SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

PRGX GLOBAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

PRGX GLOBAL, INC.

600 GALLERIA PARKWAY

SUITE 100

ATLANTA, GEORGIA 30339

(770) 779-3900

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD THURSDAY, JUNE 18, 2020

TO THE SHAREHOLDERS OF

PRGX GLOBAL, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of PRGX GLOBAL, INC. (the “Company”) will be held at the Company’s offices, 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339, on Thursday, June 18, 2020, at 9:00 a.m., for the following purposes:

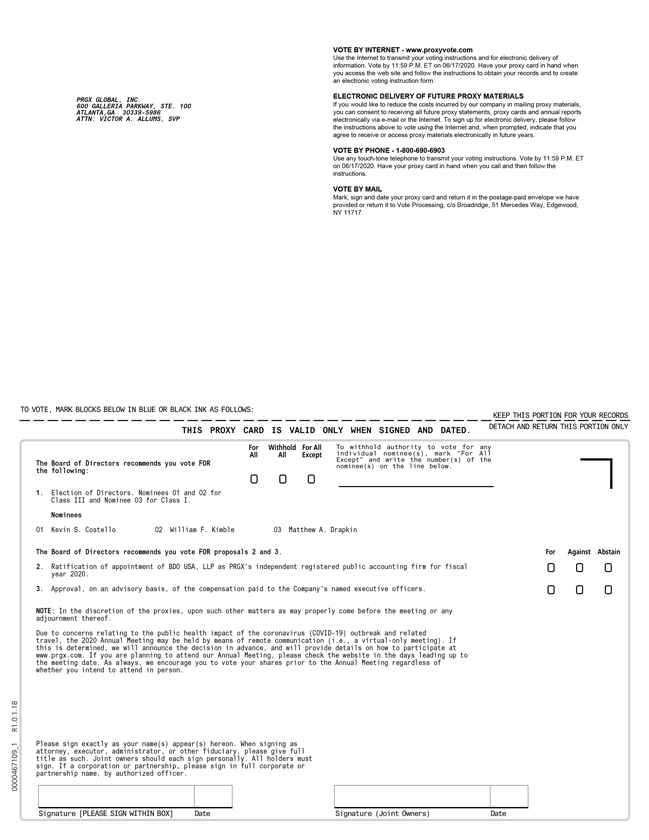

| 1. | To elect two Class III directors and one Class I director to serve until the Annual Meetings of Shareholders to be held in 2023 and 2021, respectively, or until their successors are elected and qualified; |

| 2. | To ratify BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year 2020; |

| 3. | To approve the Company’s executive compensation (the “Say-on-Pay Resolution”); and |

| 4. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

The proxy statement is attached. Only record holders of the Company’s common stock at the close of business on April 16, 2020 will be eligible to vote at the meeting.

If you are not able to attend the meeting in person, please complete, sign, date and return your completed proxy in the enclosed envelope. If you attend the meeting, you may revoke your proxy and vote in person. However, if you are not the registered holder of your shares you will need to get a proxy from the registered holder (for example, your broker or bank) in order to attend and vote at the meeting.

We continue to monitor developments regarding the coronavirus (COVID-19) pandemic. In the interest of the health and well-being of our shareholders, to the extent permitted by Georgia law, we are planning for the possibility that the Annual Meeting of Shareholders may be held solely by means of remote communication, which includes the possibility of a virtual meeting. If we make this change, we will announce the decision to do so in advance, and details on how to participate, including details on how to inspect a list of shareholders of record, will be posted on our website and filed with the U.S. Securities and Exchange Commission as proxy material. If we decide to hold a virtual meeting, all references in this Proxy Statement to attending the Annual Meeting of Shareholders in person or at the Company’s offices shall mean attending the Annual Meeting of Shareholders virtually.

By Order of the Board of Directors,

Gregory J. Owens, Executive Chairman

May 6, 2020

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 is enclosed with this notice and proxy statement.

PRGX GLOBAL, INC.

600 GALLERIA PARKWAY

SUITE 100

ATLANTA, GEORGIA 30339

(770) 779-3900

PROXY STATEMENT

FOR ANNUAL MEETING OF SHAREHOLDERS

JUNE 18, 2020

GENERAL INFORMATION

The Board of Directors (the “Board” or the “Board of Directors”) of PRGX Global, Inc. (which we refer to in this proxy statement as “PRGX”, the “Company”, “we”, “us” or “our”) is furnishing you this proxy statement to solicit proxies on its behalf to be voted at the 2020 Annual Meeting of Shareholders. The annual meeting will be held on Thursday, June 18, 2020, at 9:00 a.m., at the Company’s offices, 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339. The proxies may also be voted at any adjournments or postponements of the meeting. Upon a vote of the shareholders present at the annual meeting, we may adjourn the meeting to a later date if there are not sufficient shares present in person or by proxy to constitute a quorum or to permit additional time to solicit votes on any proposal to be presented at the annual meeting. You may obtain directions to the location of the 2020 Annual Meeting of Shareholders by contacting Victor A. Allums, Senior Vice President, General Counsel and Secretary, at the address or telephone number listed above.

This proxy statement and the accompanying form of proxy are first being mailed to shareholders on or about May 6, 2020. You must complete and return the proxy for your shares of common stock to be voted.

Any shareholder who has given a proxy may revoke it at any time before it is exercised at the meeting by:

| • | delivering to the Secretary of the Company a written notice of revocation dated later than the date of the proxy; |

| • | executing and delivering to the Secretary of the Company a subsequent proxy relating to the same shares; or |

| • | attending the meeting and voting in person, unless you are a street name holder without a legal proxy, as explained below. Attending the meeting will not in and of itself constitute revocation of a proxy. |

Shareholders who hold shares in “street name” (e.g., in a bank or brokerage account) must obtain a legal proxy form from their bank or broker to vote at the meeting. You will need to bring the legal proxy with you to the meeting, or you will not be able to vote at the meeting.

1

All communications to the Secretary of the Company should be addressed to the Company’s Secretary at the Company’s offices, 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339. Any proxy which is not revoked will be voted at the annual meeting in accordance with the shareholder’s instructions. If a shareholder returns a properly signed and dated proxy card but does not mark any choices on one or more items, the shareholder’s shares will be voted in accordance with the recommendations of the Board of Directors as to such items. The proxy card gives authority to the proxy holders to vote shares in their discretion on any other matter properly presented at the annual meeting.

We continue to monitor developments regarding the coronavirus (COVID-19) pandemic. In the interest of the health and well-being of our shareholders, to the extent permitted by Georgia law, we are planning for the possibility that the Annual Meeting of Shareholders may be held solely by means of remote communication, which includes the possibility of a virtual meeting. If we make this change, we will announce the decision to do so in advance, and details on how to participate, including details on how to inspect a list of shareholders of record, will be posted on our website and filed with the U.S. Securities and Exchange Commission (the “SEC”) as proxy material.

The Company will pay all expenses in connection with the solicitation of proxies, including postage, printing and handling and the expenses incurred by brokers, custodians, nominees and fiduciaries in forwarding proxy material to beneficial owners. In addition to solicitation by mail, solicitation of proxies may be made personally or by telephone, facsimile or other means by directors, officers and employees of the Company and its subsidiaries. Directors, officers and employees of the Company will receive no additional compensation for any such further solicitation. The Company has retained Innisfree M&A Incorporated to assist in the solicitation. The fee to be paid for such services is estimated at approximately $12,500, plus reasonable out-of-pocket expenses.

Voting Requirements

Only holders of record of the Company’s common stock at the close of business on April 16, 2020 (the “Record Date”) are entitled to notice of, and to vote at, the annual meeting. Holders on the Record Date are referred to as the “Record Holders” in this proxy statement. On the Record Date, the Company had a total of 23,592,375 shares of common stock outstanding. Each share of common stock is entitled to one vote.

To constitute a quorum with respect to each matter to be presented at the annual meeting, there must be present, in person or by proxy, a majority of the total votes entitled to be cast by Record Holders of the common stock. Abstentions will be treated as present for purposes of determining a quorum. In addition, shares held by a broker as nominee (i.e., in “street name”) that are represented by proxies at the annual meeting, but that the broker fails to vote on one or more matters as a result of incomplete instructions from a beneficial owner of the shares (“broker non-votes”), will also be treated as present for quorum purposes. The election of directors is no longer considered a “routine” matter as to which brokers may vote in their discretion on behalf of clients who have not furnished voting instructions with respect to the election of directors. As a result, if you hold your shares in street name and do not provide your broker with voting instructions, your shares will not be voted at the annual meeting with respect to the election of directors or the Company’s Say-on-Pay proposal. The ratification of BDO USA, LLP as our independent registered public accounting firm is considered a “routine matter,” and therefore, brokers will have the discretion to vote on this matter even if they do not receive voting instructions from the beneficial owner of the shares.

With respect to Proposal 1 regarding the election of directors, assuming a quorum, the candidates receiving a plurality of the votes cast by the Record Holders of the common stock will be elected directors. Under plurality voting, assuming a quorum is present, the candidates receiving the most votes will be elected, regardless of whether they receive a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome.

2

With respect to Proposal 2 regarding approval of the independent registered public accounting firm, ratification of this appointment requires that a quorum be present and that the number of votes cast “for” the proposal exceed the votes cast “against” it. Abstentions and broker non-votes will have no effect on the outcome.

With respect to Proposal 3 regarding approval of the Say-on-Pay Resolution, approval of this proposal requires that a quorum be present and that the number of votes cast “for” the proposal exceed the votes cast “against” it. Abstentions and broker non-votes will have no effect on the outcome. The Company’s Say-on-Pay vote is advisory in nature, and the ultimate outcome of the vote is non-binding on the Company.

Votes cast by proxy or in person at the annual meeting will be counted by the person or persons appointed by the Company to act as inspector(s) of election for the meeting. Prior to the meeting, the inspector(s) will sign an oath to perform their duties in an impartial manner and to the best of their abilities. The inspector(s) will ascertain the number of shares outstanding and the voting power of each of such shares, determine the shares represented at the meeting and the validity of proxies and ballots, count all votes and ballots and perform certain other duties as required by law.

We expect that shares owned by current executive officers and directors of the Company will be voted in favor of the nominees for director that have been recommended by the Board and in accordance with the Board’s recommendations on the other proposals. As of April 16, 2020, shares owned by current executive officers and directors of the Company and entitled to vote at the annual meeting represented in the aggregate approximately 18.56% of the shares of common stock outstanding on that date.

Any other proposal not addressed herein but properly presented at the meeting will be approved if a proper quorum is present and the votes cast in favor of it meet the threshold specified by the Company’s Articles, Bylaws and by Georgia law with respect to the type of matter presented. No shareholders have submitted notice of intent to present any proposals at the annual meeting as required by the Company’s Bylaws.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on June 18, 2020

In accordance with rules adopted by the SEC, we are also making this proxy statement and our annual report available to shareholders electronically via the Internet. To access this proxy statement and the Company’s Annual Report on Form 10-K on the Internet, please visit www.proxyvote.com.

3

PROPOSAL 1: ELECTION OF DIRECTORS

The Company currently has seven directors. The Board is divided into three classes of directors, designated as Class I, Class II and Class III. The directors in each class serve staggered three-year terms. Shareholders annually elect directors to serve for the three-year term applicable to the class for which such directors are nominated or until their successors are elected and qualified. The Board has nominated Kevin S. Costello and William F. Kimble for election as Class III Directors with a term ending in 2023 and has nominated Matthew A. Drapkin for election as a Class I Director with a term ending in 2021. At the annual meeting, shareholders will be voting to elect Kevin S. Costello and William F. Kimble to serve as Class III directors and Matthew A. Drapkin to serve as a Class I director. The terms of Matthew A. Drapkin, Kevin S. Costello and William F. Kimble, currently serving as Class III directors, will expire at the annual meeting unless they are re-elected.

The persons named as proxies on the enclosed proxy intend to vote FOR the election of all the nominees named below as directors of the Company, unless otherwise specified in the proxy. Those directors of the Company elected at the annual meeting to be held on June 18, 2020 to serve as Class I or Class III directors as the case may be, will each serve a one- or three- year term, respectively, or until their successors are elected and qualified. Each of the nominees has consented to serve on the Board of Directors if elected. Should any nominee become unable to accept nomination or election, which is not anticipated, it is the intention of the persons named as proxies on the enclosed proxy, unless otherwise specifically instructed in the proxy, to vote for the election of such other person as the Board of Directors may nominate.

Set forth below are the name, age and director class of each director nominee and director continuing in office following the annual meeting and the period during which each has served as a director.

The Board’s Nominee for Class I Director is:

| Nominee |

Age | Service as Director | ||

| Matthew A. Drapkin(1) |

47 | Since November 2016 | ||

|

|

|

| (1) | Member of the Nominating and Corporate Governance Committee. |

The Board’s Nominees for Class III Directors are:

| Nominee |

Age | Service as Director | ||

| Kevin S. Costello(1)(2) |

58 | Since March 2017 | ||

| William F. Kimble(1)(3) |

60 | Since April 2015 |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating and Corporate Governance Committee. |

The Board of Directors of the Company recommends a vote FOR the election of each of the nominees named above for election as a director.

4

Directors Continuing in Office

| Continuing Director |

Age | Class | Term Expires |

Service as Director | ||||||||||

| Gregory J. Owens |

60 | Class I | 2021 | Since March 2015 | ||||||||||

| Joseph E. Whitters(1)(2) |

62 | Class I | 2021 | Since January 2013 | ||||||||||

| Mylle H. Mangum(2)(3) |

71 | Class II | 2022 | Since January 2013 | ||||||||||

| Ronald E. Stewart |

65 | Class II | 2022 | Since November 2012 | ||||||||||

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating and Corporate Governance Committee. |

Information about Nominees for Election as Class III Directors

Kevin S. Costello served as Executive Chairman of Top Tech Holdings, the parent company of HotSchedules, a provider of employee scheduling and labor management solutions to the restaurant industry from 2016 to 2019. Prior to that, Mr. Costello was President of Ariba, Inc. until its acquisition by SAP AG in 2012, and President of Ariba, a SAP Company until 2014. Prior to joining Ariba in 2002, Mr. Costello served in various leadership positions with Andersen Business Consulting, and began his career in the Arthur Andersen Audit Practice in 1984. Mr. Costello currently serves on the board of directors of the following privately-held companies - FinancialForce.com, Rainmaker Group, Kaufman Hall, BlueCat Networks and Elemica. Mr. Costello previously served as the lead independent director of Rackspace Hosting, Inc. and was on the board of directors of Cbeyond, Inc., Worldpay, Inc. and HotSchedules. Mr. Costello holds a B.S. in Accounting from the University of Illinois and is a certified public accountant.

Mr. Costello’s extensive leadership experience in software-as-a-service (SaaS) companies and source-to-pay solutions and his experience serving on the boards of numerous public and private companies are beneficial to the Board.

William F. Kimble served as KPMG’s Office Managing Partner of the Atlanta office and Managing Partner – Southeastern United States, where he was responsible for the firm’s audit, advisory and tax operations from 2009 until his retirement in early 2015. Mr. Kimble was also responsible for moderating KPMG’s Audit Committee Institute (ACI) and Audit Committee Chair Sessions. Mr. Kimble had been with KPMG or its predecessor firm (Peat, Marwick, Main & Co.) since 1986. During his tenure with KPMG, Mr. Kimble held numerous senior leadership positions, including Global Chairman for Industrial Markets. Mr. Kimble also served as KPMG’s Energy Sector Leader for approximately 10 years and was the executive director of KPMG’s Global Energy Institute. Mr. Kimble currently serves as a director of DCP Midstream GP, LLC, the general partner to DCP Midstream, LP, a public company which owns, develops and operates a diversified portfolio of midstream energy assets, and as a director of Liberty Oilfield Services Inc., a public hydraulic fracturing services company.

Mr. Kimble brings many years of international business experience to the Board, having acquired knowledge of the needs and inner workings of global companies and having developed a multinational business perspective through his work at KPMG. Mr. Kimble also brings to the Board a broad knowledge of the most current and pressing audit issues faced by public companies today.

5

Information about the Nominee for Election as a Class I Director

Matthew A. Drapkin currently serves as the Chief Executive Officer and Portfolio Manager of Northern Right Capital. Prior to joining Northern Right Capital in December 2009, Mr. Drapkin had extensive investment experience including his work as Head of Research, Special Situations, and Private Equity at ENSO Capital, a New York-based hedge fund, and Senior Vice President of Corporate Development at MacAndrews & Forbes. Prior to MacAndrews, Mr. Drapkin was the General Manager of two Conde Nast Internet sites and an investment banker at Goldman, Sachs & Co. Mr. Drapkin currently serves as a director of Great Elm Capital Group, Inc. and previously served on the board of directors of Intevac, Inc., Xura, Inc. (formerly Comverse, Inc.), Ruby Tuesday, Inc., Alloy Inc., Hot Topic Inc., Glu Mobile, Inc. and Plato Learning, Inc. He has an M.B.A., Finance from Columbia University School of Business, a J.D. from Columbia University School of Law and a B.A. in American History from Princeton University.

Mr. Drapkin brings to the Board extensive financial experience in both public and private companies and has executive experience through the management of a small-cap investment fund. Mr. Drapkin’s background and insights provide our Board with valuable expertise in corporate finance, strategic planning, and capital and credit markets.

Information about the Class I Directors whose Terms will Expire at the 2021 Annual Meeting of Shareholders

Gregory J. Owens was appointed as the Executive Chairman of the Board of PRGX Global, Inc. in January 2019. Mr. Owens has served as the Group President of New Sectors & Ventures of Ritchie Bros. Auctioneers Incorporated, a global asset management and disposition company for used heavy equipment, trucks and other assets, since its acquisition of IronPlanet on May 31, 2017. Prior to that, Mr. Owens served as the Chairman and Chief Executive Officer of IronPlanet, a leading online marketplace for used heavy equipment. Prior to IronPlanet, Mr. Owens served as Managing Director of RedZone Capital, a private equity company focused on turning around and growing under-performing companies. Prior to RedZone Capital, Mr. Owens served as Chairman and Chief Executive Officer of Manugistics Group Inc., a publicly traded global enterprise software solutions company. Mr. Owens also previously served as Global Managing Partner Supply Chain Management of Andersen Consulting (now Accenture). Mr. Owens has received numerous awards from the business community including: Maryland Technology CEO of the Year, Washington Titan of Business and Mid-Atlantic Technology Entrepreneur of the Year.

Mr. Owens brings broad business experience to the Board as a result of his having held numerous executive level roles for several companies. Mr. Owens also brings to the Board many years of experience serving on boards of directors, including his previous service as a director of S1 Corporation, a publicly traded software company, and his current and past service on the board of directors of a number of private companies, primarily in the software industry.

Joseph E. Whitters was appointed as the Lead Director of the Board of PRGX Global, Inc. in January 2019. Mr. Whitters has been a consultant to Frazier Healthcare, a private equity firm, since 2005. From 1986 to 2005, Mr. Whitters served in various capacities with First Health Group Corp., a publicly traded managed care company, including for a majority of that time as its Chief Financial Officer. He also previously served as the Controller for United Healthcare Corp. from 1984 to 1986. Prior to that, Mr. Whitters served as the Manager of Accounting and Taxation for Overland Express, a publicly traded trucking company, and he began his career in public accounting with Peat Marwick (now KPMG). Mr. Whitters currently serves as a director of InfuSystem Holdings, Inc., a provider of ambulatory infusion pumps and associated clinical services, Cutera, Inc., a leading provider of laser, light and other energy-based aesthetic systems, and Accuray Inc., a radiation oncology company developing and manufacturing innovative treatment solutions. From 2017 to 2018, Mr. Whitters served as a director of Analogic Corporation, an integrated technology company, and from 2016 to 2017, Mr. Whitters served as a director of Air Methods Corporation, an air medical transportation company.

6

Mr. Whitters is a CPA (inactive) and brings to the Board over 30 years of financial and other business experience, much of it in the healthcare industry. He developed extensive financial expertise and leadership abilities during his service in senior finance roles at First Health Group and United Healthcare, which has allowed him to bring these critical abilities and accounting skills to the Board.

Information about the Class II Directors whose Terms will Expire at the 2022 Annual Meeting of Shareholders

Mylle H. Mangum is the Chief Executive Officer of IBT Holdings, LLC, a company focused on design, construction and training services for the financial services and specialty retail industries, a position that she has held since 2003. She was formerly the Chief Executive Officer of True Marketing Services, LLC. Prior to this, she served as the CEO of MMS Incentives, Inc. from 1999 to 2002. Ms. Mangum also previously served in management roles with Holiday Inn Worldwide, BellSouth and General Electric. Ms. Mangum currently serves as a director for Barnes Group Inc., Haverty Furniture Companies, Inc. and Express, Inc. and previously served as a director for Collective Brands, Inc., Emageon Inc., a provider of enterprise-level information technology to healthcare provider organizations, Matria Healthcare, Inc., a provider of health advisory services, and Respironics, Inc., a medical supply company.

Ms. Mangum brings to the Board particular knowledge and years of experience in retail, merchandising, marketing, strategy, technology, supply chain, logistics, international business, and multi-division general management experience. She also brings to the Board many years of experience serving on the boards of directors of publicly traded companies.

Ronald E. Stewart is the Company’s President and Chief Executive Officer. He was appointed interim President and interim Chief Executive Officer of the Company on November 15, 2013 and became the Company’s permanent President and Chief Executive Officer effective as of December 13, 2013. In addition to his roles with the Company, Mr. Stewart is an investor and business entrepreneur. Prior to his current pursuits, Mr. Stewart was a senior partner with Accenture, holding a number of executive positions during his 30-year career at the firm. Mr. Stewart retired from Accenture in October 2007. During his tenure at Accenture, Mr. Stewart served as the global client partner for a number of Fortune 100 clients and led the firm’s retail and consumer goods practice in the eastern United States for a number of years. Mr. Stewart also led Accenture’s global transportation and travel industry program and served as the North America Managing Partner for the automotive, industrial manufacturing and transportation/travel industry groups. Mr. Stewart is a former member of Accenture’s Global Executive Committee and of the board of directors of the Accenture Foundation.

Mr. Stewart brings to the Board management’s perspective of the Company and its operations, which is an invaluable asset to the Board in its direction of the Company’s future. Mr. Stewart also brings to the Board expertise in the fundamental analysis of investment opportunities and the evaluation of business strategies and valuable leadership skills and knowledge gained from over 30 years of providing global professional services to clients during his tenure at Accenture.

7

PROPOSAL 2: RATIFY THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Our Board of Directors, upon the recommendation of our Audit Committee, has appointed BDO USA, LLP (“BDO”) as the Company’s independent registered public accounting firm for the 2020 fiscal year. A proposal will be presented at the annual meeting to ratify the appointment of BDO as our independent registered public accounting firm for the 2020 fiscal year. Shareholder ratification of the selection of BDO as our independent registered public accounting firm is not required but is being presented to our shareholders as a matter of good corporate practice. Notwithstanding shareholder ratification of the appointment of the independent registered public accounting firm, the Audit Committee, in its discretion, may direct the appointment of a new independent registered public accounting firm if the Audit Committee believes that such a change would be in our best interests and the best interests of our shareholders. If the shareholders do not ratify the appointment, the Audit Committee will reconsider the appointment of BDO. We have been advised that a representative from BDO will be present at the annual meeting, will be given an opportunity to speak if he or she desires to do so, and will be available to answer appropriate questions.

The Board of Directors recommends a vote FOR approval to ratify the appointment of the independent registered public accounting firm.

8

PROPOSAL 3: ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires that the Company’s shareholders have the opportunity to cast a non-binding advisory vote regarding the compensation of the Company’s executive officers who are named in the Summary Compensation Table contained in this proxy statement whom we refer to as our “named executive officers.” We have disclosed the compensation of our named executive officers pursuant to rules adopted by the SEC.

At our annual meeting of shareholders held on June 27, 2017, our shareholders approved our proposal to hold a “Say-on-Pay” vote every year. As a result, we have committed to annual Say-on-Pay votes. At our annual meeting of shareholders held on June 6, 2019, our shareholders approved our Say-on-Pay resolution with approximately 99.52% of the votes cast approving the 2018 executive compensation described in our 2019 proxy statement. In determining executive compensation for 2020, the committee has considered and will continue to consider the shareholder support that the Say-on-Pay proposal received at the 2019 Annual Meeting of Shareholders. This strong support from our shareholders confirms our belief that our compensation programs are reasonable, effectively designed and continue to be aligned with the interests of our shareholders.

As we describe in detail in the Compensation Discussion and Analysis section and the accompanying compensation tables and narrative discussion contained in this proxy statement, we have designed our executive compensation programs to drive our long-term success and increase shareholder value. We use our executive compensation programs to provide compensation that will (i) attract and retain our named executive officers, (ii) encourage our named executive officers to perform at their highest levels by directly linking a material portion of their total compensation to key Company financial and operational performance objectives, and (iii) directly align our executive compensation with shareholders’ interests through the grants of long-term equity incentive awards.

Our Compensation Committee has overseen the development and implementation of our executive compensation programs using these core compensation principles as a guide. Our Compensation Committee also continuously reviews, evaluates and updates our executive compensation programs as needed to ensure that we continue to provide competitive compensation that motivates our named executive officers to perform at their highest levels while simultaneously increasing long-term shareholder value. We highlight the following aspects of our executive pay program that we believe reflect sound governance and effective program design:

| • | All executive compensation decisions made by an independent and active Compensation Committee; |

| • | A pay philosophy that seeks to emphasize variable over fixed compensation; |

| • | A pay mix that seeks to provide both short-term and long-term incentives; |

| • | Short-term and long-term incentive opportunities tied to a balanced performance measurement system that includes top line growth (revenue), operating income (adjusted EBITDA) and stock price performance; |

| • | Long-term equity incentive awards that link executive compensation to the Company’s long-term operational performance by granting performance-based restricted stock units, which will vest, if at all, only upon the attainment of certain levels of Company financial performance; |

| • | Long-term equity incentive awards that provide retention incentives to the Company’s executive officers by granting restricted stock with service-based vesting; |

| • | An equity plan that prohibits re-pricing without shareholder approval; |

9

| • | Change-of-control agreements that require a “double-trigger” (change-of-control plus actual separation) for separation payments and that do not provide an excise tax gross-up; |

| • | A recoupment (clawback) policy that provides for the recovery of performance-based compensation earned by executive officers and certain members of senior management in the event that such amounts were inflated due to financial results that later have to be restated; and |

| • | Minimal executive perquisites or other enhanced benefits for executives. |

This advisory shareholder vote, commonly referred to as a “Say-on-Pay” vote, gives you as a shareholder the opportunity to approve or not approve the compensation of our named executive officers that is disclosed in this proxy statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in this proxy statement in accordance with the compensation disclosure requirements of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and the related narrative disclosures herein, is hereby APPROVED.

Because your vote is advisory, it will not be binding on either the Board of Directors or the Company. However, our Compensation Committee will take into account the outcome of the shareholder vote on this proposal when considering future executive compensation decisions and arrangements.

The Board of Directors recommends a vote FOR approval of the compensation paid to the Company’s named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure requirements of the SEC, including in Compensation Discussion and Analysis, compensation tables and the related narrative disclosures.

10

INFORMATION ABOUT THE BOARD OF DIRECTORS

AND COMMITTEES OF THE BOARD OF DIRECTORS

Independence

The Board of Directors has evaluated the independence of each Board member and has determined that the following directors, which constitute a majority of the Board, are independent in accordance with the Nasdaq Global Select Market and SEC rules governing director independence: Ms. Mangum and Messrs. Costello, Drapkin, Kimble and Whitters.

Meetings of the Board of Directors and Attendance at the Annual Meeting of Shareholders

During 2019, there were four meetings of the Board of Directors. Each incumbent director attended more than 75 percent of the aggregate of all meetings of the Board of Directors held while he or she was a director and any committees on which that director served.

The Board of Directors does not have a policy requiring director attendance at the annual shareholders meeting. However, directors are encouraged to attend. All of our then-serving directors attended the 2019 Annual Meeting of Shareholders.

Director Compensation

The following table presents information relating to total compensation for the fiscal year ended December 31, 2019, with respect to those directors that served during the year. Information with respect to the compensation of Mr. Stewart and Mr. Owens is included below under “Executive Compensation.” As executive officers of the Company, Mr. Stewart and Mr. Owens (other than as described below) do not receive any compensation for service as directors.

| Name |

Fees Earned or Paid In Cash |

Stock Awards(1) |

Option Awards(2) |

All Other Compensation |

Total | |||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ||||||||||||||||

| Kevin S. Costello |

64,650 | 119,999 | — | — | 184,649 | |||||||||||||||

| Matthew A. Drapkin |

45,000 | 119,999 | — | — | 164,999 | |||||||||||||||

| William F. Kimble |

64,825 | 119,999 | — | — | 184,824 | |||||||||||||||

| Mylle H. Mangum |

57,500 | 119,999 | — | — | 177,499 | |||||||||||||||

| Gregory J. Owens(3) |

1,922 | — | — | — | 1,922 | |||||||||||||||

| Joseph E. Whitters |

70,564 | 119,999 | — | — | 190,563 | |||||||||||||||

| (1) | The amount represents the grant date fair value of stock awards granted in the fiscal year valued in accordance with Financial Accounting Standards Codification (“FASB ASC”) Topic 718. This amount does not represent our accounting expense for these awards during the year and does not correspond to the actual cash value recognized by the director when received. On June 5, 2019, each then-serving non-employee director whose service was expected to continue beyond the 2019 Annual Meeting of Shareholders received 18,547 shares of restricted stock or restricted stock units which vest on the later of (a) June 5, 2020 and (b) the date of, and immediately prior to, the 2020 Annual Meeting of Shareholders. The number of unvested stock awards outstanding as of December 31, 2019 for each then-serving director other than Mr. Stewart and Mr. Owens was as follows: Mr. Costello, 18,547, Mr. Drapkin, 18,547, Mr. Kimble, 18,547, Ms. Mangum, 18,547, and Mr. Whitters, 18,547. |

| (2) | The aggregate number of option awards outstanding as of December 31, 2019 for each then-serving director other than Mr. Stewart and Mr. Owens was as follows: Mr. Costello, 57,386, Mr. Drapkin, 69,053, Mr. Kimble, 93,606, Ms. Mangum, 112,835, and Mr. Whitters, 112,835. |

| (3) | Mr. Owens received $1,922 as compensation for his service as a director before his appointment as Executive Chairman. |

11

Each non-employee member of the Board is paid a $40,000 annual retainer for his or her service on the Board, and the independent Lead Director is paid a $20,000 annual retainer for his or her service on the Board. Non-employee members of Board committees are paid annual committee retainers of $10,000 for the Audit Committee, $7,500 for the Compensation Committee and $5,000 for the Nominating and Corporate Governance Committee. Chairs of each of these committees are paid supplemental annual committee chair retainers equal to the amount of the applicable member retainer for the particular committee. Directors are reimbursed for all out-of-pocket expenses, if any, incurred in attending Board and committee meetings.

In addition to cash compensation, the Board may grant nonqualified stock options or other equity awards to the non-employee directors from time to time. On June 5, 2019, the Company granted 18,547 shares of restricted stock or restricted stock units to each of the Company’s then-serving non-employee directors whose service on the Board was expected to continue beyond the 2019 Annual Meeting of Shareholders (Ms. Mangum and Messrs. Costello, Drapkin, Kimble and Whitters) All of the restricted stock and restricted stock units granted to the directors on June 5, 2019 will vest on the later of (a) June 5, 2020 and (b) the date of, and immediately prior to, the 2020 Annual Meeting of Shareholders.

Board Leadership Structure and Role in Risk Oversight

The Board of Directors determines what leadership structure it deems appropriate from time to time based on factors such as the experience of the Company’s Board members, executive officers and other members of senior management, the current business environment of the Company and other relevant factors. After considering these factors, in early 2019, the Board determined that the appropriate leadership structure for the Company at this time is a Board of Directors with an independent Lead Director (Mr. Whitters), a Chief Executive Officer (Mr. Stewart) who also serves on the Company’s Board, and an Executive Chairman of the Board (Mr. Owens) who provides additional leadership to the Board and support to senior management of the Company, particularly on strategic matters. The Board believes that the role of an independent Lead Director enhances the Board’s oversight of management of the Company and helps to ensure that the Board is fully engaged with the Company’s strategy and its implementation.

Management of the Company is responsible for the Company’s day-to-day risk management and the Board serves in a risk management oversight role. The Audit Committee assists the Board of Directors in fulfilling this oversight function. The Audit Committee and management of the Company periodically review various risks facing the Company and the internal controls and procedures in place to manage such risks. In addition, the Audit Committee and full Board consider risk-related matters on an ongoing basis in connection with deliberations regarding specific transactions and issues.

Stock Ownership Guidelines

Directors. In May 2008, the Nominating and Corporate Governance Committee adopted stock ownership guidelines for the Company’s non-employee directors to better align the interests of non-employee directors with shareholders. In September 2015, the Nominating and Corporate Governance Committee amended the stock ownership guidelines for the Company’s non-employee directors to more closely align them with the ownership guidelines that were adopted for executive officers in September 2011. The guidelines require non-employee directors to own shares of Company stock with a value equal to or greater than the lesser of (x) four times the amount of the annual retainer paid to the non-employee director for Board service or (y) 25,000 shares of the Company’s common stock. Directors have five years to achieve compliance with the guidelines. Shares must be owned directly by the director or his immediate family residing in the same household or in trust for the benefit of the non-employee director or his

12

immediate family. One-third of vested options count toward satisfaction of the guidelines, but restricted stock units, unvested shares of restricted stock and unvested stock options do not count toward satisfaction of the guidelines. The Nominating and Corporate Governance Committee has authority to grant exceptions to the guidelines in rare circumstances. As of December 31, 2019, all directors were in compliance with the director stock ownership guidelines.

Executive Officers. In September 2011, the Board of Directors established stock ownership guidelines for the Company’s executive officers to further align their interests with those of the Company’s shareholders. See “Compensation Discussion and Analysis – Executive Stock Ownership Guidelines” below for a discussion of these stock ownership guidelines.

Audit Committee

The Company’s Audit Committee consists of three independent directors: Messrs. Kimble, Costello and Whitters. Mr. Kimble currently serves as Chairman of the Audit Committee, and the Board has designated Mr. Whitters and Mr. Kimble as “audit committee financial experts,” as such term is defined in Item 407(d) of SEC Regulation S-K under the Exchange Act. The Board of Directors has determined that the current Audit Committee members satisfy the independence criteria included in the current listing standards for the Nasdaq Global Select Market and by the SEC for audit committee membership. The Audit Committee met twelve times in 2019. The Audit Committee has sole authority to retain the Company’s independent registered public accounting firm and reviews the scope of the Company’s annual audit and the services to be performed for the Company in connection therewith. The Audit Committee also formulates and reviews various Company policies, including those relating to accounting practices and the internal control structure of the Company, and the Company’s procedures for receiving and investigating reports of alleged violations of the Company’s policies and applicable regulations by the Company’s directors, officers and employees. The Audit Committee also reviews and approves any related party transactions. The Board has adopted a written Audit Committee Charter which is available at the Company’s website: www.prgx.com or upon written request to the Secretary of the Company at 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339. See “Report of the Audit Committee.”

Audit Committee Pre-Approval Policies and Procedures. The Audit Committee approves each engagement of the Company’s principal accountants for audit and non-audit related services and associated projected fees in advance of such engagement.

Compensation Committee

The Company’s Compensation Committee consists of three independent directors: Messrs. Costello and Whitters and Ms. Mangum. Mr. Costello is Chairman of the Compensation Committee. The Board of Directors has determined that each of the Compensation Committee members is independent based on the current listing standards for the Nasdaq Global Select Market.

The Compensation Committee held six meetings in 2019. The Compensation Committee determines the compensation of the executive officers of the Company and the other members of the Company’s senior leadership team. The Compensation Committee also administers the Company’s equity plans, including the PRGX Global, Inc. 2017 Equity Incentive Compensation Plan (the “2017 Equity Incentive Compensation Plan”), and the Short-Term Incentive Plan, and makes recommendations to the Nominating and Corporate Governance Committee regarding director compensation. The Compensation Committee determines the amounts and types of all awards of stock-based compensation to individuals who file reports pursuant to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each member of the Compensation Committee is a “nonemployee” director, as such term is defined in Rule 16b-3 promulgated pursuant to the Exchange Act. Each member is also an “outside” director, as

13

such term was defined previously in the regulations promulgated pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) (as in effect for years prior to January 1, 2018). The Compensation Committee’s charter requires that all members of the Committee shall be independent from the Company and that at least two members shall satisfy the definition of “nonemployee” director described above. The Compensation Committee charter is available at the Company’s website: www.prgx.com or upon written request to the Secretary of the Company at 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339. For information regarding the Company’s 2019 executive compensation, see “Compensation Discussion and Analysis.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (“NCG Committee”) consists of three independent directors: Ms. Mangum and Messrs. Drapkin and Kimble. Ms. Mangum serves as Chairman of the NCG Committee. The Board of Directors has determined that each of the NCG Committee members is independent based on the listing standards for the Nasdaq Global Select Market. The NCG Committee met three times in 2019. The NCG Committee has the responsibility to consider and recommend nominees for the Board of Directors and its committees, to oversee review and assessment of the performance of the Board, set Board compensation, and monitor and recommend governance principles and guidelines for adoption by the Board.

The Board has delegated to the NCG Committee the responsibility for evaluating current Board members at the time they are considered for re-nomination. After considering the appropriate skills, expertise and experience needed on the Board, the independence, expertise, experience, skills and performance of the current membership of the Board, and the willingness of Board members whose terms are expiring to be re-nominated, the NCG Committee recommends to the Board whether those directors should be re-nominated.

In preparation for the Company’s annual meeting of shareholders and at such other times as appropriate, the NCG Committee considers whether the Board would benefit from adding one or more additional Board members, and if so, the skills, expertise and experience sought. If the Board determines that a new member or members would be beneficial, the NCG Committee sets the qualifications for the position(s) and conducts searches to identify qualified candidates. Such searches may use the services of an executive search firm that would receive a fee for its services. The NCG Committee (or its Chairman) screens the available information about the potential candidates. Based on the results of the initial screening, interviews with the viable candidates are scheduled with NCG Committee members, other members of the Board and, from time to time, senior members of management. Upon completion of these interviews and other due diligence, the NCG Committee may recommend to the Board the election or nomination of a candidate. All potential candidates, regardless of whether they are developed through the executive search firm or otherwise, are reviewed and evaluated using the same process.

When the NCG Committee engages an executive search firm, the search firm performs research to identify and qualify potential candidates using the desired qualifications identified by the NCG Committee, contacts such qualified candidates to ascertain their interest in serving on the Company’s Board, collects resumes and other data about the interested candidates and recommends candidates for further consideration by the NCG Committee.

The NCG Committee has no set minimum criteria for selecting Board nominees, although its preference is that a substantial majority of all non-executive directors possess the following qualifications: independence in accordance with the listing standards established for companies listed on the Nasdaq Global Select Market; significant leadership experience at the corporate level in substantial and successful organizations; relevant, but non-competitive, business experience; the ability and commitment to devote

14

the time required to fully participate in Board and committee activities; strong communication and analytical skills; and a personality that indicates an ability to work effectively with the other members of the Board and management. In evaluating candidates for the Board of Directors, the NCG Committee seeks to maintain a balance of diverse business experience, education, skills and other individual qualities and attributes in order to enhance the quality of the Board’s deliberations and decision-making processes. In any given search, the NCG Committee may also define particular characteristics for candidates to balance the overall skills and characteristics of the Board with the perceived needs of the Company.

The NCG Committee will also consider nominating for service on the Company’s Board candidates recommended by shareholders. Such recommendations will only be considered by the NCG Committee if they are submitted to the NCG Committee in accordance with the requirements of the Company’s Bylaws and accompanied by all the information that is required to be disclosed in connection with the solicitation of proxies for election of director nominees pursuant to Regulation 14A under the Exchange Act, including the candidate’s written consent to serve as director, if nominated and elected. To be considered by the NCG Committee, shareholder recommendations for director nominees to be elected at the 2021 Annual Meeting of Shareholders, together with the requisite consent to serve and proxy disclosure information in written form, must be received by Victor A. Allums, Secretary, at the offices of the Company at 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339, no earlier than January 6, 2021 and no later than February 5, 2021.

The Company did not receive any shareholder recommendations of director candidates for election at the 2020 Annual Meeting of Shareholders prior to the deadline contained in the Company’s Bylaws.

The NCG Committee’s charter is available at the Company’s website: www.prgx.com or upon written request to the Secretary of the Company at 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339.

Shareholder Communications to the Board of Directors

In addition to recommendations for director nominees, the Board of Directors welcomes hearing from shareholders regarding the management, performance and prospects for the Company. To facilitate complete and accurate transmittal of shareholder communications to the directors, the Company requests that all shareholder communication to the Board or any of its members be made in writing and addressed to the Company’s Secretary, Victor A. Allums, at PRGX Global, Inc., 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339. The Company also requests that any such communication specifies whether it is directed to one or more individual directors, all the members of a Board committee, the independent members of the Board, or all members of the Board and the mailing address to which any reply should be sent. On receipt, Mr. Allums will forward the communication to the director(s) to whom it is addressed as specified by the shareholder. If the shareholder does not specify which directors should receive the communication, Mr. Allums will distribute the communication to all directors.

15

REPORT OF THE AUDIT COMMITTEE

The purpose of the Audit Committee is to assist the Board in its general oversight of the Company’s financial reporting, internal controls and audit functions. The Board has adopted a written Audit Committee Charter (available at the Company’s website: www.prgx.com) that sets out the organization, purpose, duties and responsibilities of the Audit Committee.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements; accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with U.S. generally accepted accounting principles, as well as expressing an opinion on the effectiveness of internal control over financial reporting.

In fulfilling its oversight responsibilities with respect to the year ended December 31, 2019, the Audit Committee:

| • | reviewed and discussed the consolidated financial statements of the Company set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 with management of the Company and BDO USA, LLP, independent registered public accounting firm for the Company; |

| • | discussed with BDO USA, LLP the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301, “Communications with Audit Committees,” as modified and supplemented to date; |

| • | obtained a formal written statement from BDO USA, LLP delineating all relationships between the auditors and the Company consistent with the applicable requirements of the Public Company Accounting Oversight Board and discussed with the auditors all significant relationships the auditors have with the Company which may affect the independent registered public accounting firm; and |

| • | based on the review and discussions with management of the Company and BDO USA, LLP referred to above, recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019. |

| AUDIT COMMITTEE |

| William F. Kimble, Chairman |

| Kevin S. Costello |

| Joseph E. Whitters |

Notwithstanding anything to the contrary which is or may be set forth in any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate Company filings, including this proxy statement, in whole or in part, the preceding Report of the Audit Committee shall not be incorporated by reference into any such filings.

16

COMPENSATION DISCUSSION AND ANALYSIS

As discussed above under “Information About the Board of Directors and Committees of the Board of Directors,” the Compensation Committee of the Board of Directors has the overall responsibility for our executive compensation plans, policies and programs. The Compensation Committee approves the compensation of each of our named executive officers, other executive officers of the Company and other members of the Company’s senior leadership team. The Compensation Committee is also responsible for recommending to the Nominating and Corporate Governance Committee the compensation and compensation plans, policies and programs for our directors. The Compensation Committee consists of three members who are “independent” directors under the Company’s corporate governance guidelines and the rules of the Nasdaq Global Select Market.

Executive Summary

This Compensation Discussion and Analysis does not address the impact of the coronavirus (or COVID-19) on the global economy, our business and financial results, or our executive compensation for 2020. Prior to the global outbreak of the COVID-19 pandemic, the Compensation Committee took certain actions with respect to the 2020 executive compensation program, including reviewing the salaries of the Company’s executive officers, granting long-term equity incentive awards to executive officers and establishing the terms of the 2020 Short-Term Incentive Plan. As the COVID-19 pandemic evolves and the associated economic circumstances continue to develop, the Compensation Committee expects to continue monitoring the situation and taking into consideration the impact of the pandemic in its ongoing assessment of the compensation arrangements and practices it determines to be in the best interests of the Company’s shareholders, and where appropriate, other stakeholders. The 2020 executive compensation program decisions will be described in our proxy statement for next year’s annual meeting.

In January 2019, the Board of Directors appointed Gregory J. Owens to serve as Executive Chairman. Mr. Owens’ compensation was determined by the Compensation Committee after consultation with Meridian Compensation Partners, LLC. References in this Compensation Discussion and Analysis to “executive officers” does not refer to Mr. Owens unless otherwise noted. For a description of Mr. Owens’ compensation arrangement, see “Process for Establishing Executive Compensation – Compensation of the Executive Chairman” below.

Compensation Considerations

The Compensation Committee considers the following factors, among others, in making decisions regarding the compensation program for our executive officers:

| • | the Compensation Committee’s goal of maintaining a strong linkage between Company financial performance and executive pay (see “Pay-For-Performance Compensation Philosophy” below); |

| • | the Board of Directors’ goal of retaining and appropriately rewarding executive officers; |

| • | the Board of Directors’ expectations for the Company’s financial performance; |

| • | the roles, responsibilities and performance of executive officers; |

| • | the limited number of shares available for grant under the Company’s shareholder-approved equity plan; |

| • | the balance between the number of long-term equity incentive awards granted and the likelihood of vesting of such awards; |

| • | market data regarding the mix of time-based and performance-based long-term equity incentive awards; |

17

| • | market data regarding competitive compensation for the Company’s executive officers; and |

| • | the Company’s annual Say-on-Pay vote (in 2019, approximately 99.52% of the shares voted by shareholders approved the Company’s executive compensation program). |

Pay-For-Performance Compensation Philosophy

We have a pay-for-performance compensation philosophy and strive to have executive compensation programs and practices that will align executive pay with Company performance. In recent years, the Compensation Committee has taken steps to significantly strengthen the alignment of executive compensation with the financial performance of the Company, including (i) implementing long-term equity incentive awards emphasizing grants of performance-based vesting restricted stock units (“PBUs”), which vest, if at all, only upon the attainment of certain levels of revenue and adjusted EBITDA and (ii) requiring the achievement of minimum levels of adjusted EBITDA and revenue prior to any bonuses being paid out under the applicable Short-Term Incentive Plan with respect to those plan components.

2019 Compensation Overview

In 2019, the Compensation Committee took the following actions with respect to the compensation program for our executive officers:

| • | granting long-term equity incentive awards to executive officers consisting of: |

| • | PBUs, which will vest and become payable in common stock, if at all, only upon the attainment of certain levels of revenue and adjusted EBITDA for the two-year period ending December 31, 2020; and |

| • | restricted stock, which will vest in three approximately equal installments on each of November 15, 2020, November 15, 2021 and November 15, 2022; |

| • | continuing the use of adjusted EBITDA and revenue as the relevant financial performance criteria for the Short-Term Incentive Plan; |

| • | slightly increasing the base salaries of two of our executive officers; and |

| • | slightly increasing the target and maximum short-term incentive opportunities (as a percentage of base salary) for one of our executive officers. |

Executive Compensation Philosophy

We strive to establish compensation practices that attract, retain and reward our executive officers, as well as strengthen the mutuality of interests between our executive officers and our shareholders. We believe that the most effective executive compensation program is one that is conservative, but competitive, and that aligns the compensation of our executive officers with the creation of shareholder value. Under the oversight of the Compensation Committee, we have developed and implemented a pay-for-performance executive compensation program that rewards executive officers for the achievement of certain financial performance objectives. We achieve the philosophies of pay-for-performance and alignment of executive officer compensation with shareholder value creation primarily by providing a substantial portion of each executive’s total annual compensation through annual short-term incentive opportunities and long-term equity incentive awards. Since 2006, the Compensation Committee has tied the executive officers’ bonus opportunity under our Short-Term Incentive Plan to the achievement of certain financial performance objectives and in 2015 the Compensation Committee began tying the vesting of all or a portion of long-term equity incentive awards to the financial performance of the Company by granting PBUs, which vest and become payable, if at all, only upon the attainment of certain levels of Company financial performance, including revenue and adjusted EBITDA over a two-year performance period. In 2019, the Compensation Committee granted PBUs with vesting terms that require the Company to attain certain levels of revenue and adjusted EBITDA for the two-year performance period ending December 31, 2020. We describe our 2019 Short-Term Incentive Plan in greater detail below under “Cash Bonus – 2019 Short-Term Incentive Plan” and describe the 2019 long-term equity incentive awards in more detail under “Long-Term Equity Incentive Compensation.”

18

Although it is not tied to any particular compensation formula for the compensation of its named executive officers, the Compensation Committee periodically reviews external market data from peer companies and relevant compensation surveys, including data regarding base salaries, total cash compensation (salary plus target bonus), and total direct compensation (total cash compensation plus equity grant value). This data is among many of the variables, including the recent performance and strategic fit of the named executive officers, considered by the Compensation Committee when making compensation decisions.

Overview of Executive Compensation Program

We have designed our compensation program to provide our executive officers with a combination of cash (salary and short-term incentive-based) and long-term equity incentive compensation to align their interests with those of our shareholders. During 2019, our executive officer compensation program primarily consisted of the following elements:

| • | base salary; |

| • | cash Short-Term Incentive Plan; and |

| • | long-term equity incentive awards. |

Although the Compensation Committee has not established a policy or formula for the allocation of total compensation among these different elements of total executive officer compensation, the Compensation Committee strives to achieve an appropriate mix between the different forms of compensation to:

| • | motivate executive officers to deliver superior performance in the short-term by providing competitive base salaries and annual cash short-term incentive opportunities; |

| • | align the interests of executive officers with the long-term interests of the shareholders through the grant of long-term equity incentive awards that vest over time or based on the multi-year financial performance of the Company; and |

| • | provide an overall compensation package that is competitive and, therefore, promotes executive recruitment and retention. |

For purposes of this proxy statement, our named executive officers for the year ended December 31, 2019 were as follows:

| Name |

Title | |

| Gregory J. Owens(1) | Executive Chairman | |

| Ronald E. Stewart | President and Chief Executive Officer | |

| Kurt J. Abkemeier(2) | Executive Vice President, Chief Financial Officer and Treasurer |

| (1) | Mr. Owens was appointed the Company’s Executive Chairman in January 2019. |

| (2) | Mr. Abkemeier was appointed the Company’s Chief Financial Officer, Treasurer and Controller in January 2019 and, thereafter, the Company’s Executive Vice President, Chief Financial Officer and Treasurer in February 2020. |

19

Process for Establishing Executive Compensation

Role and Use of Compensation Consultants. The Compensation Committee from time to time engages compensation consultants to assist the Compensation Committee in making compensation decisions. In January 2018, the Compensation Committee made the determination that it was in the best interest of the Compensation Committee and the Company to engage Meridian Compensation Partners, LLC (“Meridian”) as its independent compensation consultant to provide a new perspective to the Compensation Committee with respect to executive compensation. The Compensation Committee has confirmed that there are no conflicts of interest between any of our directors or executive officers and Meridian.

Market Compensation Information. To assist the Compensation Committee in its review of the Company’s executive compensation, from time to time, Meridian provided compensation data for a “peer group” of publicly traded companies. In 2019, the Compensation Committee, with the assistance of Meridian, reviewed the composition of the Company’s peer group and made recommendations regarding certain updates to the peer group. In March 2019, Meridian presented the Compensation Committee with its findings and recommendations for a revised peer group for the Company after evaluating industry financial statistics (such as revenue, market capitalization, and profitability), business characteristics and international operations of other public companies. After careful deliberation and review of the Meridian input, the Compensation Committee approved the following professional/business services and information technology services companies as the Company’s peer group for compensation reference purposes in June 2019:

| MicroStrategy Incorporated | eGain Corporation | |

| Bottomline Technologies (de), Inc. | EVO Payments, Inc. | |

| QAD Inc. | GreenSky, Inc. | |

| Upland Software, Inc. | Information Services Group, Inc. | |

| Majesco | International Money Express, Inc. | |

| American Software, Inc. | Cass Information Systems, Inc. | |

| NetSol Technologies, Inc. | Perficient, Inc. | |

| The Hackett Group, Inc. | CRA International, Inc. | |

| Forrester Research, Inc. |

Compensation of the CEO. On November 15, 2013, following the departure of our former President and CEO, the Board of Directors appointed Ronald E. Stewart, a member of our Board of Directors since November 2012, to serve as interim President and interim CEO until the Board of Directors appointed a permanent President and CEO. On December 13, 2013, the Board of Directors announced the appointment of Mr. Stewart as our President and CEO, effective December 13, 2013.

In connection with the appointment of Mr. Stewart as our President and CEO, the Compensation Committee consulted with Pearl Meyer & Partners, the Company’s prior independent compensation consultant, regarding the design of Mr. Stewart’s compensation arrangement. The Compensation Committee also took into consideration Mr. Stewart’s abilities and experience and his knowledge of the Company through his service as a director, as well as the results of the Company’s 2013 Say-on-Pay vote and input from a number of our large shareholders. Mr. Stewart’s overall compensation package was established through arm’s length negotiations with the Compensation Committee and was reflected in an employment agreement. While Mr. Stewart’s employment agreement provided for an attractive and competitive compensation arrangement, it included a lower base salary and lower target and maximum short-term incentive opportunities than those of his predecessor. Mr. Stewart’s original employment agreement provided for an annual base salary of $515,000 and an annual target short-term incentive equal to 75% of his annual base salary and a maximum short-term incentive equal to 150% of his annual base salary, based on the achievement of certain performance objectives to be set by the Company’s Compensation Committee.

20

In addition to his salary and annual bonus opportunity, the Compensation Committee also granted on December 13, 2013, the day that he was named permanent President and CEO, a one-time equity grant of 100,000 non-qualified stock options and 150,000 shares of restricted stock, subject to time-vesting requirements. The non-qualified stock options have a seven-year term, and an exercise price of $6.54, which was the closing price of the Company’s common stock on the date of the grant. One-third of the non-qualified stock options vested on each of June 15, 2015, 2016, and 2017. The shares of restricted stock vested in full on December 13, 2016.

In April 2016 and October 2017, the Company entered into amendments to Mr. Stewart’s original employment agreement, which, among other things, extended the term of the original employment agreement, provided for the increase of Mr. Stewart’s salary and his target and maximum short-term incentive opportunities, and provided for the grant of additional equity awards, all of which are further described under the section “Employment Agreements” below.

The Compensation Committee reviews the performance and compensation of our CEO each year. In evaluating the compensation of the CEO, the Compensation Committee considers factors such as his skills, relevant experience and recent performance, as well as market compensation data. Following such review in December 2018, the Compensation Committee approved an increase, effective as of January 1, 2019, in Mr. Stewart’s salary to $625,000. See “Employment Agreements” below for a further description of the Company’s employment agreement with Mr. Stewart.

Compensation of the Executive Chairman. In January 2019, the Board of Directors appointed Gregory J. Owens to serve as Executive Chairman. After consultation with Meridian regarding the design of Mr. Owens’ compensation arrangement, the Compensation Committee approved an annual base salary for Mr. Owens of $415,000. On April 16, 2019, upon consideration of the responsibilities undertaken by Mr. Owens following his appointment as Executive Chairman, the Compensation Committee granted to Mr. Owens 104,856 shares of time-vested restricted stock as follows: (i) 48,059 shares, which vest in eleven installments of 4,369 shares on each of the first through eleventh monthly anniversaries of April 16, 2019, provided that Mr. Owens continues serving as Executive Chairman on such monthly anniversary, and (ii) 56,797 shares, which vest in thirteen installments of 4,369 shares on each of the twelfth through twenty-fourth monthly anniversaries of April 16, 2019, provided that Mr. Owens continues serving as Executive Chairman on such monthly anniversary. The Compensation Committee has determined that Mr. Owens will not participate in the Company’s Short-Term Incentive Plan.

Compensation of Other Named Executive Officers. In setting the initial compensation for our other named executive officers, the Compensation Committee, in consultation with the CEO, considers the skills, relevant experience and qualifications of the officer, as well as market compensation data and the compensation arrangement with the executive officer’s former employer. We establish the overall compensation package of these executive officers through arm’s length negotiations and reflect the terms in an employment agreement. The CEO annually reviews the performance of the other executive officers, including our named executive officers. The Compensation Committee, in consultation with the CEO, then determines the amount of compensation for the other executive officers, including our other named executive officers, for the upcoming year. With respect to these executive officers, the Compensation Committee and the CEO consider multiple factors in establishing the terms of their compensation packages, including the skills, relevant experience, recent performance and strategic fit of each executive officer at the Company, as well as market compensation data.

21

2019 Compensation Decisions

Effective as of January 3, 2019, the Company entered into an employment agreement with Mr. Abkemeier in connection with his appointment as the Company’s Chief Financial Officer, Treasurer and Controller. Mr. Abkemeier was subsequently appointed the Company’s Executive Vice President, Chief Financial Officer and Treasurer in February 2020. See “Employment Agreements” below for a description of Mr. Abkemeier’s employment agreement.

In January 2019, the Compensation Committee approved the base salary for Mr. Owens in connection with his appointment as Executive Chairman of the Company. Mr. Owens’ salary was determined by the Compensation Committee after a review of market data for similar positions in consultation with Meridian. In April 2019, after further consideration by the Compensation Committee of his responsibilities, Mr. Owens was granted certain equity awards in connection with his service as Executive Chairman. See “Compensation of the Executive Chairman” above for a detailed description of Mr. Owens’ equity grants.

In March 2019, the Compensation Committee approved the material terms of the 2019 Short-Term Incentive Plan, as described below under “Cash Bonus – 2019 Short-Term Incentive Plan.” The Compensation Committee included revenue and adjusted EBITDA objectives in the 2019 Short-Term Incentive Plan as criteria for the amounts of the actual bonus payouts, if any, to Mr. Stewart, Mr. Abkemeier and other plan participants. Both revenue and adjusted EBITDA objectives were included in the design of the 2019 Short-Term Incentive Plan to ensure that the Company’s executive officers maintained their focus on revenue, while at the same time achieving a certain level of profitability. The Compensation Committee also included individual performance objectives in the 2019 Short-Term Incentive Plan for each member of the Company’s executive management committee participating in the STI Plan, including Mr. Stewart and Mr. Abkemeier. The individual performance objectives varied for, and were tailored to the job responsibilities of, each member of the Company’s executive management committee.