Exhibit 10.1 FIRST AMENDMENT TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT AND FIRST AMENDMENT TO AMENDED AND RESTATED SECURITY AND PLEDGE AGREEMENT THIS FIRST AMENDMENT TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT AND FIRST AMENDMENT TO AMENDED AND RESTATED SECURITY AND PLEDGE AGREEMENT (this “Amendment”) dated as of August 26, 2019 is among Knoll, Inc., a Delaware corporation (the “Parent Borrower”), the Foreign Borrowers party thereto, the Guarantors party thereto, the Lenders party hereto and Bank of America, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer. RECITALS WHEREAS, pursuant to the terms of that certain Third Amended and Restated Credit Agreement, dated as of January 23, 2018 (as amended, restated, amended and restated, extended, increased, supplemented or otherwise modified from time to time, the “Credit Agreement”), among the Parent Borrower, the Foreign Borrowers party thereto, the Guarantors party thereto, the Lenders from time to time party thereto and Bank of America, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer, the Lenders and the L/C Issuers provide credit facilities to the Borrower; WHEREAS, the Loan Parties have requested that the Lenders amend the Credit Agreement and the Security Agreement as set forth below; WHEREAS, the Lenders agree to provide such requested amendments subject to the terms and conditions herein; NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows: 1. Introductory Paragraph and Recitals. The above introductory paragraph and recitals of this Amendment are incorporated herein by reference as if fully set forth in the body of this Amendment. 2. Definitions. Capitalized terms used herein (including in the recitals hereof) and not otherwise defined herein shall have the meanings provided in the Credit Agreement. 3. Amendments. (a) The following definitions are added to Section 1.01 of the Credit Agreement in the appropriate alphabetical order: “Beneficial Ownership Certification” means a certification regarding beneficial ownership required by the Beneficial Ownership Regulation. “Beneficial Ownership Regulation” means 31 C.F.R. § 1010.230. “BHC Act Affiliate” of a party means an “affiliate” (as such term is defined under, and interpreted in accordance with, 12 U.S.C. 1841(k)) of such party. “BofA Securities” means BofA Securities, Inc.

“Covered Entity” means any of the following: (a) a “covered entity” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 252.82(b); (b) a “covered bank” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 47.3(b); or (c) a “covered FSI” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 382.2(b). “Covered Party” has the meaning specified in Section 11.28. “Danish Share Pledge Agreement (Knoll Denmark Equity Interests)” means that certain Share Pledge Agreement dated June 21, 2018 between Knoll Europe, as pledgor, the Secured Parties (as represented by the Administrative Agent), as pledgees, and the Administrative Agent, as the security agent, as may be amended, supplemented, modified, restated or replaced. “Danish Share Pledge Agreement (Muuto A/S Equity Interests)” means that certain Share Pledge Agreement dated June 21, 2018 between Knoll Denmark, as pledgor, the Secured Parties (as represented by the Administrative Agent), as pledgees, and the Administrative Agent, as the security agent, as may be amended, supplemented, modified, restated or replaced. “Default Right” has the meaning assigned to that term in, and shall be interpreted in accordance with, 12 C.F.R. §§ 252.81, 47.2 or 382.1, as applicable. “First Amendment Effective Date” means August 26, 2019. “Multicurrency Term Loan Assumption Agreement” means that certain Foreign Borrower Request and Assumption Agreement dated as of August 28, 2018 by the Parent Borrower, Knoll Denmark and Muuto A/S. “QFC” has the meaning assigned to the term “qualified financial contract” in, and shall be interpreted in accordance with, 12 U.S.C. 5390(c)(8)(D). “QFC Credit Support” has the meaning specified in Section 11.28. “Relevant Governmental Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York for the purpose of recommending a benchmark rate to replace LIBOR in loan agreements similar to this Agreement. “SOFR” with respect to any day means the secured overnight financing rate published for such day by the Federal Reserve Bank of New York, as the administrator of the benchmark (or a successor administrator) on the Federal Reserve Bank of New York’s website (or any successor source) and, in each case, that has been selected or recommended by the Relevant Governmental Body. “SOFR-Based Rate” means SOFR or Term SOFR. “Supported QFC” has the meaning specified in Section 11.28. “Term SOFR” means the forward-looking term rate for any period that is approximately (as determined by the Administrative Agent) as long as any of the Interest Period options set forth in the definition of “Interest Period” and that is based on SOFR and that has been selected or recommended by the Relevant Governmental Body, in each case as published on an information service as selected by the Administrative Agent from time to time in its reasonable discretion. 2 CHAR1\1675275v4

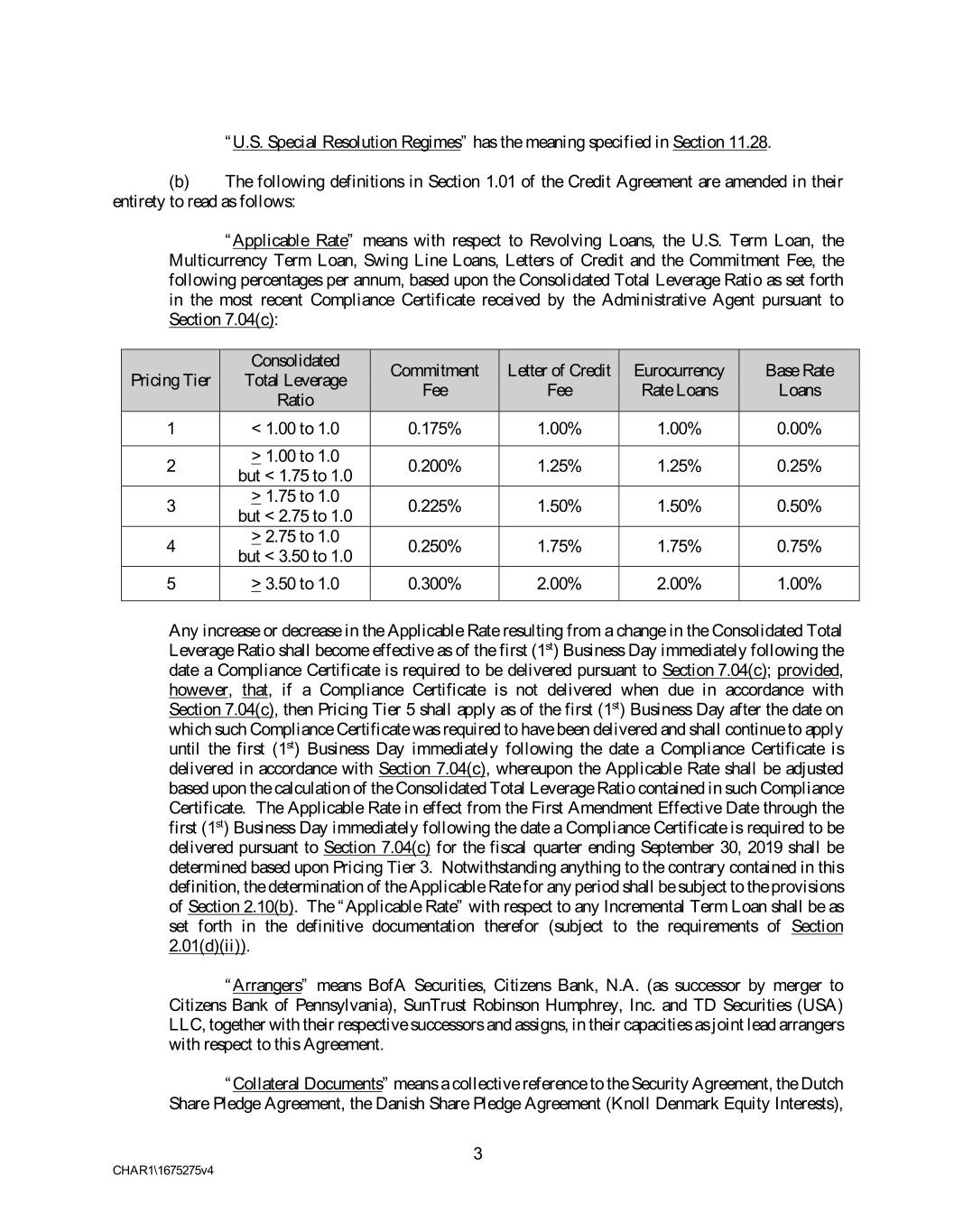

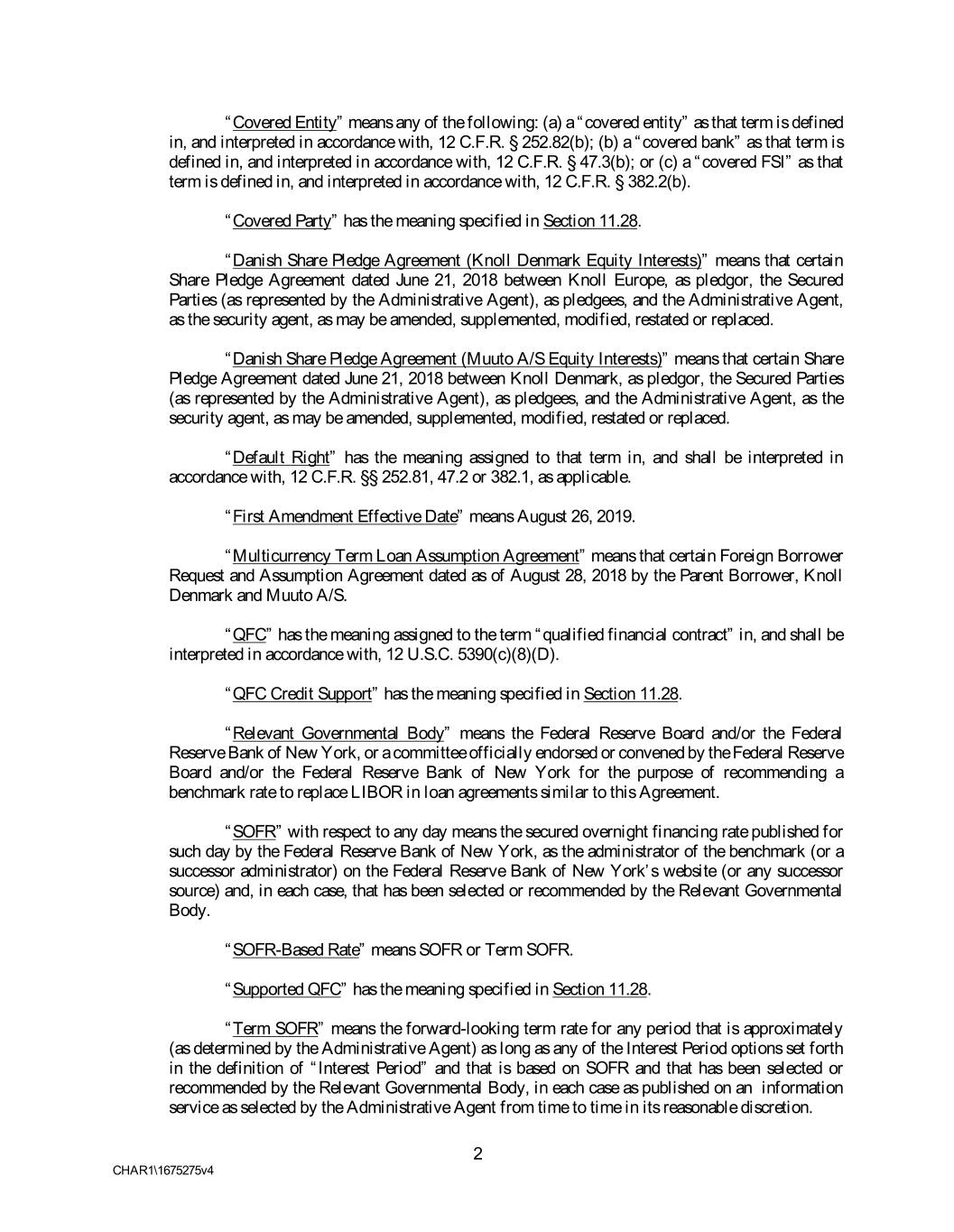

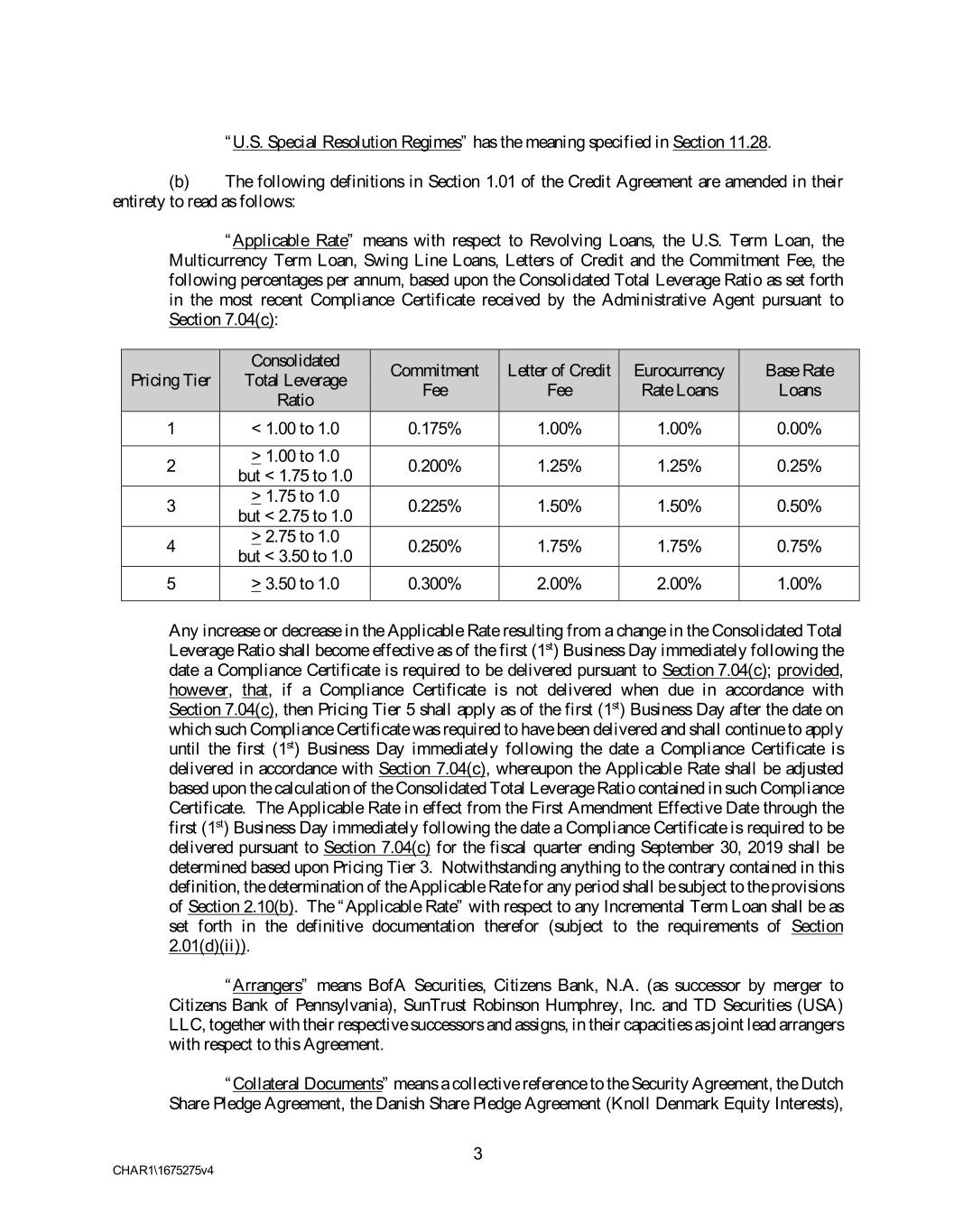

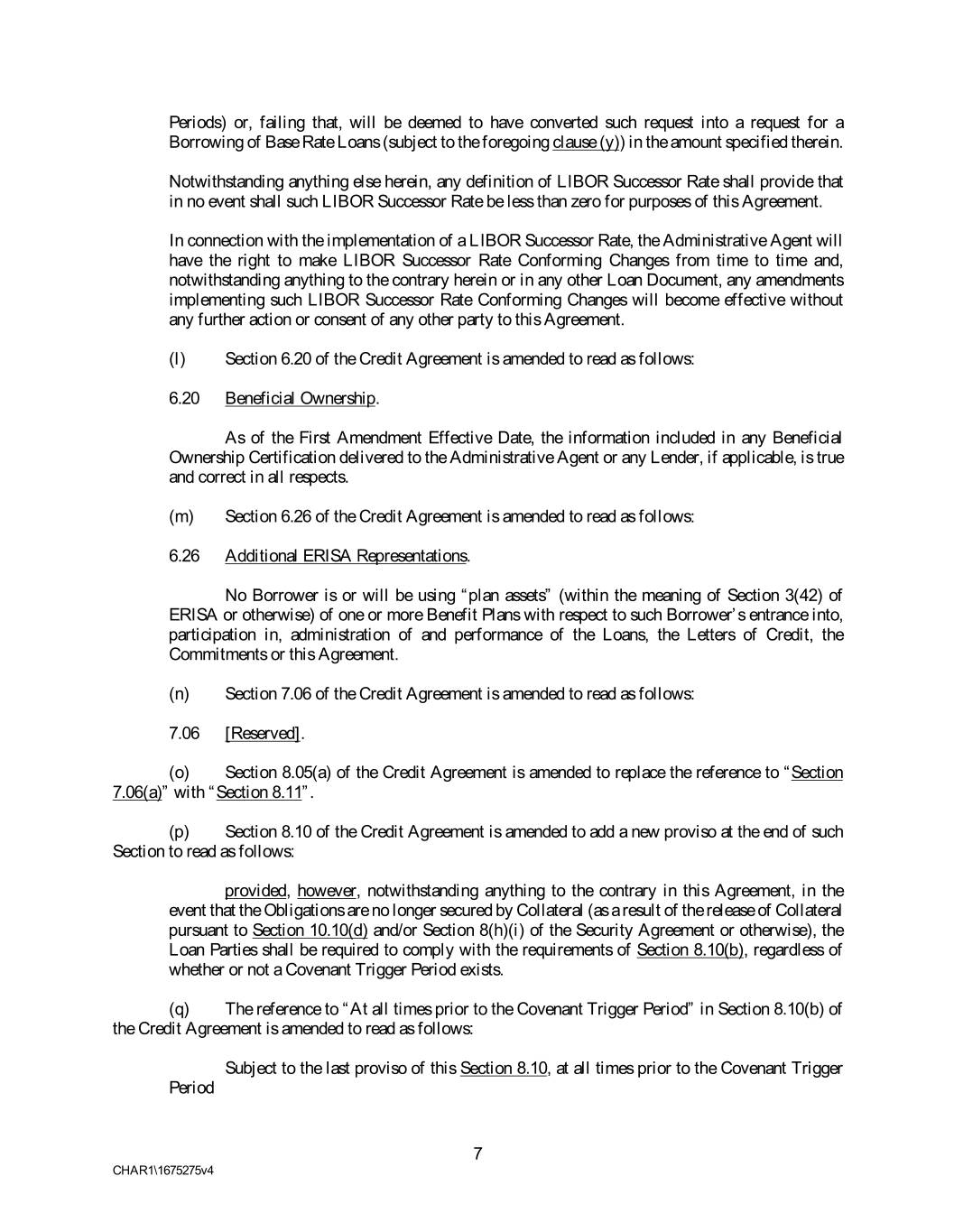

“U.S. Special Resolution Regimes” has the meaning specified in Section 11.28. (b) The following definitions in Section 1.01 of the Credit Agreement are amended in their entirety to read as follows: “Applicable Rate” means with respect to Revolving Loans, the U.S. Term Loan, the Multicurrency Term Loan, Swing Line Loans, Letters of Credit and the Commitment Fee, the following percentages per annum, based upon the Consolidated Total Leverage Ratio as set forth in the most recent Compliance Certificate received by the Administrative Agent pursuant to Section 7.04(c): Consolidated Commitment Letter of Credit Eurocurrency Base Rate Pricing Tier Total Leverage Fee Fee Rate Loans Loans Ratio 1 < 1.00 to 1.0 0.175% 1.00% 1.00% 0.00% > 1.00 to 1.0 2 0.200% 1.25% 1.25% 0.25% but < 1.75 to 1.0 > 1.75 to 1.0 3 0.225% 1.50% 1.50% 0.50% but < 2.75 to 1.0 > 2.75 to 1.0 4 0.250% 1.75% 1.75% 0.75% but < 3.50 to 1.0 5 > 3.50 to 1.0 0.300% 2.00% 2.00% 1.00% Any increase or decrease in the Applicable Rate resulting from a change in the Consolidated Total Leverage Ratio shall become effective as of the first (1st) Business Day immediately following the date a Compliance Certificate is required to be delivered pursuant to Section 7.04(c); provided, however, that, if a Compliance Certificate is not delivered when due in accordance with Section 7.04(c), then Pricing Tier 5 shall apply as of the first (1st) Business Day after the date on which such Compliance Certificate was required to have been delivered and shall continue to apply until the first (1st) Business Day immediately following the date a Compliance Certificate is delivered in accordance with Section 7.04(c), whereupon the Applicable Rate shall be adjusted based upon the calculation of the Consolidated Total Leverage Ratio contained in such Compliance Certificate. The Applicable Rate in effect from the First Amendment Effective Date through the first (1st) Business Day immediately following the date a Compliance Certificate is required to be delivered pursuant to Section 7.04(c) for the fiscal quarter ending September 30, 2019 shall be determined based upon Pricing Tier 3. Notwithstanding anything to the contrary contained in this definition, the determination of the Applicable Rate for any period shall be subject to the provisions of Section 2.10(b). The “Applicable Rate” with respect to any Incremental Term Loan shall be as set forth in the definitive documentation therefor (subject to the requirements of Section 2.01(d)(ii)). “Arrangers” means BofA Securities, Citizens Bank, N.A. (as successor by merger to Citizens Bank of Pennsylvania), SunTrust Robinson Humphrey, Inc. and TD Securities (USA) LLC, together with their respective successors and assigns, in their capacities as joint lead arrangers with respect to this Agreement. “Collateral Documents” means a collective reference to the Security Agreement, the Dutch Share Pledge Agreement, the Danish Share Pledge Agreement (Knoll Denmark Equity Interests), 3 CHAR1\1675275v4

the Danish Share Pledge Agreement (Muuto A/S Equity Interests), and other security documents as may be executed and delivered by the Loan Parties pursuant to the terms of Section 7.09, in each case as amended, modified or reaffirmed from time to time, including pursuant to any reaffirmation agreement. “Dutch Share Pledge Agreement” means that certain notarial deed of pledge dated June 26, 2018 between Knoll Overseas, Inc., a Delaware corporation, as pledgor, the Administrative Agent, as pledgee, and Knoll Europe, as the company, as may be amended, supplemented, modified, restated or replaced. “Fee Letter” means that certain letter agreement, dated December 27, 2017, among the Parent Borrower, BofA Securities (as successor in interest to Merrill Lynch, Pierce, Fenner & Smith Incorporated) and Bank of America. “LIBOR Successor Rate Conforming Changes” means, with respect to any proposed LIBOR Successor Rate, any conforming changes to the definition of Base Rate, Interest Period, timing and frequency of determining rates and making payments of interest and other technical, administrative or operational matters as may be appropriate, in the discretion of the Administrative Agent, to reflect the adoption and implementation of such LIBOR Successor Rate and to permit the administration thereof by the Administrative Agent in a manner substantially consistent with market practice (or, if the Administrative Agent determines that adoption of any portion of such market practice is not administratively feasible or that no market practice for the administration of such LIBOR Successor Rate exists, in such other manner of administration as the Administrative Agent determines is reasonably necessary in connection with the administration of this Agreement). “Maturity Date” means August 26, 2024; provided, however, that, in each case, if such date is not a Business Day, the Maturity Date shall be the next preceding Business Day. (c) The definition of “MLPFS” in Section 1.01 of the Credit Agreement is deleted in its entirety. (d) The definition of “Multicurrency Term Loan Commitment” in Section 1.01 of the Credit Agreement is amended to add a new sentence at the end of such definition to read as follows: As of the First Amendment Effective Date, the aggregate outstanding principal amount of the Multicurrency Term Loan is EUR 76,624,132.50. (e) The definition of “U.S. Term Loan Commitment” in Section 1.01 of the Credit Agreement is amended to add a new sentence at the end of such definition to read as follows: As of the First Amendment Effective Date, the aggregate outstanding principal amount of the U.S. Term Loan is $234,375,000. (f) Section 1.02 of the Credit Agreement is amended by adding a new clause (f) at the end of such Section to read as follows: (f) Any reference herein to a merger, transfer, consolidation, amalgamation, assignment, sale, disposition or transfer, or similar term, shall be deemed to apply to a division of or by a limited liability company, or an allocation of assets to a series of a limited liability company (or the unwinding of such a division or allocation), as if it were a merger, transfer, consolidation, amalgamation, assignment, sale, disposition or transfer, or similar term, as applicable, to, of or with 4 CHAR1\1675275v4

a separate Person. Any division of a limited liability company shall constitute a separate Person hereunder (and each division of any limited liability company that is a Subsidiary, joint venture or any other like term shall also constitute such a Person or entity). (g) Article I of the Credit Agreement is amended by adding a new Section 1.09 to read as follows: 1.09 Rates. The Administrative Agent does not warrant, nor accept responsibility, nor shall the Administrative Agent have any liability with respect to the administration, submission or any other matter related to the rates in the definition of “Eurocurrency Rate” or with respect to any rate that is an alternative or replacement for or successor to any of such rate (including any LIBOR Successor Rate) or the effect of any of the foregoing, or of any LIBOR Successor Rate Conforming Changes. (h) Section 2.01(c) of the Credit Agreement is amended to add a new sentence at the end of such definition to read as follows: As of the First Amendment Effective, each of Knoll Denmark and Muuto A/S is a Borrower under, and holds a portion of, the Multicurrency Term Loan (with Muuto A/S having assumed a portion, and having agreed to assume additional portions in the future, of the Multicurrency Term Loan held by Knoll Denmark pursuant to the Multicurrency Term Loan Assumption Agreement). (i) Sections 2.07(c) and (d) of the Credit Agreement are amended to read as follows: (c) U.S. Term Loan. The Parent Borrower shall repay the outstanding principal amount of the U.S. Term Loan in Dollars in equal quarterly installments of $3,125,000 on the last Business Day of each March, June, September and December, commencing on June 29, 2018, with the remaining outstanding principal amount and any accrued and unpaid interest due and payable in full on the Maturity Date (as such installments may hereafter be adjusted as a result of prepayments made pursuant to Section 2.05), unless accelerated sooner pursuant to Section 9.01. (d) Multicurrency Term Loan. Each applicable Borrower shall repay the outstanding principal amount of the Multicurrency Term Loan in Euro in equal quarterly installments of EUR 1,021,655.10 on the last Business Day of each March, June, September and December, commencing on June 29, 2018, with the remaining outstanding principal amount and any accrued and unpaid interest due and payable in full on the Maturity Date (as such installments may hereafter be adjusted as a result of prepayments made pursuant to Section 2.05), unless accelerated sooner pursuant to Section 9.01. (j) Sections 2.16(a) of the Credit Agreement is amended to read as follows: (a) Effective as of the First Amendment Effective Date, Knoll Denmark, Knoll Europe and Muuto A/S shall each be a “Foreign Borrower” hereunder and may receive Loans for its account on the terms and conditions set forth in this Agreement. (k) Section 3.03(c) of the Credit Agreement is amended to read as follows: (c) Notwithstanding anything to the contrary in this Agreement or any other Loan Documents, if the Administrative Agent determines (which determination shall be conclusive absent manifest error), or the Parent Borrower or Required Lenders notify the Administrative Agent 5 CHAR1\1675275v4

(with, in the case of the Required Lenders, a copy to the Parent Borrower) that the Parent Borrower or Required Lenders (as applicable) have determined, that: (i) adequate and reasonable means do not exist for ascertaining LIBOR for any requested Interest Period, including because the LIBOR Screen Rate is not available or published on a current basis and such circumstances are unlikely to be temporary, (ii) the administrator of the LIBOR Screen Rate or a Governmental Authority having jurisdiction over the Administrative Agent has made a public statement identifying a specific date after which LIBOR or the LIBOR Screen Rate shall no longer be made available, or used for determining the interest rate of loans; provided, that, at the time of such statement, there is no successor administrator that is satisfactory to the Administrative Agent, that will continue to provide LIBOR after such specific date (such specific date, the “Scheduled Unavailability Date”), or (iii) syndicated loans currently being executed, or that include language similar to that contained in this Section 3.03, are being executed or amended (as applicable) to incorporate or adopt a new benchmark interest rate to replace LIBOR, then, reasonably promptly after such determination by the Administrative Agent or receipt by the Administrative Agent of such notice, as applicable, the Administrative Agent and the Parent Borrower may amend this Agreement to replace LIBOR with (x) one or more SOFR-Based Rates or (y) another alternate benchmark rate giving due consideration to any evolving or then existing convention for similar U.S. Dollar denominated syndicated credit facilities for such alternative benchmarks and, in each case, including any mathematical or other adjustments to such benchmark giving due consideration to any evolving or then existing convention for similar U.S. Dollar denominated syndicated credit facilities for such benchmarks, which adjustment or method for calculating such adjustment shall be published on an information service as selected by the Administrative Agent from time to time in its reasonable discretion and may be periodically updated (the “Adjustment”; and any such proposed rate, a “LIBOR Successor Rate”), and any such amendment shall become effective at 5:00 p.m. on the fifth (5th) Business Day after the Administrative Agent shall have posted such proposed amendment to all Lenders and the Parent Borrower unless, prior to such time, Lenders comprising the Required Lenders have delivered to the Administrative Agent written notice that such Required Lenders (A) in the case of an amendment to replace LIBOR with a rate described in clause (x), object to the Adjustment, or (B) in the case of an amendment to replace LIBOR with a rate described in clause (y), object to such amendment; provided, that, for the avoidance of doubt, in the case of clause (A), the Required Lenders shall not be entitled to object to any SOFR-Based Rate contained in any such amendment. Such LIBOR Successor Rate shall be applied in a manner consistent with market practice; provided, that, to the extent such market practice is not administratively feasible for the Administrative Agent, such LIBOR Successor Rate shall be applied in a manner as otherwise reasonably determined by the Administrative Agent. If no LIBOR Successor Rate has been determined and the circumstances under clause (i) above exist or the Scheduled Unavailability Date has occurred (as applicable), the Administrative Agent will promptly so notify the Parent Borrower and each Lender. Thereafter, (x) the obligation of the Lenders to make or maintain Eurocurrency Rate Loans shall be suspended, (to the extent of the affected Eurocurrency Rate Loans or Interest Periods), and (y) the Eurocurrency Rate component shall no longer be utilized in determining the Base Rate. Upon receipt of such notice, the Parent Borrower may revoke any pending request for a Borrowing of, conversion to or continuation of Eurocurrency Rate Loans (to the extent of the affected Eurocurrency Rate Loans or Interest 6 CHAR1\1675275v4

Periods) or, failing that, will be deemed to have converted such request into a request for a Borrowing of Base Rate Loans (subject to the foregoing clause (y)) in the amount specified therein. Notwithstanding anything else herein, any definition of LIBOR Successor Rate shall provide that in no event shall such LIBOR Successor Rate be less than zero for purposes of this Agreement. In connection with the implementation of a LIBOR Successor Rate, the Administrative Agent will have the right to make LIBOR Successor Rate Conforming Changes from time to time and, notwithstanding anything to the contrary herein or in any other Loan Document, any amendments implementing such LIBOR Successor Rate Conforming Changes will become effective without any further action or consent of any other party to this Agreement. (l) Section 6.20 of the Credit Agreement is amended to read as follows: 6.20 Beneficial Ownership. As of the First Amendment Effective Date, the information included in any Beneficial Ownership Certification delivered to the Administrative Agent or any Lender, if applicable, is true and correct in all respects. (m) Section 6.26 of the Credit Agreement is amended to read as follows: 6.26 Additional ERISA Representations. No Borrower is or will be using “plan assets” (within the meaning of Section 3(42) of ERISA or otherwise) of one or more Benefit Plans with respect to such Borrower’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments or this Agreement. (n) Section 7.06 of the Credit Agreement is amended to read as follows: 7.06 [Reserved]. (o) Section 8.05(a) of the Credit Agreement is amended to replace the reference to “Section 7.06(a)” with “Section 8.11”. (p) Section 8.10 of the Credit Agreement is amended to add a new proviso at the end of such Section to read as follows: provided, however, notwithstanding anything to the contrary in this Agreement, in the event that the Obligations are no longer secured by Collateral (as a result of the release of Collateral pursuant to Section 10.10(d) and/or Section 8(h)(i) of the Security Agreement or otherwise), the Loan Parties shall be required to comply with the requirements of Section 8.10(b), regardless of whether or not a Covenant Trigger Period exists. (q) The reference to “At all times prior to the Covenant Trigger Period” in Section 8.10(b) of the Credit Agreement is amended to read as follows: Subject to the last proviso of this Section 8.10, at all times prior to the Covenant Trigger Period 7 CHAR1\1675275v4

(r) The reference to “At all times during the Covenant Trigger Period” in Section 8.10(c) of the Credit Agreement is amended to read as follows: Subject to the last proviso of this Section 8.10, at all times during the Covenant Trigger Period (s) Section 11.07 of the Credit Agreement is amended to add a new paragraph at the end of such Section read as follows: The Administrative Agent and the Lenders may disclose the existence of this Agreement and information about this Agreement to market data collectors, similar service providers to the lending industry and service providers to the Administrative Agent and the Lenders in connection with the administration of this Agreement, the other Loan Documents and the Commitments. (t) The last sentence of Section 11.17 of the Credit Agreement is amended to read as follows: Each Borrower shall, promptly following a request by the Administrative Agent or any Lender, provide all documentation and other information that the Administrative Agent or such Lender requests in order to comply with its ongoing obligations under applicable “know your customer” and anti-money laundering rules and regulations, including the Patriot Act and the Beneficial Ownership Regulation. (u) Section 11.23 of the Credit Agreement is amended to read as follows: 11.23 Lender ERISA Representations. (a) Each Lender (x) represents and warrants, as of the date such Person became a Lender party hereto, to, and (y) covenants, from the date such Person became a Lender party hereto to the date such Person ceases being a Lender party hereto, for the benefit of, the Administrative Agent, and not, for the avoidance of doubt, to or for the benefit of the Parent Borrower or any other Loan Party, that at least one of the following is and will be true: (i) such Lender is not using “plan assets” (within the meaning of Section 3(42) of ERISA or otherwise) of one or more Benefit Plans with respect to such Lender’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments, or this Agreement, (ii) the transaction exemption set forth in one or more PTEs, such as PTE 84- 14 (a class exemption for certain transactions determined by independent qualified professional asset managers), PTE 95-60 (a class exemption for certain transactions involving insurance company general accounts), PTE 90-1 (a class exemption for certain transactions involving insurance company pooled separate accounts), PTE 91-38 (a class exemption for certain transactions involving bank collective investment funds) or PTE 96- 23 (a class exemption for certain transactions determined by in-house asset managers), is applicable with respect to such Lender’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement, (iii) (A) such Lender is an investment fund managed by a “Qualified Professional Asset Manager” (within the meaning of Part VI of PTE 84-14), (B) such Qualified Professional Asset Manager made the investment decision on behalf of such Lender to enter into, participate in, administer and perform the Loans, the Letters of Credit, 8 CHAR1\1675275v4

the Commitments and this Agreement, (C) the entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement satisfies the requirements of sub-sections (b) through (g) of Part I of PTE 84-14 and (D) to the best knowledge of such Lender, the requirements of subsection (a) of Part I of PTE 84-14 are satisfied with respect to such Lender’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement, or (iv) such other representation, warranty and covenant as may be agreed in writing between the Administrative Agent, in its sole discretion, and such Lender. (b) In addition, unless Section 11.23(a)(i) is true with respect to a Lender or such Lender has not provided another representation, warranty and covenant as provided in Section 11.23(a)(iv), such Lender further (x) represents and warrants, as of the date such Person became a Lender party hereto, to, and (y) covenants, from the date such Person became a Lender party hereto to the date such Person ceases being a Lender party hereto, for the benefit of, the Administrative Agent, and not, for the avoidance of doubt, to or for the benefit of the Parent Borrower or any other Loan Party, that the Administrative Agent is not a fiduciary with respect to the assets of such Lender involved in such Lender’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement (including in connection with the reservation or exercise of any rights by the Administrative Agent under this Agreement, any Loan Document or any documents related hereto or thereto). (v) Article XI of the Credit Agreement is amended by adding a new Section 11.28 to read as follows: 11.28 Acknowledgement Regarding Any Supported QFCs. To the extent that the Loan Documents provide support, through a guarantee or otherwise, for any Swap Contract or any other agreement or instrument that is a QFC (such support, “QFC Credit Support”, and each such QFC, a “Supported QFC”), the parties acknowledge and agree as follows with respect to the resolution power of the Federal Deposit Insurance Corporation under the Federal Deposit Insurance Act and Title II of the Dodd-Frank Wall Street Reform and Consumer Protection Act (together with the regulations promulgated thereunder, the “U.S. Special Resolution Regimes”) in respect of such Supported QFC and QFC Credit Support (with the provisions below applicable notwithstanding that the Loan Documents and any Supported QFC may in fact be stated to be governed by the laws of the State of New York and/or of the United States or any other state of the United States): In the event a Covered Entity that is party to a Supported QFC (each, a “Covered Party”) becomes subject to a proceeding under a U.S. Special Resolution Regime, the transfer of such Supported QFC and the benefit of such QFC Credit Support (and any interest and obligation in or under such Supported QFC and such QFC Credit Support, and any rights in property securing such Supported QFC or such QFC Credit Support) from such Covered Party will be effective to the same extent as the transfer would be effective under such U.S. Special Resolution Regime if the Supported QFC and such QFC Credit Support (and any such interest, obligation and rights in property) were governed by the laws of the United States or a state of the United States. In the event a Covered Party or a BHC Act Affiliate of a Covered Party becomes subject to a proceeding under a U.S. Special Resolution Regime, Default Rights under the Loan Documents that might otherwise apply to such Supported QFC or any QFC Credit Support that may be exercised against such Covered Party are permitted to be exercised to no greater extent than such Default Rights 9 CHAR1\1675275v4

could be exercised under such U.S. Special Resolution Regime if the Supported QFC and the Loan Documents were governed by the laws of the United States or a state of the United States. Without limitation of the foregoing, it is understood and agreed that rights and remedies of the parties with respect to a Defaulting Lender shall in no event affect the rights of any Covered Party with respect to a Supported QFC or any QFC Credit Support. (w) Section 11.16 of the Security Agreement is amended to read as follows: 16. Governing Law; Jurisdiction; Waiver of Venue; Waiver of Right to Trial by Jury; Acknowledgement Regarding Any Supported QFCs. The terms of Sections 11.14, 11.15 and 11.28 of the Credit Agreement with respect to governing Law, submission to jurisdiction, waiver of venue, waiver of right to trial by jury and acknowledgment regarding any Supported QFCs are incorporated herein by reference, mutatis mutandis, and the parties hereto agree to such terms. 4. Conditions Precedent. This Amendment shall be effective upon satisfaction of the following conditions precedent: (a) Receipt by the Administrative Agent of counterparts of this Amendment duly executed by the Loan Parties, the Lenders, the Swing Line Lender, the L/C Issuers, and the Administrative Agent; (b) Receipt by the Administrative Agent of counterparts of an exiting lender consent duly executed by the Loan Parties, each Person that was a Lender under the Credit Agreement (immediately prior to giving effect to this Amendment) but is not a Lender under the Credit Agreement (as amended by this Amendment), and the Administrative Agent, in form and substance satisfactory to the Administrative Agent and its legal counsel. (c) Receipt by the Administrative Agent of customary opinions of legal counsel to the Loan Parties, addressed to the Administrative Agent and each Lender, dated as of the First Amendment Effective Date, and in form and substance satisfactory to the Administrative Agent. (d) Receipt by the Administrative Agent of the following, in form and substance satisfactory to the Administrative Agent and its legal counsel: (i) Copies of the Organization Documents of each Loan Party certified to be true and complete as of a recent date by the appropriate Governmental Authority of the state or other jurisdiction of its incorporation or organization, where applicable, including in respect of a Dutch Loan Party an up-to-date extract from the Dutch trade register (handelsregister) relating to it, (or, as to any such Organization Documents that have not been amended, modified or terminated since previously certified to the Administrative Agent, certified that such Organization Documents have not been amended, modified or terminated since such date and remain in full force and effect, and true and complete, in the form previously delivered to the Administrative Agent on such date) and certified by a secretary or assistant secretary of such Loan Party to be true and correct as of the First Amendment Effective Date. (ii) Such certificates of resolutions or other action, incumbency certificates and/or other certificates of Responsible Officers of each Loan Party as the Administrative Agent may require evidencing the identity, authority and capacity of each Responsible Officer thereof authorized to act as a Responsible Officer in connection with this Amendment and the other Loan Documents to which such Loan Party is a party, including in respect of a Dutch Loan Party (A) a copy of a resolution of its management board (I) approving the execution of, and the terms of, and the transactions contemplated by, the Loan Documents, and (II) if applicable, appointing one or 10 CHAR1\1675275v4

more authorised persons to represent the relevant Dutch Loan Party in the event of a conflict of interest or confirming that no such person has been appointed; (B) a copy of a resolution of its general meeting of shareholders (I) approving the execution of, and the terms of, and the transactions contemplated by, the Loan Documents; and (II) if applicable, appointing one or more authorised persons to represent the relevant Dutch Loan Party in the event of a conflict of interest or confirming that no such person has been appointed; and (C) a copy of a resolution of its board of supervisory directors (if any) (I) approving the execution of, and the terms of, and the transactions contemplated by, the Loan Documents; and (II) if applicable, appointing one or more authorised persons to represent the relevant Dutch Loan Party in the event of a conflict of interest or confirming that no such person has been appointed. (iii) Such documents and certifications as the Administrative Agent may reasonably require to evidence that each Loan Party is duly organized or formed, and is validly existing, in good standing and qualified to engage in business in its state of organization or formation, including in respect of a Dutch Loan Party, evidence of unconditional positive advice of any works council which has advisory rights in respect of the entry into and performance of the transactions contemplated in the Loan Documents. (e) Receipt by the Administrative Agent of (i) searches of Uniform Commercial Code filings in the jurisdiction of formation of each Domestic Loan Party or where a filing would need to be made in order to perfect the Administrative Agent’s security interest in the Collateral, copies of the financing statements on file in such jurisdictions and evidence that no Liens exist other than Permitted Liens, (ii) UCC financing statements for each appropriate jurisdiction as is necessary, in the Administrative Agent’s sole discretion, to perfect the Administrative Agent’s security interest in the Collateral, (iii) searches of ownership of, and Liens on, Intellectual Property of each Domestic Loan Party in the appropriate governmental offices, (iv) duly executed notices of grant of security interest in the form required by the Security Agreement as are necessary, in the Administrative Agent’s sole discretion, to perfect the Administrative Agent’s security interest in the Intellectual Property of the Domestic Loan Parties, and (v) to the extent reasonably requested by the Administrative Agent, additional filings or documents as may be required to confirm the Administrative Agent’s security interest in the Equity Interests pledged pursuant to the Dutch Share Pledge Agreement, the Danish Share Pledge Agreement (Knoll Denmark Equity Interests), and the Danish Share Pledge Agreement (Muuto A/S Equity Interests). (f) Receipt by the Administrative Agent of a certificate of the Parent Borrower, duly executed by a Responsible Officer of the Parent Borrower, dated as of the First Amendment Effective Date, certifying (i) as to the matters set forth in Section 6(d)(iv) and (v), (ii) that there has not occurred since December 31, 2018, a Material Adverse Effect, and (iii) as of the First Amendment Effective Date, that there does not exist any action, suit, investigation or proceeding pending or, to the knowledge of the Parent Borrower, threatened in any court or before an arbitrator or Governmental Authority that could reasonably be expected to have a Material Adverse Effect. (g) Receipt by each Lender of all documentation and other information that such Lender has reasonably requested in writing that such Lender has reasonably determined is required by regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including without limitation the Patriot Act. (h) If the Borrower qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, delivery by the Parent Borrower, to each Lender that so requests, of a Beneficial Ownership Certification in relation to the Parent Borrower. 11 CHAR1\1675275v4

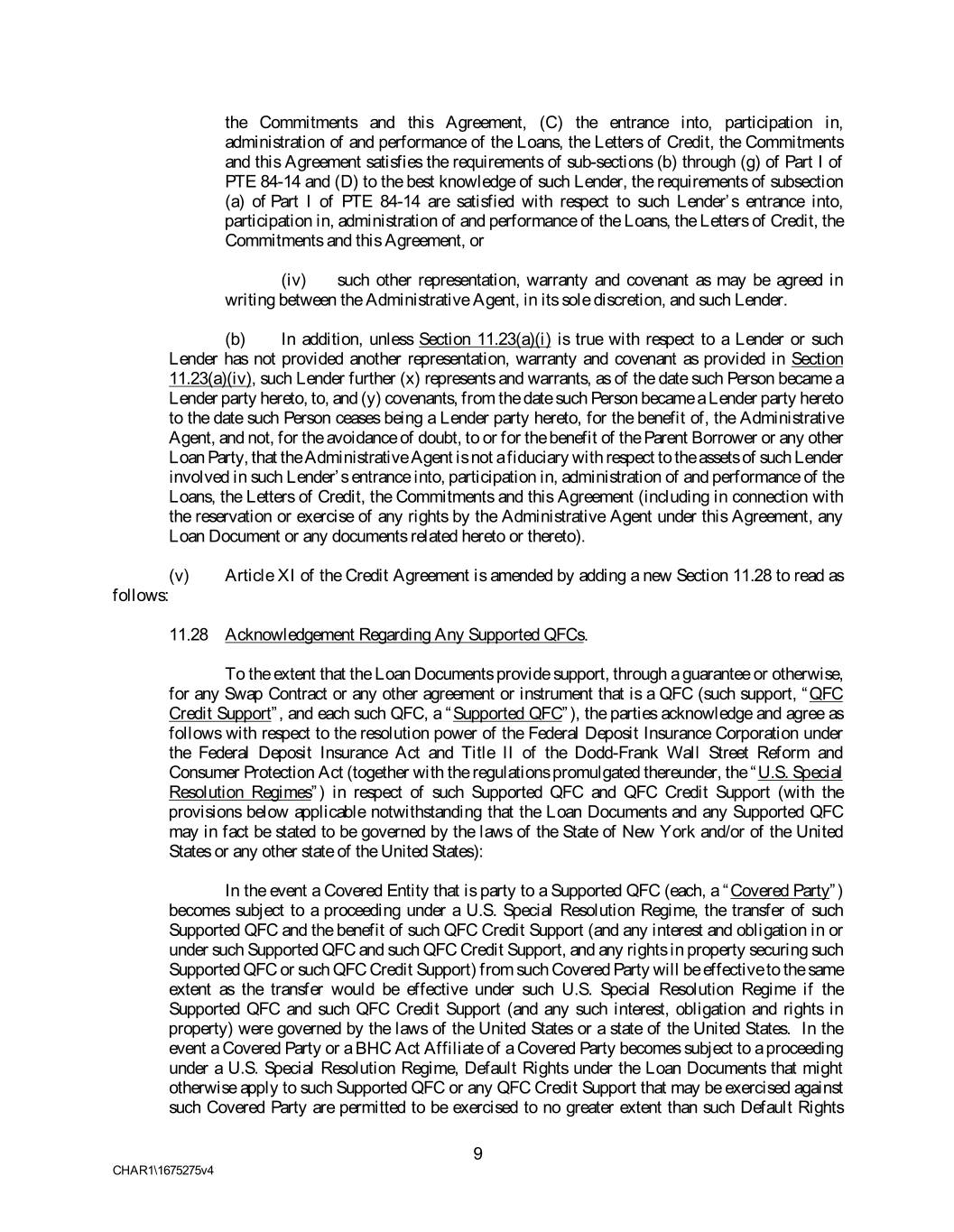

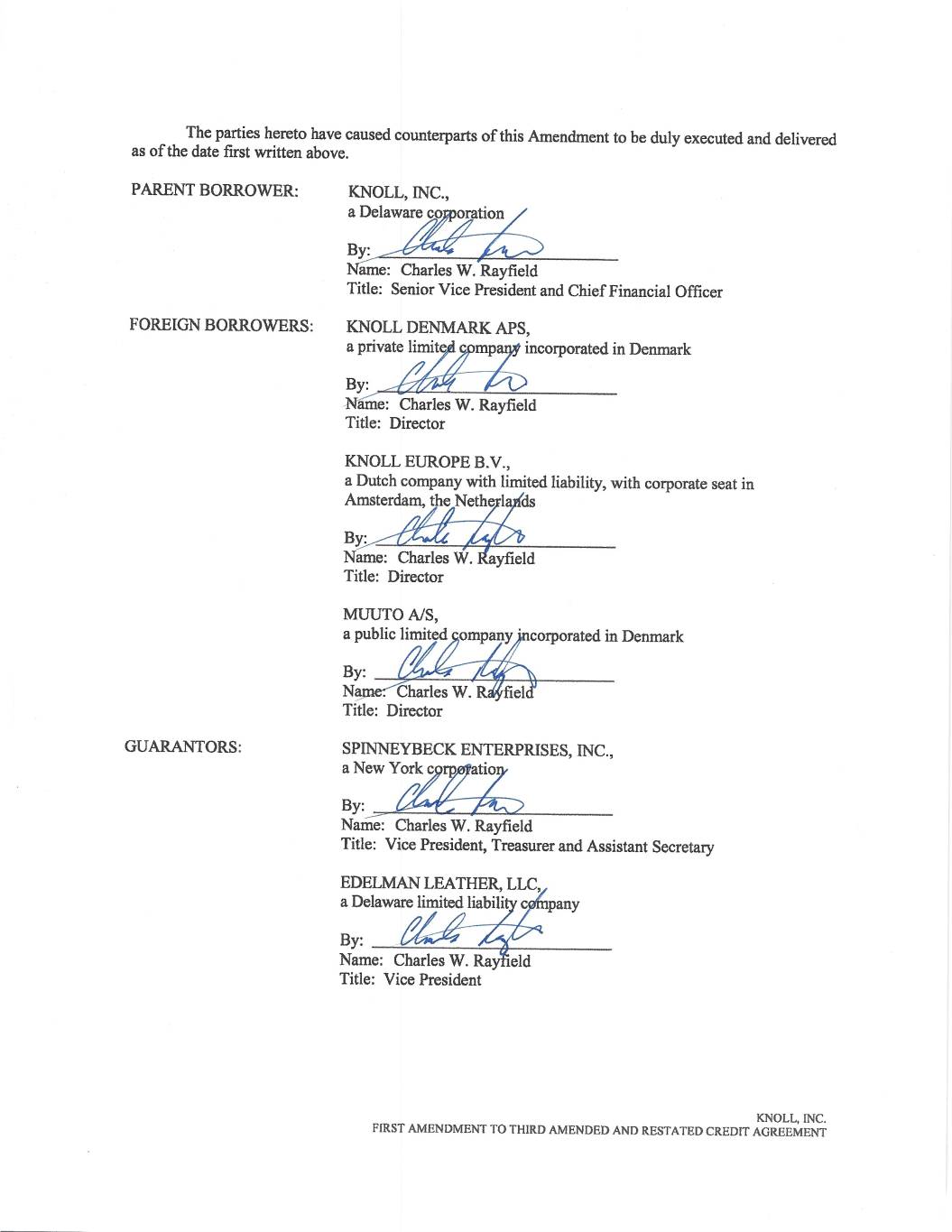

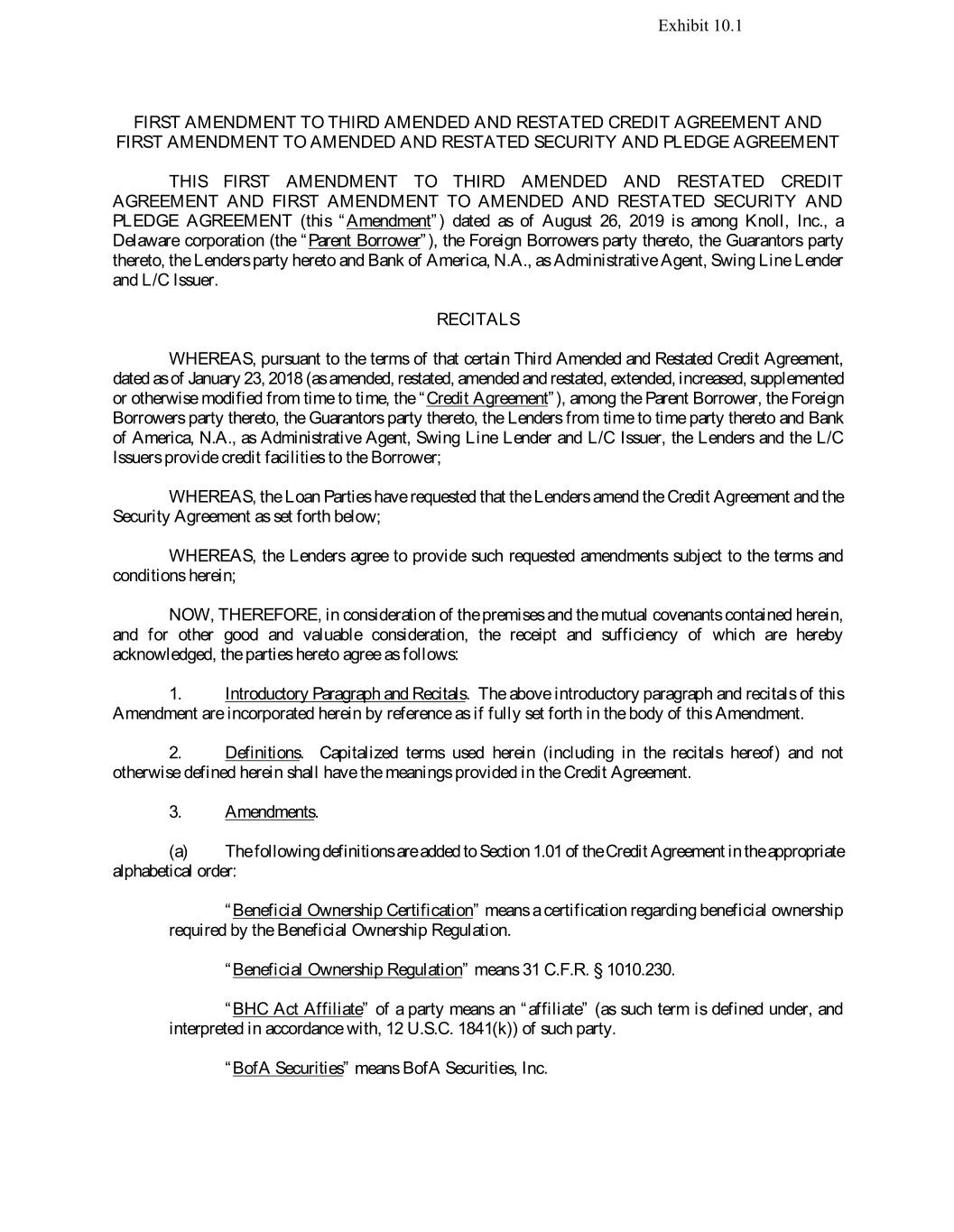

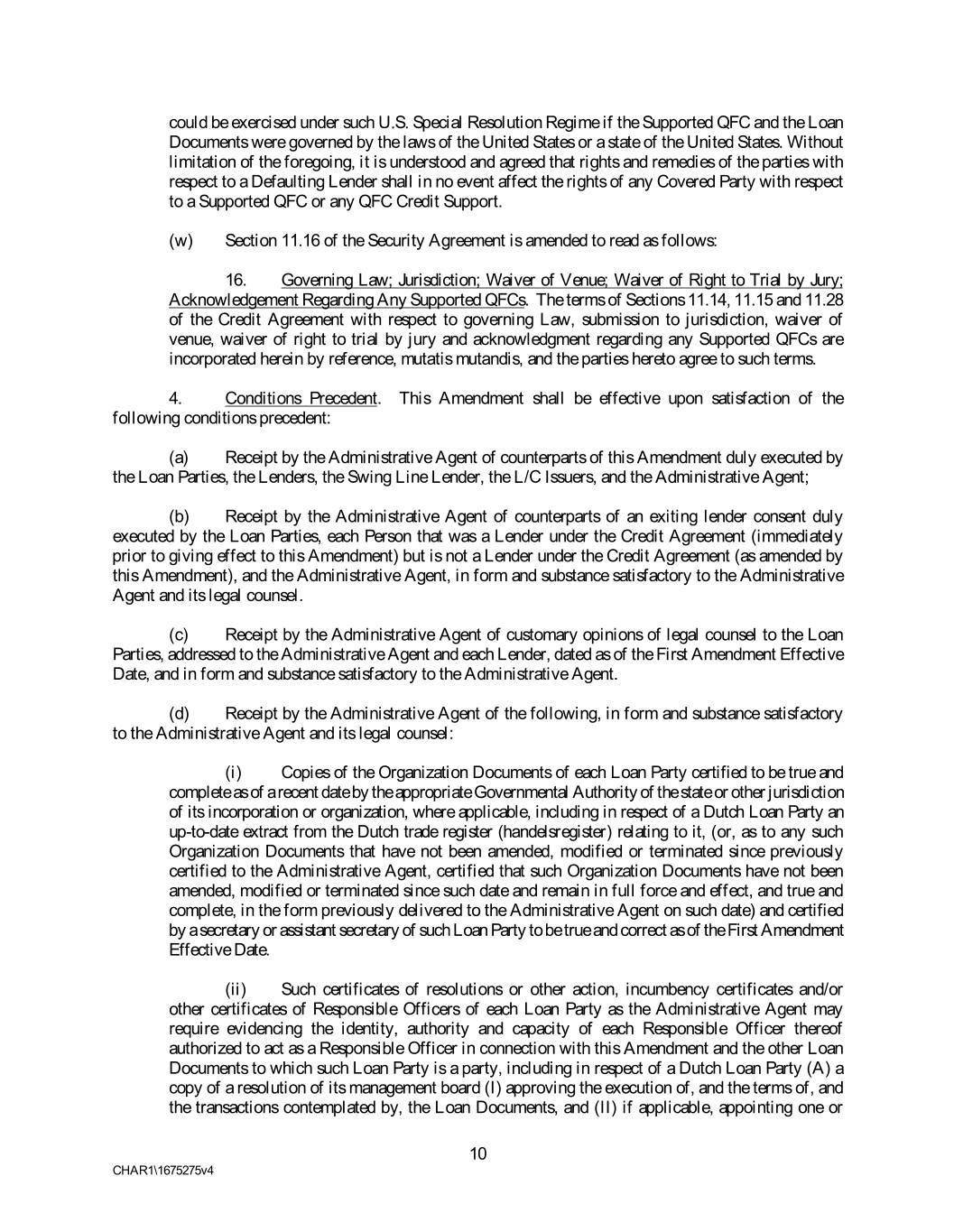

(i) Receipt by the Administrative Agent of (i) all interest and fees owing under the Credit Agreement that have accrued and are unpaid as of the First Amendment Effective Date and (ii) all other fees and expenses owing to the Administrative Agent (including all reasonable fees, expenses and disbursements of any law firm or other counsel of the Administrative Agent), the Lenders and the Arrangers required to be paid on or before the First Amendment Effective Date. 5. Commitments and Outstanding Loans; Reallocation. Each Lender party hereto hereby agrees that, subject to the terms and conditions set forth herein and in the Credit Agreement (as amended by this Amendment), upon giving effect to this Amendment, (a) its Revolving Commitment is set forth opposite its name on Schedule 2.01 attached to this Amendment under the caption “Revolving Commitments”, (b) its portion of the Outstanding Amount of the U.S. Term Loan as of the First Amendment Effective Date is set forth opposite its name on Schedule 2.01 attached to this Amendment under the caption “Outstanding Amount of U.S. Term Loan”, and (c) its portion of the Outstanding Amount of the Multicurrency Term Loan as of the First Amendment Effective Date is set forth opposite its name on Schedule 2.01 attached to this Amendment under the caption “Outstanding Amount of Multicurrency Term Loan”, with the reallocation of any Loans outstanding under the Commitments of the Lenders as they existed immediately prior to the First Amendment Effective Date having been made per instructions from the Administrative Agent (it being understood and agreed that no Assignment and Assumption or any other action of any Person is required to give effect to such reallocation). 6. Miscellaneous. (a) This Amendment shall be deemed to be, and is, a Loan Document. (b) Each Loan Party (i) agrees to all of the terms and conditions of this Amendment, (ii) agrees that this Amendment and all documents executed in connection herewith do not operate to reduce or discharge its obligations under the Credit Agreement or the other Loan Documents or any certificates, documents, agreements and instruments executed in connection therewith, (iii) affirms all of its obligations under the Loan Documents, (iv) agrees that this Amendment shall in no manner impair or otherwise adversely affect any of the Liens granted in or pursuant to the Loan Documents, (v) affirms that each of the Liens granted in or pursuant to the Loan Documents are valid and subsisting and (vi) confirms that each security right created under each Collateral Document was, when it was entered into, intended to extend, and shall in fact extend, to all obligations under all Loan Documents as amended under this Amendment. (c) Effective as of the First Amendment Effective Date, all references to the Credit Agreement and the Security Agreement in each of the Loan Documents shall mean the Credit Agreement and the Security Agreement, in each case, as amended by this Amendment. (d) Each of the Loan Parties hereby represents and warrants to the Administrative Agent as follows: (i) such Loan Party has taken all necessary action to authorize the execution, delivery and performance of this Amendment; (ii) this Amendment has been duly executed and delivered by such Loan Party and constitutes such Loan Party’s legal, valid and binding obligations, enforceable in accordance with its terms, except as such enforceability may be subject to (A) bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and (B) general principles of equity (regardless of whether such enforceability is considered in a proceeding at law or in equity); 12 CHAR1\1675275v4

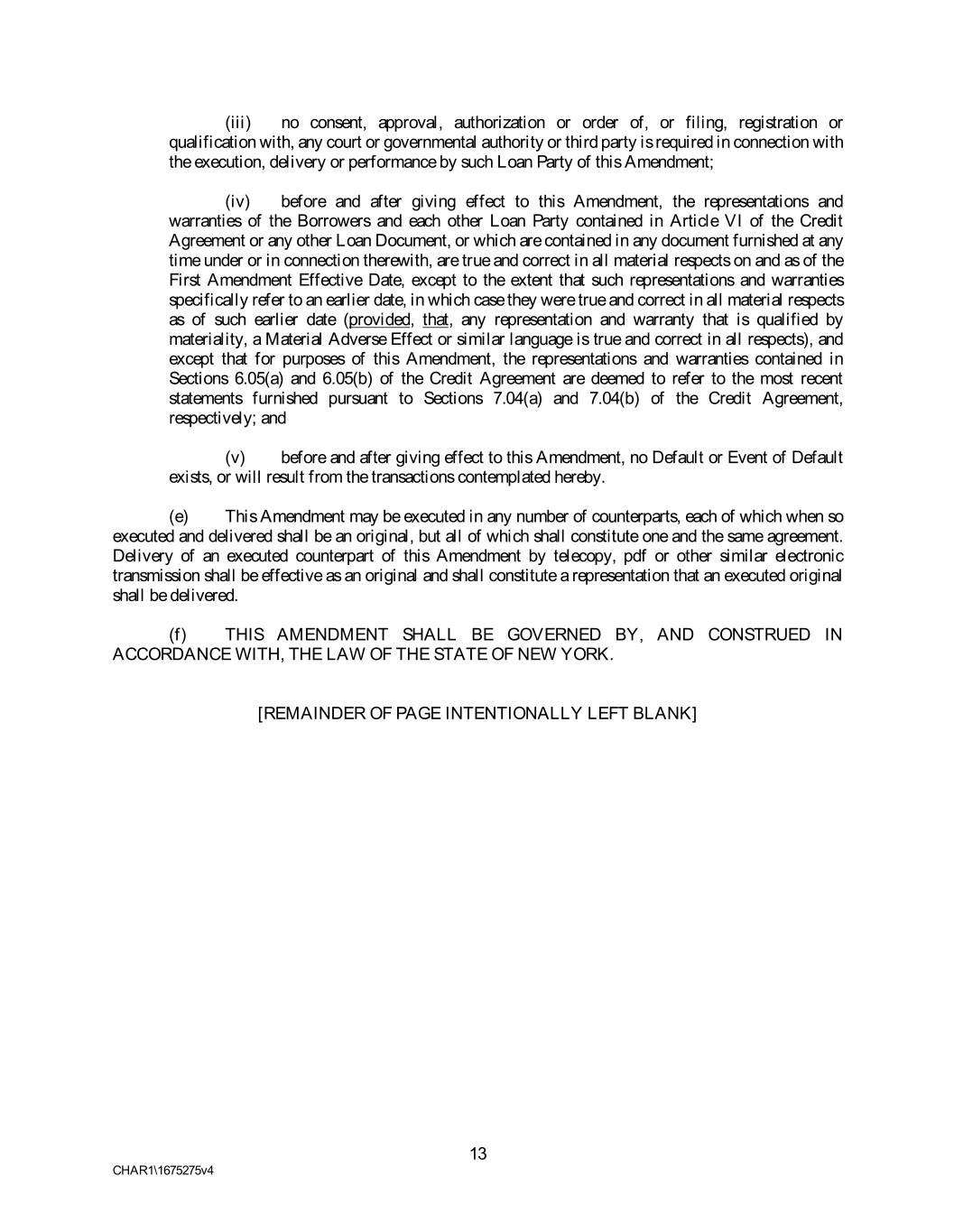

(iii) no consent, approval, authorization or order of, or filing, registration or qualification with, any court or governmental authority or third party is required in connection with the execution, delivery or performance by such Loan Party of this Amendment; (iv) before and after giving effect to this Amendment, the representations and warranties of the Borrowers and each other Loan Party contained in Article VI of the Credit Agreement or any other Loan Document, or which are contained in any document furnished at any time under or in connection therewith, are true and correct in all material respects on and as of the First Amendment Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they were true and correct in all material respects as of such earlier date (provided, that, any representation and warranty that is qualified by materiality, a Material Adverse Effect or similar language is true and correct in all respects), and except that for purposes of this Amendment, the representations and warranties contained in Sections 6.05(a) and 6.05(b) of the Credit Agreement are deemed to refer to the most recent statements furnished pursuant to Sections 7.04(a) and 7.04(b) of the Credit Agreement, respectively; and (v) before and after giving effect to this Amendment, no Default or Event of Default exists, or will result from the transactions contemplated hereby. (e) This Amendment may be executed in any number of counterparts, each of which when so executed and delivered shall be an original, but all of which shall constitute one and the same agreement. Delivery of an executed counterpart of this Amendment by telecopy, pdf or other similar electronic transmission shall be effective as an original and shall constitute a representation that an executed original shall be delivered. (f) THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. [REMAINDER OF PAGE INTENTIONALLY LEFT BLANK] 13 CHAR1\1675275v4

SUNTRUST BANK, By: Name: KNOLL, INC. FIRST AMENDMENT TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT

THE BANK OF NOVA SCOTIA, as a Lender By: Name: Michael Grad Title: Director KNOLL, INC. FIRST AMENDMENT TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT

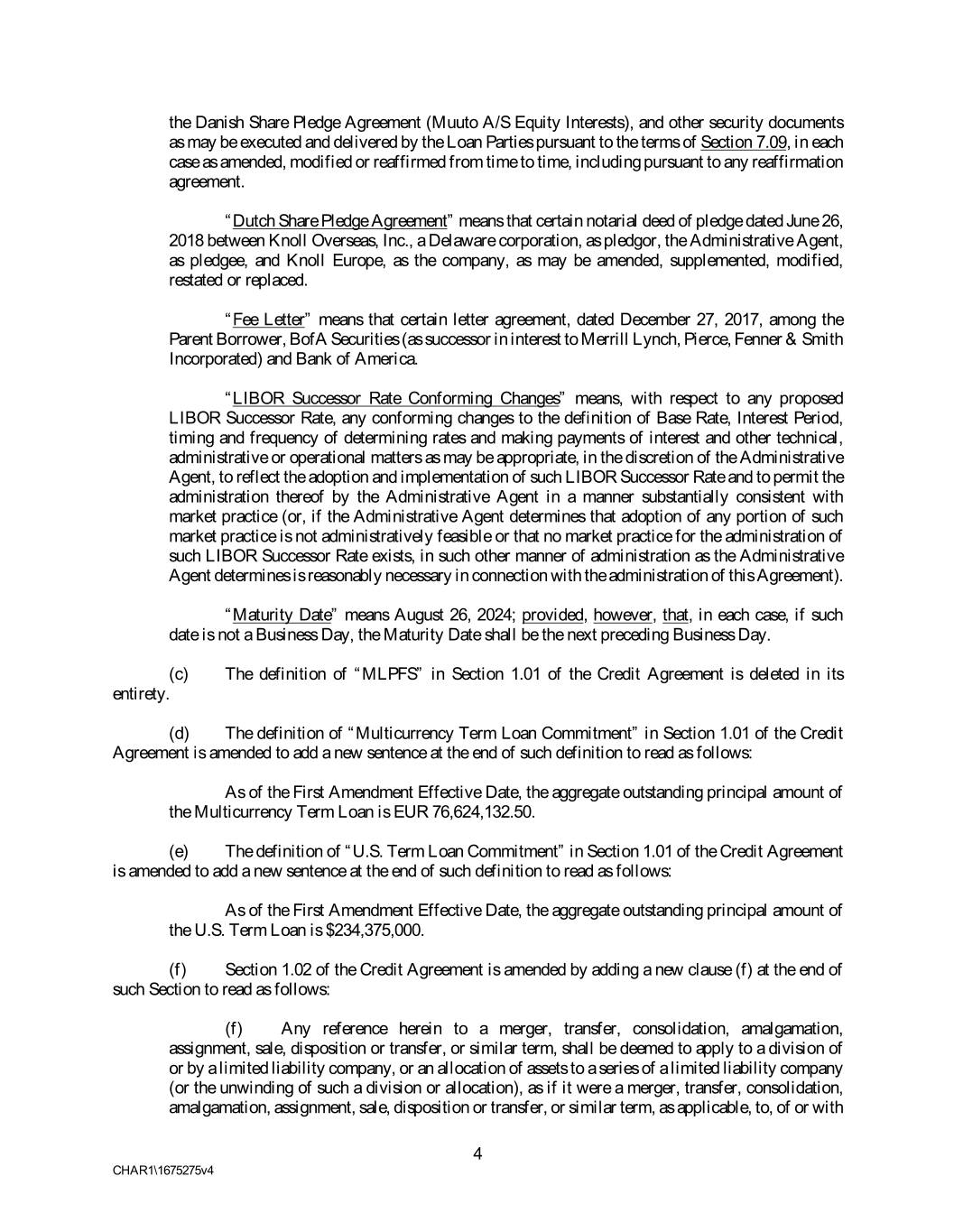

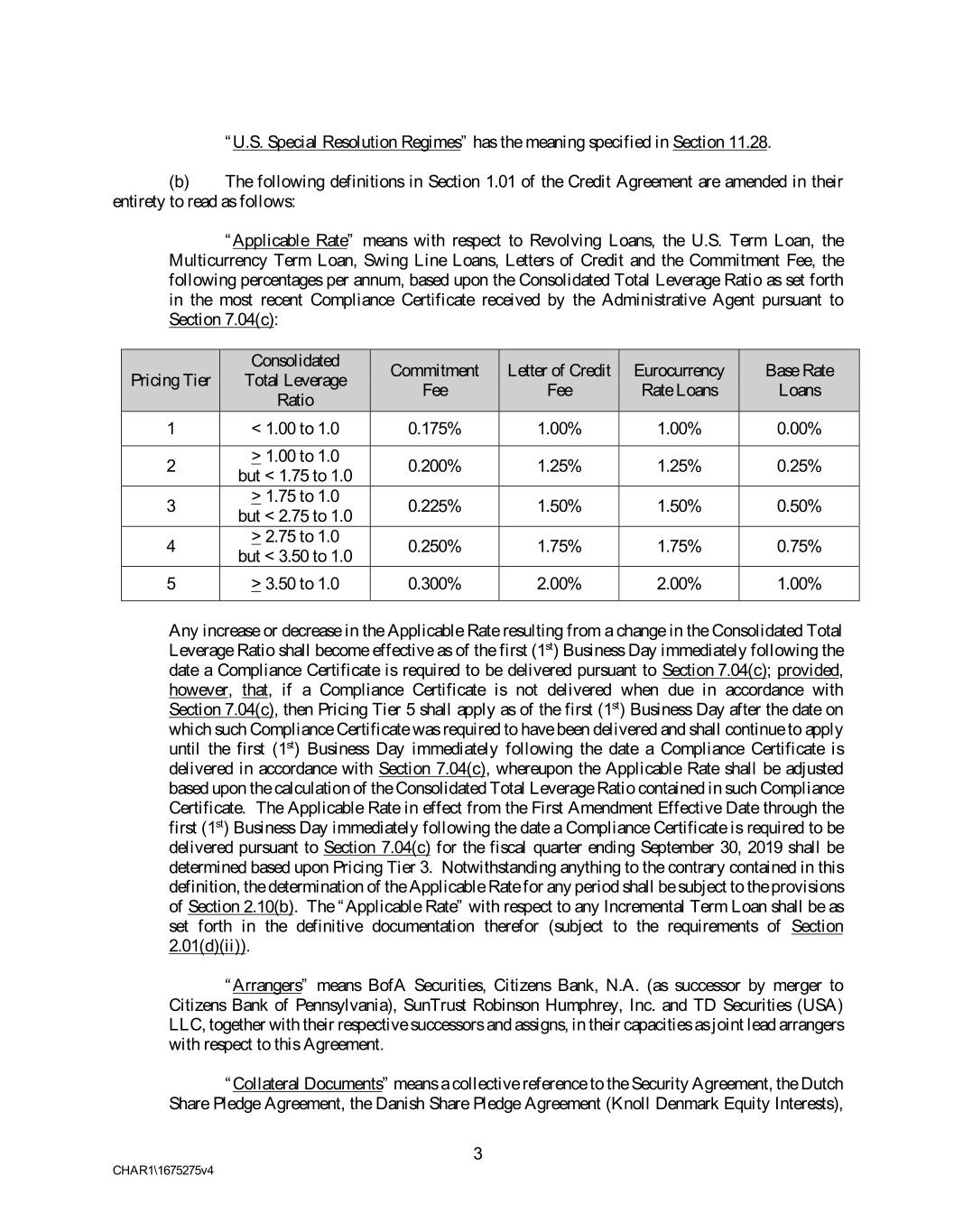

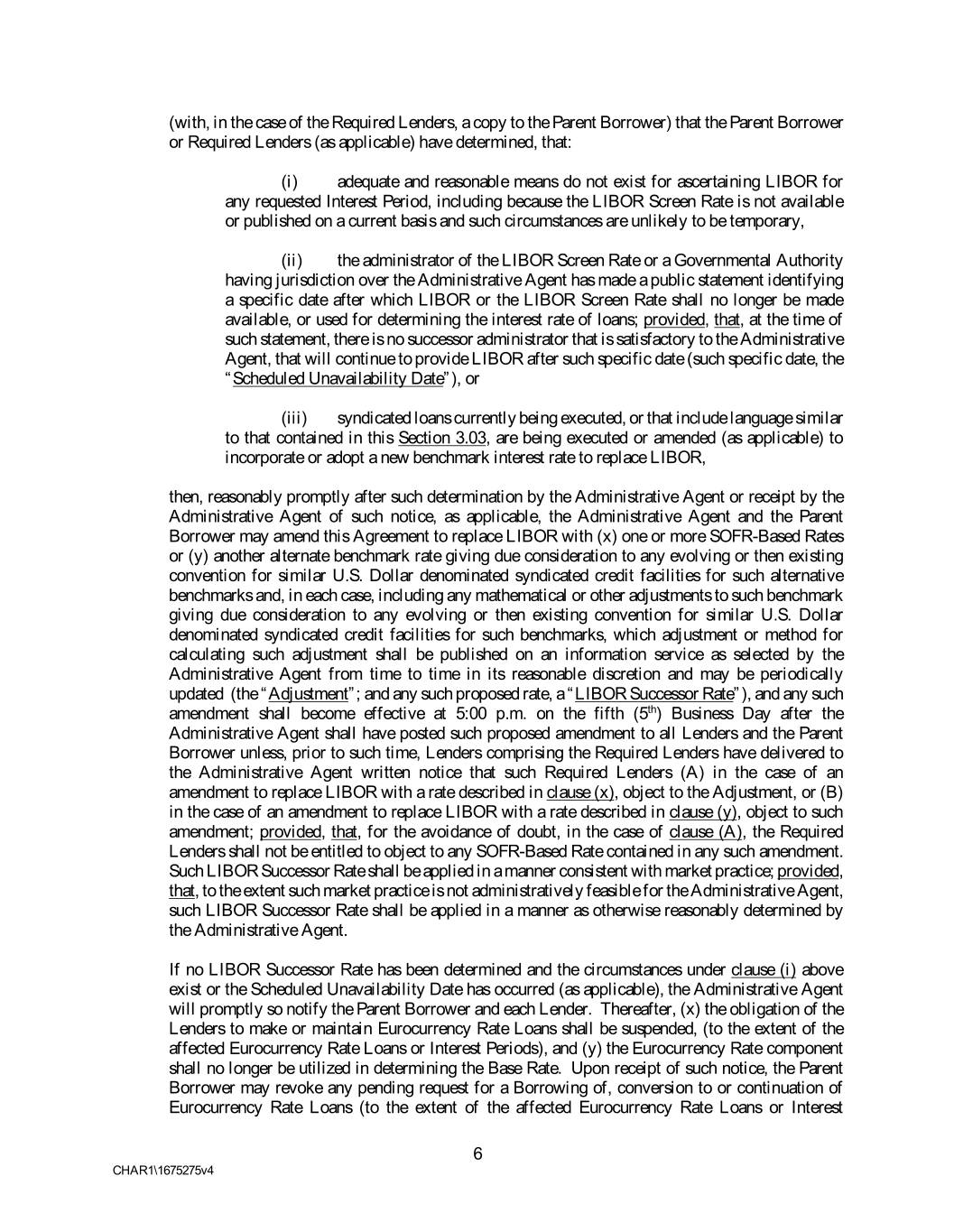

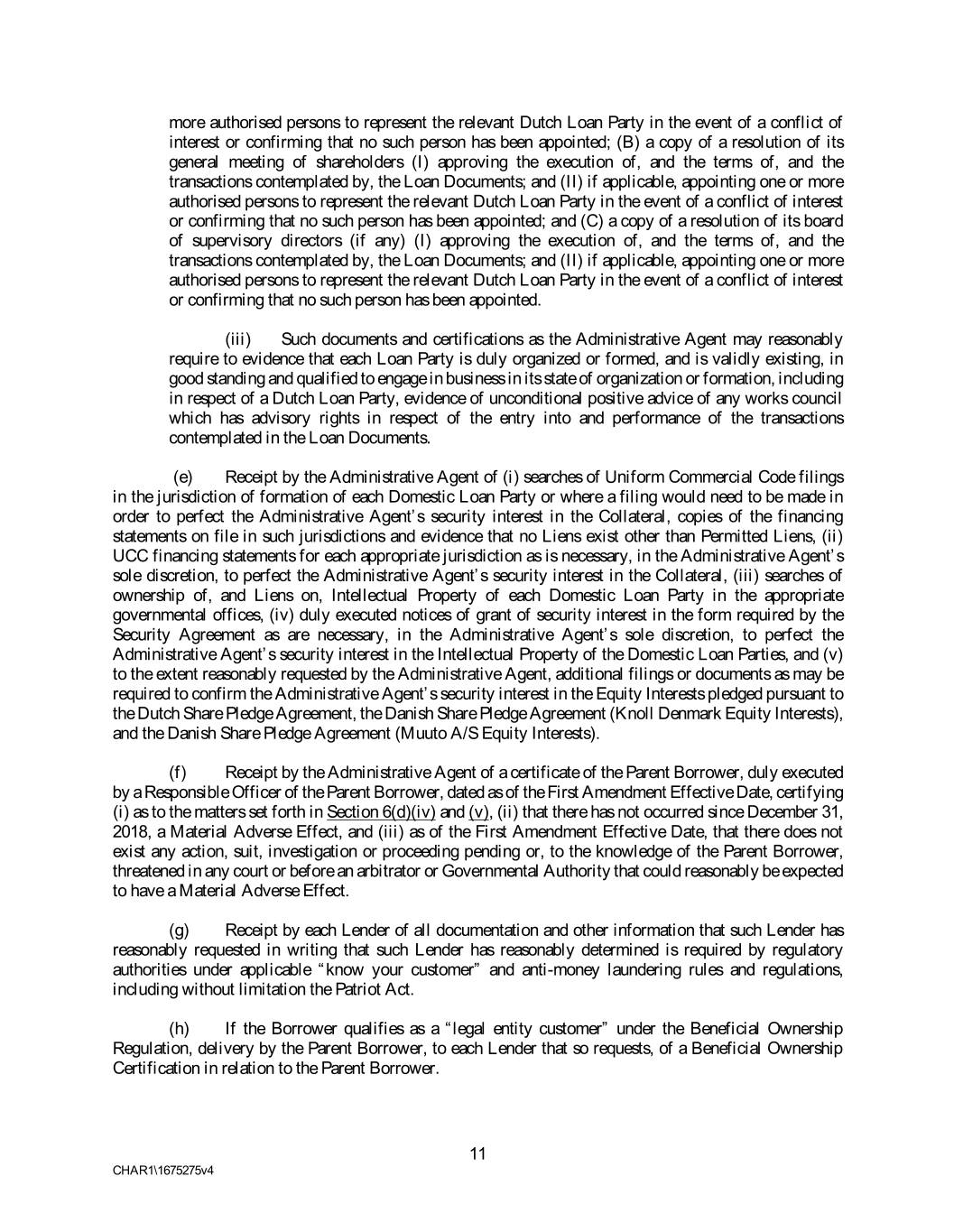

Schedule 2.01 Commitments, Outstanding Loans and Applicable Percentages1 Applicable Applicable Applicable Outstanding Percentage of Outstanding Percentage of Revolving Percentage of Amount of Outstanding Lender Amount of U.S. Outstanding Commitment Revolving Multicurrency Amount of Term Loan Amount of U.S. Commitment Term Loan Multicurrency Term Loan Term Loan Bank of America, N.A. $78,133,088.32 19.533272079% $45,781,106.43 19.533272076% €14,967,200.28 19.533272079% Citizens Bank, N.A. (as successor by merger to Citizens Bank of $61,159,717.19 15.289929297% $35,835,771.79 15.289929296% €11,715,775.69 15.289929305% Pennsylvania) SunTrust Bank $50,039,768.62 12.509942154% $29,320,176.92 12.509942153% €9,585,634.65 12.509942152% TD Bank, N.A. $61,159,717.19 15.289929297% $35,835,771.79 15.289929297% €11,715,775.69 15.289929305% Branch Banking and Trust $11,119,948.59 2.779987148% $6,515,594.87 2.779987145% €2,130,141.03 2.779987140% Company U.S. Bank National Association $44,479,794.33 11.119948583% $26,062,379.49 11.119948582% €8,520,564.13 11.119948575% The Bank of Nova Scotia $27,799,871.45 6.949967863% $16,288,987.19 6.949967868% €5,325,352.58 6.949967858% The Huntington National Bank $27,799,871.45 6.949967863% $16,288,987.19 6.949967868% €5,325,352.58 6.949967858% The Northern Trust Company $13,288,338.55 3.322084638% $7,786,135.87 3.322084638% €2,545,518.54 3.322084645% Webster Bank, N.A. $11,119,948.58 2.779987145% $6,515,594.87 2.779987145% €2,130,141.04 2.779987154% First National Bank of $13,899,935.73 3.474983933% $8,144,493.59 3.474983932% €2,662,676.29 3.474983929% Pennsylvania Total: $400,000,000.00 100.000000000% $234,375,000.00 100.000000000% €76,624,132.50 100.000000000% 1 Outstanding Amounts of the U.S. Term Loan and the Multicurrency Term Loan are as of the First Amendment Effective Date. CHAR1\1675275v4