|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission File Number 1-6075

UNION PACIFIC CORPORATION

(Exact name of registrant as specified in its charter)

|

UTAH |

|

13-2626465 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

1400 DOUGLAS STREET, OMAHA, NEBRASKA

(Address of principal executive offices)

68179

(Zip Code)

(402) 544-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class |

|

Name of each exchange on which registered |

|

Common Stock (Par Value $2.50 per share) |

|

New York Stock Exchange, Inc. |

|

§ |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

☑ Yes ☐ No

|

§ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. |

☐ Yes ☑ No

|

§ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

☑ Yes ☐ No

|

§ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

☑ Yes ☐ No

|

§ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |

☑

|

§ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

|

Large accelerated filer ☑ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

|

§ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). |

☐ Yes ☑ No

As of June 30, 2016, the aggregate market value of the registrant’s Common Stock held by non-affiliates (using the New York Stock Exchange closing price) was $72.7 billion.

The number of shares outstanding of the registrant’s Common Stock as of January 27, 2017 was 813,795,240.

|

|

|

|

Documents Incorporated by Reference – Portions of the registrant’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 11, 2017, are incorporated by reference into Part III of this report. The registrant’s Proxy Statement will be filed with the Securities and Exchange Commission pursuant to Regulation 14A.

TABLE OF CONTENTS

|

|

3 |

|

|

|

4 |

|

|

|

|

|

|

|

||

|

|

|

|

|

Item 1. |

5 |

|

|

Item 1A. |

10 |

|

|

Item 1B. |

14 |

|

|

Item 2. |

14 |

|

|

Item 3. |

17 |

|

|

Item 4. |

18 |

|

|

|

Executive Officers of the Registrant and Principal Executive Officers of Subsidiaries |

19 |

|

|

|

|

|

|

||

|

|

|

|

|

Item 5. |

20 |

|

|

Item 6. |

22 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

|

39 |

|

|

|

44 |

|

|

Item 7A. |

45 |

|

|

Item 8. |

46 |

|

|

|

47 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

80 |

|

Item 9A. |

80 |

|

|

|

Management’s Annual Report on Internal Control Over Financial Reporting |

81 |

|

|

82 |

|

|

Item 9B. |

83 |

|

|

|

|

|

|

|

||

|

|

|

|

|

Item 10. |

83 |

|

|

Item 11. |

83 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

83 |

|

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

84 |

|

Item 14. |

84 |

|

|

|

|

|

|

|

||

|

|

|

|

|

Item 15. |

85 |

|

|

|

Certifications |

86 96

|

2

February 3, 2017

2016 was the second consecutive year of significant volume declines and business mix shifts at our company. However, even with these challenges, the Union Pacific team remained focused on the things which were in our control, enabling us to deliver solid results in a difficult environment. We generated earnings of $5.07 per share, compared with last year’s $5.49 per share, and our operating ratio was 63.5, just 0.4 points worse than last year’s record best 63.1 percent.

Market factors such as soft energy prices, the impact of the strong U.S. dollar on exports and a sluggish domestic consumer economy were the major drivers of a 7 percent decline in total volume last year. Carloadings were down in four of our six commodity groups, including a 20 percent decrease in coal traffic alone. On the positive side, a large U.S. grain harvest, along with strong global demand, drove a significant increase in our grain shipments, especially in the latter part of the year.

Throughout the year, the men and women of Union Pacific worked through these challenges by implementing the six Value Tracks that encompass our strategy for creating long-term value at our company.

The first of these Tracks is World Class Safety, and I am pleased to report that 2016 was an outstanding year for employee safety performance. Our reportable personal injury rate of 0.75 declined 14 percent from last year to an all-time record low. As we move forward, we continue to follow our safety strategy to yield record results on our way toward achieving our ultimate goal of an incident free environment. We have an unrelenting focus on risk reduction through internal programs such as Courage to Care and Total Safety Culture, so that every employee returns home safely at the end of each day.

As volumes decreased from 2015 levels, our Engaged Team, across the company, was successful in aligning our resources to meet demand while safely and efficiently serving our customers. Our operating metrics showed a step function improvement throughout last year. Average system velocity, as reported to the AAR, increased 5 percent and average terminal dwell improved 4 percent when compared to 2015. Through Innovation and the implementation of our “Grow to 55 and Zero” initiatives, we generated significant Resource Productivity, and have turbocharged our efforts toward further productivity in the future.

Our robust capital program helps ensure that we have the necessary resources and network capacity to provide an Excellent Customer Experience. It enables us to handle current volumes safely and efficiently, improve network fluidity, and prepare for future profitable growth. We invested about $3.5 billion in 2016, including about $1.8 billion in replacement capital to harden our infrastructure, and to improve the safety and resiliency of our network, as well as about $370 million toward completing the federally mandated Positive Train Control project. The largest driver of the $800 million reduction to this year’s program was lower spending for locomotives and other equipment.

Targeted capital investment combined with a thoughtful approach to both existing markets and new business development all work to ensure that we continue to Maximize our Franchise value. A key reflection of increased value for our shareholders is in total shareholder return, which increased 36% in 2016, compared with 12% for the S&P 500. While return on invested capital* of 12.7 percent fell short of last year’s 14.3 percent, Union Pacific was able to increase our quarterly declared dividend per share by 10 percent, with dividends paid in 2016 totaling $1.9 billion. We also repurchased 35 million Union Pacific shares, which was 4 percent of total shares outstanding. Between dividends and share repurchases, Union Pacific returned $5 billion to our shareholders in 2016.

Looking to 2017, we are gaining optimism about some of the macro-economic indicators which drive our core business. Higher energy prices, favorable agricultural markets, and improving demand for U.S. consumer products all give us confidence we can return to year-over-year positive volume growth. The strength and diversity of the Union Pacific franchise have us well-positioned to safely and efficiently leverage stronger volumes as our markets rebound and we continue to execute on our Strategic Value Tracks to generate strong returns for our shareholders.

Chairman, President and Chief Executive Officer

*See Item 7 of this report for reconciliations to U.S. GAAP.

3

DIRECTORS AND SENIOR MANAGEMENT

|

BOARD OF DIRECTORS |

||||

|

|

||||

|

Andrew H. Card, Jr. |

Deborah C. Hopkins |

Michael W. McConnell |

||

|

Former White House |

Former Chief Executive Officer |

General Partner and |

||

|

Chief of Staff |

Citi Ventures |

Former Managing Partner |

||

|

Board Committees: Audit, |

Former Chief Innovation Officer |

Brown Brothers Harriman & Co. |

||

|

Compensation and Benefits |

Citi |

Board Committees: Audit, Finance |

||

|

|

Board Committees: Corporate |

|||

|

Erroll B. Davis, Jr. |

Governance and Nominating, Finance |

Thomas F. McLarty III |

||

|

Former Chairman, |

President |

|||

|

President & CEO |

Charles C. Krulak |

McLarty Associates |

||

|

Alliant Energy Corporation |

General, USMC, Ret. |

Board Committees: Finance (Chair), |

||

|

Board Committees: Compensation |

Board Committees: Audit, Finance |

Corporate Governance and |

||

|

and Benefits (Chair), Corporate |

Nominating |

|||

|

Governance and Nominating |

Jane H. Lute |

|||

|

|

Former Chief Executive Officer |

Steven R. Rogel |

||

|

David B. Dillon |

Center for Internet Security |

Former Chairman |

||

|

Former Chairman |

Board Committees: Audit, Corporate |

Weyerhaeuser Company |

||

|

The Kroger Company |

Governance and Nominating |

Board Committees: Compensation |

||

|

Board Committees: Audit (Chair), |

and Benefits, Corporate Governance |

|||

|

Compensation and Benefits |

Michael R. McCarthy |

and Nominating |

||

|

|

Chairman |

|||

|

Lance M. Fritz |

McCarthy Group, LLC |

Jose H. Villarreal |

||

|

Chairman, President and |

Lead Independent Director |

Advisor |

||

|

Chief Executive Officer |

Board Committees: Corporate |

Akin, Gump, Strauss, Hauer & |

||

|

Union Pacific Corporation and |

Governance and Nominating (Chair), |

Feld, LLP |

||

|

Union Pacific Railroad Company |

Finance |

Board Committees: Audit, |

||

|

|

Compensation and Benefits |

|||

|

|

||||

|

|

SENIOR MANAGEMENT

|

|

||||

|

Lance M. Fritz |

Robert M. Knight, Jr. |

Todd M. Rynaski |

||

|

Chairman, President and |

Executive Vice President |

Vice President and Controller |

||

|

Chief Executive Officer |

and Chief Financial Officer |

Union Pacific Corporation |

||

|

Union Pacific Corporation and |

Union Pacific Corporation |

|||

|

Union Pacific Railroad Company |

Cameron A. Scott |

|||

|

|

Scott D. Moore |

Executive Vice President and |

||

|

Eric L. Butler |

Senior Vice President– |

Chief Operating Officer |

||

|

Executive Vice President, |

Corporate Relations |

Union Pacific Railroad Company |

||

|

Chief Administrative Officer, and |

Union Pacific Corporation |

|||

|

Corporate Secretary |

Lynden L. Tennison |

|||

|

Union Pacific Corporation |

Joseph E. O’Connor, Jr. |

Senior Vice President and |

||

|

|

Vice President–Labor Relations |

Chief Information Officer |

||

|

Diane K. Duren |

Union Pacific Railroad Company |

Union Pacific Corporation |

||

|

Senior Vice President |

||||

|

Union Pacific Corporation |

Patrick J. O’Malley |

Elizabeth F. Whited |

||

|

|

Vice President–Taxes and General |

Executive Vice President and |

||

|

Rhonda S. Ferguson |

Tax Counsel |

Chief Marketing Officer |

||

|

Executive Vice President and |

Union Pacific Corporation |

Union Pacific Railroad Company |

||

|

Chief Legal Officer |

||||

|

Union Pacific Corporation |

Michael A. Rock |

|||

|

|

Vice President-External Relations |

|||

|

Mary Sanders Jones |

Union Pacific Corporation |

|||

|

Vice President and Treasurer |

||||

|

Union Pacific Corporation |

||||

|

|

||||

|

D. Lynn Kelley |

||||

|

Senior Vice President-Supply and |

||||

|

Continuous Improvement |

||||

|

Union Pacific Railroad Company |

||||

|

|

.

4

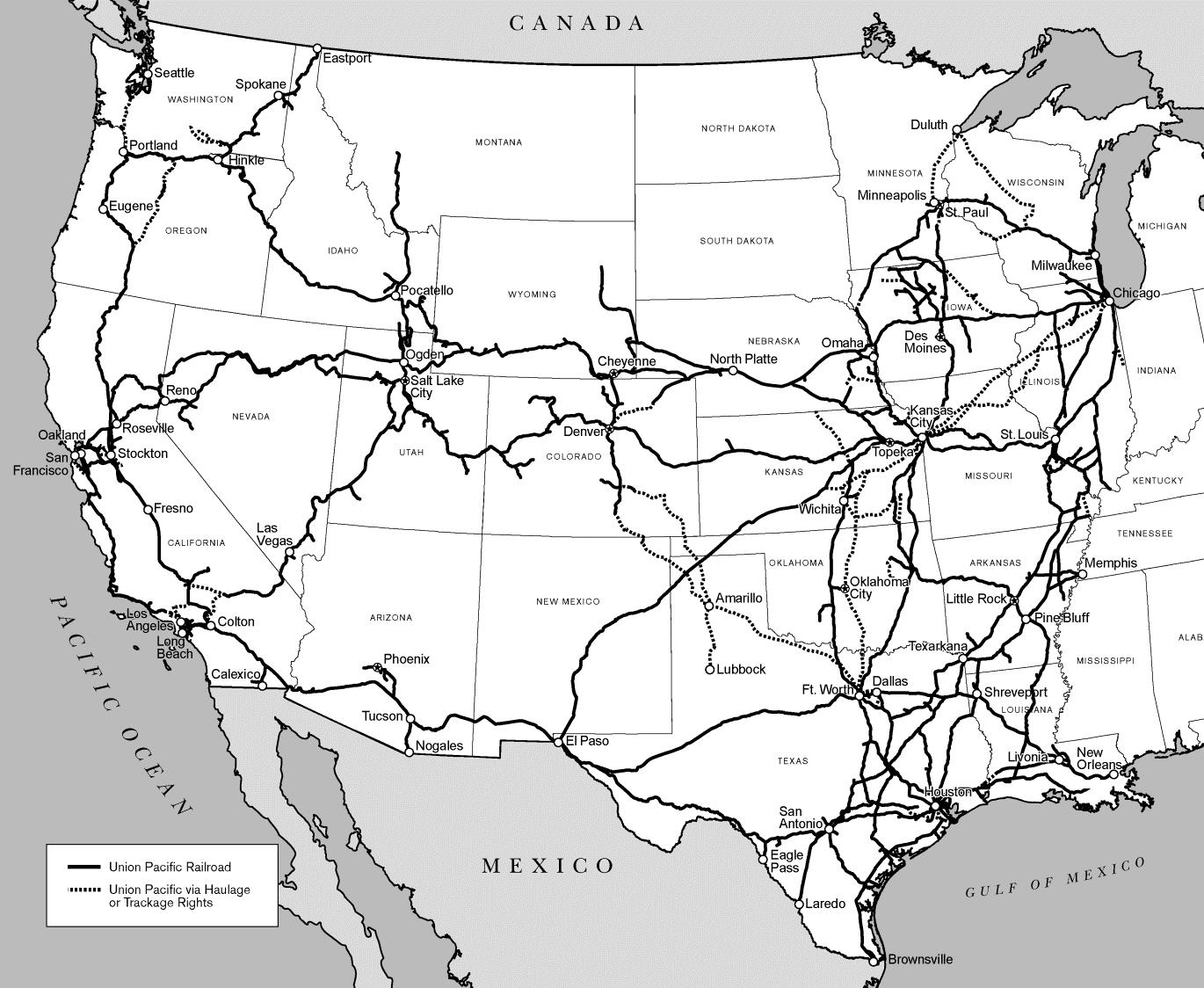

GENERAL

Union Pacific Railroad Company is the principal operating company of Union Pacific Corporation. One of America's most recognized companies, Union Pacific Railroad Company links 23 states in the western two-thirds of the country by rail, providing a critical link in the global supply chain. The Railroad’s diversified business mix includes Agricultural Products, Automotive, Chemicals, Coal, Industrial Products and Intermodal. Union Pacific serves many of the fastest-growing U.S. population centers, operates from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada's rail systems and is the only railroad serving all six major Mexico gateways. Union Pacific provides value to its roughly 10,000 customers by delivering products in a safe, reliable, fuel-efficient and environmentally responsible manner.

Union Pacific Corporation was incorporated in Utah in 1969 and maintains its principal executive offices at 1400 Douglas Street, Omaha, NE 68179. The telephone number at that address is (402) 544-5000. The common stock of Union Pacific Corporation is listed on the New York Stock Exchange (NYSE) under the symbol “UNP”.

For purposes of this report, unless the context otherwise requires, all references herein to “UPC”, “Corporation”, “Company”, “we”, “us”, and “our” shall mean Union Pacific Corporation and its subsidiaries, including Union Pacific Railroad Company, which we separately refer to as “UPRR” or the “Railroad”.

Available Information – Our Internet website is www.up.com. We make available free of charge on our website (under the “Investors” caption link) our Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; eXtensible Business Reporting Language (XBRL) documents; our current reports on Form 8-K; our proxy statements; Forms 3, 4, and 5, filed on behalf of our directors and certain executive officers; and amendments to such reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the Exchange Act). We provide these reports and statements as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). We also make available on our website previously filed SEC reports and exhibits via a link to EDGAR on the SEC’s Internet site at www.sec.gov. Additionally, our corporate governance materials, including By-Laws, Board Committee charters, governance guidelines and policies, and codes of conduct and ethics for directors, officers, and employees are available on our website. From time to time, the corporate governance materials on our website may be updated as necessary to comply with rules issued by the SEC and the NYSE or as desirable to promote the effective and efficient governance of our Company. Any security holder wishing to receive, without charge, a copy of any of our SEC filings or corporate governance materials should send a written request to: Secretary, Union Pacific Corporation, 1400 Douglas Street, Omaha, NE 68179.

We have included the Chief Executive Officer (CEO) and Chief Financial Officer (CFO) certifications regarding our public disclosure required by Section 302 of the Sarbanes-Oxley Act of 2002 as Exhibits 31(a) and (b) to this report.

References to our website address in this report, including references in Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7, are provided as a convenience and do not constitute, and should not be deemed, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this report.

OPERATIONS

The Railroad, along with its subsidiaries and rail affiliates, is our one reportable operating segment. Although we provide revenue by commodity group, we analyze the net financial results of the Railroad as one segment due to the integrated nature of our rail network. Additional information regarding our business and operations, including revenue and financial information and data and other information regarding environmental matters, is presented in Risk Factors, Item 1A; Legal Proceedings, Item 3; Selected Financial Data, Item 6; Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7; and the Financial Statements and Supplementary Data, Item 8 (which include information regarding revenues, statements of income, and total assets).

|

|

|

5

|

Operations – UPRR is a Class I railroad operating in the U.S. We have 32,070 route miles, linking Pacific Coast and Gulf Coast ports with the Midwest and eastern U.S. gateways and providing several corridors to key Mexican gateways. We serve the Western two-thirds of the country and maintain coordinated schedules with other rail carriers to move freight to and from the Atlantic Coast, the Pacific Coast, the Southeast, the Southwest, Canada, and Mexico. Export and import traffic moves through Gulf Coast and Pacific Coast ports and across the Mexican and Canadian borders. Our freight traffic consists of bulk, |

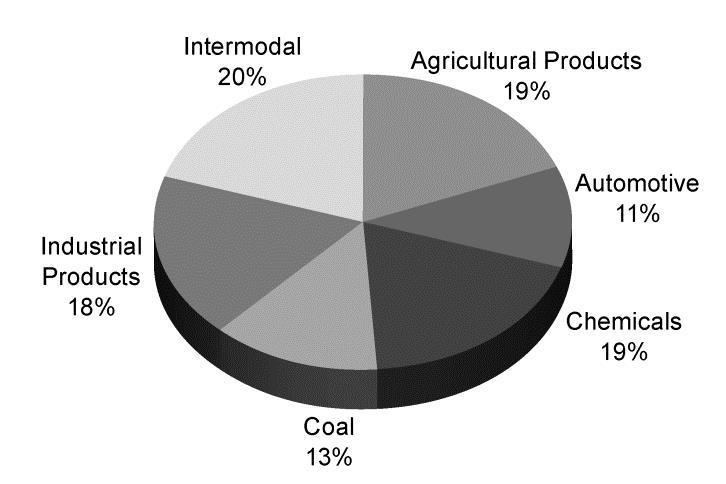

2016 Freight Revenue |

manifest, and premium business. Bulk traffic primarily consists of coal, grain, soda ash, ethanol, rock and crude oil shipped in unit trains – trains transporting a single commodity from one origin to one destination. Manifest traffic includes individual carload or less than train-load business involving commodities such as lumber, steel, paper, food and chemicals. The transportation of finished vehicles, auto parts, intermodal containers and truck trailers are included as part of our premium business. In 2016, we generated freight revenues totaling $18.6 billion from the following six commodity groups:

Agricultural Products – Transportation of grains, commodities produced from these grains, and food and beverage products generated 19% of the Railroad’s 2016 freight revenue. We access most major grain markets, linking the Midwest and Western U.S. producing areas to export terminals in the Pacific Northwest and Gulf Coast ports, as well as Mexico. We also serve significant domestic markets, including grain processors, animal feeders and ethanol producers in the Midwest, West, South and Rocky Mountain states. Unit trains, which transport a single commodity between producers and export terminals or domestic markets, represent approximately 41% of our agricultural shipments.

Automotive – We are the largest automotive carrier west of the Mississippi River and operate or access over 40 vehicle distribution centers. The Railroad’s extensive franchise serves five vehicle assembly plants and connects to West Coast ports, all six major Mexico gateways, and the Port of Houston to accommodate both import and export shipments. In addition to transporting finished vehicles, UPRR provides expedited handling of automotive parts in both boxcars and intermodal containers destined for Mexico, the U.S. and Canada. The automotive group generated 11% of Union Pacific’s freight revenue in 2016.

Chemicals – Transporting chemicals generated 19% of our freight revenue in 2016. The Railroad’s unique franchise serves the chemical producing areas along the Gulf Coast, where roughly 58% of the Company’s chemical business originates, travels through, or terminates. Our chemical franchise also accesses chemical producers in the Rocky Mountains and on the West Coast. The Company’s chemical shipments include six categories: industrial chemicals, plastics, fertilizer, petroleum and liquid petroleum gases, crude oil and soda ash. Currently, these products move primarily to and from the Gulf Coast region. Fertilizer movements originate in the Gulf Coast region, the western U.S. and Canada (through interline access) for delivery to major agricultural users in the Midwest, western U.S., as well as abroad. Soda ash originates in southwestern Wyoming and California, destined for chemical and glass producing markets in North America and abroad.

Coal – Shipments of coal, petroleum coke, and biomass accounted for 13% of our freight revenue in 2016. The Railroad’s network supports the transportation of coal, petroleum coke, and biomass to independent and regulated power companies and industrial facilities throughout the U.S. Through interchange gateways and ports, UPRR’s reach extends to eastern U.S. utilities, as well as to Mexico and other international destinations. Coal traffic originating in the Powder River Basin (PRB) area of Wyoming is the largest segment of the Railroad’s coal business.

Industrial Products – Our extensive network facilitates the movement of numerous commodities between thousands of origin and destination points throughout North America. The Industrial Products group consists of several categories, including construction products, minerals, consumer goods, metals, lumber, paper, and other miscellaneous products. In 2016, this group generated 18% of our total freight revenue. Commercial, residential and governmental infrastructure investments drive shipments of steel, aggregates (cement components), cement and wood products. Oil and gas drilling generates demand for

6

raw steel, finished pipe, frac sand, stone and drilling fluid commodities. Industrial and light manufacturing plants receive steel, nonferrous materials, minerals and other raw materials. Paper and packaging commodities, as well as appliances, move to major metropolitan areas for consumers. Lumber shipments originate primarily in the Pacific Northwest and western Canada and move throughout the U.S. for use in new home construction and repair and remodeling.

Intermodal – Our Intermodal business includes two segments: international and domestic. International business consists of import and export container traffic that mainly passes through West Coast ports served by UPRR’s extensive terminal network. Domestic business includes container and trailer traffic picked up and delivered within North America for intermodal marketing companies (primarily shipper agents and logistics companies), as well as truckload carriers. Less-than-truckload and package carriers with time-sensitive business requirements are also an important part of domestic shipments. Together, our international and domestic Intermodal business generated 20% of our 2016 freight revenue.

Seasonality – Some of the commodities we carry have peak shipping seasons, reflecting either or both the nature of the commodity and the demand cycle for the commodity (such as certain agricultural and food products that have specific growing and harvesting seasons). The peak shipping seasons for these commodities can vary considerably each year depending upon various factors, including the strength of domestic and international economies and currencies and the strength of harvests and market prices for agricultural products.

Working Capital – At December 31, 2016, we had a working capital deficit, which does not indicate a lack of liquidity. We maintain adequate resources and, when necessary, have adequate access to capital markets to meet any foreseeable cash requirements, in addition to sufficient financial capacity to satisfy our current liabilities. The decrease at 2016 year-end was primarily due to a decrease in other current assets related to a tax receivable for the late extension of bonus depreciation at December 31, 2015, along with an increase at December 31, 2016, in accounts payable and upcoming debt maturities. At December 31, 2015, we had a working capital surplus.

Competition – We are subject to competition from other railroads, motor carriers, ship and barge operators, and pipelines. Our main railroad competitor is Burlington Northern Santa Fe LLC. Its primary subsidiary, BNSF Railway Company (BNSF), operates parallel routes in many of our main traffic corridors. In addition, we operate in corridors served by other railroads and motor carriers. Motor carrier competition exists for five of our six commodity groups (excluding most coal shipments). Because of the proximity of our routes to major inland and Gulf Coast waterways, barges can be particularly competitive, especially for grain and bulk commodities in certain areas where we operate. In addition to price competition, we face competition with respect to transit times, quality and reliability of service from motor carriers and other railroads. Motor carriers in particular can have an advantage over railroads with respect to transit times and timeliness of service. However, railroads are much more fuel-efficient than trucks, which reduces the impact of transporting goods on the environment and public infrastructure, and we have been making efforts to convert certain truck traffic to rail. Additionally, we must build or acquire and maintain our rail system; trucks and barges are able to use public rights-of-way maintained by public entities. Any of the following could also affect the competitiveness of our transportation services for some or all of our commodities: (i) improvements or expenditures materially increasing the quality or reducing the costs of these alternative modes of transportation, (ii) legislation that eliminates or significantly reduces the size or weight limitations applied to motor carriers, or (iii) legislation or regulatory changes that impose operating restrictions on railroads or that adversely affect the profitability of some or all railroad traffic. Finally, many movements face product or geographic competition where our customers can use different products (e.g. natural gas instead of coal, sorghum instead of corn) or commodities from different locations (e.g. grain from states or countries that we do not serve, crude oil from different regions). Sourcing different commodities or different locations allows shippers to substitute different carriers and such competition may reduce our volume or constrain prices. For more information regarding risks we face from competition, see the Risk Factors in Item 1A of this report.

Key Suppliers – We depend on two key domestic suppliers of high horsepower locomotives. Due to the capital intensive nature of the locomotive manufacturing business and sophistication of this equipment, potential new suppliers face high barriers of entry into this industry. Therefore, if one of these domestic suppliers discontinues manufacturing locomotives for any reason, including insolvency or bankruptcy, we could experience a significant cost increase and risk reduced availability of the locomotives that are necessary to our operations. Additionally, for a high percentage of our rail purchases, we utilize two steel producers (one domestic and one international) that meet our specifications. Rail is critical for maintenance, replacement, improvement, and expansion of our network and facilities. Rail manufacturing

7

also has high barriers of entry, and, if one of those suppliers discontinues operations for any reason, including insolvency or bankruptcy, we could experience cost increases and difficulty obtaining rail.

Employees – Approximately 84% of our 42,919 full-time-equivalent employees are represented by 14 major rail unions. On January 1, 2015, current labor agreements became subject to modification and we began the current round of negotiations with the unions. Existing agreements remain in effect until new agreements are reached or the Railway Labor Act’s (RLA) procedures (which include mediation, cooling-off periods, and the possibility of Presidential Emergency Boards and Congressional intervention) are exhausted. The railroad industry is currently in mediation with all bargaining coalitions. Under the Railway Labor Act, the National Mediation Board controls timing and location of mediation conferences and when to terminate mediation, moving the parties to the next stages of the RLA process. Contract negotiations historically continue for an extended period of time and we rarely experience work stoppages while negotiations are pending.

Railroad Security – Our security efforts consist of a wide variety of measures including employee training, engagement with our customers, training of emergency responders, and partnerships with numerous federal, state, and local government agencies. While federal law requires us to protect the confidentiality of our security plans designed to safeguard against terrorism and other security incidents, the following provides a general overview of our security initiatives.

UPRR Security Measures – We maintain a comprehensive security plan designed to both deter and respond to any potential or actual threats as they arise. The plan includes four levels of alert status, each with its own set of countermeasures. We employ our own police force, consisting of more than 250 commissioned and highly-trained officers. Our employees also undergo recurrent security and preparedness training, as well as federally-mandated hazardous materials and security training. We regularly review the sufficiency of our employee training programs. We maintain the capability to move critical operations to back-up facilities in different locations.

We operate an emergency response management center 24 hours a day. The center receives reports of emergencies, dangerous or potentially dangerous conditions, and other safety and security issues from our employees, the public, law enforcement and other government officials. In cooperation with government officials, we monitor both threats and public events, and, as necessary, we may alter rail traffic flow at times of concern to minimize risk to communities and our operations. We comply with the hazardous materials routing rules and other requirements imposed by federal law. We also design our operating plan to expedite the movement of hazardous material shipments to minimize the time rail cars remain idle at yards and terminals located in or near major population centers. Additionally, in compliance with Transportation Security Agency regulations, we deployed information systems and instructed employees in tracking and documenting the handoff of Rail Security Sensitive Materials with customers and interchange partners.

We also have established a number of our own innovative safety and security-oriented initiatives ranging from various investments in technology to The Officer on the Train program, which provides local law enforcement officers with the opportunity to ride with train crews to enhance their understanding of railroad operations and risks. Our staff of information security professionals continually assesses cyber security risks and implements mitigation programs that evolve with the changing technology threat environment. To date, we have not experienced any material disruption of our operations due to a cyber threat or attack directed at us.

Cooperation with Federal, State, and Local Government Agencies – We work closely on physical and cyber security initiatives with government agencies, including the U.S. Department of Transportation (DOT) and the Department of Homeland Security (DHS) as well as local police departments, fire departments, and other first responders. In conjunction with the Association of American Railroads (AAR), we sponsor Ask Rail, a mobile application which provides first responders with secure links to electronic information, including commodity and emergency response information required by emergency personnel to respond to accidents and other situations. We also participate in the National Joint Terrorism Task Force, a multi-agency effort established by the U.S. Department of Justice and the Federal Bureau of Investigation to combat and prevent terrorism.

We work with the Coast Guard, U.S. Customs and Border Protection (CBP), and the Military Transport Management Command, which monitor shipments entering the UPRR rail network at U.S. border crossings and ports. We were the first railroad in the U.S. to be named a partner in CBP’s Customs-

8

Trade Partnership Against Terrorism, a partnership designed to develop, enhance, and maintain effective security processes throughout the global supply chain.

Cooperation with Customers and Trade Associations – Through TransCAER (Transportation Community Awareness and Emergency Response) we work with the AAR, the American Chemistry Council, the American Petroleum Institute, and other chemical trade groups to provide communities with preparedness tools, including the training of emergency responders. In cooperation with the Federal Railroad Administration (FRA) and other interested groups, we are also working to develop additional improvements to tank car design that will further limit the risk of releases of hazardous materials.

GOVERNMENTAL AND ENVIRONMENTAL REGULATION

Governmental Regulation – Our operations are subject to a variety of federal, state, and local regulations, generally applicable to all businesses. (See also the discussion of certain regulatory proceedings in Legal Proceedings, Item 3.)

The operations of the Railroad are also subject to the regulatory jurisdiction of the STB. The STB has jurisdiction over rates charged on certain regulated rail traffic; common carrier service of regulated traffic; freight car compensation; transfer, extension, or abandonment of rail lines; and acquisition of control of rail common carriers. In 2016, the STB continued its efforts to explore expanding rail regulation and is reviewing proposed rulemaking in various areas, including reciprocal switching, commodity exemptions, and expanding and easing procedures for smaller rate complaints. The STB also continues to develop a methodology for determining railroad revenue adequacy and the possible use of a revenue adequacy constraint in regulating railroad rates.

The Surface Transportation Board Reauthorization Act of 2015 became law on December 18, 2015. The legislation increased the number of STB board members from three to five, requires the STB to post quarterly reports on rate reasonableness cases and maintain a database on service complaints, and grants the STB authority to initiate investigations, among other things.

The operations of the Railroad also are subject to the regulations of the FRA and other federal and state agencies. In 2010, the FRA issued initial rules governing installation of Positive Train Control (PTC) by the end of 2015. On October 29, 2015, Congress extended the December 31, 2015, PTC implementation deadline until December 31, 2018. The PTC implementation deadline may be extended to December 31, 2020, provided certain other criteria are satisfied. We submitted our required PTC safety plan to the FRA in the first half of 2016. PTC is a collision avoidance technology intended to override engineer controlled locomotives and stop train-to-train and overspeed accidents, misaligned switch derailments, and unauthorized entry to work zones. Through 2016, we have invested approximately $2.3 billion in the ongoing development of PTC.

On May 1, 2015, the Pipeline and Hazardous Materials Safety Administration (PHMSA) issued final rules governing the transportation of flammable liquids. The final rule included provisions for improved tank car standards, braking system requirements, community notification, and operating restrictions for certain trains carrying flammable liquids. Subsequently, Congress enacted the Fixing America’s Surface Transportation Act, which requires the Government Accountability Office (GAO) to conduct an independent study on the rule’s proposed braking system requirements. In October, 2016, GAO released the results of its study, concluding that the proposed rule suffered from limited data; that the modeling DOT used in the rule was not replicable; and that DOT had a lack of transparency in parts of its rulemaking process. The study recommended DOT conduct additional evaluation and analysis of its ECP braking system requirement.

DOT, the Occupational Safety and Health Administration, PHMSA and DHS, along with other federal agencies, have jurisdiction over certain aspects of safety, movement of hazardous materials and hazardous waste, emissions requirements, and equipment standards. Additionally, various state and local agencies have jurisdiction over disposal of hazardous waste and seek to regulate movement of hazardous materials in ways not preempted by federal law.

Environmental Regulation – We are subject to extensive federal and state environmental statutes and regulations pertaining to public health and the environment. The statutes and regulations are administered and monitored by the Environmental Protection Agency (EPA) and by various state environmental agencies. The primary laws affecting our operations are the Resource Conservation and Recovery Act, regulating the management and disposal of solid and hazardous wastes; the

9

Comprehensive Environmental Response, Compensation, and Liability Act, regulating the cleanup of contaminated properties; the Clean Air Act, regulating air emissions; and the Clean Water Act, regulating waste water discharges.

Information concerning environmental claims and contingencies and estimated remediation costs is set forth in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Environmental, Item 7 and Note 18 to the Consolidated Financial Statements in Item 8, Financial Statements and Supplementary Data.

The information set forth in this Item 1A should be read in conjunction with the rest of the information included in this report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7, and Financial Statements and Supplementary Data, Item 8.

We Must Manage Fluctuating Demand for Our Services and Network Capacity – If there are significant reductions in demand for rail services with respect to one or more commodities or changes in consumer preferences that affect the businesses of our customers, we may experience increased costs associated with resizing our operations, including higher unit operating costs and costs for the storage of locomotives, rail cars, and other equipment; work-force adjustments; and other related activities, which could have a material adverse effect on our results of operations, financial condition, and liquidity. If there is significant demand for our services that exceeds the designed capacity of our network, we may experience network difficulties, including congestion and reduced velocity, that could compromise the level of service we provide to our customers. This level of demand may also compound the impact of weather and weather-related events on our operations and velocity. Although we continue to improve our transportation plan, add capacity, improve operations at our yards and other facilities, and improve our ability to address surges in demand for any reason with adequate resources, we cannot be sure that these measures will fully or adequately address any service shortcomings resulting from demand exceeding our planned capacity. We may experience other operational or service difficulties related to network capacity, dramatic and unplanned fluctuations in our customers’ demand for rail service with respect to one or more commodities or operating regions, or other events that could negatively impact our operational efficiency, any of which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Transport Hazardous Materials – We transport certain hazardous materials and other materials, including crude oil, ethanol, and toxic inhalation hazard (TIH) materials, such as chlorine, that pose certain risks in the event of a release or combustion. Additionally, U.S. laws impose common carrier obligations on railroads that require us to transport certain hazardous materials regardless of risk or potential exposure to loss. A rail accident or other incident or accident on our network, at our facilities, or at the facilities of our customers involving the release or combustion of hazardous materials could involve significant costs and claims for personal injury, property damage, and environmental penalties and remediation in excess of our insurance coverage for these risks, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Subject to Significant Governmental Regulation – We are subject to governmental regulation by a significant number of federal, state, and local authorities covering a variety of health, safety, labor, environmental, economic (as discussed below), and other matters. Many laws and regulations require us to obtain and maintain various licenses, permits, and other authorizations, and we cannot guarantee that we will continue to be able to do so. Our failure to comply with applicable laws and regulations could have a material adverse effect on us. Governments or regulators may change the legislative or regulatory frameworks within which we operate without providing us any recourse to address any adverse effects on our business, including, without limitation, regulatory determinations or rules regarding dispute resolution, increasing the amount of our traffic subject to common carrier regulation, business relationships with other railroads, calculation of our cost of capital or other inputs relevant to computing our revenue adequacy, the prices we charge, and costs and expenses. Significant legislative activity in Congress or regulatory activity by the STB could expand regulation of railroad operations and prices for rail services, which could reduce capital spending on our rail network, facilities and equipment and have a material adverse effect on our results of operations, financial condition, and liquidity. As part of the Rail Safety Improvement Act of 2008, rail carriers were to implement PTC by the end of 2015 (the Rail Safety Improvement Act). The Surface Transportation Extension Act of 2015 amended the Rail Safety Improvement Act to require implementation of PTC by the end of 2018, which deadline may be extended to December 31, 2020, provided certain other criteria are satisfied. This implementation could have a

10

material adverse effect on our ability to make other capital investments. Additionally, one or more consolidations of Class I railroads could also lead to increased regulation of the rail industry.

We May Be Affected by General Economic Conditions – Prolonged severe adverse domestic and global economic conditions or disruptions of financial and credit markets may affect the producers and consumers of the commodities we carry and may have a material adverse effect on our access to liquidity and our results of operations and financial condition.

We Face Competition from Other Railroads and Other Transportation Providers – We face competition from other railroads, motor carriers, ships, barges, and pipelines. In addition to price competition, we face competition with respect to transit times and quality and reliability of service. We must build or acquire and maintain our rail system, while trucks, barges and maritime operators are able to use public rights-of-way maintained by public entities. Any future improvements or expenditures materially increasing the quality or reducing the cost of alternative modes of transportation, or legislation that eliminates or significantly reduces the burden of the size or weight limitations currently applicable to motor carriers, could have a material adverse effect on our results of operations, financial condition, and liquidity. Additionally, any future consolidation of the rail industry could materially affect the competitive environment in which we operate.

We Rely on Technology and Technology Improvements in Our Business Operations – We rely on information technology in all aspects of our business. If we do not have sufficient capital to acquire new technology or if we are unable to develop or implement new technology such as PTC or the latest version of our transportation control systems, we may suffer a competitive disadvantage within the rail industry and with companies providing other modes of transportation service, which could have a material adverse effect on our results of operations, financial condition, and liquidity. Additionally, if a cyber attack or other event causes significant disruption or failure of one or more of our information technology systems, including computer hardware, software, and communications equipment, we could suffer a significant service interruption, safety failure, security breach, or other operational difficulties, which could have a material adverse impact on our results of operations, financial condition, and liquidity.

We May Be Subject to Various Claims and Lawsuits That Could Result in Significant Expenditures – As a railroad with operations in densely populated urban areas and other cities and a vast rail network, we are exposed to the potential for various claims and litigation related to labor and employment, personal injury, property damage, environmental liability, and other matters. Any material changes to litigation trends or a catastrophic rail accident or series of accidents involving any or all of property damage, personal injury, and environmental liability that exceed our insurance coverage for such risks could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Subject to Significant Environmental Laws and Regulations – Due to the nature of the railroad business, our operations are subject to extensive federal, state, and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; handling, storage, transportation, disposal of waste and other materials; and hazardous material or petroleum releases. We generate and transport hazardous and non-hazardous waste in our operations, and we did so in our former operations. Environmental liability can extend to previously owned or operated properties, leased properties, and properties owned by third parties, as well as to properties we currently own. Environmental liabilities have arisen and may also arise from claims asserted by adjacent landowners or other third parties in toxic tort litigation. We have been and may be subject to allegations or findings that we have violated, or are strictly liable under, these laws or regulations. We currently have certain obligations at existing sites for investigation, remediation and monitoring, and we likely will have obligations at other sites in the future. Liabilities for these obligations affect our estimate based on our experience and, as necessary, the advice and assistance of our consultants. However, actual costs may vary from our estimates due to any or all of several factors, including changes to environmental laws or interpretations of such laws, technological changes affecting investigations and remediation, the participation and financial viability of other parties responsible for any such liability and the corrective action or change to corrective actions required to remediate any existing or future sites. We could incur significant costs as a result of any of the foregoing, and we may be required to incur significant expenses to investigate and remediate known, unknown, or future environmental contamination, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We May Be Affected by Climate Change and Market or Regulatory Responses to Climate Change – Climate change, including the impact of global warming, could have a material adverse effect on our results of operations, financial condition, and liquidity. Restrictions, caps, taxes, or other controls on

11

emissions of greenhouse gasses, including diesel exhaust, could significantly increase our operating costs. Restrictions on emissions could also affect our customers that (a) use commodities that we carry to produce energy, (b) use significant amounts of energy in producing or delivering the commodities we carry, or (c) manufacture or produce goods that consume significant amounts of energy or burn fossil fuels, including chemical producers, farmers and food producers, and automakers and other manufacturers. Significant cost increases, government regulation, or changes of consumer preferences for goods or services relating to alternative sources of energy or emissions reductions could materially affect the markets for the commodities we carry, which in turn could have a material adverse effect on our results of operations, financial condition, and liquidity. Government incentives encouraging the use of alternative sources of energy could also affect certain of our customers and the markets for certain of the commodities we carry in an unpredictable manner that could alter our traffic patterns, including, for example, increasing royalties charged to producers of PRB coal by the U.S. Department of Interior and the impacts of ethanol incentives on farming and ethanol producers. Finally, we could face increased costs related to defending and resolving legal claims and other litigation related to climate change and the alleged impact of our operations on climate change. Any of these factors, individually or in operation with one or more of the other factors, or other unforeseen impacts of climate change could reduce the amount of traffic we handle and have a material adverse effect on our results of operations, financial condition, and liquidity.

Severe Weather Could Result in Significant Business Interruptions and Expenditures – As a railroad with a vast network, we are exposed to severe weather conditions and other natural phenomena, including earthquakes, hurricanes, fires, floods, mudslides or landslides, extreme temperatures, and significant precipitation. Line outages and other interruptions caused by these conditions can adversely affect our entire rail network and can adversely affect revenue, costs, and liabilities, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

Strikes or Work Stoppages Could Adversely Affect Our Operations – The U.S. Class I railroads are party to collective bargaining agreements with various labor unions. The majority of our employees belong to labor unions and are subject to these agreements. Disputes with regard to the terms of these agreements or our potential inability to negotiate acceptable contracts with these unions could result in, among other things, strikes, work stoppages, slowdowns, or lockouts, which could cause a significant disruption of our operations and have a material adverse effect on our results of operations, financial condition, and liquidity. Additionally, future national labor agreements, or renegotiation of labor agreements or provisions of labor agreements, could compromise our service reliability or significantly increase our costs for health care, wages, and other benefits, which could have a material adverse impact on our results of operations, financial condition, and liquidity. Labor disputes, work stoppages, slowdowns or lockouts at loading/unloading facilities, ports or other transport access points could compromise our service reliability and have a material adverse impact on our results of operations, financial condition, and liquidity. Labor disputes, work stoppages, slowdowns or lockouts by employees of our customers or our suppliers could compromise our service reliability and have a material adverse impact on our results of operations, financial condition, and liquidity.

The Availability of Qualified Personnel Could Adversely Affect Our Operations – Changes in demographics, training requirements, and the availability of qualified personnel could negatively affect our ability to meet demand for rail service. Unpredictable increases in demand for rail services and a lack of network fluidity may exacerbate such risks, which could have a negative impact on our operational efficiency and otherwise have a material adverse effect on our results of operations, financial condition, and liquidity.

We May Be Affected By Fluctuating Fuel Prices – Fuel costs constitute a significant portion of our transportation expenses. Diesel fuel prices can be subject to dramatic fluctuations, and significant price increases could have a material adverse effect on our operating results. Although we currently are able to recover a significant amount of our fuel expenses from our customers through revenue from fuel surcharges, we cannot be certain that we will always be able to mitigate rising or elevated fuel costs through our fuel surcharges. Additionally, future market conditions or legislative or regulatory activities could adversely affect our ability to apply fuel surcharges or adequately recover increased fuel costs through fuel surcharges. As fuel prices fluctuate, our fuel surcharge programs trail such fluctuations in fuel price by approximately two months, and may be a significant source of quarter-over-quarter and year-over-year volatility, particularly in periods of rapidly changing prices. International, political, and economic factors, events and conditions affect the volatility of fuel prices and supplies. Weather can also affect fuel supplies and limit domestic refining capacity. A severe shortage of, or disruption to, domestic fuel supplies could have a material adverse effect on our results of operations, financial condition, and

12

liquidity. Alternatively, lower fuel prices could have a positive impact on the economy by increasing consumer discretionary spending that potentially could increase demand for various consumer products we transport. However, lower fuel prices could have a negative impact on other commodities we transport, such as coal and domestic drilling-related shipments, which could have a material adverse affect on our results of operations, financial condition, and liquidity.

We Utilize Capital Markets – Due to the significant capital expenditures required to operate and maintain a safe and efficient railroad, we rely on the capital markets to provide some of our capital requirements. We utilize long-term debt instruments, bank financing and commercial paper from time-to-time, and we pledge certain of our receivables. Significant instability or disruptions of the capital markets, including the credit markets, or deterioration of our financial condition due to internal or external factors could restrict or prohibit our access to, and significantly increase the cost of, commercial paper and other financing sources, including bank credit facilities and the issuance of long-term debt, including corporate bonds. A significant deterioration of our financial condition could result in a reduction of our credit rating to below investment grade, which could restrict, or at certain credit levels below investment grade may prohibit us, from utilizing our current receivables securitization facility. This may also limit our access to external sources of capital and significantly increase the costs of short and long-term debt financing.

A Significant Portion of Our Revenue Involves Transportation of Commodities to and from International Markets – Although revenues from our operations are attributable to transportation services provided in the U.S., a significant portion of our revenues involves the transportation of commodities to and from international markets, including Mexico and Southeast Asia, by various carriers and, at times, various modes of transportation. Significant and sustained interruptions of trade with Mexico or countries in Southeast Asia, including China, could adversely affect customers and other entities that, directly or indirectly, purchase or rely on rail transportation services in the U.S. as part of their operations, and any such interruptions could have a material adverse effect on our results of operations, financial condition and liquidity. Any one or more of the following could cause a significant and sustained interruption of trade with Mexico or countries in Southeast Asia: (a) a deterioration of security for international trade and businesses; (b) the adverse impact of new laws, rules and regulations or the interpretation of laws, rules and regulations by government entities, courts or regulatory bodies, including taxing authorities, that affect our customers doing business in foreign countries; (c) any significant adverse economic developments, such as extended periods of high inflation, material disruptions in the banking sector or in the capital markets of these foreign countries, and significant changes in the valuation of the currencies of these foreign countries that could materially affect the cost or value of imports or exports; (d) shifts in patterns of international trade that adversely affect import and export markets; and (e) a material reduction in foreign direct investment in these countries.

We Are Subject to Legislative, Regulatory, and Legal Developments Involving Taxes – Taxes are a significant part of our expenses. We are subject to U.S. federal, state, and foreign income, payroll, property, sales and use, fuel, and other types of taxes. Changes in tax rates, enactment of new tax laws, revisions of tax regulations, and claims or litigation with taxing authorities could result in substantially higher taxes and, therefore, could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Dependent on Certain Key Suppliers of Locomotives and Rail – Due to the capital intensive nature and sophistication of locomotive equipment, potential new suppliers face high barriers to entry. Therefore, if one of the domestic suppliers of high horsepower locomotives discontinues manufacturing locomotives for any reason, including bankruptcy or insolvency, we could experience significant cost increases and reduced availability of the locomotives that are necessary for our operations. Additionally, for a high percentage of our rail purchases, we utilize two steel producers (one domestic and one international) that meet our specifications. Rail is critical to our operations for rail replacement programs, maintenance, and for adding additional network capacity, new rail and storage yards, and expansions of existing facilities. This industry similarly has high barriers to entry, and if one of these suppliers discontinues operations for any reason, including bankruptcy or insolvency, we could experience both significant cost increases for rail purchases and difficulty obtaining sufficient rail for maintenance and other projects.

We May Be Affected by Acts of Terrorism, War, or Risk of War – Our rail lines, facilities, and equipment, including rail cars carrying hazardous materials, could be direct targets or indirect casualties of terrorist attacks. Terrorist attacks, or other similar events, any government response thereto, and war or risk of war may adversely affect our results of operations, financial condition, and liquidity. In addition, insurance

13

premiums for some or all of our current coverages could increase dramatically, or certain coverages may not be available to us in the future.

Item 1B. Unresolved Staff Comments

None.

We employ a variety of assets in the management and operation of our rail business. Our rail network covers 23 states in the western two-thirds of the U.S.

TRACK

Our rail network includes 32,070 route miles. We own 26,053 miles and operate on the remainder pursuant to trackage rights or leases. The following table describes track miles at December 31, 2016, and 2015:

|

|

||

|

|

2016 | 2015 |

|

Route |

32,070 | 32,084 |

|

Other main line |

7,070 | 7,012 |

|

Passing lines and turnouts |

3,245 | 3,235 |

|

Switching and classification yard lines |

9,115 | 9,108 |

|

Total miles |

51,500 | 51,439 |

14

HEADQUARTERS BUILDING

We own our headquarters building in Omaha, Nebraska. The facility has 1.2 million square feet of space for approximately 4,000 employees.

HARRIMAN DISPATCHING CENTER

The Harriman Dispatching Center (HDC), located in Omaha, Nebraska, is our primary dispatching facility. It is linked to regional dispatching and locomotive management facilities at various locations along our network. HDC employees coordinate moves of locomotives and trains, manage traffic and train crews on our network, and coordinate interchanges with other railroads. Approximately 900 employees currently work on-site in the facility. In the event of a disruption of operations at HDC due to a cyber attack, flooding or severe weather or other event, we maintain the capability to conduct critical operations at back-up facilities in different locations.

RAIL FACILITIES

In addition to our track structure, we operate numerous facilities, including terminals for intermodal and other freight; rail yards for building trains (classification yards), switching, storage-in-transit (the temporary storage of customer goods in rail cars prior to shipment) and other activities; offices to administer and manage our operations; dispatching centers to direct traffic on our rail network; crew quarters to house train crews along our network; and shops and other facilities for fueling, maintenance, and repair of locomotives and repair and maintenance of rail cars and other equipment. The following table includes the major yards and terminals on our system:

|

|

|

|

Major Classification Yards |

Major Intermodal Terminals |

|

North Platte, Nebraska |

Joliet (Global 4), Illinois |

|

North Little Rock, Arkansas |

East Los Angeles, California |

|

Englewood (Houston), Texas |

ICTF (Los Angeles), California |

|

Fort Worth, Texas |

Global I (Chicago), Illinois |

|

Livonia, Louisiana |

DIT (Dallas), Texas |

|

Proviso (Chicago), Illinois |

Mesquite, Texas |

|

Roseville, California |

City of Industry, California |

|

West Colton, California |

Global II (Chicago), Illinois |

|

Pine Bluff, Arkansas |

Marion (Memphis), Tennessee |

|

Neff (Kansas City), Missouri |

Lathrop, California |

RAIL EQUIPMENT

Our equipment includes owned and leased locomotives and rail cars; heavy maintenance equipment and machinery; other equipment and tools in our shops, offices, and facilities; and vehicles for maintenance, transportation of crews, and other activities. As of December 31, 2016, we owned or leased the following units of equipment:

|

|

||||

|

|

Average |

|||

|

Locomotives |

Owned |

Leased |

Total |

Age (yrs.) |

|

Multiple purpose |

6,247 | 1,958 | 8,205 | 19.2 |

|

Switching |

214 | 12 | 226 | 34.5 |

|

Other |

51 | 57 | 108 | 37.5 |

|

Total locomotives |

6,512 | 2,027 | 8,539 |

N/A |

15

|

|

||||

|

|

Average |

|||

|

Freight cars |

Owned |

Leased |

Total |

Age (yrs.) |

|

Covered hoppers |

13,382 | 13,736 | 27,118 | 20.6 |

|

Open hoppers |

7,183 | 2,624 | 9,807 | 30.1 |

|

Gondolas |

6,007 | 2,778 | 8,785 | 25.8 |

|

Boxcars |

3,007 | 6,740 | 9,747 | 35.0 |

|

Refrigerated cars |

2,657 | 3,485 | 6,142 | 24.4 |

|

Flat cars |

2,596 | 1,384 | 3,980 | 30.4 |

|

Other |

1 | 351 | 352 | 21.1 |

|

Total freight cars |

34,833 | 31,098 | 65,931 |

N/A |

|

|

||||

|

|

Average |

|||

|

Highway revenue equipment |

Owned |

Leased |

Total |

Age (yrs.) |

|

Containers |

33,574 | 21,631 | 55,205 | 8.4 |

|

Chassis |

22,071 | 23,509 | 45,580 | 10.3 |

|

Total highway revenue equipment |

55,645 | 45,140 | 100,785 |

N/A |

CAPITAL EXPENDITURES

Our rail network requires significant annual capital investments for replacement, improvement, and expansion. These investments enhance safety, support the transportation needs of our customers, and improve our operational efficiency. Additionally, we add new locomotives and freight cars to our fleet to replace older, less efficient equipment, to support growth and customer demand, and to reduce our impact on the environment through the acquisition of more fuel-efficient and low-emission locomotives.

2016 Capital Program – During 2016, our capital program totaled approximately $3.5 billion. (See the cash capital expenditures table in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources, Item 7.)

2017 Capital Plan – In 2017, we expect our capital plan to be approximately $3.1 billion, which will include expenditures for PTC of approximately $300 million and may include non-cash investments. We may revise our 2017 capital plan if business conditions warrant or if new laws or regulations affect our ability to generate sufficient returns on these investments. (See discussion of our 2017 capital plan in Management’s Discussion and Analysis of Financial Condition and Results of Operations – 2017 Outlook, Item 7.)

OTHER

Equipment Encumbrances – Equipment with a carrying value of approximately $2.3 billion and $2.6 billion at December 31, 2016, and 2015, respectively served as collateral for capital leases and other types of equipment obligations in accordance with the secured financing arrangements utilized to acquire or refinance such railroad equipment.

As a result of the merger of Missouri Pacific Railroad Company (MPRR) with and into UPRR on January 1, 1997, and pursuant to the underlying indentures for the MPRR mortgage bonds, UPRR must maintain the same value of assets after the merger in order to comply with the security requirements of the mortgage bonds. As of the merger date, the value of the MPRR assets that secured the mortgage bonds was approximately $6.0 billion. In accordance with the terms of the indentures, this collateral value must be maintained during the entire term of the mortgage bonds irrespective of the outstanding balance of such bonds.

Environmental Matters – Certain of our properties are subject to federal, state, and local laws and regulations governing the protection of the environment. (See discussion of environmental issues in Business – Governmental and Environmental Regulation, Item 1, and Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Environmental, Item 7.)

16

From time to time, we are involved in legal proceedings, claims, and litigation that occur in connection with our business. We routinely assess our liabilities and contingencies in connection with these matters based upon the latest available information and, when necessary, we seek input from our third-party advisors when making these assessments. Consistent with SEC rules and requirements, we describe below material pending legal proceedings (other than ordinary routine litigation incidental to our business), material proceedings known to be contemplated by governmental authorities, other proceedings arising under federal, state, or local environmental laws and regulations (including governmental proceedings involving potential fines, penalties, or other monetary sanctions in excess of $100,000), and such other pending matters that we may determine to be appropriate.

ENVIRONMENTAL MATTERS

We receive notices from the EPA and state environmental agencies alleging that we are or may be liable under federal or state environmental laws for remediation costs at various sites throughout the U.S., including sites on the Superfund National Priorities List or state superfund lists. We cannot predict the ultimate impact of these proceedings and suits because of the number of potentially responsible parties involved, the degree of contamination by various wastes, the scarcity and quality of volumetric data related to many of the sites, and the speculative nature of remediation costs.

Information concerning environmental claims and contingencies and estimated remediation costs is set forth in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Environmental, Item 7.

OTHER MATTERS

Antitrust Litigation - As we reported in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2007, 20 rail shippers (many of whom are represented by the same law firms) filed virtually identical antitrust lawsuits in various federal district courts against us and four other Class I railroads in the U.S. Currently, UPRR and three other Class I railroads are the named defendants in the lawsuit. The original plaintiff filed the first of these claims in the U.S. District Court in New Jersey on May 14, 2007. The number of complaints reached a total of 30. These suits allege that the named railroads engaged in price-fixing by establishing common fuel surcharges for certain rail traffic.

In addition to suits filed by direct purchasers of rail transportation services, a few of the suits involved plaintiffs alleging that they are or were indirect purchasers of rail transportation and sought to represent a purported class of indirect purchasers of rail transportation services that paid fuel surcharges. These complaints added allegations under state antitrust and consumer protection laws. On November 6, 2007, the Judicial Panel on Multidistrict Litigation ordered that all of the rail fuel surcharge cases be transferred to Judge Paul Friedman of the U.S. District Court in the District of Columbia for coordinated or consolidated pretrial proceedings. Following numerous hearings and rulings, Judge Friedman dismissed the complaints of the indirect purchasers, which the indirect purchasers appealed. On April 16, 2010, the U.S. Court of Appeals for the District of Columbia affirmed Judge Friedman’s ruling dismissing the indirect purchasers’ claims based on various state laws.

On June 21, 2012, Judge Friedman issued a decision that certified a class of plaintiffs with eight named plaintiff representatives. The decision included in the class all shippers that paid a rate-based fuel surcharge to any one of the defendant railroads for rate-unregulated rail transportation from July 1, 2003, through December 31, 2008. This was a procedural ruling, which did not affirm any of the claims asserted by the plaintiffs and does not address the ability of the railroad defendants to disprove the allegations made by the plaintiffs. On July 5, 2012, the defendant railroads filed a petition with the U.S. Court of Appeals for the District of Columbia requesting that the court review the class certification ruling. On August 28, 2012, a panel of the Circuit Court of the District of Columbia referred the petition to a merits panel of the court to address the issues in the petition and to address whether the district court properly granted class certification. The Circuit Court heard oral arguments on May 3, 2013. On August 9, 2013, the Circuit Court vacated the class certification decision and remanded the case to the district court to reconsider the class certification decision in light of a recent Supreme Court case and incomplete consideration of errors in the expert report of the plaintiffs. On October 31, 2013, Judge Friedman approved a schedule agreed to by all parties for consideration of the class certification issue on remand.

On October 2, 2014, the plaintiffs informed Judge Friedman that their economic expert had a previously

17

undisclosed conflict of interest. Judge Friedman ruled on November 26, 2014, that the plaintiffs had until April 1, 2015, to file a supplemental expert report to support their motion for class certification. The plaintiffs filed their supplemental expert report on April 1, 2015. Judge Friedman issued a scheduling order on June 19, 2015, scheduling a class certification hearing for November 2, 2015. Judge Friedman then vacated the hearing date in an Order on September 28, 2015 because of the potential impact resulting from the decision of the U.S. Supreme Court case, Tyson Foods v. Bouaphakeo, related to class action certification and damages. The U.S. Supreme Court issued a decision in that case on March 22, 2016. After reviewing the Supreme Court’s decision and related briefings from the parties, Judge Friedman issued an order scheduling the class certification hearing for the week of September 26, 2016, which was conducted as scheduled. The parties are awaiting the results of that hearing.

As we reported in our Current Report on Form 8-K, filed on June 10, 2011, the Railroad received a complaint filed in the U.S. District Court for the District of Columbia on June 7, 2011, by Oxbow Carbon & Minerals LLC and related entities (Oxbow). The complaint named the Railroad and one other U.S. Class I Railroad as defendants and alleged that the named railroads engaged in price-fixing and monopolistic practices in connection with fuel surcharge programs and pricing of shipments of certain commodities, including coal and petroleum coke. The complaint sought injunctive relief and payment of damages of over $30 million, and other unspecified damages, including treble damages. Some of the allegations in the complaint were addressed in the existing fuel surcharge litigation referenced above. The complaint also included additional unrelated allegations regarding alleged limitations on competition for shipments of Oxbow’s commodities. Judge Friedman, who presides over the fuel surcharge matter described above, also presides over this matter. On February 26, 2013, Judge Friedman granted the defendants’ motion to dismiss Oxbow’s complaint for failure to properly state a claim under the antitrust laws. However, the dismissal was without prejudice to refile the complaint. Judge Friedman approved a schedule that allowed Oxbow to file a revised complaint, which Oxbow filed on May 1, 2013. The amended complaint alleges that UPRR and one other Class I railroad violated Sections 1 and 2 of the Sherman Antitrust Act and that UPRR also breached a tolling agreement between Oxbow and UPRR. Oxbow claims that it paid more than $50 million in wrongfully imposed fuel surcharges. UPRR and the other railroad filed separate motions to dismiss the Oxbow revised complaint on July 1, 2013. Judge Friedman heard oral arguments on the motions to dismiss filed by UPRR and the other railroad on January 8, 2015. Judge Friedman denied the motions to dismiss on February 24, 2015. This was a procedural ruling, which did not affirm any of the claims asserted by Oxbow and does not affect the ability of the railroad defendants to disprove the allegations made by Oxbow. UPRR filed its answer to Oxbow’s complaint on March 24, 2015, and the parties continue to conduct discovery.