10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 10-K

|

| |

(Mark One) |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 26, 2015

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from to

Commission file number 1-11657

________________________________________

TUPPERWARE BRANDS CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 36-4062333 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

14901 South Orange Blossom Trail, Orlando, Florida | 32837 |

(Address of principal executive offices) | (Zip Code) |

| |

Registrant's telephone number, including area code: (407) 826-5050 |

| |

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value | New York Stock Exchange |

| |

Securities registered pursuant to Section 12(g) of the Act: None |

________________________________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates on the New York Stock Exchange-Composite Transaction Listing on June 26, 2015 (the last business day of the registrant's most recently completed second fiscal quarter) was $3,312,415,604. For the purposes of making this calculation only, the registrant included all of its directors, executive officers and beneficial owners of more than ten percent of its common stock.

As of February 29, 2016, 50,500,182 shares of the common stock, $0.01 par value, of the registrant were outstanding.

Documents Incorporated by Reference:

Portions of the Proxy Statement relating to the Annual Meeting of Shareholders to be held May 24, 2016 are incorporated by reference into Part III of this Report.

Table of Contents

|

| | |

Item | | Page |

Part I |

| | |

Item 1 | | |

Item 1A | | |

Item 1B | | |

Item 2 | | |

Item 3 | | |

Item 4 | | |

|

Part II |

| | |

Item 5 | | |

Item 5a | | |

Item 5c | | |

Item 6 | | |

Item 7 | | |

Item 7A | | |

Item 8 | | |

Item 9 | | |

Item 9A | | |

Item 9B | | |

| | |

Part III |

| | |

Item 10 | | |

Item 11 | | |

Item 12 | | |

Item 13 | | |

Item 14 | | |

| | |

Part IV |

| | |

Item 15 | | |

| | |

| | |

| | |

| |

PART I

(a) General Development of Business

Tupperware Brands Corporation (“Registrant”, “Tupperware Brands” or the “Company”) is a global direct-to-consumer marketer of premium, innovative products across multiple brands and categories through an independent sales force of 3.1 million. Product brands and categories include design-centric preparation, storage and serving solutions for the kitchen and home through the Tupperware® brand and beauty and personal care products through the Avroy Shlain®, BeautiControl®, Fuller®, NaturCare®, Nutrimetics® and Nuvo® brands. The Registrant is a Delaware corporation that was organized on February 8, 1996 in connection with the corporate reorganization of Premark International, Inc. (“Premark”).

(b) New York Stock Exchange-Required Disclosures

General. The address of the Registrant's principal office is 14901 South Orange Blossom Trail, Orlando, Florida 32837. The names of the Registrant's directors are Catherine A. Bertini, Susan M. Cameron, Kriss Cloninger, III, Meg Crofton, E.V. Goings, Joe R. Lee, Angel R. Martinez, Antonio Monteiro de Castro, Robert J. Murray, David R. Parker, Richard T. Riley, Joyce M. Roché and M. Anne Szostak. Members of the Audit, Finance and Corporate Responsibility Committee of the Board of Directors are Mr. Monteiro de Castro (Chair), Mses. Bertini and Szostak and Messrs. Lee, Murray and Riley. The members of the Compensation and Management Development Committee of the Board of Directors are Mr. Parker (Chair), Mses. Cameron, Crofton and Roché and Messrs. Cloninger and Martinez. The members of the Nominating and Governance Committee of the Board of Directors are Mr. Murray (Chair), Ms. Roché and Messrs. Cloninger, Monteiro de Castro and Parker. The members of the Executive Committee of the Board of Directors are Mr. Goings (Chair) and Messrs. Cloninger, Monteiro de Castro, Murray and Parker. The Chairman and Chief Executive Officer is Mr. Goings and the Presiding Director is Mr. Murray. The Registrant's executive officers and the number of its employees are set forth below in Part I of this Report. The name and address of the Registrant's transfer agent and registrar is Wells Fargo Bank, N.A., c/o Wells Fargo Shareowner Services, 1110 Centre Pointe Curve, Suite 101, MAC N9173-010, Mendota Heights, MN 55120. The number of the Registrant's shareholders is set forth below in Part II, Item 5 of this Report. The Registrant is satisfying its annual distribution requirement to shareholders under the New York Stock Exchange (“NYSE”) rules by the distribution of its Annual Report on Form 10-K as filed with the United States Securities and Exchange Commission (“SEC”) in lieu of a separate annual report.

Corporate Governance. Investors can obtain access to periodic reports and corporate governance documents, including board committee charters, corporate governance principles and codes of conduct and ethics for financial executives, and information regarding the Registrant's transfer agent and registrar through the Registrant's website free of charge (as soon as reasonably practicable after reports are filed with the SEC, in the case of periodic reports) by going to www.tupperwarebrands.com and searching under Investor Relations / SEC Filings and Governance Documents. The Chief Executive Officer of the Registrant has certified to the NYSE that he is not aware of any violation by the Registrant of NYSE corporate governance listing standards.

BUSINESS OF TUPPERWARE BRANDS CORPORATION

The Registrant is a worldwide direct-to-consumer company engaged in the manufacture and sale of Tupperware® products and cosmetics and personal care products under a variety of trade names, including Avroy Shlain®, BeautiControl®, Fuller®, NaturCare®, Nutrimetics® and Nuvo®. Each business manufactures and/or markets a broad line of high quality products.

I. PRINCIPAL PRODUCTS

Tupperware. The core of the Tupperware product line consists of design-centric preparation, storage, and serving solutions for the kitchen and home. Tupperware also has established lines of cookware, knives, microwave products, microfiber textiles, water-filtration related items and an array of products for on-the-go consumers. The Company has continued to refresh its traditional kitchen and home products, such as the Salad Spinner and Measuring Cups, as well as the EZ Mix n Stor and EZ Shaker*, with updated designs and incremental technological enhancements while evolving towards more lifestyle-oriented products. These new lifestyle solutions are based on consumer insights from the Company's market and product leaders around the globe. In 2015, key launches to contemporize the Tupperware product offering included the efficient Tupperware Click Series* Peeler System and the introduction of the Warmie-Tup* Serving Range, which insulates foods to maintain serving temperatures for longer. Other key launches and line extensions introduced included the fun and versatile Silicone Baking Forms Football Sheet with Rim, the Microwave Rice Maker Large, the Eco Prep Fruit Juicer and the Click to Go Containers. The successful Fusion Master* System was expanded to include the new Chef Press* Dicer for added functionality and the Freezer Mates* range was also extended to include new size options. A new knife range, Chef Series Pure Knives, was introduced last year featuring a Bread Knife, a Chef Knife, a Paring Knife and a Utility Knife. A new generation of Eco Bottles, now printable, was also introduced in 2015, while the Kids' Eco Bottle range was further expanded.

The Company continues to introduce new materials, designs, colors and decoration in its product lines, to vary its offerings including by season and to extend existing products into new markets. The development of new products varies across markets in order to address differences in cultures, lifestyles, tastes and needs, although most products are offered in a large number of markets.

Research and development and the resultant new products will continue to be an important part of the Company's strategy going forward.

Beauty. In Beauty, the Company manufactures and distributes skin and hair care products, cosmetics, bath and body care, toiletries, fragrances, jewelry and nutritional products. There were a number of key product launches by brand in 2015:

Beauticontrol saw several key product launches that expanded the Regeneration* Tight, Firm & Fill* range. These included Regeneration* Tight, Firm & Fill*, Dramatic New Anti-Aging Crème, Regeneration* Tight, Firm & Fill* PM Miracle Complex with Retinol, Regeneration* Tight, Firm & Fill* PM Intensive Moisturizing Lip Treatment and Regeneration* Tight, Firm & Fill* PM Intensive Moisturizing Eye Elixir. The Beauticontrol Lovely Eyes Palette was added in the color cosmetics category.

Fuller Cosmetics expanded its fragrance lines by introducing Azul Life* fragrance for Father’s Day, Exclusive by Armand Dupree* for him and Armand Dupree Glam* for her fragrances for the winter holiday season and a new Hello Kitty scent, under license, for the summer. The Hola Bebe fragrance for her was also introduced in 2015, under license, featuring popular Mexican pop star, Espinoza Paz.

Tupperware Brands Brazil introduced the Nutrimetics* brand by launching a new range of cosmetics, fragrances and skin care products. Major launches included Nutrimetics Nutri-Rich Oil with Apricot Kernel Oil and 5 fragrances: Miami, Paris, NYC, London and Rouge, all under the Nutrimetics* brand.

Tupperware Brands Philippines redesigned its top 2 women’s fragrances: Ivana* and A Little Romance*. The fragrances were reintroduced to the sales force via product roadshows.

Nutrimetics Australia’s Ultra Care+ Platinum Skin Care range continues to rank in their top 10 products. The launch of the Ultra Care+ Platinum Skin Care Hand Crème helped to support the sale of the other key products within this range. A similar strategy was used in the color category with the introduction of the Nutrimetics Professional* Colour Range, which featured 5 products in 2015, with the most popular being the Nutrimetics Professional* Nude Color Palette.

Avroy Shlain relaunched its daily skincare ranges with 2 variants, the Nucelle* range for dry skin and Tahlita* range, which features more advanced ingredients, for combination skin. In the technologically advanced skincare range, Cell Revitalization Therapy (CRT*), they introduced CRT* Youth Gel Eye Serum, CRT* Hydration Serum and CRT* Anti-wrinkle Serum. Their fragrance category’s key launches included Adrenalin* for men and Inspired Dreams* for ladies fragrances, and the introduction of the Destination Collection New York fragrance. Gel Nails and CC Creams were introduced to the Coppelia Colour* range.

(Words followed by * are registered or unregistered trademarks of the Registrant.)

II. MARKETS

The Company operates its business under five reporting segments in three broad geographic regions: Europe (Europe, Africa and the Middle East), Asia Pacific and the Americas. Market penetration varies throughout the world. Several areas that have low penetration, such as Latin America, Asia and Eastern and Central Europe, provide the Company significant growth potential. The Company's strategy continues to include greater penetration in markets throughout the world.

Tupperware Brands' products are sold around the world under seven brands: Tupperware, Avroy Shlain, BeautiControl, Fuller, NaturCare, Nutrimetics and Nuvo. The Company defines its established market economy units as those in Western Europe (including Scandinavia), Australia, Canada, Japan, New Zealand and the United States. All other units are classified as operating in emerging market economies. Businesses operating in emerging markets accounted for 66 percent of 2015 sales, while businesses operating in established markets accounted for the other 34 percent. For the past five fiscal years, 90 to 92 percent of total revenues from the sale of Tupperware Brands' products have been in international markets.

See Note 15 to the Consolidated Financial Statements for further details regarding segments and geographic areas.

III. DISTRIBUTION OF PRODUCTS

The Company's products are distributed worldwide primarily through the “direct-to-consumer” method, under which products are sold by an independent sales force to consumers outside traditional retail store locations. The system facilitates the timely distribution of products to consumers, without having to work through retail intermediaries, and establishes uniform practices regarding the use of Tupperware Brands' trademarks and administrative arrangements, such as order entry, delivery and payment, along with the addition and training of new sales force members.

Products are primarily sold directly to distributors, directors, managers and dealers (“sales force”) throughout the world. Where distributorships are granted, they have the right to market the Company's products using parties and other non-retail methods and to utilize Tupperware Brands' trademarks. The vast majority of the sales force members are independent contractors and not employees of Tupperware. In certain limited circumstances, the Company has acquired ownership of distributorships for a period of time, until an independent distributor can be installed, in order to maintain market presence.

In addition to the introduction of new products and development of new geographic markets, a key element of the Company's strategy is expanding its business by increasing the size of its sales force. Under the system, distributors, directors, team leaders and managers, and dealers add, train, and motivate a large number of dealers. Managers are developed from among the dealer group and promoted to assist in adding, training and motivating dealers, while continuing to sell products.

As of December 26, 2015, the Company's distribution system had approximately 2,000 distributors, 101,700 managers (including directors and team leaders) and 3.1 million dealers worldwide.

Tupperware has traditionally relied upon the group presentation method of sales, which is designed to enable purchasers to appreciate, through demonstration, the features and benefits of the Company's products. Parties are held in homes, offices, social clubs and other locations. Products are also promoted through brochures mailed or given to people invited to attend parties and various other types of demonstrations. Some business units utilize a campaign merchandising system, whereby sales force members sell through brochures generated every two or three weeks, to their friends, neighbors and relatives. Sales of products are supported through programs of sales promotions, sales and training aids and motivational conferences for the sales force. In addition, to support its sales force, the Company utilizes catalogs and television and magazine advertising, which help to increase its sales levels with hard-to-reach customers and generate leads for sales and new dealers. A significant portion of the Company's business is operated through distributors, many of whom stock inventory and fulfill orders of the sales force that are generally placed after orders have been received from end consumers. In other cases, the Company sells directly to the sales force, also generally after they have received a consumer order.

In 2015, the Company continued to sell directly, and/or through its sales force, to end consumers via the Internet. It also entered into a limited number of business-to-business transactions, in which it sells products to a partner company for sale to consumers through the partner's distribution channel, with a link back to the core business. Internet and business-to-business transactions do not constitute a significant portion of the Company's sales.

IV. COMPETITION

There are many competitors to Tupperware Brands' businesses both domestically and internationally. The principal bases of competition generally are marketing, price, quality and innovation of products, as well as competition with other “direct-to-consumer” companies for sales personnel and demonstration dates. Due to the nature of the direct-to-consumer industry, it is critical that the Company provides a compelling earnings opportunity for the sales force, along with developing new and innovative products. The Company maintains its competitive position, in part, through the use of strong incentives and promotional programs.

Through its Tupperware® brand, the Company competes in the food storage, serving and preparation, containers, toys and gifts categories. Through its beauty and personal care brands, the Company also competes in the skin care, cosmetics, toiletries, fragrances and nutritionals categories. The Company works to differentiate itself from its competitors through its brand names, product innovation, quality, value-added services, celebrity endorsements, technological sophistication, new product introductions and its channel of distribution, including the training, motivation and compensation arrangements for its independent sales forces.

V. EMPLOYEES

The Registrant employs approximately 13,000 people, of whom approximately 1,000 are based in the United States.

VI. RESEARCH AND DEVELOPMENT

The Registrant incurred $18.1 million, $19.3 million and $20.0 million for fiscal years 2015, 2014 and 2013, respectively, on research and development activities for new products and production processes.

VII. RAW MATERIALS

Many of the products manufactured by and for the Company require plastic resins that meet its specifications. These resins are purchased through various arrangements with a number of large chemical companies located throughout the Company's markets. As a result, the Company has not experienced difficulties in obtaining adequate supplies and generally has been successful in obtaining favorable resin prices on a relative basis. Research and development relating to resins used in Tupperware® products is performed by both the Company and its suppliers.

Materials used in the Company's skin care, cosmetic and bath and body care products consist primarily of readily available ingredients, containers and packaging materials. Such raw materials and components used in goods manufactured and assembled by the Company and through outsource arrangements are available from a number of sources. To date, the Company has been able to secure an adequate supply of raw materials for its products, and it endeavors to maintain relationships with backup suppliers in an effort to ensure that no interruptions occur in its operations.

VIII. TRADEMARKS AND PATENTS

Tupperware Brands considers its trademarks and patents to be of material importance to its business; however, except for the Tupperware® trademark, Tupperware Brands is not dependent upon any single patent or trademark, or group of patents or trademarks. The Tupperware® trademark, as well as its other trademarks, are registered on a country-by-country basis. The current duration for such registration ranges from five years to ten years; however, each such registration may be renewed an unlimited number of times. The patents used in Tupperware Brands' business are registered and maintained on a worldwide basis, with a variety of durations. Tupperware Brands has followed the practice of applying for design and utility patents with respect to most of its significant patentable developments.

IX. ENVIRONMENTAL LAWS

Compliance with federal, state and local environmental protection laws has not had in the past, and is not expected to have in the future, a material effect upon the Registrant's capital expenditures, liquidity, earnings or competitive position.

X. OTHER

Sales do not vary significantly on a quarterly basis; however, third quarter sales are generally lower than the other quarters in any year due to vacations by dealers and their customers, as well as reduced promotional activities during this quarter. Sales generally increase in the fourth quarter, as it includes traditional gift-giving occasions in many markets and as children return to school and households refocus on activities that include party plan sales events and the use of the Company's housewares products, along with increased promotional activities supporting these opportunities.

Generally, there are no working capital practices or backlog conditions which are material to an understanding of the Registrant's business, although the Company generally seeks to minimize its net working capital position at the end of each fiscal year and normally generates a significant portion of its annual cash flow from operating activities in its fourth quarter. The Registrant's business is not dependent on a small number of customers, nor is any of its business subject to renegotiation of profits or termination of contracts or subcontracts at the election of the United States government.

XI. EXECUTIVE OFFICERS OF THE REGISTRANT

Following is a list of the names and ages of all the Executive Officers of the Registrant, indicating all positions and offices held by each such person with the Registrant, and each such person's principal occupations or employment during the past five years. Each such person has been elected to serve until the next annual election of officers of the Registrant (expected to occur on May 24, 2016).

|

| | |

Name and Age | | Positions and Offices Held and Principal Occupations of Employment- During Past Five Years |

Allen Dando, age 62 | | Group President, Tupperware Europe, Africa & Middle East since September 2015, after serving as its Area Vice President since January 2015 and prior thereto in various leadership positions in Europe and Africa. |

Lillian D. Garcia, age 59 | | Executive Vice President and Chief Human Resources Officer, after serving as Executive Vice President and Area Vice President, Argentina, Uruguay, Venezuela and Ecuador from January 2011 to December 2012, and as Executive Vice President and President, Fuller Argentina since January 2010. |

E.V. Goings, age 70 | | Chairman and Chief Executive Officer since October 1997. |

Asha Gupta, age 44 | | Group President, Asia Pacific since January 1, 2014 after serving as Area Vice President, India, Philippines and Nutrimetics Australia since January 2012. Prior thereto she served as Managing Director, Tupperware India. |

Josef Hajek, age 57 | | Senior Vice President, Tax and Governmental Affairs since February 2006. |

Simon C. Hemus, age 66 | | President and Chief Operating Officer since January 2007. |

Georg H. Jaggy, age 58 | | Executive Vice President and Chief Global Marketing Officer since January 2015, after serving as President, Tupperware Germany and Area Vice President, Northern Europe since March 2013, and President & Area Vice President, Tupperware Germany since November 2008. |

Michael S. Poteshman, age 52 | | Executive Vice President and Chief Financial Officer since August 2004. |

Nicholas K. Poucher, age 54 | | Senior Vice President and Controller since November 2014, after serving as Vice President and Controller since August 2007. |

Thomas M. Roehlk, age 65 | | Executive Vice President, Chief Legal Officer & Secretary since August 2005. |

Patricia A. Stitzel, age 50 | | Group President, Americas since January 2014 after serving as Senior Area Vice President, Central Europe since 2012 and prior thereto in various leadership positions in Europe. |

William J. Wright, age 53 | | Executive Vice President, Supply Chain Worldwide since October 2015, after serving as Senior Vice President, Global Supply Chain since October 2014, Senior Vice President, Global Product Development, Tupperware since March 2013, and Senior Vice President, Global Product Marketing since October 2010. |

Item 1A. Risk Factors.

The risks and uncertainties described below are not the only ones facing the Company. Other events that the Company does not currently anticipate or that the Company currently deems immaterial also may affect results of operations and financial condition.

Sales Force Factors

The Company’s products are marketed and sold through the "direct-to-consumer" method of distribution, in which products are primarily marketed and sold to consumers, without the use of retail establishments, by a sales force made up of independent contractors. This distribution system depends upon the successful addition, activation and retention of a large force of sales personnel to grow and compensate for a high turnover rate. The addition and retention of sales force members is dependent upon the competitive environment among direct-to-consumer companies and upon the general labor market, unemployment levels, general economic conditions, and demographic and cultural changes in the workforce. The activation of the sales force is dependent, in part, upon the effectiveness of compensation and promotional programs of the Company, the competitiveness of the same compared with other direct-to-consumer companies, the introduction of new products and the ability to advance through the sales force structure.

The Company’s sales are directly tied to the activity levels of its sales force, which is in large part a temporary working activity for many sales force members. Activity levels may be affected by the degree to which a market is penetrated by the presence of the Company’s sales force, the amount of average sales per order, the amount of sales per sales force member, the mix of high-margin and low-margin products sold at parties and elsewhere, and the activities and actions of the Company’s product line and channel competitors. In addition, the Company’s sales force members may be affected by initiatives undertaken by the Company to grow its revenue base that may lead to the inaccurate perception that the independent sales force system is at risk of being phased out.

International Operations

A significant portion of the Company’s sales and profit comes from its international operations. Although these operations are geographically dispersed, which partially mitigates the risks associated with operating in particular countries, the Company is subject to the usual risks associated with international operations. Amongst others, these risks include local political and economic environments, adverse new tax regulations and relations between the U.S. and foreign governments.

The Company derived 91 percent of its net sales from operations outside the United States in 2015. As a result, movement in exchange rates has had and may continue to have a significant impact on the Company’s earnings, cash flows and financial position. The Company’s most significant exposures are to the Brazilian real, Chinese renminbi, euro, Indonesian rupiah and Mexican peso. Business units in which the Company generated at least $100 million of sales in 2015 included Brazil, China, Fuller Mexico, Germany, Indonesia, Tupperware Mexico and Tupperware United States and Canada. Of these units, sales in Brazil and Indonesia exceeded $200 million. Although the Company's currency risk is partially mitigated by the natural hedge arising from its local product sourcing in many markets, a strengthening U.S. dollar generally has a negative impact on the Company. In response to this fact, the Company continues to implement foreign currency hedging and risk management strategies to reduce the exposure to fluctuations in earnings associated with changes in foreign currency exchange rates. The Company generally does not seek to hedge the impact of currency fluctuations on the translated value of the sales, profit or cash flow generated by its operations. Some of the hedging strategies implemented have a positive or negative impact on cash flows as foreign currencies fluctuate versus the U.S. dollar. There can be no assurance that foreign currency fluctuations and related hedging activities will not have a material adverse impact on the Company’s results of operations, cash flows and/or financial condition.

Another risk associated with the Company’s international operations is restrictions foreign governments may impose on currency remittances. Due to the possibility of government restrictions on transfers of cash out of countries and control of exchange rates and currency convertibility, the Company may not be able to immediately access its cash at the exchange rate used to translate its financial statements. This has been a particular issue in Argentina, Egypt, and Venezuela. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations for further discussion regarding Egypt, as well as the impacts of the Venezuelan government's currency restrictions on the Company's operations.

Legal and Regulatory Issues

The Company's business may also be affected by actions of domestic and foreign governments to restrict the activities of direct-to-consumer companies for various reasons, including the limitation on the ability of direct-to-consumer companies to operate without the involvement of a traditional retail channel. Foreign governments may also introduce other forms of protectionist legislation, such as limitations on the products which can be produced locally or requirements that non-domestic companies doing or seeking to do business place a certain percentage of ownership of legal entities in the hands of local nationals to protect the commercial interests of its citizens. Customs laws, tariffs, import duties, export and import quotas and restrictions on repatriation of foreign earnings and/or other methods of accessing cash generated internationally, may negatively affect the Company's international operations. Governments may seek either to impose taxes on independent sales force members or to classify independent sales force members as employees of direct-to-consumer companies with whom they may be associated, triggering employment-related taxes on the part of the direct-to-consumer companies. Additionally, some governments prohibit or impose limitations on the requirement to purchase demonstration products upon joining a direct-to-consumer business and/or the types of activities for which a direct-to-consumer sales force can be compensated.The U.S. government may impose restrictions on the Company's ability to engage in business in a foreign country in connection with the foreign policy of the United States.

Product Safety

Certain of the materials used in the Company’s product lines may give rise to concerns of consumers based upon scientific theories which are espoused from time to time, including the risk of certain materials leaching out of plastic containers used for their intended purposes or the ingredients used in cosmetics, personal care or nutritional products causing harm to human health. This includes polycarbonate, which contains the chemical Bisphenol A, and polyethersulfone, which contains the chemical Bisphenol S. It is the Company’s policy to market products in each of its business units containing only those materials or ingredients that are approved by relevant regulatory authorities for contact with food or skin or for ingestion by consumers, as applicable.

Technology and Cyber-Security

The Company relies extensively on information technology systems, some of which are managed by third-party service providers, to conduct its business. These systems include, but are not limited to, programs and processes relating to internal communications and communications with other parties, ordering and managing materials from suppliers, converting materials to finished products, receiving orders and shipping product to customers, billing customers and receiving and applying payment, processing transactions, summarizing and reporting results of operations, complying with regulatory, legal or tax requirements, collecting and storing certain customer, employee, investor, and other stakeholder information and personal data, and other processes necessary to manage the Company’s business. Increased information technology security threats and more sophisticated computer crime, including advanced persistent threats, pose a potential risk to the security of the information technology systems, networks, and services of the Company, its customers and other business partners, as well as the confidentiality, availability, and integrity of the data of the Company, its customers and other business partners. As a result, the Company’s information technology systems, networks or service providers could be damaged or cease to function properly or the Company could suffer a loss or disclosure of business, personal or stakeholder information, due to any number of causes, including catastrophic events, power outages and security breaches. Although the Company has business continuity plans in place, if these plans do not provide effective alternative processes on a timely basis, the Company may suffer interruptions in its ability to manage or conduct its operations, which may adversely affect its business. The Company may need to expend additional resources in the future to continue to protect against, or to address problems caused by, any business interruptions or data security breaches. Any business interruptions or data security breaches, including cyber-security breaches resulting in private data disclosure, could result in lawsuits or regulatory proceedings, damage the Company’s reputation or adversely impact the Company’s results of operations and cash flows. While the Company maintains insurance coverage that could cover some of these types of issues, the coverage has limitations and includes deductibles such that it may not be adequate to offset losses incurred.

General Business Factors

The Company’s business can be affected by a wide range of factors that affect other businesses. Weather, natural disasters, strikes, epidemics/pandemics, political instability, terrorist activity and public scrutiny of the direct-to-consumer channel, may have a significant impact on the willingness or ability of consumers to attend parties or otherwise purchase the Company’s products. The supply and cost of raw materials, particularly petroleum and natural gas-based resins, may have an impact on the availability or cost of the Company’s plastic products. The Company is also subject to frequent product counterfeiting and other intellectual property infringement, which may be difficult to police and prevent, depending upon the ability to identify infringers and the availability and/or enforceability of intellectual property rights. Other risks, as discussed under the sub-heading “Forward-Looking Statements” contained in Part II, Item 7A of this Report, may be relevant to performance as well.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

The principal executive office of the Registrant is owned by the Registrant and is located in Orlando, Florida. The Registrant owns and maintains significant manufacturing and distribution facilities in Brazil, France, Greece, Indonesia, Japan, Korea, Mexico, New Zealand, Portugal, South Africa and the United States, and leases significant manufacturing and distribution facilities in Belgium, China, India and Venezuela. The Registrant owns and maintains the BeautiControl headquarters and leases its manufacturing and distribution facility in Texas. The Registrant conducts a continuing program of new product design and development at its facilities in Florida, Texas, Australia, Belgium and Mexico. None of the owned principal properties is subject to any encumbrance material to the consolidated operations of the Company. The Registrant considers the condition and extent of utilization of its plants, warehouses and other properties to be good, the capacity of its plants and warehouses generally to be adequate for its needs, and the nature of the properties to be suitable for its needs.

In addition to the above-described improved properties, the Registrant owns unimproved real estate surrounding its corporate headquarters in Orlando, Florida. The Registrant prepared certain portions of this real estate for a variety of development purposes and, in 2002, began selling parts of this property. To date, approximately 263 acres have been sold and about 290 acres remain to be sold in connection with this project that is expected to continue for a number of years.

Item 3. Legal Proceedings.

A number of ordinary-course legal and administrative proceedings against the Registrant or its subsidiaries are pending. In addition to such proceedings, there are certain proceedings that involve the discharge of materials into, or otherwise relating to the protection of, the environment. Certain of such proceedings involve federal environmental laws such as the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as well as state and local laws. The Registrant has established reserves with respect to certain of such proceedings. Because of the involvement of other parties and the uncertainty of potential environmental impacts, the eventual outcomes of such actions and the cost and timing of expenditures cannot be determined with certainty. It is not expected that the outcome of such proceedings, either individually or in the aggregate, will have a material adverse effect upon the Registrant.

As part of the 1986 reorganization involving the formation of Premark, Premark was spun-off by Dart & Kraft, Inc., and Kraft Foods, Inc. assumed any liabilities arising out of any legal proceedings in connection with certain divested or discontinued former businesses of Dart Industries Inc., a subsidiary of the Registrant, including matters alleging product and environmental liability. The assumption of liabilities by Kraft Foods, Inc. remains effective subsequent to the distribution of the equity of the Registrant to Premark shareholders in 1996.

As part of the 2005 acquisition of the direct-to-consumer businesses of Sara Lee Corporation (which has since changed its name to Hillshire Brands Co.), that company indemnified the Registrant for any liabilities arising out of any existing litigation at that time and for certain legal and tax matters arising out of circumstances that might relate to periods before or after the date of that acquisition.

Item 4. Mine Safety Procedures.

Not applicable.

PART II

| |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

The Registrant has not sold any securities in 2013 through 2015 that were not registered under the Securities Act of 1933 as amended. As of February 29, 2016, the Registrant had 78,689 shareholders of record and beneficial holders. The principal United States market on which the Registrant’s common stock is being traded is the New York Stock Exchange. The stock price and dividend information set forth in Note 19 to the Consolidated Financial Statements, entitled “Quarterly Financial Summary (Unaudited),” is included in Item 8 of Part II of this Report and is incorporated by reference into this Item 5.

| |

Item 5a. | Performance Graph. |

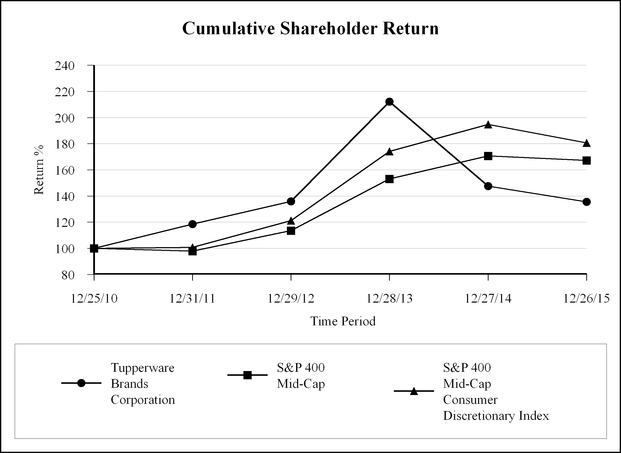

The following performance graph compares the performance of the Company's common stock to the Standard & Poor's 400 Mid-Cap Stock Index and the Standard & Poor's 400 Mid-Cap Consumer Discretionary Index. The graph assumes that the value of the investment in the Company's common stock and each index was $100 at December 25, 2010 and that all dividends were reinvested. The Company's stock is included in both indices.

|

| | | | | | | | |

Measurement Period (Fiscal Year Ended) | Tupperware Brands Corporation | | S&P 400 Mid-Cap | | S&P 400 Mid-Cap Consumer Discretionary Index |

12/25/2010 | 100.00 |

| | 100.00 |

| | 100.00 |

|

12/31/2011 | 118.51 |

| | 97.92 |

| | 100.72 |

|

12/29/2012 | 135.95 |

| | 113.53 |

| | 121.29 |

|

12/28/2013 | 212.08 |

| | 153.18 |

| | 174.22 |

|

12/27/2014 | 147.67 |

| | 170.63 |

| | 194.86 |

|

12/26/2015 | 135.62 |

| | 167.20 |

| | 180.68 |

|

| |

Item 5c. | Changes in Securities, Use of Proceeds and Issuer Purchases of Equity Securities. |

None.

| |

Item 6. | Selected Financial Data. |

The following table presents the Company’s selected historical financial information for the last five years. The selected financial information has been derived from the Company's audited consolidated financial statements which, for the data presented for fiscal years 2015 and 2014 and for some data presented for 2013, are included as Item 8 of this Report. This data should be read in conjunction with the Company's other financial information, including "Management's Discussion and Analysis of Financial Condition and Results of Operations" (MD&A) and the Consolidated Financial Statements and Notes to the Consolidated Financial Statements included as Items 7 and 8, respectively, in this report. The Company's fiscal year ends on the last Saturday of December and, as a result, the 2011 fiscal year contained 53 weeks as compared with 52 weeks for the other fiscal years presented.

During 2015, the Company adopted Accounting Standards Update (ASU) 2015-17, Balance Sheet Classification of Deferred Taxes. As a result, previously reported amounts related to working capital and the current ratio have been re-calculated to exclude deferred tax assets and liabilities in order to conform with the new ASU.

|

| | | | | | | | | | | | | | | | | | | |

(In millions, except per share amounts) | 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

Operating results | | | | | | | | | |

Net sales: | | | | | | | | | |

Europe | $ | 604.9 |

| | $ | 730.3 |

| | $ | 771.5 |

| | $ | 780.0 |

| | $ | 835.9 |

|

Asia Pacific | 779.0 |

| | 849.9 |

| | 848.1 |

| | 792.1 |

| | 727.0 |

|

Tupperware North America | 353.7 |

| | 349.9 |

| | 358.0 |

| | 344.8 |

| | 352.0 |

|

Beauty North America | 240.0 |

| | 290.9 |

| | 320.1 |

| | 348.3 |

| | 395.5 |

|

South America | 306.2 |

| | 385.1 |

| | 373.9 |

| | 318.6 |

| | 274.6 |

|

Total net sales | $ | 2,283.8 |

| | $ | 2,606.1 |

| | $ | 2,671.6 |

| | $ | 2,583.8 |

| | $ | 2,585.0 |

|

Segment profit: | | | | | | | | | |

Europe | $ | 93.3 |

| | $ | 118.2 |

| | $ | 130.6 |

| | $ | 132.0 |

| | $ | 148.4 |

|

Asia Pacific | 175.0 |

| | 191.0 |

| | 187.5 |

| | 172.3 |

| | 146.9 |

|

Tupperware North America | 67.4 |

| | 68.3 |

| | 65.9 |

| | 63.7 |

| | 58.4 |

|

Beauty North America | 2.3 |

| | 1.3 |

| | 16.1 |

| | 30.2 |

| | 37.9 |

|

South America | 46.5 |

| | 27.1 |

| | 68.9 |

| | 61.0 |

| | 48.6 |

|

Unallocated expenses | (72.8 | ) | | (55.9 | ) | | (62.4 | ) | | (62.6 | ) | | (58.9 | ) |

Gain on disposal of assets including insurance recoveries, net (a),(b) | 13.7 |

| | 2.7 |

| | 0.7 |

| | 7.9 |

| | 3.8 |

|

Re-engineering and impairment charges | (20.3 | ) | | (11.0 | ) | | (9.3 | ) | | (22.4 | ) | | (7.9 | ) |

Impairment of goodwill and intangible assets (c) | — |

| | — |

| | — |

| | (76.9 | ) | | (36.1 | ) |

Interest expense, net (d) | (45.2 | ) | | (43.5 | ) | | (37.6 | ) | | (32.4 | ) | | (45.8 | ) |

Income before income taxes | 259.9 |

| | 298.2 |

| | 360.4 |

| | 272.8 |

| | 295.3 |

|

Provision for income taxes | 74.1 |

| | 83.8 |

| | 86.2 |

| | 79.8 |

| | 77.0 |

|

Net income | $ | 185.8 |

| | $ | 214.4 |

| | $ | 274.2 |

| | $ | 193.0 |

| | $ | 218.3 |

|

Basic earnings per common share | $ | 3.72 |

| | $ | 4.28 |

| | $ | 5.28 |

| | $ | 3.49 |

| | $ | 3.63 |

|

Diluted earnings per common share | $ | 3.69 |

| | $ | 4.20 |

| | $ | 5.17 |

| | $ | 3.42 |

| | $ | 3.55 |

|

See footnotes beginning on the following page.

|

| | | | | | | | | | | | | | | | | | | |

(Dollars in millions, except per share amounts) | 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

Profitability ratios | | | | | | | | | |

Segment profit as a percent of sales: | | | | | | | | | |

Europe | 15 | % | | 16 | % | | 17 | % | | 17 | % | | 18 | % |

Asia Pacific | 22 |

| | 22 |

| | 22 |

| | 22 |

| | 20 |

|

Tupperware North America | 19 |

| | 20 |

| | 18 |

| | 19 |

| | 17 |

|

Beauty North America | 1 |

| | — |

| | 5 |

| | 9 |

| | 10 |

|

South America | 15 |

| | 7 |

| | 18 |

| | 19 |

| | 18 |

|

Return on average equity (e) | 107.8 |

| | 77.7 |

| | 76.1 |

| | 37.4 |

| | 30.0 |

|

Return on average invested capital (f) | 21.2 |

| | 21.2 |

| | 26.0 |

| | 18.7 |

| | 20.5 |

|

Financial Condition | | | | | | | | | |

Cash and cash equivalents | $ | 79.8 |

| | $ | 77.0 |

| | $ | 127.3 |

| | $ | 119.8 |

| | $ | 138.2 |

|

Net working capital | (63.5 | ) | | (105.0 | ) | | (53.8 | ) | | (22.0 | ) | | 2.4 |

|

Property, plant and equipment, net | 253.6 |

| | 290.3 |

| | 300.9 |

| | 298.8 |

| | 273.1 |

|

Total assets | 1,598.2 |

| | 1,769.8 |

| | 1,843.9 |

| | 1,821.8 |

| | 1,822.6 |

|

Short-term borrowings and current portion

of long-term obligations | 162.5 |

| | 221.4 |

| | 235.4 |

| | 203.4 |

| | 195.7 |

|

Long-term obligations | 608.2 |

| | 612.1 |

| | 619.9 |

| | 414.4 |

| | 415.2 |

|

Shareholders’ equity | 161.0 |

| | 185.8 |

| | 252.9 |

| | 479.1 |

| | 500.8 |

|

Current ratio | 0.90 |

| | 0.86 |

| | 0.93 |

| | 0.97 |

| | 1.00 |

|

Other Data | | | | | | | | | |

Net cash provided by operating activities | $ | 225.7 |

| | $ | 284.1 |

| | $ | 323.5 |

| | $ | 298.7 |

| | $ | 274.7 |

|

Net cash used in investing activities | (43.1 | ) | | (62.3 | ) | | (60.1 | ) | | (64.8 | ) | | (68.9 | ) |

Net cash used in financing activities | (157.1 | ) | | (211.0 | ) | | (237.6 | ) | | (252.5 | ) | | (300.9 | ) |

Capital expenditures | 61.1 |

| | 69.4 |

| | 69.0 |

| | 75.6 |

| | 73.9 |

|

Depreciation and amortization | 62.4 |

| | 63.7 |

| | 54.8 |

| | 49.6 |

| | 49.8 |

|

Common Stock Data | | | | | | | | | |

Dividends declared per share | $ | 2.72 |

| | $ | 2.72 |

| | $ | 2.48 |

| | $ | 1.44 |

| | $ | 1.20 |

|

Dividend payout ratio (g) | 73.1 | % | | 63.6 | % | | 47.0 | % | | 41.3 | % | | 33.1 | % |

Average common shares outstanding (thousands): | | | | | | | | | |

Basic | 49,947 |

| | 50,131 |

| | 51,892 |

| | 55,271 |

| | 60,046 |

|

Diluted | 50,401 |

| | 51,011 |

| | 53,079 |

| | 56,413 |

| | 61,432 |

|

Period-end book value per share (h) | $ | 3.19 |

| | $ | 3.64 |

| | $ | 4.76 |

| | $ | 8.49 |

| | $ | 8.15 |

|

Period-end price/earnings ratio (i) | 15.1 |

| | 15.2 |

| | 18.4 |

| | 18.3 |

| | 15.8 |

|

Period-end market/book ratio (j) | 17.5 |

| | 17.5 |

| | 19.9 |

| | 7.4 |

| | 6.9 |

|

| |

(a) | In 2002, the Company began to sell land held for development near its Orlando, Florida headquarters. During 2015, 2014, 2013 and 2011, in connection with this program, pretax gains of $12.9 million, $1.3 million, $0.9 million and $0.7 million, respectively, were included in gains on disposal of assets including insurance recoveries, net. There were no land sales under this program in 2012. |

| |

(b) | Included in gain on disposal of assets including insurance recoveries, net are: |

| |

• | Pretax gains of $0.2 million in 2012 and $3.0 million in 2011, as a result of respective insurance recoveries from flood damage in Venezuela in 2012 and Australia in 2011; and |

| |

• | Pretax gains from the sale of property in Australia of $1.1 million in 2014 and $0.2 million in 2013, a pretax gain of $7.5 million in 2012 from the sale of a facility in Belgium and a pretax gain of $0.2 million of equipment sales in 2012. |

| |

(c) | Valuations completed on the Company’s intangible assets resulted in the conclusion that certain tradenames and goodwill values were impaired. This resulted in non-cash charges of $76.9 million and $36.1 million in 2012 and 2011, respectively. See Note 6 to the Consolidated Financial Statements. |

| |

(d) | In 2011, the Company entered into certain credit agreements, which resulted in a non-cash write-off of deferred debt costs to interest expense of $0.9 million. In connection with the termination of the previous credit facilities, the Company also impaired certain floating-to-fixed interest rate swaps resulting in interest expense of $18.9 million. |

| |

(e) | Return on average equity is calculated by dividing net income by the average monthly balance of shareholders’ equity. |

| |

(f) | Return on average invested capital is calculated by dividing net income plus net interest expense multiplied by one minus the estimated marginal tax rate of 37%, by average shareholders’ equity plus debt, for the last five quarters. |

| |

(g) | The dividend payout ratio is dividends declared per share divided by basic earnings per share. |

| |

(h) | Period-end book value per share is calculated as year-end shareholders’ equity divided by full-year diluted shares. |

| |

(i) | Period-end price/earnings ratio is calculated as the year-end market price of the Company’s common stock divided by full year diluted earnings per share. |

| |

(j) | Period-end market/book ratio is calculated as the period-end market price of the Company’s common stock divided by period-end book value per share. |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following is a discussion of the results of operations for 2015 compared with 2014 and 2014 compared with 2013, and changes in financial condition during 2015. The Company’s fiscal year ends on the last Saturday of December and included 52 weeks during 2015, 2014 and 2013. Its 2016 fiscal year will include 53 weeks. This information should be read in conjunction with the consolidated financial information provided in Item 8 of this Annual Report.

The Company's primary means of distributing its products is through independent sales organizations and individuals, which in many cases are also its customers. The vast majority of the Company's products are, in turn, sold to end customers who are not members of its sales force. The Company is largely dependent upon these independent sales organizations and individuals to reach end consumers, and any significant disruption of this distribution network would have a negative financial impact on the Company and its ability to generate sales, earnings and operating cash flows. The Company's primary business drivers are the size, activity, diversity and productivity of its independent sales organizations.

As the impacts of foreign currency translation are an important factor in understanding period-to-period comparisons, the Company believes the presentation of results on a local currency basis, as a supplement to reported results, helps improve readers' ability to understand the Company's operating results and evaluate performance in comparison with prior periods. The Company presents local currency information that compares results between periods as if current period exchange rates had been the exchange rates in the prior period. The Company uses results on a local currency basis as one measure to evaluate performance. The Company generally refers to such amounts as calculated on a "local currency" basis or "excluding the impact of foreign currency." These results should be considered in addition to, not as a substitute for, results reported in accordance with generally accepted accounting principles in the United States ("GAAP"). Results on a local currency basis may not be comparable to similarly titled measures used by other companies.

Estimates included herein are those of the Company’s management and are subject to the risks and uncertainties as described in the Forward Looking Statements caption included in Item 7A.

Overview

(Dollars in millions, except per share amounts)

Total Company Results 2015 vs. 2014

|

| | | | | | | | | | | | | | | | | |

| 52 weeks ended | | Change | | Change excluding the impact of foreign exchange | | Foreign exchange impact |

| December 26,

2015 | | December 27,

2014 | | | |

Net sales | $ | 2,283.8 |

| | $ | 2,606.1 |

| | (12 | )% | | 4 | % | | $ | (413.1 | ) |

Gross margin as a percent of sales | 67.4 | % | | 66.1 | % | | 1.3 | pp | | na |

| | na |

|

DS&A as a percent of sales | 53.3 | % | | 51.7 | % | | 1.6 | pp | | na |

| | na |

|

Operating income | $ | 315.2 |

| | $ | 367.7 |

| | (14 | )% | | 14 | % | | $ | (91.7 | ) |

Net income | $ | 185.8 |

| | $ | 214.4 |

| | (13 | )% | | 28 | % | | $ | (69.3 | ) |

Net income per diluted share | $ | 3.69 |

| | $ | 4.20 |

| | (12 | )% | | 30 | % | | $ | (1.36 | ) |

Total Company Results 2014 vs. 2013

|

| | | | | | | | | | | | | | | | | |

| 52 weeks ended | | Change | | Change excluding the impact of foreign exchange | | Foreign exchange impact |

| December 27,

2014 | | December 28,

2013 | | | |

Net sales | $ | 2,606.1 |

| | $ | 2,671.6 |

| | (2 | )% | | 5 | % | | $ | (188.8 | ) |

Gross margin as a percent of sales | 66.1 | % | | 66.7 | % | | (0.6 | ) pp | | na |

| | na |

|

DS&A as a percent of sales | 51.7 | % | | 51.3 | % | | 0.4 | pp | | na |

| | na |

|

Operating income | $ | 367.7 |

| | $ | 403.5 |

| | (9 | )% | | 2 | % | | $ | (44.1 | ) |

Net income | $ | 214.4 |

| | $ | 274.2 |

| | (22 | )% | | (11 | )% | | $ | (33.5 | ) |

Net income per diluted share | $ | 4.20 |

| | $ | 5.17 |

| | (19 | )% | | (7 | )% | | $ | (0.64 | ) |

____________________

na not applicable

pp percentage points

Net Sales

Reported sales decreased 12 percent in 2015 compared with 2014. Excluding the impact of changes in foreign currency exchange rates, sales increased 4 percent, reflecting strong local currency growth in the Company’s emerging market economy businesses, while its sales in established market economy businesses decreased slightly compared with 2014. The Company defines established markets as those in Western Europe including Scandinavia, Australia, Canada, Japan, New Zealand, and the United States. All other markets are classified as emerging markets.

The Company’s units operating in emerging markets accounted for 66 percent of reported sales in both 2015 and 2014. Reported sales in the emerging markets were down 12 percent in 2015 compared with 2014, including a negative translation impact of $303.9 million from changes in foreign currency exchange rates. Excluding the impact of foreign currency, these units had strong growth of 8 percent. The average impact of higher prices in these markets was 4 percent. The strong increase in local currency sales in the Company's emerging market units was primarily in Brazil, due to a significant increase in sales force size and its productivity, and China, reflecting continued growth in the number of experience studios along with higher sales per studio. Also contributing to the local currency sales increase was inflation related pricing in Argentina, the benefit of larger sales forces in Tupperware Mexico and the Company's businesses in the Middle East and North Africa, as well as from significantly increased sales force activity in Tupperware South Africa. The local currency sales growth in these units was partially offset by decreases in Malaysia/Singapore and Turkey, reflecting less active and less productive sales forces. Local currency sales in Indonesia, the Company's largest business unit, decreased slightly in 2015 compared with 2014.

Reported sales in the Company’s units operating in established market economies were down 14 percent, including a negative translation impact of $109.2 million from changes in foreign currency exchange rates. Excluding the impact of foreign currency, sales by these units decreased 2 percent, primarily in France, reflecting lingering impacts on sales force additions and party scheduling from terrorist attacks and changes in the structure of compensation for sales force managers in 2015, Italy, due to less activity and lower productivity, and BeautiControl due to the impacts of a revised sales force compensation plan launched at the beginning of the second quarter. These decreases were partially offset by a strong increase in the United States and Canada, reflecting increased sales volume through a larger sales force from strong additions. The average price increase in the established market units was 1 percent.

Reported sales decreased 2 percent in 2014 compared with 2013. Excluding the impact of changes in foreign currency exchange rates, sales increased 5 percent, reflecting strong growth in the Company’s emerging market economy businesses, while its sales in established market economy businesses decreased compared with 2013.

The Company’s emerging markets accounted for 66 and 65 percent of reported sales in 2014 and 2013, respectively. Reported 2014 sales in the emerging markets were down 1 percent compared with 2013, including a negative $173.1 million translation impact on the comparison from changes in foreign currency exchange rates. Excluding the impact of foreign currency, these units had strong growth of 10 percent. The average impact of higher prices in these markets was 9 percent. The strong local currency results in the emerging markets were led by Argentina, Brazil, China, Indonesia, Turkey and Venezuela. This primarily reflected larger and more productive sales forces, significant growth in the number of experience studios and studio productivity in China and significant inflation related price increases in some of the units, as well as a product mix benefit in Argentina. Venezuela contributed to the local currency sales increase, primarily reflecting inflation related price increases, despite government restrictions reducing the prices that would otherwise have been charged, as well as higher volume of products sold through a more productive sales force. Among the emerging market units, those with notable declines in local currency sales were Fuller Mexico, due to a smaller sales force resulting from lower additions of sales force members, mainly from high field manager turnover; India, reflecting a smaller and less active sales force; as well as in Russia due to the external political and economic situation and continuing challenges in additions and activation of sales force members. The Company’s established market businesses' sales were down 5 percent, including a negative $15.8 million translation impact on the comparison from changes in foreign currency exchange rates. Excluding the impact of foreign currency, sales by these units decreased 4 percent. The average price increase in the established market units was 2 percent. Among these units, there was a larger local currency decrease in Germany, due to a less active sales force, along with the loss of sales in light of the decision to cease operating the Armand Dupree business in the United States in the second quarter of 2014.

Specific segment impacts are further discussed in the Segment Results section.

Gross Margin

Gross margin as a percentage of sales was 67.4 percent in 2015 and 66.1 percent in 2014. The increase of 1.3 percentage points ("pp") primarily reflected better pricing and mix (1.0 pp), favorable resin pricing (0.5 pp), a lower year-over-year impact of inventory in Venezuela being included in cost of goods sold at its stronger, historical exchange rate rather than the rate used to translate its sales (0.4 pp), the translation impact of changes in foreign currency exchange rates (0.3 pp). These were partially offset by the mix impact from relatively higher sales in certain units with lower than average gross margins, primarily in South America (0.6 pp) and increased manufacturing costs (0.5 pp).

Gross margin as a percentage of sales was 66.1 percent in 2014 and 66.7 percent in 2013. The decrease of 0.6 percentage points primarily reflected the net year-over-year impact of inventory in Venezuela being included in cost of goods sold at its stronger, historical exchange rate rather than the rate used to translate sales (0.6 pp). Also contributing to the decrease in gross margin were higher resin costs (0.5 pp), the mix impact from relatively higher sales in certain units with lower than average gross margins, primarily in South America (0.2 pp), and higher obsolescence, particularly in Beauty North America due to the decision to cease operating the Armand Dupree business in the United States (0.2 pp). These decreases were partially offset by the impact of product mix in light of changes in manufacturing costs and related price increases that had a positive impact on the gross margin comparison (0.7 pp) and the translation impact of changes in foreign currency exchange rates, mainly in South America (0.2 pp).

Operating Expenses

Delivery, sales and administrative expense ("DS&A") as a percentage of sales was 53.3 percent in 2015, compared with 51.7 percent in 2014. The higher DS&A expense was primarily due to the translation effect of changes in foreign currency exchange rates, particularly the impact of overall dollar denominated costs as a ratio of sales in light of weaker foreign exchange rates (1.5 pp), as well as increased unallocated corporate expenses related to global initiative investments and management incentive accruals (0.3 pp) and higher freight costs, mainly in Tupperware North America (0.1 pp). These were partially offset by lower commission expense due to the mix of sales performances in units that pay commissions versus those that do not (0.2 pp) and decreased promotional costs in Beauty North America and Europe (0.1 pp).

DS&A as a percentage of sales was 51.7 percent in 2014, compared with 51.3 percent in 2013. The higher DS&A percentage in 2014 was primarily due to mix in light of weaker foreign currency exchange rates in units that have relatively low DS&A expenses as a percentage of sales, particularly in Venezuela, as well as the impact of overall dollar costs as a ratio of sales that are higher in light of weaker foreign exchange rates (0.8 pp), higher warehousing costs in Brazil (0.4 pp), amortization of the Company's definite-lived tradename intangible asset that began in September 2013 (0.3 pp) and higher freight costs in Asia and Tupperware North America (0.2 pp). These were partially offset by lower unallocated corporate expenses, mainly for lower accruals under the Company's incentive plans (0.3 pp), lower promotional spending in Asia and Tupperware North America (0.3 pp), lower marketing costs in Asia (0.3 pp), lower selling costs in Beauty North America (0.2 pp) and lower commission expense due to the mix of sales performances in units that pay commissions versus those that do not (0.2 pp).

The Company segregates corporate operating expenses into allocated and unallocated components based upon the estimated time spent managing segment operations. The allocated costs are then apportioned on a local currency basis to each segment based primarily upon segment revenues. The unallocated expenses reflect amounts unrelated to segment operations. Operating expenses to be allocated are determined at the beginning of the year based upon estimated expenditures. Total unallocated expenses in 2015 increased $16.9 million compared with 2014, reflecting higher incentive and equity compensation costs and the impact from variations in foreign exchange rates.

Total unallocated expenses in 2014 decreased $6.5 million compared with 2013, reflecting lower incentive and equity compensation costs and the impact from variations in foreign exchange rates.

As discussed in Note 1 to the Consolidated Financial Statements, the Company includes costs related to the distribution of its products in DS&A expense. As a result, the Company’s gross margin may not be comparable with other companies that include these elements in cost of products sold.

Re-engineering Costs

As the Company continuously evaluates its operating structure in light of current business conditions and strives to maintain the most efficient possible structure, it periodically implements actions designed to reduce costs and improve operating efficiency. These actions often result in re-engineering costs related to headcount reductions and to facility downsizing and closure, as well as related asset write downs and other costs that may be necessary in light of the revised operating landscape. In addition, the Company may recognize gains or losses upon disposal of closed facilities or other activities directly related to its re-engineering efforts. Included in 2015 net income were pretax charges of $6.8 million for re-engineering and impairment charges, compared with $11.0 million and $9.3 million in 2014 and 2013, respectively.

Over the past three years, the Company has incurred such costs as detailed below that were included in the following income statement captions:

|

| | | | | | | | | | | |

(In millions) | 2015 | | 2014 | | 2013 |

Re-engineering and impairment charges | $ | 6.8 |

| | $ | 11.0 |

| | $ | 9.3 |

|

Cost of products sold | — |

| | 2.3 |

| | — |

|

Total pretax re-engineering costs | $ | 6.8 |

| | $ | 13.3 |

| | $ | 9.3 |

|

The severance costs incurred were associated with headcount reductions in several of the Company's operations in connection with changes in its management and organizational structures, and in 2014, the decision to cease operating the Armand Dupree business in the United States, the Nutrimetics business in Thailand and a manufacturing plant in India. In 2014, this also included a write-off of $1.1 million in capitalized software in connection with a new information systems project, and in 2013 amounts related to changes in the Company's European operations.

See also Note 2 to the Consolidated Financial Statements, regarding the Company's re-engineering actions.

Fixed Asset Impairment

In February 2015, the Venezuelan government launched an overhaul of its foreign currency exchange structure, eliminating the SICAD 2 mechanism that the Company had referenced for translating and measuring its financial statements, replacing it with a new exchange mechanism called Simadi. During the first quarter of 2015, Simadi published a rate that was approximately 75 percent lower than the final SICAD 2 rate, which was expected to, and subsequently has, severely reduced the unit’s sales and profit. As a result, the Company deemed this change to be a triggering event to evaluate the $15.7 million of long-term fixed assets in Venezuela at that time, which had continued to be included on the balance sheet at the historical rates in effect when the assets were purchased. As a result of this evaluation, the Company recorded an impairment charge of $13.5 million to reduce the carrying value of its long-term fixed assets in Venezuela in the first quarter of 2015. This impairment charge was included in the re-engineering and impairment charge caption of the Company's consolidated income statement.

A more detailed description of the changes in the Venezuelan exchange mechanisms and the resulting impacts on the Company is provided below in the discussion of the South America segment.

See Note 2 to the Consolidated Financial Statements for further details regarding the circumstances leading to the triggering event and the impairment conclusion.

Goodwill and Intangible Assets

In the third quarters of 2015 and 2014, the Company completed the annual impairment assessments for all of its reporting units and indefinite-lived intangible assets, concluding there were no impairments. The Company only considers the 2015 goodwill balances of $88.6 million and $23.5 million associated with the Fuller Mexico and NaturCare reporting units, respectively, to be significant relative to total equity.

The Company completed a step 1 analysis related to Fuller Mexico, for which the significant assumptions included annual revenue changes ranging from negative 2 percent to positive 5 percent with an average growth rate of 3 percent, including a 3 percent growth rate used in calculating the terminal value. The discount rate used in Fuller Mexico was 14.6 percent. As the forecast results of Fuller Mexico at the time the step 1 analysis was completed were below the expectations used in completing the step 1 analysis done in 2014, the amount by which the estimated fair value of the Fuller Mexico reporting unit exceeded its carrying value, at 13 percent, was smaller in the third quarter of 2015 than in the 2014 assessment. This decrease reflected lower than expected additions of sales force members in light of high field manager turnover. Along with a difficult competitive environment, this led to worse 2015 operating performance than foreseen in 2014. Field managers are those directly responsible for sales force additions, motivating and training sales force members. Local currency sales and operating profit have been declining since 2011, at which time the fair value of Fuller Mexico exceeded the carrying value by 77 percent. Since 2011, local currency sales declined 9 percent in 2012, 7 percent in 2013 and 3 percent in 2014. Continuing this trend of sequential improvements, local currency sales declined 2 percent in 2015. Over this same time period, operating profit as a percentage of sales declined from 15 percent in 2012 to 10 percent in 2015. This operating performance has led to decreases in the estimated fair value over time, but have been offset by lower discount rates and a lower entity carrying value from amortization of the definite lived Fuller tradename asset that began in the third quarter of 2013, as well as a net asset position that has, over time, been reduced in light of the smaller scope of the business. As of the end of the third quarter, Fuller Mexico had a year-over-year sales force size advantage of 1 percent, despite less new seller additions, reflecting new programs aimed at higher rates of retention. There are also programs intended to create a pipeline of strong candidates who can be trained and motivated for promotion to field manager, a critical component of growth going forward. While the sales force size advantage evolved to a slight deficit as of the end of 2015, at least in part due to a competitor's promotional activity, the Company anticipates it will be able to improve its key performance indicators going forward. As a result of these factors including the assumptions made, the fair value exceeded the carrying value as of the end of the third quarter of 2015. Despite these positive performance indicators in the business and the amount by which the estimated fair value of the reporting unit exceeded its carrying value, a smaller sales force size, reversal of retention rates, operating performance significantly below current expectations, including changes in projected future revenue, profitability and cash flow, as well as higher working capital, interest rates or cost of capital, could have a further negative effect on the estimated fair value of the reporting unit and therefore reduce the estimated fair value below the carrying value. This could result in recording an impairment to the goodwill of Fuller Mexico, including prior to the 2016 annual assessment.

A step 1 analysis was also performed for NaturCare, which had significant assumptions including annual revenue growth ranging from 3 percent to 5 percent with an average growth rate of 4 percent, including a 3 percent growth rate used in calculating the terminal value. The discount rate used in NaturCare was 10 percent. The estimated fair value of the NaturCare reporting unit exceeded the carrying value by 130 percent. Based on the Company's evaluation of the assumptions and sensitivities associated with the step 1 analysis for NaturCare, the Company concluded that the fair value substantially exceeded its carrying value as of the end of the third quarter of 2015.

Other than for the Fuller Mexico reporting unit, management has concluded there is no significant foreseeable risk of failing a future step 1 impairment evaluation, nor is there significant foreseeable risk of the fair value of the indefinite-lived intangible assets falling below their respective carrying values. Given the sensitivity of fair value valuations to changes in cash flow or market multiples, the Company may be required to recognize an impairment of goodwill or indefinite-lived intangible assets in the future due to changes in market conditions or other factors related to the Company’s performance. Actual results below forecasted results or a decrease in the forecasted future results of the Company’s business plans or changes in discount rates could also result in an impairment charge, as could changes in market characteristics including declines in valuation multiples of comparable publicly-traded companies. Impairment charges would have an adverse impact on the Company’s net income and shareholders' equity.

Refer to Note 6 of the Consolidated Statements.

Gains on Disposal of Assets

The Company continues with its program to sell land for development near its Orlando, Florida headquarters, which began in 2002, recognizing gains of $12.9 million and $1.3 million under this program in 2015 and 2014, respectively. There were no land sales under this program in 2013. Included in this caption in 2013 was $0.9 million related to the collection of proceeds on land sold in 2006. Gains on land transactions are recorded based upon when the transactions close and proceeds are collected. Transactions in one period may not be representative of what may occur in future periods. Since the Company began this program in 2002, cumulative proceeds from these sales have totaled $88.0 million with an additional $55 to $80 million expected as the program is completed. The carrying value of the remaining land included in the Company's land sales program was $18.4 million as of December 26, 2015. Of this amount, $2.1 million has been classified in other short-term assets as the Company expects to sell certain parcels within the next twelve months for amounts exceeding the carrying value. The remaining carrying value of land was included in property, plant and equipment held for use within the Consolidated Balance Sheet as it is not considered probable that any significant land sales will be completed within one year. The Company has concluded that the fair value of the land under this program significantly exceeded the carrying value as of the end of 2015 and will continue to do so into the foreseeable future. Also in 2014, the Company recognized gains of $1.1 million from the sale of land in Australia.