UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-07527 | |||||||

|

| ||||||||

|

Turner Funds | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

1205 Westlakes Drive, Suite 100 Berwyn, PA |

|

19312 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Michael P. Malloy Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

1-800-224-6312 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

September 30 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

March 31, 2016 |

| ||||||

Item 1. Reports to Stockholders.

Semiannual Report

March 31, 2016 (unaudited)

Long/short equity funds

Turner Medical Sciences Long/Short Fund

Turner Titan Long/Short Fund (formerly Turner Spectrum Fund, subsequently Turner Titan II Fund)

U.S. growth equity funds

Turner SMID Cap Growth Opportunities Fund (formerly Turner Emerging Growth Fund)

Turner Midcap Growth Fund

Turner Small Cap Growth Fund

Contents

|

2 |

Letter to shareholders |

||||||

|

3 |

Schedules of investments |

||||||

|

12 |

Sector Weightings |

||||||

| 14 |

Financial statements |

||||||

| 26 |

Notes to financial statements |

||||||

|

33 |

Board of Trustees considerations in approving the Advisory Agreement |

||||||

| 34 |

Disclosure of fund expenses |

||||||

Turner Funds

As of March 31, 2016, the Turner Funds offered a series of five mutual funds to individual and institutional investors. The minimum initial investment for Institutional Class Shares in a Turner Fund is $250,000 (except for $100,000 for the Turner Medical Sciences Long/Short Fund and the Turner Titan Long/Short Fund) for regular accounts and $100,000 for individual retirement accounts. The minimum initial investment for Investor Class Shares, Retirement Class Shares and Class C Shares is $2,500 for regular accounts and $2,000 for individual retirement accounts.

Turner Investments, L.P., based in Berwyn, Pennsylvania, serves as the investment adviser for the Turner Funds. Turner Investments, L.P., founded in 1990, manages approximately $405 million in equity investments as of March 31, 2016.

Shareholder services

Turner Funds shareholders receive annual and semiannual reports, and quarterly account statements. Shareholders who have questions about their accounts may call a toll-free telephone number, 1.800.224.6312, may visit our website, www.turnerinvestments.com, or may write to Turner Funds, P.O. Box 219805, Kansas City, Missouri 64121-9805.

TURNER FUNDS 2016 SEMIANNUAL REPORT 1

LETTER TO SHAREHOLDERS

To our shareholders

Global GDP for 2015 was just under 3% with inflation about the same. Projections for 2016 are not too dissimilar. Our belief is that there is a strong probability that this pattern of modest global growth and inflation continues for a few years. China's hyper growth has clearly slowed, India's growth is steady but modest, and the rest of the developing countries are mixed with many of them dependent on China for growth. In developed markets, Europe and Japan are showing no growth while the US is the beacon of developed market growth (2.5% in 2015) driven by population growth and increased productivity.

In a way, no one should be chagrined or disappointed by this. There are worse scenarios than modest growth with modest inflation. With this backdrop, it stands to reason that the stock market should be "steady as she goes" with mid-single-digit gains. As we all know, however, there is no such thing as "steady as she goes "with the stock market. While the market (as measured by the S&P 500) has risen over 200% since the bottom in March 2009, there have been six significant corrections during that time.

There were very good and real reasons behind those corrections (European debt crisis, Fed tapering, Ebola scare, etc.) The most recent correction of nearly 15% from late last year to early this year was driven by the first US Federal Reserve rate increase in eight years along with concern over Chinese growth. However, after sharp corrections that are exacerbated by the impact of hedge funds and ETFs, the market seems to remind itself, "Oh yeah, the global economy is growing by 3% and inflation is under control". At that point, the market stabilizes and then moves back to new highs.

For most companies it is hard to grow earnings meaningfully with this backdrop. Through revenue enhancements and cost efficiencies, larger blue chip companies like Boeing, Comcast or MMM are able to grow their earnings above global GDP — say 5%. They then buy back shares at a rate of 3% or so and they have a dividend of about 2%. By doing this, their stock price advances 10% per year, which is very impressive in light of overall modest stock market returns and anemic bond returns (around 2% per annum).

Most companies, however, are not as disciplined as the three aforementioned companies. They tend to be poor stewards of capital and are challenged by a very competitive global backdrop. This is particularly acute among smaller companies.

As a result, outside of a few big companies who are good stewards of capital and can grow earnings above that of global GDP, to have success it is critical to find industries and companies within those industries where growth rates are nicely above global growth rates. Examples of these industries and companies are: 1. Internet and Social Networking — Facebook, Amazon, Google and Tencent; 2. Cloud Computing — Salesforce.com, ServiceNow, Hubspot and Shopify; 3. Cybersecurity — Palo Alto Networks, Fireye and Fortinet; 4. Advanced Semiconductors — Cavium, ASM Lithography and Broadcom; 5. Next Generation Biotech — Horizon Pharmaceutical, Prothena and Achillion Pharmaceutical;

6. Virtual and Augmented Reality — Activision and Electronic Arts; 7. Technology Based Education — 2U and Instructure; and 8. Next Generation and Smart Automotive — Tesla and Mobileye.

At Turner Investments, we strive to identify those fast growing industries and the fastest growing companies within those industries. Unfortunately, there aren't a lot of these. We have, however, found success with portfolios that contain fewer stocks — but holding stocks that offer very high growth rates in revenues and earnings, with the anticipation that the stock price will follow suit.

Moving forward, we believe that we are destined to more of the same, namely modest global economic growth with modest inflation. At some point, a crisis will develop, undoubtedly led by excesses in the credit markets, but in the meantime, corrections are buying opportunities for the high growth companies in the new innovative industries.

We appreciate your investments in the Turner Funds and we look forward to continuing to serve you in the years ahead.

Sincerely,

Bob Turner

Chairman and Chief Investment Officer

Turner Investments

Past performance is no guarantee of future results. The views expressed are those of Turner Investments as of March 31, 2016, and are not intended as a forecast or investment recommendations. The indexes mentioned are not available for investment.

Bob Turner

2 TURNER FUNDS 2016 SEMIANNUAL REPORT

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Medical Sciences Long/Short Fund

March 31, 2016

|

Shares |

Value (000) |

||||||||||

|

Common stock—94.7% |

|||||||||||

|

Biotechnology—33.4% |

|||||||||||

|

Achillion Pharmaceuticals* |

379,270 |

$ |

2,928 |

||||||||

|

Aduro Biotech* |

62,900 |

806 |

|||||||||

|

Biogen* |

5,850 |

1,523 |

|||||||||

|

Bluebird Bio* |

27,980 |

1,189 |

|||||||||

|

Chimerix* |

163,730 |

837 |

|||||||||

|

Emergent BioSolutions* |

37,620 |

1,367 |

|||||||||

|

Heron Therapeutics* |

96,570 |

1,834 |

|||||||||

|

ImmunoGen* |

81,020 |

690 |

|||||||||

|

Momenta Pharmaceuticals* |

304,600 |

2,815 |

|||||||||

|

Progenics Pharmaceuticals* |

236,856 |

1,033 |

|||||||||

|

Prothena* |

81,520 |

3,355 |

|||||||||

|

Raptor Pharmaceuticals* |

161,100 |

741 |

|||||||||

|

Retrophin* |

142,864 |

1,952 |

|||||||||

|

Tesaro* |

45,860 |

2,019 |

|||||||||

|

Trevena* |

145,420 |

1,203 |

|||||||||

|

Vertex Pharmaceuticals* |

7,340 |

583 |

|||||||||

|

Total Biotechnology |

24,875 |

||||||||||

|

Health care equipment & supplies—13.8% |

|||||||||||

|

CONMED |

64,300 |

2,697 |

|||||||||

|

Edwards Lifesciences* |

30,680 |

2,705 |

|||||||||

|

Intuitive Surgical* |

4,440 |

2,669 |

|||||||||

|

St. Jude Medical |

40,140 |

2,208 |

|||||||||

|

Total Health care equipment & supplies |

10,279 |

||||||||||

|

Health care providers & services—2.6% |

|||||||||||

|

Adeptus Health, Cl A* |

13,890 |

771 |

|||||||||

|

BioTelemetry* |

97,778 |

1,142 |

|||||||||

|

Total Health care providers & services |

1,913 |

||||||||||

|

Life sciences tools & services—6.0% |

|||||||||||

|

Illumina* |

8,280 |

1,342 |

|||||||||

|

Thermo Fisher Scientific |

22,060 |

3,124 |

|||||||||

|

Total Life sciences tools & services |

4,466 |

||||||||||

|

Pharmaceuticals—38.9% |

|||||||||||

|

Aclaris Therapeutics (a)* |

87,004 |

1,649 |

|||||||||

|

Allergan* |

5,880 |

1,576 |

|||||||||

|

Aratana Therapeutics* |

500,000 |

2,760 |

|||||||||

|

Bristol-Myers Squibb |

59,560 |

3,806 |

|||||||||

|

Cardiome Pharma (a)* |

505,420 |

2,067 |

|||||||||

|

Corium International* |

62,513 |

241 |

|||||||||

|

Shares |

Value (000) |

||||||||||

|

Flamel Technologies ADR* |

142,148 |

$ |

1,569 |

||||||||

|

GlaxoSmithKline ADR |

56,730 |

2,300 |

|||||||||

|

Horizon Pharma* |

155,460 |

2,576 |

|||||||||

|

Johnson & Johnson |

20,900 |

2,261 |

|||||||||

|

Mallinckrodt* |

18,920 |

1,159 |

|||||||||

|

Ocera Therapeutics (a)* |

450,000 |

1,323 |

|||||||||

|

Pfizer |

127,220 |

3,772 |

|||||||||

|

SteadyMed (a)* |

270,000 |

664 |

|||||||||

|

Teligent* |

267,776 |

1,312 |

|||||||||

|

Total Pharmaceuticals |

29,035 |

||||||||||

|

Total Common stock (Cost $68,168)** |

70,568 |

||||||||||

|

Warrant—0.0% |

|||||||||||

|

Biotechnology—0.0% |

|||||||||||

|

NephroGenex (a)* |

65,000 |

— |

|||||||||

|

Total Biotechnology |

— |

||||||||||

|

Total Warrant (Cost $—)** |

$ |

— |

|||||||||

|

Cash equivalent—1.2% |

|||||||||||

|

BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.357%‡ |

870,721 |

871 |

|||||||||

|

Total Cash equivalent (Cost $871)** |

871 |

||||||||||

|

Total Investments—95.9% (Cost $69,039)** |

71,439 |

||||||||||

|

Segregated cash with brokers—84.2% |

62,769 |

||||||||||

|

Securities sold short—(79.9)% (Proceeds $(65,714))** |

(59,523 |

) |

|||||||||

|

Net Other assets (liabilities)—(0.2)% |

(147 |

) |

|||||||||

|

Net Assets—100.0% |

$ |

74,538 |

|||||||||

Amounts designated as "—" have been rounded to $0.

(a) These securities have been deemed illiquid by the Adviser and represent 7.65% of Net Assets.

* Non-income producing security.

** This number is listed in thousands.

‡ Rate shown is the 7-day effective yield as of March 31, 2016.

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2016 SEMIANNUAL REPORT 3

FINANCIAL STATEMENTS (Unaudited)

Schedule of securities sold short

Turner Medical Sciences Long/Short Fund

March 31, 2016

|

Shares |

Value (000) |

||||||||||

|

Common stock—44.3% |

|||||||||||

|

Biotechnology—7.1% |

|||||||||||

|

Alexion Pharmaceuticals |

12,460 |

$ |

1,735 |

||||||||

|

BeiGene ADR |

17,550 |

514 |

|||||||||

|

Regeneron Pharmaceuticals |

4,030 |

1,453 |

|||||||||

|

Regulus Therapeutics |

122,460 |

849 |

|||||||||

|

Seattle Genetics |

20,270 |

711 |

|||||||||

|

Total Biotechnology |

5,262 |

||||||||||

|

Food & staples retailing—1.8% |

|||||||||||

|

CVS Health |

13,180 |

1,367 |

|||||||||

|

Total Food & staples retailing |

1,367 |

||||||||||

|

Health care equipment & supplies—12.8% |

|||||||||||

|

Anika Therapeutics |

34,650 |

1,550 |

|||||||||

|

C.R. Bard |

5,170 |

1,048 |

|||||||||

|

Hologic |

38,370 |

1,324 |

|||||||||

|

Medtronic |

28,100 |

2,107 |

|||||||||

|

Nevro |

14,280 |

803 |

|||||||||

|

Stryker |

24,930 |

2,674 |

|||||||||

|

Total Health care equipment & supplies |

9,506 |

||||||||||

|

Health care providers & services—8.5% |

|||||||||||

|

HCA Holdings |

19,100 |

1,491 |

|||||||||

|

Henry Schein |

10,530 |

1,817 |

|||||||||

|

Laboratory Corp. of America Holdings |

12,360 |

1,448 |

|||||||||

|

UnitedHealth Group, Cl B |

12,010 |

1,548 |

|||||||||

|

Total Health care providers & services |

6,304 |

||||||||||

|

Health care technology—0.7% |

|||||||||||

|

athenahealth |

3,810 |

529 |

|||||||||

|

Total Health care technology |

529 |

||||||||||

|

Life sciences tools & services—8.9% |

|||||||||||

|

ICON |

20,070 |

1,507 |

|||||||||

|

Mettler-Toledo International |

5,700 |

1,966 |

|||||||||

|

PerkinElmer |

30,710 |

1,519 |

|||||||||

|

Waters |

12,510 |

1,650 |

|||||||||

|

Total Life sciences tools & services |

6,642 |

||||||||||

|

Shares |

Value (000) |

||||||||||

|

Pharmaceuticals—4.5% |

|||||||||||

|

Aerie Pharmaceuticals |

69,830 |

$ |

849 |

||||||||

|

Dr. Reddy's Laboratories ADR |

55,720 |

2,518 |

|||||||||

|

Total Pharmaceuticals |

3,367 |

||||||||||

|

Total Common stock (Proceeds $33,642)* |

32,977 |

||||||||||

|

Exchange traded funds—35.6% |

|||||||||||

|

Health Care Select Sector SPDR Fund |

111,020 |

7,525 |

|||||||||

|

iShares NASDAQ Biotechnology ETF |

33,320 |

8,691 |

|||||||||

|

iShares Russell 2000 Growth ETF |

22,790 |

2,521 |

|||||||||

|

SPDR S&P Biotech ETF |

151,170 |

7,809 |

|||||||||

|

Total Exchange traded funds (Proceeds $32,072)* |

26,546 |

||||||||||

|

Total Securities sold short—79.9% (Proceeds $65,714)* |

$ |

59,523 |

|||||||||

Percentages disclosed are based on total net assets of the Fund at March 31, 2016.

* This number is listed in thousands.

ADR — American Depositary Receipt

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

4 TURNER FUNDS 2016 SEMIANNUAL REPORT

Schedule of investments

Turner Titan Long/Short Fund

March 31, 2016

|

Shares |

Value (000) |

||||||||||

|

Common stock—91.0%† |

|||||||||||

|

Consumer discretionary—16.8% |

|||||||||||

|

CBS, Cl B^ |

15,900 |

$ |

876 |

||||||||

|

Coach |

12,600 |

505 |

|||||||||

|

Dollar General |

7,200 |

616 |

|||||||||

|

Hilton Worldwide Holdings^ |

32,000 |

721 |

|||||||||

|

Lowe's^ |

8,600 |

651 |

|||||||||

|

lululemon athletica*^ |

8,800 |

596 |

|||||||||

|

Priceline Group*^ |

560 |

722 |

|||||||||

|

Ross Stores |

10,300 |

596 |

|||||||||

|

Royal Caribbean Cruises |

10,600 |

871 |

|||||||||

|

The Walt Disney |

5,850 |

581 |

|||||||||

|

Total Consumer discretionary |

6,735 |

||||||||||

|

Consumer staples—7.7% |

|||||||||||

|

Constellation Brands, Cl A^ |

11,940 |

1,804 |

|||||||||

|

PepsiCo^ |

7,500 |

769 |

|||||||||

|

The Clorox |

4,030 |

508 |

|||||||||

|

Total Consumer staples |

3,081 |

||||||||||

|

Energy—4.8% |

|||||||||||

|

Anadarko Petroleum^ |

18,000 |

838 |

|||||||||

|

Pioneer Natural Resources^ |

4,300 |

605 |

|||||||||

|

Weatherford International* |

60,000 |

467 |

|||||||||

|

Total Energy |

1,910 |

||||||||||

|

Financials—8.5% |

|||||||||||

|

CME Group^ |

7,200 |

692 |

|||||||||

|

MetLife |

8,200 |

360 |

|||||||||

|

QTS Realty Trust, Cl A |

25,600 |

1,213 |

|||||||||

|

T. Rowe Price Group |

7,200 |

529 |

|||||||||

|

The Charles Schwab^ |

21,700 |

608 |

|||||||||

|

Total Financials |

3,402 |

||||||||||

|

Health care—9.5% |

|||||||||||

|

Allergan*^ |

3,300 |

885 |

|||||||||

|

Becton Dickinson^ |

5,400 |

820 |

|||||||||

|

Boston Scientific*^ |

40,600 |

764 |

|||||||||

|

Bristol-Myers Squibb^ |

12,590 |

804 |

|||||||||

|

Celgene*^ |

5,200 |

520 |

|||||||||

|

Total Health care |

3,793 |

||||||||||

|

Shares |

Value (000) |

||||||||||

|

Industrials—13.1% |

|||||||||||

|

C.H. Robinson Worldwide |

5,700 |

$ |

423 |

||||||||

|

Danaher |

7,500 |

711 |

|||||||||

|

Eaton^ |

17,790 |

1,113 |

|||||||||

|

Kansas City Southern^ |

8,600 |

735 |

|||||||||

|

Raytheon |

4,000 |

491 |

|||||||||

|

Southwest Airlines^ |

27,550 |

1,234 |

|||||||||

|

Terex |

22,000 |

547 |

|||||||||

|

Total Industrials |

5,254 |

||||||||||

|

Information technology—28.0% |

|||||||||||

|

Alphabet, Cl A*^ |

1,600 |

1,222 |

|||||||||

|

Apple^ |

6,500 |

708 |

|||||||||

|

Broadcom |

2,600 |

402 |

|||||||||

|

Broadridge Financial Solutions |

11,000 |

652 |

|||||||||

|

Cisco Systems |

18,200 |

518 |

|||||||||

|

Electronic Arts*^ |

10,000 |

661 |

|||||||||

|

Facebook, Cl A*^ |

7,710 |

880 |

|||||||||

|

Finisar* |

17,400 |

317 |

|||||||||

|

Hewlett Packard Enterprise |

17,470 |

310 |

|||||||||

|

Lam Research |

10,000 |

826 |

|||||||||

|

NXP Semiconductors*^ |

15,000 |

1,216 |

|||||||||

|

Palo Alto Networks* |

3,360 |

548 |

|||||||||

|

Salesforce.com*^ |

13,600 |

1,004 |

|||||||||

|

ServiceNow* |

12,000 |

734 |

|||||||||

|

Vantiv, Cl A*^ |

13,000 |

700 |

|||||||||

|

Visa, Cl A^ |

7,400 |

566 |

|||||||||

|

Total Information technology |

11,264 |

||||||||||

|

Materials—2.6% |

|||||||||||

|

PPG Industries |

5,000 |

558 |

|||||||||

|

Summit Materials, Cl A* |

25,000 |

486 |

|||||||||

|

Total Materials |

1,044 |

||||||||||

|

Total Common stock (Cost $32,476)** |

36,483 |

||||||||||

|

Exchange traded funds—1.9% |

|||||||||||

|

SPDR Metals & Mining ETF |

36,700 |

752 |

|||||||||

|

Total Exchange traded funds (Cost $762)** |

752 |

||||||||||

TURNER FUNDS 2016 SEMIANNUAL REPORT 5

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Titan Long/Short Fund

|

Shares |

Value (000) |

||||||||||

|

Warrant—0.1% |

|||||||||||

|

Financials—0.1% |

|||||||||||

|

Atlas Mara (a)* |

472,160 |

$ |

47 |

||||||||

|

Total Financials |

47 |

||||||||||

|

Total Warrant (Cost $92)** |

47 |

||||||||||

|

Total Investments—93.0% (Cost $33,330)** |

37,282 |

||||||||||

|

Segregated cash with brokers—60.8% |

24,386 |

||||||||||

|

Securities sold short—(58.1)% (Proceeds $(22,804))** |

(23,271 |

) |

|||||||||

|

Net Other assets (liabilities)—4.3% |

1,688 |

||||||||||

|

Net Assets—100.0% |

$ |

40,085 |

|||||||||

(a) These securities have been deemed illiquid by the Adviser and represent 0.12% of Net Assets.

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

6 TURNER FUNDS 2016 SEMIANNUAL REPORT

Schedule of securities sold short

Turner Titan Long/Short Fund

March 31, 2016

|

Shares |

Value (000) |

||||||||||

|

Common stock—44.5% |

|||||||||||

|

Consumer discretionary—13.3% |

|||||||||||

|

CarMax |

6,000 |

$ |

307 |

||||||||

|

Dillard's, Cl A |

7,000 |

594 |

|||||||||

|

Discovery Communications, Cl A |

19,820 |

567 |

|||||||||

|

Expedia |

3,780 |

408 |

|||||||||

|

Marriott International, Cl A |

11,500 |

819 |

|||||||||

|

McDonald's |

2,600 |

327 |

|||||||||

|

Nordstrom |

4,900 |

280 |

|||||||||

|

O'Reilly Automotive |

820 |

224 |

|||||||||

|

Tesla Motors |

2,500 |

574 |

|||||||||

|

Tiffany |

5,000 |

367 |

|||||||||

|

TripAdvisor |

12,700 |

844 |

|||||||||

|

Total Consumer discretionary |

5,311 |

||||||||||

|

Consumer staples—3.4% |

|||||||||||

|

The Coca-Cola |

10,000 |

464 |

|||||||||

|

The Kroger |

7,900 |

302 |

|||||||||

|

Wal-Mart Stores |

9,000 |

616 |

|||||||||

|

Total Consumer staples |

1,382 |

||||||||||

|

Energy—3.6% |

|||||||||||

|

Cimarex Energy |

4,300 |

418 |

|||||||||

|

Frank's International |

13,000 |

214 |

|||||||||

|

Range Resources |

25,000 |

810 |

|||||||||

|

Total Energy |

1,442 |

||||||||||

|

Financials—4.5% |

|||||||||||

|

Cullen/Frost Bankers |

8,300 |

457 |

|||||||||

|

Deutsche Bank |

15,000 |

254 |

|||||||||

|

Franklin Resources |

10,000 |

391 |

|||||||||

|

Moody's |

4,440 |

429 |

|||||||||

|

Morgan Stanley |

11,000 |

275 |

|||||||||

|

Total Financials |

1,806 |

||||||||||

|

Health care—3.6% |

|||||||||||

|

Abbott Laboratories |

10,000 |

418 |

|||||||||

|

Express Scripts Holdings |

6,000 |

412 |

|||||||||

|

Varian Medical Systems |

7,500 |

601 |

|||||||||

|

Total Health care |

1,431 |

||||||||||

|

Industrials—6.3% |

|||||||||||

|

Alaska Air Group |

3,900 |

320 |

|||||||||

|

Deere |

8,000 |

617 |

|||||||||

|

General Electric |

14,000 |

445 |

|||||||||

|

Shares |

Value (000) |

||||||||||

|

Roper Technologies |

2,300 |

$ |

420 |

||||||||

|

Textron |

7,000 |

255 |

|||||||||

|

The Boeing |

3,800 |

482 |

|||||||||

|

Total Industrials |

2,539 |

||||||||||

|

Information technology—8.0% |

|||||||||||

|

Atlassian, Cl A |

11,200 |

282 |

|||||||||

|

Autodesk |

7,000 |

408 |

|||||||||

|

Check Point Software Technologies |

3,700 |

324 |

|||||||||

|

Fortinet |

9,600 |

294 |

|||||||||

|

Grubhub |

4,000 |

101 |

|||||||||

|

Intel |

10,000 |

324 |

|||||||||

|

Linear Technology |

10,000 |

445 |

|||||||||

|

LinkedIn, Cl A |

3,800 |

434 |

|||||||||

|

New Relic |

10,000 |

261 |

|||||||||

|

Skyworks Solutions |

3,700 |

288 |

|||||||||

|

Total Information technology |

3,161 |

||||||||||

|

Materials—0.7% |

|||||||||||

|

Compass Minerals International |

4,200 |

298 |

|||||||||

|

Total Materials |

298 |

||||||||||

|

Telecommunication services—1.1% |

|||||||||||

|

SBA Communications, Cl A |

4,500 |

451 |

|||||||||

|

Total Telecommunication services |

451 |

||||||||||

|

Total Common stock (Proceeds $17,392)* |

17,821 |

||||||||||

|

Exchange traded funds—13.6% |

|||||||||||

|

iShares Russell 1000 Growth ETF |

20,000 |

1,996 |

|||||||||

|

SPDR S&P 500 ETF Trust |

15,000 |

3,082 |

|||||||||

|

SPDR S&P Biotech ETF |

7,200 |

372 |

|||||||||

|

Total Exchange traded funds (Proceeds $5,412)* |

5,450 |

||||||||||

|

Total Securities sold short—58.1% (Proceeds $22,804)* |

$ |

23,271 |

|||||||||

Percentages disclosed are based on total net assets of the Fund at March 31, 2016.

* This number is listed in thousands.

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2016 SEMIANNUAL REPORT 7

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner SMID Cap Growth Opportunities Fund

March 31, 2016

|

Shares |

Value (000) |

||||||||||

|

Common stock—92.8%† |

|||||||||||

|

Consumer discretionary—17.2% |

|||||||||||

|

Carrols Restaurant Group* |

107,000 |

$ |

1,545 |

||||||||

|

Chuy's Holdings* |

15,000 |

466 |

|||||||||

|

Domino's Pizza |

13,000 |

1,714 |

|||||||||

|

Duluth Holdings* |

45,000 |

877 |

|||||||||

|

Grand Canyon Education* |

23,000 |

983 |

|||||||||

|

Motorcar Parts of America* |

47,000 |

1,785 |

|||||||||

|

Ollie's Bargain Outlet Holdings* |

72,000 |

1,687 |

|||||||||

|

Sonic |

10,000 |

352 |

|||||||||

|

TAL Education Group ADR* |

4,000 |

199 |

|||||||||

|

Vista Outdoor* |

34,000 |

1,765 |

|||||||||

|

Total Consumer discretionary |

11,373 |

||||||||||

|

Consumer staples—2.2% |

|||||||||||

|

Sprouts Farmers Market* |

50,000 |

1,452 |

|||||||||

|

Total Consumer staples |

1,452 |

||||||||||

|

Energy—0.9% |

|||||||||||

|

Parsley Energy, Cl A* |

25,000 |

565 |

|||||||||

|

Total Energy |

565 |

||||||||||

|

Financials—7.5% |

|||||||||||

|

CoreSite Realty |

33,000 |

2,311 |

|||||||||

|

MSCI, Cl A |

16,000 |

1,185 |

|||||||||

|

Physicians Realty Trust |

77,500 |

1,440 |

|||||||||

|

Total Financials |

4,936 |

||||||||||

|

Health care—9.5% |

|||||||||||

|

Intuitive Surgical* |

3,300 |

1,983 |

|||||||||

|

Ligand Pharmaceuticals, Cl B*^ |

22,000 |

2,357 |

|||||||||

|

Prestige Brands Holdings* |

37,000 |

1,975 |

|||||||||

|

Total Health care |

6,315 |

||||||||||

|

Industrials—6.0% |

|||||||||||

|

Controladora Vuela ADR* |

45,000 |

948 |

|||||||||

|

Huntington Ingalls Industries |

12,000 |

1,643 |

|||||||||

|

Toro |

16,000 |

1,378 |

|||||||||

|

Total Industrials |

3,969 |

||||||||||

|

Information technology—47.2% |

|||||||||||

|

Alarm.com Holding*^ |

40,000 |

948 |

|||||||||

|

Autobytel* |

11,000 |

191 |

|||||||||

|

Cray* |

28,000 |

1,173 |

|||||||||

|

Cree* |

55,000 |

1,601 |

|||||||||

|

Shares |

Value (000) |

||||||||||

|

Ellie Mae* |

20,000 |

$ |

1,813 |

||||||||

|

Exlservice Holdings* |

35,000 |

1,813 |

|||||||||

|

First Solar* |

27,000 |

1,849 |

|||||||||

|

Inphi* |

41,000 |

1,367 |

|||||||||

|

Littelfuse |

17,000 |

2,092 |

|||||||||

|

Lumentum Holdings* |

63,000 |

1,699 |

|||||||||

|

MA-Com Technology Solutions Holdings*^ |

40,000 |

1,752 |

|||||||||

|

MaxLinear, Cl A* |

110,000 |

2,034 |

|||||||||

|

Mellanox Technologies* |

36,000 |

1,955 |

|||||||||

|

Mercury Systems* |

66,000 |

1,340 |

|||||||||

|

NVIDIA |

40,000 |

1,425 |

|||||||||

|

Shopify, Cl A* |

55,000 |

1,552 |

|||||||||

|

SolarEdge Technologies*^ |

50,000 |

1,257 |

|||||||||

|

Square, Cl A* |

50,000 |

764 |

|||||||||

|

The Rubicon Project* |

20,000 |

366 |

|||||||||

|

Ultratech* |

44,400 |

970 |

|||||||||

|

Universal Display* |

25,000 |

1,353 |

|||||||||

|

Vantive, Cl A* |

36,000 |

1,940 |

|||||||||

|

Total Information technology |

31,254 |

||||||||||

|

Materials—1.0% |

|||||||||||

|

Agnico Eagle Mines^ |

19,000 |

687 |

|||||||||

|

Total Materials |

687 |

||||||||||

|

Telecommunication services—1.3% |

|||||||||||

|

ORBCOMM* |

83,000 |

841 |

|||||||||

|

Total Telecommunication services |

841 |

||||||||||

|

Total Common stock (Cost $55,257)** |

61,392 |

||||||||||

|

Cash equivalent—14.9% |

|||||||||||

|

BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.357%‡ (1) |

9,875,204 |

9,875 |

|||||||||

|

Total Cash equivalent (Cost $9,875)** |

9,875 |

||||||||||

|

Total Investments—107.7% (Cost $65,132)** |

71,267 |

||||||||||

|

Net Other assets (liabilities)—(7.7)% |

(5,089 |

) |

|||||||||

|

Net Assets—100.0% |

$ |

66,178 |

|||||||||

8 TURNER FUNDS 2016 SEMIANNUAL REPORT

Schedule of investments

Turner SMID Cap Growth Opportunities Fund

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2016 was $1,918**.

^ Security fully or partially on loan at March 31, 2016. The total value of securities on loan at March 31, 2016 was $1,868**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2016.

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2016 SEMIANNUAL REPORT 9

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Midcap Growth Fund

March 31, 2016

|

Shares |

Value (000) |

||||||||||

|

Common stock—97.5%† |

|||||||||||

|

Consumer discretionary—22.2% |

|||||||||||

|

Aramark |

132,030 |

$ |

4,373 |

||||||||

|

AutoZone* |

1,900 |

1,514 |

|||||||||

|

CBS, Cl B |

72,330 |

3,985 |

|||||||||

|

lululemon athletica* |

38,110 |

2,580 |

|||||||||

|

Mohawk Industries* |

11,490 |

2,193 |

|||||||||

|

Netflix* |

18,940 |

1,936 |

|||||||||

|

Newell Rubbermaid |

69,880 |

3,095 |

|||||||||

|

The Walt Disney |

24,720 |

2,455 |

|||||||||

|

Ulta Salon, Cosmetics & Fragrance* |

7,980 |

1,546 |

|||||||||

|

Wynn Resorts^ |

42,690 |

3,989 |

|||||||||

|

Total Consumer discretionary |

27,666 |

||||||||||

|

Consumer staples—6.6% |

|||||||||||

|

Constellation Brands, Cl A |

32,780 |

4,953 |

|||||||||

|

Monster Beverage* |

24,410 |

3,256 |

|||||||||

|

Total Consumer staples |

8,209 |

||||||||||

|

Energy—4.2% |

|||||||||||

|

Pioneer Natural Resources |

19,720 |

2,775 |

|||||||||

|

Weatherford International* |

318,880 |

2,481 |

|||||||||

|

Total Energy |

5,256 |

||||||||||

|

Financials—3.0% |

|||||||||||

|

Intercontinental Exchange Group |

15,660 |

3,682 |

|||||||||

|

Total Financials |

3,682 |

||||||||||

|

Health care—17.3% |

|||||||||||

|

Acadia Healthcare* |

49,790 |

2,744 |

|||||||||

|

Achillion Pharmaceuticals*^ |

329,590 |

2,544 |

|||||||||

|

Boston Scientific* |

148,560 |

2,794 |

|||||||||

|

CONMED |

61,750 |

2,590 |

|||||||||

|

Edwards Lifesciences* |

21,300 |

1,879 |

|||||||||

|

Intuitive Surgical* |

7,010 |

4,213 |

|||||||||

|

Ligand Pharmaceuticals, Cl B* |

18,140 |

1,943 |

|||||||||

|

Prothena*^ |

70,190 |

2,889 |

|||||||||

|

Total Health care |

21,596 |

||||||||||

|

Industrials—5.2% |

|||||||||||

|

Fortune Brands Home & Security |

49,120 |

2,753 |

|||||||||

|

Southwest Airlines |

82,360 |

3,689 |

|||||||||

|

Total Industrials |

6,442 |

||||||||||

|

Shares |

Value (000) |

||||||||||

|

Information technology—37.4% |

|||||||||||

|

Alphabet, Cl A* |

4,310 |

$ |

3,288 |

||||||||

|

Broadcom |

30,330 |

4,687 |

|||||||||

|

Cavium* |

65,904 |

4,031 |

|||||||||

|

Electronic Arts* |

48,760 |

3,224 |

|||||||||

|

Facebook, Cl A* |

34,640 |

3,952 |

|||||||||

|

HubSpot*^ |

42,140 |

1,838 |

|||||||||

|

Lam Research |

30,740 |

2,539 |

|||||||||

|

Monolithic Power Systems |

64,730 |

4,119 |

|||||||||

|

NXP Semiconductors* |

38,920 |

3,155 |

|||||||||

|

Palo Alto Networks* |

25,940 |

4,232 |

|||||||||

|

Proofpoint* |

43,010 |

2,313 |

|||||||||

|

Salesforce.com* |

53,740 |

3,968 |

|||||||||

|

SolarEdge Technologies* |

101,300 |

2,547 |

|||||||||

|

Vantive, Cl A* |

52,100 |

2,807 |

|||||||||

|

Total Information technology |

46,700 |

||||||||||

|

Materials—1.6% |

|||||||||||

|

PPG Industries |

18,040 |

2,011 |

|||||||||

|

Total Materials |

2,011 |

||||||||||

|

Total Common stock (Cost $109,180)** |

121,562 |

||||||||||

|

Cash equivalent—9.1% |

|||||||||||

|

BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.357%‡ (1) |

11,320,336 |

11,320 |

|||||||||

|

Total Cash equivalent (Cost $11,320)** |

11,320 |

||||||||||

|

Total Investments—106.6% (Cost $120,500)** |

132,882 |

||||||||||

|

Net Other assets (liabilities)—(6.6)% |

(8,182 |

) |

|||||||||

|

Net Assets—100.0% |

$ |

124,700 |

|||||||||

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2016 was $8,128**.

^ Security fully or partially on loan at March 31, 2016. The total value of securities on loan at March 31, 2016 was $8,036**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2016.

Cl — Class

The accompanying notes are an integral part of the financial statements.

10 TURNER FUNDS 2016 SEMIANNUAL REPORT

Schedule of investments

Turner Small Cap Growth Fund

March 31, 2016

|

Shares |

Value (000) |

||||||||||

|

Common stock—99.5%† |

|||||||||||

|

Consumer discretionary—6.3% |

|||||||||||

|

Fiesta Restaurant Group* |

32,000 |

$ |

1,049 |

||||||||

|

Kate Spade* |

32,000 |

817 |

|||||||||

|

Oxford Industries |

7,000 |

471 |

|||||||||

|

Zoe's Kitchen*^ |

7,500 |

292 |

|||||||||

|

Total Consumer discretionary |

2,629 |

||||||||||

|

Consumer staples—2.4% |

|||||||||||

|

Amplify Snack Brands* |

70,000 |

1,002 |

|||||||||

|

Total Consumer staples |

1,002 |

||||||||||

|

Energy—1.0% |

|||||||||||

|

Parsley Energy, Cl A* |

18,000 |

407 |

|||||||||

|

Total Energy |

407 |

||||||||||

|

Financials—4.8% |

|||||||||||

|

CyrusOne |

30,000 |

1,370 |

|||||||||

|

Home BancShares |

15,000 |

614 |

|||||||||

|

Total Financials |

1,984 |

||||||||||

|

Health care—24.0% |

|||||||||||

|

ABIOMED* |

18,000 |

1,708 |

|||||||||

|

Achillion Pharmaceuticals*^ |

100,000 |

772 |

|||||||||

|

Adeptus Health, Cl A*^ |

16,000 |

889 |

|||||||||

|

Cantel Medical Corp. |

15,000 |

1,070 |

|||||||||

|

Intrexon Corp.^ |

27,500 |

932 |

|||||||||

|

LDR Holding* |

58,000 |

1,478 |

|||||||||

|

Ligand Pharmaceuticals, Cl B*^ |

14,000 |

1,499 |

|||||||||

|

Prothena*^ |

12,000 |

494 |

|||||||||

|

Repligen* |

42,000 |

1,126 |

|||||||||

|

Total Health care |

9,968 |

||||||||||

|

Industrials—12.3% |

|||||||||||

|

Echo Global Logistics* |

30,000 |

815 |

|||||||||

|

HEICO |

15,000 |

902 |

|||||||||

|

Insperity |

35,000 |

1,810 |

|||||||||

|

John Bean Technologies |

11,500 |

649 |

|||||||||

|

Masonite International* |

14,000 |

917 |

|||||||||

|

Total Industrials |

5,093 |

||||||||||

|

Information technology—46.7% |

|||||||||||

|

Cavium* |

16,000 |

979 |

|||||||||

|

CUI Global*^ |

185,000 |

1,495 |

|||||||||

|

Digimarc*^ |

81,000 |

2,452 |

|||||||||

|

Ellie Mae* |

11,000 |

997 |

|||||||||

|

HubSpot* |

23,000 |

1,003 |

|||||||||

|

Marchex, Cl B |

70,000 |

312 |

|||||||||

|

Shares |

Value (000) |

||||||||||

|

Mellanox Technologies* |

18,000 |

$ |

978 |

||||||||

|

NeoPhotonics* |

62,000 |

870 |

|||||||||

|

Oclaro* |

65,000 |

351 |

|||||||||

|

Paycom Software* |

27,000 |

961 |

|||||||||

|

Proofpoint* |

24,000 |

1,291 |

|||||||||

|

Remark Media (a)* |

445,000 |

2,105 |

|||||||||

|

Shopify, Cl A* |

54,000 |

1,523 |

|||||||||

|

SolarEdge Technologies*^ |

47,000 |

1,182 |

|||||||||

|

Stamps.com* |

7,000 |

744 |

|||||||||

|

Ultratech* |

40,000 |

874 |

|||||||||

|

Universal Display* |

22,000 |

1,190 |

|||||||||

|

Total Information technology |

19,307 |

||||||||||

|

Materials—2.0% |

|||||||||||

|

Senomyx (a)*^ |

325,000 |

845 |

|||||||||

|

Total Materials |

845 |

||||||||||

|

Total Common stock (Cost $36,000)** |

41,235 |

||||||||||

|

Cash equivalent—24.2% |

|||||||||||

|

BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.357%‡ (1) |

10,040,925 |

10,041 |

|||||||||

|

Total Cash equivalent (Cost $10,041)** |

10,041 |

||||||||||

|

Total Investments—123.7% (Cost $46,041)** |

51,276 |

||||||||||

|

Net Other assets (liabilities)—(23.7)% |

(9,820 |

) |

|||||||||

|

Net Assets—100.0% |

$ |

41,456 |

|||||||||

(a) These securities have been deemed illiquid by the Adviser and represent 7.12% of Net Assets.

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2016 was $9,442**.

^ Security fully or partially on loan at March 31, 2016. The total value of securities on loan at March 31, 2016 was $9,187**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2016.

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2016 SEMIANNUAL REPORT 11

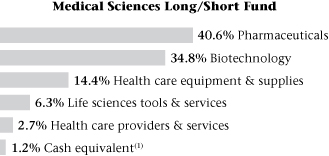

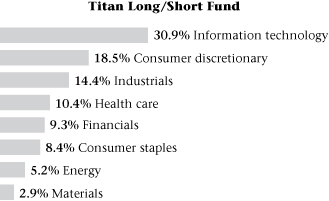

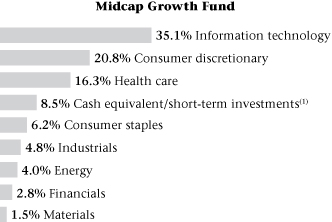

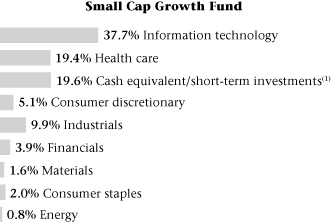

SECTOR WEIGHTINGS (Unaudited)

The following tables show the fund composition allocated by sector. The fund composition is subject to change, and the percentages are based on total investments.

1 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in the Notes to financial statements for more detailed information.

12 TURNER FUNDS 2016 SEMIANNUAL REPORT

THIS PAGE WAS INTENTIONALLY LEFT BLANK

TURNER FUNDS 2016 SEMIANNUAL REPORT 13

FINANCIAL STATEMENTS (Unaudited)

Statements of assets and liabilities (000)

March 31, 2016

|

Turner Medical Sciences Long/Short Fund |

Turner Titan Long/Short Fund |

Turner SMID Cap Growth Opportunities Fund |

|||||||||||||

|

Assets: |

|||||||||||||||

|

Investment securities, at cost |

$ |

69,039 |

$ |

33,330 |

$ |

65,132 |

|||||||||

|

Investment securities, at value |

$ |

71,439 |

$ |

37,282 |

$ |

71,267 |

|||||||||

|

Cash |

— |

4,054 |

— |

||||||||||||

|

Deposits with brokers for securities sold short |

62,769 |

24,386 |

— |

||||||||||||

|

Foreign currency, at value |

— |

3 |

— |

||||||||||||

|

Receivable for investment securities sold |

3,457 |

4,079 |

1,440 |

||||||||||||

|

Receivable for capital shares sold |

22 |

34 |

4 |

||||||||||||

|

Prepaid expenses |

44 |

28 |

29 |

||||||||||||

|

Receivable for dividend income |

183 |

19 |

49 |

||||||||||||

|

Total assets |

137,914 |

69,885 |

72,789 |

||||||||||||

|

Liabilities: |

|||||||||||||||

|

Securities sold short, at proceeds |

65,714 |

22,804 |

— |

||||||||||||

|

Securities sold short, at value |

59,523 |

23,271 |

— |

||||||||||||

|

Payable for investment securities purchased |

2,218 |

6,324 |

4,589 |

||||||||||||

|

Obligation to return securities lending collateral |

— |

— |

1,918 |

||||||||||||

|

Payable for capital shares redeemed |

1,432 |

95 |

11 |

||||||||||||

|

Dividends payable on securities sold short (Note 2) |

64 |

24 |

— |

||||||||||||

|

Payable due to investment adviser |

78 |

30 |

25 |

||||||||||||

|

Payable due to administrator |

4 |

2 |

2 |

||||||||||||

|

Payable due to shareholder servicing |

13 |

2 |

11 |

||||||||||||

|

Payable due to distributor |

3 |

1 |

— |

||||||||||||

|

Payable due to transfer agent |

4 |

5 |

5 |

||||||||||||

|

Payable due to custodian |

2 |

9 |

5 |

||||||||||||

|

Payable due to compliance services |

16 |

16 |

20 |

||||||||||||

|

Other accrued expenses |

19 |

21 |

25 |

||||||||||||

|

Total liabilities |

63,376 |

29,800 |

6,611 |

||||||||||||

|

Net assets |

$ |

74,538 |

$ |

40,085 |

$ |

66,178 |

|||||||||

|

*Includes market value of securities on loan of |

$ |

— |

$ |

— |

$ |

1,868 |

|||||||||

|

Net assets: |

|||||||||||||||

|

Portfolio capital |

$ |

94,006 |

$ |

41,849 |

$ |

75,640 |

|||||||||

|

Accumulated net investment loss |

(3,234 |

) |

(1,205 |

) |

(712 |

) |

|||||||||

|

Accumulated net realized loss from investments, securities sold short and foreign currency transactions |

(24,825 |

) |

(4,044 |

) |

(14,885 |

) |

|||||||||

|

Net unrealized appreciation on investments, securities sold short, foreign currencies and translation of other assets and liabilities denominated in foreign currencies |

8,591 |

3,485 |

6,135 |

||||||||||||

|

Net assets |

$ |

74,538 |

$ |

40,085 |

$ |

66,178 |

|||||||||

|

Outstanding shares of beneficial interest — Institutional Class Shares (1) |

2,043 |

3,366 |

763 |

||||||||||||

|

Outstanding shares of beneficial interest — Investor Class Shares (1) |

3,801 |

1,115 |

3,572 |

||||||||||||

|

Outstanding shares of beneficial interest — Class C Shares (1) |

418 |

177 |

— |

||||||||||||

|

Outstanding shares of beneficial interest — Retirement Class Shares (1) |

— |

— |

— |

||||||||||||

|

Net assets — Institutional Class Shares |

$ |

24,595 |

$ |

29,229 |

$ |

12,332 |

|||||||||

|

Net assets — Investor Class Shares |

$ |

45,174 |

$ |

9,444 |

$ |

53,846 |

|||||||||

|

Net assets — Class C Shares |

$ |

4,769 |

$ |

1,412 |

$ |

— |

|||||||||

|

Net assets — Retirement Class Shares |

$ |

— |

$ |

— |

$ |

— |

|||||||||

|

Net asset value, offering and redemption price per share — Institutional Class Shares |

$ |

12.04 |

$ |

8.68 |

$ |

16.16 |

|||||||||

|

Net asset value, offering and redemption price per share — Investor Class Shares |

$ |

11.89 |

† |

$ |

8.47 |

$ |

15.08 |

† |

|||||||

|

Net asset value, offering and redemption price per share — Class C Shares |

$ |

11.40 |

† |

$ |

7.96 |

† |

$ |

— |

|||||||

|

Net asset value, offering and redemption price per share — Retirement Class Shares |

$ |

— |

$ |

— |

$ |

— |

|||||||||

14 TURNER FUNDS 2016 SEMIANNUAL REPORT

|

Turner Midcap Growth Fund |

Turner Small Cap Growth Fund |

||||||||||

|

Assets: |

|||||||||||

|

Investment securities, at cost |

$ |

120,500 |

$ |

46,041 |

|||||||

|

Investment securities, at value |

$ |

132,882 |

$ |

51,276 |

|||||||

|

Cash |

— |

— |

|||||||||

|

Deposits with brokers for securities sold short |

— |

— |

|||||||||

|

Foreign currency, at value |

— |

— |

|||||||||

|

Receivable for investment securities sold |

— |

— |

|||||||||

|

Receivable for capital shares sold |

39 |

7 |

|||||||||

|

Prepaid expenses |

41 |

21 |

|||||||||

|

Receivable for dividend income |

64 |

39 |

|||||||||

|

Total assets |

133,026 |

51,343 |

|||||||||

|

Liabilities: |

|||||||||||

|

Securities sold short, at proceeds |

— |

— |

|||||||||

|

Securities sold short, at value |

— |

— |

|||||||||

|

Payable for investment securities purchased |

— |

— |

|||||||||

|

Obligation to return securities lending collateral |

8,128 |

9,442 |

|||||||||

|

Payable for capital shares redeemed |

29 |

377 |

|||||||||

|

Dividends payable on securities sold short (Note 2) |

— |

— |

|||||||||

|

Payable due to investment adviser |

22 |

10 |

|||||||||

|

Payable due to administrator |

15 |

— |

|||||||||

|

Payable due to shareholder servicing |

22 |

9 |

|||||||||

|

Payable due to distributor |

1 |

— |

|||||||||

|

Payable due to transfer agent |

11 |

4 |

|||||||||

|

Payable due to custodian |

3 |

6 |

|||||||||

|

Payable due to compliance services |

42 |

17 |

|||||||||

|

Other accrued expenses |

53 |

22 |

|||||||||

|

Total liabilities |

8,326 |

9,887 |

|||||||||

|

Net assets |

$ |

124,700 |

$ |

41,456 |

|||||||

|

*Includes market value of securities on loan of |

$ |

8,036 |

$ |

9,187 |

|||||||

|

Net assets: |

|||||||||||

|

Portfolio capital |

$ |

127,134 |

$ |

43,616 |

|||||||

|

Accumulated net investment loss |

(1,413 |

) |

(429 |

) |

|||||||

|

Accumulated net realized loss from investments, securities sold short and foreign currency transactions |

(13,403 |

) |

(6,966 |

) |

|||||||

|

Net unrealized appreciation on investments, securities sold short, foreign currencies and translation of other assets and liabilities denominated in foreign currencies |

12,382 |

5,235 |

|||||||||

|

Net assets |

$ |

124,700 |

$ |

41,456 |

|||||||

|

Outstanding shares of beneficial interest — Institutional Class Shares (1) |

1,014 |

— |

|||||||||

|

Outstanding shares of beneficial interest — Investor Class Shares (1) |

6,368 |

3,604 |

|||||||||

|

Outstanding shares of beneficial interest — Class C Shares (1) |

— |

— |

|||||||||

|

Outstanding shares of beneficial interest — Retirement Class Shares (1) |

168 |

— |

|||||||||

|

Net assets — Institutional Class Shares |

$ |

17,441 |

$ |

— |

|||||||

|

Net assets — Investor Class Shares |

$ |

104,816 |

$ |

41,456 |

|||||||

|

Net assets — Class C Shares |

$ |

— |

$ |

— |

|||||||

|

Net assets — Retirement Class Shares |

$ |

2,443 |

$ |

— |

|||||||

|

Net asset value, offering and redemption price per share — Institutional Class Shares |

$ |

17.21 |

† |

$ |

— |

||||||

|

Net asset value, offering and redemption price per share — Investor Class Shares |

$ |

16.46 |

$ |

11.50 |

|||||||

|

Net asset value, offering and redemption price per share — Class C Shares |

$ |

— |

$ |

— |

|||||||

|

Net asset value, offering and redemption price per share — Retirement Class Shares |

$ |

14.57 |

† |

$ |

— |

||||||

(1) Unlimited authorization — par value $0.00001.

† Differences in net asset value recalculation and net asset value stated are caused by rounding differences.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2016 SEMIANNUAL REPORT 15

FINANCIAL STATEMENTS (Unaudited)

Statements of operations (000)

|

Turner Medical Sciences Long/Short Fund |

Turner Titan Long/Short Fund |

Turner SMID Cap Growth Opportunities Fund |

|||||||||||||

|

period ended 3/31/16 |

period ended 3/31/16 |

period ended 3/31/16 |

|||||||||||||

|

Investment income: |

|||||||||||||||

|

Dividend |

$ |

506 |

$ |

366 |

$ |

152 |

|||||||||

|

Securities lending |

— |

— |

226 |

||||||||||||

|

Total investment income |

506 |

366 |

378 |

||||||||||||

|

Expenses: |

|||||||||||||||

|

Investment advisory fees |

940 |

407 |

381 |

||||||||||||

|

Administration fees |

94 |

41 |

57 |

||||||||||||

|

Shareholder service fees (1) |

102 |

26 |

78 |

||||||||||||

|

Shareholder service fees (2) |

7 |

2 |

— |

||||||||||||

|

Shareholder service fees (3) |

— |

— |

— |

||||||||||||

|

Distribution fees (2) |

20 |

6 |

— |

||||||||||||

|

Distribution fees (3) |

— |

— |

— |

||||||||||||

|

Accounting agent fees |

1 |

1 |

1 |

||||||||||||

|

Dividend expense |

232 |

145 |

— |

||||||||||||

|

Broker fees and charges on short sales |

506 |

54 |

— |

||||||||||||

|

Custodian fees |

11 |

18 |

12 |

||||||||||||

|

Transfer agent fees |

79 |

50 |

50 |

||||||||||||

|

Registration fees |

36 |

29 |

15 |

||||||||||||

|

Professional fees |

41 |

20 |

28 |

||||||||||||

|

Trustees' fees |

43 |

20 |

28 |

||||||||||||

|

Compliance service fees |

30 |

14 |

20 |

||||||||||||

|

Insurance and other fees |

43 |

19 |

32 |

||||||||||||

|

Total expenses |

2,185 |

852 |

702 |

||||||||||||

|

Less: |

|||||||||||||||

|

Investment advisory fee waiver |

(133 |

) |

(106 |

) |

(189 |

) |

|||||||||

|

Net expenses |

2,052 |

746 |

513 |

||||||||||||

|

Net investment loss |

(1,546 |

) |

(380 |

) |

(135 |

) |

|||||||||

|

Net realized loss from securities sold |

(29,108 |

) |

(4,365 |

) |

(10,731 |

) |

|||||||||

|

Net realized gain from securities sold short |

9,190 |

1,754 |

— |

||||||||||||

|

Net change in unrealized appreciation (depreciation) on investments |

11,889 |

4,153 |

4,488 |

||||||||||||

|

Net change in unrealized appreciation (depreciation) on securities sold short |

(7,781 |

) |

(2,363 |

) |

— |

||||||||||

|

Net realized and unrealized gain (loss) from investments and foreign currencies |

(15,810 |

) |

(821 |

) |

(6,243 |

) |

|||||||||

|

Net decrease in net assets resulting from operations |

$ |

(17,356 |

) |

$ |

(1,201 |

) |

$ |

(6,378 |

) |

||||||

16 TURNER FUNDS 2016 SEMIANNUAL REPORT

|

Turner Midcap Growth Fund |

Turner Small Cap Growth Fund |

||||||||||

|

period ended 3/31/16 |

period ended 3/31/16 |

||||||||||

|

Investment income: |

|||||||||||

|

Dividend |

$ |

356 |

$ |

50 |

|||||||

|

Securities lending |

88 |

151 |

|||||||||

|

Total investment income |

444 |

201 |

|||||||||

|

Expenses: |

|||||||||||

|

Investment advisory fees |

559 |

247 |

|||||||||

|

Administration fees |

112 |

37 |

|||||||||

|

Shareholder service fees (1) |

150 |

62 |

|||||||||

|

Shareholder service fees (2) |

— |

— |

|||||||||

|

Shareholder service fees (3) |

3 |

— |

|||||||||

|

Distribution fees (2) |

— |

— |

|||||||||

|

Distribution fees (3) |

3 |

— |

|||||||||

|

Accounting agent fees |

1 |

— |

|||||||||

|

Dividend expense |

— |

— |

|||||||||

|

Broker fees and charges on short sales |

— |

— |

|||||||||

|

Custodian fees |

7 |

12 |

|||||||||

|

Transfer agent fees |

110 |

36 |

|||||||||

|

Registration fees |

30 |

10 |

|||||||||

|

Professional fees |

57 |

20 |

|||||||||

|

Trustees' fees |

55 |

20 |

|||||||||

|

Compliance service fees |

39 |

14 |

|||||||||

|

Insurance and other fees |

66 |

25 |

|||||||||

|

Total expenses |

1,192 |

483 |

|||||||||

|

Less: |

|||||||||||

|

Investment advisory fee waiver |

(345 |

) |

(176 |

) |

|||||||

|

Net expenses |

847 |

307 |

|||||||||

|

Net investment loss |

(403 |

) |

(106 |

) |

|||||||

|

Net realized loss from securities sold |

(8,242 |

) |

(5,032 |

) |

|||||||

|

Net realized gain from securities sold short |

— |

— |

|||||||||

|

Net change in unrealized appreciation (depreciation) on investments |

(2,204 |

) |

474 |

||||||||

|

Net change in unrealized appreciation (depreciation) on securities sold short |

— |

— |

|||||||||

|

Net realized and unrealized gain (loss) from investments and foreign currencies |

(10,446 |

) |

(4,558 |

) |

|||||||

|

Net decrease in net assets resulting from operations |

$ |

(10,849 |

) |

$ |

(4,664 |

) |

|||||

(1) Attributable to Investor Class Shares only.

(2) Attributable to Class C Shares only.

(3) Attributable to Retirement Class Shares only.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2016 SEMIANNUAL REPORT 17

FINANCIAL STATEMENTS

Statements of changes in net assets (000)

|

Turner Medical Sciences Long/Short Fund |

Turner Titan Long/ Short Fund |

||||||||||||||||||

|

period ended 3/31/16 (Unaudited) |

year ended 9/30/15 |

period ended 3/31/16 (Unaudited) |

year ended 9/30/15 |

||||||||||||||||

|

Investment activities: |

|||||||||||||||||||

|

Net investment loss |

$ |

(1,546 |

) |

$ |

(1,904 |

) |

$ |

(380 |

) |

$ |

(1,227 |

) |

|||||||

|

Net realized gain (loss) from securities sold and securities sold short |

(19,918 |

) |

(221 |

) |

(2,611 |

) |

7,630 |

||||||||||||

|

Net realized gain on foreign currency transactions |

— |

— |

— |

2 |

|||||||||||||||

|

Net change in unrealized appreciation (depreciation) on investments and securities sold short |

4,108 |

1,534 |

1,790 |

(9,128 |

) |

||||||||||||||

|

Net change in unrealized appreciation (depreciation) on foreign currencies and translation of other assets and liabilities denominated in foreign currencies |

— |

— |

— |

— |

|||||||||||||||

|

Net increase (decrease) in net assets resulting from operations |

(17,356 |

) |

(591 |

) |

(1,201 |

) |

(2,723 |

) |

|||||||||||

|

Dividends and distributions to shareholders: |

|||||||||||||||||||

|

Realized capital gains: |

|||||||||||||||||||

|

Institutional Class Shares |

(745 |

) |

(1,619 |

) |

(1,929 |

) |

(20,550 |

) |

|||||||||||

|

Investor Class Shares |

(1,619 |

) |

(454 |

) |

(1,621 |

) |

(2,460 |

) |

|||||||||||

|

Class C Shares |

(104 |

) |

(176 |

) |

(92 |

) |

(595 |

) |

|||||||||||

|

Total dividends and distributions |

(2,468 |

) |

(2,249 |

) |

(3,642 |

) |

(23,605 |

) |

|||||||||||

|

Capital share transactions: |

|||||||||||||||||||

|

Institutional Class Shares |

|||||||||||||||||||

|

Proceeds from shares issued |

11,169 |

30,321 |

9,153 |

11,521 |

|||||||||||||||

|

Proceeds from shares issued in lieu of cash distributions |

570 |

1,163 |

1,502 |

14,739 |

|||||||||||||||

|

Cost of shares redeemed |

(21,642 |

) |

(18,381 |

) |

(13,215 |

) |

(89,272 |

) |

|||||||||||

|

Net increase (decrease) in net assets from Institutional Class Shares transactions |

(9,903 |

) |

13,103 |

(2,560 |

) |

(63,012 |

) |

||||||||||||

|

Investor Class Shares |

|||||||||||||||||||

|

Proceeds from shares issued |

26,180 |

118,863 |

7,249 |

20,650 |

|||||||||||||||

|

Proceeds from shares issued in lieu of cash distributions |

1,605 |

400 |

1,595 |

2,346 |

|||||||||||||||

|

Cost of shares redeemed |

(60,698 |

) |

(31,830 |

) |

(22,723 |

) |

(10,096 |

) |

|||||||||||

|

Net increase (decrease) in net assets from Investor Class Shares transactions |

(32,913 |

) |

87,433 |

(13,879 |

) |

12,900 |

|||||||||||||

|

Class C Shares |

|||||||||||||||||||

|

Proceeds from shares issued |

1,147 |

3,409 |

68 |

38 |

|||||||||||||||

|

Proceeds from shares issued in lieu of cash distributions |

89 |

142 |

89 |

565 |

|||||||||||||||

|

Cost of shares redeemed |

(1,068 |

) |

(1,020 |

) |

(174 |

) |

(1,357 |

) |

|||||||||||

|

Net increase (decrease) in net assets from Class C Shares transactions |

168 |

2,531 |

(17 |

) |

(754 |

) |

|||||||||||||

|

Net increase (decrease) in net assets from capital share transactions |

(42,648 |

) |

103,067 |

(16,456 |

) |

(50,866 |

) |

||||||||||||

|

Total increase (decrease) in net assets |

(62,472 |

) |

100,227 |

(21,299 |

) |

(77,194 |

) |

||||||||||||

|

Net assets: |

|||||||||||||||||||

|

Beginning of period |

137,010 |

36,783 |

61,384 |

138,578 |

|||||||||||||||

|

End of period |

$ |

74,538 |

$ |

137,010 |

$ |

40,085 |

$ |

61,384 |

|||||||||||

|

Accumulated net investment loss |

$ |

(3,234 |

) |

$ |

(1,688 |

) |

$ |

(1,205 |

) |

$ |

(825 |

) |

|||||||

|

Share issued and redeemed: |

|||||||||||||||||||

|

Institutional Class Shares |

|||||||||||||||||||

|

Issued |

833 |

2,117 |

1,032 |

1,216 |

|||||||||||||||

|

Issued in lieu of cash distributions |

43 |

103 |

169 |

1,694 |

|||||||||||||||

|

Redeemed |

(1,726 |

) |

(1,418 |

) |

(1,481 |

) |

(9,308 |

) |

|||||||||||

|

Net increase (decrease) in Institutional Class Shares |

(850 |

) |

802 |

(280 |

) |

(6,398 |

) |

||||||||||||

|

Investor Class Shares |

|||||||||||||||||||

|

Issued |

1,956 |

8,356 |

817 |

2,209 |

|||||||||||||||

|

Issued in lieu of cash distributions |

122 |

36 |

183 |

275 |

|||||||||||||||

|

Redeemed |

(4,837 |

) |

(2,284 |

) |

(2,682 |

) |

(1,014 |

) |

|||||||||||

|

Net increase (decrease) in Investor Class Shares |

(2,759 |

) |

6,108 |

(1,682 |

) |

1,470 |

|||||||||||||

|

Class C Shares |

|||||||||||||||||||

|

Issued |

89 |

245 |

8 |

4 |

|||||||||||||||

|

Issued in lieu of cash distributions |

7 |

13 |

11 |

70 |

|||||||||||||||

|

Redeemed |

(87 |

) |

(76 |

) |

(21 |

) |

(152 |

) |

|||||||||||

|

Net increase (decrease) in Class C Shares |

9 |

182 |

(2 |

) |

(78 |

) |

|||||||||||||

|

Net increase (decrease) in share transactions |

(3,600 |

) |

7,092 |

(1,964 |

) |

(5,006 |

) |

||||||||||||

18 TURNER FUNDS 2016 SEMIANNUAL REPORT

|

Turner SMID Cap Growth Opportunities |

|||||||||||

|

period ended 3/31/16 (Unaudited) |

year ended 9/30/15 |

||||||||||

|

Investment activities: |

|||||||||||

|

Net investment loss |

$ |

(135 |

) |

$ |

(585 |

) |

|||||

|

Net realized gain (loss) from securities sold and securities sold short |

(10,731 |

) |

33,794 |

||||||||

|

Net realized gain on foreign currency transactions |

— |

— |

|||||||||

|

Net change in unrealized appreciation (depreciation) on investments and securities sold short |

4,488 |

(24,302 |

) |

||||||||

|

Net change in unrealized appreciation (depreciation) on foreign currencies and translation of other assets and liabilities denominated in foreign currencies |

— |

— |

|||||||||

|

Net increase (decrease) in net assets resulting from operations |

(6,378 |

) |

8,907 |

||||||||

|

Dividends and distributions to shareholders: |

|||||||||||

|

Realized capital gains: |

|||||||||||

|

Institutional Class Shares |

(6,644 |

) |

(8,970 |

) |

|||||||

|

Investor Class Shares |

(29,725 |

) |

(49,724 |

) |

|||||||

|

Class C Shares |

— |

— |

|||||||||

|

Total dividends and distributions |

(36,369 |

) |

(58,694 |

) |

|||||||

|

Capital share transactions: |

|||||||||||

|

Institutional Class Shares |

|||||||||||

|

Proceeds from shares issued |

865 |

1,684 |

|||||||||

|

Proceeds from shares issued in lieu of cash distributions |

6,630 |

8,776 |

|||||||||

|