Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| GOLDEN MINERALS COMPANY | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

o |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

ý |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

350 Indiana Street, Suite 800

Golden, Colorado 80401

To Our Stockholders:

You are cordially invited to attend a special meeting of stockholders of Golden Minerals Company ("Golden") to be held at Courtyard by Marriott Denver West/Golden, 14700 W. 6th Avenue Frontage Road, Golden, Colorado 80401 on Tuesday, August 30, 2011 at 9:00 a.m., Denver time to consider and vote on the issuance of Golden shares in connection with the proposed "merger of equals" business combination transaction (the "Transaction") between Golden and ECU Silver Mining Inc. ("ECU"). The Transaction will be carried out by way of a plan of arrangement pursuant to the Business Corporations Act (Quebec) under which ECU shareholders will receive 0.05 shares of Golden common stock and Cdn$0.000394 in cash for each ECU common share held immediately prior to the consummation of the Transaction. You will also be asked to consider and vote on a proposal to increase the authorized common stock of Golden following the Transaction from 50,000,000 shares to 100,000,000 shares. The increase in authorized capital will assist the combined company in future acquisition or financing transactions.

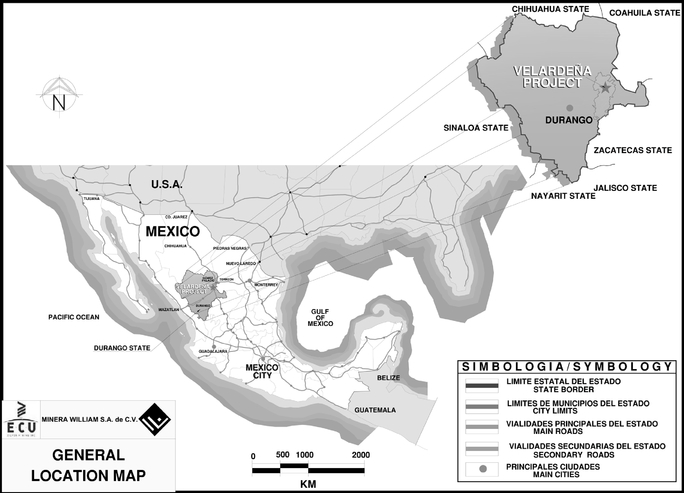

This merger of equals will be a transformative transaction for Golden and create a new junior silver mining company with a diversified portfolio of assets including ECU's silver, gold and base metals mines and exploration projects in the Velardeña Mining District, Durango, Mexico; Golden's El Quevar advanced silver exploration project in the Salta Province, Argentina; and Golden's Zacatecas silver exploration project in Zacatecas, Mexico. In evaluating and approving the Transaction, Golden's board of directors considered a number of factors including, among others:

- •

- Portfolio Growth—The Transaction will provide Golden, through

ECU's Velardeña project, with exposure to ECU's position in one of Mexico's most prolific silver belts, and a producing mine with significant potential growth prospects.

- •

- Value Creation—The Transaction is expected to allow Golden to

leverage its existing cash position by supporting the further development and expansion of exploration and production at ECU's Velardeña Properties.

- •

- Unification of Complementary Management Teams—Golden and ECU

have complementary management teams with proven successful track records that are expected to allow the combined company to optimize existing exploration and development plans and mining operations.

Upon completion of the Transaction, management will have a significant depth of experience in exploration, resource conversion, project development, and mining of both open pit and underground

operations.

- •

- Geographic Diversification—The Transaction increases asset and

geographic diversification benefits for Golden with production in Mexico and advanced exploration properties in Argentina, Mexico and Peru.

- •

- Increased Scale—The Transaction will create a combined company with greater scale, financial strength and an enhanced capital markets profile, with available funds to continue to advance expansion plans at Velardeña and the exploration of the El Quevar project. The Transaction will also provide Golden with exposure to new investors and is expected to improve the company's access to global capital markets to assist future growth objectives.

- •

- Increased Portfolio of Silver Assets—The Transaction continues the strategy that Golden is currently pursuing of building a portfolio of quality silver producing assets in low political risk jurisdictions.

The Sentient Group, one of Golden's largest stockholders with approximately a 19% ownership stake, has indicated to Golden that it supports and intends to vote in favor of the proposed Transaction. Sentient has also expressed an interest in investing further capital in the combined company to retain its current proportionate ownership, although no agreement has been reached.

Your vote is very important. We cannot complete the Transaction unless the Golden common stockholders vote to approve the issuance of Golden common stock in connection with the Transaction, and it is important for our future flexibility in pursuing growth and financing opportunities that Golden stockholders approve the increase in our authorized common stock.

The board of directors hopes that you will attend the special meeting. However, whether or not you plan to attend the meeting, please sign, date and return the accompanying proxy card in the enclosed postage paid pre-addressed envelope, or otherwise return your proxy in a manner described in the accompanying proxy card, as soon as possible. Your vote is important, regardless of the number of shares you own, so please return your proxy card TODAY.

All of us at Golden Minerals appreciate your continued support, and look forward to seeing you at the special meeting.

| Sincerely, | ||

|

||

Jeffrey G. Clevenger Chairman of the Board, President and Chief Executive Officer |

||

July 29, 2011 |

350 Indiana Street, Suite 800

Golden, Colorado 80401

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held August 30, 2011

To Our Stockholders:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders of Golden Minerals Company ("Golden") will be held at Courtyard by Marriott Denver West/Golden, 14700 W. 6th Avenue Frontage Road, Golden, Colorado 80401 on Tuesday, August 30, 2011 at 9:00 a.m., Denver time, for the following purposes:

- 1.

- To

consider and vote on the proposed issuance of shares of Golden common stock, par value $0.01 per share, to the stockholders of ECU Silver

Mining Inc. ("ECU") (including common stock issuable upon the exercise of Golden convertible securities that are issued in exchange for ECU convertible securities) in connection with the

combination of ECU and Golden pursuant to a court-approved plan of arrangement under the Business Corporations Act (Québec), and in

accordance with the arrangement agreement dated June 24, 2011, between Golden and ECU, all as further described in the attached proxy statement.

- 2.

- To

consider and vote upon a proposal to amend Golden's certificate of incorporation to increase the authorized number of shares of Golden common stock from

50,000,000 to 100,000,000.

- 3.

- To consider and vote upon any other matters that properly come before the special meeting and any adjournments or postponements thereof.

Our board of directors has fixed the close of business on July 29, 2011 as the record date for the determination of stockholders entitled to notice of, and to vote at, the special meeting or any adjournments, postponements or delays thereof. This proxy statement and accompanying proxy card are dated July 29, 2011, and are first being mailed or given to Golden stockholders on or about August 2, 2011.

| By Order of our Board of Directors, | ||

Deborah J. Friedman Corporate Secretary |

||

July 29, 2011 |

Whether or not you plan to attend the special meeting, please complete, sign and return the enclosed proxy card or submit your proxy by telephone or over the Internet following the instructions on the proxy card. If you hold your shares in "street name," you should instruct your broker how to vote in accordance with the voting instruction form that you will receive from your bank, broker or other nominee. If you have any questions or need assistance, please call Morrow & Co., LLC, which is assisting us in our solicitation efforts, at 1-877-705-9707.

i

ii

iii

CAUTIONARY NOTE TO UNITED STATES STOCKHOLDERS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

The terms "mineral resource," "measured mineral resource," "indicated mineral resource" and "inferred mineral resource" that are used in this proxy statement are defined in Canadian National Instrument 43-101—Standards of Disclosure for Mineral Projects ("NI 43-101"). These Canadian terms are not recognized under Securities and Exchange Commission ("SEC") Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC by U.S. registered companies. Under SEC disclosure standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. In addition, disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, stockholders are cautioned that the information contained in this proxy statement regarding ECU describing "mineral resources" is not directly comparable to information made public by U.S. companies subject to reporting requirements under U.S. securities laws. Stockholders are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically minable.

CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING INFORMATION

Some information contained in or incorporated by reference into this proxy statement may contain forward-looking statements. These statements include statements in respect of the expected timing and anticipated benefits of the proposed business combination transaction between Golden and ECU (the "Transaction") and statements regarding future operations and activities of ECU, Golden or the combined company, including planned and potential exploration and development opportunities of the combined company, plans, expectations and assumptions concerning the El Quevar project or the Velardeña project, the timing and budget for exploration of our portfolio of exploration properties, our expected cash needs, and statements concerning our financial condition, operating strategies and operating and legal risks. There are also risks inherent in the nature of the proposed Transaction, including risks regarding the integration of the two entities, incorrect assessments of the values of the other entity, and failure to obtain the required securityholder, court, regulatory and other third party approvals.

This proxy statement also includes forward-looking statements relating to the potential for further investment by The Sentient Group in the combined company. Golden and ECU caution investors that no agreement with respect to such further investment has been reached and provide no assurance that any such agreement will be reached.

We use the words "anticipate," "continue," "likely," "estimate," "expect," "may," "could," "will," "project," "should," "believe" and similar expressions to identify forward-looking statements. Statements that contain these words discuss our future expectations, contain projections or state other forward-looking information. Although we believe the expectations and assumptions reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. The actual results of the combined company could differ materially from those expressed or implied in these forward-looking statements as a result of various risks, including the risk factors described in this proxy statement beginning on page 14, the risk factors

1

set forth in our annual report on Form 10-K, and the risk factors set forth in ECU's annual information form, including:

- •

- Results of future exploration at Golden's El Quevar project;

- •

- The feasibility and economic viability of potential expansion plans at ECU's Velardeña project;

- •

- The feasibility and economic viability of Golden's El Quevar project;

- •

- The combined company's ability to raise necessary capital to complete expansion plans at ECU's Velardeña

project and if justified by results the development of Golden's El Quevar project;

- •

- The combined company's ability to retain key management and mining personnel necessary to successfully operate and grow

our business;

- •

- Worldwide economic and political events affecting the market prices for silver and other minerals which may be found on

our exploration properties; and

- •

- Political and economic instability in Argentina, Mexico, Peru, and other countries in which we conduct our business, and future actions of the governments in such countries with respect to nationalization of natural resources or other changes in mining or taxation policies.

Many of those factors are beyond our ability to control or predict. You should not unduly rely on any of our forward-looking statements. These statements speak only as of the date of this proxy statement. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this proxy statement.

In this proxy statement, figures are presented in both metric and United States standard measurements. Conversion rates from United States standard to metric and metric to United States standard measurement systems are provided in the table below.

| US. Unit | Metric Measure | Metric Unit | U.S. Measure | |||

|---|---|---|---|---|---|---|

| 1 acre | 0.4047 hectares | 1 hectare | 2.47 acres | |||

| 1 foot | 0.3048 meters | 1 meter | 3.28 feet | |||

| 1 mile | 1.609 kilometres | 1 kilometre | 0.62 miles | |||

| 1 ounce (troy) | 31.103 grams | 1 gram | 0.032 ounces (troy) | |||

| 1 ton | 0.907 tonnes | 1 tonne | 1.102 tons |

REPORTING CURRENCIES AND ACCOUNTING PRINCIPLES

Unless otherwise indicated, all references to "$" or "dollars" in this proxy statement refer to United States dollars. References to "Cdn$" in this proxy statement refer to Canadian dollars. ECU's financial statements are reported in Canadian dollars and are prepared in accordance with Canadian GAAP (for periods prior to 2011) or IFRS (for 2011). Golden's financial statements that are incorporated by reference herein, as well as the pro forma financial statements included as Annex E to this proxy statement, are reported in U.S. dollars and are prepared in accordance with U.S. GAAP. Accordingly, in preparing the unaudited pro forma consolidated financial statements of the combined company as at and for the three months ended March 31, 2011, and the fiscal year ended December 31, 2010, as applicable, certain material adjustments were made in order to reconcile Canadian GAAP and IFRS with U.S. GAAP, as described in "Unaudited Pro Forma Combined Condensed Financial Statements" attached as Annex E.

2

The following table sets forth (i) the noon rates of exchange for the Canadian dollar, expressed in Canadian dollars per U.S. dollar, in effect at the end of the period indicated, (ii) the average noon rates of exchange for such periods, and (iii) the high and low noon rates of exchange during such periods, in each case based on the noon rates of exchange as quoted by the Bank of Canada.

| |

|

Year ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

January 1, 2011 through July 26, 2011 |

|||||||||||

Canadian Dollar per U.S. dollar

|

2010 | 2009 | 2008 | |||||||||

Noon rate at end of period |

0.9449 | 0.9946 | 1.0466 | 1.2246 | ||||||||

Average noon rate for period |

0.9745 | 1.0299 | 1.1420 | 1.0660 | ||||||||

High noon rate for period |

1.0022 | 1.0778 | 1.3000 | 1.2969 | ||||||||

Low noon rate for period |

0.9449 | 0.9946 | 1.0292 | 0.9719 | ||||||||

On June 23, 2011, the last trading day before the announcement of the Transaction, the rate of exchange was $1.00 equals Cdn$0.9799, based on the noon rate of exchange as quoted by the Bank of Canada.

On July 26, 2011, the rate of exchange was $1.00 equals Cdn$0.9449 based on the noon rate of exchange as quoted by the Bank of Canada.

INFORMATION CONTAINED IN THIS PROXY STATEMENT

The information contained in this proxy statement is given as of July 29, 2011 except where otherwise noted and except that information in documents incorporated by reference is given as of the dates noted therein.

No person has been authorized by Golden to give any information or to make any representation in connection with the proposed business combination transaction or any other matters described herein other than as contained in this proxy statement and, if given or made, any such information or representation should be considered not to have been authorized by Golden or ECU.

Certain information pertaining to ECU included or described herein (including financial statements of ECU) has been provided by or on behalf of ECU or is based on publicly available documents and records on file with the relevant Canadian provincial securities regulators and other public sources. Although Golden does not have any knowledge that would indicate that any such information is inaccurate or incomplete, Golden assumes no responsibility for the accuracy or completeness of such information, nor for the failure by ECU to disclose events which may have occurred or which may affect the completeness or accuracy of such information but which is unknown to Golden. Unless the context otherwise indicates, references in this proxy statement to "we," "our," "ours" and "us" refer to Golden and its subsidiaries, collectively.

This proxy statement does not constitute the solicitation of an offer to purchase any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation is not authorized or in which the person making such solicitation is not qualified to do so or to any person to whom it is unlawful to make such solicitation.

Information contained in this proxy statement should not be construed as legal, tax or financial advice and Golden stockholders are urged to consult their own professional advisors in connection with the proposed transaction.

3

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION AND THE SPECIAL MEETING

The following questions and answers briefly address some commonly asked questions about the Transaction and the special meeting. You should carefully read this entire proxy statement, including the attached Annexes. Capitalized terms in this proxy statement have the meanings set out in the Glossary of Terms attached as Annex A or in the proxy statement.

Q: What is Golden proposing?

- A:

- Golden stockholders are being asked to consider and vote upon two proposals. First, Golden stockholders will vote upon a proposal approving the issuance of Golden common stock in connection with a business combination transaction pursuant to which Golden will acquire all of ECU's outstanding common shares and convertible securities and ECU will become a wholly-owned subsidiary of Golden. The Transaction will be carried out pursuant to (i) an arrangement agreement dated June 24, 2011, between Golden and ECU, which we refer to as the "Arrangement Agreement," and (ii) a court-approved plan of arrangement under Chapter XVI—Division II of the Business Corporations Act (Québec), which we refer to as the "Plan of Arrangement." The Arrangement Agreement and Plan of Arrangement provide that ECU shareholders will receive 0.05 shares of Golden common stock and Cdn$0.000394 in cash for each ECU common share held immediately prior to the consummation of the Transaction. In addition, upon the consummation of the Transaction, new Golden options to purchase Golden common stock, or "Golden Replacement Options," will be exchanged for all outstanding options to purchase ECU common shares, and new Golden warrants to purchase Golden common stock, or "Golden Replacement Warrants," will be exchanged for all outstanding warrants to purchase ECU common shares. It is anticipated that consummation of the Transaction pursuant to the Plan of Arrangement will result in Golden paying an aggregate of approximately Cdn$125,000 in cash and issuing a total of approximately 16.0 million new shares, not including up to approximately 2.9 million new shares that will be issuable following the exercise of currently outstanding ECU options and warrants (or upon the exercise of the Golden Replacement Options and Golden Replacement Warrants to be received in exchange therefor) and approximately 167,000 shares that are expected to be issued, in the aggregate, in satisfaction of certain ECU change of control payments.

In addition, Golden stockholders will vote upon a proposal to amend Golden's certificate of incorporation to increase the authorized number of shares of Golden common stock from 50,000,000 to 100,000,000. The approval of this proposal is not a condition to the closing of the Transaction.

Q: How does the board of directors recommend that I vote?

- A:

- Golden's

board of directors unanimously recommends that Golden's stockholders vote:

- •

- FOR the issuance of Golden common stock (including stock issuable upon

exercise of Golden Replacement Options and the Golden Replacement Warrants) in connection with the Transaction, which we refer to as the "Share Issuance Proposal;" and

- •

- FOR the adoption of the amendment to Golden's certificate of incorporation to increase the authorized number of shares of Golden's common stock, which we refer to as the "Charter Amendment Proposal."

Q: Why is Golden proposing to combine with ECU?

- A:

- Golden is proposing to combine with ECU because Golden believes that the Transaction will create a combined company with an attractive and more diversified portfolio of assets, greater scale and financial strength, and an enhanced capital markets profile. We believe that the

4

combined company will be sufficiently capitalized to advance expansion plans at ECU's Velardeña project and the exploration of Golden's El Quevar project, and that combining the complementary management teams of the two companies will provide the broad experience and expertise necessary to lead these efforts. For additional information regarding ECU's Velardeña project and Golden's El Quevar project, see "Information Concerning ECU" and "Information Concerning Golden," beginning on pages 75 and 69, respectively.

Q: Why is Golden proposing to amend its certificate of incorporation?

- A:

- Golden is proposing to amend its certificate of incorporation because, while an increase in authorized shares is not necessary to enable Golden to complete the Transaction, the increase will provide the Golden board with additional capacity to issue shares in future offerings or acquisitions following consummation of the Transaction as determined by Golden's board to be in the best interests of Golden's stockholders. The approval of the Charter Amendment Proposal is not a condition precedent to the consummation of the Transaction. Moreover, if the Share Issuance Proposal is not approved or the Transaction is not consummated for any reason, Golden will not amend its certificate of incorporation even if the Charter Amendment Proposal is approved.

Q: Are there risks I should consider in deciding whether to vote for the Share Issuance Proposal?

- A:

- Yes. The Share Issuance Proposal and the Transaction are subject to a number of risks and uncertainties. Golden may not realize the benefits it currently anticipates from the Transaction due to the challenges associated with integrating the companies and other risks inherent in its mining business. See "Risk Factors" beginning on page 14.

Q: Am I entitled to dissenters' appraisal rights?

- A:

- No. Holders of Golden shares are not entitled to dissenters' appraisal rights in connection with the Transaction or any other action to be taken at the special meeting. See "General Information Concerning the Golden Meeting—Dissent Rights" beginning on page 29.

Q: How does Golden intend to finance the Transaction?

- A:

- The consideration to be paid by Golden in the Transaction consists primarily of Golden common stock. In addition, Golden will pay cash consideration of Cdn$0.000394 for each ECU share outstanding (an aggregate of approximately Cdn$125,000), with all such payments made from available cash on hand.

Q: When do Golden and ECU expect to complete the Transaction?

- A:

- Golden and ECU expect to complete the Transaction when all of the conditions to completion of the Transaction have been satisfied or waived. The parties are working toward satisfying these conditions and completing the Transaction as quickly as possible. The parties currently plan to complete the Transaction on or about September 2, 2011.

Q: What is the role of Canadian courts with respect to the Transaction?

- A:

- Under the Business Corporations Act (Québec), a Québec court must approve the Plan of Arrangement. If ECU Securityholders approve the Transaction and Golden Stockholders approve the issuance of Golden common stock to be issued pursuant to the Transaction, the Superior Court of Québec will hold a hearing regarding a final order to approve the Plan of Arrangement and any amendments thereto made in accordance with the Arrangement Agreement. The court will consider, among other things, the fairness and reasonableness of the Plan of Arrangement. The

5

court may approve the Plan of Arrangement in any manner and subject to compliance with such terms and conditions, if any, as the court may direct. The court's approval of the fairness of the Plan of Arrangement will serve as the basis for an exemption from the registration requirements of the United States Securities Act of 1933, as amended, or the "Securities Act," for the issuance of the Golden common stock, the Golden Replacement Options and the Golden Replacement Warrants to the ECU shareholders, optionholders and warrantholders, as applicable, in connection with the Plan of Arrangement and the Arrangement Agreement.

Q: What will the share ownership, board of directors and management of Golden look like after the combination?

- A:

- We estimate that upon completion of the Transaction, former shareholders of ECU will own approximately 51% of the outstanding common stock of Golden, assuming that no outstanding ECU options or warrants are exercised before the consummation of the Transaction. If all of those options and warrants are exercised before the consummation of the Transaction, former securityholders of ECU will own approximately 55% of the outstanding stock of Golden. Upon consummation of the Transaction, we expect that we will expand the size of our board of directors in order to add one current ECU director, Michael T. Mason, to our board. In addition, it is our intention that ECU's current President, Stephen J. Altmann, will become the President of Golden after the Transaction. Golden's current Chairman and CEO, Jeffrey G. Clevenger, will retain these positions following the Transaction.

Q: Why am I receiving this proxy statement?

- A:

- You are receiving this proxy statement and enclosed proxy card because, as of July 29, 2011, the record date for the special meeting, you owned shares of Golden common stock. Only holders of record of Golden common stock as of the close of business on July 29, 2011 will be entitled to vote those shares at the special meeting. Our board of directors is providing these proxy materials to give you information to determine how to vote in connection with the special meeting of our stockholders.

This proxy statement describes the proposals on which we would like you, as a stockholder, to vote. It also provides you with important information about these proposals to enable you to make an informed decision as to whether to vote your shares of Golden common stock to approve the matters described herein.

Your vote is very important and we encourage you to complete, sign, date and mail your proxy card, as soon as possible, whether or not you plan to attend the special meeting. Convenient telephone and Internet voting options are also available.

Q: When and where is the special meeting?

- A:

- The special meeting will be held at Courtyard by Marriott Denver West/Golden, 14700 W. 6th Avenue Frontage Road, Golden, Colorado 80401 on Tuesday, August 30, 2011 at 9:00 a.m., Denver time.

Q: What vote is required to approve the proposals?

- A:

- The Share Issuance Proposal must be approved by the affirmative vote of a majority of the shares of Golden common stock present at the special meeting and entitled to vote thereon, assuming a quorum is present.

The Charter Amendment Proposal must be approved by the affirmative vote of a majority of the outstanding shares of Golden common stock.

6

Q: What constitutes a quorum at the special meeting?

- A:

- The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Golden common stock entitled to vote at the special meeting constitutes a quorum for the transaction of business at the special meeting. If you hold your shares through a broker or bank, and your broker or bank votes your shares on the Charter Amendment Proposal, those shares will be counted for purposes of determining the presence of a quorum at the meeting.

Q: How many votes do I have?

- A:

- You have one vote for each share of Golden common stock that you own as of the record date.

Q: How are votes counted?

- A:

- Votes will be counted by the inspector of election appointed for the special meeting, who will separately count "For" and "Against" votes, abstentions and broker non-votes. A "broker non-vote" occurs when a nominee holding shares for a beneficial owner does not receive instructions from the beneficial owner with respect to proposals relating to non-routine matters. The Share Issuance Proposal is considered a non-routine matter and the Charter Amendment Proposal is considered a routine matter.

Q: How do I vote my Golden common stock?

- A:

- Before you vote, you should read this proxy statement in its entirety, including its Annexes, and carefully consider how the Transaction affects you. If you are a stockholder of record, you should mail your completed, dated and signed proxy card in the enclosed return envelope or submit your proxy by telephone or over the Internet as soon as possible so that your shares can be voted at the special meeting. For more information on how to vote your shares, see the section entitled "How You Can Vote."

If you hold your Golden common stock in "street name," you should follow the voting directions provided by your bank, brokerage firm or other nominee. You may complete and mail a voting instruction form to your bank, brokerage firm or other nominee or, in most cases, submit voting instructions by telephone or over the Internet to your bank, brokerage firm or other nominee. If you provide specific voting instructions by mail, telephone or the Internet, your bank, brokerage firm or other nominee will vote your shares of common stock as you have directed. Please note that if you wish to vote in person at the special meeting, you must obtain a "legal" proxy from your bank, brokerage firm or other nominee. If you do not provide your bank, brokerage firm or other nominee with voting instructions, your shares held through such entity will not be voted.

Q: What happens if I do not vote?

- A:

- If you do not vote, your shares will not be counted toward the approval requirement for the Share Issuance Proposal. If you hold your shares through a broker, your broker may vote your shares on the Charter Amendment Proposal. Broker non-votes, if any, will have no effect on the Share Issuance Proposal but will have the same effect as a vote "AGAINST" the Charter Amendment Proposal. Abstentions will have the same effect as a vote "AGAINST" the Share Issuance Proposal and the Charter Amendment Proposal.

Q: What happens if I don't indicate how to vote on my proxy?

- A:

- If you are a record holder of Golden common stock and sign and send in your proxy card, but do not include instructions on how to vote, your shares will be voted "FOR" the Share Issuance Proposal and "FOR" the Charter Amendment Proposal. Golden's management does not currently

7

intend to bring any proposals to the special meeting other than those described in this proxy statement. If other proposals requiring a vote of stockholders are properly brought before the special meeting, the persons named in the enclosed proxy card intend to vote the shares they represent in accordance with their best judgment.

Q: What happens if I sell my shares of Golden common stock before the special meeting?

- A:

- The record date for stockholders entitled to vote at the special meeting is earlier than the date of the special meeting. If you transfer your shares of Golden common stock after the record date but before the special meeting, you will, unless special arrangements are made, retain your right to vote at the special meeting.

Q: If my shares are held in "street name" by my broker, will my broker vote my shares for me?

- A:

- If your shares are held through a broker, bank or other nominee (collectively referred to as "brokers"), under applicable rules of NYSE Amex LLC ("NYSE Amex") (one of the exchanges on which our common stock is traded), the broker will vote your shares according to the specific instructions it receives from you. If the broker does not receive voting instructions from you, the broker may vote only on a proposal that is considered a "routine" matter under the NYSE Amex rules. At the special meeting, your broker may vote without your instructions only on the Charter Amendment Proposal, because it is considered a routine matter. Your broker may not vote on the Share Issuance Proposal because it is non-routine. The broker's failure to vote on the Share Issuance Proposal because it lacks discretionary authority to do so, commonly referred to as a "broker non-vote," will not affect the outcome of the vote on the Share Issuance Proposal. Any broker non-votes will have the same effect as a vote "AGAINST" the Charter Amendment Proposal.

Q: Will my shares held in "street name" or another form of record ownership be combined for voting purposes with shares I hold of record?

- A:

- No. Because any shares you may hold in "street name" will be deemed to be held by a different stockholder than any shares you hold of record, shares held in "street name" will not be combined for voting purposes with shares you hold of record. Similarly, if you own shares in various registered forms, such as jointly with your spouse, as trustee of a trust or as custodian for a minor, you will receive, and will need to sign and return, a separate proxy card for those shares because they are held in a different form of record ownership. Shares held by a corporation or business entity must be voted by an authorized officer of the entity. Shares held in a retirement investment account must be voted under the rules governing the account.

Q: What does it mean if I receive more than one set of materials?

- A:

- This means you own shares of Golden common stock that are registered under different names. For example, you may own some shares directly as a stockholder of record and other shares through a broker or you may own shares through more than one broker. In these situations, you will receive multiple sets of proxy materials. You must vote, sign and return all of the proxy cards or follow the instructions for any alternative voting procedure on each of the proxy cards that you receive in order to vote all of the shares you own. Each proxy card you receive comes with its own prepaid return envelope. If you vote by mail, make sure you return each proxy card in the return envelope that accompanies that proxy card.

8

Q: May I vote in person?

- A:

- Yes. You may attend the special meeting and vote your shares in person whether or not you sign and return your proxy card. If your shares are held of record by a broker, bank or other nominee and you wish to vote at the special meeting, you must obtain a "legal" proxy from the record holder.

Q: May I change my vote after I have mailed my signed proxy card?

- A:

- Yes.

You may revoke and change your vote at any time before your proxy card is voted at the special meeting. You can do this in one of three

ways:

- •

- First, you can send a written notice to the Golden corporate secretary stating that you would like to revoke your proxy;

- •

- Second, you can complete and submit a new proxy in writing, by telephone or over the Internet; or

- •

- Third, you can attend the meeting and vote in person. Your attendance alone will not revoke your proxy.

If you have instructed a broker to vote your shares, you must follow directions received from your broker to change those instructions.

Q: Who can help answer my questions?

- A:

- If you have questions about the Transaction and the special meeting, including the procedures for voting your shares, you should contact our proxy solicitor, Morrow & Co., LLC, toll-free at 1-877-705-9707.

9

The following information is a summary of certain information contained in this proxy statement. The information contained in this summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information and financial data and statements contained elsewhere in this proxy statement, including the Annexes and the documents incorporated by reference. Capitalized terms in this Summary have the meanings set out in the Glossary of Terms attached as Annex A or as set out in this Summary.

Golden and ECU are proposing to engage in a business combination transaction pursuant to which Golden will acquire all of the outstanding common shares, options and warrants of ECU, and ECU will become a wholly-owned subsidiary of Golden. The Transaction will be carried out pursuant to (i) the Arrangement Agreement dated June 24, 2011, between Golden and ECU, and (ii) a Court-approved arrangement under Chapter XVI—Division II of the Business Corporations Act (Québec), which we refer to as the "Plan of Arrangement". The Arrangement Agreement and Plan of Arrangement provide that ECU shareholders will receive 0.05 shares of Golden common stock and Cdn$0.000394 in cash for each ECU common share held immediately prior to the consummation of the Transaction. In addition, upon the consummation of the Transaction, new Golden options to purchase Golden common stock, or "Golden Replacement Options," will be exchanged for all outstanding options to purchase ECU common shares, and new Golden warrants to purchase Golden common stock, or "Golden Replacement Warrants," will be exchanged for all outstanding warrants to purchase ECU common shares. It is anticipated that consummation of the Transaction pursuant to the Plan of Arrangement will result in Golden paying an aggregate of approximately Cdn$125,000 in cash, and issuing a total of approximately 16.0 million new shares, not including up to approximately 2.9 million new shares that will be issuable following the exercise of currently outstanding ECU options and warrants (or upon the exercise of the Golden Replacement Options and Golden Replacement Warrants to be received in exchange for those options and warrants) and approximately 167,000 shares that are expected to be issued, in the aggregate, in satisfaction of certain ECU change of control payments.

See "The Transaction" beginning on page 30.

Golden and ECU entered into the Arrangement Agreement on June 24, 2011. The terms and conditions of the Transaction are governed by the Arrangement Agreement. The Arrangement Agreement is attached to this proxy statement as Annex B and is part of this proxy statement. Golden urges you to read the Arrangement Agreement carefully as it is the legal document that governs the Transaction.

See "The Arrangement Agreement" beginning on page 53.

Golden Minerals Company

Golden Minerals Company is a Delaware corporation headquartered in Golden, Colorado. We are a mineral exploration company with a diversified portfolio of precious metals and other mineral exploration properties located in or near the traditional precious metals producing regions of Mexico and South America. We are currently focused on advancement of our 100% controlled El Quevar silver project in northwestern Argentina and are engaged in additional drilling, metallurgical analysis and other advanced exploration work at El Quevar. In addition to El Quevar, we own and control a portfolio of approximately 45 exploration properties located primarily in Mexico and South America.

10

Our 100% controlled Zacatecas silver and base metals project in Mexico is in an advanced stage of exploration, with six separate target areas on which we are currently conducting exploration activities, including drilling at the Adriana, San Manuel-San Gil, and the Pánuco targets. We also have reconnaissance properties on which we are conducting preliminary sampling and geological analysis to determine the best potential areas for more detailed exploration. Our principal offices are located in Golden, Colorado at 350 Indiana Street, Suite 800, Golden, CO 80401, and our telephone number is (303) 839-5060.

See "Information Concerning Golden" beginning on page 69 of this proxy statement.

ECU Silver Mining Inc.

ECU Silver Mining Inc., a Québec corporation, is a Canadian-based mining company focused on the exploration, development and mining of silver, gold and base metals at its Velardeña District properties in Durango, Mexico. ECU owns and operates two mills with a combined capacity of 820 tonnes per day. ECU's executive offices are located at 87 Front Street East, 2nd Floor, Toronto, Ontario M5E 1B8, and its telephone number is (416) 366-2428.

See "Information Concerning ECU" beginning on page 75.

General Information Concerning the Golden Stockholders Meeting

Date, Time and Place of the Meeting

The Golden stockholders' vote will take place at a special meeting to be held at Courtyard by Marriott Denver West/Golden, 14700 W. 6th Avenue Frontage Road, Golden, Colorado 80401 on Tuesday, August 30, 2011 at 9:00 a.m., Denver time.

Record Date for the Golden Stockholders Meeting

You are entitled to vote at the special meeting if you owned Golden common stock at the close of business on July 29, 2011.

Purpose of the Golden Stockholders Meeting

Golden's stockholders are being asked to consider and vote upon:

- (i)

- a

proposal approving the issuance of shares of Golden common stock, par value $0.01 per share, (including stock issuable upon exercise of the Golden

Replacement Options and Golden Replacement Warrants) in connection with the Transaction (this proposal is referred to as the "Share Issuance Proposal"); and

- (ii)

- a proposal to amend Golden's certificate of incorporation to increase the authorized number of shares of Golden common stock from 50,000,000 to 100,000,000 (this proposal is referred to as the "Charter Amendment Proposal").

Approval of the Share Issuance Proposal is required to enable Golden to complete the Transaction. Approval of the Charter Amendment Proposal is not required to complete the Transaction. Approval of the Charter Amendment Proposal is being solicited in order to provide the Golden board with additional capacity to issue shares in future offerings or acquisitions following consummation of the Transaction as determined by the Golden board to be in the best interests of the Golden stockholders. See "General Information Concerning the Golden Meeting" beginning on page 26.

11

Required Vote of Golden's Stockholders

The Share Issuance Proposal must be approved by the affirmative vote of a majority of the shares of Golden common stock present at the special meeting and entitled to vote thereon, assuming a quorum is present. The Charter Amendment Proposal must be approved by the affirmative vote of a majority of the outstanding shares of Golden common stock. Abstentions will have the same effect as a vote "AGAINST" the Share Issuance Proposal and the Charter Amendment Proposal. Shares held through brokers may be voted without instruction by such brokers on the Charter Amendment Proposal but not the Share Issuance Proposal. A broker's failure to vote on the Share Issuance Proposal because it lacks discretionary authority to do so, commonly referred to as a "broker non-vote," will not affect the outcome of the vote on the Share Issuance Proposal.

Golden's Board Recommendation

Golden's board of directors unanimously recommends that Golden's stockholders vote "FOR" the Share Issuance Proposal and "FOR" the Charter Amendment Proposal.

Opinion of Golden's Financial Advisor

On June 23, 2011 Golden's board of directors received an opinion from BMO Capital Markets Corp. to the effect that, as of June 23, 2011, and subject to the various assumptions in the opinion, the exchange ratio, together with the cash consideration payable in the Transaction, was fair, from a financial point of view, to Golden.

See "Fairness Opinion of Financial Advisor to Golden" beginning on page 37.

Under the Business Corporations Act (Québec), the Transaction requires court and ECU securityholder approval. On July 14, 2011, ECU obtained an interim order from the Superior Court of Québec (the "Québec Court") providing for the calling and holding of the ECU special meeting and other procedural matters. Subject to receipt of the requisite approvals of the Transaction by securityholders of ECU and Golden at their respective special meetings, the hearing in respect of a final order from the Québec Court is expected to take place on or about August 31, 2011.

Anticipated Closing of the Transaction

Golden and ECU will complete the Transaction when all of the conditions to completion of the Transaction have been satisfied or waived. The parties are working toward satisfying these conditions and completing the Transaction as quickly as possible. The parties currently plan to complete the Transaction on or about September 2, 2011, although there can be no assurance that the Transaction will be completed by this date, or at all.

Upon consummation of the Transaction, Golden plans to increase the size of its board of directors in order to add one current ECU director, Michael T. Mason, to the Golden board. In addition, ECU's current President, Stephen J. Altmann, is expected to become the President of Golden after the Transaction. Golden's current Chairman and CEO, Jeffrey G. Clevenger, will retain those positions in Golden following the Transaction.

See "Directors and Officers of the Combined Company" beginning on page 62.

12

U.S. Federal Income Tax Consequences

There are no material U.S. federal income tax consequences to Golden's current stockholders that will result from Golden's acquisition of ECU or the issuance of Golden common stock pursuant to the Transaction.

On June 24, 2011, Golden and ECU entered into the subscription agreement, pursuant to which ECU issued to Golden on July 13, 2011 Cdn$15.0 million principal amount 0.0% senior unsecured convertible notes in a private placement. The private placement is intended to provide ECU with interim financing of its operations pending consummation of the Transaction. The convertible notes will mature on June 30, 2012 (subject to extension as described below), and will be convertible by Golden at any time prior to 5:00 p.m. (Toronto time) on June 29, 2012 into ECU Shares at the rate of 1,032 shares per Cdn$1,000 principal amount, consistent with the exchange ratio. The convertible notes will also be redeemable by ECU at any time after the record date for the special meeting of ECU Shareholders to approve the Transaction and prior to the maturity date, at 100% of the face value of the notes plus accrued and unpaid interest. ECU may elect to extend the maturity of the convertible notes to December 31, 2012 for a cash payment equal to 4% of the face value of the then outstanding notes, payable on the day the extension option is exercised, with interest accruing on the notes at 10% per annum during such extension period. Under the terms of the subscription agreement, the proceeds of the private placement are held in an escrow account and may be used only for certain specified purposes. As of July 13, the shares issuable upon conversion of the convertible notes represented approximately 4.7% of ECU's common shares outstanding on an as-converted basis.

Golden, as holder of the convertible notes, is entitled to vote any ECU common shares received upon conversion of the Notes. Further, Golden may vote the convertible notes themselves in any vote of ECU's outstanding common shares, options, warrants and convertible securities voting as a single class, with respect to the vote of ECU Securityholders to approve the Transaction. See "The Transaction—Subscription Agreement and Private Placement" on page 34.

There are certain risk factors relating to Golden, ECU and the Transaction which should be carefully considered by stockholders, including the fact that the Transaction may not be completed if, among other things, Golden or ECU securityholder approval is not obtained, or if any other conditions precedent to the completion of the Transaction are not satisfied or waived, as applicable.

See "Risk Factors" beginning on page 14.

Pro Forma Financial Statements of the Combined Company

See "Unaudited Pro Forma Combined Condensed Financial Statements" attached as Annex E.

13

In addition to the other information contained in, or incorporated by reference into, this proxy statement (including the risk factors applicable to Golden contained under the heading "Risk Factors" in Golden's annual report on Form 10-K for the fiscal year ended December 31, 2010), the following factors should be considered carefully when considering risks related to the Transaction and the combined company. These risks and uncertainties are not the only risks Golden, ECU and the combined company may face, nor do they include all of the risks and uncertainties associated with the Transaction. If any such risks actually occur, the business, prospects, financial condition, cash flows and operating results of Golden, ECU and the combined company could be materially adversely affected. See "Where Stockholders Can Find More Information About Golden" beginning on page 95 for a list of the documents incorporated by reference.

Risks Related to the Transaction

The Transaction will present challenges associated with integrating operations, personnel and other aspects of the companies and assumption of liabilities that may exist at ECU and which may be known or unknown by Golden.

The results of the combined company following the Transaction will depend in part upon Golden's ability to integrate its business with ECU's business in an efficient and effective manner. Golden's attempt to integrate two companies that have previously operated independently may result in significant challenges, and Golden may be unable to accomplish the integration smoothly or successfully. In particular, the necessity of coordinating geographically dispersed organizations and addressing possible differences in corporate cultures and management philosophies may increase the difficulties of integration. ECU has operated as a Québec corporation, with substantially all of its personnel and operations in Mexico, and Golden has not previously conducted mining operations in Mexico. The integration will require the dedication of significant management resources to become familiar with the Mexican operations and the culture of ECU, which may temporarily distract management's attention from the day-to-day operations of the businesses of the combined company. In addition, the combined company may adjust the way in which ECU has conducted its operations and utilized its properties, which may require retraining and development of new procedures and methodologies. The process of integrating operations and making such adjustments after the Transaction could cause an interruption of, or loss of momentum in, the activities of one or more of the combined company's businesses and the loss of key personnel. Employee uncertainty, lack of focus or turnover during the integration process may also disrupt the businesses of the combined company. Any inability of management to integrate the operations of Golden and ECU successfully could have a material adverse effect on the business and financial condition of the combined company.

In addition, the Transaction will subject Golden to any environmental, contractual or other obligations and liabilities of ECU, some of which may be unknown. While Golden and its legal and financial advisors have conducted due diligence on ECU and its business, there can be no assurance that Golden is aware of all obligations and liabilities of ECU. These liabilities, and any additional risks and uncertainties related to ECU's business and to the Transaction not currently known to Golden or that Golden may currently be aware of, but that prove to be more significant than assessed or estimated by Golden, could negatively impact the business, financial condition and results of operations of the combined company following consummation of the Transaction.

Golden will incur significant transaction, combination-related and restructuring costs in connection with the Transaction.

Golden and ECU expect to incur transaction fees and other expenses related to the Transaction totaling approximately $12.0 million, including financial advisors' fees, filing fees, legal and accounting fees, soliciting fees, regulatory fees and mailing costs. ECU expects to incur costs for executive bonuses

14

and change of control payments related to the Transaction totaling approximately Cdn$4.0 million (some of which is expected to be paid in Golden common stock). Golden also expects to incur significant costs associated with combining the operations of the two companies. It is difficult to predict the amount of these costs before Golden begins the integration process. The combined company may incur additional unanticipated costs as a consequence of difficulties arising from efforts to integrate the operations of the two companies. Although Golden expects that the elimination of duplicative costs, as well as the realization of other efficiencies related to the integration of the businesses, can offset incremental transaction, combination-related and restructuring costs over time, Golden cannot assure that this net benefit will be achieved in the near term, or at all.

We may incur significant costs related to ECU's contractual arrangements that we don't currently anticipate.

We may incur significant costs related to ECU's contractual arrangements that we don't currently anticipate. For example, if the Transaction is completed, under certain circumstances ECU's term loan lender may terminate its contractual arrangements with ECU. Although ECU is attempting to obtain the consent of ECU's term loan lender to the transaction, ECU may not be successful in these efforts. If the Transaction is completed without the consent of ECU's term loan lender, we may be required, in certain circumstances, to immediately repay the full amount borrowed under the term loan facility (expected to be approximately $16.0 million at closing), plus certain other amounts. There may be other ECU agreements with similar provisions, contracts with respect to which there are disputes and contractual obligations of which we are not currently aware, any of which could impose unanticipated costs on the combined company following completion of the Transaction. If these events were to occur, the additional expenditures in connection with repayment of the term loan or other unanticipated costs would significantly reduce the amount of cash that we currently expect to have available for deployment at our El Quevar project, ECU's Velardeña properties, or other properties in our exploration portfolio on the schedule we currently anticipate.

The officers and directors of Golden and ECU may have interests that are different from the interests of Golden Stockholders.

Because current stockholders of ECU will own 51% of the Golden common stock after the Transaction (55% on a fully diluted basis), the Transaction constitutes a change of control under several significant agreements to which Golden is a party, which triggers certain rights and obligations under those agreements. Unvested awards under Golden's 2009 Equity Incentive Plan (including stock options, restricted stock and restricted stock units) will vest immediately upon closing of the Transaction. At the closing of the Transaction, current officers and directors of Golden will hold stock options to purchase 85,874 shares of common stock, and officers of Golden will hold 201,735 shares of restricted stock that would have vested on various dates between December 2011 and December 2013. Directors of Golden will hold 14,355 restricted stock units that would have vested during May 2012. In addition, Golden has change of control agreements with each of its executive officers that provide for severance benefits if, within two years of the closing of the Transaction, either the combined company terminates his or her employment without cause, or the officer terminates his or her employment for good reason. Although Golden does not currently anticipate that any such terminations will occur, if terminations of all the existing Golden executives were to occur, Golden's executives would be entitled to receive severance payments consisting of cash, tax reimbursement, and perquisites equal to approximately $9.9 million.

In addition, ECU will make bonus payments for successful completion of the Transaction to its executive officers totaling approximately Cdn$3.3 million (some of which is expected to be paid in Golden common stock) and severance payments to certain of its officers upon closing the Transaction totaling approximately Cdn$0.7 million.

15

These payments and potential benefits give the directors and management of Golden and ECU an interest in the Transaction that differs from the interest of Golden Stockholders.

Golden Stockholders will suffer immediate and substantial dilution to their equity and voting interests as a result of the issuance of Golden common stock to the ECU stockholders.

In connection with the Transaction, Golden will issue approximately 16.0 million shares of common stock, which excludes up to 2.9 million new shares that will be issuable upon exercise of currently outstanding ECU warrants and options (or, following the Transaction, upon the exercise of the Replacement Options and Replacement Warrants issued in exchange for ECU warrants and options) and common stock expected to be issued in lieu of Cdn$2.75 million in transaction completion bonuses to Mr. Roy and Mr. Altmann. If all outstanding ECU options and warrants were exercised before the consummation of the Transaction, former ECU Shareholders would own approximately 55% of the outstanding stock of the combined company. Accordingly, the issuance of Golden common stock to ECU Shareholders will reduce the percentage of equity and voting interests held by each of Golden's current stockholders.

Golden has previously completed private placement transactions with Sentient Global Resources Fund III, LP and SGRF III Parallel I, LP (collectively, "Sentient") and Sentient has indicated a potential interest in further investing in the combined company in a private placement following consummation of the Transaction. The Transaction will increase the need of the combined company for additional financing to support the exploration and development of ECU's Velardeña properties in addition to Golden's historic properties. Because cash from operations is not expected to be sufficient to provide needed capital, and because debt financing is difficult to obtain for early stage mining operations, the likelihood is high that Golden would seek such financing in the equity markets. If the combined company were to engage in a private equity financing with Sentient or any other party, or engage in a public equity offering following the Transaction, current Golden Stockholders' ownership interest in the combined company would be further diluted.

Golden's common stock price could be depressed by sales of shares by ECU or Golden shareholders who sell their Golden shares.

Some ECU Shareholders may intend not to hold Golden common stock and some Golden Stockholders may decide to sell their shares following the Transaction, particularly if the market reaction to the Transaction is not favorable. If a significant number of Golden or former ECU Shareholders seek to sell their Golden common stock following completion of the Transaction, the trading price of Golden common stock may be adversely affected. A decrease in the trading price of the Golden common stock could impair the combined company's ability to raise capital through future sales of common stock.

The existence of a significant number of options and warrants may have a negative effect on the market price of Golden common stock.

ECU currently has outstanding ECU Options and ECU Warrants to purchase ECU Shares, which will, in the Transaction, be replaced by the Golden Replacement Options and Golden Replacement Warrants to purchase Golden common stock. The Golden Replacement Options will consist of employee options to purchase 661,750 shares of Golden common stock at exercise prices ranging from $16.00 to $31.80, and expiring between September 2011 and October 2014, and the Golden Replacement Warrants will consist of warrants to purchase 386,363 and 1,831,929 shares of Golden common stock, respectively, at exercise prices of $18.00 and $19.00, respectively, expiring in December 2011 and February 2014, respectively. The existence of securities available for exercise and resale is referred to as an "overhang", and, particularly if the options and warrants are "in the money", the

16

anticipation of potential sales could exert downward pressure on the market price of Golden common stock.

Potential payments made to any dissenting ECU Shareholders in respect of their shares could exceed the amount of consideration otherwise due to them under the terms of the Arrangement Agreement.

Under the Business Corporations Act (Québec), ECU Shareholders will have the right to dissent with respect to the proposed Transaction. If any ECU Shareholders properly exercise their right to dissent, such ECU Shareholders will be entitled to be paid the judicially determined fair value of their ECU Shares. While Golden and ECU believe that the value of the consideration to be paid to ECU Shareholders pursuant to the Transaction is equal to or exceeds the fair value of the ECU Shares, there can be no assurance that a court would agree with this assessment and consequently the amount any dissenting ECU Shareholders receive could be higher than the consideration to which those shareholders would have been entitled under the Arrangement Agreement. In addition, Golden may be required to pay dissenting ECU Shareholders all or a portion of the judicially determined value of their ECU Shares in cash, which would reduce the cash available to the combined company for advancement of the El Quevar project, expansion efforts at the Velardeña properties and advancement of the combined company's other exploration properties. A condition to closing in the Arrangement Agreement is that holders of no more than 5% of ECU's shares have exercised dissent rights, but Golden could waive this condition.

ECU's public filings are subject to Canadian disclosure requirements, which differ from SEC requirements.

ECU is a Canadian issuer that is required to prepare and file its periodic and other filings in accordance with Canadian disclosure requirements. As a result, certain of the information about ECU that is contained in this proxy statement was prepared with a view to compliance with Canadian GAAP or IFRS and Canadian disclosure regulations, rather than the requirements that would apply in the United States. Because Canadian disclosure requirements are different from SEC requirements, the information about ECU contained in this proxy statement may not be comparable to similar information available about Golden or other U.S. issuers.

The presentation of historical financial statements of ECU will not be comparable to the presentation of ECU's financial results following completion of the Transaction.

ECU has been a Québec corporation whose financial statements, until December 31, 2010, were prepared in accordance with Canadian GAAP, and since January 1, 2011, have been prepared in accordance with IFRS. After the Transaction, ECU will be a wholly-owned subsidiary of Golden, and its financial statements will be consolidated with those of Golden, and will be prepared in accordance with U.S. GAAP. Under Canadian GAAP and IFRS, ECU has been capitalizing exploration and development costs incurred during the development stage, including the operating expenses at its active mining operations, and offsetting those capitalized costs with revenue generated from saleable minerals. Under U.S. GAAP, those exploration and development costs would have appeared as expenses on the statement of operations and revenues generated during the development stage would have appeared as Other Income, Net of Incremental and Direct Costs Associated with the Revenue, on the statement of operations. If ECU had reported in U.S. GAAP for the fiscal year ended December 31, 2010, its net losses would have increased by approximately $2.5 million. Because of these and other differences, ECU's historical financial results will not be comparable to the results as they will appear in the consolidated financial statements of the combined company.

17

Risks Relating to the Businesses of Golden, ECU and the Combined Company

After the completion of the Transaction, the business of the combined company, as well as the price of Golden common stock, will be subject to numerous risks currently affecting the businesses of Golden and ECU.

ECU and Golden have both historically incurred operating losses and operating cash flow deficits and we expect that the combined company will continue to incur operating losses in the foreseeable future.

ECU and Golden have a history of operating losses and we expect that the combined company will continue to incur operating losses unless and until such time as ECU's Velardeña Properties in Central Mexico, our El Quevar project in Argentina, or another of our exploration properties generates sufficient revenue to fund continuing operations of the combined company. None of Golden's properties is currently in commercial production. While ECU is currently in production at its Velardeña Properties, it is still considered to be a development stage company, as it has not determined that a sufficient portion of its mineral resources are economically exploitable and, accordingly, it has no mineral reserves. We do not expect that revenues generated by production at ECU's properties will exceed the expenses of the combined company for at least the next few years. In 2010, ECU suffered a decrease in cash during the year of Cdn$7.3 million, leaving cash and cash equivalents of only Cdn$344,826 at December 31, 2010, and Golden has purchased Cdn$15.0 million principal amount interest-free convertible notes from ECU to provide ECU with needed liquidity pending the closing of the Transaction. We expect the combined company's operating expenses, capital expenditures and other expenses will increase in future years as we advance exploration, development and commercial production of the combined company's properties and any other properties that we may acquire. The amounts and timing of expenditures will depend on the progress of our efforts to expand production at the Velardeña Properties, advance our El Quevar project and continue exploration at these and other properties, the results of consultants' analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners, if any, and our potential future acquisition of additional properties, in addition to other factors, many of which will be beyond our control. We expect that the advancement or development of the combined company's properties and any other properties we may acquire will require the commitment of substantial resources. There can be no assurance that the combined company will continue to generate revenues or will ever achieve profitability.

ECU's and Golden's properties may not contain mineral reserves.

None of our El Quevar project, ECU's Velardeña Properties or any of our other properties, has been shown to contain proven or probable mineral reserves. Expenditures made in the exploration and advancement of the properties of the combined company may not result in discoveries of commercially recoverable quantities of ore. Most exploration projects do not result in the discovery of commercially mineable ore deposits and we cannot assure you that any mineral deposit we identify will qualify as an ore body that can be legally and economically exploited or that any particular level of recovery of silver from discovered mineralization will in fact be realized.

Micon has completed technical reports on Golden's El Quevar property, which indicated the presence of "mineralized material," and on ECU's Velardeña Properties, which indicated the presence of measured, indicated and inferred resources. Mineralized material, and measured, indicated and inferred resource figures based on estimates made by geologists are inherently imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling that may prove to be unreliable or inaccurate. We cannot assure you that these estimates will be accurate or that proven and probable mineral reserves will be identified at El Quevar, Velardeña or any of Golden's and ECU's other properties. Even if the presence of reserves is established at a project, the economic viability of the project may not justify exploitation. We plan to spend significant amounts on the

18

advancement of El Quevar and the expansion of the Velardeña Properties prior to establishing the economic viability of the project in a technical report compliant with NI 43-101.

Estimates of reserves, mineral deposits and production costs can also be affected by such factors as governmental regulations and requirements, fluctuations in metals prices or costs of essential materials or supplies, environmental factors, unforeseen technical difficulties and unusual or unexpected geological formations. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results, sampling, feasibility studies or technical reports. Short term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. Silver or other minerals recovered in small scale laboratory tests may not be duplicated in large scale tests under on-site production conditions.

We expect that the combined company will continue to require substantial external financing to pay its operating and general and administrative expenses, continue the advancement of the Velardeña expansion and El Quevar projects, and fund its other exploration activities.

We will be required to continue to raise substantial funds from external sources in order to pay our operating and general and administrative expenses, advance the Velardeña expansion and El Quevar projects, maintain our other exploration properties and continue our exploration activities, as we do not expect that cash generated by the Velardeña mining operations will be sufficient to fund these activities. If the Velardeña expansion or the El Quevar project proceeds to development and construction, we anticipate that we would need to raise additional capital during 2011. The size and capital cost for the Velardeña expansion or a possible mine and processing facilities at El Quevar have not been determined and would depend, among other things, on the results of our ongoing efforts to further define the Yaxtché deposit. We do not have a credit agreement in place that would finance development of either the Velardeña expansion or the El Quevar project, and believe that securing credit for these projects may be difficult given our limited history and the continuing volatility in global credit markets. Access to public financing has been negatively impacted by the volatility in the credit markets, which may impact the ability of the combined company to obtain equity or debt financing in the future and, if obtained, to do so on favorable terms. We cannot assure you that we will be able to obtain the necessary financing for the Velardeña expansion or the El Quevar project on favorable terms or at all. Failure to obtain sufficient financing may also result in the delay or indefinite postponement of exploration activities at our other properties.

The existence of secured indebtedness at ECU may limit the flexibility of the combined company to obtain additional financing and pursue certain business opportunities.

Prior to the Transaction, Golden had no indebtedness. At June 30, 2011, ECU had approximately $17.0 million of outstanding term loan indebtedness, bearing interest at an effective rate of 12.8% and requiring 30 monthly principal repayments of $553,951, commencing July 31, 2011 through maturity on December 31, 2013. The term loan is secured by a first mortgage covering substantially all of ECU's assets, including its mining properties and mills. This indebtedness may be prepaid prior to maturity, subject to a prepayment penalty equal to the greater of either the total interest for the immediately preceding three months or 3% of the outstanding term loan principal amount. If such indebtedness had been prepaid on June 30, 2011, the prepayment penalty would have been $498,556. ECU refinanced this indebtedness in early 2011 to extend the maturity on the loan from January 2012 to December 2013.

The presence of secured indebtedness, particularly in a company with limited revenues, has important consequences to the combined company, including (i) making it more difficult to obtain additional financing, (ii) subjecting it to the risk that its assets may be foreclosed upon if it is unable to make required principal and interest payments, (iii) reducing cash flows available for development of

19

properties, and (iv) making the combined company more vulnerable than competitors without debt to a downturn in business, the economy or commodity prices. The combined company's ability to service its debt will depend on its operating performance, which is affected by prevailing economic conditions that are outside of its control. If it is unable to support debt service from revenues from ECU's mining operations, the combined company may be forced to divert resources from the development of its other properties, which may have material adverse effects on its growth and future prospects.