UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 1-A

TIER I OFFERING

OFFERING STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

|

WEBB INTERACTIVE SERVICES, INC. |

|

(Exact name of registrant as specified in its charter) |

Date: December 27, 2017

|

Colorado |

|

3829 |

|

|

|

(State of Other Jurisdiction |

|

(Primary Standard |

|

(IRS Employer |

Steve Slome

Chief Executive Officer

244 5th Ave, New York, NY 10001

Telephone: (347) 983-9208

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Please send copies of all correspondence to:

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION A.

PART I - NOTIFICATION

Part I should be read in conjunction with the attached XML Document for Items 1-6

PART I - END

| 2 |

PRELIMINARY OFFERING CIRCULAR DATED DECEMBER 26, 2017

An offering statement pursuant to Regulation A relating to these securities has been filed with the U.S. Securities and Exchange Commission, which we refer to as the Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

WEBB INTERACTIVE SERVICES

1,100,000,000 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

In this public offering we, “WEBB INTERACTIVE SERVICES.” are offering 700,000,000 shares of our common stock and our selling shareholders are offering 400,000,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. The offering is being made on a self-underwritten, “best efforts” basis notwithstanding the resale shares may be sold to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale, you should refer to the section entitled “Plan of Distribution” in this offering. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our Chief Operating Officer, Steve Slome. Mr. Slome is deemed to be an underwriter of this offering. He will not receive any commissions or proceeds for selling the shares on our behalf. There is uncertainty that we will be able to sell any of the 700,000,000 shares being offered herein by the Company. All of the shares being registered for sale by the Company will be sold at a fixed price of $0.005 per share for the duration of the Offering. Although our shares are quoted on the Over The Counter Marketplace “OTC” under the symbol “WEBB” shareholders may sell their own shares at prevailing market prices or at privately negotiated prices. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our company’s business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

|

|

|

PRICE TO |

|

SELLING AGENT |

|

NET PROCEEDS TO |

| |||

|

SHARES OFFERED BY COMPANY |

|

PUBLIC |

|

COMMISSIONS |

|

THE COMPANY |

| |||

|

Per Share |

|

$ | 0.005 |

|

|

Not applicable |

|

$ | 0.005 |

|

|

Minimum Purchase |

|

None |

|

|

Not applicable |

|

Not applicable |

| ||

|

Total (700,000,000 shares) |

|

$ | 3,500,000 |

|

|

Not applicable |

|

$ | 3,500,000 |

|

|

SHARES OFFERED SELLING SHAREHOLDERS |

|

PRICE TO |

|

SELLING AGENT COMMISSIONS |

|

NET PROCEEDS TO |

| |||

|

Per Share |

|

$ | 0.005 |

|

|

Not applicable |

|

$ | 0.005 |

|

|

Minimum Purchase |

|

None |

|

|

Not applicable |

|

Not applicable |

| ||

|

Total (400,000,000 shares) |

|

$ | 2,000,000 |

|

|

Not applicable |

|

$ | 2,000,000 |

|

| 3 |

Currently, our officers and directors owns approximately 86% of our Common Stock and 99% of the voting power of our outstanding capital stock (including common and preferred). After the offering, assuming all the shares being offered on behalf of the company are sold, Mr. Slome will hold or have the ability to control approximately 99% of the voting power of our outstanding capital stock.

If all the shares are not sold in the company’s offering, there is the possibility that the amount raised may be minimal and might not even cover the costs of the offering, which the Company estimates at $20,000. The proceeds from the sale of the securities will be placed directly into the Company’s account; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the offering circular. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws. All expenses incurred in this offering are being paid for by the company. There has been no public trading market for the common stock of WEBB INTERACTIVE SERVICES.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF A SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 6.

THE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

| 4 |

You should rely only on the information contained in this offering circular and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this offering circular. If anyone provides you with different information, you should not rely on it.

The date of this offering circular is December 27, 2017

The following table of contents has been designed to help you find important information contained in this offering circular. We encourage you to read the entire offering circular.

| 5 |

You should rely only on the information contained in this offering circular or contained in any free writing offering circular filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this offering circular filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this offering circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

|

|

PAGE |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

7 |

| |

|

|

9 |

| |

|

|

14 |

| |

|

|

15 |

| |

|

|

15 |

| |

|

|

15 |

| |

|

|

17 |

| |

|

|

18 |

| |

|

|

20 |

| |

|

MANAGEMENT’S DECISION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

|

20 |

|

|

|

23 |

| |

|

|

23 |

| |

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS |

|

24 |

|

|

|

24 |

| |

|

|

26 |

| |

|

|

28 |

| |

|

|

F1-F13 |

| |

|

|

|

| |

|

|

|

| |

|

|

30 |

| |

|

|

31 |

|

| 6 |

In this offering circular, ‘‘WEBB Interactive,’’ the “Company,’’ ‘‘we,’’, “WEBB”, ‘‘us,’’ and ‘‘our,’’ refer to WEBB Interactive Services, Inc., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending November 30. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This offering circular, and any supplement to this offering circular include “forward-looking statements”. To the extent that the information presented in this offering circular discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this offering circular.

This summary only highlights selected information contained in greater detail elsewhere in this offering circular. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire offering circular, including “Risk Factors” beginning on Page 6, and the financial statements, before making an investment decision.

The Company

WEBB Interactive Services, Inc. (“Webb Interactive”, “we”, “us”, “our”, or the “Company”) is a Colorado corporation which was originally incorporated as Online System Services, Inc. on March 22, 1974. Online System Services changed its name to Webb Interactive on August 31, 1999. Webb Interactive trades on OTC Markets PINKS under the symbol “WEBB”.

The address of our executive offices is: 244 5th Ave, New York, NY 10001 and our telephone number at that address is (347) 983-9208. The address of our web site is www.webbinteractiveservices.com and www.allocationmedia.com. The information at our web site is for general information and marketing purposes and is not part of this report for purposes of liability for disclosures under the federal securities laws.

Our Company

Our Company is an American production company committed to producing high-quality low- to medium-budget films and television series (“Content”) through our state-of-the-art production studio (the “Studio”).

This Offering

All dollar amounts refer to US dollars unless otherwise indicated.

| 7 |

| Table of Contents |

We have 3,119,781,537 shares of common stock issued and outstanding. Through this offering, we intend to register 1,100,000,000 (one billion one hundred million) shares for offering to the public, which represents 700,000,000 additional common stock. The price at which we offer these shares is fixed at $0.005 per share for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of the common stock.

|

Securities being offered by the Company |

|

700,000,000 shares of common stock, at a fixed price of $0.005 offered by us in a direct offering. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. |

|

|

|

|

|

Securities being offered by the Selling Stockholders |

|

400,000,000 shares of common stock, at a fixed price of $0.005 offered by selling stockholders in a resale offering. This fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. |

|

|

| |

|

Offering price per share |

|

We and the selling shareholders will sell the shares at a fixed price per share of $0.005 for the duration of this Offering. |

|

|

| |

|

Number of shares of common stock outstanding before the offering of common stock |

|

3,119,784,537 common shares are currently issued and outstanding. |

|

|

| |

|

Number of shares of common stock outstanding after the offering of common stock |

|

3,819,784,537 common shares will be issued and outstanding if we sell all of the shares we are offering herein. |

|

|

| |

|

Number of shares of preferred stock outstanding before the offering of common stock |

|

The following Preferred shares are currently issued and outstanding: 10,000,000 shares of Series A Preferred Stock 1,000,000 shares of Series B Preferred |

|

|

| |

|

Number of shares of preferred stock outstanding after the offering of common stock |

|

The following Preferred shares will be issued and outstanding after offering: 10,000,000 shares of Series A Preferred Stock 1,000,000 shares of Series B Preferred |

|

|

| |

|

The minimum number of shares to be sold in this offering |

|

None. |

|

|

| |

|

Market for the common shares |

|

There is a public market for the common shares on OTC PINKS under the symbol “WEBB”. As of December 26, 2017, WEBB is trading at $0.0011 X $0.0029 per share. The last transaction price was at $0.0006.

The offering price for the shares will remain at $0.005 per share for the duration of the offering. |

|

|

|

|

|

Use of Proceeds |

|

We intend to use the net proceeds to us for working capital, to increase our current level of inventory, to initiate marketing efforts to consumers, and to update our website so that it is more appealing to the consumer. |

| 8 |

| Table of Contents |

|

Termination of the Offering |

|

This offering will terminate upon the earlier to occur of (i) 365 days after this Offering Statement becomes qualified with the Securities and Exchange Commission, or (ii) the date on which all 1,100,000,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. |

|

|

| |

|

Subscriptions: |

|

All subscriptions once accepted by us are irrevocable. |

|

|

| |

|

Risk Factors: |

|

See “Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

An investment in our shares involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below, together with the cautionary statement that follows this section and the other information included in this Offering Circular, before purchasing our shares in this offering. If one or more of the possibilities described as risks below actually occur, our operating results and financial condition would likely suffer and the trading price, if any, of our shares could fall, causing you to lose some or all of your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment in our securities.

Since our officers and directors currently owns over 86.5%% of the outstanding common stock, investors may find that his decisions are contrary to their interests. You should not purchase shares unless you are willing to entrust all aspects of management to our sole officer and director, or his successors.

Our officers and directors own 2,700,000,000 shares of common stock representing 86.5% of our outstanding stock. Our officers and directors will own 2,700,000,000 shares of our common stock after this offering is completed representing approximately 70.7% of our outstanding common shares, assuming all securities are sold. As a result, our officers and directors will have control of the Company even if the full offering is subscribed for and be able to choose all of our directors. Their interests may differ from the ones of other stockholders. Factors that could cause his interests to differ from the other stockholders include the impact of corporate transactions on the timing of business operations and his ability to continue to manage the business given the amount of time he is able to devote to us.

Purchasers of the offered shares may not participate in our management and, therefore, are dependent upon his management abilities. The only assurance that our shareholders, including purchasers of the offered shares, have that our sole officer and director will not abuse his discretion in executing our business affairs, as his fiduciary obligation and business integrity. Such discretionary powers include, but are not limited to, decisions regarding all aspects of business operations, corporate transactions and financing.

Accordingly, no person should purchase the offered shares unless willing to entrust all aspects of management to the sole officer and director, or his successors. Potential purchasers of the offered shares must carefully evaluate the personal experience and business performance of our management.

FORWARD LOOKING STATEMENTS

This offering circular contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this offering circular.

| 9 |

| Table of Contents |

Investing in the Company’s Securities is very risky. You should be able to bear a complete loss of your investment. You should carefully consider the following factors, including those listed in this Securities Offering.

Risks Related to our Business

This offering is being conducted by our officer and director, Steve Slome, without the benefit of an underwriter, who could have confirmed the accuracy of the disclosures in our prospectus.

We have self-underwritten our offering on a “best efforts” basis, which means: No underwriter has engaged in any due diligence activities to confirm the accuracy of the disclosure in the prospectus or to provide input as to the offering price; our officers and directors will attempt to sell the shares and there can be no assurance that all of the shares offered under the prospectus will be sold or that the proceeds raised from the offering, if any, will be sufficient to cover the costs of the offering; and there is no assurance that we can raise the intended offering amount.

We are not currently profitable and may not become profitable.

We have incurred operating losses since our formation and expect to incur losses in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. There is substantial doubt as to our ability to continue as a going concern.

As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our business.

We are dependent upon the proceeds of this offering to fund our business. If we do not sell enough shares in this offering to continue operations, this could have a negative effect on the value of the common stock.

We must raise approximately $1,000,000 of the $3,500,000 offered in this offering to complete production of both television shows. Unless we begin to generate sufficient revenues to finance operations as a going concern, we may experience liquidity and solvency problems. Such liquidity and solvency problems may force us to cease operations if additional financing is not available.

Our minimal operating history gives no assurances that our future operations will result in profitable revenues, which could result in the suspension or end of our operations.

We have a limited operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the completion of this offering and our ability to generate revenues.

There is substantial doubt as to our ability to continue as a going concern. We have incurred significant operating losses since our formation and expect to incur significant losses in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our business and may cause us to go out of business.

Because we don’t have our own production facility, our business may not come to fruition.

We have not yet constructed a production facility to produce our projects and rely on 3rd party production facilities to film our projects. If we are unable to rent suitable production facilities, we may have to cease our operations, resulting in the complete loss of your investment.

| 10 |

| Table of Contents |

We are a new company with a limited operating history and we face a high risk of business failure that could result in the loss of your investment.

We are a development stage company formed recently to carry out the activities described in this prospectus and thus have only a limited operating history upon which an evaluation of our Offering Circular can be made. We have limited business operations.

Accordingly, our future revenue and operating results are difficult to forecast. As of the date of this Offering Circular, we have earned limited revenue. Failure to generate revenue in the future will cause us to go out of business, which could result in the complete loss of your investment.

Adverse developments in the global economy restricting the credit markets may materially and negatively impact our business.

The recent downturn in the world’s major economies and the constraints in the credit markets have heightened or could continue to heighten a number of material risks to our business, cash flows and financial condition, as well as our future prospects. Continued issues involving liquidity and capital adequacy affecting lenders could affect our ability to access credit facilities or obtain debt financing and could affect the ability of lenders to meet their funding requirements when we need to borrow. Further, in the uncertain event that a public market for our stock develops, the volatility in the equity markets may make it difficult in the future for us to access the equity markets for additional capital at attractive prices, if at all. The current credit crisis in other countries, for example, and concerns over debt levels of certain other European Union member states, has increased volatility in global credit and equity markets. If we are unable to obtain credit or access capital markets, our business could be negatively impacted. For example, we may be unable from this offering).

Our content may not find acceptance with the public.

We are a new company with limited established visibility or recognition in the video entertainment community. If we are not able to have our content accepted by the marketplace, we may not be able to generate revenues and our business plan may fail.

Our operating results may prove unpredictable, which could negatively affect our profit.

Our operating results are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control. Factors that may cause our operating results to fluctuate significantly include: our inability to generate enough working capital from advertising, our inability to secure high-quality scripts, projects and Content; the level of commercial acceptance of our Content; fluctuations in the demand for our Content; the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure and general economic conditions. If realized, any of these risks could have a material adverse effect on our business, financial condition and operating results.

Key management personnel may leave the Company, which could adversely affect the ability of the Company to continue operations.

Because we are entirely dependent on the efforts of our officers and directors, any one of their departure or the loss of other key personnel in the future, could have a material adverse effect on the business. We believe that all commercially reasonable efforts have been made to minimize the risks attendant with the departure by key personnel from service.

However, there is no guarantee that replacement personnel, if any, will help the Company to operate profitably. We do not maintain key-person life insurance on our sole officer and director.

If our Company is dissolved, it is unlikely that there will be sufficient assets remaining to distribute to our shareholders.

In the event of the dissolution of our company, the proceeds realized from the liquidation of our assets, if any, will be used primarily to pay the claims of our creditors, if any, before there can be any distribution to the shareholders. In that case, the ability of purchasers of the offered shares to recover all or any portion of the purchase price for the offered shares will depend on the amount of funds realized and the claims to be satisfied there from.

| 11 |

| Table of Contents |

If we are unable to manage our future growth, our business could be harmed and we may not become profitable.

Significant growth may place a significant strain on management, financial, operating and technical resources. Failure to manage growth effectively could have a material adverse effect on the Company’s financial condition or the results of its operations.

Competitors may enter this sector with superior infrastructure, content and backing, infringing on our customer or viewer base, and affecting our business adversely.

We have identified a market opportunity for our services. Competitors may enter this sector with superior service. This would infringe on our customer base, having an adverse affect upon our business and the results of our operations.

Since we anticipate operating expenses will increase prior to earning revenue, we may never achieve profitability.

We anticipate an increase in our operating expenses, without realizing any revenues from the sale of its service. Within the next 18 months, we will have costs related to (i) developing television shows, (ii) development of additional scripts; (iii) initiation of our marketing and promotional campaign, (iv) administrative expenses, and (v) the expenses of this offering.

There is no history upon which to base any assumption as to the likelihood that we will prove successful. We cannot provide investors with any assurance that our Content will attract viewers; generate any operating revenue or ever achieve profitable operations. If we are unable to address these risks, there is a high probability that our business can fail, which will result in the loss of your entire investment.

Risks Related To This Offering

Investing in our company is highly speculative and could result in the entire loss of your investment.

Purchasing the offered shares is highly speculative and involves significant risk. The offered shares should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish them. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered shares and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

Investing in our company may result in an immediate loss because buyers will pay more for our common stock than what the pro rata portion of the assets are worth.

We have only been recently formed and have only a limited operating history with limited earnings; therefore, the price of the offered shares is not based on any data. The offering price and other terms and conditions regarding our shares have been arbitrarily determined and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. No investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

The arbitrary offering price of $0.005 per share as determined herein is substantially higher than the net tangible book value per share of our common stock. Our assets do not substantiate a share price of $0.005. This premium in share price applies to the terms of this offering. The offering price will not change for the duration of the offering even if we obtain a listing on any exchange or become quoted on the OTC Bulletin Board.

We have 5,000,000,000 authorized shares, of which only 3,119,781,537 shares are currently issued and outstanding and only 3,819,781,537 shares will be issued and outstanding after this offering terminates (assuming all shares have been sold). Our management could, with the consent of the existing shareholders, issue substantially more shares, causing a large dilution in the equity position of our current shareholders.

| 12 |

| Table of Contents |

As we do not have an escrow or trust account with the subscriptions for investors, if we file for or are forced into bankruptcy protection, investors will lose their entire investment.

Invested funds for this offering will not be placed in an escrow or trust account and if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors.

We do not anticipate paying dividends in the foreseeable future, so there will be less ways in which you can make a gain on any investment in us.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

In the event that our shares are traded, they may trade under $5.00 per share, and thus will be considered a penny stock. Trading penny stocks has many restrictions and these restrictions could severely affect the price and liquidity of our shares.

In the event that our shares are traded, and our stock trades below $5.00 per share, our stock would be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a “penny stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to.

Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may also limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

You may face significant restriction on the resale of your shares due to state “Blue Sky” laws.

Each state has its own securities laws, often called “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (2) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. The applicable broker-dealer must also be registered in that state.

| 13 |

| Table of Contents |

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as market makers for our common stock. We have not yet applied to have our securities registered in any state and will not do so until we receive expressions of interest from investors resident in specific states after they have viewed this Prospectus. We will initially focus our offering in the state of New York and will rely on exemptions found under New York Law. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

The price of the current offering is fixed at $0.005 per share. This price is significantly higher than the price paid by the Company’s officer and director which was $0.00.

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash from outside investors, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of the new investors stake is diluted because each share of the same type is worth the same amount, and the new investor has paid more for the shares than earlier investors did for theirs.

We intend to sell 700,000,000 shares of our Common Stock. We were initially capitalized by the sale of our Common Stock. The following table sets forth the number of shares of Common Stock purchased from us, the total consideration paid and the price per share. The table assumes all 700,000,000 shares of Common Stock will be sold.

|

|

|

Shares Issued |

|

|

Total Consideration |

|

|

Price |

| |||||||||||

|

|

|

Number |

|

|

Percent |

|

|

Amount |

|

|

Percent |

|

|

Per Share |

| |||||

|

Existing Shareholders |

|

|

3,119,784,537 |

|

|

|

82.7 | % |

|

$ | 11,000 |

|

|

|

0.1 | % |

|

$ | 0.000 |

|

|

Purchasers of Shares |

|

|

700,000,000 |

|

|

|

18.3 | % |

|

$ | 3,500,000 |

|

|

|

99.9 | % |

|

$ | 0.005 |

|

|

Total |

|

|

3,819,784,537 |

|

|

|

100 | % |

|

$ | 3,511,000 |

|

|

|

100 | % |

|

$ | 0.001 |

|

The following table sets forth the difference between the offering price of the shares of our Common Stock being offered by us, the net tangible book value per share, and the net tangible book value per share after giving effect to the offering by us, assuming that 100%, 50%, 25% and 10% of the offered shares are sold. Net tangible book value per share represents the amount of total tangible assets less total liabilities divided by the number of shares outstanding as of November 30, 2017. Totals may vary due to rounding.

|

|

|

100% of offered shares are sold |

|

|

50% of offered shares are sold |

|

|

25% of offered shares are sold |

|

|

10% of offered shares are sold |

| ||||

|

|

|

|

100 | % |

|

|

50 | % |

|

|

25 | % |

|

|

10 | % |

|

Offering Price |

|

$ | 0.005 |

|

|

$ | 0.005 |

|

|

$ | 0.005 |

|

|

$ | 0.005 |

|

|

|

|

per share |

|

|

per share |

|

|

per share |

|

|

per share |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net tangible book value at November 30, 2017 |

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

|

|

per share |

|

|

per share |

|

|

per share |

|

|

per share |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net tangible book value after giving effect to the offering |

|

$ | 0.001 |

|

|

$ | 0.0005 |

|

|

$ | 0.00027 |

|

|

$ | 0.0001 |

|

|

|

|

per share |

|

|

per share |

|

|

per share |

|

|

per share |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to cash payments made by new investors |

|

$ | 0.001 |

|

|

$ | 0.0005 |

|

|

$ | 0.00027 |

|

|

$ | 0.0001 |

|

|

|

|

per share |

|

|

per share |

|

|

per share |

|

|

per share |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Dilution to New Investors |

|

$ | 0.0041 |

|

|

$ | 0.0045 |

|

|

$ | 0.0047 |

|

|

$ | 0.0049 |

|

|

|

|

per share |

|

|

per share |

|

|

per share |

|

|

per share |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent Dilution to New Investors |

|

|

81.67 | % |

|

|

89.91 | % |

|

|

94.69 | % |

|

|

97.81 | % |

| 14 |

| Table of Contents |

The shares being offered for resale by the selling stockholders consist of 400,000,000 shares of our common stock held by 2 (two) shareholder.

The following table sets forth the name of the selling stockholders, the number of shares of common stock beneficially owned by each of the selling stockholders as of December 26, 2017 and the number of shares of common stock being offered by the selling stockholders. The shares being offered hereby are being registered to permit public secondary trading, and the selling stockholders may offer all or part of the shares for resale from time to time. However, the selling stockholders are under no obligation to sell all or any portion of such shares nor are the selling stockholders obligated to sell any shares immediately upon effectiveness of this offering circular. All information with respect to share ownership has been furnished by the selling stockholders.

|

Name of selling stockholder |

|

Shares of Common stock owned prior to offering |

|

|

Shares of Common stock to be sold |

|

|

Shares of Common stock owned after offering (if all shares are sold) |

|

|

Percent of common stock owned after offering (if all shares are sold) |

| ||||

|

AW Finance Group Ltd* |

|

|

300,000,000 |

|

|

|

300,000,000 |

|

|

|

0 |

|

|

|

0 | % |

|

Matt Bilington |

|

|

100,000,000 |

|

|

|

100,00,000 |

|

|

|

0 |

|

|

|

0 | % |

|

Total |

|

|

400,000,000 |

|

|

|

400,000,000 |

|

|

|

0 |

|

|

|

0 | % |

_____________

* Anastasia Shishova is the Chief Executive Officer, Chief Financial Officer, and Director of the Selling Shareholder.

DETERMINATION OF OFFERING PRICE

The offering price of the common stock has been arbitrarily determined and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings or net worth. No valuation or appraisal has been prepared for our business. We cannot assure you that a public market for our securities will develop or continue or that the securities will ever trade at a price higher than the offering price.

Our common stock offered through this offering is being made by Steve Slome, our Chief Operating Officer, on behalf of the Company and by the selling shareholder through a direct public offering. Our Common Stock may be sold or distributed from time to time by Mr. Slome or the selling shareholder or directly to one or more purchasers utilizing general solicitation through the internet, social media, and any other means of widespread communication notwithstanding the selling shareholders may also use crowdfunding sites, brokers, dealers, or underwriters who may act solely as agents at a fixed price of $0.005 per share. The sale of our common stock offered by us or the selling shareholder through this offering may be effected by one or more of the following methods: internet, social media, and any other means of widespread communication including but not limited to crowdfunding sites, ordinary brokers’ transactions;· transactions involving cross or block trades; through brokers, dealers, or underwriters who may act solely as agents; in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;· in privately negotiated transactions; or· any combination of the foregoing. The selling stockholders may also sell shares of Common Stock under Rule 144 promulgated under the Securities Act, if available, rather than under this prospectus. In addition, the selling stockholder may transfer the shares of our common stock by other means not described in this prospectus. Brokers, dealers, underwriters, or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from the selling stockholder and/or purchasers of the common stock for whom the broker-dealers may act as agent.

| 15 |

| Table of Contents |

The Company has 3,119,784,537 shares of common stock issued and outstanding as of the date of this offering circular. The Company is registering an additional 700,000,000 shares of its common stock for sale at the price of $0.005 per share.

There is no arrangement to address the possible effect of the offering on the price of the stock.

In connection with the Company’s selling efforts in the offering, Steve Slome will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Cameron Cox is not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Cameron Cox will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Cox is not, nor has he been within the past 12 months, a broker or dealer, and he is not, nor has he been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Cox will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities. Cameron Cox will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

The Company will receive all proceeds from the sale of the 700,000,000 shares being offered on behalf of the company itself. The Company will not receive any proceeds from the sale of the selling shareholder’s shares. The price per share is fixed at $0.005 for the duration of this offering. Our common stock is listed on a public exchange and quoted over-the counter, OTC PINK, under the symbol, WEBB. The Company’s shares may be sold to purchasers from time to time directly by and subject to the discretion of the Company. The shares of common stock sold by the Company or selling shareholder may be occasionally sold in one or more transactions; all shares sold under this offering circular will be sold at a fixed price of $0.005 per share.

The Company will pay all expenses incidental to the registration of the shares (including registration pursuant to the securities laws of certain states), which we expect to be no more than $20,000.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must

- Execute and deliver a subscription agreement; and

- Deliver a check or certified funds to us for acceptance or rejection.

All checks for subscriptions must be made payable to “WEBB Interactive Services” or “Allocation Media.” Allocation Media the wholly own subsidiary of Webb Interactive Services. The Company will deliver stock certificates attributable to shares of common stock purchased directly to the purchasers within ninety (90) days of the close of the offering.

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected with letter by mail within 48 hours after we receive them.

| 16 |

| Table of Contents |

Our offering is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.005 The following table sets forth the uses of proceeds assuming the sale of 100%, 75%, 50%, and 25% of the securities offered for sale by the Company. There is no assurance that we will raise the full $3,500,000 as anticipated.

If 700,000,000 shares (100%) are sold:

Next 12 months

|

Planned Actions |

|

Estimated Cost to Complete |

| |

|

Salary for current or future employees |

|

$ | 200,000 |

|

|

Development costs associated with current projects |

|

$ | 1,000,000 |

|

|

Development costs for future projects |

|

$ | 1,000,000 |

|

|

Marketing and distribution costs of product(s) |

|

$ | 500,000 |

|

|

General operating capital |

|

$ | 800,000 |

|

|

TOTAL |

|

$ | 3,500,000 |

|

If 525,000,000 shares (75%) are sold:

Next 12 months

|

Planned Actions |

|

Estimated Cost to Complete |

| |

|

Salary for current or future employees |

|

$ | 200,000 |

|

|

Development costs associated with current projects |

|

$ | 1,000,000 |

|

|

Development costs for future projects |

|

$ | 500,000 |

|

|

Marketing and distribution costs of product(s) |

|

$ | 500,000 |

|

|

General operating capital |

|

$ | 425,000 |

|

|

TOTAL |

|

$ | 2,625,000 |

|

If 350,000,000 shares (50%) are sold:

Next 12 months

|

Planned Actions |

|

Estimated Cost to Complete |

| |

|

Salary for current or future employees |

|

$ | 200,000 |

|

|

Development costs associated with current projects |

|

$ | 1,000,000 |

|

|

Development costs for future projects |

|

$ | 250,000 |

|

|

Marketing and distribution costs of product(s) |

|

$ | 250,000 |

|

|

General operating capital |

|

$ | 50,000 |

|

|

TOTAL |

|

$ | 1,750,000 |

|

If 175,000,000 shares (25%) are sold:

Next 12 months

|

Planned Actions |

|

Estimated Cost to Complete |

| |

|

Salary for current or future employees |

|

$ | 200,000 |

|

|

Development costs associated with current projects |

|

$ | 500,000 |

|

|

Development costs for future projects |

|

$ | 0 |

|

|

Marketing and distribution costs of product(s) |

|

$ | 125,000 |

|

|

General operating capital |

|

$ | 50,000 |

|

|

TOTAL |

|

$ | 875,000 |

|

The above figures represent only estimated costs for the next 12 months.

| 17 |

| Table of Contents |

Item 7: Description of Business

We are a development-stage company, incorporated in the State of Colorado on March 22, 1994, as a for-profit company with a fiscal year end of November 30. Our business and registered office is located at 244 5th Ave, New York, NY 10001. Our telephone number is (347) 983-9208. Our E-Mail address is investors@webbinteractiveservices.com.

Reverse Merger

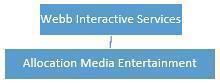

On November 30, 2017, the Company executed a reverse merger with Allocation Media Entertainment, Inc. whereby the Company acquired 100% of Allocation Media, in exchange for 2,700,000,000 shares of Webb Interactive Services common stock and 10,000,000 shares of Series A Preferred Stock. Immediately prior to the reverse merger, there were 19,781,537 common shares outstanding and no shares of Preferred shares outstanding and Matt Billington was the sole officer/director. After the reverse merger, the Company had 2,719,781,537 Common shares outstanding and 0 shares of Preferred shares outstanding.

Allocation Media Entertainment was incorporated in the State of Colorado on August 4, 2017. Allocation Media Entertainment was the surviving Company and became a wholly owned subsidiary of Webb Interactive Services. Webb Interactive Services had no operations, assets or liabilities prior to the reverse merger. This is the current corporate organization:

Webb Interactive, Inc. trades on the OTC Pink Sheets under the symbol “WEBB”.

Business of Registrant

Allocation Media Entertainment creates and distributes both unscripted and scripted television programming. We specialize in high concept material that is inspiring, entertaining and thought-provoking. Our shows are distributed to numerous broadcast, cable, syndicated, digital and foreign territories around the world.

Current Production Projects

At this time, we are in discussion with several scriptwriters and production companies who are interested in retaining our services to produce their projects; however, we have not yet entered into any binding agreements with these entities. The determining factor in securing production agreements with these entities is whether we can raise sufficient capital to produce their projects. Our current projects can be located at http://allocationmedia.com/shows/.

Government Regulations

We are unaware of and do not anticipate having to expend significant resources to comply with any local, state and governmental regulations. We are subject to the laws and regulations of those jurisdictions in which we plan to offer our programming, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and/or supervisory requirements.

Competition

At this time, we have not completed a thorough competitive analysis. We intend to use part of the proceeds to conduct such analysis and structure our strategy accordingly.

| 18 |

| Table of Contents |

Employees and Employment Agreements

As of November 30, 2017, we have no employees other than Mr. Slome and Mr. Mattheu, our officers and directors. Our officers have the flexibility to work on our business as required to execute the business plan and are prepared to devote more time to our operations as may be required and we do not have any employment agreements with them.

We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our sole director and officer.

During the initial implementation of our business plan, we intend to hire independent consultants to assist in the development of our shows.

Intellectual Property

We do not currently hold rights to any intellectual property and have not filed for copyright or trademark protection for our name, channel or intended website.

Research and Development

Since our inception to the date of this Offering Circular, we have not spent any money on research and development activities.

Reports to Security Holders

We will and will continue to make our financial information equally available to any interested parties or investors through compliance with the disclosure rules of Regulation S-K for a smaller reporting company under the Securities Exchange Act. In addition, we will file Form 8-K and other proxy and information statements from time to time as required. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Legal Proceedings

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we are an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of:

|

|

· |

the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; |

|

|

· |

the last day of the fiscal year following the fifth anniversary of the effective date of this registration statement; |

| 19 |

| Table of Contents |

|

|

· |

the date on which we have, during the previous three-year period, issued more than $1 billion in non- convertible debt; and |

|

|

· |

the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, or the Exchange Act. |

We will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months. The value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter.

The Section 107 of the JOBS Act provides that we may elect to utilize the extended transition period for complying with new or revised accounting standards and such election is irrevocable if made. As such, we have made the election to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. Please refer to a discussion on page 13 under “Risk Factors” of the effect on our financial statements of such election.

Going Concern

We have expressed substantial doubt about our ability to continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered losses and has experienced negative cash flows from operations, which raises substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to those matters are also described in Note 2 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Item 8: Description of Property

As our office space needs are limited at the current time, we are currently located at 244 5th Ave, New York, NY 10001. Mr. Slome is donating this space usage free of charge.

Item 9: Management’s Decision and Analysis of Financial Condition and Results of Operation

You should read the following discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and the related notes and other financial information included elsewhere in this prospectus. Some of the information contained in this discussion and analysis or set forth elsewhere in this prospectus, including information with respect to our plans and strategy for our business and related financing, includes forward-looking statements that reflect our current views with respect to future events and financial performance, which involve risks and uncertainties. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions, or words that, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions. You should review the “Risk Factors” section of this prospectus for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Our financial statements are stated in United States Dollars (USD or US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common shares” refer to the common shares in our capital stock.

| 20 |

| Table of Contents |

Overview

Results of Operations

There is limited historical financial information about us upon which to base an evaluation of our performance. We have not generated revenues from our operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including the financial risks associated with the limited capital resources currently available to us for the implementation of our business strategies. (See “Risk Factors”). To become profitable and competitive, we must develop the business plan and execute the plan. Our management will attempt to secure financing through various means including borrowing and investment from institutions and private individuals.

Since inception, the majority of our time has been spent refining its business plan and preparing for a primary financial offering.

Liquidity and Capital Resources

As of the date of this offering, we have not generated revenues from our business operations. For the period ending November 30, 2017, we issued 2,700,000,0000 (two billion seven hundred million shares of common stock to our officers and directors as part of the reverse merger; and 400,000,000 (four hundred million) shares to other shareholders as a group.

Our cash balance is $28 as of November 30, 2017. Our cash balance is not sufficient to fund our limited levels of operations for any period of time. Our directors and officers are paying all costs associated with this offering, and shall pay any additional funds that may be required. Accordingly, we anticipate that our current cash on hand is not sufficient to meet our obligations. Based on our disclosure above under “Use of Proceeds,” which is based on utilizing the entire cash on hand for this offering, we anticipate that any level of capital raised above 25% will allow us minimal operations for a twelve-month period.

The Company currently has no external sources of liquidity such as arrangements with credit institutions or off-balance sheet arrangements that will have or are reasonably likely to have a current or future effect on our financial condition or immediate access to capital.

Our directors and officers has made no commitments, written or oral, with respect to providing a source of liquidity in the form of cash advances, loans and/or financial guarantees.

If the Company is unable to raise the funds partially through this offering, the Company will seek alternative financing through means such as borrowings from institutions or private individuals. There can be no assurance that the Company will be able to keep costs from being more than these estimated amounts or that the Company will be able to raise such funds. Even if we sell all shares offered through this Offering Circular, we expect that the Company will seek additional financing in the future. However, the Company may not be able to obtain additional capital or generate sufficient revenues to fund our operations. If we are unsuccessful at raising sufficient funds, for whatever reason, to fund our operations, the Company may be forced to seek a buyer for our business or another entity with which we could create a joint venture. If all of these alternatives fail, we expect that the Company will be required to seek protection from creditors under applicable bankruptcy laws.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. Our Board of Directors is comprised of one individual who is also our executive officer. Our executive officer makes decisions on all significant corporate matters such as the approval of terms of the compensation of our executive officer and the oversight of the accounting functions.

| 21 |

| Table of Contents |

Although the Company has adopted a Code of Ethics and Business Conduct the Company has not yet adopted any of these other corporate governance measures and, since our securities are not yet listed on a national securities exchange, the Company is not required to do so. The Company has not adopted corporate governance measures such as an audit or other independent committees of our board of directors as we presently do not have any independent directors. If we expand our board membership in future periods to include additional independent directors, the Company may seek to establish an audit and other committees of our board of directors. It is possible that if our Board of Directors included independent directors and if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our senior officer and recommendations for director nominees may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

Trends and Key Factors Affecting Our Performance

The core elements of our growth strategy include acquisition and/or development of exceptional production projects. We plan to invest significant resources to accomplish these goals, and we anticipate that our operating expenses will continue to increase for the foreseeable future, particularly production costs, marketing costs, and overhead. These investments are intended to contribute to our long-term growth; however, they may affect our short-term profitability.

Our Company is in the process of raising capital to commence operations, and as of the date of this report, we have not begun production or licensing operations. All our operations to date have been capital raising and developing our business plan. Accordingly, we have not experienced any recognizable trends in the last fiscal year. We intend to produce and license our Content once we commence operations, and begin analyzing trends at that time.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. We have identified below the critical accounting policies which are assumptions made by management about matters that are highly uncertain and that are of critical importance and have a material impact on our financial statements. Management believes that the critical accounting policies and estimates discussed below involve the most complex management judgments due to the sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and expense amounts. Specific risks associated with these critical accounting policies are discussed throughout this MD&A, where such policies have a material effect on reported and expected financial results.

A complete listing of our significant policies is included in the notes to our financial statements for the year ended November 30, 2017.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the amounts reported in the financial statements. Estimates are based on historical experience, management expectations for future performance, and other assumptions as appropriate. We re-evaluate estimates on an ongoing basis; therefore, actual results may vary from those estimates.

| 22 |

| Table of Contents |

Financial Instruments

The Company’s balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

Item 10: Directors, Executive Officers and Significant Employees

The table below sets forth our directors and executive officers of as of the date of this Offering Circular.

|

Name (1) |

|

Position |

|

Age |

|

Term of Office |

|

Approximate Hours Per Week |

|

| ||||||||

|

Steve Slome |

President, Chief Executive Officer, |

Inception to Present |

As required | |||||

|

|

|

|

|

|

|

|

|

|

|

Lee Mattheu |

|

Chief Operating Officer |

|

Inception to Present |

|

As required |

___________

(1) All addresses shall be considered 244 5th Ave, New York, NY 10001

Steve Slome, President, Chief Executive Officer, Chief Financial Officer and Director.