UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to _____________

Commission File No. 001-15903

CARBO Ceramics Inc.

(Exact name of registrant as specified in its charter)

|

DELAWARE |

72-1100013 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

575 North Dairy Ashford

Suite 300

Houston, Texas 77079

(Address of principal executive offices)

(281) 921-6400

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.01 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the Common Stock held by non-affiliates of the Registrant, based upon the closing sale price of the Common Stock on June 30, 2016, as reported on the New York Stock Exchange, was approximately $205,760,194. Shares of Common Stock held by each director and executive officer and each person who owns 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 17, 2017, the Registrant had 27,142,528 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for Registrant’s Annual Meeting of Stockholders to be held May 16, 2017, are incorporated by reference in Part III.

|

PART I |

||||

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 1A. |

|

|

9 |

|

|

Item 1B. |

|

|

15 |

|

|

Item 2. |

|

|

15 |

|

|

Item 3. |

|

|

16 |

|

|

Item 4. |

|

|

16 |

|

|

|

|

|

|

|

|

PART II |

||||

|

|

|

|

|

|

|

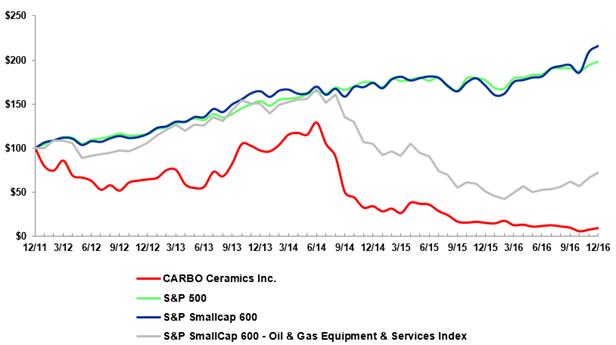

Item 5. |

|

|

17 |

|

|

Item 6. |

|

|

19 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

20 |

|

Item 7A. |

|

|

29 |

|

|

Item 8. |

|

|

30 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

30 |

|

Item 9A. |

|

|

30 |

|

|

Item 9B. |

|

|

31 |

|

|

|

|

|

|

|

|

PART III |

||||

|

|

|

|

|

|

|

Item 10. |

|

|

32 |

|

|

Item 11. |

|

|

32 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

32 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

32 |

|

Item 14. |

|

|

32 |

|

|

|

|

|

|

|

|

PART IV |

||||

|

|

|

|

|

|

|

Item 15. |

|

|

33 |

|

|

Item 16. |

|

|

33 |

|

|

|

34 |

|||

|

Management’s Report on Internal Control Over Financial Reporting |

|

F-1 |

||

|

|

F-2 |

|||

|

|

F-4 |

|||

General

CARBO Ceramics Inc. (“we,” “us,” “our” or our “Company”) is a technology company that provides products and services to the global oil and gas and industrial markets to enhance value for its clients. The Company was incorporated in 1987 in Delaware. As used herein, “Company”, “CARBO”, “we”, “our” and “us” may refer to the Company and/or its consolidated subsidiaries.

The Company conducts its business within two operating segments: 1) Oilfield Technologies and Services and 2) Environmental Products and Services. Financial information about reportable operating segments is provided in Note 13 to the Company’s Consolidated Financial Statements.

Our oilfield technologies and services segment includes the manufacturing and selling of proppant products for use primarily in the hydraulic fracturing of oil and natural gas wells, Fracpro software for the design of fracture treatments, and StrataGen consulting services for the optimizing of well completions. Hydraulic fracturing is the most widely used method of increasing production from oil and natural gas wells. The hydraulic fracturing process consists of pumping fluids down a natural gas or oil well at pressures sufficient to create fractures in the hydrocarbon-bearing rock formation. A granular material, called proppant, is suspended and transported in the fluid and fills the fracture, “propping” it open once high-pressure pumping stops. The proppant‑filled fracture creates a conductive channel through which the hydrocarbons can flow more freely from the formation to the well and then to the surface.

There are three primary types of proppant that can be utilized in the hydraulic fracturing process: sand, resin‑coated sand and ceramic. Sand is the least expensive proppant, resin-coated sand is more expensive and ceramic proppant is typically the most expensive. The higher initial cost of ceramic proppant is justified by the fact that its use in certain well conditions results in an increase in the production rate of oil and natural gas, an increase in the total oil or natural gas that can be recovered from the well and, consequently, an increase in cash flow for the operators of the well. The increased production rates are primarily attributable to the higher strength and more uniform size and shape of ceramic proppant versus alternative materials. We are one of the world’s largest suppliers of ceramic proppant.

We manufacture various distinct ceramic proppants. KRYPTOSPHERE® HD, introduced in 2013, is a high-performance ceramic proppant engineered to deliver increased conductivity and durability in the highest closure stress wells. Even in challenging, high-cost environments such as deep water wells, KRYPTOSPHERE® HD retains its integrity and enables greater Estimated Ultimate Recovery (“EUR”) from the reservoir.

KRYPTOSPHERE® LD meets client needs for a lower density proppant than KRYPTOSPHERE® HD, yet has similar characteristics and conductivity in high stress wells.

CARBOHSP® and CARBOPROP® are high and intermediate density ceramic proppants, respectively, designed primarily for use in deep oil and gas wells.

CARBOLITE®, CARBOECONOPROP® and CARBOHYDROPROP® are low-density ceramic proppants. CARBOLITE® is used in medium depth oil and gas wells, where higher production rates can be achieved due to the product’s uniform size and spherical shape. CARBOECONOPROP® was introduced to provide a lower cost ceramic to compete more directly with resin-coated sand and sand proppant, and CARBOHYDROPROP® was introduced to improve performance in “slickwater” fracture treatments.

We produce resin-coated ceramic (CARBOBOND® LITE®), which addresses a niche market in which oil and natural gas wells are subject to the risk of proppant flow-back.

CARBO NORTHERN WHITE is a frac sand that is used by operators that still value quality, but do not wish to pay the higher costs associated with ceramic or resin-coated sand proppants.

In addition, we manufacture CARBONRT®, a detectable proppant that utilizes a non-radioactive tracer material to assist operators in determining the locations of fractures in a natural gas or oil well. This tracer is added to the proppant granules during the manufacturing process, and can be added to most of the types of proppant that the Company sells.

In 2014, we began sales of SCALEGUARD®, a porous ceramic proppant that is infused with scale-inhibiting chemicals and placed throughout the fracture as part of the hydraulic fracturing process. The infused scale inhibitor in SCALEGUARD is designed

1

to be released into the fracture only on contact with water and thereby reduce or eliminate expensive remedial maintenance programs. We also are developing SALTGUARD® and PARAGUARD® to help prevent salt and paraffin wax buildup in wells, which we expect to begin marketing and selling during 2017.

Our FUSION® technology, introduced in 2015, improves well productivity by forming a stable, high-permeability proppant pack that prevents proppant washout from the non-compressive annulus and near-wellbore areas.

CARBOAIRTM, introduced in late 2016, is a high-transport, ultra-low-density ceramic proppant technology that has been developed primarily to increase production and EUR from slickwater fracturing operations. The technology enables E&P operators to avoid the introduction of gel into their fracs while improving reservoir contact and fracture conductivity.

Our manufacturing facilities also produce ceramic pellets for use in various industrial technology applications, including but not limited to casting and milling.

Through our wholly-owned subsidiary StrataGen, Inc., our oilfield technologies and services segment also promotes increased production and EUR of oil and natural gas by selling one of the most widely used fracture stimulation software under the brand FracPro®, and providing fracture design and consulting services to oil and natural gas E&P companies under the brand StrataGen.

FracPro® provides a suite of stimulation software solutions used for designing fracture treatments and for on-site real-time analysis. Use of FracPro has enabled our clients to recognize and remedy potential stimulation problems. Recently, FracPro has been integrated with third party reservoir simulation software, furthering its reach and utility.

StrataGen, our specialized consulting team, works with operators around the world to help optimize well placement, fracture treatment design and production enhancement. The broad range of expertise of the StrataGen consultants includes: fracture treatment design; completion support; on-site treatment supervision, quality control; post-treatment evaluation and optimization; reservoir and fracture studies; rock mechanics and software application and training.

Our environmental products and services segment is intended to protect operators’ assets, minimize environmental risks, and lower lease operating expense (“LOE”). Asset Guard Products Inc. (“AGPI”), the only wholly-owned subsidiary of ours to operate in this segment, provides spill prevention, containment and countermeasure systems for the oil and gas industry. AGPI uses proprietary technology to make products designed to enable its clients to extend the life of their storage assets, reduce the potential for hydrocarbon spills and provide containment of stored materials. AGPI was formerly known as Falcon Technologies and Services, Inc.

Generally, demand for most of our products and services depends primarily upon the supply of and demand for natural gas and oil and on the number of natural gas and oil wells drilled, completed or re-completed worldwide. More specifically, the demand for most of our products and services is dependent on the number of oil and natural gas wells that are hydraulically fractured to stimulate production. Because the demand for these products and services is also dependent on the commodity price of oil and natural gas, lower commodity prices result in less of our premium products being purchased. In addition to rig counts and commodity prices, our results of operations are also significantly affected by a host of other factors, including but not limited to (a) well completions activity, which is not necessarily correlated with rig count, (b) customer preferences, (c) new product and technology adoption (including of our new KRYPTOSPHERE, CARBOAIR and SCALEGUARD technologies), (d) imports and competition, (e) changes in the product mix of what we sell, (f) costs of developing our products and services and running our business, and (g) changes in our strategy and execution. Current demand for proppant is extremely dynamic, but even if rig count and commodity prices remain constant, our business results are also highly dependent on these additional factors.

During the year ended December 31, 2016, we generated approximately 66% of our revenues in the United States and 34% in international markets.

Competition

As the demand for ceramic proppant (including proppant produced by us) continued to be negatively impacted by the severe decline in the oil and natural gas industry in 2016, the number of domestic and international competitors in the marketplace has decreased, and many of our competitors have shut down plants and/or reduced production. However, we do not have full visibility as to the extent or duration of these shut-downs and reductions. One of our worldwide proppant competitors is Saint-Gobain Proppants (“Saint-Gobain”). Saint-Gobain is a division of Compagnie de Saint-Gobain, a large French glass and materials company. Saint-Gobain manufactures a variety of ceramic proppants that it markets in competition with some of our products. Saint-Gobain’s primary manufacturing facilities are located in Fort Smith and Bauxite, Arkansas. Saint-Gobain also manufactures ceramic proppant in China. Mineracao Curimbaba (“Curimbaba”), based in Brazil, also manufactures and markets ceramic proppants in competition with some of our products. Imerys, S.A., a competitor based in France (“Imerys”), has ceramic proppant manufacturing facilities in Andersonville and Wrens, Georgia.

2

We are aware of two major manufacturers of ceramic proppant in Russia. Borovichi Refractory Plant (“Borovichi”) located in Borovichi, Russia, and FORES Refractory Plant (“FORES”) located in Ekaterinburg, Russia. Although we have limited information about Borovichi and FORES, we believe that Borovichi primarily manufactures intermediate-density ceramic proppants and markets its products principally within Russia, and that FORES manufactures intermediate-density and low-density ceramic proppant lines and markets its products both inside and outside of Russia. We believe that these companies have added manufacturing capacity in recent years and now manufacture and supply a majority of the ceramic proppant used in Russia. We are also aware of a large number of manufacturers in China. Most of these companies produce intermediate-density ceramic proppants that are marketed both inside and outside of China. Chinese proppant imports into the United States increased beginning in 2010 and 2011, which contributed to an over-supply of ceramic proppant beginning in 2012. However, beginning in early 2015, imports declined significantly.

Competition for CARBOHSP® and CARBOPROP® principally includes ceramic proppant manufactured by Saint-Gobain, Curimbaba and various producers located in China. Our CARBOLITE®, CARBOECONOPROP® and CARBOHYDROPROP® products compete primarily with ceramic proppant produced by Saint-Gobain, Curimbaba and Imerys and with sand-based proppant for use in the hydraulic fracturing of medium depth natural gas and oil wells. At this time, there is not in our view a comparable competitor’s product to our KRYPTOSPHERE product line, which is the subject of patent protection.

The leading suppliers of mined sand are Unimin Corp., U.S. Silica Company, Fairmount Minerals Limited, Inc., Hi-Crush Partners LP, and Badger Mining Corp. The leading suppliers of resin-coated sand are Hexion and Santrol, a subsidiary of Fairmount Minerals.

We believe that some of the significant factors that influence a customer’s decision to purchase our ceramic proppant are (i) reservoir and geological characteristics, (ii) price/performance ratio, (iii) on-time delivery performance, (iv) technical support, (v) proppant availability and (vi) the financial status of E&P operators. We believe that our products are competitively priced and that our delivery performance is good. We also believe that our superior technical support has enabled us to persuade customers to use our technology products in an increasingly broad range of applications and has increased the overall market for our technology products.

Product Development

We continually conduct testing and development activities with respect to alternative raw materials to be used in our existing and alternative production methods. During 2015, we completed the first line of a plant retrofit to enable production of KRYPTOSPHERE® products including both KRYPTOSPHERE® LD and KRYPTOSPHERE® HD. We introduced KRYPTOSPHERE® HD in 2013, a proppant with greatly increased strength and conductivity when compared to our traditional proppants. This new proppant is intended for use in ultra-high stress wells. In 2015, we introduced KRYPTOSPHERE® LD, a lower density proppant than KRYPTOSPHERE® HD. For information regarding our research and development expenditures, see Note 1 to the “Notes to Consolidated Financial Statements.”

SCALEGUARD®, our new proppant-delivered, scale-inhibiting technology continues to show positive performance results in multiple basins across North America. SCALEGUARD has now been successfully used in hundreds of hydraulic fracturing stages. We are pursuing the development of other infused proppant technologies, some of which underwent field trials in 2016.

Going beyond our existing proppant detection capabilities, we are developing technology for far-field detection of proppant in a fracture, which has shown positive results.

We are aware of others engaged in the development of alternative products for use as proppants in the hydraulic fracturing process, but are uncertain of the financial status and product viability of these potential competitors. We believe that while there are potential specialty applications for such products, they will not significantly impact the use of ceramic proppants. We believe that the “know-how” and trade secrets necessary to efficiently manufacture a product of consistently high quality are difficult barriers to entry to overcome.

Customers and Marketing

Our largest customers are participants in the hydraulic fracturing industry. Specifically, Halliburton Energy Services, Inc. and Baker Hughes Incorporated each accounted for more than 10% of our 2016 revenues while Halliburton Energy Services, Inc. and Schlumberger Limited each accounted for more than 10% of our 2015 and 2014 revenues. However, the end users of our products are the operators of natural gas and oil wells that hire the pressure pumping service companies to hydraulically fracture wells. We work both with the pressure pumping service companies and with the operators of natural gas and oil wells to present the technical and economic advantages of using ceramic proppant. We generally supply our customers with products on a just-in-time basis, as specified in individual purchase orders. Continuing sales of product depend on our direct customers and the operators being satisfied with product quality, availability and delivery performance. In addition, continuing sales of product depend heavily on a favorable

3

level of activity in the upstream natural gas and oil industries. We provide our software products and consulting services directly to operators of oil and natural gas wells as well as service companies involved in hydraulic fracturing.

We recognize the importance of a technical marketing program in demonstrating long-term economic advantages when selling products and services that offer financial benefits over time. We have a broad technical sales force to advise end users on the benefits of using ceramic proppant, fracture simulation software, and related consulting services.

Although originally our ceramic products were intended for use in deeper, higher-stress wells that require high-strength proppant, we believe that there is economic benefit to operators of using ceramic proppant in shallower, lower-stress wells. We believe that our new product introductions and education-based technical marketing efforts have enabled us to maintain our position not only as one of the world’s largest suppliers of ceramic proppant but also as a leading innovator in our industry.

We provide a variety of technical support services and have developed computer software that models the return on investment achievable by using our ceramic proppant versus alternatives in the hydraulic fracturing of a natural gas or oil well. In addition to the technical marketing effort, we from time to time engage in field trials to demonstrate the economic benefits of our products and validate the findings of our computer simulations. Periodically, we provide proppant to operators for field trials, on a discounted basis, in exchange for their agreement to provide production data for direct comparison of the results of fracturing with ceramic proppant as compared to alternative proppants.

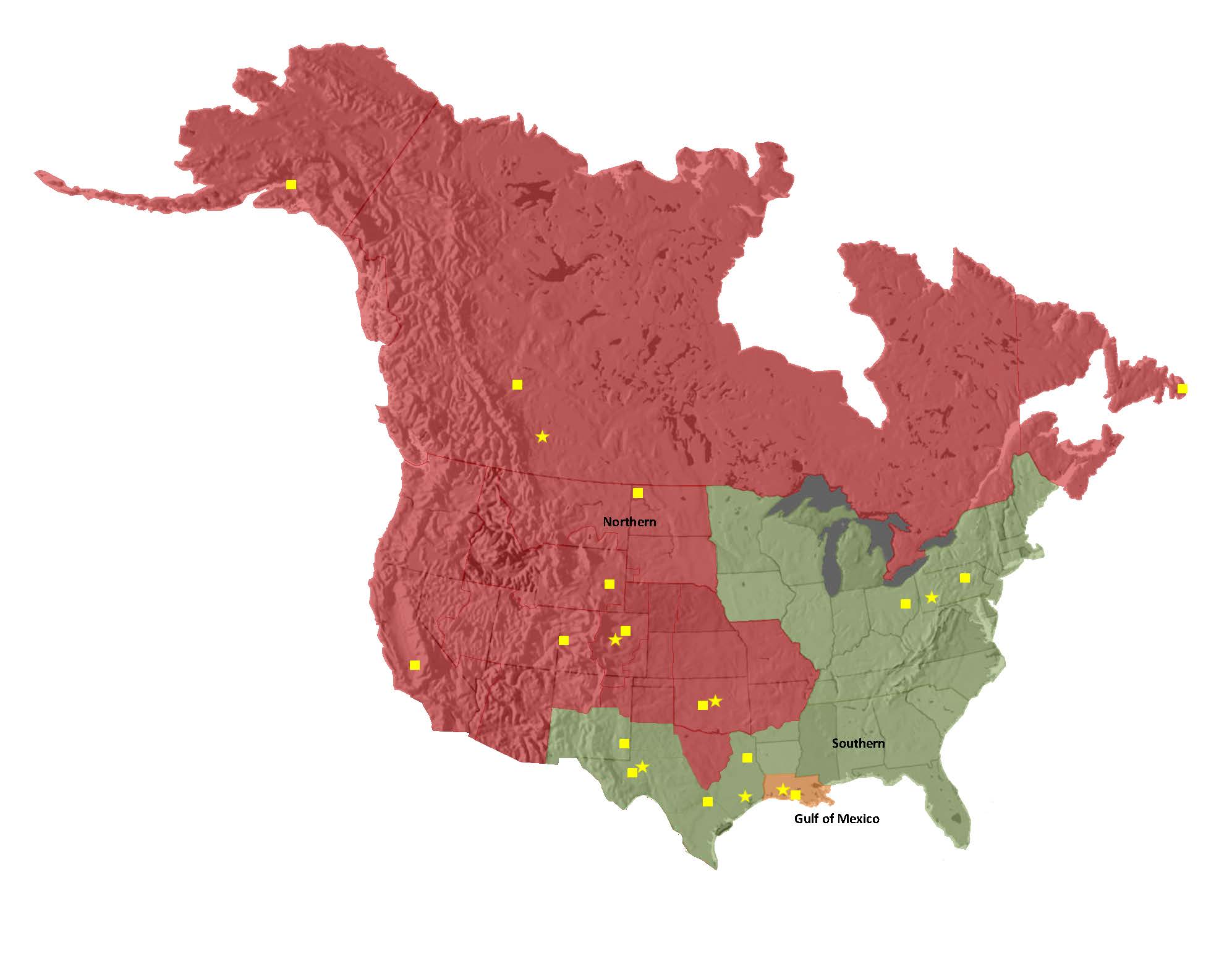

Our international marketing efforts are conducted primarily through our sales offices in the United Arab Emirates, Canada, Russia, and South America. Our products and services are used worldwide by U.S. customers operating domestically and abroad, and by foreign customers. Sales outside the United States accounted for 34%, 29% and 24% of our sales for 2016, 2015 and 2014, respectively. The distribution of our international and domestic revenues is shown below, based upon the region in which the customer used the products and services:

|

|

|

For the years ended December 31, |

|

|||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|||

|

|

|

($ in millions) |

|

|||||||||

|

Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

67.6 |

|

|

$ |

199.2 |

|

|

$ |

491.0 |

|

|

International |

|

|

35.4 |

|

|

|

80.4 |

|

|

|

157.3 |

|

|

Total |

|

$ |

103.0 |

|

|

$ |

279.6 |

|

|

$ |

648.3 |

|

Production Capacity

We have constructed adequate capacity to support present and foreseeable demand for our ceramic proppant. We continue to incorporate new methods and technologies to reduce our manufacturing costs and make our products more cost-competitive. As production levels increase, our manufacturing costs per unit tend to decrease.

During 2014, we completed construction of the first 250 million pound ceramic proppant production line in Millen, Georgia and the plant commenced operations. In addition, we began the construction on a second 250 million pound production line in Millen. However, due to current market conditions, the completion of this second line continues to be suspended until such time that market conditions improve sufficiently to warrant completion. Similarly, the first production line is idled due to current market conditions.

The following table sets forth the current stated capacity of each of our existing ceramic manufacturing and other facilities:

|

|

|

Annual |

|

|

|

|

Location |

|

Capacity |

|

|

|

|

|

|

(millions of pounds) |

|

|

|

|

Eufaula, Alabama |

|

|

275 |

|

* |

|

McIntyre, Georgia |

|

|

275 |

|

* |

|

Toomsboro, Georgia |

|

|

1,000 |

|

* |

|

Millen, Georgia |

|

|

250 |

|

* |

|

Kopeysk, Russia |

|

|

100 |

|

|

|

Total ceramic manufacturing capacity |

|

|

1,900 |

|

** |

|

Marshfield, Wisconsin – sand processing |

|

|

1,500 |

|

* |

|

New Iberia, Louisiana – resin-coating |

|

|

300 |

|

*** |

|

Total current capacity |

|

|

3,700 |

|

|

4

|

* |

Given market conditions, throughout 2016, we mothballed our Millen manufacturing facility and greatly reduced output levels at our Eufaula, McIntyre, Toomsboro and Marshfield facilities. |

|

** |

During 2013, the Company began production of KRYPTOSPHERE® at its New Iberia facility. Production volumes will vary, but are not expected to exceed 15 million pounds annually. |

|

*** |

Processing activities at the New Iberia facility primarily involve resin-coating of previously manufactured ceramic proppant substrate. |

The retrofit of the first production line at an existing plant to produce KRYPTOSPHERE® was completed in late 2015. With this retrofit, we can now produce up to approximately 100 million pounds of KRYPTOSPHERE® annually. While this retrofit enables production of our new KRYPTOSPHERE® technology products, it did not add additional production capacity. The retrofit of a second production line has been deferred until market conditions warrant moving forward with the project.

During 2016, our overall total ceramic plant utilization was approximately 18% of stated capacity. Our sand processing plant in Marshfield operated at approximately 5% of its stated capacity during 2016. We do not expect any significant improvements to our ceramic plant utilization in 2017; however, we expect utilization at our sand processing plant to improve during 2017. If industry conditions do not improve, we expect to reduce output levels or idle operations at plants as a result of decreased demand for our products. Refer to our discussion of impairment considerations in the “Critical Accounting Policies” section of Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations. Construction of additional manufacturing capacity beyond these facilities is not expected in the foreseeable future, and would be dependent on the expected future demand for our products, access to needed capital and the ability to obtain necessary environmental permits.

Long-Lived Assets by Geographic Area

Long-lived assets, consisting of net property, plant and equipment, goodwill, intangibles, and other long-term assets as of December 31 in the United States and other countries are as follows:

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|||

|

|

|

($ in millions) |

|

|||||||||

|

Long-lived assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

496.0 |

|

|

$ |

538.8 |

|

|

$ |

578.5 |

|

|

International (primarily Russia, Canada, and China) |

|

|

10.2 |

|

|

|

12.3 |

|

|

|

18.1 |

|

|

Total |

|

$ |

506.2 |

|

|

$ |

551.1 |

|

|

$ |

596.6 |

|

Distribution

We maintain finished goods inventories at each of our manufacturing facilities and at remote stocking facilities. The North American remote stocking facilities consist of bulk storage silos with truck trailer loading facilities, as well as rail yards for direct transloading from rail car to tank trucks. International remote stocking sites are duty-free warehouses operated by independent owners. North American sites are typically supplied by rail, and international sites are typically supplied by container ship. In total, we lease approximately 2,530 rail cars for use in the distribution of our products, of which we have subleased approximately 545 rail cars. The price of our products sold for delivery in the lower 48 United States and Canada typically includes just-in-time delivery of proppant to the operator’s well site, which eliminates the need for customers to maintain an inventory of ceramic proppant.

Raw Materials

Ceramic proppant is made from alumina-bearing ores (commonly referred to as clay, bauxite, bauxitic clay or kaolin, depending on the alumina content) that are readily available on the world market. Bauxite is largely used in the production of aluminum metal, refractory material and abrasives. The main known deposits of alumina-bearing ores in the United States are in Arkansas, Alabama and Georgia; other economically mineable known deposits are located in Australia, Brazil, China, Gabon, Guyana, India, Jamaica, Russia and Surinam.

For the production of CARBOHSP® and CARBOPROP® in the United States we use bauxite, and have historically purchased our annual requirements at the seller’s current prices. We believe that our ability to purchase bauxite on the open market and current bauxite inventories will sufficiently provide for our bauxite needs in the United States during 2017.

Our Eufaula, McIntyre, Toomsboro and Millen facilities primarily use locally mined kaolin for the production of CARBOLITE®, CARBOECONOPROP® and CARBOHYDROPROP®. We have entered into bi-lateral contracts that require a

5

supplier to sell to us, and us to purchase from the supplier, at least fifty percent of the Eufaula facility’s and Millen facility’s annual kaolin requirements. The Eufaula contract runs through May 2017, with options to extend this agreement for additional three year terms. The Millen contract, which commenced in July 2014, has an initial term of five years with options to extend the agreement for additional five year terms. We have obtained ownership rights in acreage in Wilkinson County, Georgia, which contains in excess of a twelve year supply of kaolin for our Georgia facilities based on full capacity production rates. We have entered into a long-term agreement with a third party to mine and transport this material at a fixed price subject to annual adjustment. The agreement requires us to utilize the third party to mine and transport a majority of the McIntyre and Toomsboro facility’s annual kaolin requirement. Overall, we estimate that our fee simple and leasehold mineral rights in the states of Alabama and Georgia contain approximately 20.1 million tons of kaolin suitable for use in production of our kaolin-based proppants.

Our production facility in Kopeysk, Russia currently uses bauxite for the production of CARBOPROP®. Bauxite is purchased under annual agreements that stipulate fixed prices for up to a specified quantity of material.

We utilize our own CARBO Northern White sand and purchase third party wet processed sand reserves for our sand processing facility in Marshfield, Wisconsin, which supplies raw frac sand to the proppant market.

Ceramic Production Process

Ceramic proppants are made by grinding or dispersing ore to a fine powder, combining the powder into small pellets and firing the pellets in a rotary kiln. We use three different methods to produce ceramic proppant.

Our plants in McIntyre, Georgia and Kopeysk, Russia use a dry process, which utilizes clay, bauxite, bauxitic clay or kaolin. The raw material is ground, pelletized and screened. The manufacturing process is completed by firing the product in a rotary kiln.

Our plants in Eufaula, Alabama, Toomsboro, Georgia, and Millen, Georgia, use a wet process, which starts with kaolin that is formed into slurry. The slurry is then pelletized in a dryer and the pellets are then fired in a rotary kiln.

The portion of our plant in New Iberia, Louisiana that manufactures ceramic proppant uses a new manufacturing process associated with the Company’s KRYPTOSPHERE® product line. The first phase of a retrofit with this new process was substantially completed during late 2015 at our manufacturing facility in Eufaula, Alabama.

Our rotary kilns are primarily heated by the use of natural gas.

Patent Protection and Intellectual Property

We make ceramic proppant and ceramic media used in foundry and scouring processes (the latter two items comprising a minimal volume of overall sales) by processes and techniques that involve a high degree of proprietary technology, some of which is protected by patents.

We own multiple patents in the United States and various foreign countries that relate to different types of ceramic proppant and production methods used for ceramic proppant and media; however, depending on market conditions, production of products pursuant to these patents may not necessarily constitute a material portion of our output. We also own multiple U.S. and foreign patents that relate to methods for the detection of subterranean fractures and material, including gravel packs, in the near-borehole region. We also own multiple U.S. patents that relate to detectable proppant.

During 2014 and 2015, we obtained three U.S. patents relating to our KRYPTOSPHERE® manufacturing process, and expect these patents to provide assistance in the future sales of this product line. During 2015, 2016 and January 2017, we obtained four U.S. patents relating to our far-field proppant detection products, systems, and methods which relate to our iONTM product line and the QUANTUMTM service line, which are still under development.

We own multiple U.S. patent applications (together with a number of counterpart applications pending in foreign jurisdictions). A portion of the U.S. patent applications cover ceramic proppant, detectable proppant, processes for making ceramic and detectable proppant, detection of subterranean fractures, and our GUARDTM, FUSION® and AIRTM product lines and methods for making and using these products. The applications are in various stages of the patent prosecution process, and patents may not issue on such applications in any jurisdiction for some time, if they issue at all.

AGPI (formerly Falcon) owns three U.S. patents, which expire in 2026, 2027 and 2034 and relate to construction of secondary containment areas. In addition, AGPI owns three U.S. patents, which expire in 2030 and 2031 and relate to polyurea-encapsulated

6

tank bases. AGPI also owns multiple U.S. patent applications (together with a number of counterpart applications pending in foreign jurisdictions), each of which relates to tank bases or methods of constructing secondary containment areas.

We believe that our patents have historically been important in enabling us to compete in the market to supply proppant to the natural gas and oil industry. We intend to enforce, and have in the past vigorously enforced, our patents. We may from time to time in the future be involved in litigation to determine the enforceability, scope and validity of our patent rights. In addition to patent rights, and perhaps more notably, we use a significant amount of trade secrets, or “know-how,” and other proprietary information and technology in the conduct of our business. None of this “know-how” and technology is licensed from third parties. However, we have negotiated a long term license for some third party intellectual property used or jointly developed in connection with our QUANTUM service line.

Seasonality

Historically, our business has not been subject to regular material seasonality fluctuations. However, with the activity in resource plays in the northern and eastern United States, we have experienced higher levels of proppant sales activities during warmer weather periods and less during colder weather months. In addition, sales activities can be decreased by the spring snow and ice “break-up” in Canada, North Dakota, Montana, and the Northeast U.S., as well as the winter holidays in December and January.

Environmental and Other Governmental Regulations

We believe that our operations are in substantial compliance with applicable domestic and foreign federal, state and local environmental and safety laws and regulations.

Existing federal environmental requirements such as the Clean Air Act and the Clean Water Act, as amended, impose certain restrictions on air and water pollutants from our operations via permits and regulations. Those pollutants include volatile organic compounds, nitrogen oxides, sulfur dioxide, particulate matter, storm water and wastewater discharges and other by-products. In addition to meeting environmental requirements for existing operations, we must also demonstrate compliance with environmental regulations in order to obtain permits prior to any future expansion. The United States Environmental Protection Agency (“EPA”) and state programs require covered facilities to obtain individual permits or have coverage under an EPA general permit issued to groups of facilities. A number of federal and state agencies, including but not limited to, the EPA, the Texas Commission of Environmental Quality, the Louisiana Department of Environmental Quality, the Alabama Department of Environmental Management, the Wisconsin Department of Natural Resources, and the Georgia Environmental Protection Division, in states in which we do business, have environmental regulations applicable to our operations. Historically we have been able to obtain permits, where necessary, to build new facilities and modify existing facilities that allow us to continue compliant operations and obtaining these permits in a timely manner will continue to be an important factor in our ability to do so in the future.

Employees

As of December 31, 2016, we had 431 employees worldwide. In addition to the services of our employees, we employ the services of consultants as required. Our employees are not represented by labor unions. There have been no work stoppages or strikes during the last three years that have resulted in the loss of production or production delays. We believe our relations with our employees are satisfactory.

Executive Officers of the Registrant

Gary A. Kolstad (age 58) was elected in June 2006, by our Board of Directors to serve as President and Chief Executive Officer and a Director of the Company. Mr. Kolstad previously served in a variety of positions over 21 years with Schlumberger. Mr. Kolstad became a Vice President of Schlumberger in 2001, where he last held the positions of Vice President, Oilfield Services – U.S. Onshore and Vice President, Global Accounts.

Ernesto Bautista III (age 45) joined the Company as a Vice President and Chief Financial Officer in January 2009. From July 2006 until joining the Company, Mr. Bautista served as Vice President and Chief Financial Officer of W-H Energy Services, Inc., a Houston, Texas based diversified oilfield services company (“W-H Energy”). From July 2000 to July 2006, he served as Vice President and Corporate Controller of W-H Energy. From September 1994 to May 2000, Mr. Bautista served in various positions at Arthur Andersen LLP, most recently as a manager in the assurance practice, specializing in emerging, high growth companies. Mr. Bautista is a certified public accountant in the State of Texas.

Don P. Conkle (age 52) was appointed Vice President, Marketing and Sales in October 2012. Mr. Conkle previously held a variety of domestic and international managerial positions in engineering, marketing and sales, and technology development over a 26

7

year period with Schlumberger. He served in the positions of Vice President of Stimulation Services from 2007 until 2009, as GeoMarket Manager (Qatar & Yemen) from 2009 until 2011 and as Production Group Marketing and Technology Director from 2011 until he joined the Company.

Roger Riffey (age 58) joined the Company in July 2006 as Director of Logistics and Customer Service. He was appointed Plant Manager of the Toomsboro, Georgia, facility in July 2010, and was named Vice President, Manufacturing in May 2013. Previously, Mr. Riffey held positions with Rio Tinto Energy in Special Projects, U.S. Borax as Global Logistics Manager and Kerr-McGee Coal Corporation as Manager of Marketing.

John R. Bakht (age 47) was appointed Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer in June 2015. Mr. Bakht joined the Company after 13 years with Baker Hughes Incorporated, where he last served as Vice President – Legal, U.S. Operations, Strategy and Corporate Development, and Reservoir Development Services. Mr. Bakht holds a B.A. in Economics from the University of North Carolina at Chapel Hill and a J.D. from The University of Texas.

All officers are elected for one-year terms or until their successors are duly elected. There are no arrangements between any officer and any other person pursuant to which he was selected as an officer. There is no family relationship between any of the named executive officers or between any of them and the Company’s directors.

Forward-Looking Information

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. This Form 10-K, our Annual Report to Shareholders, any Form 10-Q or any Form 8-K of the Company or any other written or oral statements made by or on behalf of the Company may include forward-looking statements which reflect the Company’s current views with respect to future events and financial performance. The words “believe”, “expect”, “anticipate”, “project”, “estimate”, “forecast”, “plan” or “intend” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, each of which speaks only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Our forward-looking statements are based on assumptions that we believe to be reasonable but that may not prove to be accurate. All of our forward-looking information is subject to risks and uncertainties that could cause actual results to differ materially from the results expected. Although it is not possible to identify all factors, these risks and uncertainties include the risk factors discussed below.

Our results of operations could be adversely affected if our business assumptions do not prove to be accurate or if adverse changes occur in our business environment, including but not limited to:

|

|

• |

changes in the cost of raw materials and natural gas used in manufacturing our products; |

|

|

• |

risks related to our ability to access needed cash and capital; |

|

|

• |

our ability to meet our current and future debt service obligations, including our ability to maintain compliance with our debt covenants; |

|

|

• |

our ability to manage distribution costs effectively; |

|

|

• |

changes in demand and prices charged for our products; |

|

|

• |

technological, manufacturing and product development risks; |

|

|

• |

our dependence on and loss of key customers and end users; |

|

|

• |

potential declines or increased volatility in oil and natural gas prices that adversely affect our customers, the energy industry or our production costs; |

|

|

• |

potential reductions in spending on exploration and development drilling in the oil and natural gas industry that reduce demand for our products and services; |

|

|

• |

seasonal sales fluctuations; |

|

|

• |

an increase in competition in the proppant market, including imports from foreign countries; |

|

|

• |

logistical and distribution challenges relating to certain resource plays that do not have the type of infrastructure systems that are needed to efficiently support oilfield services activities; |

|

|

• |

the development of alternative stimulation techniques that would not benefit from the use of our existing products and services, such as extraction of oil or gas without fracturing; |

8

|

|

• |

changes in foreign and domestic governmental regulations, including environmental restrictions on operations and regulation of hydraulic fracturing; |

|

|

• |

increased regulation of emissions from our manufacturing facilities; |

|

|

• |

the development and utilization of alternative proppants for use in hydraulic fracturing; |

|

|

• |

general global economic and business conditions; |

|

|

• |

weather-related risks and other risks and uncertainties; |

|

|

• |

changes in foreign and domestic political and legislative risks; |

|

|

• |

risks of war and international and domestic terrorism; |

|

|

• |

risks associated with foreign operations and foreign currency exchange rates and controls; and |

|

|

• |

the potential expropriation of assets by foreign governments. |

Our results of operations could also be adversely affected as a result of worldwide economic, political and military events, including, but not limited to, war, terrorist activity or initiatives by the Organization of the Petroleum Exporting Countries (“OPEC”). For further information, see “Item 1A. Risk Factors.”

Available Information

Our annual reports on Form 10-K, proxy statements, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”) are made available free of charge on our internet website at http://www.carboceramics.com as soon as reasonably practicable after such material is filed with, or furnished to, the Securities and Exchange Commission (“SEC”).

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, Room 1580, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

You should consider carefully the trends, risks and uncertainties described below and other information in this Form 10-K and subsequent reports filed with the SEC before making any investment decision with respect to our securities. If any of the following trends, risks or uncertainties actually occurs or continues, our business, financial condition or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment.

Our business and financial performance depend on the level of activity in the natural gas and oil industries.

Our operations are materially dependent upon the levels of activity in natural gas and oil exploration, development and production. More specifically, the demand for our products is closely related to the number of natural gas and oil wells completed in geologic formations where ceramic or sand proppants are used in fracture treatments. These activity levels are affected by both short-term and long-term trends in oil and natural gas prices. In recent years, oil and natural gas prices and, therefore, the level of exploration, development and production activity, have experienced significant fluctuations. Worldwide economic, political and military events, including war, terrorist activity, events in the Middle East and initiatives by OPEC, have contributed, and are likely to continue to contribute, to price volatility. Despite recent initiatives to curb supply, the global supply of oil is currently at historically high levels, and there is potential for geopolitical and regulatory events, such as normalization of trade relations with the Islamic Republic of Iran, to further increase supply of oil. Additionally, warmer than normal winters in North America and other weather patterns may adversely impact the short-term demand for natural gas and, therefore, demand for our products and services. Natural gas prices experienced a significant decline during 2012 and, although they increased during 2016, remain relatively low on a historic basis, resulting in generally lower gas drilling activity. Further, the price of oil declined precipitously from the second half of 2014 through mid-2016 and, although the price has rebounded from its low, it still remains at weakened levels for industry activity. This reduction in oil and natural gas prices has depressed the level of natural gas and oil exploration, development, production and well completions activity, resulting in significantly reduced demand and pricing for our products. This decline has had and continues to have a significant adverse impact on our results. If oil and natural gas prices and well completion activity do not materially improve and/or demand for our products does not otherwise increase, this decline could reasonably be expected to have a material adverse

9

effect on our financial condition or operations, including, but not limited to, temporary idling all or a portion of our facilities until such time as market conditions improve.

We may not have sufficient cash and/or be able to access liquidity alternatives in the credit and capital markets to meet our liquidity needs. In addition, an inability to comply with our obligations under our Amended Credit Agreement may have a material adverse effect on our financial condition.

Our primary sources of liquidity are cash on hand and cash flow from operations. Our ability to fund our working capital, capital expenditures, debt service under our Amended Credit Agreement and other obligations and to comply with the restrictive covenants under our credit facility depends on our future operating performance and cash from operations and other liquidity-generating transactions, which are in turn subject to prevailing oil and natural gas prices, economic conditions and other factors, many of which are beyond our control. Under the Amended Credit Agreement, our principal financial covenant requires us to have minimum cash on hand as described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”, which will be $40 million until March 2017, $30 million from April 2017 until December 2017 and $25 million thereafter. Unless the Company is able to raise additional cash as described above or there is a significant improvement in operating conditions, there is a significant risk that the Company will not be able to satisfy that covenant.

If our future operating performance falls materially below our expectations, our plans prove to be materially inaccurate, or industry conditions do not materially improve, we may require additional financing. However, our Amended Credit Agreement imposes certain restrictions on our ability to obtain additional financing, the availability of which cannot be guaranteed even if permitted under our Amended Credit Agreement. Further, our Amended Credit Agreement imposes certain restrictions on our ability to sell certain assets and to engage in more than $2.5 million in non-ordinary course asset sales, and, subject to certain exceptions, also imposes restrictions on our ability to use the future proceeds from such transactions.

Even if additional or alternative financing is permitted and is or becomes available to us, future financing transactions may significantly increase the Company’s interest expense, which could in turn reduce our financial flexibility and our ability to fund other activities and could make us more vulnerable to changes in operating performance or economic downturns generally. The inability to generate sufficient cash, modify our credit agreement, or obtain replacement or additional financing, or an event of default under our credit agreement, could have a material adverse effect on our financial condition.

We therefore cannot provide any assurance that we will be able to access the capital or credit markets on acceptable terms or timing, or at all. Access to the capital markets and the cost and availability of credit may be adversely affected by factors beyond our control, including turmoil in the financial services industry, volatility in securities trading markets, the continuing downturn in the oil and gas industry and general economic conditions. Currently, we no longer qualify as a “well-known seasoned issuer,” which previously enabled us to, among other things, file automatically effective shelf registration statements. Now, even if we are able to access the public capital markets, any attempt to do so could be more expensive or subject to significant delays when compared with previous periods.

Our business and financial performance has suffered and could suffer further if the levels of hydraulic fracturing continue to decline or cease as a result of the low commodity price of oil and natural gas, development of new processes, increased regulation or a continued decrease in drilling activity.

Substantially all of our products are proppants used in the completion and re-completion of natural gas and oil wells through the process of hydraulic fracturing. Completion activity is directly impacted by the price of oil and natural gas. In addition, demand for our proppants is substantially higher in the case of horizontally drilled wells, which allow for multiple hydraulic fractures within the same well bore but are more expensive to develop than vertically drilled wells. A reduction in horizontal drilling or the development of new processes for the completion of natural gas and oil wells leading to a reduction in, or discontinuation of the use of, hydraulic fracturing could cause a decline in demand for our products. Additionally, increased regulation or environmental restrictions on hydraulic fracturing or the materials used in this process could negatively affect our business by increasing the costs of compliance or resulting in operational delays, which could cause operators to abandon the process due to commercial impracticability. Moreover, future federal, state local or foreign laws or regulations could otherwise limit or ban hydraulic fracturing. Several states in which our customers operate have adopted, or are considering adopting, regulations that have imposed, or could impose, more stringent permitting, transparency, disposal and well construction requirements on hydraulic fracturing operations. Some states, such as New York, have banned the process of hydraulic fracturing altogether. Similar efforts have been proposed in other states. Any of these events could have a material adverse effect on our results of operations and financial condition. As stated elsewhere, the upstream oil and natural gas industry is in the midst of a severe contraction, resulting in a significant reduction in horizontal drilling and further resulting in a material decline in demand for our products and services.

10

We have distribution and logistical challenges in our business

As oil and natural gas prices fluctuate, our customers may shift their focus back and forth between different resource plays, some of which can be located in geographic areas that do not have well-developed transportation and distribution infrastructure systems. Transportation and logistical operating expenses continue to comprise a significant portion of our total delivered cost of sales. Therefore, serving our clients in these less-developed areas presents distribution and other operational challenges that affect our sales and negatively impact our operating costs. Disruptions in transportation services, including shortages of rail cars or a lack of rail transportation services or developed infrastructure, could affect our ability to timely and cost effectively deliver to our customers and could provide a competitive advantage to competitors located in closer proximity to customers. Additionally, increases in the price of diesel fuel could negatively impact operating costs if we are unable to pass those increased costs along to our customers. Failure to find long-term solutions to these logistical challenges could adversely affect our ability to respond quickly to the needs of our customers or result in additional increased costs, and thus could negatively impact our results of operations and financial condition.

We operate in an increasingly competitive market.

The proppant market is highly competitive. We compete with other domestic and international suppliers of ceramic proppant, as well as with suppliers of sand for use as proppant, in the hydraulic fracturing of natural gas and oil wells. The expiration of key patents owned by the Company has resulted in additional competition in the market for ceramic proppant. Specifically, Chinese manufacturers have imported ceramic proppant of varying quality into North America, which has led to an oversupply of product in the marketplace. While we believe our ceramic proppant can be differentiated from low quality imports, the oversupply in the marketplace had resulted in pricing and margin pressures. From 2013 through 2016, ceramic proppant imports from China decreased somewhat when compared to early 2012, but these imports were still present in the market. Imports of ceramic proppant from China into North America remained low in 2016, as demand and pricing for ceramic proppant weakened. The entry of additional competitors into the market to supply ceramic proppant or a surge in the level of ceramic proppant imports into North America could have a material adverse effect on our results of operations and financial condition.

We have been and may continue to be adversely affected by decreased demand for our proppant or the development by our competitors of alternative proppants.

Ceramic proppant is a premium product capable of withstanding higher pressure and providing more highly conductive fractures than mined sand, which is the most commonly used proppant type. During 2015 and 2016, we saw some operators that traditionally used ceramic proppant use mined sand in its place. Despite recently improving commodity prices in the oil and natural gas industry, continued pressure on operators to reduce cost or to evaluate returns on a shorter horizon has had a detrimental impact on the demand for ceramic proppant, which is a higher cost product than mined sand. Although we believe that the use of quality ceramic proppant in appropriate geologic formations typically generates higher production rates and more favorable long term production economics than mined sand, the shifting of customer demand to lower cost products, such as mined sand, has had an adverse effect on our results of operations and its continuation could have a material adverse effect on our financial condition. The development and use of alternative proppant could also cause a decline in demand for our products, and could have a material adverse effect on our results of operations and financial condition.

We have no current plans to pay cash dividends on our common stock for the foreseeable future and our Amended Credit Agreement contains restrictions on our ability to pay dividends; therefore, you may not receive any return on investment unless you sell your common stock for a price greater than you paid.

We do not plan to declare dividends on shares of our common stock in the foreseeable future. In addition, our Amended Credit Agreement prohibits us from paying such dividends. We currently intend to retain any future earnings to finance the operation of our business and meet our debt obligations. As a result, you may only receive a return on your investment in our common stock if the market price of our common stock increases. Further, one of our financing options involves the issuance of equity securities, which would dilute current stockholders and could reduce our stock price.

The outstanding indebtedness under our Amended Credit Agreement is secured by substantially all of our domestic assets and guaranteed by our two domestic operating subsidiaries, subject to certain exceptions.

The outstanding indebtedness under our Amended Credit Agreement is secured by substantially all of our domestic assets and guaranteed by our two domestic operating subsidiaries, subject to certain exceptions. A breach of certain covenants or payment obligations in the Amended Credit Agreement would result in a default. In the event of such a default, our lenders may (1) elect to declare all outstanding borrowings made under the Amended Credit Agreement and the guaranties of the two operating subsidiaries, together with accrued interest and other fees, to be immediately due and payable; (2) exercise their set-off rights; and/or (3) enforce and foreclose on their security interest and liquidate some or all of such pledged assets.

11

We rely upon, and receive a significant percentage of our revenues from, a limited number of key customers and end users.

During 2016, our key customers included several of the largest participants in the worldwide petroleum pressure pumping industry. Two of these customers each accounted for more than 10% of our 2016 revenues. However, the end users of our products are numerous operators of natural gas and oil wells that hire pressure pumping service companies to hydraulically fracture wells. During 2016, a majority of our ceramic proppant sales were directed to a concentrated number of end users. We generally supply our domestic pumping service customers with products on a just-in-time basis, with transactions governed by individual purchase orders and/or a master supply agreement. Because of their purchasing power, our key customers may have greater bargaining leverage than us with respect to the negotiation of prices and other terms of sale in their supply contracts with us, which could adversely affect our profit margins associated with those contracts. Disparities in bargaining leverage, when combined with the Company’s desire to maintain long-term relationships with key customers, could limit our practical ability to assert certain terms of our supply agreements with them. Continuing sales of our products depend on our direct customers and the end user well operators being satisfied with product quality, pricing, availability, and delivery performance. While we believe our relations with our customers and our end users are satisfactory, a material decline in the level of sales to any one of our major customers or loss of a key end user due to unsatisfactory product performance, pricing, delivery delays or any other reason could have a material adverse effect on our results of operations and financial condition.

The operations of our customers, and thus the results of our operations, are subject to a number of operational risks, interruptions and seasonal trends.

As hydraulic fracturing jobs have increased in size and intensity, common issues such as weather, equipment delays or changes in the location and types of oil and natural gas plays can result in increased variability in proppant sales volumes. Our business operations and those of our customers involve a high degree of operational risk. Natural disasters, adverse weather conditions, collisions and operator error could cause personal injury or loss of life, severe damage to and destruction of property, equipment and the environment, and suspension of operations. Our customers perform work that is subject to unexpected or arbitrary interruption or termination. The occurrence of any of these events could result in work stoppage, loss of revenue, casualty loss, increased costs and significant liability to third parties. We have not historically considered seasonality to be a significant risk, but with the increase in resource plays in the northern and eastern United States as well as our operations in Marshfield, Wisconsin, our results of operations are exposed to seasonal variations and inclement weather. Operations in certain regions involve more seasonal risk in the winter months, and work is hindered during other inclement weather events. This variability makes it more difficult to predict sales and can result in greater fluctuations to our quarterly financial results. These quarterly fluctuations could result in operating results that are below the expectations of public market analysts and investors, and therefore may adversely affect the market price for our common stock.

The ability of our customers to complete work, as well as our ability to mine sand from cold climate areas, could be affected during the winter months. Our revenue and profitability could decrease during these periods and in other severe weather conditions because work is either prevented or more costly to complete. If a substantial amount of production is interrupted, our cash flow and, in turn, our results of operations could be materially and adversely affected.

Our North American ceramic proppant production is manufactured at two plants. All of our mined sand is processed at one plant. Any adverse developments at those plants could have a material adverse effect on our financial condition and results of operations.

With the mothballing of our Millen plant and very limited production at our McIntyre plant, we are producing the majority of our North American ceramic production from two plants. Our Marshfield, Wisconsin plant represents 100% of our annual mined sand processing capacity. Any adverse developments at these plants, including a material disruption in production, an inability to supply the plant with raw materials at a competitive cost, or adverse developments due to catastrophic events, could have a material adverse effect on our financial condition and results of operations.

We provide environmental warranties on certain of our containment and spill prevention products.

AGPI’s tank liners, secondary containments and related products and services are designed to contain or avoid spills of hydrocarbons and other materials. If a release of these materials occurs, it could be harmful to the environment. Although we attempt to negotiate appropriate limitations of liability in the applicable terms of sale, some customers have required expanded warranties, indemnifications or other terms that could hold AGPI responsible in the event of a spill or release under particular circumstances. If AGPI is held responsible for a spill or release of materials from one of its customer’s facilities, it could have a material adverse effect on our results of operations and financial condition.

12

We rely upon intellectual property to protect our proprietary rights. Failure to protect our intellectual property rights may affect our competitive position, and protecting our rights or defending against third-party allegations of infringement may be costly.

The Company uses a significant amount of trade secrets, or “know-how,” and other proprietary information and technology in the conduct of its business. In some cases, we rely on trade secrets, trademarks or contractual restrictions to protect intellectual property rights that are not patented. The steps we take to protect the non-patented intellectual property may not be sufficient to protect it and any loss or diminishment of such intellectual property rights could negatively impact our competitive advantage. Additionally, our competitors could independently develop the same or similar technologies that are only protected by trade secret and thus do not prevent third parties from competing with us. Furthermore, even protected intellectual property rights can be infringed upon by third parties. Monitoring unauthorized use of Company intellectual property can be difficult and expensive, and adequate remedies may not be available.

Although the Company does not believe that it is infringing upon the intellectual property rights of others by using such proprietary information and technology, it is possible that such a claim might be asserted against the Company in the future. In the event any third party makes a claim against us for infringement of patents or other intellectual property rights of a third party, such claims, with or without merit, could be time-consuming and result in costly litigation. In addition, the Company could experience loss or cancellation of customer orders, experience product shipment delays, or be subject to significant liabilities to third parties. If our products or services were found to infringe on a third party’s proprietary rights, the Company could be required to enter into royalty or licensing agreements to continue selling its products or services. Royalty or licensing agreements, if required, may not be available on acceptable terms, if at all, which could seriously harm our business. Involvement in any patent dispute or other intellectual property dispute or action to protect trade secrets and expertise could have a material adverse effect on the Company’s business.

Significant increases in fuel prices for any extended periods of time will increase our operating expenses.

The price and supply of natural gas are unpredictable, and can fluctuate significantly based on international, political and economic circumstances, as well as other events outside of our control, such as changes in supply and demand due to weather conditions, actions by OPEC and other oil and gas producers, regional production patterns and environmental concerns. Natural gas is a significant component of our direct manufacturing costs and price escalations will likely increase our operating expenses and can have a negative impact on income from operations and cash flows. We operate in a competitive marketplace and may not be able to pass through all of the increased costs that could result from an increase in the cost of natural gas.

Environmental compliance costs and liabilities could reduce our earnings and cash available for operations.

We are subject to increasingly stringent laws and regulations relating to environmental protection, including laws and regulations governing air emissions, water discharges and waste management. The technical requirements of complying with these environmental laws and regulations are becoming increasingly expensive and complex, and may affect the Company’s ability to expand its operations. Our ability to continue the expansion of our manufacturing capacity to meet market demand is contingent upon obtaining required environmental permits and compliance with their terms, which continue to be more restrictive and require longer lead times to obtain in anticipation of any efforts to expand and increase capacity. We incur, and expect to continue to incur, capital and operating costs to comply with environmental laws and regulations.

In addition, we use some hazardous substances and generate certain industrial wastes in our operations. Many of our current and former properties are or have been used for industrial purposes. Accordingly, we could become subject to potentially material liabilities relating to the investigation and cleanup of contaminated properties, and to claims alleging personal injury or property damage as the result of exposures to, or releases of, hazardous substances. These laws also may provide for “strict liability” for damages to natural resources or threats to public health and safety. Strict liability can render a party liable for environmental damage without regard to negligence or fault on the part of the party. Some environmental laws provide for joint and several strict liability for remediation of spills and releases of hazardous substances.

Stricter enforcement of existing laws and regulations, new laws and regulations, the discovery of previously unknown contamination or the imposition of new or increased requirements could restrict our expansion efforts, require us to incur costs, or become the basis of new or increased liabilities. Any of these events could reduce our earnings and our cash available for operations.

13

Our international operations subject us to risks inherent in doing business on an international level that could adversely impact our results of operations.

International revenues accounted for approximately 34%, 29% and 24% of our total revenues in 2016, 2015 and 2014, respectively. We may not succeed in overcoming the risks that relate to or arise from operating in international markets. Risks inherent in doing business on an international level include, among others, the following:

|

|

• |

economic and political instability (including as a result of the threat or occurrence of armed international conflict or terrorist attacks); |

|

|

• |

potential declines or increased volatility in oil and natural gas prices that would adversely affect our customers, the energy industry or our production costs; |

|

|

• |

changes in regulatory requirements, economic sanctions, tariffs, customs, duties and other trade barriers; |

|

|

• |

transportation delays and costs; |

|

|

• |

power supply shortages and shutdowns; |

|

|

• |

difficulties in staffing and managing foreign operations and other labor problems; |

|

|

• |

currency rate fluctuations, convertibility and repatriation; |

|

|

• |

taxation of our earnings and the earnings of our personnel; |

|

|

• |

potential expropriation of assets by foreign governments; and |

|

|

• |

other risks relating to the administration of or changes in, or new interpretations of, the laws, regulations and policies of the jurisdictions in which we conduct our business. |

In particular, we are subject to risks associated with our production facility in Kopeysk, Russia. The legal systems in Russia are still developing and are subject to change. Accordingly, our operations and orders for products in Russia could be adversely impacted by changes to or interpretation of the country’s law. Moreover, some parts of our Russian operations have been impacted by the imposition of trade sanctions enacted by the U.S. government in response to the ongoing conflict in Ukraine. These sanctions continue in place and changes to them or additional measures implemented by the U.S. government or other applicable authorities could further affect our sales and operations in the region. Further, if manufacturing in the region is disrupted, our overall capacity could be significantly reduced and sales and/or profitability could be negatively impacted.

Undetected defects in our fracture simulation software could adversely affect our business.

Despite extensive testing, our software could contain defects, bugs or performance problems. If any of these problems are not detected, the Company could be required to incur extensive development costs or costs related to product recalls or replacements. The existence of any defects, errors or failures in our software products may subject us to liability for damages, delay the development or release of new products and adversely affect market acceptance or perception of our software products or related services, any one of which could materially and adversely affect the Company’s business, results of operations and financial condition.

The market price of our common stock will fluctuate, and could fluctuate significantly.

The market price of the Company’s common stock will fluctuate, and could fluctuate significantly, in response to various factors and events, including the following:

|

|

• |