UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-13627

GOLDEN MINERALS COMPANY

(Exact Name of Registrant as Specified in its Charter)

|

DELAWARE |

|

26-4413382 |

|

350 Indiana Street, Suite 800 |

|

80401 |

(303) 839-5060

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $0.01 par value |

|

NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer o |

|

Non-accelerated filer o |

|

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchanges Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No o

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2013 was approximately $46.2 million, based on the closing price of the registrant’s common stock of $1.36 per share on the NYSE MKT on June 30, 2013. For the purpose of this calculation, the registrant has assumed that its affiliates as of June 30, 2013 included all directors and officers and one shareholder that held approximately 19.4% of its outstanding common stock. The number of shares of common stock outstanding on February 25, 2014 was 43,530,833.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2014 Annual Meeting of Stockholders are incorporated by reference in Part III of this annual report on Form 10-K.

References to “Golden Minerals, the “Company,” “our,” “we,” or “us” mean Golden Minerals Company, its predecessors and consolidated subsidiaries, or any one or more of them, as the context requires. Many of the terms used in our industry are technical in nature. We have included a glossary of some of these terms below.

FORWARD-LOOKING STATEMENTS

Some information contained in or incorporated by reference into this annual report on Form 10-K may contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. These statements include statements relating to our plans, expectations and assumptions concerning the Velardeña Properties (as defined below), the El Quevar project and certain properties in our exploration portfolio, the timing and budget for a potential restart of mining and processing at the Velardeña Properties and other costs related to our El Quevar project and our exploration properties, our expected cash needs, and statements concerning our financial condition, business strategies and business and legal risks.

We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions to identify forward-looking statements. Statements that contain these words discuss our future expectations and plans, including the potential restart of mining and processing at the Velardeña Properties and planned exploration activities, and contain projections of 2014 expenditures or other matters, or state other forward-looking information. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Our actual results could differ materially from those expressed or implied in these forward-looking statements as a result of various factors described in this annual report on Form 10-K, including:

· Higher than anticipated holding and care and maintenance costs related to the suspension of mining and processing at the Velardeña Properties in Mexico;

· Potential inability to develop a restart plan for the Velardeña Properties that at then current silver and gold prices would indicate a sustainable cash positive margin, and the feasibility and economic viability of restart at the Velardeña Properties;

· Risks related to our Velardeña Properties, including variations in the nature, quality and quantity of any mineral deposits that may be located there, our ability to extract and sell minerals from the mines successfully or profitably at current, lower silver and gold prices, mining or processing problems, further decreases in expected silver and gold prices, our ability to obtain and maintain any necessary permits, consents, or authorizations for mining and processing at the Velardeña Properties, accidents and other unanticipated events and our ability to raise the necessary capital required to finance a potential restart of mining and processing at the Velardeña Properties;

· Risks related to the El Quevar project in Argentina, including whether we will be able to find a joint venture partner to advance the project, results of future exploration, feasibility and economic viability, delays and increased costs associated with evaluation of the project;

· Our ability to retain key management and mining personnel necessary to create a restart plan for our Velardeña Properties and to successfully run and grow our business;

· Results of future exploration at our exploration properties;

· Economic and political events affecting the market prices for silver, gold, zinc, lead and other minerals which may be found on our exploration properties;

· Political and economic instability in Mexico and Argentina and other countries in which we may conduct our business and future actions of any of these governments with respect to nationalization of natural resources or other changes in mining or taxation policies; and

· The factors set forth under “Risk Factors” in Item 1A of this annual report on Form 10-K.

Many of these factors are beyond our ability to control or predict. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, such expectations may prove to be materially incorrect due to known and unknown risk and uncertainties. You should not unduly rely on any of our

forward-looking statements. These statements speak only as of the date of this annual report on Form 10-K. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this annual report on Form 10-K.

CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL

“Mineralized material” as used in this annual report on Form 10-K, although permissible under the United States Securities and Exchange Commission’s (“SEC”) Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any deposits at the Velardeña Properties or any part of the Yaxtché deposit at the El Quevar project will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of the disclosed mineralized material estimates will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

CONVERSION TABLE

In this annual report on Form 10-K, figures are presented in both United States standard and metric measurements. Conversion rates from United States standard to metric and metric to United States standard measurement systems are provided in the table below. All currency references in this annual report on Form 10-K are to United States dollars, unless otherwise indicated.

|

U.S. Unit |

|

Metric Measure |

|

Metric Unit |

|

U.S. Measure |

|

|

1 acre |

|

0.4047 hectares |

|

1 hectare |

|

2.47 acres |

|

|

1 foot |

|

0.3048 meters |

|

1 meter |

|

3.28 feet |

|

|

1 mile |

|

1.609 kilometers |

|

1 kilometer |

|

0.62 miles |

|

|

1 ounce (troy) |

|

31.103 grams |

|

1 gram |

|

0.032 ounces (troy) |

|

|

1 ton |

|

0.907 tonnes |

|

1 tonne |

|

1.102 tons |

|

GLOSSARY OF SELECTED MINING TERMS

“Assay” means to test ores or minerals by chemical or other methods for the purpose of determining the amount of valuable metals contained.

“Autoclave” means cylindrical vessel used to subject materials to high pressure and temperature; used at mines using hydrometallurgy mineral processing techniques for refractory materials.

“Base Metal” means a classification of metals usually considered to be of low value and higher chemical activity when compared with the precious metals (gold, silver, platinum, etc.). This nonspecific term generally refers to the high-volume, low-value metals copper, lead, tin, and zinc.

“Breccia” means rock consisting of fragments, more or less angular, in a matrix of finer-grained material or of cementing material.

“Calcareous Clastic” means sedimentary rock composed of siliciclastic particles usually of conglomerate, sand, or silt-size and cemented by calcium carbonate in the form of calcite.

“Claim” means a mining interest giving its holder the right to prospect, explore for and exploit minerals within a defined area.

“Concentrates” means the clean product of ore or metal separated from its containing rock or earth by froth flotation or other methods of mineral separation.

“Concession” means a grant or lease of a tract of land made by a government or other controlling authority in return for stipulated services or a promise that the land will be used for a specific purpose.

“Core Drill” means a rotary type of rock drill that cuts a core of rock and is recovered in long cylindrical sections, two centimeters or more in diameter.

“Deposit” means an informal term for an accumulation of mineral ores.

“Development Stage” means a project with an established resource, not in production, engaged in the process of additional studies preparing for completion of feasibility study or for commercial extraction.

“Diorite” means a grey to dark grey intermediate intrusive igneous rock composed principally of plagioclase feldspar (typically andesine), biotite, hornblende, and/or pyroxene.

“Doré” means gold and silver bullion that remains in a cupelling furnace after the lead has been oxidized and skimmed off.

“Epithermal Calcite-Quartz” means deposits, typically occurring in veins, of calcite-quartz from hydrothermal fluids at shallow depths under conditions in the lower ranges of temperature and pressure.

“Euhedral” means a well-developed degree of which mineral grains show external crystal faces (fully crystal-faced).

“Exploration Stage” means a project that is not yet in either the development or production stage.

“Feasibility Study” means an engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability.

“Felsic” means igneous rocks that are relatively rich in elements that form feldspar and quartz.

“Flotation” means the separating of finely crushed minerals from one another by causing some to float in a froth and others to remain in suspension in the pulp. Oils and various chemicals are used to activate, make floatable, or depress the minerals.

“Formation” means a distinct layer of sedimentary rock of similar composition.

“Fracture System” means a set or group of contemporaneous fractures related by stress.

“Grade” means the metal content of ore, usually expressed in troy ounces per ton (2,000 pounds) or in grams per ton or metric tonnes which contain 2,204.6 pounds or 1,000 kilograms.

“Hypabyssal rock” means an intrusive igneous rock that originates at medium to shallow depths within the crust, and has intermediate grain size and often porphyritic texture between that of volcanic and plutonic rocks.

“Inferred Resource” means the part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

“Laramide Orogeny” means a period of mountain building in western North America, which started in the Late Cretaceous age, 70 to 80 million years ago, and ended 35 to 55 million years ago.

“Mineralization” means the concentration of metals within a body of rock.

“Mineralized Material” means a mineralized body that has been defined by appropriate drilling and/or underground sampling to establish continuity and support an estimate of tonnage and an average grade of the selected metals.

“Mining” means the process of extraction and beneficiation of mineral reserves or mineral deposits to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves or mineral deposits are expanded during the life of the mine activities as the exploration potential of the deposit is realized.

“Monzodiorite” means coarse-grained igneous rock consisting of essential plagioclase feldspar, orthoclase feldspar, hornblende and biotite, with or without pyroxene, with plagioclase being the dominant feldspar making up 6% to 90% of the

total feldspar and varying from oligoclase to andesine in composition. The presence of the orthoclase feldspar distinguishes this rock from a diorite.

“National Instrument 43-101” or “43-101” means the standards of disclosure for mineral projects prescribed by the Canadian Securities Administrations.

“Net Smelter Return Royalty” means a defined percentage of the gross revenue from a resource extraction operation, less a proportionate share of transportation, insurance, and processing costs.

“Open Pit” means a mine working or excavation open to the surface.

“Ore” means material containing minerals that can be economically extracted.

“Outcrop” means that part of a geologic formation or structure that appears at the surface of the earth.

“Oxide” means mineralized rock in which some of the original minerals have been oxidized (i.e., combined with oxygen).

“Precious Metal” means any of several relatively scarce and valuable metals, such as gold, silver, and the platinum-group metals.

“Probable Reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for Proven Reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Reserves, is high enough to assume continuity between points of observation.

“Production Stage” means a project that is actively engaged in the process of extraction and beneficiation of mineral reserves or mineral deposits to produce a marketable metal or mineral product.

“Proven Reserves” means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established.

“Reclamation” means the process of returning land to another use after mining is completed.

“Recovery” means that portion of the metal contained in the ore that is successfully extracted by processing, expressed as a percentage.

“Reserves” means that part of a mineral deposit that could be economically and legally extracted or produced at the time of reserve determination.

“Sampling” means selecting a fractional part of a mineral deposit for analysis.

“Sediment” means solid fragmental material that originates from weathering of rocks and is transported or deposited by air, water, or ice, or that accumulates by other natural agents, such as chemical precipitation from solution or secretion by organisms, and that forms in layers on the earth’s surface at ordinary temperatures in a loose, unconsolidated form.

“Sedimentary” means formed by the deposition of sediment.

“Silver Equivalent” means silver and gold only, with gold converted to silver equivalents at a 60 to 1 ratio.

“Stock” means discordant igneous intrusion having a surface exposure of less than 40 square miles.

“Sulfide” means a compound of sulfur and some other element.

“Tailings Pond” means a low-lying depression used to confine tailings, the prime function of which is to allow enough time for heavy metals to settle out or for cyanide to be destroyed before water is discharged into the local watershed.

“Tertiary” means the first period of the Cenozoic Era (after the Cretaceous of the Mesozoic Era and before the Quaternary) thought to have covered the span of time between 2 to 3 million years ago and 65 million years ago.

“Vein” means a fissure, fault or crack in a rock filled by minerals that have traveled upwards from some deep source.

“Waste” means rock lacking sufficient grade and/or other characteristics of ore.

PART I

ITEMS 1 AND 2: BUSINESS AND PROPERTIES

Overview

We are a mining company, and we own the Velardeña and Chicago precious metals mining properties (the “Velardeña Properties”) in the State of Durango, Mexico, the El Quevar advanced exploration property in the province of Salta, Argentina, and a diversified portfolio of precious metals and other mineral exploration properties located primarily in or near historical precious metals producing regions of Mexico and Argentina. The Velardeña Properties and the El Quevar advanced exploration property are our only material properties. Our management team is comprised of experienced mining professionals with extensive expertise in mineral exploration, mine construction and development, and mine operations. Our principal offices are located in Golden, Colorado at 350 Indiana Street, Suite 800, Golden, CO 80401, and our registered office is the Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801. We also maintain an office at the Velardeña Properties in Mexico and exploration offices in Argentina and Mexico.

We are primarily focused on efforts to create a new mining and processing plan for our Velardeña Properties and the continued advancement of the El Quevar project. We also are reviewing strategic opportunities, focusing primarily on development or operating properties in North America, including Mexico. We also plan to continue our exploration efforts on selected properties in our portfolio of approximately 30 exploration properties located primarily in Mexico and Argentina.

Effective June 19, 2013, we suspended mining and processing at our Velardeña Properties in order to conserve the asset until we are able to create new mining and processing plans that, at then current prices for silver and gold, indicate a sustainable cash margin. Earlier in 2013, we projected that mining at the Velardeña Properties would achieve cash neutrality during the third quarter 2013, assuming gold and silver prices of $1,600 per ounce and $30 per ounce, respectively. During the second quarter 2013, metals prices decreased significantly below those levels, which was the principal reason we suspended our mining and processing activities. We placed the mines and processing plants on a care and maintenance program to enable a restart when mining and processing plans and metals prices support a cash positive outlook for the properties.

During 2013 we continued efforts to actively solicit a partner to advance our El Quevar project and rationalize our exploration portfolio. We reduced general and administrative expenses in 2013 by 21% over 2012 expenses. We expect this reduced level of spending to continue in 2014.

No Proven or Probable Reserves/Exploration Stage Company

We are considered an exploration stage company under SEC criteria since we have not demonstrated the existence of proven or probable reserves at our Velardeña Properties or any of our other properties. In Industry Guide 7, the SEC defines a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Proven or probable reserves are those reserves for which (a) quantity is computed and (b) the sites for inspection, sampling, and measurement are spaced so closely that the geologic character is defined and size, shape and depth of mineral content can be established (proven) or the sites are farther apart or are otherwise less adequately spaced but high enough to assume continuity between observation points (probable). Reserves cannot be considered proven or probable unless and until they are supported by a feasibility study, indicating that the reserves have had the requisite geologic, technical and economic work performed and are economically and legally extractable.

Prior to suspending mining and processing at the Velardeña Properties in June 2013, we had revenues from the sale of gold, silver, lead and zinc products from the Velardeña and Chicago mines. We have not completed a feasibility study with

regard to all or a portion of any of our properties to date. Any mineralized material discovered or extracted by us should not be considered proven or probable reserves. As of December 31, 2013, none of our mineralized material met the definition of proven or probable reserves. We expect to remain as an exploration stage company for the foreseeable future, even though we were extracting and processing mineralized material. We will not exit the exploration stage until such time, if ever, that we demonstrate the existence of proven or probable reserves that meet the guidelines under SEC Industry Guide 7.

Company History

We were incorporated in Delaware under the Delaware General Corporation Law in March 2009, and we are the successor to Apex Silver Mines Limited (“Apex Silver”) for purposes of reporting under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). From March 2009 through September 2011, we focused on the advancement of our El Quevar silver project in Argentina. On September 2, 2011, we completed a business combination transaction with ECU Silver Mining Inc. (“ECU”) and now own the Velardeña and Chicago silver, gold and base metals mines located in the Velardeña mining district in the State of Durango, Mexico as further described under “—Velardeña Properties”. Since the business combination with ECU, we have focused primarily on the further advancement and improvement of the Velardeña Properties.

Corporate Structure

Golden Minerals Company, headquartered in Golden, Colorado, is the operating entity through which we conduct our business. Following our September 2, 2011 business combination, ECU became a wholly-owned subsidiary of Golden Minerals, and three of ECU’s wholly-owned Mexican subsidiaries hold the assets and rights associated with the Velardeña Properties. We have a number of other wholly-owned subsidiaries organized throughout the world, including in Mexico, Central America, South America, the Caribbean and Europe. We generally hold our exploration rights and properties through subsidiaries organized in the countries in which our rights and properties are located.

Our Competitive Strengths and Business Strategy

Our business strategy is to establish Golden Minerals as a mid-tier precious metals mining company, focusing on efforts to create new mining and processing plans for the Velardeña Properties and continued advancement of the El Quevar project. We also are focused on strategic opportunities, primarily on development or operating properties in North America, including Mexico.

Velardeña Properties. During the first six months of 2013, we sold approximately 252,000 ounces of silver and approximately 2,350 ounces of gold. Since the shutdown of mining and processing at the Velardeña Properties in June 2013, we have continued to focus on evaluating plans for a restart of the Velardeña Properties, with the objective of implementing a plan that at then current prices for silver and gold indicates a sustainable cash margin. We also are searching for third party sources of oxide feed for the oxide plant.

El Quevar Project. In early 2013, we completed a 2,400 meter, 16 hole drilling program at the Quevar North and South areas at El Quevar. Results may represent a significant extension of the previously defined Yaxtché deposit and a mineralized zone at Quevar North similar in structural control to the Yaxtché zone. In order to advance El Quevar, we are actively soliciting a partner to move the project forward with additional drilling in these areas, drilling in other potential areas and evaluations.

Exploration Portfolio. During 2014, we plan to focus our exploration efforts on projects in northern Mexico, and we expect our expenditures for the exploration program to be approximately $3.5 million. During 2013 we completed rationalization of our portfolio of exploration properties. We realized in 2012 and 2013 exploration property sales totaling approximately $9.0 million, relinquished properties no longer of interest and closed or consolidated our explorations offices. We reduced our portfolio of about 80 properties containing about 730,000 hectares to about 30 properties containing about 150,000 hectares. Since 2011 we have reduced ongoing annual expenditures for the exploration program by approximately 75 percent.

Experienced Management Team. We are led by a team of mining professionals with approximately 125 years of combined experience in exploration, project development, construction and operations all over the world. Our executive officers have held senior positions at various large mining companies including, among others, Cyprus Amax Minerals Company, Phelps Dodge Corporation, Barrick Gold Exploration and Noranda Exploration. Our executive team has a proven ability to manage large projects in challenging environments.

Velardeña Properties

Location, Access and Facilities

The Velardeña Properties are comprised of two underground mines and two processing plants within the Velardeña mining district, which is located in the municipality of Cuencamé, in the northeast quadrant of the State of Durango, Mexico, approximately 65 kilometers southwest of the city of Torreón, Coahuila and approximately 140 kilometers northeast of the city of Durango, which is the capital of the State of Durango. The mines are reached by a seven kilometer road from the village of Velardeña which is reached by highway from Torreón and Durango. The Velardeña mining district is situated in a hot, semi-arid region.

Of the two underground mines comprising the Velardeña Properties, the Velardeña mine includes three different major vein systems including the Santa Juana, San Juanes and San Mateo systems. During the first half of 2013, we were mining the Santa Juana vein system, which has been the focus of mining efforts at Velardeña since 1995, as well as the San Juanes, Terneras and San Mateo vein systems. During May 2013, we completed the San Mateo ramp, which provides improved access to the Santa Juana mining area. The completed ramp, which provides more efficient and less costly haulage capacity from the mine, should be helpful to the restart economic analysis. We suspended mining and processing in June 2013. During the suspension period, we are using the San Mateo ramp to access mining areas for drilling access and to create and evaluate restart plans. The Chicago mine is located approximately two kilometers south of the Velardeña property. We mined less from the Chicago mine in 2013 than in 2012 due to changed blending requirements at the plant and for mine optimization.

We own a 300 tonne per day flotation sulfide mill situated near the town of Velardeña, which accounted for approximately 42% and 33% of our revenue from saleable metals during 2013 and 2012, respectively. The mill includes lead, zinc and pyrite flotation circuits in which we can process the sulfide ore to make lead, zinc and pyrite concentrates. Most of the silver is contained in the lead concentrate, and most of the gold is in the pyrite concentrate.

We also own a conventional 550 tonne per day cyanide leach oxide mill with a Merrill-Crowe precipitation circuit and flotation circuit located adjacent to our Chicago mine, which accounted for approximately 58% and 67% of our revenue from saleable metals during 2013 and 2012, respectively. The mill is used to process oxide and mixed sulfide/oxide material from the Velardeña Properties and during the first half of 2013, generated gold and silver bearing precipitates and lead concentrates that were sold to third party refineries. There is also a small refinery at the oxide plant capable of matching the throughput of the oxide plant up to about 300 tonnes per day, or slightly more than half the maximum capacity of the oxide plant, and capable of creating doré gold and silver bars. We did not make any doré in 2013.

Ore is trucked from the Velardeña and Chicago mines to the appropriate processing plant, and each plant has its own tailings ponds. In January 2012, we completed a tailings pond expansion at the sulfide plant, which is fully permitted and has capacity to treat tailings for two years at 285 tonnes per day. For the oxide plant, we completed the first stage of a new tailings pond during May 2013. If mining activities resume, the first stage provides capacity to treat tailings for approximately one year at the processing rate of 500 tonnes per day. We would expect to complete the second stage approximately six months after the resumption of mining activities, which would provide tailings treatment capacity for approximately an additional two years at 500 tonnes per day. Completion of the third stage would provide tailings treatment capacity for approximately an additional 14 years at the 500 tonnes per day processing rate. We began using the new pond at the oxide plant during the second quarter 2013. We are actively searching for oxide feed from outside sources, which could enable us to restart the oxide plant ahead of and possibly during implementation of an economic restart plan at the Velardeña Properties.

Power for all of the mines is provided through a substation connected to the national grid. Water is provided for all of the mines by wells located in the valley adjacent to the Velardeña Properties.

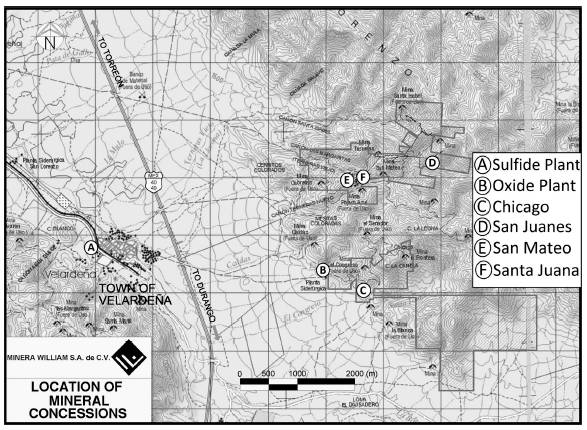

The following map shows the location of the Velardeña Properties.

Property History

Exploration and mining in the Velardeña district extends back to at least the late 1500s or early 1600s, with large scale mining beginning in 1888 with the Velardeña Mining and Smelter Company. In 1902, the mining properties were acquired by ASARCO, who mined the property until 1926 when the mines were closed. For the next 35 years, the mines were operated from time to time by small companies and local miners. The property was nationalized in 1961, and in 1968 the sulfide processing plant was built by the Mexican government. In 1994, William Resources acquired the concessions comprising the Velardeña Properties. In 1997, ECU Gold (the predecessor to ECU Silver Mining Inc.) purchased from William Resources the subsidiaries that owned the concessions. ECU built the oxide processing plant in 1998.

Title and Ownership Rights

We hold the concessions comprising the Velardeña Properties through our wholly-owned Mexican subsidiaries Minera William S.A. de C.V. and BLM Minera Mexicana S.A. de C.V. At present, a total of 29 mineral concessions comprise the Velardeña Properties. The Velardeña Properties encompass approximately 675 hectares. The mineral concessions vary in size, and the concessions comprising each mineral property are contiguous within each of the Velardeña and Chicago properties. We are required to pay annual concession holding fees to the Mexican government to maintain our rights to the Velardeña mining concessions. In 2013, we made such payments totaling approximately $9,000 and expect to pay approximately $11,800 in 2014.

The Velardeña Properties are subject to the Mexican ejido system requiring us to contract with the local communities, or ejidos, surrounding our properties to obtain surface access rights needed in connection with our mining and exploration activities. We currently have contracts with two ejidos to secure surface rights for our Velardeña Properties with a total annual cost of approximately $40,000. The first contract is a ten-year contract with the Velardeña ejido, which provides surface rights to certain roads and other infrastructure at the Velardeña Properties through 2021. The second contract is a 25-year contract with the Vista Hermosa ejido signed in March 2013, which provides exploration access and access rights for roads and utilities for our Velardeña Properties. In 2012 we entered into an agreement with the Vista Hermosa ejido to purchase the surface rights to the 144 hectares area that contains the oxide plant, tailings area and access to

the Chicago mine, along with surface lands that may be required for potential plant expansions. We paid the purchase price, filed the necessary documentation with the National Agrarian Registry (RAN), and are awaiting final approval.

The following Velardeña Properties exploitation concessions are identified below by name and number in the Federal government Public Registry of Mining.

|

Mine/Area |

|

Name of Exploitation |

|

Concession |

|

|

Velardeña |

|

AMPL. DEL ÁGUILA MEXICANA |

|

85580 |

|

|

|

|

ÁGUILA MEXICANA |

|

168290 |

|

|

|

|

LA CUBANA |

|

168291 |

|

|

|

|

TORNASOL |

|

168292 |

|

|

|

|

SAN MATEO NUEVO |

|

171981 |

|

|

|

|

SAN MATEO |

|

171982 |

|

|

|

|

RECUERDO |

|

171983 |

|

|

|

|

SAN LUIS |

|

171984 |

|

|

|

|

LA NUEVA ESPERANZA |

|

171985 |

|

|

|

|

LA PEQUEÑA |

|

171988 |

|

|

|

|

BUEN RETIRO |

|

172014 |

|

|

|

|

UNIFICACIÓN SAN JUAN EVANGELISTA |

|

172737 |

|

|

|

|

UNIFICACIÓN VIBORILLAS |

|

185900 |

|

|

|

|

BUENAVENTURA No. 3 |

|

188507 |

|

|

|

|

EL PÁJARO AZÚL |

|

188508 |

|

|

|

|

BUENAVENTURA 2 |

|

191305 |

|

|

|

|

BUENAVENTURA |

|

192126 |

|

|

|

|

LOS DOS AMIGOS |

|

193481 |

|

|

|

|

VIBORILLAS NO. 2 |

|

211544 |

|

|

|

|

KELLY |

|

218681 |

|

|

|

|

|

|

|

|

|

Chicago |

|

SANTA TERESA |

|

171326 |

|

|

|

|

SAN JUAN |

|

171332 |

|

|

|

|

LOS MUERTOS |

|

171986 |

|

|

|

|

EL GAMBUSINO |

|

171987 |

|

|

|

|

AMPLIACIÓN SAN JUAN |

|

183883 |

|

|

|

|

MUÑEQUITA |

|

196313 |

|

|

|

|

SAN AGUSTÍN |

|

210764 |

|

|

|

|

EL PISTACHÓN |

|

220407 |

|

|

|

|

LA CRUZ |

|

189474 |

|

Geology and Mineralization

The Velardeña district is located at the easternmost limit of the Sierra Madre Occidental on the boundary between the Sierra Madre Oriental and the Mesa Central sub-provinces. Both of these terrains are underlain by Paleozoic and possibly Precambrian basement rocks.

The regional geology is characterized by a thick sequence of limestone and minor calcareous clastic sediments of Cretaceous age, intruded by Tertiary plutons of acidic to intermediate composition. During the Laramide Orogeny, the sediments were folded into symmetrical anticlines and synclines that were modified into a series of asymmetrical overturned folds by a later stage of compression.

A series of younger Tertiary stocks have intruded the older Cretaceous limestone over a distance of approximately 15 kilometers along a northeast to southwest trend. The various mineral deposits of the Velardeña mining district occur along the northeast southwest axis and are spatially associated with the intrusions and their related alteration.

An important northwest southeast fracture system is associated with these intrusions and, in many cases, acts as the main focus of mineralization. The Velardeña Properties are underlain by a thick sequence of limestone that corresponds to rocks of the Aurora and Cuesta del Cura formations of Lower Cretaceous age.

Several types of Tertiary intrusive rocks are present in the Velardeña district. The largest of these rocks outcrops on the western flank of the Sierra San Lorenzo and underlies a portion of the Velardeña Properties. It is referred to as the Terneras pluton and forms a northeast oriented, slightly elongated body, considered to represent a diorite or monzodiorite that outcrops over a distance of about 2.5 kilometers. The adjacent limestone has been altered by contact metamorphism (exoskarn), and locally the intrusive has been metamorphosed (endoskarn).

The following is a description of the individual geological characteristics and mineralization found on each of the properties comprising the Velardeña Properties.

Velardeña Mine

The Santa Juana, Terneras, San Juanes and San Mateo vein deposits on the Velardeña property are hosted by Aurora Formation limestone, the Terneras intrusion and related skarn. The limestone is intruded by a series of multiphase diorite or monzodiorite stocks (Terneras intrusion) and dikes of Tertiary age that outcrop over a strike length of approximately 2.5 kilometers.

Two main vein systems are present on the Velardeña property. The first is a northwest striking system as found in the Santa Juana deposit, while the second is east-west trending and is present in the Santa Juana, Terneras, San Juanes and San Mateo deposits.

In the Santa Juana deposit, two main sets of vein trends are observed. The most significant is a steeply northeast dipping, northwest trending set that has acted as the main conduit for the mineralizing fluids in the Santa Juana deposit. This direction includes both linear and curved northwest vein sets.

The Terneras, San Juanes and San Mateo veins all strike east-west and dip steeply north. The most extensive of these is the Terneras vein, which was mined in the past over a strike length of 1,100 meters. All of these veins are observed to have extensive strike lengths and vertical continuity for hundreds of meters. The mineralogy of the east west system is somewhat different in that it contains less arsenic than the northwest Santa Juana veins.

Mineralization in the deposits located at the Velardeña mines belongs primarily to epithermal calcite quartz veins with associated lead, zinc, silver, gold and copper mineralization, typical of the polymetallic vein deposits of northern Mexico. The veins are usually thin, normally in the 0.2 meter to 0.5 meter range, but consistent along strike and down dip. Coxcomb and rhythmically banded textures are common.

Chicago Mine

On the Chicago property, the oldest rocks outcropping are Cretaceous limestone of the Aurora Formation which are highly folded. This limestone is locally metamorphosed by the intrusion of the Tertiary dioritic stocks and dykes. The general geology of the Chicago property is very similar to the geology of the Velardeña property. The Chicago veins strike northeast and dip steeply southeast. Chicago ore tends to be higher in lead and zinc and lower in arsenic than the Santa Juana ore. Vein widths at Chicago are variable and tend to be narrower than at the Santa Juana deposit, especially in the skarn host.

2012 Technical Report

During the second quarter 2012, the engineering firm of Chlumsky, Armbrust and Meyer (“CAM”) completed an estimate of mineralized material at the Velardeña Properties, set forth in the following table:

|

Mineralized Material |

|

Tonnes |

|

Gold |

|

Contained |

|

Silver |

|

Contained |

|

Lead |

|

Contained |

|

Zinc (Zn) |

|

Contained |

|

|

Mineralized Material at January 1, 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Velardeña Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

741 |

|

3.67 |

|

87,405 |

|

189 |

|

4,502 |

|

1.15 |

|

18,802 |

|

1.03 |

|

16,751 |

|

|

Sulfide |

|

1,368 |

|

3.48 |

|

153,218 |

|

203 |

|

8,935 |

|

0.94 |

|

28,379 |

|

1.18 |

|

35,450 |

|

|

Chicago Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

106 |

|

3.01 |

|

10,242 |

|

142 |

|

484 |

|

2.85 |

|

6,660 |

|

2.43 |

|

5,667 |

|

|

Sulfide |

|

118 |

|

2.31 |

|

8,765 |

|

187 |

|

710 |

|

2.98 |

|

7,752 |

|

2.83 |

|

7,362 |

|

|

Total Mineralized Material at January 1, 2012 |

|

2,333 |

|

3.46 |

|

259,629 |

|

195 |

|

14,631 |

|

1.20 |

|

61,594 |

|

1.27 |

|

65,229 |

|

Note: Results may not tie precisely due to rounding. Additionally, gold ounces are rounded to the nearest ounce and tonnes, silver ounces, zinc pounds and leads pounds are rounded to the nearest thousand. The variance in rounding different commodities and units is for convenience and does not reflect any differences in the level of accuracey of the calculated mineralized material estimate.

The CAM resource estimate assumed a gold price of $1,255.12 per troy ounce, a silver price of $23.28 per troy ounce and a cutoff grade of a net smelter return (“NSR”) of $120.00 per tonne.

The following table shows the commodity prices and metallurgical recoveries used to determine the cutoff grade.

|

Metal |

|

Metal Prices* |

|

Sulfide |

|

Oxide |

|

Mixed Metallurgical |

| |

|

Gold |

|

$ |

1,255.12(oz) |

|

64 |

|

71 |

|

29 |

|

|

Silver |

|

$ |

23.28(oz) |

|

90 |

|

68 |

|

50 |

|

|

Lead |

|

$ |

0.95(lb) |

|

61 |

|

0 |

|

25 |

|

|

Zinc |

|

$ |

0.91(lb) |

|

65 |

|

0 |

|

37 |

|

* Amounts represent three-year average prices.

The cutoff grade of $120.00 NSR per tonne of mineralized material was determined by adding the estimated average costs of mining ($50.00 per tonne), processing ($40.00 per tonne) and general and administration ($30.00 per tonne). The average cost estimates are the same for both the Velardeña and Chicago mines. The NSR value of mineralized material was determined for each type of mineralized material (sulfide, mixed, and oxide) by multiplying a fractional factor that represents an estimated combination of metallurgical recovery, treatment charges, penalties and payment terms by the unit value of each metal and then multiplying by the expected amount of that metal in each block of inventoried material.

The following tables show the reduction in mineralized material reported in the CAM report that resulted from extraction and processing of mineralized material in 2012 and 2013.

|

Mineralized |

|

Tonnes |

|

Gold |

|

Contained |

|

Silver |

|

Contained |

|

Lead |

|

Contained |

|

Zinc |

|

Contained |

|

|

2012 Extraction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Velardeña Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

51 |

|

3.45 |

|

5,652 |

|

231 |

|

378 |

|

0.86 |

|

966 |

|

0.95 |

|

1,067 |

|

|

Sulfide |

|

49 |

|

2.95 |

|

4,664 |

|

182 |

|

288 |

|

0.68 |

|

737 |

|

0.87 |

|

943 |

|

|

Chicago Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

14 |

|

2.07 |

|

934 |

|

109 |

|

49 |

|

2.28 |

|

705 |

|

1.61 |

|

498 |

|

|

Sulfide |

|

20 |

|

2.52 |

|

1,643 |

|

153 |

|

100 |

|

2.85 |

|

1,274 |

|

3.75 |

|

1,676 |

|

|

Total Tonnes Extracted in 2012 |

|

134 |

|

2.98 |

|

12,894 |

|

189 |

|

815 |

|

1.24 |

|

3,683 |

|

1.41 |

|

4,185 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mineralized Material at December 31, 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Velardeña Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

690 |

|

3.68 |

|

81,752 |

|

186 |

|

4,124 |

|

1.17 |

|

17,836 |

|

1.03 |

|

15,684 |

|

|

Sulfide |

|

1,321 |

|

3.50 |

|

148,777 |

|

204 |

|

8,665 |

|

0.95 |

|

27,683 |

|

1.19 |

|

34,558 |

|

|

Chicago Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

92 |

|

3.15 |

|

9,308 |

|

147 |

|

435 |

|

2.94 |

|

5,955 |

|

2.55 |

|

5,169 |

|

|

Sulfide |

|

98 |

|

2.27 |

|

7,122 |

|

194 |

|

610 |

|

3.01 |

|

6,478 |

|

2.64 |

|

5,686 |

|

|

Total Mineralized Material at December 31, 2012 |

|

2,201 |

|

3.49 |

|

246,959 |

|

196 |

|

13,834 |

|

1.19 |

|

57,953 |

|

1.26 |

|

61,097 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 Extraction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Velardeña Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

11 |

|

3.53 |

|

1,294 |

|

393 |

|

144 |

|

2.03 |

|

510 |

|

1.26 |

|

317 |

|

|

Sulfide |

|

40 |

|

4.38 |

|

5,664 |

|

212 |

|

275 |

|

0.96 |

|

849 |

|

1.39 |

|

1,232 |

|

|

Chicago Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

1 |

|

3.70 |

|

73 |

|

90 |

|

2 |

|

1.67 |

|

23 |

|

1.87 |

|

25 |

|

|

Sulfide |

|

9 |

|

2.45 |

|

687 |

|

136 |

|

38 |

|

2.72 |

|

523 |

|

3.41 |

|

657 |

|

|

Total Tonnes Extracted in 2013 |

|

61 |

|

3.93 |

|

7,718 |

|

234 |

|

459 |

|

1.42 |

|

1,906 |

|

1.66 |

|

2,231 |

|

|

Mineralized |

|

Tonnes |

|

Gold |

|

Contained |

|

Silver |

|

Contained |

|

Lead |

|

Contained |

|

Zinc |

|

Contained |

|

|

Mineralized Material at December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Velardeña Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

679 |

|

3.69 |

|

80,458 |

|

182 |

|

3,979 |

|

1.16 |

|

17,326 |

|

1.03 |

|

15,367 |

|

|

Sulfide |

|

1,279 |

|

3.48 |

|

142,890 |

|

204 |

|

8,372 |

|

0.95 |

|

26,793 |

|

1.18 |

|

33,274 |

|

|

Chicago Mine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide and mixed |

|

91 |

|

3.14 |

|

9,235 |

|

147 |

|

433 |

|

2.95 |

|

5,932 |

|

2.55 |

|

5,144 |

|

|

Sulfide |

|

89 |

|

2.25 |

|

6,434 |

|

200 |

|

572 |

|

3.04 |

|

5,955 |

|

2.56 |

|

5,029 |

|

|

Total Mineralized Material at December 31, 2013 |

|

2,138 |

|

3.48 |

|

239,017 |

|

194 |

|

13,357 |

|

1.19 |

|

56,005 |

|

1.25 |

|

58,813 |

|

The following table shows the recovery rates for gold, silver, lead and zinc at each of our processing facilities for 2012 and 2013.

|

|

|

2012 |

|

2013 |

|

|

Oxide plant recovery |

|

|

|

|

|

|

Gold |

|

63.4 |

% |

40.1 |

% |

|

Silver |

|

56.5 |

% |

78.0 |

% |

|

Sulfide plant recovery |

|

|

|

|

|

|

Gold |

|

64.4 |

% |

61.2 |

% |

|

Silver |

|

89.5 |

% |

72.1 |

% |

|

Lead |

|

60.9 |

% |

62.3 |

% |

|

Zinc |

|

65.4 |

% |

82.2 |

% |

For further detail regarding mineralized material, see “CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL”.

2013 Performance

On June 19, 2013, we suspended mining and processing at the Velardeña Properties in order to conserve the asset. During the first half of 2013, the processing facilities generated payable metals totaling approximately 393,000 silver equivalent ounces (equivalents calculated at 60:1 silver to gold) and included approximately 252,000 ounces of silver and 2,350 ounces of gold. Payable silver equivalents include only silver and gold equivalent ounces. Also, during the first half of 2013, the processing facilities generated approximately 500,000 pounds of payable lead and 706,000 pounds of payable zinc. The following table shows actual silver, gold and silver equivalent payables for the first six months of 2013 and the full year 2012.

|

|

|

Payable Metal |

| ||

|

|

|

2012 |

|

2013(1) |

|

|

|

|

|

|

|

|

|

Silver (oz) |

|

457,265 |

|

252,256 |

|

|

Gold (oz) |

|

6,435 |

|

2,349 |

|

|

Silver equivalent (AgEq)(oz)(2) |

|

843,365 |

|

393,196 |

|

(1) Mining and processing activities were suspended at the Velardeña Properties on June 19, 2013.

(2) Equivalents calculated at 60:1 silver to gold.

Combined grades feeding both plants increased year over year by 27% for gold and 30% for silver. The amount of silver and gold payables for the first half of 2013 was negatively impacted by an approximately 33 day suspension of the explosives permit between the first and second quarters, which reduced mill throughput during the period, and the shutdown of mining and processing activities in June 2013. Our payable metals increased approximately 25% on a silver equivalent daily basis in the first half of the year compared to the previous year, but prices decreased significantly below the $1,600 and $30 per ounce levels originally projected. For the second quarter, on a daily basis, 2013 payable metals increased by 67% for silver and 15% for gold as compared to the second quarter 2012. Gold payables were negatively impacted in 2013 by reduced gold recoveries from material mined from new areas, which appeared to have different metallurgy, and a decrease in the percentage of oxide ores which achieve favorable recoveries in the leach circuit.

The table below sets forth the mining and processing statistics of our Velardeña Properties for the first six months of 2013 and the full year 2012.

|

|

|

The Year Ended December 31, |

| ||

|

|

|

2013 (1) |

|

2012 |

|

|

Tonnes Milled |

|

|

|

|

|

|

(includes stockpiles) |

|

|

|

|

|

|

Oxide plant |

|

41,383 |

|

111,003 |

|

|

Sulfide plant |

|

30,680 |

|

74,904 |

|

|

|

|

72,063 |

|

185,907 |

|

|

Combined plant grades |

|

|

|

|

|

|

(Grams per tonne) |

|

|

|

|

|

|

Gold |

|

2.56 |

|

2.02 |

|

|

Silver |

|

163 |

|

125 |

|

|

Combined plant recovery (2) |

|

|

|

|

|

|

Gold |

|

48.7 |

% |

63.7 |

% |

|

Silver |

|

75.8 |

% |

69.2 |

% |

|

|

|

|

|

|

|

|

Contained Metals (2) |

|

|

|

|

|

|

(includes stockpiles) |

|

|

|

|

|

|

Gold ounces |

|

2,885 |

|

7,723 |

|

|

Silver ounces |

|

286,394 |

|

534,372 |

|

|

Silver equivalent ounces (60:1) |

|

459,494 |

|

997,740 |

|

|

Lead - pounds (000) |

|

564 |

|

1,137 |

|

|

Zinc - pounds (000) |

|

836 |

|

1,686 |

|

|

|

|

|

|

|

|

|

Payable Metals (2) |

|

|

|

|

|

|

(includes stockpiles) |

|

|

|

|

|

|

Gold ounces |

|

2,349 |

|

6,435 |

|

|

Silver ounces |

|

252,256 |

|

457,265 |

|

|

Silver equivalent ounces (60:1) |

|

393,196 |

|

843,365 |

|

|

Lead - pounds (000) |

|

500 |

|

1,042 |

|

|

Zinc - pounds (000) |

|

706 |

|

1,388 |

|

|

|

|

|

|

|

|

|

Products sold |

|

|

|

|

|

|

Doré - kilograms |

|

— |

|

2.55 |

|

|

Precipitate - kilograms |

|

9.07 |

|

14.41 |

|

|

Lead concentrates - tonnes |

|

1,147 |

|

1,526 |

|

|

Zinc concentrates - tonnes |

|

1,054 |

|

1,766 |

|

|

Pyrite concentrates - tonnes |

|

2,789 |

|

4,939 |

|

|

Copper concentrates - tonnes |

|

— |

|

173 |

|

|

|

|

|

|

|

|

|

Payable metals in products sold |

|

|

|

|

|

|

Gold ounces |

|

2,845 |

|

7,258 |

|

|

Silver ounces |

|

310,791 |

|

486,087 |

|

|

Silver equivalent ounces (60:1) |

|

481,491 |

|

921,567 |

|

|

Lead - pounds (000) |

|

720 |

|

1,169 |

|

|

Zinc - pounds (000) |

|

927 |

|

1,400 |

|

(1) Mining and processing activities were suspended at the Velardeña Properties on June 19, 2013.

(2) Current payable metals and recoveries include final metal settlements pertaining to sales of previously reported payable metals.

Velardeña Properties and Plans

On June 19, 2013 we suspended mining at our Velardeña Properties. We placed the mines and processing plants on a care and maintenance program to enable a restart when mining and processing plans and metals prices support a cash positive outlook. Approximately 420 positions at the Velardeña Properties were eliminated at the beginning of July 2013, with an additional approximately 20 positions eliminated in October 2013 following the completion of certain suspension activities primarily related to the idling of plant and mobile equipment. We currently plan to retain a core group of approximately 40 employees to facilitate a restart of mining activities and to maintain and safeguard the longer term value of the asset. This group may be further reduced in 2014 as we continue to evaluate restart plans.

Since the shutdown, we have continued to evaluate plans for a restart of mining at the Velardeña Properties, with the objective of implementing a plan that at then current prices for silver and gold indicates a sustainable cash margin for mining. We have been mapping and sampling veins underground containing higher grade shoots to verify mine modeling in support of restart planning. We are analyzing the potential of mining from a combination of different veins at our Velardeña

Properties based primarily on grades and metallurgy. Additionally, we are reviewing alternative high grade narrow vein mining methods to determine the most beneficial mining method for a potential restart. In these efforts, we are using our own technical personnel as well as independent third party consultants. During the first quarter 2014 we commenced a 5,000 meter underground drill program at the Velardeña mine in order to obtain additional information to assist us in creating our restart plan. We expect to receive the drill results in the second quarter 2014.

During 2013 we continued to work on treatment options to improve gold recoveries from gold bearing pyrites. Testing to date for an autoclave process and roasting technologies has demonstrated significant improvement in recoveries, but both of these processes require a larger scale mining project than data currently suggests is feasible. Other enhanced recovery technologies, including fine grinding and leaching, ferric chloride oxidation and leaching and other oxidation processes, have not demonstrated an economic benefit in lab testing thus far. Our current efforts are focused on whether different types of pyrites can be separated to enhance gold recoveries.

We also are actively searching for oxide feed from outside sources, which could enable us to restart the oxide plant at the Velardeña Properties ahead of and possibly during implementation of an economic restart mining plan.

Product Mix

In 2013 the Company sold from the Velardeña Properties primarily precipitates containing payable quantities of gold and silver and lead, zinc and pyrite concentrates containing payable quantities of gold, silver, lead and zinc. In addition to the product mix described in the foregoing sentence, in 2012, the Company also sold doré.

Precipitates

The oxide plant at the Velardeña Properties is a typical agitation leach circuit utilizing Merrill-Crowe to make a filtered precipitate product containing approximately 40% to 45% silver and about 0.5% gold. The precipitate also contains about 10% to 12% lead, 2% copper and 40% other base metals and insoluble elements. The precipitate is sold directly to customers or can be fed directly to a small furnace at the oxide plant to smelt the precipitates into a silver and gold doré bar. During 2013, we sold all of our precipitates from the oxide plant directly to customers, selling the precipitates to two different customers, as described below. Typically, we are paid for 95% to 97% of the contained gold and contained silver in the precipitates with minimal charges for treatment and refining costs. Minimal freight costs to ship the product to the customers are borne by the Company. Pricing is generally determined with reference to an average monthly price for gold and silver relating to the month the precipitates are received by the customer.

In 2013 we incurred approximately $0.2 million in smelting and refining charges for our precipitates sold. Treatment charges are netted against revenue in our consolidated statement of operations.

Doré

In 2012 we made silver and gold doré bars at the Velardeña Properties’ oxide plant, which typically contain about 85% to 90% silver, 2% to 3% gold, and 6% to 8% lead, with the balance being other base metals and insoluble elements. Bars generally weigh around 20 to 25 kilograms. Because of lower silver recoveries experienced during the smelting process, we ceased selling doré in the second quarter 2012.

Concentrates

The sulfide plant at the Velardeña Properties contains a typical flotation circuit that processes material from the Velardeña Properties into lead, zinc and pyrite concentrate products.

Lead concentrates comprise approximately 15% to 20% of total concentrate products from the sulfide plant. The lead concentrates have typical assays of 35% to 40% lead, 4,500 to 5,000 grams per tonne silver, 5 to 10 grams per tonne gold, 5% to 6% zinc and 3% to 4% copper. After metal deductions, we are typically paid for 95% of contained lead and silver with lesser amounts payable for the contained gold. Concentrate treatment charges are negotiated annually and generally reflect market terms for the industry for similar products. Treatment charges in 2013 ranged from $350.00 to $400.00 per tonne. Additional charges are incurred for gold and silver refining, and penalties are assessed for certain elements, such as arsenic and antimony that exceed agreed limits.

Zinc concentrates comprise approximately 25% to 30% of total concentrate products from the sulfide plant. The zinc concentrates have typical assays of 40% to 45% zinc, 600 to 700 grams per tonne silver, 3 to 5 grams per tonne gold and 5% to 6% lead. After metal deductions, we are typically paid for approximately 80% of contained zinc and 55% of silver with lesser amounts payable for the contained gold. Concentrate treatment charges are negotiated annually and generally reflect market terms for the industry for similar products. Treatment charges in 2013 ranged from $175.00 to $200.00 per tonne. Additional charges are incurred for gold and silver refining, and penalties are assessed for certain elements, such as arsenic, that exceed agreed limits.

Pyrite concentrates comprise approximately 50% to 60% of total concentrate production from the sulfide plant. The pyrite concentrates have typical assays of 17 to 19 grams per tonne gold, approximately 200 grams per tonne silver and 33% to 38% sulfur. We are generally paid for only 60% to 65% of the contained gold. Concentrate treatment charges are negotiated annually and generally reflect market terms for the industry for similar products. Treatment charges currently range from $150.00 to $200.00 per tonne, with additional penalties assessed for certain elements, such as zinc, that exceed agreed upon limits.

In 2013, we incurred approximately $1.9 million in smelting and refining charges and approximately $0.7 million in penalty charges, primarily for arsenic and antimony included in our lead and zinc concentrates. Treatment and penalty charges are netted against revenue in our consolidated statement of operations.

Customers

During 2013 all of our revenues from mining were attributable to the sale of products from the Velardeña Properties, including precipitates and lead, zinc and pyrite concentrates. In 2013 we sold some of our precipitates to a single customer under a contract that expired at the end of 2013. Under this contract, we were required to deliver to the customer a minimum of 65% of all our precipitates during the contract period. We have one additional customer to which we sold precipitates during 2013 on a spot basis. During 2013, we also sold lead, zinc and pyrite concentrate products to various customers under exclusive annual contracts that are generally re-negotiated each calendar year. Our sales contracts include terms typical for the industry, including deductions for smelting and refining charges (or treatment charges) and penalties for contaminates present in our products sold.

Our customer contracts are such as ordinarily accompany the kind of business conducted by us and our subsidiaries and are entered into in the ordinary course. Most of our customer contracts are not material in amount, and any contract that is material in amount is not a contract on which our business is substantially dependent. Most of our customer contracts are for a term of one year or less, and many of the contract terms are negotiable during the term of the contract. The global gold and silver markets are competitive with numerous refineries willing to buy precipitates and concentrates on short notice. If any one of our customer contracts were terminated, including the contract pursuant to which a customer purchased approximately 65% of our precipitates, we have identified other precipitate customers during the bidding process as additional avenues in which to sell our product. We do not believe that a loss of the customer that purchased approximately 65% of our precipitates would materially delay, disrupt or reduce revenues in the future if we resume mining activities.

Environmental Matters and Permitting

We conducted environmental audits of the Velardeña Properties in 2011, 2012 and 2013 and identified non-compliance matters that have been remediated, including general site clean-up and permit renewals. We have completed 92% of the remediation plan and expect to have fully completed the plan in March 2014. During 2013 we spent approximately $135,000 remediating or otherwise addressing these issues and currently anticipate that future costs of addressing these issues will not exceed $70,000. In early 2012, for the sulfide plant, we applied for and were accepted into the Mexican National Environmental Auditing Program (“NEAP”). Under NEAP, we are participating in an audit program that verifies compliance with existing regulations and identifying non-regulated potential issues that could result in environmental contingencies. Under the program, we have received recommendations regarding steps to be taken to achieve compliance, and we have agreed to a schedule for achieving compliance. If we comply with the recommendations, and if and when we resume mining and processing at the Velardeña Properties, we expect to obtain a “clean industry” certification issued by the Mexican government. We hold various permits required to conduct mining activities at the Velardeña Properties, and our participation in NEAP allows us to continue mining activities during the remediation of non-compliance matters.

We are required to update our environmental licenses and environmental impact assessments for expansion of or modification to any of the existing two plants. The construction of new infrastructure beyond the current plant facilities also

would require additional permitting, which could include environmental impact assessments and land use permits. We do not expect to have difficulty obtaining additional permits or environmental impact assessments.

Certain Laws Affecting Mining in Mexico

Mexico, officially the United Mexican States, is a federal constitutional republic in North America and bordered by the United States of America, Belize and Guatemala. Mexico is a federal democratic republic with 31 states and one federal district. Each state has its own constitution and its citizens elect a governor, as well as representatives, to their respective state congresses. The President of Mexico is the head of the executive federal government. Executive power is exercised by the President, while legislative power is vested in the two chambers of the Congress of the Union. The three constitutional powers are the Judiciary, the Executive and the Legislature which are independent of each other.

Legislation Affecting Mining

The Mining Law, originally published in 1992 and amended in 1996, 2005 and 2006, is the primary legislation governing mining activities in Mexico. Other significant legislation applicable to mining in Mexico includes the regulations to the Mining Law, the Federal Law of Waters, the Federal Labour Law, the Federal Law of Fire Arms and Explosives, the General Law on Ecological Balance and Environmental Protection and regulations, the Federal Law of Duties and the Federal Law on Metrology and Standards.

The Concession System

Under Mexican law, mineral deposits are property of the Mexican republic, and a mining concession, granted by the executive branch of the federal government, is required for the exploration, exploitation and processing of mineral deposits. Mining concessions may only be granted to Mexican individuals domiciled in Mexico or companies incorporated and validly existing under the laws of Mexico. Mexican companies that have foreign shareholders must register with the National Registry of Foreign Investments and renew their registration on an annual basis. Mining concessions grant rights to explore and exploit mineral deposits but do not grant surface rights over the land where the concession is located. Mining concession holders are required to negotiate surface access with the land owner or holder (e.g., agrarian communities) or, should such negotiations prove unsuccessful, file an application with the corresponding administrative authority (Ministry of Economy or Ministry of Agrarian-Territorial-Urban Development) to obtain an easement, temporary occupancy, or expropriation of the land, as the case may be. An application for a concession must be filed with the Mining Agency or Mining Delegation located closest to the area to which the application relates.

Mining concessions have a term of 50 years from the date on which title is recorded in the Public Registry of Mining. Holders of mining concessions are required to comply with various obligations, including the payment of certain mining duties based on the number of hectares of the concession and the number of years the concession has been in effect. Failure to pay the mining duties can lead to cancellation of the relevant concession. Holders of mining concessions are also obliged to carry out and prove assessment works in accordance with the terms and conditions set forth in the Mining Law and its regulations. The regulations to the Mining Law establish minimum amounts that must be spent or invested on mining activities. A report must be filed in May of each year regarding the assessment works carried out during the preceding year. The mining authorities may impose a fine on the mining concession holder if one or more proof of assessment work reports is not timely filed.

Pursuant to amendments to the federal corporate income tax law, effective January 2014, new additional duties will be imposed on mining concession holders; see “—Taxes in Mexico”.

Environmental Legislation