember2023-08-310001013237us-gaap:TreasuryStockCommonMember2023-08-310001013237us-gaap:RetainedEarningsMember2023-08-310001013237us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-31fds:segmentfds:workflow0001013237us-gaap:ComputerEquipmentMembersrt:MinimumMember2023-08-310001013237us-gaap:ComputerEquipmentMembersrt:MaximumMember2023-08-310001013237us-gaap:FurnitureAndFixturesMember2023-08-31fds:reporting_unit0001013237us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2023-08-310001013237us-gaap:SoftwareDevelopmentMembersrt:MaximumMember2023-08-310001013237fds:SupplierOneMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2022-09-012023-08-31xbrli:pure0001013237us-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMemberfds:SupplierTwoMember2022-09-012023-08-310001013237fds:AmericasSegmentMember2022-09-012023-08-310001013237fds:AmericasSegmentMember2021-09-012022-08-310001013237fds:AmericasSegmentMember2020-09-012021-08-310001013237fds:EMEASegmentMember2022-09-012023-08-310001013237fds:EMEASegmentMember2021-09-012022-08-310001013237fds:EMEASegmentMember2020-09-012021-08-310001013237fds:AsiaPacificSegmentMember2022-09-012023-08-310001013237fds:AsiaPacificSegmentMember2021-09-012022-08-310001013237fds:AsiaPacificSegmentMember2020-09-012021-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-08-310001013237us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2023-08-310001013237us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2023-08-310001013237us-gaap:MoneyMarketFundsMember2023-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:MutualFundMember2023-08-310001013237us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Member2023-08-310001013237us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Member2023-08-310001013237us-gaap:MutualFundMember2023-08-310001013237us-gaap:FairValueInputsLevel1Member2023-08-310001013237us-gaap:FairValueInputsLevel2Member2023-08-310001013237us-gaap:FairValueInputsLevel3Member2023-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-08-310001013237us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2022-08-310001013237us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2022-08-310001013237us-gaap:MoneyMarketFundsMember2022-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:MutualFundMember2022-08-310001013237us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Member2022-08-310001013237us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Member2022-08-310001013237us-gaap:MutualFundMember2022-08-310001013237us-gaap:FairValueInputsLevel1Member2022-08-310001013237us-gaap:FairValueInputsLevel2Member2022-08-310001013237us-gaap:FairValueInputsLevel3Member2022-08-310001013237us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2023-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2027Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2027Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2027Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2027Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2032Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2032Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2032Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-08-310001013237us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberfds:Notes2032Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-08-310001013237us-gaap:SecuredDebtMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-08-310001013237us-gaap:SecuredDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Member2023-08-310001013237us-gaap:SecuredDebtMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-08-310001013237us-gaap:SecuredDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Member2022-08-310001013237us-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-08-310001013237us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Member2023-08-310001013237us-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-08-310001013237us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Member2022-08-310001013237us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-08-310001013237us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-08-310001013237us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-08-310001013237us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-08-310001013237srt:MinimumMember2022-09-012023-08-310001013237srt:MaximumMember2022-09-012023-08-310001013237us-gaap:CashFlowHedgingMemberfds:BritishPoundSterlingForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-31iso4217:GBP0001013237us-gaap:CashFlowHedgingMemberfds:BritishPoundSterlingForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237fds:EuroForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-31iso4217:EUR0001013237fds:EuroForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237fds:IndianRupeeForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-31iso4217:INR0001013237fds:IndianRupeeForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberfds:PhilippinePesoForeignExchangeForwardMember2023-08-31iso4217:PHP0001013237us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberfds:PhilippinePesoForeignExchangeForwardMember2022-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-03-010001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-05-312022-05-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-03-050001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-03-012022-03-010001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-310001013237us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-310001013237us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-09-012023-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-012022-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-09-012021-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-09-012023-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-012022-08-310001013237us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-09-012021-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-09-012023-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-012022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-09-012021-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-09-012023-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-012022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-09-012021-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-09-012023-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-012022-08-310001013237us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-09-012021-08-3100010132372023-08-312023-08-310001013237fds:CUSIPGlobalServicesMember2022-03-012022-03-010001013237fds:CUSIPGlobalServicesMember2022-03-010001013237us-gaap:LicensingAgreementsMemberfds:CUSIPGlobalServicesMember2022-03-010001013237us-gaap:CustomerRelationshipsMemberfds:CUSIPGlobalServicesMember2022-03-010001013237fds:CUSIPGlobalServicesMemberus-gaap:DatabasesMember2022-03-010001013237fds:CobaltSoftwareIncMember2021-10-122021-10-120001013237fds:CobaltSoftwareIncMember2021-10-120001013237fds:CobaltSoftwareIncMemberus-gaap:ComputerSoftwareIntangibleAssetMember2021-10-120001013237fds:CobaltSoftwareIncMemberus-gaap:CustomerRelationshipsMember2021-10-120001013237fds:TruvalueLabsIncMember2020-11-022020-11-020001013237fds:TruvalueLabsIncMember2020-11-020001013237us-gaap:ComputerSoftwareIntangibleAssetMemberfds:TruvalueLabsIncMember2020-11-020001013237fds:TruvalueLabsIncMemberus-gaap:TradeNamesMember2020-11-020001013237fds:TruvalueLabsIncMemberus-gaap:CustomerRelationshipsMember2020-11-020001013237us-gaap:LeaseholdImprovementsMember2023-08-310001013237us-gaap:LeaseholdImprovementsMember2022-08-310001013237us-gaap:ComputerEquipmentMember2023-08-310001013237us-gaap:ComputerEquipmentMember2022-08-310001013237us-gaap:FurnitureAndFixturesMember2022-08-310001013237fds:AmericasSegmentMember2021-08-310001013237fds:EMEASegmentMember2021-08-310001013237fds:AsiaPacificSegmentMember2021-08-310001013237fds:AmericasSegmentMember2022-08-310001013237fds:EMEASegmentMember2022-08-310001013237fds:AsiaPacificSegmentMember2022-08-310001013237fds:AmericasSegmentMember2023-08-310001013237fds:EMEASegmentMember2023-08-310001013237fds:AsiaPacificSegmentMember2023-08-310001013237us-gaap:LicensingAgreementsMember2023-08-310001013237us-gaap:LicensingAgreementsMember2022-08-310001013237us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-08-310001013237us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-08-310001013237us-gaap:CustomerRelationshipsMember2023-08-310001013237us-gaap:CustomerRelationshipsMember2022-08-310001013237us-gaap:DevelopedTechnologyRightsMembersrt:MinimumMember2023-08-310001013237us-gaap:DevelopedTechnologyRightsMembersrt:MaximumMember2023-08-310001013237us-gaap:DevelopedTechnologyRightsMember2023-08-310001013237us-gaap:DevelopedTechnologyRightsMember2022-08-310001013237us-gaap:DatabasesMember2023-08-310001013237us-gaap:DatabasesMember2022-08-310001013237us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MinimumMember2023-08-310001013237us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2023-08-310001013237us-gaap:ComputerSoftwareIntangibleAssetMember2023-08-310001013237us-gaap:ComputerSoftwareIntangibleAssetMember2022-08-310001013237fds:DataContentMembersrt:MinimumMember2023-08-310001013237fds:DataContentMembersrt:MaximumMember2023-08-310001013237fds:DataContentMember2023-08-310001013237fds:DataContentMember2022-08-310001013237us-gaap:NoncompeteAgreementsMember2023-08-310001013237us-gaap:NoncompeteAgreementsMember2022-08-310001013237us-gaap:TradeNamesMember2023-08-310001013237us-gaap:TradeNamesMember2022-08-310001013237fds:AcquisitionsExcludingCGSMember2022-09-012023-08-310001013237us-gaap:DomesticCountryMember2023-08-310001013237us-gaap:StateAndLocalJurisdictionMember2023-08-310001013237srt:MinimumMember2023-08-310001013237srt:MaximumMember2023-08-310001013237us-gaap:SecuredDebtMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2023-08-310001013237us-gaap:SecuredDebtMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-08-310001013237us-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2023-08-310001013237us-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-08-310001013237us-gaap:SeniorNotesMemberfds:Notes2027Member2023-08-310001013237us-gaap:SeniorNotesMemberfds:Notes2027Member2022-08-310001013237us-gaap:SeniorNotesMemberfds:Notes2032Member2023-08-310001013237us-gaap:SeniorNotesMemberfds:Notes2032Member2022-08-310001013237us-gaap:SecuredDebtMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-03-010001013237us-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-03-012022-03-010001013237us-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-03-010001013237us-gaap:LetterOfCreditMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-03-010001013237fds:CreditAgreement2022Memberus-gaap:BridgeLoanMemberus-gaap:LineOfCreditMember2022-03-010001013237us-gaap:RevolvingCreditFacilityMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2023-08-312023-08-310001013237fds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-08-310001013237us-gaap:SecuredDebtMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-09-012023-08-310001013237us-gaap:SecuredDebtMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2022-03-012023-08-310001013237fds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberfds:TermSecuredOvernightFinancingRateMember2023-08-312023-08-310001013237fds:InterestRateMarginMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberfds:TermSecuredOvernightFinancingRateMember2023-08-312023-08-310001013237fds:CreditSpreadAdjustmentMemberfds:CreditAgreement2022Memberus-gaap:LineOfCreditMemberfds:TermSecuredOvernightFinancingRateMember2023-08-312023-08-310001013237fds:CreditAgreement2022Memberus-gaap:LineOfCreditMember2023-08-310001013237us-gaap:SeniorNotesMemberfds:Notes2027Member2022-03-010001013237us-gaap:SeniorNotesMemberfds:Notes2032Member2022-03-010001013237us-gaap:SeniorNotesMember2022-03-010001013237us-gaap:SeniorNotesMember2022-03-012022-03-010001013237us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberfds:CreditAgreement2019Member2019-03-290001013237us-gaap:LineOfCreditMemberfds:CreditAgreement2019Member2019-03-290001013237us-gaap:LineOfCreditMemberfds:CreditAgreement2019Member2022-03-012022-03-010001013237fds:CapitalCommitmentMember2023-08-310001013237fds:CapitalCommitmentMember2022-08-310001013237us-gaap:RestrictedStockMember2022-09-012023-08-310001013237us-gaap:RestrictedStockMember2021-09-012022-08-310001013237us-gaap:RestrictedStockMember2020-09-012021-08-3100010132372023-06-2000010132372022-11-3000010132372022-09-012022-11-3000010132372022-12-012023-02-2800010132372023-05-3100010132372023-03-012023-05-3100010132372023-06-012023-08-3100010132372021-11-3000010132372021-09-012021-11-3000010132372022-02-2800010132372021-12-012022-02-2800010132372022-05-3100010132372022-03-012022-05-3100010132372022-06-012022-08-3100010132372020-11-3000010132372020-09-012020-11-3000010132372021-02-2800010132372020-12-012021-02-2800010132372021-05-3100010132372021-03-012021-05-3100010132372021-06-012021-08-310001013237us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-08-310001013237us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-08-310001013237us-gaap:AccumulatedTranslationAdjustmentMember2023-08-310001013237us-gaap:AccumulatedTranslationAdjustmentMember2022-08-310001013237us-gaap:EmployeeStockOptionMember2022-09-012023-08-310001013237us-gaap:EmployeeStockOptionMember2021-09-012022-08-310001013237us-gaap:EmployeeStockOptionMember2020-09-012021-08-310001013237us-gaap:PerformanceSharesMember2022-09-012023-08-310001013237us-gaap:PerformanceSharesMember2021-09-012022-08-310001013237us-gaap:PerformanceSharesMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMember2022-09-012023-08-310001013237us-gaap:EmployeeStockOptionMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:EmployeeStockOptionMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:EmployeeStockOptionMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:EmployeeStockOptionMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2022-11-012022-11-010001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2021-11-012021-11-010001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2020-11-092020-11-090001013237fds:RestrictedStockRSUsAndPerformanceSharesMember2020-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberfds:RestrictedStockRSUsAndPerformanceSharesMember2020-09-012021-08-310001013237fds:RestrictedStockRSUsAndPerformanceSharesMember2020-09-012021-08-310001013237fds:RestrictedStockRSUsAndPerformanceSharesMember2021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberfds:RestrictedStockRSUsAndPerformanceSharesMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberfds:RestrictedStockRSUsAndPerformanceSharesMember2021-09-012022-08-310001013237fds:RestrictedStockRSUsAndPerformanceSharesMember2021-09-012022-08-310001013237fds:RestrictedStockRSUsAndPerformanceSharesMember2022-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberfds:RestrictedStockRSUsAndPerformanceSharesMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:RestrictedStockUnitsRSUMember2022-09-012023-08-310001013237fds:RestrictedStockRSUsAndPerformanceSharesMember2022-09-012023-08-310001013237fds:RestrictedStockRSUsAndPerformanceSharesMember2023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMembersrt:MinimumMemberus-gaap:PerformanceSharesMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:PerformanceSharesMembersrt:MaximumMember2022-09-012023-08-310001013237us-gaap:EmployeeStockMember2022-09-012023-08-310001013237us-gaap:EmployeeStockMember2023-08-310001013237us-gaap:EmployeeStockMember2021-09-012022-08-310001013237us-gaap:EmployeeStockMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2020-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMember2020-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:EmployeeStockOptionMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:RestrictedStockUnitsRSUMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:PerformanceSharesMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:StockCompensationPlanMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:StockCompensationPlanMember2020-09-012021-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2021-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:EmployeeStockOptionMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:RestrictedStockUnitsRSUMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:PerformanceSharesMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:StockCompensationPlanMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:StockCompensationPlanMember2021-09-012022-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2022-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMember2022-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:EmployeeStockOptionMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:PerformanceSharesMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:StockCompensationPlanMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:StockCompensationPlanMember2022-09-012023-08-310001013237us-gaap:ShareBasedPaymentArrangementEmployeeMember2023-08-310001013237us-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-08-310001013237country:US2022-09-012023-08-310001013237country:US2021-09-012022-08-310001013237country:US2020-09-012021-08-310001013237country:GB2022-09-012023-08-310001013237country:GB2021-09-012022-08-310001013237country:GB2020-09-012021-08-310001013237fds:AllOtherEMEACountriesMember2022-09-012023-08-310001013237fds:AllOtherEMEACountriesMember2021-09-012022-08-310001013237fds:AllOtherEMEACountriesMember2020-09-012021-08-310001013237fds:OtherCountriesMember2022-09-012023-08-310001013237fds:OtherCountriesMember2021-09-012022-08-310001013237fds:OtherCountriesMember2020-09-012021-08-310001013237country:US2023-08-310001013237country:US2022-08-310001013237country:PH2023-08-310001013237country:PH2022-08-310001013237country:IN2023-08-310001013237country:IN2022-08-310001013237country:GB2023-08-310001013237country:GB2022-08-310001013237fds:OtherCountriesMember2023-08-310001013237fds:OtherCountriesMember2022-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K | | | | | |

| ☒ | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended August 31, 2023 | | | | | |

| ☐ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 1-11869

FACTSET RESEARCH SYSTEMS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 13-3362547 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

45 Glover Avenue, Norwalk, Connecticut 06850

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (203) 810-1000

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbols(s) | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | FDS | New York Stock Exchange LLC |

| The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicated by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant based upon the closing price of a share of the registrant’s common stock on February 28, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, as reported by the New York Stock Exchange on that date, was $15,868,442,481.

As of October 20, 2023, there were 37,988,456 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this Annual Report on Form 10-K is incorporated by reference to our definitive Proxy Statement for our 2023 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission not later than 120 days after August 31, 2023.

FACTSET RESEARCH SYSTEMS INC.

FORM 10-K

For The Fiscal Year Ended August 31, 2023

Special Note Regarding Forward-Looking Statements

FactSet Research Systems Inc. has made statements under the captions Item 1. Business, Item 1A. Risk Factors, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and in other sections of this Annual Report on Form 10-K that are forward-looking statements. In some cases, you can identify these statements by words such as "may," "might," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "intends," "projects," "indicates," "predicts," "potential," or "continue," and similar expressions.

These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance and anticipated trends in our business. These statements are only predictions based on our current expectations, estimates, forecasts and projections about future events. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. There are many important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including the numerous factors discussed under Item 1A. Risk Factors in this Annual Report on Form 10-K, that should be specifically considered.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Forward-looking statements speak only as of the date they are made, and actual results could differ materially from those anticipated in forward-looking statements. We do not intend, and are under no duty, to update any of these forward-looking statements after the date of this Annual Report on Form 10-K to reflect actual results, future events or circumstances, or revised expectations.

We intend that all forward-looking statements we make will be subject to safe harbor protection of the federal securities laws as found in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Part I

ITEM 1. BUSINESS

Business Overview

FactSet Research Systems Inc. and its wholly-owned subsidiaries (collectively, "we," "our," "us," the "Company" or "FactSet") is a global financial digital platform and enterprise solutions provider with open and flexible products that drive the investment community to see more, think bigger and do its best work.

Our platform delivers expansive data, sophisticated analytics, and flexible technology used by global financial professionals to power their critical investment workflows. As of August 31, 2023, we had nearly 8,000 clients comprised of almost 190,000 investment professionals, including asset managers, bankers, wealth managers, asset owners, partners, hedge funds, corporate users and private equity & venture capital professionals. Our revenues are primarily derived from subscriptions to our multi-asset class data and solutions powered by our connected content, referred to as our "content refinery." Our products and services include workstations, portfolio analytics and enterprise solutions.

We drive our business based on our detailed understanding of our clients’ workflows, which helps us to solve their most complex challenges. We provide financial data and market intelligence on securities, companies, industries and people to enable our clients to research investment ideas, as well as to analyze, monitor and manage their portfolios. Our on- and off-platform solutions span the investment life cycle of investment research, portfolio construction and analysis, trade execution, performance measurement, risk management and reporting. We provide open and flexible technology offerings, including a configurable desktop and mobile platform, comprehensive data feeds, cloud-based digital solutions and application programming interfaces ("APIs"). Our CUSIP Global Services ("CGS") business supports security master files relied on by the investment industry for critical front, middle and back-office functions. Our platform and solutions are supported by our dedicated client service team.

We operate our business through three reportable segments ("segments"): the Americas, EMEA and Asia Pacific. Refer to Note 18, Segment Information, in the Notes to the Consolidated Financial Statements included in Part II, Item 8. of this Annual Report on Form 10-K for further discussion. For each of our segments, we execute our strategy through three workflow solutions: Research & Advisory; Analytics & Trading; and Content & Technology Solutions ("CTS"). CGS operates as part of CTS.

Corporate History

FactSet was founded in 1978 and has been publicly traded since June 1996. We are dual-listed on the New York Stock Exchange ("NYSE") and the NASDAQ Stock Market ("NASDAQ") under the symbol "FDS". FactSet has been a member of the S&P 500 since December 2021.

Business Strategy

Our strategy is to build the leading open content and analytics platform and powerful enterprise solutions that deliver a differentiated advantage for our clients’ success. By offering personalized digital products, we strive to be a trusted partner and service provider, delivering relevant insights and research ideas tailored to our clients' specific business models.

To execute our strategy, we have outlined the following key initiatives:

•Expanding our Digital Platform: We are scaling up our content refinery to provide a comprehensive inventory of industry, proprietary and third-party data. This includes granular data for key industry verticals, real-time data, fund data and sustainable finance. Through an open ecosystem of cloud-based data and analytics, we aim to offer flexible solutions and content accessible through various delivery methods. In addition, we are working to expand our use of artificial intelligence to drive efficiencies for our clients, with anticipated initiatives including automation of tasks and integration of natural language queries. We believe that our breadth of high-quality, connected content will be a critical raw material for large language models.

•Ensuring Execution Excellence: Innovation and collaboration are at the core of our approach. We employ technology to accelerate content collection, data connectivity and the development of summaries and themes. Our sales force is committed to enhancing price realization, productivity, efficiency and improved client outcomes. We are also optimizing operations and managing expenses to improve returns on our investments.

•Fostering a Growth Mindset: We prioritize recruiting, training and empowering a diverse and efficient workforce. We are driving sustainable growth by investing in talent that can create leading technological solutions and efficiently execute our strategy. Additionally, strategic partnerships and acquisitions help to accelerate our expansion in key areas.

We are focused on growing our global business through three strategically aligned geographic segments: the Americas, EMEA and Asia Pacific. This approach allows us to better manage resources, target solutions and interact with clients effectively. We executed on our growth strategy during fiscal 2023 by offering data, products and analytical applications for three workflow solutions: Research & Advisory; Analytics & Trading; and CTS.

Research & Advisory

Research & Advisory delivers essential content and workflow solutions in one flexible platform for investment bankers, wealth advisors, buy and sell-side analysts, corporate users, portfolio managers and investment relationship professionals. Our workstation, advisor dashboard, research management solutions ("RMS"), and FactSet for client relationship management ("CRM") enable our clients to personalize and automate their workflows. These tools provide insight and efficiency for idea generation, company and market analysis, fundamental research, presentation building and distribution, and research management. Our Research & Advisory solutions also offer global coverage, deep history, and transparency through proprietary and third-party sourced databases. These solutions provide deep company and sector-specific analyses, spanning the public and private markets. Our solutions easily integrate with our clients’ technology, offering additional flexibility through mobile, API, data feeds and web-based components. Our RMS and advisory solutions also enable our wealth clients to provide market-leading support for their businesses, including home office, advisory, and client engagement work.

Analytics & Trading

Analytics & Trading offers comprehensive solutions to institutional asset managers and asset owners across the investment portfolio life cycle. Our front office tools connect fundamental and quantitative research, portfolio construction, order management and trade execution. These outputs seamlessly integrate with advanced middle office workflows, including portfolio attribution, performance measurement, risk management, and reporting. Our flexible and open framework supports both proprietary and third-party models, connected data, analytics and reporting. Whether deployed as a multi-asset class enterprise system or individual workflow components, our platform and APIs meet the diverse needs of multi-asset class investing. Additionally, our tools can integrate client holdings data with global market data to power our investment portfolio life cycle workflows.

CTS

CTS focuses on delivering data directly to our clients by leveraging our core content and technology. Clients can seamlessly discover, explore, and access organized and connected content via multiple delivery channels. Whether a client needs market data, company data, alternative data, customized client facing digital solutions or data elements uniquely identifying financial instruments, we provide structured data through a variety of technologies, including APIs and cloud infrastructures. Through our data management solutions ("DMS"), we provide entity mapping and integration of client data. Our symbology links and aggregates a diverse set of content sources to ensure consistency, transparency, and data integrity. We empower our clients to centralize, integrate, and analyze disparate data sources for faster and more cost-effective decision making. Given this integration capability, our clients can then choose their preferred cloud infrastructure, industry standard databases, programming languages and data visualization tools. Through CGS, we are also the exclusive issuer of the Committee on Uniform Security Identification Procedures ("CUSIP") and CUSIP International Number System ("CINS") identifiers globally, acting as the official numbering agency for International Securities Identification Number ("ISIN") identifiers in the United States and as a substitute number agency for more than 30 other countries.

Revised Organizational Approach

We have a long-term view of our business and are committed to investing for growth and efficiency. Starting September 1, 2023, the beginning of our fiscal 2024 year, we revised our internal organization by firm type to better align with our clients, as follows:

•Analytics & Trading will become "Institutional Buyside," focusing on asset managers, asset owners, and hedge fund companies.

•Research & Advisory will become two groups:

◦"Dealmakers," focusing on banking and sell-side research, corporate, and private equity and venture capital workflows; and

◦"Wealth," focusing on wealth management workflows.

•We will discuss the results of our Partnerships and CGS groups in combination. Partnerships delivers solutions primarily to content providers, financial exchanges, and rating agencies, while CGS is the exclusive issuer of CUSIP and CINS identifiers globally.

•The activities of CTS will be reassigned to Institutional Buyside, Dealmakers, Wealth, and Partnerships and CGS.

This realignment of firm types is not expected to impact our segment reporting for fiscal 2024.

Institutional Buyside

Institutional Buyside offers multi-asset class solutions to global asset managers, asset owners and hedge fund professionals across the investment portfolio life cycle. It includes workflows for research analysts, portfolio managers, and traders in the front office, as well as performance analysts, risk managers, and client service and marketing professionals in the middle office. Our front office on-platform solutions are designed for portfolio construction, research management, order management, and trade execution capabilities. Our middle office on-platform solutions are designed for performance measurement, attribution, risk management, and reporting capabilities. In addition to our platform offerings, we offer comprehensive off-platform content and technology solutions including data feeds, APIs, and programmatic access for clients to engage with us in the environment best suited to them.

Dealmakers

Dealmakers delivers content and workflow solutions in a flexible platform for investment bankers, sell-side research analysts, corporate users, private equity and venture capital professionals and investment relationship managers. We provide comprehensive solutions to our clients including workstations, data feeds, APIs, proprietary and third-party content, and productivity tools for Microsoft® Office. We also deliver firm-type tailored solutions for CRM and RMS for research authoring and publishing. These open and flexible products enable our clients to personalize and automate their workflows and to easily integrate them with their own technology. These tools are used to monitor investments, generate ideas, analyze companies and markets, perform fundamental research, and build and distribute presentations. Our Dealmakers solutions also offer global coverage of public and private markets, deep history, and transparency through proprietary and third-party sourced databases.

Wealth

Wealth delivers comprehensive solutions to wealth management clients including our web-based workstation, advisor dashboards, data feeds, APIs, proprietary and third-party content, and productivity tools for Microsoft® Office. It also provides RMS for research authoring and publishing. Our Wealth solution enables our clients to easily integrate our products into their CRM software and internally developed applications. Wealth clients use our advisory tools to provide market-leading support for their businesses, including home office, advisory, and client engagement work. We continue to focus on expanding our content and increasing workflow efficiency for wealth-management firms.

Partnerships and CGS

Partnerships delivers solutions including off-platforms (feeds, APIs), workstations, and digital or analytics solutions to other firms in the financial services ecosystem including content providers, financial exchanges and rating agencies. CGS is the exclusive issuer of CUSIP and CINS identifiers globally. CGS also acts as the official numbering agency for ISIN identifiers in the United States and as a substitute ISIN agency for more than 30 other countries. The results of Partnerships and CGS will be discussed together.

FactSet Clients

Buy-side

Buy-side clients continue to shift toward multi-asset class investment strategies, where we are well-positioned to be a partner of choice. We are able to compete for greater market share given our ability to provide enterprise-wide solutions to our clients by leveraging their portfolio data for multiple asset classes. Buy-side clients primarily include asset managers, wealth managers, asset owners, partners, hedge funds and corporate firms. These clients access our multi-asset class tools through our workstations, analytics & trading tools, proprietary and third-party content, data feeds, APIs and portfolio services.

The buy-side organic annual subscription value ("Organic ASV") annual growth rate as of August 31, 2023 was 6.9%. Buy-side clients accounted for 82% of our organic ASV as of August 31, 2023. Refer to Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, Annual Subscription Value ("ASV"), of this Annual Report on Form 10-K for the definition of Organic ASV.

Sell-side

We deliver comprehensive solutions to sell-side clients including workstation, data feeds, APIs, proprietary and third-party content, productivity tools for Microsoft® Office, web and mobile, and RMS for research authoring and publishing. Our focus remains on expanding the depth of content offered and increasing workflow efficiency for sell-side firms. These firms primarily include broker-dealers, banking & advisory and private equity & venture capital firms.

The sell-side Organic ASV annual growth rate as of August 31, 2023 was 9.3%. Sell-side clients accounted for 18% of our organic ASV as of August 31, 2023.

Client and User Additions

Our total client count as of August 31, 2023 was 7,921, representing a net increase of 5.1%, or 383 clients compared to the prior year, mainly due to an increase in corporate clients, wealth management clients and partners. Our client count includes clients with ASV of $10,000 and above.

As of August 31, 2023, there were 189,972 professionals using FactSet, representing a net increase of 5.6%, or 9,990 users compared to the prior year, mainly driven by an increase from our wealth management firms and sell-side users from our banking clients.

Annual ASV retention was greater than 95% for the year ended August 31, 2023 and August 31, 2022. When expressed as a percentage of clients, annual retention was approximately 91% for the year ended August 31, 2023, compared with approximately 92% for the year ended August 31, 2022.

Financial Information on Geographic Areas

Operating segments are defined as components of an enterprise that have the following characteristics: (i) they engage in business activities from which they may recognize revenues and incur expenses, (ii) their operating results are regularly reviewed by the chief operating decision maker ("CODM") for resource allocation decisions and performance assessment, and (iii) their discrete financial information is available. Our Chief Executive Officer functions as our CODM.

We have three operating segments: Americas, EMEA and Asia Pacific. This is how we and our CODM manage our business and the geographic markets in which we operate. These operating segments are consistent with our reportable segments.

The Americas segment serves clients in North, Central and South America. In the Americas, we have offices in 12 states in the United States ("U.S."), including our corporate headquarters in Norwalk, Connecticut. We also have offices in both Brazil and Canada. The EMEA segment serves clients in Europe, the Middle East and Africa via offices in Bulgaria, England, France, Germany, Italy, Ireland, Latvia, Luxembourg, the Netherlands, Sweden and the United Arab Emirates. The Asia Pacific segment serves clients in Asia and Australasia via office locations in Australia, China, Hong Kong Special Administrative Region ("SAR") of China, India, Japan, the Philippines and Singapore. These offices exclude any leases that we have fully vacated in advance of their originally scheduled lease term.

Segment revenues reflect client sales based on geographic location. Each segment records expenses related to its individual operations with the exception of data center expenditures, third-party data costs and corporate headquarters charges. These expenses are recorded in the Americas and are not allocated to the other segments. The expenses incurred at our content collection centers, located in India, the Philippines and Latvia, are allocated to each segment based on their respective percentage of revenues.

The following table reflects the Revenues and Operating income of our segments:

| | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | Operating Income |

| Years ended August 31, | | Years ended August 31, |

(in thousands) | 2023 | 2022 | 2021 | | 2023 | 2022 | 2021 |

| Americas | $ | 1,335,484 | | $ | 1,173,946 | | $ | 1,008,046 | | | $ | 239,438 | | $ | 159,140 | | $ | 218,180 | |

| EMEA | 539,843 | | 484,279 | | 427,700 | | | 243,028 | | 196,231 | | 159,704 | |

| Asia Pacific | 210,181 | | 185,667 | | 155,699 | | | 146,741 | | 120,111 | | 96,157 | |

Total | $ | 2,085,508 | | $ | 1,843,892 | | $ | 1,591,445 | | | $ | 629,207 | | $ | 475,482 | | $ | 474,041 | |

Refer to Note 18, Segment Information in the Notes to the Consolidated Financial Statements included in Part II, Item 8. of this Annual Report on Form 10-K for additional segment information.

Organic ASV plus Professional Services Growth

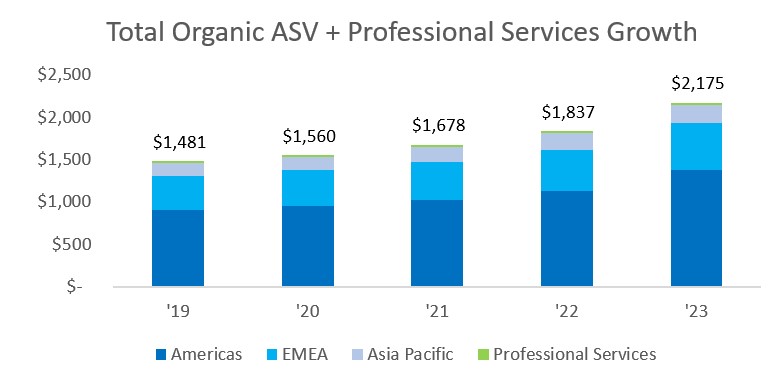

As of August 31, 2023, our Organic ASV plus Professional Services totaled $2.2 billion, up 7.1% compared with August 31, 2022. The increase in Organic ASV plus Professional Services was primarily driven by higher Organic ASV in all our segments, with the majority of the increase related to the Americas, followed by EMEA and Asia Pacific. This increase was driven by additional sales in our workflow solutions, primarily in Analytics & Trading, followed by CTS and Research & Advisory. Refer to Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, Annual Subscription Value ("ASV"), of this Annual Report on Form 10-K for the definitions of Organic ASV and Organic ASV plus Professional Services.

The following chart provides a snapshot of our historic Organic ASV plus Professional Services growth:

(in millions)

Human Capital Management

Our employees are key to our success and enable us to execute at a high level. We have built a collaborative culture that recognizes and rewards innovation and offers employees a variety of opportunities and experiences. We believe that our continued focus on our employees helps us to provide high quality insights and service to our clients.

Who We Are

As of August 31, 2023, we had 34 offices in 19 countries with 12,237 employees, representing an increase of 9.2% compared with August 31, 2022. Of our total employees, 8,322 (68%) were located in Asia Pacific, 2,487 (20%) in the Americas and 1,428 (12%) in EMEA. We continue to invest in our centers of excellence ("COEs"), which accounted for approximately 67% of our employees, by expanding our talent pool primarily in India and the Philippines. Functionally, as of August 31, 2023, 47% of our employees were in Content Operations, 28% were in Technology & Product Development, 21% were in Sales and Client Solutions and 4% were in Corporate Support. As of August 31, 2023, 447 of our employees were represented by mandatory works councils in our French and German subsidiaries and 24 of our employees were represented by collective bargaining agreements in the United States.

Employee Engagement

We conduct an annual, anonymous and confidential global employee engagement survey administered by a third-party to capture our employees’ feedback on a range of topics. The survey's scores and comments provide insight on appropriate actions to improve our employees’ experience and overall effectiveness. Aggregated survey results are reviewed by senior leadership and direct managers to identify areas of focus and to create improvement plans. We share survey results with employees to highlight strengths as well as opportunities for positive change. In our fiscal 2023 employee engagement survey, we achieved a 90% response rate. The majority of our employees indicated that they feel they are treated fairly regardless of diversity characteristics, are comfortable being their authentic selves at work, believe that FactSet has a great culture and understand how their work contributes to the Company’s success. In all areas, our scores either remained the same or increased from the previous year's survey and our overall survey engagement score was the highest since the survey began.

Diversity, Equity & Inclusion

As part of our core values and our efforts to attract and retain top talent, we are committed to building a globally diverse, equitable and inclusive workplace. Diversity, Equity, and Inclusion (“DE&I”) at FactSet is supported by our DE&I Council, comprised of executive leaders and chaired by our CEO, Phil Snow. An important component of our DE&I strategy is our Business Resource Groups (“BRGs”), which help create an inclusive culture for all our employees. Our BRGs are supported by senior leaders who serve as executive sponsors to our eight BRGs - the Asian BRG, Black BRG, Families BRG, Pride BRG, Multicultural BRG, Latinx BRG, Women’s BRG, and Veterans BRG. Our BRGs host a variety of educational and networking events globally and many also co-sponsor external community events.

During fiscal 2023, we continued to publish our workforce demographics and annual EEO-1 Federal data in our Sustainability Report, launched DE&I annual performance goals for all employees and initiated an internal sponsorship program designed to create equitable opportunities for those seeking career advancement. Our DE&I annual performance goals included adhering to inclusive hiring best practices and completing unconscious bias training. Our sponsorship program aimed to increase visibility for underrepresented talent and connect participating leaders with employees who identify differently from them across lines of gender and/or race.

How We Work

Based on our success working in a remote environment during the COVID-19 pandemic, in fiscal 2022 we rolled out our “How We Work” guide to flexible working arrangements. Employees in many of our locations, where permitted by local laws and regulations, and where the role and department permits, can choose between working full-time in the office, remotely or in a hybrid arrangement. Some employees may also elect to work a flexible schedule. These arrangements help to retain talent, increase employee satisfaction, and support our commitment to creating a diverse, equitable and inclusive workplace.

Learning & Development

We offer a range of learning opportunities to empower employees through experiences that support their personal and professional growth. We identify learning needs to ensure that our employees have the skills and knowledge to excel in their roles, grow their careers, and contribute to the success of our organization. During fiscal 2023, our employees increasingly made use of non-mandatory learning, particularly expanded technical learning and upskilling courses. During fiscal 2023, the FactSet Leadership Advantage Academy helped employees refine their leadership skills and style, expand their enterprise perspective and create a stronger cross-departmental network.

Compensation, Benefits and Wellbeing

We offer our employees a broad range of competitive compensation, benefits and well-being programs reflective of our values and culture which are designed to meet the diverse needs of our global employee population and are essential to our recruitment, development, and retention strategies. Our employee compensation may include one or more of the following elements: base salaries, annual incentive awards, sales incentive awards and equity awards. We differentiate individual salary, bonus and equity awards based on performance against key objectives and how effectively our employees demonstrate behaviors consistent with our values and culture. We are committed to offering high-quality, affordable, and locally competitive benefits options, designed to support the physical, emotional, financial and social well-being of our employees and their families.

Third-Party Content

We aggregate content from third-party data suppliers, news sources, exchanges, brokers and contributors into our dedicated managed databases, which our clients access through our flexible delivery platforms. We seek to maintain contractual relationships with a minimum of two content providers for each major type of financial data, though certain data sets on which we rely have a limited number of suppliers. We make every effort to assure that, where reasonable, alternative sources are available. We have entered into third-party content agreements of varying lengths, which in some cases can be terminated with one year’s notice, at predefined dates, and in other cases on shorter notice. We are not dependent on any one third-party data supplier to meet the needs of our clients, with only two data suppliers each representing more than 10% of our total data costs during fiscal 2023.

Data Centers and Cloud Computing

Our business is dependent on our ability to process substantial volumes of data and transactions rapidly and efficiently on our networks and systems. Our global technology infrastructure supports our operations and is designed to facilitate reliable and efficient processing and delivery of data and analytics to our clients. As part of our hybrid cloud strategy, we operate two fully redundant, physically separated data centers in the U.S. that provide client services, while also using market-leading cloud providers to run products and services to best benefit from the cloud's elasticity, resiliency, security, and regionalization. We currently use several cloud providers; however, one supplier provided the majority of our cloud computing support for fiscal 2023. Our physical data centers provide layers of redundancy to enhance system performance, including maintaining, processing and storing data at multiple locations. In the event of a single site failure or localized disaster, client workloads will automatically move to unaffected sites. We continue to focus on maintaining a global technological infrastructure that allows us to support our growing business.

The Competitive Landscape

We are a part of the financial information services industry focused on delivering expansive data, sophisticated analytics, and flexible technology through our platform to the global investment community. This competitive market is comprised of both large, well-capitalized companies and smaller, niche firms including market data suppliers, news and information providers, and many third-party content providers that supply us with financial information included in our products. Our largest competitors are Bloomberg L.P., Market Intelligence (an S&P Global business) and Refinitiv (a London Stock Exchange Group business). Other competitors and competitive products include online database suppliers and integrators and their applications, such as BlackRock Solutions, MSCI Inc. and Morningstar Inc. Many of these firms provide products or services similar to our offerings.

We believe there are high barriers to entry to our business, and we expect it would be difficult for another vendor to quickly replicate the extensive data we currently offer. We offer clients comprehensive solutions with a broad set of products delivered through a desktop or mobile user interface, cloud-based platforms, or through standardized or bespoke data feeds, as well as APIs. In addition, our applications and client support and service offerings are entrenched in the workflow of many financial professionals given the data management and portfolio analysis/screening capabilities offered. We are entrusted with significant amounts of our clients' own proprietary data, including portfolio holdings. As a result, we believe our products are central to our clients’ investment analysis and decision-making.

Intellectual Property

We have registered trademarks and copyrights for many of our products and services and will continue to evaluate the registration of additional trademarks and copyrights as appropriate. We enter into confidentiality agreements with our employees, clients, data suppliers and vendors. We seek to protect our workflow solutions, documentation and other written materials under trade secret, copyright and patent laws. While we do not believe we are dependent on any one of our intellectual property rights, we do rely on the combination of intellectual property rights and other measures to protect our proprietary rights. Despite these efforts, existing intellectual property laws may afford only limited protection.

Research & Product Development Costs

A key aspect of our growth strategy is to offer new solutions and enhance our existing products and applications by making them faster and with more reliable and deeper data. We strive to rapidly adopt new technology that can improve our products and services.

Government Regulation

We are subject to reporting requirements, disclosure obligations and other recordkeeping requirements of the Securities and Exchange Commission ("SEC") and the various local authorities that regulate each location in which we operate. Our P.A.N. Securities, LP subsidiary is a member of the Financial Industry Regulatory Authority, Inc. and is a registered broker-dealer under Section 15 of the Securities Exchange Act of 1934. P.A.N. Securities, LP, as a registered broker-dealer, is subject to Rule 15c3-1 under the Securities Exchange Act of 1934, which requires that we maintain minimum net capital requirements. We claim exemption under Rule 15c3-3(k)(2)(i).

Corporate Contact Information

FactSet was founded as a Delaware corporation in 1978, and our principal executive office is in Norwalk, Connecticut.

Mailing address of FactSet's headquarters: 45 Glover Avenue, Norwalk, CT 06850

Telephone number: +1 (203) 810-1000

Website address: www.factset.com

Available Information

Through the Investor Relations section of our website (https://investor.factset.com), we make available free of charge the following filings as soon as practicable after they are electronically filed with, or furnished to, the SEC: our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements for the annual stockholder meetings, Reports on Forms 3, 4 and 5, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. The SEC maintains a website that contains reports, proxy and information statements and other information that we file with the SEC at www.sec.gov.

Additionally, we broadcast our quarterly earnings calls live via the investor relations section of our website. We also provide notifications of news or announcements regarding our financial performance, including investor events and press and earnings releases on our investor relations website. The contents of this website section are not intended to be incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC and any reference to this section of our website is intended to be inactive textual references only.

Executive Officers of the Registrant

The following table shows our current executive officers: | | | | | | | | | | | |

| Name of Officer | Age | Office Held with FactSet | Officer Since |

| F. Philip Snow | 59 | Chief Executive Officer | 2014 |

| Linda S. Huber | 65 | Executive Vice President, Chief Financial Officer | 2021 |

| Rachel R. Stern | 58 | Executive Vice President, Chief Legal Officer, Global Head of Strategic Resources and Secretary | 2009 |

| Robert J. Robie | 45 | Executive Vice President, Head of Institutional Buyside | 2018 |

| Helen L. Shan | 56 | Executive Vice President, Chief Revenue Officer | 2018 |

| Goran Skoko | 62 | Executive Vice President, Managing Director EMEA and Asia Pacific, Head of Dealmakers and Wealth | 2019 |

| Kristina W. Karnovsky | 44 | Executive Vice President, Chief Product Officer | 2021 |

| John Costigan | 54 | Executive Vice President, Chief Data Officer | 2022 |

| Katherine M. Stepp | 38 | Executive Vice President, Chief Technology Officer | 2022 |

| Catrina Harding | 51 | Executive Vice President, Chief People Officer | 2023 |

F. Philip Snow – Chief Executive Officer. Mr. Snow was named Chief Executive Officer effective July 1, 2015. Prior to that, Mr. Snow held the title of President. He began his career at FactSet in 1996 as a Consultant, before moving to Asia to hold positions in the Tokyo and Sydney offices. Following his move back to the U.S. in 2000, Mr. Snow held various sales leadership roles prior to assuming the role of Senior Vice President, Director of U.S. Investment Management Sales in 2013. Mr. Snow received a Bachelor of Arts in Chemistry from the University of California at Berkeley and a Master of International Management from the Thunderbird School of Global Management. He has earned the right to use the Chartered Financial Analyst designation.

Linda S. Huber – Executive Vice President, Chief Financial Officer. Ms. Huber was appointed Executive Vice President, Chief Financial Officer of FactSet in October 2021. As Chief Financial Officer, she is responsible for FactSet’s global finance organization and oversees all financial functions, including accounting, corporate development, financial planning and analysis, treasury, tax and investor relations. Prior to joining FactSet, Ms. Huber served as Chief Financial Officer and Treasurer at MSCI Inc. Prior to joining MSCI, she served as Executive Vice President and Chief Financial Officer of Moody’s Corporation from May 2005 to June 2018. Earlier in her career, Ms. Huber served in several increasingly senior roles in financial services, including Executive Vice President and Chief Financial Officer at U.S. Trust Company, a subsidiary of Charles Schwab & Company, Inc.; Managing Director at Freeman & Co.; Vice President of Corporate Strategy and Development and Vice President and Assistant Treasurer at PepsiCo.; Vice President of Energy Investment Banking Group at Bankers Trust Co.; and Associate in the Natural Resources Group at The First Boston Corp. Ms. Huber also held the rank of Captain in the U.S. Army. Ms. Huber earned an MBA from the Stanford Graduate School of Business and a B.S. degree in business and economics from Lehigh University. Ms. Huber also serves on the Board of Directors of the Bank of Montreal.

Rachel R. Stern – Executive Vice President, Chief Legal Officer, Global Head of Strategic Resources and Secretary. Ms. Stern was appointed Executive Vice President, Chief Legal Officer and Global Head of Strategic Resources and Secretary in October 2018. In addition to her role in the Legal Department, Ms. Stern is also responsible for Compliance, Facilities Management and Real Estate Planning, and the administration of our offices in Hyderabad, Manila and Riga. Ms. Stern joined FactSet in January 2001 as General Counsel. Ms. Stern is admitted to practice in New York, Washington D.C., and as House Counsel in Connecticut. Ms. Stern received a Bachelor of Arts from Yale University, a Master of Arts from the University of London and a Juris Doctor from the University of Pennsylvania Law School. She sits on the Board of Directors of Baron Capital Group, Inc. and Morrow Sodali, a TPG Growth Company.

Robert J. Robie – Executive Vice President, Head of Institutional Buyside. Mr. Robie was appointed Executive Vice President, Head of Institutional Buyside, effective September 1, 2023. In his current role, he oversees strategy, research, development and engineering for Institutional Buyside solutions. Prior to that, he served as Executive Vice President, Head of Analytics & Tradition Solutions starting in September 2018. Mr. Robie joined FactSet in July 2000 as a Product Sales Specialist. During his tenure at FactSet, Mr. Robie has held several positions of increased responsibility, including Senior Director of Analytics and Director of Global Fixed Income. Although Mr. Robie joined FactSet in 2000, he did work at BTN Partners from 2004 through 2005 in their quantitative portfolio management and performance division, before returning to continue his career with FactSet. Mr. Robie holds a Bachelor of Arts in Economics and Fine Arts from Beloit College.

Helen L. Shan – Executive Vice President, Chief Revenue Officer. Ms. Shan was appointed Executive Vice President, Chief Revenue Officer effective May 3, 2021. As the Chief Revenue Officer, she is responsible for driving revenue growth by managing global sales, client solutions, marketing and media relations. Ms. Shan joined FactSet as Chief Financial Officer in September 2018 where she oversaw all financial functions at FactSet. Prior to that, she was at Marsh McLennan Companies, where she served in a variety of roles, including as the company's Corporate Treasurer and as Chief Financial Officer for Mercer, a professional services firm where she was responsible for global financial reporting and performance, operational finance, investments, and corporate strategy. Preceding that, Ms. Shan also served as the Vice President and Treasurer for Pitney Bowes Inc. and served as a Managing Director at J.P. Morgan. In September 2018, Ms. Shan joined the Board of Directors of EPAM Systems Inc., a global provider of digital platform engineering and software development services. Ms. Shan holds dual degrees with a Bachelor of Science and a Bachelor of Applied Science from the University of Pennsylvania’s Wharton School of Business and School of Applied Science and Engineering. Ms. Shan also has a Master of Business Administration from Cornell University’s SC Johnson College of Business.

Goran Skoko – Executive Vice President, Managing Director EMEA and Asia Pacific, Head of Dealmakers and Wealth. Mr. Skoko was appointed Executive Vice President, Managing Director EMEA and Asia Pacific, Head of Dealmakers & Wealth, effective September 1, 2023. In his current role, Mr. Skoko is responsible for providing direction to address the product and content needs for EMEA and Asia Pacific clients while also focusing on increased deployment and building community within our Dealmakers & Wealth space. Prior to that, he served as Executive Vice President, Managing Director EMEA and Asia Pacific and Head of Research & Advisory Solutions starting in July 2021, after having served as Executive Vice President, Managing Director EMEA and Asia Pacific and Head of Wealth Solutions. He joined FactSet in 2004 as a Senior Product developer and has held a number of positions of increased responsibility. Prior to FactSet, he spent 16 years in various engineering and product management roles at Thomson Financial. Mr. Skoko earned his B.S. in Physics and Computer Science from Fordham University.

Kristina W. Karnovsky – Executive Vice President, Chief Product Officer. Ms. Karnovsky was appointed Executive Vice President, Chief Product Officer in July 2021. In this current role she works across the entire product portfolio to deliver a differentiated advantage for clients and support their success. Prior to this role, Ms. Karnovsky was Head of Research Solutions. Ms. Karnovsky joined FactSet in 2001 as a Consultant and spent over a decade building FactSet's sell-side business in Sales leadership roles. Ms. Karnovsky earned a bachelor's degree from the University of Scranton.

John Costigan – Executive Vice President, Chief Data Officer. Mr. Costigan was appointed Chief Data Officer of FactSet effective June 1, 2023. Prior to that, he served as Chief Content Officer of FactSet starting in April 2022. As Chief Data Officer, he is responsible for FactSet's enterprise-wide data strategy and leads data development from planning through production. This includes data digital transformation using modern techniques and technology to drive timeliness, accuracy, coverage, consistency and usability across all FactSet data assets. Mr. Costigan has been at FactSet since September 2007 in a variety of roles. Prior to joining FactSet, Mr. Costigan served as Vice President, Product Management at Thomson Financial, and spent 11 years in a variety of Product Management roles at First Call, Autex, ILX, and Tradeweb. Mr. Costigan earned a bachelor's degree in Economics from St. Michael's College.

Katherine M. Stepp – Executive Vice President, Chief Technology Officer. Ms. Stepp was appointed Chief Technology Officer, effective September 1, 2022. As Chief Technology Officer, she is responsible for leading FactSet's technology organization and overseeing its digital transformation strategy. Ms. Stepp joined FactSet in 2008 and previously served as Senior Director of Product Management within FactSet's Research and Advisory workflow solutions business. Prior to that role, she was Senior Director of Engineering within FactSet's Research workflow solutions business. Ms. Stepp holds a B.S. in Computer Science from Carnegie Mellon University.