UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

CARBO CERAMICS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1) |

Title of each class of securities to which transaction applies: |

|

|

2) |

Aggregate number of securities to which transaction applies: |

|

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

4) |

Proposed maximum aggregate value of transaction: |

|

|

5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1) |

Amount Previously Paid: |

|

|

2) |

Form, Schedule or Registration Statement No.: |

|

|

3) |

Filing Party: |

|

|

4) |

Date Filed: |

|

2019

|

NOTICE OF ANNUAL MEETING

|

Tuesday, May 21, 2019 at 9:00 a.m. CT

The Hotel Granduca

1080 Uptown Park Boulevard

Houston, Texas 77056

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Tuesday, May 21, 2019, at 9:00 a.m. CT

CARBO Ceramics Inc., 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079

The Stockholders of CARBO Ceramics Inc.:

Notice is hereby given that the Annual Meeting of Stockholders of CARBO Ceramics Inc. will be held Tuesday, May 21, 2019, at 9:00 a.m. local time, at the Hotel Granduca, 1080 Uptown Park Boulevard, Houston, Texas 77056, for the following purposes:

|

1. |

To elect six Directors, the names of whom are set forth in the accompanying proxy statement, to serve until the 2020 Annual Meeting of Stockholders. |

|

2. |

To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm. |

|

3. |

To approve the 2019 CARBO Ceramics Inc. Omnibus Incentive Plan. |

|

4. |

To approve, by advisory vote, the compensation of the named executive officers. |

|

5. |

To transact such other business as may properly be brought before the meeting. |

Stockholders of record at the close of business on March 18, 2019 are the only stockholders entitled to notice of, and to vote at, the Annual Meeting of Stockholders. A complete list of stockholders entitled to vote at the Annual Meeting of Stockholders will be available for examination at the Company’s principal executive offices located at 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079, for a period of ten days prior to the Annual Meeting of Stockholders. This list of stockholders will also be available for inspection at the Annual Meeting of Stockholders and may be inspected by any stockholder for any purpose germane to the Annual Meeting of Stockholders.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. Accordingly, even if you plan to attend the meeting in person, please complete, sign, date and promptly return the enclosed proxy card in the postage-prepaid envelope prior to the Annual Meeting of Stockholders or follow the Internet or telephone voting procedures described on the proxy card. If you attend the meeting and wish to vote in person, you may withdraw your proxy and vote in person. Your prompt consideration is greatly appreciated.

|

By Order of the Board of Directors, |

|

|

|

/s/ Robert J. Willette |

|

|

|

Robert J. Willette |

|

Corporate Secretary |

|

|

|

April 1, 2019 |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 21, 2019:

The Proxy Statement and Annual Report to Stockholders are available at:

www.carboannualmeeting.com. |

|

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

|

3 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

3 |

|

|

5 |

|

|

BOARD OF DIRECTORS, COMMITTEES OF THE BOARD OF DIRECTORS AND MEETING ATTENDANCE |

|

8 |

|

|

10 |

|

|

|

10 |

|

|

|

11 |

|

|

|

12 |

|

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

|

|

16 |

|

|

|

17 |

|

|

|

17 |

|

|

|

18 |

|

|

|

22 |

|

|

|

23 |

|

|

|

24 |

|

|

|

25 |

|

|

|

26 |

|

|

|

26 |

|

|

|

27 |

|

|

|

27 |

|

|

|

30 |

|

|

|

31 |

|

|

|

31 |

|

|

|

32 |

|

|

|

33 |

|

|

APPROVAL OF 2019 CARBO CERAMICS INC. OMNIBUS INCENTIVE PLAN (PROPOSAL NO. 3) |

|

33 |

|

APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS (PROPOSAL NO. 4) |

|

39 |

|

|

39 |

|

|

|

39 |

|

|

|

A-1 |

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of CARBO Ceramics Inc. (the “Company”) for use at the Company’s Annual Meeting of Stockholders (the “Annual Meeting”). We encourage you to read the entire proxy statement. For more complete information regarding the Company’s 2018 performance, please read our 2018 Annual Report. The Annual Meeting will take place:

|

Date: |

May 21, 2019 |

Place: |

The Hotel Granduca |

|

Time: |

9:00 a.m. CT |

|

1080 Uptown Park Boulevard Houston, Texas 77056 |

The Company’s principal executive offices are located at 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079. The telephone number at that address is (281) 921-6400.

|

|

Visit the website listed on your proxy card/voting instruction form to vote via the Internet. |

|

Call the telephone number on your proxy card/voting instruction form to vote by telephone. |

|

|

Sign, date and return your proxy card/voting instruction form to vote by mail. |

|

Vote in person at the annual meeting. Owners with shares held through a bank or broker may vote in person at the meeting if they have a legal proxy from the bank or broker and bring it to the meeting. |

Most stockholders (including participants in the Company stock fund in the Company’s Savings and Profit Sharing Plan) have a choice of granting their proxies by telephone, over the Internet or by using a traditional proxy card. You should refer to your proxy or voting instruction card to see which options are available to you and how to use them. The Internet and telephone voting procedures are designed to authenticate stockholders’ identities and to confirm that their instructions have been properly recorded.

The cost of preparing, assembling and mailing the proxy material and of reimbursing brokers, nominees and fiduciaries for the out-of-pocket and clerical expenses of transmitting copies of the proxy material to the beneficial owners of shares held of record by such persons, will be borne by the Company. The Company has retained Alliance Advisors (“Alliance”) to aid in the solicitation of proxies. It is estimated that the cost of Alliance’s services will be approximately $6,500 plus expenses. In addition to the solicitation of proxies by mail, proxies may also be solicited by telephone, electronic communication, or personal communication by employees of Alliance and the Company. These proxy solicitation materials are being mailed and made available at www.carboannualmeeting.com on or about April 16, 2019 to all stockholders entitled to vote at the Annual Meeting.

A stockholder giving a proxy pursuant to this solicitation (including via telephone or via the Internet) may revoke it at any time before the Annual Meeting by delivering to the Corporate Secretary of the Company a written notice of revocation or a valid proxy (including via telephone or via the Internet) bearing a date later than the original proxy or by attending the Annual Meeting and voting in person.

Deadline for Receipt of Stockholder Proposals

Pursuant to regulations of the Securities and Exchange Commission (the “SEC”), in order to be included in the Company’s proxy statement for its 2020 Annual Meeting, stockholder proposals must be received at the Company’s principal executive offices located at, 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079, Attention: Corporate Secretary, no later than December 13, 2019 and must comply with additional requirements established by the SEC. In addition, the Company’s Third Amended and Restated By-Laws provide that any stockholder who desires either to bring a stockholder proposal before an annual meeting of stockholders or to present a nomination for Director at an annual meeting of stockholders must give advance notice to the Corporate Secretary of the Company with respect to such proposal or nominee. The Company’s Third Amended and Restated Bylaws generally require that written notice be delivered to the Corporate Secretary of the Company at the Company’s principal executive offices not less than 90 days nor more than 120 days prior to the anniversary of the preceding year’s annual meeting of stockholders and contain certain information regarding the stockholder desiring to present a proposal or make a nomination and, in the case of a nomination, information regarding the proposed Director nominee. For the 2020 Annual Meeting, the Corporate Secretary of the Company must receive written notice between January 21, 2020 and February 20, 2020 (both days inclusive). A copy of the Company’s Third Amended and Restated Bylaws is available upon request from the Corporate Secretary of the Company.

|

CARBO CERAMICS INC 2019 Proxy Statement |

1 |

Proposals and Board Recommendations

|

|

|

|

|

|

Proposals |

|

Board’s Voting Recommendation |

Page |

|

|

|

|

|

|

Proposal No. 1 |

Election of Directors |

FOR |

5 |

|

|

|

|

|

|

Proposal No. 2 |

Ratification of Appointment of the Company’s Independent Registered Public Accounting Firm |

FOR |

33 |

|

|

|

|

|

|

Proposal No. 3 |

Approval of the 2019 CARBO Ceramics Inc. Omnibus Incentive Plan |

FOR |

33 |

|

|

|

|

|

|

Proposal No. 4 |

Approval of the Compensation of the Named Executive Officers |

FOR |

39 |

Record Date, Shares Outstanding and Voting

Only stockholders of record at the close of business on March 18, 2019 are entitled to notice of, and to vote at, the Annual Meeting. At the record date, 28,599,963 shares of the Company’s Common Stock were issued and outstanding and entitled to be voted at the meeting. The presence, in person or by proxy, of stockholders holding a majority of the shares of the Company’s Common Stock entitled to vote will constitute a quorum for the Annual Meeting.

Every stockholder is entitled to one vote for each share held with respect to each matter, including the election of Directors, which comes before the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of Directors. If a stockholder specifies how the proxy is to be voted with respect to any of the proposals for which a choice is provided, the proxy will be voted in accordance with such specifications. If a stockholder fails to specify a choice with respect to such proposals, the proxy will be voted (i) FOR all Director nominees, (ii) FOR the ratification of the appointment of Ernst & Young LLP (“Ernst & Young”) as the Company’s independent registered public accounting firm, (iii) FOR the approval of the 2019 CARBO Ceramics Inc. Omnibus Incentive Plan, and (iv) FOR the advisory vote to approve the compensation of the named executive officers.

At the Annual Meeting (and any other uncontested election), each Director nominee will be elected to the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. The Nominating and Corporate Governance Committee has established procedures under which a Director standing for reelection in an uncontested election must tender a resignation conditioned on the incumbent Director's failure to receive a majority of the votes cast. If an incumbent Director who is standing for re-election does not receive a majority of the votes cast, the Nominating and Corporate Governance Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. The Director who fails to receive a majority vote will not participate in the committee’s recommendation or the Board's decision. However, Director nominees will be elected by the affirmative vote of holders of a plurality of the shares of Common Stock at any meeting of stockholders for which (a) the Company receives a notice that a stockholder has nominated a person for election to the Board that was timely made in accordance with the applicable nomination periods provided in the Company’s Third Amended and Restated Bylaws, and (b) such nomination or notice has been withdrawn on or before the 10th day before the Company first mails its proxy statement in connection with such election.

The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy at the meeting and entitled to vote is required for Proposal 2 and 3. With respect to the advisory proposal regarding the compensation of the named executive officers as disclosed in this proxy statement (Proposal 4), the proposal will be considered approved if it receives the affirmative vote of a majority of the shares of Common Stock cast on the resolution. This advisory vote is non-binding on the Company and the Board.

New York Stock Exchange (“NYSE”) rules permit brokers to vote for routine matters such as the ratification of the appointment of Ernst & Young without receiving instructions from the beneficial owner of the shares. NYSE rules prohibit brokers from voting on the election of Directors, executive compensation and other non-routine matters without receiving instructions from the beneficial owner of the shares. In the absence of instructions, the shares are viewed as being subject to “broker non-votes.” “Broker non-votes” will be counted for quorum purposes (as they are present and entitled to vote on the ratification of Ernst & Young’s appointment) but will not affect the outcome of any other matter being voted upon at the Annual Meeting. A broker or other nominee holding shares for a beneficial owner may not vote these shares in regard to the election of Directors (Proposal 1), the approval of the 2019 CARBO Ceramics Inc. Omnibus Incentive Plan (Proposal 3), or the advisory vote regarding the compensation of the named executive officers (Proposal 4) without specific instructions from the beneficial owner. Abstentions are treated as present and entitled to vote and thus, will be counted in determining whether a quorum is present. Abstentions will have the effect of a vote cast against Proposal 2 and 3, but otherwise will not be counted as a vote cast and will not have an effect on the outcome of Proposals 1 and 4.

|

2 |

CARBO CERAMICS INC 2019 Proxy Statement |

“Householding” of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers use this process for proxy materials, delivering a single proxy statement to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or the Company that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, or if you are receiving multiple copies of the proxy statement and wish to receive only one, please notify your broker if your shares are held in a brokerage account or the Company if you hold shares registered in your name, and the Company will promptly undertake to carry out your request. You can notify the Company by sending a written request to the Company at: CARBO Ceramics Inc., c/o Corporate Secretary, 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079, or by telephone at (281) 921-6400.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists as of March 18, 2019, with respect to each person who is known to the Company to be the beneficial owner of more than 5 percent of the outstanding shares of Common Stock of the Company, the name and address of such owner, the number of shares of Common Stock beneficially owned and the percentage such shares comprised of the outstanding shares of Common Stock of the Company. Except as indicated, each holder has sole voting and dispositive power over the listed shares. Percentage of beneficial ownership is based on 28,599,963 shares of Common Stock outstanding on March 18, 2019.

|

|

|

Shares Beneficially Owned |

|

|||||

|

Name and Address of Beneficial Owner |

|

Number |

|

|

% |

|

||

|

FMR LLC (1) |

|

|

3,687,236 |

|

|

12.9% |

|

|

|

245 Summer Street Boston, Massachusetts 02210 |

|

|

|

|

|

|

|

|

|

William C. Morris (2) |

|

|

3,375,622 |

|

|

11.8% |

|

|

|

60 East 42nd Street, Suite 3200 New York, New York 10165 |

|

|

|

|

|

|

|

|

|

Wilks Brothers, LLC(3) |

|

|

3,091,893 |

|

|

10.8% |

|

|

|

17010 Interstate 20 Cisco, Texas 76437 |

|

|

|

|

|

|

|

|

|

BlackRock, Inc. (4) |

|

|

3,000,740 |

|

|

10.5% |

|

|

|

55 East 52nd Street New York, New York 10055 |

|

|

|

|

|

|

|

|

|

(1) |

Based on a Schedule 13G/A filing with the SEC, as of December 31, 2018, FMR LLC reported sole voting power as to 141,922 shares of Common Stock and sole dispositive power as to 3,687,236 shares of Common Stock. |

|

(2) |

Based on a Schedule 13G/A filing with the SEC, as of December 31, 2018, Mr. Morris reported sole voting and dispositive power as to 3,160,659 shares of Common Stock. Also includes 214,963 shares of Common Stock held by Mr. Morris’ spouse, for which Mr. Morris shares voting and dispositive power. |

|

(3) |

Based on a Schedule 13F filing with the SEC as of December 31, 2018, Wilks Brothers, LLC have sole voting and dispositive power as to 3,091,893 shares of Common Stock |

|

(4) |

Based on a Schedule 13G/A filing with the SEC, as of December 31, 2018, BlackRock, Inc. reported sole voting power as to 2,941,424 shares of Common Stock and sole dispositive power as to 3,000,740 shares of Common Stock. |

|

CARBO CERAMICS INC 2019 Proxy Statement |

3 |

The following table sets forth the number of shares of Common Stock of the Company beneficially owned by (i) each Director of the Company, (ii) each named executive officer of the Company, and (iii) Directors and all named executive officers of the Company as a group, as of March 18, 2019. For purposes of this proxy statement, Gary A. Kolstad, Ernesto Bautista, III and Don P. Conkle are referred to as the Company’s “named executive officers” or “NEOs.” Except as indicated, each holder has sole voting and dispositive power over the listed shares. No current Director, nominee Director or NEO has pledged any of the shares of Common Stock disclosed below. Percentage of beneficial ownership is based on 28,599,963 shares of Common Stock outstanding on March 18, 2019. The number and percentage of shares of Common Stock beneficially owned is determined under the rules of the SEC and is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares of Common Stock for which a person has sole or shared voting power or investment power and also any shares of Common Stock that such person has a right to acquire within 60 days of March 18, 2019. Unless otherwise indicated in the footnotes, the address for each NEO and Director is c/o CARBO Ceramics Inc., 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079.

|

|

|

Amount and Nature of Beneficial Ownership |

|

% of Common |

|

|||||

|

|

|

Currently Owned |

|

|

Acquirable Within 60 Days |

|

Stock Beneficially Owned |

|

||

|

Directors |

|

|

|

|

|

|

|

|

|

|

|

Sigmund L. Cornelius |

|

|

31,198 |

|

|

|

|

* |

|

|

|

Chad C. Deaton (2) |

|

|

32,708 |

|

|

|

|

* |

|

|

|

H. E. Lentz, Jr. |

|

|

35,698 |

|

|

|

|

* |

|

|

|

Randy L. Limbacher |

|

|

34,690 |

|

|

|

|

* |

|

|

|

Gary A. Kolstad (1)(3) |

|

|

462,650 |

|

|

|

|

1.6% |

|

|

|

William C. Morris (4) |

|

|

3,375,622 |

|

|

|

|

11.8% |

|

|

|

Other Named Executive Officers |

|

|

|

|

|

|

|

|

|

|

|

Ernesto Bautista, III (1) |

|

|

126,240 |

|

|

|

|

* |

|

|

|

Don P. Conkle (1) |

|

|

153,237 |

|

|

|

|

* |

|

|

|

Directors and All Executive Officers as a Group (9 persons) (2)(3)(4)(5) |

|

|

4,282,911 |

|

|

|

|

15.0% |

|

|

|

* |

Less than 1 %. |

|

(1) |

Shares shown above for Messrs. Kolstad, Bautista and Conkle include 167,334, 56,160 and 69,621 shares of unvested restricted stock, respectively, for which the holder has sole voting but no dispositive power. |

|

(2) |

Shares shown as beneficially owned by Mr. Deaton include 2,860 shares of Common Stock held jointly with his spouse. |

|

(3) |

Shares shown as beneficially owned by Mr. Kolstad includes 2,750 shares of Common Stock held jointly with his spouse, with whom Mr. Kolstad shares voting and dispositive power. |

|

(4) |

Shares shown as beneficially owned by Mr. Morris include 214,963 shares of Common Stock held by his spouse. |

|

(5) |

Shares shown include 320,541 shares of unvested restricted stock held by executive officers as a group for which each holder has sole voting but no dispositive power. |

|

4 |

CARBO CERAMICS INC 2019 Proxy Statement |

ELECTION OF DIRECTORS (PROPOSAL NO. 1)

Nominees. A board of six Directors is to be elected at the meeting. Each Director elected to the Board will hold office until the next Annual Meeting or until his or her successor has been elected and qualified. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the six nominees named below, all of whom are presently Directors of the Company. In the event that any nominee is unable or declines to serve as a Director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy, unless the size of the Board is reduced. The proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement. It is not expected that any nominee will be unable or will decline to serve as a Director. Biographical information regarding each nominee is set forth below, as well as a summary of the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the nominee should serve as a Director of the Company. Each nominee’s experience and understanding is evaluated in determining the overall composition of the Board.

DIRECTOR NOMINEE SNAPSHOT

|

|

Independent Directors 83.33% |

|

Ind. Director Avg. Tenure 9.7 Years |

|

Age Range 56 ► 74 |

|

Average Age 63.3 Years |

|

Gender Diversity 16.7% |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

CARBO CERAMICS INC 2019 Proxy Statement |

5 |

|

|

|

|

SIGMUND L. CORNELIUS

Director since: 2009

Age: 64 |

Since April 1, 2014, Mr. Cornelius has served as President and Chief Operating Officer of Freeport LNG Development, L.P. (a Texas-based owner and operator of liquefied natural gas facilities). From October 2008 until December 2010, he served as Senior Vice President, Finance, and Chief Financial Officer of ConocoPhillips (a Houston-based energy company). Prior to that, he served as Senior Vice President, Planning, Strategy and Corporate Affairs of ConocoPhillips from September 2007, having previously served as President, Exploration and Production — Lower 48 from 2006. He served as President, Global Gas of ConocoPhillips from 2004 to 2006, and prior to that served as President, Lower 48, Latin America and Midstream from 2003. Mr. Cornelius retired from ConocoPhillips in December 2010 after 30 years of service with the company. Mr. Cornelius currently serves as a Director of Andeavor Logistics and various Freeport LNG entities, and was a Director of DCP Midstream GP, LLC from November 2007 to October 2008, USEC Inc. from 2011 to 2014, Ni Source Inc. from 2011 to 2015, Columbia Pipeline Group, Inc. from 2015 to 2016, Parallel Energy Trust from 2011 to 2016 and Western Refining, Inc. from 2012 to 2017. Mr. Cornelius has significant domestic and international executive experience in the Exploration and Production industry, which is the primary end user of the Company’s products and services. In addition, as the former CFO of a public company, he has extensive experience and skills in the areas of corporate finance, accounting, strategic planning and risk oversight. |

|

|

|

|

CHAD C. DEATON

Director since: 2013

Age: 66 |

Mr. Deaton served as Executive Chairman of the Board of Baker Hughes Incorporated, a Houston-based oilfield services company, from January 2012 until his retirement on April 25, 2013. Prior to that, he served as Chairman, President and Chief Executive Officer from October 2004 until January 2012. From August 2002 to October 2004, he served as President, Chief Executive Officer and a Director of the Hanover Compressor Company (a Houston-based natural gas compression package supplier). Mr. Deaton was employed in a variety of positions by Schlumberger Oilfield Services and/or its affiliates from 1976 through 2001. Mr. Deaton currently serves as a Director of Ariel Corporation (a private corporation), Air Products and Chemicals Inc., Transocean Ltd. and Marathon Oil Corporation. Mr. Deaton also served as a Director of the Company from 2004-2009. |

|

|

|

|

GARY A. KOLSTAD

Director since: 2006

Age: 60 |

Mr. Kolstad was appointed by the Board to serve as President and Chief Executive Officer and a Director of the Company, effective as of June 1, 2006. Mr. Kolstad was previously employed by Schlumberger from 1985 to mid-2006, where he served as Vice President, Global Accounts for Schlumberger Oilfield Services and led Schlumberger’s U.S. Onshore business unit as Vice President, Oilfield Services. In addition to senior management roles in Schlumberger, he also held positions in marketing strategy, human resources and sales. Mr. Kolstad has a Bachelor of Science degree in Petroleum Engineering and a strong executive background in the oil field services business. He also has a solid understanding of global operations, strategic planning, technology, and business models. |

|

|

|

|

H. E. LENTZ, JR.

Director since: 2003

Age:74 |

From June 2009 to May 2011, Mr. Lentz served as a Managing Director of Lazard Frères & Co. (an investment banking firm). Formerly, he served as a Managing Director of Barclays Capital, an investment banking firm and successor to Lehman Brothers, from September 2008 to March 2009; a Managing Director of Lehman Brothers from 1993 to 2002; consultant to Lehman in 2003 and an Advisory Director of Lehman from 2004 to 2008. He also served as the non-executive Chairman of the Board of Rowan Companies plc, from 2010 to 2014 and as a Director of Peabody Energy Corporation from 1998 to 2017. He currently serves as a Director of Macquarie Infrastructure Company and WPX Energy, Inc. Mr. Lentz has significant experience in the areas of corporate finance, mergers and acquisitions and strategic planning. As a Director of two other public companies, he also has experience in the area of corporate governance. |

|

|

|

|

6 |

CARBO CERAMICS INC 2019 Proxy Statement |

The Board recommends a vote “FOR” the election of each of the nominees for Director named in this proxy statement.

The Board has determined that each of the following Directors is (or, in the case of Mr. Rubin, during his service as a Director, was) independent within the meaning of the applicable rules of the SEC and the listing standards of the NYSE:

|

Sigmund L. Cornelius |

Chad C. Deaton |

|

H. E. Lentz, Jr. |

Randy L. Limbacher |

|

Carla S. Mashinski |

William C. Morris |

|

Robert S. Rubin |

|

The Board has evaluated the independence of the members of the Board under the independence standards promulgated by the NYSE. In conducting this evaluation, the Board and Audit Committee considered transactions and relationships between each Director or Director nominee, or his or her immediate family and the Company to determine whether any such transactions or relationships were material and, therefore, inconsistent with a determination that each such Director or Director nominee is independent. Based upon that evaluation, the Board determined that Messrs. Cornelius, Deaton, Limbacher, Lentz, Morris and Rubin and Ms. Mashinski have (or, in the case of Mr. Rubin, during his service as Director, had) no material relationship with the Company and, as a result, are (or, in the case of Mr. Rubin, during his service as Director, was) independent.

Please see the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 for information about the Company’s executive officers.

Interested parties may contact the Board, or the non-management Directors as a group, at the following address:

Board of Directors or

Non-Management Directors

c/o CARBO Ceramics Inc.

575 N. Dairy Ashford, Suite 300

Houston, Texas 77079

Communications may also be sent to individual Directors at the above address. Communications to Directors will be reviewed and referred in compliance with the Procedures for Unsolicited Communications, as approved by the Nominating and Corporate Governance Committee of the Board on July 12, 2004 (which comprise a majority of the Board’s independent Directors). Communications to the Board, the non-management Directors or any individual Director that relate to the Company’s accounting, internal accounting controls or auditing matters will also be referred to the Chairman of the Audit Committee. Other communications will be referred to the appropriate Committee chairman and may also be sent, as appropriate, to the Company’s Chief Compliance Officer.

|

CARBO CERAMICS INC 2019 Proxy Statement |

7 |

BOARD OF DIRECTORS, COMMITTEES OF THE BOARD OF DIRECTORS AND MEETING ATTENDANCE

The Board met eight times and took action by unanimous written consent two times during the last fiscal year. Each Director attended at least 75 percent of all meetings of the Board and the Committees of which such Director is a member. Although there is no formal policy as to Director attendance at the Annual Meeting, all Directors attended the 2018 Annual Meeting and all current Directors are anticipated to attend the 2019 Annual Meeting as well.

The primary function of the Board is oversight, which includes among other matters, oversight of the principal risk exposures of the Company. To assist the Board in this role, the Audit Committee periodically requests the Company’s internal auditor to conduct a review of enterprise risks associated with the Company. The internal audit firm reports its findings and assessments to the Audit Committee, which then reports the findings to the Board as a whole.

The Board has an Audit Committee, currently comprised of five members and a Compensation Committee and a Nominating and Corporate Governance Committee, each of which is currently comprised of six members. Each of these Committees has a charter, each of which is available free of charge on the Company’s website at www.carboceramics.com (together with the Company’s Corporate Governance Guidelines) or by writing to the Company at: CARBO Ceramics Inc., c/o Corporate Secretary, 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079. The Board votes annually on the membership and chairmanship of all Committees.

Audit Committee. The Audit Committee currently consists of Sigmund L. Cornelius (Chairman), Chad C. Deaton, H. E. Lentz, Jr., Randy L. Limbacher and Carla S. Mashinski. The Committee met nine times during the last fiscal year. The Board has determined that all of the members of the Audit Committee are independent within the meaning of the applicable rules of the SEC and the listing standards of the NYSE. The Board has also determined that Sigmund L. Cornelius and Carla S. Mashinski meet the requirements for being an “audit committee financial expert,” as that term is defined by applicable SEC and NYSE rules. The Audit Committee appoints and retains the Company’s independent registered public accounting firm, approves the fee arrangement and scope of the audit, reviews the financial statements and the independent registered public accounting firm’s report, considers comments made by the independent registered public accounting firm with respect to the Company’s internal control structure and reviews internal accounting procedures and controls with the Company’s financial and accounting staff. The Audit Committee also conducts the review of the non-audit services provided by the independent registered public accounting firm to determine their compatibility with its independence. The Audit Committee reviews the independent registered public accounting firm’s performance, qualification and quality control procedures and establishes policies for: (i) the pre-approval of audit and permitted non-audit services by the independent registered public accounting firm; (ii) the hiring of former employees of the independent registered public accounting firm; and (iii) the submission and confidential treatment of concerns from employees or others about accounting, internal controls, auditing or other matters.

The Audit Committee reviews with management the Company’s disclosure controls and procedures and internal control over financial reporting and the processes supporting the certifications of the Chief Executive Officer and Chief Financial Officer. It also reviews with management and the Company’s independent registered public accounting firm the Company’s critical accounting policies. The Audit Committee reviews the Company’s annual and quarterly SEC filings and other related Company disclosures. The Audit Committee reviews the Company’s compliance with the Code of Business Conduct and Ethics as well as other legal and regulatory matters. In performing these duties, the Audit Committee has full authority to: (i) investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company; (ii) retain outside legal, accounting or other consultants to advise the Committee; and (iii) request any officer or employee of the Company, the Company’s in-house or outside counsel, internal audit service providers or independent registered public accounting firm to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee.

Compensation Committee. The Compensation Committee currently consists of H. E. Lentz, Jr. (Chairman), Sigmund L. Cornelius, Chad C. Deaton, Randy L. Limbacher, William C. Morris and Carla S. Mashinski. The Committee met four times during the last fiscal year. The Board has determined that all of the members of the Compensation Committee are independent within the meaning of the listing standards of the NYSE. The Compensation Committee (i) establishes policies relating to the compensation of the non-employee Directors, officers and key management employees of the Company; (ii) reviews and approves the compensation of the non-employee Directors, officers and the President and Chief Executive Officer; (iii) reviews payment estimates with respect to cash incentive compensation awards for non-officer employees; (iv) oversees the administration of the Company’s equity compensation plans; and (v) reviews and approves periodically, but no less than annually, the Company’s compensation goals and objectives with respect to its officers, including oversight of the risks associated with the Company’s compensation programs. The Compensation Committee also evaluates and approves post-service arrangements with management and establishes and reviews periodically the Company’s perquisite policies for management and Directors.

In performing its duties, the Compensation Committee has ultimate authority and responsibility to engage and terminate any compensation consultant, legal counsel or other adviser (together “advisers”) to assist in determining appropriate compensation

|

8 |

CARBO CERAMICS INC 2019 Proxy Statement |

levels for the Chief Executive Officer or any other member of the Company’s management and to approve the terms of any such engagement and the fees of any such adviser. For 2018, Frederic W. Cook & Co., Inc. (“FW Cook”) was engaged by the Committee to provide compensation consulting services in connection with the review of executive compensation. FW Cook did not provide any other services to the Company in 2018. In addition, the Committee has full access to any relevant records of the Company and may also request that any officer or other employee of the Company (including the Company’s senior compensation or human resources executives), the Company’s in-house or outside counsel, or any other person meet with any members of, or consultant to, the Committee. In addition to information provided by outside compensation consultants, the officers of the Company may also collect peer group compensation data for review by the Committee.

The Committee sets the compensation policy for the Company as a whole and specifically decides all compensation matters related to the officers of the Company. The Committee has delegated to its Chairman the ability to grant interim equity awards to non-officer employees of the Company under the stockholder-approved equity plans of the Company in an amount not to exceed $100,000 of Common Stock per employee award, with such awards to be reported to the full Committee at its next meeting.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of William C. Morris (Chairman), Sigmund L. Cornelius, Chad C. Deaton, Randy L. Limbacher, H. E. Lentz, Jr. and Carla S. Mashinski. The Committee met three times during the last fiscal year. The Board has determined that all of the members of the Nominating and Corporate Governance Committee are independent within the meaning of the listing standards of the NYSE. The Nominating and Corporate Governance Committee establishes the Company’s corporate governance principles and guidelines. These principles and guidelines address, among other matters, the size, composition and responsibilities of the Board and its Committees, including their oversight of management. The Committee also advises the Board with respect to the charter, structure and operation of each Committee of the Board. The Nominating and Corporate Governance Committee oversees the evaluation of the Board and officers of the Company and reviews and periodically reports to the Board on matters concerning Company succession planning. The Committee has full access to any relevant records of the Company and may retain outside consultants to advise it. The Committee has the ultimate authority and responsibility to engage or terminate any outside consultant to identify Director candidate(s) and to approve the terms and fees of such engagement of any such consultant. The Committee may also request that any officer or other employee of the Company, the Company’s outside counsel, or any other person meet with any members of, or consultants to, the Committee.

The Company’s Board has charged the Nominating and Corporate Governance Committee with identifying individuals qualified to become members of the Board and recommending Director nominees for each Annual Meeting, including the recommendation of nominees to fill any vacancies on the Board. The Nominating and Corporate Governance Committee considers Director candidates suggested by its members, other Directors, officers and stockholders. Stockholders desiring to make such recommendations should timely submit the candidate’s name, together with biographical information and the candidate’s written consent to be nominated and, if elected, to serve to: Chairman, Nominating and Corporate Governance Committee of the Board of Directors of CARBO Ceramics Inc., 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079. To assist it in identifying Director candidates, the Committee is also authorized to retain, at the expense of the Company, third party search firms and legal, accounting, or other advisors, including for purposes of performing background reviews of potential candidates. The Committee provides guidance to search firms it retains about the particular qualifications the Board is then seeking.

All Director candidates, including those recommended by stockholders, are evaluated on the same basis. Candidates are selected for their character, judgment, business experience and specific areas of expertise, among other relevant considerations, such as the requirements of applicable law and listing standards (including independence standards) and diversity of membership. The Company’s Corporate Governance Guidelines require the Nominating and Governance Committee to consider all aspects of each candidate’s qualifications and skills with a view to creating a Board with a diversity of experience and perspectives, including diversity with respect to race, gender, geography, and areas of expertise. Accordingly, the Nominating and Governance Committee must consider (and will ask any search firm that it engages to provide) a slate of diverse candidates including, but not limited to, women and minorities. The Board recognizes the importance of soliciting new candidates for membership on the Board and that the needs of the Boards, in terms of the relative experience and other qualifications of candidates, may change over time. In determining the needs of the Board and the Company, the Nominating and Corporate Governance Committee considers the qualifications of sitting Directors and consults with the Board, the Chief Executive Officer and certain other officers and, where appropriate, external advisors. All Directors are expected to exemplify the highest standards of personal and professional integrity and to assume the responsibility of challenging management through their active and constructive participation and questioning in meetings of the Board and its various Committees, as well as in less formal contacts with management. Director candidates, other than sitting Directors, are interviewed at the direction of the Committee, which may include (at the Committee’s direction) interviews by the Chairman of the Board, other Directors, the Chief Executive Officer and certain other officers, and the results of those interviews are considered by the Committee in its deliberations.

The members of the Nominating and Corporate Governance Committee constitute all of the non-management Directors on the Board. As the Chairman of the Nominating and Corporate Governance Committee, William C. Morris serves as the presiding Director for non-management executive sessions of these Directors.

|

CARBO CERAMICS INC 2019 Proxy Statement |

9 |

CODE OF BUSINESS CONDUCT AND ETHICS

The Company has adopted a Code of Business Conduct and Ethics that applies to its Directors and employees, including its Chief Executive Officer, Chief Financial Officer and Controller. The Code of Business Conduct and Ethics, including future amendments, is available free of charge on the Company’s website at www.carboceramics.com or by writing to the Company at: CARBO Ceramics Inc., c/o General Counsel, 575 N. Dairy Ashford, Suite 300, Houston, Texas 77079. The Company will also post on its website any amendment to or waiver under the Code of Business Conduct and Ethics granted to any of its Directors or executive officers. No such waivers were requested or granted in 2018.

CERTAIN RELATED PARTY TRANSACTIONS

The Audit Committee reviews related person transactions in accordance with the Company’s Code of Business Conduct and Ethics and applicable SEC guidelines. Such reviews are conducted periodically, but no less frequently than annually, and are reflected in the minutes of the Audit Committee meetings. In accordance with Company policies, Directors, officers and employees, and their family members, may not engage in transactions that create conflicts of interest with the Company. Each of our Directors and executive officers is instructed and periodically reminded to inform the General Counsel or Chief Financial Officer of any potential related party transactions. In addition, each such Director and executive officer completes a questionnaire on an annual basis designed to elicit information about any potential related party transactions. Moreover, through its accounting department, management conducts an annual review of accounting records for potential related party transactions. Based on the information provided from all relevant sources, the General Counsel evaluates potential conflicts. The Chief Financial Officer or General Counsel, as the case may be, brings relevant transactions to the attention of the Audit Committee. The Audit Committee then considers those transactions in accordance with its charter and reports to the Board on its conclusions and recommendations, with any members involved in the subject transaction abstaining from discussion and voting. The Audit Committee takes into account, among other things, the details of the transaction, whether the transaction was voluntarily disclosed in advance or as soon as the conflict became apparent, whether the terms are fair to the Company, whether there are genuine business reasons for the Company to enter into the transaction, and the opinion of counsel whether the transaction represents an improper conflict for any Director or executive officer.

In May 2016, the Company received proceeds of $25.0 million from the issuance of separate unsecured Promissory Notes (the “Notes”) to Director William C. Morris and Robert S. Rubin, who was then a Director, in the principal amounts of $20.0 million and $5.0 million respectively. During 2017 and 2018, the Company made a total of $2.0 million and $0, respectively, in interest payments as payment-in-kind and capitalized the resulting amount to the outstanding principal balances. During 2017 and 2018, the Company made a total of $0 and $1.9 million, respectively, in cash interest payments. Each Note matured on April 1, 2019 and beared interest at 7.00 percent. The Company repaid both Notes totaling $27.0 million in principal and an additional $0.9 million in cash interest on April 1, 2019.

On March 2, 2017, the Company entered into an Amended and Restated Credit Agreement (the “New Credit Agreement”) with our stockholder Wilks Brothers, LLC (“Wilks”) to replace our current term loan with Wells Fargo Bank, National Association (“Wells Fargo”) and provide the Company with additional liquidity for a longer term. The New Credit Agreement is a $65,000,000 facility maturing on December 31, 2022, that consists of a $52,651,000 term loan made at closing to pay off Wells Fargo and an additional term loan of $12,349,000 that was made to the Company after the Company satisfied certain post-closing conditions. The Company’s obligations bear interest at 9.00 percent and are guaranteed by its two domestic operating subsidiaries. No principal repayments are required until maturity (except in certain circumstances), and there are no financial covenants. As of March 18, 2019, $65,000,000 principal amount is outstanding. As a result of the sale of our Millen, Georgia plant, within 270 days of completion of all post-closing matters relating to the sale, the Company is required to use 100% of the Net Cash Proceeds (as defined in the New Credit Agreement) from the sale to either (1) prepay the outstanding principal amount of the Term Loans or (2) reinvest in fixed or capital assets of any Credit Party. The Company is currently evaluating these options, and the Company may engage in negotiations with its lenders with respect to other options. As of December 31, 2018, the Company has classified $15,733 of the outstanding debt as current liabilities, which represents an estimate of the Net Cash Proceeds that the Company would be required to prepay if it did not reinvest in fixed or capital assets. In lieu of making cash interest payments, the Company had the option during the first two years of the loan to make interest payments as payment-in-kind, or PIK, by applying an 11.00 percent rate to the interest payment due (instead of the 9.00 percent cash interest rate) and capitalizing the resulting amount to the outstanding principal balance of the loan. The Company did not exercise the option to make interest payments as PIK and instead made cash interest payments. During 2017 and 2018, the Company made $1.6 million and $5.8 million, respectively, in cash interest payments. The loan cannot be prepaid during the first three years without making the lenders whole for interest that would have been payable over the entire remaining term of the loan. The Company’s obligations under the New Credit Agreement are secured by: (i) a pledge of all accounts receivable and inventory, (ii) cash in certain accounts, (iii) domestic distribution assets residing on owned real property, (iv) the Company’s Marshfield, Wisconsin and Toomsboro, Georgia plant facilities and

|

10 |

CARBO CERAMICS INC 2019 Proxy Statement |

equipment, and (v) certain real property interests in mines and minerals. Other liens previously in favor of Wells Fargo were released.

On March 2, 2017, in connection with entry into the New Credit Agreement, the Company issued a Warrant (the “Warrant”) to Wilks. Subject to the terms of the Warrant, the Warrant entitles the holder thereof to purchase up to 523,022 shares of the Common Stock, at an exercise price of $14.91 per share, payable in cash. The Warrant expires on December 31, 2022.

The following table sets forth information regarding the compensation of the Company’s non-employee Directors. Mr. Kolstad did not receive any additional compensation for his service on the Board in 2018. Compensation received by Mr. Kolstad in his capacity as President and Chief Executive Officer is disclosed under “Modified Compensation Discussion and Analysis” below. We note that Ms. Mashinski, who was appointed to the Board on January 22, 2019, is not included in this table and did not receive any compensation from the Company during 2018.

Director Compensation for Fiscal Year 2018

|

Name |

|

Fees Earned or Paid in Cash ($) |

|

|

Stock Awards ($)(1) |

|

|

Option Awards ($) |

|

|

Non-Equity Incentive Plan Compensation ($) |

|

|

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

|

|

All Other Compensation ($) |

|

|

Total ($) |

|

|||||||

|

Sigmund L. Cornelius |

|

|

61,000 |

|

|

|

80,004 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

141,004 |

|

|

Chad C. Deaton |

|

|

51,000 |

|

|

|

80,004 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

131,004 |

|

|

H. E. Lentz, Jr. |

|

|

61,000 |

|

|

|

80,004 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

141,004 |

|

|

Randy L. Limbacher |

|

|

51,000 |

|

|

|

80,004 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

131,004 |

|

|

William C. Morris |

|

|

68,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

68,000 |

|

|

Robert S. Rubin (2) |

|

|

13,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,000 |

|

|

(1) |

Amounts shown represent the value of the 7,498 shares of stock granted to each Director, excluding Mr. Rubin, who was not a Director at the time of the grant and excluding Mr. Morris, who elected to receive 0 shares, on May 23, 2018, the first business day after last year’s Annual Meeting, computed by multiplying the closing price of the Company’s stock on the date of grant by the number of shares subject to the grant. |

|

(2) |

Mr. Rubin passed away on March 17, 2018. |

Cash Fees. Directors who are not employees of the Company are paid a quarterly cash retainer of $10,000 plus $2,000 for each meeting of the Board that they attend, all paid on a quarterly basis. Non-employee Directors also receive $1,000 for each Committee meeting that they attend that does not immediately precede or follow a meeting of the Board, also paid on a quarterly basis. Effective July 1, 2016, the Directors voluntarily reduced their quarterly cash retainers to $8,000. In addition to their compensation as Directors, the Chairmen of the Audit and Compensation Committees each receive $10,000 annually as compensation for their service as Chairmen of these Committees. The Chairman of the Nominating and Corporate Governance Committee does not currently receive a separate payment for service as Chairman of this Committee. In addition to his compensation as a Director, the Chairman of the Board receives $20,000 annually as compensation for his service as Chairman of the Board, paid quarterly in equal installments. All Directors are reimbursed for out-of-pocket expenses incurred by them in attending meetings of the Board and its Committees and otherwise in performing their duties.

Equity Awards. Each non-employee Director who is serving in such capacity on the first business day after each Annual Meeting of Stockholders receives an annual grant of Common Stock with a market value of $100,000 as of such date (each, an “Annual Director Stock Grant”). However, in consideration of numerous cost reduction efforts being undertaken by the Company, beginning in March 2016 the Board voluntarily reduced the value of the Annual Director Stock Grant from $100,000 to $80,000 for 2016, 2017 and 2018. Mr. Morris waived his 2016, 2017 and 2018 Annual Director Stock Grants altogether. In 2018, each non-employee Director (other than Messrs. Rubin and Morris) received 7,498 shares of Common Stock as an Annual Director Stock Grant.

Stock Ownership Requirements. Each non-employee Director is required to hold a minimum amount of shares of Common Stock (including shares of restricted stock) equal to all shares received as Annual Director Stock Grants during their tenure as a Director. Each non-employee Director currently meets this requirement.

|

CARBO CERAMICS INC 2019 Proxy Statement |

11 |

BOARD RESPONSIVENESS TO OUR STOCKHOLDERS

Our Response to Stockholders

Stockholder Outreach

We are committed to engaging in constructive and meaningful conversations with our stockholders and building long-term relationships based on mutual trust and respect. We value input from our stockholders and believe that regular and effective communication strengthens the Company.

CARBO’s Board and management team were disappointed with the result of the 2018 Say on Pay vote, which received 60.4 percent support. Throughout 2018 and into early 2019, we undertook an extensive effort to understand our stockholders’ interests and requested meetings with stockholders representing approximately 81 percent of our outstanding stock. One stockholder commented, “We engage hundreds of companies a year and this has been a model engagement.”

In total, senior management from human resources, investor relations and finance conducted meetings with stockholders representing approximately 43 percent of our outstanding stock, and our Chairman of the Compensation Committee, H.E. Lentz, Jr., met with stockholders representing approximately 55 percent of that group.

As a result of our communications with our stockholders, we implemented several changes to our governance and compensation program for both 2018 and 2019. Our Compensation Committee believes that these changes to our program going forward reflect our ongoing commitment to our stockholders. Although 2019 program changes are discussed here, the full impact of these changes will be reflected in the proxy statement for the 2020 Annual Meeting of Stockholders.

Stockholder Outreach by the Numbers

|

We held meetings with stockholders representing approximately 43% of our outstanding shares.

|

|

We requested meetings with stockholders representing approximately 80% of our outstanding shares.

|

|

What We Heard

Our outreach meetings gave us the opportunity to engage our stockholders on the issues most important to them, as well as discuss our strategy and the industry dynamics we face. Specific matters discussed during these meetings included execution of our strategy, alignment of our executive compensation program with performance and board composition and governance. We heard constructive comments over the course of these conversations, in particular:

|

1. |

Consider board governance matters |

|

2. |

Consider the appropriateness of executive pay |

|

3. |

Consider the appropriateness of long-term incentive (“LTI”) mix and design |

|

4. |

Consider executive stock ownership requirements |

|

12 |

CARBO CERAMICS INC 2019 Proxy Statement |

After our constructive engagement with stockholders, we implemented the following changes which we believe are in the best interest of our stockholders and CARBO:

|

What We Heard |

What We Did |

|

✔ Consider board governance matters |

• We added a female director in January 2019, and revised the Company’s Corporate Governance Guidelines to require that the Nominating and Corporate Governance Committee consider a slate of diverse candidates with respect to gender and race for all director openings. • In January 2019, the Company’s Corporate Governance Guidelines were revised to include a mandatory retirement age for directors. Unless otherwise waived by the Board, a director is required to submit his or her resignation from the Board at the end of the term in which he or she attains 76 years of age. • Following the 2019 Annual Stockholder Meeting, if all nominees are elected, our average director tenure will decrease: three directors will have 10 years or less tenure with CARBO and three directors will have more than 10 years of tenure. • In 2019, the Company’s By Laws were amended to provide for a majority voting standard and for a director resignation process for the election of directors in uncontested elections, rather than a plurality voting standard. |

|

✔ Consider the appropriateness of executive pay |

• For 2018, we reviewed target compensation levels and determined to hold target pay flat for our NEOs. In addition, on November 1, 2018, the CEO voluntarily elected to reduce his base salary by $100,000. • Based on performance during 2018, the Compensation Committee determined that no annual incentive payments would be earned for fiscal year 2018 given the Company’s performance against pre-established goals. • The Compensation Committee determined that 30 percent of the earned fiscal year 2017 annual incentive, which was withheld in 2017 and made subject to an additional 2018 performance criterion, would be forfeited. The forfeited amount for the CEO was $167,471. • For 2019, the Compensation Committee reviewed and modified our Peer Group to include a larger number of more size-appropriate companies in industries representative of our transformative strategy. • Additionally, for 2019, the CEO recommended and the Board approved total LTI award reductions of approximately 39 percent for the CEO and 11 percent for our other NEOs. In 2019, the CEO was granted equity awards, restricted stock and restricted stock units, valued at $591,600. |

|

✔ Consider the appropriateness of LTI mix and design |

• Beginning in 2018, awards under the long-term incentive award program require positive stockholder return for payouts greater than 100 percent. • For 2019, we increased weighting of performance-based long-term incentive awards to 60 percent of the total long-term incentive mix (previously weighted 40 percent). • Beginning in 2019, Relative Total Stockholder Return will be measured once at the end of the three-year period rather than using four distinct measurement periods as in the past and payout at target will require above-median performance, the 52nd percentile. • Beginning in 2019, long term performance-based cash award agreements no longer allow partial vesting for terminations without cause. |

|

✔ Consider executive stock ownership requirements |

• In 2019, a formal Stock Ownership Policy was adopted requiring stock ownership of five times base salary for the CEO and two times base salary for other specifically designated officers. The ownership requirement will be calculated and set at the time the officer is appointed as such. • In 2019, a formal Anti-Hedging and Pledging Policy was adopted for specifically designated officers. |

The significant changes made to our governance and compensation plans in the last year demonstrates CARBO’s commitment to keeping our stockholders apprised of our business results and being responsive to stockholder feedback. As a smaller reporting company, we are no longer required to provide a Compensation Discussion and Analysis but as part of our on-going stockholder outreach efforts, we will continue to provide many of those details in our proxy, although in a slightly different format (“Modified Compensation Discussion and Analysis” or “MCD&A”). We hope that our responsiveness to stockholder feedback supports your vote in favor of our revised compensation program.

|

CARBO CERAMICS INC 2019 Proxy Statement |

13 |

MODIFIED COMPENSATION DISCUSSION AND ANALYSIS

In this MCD&A, we will highlight the objectives and design of our executive compensation program and provide detailed compensation data for the Chief Executive Officer and the two most highly compensated executive officers (other than our Chief Executive Officer:

|

|

• |

Gary Kolstad, President and Chief Executive Officer |

|

|

• |

Ernesto Bautista, III, Vice President and Chief Financial Officer |

|

|

• |

Don P. Conkle, Vice President of Marketing and Sales |

Market Context and Company Strategy and Performance

In fiscal year 2018, oilfield services companies continued to experience considerable cost pressure driven by the severe industry downturn that began in late 2014. Our primary end users, exploration and production (“E&P”) operators, continued a movement to reduce capital budgets, which impacted the type of oilfield products and services in demand. The prioritization of low-cost completions over long-term production had a negative impact on oilfield service companies such as CARBO. Due to the focus on low-cost completions, some of our E&P clients opted for proppants that differ from our long-standing core competency and dominant source of revenue, base ceramic. In order to reduce our reliance on the cyclical oil and gas industry, CARBO responded by focusing its efforts on a transformation strategy to add revenue streams to build a more diversified, stable and profitable company.

In 2014, base ceramic represented approximately 80 percent of our consolidated revenue. By 2018, it represented only approximately 20 percent. Our growing industrial sector and environmental businesses contributed nearly 25 percent of our total revenue in 2018. Our change in strategy reflects CARBO’s responsiveness to macroeconomic conditions. We are proactively addressing changes in the oil and gas services industry by undergoing a strategic transformation designed to diversify revenue streams and return the Company to profitability.

|

14 |

CARBO CERAMICS INC 2019 Proxy Statement |

Progress on our strategic objectives to transform the Company include:

|

Strategic Objective |

Progress |

|

✔ Reduce costs |

• Right-sized the organization • Generated cash from idled assets • Changed sales and distribution models |

|

✔ Limit capital expenditures |

• 2017 $2.6 million • 2018 $2.0 million |

|

✔ Grow revenue and leverage our strengths in technology |

• 2016 $103.051 million in consolidated revenue • 2017 $188.756 million in consolidated revenue • 2018 $210.745 million in consolidated revenue • From 2017 to 2018, the oilfield sector revenue increased approximately 14 percent (excluding prior year Russia proppant sales), the industrial sector increased approximately 24 percent and the environmental business increased approximately 39 percent • From 2017 to 2018, sales of technology-driven oilfield products increased 15 percent |

|

✔ Improve cash position |

• 2018 year-end total cash of approximately $83 million, with approximately $92 million in debt, representing minimal net debt • Generated positive cash flow from operations for the second half of 2018 • Excluding the proceeds from the sale of Millen facility, total cash grew in the second half of 2018 by approximately $6 million • Sold Millen, GA manufacturing facility for a sales price of $23 million |

|

✔ Obtain positive EBITDA* |

• 2016 ($70.378 million) • 2017 ($49.432 million) • 2018 ($29.519 million) • 2018 Adjusted EBITDA gains of approximately $20 million resulted in 91 percent fall through |

|

✔ Expand Contract Manufacturing opportunities |

• Made a strategic investment for a contract manufacturing opportunity with PicOnyx, Inc., a provider of an environmentally safe alternative to carbon black • Renewed and entered into a long-term agricultural contract manufacturing agreement |

We believe that our progress on these strategic initiatives demonstrates the effectiveness of our transformation and that this progress will position the Company towards returning to positive EBITDA and improved cash flow in the near future.

*EBITDA is a non-GAAP financial measure. EBITDA as presented in this table has been adjusted for certain non-recurring items (“Adjusted EBITDA”). See discussion and reconciliation in the Supplemental Information section of this proxy statement.

|

CARBO CERAMICS INC 2019 Proxy Statement |

15 |

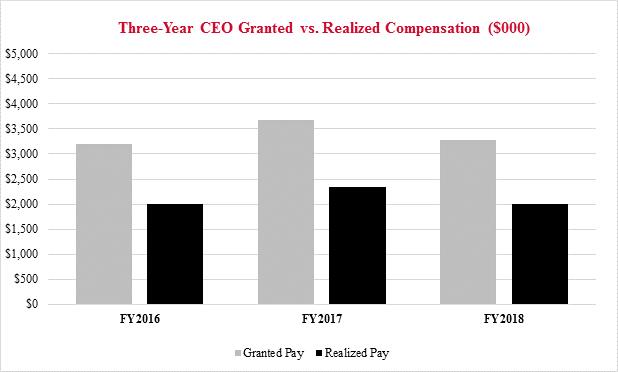

Pay and Performance Alignment: CEO Granted vs. Realized Pay

During this period of transformation, our Compensation Committee has been committed to ensuring our compensation programs align with the stockholder experience. As we progress on our strategic repositioning, the compensation realized by our CEO has been meaningfully below granted pay. The following chart illustrates this relationship by comparing our CEO’s granted and realized pay over the prior three years. Over the 2016-2018 period, our CEO’s aggregate realized pay was approximately 38 percent lower than his aggregate target pay.

Note: Granted pay reflects base salary, actual bonus payouts, and the grant date value of restricted stock, cash-settled restricted stock units and cash-based performance units for the years reported. Realized pay reflects base salary, actual bonus payouts, the value of vested restricted stock following the expiration of the two-year holding period, the value of vested restricted stock units upon vesting and the value of cash-based performance units based on projected payouts.

In 2018, our NEOs did not earn a payout under the annual bonus program and earned a long-term incentive payout of 59 percent. Payouts under our incentive programs reflect our commitment to aligning our compensation programs with the experience of our stockholders.

|

16 |

CARBO CERAMICS INC 2019 Proxy Statement |

Governance and Compensation Best Practices

The Company’s compensation program has been designed to support a strong governance model. Key elements of the program in support of this objective include:

|

What We Do

|

|

What We Don’t Do

|

|

✔ Determine annual incentive compensation based upon the achievement of pre-established performance goals

✔ Determine long-term performance award payouts based upon the achievement of pre-established performance goals

✔ Target the market median for all elements of compensation

✔ Require NEOs to hold vested shares of restricted stock for two years post-vesting

✔ Require stock ownership of five times base salary for the CEO and two times base salary for specifically designated officers

✔ Maintain a clawback policy for executive equity and cash incentive awards

✔ Evaluate the risk of our compensation program annually

✔ Use an independent compensation consultant

✔ Follow a Compensation Committee charter

✔ Hold regular executive sessions of the Compensation Committee without management present

✔ Active stockholder engagement

✔ Independent Board except CEO

✔ Majority vote standard in uncontested elections

✔ Diversity policy for director elections and annual election of all directors

✔ Mandatory director retirement age |

|

✘ No tax gross ups

✘ No short-term or speculative trading of Company stock

✘ No excessive perquisites

✘ No re-pricing of incentive awards

✘ No supplemental retirement plans

✘ No pledging or hedging for directors and designated officers

✘ No share recycling for shares withheld to pay the exercise price of options/SARs

|

Objectives and Elements of Compensation

The goal of the Company’s compensation program is to strengthen alignment between NEOs and stockholders’ interests and to help attract and retain qualified executives to enhance stockholder value. To achieve this goal, the Compensation Committee’s decisions are guided by the following principles:

|

|

• |

Provide a competitive compensation package; |

|

|

• |

Relate compensation to the performance of the Company and the individual; and |

|

|

• |

Align employee objectives with the objectives of stockholders by encouraging executive stock ownership. |

|

CARBO CERAMICS INC 2019 Proxy Statement |

17 |

In order to achieve these objectives, the Compensation Committee uses a combination of cash, non-equity incentive awards and equity-based compensation. The Compensation Committee structures executive total direct compensation to emphasize performance through the annual incentive program and long-term incentives including long-term performance-based cash awards. The Compensation Committee believes that the compensation program should promote long-term returns without motivating or rewarding excessive or inappropriate risk taking. The components of our compensation program and their purposes are summarized in the following chart:

|

|

Compensation Element |

Form |

Purpose |

Benchmark/Performance Metrics |

|

Fixed |

Base Salary |

Cash |

Competitive base salary that allows the Company to attract and retain executives |

Benchmarked to compensation peer group average; adjusted for experience, responsibility, performance and potential

|

|

Performance based |

Annual Incentive Awards |

Cash |

Reward executives for annual performance against Company fiscal year business plan |

Net income (loss) before interest, income taxes, depreciation and amortization (“EBITDA”)

Industrial Sales Growth

End of Year Cash

Consolidated Revenue

|

|

Performance based |

Long-term Incentive Programs |

Restricted Stock, Cash-Settled Restricted Stock Units and Long-term Performance-based Cash Awards |

Promote the creation of long-term stockholder value and emphasize long term strategic objectives |

Long Term Stock Appreciation

Relative Total Stockholder Return

New Technology Revenue |

2018 Executive Compensation Program

In determining the total compensation to be awarded to NEOs in 2018, the Compensation Committee evaluated each executive’s overall performance in his respective position, as well as the Company’s overall financial performance. Key performance initiatives that were considered included improving cash position, reducing expenses, expanding revenue growth to business segments beyond base ceramic and sand, finding revenue streams with minimal capital investment, leading in the market through technology, and maintaining employee morale.

Base Salary. Base salaries reflect demonstrated experience, skills, and competencies of our NEOs. The Compensation Committee reviews the competitiveness and appropriateness of base salaries as part of the annual performance review process. The Company believes that base salaries should remain competitive in order to attract and retain superior executives particularly during our strategic transformation and the remaining elements of total compensation are all subject to variability or at risk.