Exhibit 99.1

[Graphic Appears Here]

What you eat & drink. Where you go. What you ship.

CONTENTS

Financial Highlights 2

CEO Letter 3

Protection 6

Food & Beverage 8

Institutional & Laundry 12

Protective Packaging 16

Our Approach 20

Our Footprint 22

Sustainability 24

Our Team 26

[Graphic Appears Here]

ABOUT

US

SEALED AIR

Sealed Air is a global leader in food safety and security, facility hygiene and product protection. With widely recognized and inventive brands such as Bubble Wrap® brand cushioning, Cryovac® brand food packaging solutions and Diversey™ brand cleaning and hygiene solutions, we offer efficient and sustainable solutions that create business value for customers, enhance the quality of life for consumers and provide a cleaner and healthier environment for future generations.

Values

INTEGRITY TRUST

Always act with the Doing our best to meet highest ethical and our commitment, be legal standards open and honest and keep our word

RESPECT

Always act in a manner that treats all people, cultures, backgrounds and viewpoints with fairness and respect

LEAD

“Setting the bar” in all we do and in the markets we create

KEY FACTS

Founded 1960 + Solid free cash flow generation +

HQ: Elmwood Park, NJ, USA + Scale & efficiency: 145 manufacturing facilities +

Extensive reach: 62-country presence &

NYSE listed: SEE + + 175-country distribution

26,300 employees + Innovation driven: 2% of sales on R&D +

$8.1 billion pro forma 2011 net sales + Differentiated by a total systems solution +

| 1 |

|

FINANCIAL HIGHLIGHTS

Pro Forma Year Ended

December 31, Year Ended December 31,

($ in millions, except per common share data) 2011 2010 20111 2010 2009

Total Net Sales $8,105 $7,618 $5,641 $4,490 $4,243 P ercent U.S. 30% 30% 41% 46% 46% P ercent International 70% 70% 59% 54% 54%

U.S. GAAP Operating Profit $ 638 $ 689 $ 447 $ 535 $ 492 A djusted Operating Profit* $ 728 $ 749 $ 590 $ 549 $ 509 Ad justed Operating Profit Margin 9.0% 9.8% 10.5% 12.2% 12.0%

Adjusted EBITDA* $1,061 $1,122 $ 786 $ 731 $ 707 A s a Percent of Net Sales 13.1% 14.7% 13.9% 16.3% 16.7%

U.S. GAAP Net Earnings—Diluted $ 130 $ 174 $ 148 $ 254 $ 247 Ad justed Net Earnings—Diluted* $ 184 $ 227 $ 243 $ 281 $ 263

U.S. GAAP Earnings Per Common Share—Diluted $ 0.62 $ 0.83 $ 0.80 $ 1.44 $ 1.35 A djusted Earnings Per Common Share*—Diluted $ 0.88 $ 1.09 $ 1.31 $ 1.60 $ 1.44

Cash Dividends Paid per Common Share $ 0.52 $ 0.52 $ 0.52 $ 0.50 $ 0.48 Total Return to Shareholders (Dividends & Share Repurchases) — — $ 87 $ 90 $ 76 Net Cash Provided by Operating Activities — — $ 392 $ 483 $ 552 Capital Expenditures $ 166 $ 137 $ 125 $ 88 $ 80

Free Cash Flow* — — $ 354 $ 388 $ 524

Net Debt (includes Grace Settlement) — — $5,156 $1,542 $1,713 Return on Total Assets* — — — 4.7% 4.7% Three Year Return on Invested Capital* — — 9.5% 9.1% 8.9% Return on Stockholders’ Equity* — — — 11.1% 11.8%

12011 results include Diversey results from October 3, 2011 through December 31, 2011.

*Please refer to the following definition and reconciliation pages for reconciliation of non-U.S. GAAP financial measures.

[Graphic Appears Here]

| 2 |

|

CEO

LETTER

William V. Hickey,

President and Chief Executive Officer

DEAR FELLOW STOCKHOLDERS:

The year 2011 was a transformative one for Sealed Air, 3. E xpanding global supply chains and e-commerce chan-marked by our acquisition of Diversey. It was also a year of nels, which require efficient protective packaging solutions sound operational performance, ongoing productivity from the factory floor to consumers’ doorsteps. improvements, record safety performance and solid free While our legacy organization has actively addressed these cash flow generation from our legacy business—all in the trends, our acquisition of Diversey provides a catalyst for us face of challenging macro-economic conditions. These to redefine protection and be a leader in providing solu-events and achievements have created a foundation for tions that ensure safer and more hygienic environments. As what we believe will be a successful 2012. a result, we have expanded our growth opportunities to include an estimated $40 billion cleaning and sanitation

Committed to Long-Term Growth & Value Creation market1, with attractive growth opportunities among food Throughout our history, we have prided ourselves in our and beverage processors and in developing regions—key inventive and entrepreneurial culture, our broad portfolio areas of focus for us. of proprietary solutions that improve customers’ productivity and reduce their operating costs. We have also earned We expect that the combination of our two leading global our customers’ trust as their partner and an industry organizations will produce next-generation solutions that thought leader. These traits and a lot of hard work have will offer stronger value propositions to customers, improved allowed us to position the organization on the “right side of sales growth, and greater differentiation for our shared the growth curve,” and achieve or maintain a #1 or #2 mar- portfolio and global platform. The addition of Diversey ket position in the principal applications we target. provides greater reach, most notably in shared and under-penetrated food and beverage processor accounts. Here, We have also demonstrated the flexibility to adapt and our new organization can leverage a more extensive service reinvent our business to maximize our growth opportuni-platform and deeper customer relationships to drive ties and maintain our leadership position with integrated growth. We also have enhanced growth opportunities solutions—no matter where our customers do business. In among business supply distributors, a sales channel utilized 2011, we adapted our business and aligned our growth by both legacy organizations. And lastly, we have the strategy with three primary mega-trends: opportunity to leverage Diversey’s extensive infrastructure,

1. I ncreasing demand for protein and high-quality, pre- market presence and customer relationships in developing pared foods from an expanding middle class, who are regions to accelerate growth programs across each of our seeking higher standards of living in developing regions, businesses. and are being served by expanding regional and global food supply chain networks; The Synergy Value of Redefining Protection

2. G reater public awareness and regulatory mandates for We continue to believe strongly that 2011 was the right safe, efficient, and hygienic environments that reinforce time to expand our growth opportunities and invest in personal safety and the well-being of employees and our future to improve value creation for all of our stake-customers in increasingly urbanized environments; and holders. After investing resources over the past five years

1”World Food Safety Products” Freedonia, 2010; “World Industrial and Institutional Cleaning Chemicals” Freedonia, 2010

| 3 |

|

CEO

LETTER

“S EALED AIR’S GROWTH HAS ALWAYS COME FROM CHALLENGING OUR OWN

NOTION OF HOW ‘OUR PRODUCTS PROTECT YOUR PRODUCTS.’ BY HAVING THE COURAGE TO REDEFINE PROTECTION, WE HAVE ALWAYS MAXIMIZED THE VALUE WE OFFER AS CUSTOMER AND CONSUMER NEEDS EVOLVE.”

to optimize our legacy internal operations, lower our cost structure, transition to a standard ERP system, revitalize our R&D pipeline, and build a solid balance sheet—our team was ready to focus on the next 10 years as a period of transformational growth. While the Diversey transaction initially met with a mixed reaction from investors, I believe that our commitment to expand our leadership presence in food safety and security and facility hygiene is the right long-term strategy for the organization and Diversey was the right investment to drive long-term stockholder value. With Diversey, we are focused on being a global leader in sustainable solutions that improve food safety and security, facility hygiene and product protection—protecting what is important: what you eat and drink, where you go and the valuable goods you ship.

The global business unit structure we expect to implement in 2012 will align three business areas to a specific protection theme: Food & Beverage, Institutional & Laundry, and Protective Packaging. Each business area will continue to leverage our expansive, shared global infrastructure and our core competencies in advanced material science, microbiology, food science and engineering to improve the efficiency and efficacy of protection solutions for customers worldwide. As we transition to this structure, our businesses will be focusing their attention and investments on a core growth strategy that emphasizes sustaining our current market footprint in North America, maintaining our leadership positions in the EMEA markets, and accelerating growth in developing regions. We believe this approach will ultimately generate the most growth opportunity, value and return on our investment.

As you will see in this year’s annual report, the new Sealed Air is positioned to create measurable value for our customers and their operations through solutions that improve safety and risk management, drive operational efficiencies through automation and deliver water, waste and energy reduction. Additionally, we ensure downstream benefits such as extended shelf life, which reduces food waste, brand enhancement, and value-added convenience features for both customers and consumers.

I am excited about the opportunities ahead for Sealed Air based on what we have learned following the close of the Diversey transaction in October 2011. The diligent analysis of over ten integration teams has yielded 2013 goals that include cost synergy targets that are double our initial estimate and have reinforced our free cash flow targets—core to achieving our net debt target and long-term capital structure of a 3.0x to 3.5x net debt to EBITDA ratio by the end of 2013. These goals include: • $ 8.6 billion in annual revenue, including $70 million in rev-

enue synergies;

• $ 100 million in annual cost synergies;

• $ 1.4 billion in adjusted EBITDA ($1.45 billion run-rate at

end-2013);

• $ 600 million in annual free cash flow; and • $ 4.5 billion in net debt.

Committed and Aligned to Achieve Success

Both senior management and the Board are committed to achieving a successful integration, realizing our 2013 goals, and delivering the earnings improvement and stockholder value creation that we expect will follow when we perform to plan over the next two years. To our disappointment, 2011 became a challenging year for our stockholders due to the significant decline in our stock price following the announcement of our Diversey acquisition. In response, the Board took a hard look at our strategy and took meaningful actions. We reaffirmed the strategic rationale supporting the Diversey transaction, appointed a new lead director, Mr. William Marino, and two additional independent Board members, and we aligned our incentive compensation programs to include our 2013 goals and total shareholder return (among other metrics).

As we move ahead and execute on our plans, we commit to our stockholders that we will:

• P ut our full effort into achieving the success of our deal; • S et clear, reasonable performance goals and communicate them;

• R eport on our progress toward achieving our goals; and • S hare our insights along the way.

| 4 |

|

2012 PRIORITIES 2013 GOALS

1. Integrate Diversey + 1. A chieve synergy targets: $100 million cost + synergies & $70 million revenue synergies 2. Achieve our synergy targets + 2. Net sales of $8.6 billion + 3. Reduce debt + 3. Adjusted EBITDA of $1.4 billion + 4. Develop our people + 4. Free cash flow of $600 million + 5. Net debt of $4.5 billion +

These commitments, along with the placement of a solid senior management team which represents industry-leading executives with an average tenure of 20 years, who know their markets and know how to win, position us to successfully execute on our integration and growth programs.

Focused on the Deliverables: 2012 Milestones

As we continue to look to the future with great optimism, our priorities are to place our customers first and complete key milestones necessary to achieve our long-term goals. In 2012, our organization will be focused on five objectives:

Growing on Solid Fundamentals • A chieving $50 million in cost synergies and increasing Our 2013 plans are built on a solid legacy Sealed Air foun- our rate of revenue synergies to meet our 2013 goal of dation. In 2011, despite the slowing pace of growth in the $70 million; second half of the year, our businesses maintained con- • S uccessful integration of the business by executing on stant dollar growth, solid free cash flow generation and integration plans across back-office functions and within ongoing penetration across customer accounts and in our supply chain network, as well as transitioning to three developing regions. Our core drivers of success were our business areas; ongoing expansion into developing regions, our solid • A chieving approximately $1.2 billion in adjusted EBITDA pipeline of innovations, which continued to offer lower total from the benefits of organic sales growth, productivity cost solutions for customers, superior customer service improvements, synergies and legacy restructuring and strong access to diverse distribution channels. For the programs; legacy Sealed Air business, this resulted in full year: • 5 % constant dollar growth, including 2% volume growth • G enerating cash flow to reduce debt, with estimated and 3% price/mix growth; $450 to $475 million of free cash flow (includes working capital), and decreasing net debt from $5.2 billion to a • L aunch of nearly 40 new solutions, with 17% of sales from target of $4.9 billion by year-end; and new solutions (+200 bps vs. 2010); • D eveloping our people by providing a cohesive and • A pproximately $30 million in productivity benefits from collaborative environment that will allow our employees our commitment to continuous improvement; to thrive, offer greater development opportunities and • A nother year of record safety performance; and ensure skills required to achieve our growth strategies are in place.

• M aintenance of relatively steady operating profit margins versus 2010, reflecting 80% recovery of petrochemical- As we look ahead, we believe we have identified the right based raw material costs. markets for growth and the right strategy to achieve our goals. We have the expertise and leadership, technological During the year, we maintained our strong liquidity position capability and global platform that will define Sealed Air as with approximately $1.5 billion in available funds to meet an an unparalleled protection company dedicated to deliver estimated $830 million obligation associated with the W. R. on our commitments to our stakeholders.

Grace settlement. We finished the year with over $700 million in cash and cash equivalents, allowing us to be well positioned to fund the settlement when it becomes due. We continue to expect the payment of the settlement to be accretive to our post-payment diluted earnings per

William V. Hickey share by $0.13 annually and yield over $350 million in cash

President and Chief Executive Officer tax benefits, which will either aid in our reduction of debt or allow us to return cash to stockholders if we have already achieved our targeted $4.5 billion net debt level.

| 5 |

|

PROTECTION

Sealed Air’s 26,300 employees focus on PROTECTION every day and focus their energy on innovating solutions that deliver greater operational efficiency, total cost reduction and brand protection for our customers.

For over fifty years, we have reinvented and redefined protection, but have always reinforced our founding principle that “our products protect your products®.” With the addition of Diversey in 2011, we are now a global leader in food safety and security, facility hygiene and product protection—protecting what you eat and drink; where you live, work, shop and vacation and where you receive your health care; and the valuable goods you ship.

BY TRANSFORMING OUR CAPABILITIES, WE NOW PROVIDE CUSTOMERS WITH:

[Graphic Appears Here]

Greater confidence in food Efficient facility hygiene Practical solutions for demanding safety and security solutions protective packaging needs

We offer the industry’s broadest We deliver tailored system solutions We offer the broadest portfolio of expertise in food science and for building care, food safety, laundry protective, industrial and display microbiology to help improve the and infection control applications. packaging systems to meet diverse management of contaminants and Our solutions incorporate automated application requirements across a improve supply chain efficiencies equipment, tools and utensils with wide range of industries. We focus with complete system solutions. tailored cleaning solutions from on minimizing material use and maxi-Our solutions improve customers’ one trusted partner. We design our mizing operational efficiency and confidence that food and beverages solutions to simplify and automate product protection, which generates are processed, sold and prepared in cleaning functions to improve pro- total cost savings from the customers’ safe, efficient environments, have ductivity, minimize water and energy facility to the consumers’ doorstep. extended shelf life and reduced use and reduce customers’ total waste, while providing value-added operating costs. convenience features and formats for consumers.

| 6 |

|

[Graphic Appears Here]

| 7 |

|

PROTECTION

FOOD & BEVERAGE

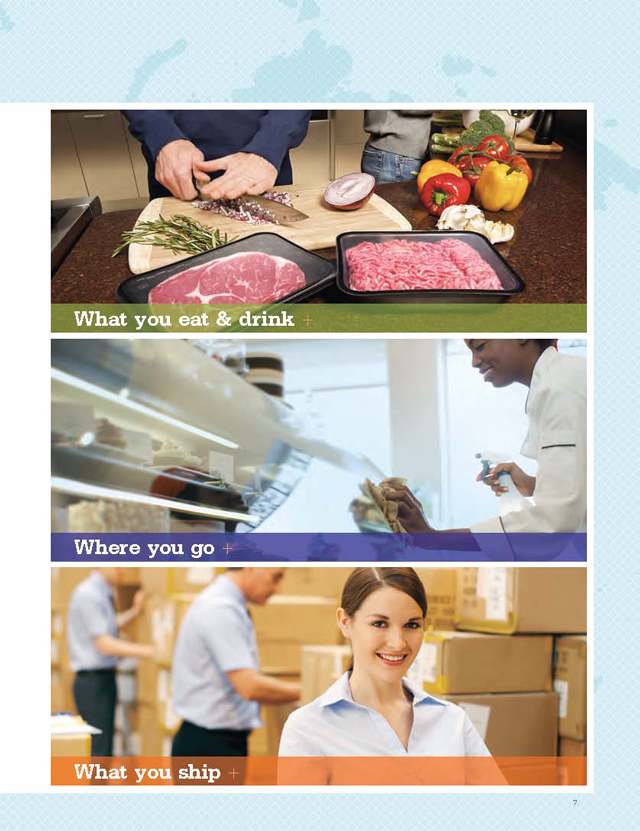

What you eat & drink

In 2012, we will transition to a Food & Beverage (F&B) offering, which will combine Sealed Air’s legacy Food Packaging and Food Solutions businesses with Diversey’s food and beverage applications.

The F&B team will create measurable value by helping food and beverage processors, retailers and foodservice operators cost-effectively produce safer, more hygienic products that stay fresher longer, and protect and enhance their brand and merchandising appeal with consumers.

WHAT SETS F&B APART?

[Graphic Appears Here]

Decades of industry experience and expertise in food science, microbiology, application engineering, processes and protocols, and in cleaning and sanitation solutions has allowed us to offer a total systems approach and unparalleled customer support. We partner with food and beverage processors globally to help them produce, process and deliver their products cost-effectively, safely, efficiently, and with confidence through their supply chain.

F&B solutions will focus on:

• I mproving the management of leveraging the GE alliance to contamination risk associated with deliver water treatment solutions food production and processing and energy management services with integrated and automated to food and beverage processors clean-in-place solutions that inte- globally grate equipment, packaging mate-• I mproving productivity, efficiency rials and cleaning solutions and quality through automation • H elping processors in developing and preventative diagnostics, ser-regions improve their processes vices for equipment systems and and protocols to enhance product quality management performance and safety • A dding value with sustainable, • R educing water and energy con- proprietary and functional package sumption through efficient, open- features plant cleaning solutions and by

• E xtending product shelf life, maintaining freshness and reducing food waste through specialty packaging technologies and systems

• E nhancing merchandising appeal and ease-of-use, handling and storage for retailers, food service operators and consumers

• H elping customers build strong brands through differentiated features and solutions

| 8 |

|

[Graphic Appears Here]

North America 39% Packaging 80% Direct Sales 99% EMEA 32% Cleaning & Sanitation 20% Distributor Sales 1% Asia-Pacific 16% Latin America 13%

$3.8 BILLION SALES*

*Represents estimated pro forma 2011 net sales data, which is preliminary and subject to change.

9

[Graphic Appears Here]

Cryovac® Darfresh® and Cryovac® vacuum shrink Cryovac® QuickRip™ Cryovac® TBG vacuum Cryovac® Grip & Tear® bags Cryovac® Mirabella® case systems vacuum shrink bag shrink bags for bone-in ready solutions products

POULTRY

[Graphic Appears Here]

Cryovac® SES oxygen permeable Cryovac® BDF® Cryovac® Grip & Tear® bags Cryovac® rollstock solutions stretch-shrink poultry farms for Whole Birds

SMOKED & PROCESSED MEATS

[Graphic Appears Here]

Cryovac® Grip & Tear® bags Cryovac® Freshness Plus® Cryovac® Deli-Snap!™ easy Cryovac® Multi-Seal® easy Cryovac® rollstock solutions odor scavenging solutions open/reclose solution open/reclose solution

DAIRY

[Graphic Appears Here]

Cryovac® Multi-Seal® Cryovac® Grip & Tear® bags Cryovac® vacuum shrink Cryovac® rollstock solutions Cryovac® vertical form fill FoldLOK easy open/reclose bags seal for dairy applications solution

10

[Graphic Appears Here]

Cryovac® n’Oven Cryovac® Oven Ease™ Cryovac® BDF® Soft Cryovac® LID Film Simple Steps®

Ovenable Foam Tray solutions microwavable packaging

FLUIDS PACKAGING

[Graphic Appears Here]

Cryovac® VPP Vertical Pouch Packaging ProAseptic pouch solutions Entapack® IBC liners and bag-in-box solutions (frozen, chilled and shelf stable packaging)

DIVERSEY™ CLEANING AND SANITATION

[Graphic Appears Here]

Diverclean™ portable foamer with Diversey™ detergents and Divosan® Dry Tech™ lubricant ZipClean™ conveyor EnduroChlor™ for open plant cleaning disinfectants belt cleaning

11

PROTECTION

INSTITUTIONAL & LAUNDRY

Where you go

The Institutional & Laundry (I&L) business will represent the broad offering of Diversey™-branded total system solutions that ensure facility hygiene, food safety and security in food service operations, and infection control to customers worldwide. I&L integrates cleaning chemicals, floor care equipment, cleaning tools, and a wide range of value-added services. These services include food safety and application training/consulting and the auditing of hygiene and water management to improve the operational efficiency of customers’ processes and improve their cleaning methods.

I&L’s efficient, easy-to-use solutions include super concentrated cleaning formulations and proprietary and patented dosing and dilution technology that allows for significant savings. Additionally, floor care equipment and cleaning tools improve productivity by either automating or reducing manual procedures, minimizing waste, and lowering water and energy consumption across the customers’ processes and operations. Together, these solutions reduce the overall environmental footprint of customers’ commercial and industrial facilities and reduce the customer’s “total cost to clean.”

I&L SERVES INSTITUTIONS AND INDUSTRIAL END-USERS IN:

[Graphic Appears Here]

I&L solutions target four primary application categories: kitchen hygiene, floor care, restroom care & housekeeping, and laundry, which are most commonly applied as follows:

PRIMARY SECTORS WHERE SOLUTIONS ARE IN USE

Building Care Commercial Food Service Lodging Maintenance Retail Healthcare Laundry

Kitchen Hygiene

Floor Care

Restroom Care & Housekeeping

Laundry

Primary solutions include fully integrated lines of products and dispensing systems for hard surface cleaning, disinfecting and sanitizing, hand washing, deodorizing, ware washing, hard surface and carpeted floor cleaning systems, tools and utensils, and fabric care for laundry applications, including detergents, stain removers, bleaches and a broad range of dispensing equipment and process control and management information systems.

12

[Graphic Appears Here]

EMEA 50% Distribution1 37% Distributor Sales2 52% North America 22% Building Service Contractors 17% Direct Sales 48% Asia-Pacific 21% Food Service 13% Latin America 7% Retail 12% Lodging & Laundry 11% Healthcare 8% Other 2%

$2.5 BILLION SALES*

| 1 |

|

End-users managed by distributors. |

| 2 |

|

Includes end-users managed by I&L. |

*Represents estimated pro forma 2011 net sales data, which is preliminary and subject to change.

13

PROTECTION

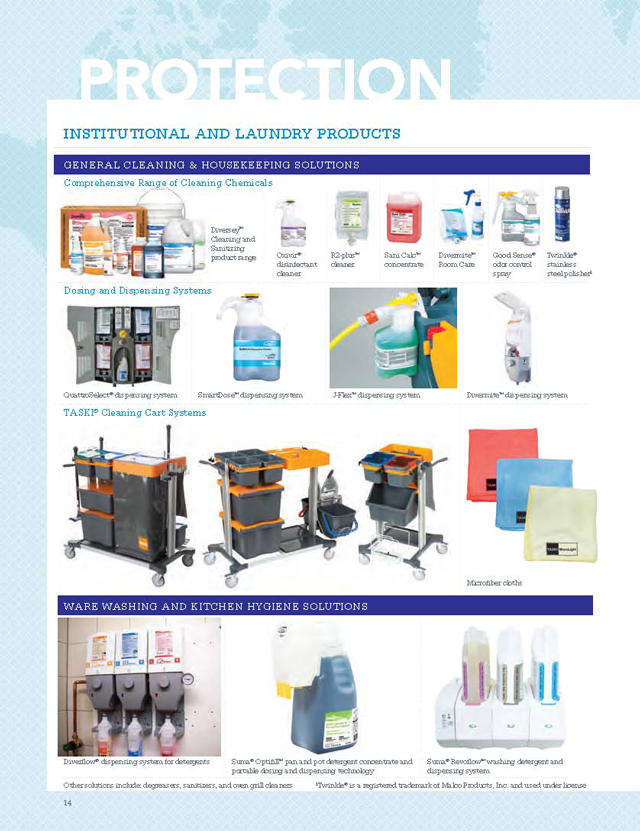

INSTITUTIONAL AND LAUNDRY PRODUCTS

GENERAL CLEANING & HOUSEKEEPING SOLUTIONS

Comprehensive Range of Cleaning Chemicals

[Graphic Appears Here]

[Graphic Appears Here]

Diversey™ Cleaning and Sanitizing

Oxivir® R2-plus™ Sani Calc™ Divermite™ Good Sense® Twinkle® product range disinfectant cleaner concentrate Room Care odor control stainless cleaner spray steel polisher1

[Graphic Appears Here]

Diverflow® dispensing system for detergents Suma® Optifill™ pan and pot detergent concentrate and Suma® Revoflow™ washing detergent and portable dosing and dispensing technology dispensing system Other solutions include: degreasers, sanitizers, and oven grill cleaners 1Twinkle® is a registered trademark of Malco Products, Inc. and used under license

14

[Graphic Appears Here]

Clax® Revoflow™ laundry dispensing Diverflow™ 2 laundry dispensing Soft Care® Dispenser Soft Care® Sensations system system

15

PROTECTION

PROTECTIVE PACKAGING

What you ship

Protective Packaging will combine Sealed Air’s legacy Protective Packaging, Shrink Packaging and Specialty Materials businesses to be the preferred provider of protective packaging solutions for the distribution of goods globally. This new business provides customers with the industry’s broadest and most versatile range of protective packaging solutions to meet cushioning, void fill, positioning/block-and-bracing, surface protection, retail display, containment and dunnage needs.

Today, solutions are largely used in B2B/industrial applications with customers representing over 400-SIC* codes, in e-commerce/fulfillment applications, and at retail level where Protective Packaging offers select products for consumer use.

[Graphic Appears Here]

• Innovative systems that deliver the highest performing products

• Engineered solutions that meet premium quality and environmental standards • Industry leading brands • Extensive global sales, service and development lab network • Broad distribution—both geographically and across numerous sales channels

Together, these strengths allow Protective Packaging to commercialize systems globally that are designed to minimize material use while maximizing packaging performance, productivity, recyclability, re-use, and total cost savings for our customers.

*SIC=Standard Industrial Classification

16

[Graphic Appears Here]

North America 55% Cushioning 38% Distributor & Fabricator 82% EMEA 28% Core Solutions 36% Direct & Retail 18% Asia-Pacific 12% Shrink Films 18% Latin America 5% Packaging Systems 8%

$1.6 BILLION SALES*

*Represents estimated pro forma 2011 net sales data, which is preliminary and subject to change.

17

[Graphic Appears Here]

[Graphic Appears Here]

Instapak Complete® system Instapak iMold® automated SpeedyPacker® foam-in-bag systems foam packaging system

18

[Graphic Appears Here]

NewAir I.B.® systems PriorityPak® automated Fill-Air® inflatable FillTeck™ inflatable cushioning packaging systems packaging system systems

[Graphic Appears Here]

PackTiger® paper packaging systems FasFil® EZ™ paper void fill systems Rapid Fill® automated void fill packaging system

19

OUR

APPROACH

TOTAL SYSTEMS APPROACH

Sealed Air protection uses a unique “total systems approach,” which leverages our extensive R&D and Equipment, Automation & Integration teams’ expertise to generate differentiated solutions that incorporate engineered, specialty materials or cleaning chemicals with equipment, cleaning tools, or utensils to improve customers’ operations. Additionally, we enhance our solutions with various services, such as water and energy management, life cycle assessment, remote diagnostics, technical training, and equipment maintenance and repair. Our comprehensive total systems approach differentiates our solutions in market, delivers measurable value to our customers, enhances the quality of life for consumers, and provides a healthier, cleaner environment for future generations.

“W E TAKE PRIDE IN OUR HISTORY OF PIONEERING NEW

TECHNOLOGIES AND APPLICATIONS AND EARNING OUR VALUE WITH CUSTOMERS THROUGH UNIQUE, INVENTIVE SOLUTIONS.”

Dr. Ann Savoca, Vice President, Technology & Innovation

[Graphic Appears Here]

56 labs and 4 customer learning centers worldwide + Open innovation with key academic partnerships + 500+ scientists and engineers + 1,000+ equipment and application experts + Robust R&D pipeline of proprietary solutions + Over 4,600 patents + Over 9,000 trademarks +

Ranked as a top 10 innovator globally by Fortune’s + “World’s Most Admired Companies” list—2012

20

[Graphic Appears Here]

•P ackForum ® seminars • Life cycle assessment •P ackaging design • Food safety compliance

•T raining and compliance • Product/facility certification programs • Cleaning validation tools

[Graphic Appears Here]

[Graphic Appears Here]

• Disinfectants•Installation & process integration • Ware washing • Technical training

• Hand care •R epair & maintenance services • Air fresheners • Replacement parts • Remote diagnostics

21

OUR FOOTPRINT

GEOGRAPHIC REACH

Sealed Air maintains an unparalleled manufacturing footprint and extensive global sales and distribution network that provides access to over 80% of the world’s population. The integration of Diversey’s expansive international footprint and strong orientation in developing regions further bolsters our reach and opportunities for growth and improved customer service levels in many of the fastest growing economies today. Together our global supply chain produces best-in-class solutions that are delivered safely and on time worldwide, while optimizing the effective use of our assets.

Our established local presence and experience provide both domestic and multinational customers with local market insight and expertise, as well as the ability to gain from key learnings and innovations sourced from other Sealed Air regions and businesses. We are also well positioned to maintain high service levels, provide rapid response to customer needs, and 24/7 maintenance and repair.

[Graphic Appears Here]

[Graphic Appears Here]

OUR PRESENCE

+50 years Yagmur Sagnak,

Developing Markets Leader

+40 years Emile Chammas,

Senior Vice President, +40 years Europe Chief Supply Chain Officer

+25 years ME/Africa

+35 years “A d iverse team and solid infrastructure in emerging Packforu markets allows us to collaborate locally to define new Design/Testing rules for new markets and drive growth.” lab(s)

Yagmur Sagnak,

OUR REACH & SCALE Developing Markets Leader

26,000 Employees

[Graphic Appears Here]

Facilities

69 Country presence

Country distribution

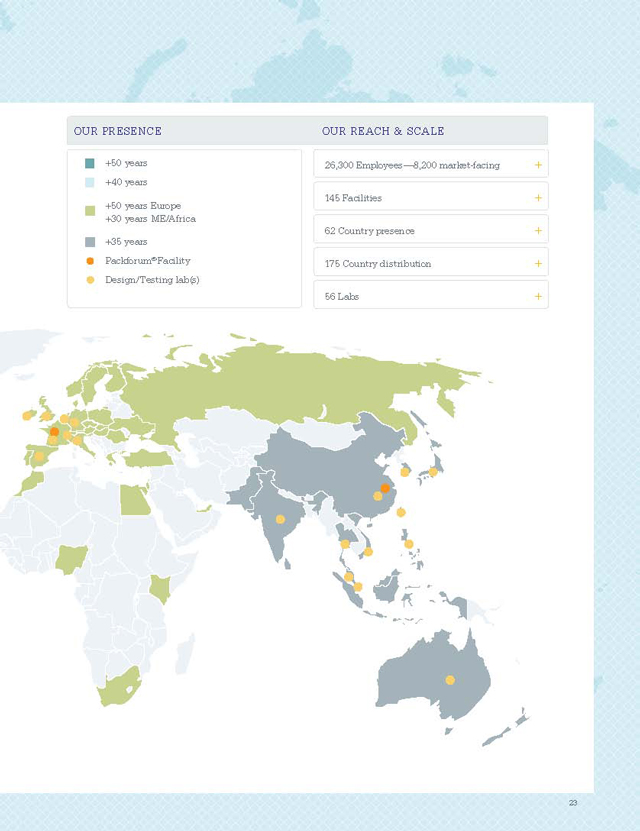

OUR PRESENCE OUR REACH & SCALE

+50 years 26,300 Employees—8,200 market-facing + +40 years 145 Facilities + +50 years Europe +30 years ME/Africa 62 Country presence + +35 years Packforum® Facility 175 Country distribution + Design/Testing lab(s) 56 Labs +

[Graphic Appears Here]

OUR SMARTLIFE™

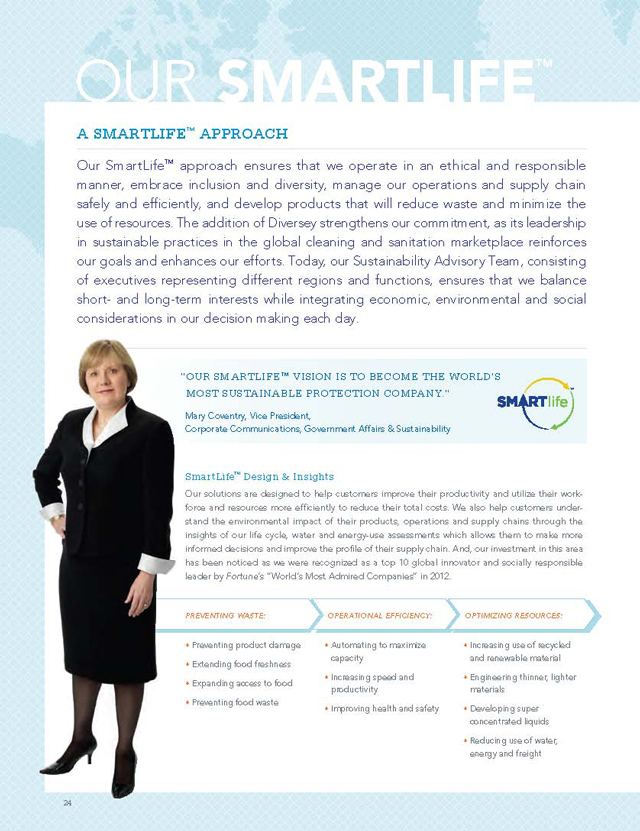

A SMARTLIFE™ APPROACH

Our SmartLife™ approach ensures that we operate in an ethical and responsible manner, embrace inclusion and diversity, manage our operations and supply chain safely and efficiently, and develop products that will reduce waste and minimize the use of resources. The addition of Diversey strengthens our commitment, as its leadership in sustainable practices in the global cleaning and sanitation marketplace reinforces our goals and enhances our efforts. Today, our Sustainability Advisory Team, consisting of executives representing different regions and functions, ensures that we balance short- and long-term interests while integrating economic, environmental and social considerations in our decision making each day.

[Graphic Appears Here]

“OUR SMARTLIFE™ VISION IS TO BECOME THE WORLD’S

MOST SUSTAINABLE PROTECTION COMPANY.” ™

Mary Coventry, Vice President,

Corporate Communications, Government Affairs & Sustainability

[Graphic Appears Here]

SmartLife™ Design & Insights

Our solutions are designed to help customers improve their productivity and utilize their work-force and resources more efficiently to reduce their total costs. We also help customers understand the environmental impact of their products, operations and supply chains through the insights of our life cycle, water and energy-use assessments which allows them to make more informed decisions and improve the profile of their supply chain. And, our investment in this area has been noticed as we were recognized as a top 10 global innovator and socially responsible leader by Fortune’s “World’s Most Admired Companies” in 2012.

PREVENTING WASTE: OPERATIONAL EFFICIENCY: OPTIMIZING RESOURCES:

• P reventing product damage • A utomating to maximize • I ncreasing use of recycled capacity and renewable material • E xtending food freshness • I ncreasing speed and • E ngineering thinner, lighter • E xpanding access to food productivity materials • P reventing food waste • I mproving health and safety • D eveloping super concentrated liquids

• R educing use of water, energy and freight

24

APPROACH

Responsible Operational Performance

Our operations are designed to ensure that our products are manufactured in a safe and responsible manner worldwide. Both Sealed Air and Diversey organizations have established rigorous sustainability goals and a commitment to continuous improvement in sustainable operations.

Sealed Air Operational Goals & 2011 Achievements: Diversey Goals & 2011 Achievements:

Goal: 0% of plastic scrap raw Goal: 20% reduction in greenhouse Goal: 25% reduction in greenhouse materials to landfills by 2015* gas emissions from 2006–2015* gas emissions for all Diversey

2011 Actual: 4% of our plastic scrap raw 2011 Actual: 20.9% reduction from the operations from 2003–2013 materials were sent to landfills—an baseline 2011 Actual: 37.4% reduction from the improvement from 4.9% in 2010 baseline

Goal: 1.30 Total Recordable Incident

Goal: 10% reduction in energy Rate (TRIR) Goal: 10% reduction in Incident intensity from 2006–2015* 2011 Actual: Record 0.82 TRIR vs. 0.97 Frequency Rate (IFR)

2011 Actual: 8% reduction from in 2010 2011 Actual: 67.4% reduction in IFR the baseline since the 2002 launch of the Target

*T hese goals target Sealed Air’s Zero Health & Safety program manufacturing facilities only.

Responsible Neighbor

Our SmartLife™ commitment emphasizes that we make a difference in our communities worldwide. We do this through our estimated $3 million in 2011 donations, but by also encouraging volunteerism, by responding to natural disasters and by combating growing issues of world hunger and water conservation through financial, technological and employee donations. We are also engaged in numerous local activities:

Community Natural Disaster Local Charity Improvement

Education Relief Donations Donations Product Donations Environment

•Students in Free •Monetary and •Raised almost 9 •Site renovations and •Bubble Wrap® cush- •Adopt-a-Highway Enterprise (SIFE) product donations tons of food across clean up projects ioning donations

•WWF Climate sponsorship for various natural several food drive for various charity

•Habitat for Savers: WWF disasters in Haiti, campaigns events

•School/University Humanity Partnership for Japan, New Zealand program donations •United Way and •Over $1 million in Fresh Water Science and Thailand •Global Children’s American Red Cross donated cleaning & Solutions

•Mentoring, sponsor- Initiative for hand support and sanitation ship and work study washing training •Sponsored products programs •Monetary and engineering

•Children’s medical donation support projects focused

•Education scholar- ward improvements of local nonprofit on greenhouse ships for employees’ organizations in •Blood drives gas abatement children various countries

•Meals on wheels •Constructed a

•Health charity and other food school out of events donation programs recycled PET water bottles in

•Youth sports the Philippines programs

25

[Graphic Appears Here]

DEAR STOCKHOLDERS:

Over the course of Sealed Air’s fifty-year history, our Board members have developed and maintained a tradition of sound governance and management of the business with the highest standards of business ethics as outlined in Sealed Air’s Code of Conduct. This commitment has led to solid business performance, even in challenging economic times.

2011 marked a year of transformation for Sealed Air through our investment in Diversey—a transaction that we believe provides considerable long-term growth opportunities for the organization and solid value creation for our investors.

Having expanded Sealed Air’s scope and size of operations following the acquisition, the Board enhanced governance practices to improve the facilitation of the Company’s affairs by creating a Lead Director position and announced my appointment to this position. We believe that this change will continue to enhance the Company’s corporate governance practices and more fully align the Company with stockholder interests, particularly as they relate to achieving the benefits of the recent acquisition.

The Board takes pride in the solid foundation the Company’s leaders have achieved, the reputation of leading governance practices, and the balanced approach we have tried to consistently apply to align and meet the interests of our stockholders, customers and employees. We encourage our investors to read our annual report and proxy to become better acquainted with Sealed Air, to understand our commitment to the business and how we work hard to meet the interests of all of our stakeholders.

[Graphic Appears Here]

26

DIRECTORS

Hank Brown 1, 2

Senior Counsel, Brownstein Hyatt Farber Schreck, LLP (Law Firm) Elected to the Board in 1997

Michael Chu 1, 3 Managing Director and Co-founder of IGNIA Fund (Investment Firm)

Senior Lecturer, Harvard Business School Elected to the Board in 2002

Lawrence R. Codey 1, 3

Retired President and Chief Operating Officer, Public Service Electric and Gas Company (Public Utility) Elected to the Board in 1993

Patrick Duff 1

General Partner, Prospect Associates (Private Investment Firm) Elected to the Board in 2010

T. J. Dermot Dunphy William J. Marino 2, 3, 4

Chairman, Kildare Enterprises, LLC Retired Chairman, President and Chief (Private Equity Investment and Executive Officer, Horizon Blue Cross Management Firm) Blue Shield of New Jersey (Not-for-Profit Elected to the Board in 1969 Health Services Corporation) Elected to the Board in 2002

William V. Hickey

President and Chief Executive Officer, Richard L. Wambold

Sealed Air Corporation Retired Chief Executive Officer of Pactiv/ Elected to the Board in 1999 Reynolds Foodservice and Consumer Products (Global manufacturer and supplier of consumer food and beverage Jacqueline B. Kosecoff 2, 3 packaging and store products) Managing Partner, Moriah Partners, LLC

Elected to the Board in 2012 (Investment Firm) Elected to the Board in 2005 Jerry R. Whitaker

Retired President of the Electrical Sector-Kenneth P. Manning 1, 2 Americas Group of Eaton Corporation Chairman and Chief Executive Officer, (Global power management company Sensient Technologies Corporation that manufactures and supplies electrical (Global manufacturer and marketer of and industrial products and services) colors, flavors and fragrances and other Elected to the Board in 2012 specialty chemicals) Elected to the Board in 2002 1. Member of the Audit Committee 2. M ember of Nominating and Corporate

Governance Committee

3. M ember of Organization and Compensation Committee 4. Appointed Lead Director in December 2011

The dates shown indicate the year in which each of the directors was first elected a director of the Company or of the former Sealed Air.

27

[Graphic Appears Here]

From left to right: Chip Cook (Sales & Customer Service), Pedro Chidichimo (Diversey, Institutional & Laundry), Warren Kudman (CIO), Ruth Roper (Strategy), Tod Christie (Treasurer & Interim CFO), Emile Chammas (Supply Chain), Ann Savoca (T&I), Bill Hickey (President & CEO), Jean-Marie Deméautis (Marketing), Katherine White (Law), Mary Coventry (Corporate Communications & Sustainability), Ryan Flanagan (Protective Packaging), Karl Deily (Food and Beverage), Yagmur Sagnak (Diversey, Emerging Markets). Not pictured: Larry Pillote (Equipment, Automation & Integration)

OFFICERS

William V. Hickey Karl R. Deily Ruth Roper President and Chief Executive Officer Vice President Vice President

First elected an officer in 1980 First elected an officer in 2006 First elected an officer in 2004 Tod S. Christie Jean-Marie Deméautis Yagmur Sagnak Treasurer and Interim Vice President Vice President Chief Financial Officer First elected an officer in 2006 First elected an officer in 2012 First elected an officer in 1999 J. Ryan Flanagan Dr. Ann C. Savoca Emile Z. Chammas Vice President Vice President Senior Vice President First elected an officer in 2009 First elected an officer in 2008 First elected an officer in 2010 Warren J. Kudman H. Katherine White Jonathan B. Baker Vice President Vice President, General Counsel Vice President First elected an officer in 2009 and Secretary First elected an officer in 1994 First elected an officer in 1996 James P. Mix Pedro Chidichimo Vice President Christopher C. Woodbridge Vice President First elected an officer in 1994 Vice President First elected an officer in 2012 First elected an officer in 2005 Manuel Mondragón Mary A. Coventry Vice President Jeffrey S. Warren Vice President First elected an officer in 1999 Controller First elected an officer in 1994 First elected an officer in 1996 Larry Pillote Vice President First elected an officer in 2010

The dates shown indicate the year in which each of the officers was first elected an officer of the Company or of the former Sealed Air.

28

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 concerning our business, consolidated financial condition and results of operations. All statements other than statements of historical facts included in this report regarding our strategies, prospects, financial condition, costs, plans and objectives are forward-looking statements. The SEC encourages companies to disclose forward-looking statements so that investors can better understand a company’s future prospects and make informed investment decisions. Some of our statements in this report, in documents incorporated by reference into this report and in our future oral and written statements may be forward-looking. These statements reflect our beliefs and expectations as to future events and trends affecting our business, our consolidated financial condition and results of operations. These forward-looking statements are based upon our current expectations concerning future events and discuss, among other things, anticipated future financial performance and future business plans. Forward-looking statements are necessarily subject to risks and uncertainties, many of which are outside our control, that could cause actual results to differ materially from these statements. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will” and similar expressions.

The following are important factors that we believe could cause actual results to differ materially from those in our forward-looking statements: the implementation of our Settlement agreement regarding the various asbestos-related, fraudulent transfer, successor liability, and indemnification claims made against the Company arising from a 1998 transaction with W. R. Grace & Co.; global economic conditions; credit ratings; changes in raw material pricing and availability; changes in energy costs; competitive conditions and contract terms; currency translation and devaluation effects, including in Venezuela; the success of our financial growth, profitability, cash generation and manufacturing strategies and our cost reduction and productivity efforts; the effects of animal and food-related health issues; pandemics; consumer preferences; environmental matters; regulatory actions and legal matters; successful integration and other information included in our Annual Report on Form 10-K under Item 1A, “Risk Factors.” Except as required by the federal securities laws, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

DEFINITIONS AND RECONCILIATIONS OF NON-U.S. GAAP FINANCIAL MEASURES

In our annual report, we present financial information in accordance with U.S. GAAP. In addition, we present financial information that does not conform to U.S. GAAP, which we refer to as non-U.S. GAAP, as our management believes it is useful to investors. In addition, non-U.S. GAAP measures are used by management to review and analyze our operating performance and, along with other data, as internal measures for setting annual budgets and forecasts, assessing financial performance, providing guidance and comparing our financial performance with our peers. The non-U.S. GAAP information has limitations as an analytical tool and should not be considered in isolation from or as a substitute for U.S. GAAP information. It does not purport to represent any similarly titled U.S. GAAP information and is not an indicator of our performance under U.S. GAAP. Further, non-U.S. GAAP financial measures that we present may not be comparable with similarly titled measures used by others. Investors are cautioned against placing undue reliance on these non-U.S. GAAP measures. Further, investors are urged to review and consider carefully the adjustments made by management to the most directly comparable U.S. GAAP financial measure to arrive at these non-U.S. GAAP financial measures.

Our management may assess our financial results, such as gross profit, operating profit and diluted net earnings per common share (“EPS”), both on a U.S. GAAP basis and on an adjusted non-U.S. GAAP basis. Examples of some other supplemental financial metrics our management will also use to assess our financial performance include Earnings before Interest Expense, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA, Adjusted EPS, Adjusted Cash EPS and Free Cash Flow. These non-U.S. GAAP financial measures provide management with additional means to understand and evaluate the core operating results and trends in our ongoing business by eliminating certain one-time expenses and/or gains (which may not occur in each period presented) and other items that management believes might otherwise make comparisons of our ongoing business with prior periods and peers more difficult, obscure trends in ongoing operations or reduce management’s ability to make useful forecasts. Our non-U.S. GAAP financial measures may also be considered in calculations of our performance measures set by the Organization and Compensation Committee of our Board of Directors for purposes of determining incentive compensation.

The non-U.S. GAAP financial metrics mentioned above exclude items we consider unusual or special items and also exclude their related tax effects. We evaluate the unusual or special items on an individual basis. Our evaluation of whether to exclude an unusual or special item for purposes of determining our non-U.S. GAAP financial measures considers both the quantitative and qualitative aspects of the item, including, among other things (i) its nature, (ii) whether or not it relates to our ongoing business operations, and (iii) whether or not we expect it to occur as part of our normal business on a regular basis.

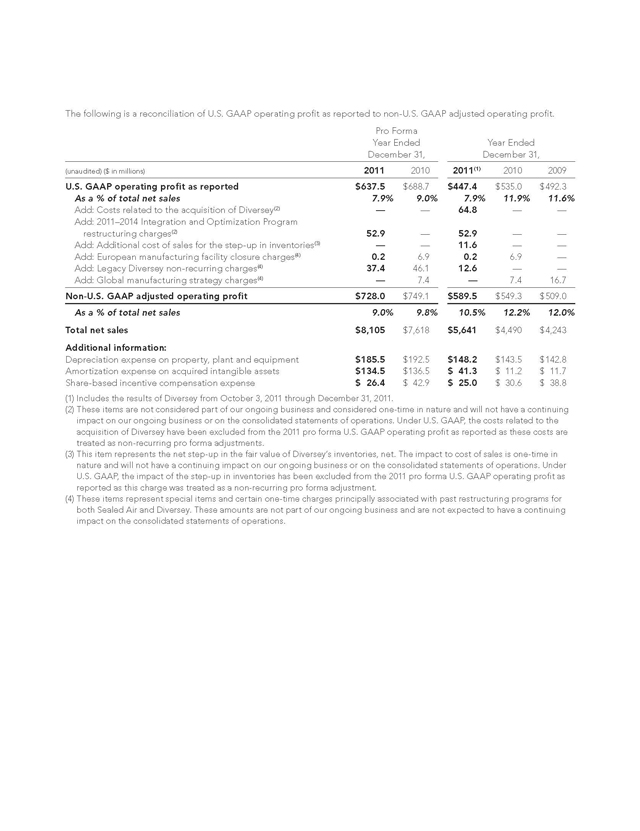

The following is a reconciliation of U.S. GAAP operating profit as reported to non-U.S. GAAP adjusted operating profit.

Pro Forma

Year Ended Year Ended December 31, December 31,

(unaudited) ($ in millions) 2011 2010 2011(1) 2010 2009

U.S. GAAP operating profit as reported $637.5 $688.7 $447.4 $535.0 $492.3

As a % of total net sales 7.9% 9.0% 7.9% 11.9% 11.6%

Add: Costs related to the acquisition of Diversey(2) — — 64.8 — — Add: 2011–2014 Integration and Optimization Program restructuring charges(2) 52.9 — 52.9 — — Add: Additional cost of sales for the step-up in inventories(3) — — 11.6 — — Add: European manufacturing facility closure charges(4) 0.2 6.9 0.2 6.9 — Add: Legacy Diversey non-recurring charges(4) 37.4 46.1 12.6 — — Add: Global manufacturing strategy charges(4) — 7.4 — 7.4 16.7

Non-U.S. GAAP adjusted operating profit $728.0 $749.1 $589.5 $549.3 $509.0

As a % of total net sales 9.0% 9.8% 10.5% 12.2% 12.0%

Total net sales $8,105 $7,618 $5,641 $4,490 $4,243 Additional information:

Depreciation expense on property, plant and equipment $185.5 $192.5 $148.2 $143.5 $142.8 Amortization expense on acquired intangible assets $134.5 $136.5 $ 41.3 $ 11.2 $ 11.7 Share-based incentive compensation expense $ 26.4 $ 42.9 $ 25.0 $ 30.6 $ 38.8

| (1) |

|

Includes the results of Diversey from October 3, 2011 through December 31, 2011. |

(2) These items are not considered part of our ongoing business and considered one-time in nature and will not have a continuing impact on our ongoing business or on the consolidated statements of operations. Under U.S. GAAP, the costs related to the acquisition of Diversey have been excluded from the 2011 pro forma U.S. GAAP operating profit as reported as these costs are treated as non-recurring pro forma adjustments.

(3) This item represents the net step-up in the fair value of Diversey’s inventories, net. The impact to cost of sales is one-time in nature and will not have a continuing impact on our ongoing business or on the consolidated statements of operations. Under U.S. GAAP, the impact of the step-up in inventories has been excluded from the 2011 pro forma U.S. GAAP operating profit as reported as this charge was treated as a non-recurring pro forma adjustment.

(4) These items represent special items and certain one-time charges principally associated with past restructuring programs for both Sealed Air and Diversey. These amounts are not part of our ongoing business and are not expected to have a continuing impact on the consolidated statements of operations.

The following is a reconciliation of U.S. GAAP net earnings as reported to non-U.S. GAAP EBIT, EBITDA and Adjusted EBITDA.

Pro Forma

Year Ended Year Ended December 31, December 31,

(unaudited) ($ in millions) 2011 2010 2011 2010 2009

U.S. GAAP net earnings available to common stockholders—diluted as reported $ 129.8 $ 173.8 $ 148.3 $ 254.4 $ 246.9 Add: Interest expense 402.2 409.7 217.1 161.6 154.9 Add: Income tax provision 94.2 74.9 67.0 87.5 85.6

Non-U.S. GAAP EBIT $ 626.2 $ 658.4 $ 432.4 $ 503.5 $ 487.4 Add: Depreciation and amortization expense 320.0 329.0 189.5 154.7 154.5

Non-U.S. GAAP EBITDA $ 946.2 $ 987.4 $ 621.9 $ 658.2 $ 641.9 Add: Share-based incentive compensation expense 26.4 42.9 25.0 30.6 38.8 Add: Costs related to the acquisition of Diversey(2) — — 64.8 — — Add: 2011–2014 Integration and Optimization Program restructuring charges 52.9 — 52.9 — — Add: Additional cost of sales for the step-up in inventories, net(2) — — 11.6 — — Add: Legacy Diversey non-recurring charges 37.4 46.1 12.6 — — Add: Loss on debt redemption — 38.5 — 38.5 3.4 Add: Global manufacturing strategy charges — 7.4 — 7.4 16.7 Add: European manufacturing facility closure charges 0.3 6.9 0.3 6.9 — Less: Gain on sale of facility (3.9) — (3.9) — — Less: Gain on sale of available-for-sale securities, net of impairment — (5.9) — (5.9) 4.0 Add/(less): Foreign currency exchange losses (gains) related to Venezuelan subsidiary 0.3 (1.6) 0.3 (5.5) — Add: Settlement agreement related costs 0.9 0.6 0.9 0.6 1.8

Non-U.S. GAAP adjusted EBITDA $1,060.5 $1,122.3 $ 786.4 $ 730.8 $ 706.6 Total net sales $8,105.4 $7,617.8 $5,640.9 $4,490.1 $4,242.8

Non-U.S. GAAP adjusted EBITDA as a percentage of total net sales 13.1% 14.7% 13.9% 16.3% 16.7%

| (1) |

|

Our 2010 and 2009 adjusted EBITDA calculations have been revised to conform to our 2011 presentation. |

| (2) |

|

See Notes 2 and 3 of “Reconciliation of U.S. GAAP operating profit to non-U.S. GAAP adjusted operating profit.” |

The following is a reconciliation of U.S. GAAP pro forma net earnings to non-U.S. GAAP pro forma adjusted net earnings.

Pro Forma Year Ended December 31,

(unaudited) ($ in millions, except per share data) 2011 2010

U.S. GAAP pro forma net earnings $129.8 $173.8 Pro forma net earnings per common share—diluted $ 0.62 $ 0.83

Items excluded from the calculation of non-U.S. GAAP pro forma adjusted net earnings, net of taxes:

Add: 2011–2014 Integration and Optimization Program restructuring charges 34.3 — Add: Legacy Diversey non-recurring charges 22.8 23.8 Add: Loss on debt redemption — 24.3 Add: Global manufacturing strategy charges — 5.1 Add: European manufacturing facility closure charges 0.2 4.8 Less: Gain on sale of facility (3.2) — Less: Gain on sale of available-for-sale securities, net of impairment — (3.7) Add/(less): Foreign currency exchange losses (gains) related to Venezuelan subsidiaries 0.2 (1.1)

Non-U.S. GAAP pro forma adjusted net earnings $184.1 $227.0 Non-U.S. GAAP pro forma adjusted net earnings per common share—diluted $ 0.88 $ 1.09 Pro forma weighted average number of common shares outstanding—diluted 209.2 208.4 Note: The 2011 U.S. GAAP pro forma net earnings presented above excludes the following material, non-recurring adjustments: —costs related to the acquisition of Diversey of $70 million; and —the impact of the step-up in inventories, net of $12 million.

The following reconciliations of U.S. GAAP net earnings as reported to non-U.S. GAAP adjusted net earnings and U.S. GAAP diluted net earnings per common share as reported to non-U.S. GAAP adjusted net earnings per common share.

Year Ended December 31,

(unaudited) ($ in millions, except per share data) 2011 2010 2009

Net Net Net

Earnings EPS Earnings EPS Earnings EPS U.S. GAAP net earnings and EPS available to common stockholders—diluted $148.3 $ 0.80 $254.4 $ 1.44 $246.9 $1.35

Items excluded from the calculation of adjusted net earnings available to common stockholders and adjusted EPS, net of taxes(1): Special items:

Add: Costs related to the acquisition of Diversey 46.0 0.24 — — — — Add: 2011–2014 Integration and Optimization Program restructuring charges 34.3 0.19 — — — — Add: Additional cost of sales for the step-up in inventories 8.6 0.05 — — — — Add: Legacy Diversey non-recurring charges 9.0 0.05 — — — — Add: Loss on debt redemption — — 24.3 0.14 2.1 0.01 Add: Global manufacturing strategy charges — — 5.1 0.03 11.4 0.07 Add: European manufacturing facility closure charges 0.2 — 4.8 0.03 — — Less: Gain on sale of facility (3.2) (0.02) — — — — Less: Gain on sale of available-for-sale securities, net of impairment — — (3.7) (0.02) 2.5 0.01 Add/(less): Foreign currency exchange losses (gains) related to Venezuelan subsidiaries 0.2 — (3.6) (0.02) — —Non-U.S. GAAP adjusted net earnings and EPS $243.4 $ 1.31 $281.3 $ 1.60 $262.9 $1.44 Weighted average number of common shares outstanding— diluted 185.4 176.7 182.6

| (1) |

|

See “Tax Effect on Special Items” below for the tax effect of each item included in the calculations above. |

Year Ended

TAX EFFECT on SPECIAL ITEMS December 31,

(unaudited) ($ in millions) 2011 2010 2009

Costs related to the acquisition of Diversey $18.8 $ — $ —2011–2014 Integration and Optimization Program restructuring charges 18.6 — —Additional cost of sales for the step-up in inventories 3.0 — —Legacy Diversey non-recurring charges 3.6 — —European manufacturing facility closure charges 0.1 2.1 —Gain on sale of facility (0.7) — —Foreign currency exchange losses related to Venezuelan subsidiaries 0.1 (1.9) —Loss on debt redemption — 14.2 1.3 Global manufacturing strategy charges — 2.3 5.3 Gain on sale of available-for-sale securities, net of impairment — 2.2 (1.5)

We calculate non-U.S. GAAP free cash flow as follows:

Year Ended December 31,

(unaudited) ($ in millions) 2011 2010(1) 2009(1)

U.S. GAAP net earnings available to common stockholders—diluted $148.3 $254.4 $246.9

Items excluded from the calculation of adjusted cash net earnings available to common stockholders, net of taxes when applicable:

Add: Amortization expense of acquired intangible assets 28.4 7.1 8.6 Add: Non-cash interest expense, including accrued interest related to the Settlement agreement 51.0 20.5 40.0 Add/(Less): Non-cash income taxes 24.4 31.9 (28.7) Add: Costs related to the acquisition of Diversey 46.0 — — Add: 2011–2014 Integration and Optimization Program restructuring charges 34.3 — — Add: Additional cost of sales for the step-up in inventories, net 8.6 — — Add: Legacy Diversey non-recurring charges 9.0 — — Add: Loss on debt redemption — 24.3 2.1 Add: Global manufacturing strategy charges — 5.1 11.4 Add: European manufacturing facility closure charges 0.2 4.8 — Less: Gain on sale of facility (3.2) — — Less: Gain on sale of available-for-sale securities, net of impairment — (3.7) 2.5 Add/(less): Foreign currency exchange losses (gains) related to Venezuelan subsidiary 0.2 (3.6) —

Non-U.S. GAAP adjusted cash net earnings available to common stockholders $ 347.2 $340.8 $282.8 Add: Depreciation expense on property, plant and equipment 148.2 143.5 154.5 Add: Share-based incentive compensation expense 25.0 30.6 38.8 Less: Capital expenditures (124.5) (87.6) (80.3)

Changes in working capital items:(2)

Receivables, net, excluding acquired receivables balance from Diversey of $592.7 million in 2011, net of cash used to repay accounts receivables securitization program of $80 million in 2009 (96.0) (30.4) 96.1 Inventories, net, excluding the acquired inventories balance from Diversey of $308.1 million in 2011 5.8 (26.4) 94.9 Accounts payable, excluding the acquired balance from Diversey of $337.8 million and accrued acquisition costs of $1.3 million in 2011 47.9 17.8 (63.0)

Non-U.S. GAAP free cash flow $ 353.6 $388.3 $523.8

(1) Our 2010 and 2009 free cash flow calculations have been revised to conform to our 2011 presentation. (2) Includes the impact of foreign currency translation.

DEFINITIONS

Return on Total Assets = Net Earnings / Average Total Assets

Return on Stockholders’ Equity = Net Earnings / Average Total Stockholders’ Equity

Return on Invested Capital = Full year adjusted net operating profit after core taxes / Average invested capital in the period. Core taxes represent the U.S. GAAP effective tax rate after adjusting for permitted exclusions.

Invested capital = Total debt + settlement liability and related accrued interest + total stockholders’ equity — accumulated other comprehensive income — cash and cash equivalents.

[Graphic Appears Here]

STOCK INFORMATION

Our common stock is listed on the New York Stock Exchange and is traded under the ticker symbol SEE. As of January 31, 2012, there were approximately 192.1 million shares of our common stock outstanding and approximately 6,000 holders of record of our common stock.

ANNUAL MEETING

Our Annual Meeting of Stockholders is scheduled to be held on Thursday, May 17, 2012 at 10:00 am (ET) at the Saddle Brook Marriott, 138 New Pehle Avenue, Saddle Brook, New Jersey 07663, USA. This meeting will be webcast.

INFORMATION RESOURCES

Our website, www.sealedair.com, offers news about the Company, our products and solutions, and our citizenship efforts. Our financial news releases, Annual Reports on Form 10-K, Proxy Statements, Annual Reviews, Quarterly Reports on Form 10-Q and other SEC filings are available in the “Investor nformation” section of the web site.

Stockholders who wish to receive paper copies of the information listed above, without charge, should contact our Investor Relations Department by calling (201) 791-7600, by email: investor.relations@ sealedair.com, or by writing to Investor Relations at the following address:

Sealed Air Corporation nvestor Relations 200 Riverfront Boulevard Elmwood Park, New Jersey, USA 07407-1033

For additional information, please contact: Amanda Butler

Executive Director of Investor Relations at (201) 703-4210

INTERESTED IN LEARNING ABOUT OUR CITIZENSHIP INITIATIVES?

Please visit the “Citizenship & Environment” section of our website at www.sealedair.com.

SHAREOWNER ACCOUNT ASSISTANCE

For information and maintenance on your shareholder of record account, please contact:

Computershare Shareowner Services LLC

Newport Office Center VII

480 Washington Boulevard

Jersey City, New Jersey, USA 07310

(800) 648-8381 (US and Canada)

(201) (680)-6578 (International)

(201) 680-6610 (TDD for hearing impaired)

Automated telephone support services are available 24 hours per day 7 days per week. BNY Mellon Shareowner Services customer service representatives are available 9:00 a.m. to 7:00 p.m. (ET), Monday through Friday.

SHAREOWNER INTERNET ACCOUNT ACCESS

For account access via the Internet, please log on to www.bnymellon.com/shareowner.isd. Once registered, shareowners can view account history and complete transactions online.

DIRECT STOCK PURCHASE AND DIVIDEND REINVESTMENT

BNY Mellon Shareowner Services offers the Investor Services program for investors of the Sealed Air Corporation to directly purchase and sell shares of Sealed Air common stock or reinvest dividends.

To request program material and access enrollment, you may visit www.bnymellon.com/shareowner/isd or by contacting BNY Mellon Shareowner Services at the numbers listed above.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

KPMG LLP

Annual Report Design by Curran & Connors, Inc. / www.curran-connors.com

[Graphic Appears Here]

[Graphic Appears Here]

Corporate Headquarters

200 Riverfront Boulevard

Elmwood Park, NJ 07407-1033

(P) 201.791.7600 (F) 201.703.4205

www.sealedair.com

[Graphic Appears Here]

printed on paper with up to 50% recycled content