|

Key responsibilities

The audit and finance committee supports the board in fulfilling its oversight responsibilities regarding the integrity of our accounting and

financial reporting, the adequacy and effectiveness of our internal controls and disclosure controls, legal, regulatory (excluding safety, health and the environment) and ethical compliance, the independence and performance of our external and

internal auditors, oversight of specific risks, prevention and detection of fraudulent activities, and financial oversight.

2021 Committee highlights

Financial reporting

· oversaw

the quality and integrity of our accounting and financial reporting processes · reviewed and recommended the annual and quarterly financial statements and MD&A and quarterly press releases to the board for approval

· approved

the annual audit plan and the external auditors’ fees, including pre-approval of all services to be provided (see page 6 for details about the external auditor and the fees paid to them in 2021)

· received

regular reports from the external auditors on the audit of our financial statements and the results of their reviews of the unaudited quarterly financial statements

· reviewed

audit quality indicators

· assessed

the performance of the external auditors · reviewed the auditor’s qualifications, independence and depth of business and industry knowledge and recommended the appointment of our external

auditor for the coming year

· regularly

met with the external auditor without management present

Risk oversight and compliance

· reviewed

the effectiveness and integrity of our internal control systems and disclosure controls · assessed the internal auditor, reviewed the internal audit mandate, and approved the internal audit plan for the year

· received

regular reports from the internal auditor on the fulfillment of its plan and its recommendations to management · regularly met with the internal auditor without management present

· reviewed

reports about our compliance programs, including the code of conduct and ethics and our global anti-corruption program

· reviewed

related-party transactions

· reviewed

policies and programs to monitor compliance with legal and regulatory requirements and received and reviewed litigation reports

· received

briefings and reports on compliance with Cameco’s investment and hedging program · reviewed, and recommended to the board for approval, amendments to its mandate and code of conduct and ethics

· received

briefings on significant litigation matters · received a report on regulatory developments and impacts of ESG on financial reporting

· received

reports on enterprise risks that the committee oversees · received quarterly updates on the status of mitigation plans for risks that the committee oversees (including financial, fraud and other material

risks within the committee’s mandate) · monitored the company’s transfer pricing dispute with the CRA, including receipt of regular updates from management

Financial oversight

· received

and reviewed reports on our insurance program and directors’ and officers’ liability insurance · received and reviewed the annual supply chain management report

· received

and reviewed reports on the company’s funding (including finance and cash flow planning)

· received

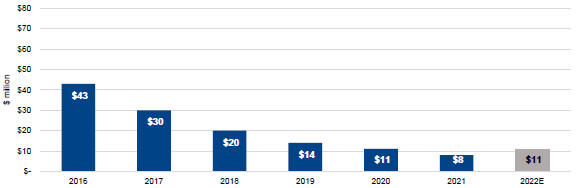

and reviewed reports pertaining to the financial aspects of the company’s operations (including monitoring of care and maintenance spend and developments related to the COVID-19 pandemic)

|

Safety and Environment

Safety and Environment  People

People  Integrity

Integrity  Excellence

Excellence