|

[x]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

33-0704889

|

|

|

(State or other jurisdiction of incorporation

|

(I.R.S. Employer

|

|

|

or organization)

|

Identification Number)

|

|

|

3756 Central Avenue, Riverside, California

|

92506

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

Common Stock, par value $.01 per share

|

Trading Symbol(s)

PROV

|

Name of each exchange on which registered

The NASDAQ Stock Market LLC

|

|

Large accelerated filer [ ]

|

|

Accelerated filer [X]

|

|

Non-accelerated filer [ ]

|

|

Smaller reporting company [X]

|

|

|

|

Emerging growth company [ ]

|

|

1.

|

Portions of the Annual Report to Shareholders are incorporated by reference into Part II.

|

|

2.

|

Portions of the definitive Proxy Statement for the fiscal 2019 Annual Meeting of Shareholders (“Proxy Statement”) are incorporated by reference into Part III.

|

|

Page

|

|

|

PART I

|

|

|

Item 1. Business:

|

1 |

|

General

|

1 |

|

Subsequent Events

|

1 |

|

Market Area

|

2 |

|

Competition

|

2 |

|

Personnel

|

3 |

|

Segment Reporting

|

3 |

|

Internet Website

|

3 |

|

Lending Activities

|

3 |

|

Loan Servicing

|

12 |

|

Delinquencies and Classified Assets

|

13 |

|

Investment Securities Activities

|

20 |

|

Deposit Activities and Other Sources of Funds

|

22 |

|

Subsidiary Activities

|

26 |

|

Regulation

|

27 |

|

Taxation

|

36 |

|

Executive Officers

|

38 |

|

Item 1A. Risk Factors

|

39 |

|

Item 1B. Unresolved Staff Comments

|

52 |

|

Item 2. Properties

|

52 |

|

Item 3. Legal Proceedings

|

52 |

|

Item 4. Mine Safety Disclosures

|

54 |

|

PART II

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

54 |

|

Item 6. Selected Financial Data

|

56 |

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations:

|

57

|

|

General

|

58 |

|

Critical Accounting Policies

|

59 |

|

Executive Summary and Operating Strategy

|

61 |

|

Off-Balance Sheet Financing Arrangements and Contractual Obligations

|

62 |

|

Comparison of Financial Condition at June 30, 2019 and 2018

|

63 |

|

Comparison of Operating Results for the Years Ended June 30, 2019 and 2018

|

64 |

|

Average Balances, Interest and Average Yields/Costs

|

69 |

|

Rate/Volume Analysis

|

70 |

|

Liquidity and Capital Resources

|

71 |

|

Impact of Inflation and Changing Prices

|

72 |

|

Impact of New Accounting Pronouncements

|

72 |

|

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

|

73 |

|

Item 8. Financial Statements and Supplementary Data

|

77 |

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

77 |

|

Item 9A. Controls and Procedures

|

77 |

|

Item 9B. Other Information

|

80 |

|

Page

|

|

|

PART III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

80 |

|

Item 11. Executive Compensation

|

81 |

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

81 |

|

Item 13. Certain Relationships and Related Transactions, and Director Independence

|

82 |

|

Item 14. Principal Accountant Fees and Services

|

82 |

|

PART IV

|

|

|

Item 15. Exhibits, Financial Statement Schedules

|

83 |

|

Signatures

|

85 |

|

At June 30,

|

||||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||||||||||||

|

(Dollars In Thousands)

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

||||||||||||||||||||

|

Mortgage loans:

|

||||||||||||||||||||||||||||||

|

Single-family

|

$

|

324,952

|

36.87

|

%

|

$

|

314,808

|

34.80

|

%

|

$

|

322,197

|

35.51

|

%

|

$

|

324,497

|

38.44

|

%

|

$

|

365,961

|

44.65

|

%

|

||||||||||

|

Multi-family

|

439,041

|

49.81

|

476,008

|

52.63

|

479,959

|

52.89

|

415,627

|

49.23

|

347,020

|

42.34

|

||||||||||||||||||||

|

Commercial real

estate

|

111,928

|

12.70

|

109,726

|

12.13

|

97,562

|

10.75

|

99,528

|

11.79

|

100,897

|

12.31

|

||||||||||||||||||||

|

Construction

|

4,638

|

0.53

|

3,174

|

0.35

|

6,994

|

0.77

|

3,395

|

0.40

|

4,831

|

0.59

|

||||||||||||||||||||

|

Other

|

167

|

0.02

|

167

|

0.02

|

—

|

—

|

332

|

0.04

|

—

|

—

|

||||||||||||||||||||

|

Total mortgage loans

|

880,726

|

99.93

|

903,883

|

99.93

|

906,712

|

99.92

|

843,379

|

99.90

|

818,709

|

99.89

|

||||||||||||||||||||

|

Commercial business

loans

|

478

|

0.05

|

500

|

0.06

|

576

|

0.07

|

636

|

0.08

|

666

|

0.08

|

||||||||||||||||||||

|

Consumer loans

|

134

|

0.02

|

109

|

0.01

|

129

|

0.01

|

203

|

0.02

|

244

|

0.03

|

||||||||||||||||||||

|

Total loans held for

investment, gross

|

881,338

|

100.00

|

%

|

904,492

|

100.00

|

%

|

907,417

|

100.00

|

%

|

844,218

|

100.00

|

%

|

819,619

|

100.00

|

%

|

|||||||||||||||

|

Advance payments of

escrows

|

53

|

18

|

61

|

56

|

199

|

|||||||||||||||||||||||||

|

Deferred loan costs, net

|

5,610

|

5,560

|

5,480

|

4,418

|

3,140

|

|||||||||||||||||||||||||

|

Allowance for loan

losses

|

(7,076

|

)

|

(7,385

|

)

|

(8,039

|

)

|

(8,670

|

)

|

(8,724

|

)

|

||||||||||||||||||||

|

Total loans held for

investment, net

|

$

|

879,925

|

$

|

902,685

|

$

|

904,919

|

$

|

840,022

|

$

|

814,234

|

||||||||||||||||||||

|

(In Thousands)

|

Within

One Year

|

After

One Year

Through

3 Years

|

After

3 Years

Through

5 Years

|

After

5 Years

Through

10 Years

|

Beyond

10 Years

|

Total

|

||||||||||||

|

Mortgage loans:

|

||||||||||||||||||

|

Single-family

|

$

|

1,500

|

$

|

251

|

$

|

2,012

|

$

|

4,687

|

$

|

316,502

|

$

|

324,952

|

||||||

|

Multi-family

|

183

|

604

|

2,182

|

6,970

|

429,102

|

439,041

|

||||||||||||

|

Commercial real estate

|

153

|

2,194

|

11,335

|

83,111

|

15,135

|

111,928

|

||||||||||||

|

Construction

|

3,705

|

522

|

—

|

—

|

411

|

4,638

|

||||||||||||

|

Other

|

167

|

—

|

—

|

—

|

—

|

167

|

||||||||||||

|

Commercial business loans

|

74

|

50

|

68

|

—

|

286

|

478

|

||||||||||||

|

Consumer loans

|

134

|

—

|

—

|

—

|

—

|

134

|

||||||||||||

|

Total loans held for investment, gross

|

$

|

5,916

|

$

|

3,621

|

$

|

15,597

|

$

|

94,768

|

$

|

761,436

|

$

|

881,338

|

||||||

|

(Dollars In Thousands)

|

Fixed-Rate

|

%(1)

|

Floating or

Adjustable

Rate

|

%(1)

|

||||||

|

Mortgage loans:

|

||||||||||

|

Single-family

|

$

|

12,116

|

4

|

%

|

$

|

311,336

|

96

|

%

|

||

|

Multi-family

|

187

|

—

|

%

|

438,671

|

100

|

%

|

||||

|

Commercial real estate

|

449

|

—

|

%

|

111,326

|

100

|

%

|

||||

|

Construction

|

—

|

—

|

%

|

933

|

100

|

%

|

||||

|

Commercial business loans

|

354

|

88

|

%

|

50

|

12

|

%

|

||||

|

Total loans held for investment, gross

|

$

|

13,106

|

1

|

%

|

$

|

862,316

|

99

|

%

|

||

|

Inland

Empire

|

Southern

California(1)

|

Other

California

|

Other

States

|

Total

|

|||||||||||||||||||||

|

Loan Category

|

Balance

|

%

|

Balance

|

%

|

Balance

|

%

|

Balance

|

%

|

Balance

|

%

|

|||||||||||||||

|

Single-family

|

$

|

104,967

|

33

|

%

|

$

|

146,963

|

45

|

%

|

$

|

71,997

|

22

|

%

|

$

|

1,025

|

—

|

%

|

$

|

324,952

|

100

|

%

|

|||||

|

Multi-family

|

70,241

|

16

|

%

|

272,282

|

62

|

%

|

96,192

|

22

|

%

|

326

|

—

|

%

|

439,041

|

100

|

%

|

||||||||||

|

Commercial real

estate

|

30,551

|

27

|

%

|

54,010

|

48

|

%

|

27,367

|

25

|

%

|

—

|

—

|

%

|

111,928

|

100

|

%

|

||||||||||

|

Construction

|

525

|

11

|

%

|

3,579

|

77

|

%

|

534

|

12

|

%

|

—

|

—

|

%

|

4,638

|

100

|

%

|

||||||||||

|

Other

|

—

|

—

|

%

|

—

|

—

|

%

|

167

|

100

|

%

|

—

|

—

|

%

|

167

|

100

|

%

|

||||||||||

|

Total

|

$

|

206,284

|

24

|

%

|

$

|

476,834

|

54

|

%

|

$

|

196,257

|

22

|

%

|

$

|

1,351

|

—

|

%

|

$

|

880,726

|

100

|

%

|

|||||

|

(1)

|

Other than the Inland Empire.

|

|

Inland

Empire

|

Southern

California(1)

|

Other

California

|

Other

States

|

Total

|

|||||||||||||||||||||

|

Loan Category

|

Balance

|

%

|

Balance

|

%

|

Balance

|

%

|

Balance

|

%

|

Balance

|

%

|

|||||||||||||||

|

Single-family

|

$

|

110,510

|

35

|

%

|

$

|

149,261

|

48

|

%

|

$

|

53,960

|

17

|

%

|

$

|

1,077

|

—

|

%

|

$

|

314,808

|

100

|

%

|

|||||

|

Multi-family

|

76,473

|

16

|

%

|

287,174

|

60

|

%

|

109,684

|

23

|

%

|

2,677

|

1

|

%

|

476,008

|

100

|

%

|

||||||||||

|

Commercial real

estate

|

32,224

|

29

|

%

|

47,903

|

44

|

%

|

29,599

|

27

|

%

|

—

|

—

|

%

|

109,726

|

100

|

%

|

||||||||||

|

Construction

|

208

|

3

|

%

|

6,763

|

90

|

%

|

505

|

7

|

%

|

—

|

—

|

%

|

7,476

|

100

|

%

|

||||||||||

|

Other

|

—

|

—

|

%

|

—

|

—

|

%

|

167

|

100

|

%

|

—

|

—

|

%

|

167

|

100

|

%

|

||||||||||

|

Total

|

$

|

219,415

|

24

|

%

|

$

|

491,101

|

54

|

%

|

$

|

193,915

|

21

|

%

|

$

|

3,754

|

1

|

%

|

$

|

908,185

|

100

|

%

|

|||||

|

(1)

|

Other than the Inland Empire.

|

9

|

Year Ended June 30,

|

|||||||||

|

(In Thousands)

|

2019

|

2018

|

2017

|

||||||

|

Loans originated and purchased for sale:

|

|||||||||

|

Retail originations

|

$

|

296,992

|

$

|

679,504

|

$

|

997,142

|

|||

|

Wholesale originations

|

170,102

|

506,492

|

915,896

|

||||||

|

Total loans originated and purchased for sale

|

467,094

|

1,185,996

|

1,913,038

|

||||||

|

Loans sold:

|

|||||||||

|

Servicing released

|

(551,754

|

)

|

(1,174,618

|

)

|

(1,935,349

|

)

|

|||

|

Servicing retained

|

(7,196

|

)

|

(27,566

|

)

|

(38,250

|

)

|

|||

|

Total loans sold

|

(558,950

|

)

|

(1,202,184

|

)

|

(1,973,599

|

)

|

|||

|

Loans originated for investment:

|

|||||||||

|

Mortgage loans:

|

|||||||||

|

Single-family

|

55,410

|

90,434

|

80,280

|

||||||

|

Multi-family

|

42,191

|

66,355

|

87,511

|

||||||

|

Commercial real estate

|

15,402

|

24,749

|

11,989

|

||||||

|

Construction

|

7,159

|

4,667

|

12,123

|

||||||

|

Other

|

—

|

167

|

—

|

||||||

|

Commercial business loans

|

—

|

—

|

45

|

||||||

|

Consumer loans

|

—

|

4

|

1

|

||||||

|

Total loans originated for investment

|

120,162

|

186,376

|

191,949

|

||||||

|

Loans purchased for investment:

|

|||||||||

|

Mortgage loans:

|

|||||||||

|

Single-family

|

33,256

|

—

|

19,516

|

||||||

|

Multi-family

|

16,645

|

12,654

|

42,188

|

||||||

|

Commercial real estate

|

1,157

|

868

|

—

|

||||||

|

Total loans purchased for investment

|

51,058

|

13,522

|

61,704

|

||||||

|

Loan principal repayments

|

(195,386

|

)

|

(208,503

|

)

|

(196,993

|

)

|

|||

|

Real estate acquired in the settlement of loans

|

—

|

(2,171

|

)

|

(1,845

|

)

|

||||

|

(Decrease) increase in other items, net(1)

|

(3,036

|

)

|

4,480

|

(2,267

|

)

|

||||

|

Net decrease in loans held for investment and loans held for sale at fair value

|

$

|

(119,058

|

)

|

$

|

(22,484

|

)

|

$

|

(8,013

|

)

|

|

(1)

|

Includes net changes in undisbursed loan funds, deferred loan fees or costs, allowance for loan losses, fair value of loans held for investment, fair value of loans held for sale, advance

payments of escrows and repurchases.

|

|

At June 30,

|

|||||||||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

|||||||||||||||||||||||||||||||||

|

30 – 89 Days

|

Non-performing

|

30 - 89 Days

|

Non-performing

|

30 - 89 Days

|

Non-performing

|

||||||||||||||||||||||||||||||

|

(Dollars In Thousands)

|

Number

of

Loans

|

Principal

Balance

of Loans

|

Number

of

Loans

|

Principal

Balance

of Loans

|

Number

of

Loans

|

Principal

Balance

of Loans

|

Number

of

Loans

|

Principal

Balance

of Loans

|

Number

of

Loans

|

Principal

Balance

of Loans

|

Number

of

Loans

|

Principal

Balance

of Loans

|

|||||||||||||||||||||||

|

Mortgage loans:

|

|||||||||||||||||||||||||||||||||||

|

Single-family

|

2

|

$

|

660

|

20

|

$

|

5,640

|

1

|

$

|

804

|

21

|

$

|

6,141

|

3

|

$

|

1,035

|

27

|

$

|

8,016

|

|||||||||||||||||

|

Commercial real estate

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

1

|

201

|

|||||||||||||||||||||||

|

Construction

|

—

|

—

|

1

|

971

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

|||||||||||||||||||||||

|

Commercial business

loans

|

—

|

—

|

1

|

49

|

—

|

—

|

1

|

70

|

—

|

—

|

1

|

80

|

|||||||||||||||||||||||

|

Consumer loans(1)

|

61

|

5

|

—

|

—

|

2

|

1

|

—

|

—

|

—

|

—

|

—

|

—

|

|||||||||||||||||||||||

|

Total

|

63

|

$

|

665

|

22

|

$

|

6,660

|

3

|

$

|

805

|

22

|

$

|

6,211

|

3

|

$

|

1,035

|

29

|

$

|

8,297

|

|||||||||||||||||

|

(1)

|

At June 30, 2019, the balance includes 61 overdrawn consumer deposit accounts which were not reported in prior years due to

immateriality.

|

|

At June 30,

|

|||||||||||||||

|

(Dollars In Thousands)

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||

|

Loans on non-performing status

(excluding restructured loans):

|

|||||||||||||||

|

Mortgage loans:

|

|||||||||||||||

|

Single-family

|

$

|

3,315

|

$

|

2,665

|

$

|

4,668

|

$

|

6,292

|

$

|

7,010

|

|||||

|

Multi-family

|

—

|

—

|

—

|

709

|

653

|

||||||||||

|

Commercial real estate

|

—

|

—

|

201

|

—

|

680

|

||||||||||

|

Construction

|

971

|

—

|

—

|

—

|

—

|

||||||||||

|

Total

|

4,286

|

2,665

|

4,869

|

7,001

|

8,343

|

||||||||||

|

Accruing loans past due 90 days or more

|

—

|

—

|

—

|

—

|

—

|

||||||||||

|

Restructured loans on non-performing status:

|

|||||||||||||||

|

Mortgage loans:

|

|||||||||||||||

|

Single-family

|

1,891

|

3,328

|

3,061

|

3,232

|

2,902

|

||||||||||

|

Multi-family

|

—

|

—

|

—

|

—

|

1,593

|

||||||||||

|

Commercial real estate

|

—

|

—

|

—

|

—

|

1,019

|

||||||||||

|

Commercial business loans

|

41

|

64

|

65

|

76

|

89

|

||||||||||

|

Total

|

1,932

|

3,392

|

3,126

|

3,308

|

5,603

|

||||||||||

|

Total non-performing loans

|

6,218

|

6,057

|

7,995

|

10,309

|

13,946

|

||||||||||

|

Real estate owned, net

|

—

|

906

|

1,615

|

2,706

|

2,398

|

||||||||||

|

Total non-performing assets

|

$

|

6,218

|

$

|

6,963

|

$

|

9,610

|

$

|

13,015

|

$

|

16,344

|

|||||

|

Non-performing loans as a percentage of

loans held for investment, net

|

0.71

|

%

|

0.67

|

%

|

0.88

|

%

|

1.23

|

%

|

1.71

|

%

|

|||||

|

Non-performing loans as a percentage

of total assets

|

0.57

|

%

|

0.52

|

%

|

0.67

|

%

|

0.88

|

%

|

1.19

|

%

|

|||||

|

Non-performing assets as a percentage

of total assets

|

0.57

|

%

|

0.59

|

%

|

0.80

|

%

|

1.11

|

%

|

1.39

|

%

|

|||||

|

At June 30, 2019

|

At June 30, 2018

|

||||||||||

|

(Dollars In Thousands)

|

Balance

|

Count

|

Balance

|

Count

|

|||||||

|

Special mention loans:

|

|||||||||||

|

Mortgage loans:

|

|||||||||||

|

Single-family

|

$

|

3,795

|

13

|

$

|

2,584

|

8

|

|||||

|

Multi-family

|

3,864

|

3

|

3,947

|

3

|

|||||||

|

Commercial real estate

|

927

|

1

|

940

|

1

|

|||||||

|

Total special mention loans

|

8,586

|

17

|

7,471

|

12

|

|||||||

|

Substandard loans:

|

|||||||||||

|

Mortgage loans:

|

|||||||||||

|

Single-family

|

6,631

|

23

|

7,391

|

24

|

|||||||

|

Construction

|

971

|

1

|

—

|

—

|

|||||||

|

Commercial business loans

|

41

|

1

|

64

|

1

|

|||||||

|

Total substandard loans

|

7,643

|

25

|

7,455

|

25

|

|||||||

|

Total classified loans

|

16,229

|

42

|

14,926

|

37

|

|||||||

|

Real estate owned:

|

|||||||||||

|

Single-family

|

—

|

—

|

906

|

2

|

|||||||

|

Total real estate owned

|

—

|

—

|

906

|

2

|

|||||||

|

Total classified assets

|

$

|

16,229

|

42

|

$

|

15,832

|

39

|

|||||

|

Total classified assets as a percentage of total assets

|

1.50

|

%

|

1.35

|

%

|

|||||||

|

Year Ended June 30,

|

|||||||||||||||

|

(Dollars In Thousands)

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||

|

Allowance at beginning of period

|

$

|

7,385

|

$

|

8,039

|

$

|

8,670

|

$

|

8,724

|

$

|

9,744

|

|||||

|

Recovery from the allowance for loan losses

|

(475

|

)

|

(536

|

)

|

(1,042

|

)

|

(1,715

|

)

|

(1,387

|

)

|

|||||

|

Recoveries:

|

|||||||||||||||

|

Mortgage Loans:

|

|||||||||||||||

|

Single-family

|

198

|

278

|

507

|

539

|

635

|

||||||||||

|

Multi-family

|

—

|

—

|

18

|

1,228

|

360

|

||||||||||

|

Commercial real estate

|

—

|

—

|

—

|

216

|

—

|

||||||||||

|

Commercial business loans

|

—

|

—

|

75

|

85

|

—

|

||||||||||

|

Consumer loans

|

2

|

—

|

13

|

1

|

1

|

||||||||||

|

Total recoveries

|

200

|

278

|

613

|

2,069

|

996

|

||||||||||

|

Charge-offs:

|

|||||||||||||||

|

Mortgage loans:

|

|||||||||||||||

|

Single-family

|

(31

|

)

|

(392

|

)

|

(199

|

)

|

(406

|

)

|

(552

|

)

|

|||||

|

Multi-family

|

—

|

—

|

—

|

—

|

(4

|

)

|

|||||||||

|

Commercial real estate

|

—

|

—

|

—

|

—

|

(73

|

)

|

|||||||||

|

Consumer loans

|

(3

|

)

|

(4

|

)

|

(3

|

)

|

(2

|

)

|

—

|

||||||

|

Total charge-offs

|

(34

|

)

|

(396

|

)

|

(202

|

)

|

(408

|

)

|

(629

|

)

|

|||||

|

Net (charge-offs) recoveries

|

166

|

(118

|

)

|

411

|

1,661

|

367

|

|||||||||

|

Allowance at end of period

|

$

|

7,076

|

$

|

7,385

|

$

|

8,039

|

$

|

8,670

|

$

|

8,724

|

|||||

|

Allowance for loan losses as a percentage of

gross loans held for investment

|

0.80

|

%

|

0.81

|

%

|

0.88

|

%

|

1.02

|

%

|

1.06

|

%

|

|||||

|

Net charge-offs (recoveries) as a percentage

of average loans receivable, net, during the

period

|

(0.02

|

)%

|

0.01

|

%

|

(0.04

|

)%

|

(0.17

|

)%

|

(0.04

|

)%

|

|||||

|

At June 30,

|

|||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||||||||||||

|

(Dollars In Thousands)

|

Amount

|

% of

Loans in

Each

Category

to Total

Loans

|

Amount

|

% of

Loans in

Each

Category

to Total

Loans

|

Amount

|

% of

Loans in

Each

Category

to Total

Loans

|

Amount

|

% of

Loans in

Each

Category

to Total

Loans

|

Amount

|

% of

Loans in

Each

Category

to Total

Loans

|

|||||||||||||||||||

|

Mortgage loans:

|

|||||||||||||||||||||||||||||

|

Single-family

|

$

|

2,709

|

36.87

|

%

|

$

|

2,783

|

34.80

|

%

|

$

|

3,601

|

35.51

|

%

|

$

|

4,933

|

38.44

|

%

|

$

|

5,280

|

44.65

|

%

|

|||||||||

|

Multi-family

|

3,219

|

49.81

|

3,492

|

52.63

|

3,420

|

52.89

|

2,800

|

49.23

|

2,616

|

42.34

|

|||||||||||||||||||

|

Commercial real estate

|

1,050

|

12.70

|

1,030

|

12.13

|

879

|

10.75

|

848

|

11.79

|

734

|

12.31

|

|||||||||||||||||||

|

Construction

|

61

|

0.53

|

47

|

0.35

|

96

|

0.77

|

31

|

0.40

|

42

|

0.59

|

|||||||||||||||||||

|

Other

|

3

|

0.02

|

3

|

0.02

|

—

|

—

|

7

|

0.04

|

—

|

—

|

|||||||||||||||||||

|

Commercial business loans

|

26

|

0.05

|

24

|

0.06

|

36

|

0.07

|

43

|

0.08

|

43

|

0.08

|

|||||||||||||||||||

|

Consumer loans

|

8

|

0.02

|

6

|

0.01

|

7

|

0.01

|

8

|

0.02

|

9

|

0.03

|

|||||||||||||||||||

|

Total allowance for

loan losses

|

$

|

7,076

|

100.00

|

%

|

$

|

7,385

|

100.00

|

%

|

$

|

8,039

|

100.00

|

%

|

$

|

8,670

|

100.00

|

%

|

$

|

8,724

|

100.00

|

%

|

|||||||||

|

At June 30,

|

||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

||||||||||||||||||||||||

|

(Dollars In Thousands)

|

Amortized

Cost

|

Estimated

Fair

Value

|

Percent

|

Amortized

Cost

|

Estimated

Fair

Value

|

Percent

|

Amortized

Cost

|

Estimated

Fair

Value

|

Percent

|

|||||||||||||||||

|

Held to maturity securities:

|

||||||||||||||||||||||||||

|

U.S. government sponsored

enterprise MBS (1)

|

$

|

90,394

|

$

|

91,669

|

90.47

|

%

|

$

|

84,227

|

$

|

83,668

|

88.32

|

%

|

$

|

59,841

|

$

|

60,029

|

85.82

|

%

|

||||||||

|

U.S. SBA securities(2)

|

2,896

|

2,890

|

2.85

|

2,986

|

2,971

|

3.14

|

—

|

—

|

—

|

|||||||||||||||||

|

Certificates of deposits

|

800

|

800

|

0.79

|

600

|

600

|

0.63

|

600

|

600

|

0.86

|

|||||||||||||||||

|

Total investment securities -

held to maturity

|

$

|

94,090

|

$

|

95,359

|

94.11

|

%

|

$

|

87,813

|

$

|

87,239

|

92.09

|

%

|

$

|

60,441

|

$

|

60,629

|

86.68

|

%

|

||||||||

|

Available for sale securities:

|

||||||||||||||||||||||||||

|

U.S. government agency MBS(1)

|

$

|

3,498

|

$

|

3,613

|

3.57

|

%

|

$

|

4,234

|

$

|

4,384

|

4.63

|

%

|

$

|

5,197

|

$

|

5,383

|

7.69

|

%

|

||||||||

|

U.S. government sponsored

enterprise MBS(1)

|

1,998

|

2,087

|

2.06

|

2,640

|

2,762

|

2.91

|

3,301

|

3,474

|

4.97

|

|||||||||||||||||

|

Private issue CMO(3)

|

261

|

269

|

0.26

|

346

|

350

|

0.37

|

456

|

461

|

0.66

|

|||||||||||||||||

|

Total investment securities -

available for sale

|

$

|

5,757

|

$

|

5,969

|

5.89

|

%

|

$

|

7,220

|

$

|

7,496

|

7.91

|

%

|

$

|

8,954

|

$

|

9,318

|

13.32

|

%

|

||||||||

|

Total investment securities

|

$

|

99,847

|

$

|

101,328

|

100.00

|

%

|

$

|

95,033

|

$

|

94,735

|

100.00

|

%

|

$

|

69,395

|

$

|

69,947

|

100.00

|

%

|

||||||||

|

(1)

|

Mortgage-backed securities (“MBS”)

|

|

(2)

|

Small Business Administration ("SBA")

|

|

(3)

|

Collateralized mortgage obligations (“CMO”)

|

|

Due in

One Year

or Less

|

Due

After One to

Five Years

|

Due

After Five to

Ten Years

|

Due

After

Ten Years

|

Total

|

||||||||||||||||||||||

|

(Dollars in Thousands)

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

||||||||||||||||

|

Held to maturity securities:

|

||||||||||||||||||||||||||

|

U.S. government sponsored

enterprise MBS

|

$

|

—

|

—

|

%

|

$

|

32,184

|

2.15

|

%

|

$

|

35,306

|

2.97

|

%

|

$

|

22,904

|

3.62

|

%

|

$

|

90,394

|

2.84

|

%

|

||||||

|

U.S. SBA securities

|

—

|

—

|

—

|

—

|

—

|

—

|

2,896

|

2.85

|

2,896

|

2.85

|

||||||||||||||||

|

Certificates of deposits

|

400

|

2.51

|

400

|

2.74

|

—

|

—

|

—

|

—

|

800

|

2.63

|

||||||||||||||||

|

Total investment securities

held to maturity

|

$

|

400

|

2.51

|

%

|

$

|

32,584

|

2.16

|

%

|

$

|

35,306

|

2.97

|

%

|

$

|

25,800

|

3.53

|

%

|

$

|

94,090

|

2.84

|

%

|

||||||

|

Available for sale securities:

|

||||||||||||||||||||||||||

|

U.S. government agency MBS

|

$

|

—

|

—

|

%

|

$

|

—

|

—

|

%

|

$

|

—

|

—

|

%

|

$

|

3,613

|

3.86

|

%

|

$

|

3,613

|

3.86

|

%

|

||||||

|

U.S. government sponsored

enterprise MBS

|

—

|

—

|

—

|

—

|

—

|

—

|

2,087

|

4.75

|

2,087

|

4.75

|

||||||||||||||||

|

Private issue CMO

|

—

|

—

|

—

|

—

|

—

|

—

|

269

|

4.66

|

269

|

4.66

|

||||||||||||||||

|

Total investment securities

available for sale

|

$

|

—

|

—

|

%

|

$

|

—

|

—

|

%

|

$

|

—

|

—

|

%

|

$

|

5,969

|

4.21

|

%

|

$

|

5,969

|

4.21

|

%

|

||||||

|

Total investment securities

|

$

|

400

|

2.51

|

%

|

$

|

32,584

|

2.16

|

%

|

$

|

35,306

|

2.97

|

%

|

$

|

31,769

|

3.66

|

%

|

$

|

100,059

|

2.92

|

%

|

||||||

|

Weighted

Average Interest Rate

|

Original Term

|

Deposit Account Type

|

Minimum

Amount

|

Balance

(In Thousands)

|

Percentage

of Total Deposits

|

|||||

|

Transaction accounts:

|

||||||||||

|

—%

|

N/A

|

Checking accounts – non interest-bearing

|

$

|

—

|

$

|

90,184

|

10.72

|

%

|

||

|

0.12%

|

N/A

|

Checking accounts – interest-bearing

|

$

|

—

|

257,909

|

30.66

|

||||

|

0.20%

|

N/A

|

Savings accounts

|

$

|

10

|

264,387

|

31.43

|

||||

|

0.28%

|

N/A

|

Money market accounts

|

$

|

—

|

35,646

|

4.24

|

||||

|

Time deposits:

|

||||||||||

|

0.05%

|

30 days or less

|

Fixed-term, fixed rate

|

$

|

1,000

|

20

|

—

|

||||

|

0.13%

|

31 to 90 days

|

Fixed-term, fixed rate

|

$

|

1,000

|

4,104

|

0.49

|

||||

|

1.67%

|

91 to 180 days

|

Fixed-term, fixed rate

|

$

|

1,000

|

15,432

|

1.83

|

||||

|

0.21%

|

181 to 365 days

|

Fixed-term, fixed rate

|

$

|

1,000

|

25,293

|

3.01

|

||||

|

0.54%

|

Over 1 to 2 years

|

Fixed-term, fixed rate

|

$

|

1,000

|

27,657

|

3.29

|

||||

|

0.98%

|

Over 2 to 3 years

|

Fixed-term, fixed rate

|

$

|

1,000

|

28,383

|

3.37

|

||||

|

1.49%

|

Over 3 to 5 years

|

Fixed-term, fixed rate

|

$

|

1,000

|

79,601

|

9.46

|

||||

|

1.85%

|

Over 5 to 10 years

|

Fixed-term, fixed rate

|

$

|

1,000

|

12,655

|

1.50

|

||||

|

0.37%

|

$

|

841,271

|

100.00

|

%

|

||||||

|

Maturity Period

|

Amount

|

||

|

(In Thousands)

|

|||

|

Three months or less

|

$

|

19,219

|

|

|

Over three to six months

|

20,791

|

||

|

Over six to twelve months

|

17,978

|

||

|

Over twelve months

|

40,957

|

||

|

Total

|

$

|

98,945

|

|

|

At June 30,

|

||||||||||||||||||||||

|

2019

|

2018

|

|||||||||||||||||||||

|

(Dollars In Thousands)

|

Amount

|

Percent

of

Total

|

Increase

(Decrease)

|

Amount

|

Percent

of

Total

|

Increase

(Decrease)

|

||||||||||||||||

|

Checking accounts – non interest-bearing

|

$

|

90,184

|

10.72

|

%

|

$

|

4,010

|

$

|

86,174

|

9.49

|

%

|

$

|

8,257

|

||||||||||

|

Checking accounts – interest-bearing

|

257,909

|

30.66

|

(1,463

|

)

|

259,372

|

28.58

|

(65

|

)

|

||||||||||||||

|

Savings accounts

|

264,387

|

31.43

|

(25,404

|

)

|

289,791

|

31.93

|

3,824

|

|||||||||||||||

|

Money market accounts

|

35,646

|

4.24

|

1,013

|

34,633

|

3.82

|

(690

|

)

|

|||||||||||||||

|

Time deposits:

|

||||||||||||||||||||||

|

Fixed-term, fixed rate which mature:

|

||||||||||||||||||||||

|

Within one year

|

106,080

|

12.61

|

(10,253

|

)

|

116,333

|

12.82

|

2,387

|

|||||||||||||||

|

Over one to two years

|

37,117

|

4.41

|

(28,083

|

)

|

65,200

|

7.18

|

451

|

|||||||||||||||

|

Over two to five years

|

49,253

|

5.85

|

(5,027

|

)

|

54,280

|

5.98

|

(24,535

|

)

|

||||||||||||||

|

Over five years

|

695

|

0.08

|

(1,120

|

)

|

1,815

|

0.20

|

(8,552

|

)

|

||||||||||||||

|

Total

|

$

|

841,271

|

100.00

|

%

|

$

|

(66,327

|

)

|

$

|

907,598

|

100.00

|

%

|

$

|

(18,923

|

)

|

||||||||

|

At June 30,

|

|||||||||

|

(Dollars In Thousands)

|

2019

|

2018

|

2017

|

||||||

|

Below 1.00%

|

$

|

80,701

|

$

|

114,975

|

$

|

143,133

|

|||

|

1.00 to 1.99%

|

95,904

|

113,211

|

115,555

|

||||||

|

2.00 to 2.99%

|

16,540

|

7,875

|

7,622

|

||||||

|

3.00 to 3.99%

|

—

|

1,567

|

1,567

|

||||||

|

Total

|

$

|

193,145

|

$

|

237,628

|

$

|

267,877

|

|||

|

(Dollars In Thousands)

|

One Year

or Less

|

Over One

to

Two Years

|

Over Two

to

Three Years

|

Over Three

to

Four Years

|

After

Four

Years

|

Total

|

||||||||||||

|

Below 1.00%

|

$

|

62,477

|

$

|

15,306

|

$

|

2,791

|

$

|

125

|

$

|

2

|

$

|

80,701

|

||||||

|

1.00 to 1.99%

|

32,270

|

21,811

|

23,543

|

9,803

|

8,477

|

95,904

|

||||||||||||

|

2.00 to 2.99%

|

11,333

|

—

|

—

|

5,207

|

—

|

16,540

|

||||||||||||

|

Total

|

$

|

106,080

|

$

|

37,117

|

$

|

26,334

|

$

|

15,135

|

$

|

8,479

|

$

|

193,145

|

||||||

|

At or For the Year Ended June 30,

|

|||||||||

|

(In Thousands)

|

2019

|

2018

|

2017

|

||||||

|

Beginning balance

|

$

|

907,598

|

$

|

926,521

|

$

|

926,384

|

|||

|

Net withdrawals before interest credited

|

(69,708

|

)

|

(22,418

|

)

|

(3,671

|

)

|

|||

|

Interest credited

|

3,381

|

3,495

|

3,808

|

||||||

|

Net (decrease) increase in deposits

|

(66,327

|

)

|

(18,923

|

)

|

137

|

||||

|

Ending balance

|

$

|

841,271

|

$

|

907,598

|

$

|

926,521

|

|||

|

At or For the Year Ended June 30,

|

||||||||||||||

|

(Dollars In Thousands)

|

2019

|

2018

|

2017

|

|||||||||||

|

Balance outstanding at the end of period:

|

||||||||||||||

|

FHLB – San Francisco advances

|

$

|

101,107

|

$

|

126,163

|

$

|

126,226

|

||||||||

|

Weighted average rate at the end of period:

|

||||||||||||||

|

FHLB – San Francisco advances

|

2.62

|

%

|

2.47

|

%

|

2.39

|

%

|

||||||||

|

Maximum amount of borrowings outstanding at any month end:

|

||||||||||||||

|

FHLB – San Francisco advances

|

$

|

136,158

|

$

|

126,163

|

$

|

181,287

|

||||||||

|

Average short-term borrowings during the period

with respect to:(1)

|

||||||||||||||

|

FHLB – San Francisco advances

|

$

|

8,425

|

$

|

8,687

|

$

|

14,022

|

||||||||

|

Weighted average short-term borrowing rate during the period

with respect to:(1)

|

||||||||||||||

|

FHLB – San Francisco advances

|

1.69

|

%

|

2.53

|

%

|

0.45

|

%

|

||||||||

|

•

|

before any savings and loan holding company or bank holding company could acquire 5% or more of the common stock of the Corporation; and

|

|

•

|

before any other company could acquire 25% or more of the common stock of the Corporation, and may be required for an acquisition of as little as 10% of such stock.

|

|

Position

|

|||

|

Name

|

Age(1)

|

Corporation

|

Bank

|

|

Craig G. Blunden

|

71

|

Chairman and

|

Chairman and

|

|

Chief Executive Officer

|

Chief Executive Officer

|

||

|

Robert "Scott" Ritter

|

50

|

—

|

Senior Vice President

|

|

Single-Family Division

|

|||

|

Donavon P. Ternes

|

59

|

President

|

President

|

|

Chief Operating Officer

|

Chief Operating Officer

|

||

|

Chief Financial Officer

|

Chief Financial Officer

|

||

|

Corporate Secretary

|

Corporate Secretary

|

||

|

David S. Weiant

|

60

|

—

|

Senior Vice President

|

|

Chief Lending Officer

|

|||

|

Gwendolyn L. Wertz

|

53

|

—

|

Senior Vice President

|

|

Retail Banking Division

|

|||

|

(1)

|

As of June 30, 2019.

|

38

|

•

|

an increase in loan delinquencies, problem assets and foreclosures;

|

|

•

|

we may increase our allowance for loan losses

|

|

•

|

the slowing of sales of foreclosed assets;

|

|

•

|

a decline in demand for our products and services;

|

|

•

|

a decline in the value of collateral for loans may in turn reduce customers' borrowing power, and the value of assets and collateral associated with existing loans;

|

|

•

|

the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; and

|

|

•

|

a decrease in the amount of our low cost or non interest-bearing deposits.

|

|

•

|

cash flow of the borrower and/or the project being financed;

|

|

•

|

the changes and uncertainties as to the future value of the collateral, in the case of a collateralized loan;

|

|

•

|

the duration of the loan;

|

|

•

|

the character and creditworthiness of a particular borrower; and

|

|

•

|

changes in economic and industry conditions.

|

|

•

|

our collectively evaluated allowance, based on our historical default and loss experience and certain macroeconomic factors based on management's expectations of future events; and

|

|

•

|

our individually evaluated allowance, based on our evaluation of non-performing loans and the underlying fair value of collateral or based on discounted cash flow for restructured loans.

|

|

•

|

we record interest income only on a cash basis for non-accrual loans except for non-performing loans under the cost recovery method where interest is applied to the principal of the loan

as a recovery of the charge-offs, if any, and we do not record interest income for REO;

|

|

•

|

we must provide for probable loan losses through a current period charge to the provision for loan losses;

|

|

•

|

non-interest expense increases when we write down the value of properties in our REO portfolio to reflect changing market values or recognize other-than-temporary impairment (“OTTI”) on

non-performing investment securities;

|

|

•

|

there are legal fees associated with the resolution of problem assets, as well as carrying costs, such as taxes, insurance, and maintenance fees related to our REO; and

|

|

•

|

the resolution of non-performing assets requires the active involvement of management, which can distract them from more profitable activity.

|

|

•

|

available interest rate hedging may not correspond directly with the interest rate risk for which protection is sought;

|

|

•

|

the duration of the hedge may not match the duration of the related liability;

|

|

•

|

the party owing money in the hedging transaction may default on its obligation to pay;

|

|

•

|

the credit quality of the party owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction;

|

|

•

|

the value of derivatives used for hedging may be adjusted from time to time in accordance with accounting rules to reflect changes in fair value; and

|

|

•

|

downward adjustments, or “mark-to-market losses,” would reduce our stockholders' equity.

|

53

|

Period

|

(a) Total Number of

Shares Purchased

|

(b) Average Price

Paid per Share

|

(c) Total Number of

Shares Purchased as

Part of Publicly

Announced Plan

|

(d) Maximum

Number of Shares

that May Yet Be

Purchased Under

the Plan (1)

|

|||||

|

April 1, 2019 – April 30, 2019

|

—

|

$

|

—

|

—

|

349,252

|

||||

|

May 1, 2019 – May 31, 2019

|

4,483

|

$

|

20.18

|

4,483

|

344,769

|

||||

|

June 1, 2019 – June 30, 2019

|

23,768

|

$

|

20.04

|

23,768

|

321,001

|

||||

|

Total

|

28,251

|

$

|

20.06

|

28,251

|

321,001

|

||||

|

(1)

|

Represents the remaining shares available for future purchases under the April 2018 stock repurchase plan.

|

|

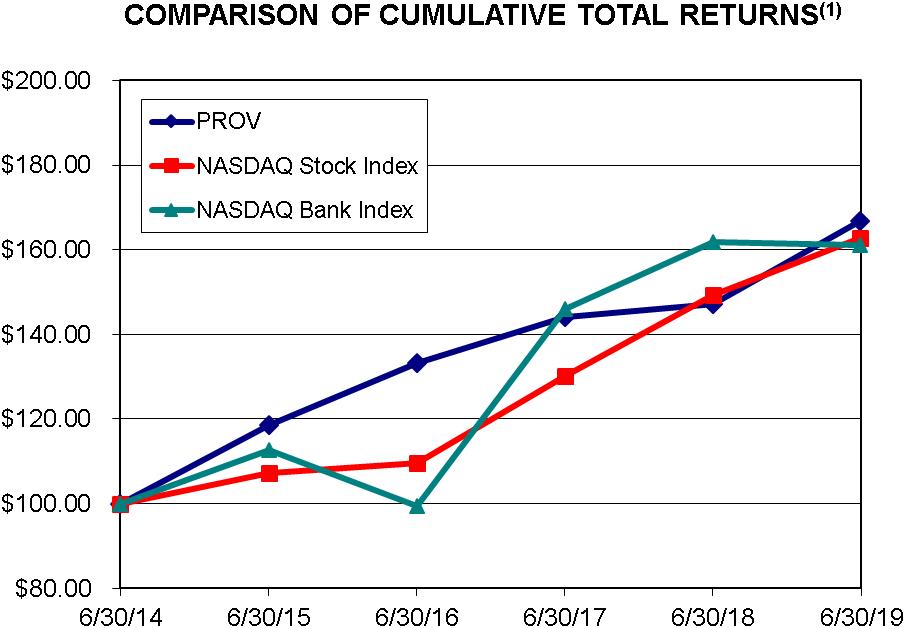

6/30/2014

|

6/30/2015

|

6/30/2016

|

6/30/2017

|

6/30/2018

|

6/30/2019

|

|||||||||||||

|

PROV

|

$

|

100.00

|

$

|

118.52

|

$

|

133.23

|

$

|

144.05

|

$

|

147.14

|

$

|

166.74

|

||||||

|

NASDAQ Stock Index

|

$

|

100.00

|

$

|

107.13

|

$

|

109.063

|

$

|

130.03

|

$

|

149.33

|

$

|

162.76

|

||||||

|

NASDAQ Bank Index

|

$

|

100.00

|

$

|

112.73

|

$

|

99.53

|

$

|

145.89

|

$

|

161.76

|

$

|

160.99

|

||||||

|

(1) Assumes that the value of the investment in the Corporation’s common stock and each index was $100 on June 30, 2014 and that all

dividends were reinvested.

|

59

|

•

|

A reduction in the stated interest rate.

|

|

•

|

An extension of the maturity at an interest rate below market.

|

|

•

|

A reduction in the accrued interest.

|

|

•

|

Extensions, deferrals, renewals and rewrites.

|

|

Year Ended June 30,

|

||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

||||||||||||||||||||||||

|

(Dollars In Thousands)

|

Average

Balance |

Interest

|

Yield/

Cost

|

Average

Balance |

Interest

|

Yield/

Cost |

Average

Balance |

Interest

|

Yield/

Cost

|

|||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||||

|

Loans receivable, net(1)

|

$

|

926,003

|

$

|

40,092

|

4.33

|

%

|

$

|

986,815

|

$

|

40,016

|

4.06

|

%

|

$

|

1,025,885

|

$

|

40,249

|

3.92

|

%

|

||||||||

|

Investment securities

|

97,870

|

2,042

|

2.09

|

%

|

90,719

|

1,344

|

1.48

|

%

|

51,575

|

575

|

1.11

|

%

|

||||||||||||||

|

FHLB – San Francisco stock

|

8,199

|

707

|

8.62

|

%

|

8,126

|

568

|

6.99

|

%

|

8,097

|

967

|

11.94

|

%

|

||||||||||||||

|

Interest-earning deposits

|

67,816

|

1,537

|

2.24

|

%

|

53,438

|

784

|

1.45

|

%

|

81,027

|

626

|

0.76

|

%

|

||||||||||||||

|

Total interest-earning assets

|

1,099,888

|

44,378

|

4.03

|

%

|

1,139,098

|

42,712

|

3.75

|

%

|

1,166,584

|

42,417

|

3.64

|

%

|

||||||||||||||

|

Non interest-earning assets

|

30,778

|

32,905

|

32,003

|

|||||||||||||||||||||||

|

Total assets

|

$

|

1,130,666

|

$

|

1,172,003

|

$

|

1,198,587

|

||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||||

|

Checking and money market

accounts(2)

|

$

|

381,790

|

428

|

0.11

|

%

|

$

|

372,781

|

407

|

0.11

|

%

|

$

|

358,532

|

387

|

0.11

|

%

|

|||||||||||

|

Savings accounts

|

277,896

|

572

|

0.21

|

%

|

290,959

|

595

|

0.20

|

%

|

283,520

|

579

|

0.20

|

%

|

||||||||||||||

|

Time deposits

|

220,432

|

2,381

|

1.08

|

%

|

251,604

|

2,493

|

0.99

|

%

|

290,080

|

2,842

|

0.98

|

%

|

||||||||||||||

|

Total deposits

|

880,118

|

3,381

|

0.38

|

%

|

915,344

|

3,495

|

0.38

|

%

|

932,132

|

3,808

|

0.41

|

%

|

||||||||||||||

|

Borrowings

|

109,558

|

2,827

|

2.58

|

%

|

113,984

|

2,917

|

2.56

|

%

|

117,329

|

2,871

|

2.45

|

%

|

||||||||||||||

|

Total interest-bearing

liabilities

|

989,676

|

6,208

|

0.63

|

%

|

1,029,328

|

6,412

|

0.62

|

%

|

1,049,461

|

6,679

|

0.64

|

%

|

||||||||||||||

|

Non interest-bearing

liabilities

|

19,288

|

19,392

|

16,828

|

|||||||||||||||||||||||

|

Total liabilities

|

1,008,964

|

1,048,720

|

1,066,289

|

|||||||||||||||||||||||

|

Stockholders’ equity

|

121,702

|

123,283

|

132,298

|

|||||||||||||||||||||||

|

Total liabilities and

stockholders’ equity

|

$

|

1,130,666

|

$

|

1,172,003

|

$

|

1,198,587

|

||||||||||||||||||||

|

Net interest income

|

$

|

38,170

|

$

|

36,300

|

$

|

35,738

|

||||||||||||||||||||

|

Interest rate spread(3)

|

3.40

|

%

|

3.13

|

%

|

3.00

|

%

|

||||||||||||||||||||

|

Net interest margin(4)

|

3.47

|

%

|

3.19

|

%

|

3.06

|

%

|

||||||||||||||||||||

|

Ratio of average interest-

earning assets to average

interest-bearing liabilities

|

111.14

|

%

|

110.66

|

%

|

111.16

|

%

|

||||||||||||||||||||

|

(1)

|

Includes loans held for sale and non-performing loans, as well as net deferred loan costs of $1.2 million, $1.1 million and $874 for the years ended June 30, 2019, 2018 and 2017,

respectively.

|

|

(2)

|

Includes the average balance of non interest-bearing checking accounts of $84.1 million, $79.9 million and $72.9 million in fiscal 2019, 2018 and 2017, respectively.

|

|

(3)

|

Represents the difference between the weighted-average yield on all interest-earning assets and the weighted-average rate on all interest-bearing liabilities.

|

|

(4)

|

Represents net interest income as a percentage of average interest-earning assets.

|

|

Year Ended June 30, 2019 Compared

To Year Ended June 30, 2018 Increase (Decrease) Due to |

||||||||||||

|

(In Thousands)

|

Rate

|

Volume

|

Rate/

Volume

|

Net

|

||||||||

|

Interest-earning assets:

|

||||||||||||

|

Loans receivable(1)

|

$

|

2,709

|

$

|

(2,469

|

)

|

$

|

(164

|

)

|

$

|

76

|

||

|

Investment securities

|

548

|

106

|

44

|

698

|

||||||||

|

FHLB – San Francisco stock

|

133

|

5

|

1

|

139

|

||||||||

|

Interest-earning deposits

|

431

|

208

|

114

|

753

|

||||||||

|

Total net change in income on interest-earning assets

|

3,821

|

(2,150

|

)

|

(5

|

)

|

1,666

|

||||||

|

Interest-bearing liabilities:

|

||||||||||||

|

Checking and money market accounts

|

—

|

21

|

—

|

21

|

||||||||

|

Savings accounts

|

29

|

(51

|

)

|

(1

|

)

|

(23

|

)

|

|||||

|

Time deposits

|

225

|

(309

|

)

|

(28

|

)

|

(112

|

)

|

|||||

|

Borrowings

|

24

|

(113

|

)

|

(1

|

)

|

(90

|

)

|

|||||

|

Total net change in expense on interest-bearing liabilities

|

278

|

(452

|

)

|

(30

|

)

|

(204

|

)

|

|||||

|

Net increase (decrease) in net interest income

|

$

|

3,543

|

$

|

(1,698

|

)

|

$

|

25

|

$

|

1,870

|

|||

|

(1)

|

Includes loans held for sale and non-performing loans. For purposes of calculating volume, rate and rate/volume variances, non-performing loans were included in the weighted-average balance outstanding.

|

|

Year Ended June 30, 2018 Compared

To Year Ended June 30, 2017 Increase (Decrease) Due to |

||||||||||||

|

(In Thousands)

|

Rate

|

Volume

|

Rate/

Volume

|

Net

|

||||||||

|

Interest-earning assets:

|

||||||||||||

|

Loans receivable(1)

|

$

|

1,354

|

$

|

(1,532

|

)

|

$

|

(55

|

)

|

$

|

(233

|

)

|

|

|

Investment securities

|

190

|

434

|

145

|

769

|

||||||||

|

FHLB – San Francisco stock

|

(401

|

)

|

3

|

(1

|

)

|

(399

|

)

|

|||||

|

Interest-earning deposits

|

558

|

(210

|

)

|

(190

|

)

|

158

|

||||||

|

Total net change in income on interest-earning assets

|

1,701

|

(1,305

|

)

|

(101

|

)

|

295

|

||||||

|

Interest-bearing liabilities:

|

||||||||||||

|

Checking and money market accounts

|

—

|

20

|

—

|

20

|

||||||||

|

Savings accounts

|

—

|

16

|

—

|

16

|

||||||||

|

Time deposits

|

32

|

(377

|

)

|

(4

|

)

|

(349

|

)

|

|||||

|

Borrowings

|

132

|

(82

|

)

|

(4

|

)

|

46

|

||||||