a50823769.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

For the Fiscal Year Ended December 31, 2013

|

| |

|

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to ____________

Commission File Number 0-28104

JAKKS PACIFIC, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

95-4527222

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

22619 Pacific Coast Highway

|

|

|

Malibu, California

|

90265

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (310) 456-7799

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Name of each exchange

on which registered

|

|

Common Stock, $.001 par value per share

|

Nasdaq Global Select

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

Title of Class

Common Stock, $.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of “large accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

|

o Large Accelerated Filer

|

x Accelerated Filer

|

o Non-Accelerated Filer

|

o Smaller Reporting Company

|

|

|

|

(Do not check if a Smaller Reporting Company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity (the only such common equity being Common Stock, $.001 par value per share) held by non-affiliates of the registrant (computed by reference to the closing sale price of the Common Stock on June 28, 2013 of $11.25) is $254,435,906.

The number of shares outstanding of the registrant’s Common Stock, $.001 par value (being the only class of its common stock), is 23,277,563 as of March14, 2014.

Documents Incorporated by Reference

None.

JAKKS PACIFIC, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

For the Fiscal Year ended December 31, 2013

Items in Form 10-K

| |

|

Page

|

| |

PART I

|

|

|

|

|

2

|

|

|

|

11

|

|

Item 1B.

|

Unresolved Staff Comments

|

None

|

|

|

|

16

|

|

|

|

17

|

|

|

|

N/A

|

| |

PART II

|

|

|

|

|

19

|

|

|

|

23

|

|

|

|

25

|

|

|

|

38

|

|

|

|

40

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

None

|

|

|

|

76

|

|

Item 9B.

|

Other Information

|

None

|

| |

PART III

|

|

|

|

|

78

|

|

|

|

81

|

|

|

|

96

|

|

|

|

98

|

|

|

|

98

|

| |

PART IV

|

|

|

|

|

100

|

|

|

|

102

|

|

Certifications

|

|

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. For example, statements included in this report regarding our financial position, business strategy and other plans and objectives for future operations, and assumptions and predictions about future product demand, supply, manufacturing, costs, marketing and pricing factors are all forward-looking statements. When we use words like “intend,” “anticipate,” “believe,” “estimate,” “plan” or “expect,” we are making forward-looking statements. We believe that the assumptions and expectations reflected in such forward-looking statements are reasonable, based upon information available to us on the date hereof, but we cannot assure you that these assumptions and expectations will prove to have been correct or that we will take any action that we may presently be planning. We have disclosed certain important factors that could cause our actual results to differ materially from our current expectations elsewhere in this report. You should understand that forward-looking statements made in this report are necessarily qualified by these factors. We are not undertaking to publicly update or revise any forward-looking statement if we obtain new information or upon the occurrence of future events or otherwise.

PART I

In this report, “JAKKS,” the “Company,” “we,” “us” and “our” refer to JAKKS Pacific, Inc. and its subsidiaries.

Company Overview

We are a leading multi-line, multi-brand toy company that designs, produces, markets and distributes toys and related products, pet toys, consumables and related products, electronics and related products, kids indoor and outdoor furniture, and other consumer products. We focus our business on acquiring or licensing well-recognized trademarks and brand names, most with long product histories (“evergreen brands”). We seek to acquire these evergreen brands because we believe they are less subject to market fads or trends. We also develop proprietary products marketed under our own trademarks and brand names, and have historically acquired complementary businesses to further grow our portfolio. For accounting purposes, our products can be divided into two segments: (i) traditional toys and electronics and (ii) role play, novelty and seasonal toys. Segment information with respect to revenues, assets and profits or losses attributable to each segment is contained in Note 3 to the audited consolidated financial statements contained below in Item 8. Our products include:

Traditional Toys and Electronics

|

●

|

Action figures and accessories, including licensed characters, principally based on Batman, Star Wars, and Nintendo® franchises;

|

| |

|

|

●

|

Toy vehicles, including Road Champs®, Fly Wheels® and MXS® toy vehicles and accessories;

|

| |

|

|

●

|

Electronics products, including Spy Net® spy products, Plug It In & Play TV Games ™ video games based on Disney® brands, and Duck Commander, and other popular brands;

|

| |

|

|

●

|

Dolls and accessories, including small dolls, large dolls, fashion dolls and baby dolls based on licenses, including Disney Princess®, Disney Fairies®, Cabbage Patch Kids®, and Graco® and Fisher Price® plush, infant, and pre-school toys based on PBS’s Daniel Tiger’s neighborhood;

|

| |

|

|

●

|

Private label products as “exclusives” for a myriad of retail customers in many product categories;

|

| |

|

|

●

|

Foot-to-floor ride-on toys based on Fisher Price®, Kawasaki®, and DC Comics®, inflatable environments, tents and wagons; and

|

| |

|

|

●

|

Pet products, including toys, consumables, and accessories, branded JAKKS Pets® and American Classics™, some of which also feature licenses, including Kong.

|

Role Play, Novelty and Seasonal Toys

|

●

|

Role play, dress-up, pretend play and novelty products for boys and girls based on well known brands and entertainment properties such as Black & Decker®, McDonald’s®, Dirt Devil®, Disney Princess®, Disney Fairies® and Dora the Explorer®, as well as those based on our own proprietary brands;

|

| |

|

|

●

|

Indoor and outdoor kids’ furniture, activity trays and tables and room décor; kiddie pools, seasonal and outdoor products, including those based on Crayola®, Disney® characters and more, and Funnoodle® pool floats;

|

| |

|

|

●

|

Halloween and everyday costumes for all ages based on licensed and proprietary non-licensed brands, including Spiderman®, Iron Man, Toy Story®, Sesame Street®, Power Rangers®¸Hasbro® brands and Disney Princess®, and related Halloween accessories; and

|

| |

|

|

●

|

Junior sports and outdoor activity toys including Skyball® hyper-charged balls and sport sets and Wave Hoops® toy hoops marketed under our Maui Toys brand.

|

We continually review the marketplace to identify and evaluate popular and evergreen brands and product categories that we believe have the potential for growth. We endeavor to generate growth within these lines by:

| |

●

|

creating innovative products under our established licenses and brand names;

|

| |

●

|

adding new items to the branded product lines that we expect will enjoy greater popularity;

|

| |

●

|

infusing innovation and technology when appropriate to make them more appealing to today’s kids; and

|

| |

●

|

focusing our marketing efforts to enhance consumer recognition and retailer interest.

|

Our Business Strategy

In addition to developing our own proprietary brands and marks, licensing popular trademarks enables us to use these high-profile marks at a lower cost than we would incur if we purchased these marks or developed comparable marks on our own. By licensing trademarks, we have access to a far greater range of marks than would be available for purchase. We also license technology developed by unaffiliated inventors and product developers to enhance the design and functionality of our products.

We sell our products through our in-house sales staff and independent sales representatives to toy and mass-market retail chain stores, department stores, office supply stores, drug and grocery store chains, club stores, toy specialty stores and wholesalers. Our three largest customers are Wal-Mart, Target and Toys ‘R’ Us, which accounted for approximately 21.4%, 15.6% and 10.8%, respectively, of our net sales in 2013. No other customer accounted for more than 10.0% of our net sales in 2013.

Our Growth Strategy

In 2012 and 2013, we generated net sales of $666.8 million and $632.9 million, respectively, and net loss of $104.8 million and $53.9 million, respectively. Approximately 42.4% and 47.2% of our net sales in 2012 and 2013, respectively, were attributable to our acquisitions since 2008. Key elements of our growth strategy include:

● Expand Core Products. We manage our existing and new brands through strategic product development initiatives, including introducing new products, modifying existing products and extending existing product lines to maximize their longevity. Our marketing teams and product designers strive to develop new products or product lines to offer added technological, aesthetic and functional improvements to our extensive portfolio.

● Enter New Product Categories. We use our extensive experience in the toy and other consumer product industries to evaluate products and licenses in new product categories and to develop additional product lines. We began marketing licensed classic video games for simple plug-in use with television sets and expanded into several related categories by infusing additional technologies such as motion gaming and through the licensing of this category from our current licensors, such as Disney® and MTV Networks which owns Nickelodeon® .

● Pursue Strategic Acquisitions. We supplement our internal growth with selected strategic acquisitions. In July 2012 we acquired the business of Maui, Inc., an Ohio corporation, and A.S. Design Limited, a related Hong Kong corporation (collectively, “Maui”). Maui is a leading manufacturer and distributor of spring and summer activity toys and impulse toys. We will continue focusing our acquisition strategy on businesses or brands that we believe have compatible product lines and/or offer valuable trademarks or brands.

● Acquire Additional Character and Product Licenses. We have acquired the rights to use many familiar brand and character names and logos from third parties that we use with our primary trademarks and brands. Currently, among others, we have license agreements with Nickelodeon®, Disney®, and Warner Bros®, as well as with the licensors of the many popular licensed children’s characters previously mentioned, among others. We intend to continue to pursue new licenses from these entertainment and media companies and other licensors. We also intend to continue to purchase additional inventions and product concepts through our existing network of inventors and product developers.

● Expand International Sales. We believe that foreign markets, especially Europe, Australia, Canada, Latin America and Asia, offer us significant growth opportunities. In 2013, our sales generated outside the United States were approximately $108.7 million, or 17.2% of total net sales. While our international sales declined in 2013 compared to 2012, we intend to continue to try to expand our international sales and in 2012 opened sales offices and expanded distribution agreements in Latin America and China to capitalize on our experience and our relationships with foreign distributors and retailers. We expect these initiatives to contribute to our international growth in 2014.

● Capitalize On Our Operating Efficiencies. We believe that our current infrastructure and operating model can accommodate growth without a proportionate increase in our operating and administrative expenses, thereby increasing our operating margins.

The execution of our growth strategy, however, is subject to several risks and uncertainties and we cannot assure you that we will continue to experience growth in, or maintain our present level of net sales (see “Risk Factors,” beginning on page 11). For example, our growth strategy will place additional demands upon our management, operational capacity and financial resources and systems. The increased demand upon management may necessitate our recruitment and retention of additional qualified management personnel. We cannot assure you that we will be able to recruit and retain qualified personnel or expand and manage our operations effectively and profitably. To effectively manage future growth, we must continue to expand our operational, financial and management information systems and to train, motivate and manage our work force. While we believe that our operational, financial and management information systems will be adequate to support our future growth, no assurance can be given they will be adequate without significant investment in our infrastructure. Failure to expand our operational, financial and management information systems or to train, motivate or manage employees could have a material adverse effect on our business, financial condition and results of operations.

Moreover, implementation of our growth strategy is subject to risks beyond our control, including competition, market acceptance of new products, changes in economic conditions, our ability to obtain or renew licenses on commercially reasonable terms and our ability to finance increased levels of accounts receivable and inventory necessary to support our sales growth, if any.

Furthermore, we cannot assure you that we can identify attractive acquisition candidates or negotiate acceptable acquisition terms, and our failure to do so may adversely affect our results of operations and our ability to sustain growth.

Finally, our acquisition strategy involves a number of risks, each of which could adversely affect our operating results, including difficulties in integrating acquired businesses or product lines, assimilating new facilities and personnel and harmonizing diverse business strategies and methods of operation; diversion of management attention from operation of our existing business; loss of key personnel from acquired companies; and failure of an acquired business to achieve targeted financial results.

Industry Overview

According to Toy Industry Association, Inc., the leading toy industry trade group, the United States is the world’s largest toy market, followed by Japan and Western Europe. Total retail sales of toys, excluding video games, in the United States, were approximately $16.3 billion in 2013. We believe the two largest United States toy companies, Mattel and Hasbro, collectively hold a dominant share of the domestic non-video toy market. In addition, hundreds of smaller companies compete in the design and development of new toys, the procurement of character and product licenses, and the improvement and expansion of previously introduced products and product lines.

Over the past few years, the toy industry has experienced substantial consolidation among both toy companies and toy retailers. We believe that the ongoing consolidation of toy companies provides us with increased growth opportunities due to retailers’ desire to not be entirely dependent upon a few dominant toy companies. Retailer concentration also enables us to ship products, manage account relationships and track point of sale information more effectively and efficiently.

Products

We focus our business on acquiring or licensing well-recognized trademarks or brand names, and we seek to acquire evergreen brands which are less subject to market fads or trends. Generally, our license agreements for products and concepts call for royalties ranging from 1% to 14% of net sales, and some may require minimum guarantees and advances. Our principal products include:

Traditional Toys and Electronics

Electronics Products

Our electronic products category includes our Plug It In & Play TV Games®, SpyNet Spy products and Laser Challenge® product lines. Our current Plug It In & Play TV Games® titles, geared to the pre-school and leisure gamer segments, include licenses from Namco®, Disney, Marvel® and Nickelodeon® , and feature such games as SpongeBob SquarePants®, Duck Commander®, Walking Dead®, Dora the Explorer®, Disney Princess®, Ms. Pac-Man® and Pac-Man®.

In 2013, we launched our EZ Pro® DJ platform enabling users to mix and match tunes as well as portable baby monitors, and in 2014 we expect to launch Hero Portal ™ video games with collectible figurines that interact with an all-in-one video console.

Wheels Products

Motorized and plastic toy vehicles and accessories.

Our extreme sports offerings include our MXS line of motorcycles with generic and well-known riders and other vehicles include off-road vehicles and skateboards, which are sold individually and with playsets and accessories. In 2012, we launched our proprietary line of motorized trains and track sets under the brand Power Trains, and in 2014, we will expand the product line to include buildings, automobiles and freeways under the Power City™ brand. We relaunched our proprietary line of rip cord powered action wheels and propellers, Fly Wheels®.

Action Figures and Accessories

We currently develop, manufacture and distribute other action figures and action figure accessories including those based on the animated series El Chavo®, Star Wars®, and Batman®, capitalizing on the expertise we built in the action figure category.

In 2013, we expanded our line of 31” figures to include Superman®, Power Rangers® and Star Wars®. In 2014, we expect to expand the range of large figures to include an assortment of 20” figures.

Dolls

Dolls and accessories include small dolls, large dolls, fashion dolls and baby dolls based on licenses, including Disney Princess®, Disney Fairies®, Cabbage Patch Kids®, and, Graco®, including an extensive line of baby doll accessories that emulate real baby products that mothers today use; plush, infant and pre-school toys, and private label fashion dolls for other retailers and sold to Disney Stores and Disney Parks and Resorts.

In 2013, we launched MiWorld™, a line of mall-based playhouse elements featuring Claire’s, Skechers and O.P.I. among others which incorporates DreamPlay technology adding a virtual experience to a physical toy.

PetProducts

We entered the Pet Products category with our acquisition of Pet Pal, whose products include pet toys, treats, beds, clothes and related pet products. These products are marketed under JAKKS Pets® and our own proprietary brand of assorted pet products under the brand American Classics® as well as licenses including Kong® and numerous other entertainment and consumer product properties.

Role Play, Novelty & Seasonal

Role play and Dress-up Products

Our line of role play and dress-up products for boys and girls features entertainment and consumer products properties such as Disney Princess®, Disney Fairies®, Dora the Explorer®, and Black & Decker®. These products generated a significant amount of sales in 2012 and 2013.

Seasonal/ Outdoor Products

We have a wide range of seasonal toys and outdoor and leisure products including our recently acquired Maui line of proprietary products including Sky Ball and Wave Hoop among other outdoor toys. Our Funnoodle® pool toys include the basic Funnoodle pool floats and a variety of other pool toys.

Indoor and Outdoor Kids’ Furniture

We produce an extensive array of licensed indoor and outdoor kids' furniture and activity tables, and room decor. Our licensed portfolio includes character licenses, including Crayola®, Disney Princess®, Toy Story®, Mickey Mouse®, Dora the Explorer®, and others. Products include children’s puzzle furniture, tables and chairs to activity sets, trays, stools and a line of licensed molded kiddie pools, among others.

Halloween and Everyday Costume Play

We produce an expansive and innovative line of Halloween costumes and accessories which includes a wide range of non-licensed Halloween costumes such as horror, pirates, historical figures and aliens to animals, vampires, angels and more, as well as popular licensed characters from top intellectual property owners including Disney®, Hasbro®, Marvel®, Sesame Workshop®, Mattel®, and many others.

DreamPlay Technology

In September 2012, we formed a joint venture with NantWorks LLC called DreamPlay Toys LLC to exploit their patented recognition technologies in conjunction with toy and consumer products. In 2013, we launched two lines of toy products which utilize the technologies to enhance the play pattern of the toys as well as enhance the in-store experience of the consumer. The first product line was based on Disney’s Little Mermaid followed by our propriety concept, MiWorld. Both product lines were accompanied by a software application which brings the toy products to life adding a rich virtual experience to a physical experience. In 2014, we expect to launch updates to these apps as well as launch several other toys with application based product lines.

Sales, Marketing and Distribution

We sell all of our products through our own in-house sales staff and independent sales representatives to toy and mass-market retail chain stores, department stores, office supply stores, drug and grocery store chains, club stores, toy specialty stores and wholesalers. Our three largest customers are Wal-Mart, Target, and Toys ‘R’ Us, which accounted for approximately 46.8% of our net sales in 2012 and 47.8% of our net sales in 2013. With the JAKKS Pets® product line, we distribute pet products to key pet supply retailers Petco and Petsmart in addition to many other pet retailers and our existing customers. We generally sell products to our customers pursuant to letters of credit or, in some cases, on open account with payment terms typically varying from 30 to 90 days. From time to time, we allow our customers credits against future purchases from us in order to facilitate their retail markdown and sales of slow-moving inventory. We also sell our products through e-commerce sites, including Toysrus.com and Amazon.com.

We contract the manufacture of most of our products to unaffiliated manufacturers located in The People’s Republic of China (“China”). We sell the finished products on a letter of credit basis or on open account to our customers, many of whom take title to the goods in Hong Kong or China. These methods allow us to reduce certain operating costs and working capital requirements. A portion of our sales originate in the United States, so we hold certain inventory in our warehouse and fulfillment facilities. To date, a significant portion of all of our sales has been to domestic customers. We intend to continue expanding distribution of our products into foreign territories and, accordingly, we have:

| |

●

|

engaged representatives to oversee sales in certain territories,

|

| |

●

|

engaged distributors in certain territories,

|

| |

●

|

established direct relationships with retailers in certain territories,

|

| |

●

|

opened sales offices in Europe,

|

| |

●

|

opened sales offices and a distribution center in Canada, and

|

| |

●

|

expanded in-house resources dedicated to product development and marketing of our lines.

|

Outside of the United States, we currently sell our products primarily in Europe, Australia, Canada, Latin America and Asia. Sales of our products abroad accounted for approximately $132.0 million, or 19.8% of our net sales, in 2012 and approximately $108.7 million, or 17.2% of our net sales, in 2013. We believe that foreign markets present an attractive opportunity, and we plan to intensify our marketing efforts and further expand our distribution channels abroad.

We establish reserves for sales allowances, including promotional allowances and allowances for anticipated defective product returns, at the time of shipment. The reserves are determined as a percentage of net sales based upon either historical experience or upon estimates or programs agreed upon by our customers and us.

We obtain, directly, or through our sales representatives, orders for our products from our customers and arrange for the manufacture of these products as discussed below. Cancellations generally are made in writing, and we take appropriate steps to notify our manufacturers of these cancellations. We may incur costs or other losses as a result of cancellations.

We maintain a full-time sales and marketing staff, many of whom make on-site visits to customers for the purpose of showing product and soliciting orders for products. We also retain a number of independent sales representatives to sell and promote our products, both domestically and internationally. Together with retailers, we occasionally test the consumer acceptance of new products in selected markets before committing resources to large-scale production.

We publicize and advertise our products in trade and consumer magazines and other publications, market our products at international, national and regional toy and other specialty trade shows, conventions and exhibitions and carry on cooperative advertising programs with toy and mass market retailers and other customers which include the use of print and television ads and in-store displays. We also produce and broadcast television commercials for several of our product lines, if we expect that the resulting increase in our net sales will justify the relatively high cost of television advertising.

Product Development

Each of our product lines has an in-house manager responsible for product development. The in-house manager identifies and evaluates inventor products and concepts and other opportunities to enhance or expand existing product lines or to enter new product categories. In addition, we create proprietary products to fully exploit our concept and character licenses. Although we do have the capability to create and develop products from inception to production, we also use third-parties to provide a portion of the sculpting, sample making, illustration and package design required for our products in order to accommodate our increasing product innovations and introductions. Typically, the development process takes from three to nine months from concept to production and shipment to our customers.

We employ a staff of designers for all of our product lines. We occasionally acquire our other product concepts from unaffiliated third parties. If we accept and develop a third party’s concept for new toys, we generally pay a royalty on the sale of the toys developed from this concept, and may, on an individual basis, as well as some of our DreamPlay apps, guarantee a minimum royalty. In addition, we engage third-party developers to program our line of Plug it in & Play TV Games. Royalties payable to inventors and developers generally range from 1% to 5% of the wholesale sales price for each unit of a product sold by us. We believe that utilizing experienced third-party inventors gives us access to a wide range of development talent. We currently work with numerous toy inventors and designers for the development of new products and the enhancement of existing products.

Safety testing of our products is done at the manufacturers’ facilities by quality control personnel employed by us or by independent third-party contractors engaged by us. Safety testing is designed to meet or exceed regulations imposed by federal and state, as well as applicable international governmental authorities, our retail partners, licensors and the Toy Industry Association. We also closely monitor quality assurance procedures for our products for safety purposes. In addition, independent laboratories engaged by some of our larger customers and licensors test certain of our products.

Manufacturing and Supplies

Most of our products are currently produced by overseas third-party manufacturers, which we choose on the basis of quality, reliability and price. Consistent with industry practice, the use of third-party manufacturers enables us to avoid incurring fixed manufacturing costs, while maximizing flexibility, capacity and production technology. Substantially all of the manufacturing services performed overseas for us are paid for on open account with the manufacturers. To date, we have not experienced any material delays in the delivery of our products; however, delivery schedules are subject to various factors beyond our control, and any delays in the future could adversely affect our sales. Currently, we have ongoing relationships with over eighty different manufacturers. We believe that alternative sources of supply are available to us although we cannot be assured that we can obtain adequate supplies of manufactured products.

Although we do not conduct the day-to-day manufacturing of our products, we are extensively involved in the design of the product prototype and production tools, dyes and molds for our products and we seek to ensure quality control by actively reviewing the production process and testing the products produced by our manufacturers. We employ quality control inspectors who rotate among our manufacturers’ factories to monitor the production of substantially all of our products.

The principal raw materials used in the production and sale of our toy products are plastics, zinc alloy, plush, printed fabrics, paper products and electronic components, all of which are currently available at reasonable prices from a variety of sources. Although we do not manufacture our products, we own the majority of the tools, dyes and molds used in the manufacturing process, and these are transferable among manufacturers if we choose to employ alternative manufacturers. Tools, dyes and molds represent a substantial portion of our property and equipment with a net book value of $10.8 million in 2012 and $8.5 million in 2013; substantially all of these assets are located in China.

Trademarks and Copyrights

Most of our products are produced and sold under trademarks owned by or licensed to us. We typically register our properties, and seek protection under the trademark, copyright and patent laws of the United States and other countries where our products are produced or sold. These intellectual property rights can be significant assets. Accordingly, while we believe we are sufficiently protected, the loss of some of these rights could have an adverse effect on our business, financial condition and results of operations.

Competition

Competition in the toy industry is intense. Globally, certain of our competitors have greater financial resources, larger sales and marketing and product development departments, stronger name recognition, longer operating histories and benefit from greater economies of scale. These factors, among others, may enable our competitors to market their products at lower prices or on terms more advantageous to customers than those we could offer for our competitive products. Competition often extends to the procurement of entertainment and product licenses, as well as the marketing and distribution of products and the obtaining of adequate shelf space. Competition may result in price reductions, reduced gross margins and loss of market share, any of which could have a material adverse effect on our business, financial condition and results of operations. In each of our product lines we compete against one or both of the toy industry’s two dominant companies, Mattel and Hasbro. In addition, we compete in our Halloween costume lines with Rubies. We also compete with numerous smaller domestic and foreign toy manufacturers, importers and marketers in each of our product categories.

Seasonality and Backlog

In 2013, approximately 70.9% of our net sales were made in the third and fourth quarters. Generally, the first quarter is the period of lowest shipments and sales in our business and in the toy industry and therefore it is also the least profitable quarter due to various fixed costs. Seasonality factors may cause our operating results to fluctuate significantly from quarter to quarter. However, our seasonal products are primarily sold in the spring and summer seasons. Our results of operations may also fluctuate as a result of factors such as the timing of new products (and related expenses) introduced by us or our competitors, the advertising activities of our competitors, delivery schedules set by our customers and the emergence of new market entrants. We believe, however, that the low retail price of most of our products may be less subject to seasonal fluctuations than higher priced toy products.

We ship products in accordance with delivery schedules specified by our customers, who generally request delivery of products within three to six months of the date of their orders for orders shipped FOB China or Hong Kong and within three days for orders shipped domestically. Because customer orders may be canceled at any time without penalty, our backlog may not accurately indicate sales for any future period.

Government and Industry Regulation

Our products are subject to the provisions of the Consumer Product Safety Act (“CPSA”), the Federal Hazardous Substances Act (“FHSA”), the Flammable Fabrics Act (“FFA”) and the regulations promulgated there under. The CPSA and the FHSA enable the Consumer Products Safety Commission (“CPSC”) to exclude from the market consumer products that fail to comply with applicable product safety regulations or otherwise create a substantial risk of injury, and articles that contain excessive amounts of a banned hazardous substance. The FFA enables the CPSC to regulate and enforce flammability standards for fabrics used in consumer products. The CPSC may also require the repurchase by the manufacturer of articles. Similar laws exist in some states and cities and in various international markets. We maintain a quality control program designed to ensure compliance with all applicable laws.

Employees

As of February 28, 2014, we employed 758 persons, all of whom are full-time employees, including three executive officers. We employed 355 people in the United States, 10 people in Canada, 266 people in Hong Kong, 114 people in China, 12 people in the United Kingdom, and 1 person in France. We believe that we have good relationships with our employees. None of our employees are represented by a union.

Environmental Issues

We are subject to legal and financial obligations under environmental, health and safety laws in the United States and in other jurisdictions where we operate. We are not currently aware of any material environmental liabilities associated with any of our operations.

Available Information

We make available free of charge on or through our Internet website, www.jakks.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The contents of our website are not incorporated in or deemed to be a part of any such report.

Our Corporate Information

We were formed as a Delaware corporation in 1995. Our principal executive offices are located at 22619 Pacific Coast Highway, Malibu, California 90265. Our telephone number is (310) 456-7799 and our Internet Website address is www.jakks.com. The contents of our website are not incorporated in or deemed to be a part of this Annual Report on Form 10-K.

From time to time, including in this Annual Report on Form 10-K, we publish forward-looking statements, as disclosed in our Disclosure Regarding Forward-Looking Statements, beginning immediately following the Table of Contents of this Annual Report. We note that a variety of factors could cause our actual results and experience to differ materially from the anticipated results or other expectations expressed or anticipated in our forward-looking statements. The factors listed below are risks and uncertainties that may arise and that may be detailed from time to time in our public announcements and our filings with the Securities and Exchange Commission, such as on Forms 8-K, 10-Q and 10-K. We undertake no obligation to make any revisions to the forward-looking statements contained in this Annual Report on Form 10-K to reflect events or circumstances occurring after the date of the filing of this report.

Our inability to redesign, restyle and extend our existing core products and product lines as consumer preferences evolve, and to develop, introduce and gain customer acceptance of new products and product lines, may materially and adversely impact our business, financial condition and results of operations.

Our business and operating results depend largely upon the appeal of our products. Our continued success in the toy industry will depend upon our ability to redesign, restyle and extend our existing core products and product lines as consumer preferences evolve, and to develop, introduce and gain customer acceptance of new products and product lines. Several trends in recent years have presented challenges for the toy industry, including:

| |

●

|

the phenomenon of children outgrowing toys at younger ages, particularly in favor of interactive and high technology products;

|

| |

●

|

increasing use of technology;

|

| |

●

|

shorter life cycles for individual products; and

|

| |

●

|

higher consumer expectations for product quality, functionality and value.

|

We cannot assure you that:

| |

●

|

our current products will continue to be popular with consumers;

|

| |

●

|

the product lines or products that we introduce will achieve any significant degree of market acceptance;

|

| |

●

|

the life cycles of our products will be sufficient to permit us to recover licensing, design, manufacturing, marketing and other costs associated with those products.

|

| |

● |

our inclusion of new technology will result in higher sales or increase profits. |

Our failure to achieve any or all of the foregoing benchmarks may adversely affect our business, financial condition and results of operations.

The failure of our character-related and theme-related products to become and/or remain popular with children may materially and adversely impact our business, financial condition and results of operations.

The success of many of our character-related and theme-related products depends upon the popularity of characters in movies, television programs, live sporting exhibitions, and other media and events. We cannot assure you that:

| |

●

|

media associated with our character-related and theme-related product lines will be released at the times we expect or will be successful;

|

| |

●

|

the success of media associated with our existing character-related and theme-related product lines will result in substantial promotional value to our products; or

|

| |

●

|

we will be successful in renewing licenses upon expiration on terms that are favorable to us; or

|

| |

●

|

we will be successful in obtaining licenses to produce new character-related and theme-related products in the future.

|

Our failure to achieve any or all of the foregoing benchmarks may cause the infrastructure of our operations to fail, thereby adversely affecting our business, financial condition and results of operations.

There are risks associated with our license agreements.

| |

●

|

Our current licenses require us to pay minimum royalties

|

Sales of products under trademarks or trade or brand names licensed from others account for substantially all of our net sales. Product licenses allow us to capitalize on characters, designs, concepts and inventions owned by others or developed by toy inventors and designers. Our license agreements generally require us to make specified minimum royalty payments, even if we fail to sell a sufficient number of units to cover these amounts. In addition, under certain of our license agreements, if we fail to achieve certain prescribed sales targets, we may be unable to retain or renew these licenses.

| |

●

|

Some of our licenses are restricted as to use

|

Under the majority of our license agreements, the licensors have the right to review and approve our use of their licensed products, designs or materials before we may make any sales. If a licensor refuses to permit our use of any licensed property in the way we propose, or if their review process is delayed, our development or sale of new products could be impeded.

| |

●

|

New licenses are difficult and expensive to obtain

|

Our continued success will substantially depend upon our ability to obtain additional licenses. Intense competition exists for desirable licenses in our industry. We cannot assure you that we will be able to secure or renew significant licenses on terms acceptable to us. In addition, as we add licenses, the need to fund additional royalty advances and guaranteed minimum royalty payments may strain our cash resources.

| |

●

|

A limited number of licensors account for a large portion of our net sales

|

We derive a significant portion of our net sales from a limited number of licensors. If one or more of these licensors were to terminate or fail to renew our license or not grant us new licenses, our business, financial condition and results of operations could be adversely affected.

The toy industry is highly competitive and our inability to compete effectively may materially and adversely impact our business, financial condition and results of operations.

The toy industry is highly competitive. Globally, certain of our competitors have financial and strategic advantages over us, including:

| |

●

|

greater financial resources;

|

| |

●

|

larger sales, marketing and product development departments;

|

| |

●

|

stronger name recognition;

|

| |

●

|

longer operating histories; and

|

| |

●

|

greater economies of scale.

|

In addition, the toy industry has no significant barriers to entry. Competition is based primarily upon the ability to design and develop new toys, procure licenses for popular characters and trademarks and successfully market products. Many of our competitors offer similar products or alternatives to our products. Our competitors have obtained and are likely to continue to obtain licenses that overlap our licenses with respect to products, geographic areas and markets. We cannot assure you that we will be able to obtain adequate shelf space in retail stores to support our existing products, expand our products and product lines or continue to compete effectively against current and future competitors.

We may not be able to sustain or manage our product line growth, which may prevent us from increasing our net revenues.

Historically, we have experienced growth in our product lines through acquisitions of businesses, products and licenses. This growth in product lines has contributed significantly to our total revenues over the last few years. For example, revenues associated with companies we acquired since 2008 were approximately $282.6 million and $298.5 million, in 2012 and 2013, respectively, representing 42.4% and 47.2%, respectively, of our total revenues for those periods. As a result, even though we had no acquisitions in 2013, comparing our period-to-period operating results may not be meaningful and results of operations from prior periods may not be indicative of future results. We cannot assure you that we will continue to experience growth in, or maintain our present level of, net sales.

Our growth strategy calls for us to continuously develop and diversify our toy business by acquiring other companies, entering into additional license agreements, refining our product lines and expanding into international markets, which will place additional demands upon our management, operational capacity and financial resources and systems. The increased demand upon management may necessitate our recruitment and retention of qualified management personnel. We cannot assure you that we will be able to recruit and retain qualified personnel or expand and manage our operations effectively and profitably. To effectively manage future growth, we must continue to expand our operational, financial and management information systems and to train, motivate and manage our work force. There can be no assurance that our operational, financial and management information systems will be adequate to support our future operations. Failure to expand our operational, financial and management information systems or to train, motivate or manage employees could have a material adverse effect on our business, financial condition and results of operations.

In addition, implementation of our growth strategy is subject to risks beyond our control, including competition, market acceptance of new products, changes in economic conditions, our ability to obtain or renew licenses on commercially reasonable terms and our ability to finance increased levels of accounts receivable and inventory necessary to support our sales growth, if any. Accordingly, we cannot assure you that our growth strategy will be successful.

If we are unable to acquire and integrate companies and new product lines successfully, we will be unable to implement a significant component of our growth strategy.

Our growth strategy depends, in part, upon our ability to acquire companies and new product lines. Future acquisitions, if any, may succeed only if we can effectively assess characteristics of potential target companies and product lines, such as:

| |

●

|

attractiveness of products;

|

| |

●

|

suitability of distribution channels;

|

| |

●

|

financial condition and results of operations; and

|

| |

●

|

the degree to which acquired operations can be integrated with our operations.

|

We cannot assure you that we can identify attractive acquisition candidates or negotiate acceptable acquisition terms, and our failure to do so may adversely affect our results of operations and our ability to sustain growth. Our acquisition strategy involves a number of risks, each of which could adversely affect our operating results, including:

| |

●

|

difficulties in integrating acquired businesses or product lines, assimilating new facilities and personnel and harmonizing diverse business strategies and methods of operation;

|

| |

●

|

diversion of management attention from operation of our existing business;

|

| |

●

|

loss of key personnel from acquired companies;

|

| |

●

|

failure of an acquired business to achieve targeted financial results; and

|

| |

● |

Limited capital to finance acquisitions. |

A limited number of customers account for a large portion of our net sales, so that if one or more of our major customers were to experience difficulties in fulfilling their obligations to us, cease doing business with us, significantly reduce the amount of their purchases from us or return substantial amounts of our products, it could have a material adverse effect on our business, financial condition and results of operations.

Our three largest customers accounted for 47.8% of our net sales in 2013. Except for outstanding purchase orders for specific products, we do not have written contracts with or commitments from any of our customers and pursuant to the terms of certain of our vendor agreements, even some purchase orders may be cancelled without penalty up until delivery. A substantial reduction in or termination of orders from any of our largest customers could adversely affect our business, financial condition and results of operations. In addition, pressure by large customers seeking price reductions, financial incentives, and changes in other terms of sale or for us to bear the risks and the cost of carrying inventory could also adversely affect our business, financial condition and results of operations. If one or more of our major customers were to experience difficulties in fulfilling their obligations to us, cease doing business with us, significantly reduce the amount of their purchases from us or return substantial amounts of our products, it could have a material adverse effect on our business, financial condition and results of operations. In addition, the bankruptcy or other lack of success of one or more of our significant retailers could negatively impact our revenues and bad debt expense.

We depend upon our Chief Executive Officer and any loss or interruption of his services could adversely affect our business, financial condition and results of operations.

Our success has been largely dependent upon the experience and continued services of Stephen G. Berman, our President and Chief Executive Officer. We cannot assure you that we would be able to find an appropriate replacement for Mr. Berman should the need arise, and any loss or interruption of the services of Mr. Berman could adversely affect our business, financial condition and results of operations.

We depend upon third-party manufacturers, and if our relationship with any of them is harmed or if they independently encounter difficulties in their manufacturing processes, we could experience product defects, production delays, cost overruns or the inability to fulfill orders on a timely basis, any of which could adversely affect our business, financial condition and results of operations.

We depend upon many third-party manufacturers who develop, provide and use the tools, dyes and molds that we generally own to manufacture our products. However, we have limited control over the manufacturing processes themselves. As a result, any difficulties encountered by the third-party manufacturers that result in product defects, production delays, cost overruns or the inability to fulfill orders on a timely basis could adversely affect our business, financial condition and results of operations.

We do not have long-term contracts with our third-party manufacturers. Although we believe we could secure other third-party manufacturers to produce our products, our operations would be adversely affected if we lost our relationship with any of our current suppliers or if our current suppliers’ operations or sea or air transportation with our overseas manufacturers were disrupted or terminated even for a relatively short period of time. Our tools, dyes and molds are located at the facilities of our third-party manufacturers.

Although we do not purchase the raw materials used to manufacture our products, we are potentially subject to variations in the prices we pay our third-party manufacturers for products, depending upon what they pay for their raw materials.

We have substantial sales and manufacturing operations outside of the United States, subjecting us to risks common to international operations.

We sell products and operate facilities in numerous countries outside the United States. For the year ended December 31, 2013, sales to our international customers comprised approximately 17.2% of our net sales. We expect our sales to international customers to account for a greater portion of our revenues in future fiscal periods. Additionally, we utilize third-party manufacturers, located principally in China, and are subject to the risks normally associated with international operations, including:

| |

●

|

currency conversion risks and currency fluctuations;

|

| |

●

|

limitations, including taxes, on the repatriation of earnings;

|

| |

●

|

political instability, civil unrest and economic instability;

|

| |

●

|

greater difficulty enforcing intellectual property rights and weaker laws protecting such rights;

|

| |

●

|

complications in complying with laws in varying jurisdictions and changes in governmental policies;

|

| |

●

|

greater difficulty and expenses associated with recovering from natural disasters;

|

| |

●

|

transportation delays and interruptions;

|

| |

●

|

the potential imposition of tariffs; and

|

| |

●

|

the pricing of intercompany transactions may be challenged by taxing authorities in both Hong Kong and the United States, with potential increases in income taxes.

|

Our reliance upon external sources of manufacturing can be shifted, over a period of time, to alternative sources of supply, should such changes be necessary. However, if we were prevented from obtaining products or components for a material portion of our product line due to medical, political, labor or other factors beyond our control, our operations would be disrupted while alternative sources of products were secured. Also, the imposition of trade sanctions by the United States against a class of products imported by us from, or the loss of “normal trade relations” status by, China could significantly increase our cost of products imported from that nation. Because of the importance of international sales and international sourcing of manufacturing to our business, our financial condition and results of operations could be significantly and adversely affected if any of the risks described above were to occur.

Our business is subject to extensive government regulation and any violation by us of such regulations could result in product liability claims, loss of sales, diversion of resources, damage to our reputation, increased warranty costs or removal of our products from the market, and we cannot assure you that our product liability insurance for the foregoing will be sufficient.

Our business is subject to various laws, including the Federal Hazardous Substances Act, the Consumer Product Safety Act, the Flammable Fabrics Act and the rules and regulations promulgated under these acts. These statutes are administered by the CPSC, which has the authority to remove from the market products that are found to be defective and present a substantial hazard or risk of serious injury or death. The CPSC can require a manufacturer to recall, repair or replace these products under certain circumstances. We cannot assure you that defects in our products will not be alleged or found. Any such allegations or findings could result in:

| |

●

|

product liability claims;

|

| |

●

|

diversion of resources;

|

| |

●

|

damage to our reputation;

|

| |

●

|

increased warranty costs; and

|

| |

●

|

removal of our products from the market.

|

Any of these results may adversely affect our business, financial condition and results of operations. There can be no assurance that our product liability insurance will be sufficient to avoid or limit our loss in the event of an adverse outcome of any product liability claim.

We depend upon our proprietary rights and our inability to safeguard and maintain the same, or claims of third parties that we have violated their intellectual property rights, could have a material adverse effect on our business, financial condition and results of operations.

We rely upon trademark, copyright and trade secret protection, nondisclosure agreements and licensing arrangements to establish, protect and enforce our proprietary rights in our products. The laws of certain foreign countries may not protect intellectual property rights to the same extent or in the same manner as the laws of the United States. We cannot assure you that we or our licensors will be able to successfully safeguard and maintain our proprietary rights. Further, certain parties have commenced legal proceedings or made claims against us based upon our alleged patent infringement, misappropriation of trade secrets or other violations of their intellectual property rights. We cannot assure you that other parties will not assert intellectual property claims against us in the future. These claims could divert our attention from operating our business or result in unanticipated legal and other costs, which could adversely affect our business, financial condition and results of operations.

Market conditions and other third-party conduct could negatively impact our margins and implementation of other business initiatives.

Economic conditions, such as decreased consumer confidence, may adversely impact our margins. In addition, general economic conditions were significantly and negatively affected by the September 11th terrorist attacks and could be similarly affected by any future attacks. Such a weakened economic and business climate, as well as consumer uncertainty created by such a climate, could adversely affect our sales and profitability. Other conditions, such as the unavailability of electronics components, may impede our ability to manufacture, source and ship new and continuing products on a timely basis. Significant and sustained increases in the price of oil could adversely impact the cost of the raw materials used in the manufacture of our products, such as plastic.

We may not have the funds necessary to purchase our outstanding convertible senior notes upon a fundamental change or other purchase date, as required by the indenture governing the notes.

On July 24, 2013, the Company sold an aggregate of $100.0 million principal amount of 4.25% Convertible Senior Notes due on August 1, 2018 (the “2018 Notes”). Holders of the 2018 Notes may convert their notes upon the occurrence of specified events. Upon conversion, the 2018 Notes will be settled in shares of the Company’s common stock. The Company used $61.0 million of the approximate $96.0 million in net proceeds from the offering to repurchase at par $61.0 million principal amount of the aggregate of $100.0 million principal amount of 4.50% Convertible Senior Notes due 2014 originally sold on November 10, 2009 (the “2014 Notes”). The 2014 Notes are senior unsecured obligations of JAKKS, which pay interest semi-annually at a rate of 4.50% per annum and mature on November 1, 2014. Prior to August 1, 2014, holders of the 2014 Notes may convert their notes only upon specified events. Upon conversion, the 2014 Notes may be settled, at our election, in cash, shares of our common stock, or a combination of cash and shares of our common stock. Holders of the 2014 Notes may require us to repurchase for cash all or some of their notes upon the occurrence of a fundamental change (as defined in the 2014 Notes).

We have a history of making acquisitions that result in material amounts of goodwill. Any future acquisitions may also result in material amounts of goodwill which, if impaired, would result in a reduction in our net income.

Goodwill is the amount by which the cost of an acquisition exceeds the fair value of the net assets we acquire. Current accounting standards require that goodwill not be amortized but instead be periodically evaluated for impairment based upon the fair value of the reporting unit. Goodwill currently on our books and any goodwill associated with future acquisitions are subject to impairment risk.

We have a full valuation allowance on the entire balance of deferred taxes on our books since their future realization is uncertain.

Deferred tax assets are realized by prior and future taxable income of appropriate character. Current accounting standards require that a valuation allowance be recorded if it is not likely that sufficient taxable income of appropriate character will be generated to realize the deferred tax assets. In the fourth quarter of 2012, we established a full valuation allowance against our United States deferred tax assets, resulting in a non-cash charge to income of $91.7 million.

The following is a listing of the principal leased offices maintained by us as of February 28, 2014:

|

Property

|

|

Location

|

|

Approximate

Square Feet

|

|

Lease Expiration

Date

|

|

Domestic

|

|

|

|

|

|

|

|

Corporate Office

|

|

Malibu, California

|

|

29,500

|

|

February 28, 2015

|

|

Showroom and Design Center

|

|

Santa Monica, California

|

|

28,200

|

|

February 28, 2016

|

|

Distribution Center

|

|

City of Industry, California

|

|

800,000

|

|

April 30, 2018

|

|

Distribution Center

|

|

Hickory, NC

|

|

139,438

|

|

August 31, 2014

|

|

Moose Mountain/Kids Only Office

|

|

Parisippany-Troy Hills, NJ

|

|

2,100

|

|

March 31, 2014

|

|

Sales Office/Showroom

|

|

Bentonville, Arkansas

|

|

9,000

|

|

September 30, 2014

|

|

Showroom

|

|

Minneapolis, Minnesota

|

|

1,560

|

|

December 31, 2014

|

|

Disguise Office

|

|

Poway, California

|

|

24,200

|

|

December 31, 2015

|

|

Maui Toys Office/Warehouse

|

|

Youngstown, Ohio

|

|

73,000

|

|

Month-to-month

|

|

Maui Toys Office

|

|

Santa Monica, California

|

|

10,000

|

|

December 31, 2014

|

|

Sales Office

|

|

Hoffman Estates, II

|

|

3,071

|

|

August 31, 2015

|

|

Design Office

|

|

Culver City, California

|

|

28,758

|

|

January 31, 2016

|

|

International

|

|

|

|

|

|

|

|

Distribution Center

|

|

Brampton, Ontario, Canada

|

|

105,700

|

|

December 31, 2014

|

|

Europe Office

|

|

Berkshire, UK

|

|

2,215

|

|

February 25, 2015

|

|

Hong Kong Headquarters

|

|

Kowloon, Hong Kong

|

|

36,600

|

|

June 30, 2016

|

|

Hong Kong Showroom

|

|

Kowloon, Hong Kong

|

|

22,630

|

|

June 30, 2016

|

|

Production Inspection and Testing Office

|

|

Shenzhen, China

|

|

5,417

|

|

May 14, 2014

|

|

Production Inspection Office

|

|

Nanjing, China

|

|

501

|

|

August 18, 2014

|

|

Moose Mountain HK Office

|

|

Kowloon, Hong Kong

|

|

6,198

|

|

June 30, 2015

|

|

Production Inspection and Testing Lab

|

|

Guangdong, Hong Kong

|

|

23,200

|

|

December 31, 2014

|

|

Tollytots Office

|

|

Zhejiang, China

|

|

120

|

|

April 19, 2014

|

|

Tollytots Office

|

|

Zhejiang, China

|

|

147

|

|

April 19, 2014

|

|

Moose Mountain Warehouse

|

|

Shatin, Hong Kong

|

|

1,407

|

|

November 30, 2014

|

|

Moose Mountain Tooling Office

|

|

Guangdong, Hong Kong

|

|

792

|

|

December 31, 2014

|

In or about the end of July 2013 two purported class action lawsuits were filed in the United States District Court for the Central District of California: (1) Melot v. JAKKS PACIFIC, INC. et al, Case No. CV13-05388 (JAK) (filed on July 25, 2013); and (2) Dylewicz v. JAKKS PACIFIC, INC. et al, Case No.CV13-5487 (OON) (filed on July 30, 2013) (collectively, the “Class Action”). The complaints in the Class Action alleged that the Company made false and/or misleading statements concerning the extent of the negative impact that the shift in children’s preference for electronic devices was having on sales of the Company’s more traditional toys, and the extent of the negative impact from poor sales of various of the Company’s licensed products, and/or that the Company’s financial statements were materially false and misleading. These allegations make reference to matters contained in the July 17, 2013 Press Release. The Class Period in the Class Action is from July 17, 2012 –July 17, 2013. The Class Action sought compensatory and other damages in an undisclosed amount, and alleged violations of Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 promulgated thereunder by each of the defendants (namely the Company and Messrs. Berman and Bennett), and violations of Section 20(a) of the Exchange Act by Messrs. Berman and Bennett. The Court appointed a lead plaintiff and selected Class Counsel. An amended complaint (the “FAC”) was filed which alleged the same Class Period and causes of action and the Company has filed a motion to dismiss the FAC. Briefing is in progress with respect to that motion. We believe that the claims in the Class Action are without merit and we intend to defend vigorously against them. However, because the Class Action is in a preliminary stage, we cannot assure you as to its outcome, or that an adverse decision in such action would not have a material adverse effect on our business, financial condition or results of operations.

On February 25, 2014, a shareholder derivative action was filed in the Central District of California by Advisors, G.P. against the Company, nominally, and against Messrs. Berman, Bennett, Miller, Skala, Glick, Ellin, Almagor, Poulsen and Reilly and Ms. Brodsky (Advanced Partners, G.P.,v. Berman, et al., CV14-1420 DSF) (the “Derivative Action”). The Derivative Action seeks to hold the individual defendants liable for damages allegedly caused to the Company by their actions and, in particular, to hold Messrs. Berman and Bennett liable on contribution and breach of fiduciary duty theories with respect to any liability the Company incurs in connection with the Class Action; to hold the individual defendants other than Bennett (the “Director Defendants”) then serving as directors liable for alleged violation of Rule 14a-9 in connection with the October 25, 2013 Proxy Statement statements with respect to Berman’s compensation; and to hold certain of the Director Defendants liable for alleged breaches of their fiduciary duties in connection with the Company’s repurchase of stock, transactions with Dr. Patrick Soon, and Berman’s compensation. On March 6, 2014 a shareholder derivative action was filed in the Central District of California by Louisiana municipal Police Employees Retirement System against the Company, nominally, and against the same defendants as in the First Derivative Action (Louisiana Municipal Police Employees Retirement System v, Berman et al , CV14-1670 (GHF) (the “Second Derivative Action”). The Second Derivative Action makes substantially the same claims as set forth above in connection with the First Derivative Action.

The Company is a party to, and certain of its property is the subject of, various other pending claims and legal proceedings that routinely arise in the ordinary course of its business. The Company does not believe that any of these claims or proceedings will have a material adverse effect on its business, financial condition or results of operations.

Not applicable.

PART II

Market Information

Our common stock is traded on the Nasdaq Global Select exchange under the symbol “JAKK.” The following table sets forth, for the periods indicated, the range of high and low sales prices for our common stock on this exchange.

| |

|

Price Range of

Common Stock

|

| |

|

High

|

|

Low

|

|

2012:

|

|

|

|

|

|

|

|

First quarter

|

|

$

|

17.70

|

|

|

$

|

13.29

|

|

|

Second quarter

|

|

|

19.39

|

|

|

|

15.10

|

|

|

Third quarter

|

|

|

16.74

|

|

|

|

14.01

|

|

|

Fourth quarter

|

|

|

14.24

|

|

|

|

11.83

|

|

|

2013:

|

|

|

|

|

|

|

|

|

|

First quarter

|

|

|

13.67

|

|

|

|

10.00

|

|

|

Second quarter

|

|

|

11.35

|

|

|

|

9.46

|

|

|

Third quarter

|

|

|

11.75

|

|

|

|

4.45

|

|

|

Fourth quarter

|

|

|

7.24

|

|

|

|

4.50

|

|

Performance Graph

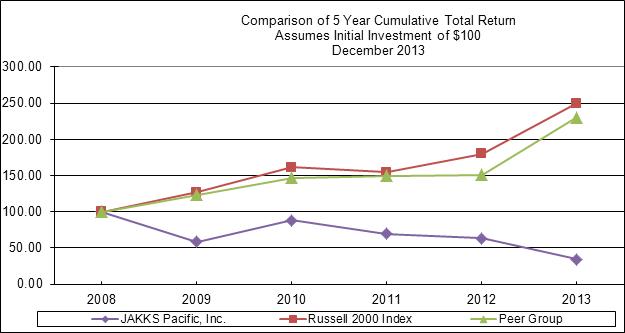

The graph and tables below display the relative performance of our common stock, the Russell 2000 Price Index (the “Russell 2000”) and a peer group index, by comparing the cumulative total stockholder return (which assumes reinvestment of dividends, if any) on an assumed $100 investment on December 31, 2007 in our common stock, the Russell 2000 and the peer group index over the period from January 1, 2008 to December 31, 2013.

In accordance with recently enacted regulations implemented by the Securities and Exchange Commission, we retained the services of an expert compensation consultant. In the performance of its services, such consultant used a peer group index for its analysis of our compensation policies. We believe that these companies represent a cross-section of publicly-traded companies with product lines and businesses similar to our own throughout the comparison period and, accordingly, we are using the same peer group for purposes of the performance graph. EMak Worldwide Inc. and THQ Inc. were excluded from the performance peer group in 2013. Our peer group index includes the following companies: Activision Blizzard, Inc., Electronic Arts, Inc. Hasbro, Inc. Leapfrog Enterprises, Inc., Mattel, Inc., Kid Brands, Inc. and Take-Two Interactive, Inc.

The historical performance data presented below may not be indicative of the future performance of our common stock, any reference index or any component company in a reference index.

Annual Return Percentage

| |

|

December 31,

2009

|

|

December 31,

2010

|

|

December 31,

2011

|

|

December 31,

2012

|

|

December 31,

2013

|

|

JAKKS Pacific

|

|

|

(41.3

|

)%

|

|

|

50.3

|

%

|

|

|

(21.6

|

)%

|

|

|

(9.0

|

)%

|

|

|

(45.6

|

)%

|

|

Peer Group

|

|

|

23.2

|

|

|

|

19.5

|

|

|

|

1.85

|

|

|

|

0.9

|

|

|

|

52.4

|

|

|

Russell 2000

|

|

|

(27.1

|

)

|

|

|

26.8

|

|

|

|

(4.2

|

)

|

|

|

16.3

|

|

|

|

38.8

|

|

Indexed Returns

| |

|

January 1,

2008

|

|

December 31,

2009

|

|

December 31,

2010

|

|

December 31,

2011

|

|

December 31,

2012

|

|

December 31,

2013

|

|

JAKKS Pacific

|

|

$

|

100.0

|

|

|

$

|

58.8

|

|

|

$

|

88.3

|

|

|

$

|

69.2

|

|

|

$

|

63.0

|

|

|

$

|

34.3

|

|

|

Peer Group

|

|

|

100.0

|

|

|

|

123.2

|

|

|

|

147.1

|

|

|

|

149.8

|

|

|

|

151.2

|

|

|

|

230.3

|

|

|

Russell 2000

|

|

|

100.0

|

|

|

|

127.1

|

|

|

|

161.2

|

|

|

|

154.4

|

|

|

|

179.8

|

|

|

|

249.5

|

|

Security Holders