Exhibit 10.2

Confidential portions of this exhibit have been omitted because it is both (i) not material and (ii) would be competitively harmful if publicly disclosed. The redacted terms have been marked at the appropriate place with “[XXX]”.

CONTRACT MANUFACTURING SERVICES AGREEMENT

This CONTRACT MANUFACTURING SERVICES AGREEMENT (the “Agreement”) is entered into and made effective as of May 28, 2019 (the “Effective Date”) by and between, CARBO Ceramics Inc., a Delaware corporation (“CARBO”), whose registered address is 575 N. Dairy Ashford, Suite 300, Houston, Texas and PicOnyx, Inc., a Delaware corporation, whose registered address is 6002 Rogerdale Road, Suite 175, Houston TX, (“PICONYX”). PICONYX and CARBO are sometimes referred to herein individually as a “Party” and collectively as the “Parties”.

WHEREAS, CARBO owns the Manufacturing Facility and has personnel with experience in contract manufacturing;

WHEREAS, PICONYX desires to engage CARBO, and CARBO desires to be so engaged, to manufacture for PICONYX the Product at the PICONYX Property, under the terms and conditions contained herein; and

NOW THEREFORE, in consideration of the covenants and obligations expressed herein, and intending to be legally bound hereby, the Parties agree as follows

|

1. |

DEFINITIONS. As used in this Agreement, the following terms shall have the following respective meanings: |

|

|

|

1.1. |

“Adequate Assurance” has the meaning set forth in Section 8.3. |

|

|

|

1.2. |

“Affiliate” means any individual or entity directly or indirectly controlling, controlled by, or under common control with a Party. For purposes of this definition, “control” means the direct or indirect ownership of at least fifty percent (50%) of the outstanding voting securities, or the right to control the management or policy decisions, of the controlled entity, by contract or otherwise. |

|

|

|

1.3. |

“Applicable Laws” means all laws, rules, pronouncements, regulations and guidance promulgated by any Regulatory Authority that are applicable to either Party’s performance of their respective obligations under this Agreement, including but not limited to the procurement, storage and handling of Raw Materials, the operation of either Party’s business and the manufacturing process for the Product. |

|

|

|

1.4. |

“CARBO Technology” means all existing proprietary technology, including but not limited to, information, ideas, concepts, inventions, schematics, designs, systems, apparatuses, formulations, methods, process conditions, software (in source code) or database, owned or controlled by CARBO that are necessary for the manufacture of the Product in accordance with the requirements of this Agreement, including any and all prior amendments, improvements, updates, upgrades and derivative works thereto existing now, excluding any PICONYX Technology and excluding any Joint Technology. |

|

Page 1 of 39

|

|

1.5. |

“Change of Control” means any transaction in which a Third Party, not already a shareholder, acquires more than 50% of the outstanding voting equity. |

|

|

|

1.6. |

“Change of Control Notice” has the meaning set forth in Section 3 and Exhibit E. |

|

|

|

1.7. |

“Change of Control Transaction” has the meaning set forth in Section 3 and Exhibit E. |

|

|

|

1.8. |

“Claim” has the meaning set forth in Section 11.1. |

|

|

|

1.9. |

“Commercial Completion” means the point in time in which the parties agree that a Commercial Product is able to be produced at the Manufacturing Facility, with the PICONYX Property including the large kiln, the pilot kiln and the milling equipment, and as set forth in Section 7. |

|

|

|

1.10. |

“Commercial Product” means any Product listed on Exhibit A, that meets the Product Specifications set forth in Exhibit B. |

|

|

|

1.11. |

“Confidential Information” means all trade secrets, know how, proprietary information, techniques, or technology, and data disclosed by one party to the other party pursuant to this Agreement or generated pursuant to this Agreement, except any portion thereof which (i) the recipient can demonstrate by its written records was known by the recipient prior to the disclosure thereof by the disclosing party; (ii) is disclosed to the recipient without restriction, after disclosure thereof by the disclosing party, by a Third Party who has the right to make such disclosure; (iii) is or becomes part of the public domain through no breach of this Agreement by the recipient; or (iv) is independently developed by employees of the recipient without use of any of the other party’s Confidential Information. |

|

|

|

1.12. |

“Contract Manufacturing Price” has the meaning set forth in Section 8.1. |

|

|

|

1.13. |

“Contract Manufacturing Services” means all operations (including but not limited to testing and release, receiving, regulatory and compliance, making, picking, packaging, quality control, testing, storage, documentation, and/or shipment) required to produce and distribute the Commercial Product. |

|

|

|

1.14. |

“Development Product” means a new Product that is produced by CARBO for purposes of developing a new Commercial Product. |

|

|

|

1.15. |

“Disclosing Party” means a Party to this Agreement which discloses Confidential Information. |

|

|

|

1.16. |

“Exhibit” means the following Exhibits, which are attached hereto, and become a part of, this Agreement. |

|

Exhibit A – Commercial Products

Page 2 of 39

Exhibit B – Products Specifications

Exhibit C – Contract Manufacturing Price Schedule

Exhibit D – Packaging Specifications and Materials

Exhibit E – Sale of PICONYX or PICONYX Property; Change of Control;

Exhibit F – Manufacturing Facility

Exhibit G – PICONYX Background IP

Exhibit H – CARBO Retained Equipment

Exhibit I – Third Party Manufacturing Payment Schedule

Exhibit J – CARBO Background IP

|

|

1.17. |

“Force Majeure Event” has the meaning set forth in Section 15.6. |

|

|

|

1.18. |

“Indemnitee” has the meaning set forth in Section 11.3. |

|

|

|

1.19. |

“Indemnitor” has the meaning set forth in Section 11.3. |

|

|

|

1.20. |

“Initial Term” has the meaning set forth in Section 12.1. |

|

|

|

1.21. |

“Intellectual Property Rights” means all intellectual or industrial property rights and protections pursuant to the laws of any jurisdiction throughout the world including without limitation any and all present and future patents, patent applications (including with respect to patents, any patent rights granted upon any reissue, division, continuation or continuation-in-part applications now or hereafter filed), utility models issued or pending, registered and unregistered design rights and databases, models, copyrights (including the copyright on software in any code), trade secrets, trademarks, tradenames, rights title and interest in any proprietary know-how, and license rights in such intellectual or industrial property. |

|

|

|

1.22. |

“Joint Technology” means any conception, discovery, idea, design, or invention, including but not limited to, processes, equipment, products, materials, material properties, product features and formulations, that at least one employee or agent of CARBO and at least one employee or agent of PICONYX jointly develop, regardless of their relative contributions. Joint Technology shall include, but is not limited to, improvements to CARBO Technology and improvements to PICONYX Technology. |

|

|

|

1.23. |

“Maintenance Costs” means all costs, expenses, and fees incurred by CARBO to the extent those costs relate to, or otherwise support or are integral to, the use and operation of the PICONYX Property and the equipment therein, including without limitation, the repair and or replacement of equipment. |

|

|

|

1.24. |

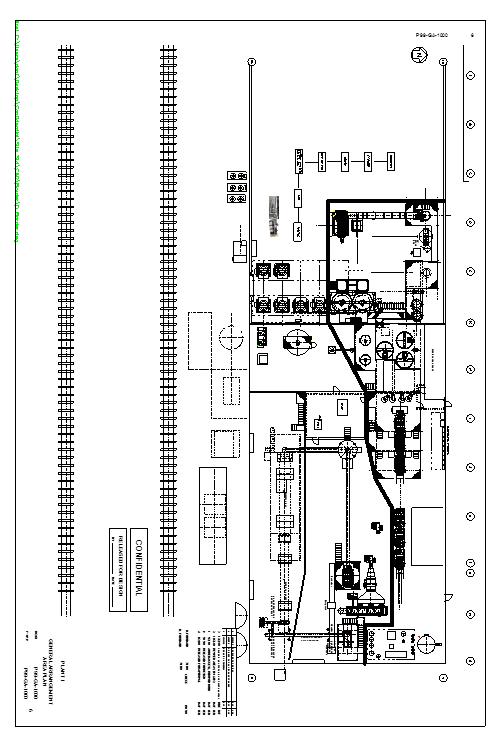

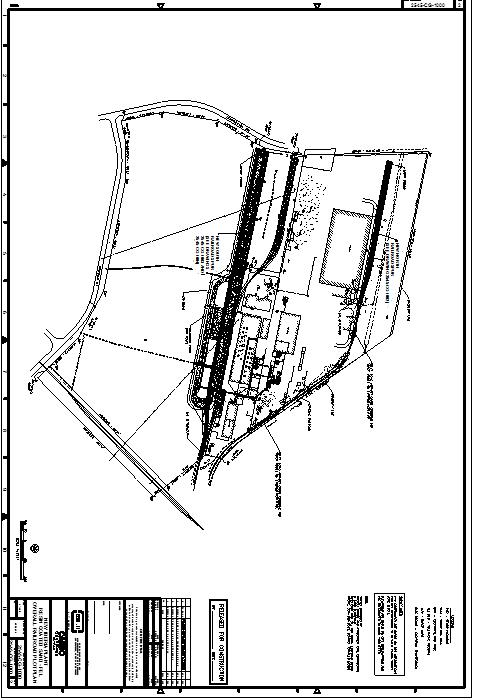

“Manufacturing Facility” means the real property located at 4810 Industrial Drive, New Iberia, Louisiana, which CARBO has agreed to lease to PICONYX pursuant to the Surface Lease Agreement, as set forth in Exhibit F. |

|

|

|

1.25. |

“Minimum Quantity Commitment” has the meaning set forth in Section 6.3. |

|

Page 3 of 39

|

|

1.26. |

“Offering Proceeds” means PICONYX securing of an additional $3,000,000 of financing by way of equity, debt, and grants. |

|

|

|

1.27. |

“Order” and “Orders” have the meanings set forth in Section 6.2. |

|

|

|

1.28. |

“Packaging Specifications and Materials” means all material required to effect the labelling and packaging of the Commercial Product, and the Specifications for the packaging and shipment of the Commercial Product, as set forth in Exhibit D. |

|

|

|

1.29. |

“PICONYX Patents” means PICONYX’S right, title and interest in: (a) the patents and applications listed on Exhibit G; (b) all United States, international, and foreign patents and patent applications, which are based upon, issue from, or claim a right of priority to the patents and applications listed on Exhibit G; (c) all reissues, reexamination certifications, or renewals, of the patents and applications described in (a) or (b); and, (d) any rights to patents and application that PICONYX acquires from a Third Party. |

|

|

|

1.30. |

“PICONYX Property” means the structure, as identified in Exhibit F, and all of its associated equipment, which CARBO transferred to PICONYX pursuant to the Subscription Agreement. PICONYX Property does not include, and specifically excludes the equipment listed in Exhibit H, which is located on or at the Manufacturing Facility and owned by CARBO. |

|

|

|

1.31. |

“PICONYX Technology” means all existing proprietary technology, including but not limited to, the PICONYX Patents, information, ideas, concepts, inventions, schematics, designs, systems, apparatuses, formulations, methods, process conditions, software (in source code) or database, owned or controlled by PICONYX that are necessary for the manufacture of the Product in accordance with the requirements of this Agreement, including any and all prior amendments, improvements, updates, upgrades and derivative works thereto existing now, excluding any CARBO Technology and excluding any Joint Technology. |

|

|

|

1.32. |

“Product” means a material with potential or actual commercial value and includes the Commercial Products listed on Exhibit A and a Development Product, as the case may be. |

|

|

|

1.33. |

“Product Specifications” means the specifications for, or concerning the manufacturing and packaging of, a Commercial Product, as listed in Exhibit A, and set forth in Exhibit B and Exhibit D, . |

|

|

|

1.34. |

“Property” means collectively, the Manufacturing Facility and the PICONYX Property. |

|

|

|

1.35. |

“Proposed Response” has the meaning set forth in Section 9.2. |

|

|

|

1.36. |

“Quarterly Average Cost” is the average Contract Manufacturing Price for the three months of the Calendar Quarter in which PICONYX fails to meet its Minimum Quantity Commitment. |

|

Page 4 of 39

|

|

1.37. |

“Raw Materials” means all materials to be incorporated or used in the manufacturing of the Commercial Product, including without limitation the materials listed in Exhibit C. |

|

|

|

1.38. |

“Receiving Party” means a Party to this Agreement which is the recipient of Confidential Information. |

|

|

|

1.39. |

“Regulatory Authority” means any national, supra-national, regional, state, or local regulatory agency, department, bureau, commission, council, or other governmental entity. |

|

|

|

1.40. |

“Renewal Term” has the meaning set forth in Section 12.1. |

|

|

|

1.41. |

“Rolling Forecast” has the meaning set forth in Section 6.1. |

|

|

|

1.42. |

“Storage Lease Agreement” means the Storage Lease Agreement of even date herewith by and between the Parties. |

|

|

|

1.43. |

“Subscription Agreement” means the Subscription and Asset Purchase Agreement of even date herewith by and between the Parties whereby CARBO has agreed to contribute certain assets and services in exchange for a certain number of shares of PICONYX Series Seed-1 Preferred stock. |

|

|

|

1.44. |

“Surface Lease Agreement” means the Surface Lease Agreement of even date herewith by and between the Parties. |

|

|

|

1.45. |

“Term” has the meaning set forth in Section 12.1. |

|

|

|

1.46. |

“Territory” means North America |

|

|

|

1.47. |

“Third Party” means any person or entity other than CARBO, PICONYX, and their respective Affiliates. |

|

|

|

1.48. |

“Third Party Manufacturing” has the meaning set forth in Section 2.4.2. |

|

|

|

1.49. |

“Unacceptable Product” has the meaning set forth in Section 5.1. |

|

|

2. |

CONTRACT MANUFACTURING SERVICES: |

|

|

|

2.1 |

Appointment; Exclusivity. |

|

|

|

2.1.1 |

PICONYX hereby appoints CARBO, and CARBO accepts its appointment, as PICONYX’s exclusive manufacturer of the Commercial Product in the Territory, subject to the terms and conditions of this Agreement. |

|

|

|

2.1.1.1 |

During the Term, CARBO shall only manufacture and supply Commercial Product to PICONYX, pursuant to the provisions of this Agreement. |

|

|

|

2.1.1.2 |

During the Term, PICONYX shall only contract with CARBO for the manufacturing of the Commercial Product, pursuant to the provisions of this Agreement. |

|

Page 5 of 39

|

|

Commercial Product in the Territory during the Term except as otherwise permitted in Section 6.4.1, Section 6.4.2 or Section 6.4.3(c). |

|

|

|

2.1.3 |

PICONYX shall offer CARBO the right of first refusal to manufacture any SiOC based product extensions or additions to PICONYX’s product line, on identical terms to a bona fide Third Party offer to perform such manufacturing. |

|

|

|

2.2 |

Raw Materials. |

|

|

|

2.2.1 |

PICONYX shall provide all Raw Materials for use at the Property to make the Commercial Product. PICONYX shall be the owner of the Raw Materials, all intermediate materials, and the Commercial Product made therefrom. |

|

|

|

2.2.2 |

CARBO may, but is not required to, offer Raw Material and other purchasing support and services, which support and services if agreed to by the Parties shall be listed on Exhibit C. |

|

|

|

2.3 |

Labeling and Packaging of Product. |

|

|

|

2.3.1 |

CARBO shall package and label the Commercial Product in accordance with the Packaging Specifications and Materials. PICONYX shall provide all packaging materials listed in Exhibit D for the packaging of Commercial Product. |

|

|

|

2.4 |

Manufacture and Delivery of Product. |

|

|

|

2.4.1 |

CARBO agrees to manufacture all Commercial Product specified in a PICONYX Order at the Property in accordance with the Product Specifications and pursuant to the provisions of this Agreement. |

|

|

|

2.4.2 |

PICONYX acknowledges that CARBO has manufactured, and may, subject the terms of this Agreement, continue to manufacture, other products for the benefit of Third Parties at the Property (“Third Party Manufacturing”). |

|

|

|

2.4.2.1 |

CARBO shall have the right to use equipment owned by CARBO, including but not limited to the equipment listed in Exhibit H, for Third Party Manufacturing. |

|

|

|

2.4.2.2 |

CARBO, upon obtaining the written agreement of PICONYX, which agreement shall not be unreasonably withheld or delayed, may use PICONYX Property for Third Party Manufacturing. It is acknowledged, that issues regarding scheduling, contamination, and damage of the PICONYX Property are not unreasonable, and can form a proper basis to withhold such agreement. |

|

2.4.2.3 Notwithstanding any other provisions, including Section

Page 6 of 39

11.4 and Section 11.5, of this Agreement, CARBO SHALL BE STRICTLY LIABLE FOR ANY AND ALL DAMAGES, WHATSOEVER, THAT OCCUR TO PICONYX AND THE PICONYX PROPERTY, AS A RESULT OF THIRD PARTY MANUFACTURING.

|

|

2.4.2.4 |

CARBO shall compensate PIXONYX for the use of PICONYX Property for Third Party Manufacturing as set forth in Exhibit I. |

|

|

|

2.4.3 |

The Commercial Product, Product Specifications and Packaging Specifications and Materials shall be amended as: (a) requested by PICONYX; or, (b) necessary to conform such Product Specifications to Applicable Laws in the reasonable discretion of PICONYX. Such amendments shall be in writing and become a part of this Agreement. |

|

|

|

2.4.4 |

If any change in the Commercial Product, Product Specifications, Packaging Specifications and Material, or if any change in the Applicable Laws or sources of Raw Materials requires either: (a) a change in the Commercial Product manufacturing process; or, (b) CARBO to conduct development, testing, or other activities (e.g., process development stability testing, validation of new specifications) in addition to those activities CARBO conducted or is required to conduct in its manufacture of the Commercial Product prior to such change being requested or required, PICONYX shall reimburse CARBO for all costs incurred by CARBO in connection with such change; provided that, prior to CARBO incurring them, CARBO provides PICONYX with a good faith estimate of such costs and they are approved in writing by PICONYX. Upon either Party becoming aware of any proposed changes in the Applicable Laws that would affect the manufacture of the Commercial Product, it shall promptly notify the other Party and shall consult with the other Party regarding the proposed changes and activities, including any adjustment to the Manufacturing Price Schedule, as provided for in this Agreement. |

|

Page 7 of 39

|

|

upon objectively reasonable bases, including historic costs, supplier estimates and historic practices. Such agreement of the Parties shall not be unreasonably withheld or delayed. PICONYX shall be responsible for all Maintenance Costs set forth in the Annual Maintenance Schedule, payable within 30 days of receipt of an invoice for the performance of any scheduled maintenance. |

|

|

|

2.5.2 |

The Parties agree that written consent from the other party shall be required prior to CARBO incurring Maintenance Costs, not set forth in the Annual Maintenace Schdule in excess of one thousand dollars ($1,000) for any single item (or a group of related items). Any such costs incurred without such consent where consent is required shall be the sole responsibility of CARBO. Any such costs incurred without such consent where consent is not required shall be the sole responsibility of PICONYX, payable within 30 days of receipt of an invoice for such maintenance. |

|

|

|

2.5.3 |

In the case of emergency maintenance, CARBO shall contact, by the most expeditious means possible, David Bening, Allen Andress, Richard Landtiser, or such other person as PICONX identifies in writing, to obtain PICONYX’s written agreement, which written agreement can be via text message, to incure the Maintenance Costs for any emergency maintenance. |

|

|

|

2.7 |

CARBO shall have the right to access, or have its agents, contractors and/or representatives access, subject to the confidentiality obligations existing between the Parties, the Property at all times in order to perform CARBO’s duties and obligations hereunder. |

|

|

|

2.8 |

Storage of Product. All Product shall be stored in accordance with the Storage Lease Agreement. |

|

|

3. |

CHANGE OF CONTROL; SALE OF PICONYX OR PICONYX PROPERTY. In the event of a Change of Control, Sale of PICONYX or the PICONYX Property, the provisions set forth in the attached Exhibit E shall control. |

|

Page 8 of 39

|

|

4.1 |

Conformity to Product Specifications. Each batch of Commercial Product shall conform to the Product Specifications. |

|

|

|

4.2 |

Quality Control. CARBO agrees to prepare and submit to PICONYX, quality control records and reports, that will include a reasonable testing schedule of the requirements set forth in the Product Specification, and shall retain samples of Commercial Products for one (1) year from the date of the production run for quality control purposes. PICONYX may request production samples from CARBO at any time during normal business hours, and CARBO shall send such samples to PICONYX at PICONYX's sole cost and expense. |

|

|

|

4.3 |

CARBO shall maintain manufacturing records in accordance with standards that are similar to or meet those of ISO 9000, including an accurate total of all PMN P-15-28 Product produced, as required by the US EPA 5(e) Consent Order. |

|

|

|

4.4 |

Compliance with Applicable Laws. Both Parties shall at all times comply with all Applicable Laws regarding the procurement of Raw Materials, and the manufacture, handling, and storage of Raw Materials, intermediate materials, and Product. Upon the reasonable written request of either Party, the other Party shall either certify in writing or provide evidence to such Party confirming its compliance with such Applicable Laws. |

|

|

5. |

INSPECTION OF PRODUCT. |

|

|

|

5.1 |

Inspection; Rejection of Unacceptable Product. PICONYX may analyze representative samples of intermediates, and each lot of material and Product delivered hereunder for purposes of determining whether the same meets the Product Specifications. PICONYX may reject any Commercial Product by promptly notifying CARBO in writing of PICONYX’s determination that such Commercial Product constitutes an Unacceptable Product. Any Commercial Product will be deemed an “Unacceptable Product” if the Commercial Product does not meet the Product Specifications. |

|

|

|

5.2 |

Third Party Analysis. If CARBO, after good faith consultation with PICONYX, disputes any finding by PICONYX that Product is an Unacceptable Product, representative samples of such Product shall be forwarded to a Third Party jointly selected by CARBO and PICONYX for analysis. The findings of such Third Party regarding whether the Product was an Unacceptable Product shall be binding upon CARBO and PICONYX. The cost of such analysis by such Third Party shall be borne by the Party whose findings differed from those generated by such Third Party. |

|

Page 9 of 39

|

6. |

PRODUCT ORDERS. |

|

|

|

6.1 |

Rolling Forecast. On or before each June 1 and November 1 during the Term, PICONYX shall provide CARBO with a written forecast of PICONYX’s expected Commercial Product needs for a period of twelve (12) calendar months beginning on the date of such forecast (the “Rolling Forecast”). Should PICONYX’s anticipated needs change, PICONYX is permitted to revise any Rolling Forecast by delivering such revised Rolling Forecast to CARBO in writing; provided that any revised Rolling Forecast shall not be effective to increase the quantity of any subsequent production run without CARBO’s consent unless such revised Rolling Forecast has been provided to CARBO at least twelve (12) weeks in advance of such production run. |

|

|

|

6.2 |

Placement of Orders. Not later than the 15th of each January, April, July, and October during the Term (“Calendar Quarter(s)”), PICONYX shall submit completed Orders to CARBO in a format chosen by PICONYX specifying the quantity of Commercial Products for CARBO to manufacture and deliver to PICONYX during the following Calendar Quarter (each an “Order” and collectively, the “Orders”); provided that the initial Order may be delivered on such date as agreed to by the Parties. CARBO shall accept all Orders submitted by PICONYX in compliance with the terms and conditions of this Agreement as binding obligations of CARBO to provide the Commercial Products set forth therein. All Orders shall be sent by PICONYX (a) to the address for CARBO specified in the Notice provisions of Section 13.4, or such other addresses as CARBO may notify PICONYX of in writing from time to time or (b) by email or facsimile to the email address or facsimile number provided by CARBO without any obligation to provide further written notice thereof or satisfy any other requirements set forth in the Notice provisions of Section13.4. Upon receipt of an Order via email, CARBO shall respond to such email to confirm the receipt of such Order. The Orders are expressly subject to the terms and conditions of this Agreement, and in the event of any conflict between the provisions of this Agreement and any Order, the provisions of this Agreement shall control. |

|

Page 10 of 39

|

|

6.4 |

Failure to Meet Quantity Commitments. |

|

|

|

6.4.1 |

In the event that CARBO cannot or does not satisfy all of PICONYX’S volume requirements up to the Maximum Quantity Commitment for a particular Calendar Quarter on a timely basis in accordance with this Agreement, and such failure is not attributable to a Force Majeure Event, then PIXONYX shall have the right, at its sole discursion, to operate the PICONYX Property using PICONYX employees and contractors; or to engage a Third Party to manufacture Commercial Product for PICONYX, until such time as CARBO is able to provide objectively reasonable assurance of its ability to resume supplying the Commercial Product in accordance with the terms of this Agreement. |

|

|

|

6.4.2 |

In the event that CARBO cannot or does not satisfy all of PICONYX’S volume requirements up to the Maximum Quantity Commitment for any two (2) Calendar Quarters on a timely basis, regardless of the reason for such failure, the exclusivity provision of Section 2.1.1.2 shall automatically become non-exclusive. |

|

|

|

6.4.3 |

Supplemental Quantities. |

|

|

|

(a) |

If, in any Calendar Quarter, PICONYX wishes for CARBO to manufacture quantities of Commercial Product in excess of the Maximum Quantity Commitment, PICONYX may give written notice to CARBO specifying the additional quantity desired (the “Supplemental Quantity”) and the desired month of delivery, and CARBO shall have the exclusive option to manufacture the Supplemental Quantity of Commercial Product for PICONYX. Such notice shall be delivered to CARBO at least thirty (30) days prior to the desired delivery month. |

|

|

|

(b) |

CARBO’s exclusive option to manufacture the Supplemental Quantity shall be exercised by giving PICONYX written notice of CARBO’s willingness to manufacture the Supplemental Quantity (or portion thereof). Such response shall be delivered at least fifteen (15) days prior to the desired month of delivery. |

|

Page 11 of 39

|

|

6.4.4 |

Provided however, when a failure to satisfy volume requirements, under Section 6.4.1, Section 6.4.2 or Section 6.4.3 (b), is limited to making an agreed upon increase in volume from a prior quarter, or in an agreed revised Rolling Forecast, PICONYX’s remedy shall be limited to: (a) having the shortage manufacture by PICONYX or a Third Party and (b) CARBO paying for any additional costs for such manufacturing. In the event CARBO does not agree to manufacture any Supplemental Quantities, PICONYX’s remedy shall be limited to having such Supplemental Quantities manufactured by PICONYX or a Third Party, at PICONYX’s sole cost and expense. |

|

|

|

6.5 |

In the event that PICONYX cannot or does not submit Orders of Commercial Product that meet or exceed the Minimum Quantity Commitment for a given Calendar Quarter, then PICONYX shall pay to CARBO an amount equal to the Quarterly Average Cost multiplied by the difference between (i) the actual amount of Commercial Product ordered and (ii) the Minimum Quantity Commitment for that Calendar Quarter. |

|

|

7. |

COMMERCIAL PROCESS DEVELOPMENT. From the Effective Date, up until such time as Commercial Completion, CARBO will assist PICONYX in the creation and development of processes to manufacture the Commercial Products using the PICONYX Property (“Commercial Process Development”). PICONYX shall bear all costs for Raw Materials and reject material for the Commercial Process Development. Commercial Completion shall occur at such time as the Parties mutually agree in writing that the Commercial Product can be consistently produced in a manner which makes the process commercially viable. |

|

|

8. |

CONTRACT MANUFACTURING PRICE AND PAYMENT. |

|

|

|

8.1 |

Contract Manufacturing Price. PICONYX shall pay CARBO for Contract Manufacturing Services, and CARBO shall provide Contract Manufacturing Services in consideration for the payment. CARBO shall manufacture Commercial Product at the price set forth in Exhibit C, (the “Contract Manufacturing Price”). |

|

Page 12 of 39

|

|

understanding of the costs for manufacturing the Commercial Product may be obtained prior to achieving Commercial Completion. Accordingly the Parties agree that the “Contract Manufacturing Price” will be determined prior to, but no later than, Commercial Completion, and adjusted annually thereafter, for the purpose of addressing such additional information and understanding, upon the written agreement of the Parties, which agreement shall not be unreasonably withheld or delayed. |

|

|

|

8.1.2 |

The Contract Manufacturing Price shall not exceed the Target Maximum Manufacturing Price. |

|

|

|

8.1.3 |

The Target Maximum Manufacturing Price shall be adjusted based upon actual changes to CARBO’S average costs accross all of CARBO’s facilites in New Iberia Lousiana (“New Iberia Average Costs”). CARBO shall provide PICONX sixty (60) days written notice prior to a change in the Target Maximum Price. Upon receipt of such notice, PICONX may request that the Parties meet and confirm regarding the change to the New Iberia Average Costs supporting the noticed change to the Target Maximum Manufacturing Price, and upon such request the Parties shall engage in good faith negotiations, based upon objective data, to reach an agreement to adjust the Target Maximum Manufacting Price, which agreement shall not be unreasonably withheld or delayed. |

|

|

|

8.1.4 |

At all times the Parties agree to work towards and seek ways to reduce manufacturing costs. |

|

|

|

8.2 |

Payment. Payments to CARBO for, the Contract Manufacturing Price of Commercial Product, as well as any other payment due from PICONYX to CARBO pursuant to this Agreement, shall be made by PICONYX within thirty (30) days after the date of a valid invoice, except as to Unacceptable Product. In the event that Commercial Product is rejected by PICONYX as Unacceptable Product, but such Product is subsequently determined to be acceptable pursuant to Section 3.2, the payment for such Product shall be due and payable within thirty (30) days after the determination with respect to such Product is made in accordance with Section 3.2. If there is a dispute relating to an invoice, the Parties shall cooperate, in good faith, to resolve such dispute in a reasonable period of time. |

|

|

|

8.2.1 |

Provided, however, that the payment for the Contract Manufacturing Services shall be made by PICONYX within thirty (30) days after the earlier of: (i) six (6) months from the receipt of the permit for the Pilot Kiln, (ii) the Offering Proceeds, or (iii) the termination of this Agreement. |

Page 13 of 39

|

|

date of this Agreement, if reasonable grounds for insecurity of payment or performance arise, CARBO may send a notice of demand to PICONYX requesting adequate assurance of performance. “Adequate Assurance” shall mean sufficient security in the form and for the term specified by and reasonably acceptable to CARBO, including, but not limited to, a standby, irrevocable letter of credit or a guarantee by a creditworthy entity. Should PICONYX not provide Adequate Assurance as requested under this Section 8.3 within fifteen business (15) days from the receipt of a notice of demand, CARBO may suspend its obligations to perform Contract Manufacturing Services, until such time as PICONYX provides Adequate Assurance. |

|

|

9. |

ACCESS TO MANUFACTURING FACILITY AND RECORDS. |

|

|

|

9.1 |

Inspection by Regulatory Authorities. Upon the request of any Regulatory Authority, such Regulatory Authority shall have access, to the extent required by law or regulation, to observe and inspect the PICONYX Property and the Manufacturing Facility, including the testing, labeling, packaging and/or warehousing of the Product and to audit such facilities for compliance with Applicable Laws. |

|

|

|

9.2 |

Notification of Inquiries and Inspections. CARBO shall notify PICONYX within three (3) business days of any written or oral inquiries, notifications, or inspection activity by any Regulatory Authority in regard to any Product at the PICONYX Property. To the extent permissible by law, CARBO shall provide a complete description of any such governmental inquiries, notifications or inspections promptly after such visit or inquiry. CARBO shall furnish to PICONYX (a) within three (3) business days after receipt, any report or correspondence issued by any Regulatory Authority and (b) not later than five (5) business days prior to the time it provides to any Regulatory Authority, copies of proposed responses or explanations relating to items set forth above (each, a “Proposed Response”), in each case trade secrets or other confidential or proprietary information of both PARTIES, shall be protected to the full extent permitted by the law. CARBO shall discuss with PICONYX and consider in good faith any comments provided by PICONYX on the Proposed Response. After the filing of a response with any Regulatory Authority or other regulatory agency, CARBO shall notify PICONYX and provide PICONYX with copies of any further contacts with such agency relating to the subject matter of the response. |

|

|

10. |

REPRESENTATIONS AND WARRANTIES; DISCLAIMERS; LIMITATION OF LIABILITY. |

|

|

|

10.1 |

Representations and Warranties by CARBO. CARBO hereby represents, warrants and covenants that: |

|

Page 14 of 39

|

|

10.1.1 |

it is a corporation or entity duly organized and validly existing under the laws of the state of its incorporation; |

|

|

|

10.1.2 |

the execution, delivery, and performance of this Agreement by CARBO has been duly authorized by all requisite corporate action and does not require any shareholder action or approval; |

|

|

|

10.1.3 |

it has the expertise, capability, power and authority to execute and deliver this Agreement and to perform its obligations hereunder; |

|

|

|

10.1.4 |

the execution, delivery, and performance by CARBO of this Agreement, and the performance of its obligations hereunder, do not and will not (i) violate any order, writ, injunction, or decree of any court or Regulatory Authority entered against it or by which any of its property is bound, (ii) violate or conflict with, result in a breach of, or constitute a default (or an event which, with or without notice or lapse of time or both, would constitute a default) under, or create in any person or entity the right to terminate, modify or cancel, any loan or credit agreement, note, mortgage, lease, or other contract or agreement to which CARBO is a party or by which CARBO or any of it properties or assets are bound, (iii) require the consent, waiver, authorization, permit or approval of, or any notice, filing or registration to or with, any Third Party, or (iv) violate or conflict with any provision of its articles of incorporation or bylaws, or formation or corporate governance documents; and, |

|

|

|

10.1.5 |

it shall at all times comply with all Applicable Laws applicable to its activities under this Agreement. |

|

|

|

10.2 |

Representations and Warranties by PICONYX. PICONYX hereby represents, warrants and covenants that: |

|

|

|

10.2.1 |

it is a corporation duly organized and validly existing under the laws of the state of its incorporation; |

|

|

|

10.2.2 |

the execution, delivery, and performance of this Agreement by PICONYX has been duly authorized by all requisite corporate action and does not require any shareholder action or approval; |

|

|

|

10.2.3 |

it has the expertise, capability, power and authority to execute and deliver this Agreement and to perform its obligations hereunder; |

|

|

|

10.2.4 |

the execution, delivery, and performance by PICONYX of this Agreement and its compliance with the provisions of this Agreement do not and shall not conflict with or result in a breach of any of the terms and provisions of or constitute a default under (i) any other agreement to which it is a party; (ii) the provisions of its charter or operative documents or bylaws; or (iii) any order, writ, injunction, or decree of any court or governmental authority entered against it or by which any of its property is bound; and |

|

Page 15 of 39

|

|

10.2.5 |

it shall at all times comply with all Applicable Laws relating to its activities under this Agreement. |

|

|

11. |

INDEMNIFICATION. |

|

|

|

11.1 |

PICONYX Indemnity. PICONYX agrees that it shall be solely responsible for all injuries to all persons and all loss or damage to property that may result from PICONYX’s negligent acts or omissions and/or willful misconduct. PICONYX further agrees to indemnify, save and hold CARBO, its Affiliates, and its and their officers, directors, employees, and agents from and against any and all Third Party losses, claims, damages, liabilities, obligations, penalties, judgments, awards, costs, expenses, and disbursements, including, without limitation, the costs, expenses, and disbursements, as and when incurred, of investigating, preparing, or defending any action, suit, proceeding, or investigation asserted by such Third Party, including, without limitation, reasonable attorneys’ fees and expenses, (each a “Claim”) caused by, relating to, based upon, arising out of, or in connection with PICONYX’s employees’ negligent acts or omissions and/or willful misconduct, including but not limited to, any acts or omissions or willful misconduct while onsite at the Manufacturing Facility or PICONYX Property, except to the extent such Claim was caused by CARBO’s negligence or willful misconduct. |

|

PICONYX further agrees that it shall release CARBO, and shall defend, indemnify and hold harmless CARBO from and against any and all Claims brought by or on behalf of any person or entity arising out of or in connection with any allegation, in whole or in part, that CARBO’s use of the PICONYX Technology infringes, misappropriates, dilutes, or violates the copyright, trade secret, trademark, trade dress, service mark, patent or any other proprietary right of any person or entity.

In addition, PICONYX shall assume all responsibility for, including control, removal and remediation of, and shall protect, defend and indemnify CARBO from and against all Claims arising from pollution or contamination associated with the Raw Materials, intermediate materials, Products, their storage, or Contract Manufacturing Services at the PIXONYX Property, as the case may be, except to the extent such Claim was caused by CARBO’s negligence or willful misconduct.

Page 16 of 39

|

|

Claim caused by, relating to, based upon, arising out of, or in connection with (a) CARBO’s employees’ negligent acts or omissions and/or willful misconduct, including but not limited to, any acts or omissions or willful misconduct while at the PICONYX Property, except to the extent such Claim was caused by PICONYX’s negligence or willful misconduct. |

|

|

|

11.3 |

Procedure for Indemnification. Each Party seeking to be reimbursed, indemnified, defended, and/or held harmless under this Agreement (each, an “Indemnitee”) shall (a) provide the Party obligated to indemnify such Indemnitee (the “Indemnitor”) with prompt, written notice of any Claim for which such Indemnitee seeks to be reimbursed, indemnified, defended, and/or held harmless, which notice shall include a reasonable identification of the alleged facts giving rise to such Claim; (b) grant the Indemnitor reasonable authority and control over the defense and settlement of any such Claim; and (c) reasonably cooperate with the Indemnitor and its agents in defense of any such Claim, at the Indemnitor’s expense. Each Indemnitee shall have the right to participate in the defense of any Claim for which Indemnitee seeks to be reimbursed, indemnified, defended, or held harmless, by using attorneys of such Indemnitee’s choice, at such Indemnitee’s expense. Any settlement of a Claim for which any Indemnitee seeks to be reimbursed, indemnified, defended, and/or held harmless under this Agreement shall be subject to the prior written approval of such Indemnitee, which approval shall not be unreasonably withheld, conditioned, or delayed. |

|

|

|

11.4 |

Equipment Damages. Notwithstanding any provision, except Section 2.4.2.3, in this Agreement to the contrary, in no event shall CARBO be responsible for any damage or loss to the PICONYX Property and/or its equipment resulting from or in connection with the Contract Manufacturing Services performed hereunder, including without limitation the processing of the Raw Products and any manufacture of the Products, except to the extent such damage or loss is determined by a court of competent jurisdiction to have been caused by the negligence or willful misconduct of CARBO. |

|

Page 17 of 39

|

|

OR CONNECTOR, AS THE CASE MAY BE, IN WHOLE OR IN PART, WHETHER SOLE, JOINT, ACTIVE OR PASSIVE. THIS SECTION 11.5 SHALL SURVIVE THE TERMINATION OF THE AGREEMENT. |

|

|

12. |

TERM AND TERMINATION. |

|

|

|

12.1 |

Term and Renewal. This Agreement shall begin on the Effective Date and shall continue for five (5) years from the Effective Date (the “Initial Term”) unless earlier terminated in accordance with the terms hereof. Thereafter, the Agreement will be automatically extended for up to fifteen (15) consecutive one (1) year terms (each a “Renewal Term”) unless PICONYX notifies CARBO in writing not less than one (1) year prior to the expiration of the Initial Term or any Renewal Term (both of which are referred to herein as the “Term”) that it will not extend the Agreement. |

|

|

|

12.2 |

Termination and Events of Default. If during the Term, (i) either Party (the “Defaulting Party”) is in breach of any of its obligations under this Agreement or in the event there is a commencement of proceedings by or against the Defaulting Party under applicable bankruptcy, insolvency or reorganization laws (an “Event of Default”), and such breach remains uncured for a period of forty five (45) days for breaches related to the payment of money and ninety (90) days for all other breaches, after the date that the Defaulting Party receives written notice of the breach from the other Party (the “Notifying Party”) then the Notifying Party shall have the right to: (a) terminate this Agreement; or (b) specific performance of the obligations or (ii) PICONYX decommissions the PICONYX Property in accordance with Section 2.6 herein, and such decommissioning lasts more than sixty (60) days, then CARBO shall have the right to terminate this Agreement. |

|

|

|

12.2.1 |

In addition, if (i) the Parties are unable to make a Commercial Product within twelve (12) months of the Effective date, then either Party shall have the right, but not the obligation to terminate this Agreement, or (ii) PICONYX is unable to secure the Offering Proceeds, within six (6) months from the receipt of the permit for the Pilot Kiln, then CARBO shall have the right, but not the obligation to terminate this Agreement. |

|

|

|

12.3 |

Actions upon Expiration or Termination. |

|

Page 18 of 39

|

|

to survive the termination of this Agreement shall so survive. |

|

|

|

12.3.2 |

Upon the expiration or termination date of this Agreement, for any reason, PICONYX shall, at PICONYX’s sole discretion: (a), remove all PICONXY Property (except for the CARBO Retained Equipment as set forth in the attached Exhibit H in which the ownership thereof shall automatically transfer to CARBO), that is located in or on the Manufacturing Facility, at PICONYX’s sole cost and expense, within six (6) months of the expiration or termination date; or (b) sell the PICONYX Property (except for the CARBO Retained Equipment as set forth in the attached Exhibit H in which the ownership thereof shall automatically transfer to CARBO) that is located in or on the Manufacturing Facility to CARBO for the then “Net Book Value” of the PICONYX Property within sixty (60) days of the expiration or termination date. |

|

|

13. |

INSURANCE. Each Party shall secure and maintain, at its sole cost and expense, the following insurance policies (with the minimum stated limits), each written as primary coverage and each waiving the insurer’s right of subrogation: (i) Workers’ Compensation: statutory limits, (ii) Employer’s Liability Insurance: $1 million per accident, (iii) Commercial General Liability: $1 million per occurrence, $2 million in the aggregate (iv) Automobile Liability: $1 million; and (v) Excess Liability: $1 million per occurrence in excess over the coverage outlined in (i) – (iv) above. |

|

|

14. |

OWNERSHIP. |

|

|

|

14.1 |

PICONYX shall be the sole and exclusive owner of: (a) PICONYX Technology; (b) all Intellectual Property Rights owned or controlled by PICONYX on the Effective Date; and, (c) all materials and information acquired by PICONYX after the Effective Date and provided to CARBO (or provided by a Third Party on PICONYX’s behalf) under this Agreement, including but not limited to, the Product Specifications, the Packaging Materials, and processes, know-how and technology developed or created by PICONYX, including all Intellectual Property Rights relating thereto. |

|

|

|

14.2 |

CARBO shall be the sole and exclusive owner of (a) CARBO Technology; (b) all Intellectual Property Rights owned or controlled by CARBO on the Effective Date; and, (c) all materials and information acquired by CARBO after the Effective Date and provided to PIXONYX (or provided by a Third Party on CARBO’s behalf) under this Agreement, including but not limited to any processes, know-how and technology developed or created by CARBO, including all Intellectual Property Rights relating thereto. |

|

|

|

14.3 |

At all times the Raw Materials, intermediate materials, and Commercial Products shall be deemed the sole and exclusive property of PICONYX. |

|

Page 19 of 39

|

|

grants to CARBO a limited, non-exclusive, non-transferrable, non-assignable (except to subcontractors for the sole purpose of performing CARBO’s obligations hereunder), royalty free, fully paid up license to use the PICONYX Property for the internal manufacture, testing and packaging of the Product. |

|

|

|

14.5 |

This Agreement does not grant, and nothing in this Agreement shall be construed as granting, any rights to CARBO, by license (express or implied) or otherwise, to any of the patents and applications listed on Exhibit G, to any United States, international, and foreign patents and patent applications, which are based upon, issue from, or claim a right of priority to the patents and applications listed on Exhibit G, or to any reissues, reexamination certifications, or renewals, of such patents and applications. |

|

|

|

14.6 |

This Agreement does not grant, and nothing in this Agreement shall be construed as granting, any rights to PICONYX, by license (express or implied) or otherwise, to any of the patents and applications listed on Exhibit J, to any United States, international, and foreign patents and patent applications, which are based upon, issue from, or claim a right of priority to the patents and applications listed on Exhibit J, or to any reissues, reexamination certifications, or renewals, of such patents and applications. |

|

|

|

14.7 |

Joint Technology shall be owned and licensed as follows: |

|

|

|

14.8.1 |

Joint technology, whether or not patentable, relating to equipment shall be owned by CARBO, with PICONYX having a royalty free, sublicensable, fully paid up exclusive license, to have made, import, and use in the field of SiOC based material processing and manufacturing. |

|

|

14.8.2 |

Joint technology, whether or not patentable, relating to processes and methods shall be owned by PICONYX, with CARBO having a royalty free, sublicensable, fully paid up exclusive license, to use and practice, in the field of non-SiOC based material processing and manufacturing. |

|

|

14.8.3 |

Joint Technology, whether or not patentable, relating to SiOC based materials and formulations, shall be owned by PICONYX. |

|

|

14.8.4 |

Joint Technology not covered by Sections 14.8.1, 14.8.2 and 14.8.3 and which is derived from, or a direct improvement of, a Party’s Background IP shall be owned by that Party, with the other Party receiving a non-exclusive, royalty free, perpetual fully paid up license to practice and in all respects commercially use such Joint Technology. |

|

|

14.8.5 |

Any other Joint Technology, not covered by Sections 14.8.1, 14.8.2, 14.8.3 and 14.8.4 shall be jointly owned by the Parties, with each Party having an |

Page 20 of 39

|

|

undivided interest in the whole. |

|

|

14.8.6 |

The Parties shall consult with each other regarding the filing of any patent applications relating to Joint Technology. No background confidential information of a Party shall be included in a patent filling, without first obtaining the written consent of that Party, which consent shall not be unreasonably withheld or delayed. |

|

|

14.8.7 |

The owner of the Joint Technology shall be solely responsible for the prosecution of, maintenance of, enforcement of, and defense of, including without limitation the costs associated therewith, the patents and patent applications on Joint Technology. |

|

|

14.8.8 |

The Parties shall cooperate and execute all documents reasonably necessary to effect the provisions of this Section 14.8. |

|

15. |

MISCELLANEOUS |

|

Page 21 of 39

|

|

forth herein. The obligations of this Section 15.1 are in addition to, and do not alter, change or effect, the existing confidentially obligations between the Parties, which obligations and agreements remain in full force and effect. |

|

|

|

15.2 |

Assignment. The rights of either Party under this Agreement shall not be assigned, nor shall the performance of either Party’s duties be delegated without the other Party’s prior written consent, such consent to not be unreasonably withheld or delayed. Provided, however, that that either Party may assign, without obtaining such consent, this Agreement or its rights and obligations hereunder to an Affiliate, or a Third Party that succeeds by purchase, merger, consolidation or otherwise to all or substantially all of the assets or business of such Party relating to this Agreement, upon written notice to the other Party. |

|

|

|

15.3 |

Entire Agreement; Amendment. This Agreement, together with its Exhibits, the Confidentiality/Ownership/Lease Agreements and the referenced schedules, embodies and shall constitute the entire agreement and understanding of the Parties relating to the subject matter of this Agreement and shall supersede all prior oral or written agreements, contracts, understandings, representations, or arrangements, whether oral or written, between them, relating to the subject matter of this Agreement. No change or addition may be made to this Agreement or any schedule attached hereto except in writing, signed by a duly-authorized representative of each Party, and expressly stating that it is a modification of this Agreement. |

|

|

|

15.4 |

Notices. All communications between the Parties with respect to any of the provisions of this Agreement shall be sent to the addresses set forth below by notice by nationally recognized courier or by prepaid certified mail, or by facsimile transmission or other electronic means of communications, with confirmation by letter given by the close of business on or before the next following business day (except that no such confirmation letter shall be required in the case of Orders and invoices delivered hereunder). All notices provided hereunder shall be effective upon receipt. |

|

If to PICONYX, to:

PicOnyx, Inc.

Attn: David Bening

6002 Rogerdale Road

Suite 175

Houston TX 77072

Tel: 614-704-0076

Fax: [none]

Page 22 of 39

Email:david.bening@piconyxinc.com

with a copy, which copy shall not constitute notice, to:

Attn: Damian Burke

Melior Innovations, Inc.

6002 Rogerdale Road

Suite 175

Houston TX 77072

Tel: 713-652-9108

Fax: [none]

Email:damian.burke@meliorinnovations.com

If to CARBO, to:

CARBO Ceramics Inc.

575 N. Dairy Ashford Road, Suite 300

Houston, Texas 77079-1121

Attn: Ernesto Bautista III

Tel: 281-921-6450

Fax:

Email: ernesto.bautista@carboceramics.com

with a copy, which copy shall not constitute notice, to:

Attn: _CARBO Ceramics Inc.

575 N. Dairy Ashford Road,

Suite 300

Houston, Texas 77079-1121

Attn: Robert J. Willette

Tel: 281-921-6490

Fax:

Email: robert.willette@carboceramics.com

Page 23 of 39

|

|

remedy under this Agreement, or waiver of any remedy hereunder, in whole or in part, shall not be deemed a waiver thereof, or prevent the subsequent exercise of that or any other rights or remedy. The headings and captions used in this Agreement are solely for the convenience of reference and shall not affect its interpretation. |

|

|

|

15.6 |

Force Majeure. Neither PICONYX nor CARBO shall be in breach of this Agreement if there is any failure of performance under this Agreement (other than a payment failure) occasioned by any act of God, fire, act of government or state, war, civil commotion, insurrection, or embargo or any other reason beyond the reasonable control of the Party affected thereby, including without limitation a Parties inability to obtain sufficient Raw Materials (a “Force Majeure Event”). Such excuse shall continue as long as the Force Majeure Event continues. Upon cessation of such Force Majeure Event, the affected Party shall promptly resume performance hereunder. Each Party agrees to give the other Party prompt written notice of the occurrence of any Force Majeure Event, the nature thereof, and the extent to which the affected Party will be unable fully to perform its obligations hereunder. Each Party further agrees to use reasonable efforts to correct the Force Majeure Event as quickly as possible and to give the other Party prompt written notice when it is again fully able to perform such obligations. |

|

|

|

15.7 |

Independent Contractors. The Parties acknowledge, agree and declare that the relationship hereby established between them is solely that of provider and recipient of manufacturing services and that each Party hereto is an independent contractor with respect to the other. Except as otherwise provided herein, no Party shall have any right, power, or authority to create any obligation, express or implied, on behalf of any other Party. Nothing in this agreement is intended to create or constitute a joint venture, partnership, agency, trust, or other association of any kind between the Parties. |

|

|

|

15.8 |

Choice of Law: Jurisdiction. The provisions of this Agreement shall be governed by and construed in accordance with the laws of the State of Texas, without regard to conflict of laws principles. Any and all disputes between the Parties arising out of or related to this Agreement shall be heard in the state and federal courts located in the State of Texas, and the Parties hereby consent and submit to the jurisdiction of such courts. |

|

|

|

15.9 |

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall constitute together the same document. |

|

[Signature Page Follows]

Page 24 of 39

IN WITNESS WHEREOF, the Parties hereto, by their authorized officers, have executed this Agreement as of the Effective Date.

|

PICONYX, INC. |

|

CARBO CERAMICS INC. |

|

|

|

|

|

By: /s/ David J. Bening |

|

By: /s/ Ernesto Bautista III |

|

Name: David J. Bening |

|

Name: Ernesto Bautista III |

|

Title: CEO |

|

Title: Vice President, Chief Financial Officer |

Page 25 of 39

EXHIBIT A

Commercial Products

M-Tone 5100

M-Tone 5000 series (vary by particle sizes)

M-Tone 6000 series High temperature grades

M-Tone 7000 series Matte Finish grades (Blend of 5000 series grades)

As specified in Exhibit B.

Page 26 of 39

Product Specifications

The Parties acknowledge that these Specifications are only guidelines as of the Effective Date. The Parties anticipate that these Specifications will be refined and modified based upon information learned form the work to reach Commercial Completion. The Parties agree that on or before Commercial Completion they will use Reasonable Objective Bases, which includes cost, regulatory, scienfitic, engineering and customer bases, to finalize these Specifications. Once finalized, these Specifications can be modified, upon the written agreement of the Parties, for Reasonable Objective Bases, which agreement shall not be unreasonably withheld or delayed.

I. For each finished Commercial Product

Particle Size [XXX]

[XXX]

[XXX]

[XXX]

Density

[XXX]

[XXX]

[XXX]

[XXX]

Color

[XXX]

[XXX]

[XXX]

[XXX]

__________

_________ for M-Tone ____[A]________

_________ for M-Tone ____[B]________

_________ for M-Tone ____[etc.]________

___________

_________ for M-Tone ____[A]________

_________ for M-Tone ____[B]________

_________ for M-Tone ____[etc.]________

Page 27 of 39

Moisture Content

[XXX]

[XXX]

[XXX]

[XXX]

II. For all Raw Materials

[XXX]

[XXX]

[XXX]

[XXX]

[XXX]

[XXX]

III. [XXX]

[XXX]

[XXX]

IV. [XXX]

[XXX]

[XXX]

V. [XXX]

[XXX]

Page 28 of 39

Contract Manufacturing Price Schedule

|

|

1. |

Manufacturing conversion costs will be based on Carbo’s cumulative cost of direct labor (material processing & handling, plant maintenance and supervision), energy consumption (electricity & natural gas),. The Carbo New Iberia, LA facility labor rates ([XXX]) and the energy rates as of the Execution Date of this Agreement are provided below for reference. |

|

Hourly:

[XXX]

[XXX]

[XXX]

[XXX]

[XXX]

[XXX]

Supervisors:

[XXX]

[XXX]

Management:

[XXX]

[XXX]

Energy:

[XXX]

[XXX]

[XXX]

[XXX]

[XXX]

|

|

2. |

Contract Manufacturing Prices will be [XXX]. Carbo will supply PicOnyx Carbo’s typical cost of Labor and Energy periodically during the Commercial Process Development in a separate document. |

|

|

|

3. |

[XXX]: |

|

Page 29 of 39

|

Expected Volume (LB)-Based on PicOnyx Business Plan |

“Target Maximum Manufacturing Price” ($/LB) Based on PicOnyx Business Plan with Carbo Margin* |

Note |

|

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

*Target Maximum Manufacturing Prices may be adjusted pursuant to Section 8.1.3 of this Agreement.

Page 30 of 39

Packaging Specification and Materials

For ALL commercial products listed in Exhibit A:

[XXX]

|

Capacity (Gallon) |

Capacity (LB) |

Diameter |

Height (in) |

Weight (LB) |

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

[XXX] |

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

[XXX] |

|

[XXX] |

[XXX] |

[XXX] |

[XXX] |

[XXX] |

[XXX]

Page 31 of 39

Sale of PICONYX or PICONYX Property; Change of Control

|

|

1. |

Sale of PICONYX or PICONYX Property; Change of Control |

|

|

a. |

In the event PICONYX (a) receives a bona fide offer from a Third Party for the acquisition of the PIXONYX Property; (b) receives a bona fide offer from a Third Party for the acquisition of more than 50% of its outstanding voting equity; or (c) engages in a merger, consolidation, or any other transaction that results in a change in more than 50% of PICONYX’s voting equity (“Change of Control Transaction”), PICONYX shall. to the extent permissible, provide to CARBO prompt written notice thereof (“Change of Control Notice”). |

|

Page 32 of 39

Manufactuing Facility

Page 33 of 39

Page 34 of 39

PICONYX Background IP

[XXX]

Page 35 of 39

CARBO Retained Equipment

|

Asset Number |

Asset Class |

Asset Description |

|

10014 |

Land |

Land 14.53 |

|

10015 |

Land |

Land 9.552 Acres |

|

10060 |

Buildings |

Building-KIII |

|

10072 |

Buildings |

Roof Access & Vent Impr P1 |

|

10280 |

Buildings |

Concrete Area 1 |

|

10282 |

Buildings |

Concrete Area 2 |

|

10284 |

Buildings |

Concrete Area 3 |

|

10285 |

Buildings |

Lights Area 3 |

|

10286 |

Buildings |

Concrete Area 4 |

|

10287 |

Buildings |

Area 04 Enclosure |

|

10288 |

Buildings |

Concrete Area 5 |

|

10289 |

Buildings |

Lights Area 4 |

|

10290 |

Buildings |

Lights Area 5 |

|

10291 |

Buildings |

Lights Area 6 |

|

10292 |

Buildings |

Lights Area 7 |

|

10293 |

Buildings |

Lights Area 8 |

|

10294 |

Buildings |

Lights Area 9 |

|

10296 |

Buildings |

Control Room/Lab |

|

10297 |

Buildings |

Lights Area 15 |

|

10310 |

Buildings |

Facility Renovations NI |

|

10333 |

Buildings |

Ventilation - All Areas |

|

10363 |

Land Imprv |

Transformer Yard Fence Grounding |

|

10364 |

Land Imprv |

Transformer Yard Limestone |

|

10396 |

Buildings |

Concrete Foundation (30% Building) |

|

23196 |

M&E |

Raw Material Nuisance Dust Collector |

|

23197 |

M&E |

Raw Material Nuisance Dust Collector Rotary |

|

23198 |

M&E |

Raw Material Nuisance Dust Collector Rotary |

|

23199 |

M&E |

Raw Material Nuisance Dust Collector Isolation |

|

23200 |

M&E |

Area P01 Vent Fan #1 |

|

23201 |

M&E |

Area P01 Vent Fan #2 |

|

23212 |

M&E |

Slurry Storage Tank |

|

23213 |

M&E |

Slurry Storage Tank Agitator |

|

23214 |

M&E |

Slurry Transfer Pump |

|

23215 |

M&E |

Slurry Cooler |

|

23218 |

M&E |

Area P02 Sump Agitator |

|

23224 |

M&E |

Piping Area 2 |

|

23225 |

M&E |

Electrical Area 2 |

|

23334 |

M&E |

Piping Area 12 |

Page 36 of 39

|

M&E |

Electrical Area 12 |

|

|

23336 |

M&E |

480V MCC NO.1 |

|

23337 |

M&E |

480V MCC NO.2 |

|

23338 |

M&E |

480V MCC NO.3 |

|

23339 |

M&E |

480V MCC NO.4 |

|

23340 |

M&E |

Lab UPS |

|

23343 |

M&E |

Automatic Transfer Switch, Power To 480V LTG PNL |

|

23344 |

M&E |

PLC Cabinet No. 1 |

|

23345 |

M&E |

PLC Cabinet No. 2 |

|

23346 |

M&E |

Network Cabinet No. 1 |

|

23347 |

M&E |

Network Cabinet No. 2 |

|

23353 |

M&E |

Ethernet Switch |

|

23440 |

M&E |

Plant 1 Ventilation Fan #1 |

|

23441 |

M&E |

Plant 1 Ventilation Fan #2 |

|

23442 |

M&E |

Plant 1 Ventilation Fan #3 |

|

23443 |

M&E |

Plant 1 Ventilation Fan #4 |

|

23580 |

M&E |

Plant PLC |

|

23601 |

M&E |

Area 07 Electrical Tray Reroute |

|

23602 |

M&E |

Area 08 Electrical/VFDs |

|

23603 |

M&E |

Area 01/02 Equipment |

|

23616 |

M&E |

Area 01 Electrical |

|

23617 |

M&E |

Area 02 Electrical |

|

23622 |

M&E |

Area 07Electrical |

|

23623 |

M&E |

Area 08 Electrical |

|

24037 |

M&E |

Heat Exchangers |

|

24046 |

M&E |

Hoppers |

|

24050 |

M&E |

Bag Unloader Setup |

|

2[XXX]3 |

Buildings |

Building |

|

3[XXX]3 |

Buildings |

Building |

|

Lab01 |

M&E |

Resin Coating QC Microwave Muffle Furnace |

|

Lab04 |

M&E |

Spec Mill |

|

Lab06 |

M&E |

High Pressure Blower |

|

Lab07 |

M&E |

Spectro Ciros ICP |

|

Lab12 |

M&E |

Photo-Optical Particle Analyzer |

|

Lab13 |

M&E |

Zeiss Stereo Zoom Microscope with Image Analysis S |

|

10281 |

Buildings |

Lights Area 1 |

|

10283 |

Buildings |

Lights Area 2 |

|

10309 |

Buildings |

Plant I Kiln Roof Replacement |

|

10332 |

Buildings |

Kiln Isolation Wall |

|

23311 |

M&E |

Electrical Area 6 |

|

24045 |

M&E |

Concrete Foundation (70% Machine Support) |

Page 37 of 39

Third Party Manufacturing Payment Schedule

The Parties shall agree on a commercially reasonable compensation, for CARBO to pay to PICONYX, for each use by CARBO of PICONYX Property for Third Party Manufacturing. Factors to include in determining a commercially reasonable compensation shall include, but are not limited to, any risk to PICONYX Property and the Contract Manufacturing Price Schedule of Exhibit C.

Page 38 of 39

CARBO Background IP

[XXX]

Page 39 of 39