When

|

Where | |

Tuesday, May 17, 2011

|

Cameco Corporation | |

1:30 p.m.

|

2121 — 11th Street West | |

| Saskatoon, Saskatchewan |

Senior Vice-President

Governance, Law and Corporate Secretary

| Exhibit Index | ||||||||

| SIGNATURE | ||||||||

| EX-99.1 | ||||||||

| EX-99.2 | ||||||||

| EX-99.3 | ||||||||

| EX-99.4 | ||||||||

| EX-99.5 | ||||||||

| Exhibit No. | Description | Page No. | ||

99.1

|

Notice of 2011 Annual Meeting of Shareholders | |||

99.2

|

Cameco Management Proxy Circular | |||

99.3

|

Cameco Proxy Form | |||

99.4

|

Cameco 2011 Business Overview Brochure | |||

99.5

|

Cameco 2010 Annual Financial Review |

| Date: April 5, 2011 | Cameco Corporation By: |

|||||

| /s/ Gary M.S. Chad

|

||||||

| Senior Vice-President, Governance, | ||||||

| Law and Corporate Secretary | ||||||

When

|

Where | |

Tuesday, May 17, 2011

|

Cameco Corporation | |

1:30 p.m.

|

2121 — 11th Street West | |

| Saskatoon, Saskatchewan |

| Notice of annual

meeting of shareholders to be held May 17, 2011 ON THE DOUBLE KEEPING PACE WITH GLOBAL URANIUM DEMAND [CAMECO LOGO] MANAGEMENT PROXY CIRCULAR April 5, 2011 |

What’s inside |

||||

Notice of our annual meeting of shareholders |

1 | |||

Management proxy circular |

2 | |||

About our shareholder meeting |

3 | |||

What the meeting will cover |

3 | |||

Who can vote |

4 | |||

How to vote |

6 | |||

About the nominated directors |

8 | |||

About the auditors |

21 | |||

Amendments to our bylaws |

22 | |||

Having a say on our approach to

executive compensation |

23 | |||

Governance at Cameco |

24 | |||

Compensating our

directors and executives |

45 | |||

Shareholder proposals |

91 | |||

Other information |

91 | |||

Appendixes |

92 | |||

A Interpretation |

92 | |||

B Board mandate |

93 | |||

When

|

Where | |

Tuesday, May 17, 2011

|

Cameco Corporation | |

1:30 p.m.

|

2121 — 11th Street West | |

| Saskatoon, Saskatchewan |

| • | suspending voting rights | |

| • | forfeiting dividends | |

| • | prohibiting the issue and transfer of Cameco shares | |

| • | requiring the sale or disposition of Cameco shares | |

| • | suspending all other shareholder rights. |

| • | assuming substantially all of the current liabilities and certain other liabilities of the two companies | |

| • | issuing common shares | |

| • | issuing one class B share | |

| • | issuing promissory notes. |

Phone:

|

1.877.304.0211 | |||

| (toll free within North America) | ||||

| 1.416.304.0211 | ||||

| (collect from outside North America) | ||||

| 1.416.304.0211 | ||||

| (institutional investors or brokers) | ||||

| • | amend Part 1 of Schedule B of the articles, which states that: |

| • | Cameco’s registered office and head office operations must be in Saskatchewan | ||

| • | the vice-chairman of the board, chief executive officer (CEO), president, chief financial officer (CFO) and generally all of the senior officers (vice-presidents and above) must live in Saskatchewan | ||

| • | all annual meetings of shareholders must be held in Saskatchewan |

| • | amalgamate, if it would require an amendment to Part 1 of Schedule B of the articles, or | |

| • | amend the articles, in a way that would change the rights of class B shareholders. |

| • | for electing the nominated directors who are listed in the form and management proxy circular | |

| • | for appointing KPMG LLP as auditors | |

| • | for confirming the amendments to our bylaws | |

| • | for the advisory resolution on our approach to executive compensation. |

| 1. | by fax | |

| 2. | by mail | |

| 3. | on the internet | |

| 4. | by appointing someone else to attend the meeting and vote your shares for you |

CIBC Mellon Trust Company

|

1.866.781.3111 (toll free within North America) | |

Attention: Proxy department

|

1.416.368.2502 (from outside North America) |

| • | before 1:30 p.m. CST on Friday, May 13, 2011, if you are submitting your voting instructions online | |

| • | before 1:30 p.m. CST on Monday, May 16, 2011, if you are sending the proxy form by fax or mail. |

| • | send a notice in writing to the corporate secretary at Cameco, at 2121 — 11th Street West, Saskatoon, Saskatchewan S7M 1J3, so he receives it by 1:30 p.m. CST on May 16, 2011. If the meeting is postponed or adjourned, the corporate secretary will need to receive the notice by 1:30 p.m. CST at least one business day before the meeting is reconvened. | |

| • | give a notice in writing to the chair of the meeting, at the meeting. |

| • | it is clear that a shareholder wants to communicate with management | |

| • | the law requires it. |

| • | the overall mix of skills and experience on the board | |

| • | how active they are in understanding our business and participating in meetings | |

| • | their character, integrity, judgment and record of achievement | |

| • | diversity (including gender, aboriginal heritage, age and geographic representation such as Canada, the US, Europe and Asia). |

Director profiles |

9 | |||

Meeting attendance |

17 | |||

Skills and experience |

18 | |||

Continuing education

and development |

19 |

| • | Finance | |

| • | Electricity industry | |

| • | International | |

| • | Mergers and acquisitions | |

| • | Nuclear industry |

| Overall attendance – n/a | ||||||||||||

| In person | Telephone | |||||||||||

| Cameco board and board committees | meetings | meetings | Other public company boards | |||||||||

n/a |

Morphosys AG, Munich | |||||||||||

| Valeo, SA, Paris | ||||||||||||

| Vivendi SA, Paris | ||||||||||||

| SGL Carbon AG, Wiesbaden | ||||||||||||

| • | Finance |

| Overall attendance – 100% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public | |||||||||

| membership | Meetings | Meetings | company boards | |||||||||

Board of directors |

6 of 6 | 5 of 5 | Inmet Mining Corporation | |||||||||

Audit (chair) |

5 of 5 | Rogers Communications Inc. | ||||||||||

Human resources and compensation |

3 of 3 | 2 of 2 | Sun Life Financial Inc. | |||||||||

Safety, health and environment |

2 of 2 | |||||||||||

| Total value of | ||||||||||||||||||||

| Total Cameco | Cameco | Meets share | ||||||||||||||||||

| Cameco | shares and | shares and | ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | DSUs | DSUs | target | |||||||||||||||

2010 |

2,000 | 12,368 | 14,368 | $ | 579,016 | Yes – by 138% | ||||||||||||||

2009 |

2,000 | 7,494 | 9,494 | $ | 322,131 | |||||||||||||||

Change |

— | 4,874 | 4,874 | $ | 256,885 | |||||||||||||||

| • | Nuclear industry | |

| • | Operational excellence | |

| • | International |

| Overall attendance – 86% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public | |||||||||

| membership | meetings | Meetings | company boards | |||||||||

Board of directors |

5 of 6 | 4 of 5 | US Ecology, Inc. | |||||||||

Nominating, corporate governance and risk |

4 of 4 | 1 of 1 | ||||||||||

Safety, health and environment (chair) |

4 of 5 | |||||||||||

| Total value of | ||||||||||||||||||||

| Total Cameco | Cameco | |||||||||||||||||||

| Cameco | shares and | shares and | Meets share | |||||||||||||||||

| Fiscal year | shares | DSUs | DSUs | DSUs | ownership target | |||||||||||||||

2010 |

4,000 | 82,281 | 86,281 | $ | 3,477,137 | Yes – by 828% | ||||||||||||||

2009 |

4,000 | 81,502 | 85,502 | $ | 2,901,083 | |||||||||||||||

Change |

— | 779 | 779 | $ | 576,054 | |||||||||||||||

| • | Nuclear industry | |

| • | Government relations | |

| • | Executive compensation |

| Overall attendance – 100% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public | |||||||||

| membership | meetings | Meetings | company boards | |||||||||

Board of directors |

6 of 6 | 5 of 5 | Constellation Energy Group | |||||||||

Human resources and compensation (chair) |

5 of 5 | 3 of 3 | ||||||||||

Nominating, corporate governance and risk |

4 of 4 | 1 of 1 | ||||||||||

| Total Cameco | Total value of | |||||||||||||||||||

| Cameco | shares and | Cameco shares | Meets share ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | DSUs | and DSUs | target | |||||||||||||||

2010 |

7,185 | 93,001 | 100,186 | $ | 4,037,483 | Yes – by 961% | ||||||||||||||

2009 |

5,700 | 92,120 | 97,820 | $ | 3,319,033 | |||||||||||||||

Change |

1,485 | 881 | 2,366 | $ | 718,450 | |||||||||||||||

| Date | Total | Value of in-the-money | ||||||||||||||

| granted | Expiry date | Exercise price | unexercised | options | ||||||||||||

March 10/03 |

March 9/11 | 5.880 | 12,000 | |||||||||||||

Sept 21/04 |

Sept 20/14 | 15.792 | 3,300 | $ | 493,916 | |||||||||||

| • | Aboriginal affairs |

| Overall attendance – 100% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

Board of directors |

6 of 6 | 5 of 5 | none | |||||||||

Reserves oversight |

2 of 2 | 1 of 1 | ||||||||||

Safety, health and environment |

5 of 5 | |||||||||||

| Total Cameco | Total value of | |||||||||||||||||||

| Cameco | shares and | Cameco shares | Meets share ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | DSUs | and DSUs | target | |||||||||||||||

2010 |

0 | 5,257 | 5,257 | $ | 211,844 | No – has met 50% of target. | ||||||||||||||

2009 |

0 | 1,739 | 1,739 | $ | 59,004 | Has until May 27, 2016 | ||||||||||||||

Change |

— | 3,518 | 3,518 | $ | 152,840 | to acquire additional shares and DSUs equal to $420,000 |

||||||||||||||

| • | Nuclear industry | |

| • | Mining | |

| • | Operational excellence | |

| • | International |

| Overall attendance – n/a | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

n/a |

none | |||||||||||

| Total value of | ||||||||||||||||||||

| Total Cameco | Cameco | |||||||||||||||||||

| shares and | shares and | |||||||||||||||||||

| Cameco | Qualifying | qualifying | qualifying | Meets share ownership | ||||||||||||||||

| Fiscal year | shares | PSUs | PSUs | PSUs | target | |||||||||||||||

2010 |

3,100 | 3,100 | 6,200 | $ | 249,860 | No – has met 12% of executive target for president. Has until December 31, 2015 to reach the target for president. |

||||||||||||||

| • | CEO experience | |

| • | Mining | |

| • | Exploration | |

| • | Operational excellence | |

| • | International |

| Overall attendance – 100% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public | |||||||||

| membership | meetings | meetings | company boards | |||||||||

Board of directors |

6 of 6 | 5 of 5 | PhosCan Chemical Corp. | |||||||||

Nominating, corporate governance and risk |

4 of 4 | 1 of 1 | ||||||||||

Reserves oversight |

2 of 2 | 1 of 1 | ||||||||||

Safety, health and environment |

5 of 5 | |||||||||||

| Total Cameco | Total value of | |||||||||||||||||||

| Cameco | shares and | Cameco shares | Meets share ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | DSUs | and DSUs | target | |||||||||||||||

2010 |

1,000 | 5,911 | 6,911 | $ | 278,523 | No – has met 66% of target. | ||||||||||||||

2009 |

1,000 | 3,179 | 4,179 | $ | 141,793 | Has until May 27, 2016 to | ||||||||||||||

Change |

— | 2,732 | 2,732 | $ | 136,730 | acquire additional shares and DSUs equal to $420,000 |

||||||||||||||

| • | CEO experience | |

| • | Nuclear industry | |

| • | Mining | |

| • | Operational excellence | |

| • | International | |

| • | Government relations |

| Overall attendance – 100% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

Board of directors |

6 of 6 | 5 of 5 | Sandspring Resources Limited | |||||||||

Not a member of any committee because he is CEO |

||||||||||||

| Total Cameco | Total value of | |||||||||||||||||||

| shares and | Cameco shares | |||||||||||||||||||

| Cameco | Qualifying | qualifying | and qualifying | Meets share | ||||||||||||||||

| Fiscal year | shares | PSUs | PSUs | PSUs | ownership target | |||||||||||||||

2010 |

674,666 | 45,200 | 719,866 | $ | 29,010,600 | Yes – meets executive |

||||||||||||||

2009 |

314,666 | 314,666 | $ | 10,676,617 | target for CEO by 711% | |||||||||||||||

Change |

360,000 | 405,200 | $ | 18,333,983 | ||||||||||||||||

| • | Legal | |

| • | Board governance |

| Overall attendance – 90% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

Board of directors |

5 of 6 | 5 of 5 | Growthworks Canadian | |||||||||

Audit |

4 of 5 | Fund Ltd. | ||||||||||

Nominating, corporate governance and risk (chair) |

4 of 4 | 1 of 1 | Growthworks Commercialization Fund Ltd. | |||||||||

| Total Cameco | Total value of | |||||||||||||||||||

| Cameco | shares and | Cameco shares | Meets share ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | DSUs | and DSUs | target | |||||||||||||||

2010 |

20,500 | 15,130 | 35,630 | $ | 1,435,903 | Yes – by 342% | ||||||||||||||

2009 |

11,500 | 13,443 | 24,943 | $ | 846,316 | |||||||||||||||

Change |

9,000 | 1,687 | 10,687 | $ | 589,587 | |||||||||||||||

| Total | Value of in-the-money | |||||||||||||||

| Date granted | Expiry date | Exercise price | Unexercised | options | ||||||||||||

Mar 10/03 |

Mar 9/11 | $ | 5.880 | 27,000 | $ | 929,340 | ||||||||||

| • | CEO experience | |

| • | Mining | |

| • | Operational excellence | |

| • | International |

| Overall attendance – 100% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

Board of directors |

6 of 6 | 5 of 5 | Inmet Mining Corporation | |||||||||

Audit |

5 of 5 | Nyrstar NV | ||||||||||

Human resources and compensation |

5 of 5 | 3 of 3 | ||||||||||

Reserves oversight |

2 of 2 | 1 of 1 | ||||||||||

| Total Cameco | Total value of | |||||||||||||||||||

| Cameco | shares and | Cameco shares | Meets share | |||||||||||||||||

| Fiscal year | shares | DSUs | DSUs | and DSUs | ownership target | |||||||||||||||

2010 |

0 | 26,566 | 26,566 | $ | 1,070,625 | Yes – by 255% | ||||||||||||||

2009 |

0 | 22,825 | 22,825 | $ | 774,452 | |||||||||||||||

Change |

— | 3,741 | 3,741 | $ | 296,173 | |||||||||||||||

| • | Government relations | |

| • | Corporate social responsibility |

| Overall attendance – 97% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

Board of directors |

6 of 6 | 5 of 5 | Agrium Inc. | |||||||||

Human resources and compensation |

5 of 5 | 2 of 3 | Nexen Inc. | |||||||||

Nominating, corporate governance and risk |

4 of 4 | 1 of 1 | ||||||||||

Safety, health and environment |

5 of 5 | |||||||||||

| Total value of | Meets share | |||||||||||||||||||

| Cameco | Total Cameco | Cameco shares | ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | shares and DSUs | and DSUs | target | |||||||||||||||

2010 |

100 | 16,161 | 16,261 | $ | 655,318 | Yes – by 156% | ||||||||||||||

2009 |

100 | 13,331 | 13,431 | $ | 455,714 | |||||||||||||||

Change |

— | 2,830 | 2,830 | $ | 199,604 | |||||||||||||||

| • | CEO experience | |

| • | Mining | |

| • | Government relations |

| Overall attendance* – 68% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

Board of directors |

5* of 6 | 3* of 5 | Claude Resources Inc. | |||||||||

Audit |

3* of 5 | Shore Gold Inc. | ||||||||||

Reserves oversight (chair) |

1* of 2 | 1 of 1 | ||||||||||

| * | Mr. McMillan’s overall attendance was 100% in 2009, 97% in 2008 and 94% in 2007. He was unable to attend one set of meetings (consisting of three meetings) because of an important family commitment. Mr. McMillan is an effective director with much to contribute, and is committed to improving his attendance going forward. |

| Total value of | ||||||||||||||||||||

| Cameco | Total Cameco | Cameco shares | Meets share ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | shares and DSUs | and DSUs | target | |||||||||||||||

2010 |

600 | 21,561 | 22,161 | $ | 893,085 | Yes – by 213% | ||||||||||||||

2009 |

600 | 18,680 | 19,280 | $ | 654,170 | |||||||||||||||

Change |

— | 2,881 | 2,881 | $ | 238,915 | |||||||||||||||

| • | CEO experience | |

| • | Finance | |

| • | International | |

| • | Mergers and acquisitions | |

| • | Board governance |

| Overall attendance* – 100% | ||||||||||||

| Cameco board and committee | In person | Telephone | Other public company | |||||||||

| membership | meetings | meetings | boards | |||||||||

Board of directors (chair) |

6 of 6 | 5 of 5 | Agrium Inc. | |||||||||

Reserves oversight |

2 of 2 | 1 of 1 | Nexen Inc. | |||||||||

| * | As board chair, Mr. Zaleschuk also attended 22 board committee meetings in an ex-officio capacity. |

| Total value of | ||||||||||||||||||||

| Cameco | Total Cameco | Cameco shares | Meets share ownership | |||||||||||||||||

| Fiscal year | shares | DSUs | shares and DSUs | and DSUs | target | |||||||||||||||

2010 |

28,615 | 50,087 | 78,702 | $ | 3,171,691 | Yes – by 311% | ||||||||||||||

2009 |

10,615 | 43,605 | 54,220 | $ | 1,839,685 | |||||||||||||||

Change |

18,000 | 6,482 | 24,482 | $ | 1,332,006 | |||||||||||||||

| • | Each director has provided the information about the Cameco shares they own or exercise control or direction over. | |

| • | DSUs refer to deferred share units under our DSU plan for directors. Directors who are Cameco executives do not receive DSUs. | |

| • | We calculated the total value of Cameco shares and DSUs using $40.30 for 2010 and $33.93 for 2009, the year-end closing prices of Cameco shares on the Toronto Stock Exchange (TSX). | |

| • | Options held refer to options under our stock option plan that have not been exercised. The board stopped granting options to directors on October 28, 2003. In 2004, Mr. Curtiss exercised reload options to receive additional options with a 10-year term. We stopped awarding reload options in 1999. | |

| • | The exercise prices and number of options have been adjusted to reflect stock splits of Cameco shares. | |

| • | The value of in-the-money options is calculated as the difference between $40.30 (the 2010 year-end closing price of Cameco shares on the TSX) and the exercise price of the options, multiplied by the number of options held at December 31, 2010. | |

| • | Qualifying PSUs refer to performance share units (PSUs) that qualify under the executive share ownership guidelines. Their value assumes the PSUs payout at 80% of target, less tax at 50%, and a share price of $40.30, the closing price of our common shares on the TSX on December 31, 2010, and that the PSUs make up no more than 50% of the executive’s holdings. |

| Human | Nominating, | Safety, | ||||||||||||||||||||||||||||||||||||||||||||||||||

| resources and | corporate | Reserves | health and | |||||||||||||||||||||||||||||||||||||||||||||||||

| Audit | compensation | governance and | oversight | environment | ||||||||||||||||||||||||||||||||||||||||||||||||

| Name | Independent | Board | committee | committee | risk committee | committee | committee | |||||||||||||||||||||||||||||||||||||||||||||

J. Clappison |

yes | 11 of 11 | 100 | % | 5 of 5 | 100 | % | 5 of 5 | 100 | % | 2 of 2 | 100 | % | |||||||||||||||||||||||||||||||||||||||

J. Colvin1 |

yes | 9 of 11 | 82 | % | 5 of 5 | 100 | % | 4 of 5 | 80 | % | ||||||||||||||||||||||||||||||||||||||||||

J. Curtiss |

yes | 11 of 11 | 100 | % | 8 of 8 | 100 | % | 5 of 5 | 100 | % | ||||||||||||||||||||||||||||||||||||||||||

G. Dembroski2 |

yes | 6 of 6 | 100 | % | 2 of 2 | 100 | % | 5 of 5 | 100 | % | 2 of 2 | 100 | % | |||||||||||||||||||||||||||||||||||||||

D. Deranger |

no | 11 of 11 | 100 | % | 3 of 3 | 100 | % | 5 of 5 | 100 | % | ||||||||||||||||||||||||||||||||||||||||||

J. Gowans |

yes | 11 of 11 | 100 | % | 5 of 5 | 100 | % | 3 of 3 | 100 | % | 5 of 5 | 100 | % | |||||||||||||||||||||||||||||||||||||||

G. Grandey3 |

no | 11 of 11 | 100 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

N. Hopkins |

yes | 10 of 11 | 91 | % | 4 of 5 | 80 | % | 5 of 5 | 100 | % | ||||||||||||||||||||||||||||||||||||||||||

O. Hushovd |

yes | 11 of 11 | 100 | % | 5 of 5 | 100 | % | 8 of 8 | 100 | % | 3 of 3 | 100 | % | |||||||||||||||||||||||||||||||||||||||

G. Ivany |

yes | 11 of 11 | 100 | % | 5 of 5 | 100 | % | 8 of 8 | 100 | % | 5 of 5 | 100 | % | |||||||||||||||||||||||||||||||||||||||

A. McLellan |

yes | 11 of 11 | 100 | % | 7 of 8 | 88 | % | 5 of 5 | 100 | % | 5 of 5 | 100 | % | |||||||||||||||||||||||||||||||||||||||

N. McMillan4 |

yes | 8 of 11 | 73 | % | 3 of 5 | 60 | % | 2 of 3 | 67 | % | ||||||||||||||||||||||||||||||||||||||||||

R. Peterson2 |

yes | 6 of 6 | 100 | % | 2 of 2 | 100 | % | 5 of 5 | 100 | % | 2 of 2 | 100 | % | |||||||||||||||||||||||||||||||||||||||

V. Zaleschuk5 |

yes | 11 of 11 | 100 | % | 4 of 5 | 80 | % | 8 of 8 | 100 | % | 5 of 5 | 100 | % | 3 of 3 | 100 | % | 5 of 5 | 100 | % | |||||||||||||||||||||||||||||||||

83% of the current board are independent |

Total # of meetings |

11 | 5 | 8 | 5 | 3 | 5 | |||||||||||||||||||||||||||||||||||||||||||||

| Notes: | ||

| 1. | Mr. Colvin was unable to attend a board meeting and a committee meeting due to illness. | |

| 2. | Mr. Dembroski and Mr. Peterson resigned from the board on May 26, 2010, and did not stand for re-election because they were over 72, our retirement age for directors. | |

| 3. | Mr. Grandey, as CEO of Cameco, is not a member of any board committees so they can operate independently of management. | |

| 4. | Mr. McMillan’s attendance was 100% in 2009, 97% in 2008 and 94% in 2007. He was unable to attend one set of meetings (consisting of three meetings) because of an important family commitment. He is committed to improving his attendance going forward. | |

| 5. | Mr. Zaleschuk attended 22 committee meetings in an ex-officio capacity, as chair of the board. | |

| Strong working | Basic level of | |||||||||||

| Self-assessment of skills and experience | Expert | knowledge | knowledge | |||||||||

Board experience |

||||||||||||

Prior or current experience as a board member

for a major organization with a current

governance mindset, including a focus on

Corporate Social Responsibility |

6 | 6 | 0 | |||||||||

Business judgment |

||||||||||||

Track record of leveraging own experience and

wisdom in making sound strategic

and operational business decisions;

demonstrates business acumen and a mindset

for risk oversight |

6 | 6 | 0 | |||||||||

Financial expertise |

||||||||||||

Experience as a professional accountant, CFO

or CEO in financial accounting and reporting

and corporate finance |

2 | 6 | 4 | |||||||||

Government relations |

||||||||||||

Experience in, or a thorough understanding

of, the workings of government and public

policy both domestically and internationally |

5 | 5 | 2 | |||||||||

Human capital |

||||||||||||

Experience in executive compensation and the

oversight of significant, sustained

succession planning and talent development

and retention programs. |

7 | 3 | 2 | |||||||||

Industry knowledge |

||||||||||||

Knowledge of the uranium/nuclear industries,

market and business imperatives,

international regulatory environment and

stakeholder management |

3 | 5 | 4 | |||||||||

International |

||||||||||||

Experience working in a major organization

that carries on business in one or more

international jurisdictions, preferably in

countries or regions where we have or are

developing operations |

5 | 4 | 3 | |||||||||

Investment banking/mergers and acquisitions |

||||||||||||

Experience in the field of investment banking

or in mergers and acquisitions |

1 | 5 | 5 | |||||||||

Managing/leading growth |

||||||||||||

Experience driving strategic direction and

leading growth of an organization, preferably

including the management of multiple

significant projects |

6 | 5 | 1 | |||||||||

Mining, exploration and operations |

||||||||||||

Experience with a leading mining or resource

company with reserves, exploration and

operations expertise |

4 | 3 | 5 | |||||||||

Operational excellence |

||||||||||||

Experience in a complex chemical or nuclear

operating environment creating and

maintaining a culture focused on safety, the

environment and operational excellence |

4 | 2 | 5 | |||||||||

| • | at least one aboriginal director from Saskatchewan because many of our operations are based in the province | |

| • | two directors who are US residents | |

| • | one or two directors from Europe and/or Asia | |

| • | at least two or three female directors | |

| • | directors of various ages. |

| 2010 | Topic | Presented/hosted by | Attended by | |||||

February 5

|

Mergers & Acquisitions | Institute of Corporate Directors (ICD) | Anne McLellan | |||||

February 22

|

Cameco’s Competitors | David Doerksen Vice-President, Corporate Development & Power Generation Ken Seitz Vice-President, Marketing Strategy & Administration |

John Clappison Joe Colvin James Curtiss Donald Deranger James Gowans Gerald Grandey |

Oyvind Hushovd George Ivany Anne McLellan Neil McMillan |

||||

March 8

|

Pension Policy Conference | University of Saskatchewan and the Johnson Shoyama Graduate School of Public Policy | Nancy Hopkins | |||||

April 20

|

Beyond Compliance — Governance in Times of Transition | Deloitte & Touche | Nancy Hopkins | |||||

April 23

|

Directors and Fraud | Deloitte & Touche | John Clappison | |||||

June 1

|

Directors College Oversight and Finance Module for Crown Investments Corporation | Presenter on Measurement, Reporting and Continuous Disclosure | Nancy Hopkins | |||||

June 6-8

|

World Nuclear Fuel Market 37th Annual Meeting & Conference |

World Nuclear Fuel Market | John Clappison James Curtiss George Ivany |

|||||

June 7-8

|

Annual Conference | International Corporate Governance Network (ICGN) |

Nancy Hopkins | |||||

June 10

|

Audit Committee Network Meeting — Relationship of the Audit Committee Chair with the CEO, CFO and the Finance Group | Ernst & Young | John Clappison | |||||

June 11

|

Overseeing Tax Risk and Reporting Under IFRS | KPMG Audit Committee Institute |

John Clappison | |||||

| 2010 | Topic | Presented/hosted by | Attended by | |||||

June 16

|

Implementation of ISO 31000 Risk Management Standards: What Directors Need to Know | Webcast by Grant Thornton, the Institute of Corporate Directors and the Canadian Standards Association | Nancy Hopkins | |||||

August 10-11

|

The Impact of Governance on the Nuclear Power Industry | Emory Goizueta Directors Institute and Institute of Nuclear Power Operations |

James Curtiss | |||||

August 11

|

Uranium Exploration at Cameco | Colin Macdonald Vice-President, Exploration |

John Clappison Joe Colvin James Curtiss Donald Deranger James Gowans Gerald Grandey |

Nancy Hopkins Oyvind Hushovd George Ivany Anne McLellan Neil McMillan Victor Zaleschuk |

||||

August 28

|

Presentation and Tour of Cigar Lake Site in Northern Saskatchewan | Grant Goddard Vice-President, Mining North |

John Clappison James Curtiss Donald Deranger James Gowans Gerald Grandey |

Nancy Hopkins Oyvind Hushovd Neil McMillan Victor Zaleschuk |

||||

September 14-15

|

World Energy Congress | The World Energy Council | Gerald Grandey | |||||

September 27

|

Presentation and Tour of Cameco’s Conversion and Fuel Manufacturing Facilities in Port Hope, Ontario | Vice-President, Fuel Services and General Managers of Cameco’s Facilities in Ontario |

Donald Deranger James Gowans Gerald Grandey |

George Ivany Anne McLellan Victor Zaleschuk |

||||

October 6

|

Audit Committee Peer Exchange | NYSE and Corporate Board Member | John Clappison | |||||

October 6

|

Compensation Committee Peer Exchange | NYSE and Corporate Board Member | James Curtiss | |||||

October 7-8

|

Annual Boardroom Summit | NYSE and Corporate Board Member | John Clappison Joe Colvin James Curtiss Donald Deranger James Gowans |

Nancy Hopkins George Ivany Anne McLellan Victor Zaleschuk |

||||

October 12

|

Canadian Audit Committee Network Meeting — Audit Committee Oversight of Fraud and Other Malfeasance and IFRS Update | Tapestry Networks | John Clappison | |||||

November 4

|

New Build in the Developing World | Ux Consulting | John Clappison Joe Colvin James Curtiss Donald Deranger James Gowans Gerald Grandey |

Nancy Hopkins Oyvind Hushovd George Ivany Anne McLellan Neil McMillan Victor Zaleschuk |

||||

November 7-9

|

Directors Financial Literacy Program | Rotman School of Management | Donald Deranger | |||||

November 9-10

|

2010 CEO Conference: Nuclear Safety — Demanding Excellence | Institute of Nuclear Power Operations (INPO) | Gerald Grandey Timothy Gitzel |

|||||

November 10

|

The Role of the Board — Adding Value, Distinct from Management | The Saskatchewan Chapter of the Institute of Corporate Directors | Nancy Hopkins | |||||

November 30

|

Executive Compensation for 2011, New Challenges and Opportunities | Hugessen Consulting | Anne McLellan | |||||

December 1

|

Corporate Social Responsibility at Cameco |

Gary Merasty Vice-President, Corporate Social Responsibility |

John Clappison Joe Colvin James Curtiss Donald Deranger James Gowans Gerald Grandey |

Nancy Hopkins Oyvind Hushovd George Ivany Anne McLellan Victor Zaleschuk |

||||

December 6

|

US Energy Policy | J. Robinson West President and CEO PFC Energy |

Anne McLellan Victor Zaleschuk |

|||||

| • | audit services — generally relate to reviewing annual and interim financial statements and notes, conducting the annual audit and providing other services that may be required by regulators. These may also include services for registration statements, prospectuses, reports and other documents that are filed with securities regulators, or other documents issued for securities offerings. | |

| • | audit-related services — include consulting on accounting matters, attest services not directly linked to the financial statements that are required by regulators, conducting audits of employee benefit plans and audits of affiliates, as well as reviewing and testing our internal controls over financial reporting. | |

| • | tax services — relate to tax compliance, tax advice and tax planning that are beyond the scope of the annual audit. These may include transfer-pricing surveys for the tax authorities, preparing corporate and personal tax returns, and advice and consulting on international tax matters, tax implications of capital market transactions and capital tax. | |

| • | other services — include other professional services that KPMG and/or its affiliates provide us and our subsidiaries or joint ventures from time to time. |

| % of total | % of total | ||||||||||||||||

| 2010 | fees | 2009 | fees | ||||||||||||||

| ($) | (%) | ($) | (%) | ||||||||||||||

Audit fees |

|||||||||||||||||

Cameco |

1,697,700 | 62.6 | 1,739,900 | 48.7 | |||||||||||||

Centerra and other subsidiaries |

256,200 | 9.5 | 978,600 | 1 | 27.4 | ||||||||||||

Total audit fees |

1,953,900 | 72.1 | 2,718,500 | 76.1 | |||||||||||||

Audit-related fees |

|||||||||||||||||

Cameco |

273,400 | 10.1 | 219,800 | 6.1 | |||||||||||||

Centerra and other subsidiaries1 |

— | — | 32,300 | 0.9 | |||||||||||||

Translation services |

44,500 | 1.6 | 424,000 | 11.9 | |||||||||||||

Pensions |

20,000 | 0.7 | 17,000 | 0.5 | |||||||||||||

Total audit-related fees |

337,900 | 12.5 | 693,100 | 19.4 | |||||||||||||

Tax fees |

|||||||||||||||||

Compliance |

199,200 | 7.3 | 40,000 | 1.1 | |||||||||||||

Planning and advice |

219,500 | 8.1 | 122,400 | 3.4 | |||||||||||||

Total tax fees |

418,700 | 15.4 | 162,400 | 4.5 | |||||||||||||

All other fees |

— | — | — | — | |||||||||||||

Total fees |

2,710,500 | 100.0 | 3,574,000 | 100.0 | |||||||||||||

| 1. | The 2009 fees include amounts related to Centerra Gold Inc. (Centerra). We disposed of our entire interest in Centerra in December 2009. |

| 1. | deleting the first sentence of Section 5.2 and replacing it with the following: |

| 2. | deleting the first sentence of Section 7.7 and replacing it with the following: |

Our governance principles and guidelines |

25 | |||

Code of conduct and ethics |

25 | |||

Disclosure policy |

25 | |||

Shareholder engagement |

26 | |||

Communicating with the board |

26 | |||

Standards and practices |

27 | |||

Maintaining separate chair and CEO positions |

27 | |||

About our board |

28 | |||

Independence |

28 | |||

Our expectations for directors |

29 | |||

The role of the board |

30 | |||

Assessing the board and director performance |

33 | |||

Board committees |

35 | |||

Compensating our directors and executives |

45 | |||

Director compensation |

46 | |||

Executive compensation |

52 |

| • | financial reporting and accountability | |

| • | confidentiality | |

| • | conflicts of interest | |

| • | complying with the laws, rules and regulations that apply to us (including safety, health, environmental, import, export, securities disclosure and insider trading laws) | |

| • | corporate opportunities | |

| • | identifying and preventing fraud | |

| • | reporting illegal or unethical behaviour | |

| • | reporting violations or breaches of the code |

| • | employees and directors must report any actual, potential or perceived conflicts of interest to the corporate secretary. The secretary brings all reports involving an employee to the attention of management’s conflicts review committee, and to the nominating, corporate governance and risk committee if it involves a director. | |

| • | directors must excuse themselves from any discussions or decisions where their business or personal interests would create a conflict of interest. |

| • | reviewing all news releases and public filings containing material information prior to their release | |

| • | evaluating the design and effectiveness of our disclosure controls and procedures to make sure they continue to provide reasonable assurance that information is gathered promptly and accurately, so we can make decisions about appropriate public disclosure that complies with legal requirements | |

| • | recommending any appropriate changes to our disclosure controls and procedures to the audit committee for approval. |

| • | prospectuses | |

| • | annual information forms | |

| • | management proxy circulars | |

| • | US Form 40-F filings | |

| • | other disclosure documents that must be approved by the directors according to securities laws, securities regulations or stock exchange rules. |

phone:

|

306.956.6309 | |

fax:

|

306.956.6318 | |

e-mail:

|

complete the e-mail form under the Contact section of our website. |

Send the sealed envelope to: |

|||||||

| Cameco Corporation | Please mark it: | ||||||

| 2121-11th Street West | Private and strictly confidential | ||||||

| Saskatoon, SK S7M 1J3 | Attention — Chair of the board of directors | ||||||

| If you want to contact the chair of either the audit committee or the human resources and compensation committee, send your sealed envelope to the same address. | Please mark it: Private and strictly confidential |

||||||

| Attention — Chair of the audit committee, or | |||||||

Chair of the human resources and |

|||||||

compensation committee |

|||||||

| • | the majority of our board is independent under the NYSE standards | |

| • | non-management directors meet separately from management at regularly scheduled meetings | |

| • | the audit committee has a written mandate and its committee members are independent under the SEC and NYSE requirements | |

| • | the audit committee conducts an annual self-assessment survey | |

| • | our internal audit department provides management and the audit committee with ongoing assessments of our internal controls | |

| • | the human resources and compensation committee has a written mandate and its members are independent under the NYSE standards | |

| • | the nominating, corporate governance and risk committee has a written mandate and its members are independent under the NYSE standards | |

| • | our enterprise risk management group provides the nominating, corporate governance and risk committee with ongoing reports of our corporate risk management system and other relevant committees with reports on our enterprise risks | |

| • | our code of conduct and ethics applies to directors, officers and employees. |

| • | if the plan does not provide for the issue of a fixed maximum number of securities, shareholders must approve the plan every three years | |

| • | if the plan has an amendment procedure, shareholders must approve an amendment only when it involves: |

| • | reducing the exercise price or extending the term of options held by insiders | ||

| • | removing an insider participation limit or when it results in an insider participation limit being exceeded | ||

| • | increasing the fixed maximum number of securities to be issued under the plan | ||

| • | changing the amendment procedure or when the plan requires the amendment to receive shareholder approval. |

| • | maintaining a governance framework that sets broad areas of responsibility and includes appropriate checks and balances for effective decision-making and approvals | |

| • | making decisions that set the tone, character and strategic direction for Cameco and approving the vision, mission and value statements developed by management | |

| • | regularly monitoring management’s effectiveness, including its leadership, recommendations, decisions and execution of strategies to ensure that the CEO and senior management carry out their responsibilities. |

| • | leading, managing and organizing the board consistent with our approach to corporate governance | |

| • | presiding as the chair at all board meetings and meetings of our shareholders | |

| • | implementing procedures so the board can carry out its work effectively, efficiently and independently of management. This includes scheduling, calling and chairing board meetings. | |

| • | acting as the liaison between the board and senior management, and as an advisor and sounding board to the CEO |

| • | ensuring that the board has timely and relevant information and access to other resources to adequately support its work. |

| • | comply with our code of conduct and ethics, including conflict of interest disclosure requirements. See Our governance principles and guidelines on page 25 for more information about the code. | |

| • | develop an understanding of our strategy, business environment and operations, the markets we operate in and our financial position and performance. See Measuring performance starting on page 63 for a discussion of our corporate performance. | |

| • | diligently prepare for each board and committee meeting by reviewing all of the meeting materials | |

| • | actively and constructively participate in each meeting, and seek clarification from management and outside advisors when necessary to fully understand the issues | |

| • | participate in continuing education programs, as appropriate | |

| • | participate in the board, committee and director self-assessment process. |

| • | information on our corporate and organizational structure | |

| • | background information on the company and the uranium and nuclear industries | |

| • | recent regulatory filings | |

| • | financial information | |

| • | governance documents | |

| • | important policies. |

| • | receiving management presentations at board and committee meetings | |

| • | visiting facilities we operate, or other nuclear facilities | |

| • | attending external conferences and seminars. |

| • | when they are making key business decisions | |

| • | during strategic planning meetings | |

| • | on topical issues from time to time | |

| • | in response to requests from directors. |

| • | selecting, evaluating and, if necessary, terminating the CEO | |

| • | assessing the integrity of the executive officers and ensuring there is a culture of integrity throughout Cameco | |

| • | succession planning and monitoring the performance and compensation of senior management | |

| • | adopting an annual strategic planning process that includes approving the strategic plans and monitoring our performance against those plans | |

| • | approving policies and procedures for identifying our principal risks and overseeing the risk management systems to mitigate those risks | |

| • | overseeing the integrity of our internal control and management information systems |

| • | making decisions about material corporate matters, including those that require director approval by law or regulations. |

| • | operating expenditures that exceed the total operating budget by more than 10% | |

| • | unbudgeted project expenditures over $10 million per transaction, or over $50 million in total per year | |

| • | cost overruns on budgeted project expenditures that are more than $15 million per transaction, or over $50 million in total per year | |

| • | any acquisition or disposition of assets over $10 million per transaction, or over $50 million in total per year. |

| • | developing a 10-year strategic plan | |

| • | setting annual corporate objectives | |

| • | establishing annual budgets and two-year financial plans | |

| • | reviewing the strategic plan annually and revising it based on our progress. |

| • | financial | |

| • | human capital | |

| • | infrastructure and security | |

| • | operational | |

| • | social, governance and compliance | |

| • | strategic. |

| Board of directors | Committee areas of responsibility | |

Overall responsibility for risk oversight at Cameco |

Audit committee Monitors financial risks, like hedging |

|

| Human resources and compensation committee Oversees compensation risk, talent management risk and succession risk |

||

| Nominating, corporate governance and risk committee Oversees governance and ensures we have a robust risk management process in place |

||

| Reserves oversight committee Oversees the estimating of our mineral reserves |

||

| Safety, health and environment committee Reviews the policies and systems related to safety, health, environment and related operational risks |

||

| Year 1 | Year 2 | ||||||

| Comprehensive set of surveys | Shorter survey | ||||||

Board survey • completed

by all directors

|

• nominating,

corporate

governance and risk

committee analyses

results and

prepares a summary

report for the

board • corporate

secretary tracks

the resulting

action items

|

Board and committee

survey • completed

by all directors

|

• about the

board, committees,

board chair,

committee chairs

and CEO • chair of

nominating,

corporate

governance and risk

committee reviews

the results and

presents them to

the committee • also

prepares a summary

report for the

board • corporate

secretary tracks

the resulting

action items |

||||

Director

self-evaluation • completed

by all directors

|

• chair of

the nominating,

corporate

governance and risk

committee analyses

results and

discusses them with

individual

directors during

their personal

interviews

|

Director

self-evaluation • completed

by all directors

|

• chair of

the nominating,

corporate

governance and risk

committee analyses

results and

discusses them with

individual

directors during

their personal

interviews |

||||

Board chair

evaluation • completed

by all directors

|

• chair of

the nominating,

corporate

governance and risk

committee reviews

the results and

presents the

results to the

board chair • also

prepares a summary

report for the

committee and the

board

|

Board chair

evaluation • completed

by all directors

|

• chair of

the nominating,

corporate

governance and risk

committee reviews

the results and

presents the

results to the

board chair • also

prepares a summary

report for the

committee and the

board |

||||

Committee surveys • completed

by members of each

committee

|

• each

committee chair

analyses the

results and

prepares a summary

report for the

committee and

reports to the

board • corporate

secretary tracks

the resulting

action items

|

Audit committee

survey • completed

by members of the

audit committee

|

• chair of

the audit committee

analyses the

results and

prepares a summary

report for the

committee and

reports to the

board • corporate

secretary tracks

the resulting

action items |

||||

Surveys of

committee chairs • completed

by members of each

committee

|

• board chair

reviews the results

and discusses the

issues raised with

each committee

chair

|

Survey of the audit

committee chair • completed

by members of the

audit committee

|

• board chair

reviews the results

and discusses the

issues raised with

the audit committee

chair |

||||

| • | audit | |

| • | human resources and compensation | |

| • | nominating, corporate governance and risk | |

| • | reserves oversight | |

| • | safety, health and environment. |

| • | John Clappison (chair, financial expert) | |

| • | Nancy Hopkins | |

| • | Oyvind Hushovd | |

| • | George Ivany | |

| • | Neil McMillan |

| • | the quality and integrity of our financial reporting | |

| • | the quality and integrity and performance of our internal control systems for finance and accounting, our internal audit function and our disclosure controls | |

| • | the annual audit plan, fees, quality, performance and independence of our external auditors | |

| • | our compliance with certain laws and regulations, our code of conduct and ethics and our international business conduct policy. |

| • | annual audited financial statements and MD&A | |

| • | quarterly financial statements and MD&A | |

| • | accounting and financial reporting process. |

| • | our disclosure controls and procedures | |

| • | our internal controls over financial reporting | |

| • | the process for the CEO and CFO to certify that our quarterly and annual securities filings are accurate. |

| • | overseeing compliance with the laws and regulations that apply to us (other than environment and safety compliance, which are the responsibility of the safety, health and environment committee, and human resources and compensation compliance, which are the responsibility of the human resources and compensation committee) | |

| • | monitoring employees’ compliance with the code of conduct and ethics and the international business conduct policy | |

| • | overseeing certain financial risks as delegated by the board. |

| • | reviewed and approved interim financial statements and MD&A, and annual audited financial statements and the annual MD&A | |

| • | carried out an assessment of the internal auditor, and reviewed and confirmed the internal audit department’s mandate, approved the 2010 audit plan and received an update on the five-year audit plan | |

| • | carried out an assessment of the external auditors and their independence, and reviewed and approved their audit plan and audit fees | |

| • | reviewed year-end audit issues | |

| • | received reports on compliance with SOx and ongoing compliance activities | |

| • | reviewed disclosure controls and procedures and management’s assessment of internal controls | |

| • | reviewed related party transactions and political and charitable donations | |

| • | reviewed the CEO’s expenses | |

| • | received updates on the implementation of IFRS and made certain accounting policy decisions regarding the adoption of the new reporting standards | |

| • | reviewed the committee’s mandate and the committee’s self-assessment | |

| • | recommended the appointment of the external auditor | |

| • | received and considered an external report on the strategic review of the function of our internal audit group. |

| • | James Curtiss (chair) |

| • | John Clappison |

| • | Oyvind Hushovd |

| • | George Ivany |

| • | Anne McLellan |

| • | human resource policies | |

| • | executive compensation | |

| • | succession planning | |

| • | our pension plans | |

| • | director compensation. |

| • | consulting with management to develop our general philosophy on compensation | |

| • | reviewing and recommending to the board for approval all compensation policies and programs for our executives (vice-presidents and above) including: |

| • | the corporate goals and objectives relating to the compensation for the CEO, president and senior vice-presidents | ||

| • | evaluating the CEO’s performance against those goals and objectives | ||

| • | the CEO’s compensation based on the committee’s evaluation | ||

| • | the compensation for our president and senior vice-presidents based on the CEO’s evaluations | ||

| • | employment contracts with executive officers |

| • | overseeing the development and implementation of compensation programs, including establishing any incentive and equity-based compensation plans. |

| • | reviewing our executive talent pool and the succession plan twice a year. The audit committee is also responsible for reviewing the succession plan for the CFO and controller and making related recommendations to the human resources and compensation committee. |

| • | ensuring the succession plan is presented to the board each year. |

38 cameco corporation

| • | Gerald W. Grandey’s title was changed from president and CEO, to CEO |

| • | Timothy S. Gitzel was appointed president, after joining Cameco in 2007 as senior vice-president and chief operating officer |

| • | Robert A. Steane, who has been with Cameco or a predecessor company since 1983, was appointed senior vice-president and chief operating officer |

| • | Kenneth A. Seitz, who has been with Cameco since 2004, was promoted to senior vice-president, marketing and business development, replacing George Assie, who retired on December 31. |

| • | making recommendations to the board on plan design and policy after receiving advice from management | |

| • | providing a high level review of the performance of the investment options | |

| • | making recommendations on the investment managers when necessary, after receiving advice from management | |

| • | receiving reports from management’s pension investment committee and the finance, human resources and legal departments from time to time on these matters. |

| • | reviewed the executive compensation market data and the comparator group to ensure that our compensation levels remain competitive |

| • | retained an independent compensation consultant and approved its fees |

| • | reviewed the corporate results |

| • | reviewed the corporate and individual objectives of the CEO, president and senior vice-presidents |

| • | reviewed the CEO’s performance |

| • | reviewed the CEO’s annual performance assessments of the president and senior vice-presidents |

| • | reviewed and recommended changes to base salary and the short and long-term incentive plan awards for the CEO, president and senior vice-presidents |

| • | assessed compensation risk |

| • | reviewed and recommended payouts of the PSUs granted in 2007 |

2011 management proxy circular 39

| • | reviewed the compensation discussion and analysis in the management proxy circular |

| • | reviewed the succession plan for the executive team, including the vice-presidents, and consulted with the audit committee about the succession plan for the CFO and senior finance employees |

| • | recommended the appointments of the president, the senior vice-president and chief operating officer and the senior vice-president, marketing and business development |

| • | received semi-annual reporting on the pension plan |

| • | recommended the board approve a change to the stock option plan |

| • | reviewed governance issues relating to executive compensation |

| • | reviewed the committee’s mandate and report on its self-assessment |

| • | reviewed director compensation |

| • | reviewed the director and executive share ownership guidelines and recommended changes to the board |

| • | reviewed the 2011 corporate goals and objectives and the CEO’s objectives |

| • | had preliminary discussions on 2011 compensation. |

40 cameco corporation

| • | Nancy Hopkins (chair) |

| • | Joe Colvin |

| • | James Curtiss |

| • | James Gowans |

| • | Anne McLellan |

| • | our approach to corporate governance, including establishing corporate governance principles and a code of conduct and ethics |

| • | identifying and recommending qualified individuals as potential members of our board and board committees |

| • | risk management. |

| • | assessing the size and composition of the board | |

| • | assessing the number of board committees and their composition and mandates | |

| • | evaluating our approach to corporate governance | |

| • | recommending the board adopt a code of conduct and ethics for the organization | |

| • | overseeing directors’ compliance with our code of conduct and ethics. |

| • | developing and implementing an evaluation process |

| • | maintaining a skills matrix for the board and identifying additional skills we should recruit when we are making changes to the board |

| • | maintaining a succession plan for the board that meets our corporate needs and the interests of shareholders. |

2011 management proxy circular 41

| • | overseeing our program and procedures to identify significant risks and the systems to mitigate risk |

| • | receiving regular reports from management on our significant risks or exposures, and the steps taken to monitor and manage these risks |

| • | recommending risk management policies to the board as appropriate |

| • | reviewing management’s reports on our insurance program and the directors’ and officers’ liability insurance and indemnity agreements. |

| • | the audit committee monitors certain financial risks |

| • | the safety, health and environment committee reviews the policies and systems related to safety, health and environmental risk |

| • | the reserves oversight committee oversees the estimating of our mineral reserves | |

| • | the human resources and compensation committee assesses compensation risk. |

| • | received quarterly enterprise risk management reports |

| • | reviewed procedures for identifying board candidates and conducted a search for a new director |

| • | reviewed the board composition and directors’ independence and conflicts |

| • | reviewed the composition of the board committees and proposed new members |

| • | reviewed and updated our corporate governance practices, reviewed third-party governance rankings and comments, and monitored corporate governance developments |

| • | reviewed the results of the board and this committee’s assessments |

| • | reviewed the governance disclosure in our management proxy circular |

| • | received management’s report on our insurance coverage |

| • | received reports on proxy voting recommendations and voting results |

| • | received reports on governance trends |

| • | reviewed the board’s mandate and the mandate for this committee |

42 cameco corporation

| • | Neil McMillan (chair) |

| • | Donald Deranger |

| • | James Gowans |

| • | Oyvind Hushovd |

| • | Victor Zaleschuk |

| • | management’s estimating of our mineral reserves and resources | |

| • | the review of our mineral reserves and resources before they are disclosed to the public |

| • | confirming the appointment of our designated qualified persons for estimating our mineral reserves and resources |

| • | reviewing management’s annual reserve and resource report and annual reconciliation of reserves to mine production |

| • | receiving management reports on our internal controls and procedures for estimating our mineral reserves and resources |

| • | keeping abreast of industry standards and regulations on estimating and publishing mineral reserve and resource information and any related issues and developments through reports from management. |

| • | receives a report on the reserve and resource estimates by the qualified persons from the leading qualified person |

| • | ensures the qualified persons have not been restricted or unduly influenced in any way |

| • | has the leading qualified person and the chief operating officer (COO) confirm that: |

| • | the information is reliable |

| • | mineral reserves and resources have been estimated and will be published according to the securities laws and regulations that apply |

| • | disclosure controls and procedures for disclosing mineral reserve and resource estimates comply with industry standards. |

| • | reviewed and recommended to the board the year-end annual estimation of reserves and resources |

| • | received a report on our internal controls and procedures related to reserves reporting and report on disclosure controls and procedures |

| • | confirmed the appointments of the qualified persons |

| • | reported annual reserves to the audit committee |

| • | reviewed the results of the committee’s self-assessment |

| • | received education sessions on the geology of uranium deposits and National Instrument 43-101 — Standards of Disclosure for Mineral Projects |

2011 management proxy circular 43

| • | Joe Colvin (chair) |

| • | Donald Deranger |

| • | James Gowans |

| • | George Ivany |

| • | Anne McLellan |

| • | assessing our policies and management systems for these areas and making any appropriate recommendations to the board |

| • | monitoring our safety, health and environmental performance. |

| • | reviewing our safety, health and environmental policies |

| • | overseeing the implementation of related systems to make sure we comply with the policies and all safety, health and environmental legislation | |

| • | bringing any material issues of non-compliance to the attention of the board in a timely fashion |

| • | monitoring the effectiveness of our policies, systems and monitoring processes to protect the safety and health of our employees, contractors, visitors and the general public and manage any environmental impacts |

| • | reviewing the benchmarking results of our policies, systems and monitoring processes against best practices in the industry | |

| • | reporting any related recommendations to the board. |

| • | keeping abreast of significant safety, health and environmental issues (and monitoring any trends and significant events) through reports from management |

| • | monitoring our corporate performance in safety, health and the environment and receiving regular updates from management |

| • | reviewing the findings of our health, safety and environmental audits, action plans and results of investigations into significant events |

| • | reviewing our sustainable development report |

| • | receiving regular compliance updates from management |

| • | reviewing the annual budget for our safety, health and environmental operations to ensure there is sufficient funding for compliance. |

| • | received reports on injuries and environmental incidents |

| • | received quarterly reports on our environmental leadership initiative (including waste, air emissions, greenhouse gas emissions and water usage) |

| • | received reports on the safety, health and environmental audits |

| • | reviewed the annual safety, health, environment and quality (SHEQ) report |

| • | determined the impact of SHEQ objectives on executive compensation |

| • | received reports on regulatory and legislative reform initiatives |

| • | reviewed the management system report and management compliance report |

| • | held one of its regular meetings in Port Hope, toured Cameco Fuel Manufacturing’s Port Hope facilities and the Port Hope Conversion Facility and had lunch with the employees |

| • | received a presentation on Cigar Lake matters and toured the Cigar Lake site |

| • | met with the general managers in our fuel services division and received reports on the implementation of the SHEQ management system and environmental performance improvement initiatives |

| • | reviewed the sustainable development report |

| • | reviewed the SHEQ, sustainable development and legal regulatory 2011 objectives and budgets |

| • | reviewed the committee’s self-assessment |

44 cameco corporation

Director compensation |

46 | |||

• Compensation discussion and analysis |

46 | |||

- Philosophy and objectives |

46 | |||

- Share ownership requirements |

46 | |||

- Fees and retainers |

47 | |||

- Assessing the program |

48 | |||

• 2010 results |

49 | |||

- Summary compensation table |

49 | |||

- Incentive plan awards |

51 | |||

- Loans to directors |

51 | |||

Executive compensation |

52 | |||

• Compensation discussion and analysis |

52 | |||

- Executive summary |

52 | |||

- Our compensation framework |

58 | |||

- Annual decision-making process |

62 | |||

- Measuring performance |

63 | |||

- Compensation components |

65 | |||

- How our executive compensation aligns with share performance |

80 | |||

• 2010 results |

81 | |||

- Summary compensation table |

81 | |||

- Incentive plan awards |

84 | |||

- Securities authorized for issue under equity compensation plans |

85 | |||

- Retirement plan benefits |

86 | |||

- Loans to executives |

88 | |||

• Developments in 2011 |

89 |

2011 management proxy circular 45

| • | Philosophy and objectives | |

| • | Share ownership requirements | |

| • | Fees and retainers | |

| • | Assessing the program. |

| • | recruiting and retaining qualified individuals to serve as members of our board of directors and contribute to our overall success |

| • | aligning the interests of the board members with those of our shareholders by requiring directors to hold a multiple of their annual retainer in shares or share equivalents, and receive at least 60% of their annual retainer in deferred share units (DSUs) until they meet the share ownership guidelines |

| • | offering competitive compensation by positioning director compensation at the median of director compensation paid by companies that are comparable in size and in a similar business. |

46 cameco corporation

| • | an annual retainer (higher retainer for the non-executive chair of the board) | |

| • | an annual fee for serving as a committee chair or committee member | |

| • | an attendance fee for each set of board and committee meetings they attend | |

| • | a travel fee to cover the necessary travel time to attend board and committee meetings. |

| Annual retainer | ($) | |||

Non-executive chair of the board |

340,000 | |||

Other directors |

140,000 | |||

Committee members (per committee) |

5,000 | |||

Committee chairs |

||||

Audit committee and Human resources and compensation committee |

20,000 | |||

Other committees |

11,000 | |||

Attendance fees (per meeting) |

||||

Board meetings |

1,500 | |||

Audit committee meetings |

2,000 | |||

Other committee meetings |

1,500 | |||

Travel fees (per trip) |

||||

Greater than 1,000 km within Canada |

1,700 | |||

From the US |

1,700 | (US) | ||

From outside North America |

2,700 | (US) | ||

2011 management proxy circular 47

| • | the compensation peer group of 21 companies we use to assess executive compensation | |

| • | broader market trends using five different third party sources | |

| • | research with various Canadian institutional shareholders. |

| • | changing the annual retainer for the non-executive chair of the board to a flat fee of $340,000, which now covers his retainer and all meeting fees |

| • | increasing the annual retainer for directors from $120,000 to $140,000 |

| • | increasing the retainer for the chairs of the audit committee and human resources and compensation committee from $15,000 to $20,000, and from $10,000 to $11,000 for the other committee chairs |

| • | increasing the retainer for committee members $3,500 to $5,000 |

| • | increasing the travel fees per trip by from $1,500/$1,500(US)/$2,500(US) to $1,700/$1,700(US)/$2,700(US) |

| • | increasing the period for meeting the guidelines from five to seven years if a director joined the board before July 1, 2010, while any director joining after this date has five years to meet the guidelines |

48 cameco corporation

| March 31, 2010 | June 30, 2010 | September 30, 2010 | December 23, 2010 | |||||||||||||

$1 (US) |

$ | 1.0195 | (Cdn) | $ | 1.0553 | (Cdn) | $ | 1.0340 | (Cdn) | $ | 1.0089 | (Cdn) | ||||

| Retainer | Attendance fees | |||||||||||||||||||||||||||||||

| % of total | ||||||||||||||||||||||||||||||||

| retainer and | ||||||||||||||||||||||||||||||||

| Committee | Committee | Committee | fees paid in | |||||||||||||||||||||||||||||

| Board | member | chair | Board | meetings | Travel fee | Total paid | DSUs | |||||||||||||||||||||||||

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ($) | (%) | ||||||||||||||||||||||||

John Clappison |

130,000 | 4,250 | 17,500 | 18,000 | 17,500 | 11,100 | 198,350 | 70 | ||||||||||||||||||||||||

Joe Colvin |

133,746 | 4,369 | 10,805 | 15,444 | 13,867 | 8,300 | 186,530 | 0 | ||||||||||||||||||||||||

James Curtiss |

133,746 | 4,369 | 17,995 | 18,578 | 16,909 | 11,641 | 203,237 | 0 | ||||||||||||||||||||||||

George Dembroski |

48,462 | 4,240 | 0 | 9,000 | 11,500 | 4,500 | 77,702 | 100 | ||||||||||||||||||||||||

Donald Deranger |

130,000 | 8,500 | 0 | 16,500 | 12,000 | 3,400 | 170,400 | 59 | ||||||||||||||||||||||||

James Gowans |

130,000 | 12,750 | 0 | 16,500 | 19,500 | 8,100 | 186,850 | 42 | ||||||||||||||||||||||||

Nancy Hopkins |

130,000 | 4,250 | 10,500 | 16,500 | 15,500 | 3,200 | 179,950 | 25 | ||||||||||||||||||||||||

Oyvind Hushovd |

133,746 | 13,107 | 0 | 16,995 | 24,066 | 16,219 | 204,132 | 50 | ||||||||||||||||||||||||

George Ivany |

130,000 | 12,750 | 0 | 16,500 | 26,500 | 11,300 | 197,050 | 0 | ||||||||||||||||||||||||

Anne McLellan |

130,000 | 12,750 | 0 | 16,500 | 22,500 | 3,400 | 185,150 | 42 | ||||||||||||||||||||||||

Neil McMillan |

130,000 | 4,250 | 10,500 | 13,500 | 9,000 | 1,500 | 168,750 | 46 | ||||||||||||||||||||||||

Robert Peterson |

48,462 | 4,240 | 0 | 9,000 | 11,500 | 0 | 73,202 | 0 | ||||||||||||||||||||||||

Victor Zaleschuk |

295,000 | 4,250 | 0 | 12,000 | 18,500 | 6,400 | 336,150 | 53 | ||||||||||||||||||||||||

Total |

1,703,162 | 94,075 | 67,300 | 195,017 | 218,842 | 89,060 | 2,367,453 | 37.5 | ||||||||||||||||||||||||

2011 management proxy circular 49

| • | Fees earned is the amount directors received in cash | |

| • | Share-based awards is the amount that directors received in DSUs in 2010, valued as of the grant date. | |

| It includes all of the DSUs that vested as of the grant date, including DSUs granted as dividend equivalents in 2010. Since these totals include the dividend equivalents, they are higher than the total fees paid disclosed on the previous page. |

| Fees earned | Share-based awards | Total | ||||||||||

| Name | ($) | ($) | ($) | |||||||||

John Clappison |

60,175 | 141,820 | 201,995 | |||||||||

Joe Colvin |

186,530 | 31,411 | 217,941 | |||||||||

James Curtiss |

203,237 | 35,503 | 238,740 | |||||||||

George Dembroski |

0 | 84,038 | 84,038 | |||||||||

Donald Deranger |

69,300 | 102,319 | 171,619 | |||||||||

James Gowans |

108,850 | 79,648 | 188,498 | |||||||||

Nancy Hopkins |

134,962 | 50,411 | 185,373 | |||||||||

Oyvind Hushovd |

102,066 | 111,415 | 213,481 | |||||||||

George Ivany |

197,050 | 9,907 | 206,957 | |||||||||

Anne McLellan |

107,150 | 83,561 | 190,711 | |||||||||

Neil McMillan |

90,750 | 85,622 | 176,372 | |||||||||

Robert Peterson |

73,202 | 2,899 | 76,101 | |||||||||

Victor Zaleschuk |

159,150 | 194,709 | 353,859 | |||||||||

Total |

1,492,422 | 1,013,263 | 2,505,685 | |||||||||

50 cameco corporation

| Option-based awards | ||||||||||||||||||||

| Number of securities | ||||||||||||||||||||

| Grant | underlying | Option | Option expiry | Value of unexercised | ||||||||||||||||

| date | unexercised options | exercise price | date | in-the-money options | ||||||||||||||||

| Name | (mm/dd/yyyy) | (#) | ($) | (mm/dd/yyyy) | ($) | |||||||||||||||

James Curtiss |

03/10/2003 | 12,000 | 5.88 | 03/09/2011 | 413,040 | |||||||||||||||

| 09/21/2004 | 3,300 | 15.79 | 09/20/2014 | 80,876 | ||||||||||||||||

Total |

15,300 | 493,916 | ||||||||||||||||||

George Dembroski |

03/10/2003 | 18,000 | 5.88 | 03/09/2011 | 619,560 | |||||||||||||||

| 03/01/2007 | 3,300 | 43.25 | 02/28/2017 | (9,735 | ) | |||||||||||||||

| 03/03/2008 | 3,300 | 38.55 | 03/02/2018 | 5,775 | ||||||||||||||||

Total |

24,600 | 615,600 | ||||||||||||||||||

Nancy Hopkins |

03/10/2003 | 27,000 | 5.88 | 03/09/2011 | 929,340 | |||||||||||||||

Total |

27,000 | 929,340 | ||||||||||||||||||

2011 management proxy circular 51

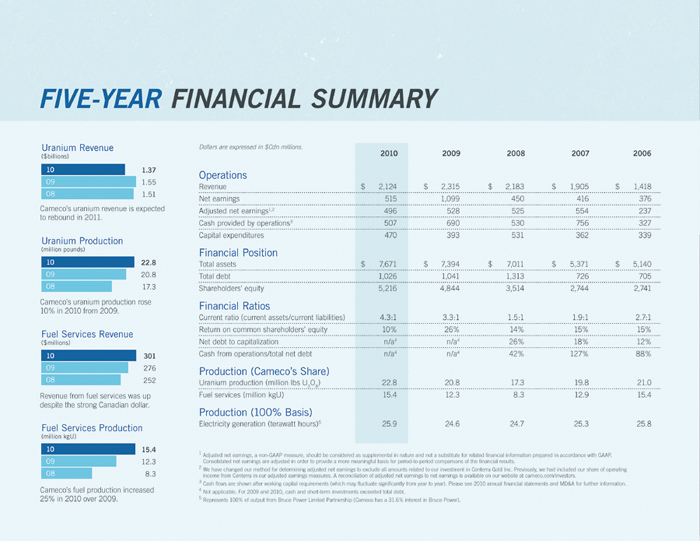

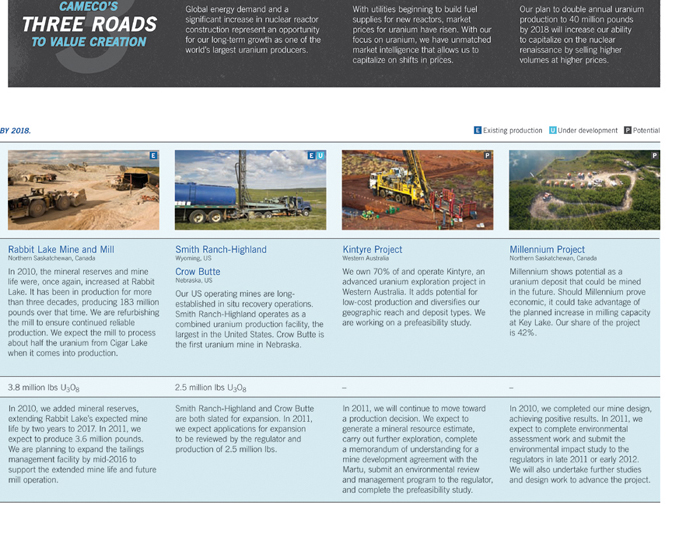

| • | uranium — double annual production to 40 million pounds by 2018 from existing assets |

| • | fuel services — invest in our fuel services business to support overall growth in the nuclear business |

| • | electricity — maintain steady cash flow while gaining exposure to new opportunities. |

| • | Net earnings in 2010 were $515 million. Last year, net earnings were higher by $584 million, due mainly to the one time gain on the sale of our interest in Centerra Gold Inc. and higher unrealized gains on financial instruments. |

| • | We ended the year with $1.3 billion cash on hand. We intend to use these funds to advance our growth strategy. |

| • | In our uranium segment this year, production was 10% higher than 2009 and 6% higher than our plan at the beginning of 2010. We had a number of successes at our mining operations: |

| • | received approval for production flexibility at McArthur River, which allowed us to exceed our production target by 6% | ||

| • | extended Rabbit Lake’s expected mine life by two years to 2017 | ||

| • | continued to ramp up production at Inkai and exceeded 2009 production by 136% | ||

| • | finished dewatering the underground development at Cigar Lake, substantially completed securing the underground development areas and began implementing a surface freeze strategy we expect will provide a number of benefits. |

| • | In our fuel services segment, production was 25% higher than 2009 due to the routine operation of the Port Hope UF6 plant. In 2009, the plant was shut down for the first five months of the year. |

| • | In our electricity segment, Bruce Power Limited Partnership (BPLP) generated 25.9 terawatt hours (TWh) of electricity, at a capacity factor of 91%. Our share of earnings before taxes was $166 million. |

| • | Our investment in GE-Hitachi Global Laser Enrichment LLC (GLE) continues to progress. GLE successfully completed initial testing of its enrichment technology, which met key performance criteria. GLE is continuing testing, and has begun engineering design work for a commercial facility. In addition, we have continued to work with GLE on potential customer contracts for the facility. The US Nuclear Regulatory Commission is assessing GLE’s application for a commercial facility construction and operating licence. |

| • | We continued to advance exploration activities, spending $11 million at five brownfield exploration projects, and $48 million for resource delineation at Kintyre and Inkai block 3. We spent $37 million on regional exploration programs. Saskatchewan saw the most expenditures, followed by Australia, northern Canada, Asia, the US and South America. |

52 cameco corporation

| • | We reached new labour agreements at Port Hope and McArthur River/Key Lake operations. |

| • | We completed delineation drilling at Kintyre. |

| • | We completed our mine design of Millennium and continued work on the environmental assessment. |