UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-07527 | |||||||

|

| ||||||||

|

Turner Funds | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

1205 Westlakes Drive, Suite 100 Berwyn, PA |

|

19312 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Michael P. Malloy Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

1-800-224-6312 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

September 30 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

September 30, 2013 |

| ||||||

Item 1. Reports to Stockholders.

Annual Report

September 30, 2013

Long/short equity funds

Turner Market Neutral Fund

Turner Medical Sciences Long/Short Fund

Turner Spectrum Fund

Turner Titan Fund

U.S. growth equity funds

Turner All Cap Growth Fund

Turner Emerging Growth Fund

Turner Large Growth Fund

Turner Midcap Growth Fund

Turner Small Cap Growth Fund

Emerging markets equity fund

Turner Emerging Markets Fund

Contents

|

2 |

Letter to shareholders |

||||||

| 4 |

Total returns of the Turner Funds |

||||||

|

7 |

Investment review: Turner Market Neutral Fund |

||||||

|

8 |

Investment review: Turner Medical Sciences Long/Short Fund |

||||||

|

9 |

Investment review: Turner Spectrum Fund |

||||||

|

10 |

Investment review: Turner Titan Fund |

||||||

|

11 |

Investment review: Turner All Cap Growth Fund |

||||||

|

12 |

Investment review: Turner Emerging Growth Fund |

||||||

|

13 |

Investment review: Turner Large Growth Fund |

||||||

|

14 |

Investment review: Turner Midcap Growth Fund |

||||||

|

15 |

Investment review: Turner Small Cap Growth Fund |

||||||

|

16 |

Investment review: Turner Emerging Markets Fund |

||||||

| 17 |

Schedules of investments |

||||||

| 46 |

Financial statements |

||||||

| 68 |

Notes to financial statements |

||||||

|

78 |

Report of independent registered public accounting firm |

||||||

| 79 |

Notice to shareholders |

||||||

| 80 |

Disclosure of fund expenses |

||||||

| 82 |

Trustees and officers of the Trust |

||||||

Turner Funds

As of September 30, 2013, the Turner Funds offered a series of 10 mutual funds to individual and institutional investors. The minimum initial investment for Institutional Class Shares in a Turner Fund is $250,000 (except for $100,000 for the Turner Market Neutral Fund, the Turner Medical Sciences Long/Short Fund, the Turner Spectrum Fund and the Turner Titan Fund) for regular accounts and $100,000 for individual retirement accounts. The minimum initial investment for Investor Class Shares, Retirement Class Shares and Class C Shares is $2,500 for regular accounts and $2,000 for individual retirement accounts.

Turner Investments, L.P., based in Berwyn, Pennsylvania, serves as the investment adviser for the Turner Funds. Turner Investments, L.P., founded in 1990, manages more than $8.8 billion in stock investments as of September 30, 2013.

Shareholder services

Turner Funds shareholders receive annual and semiannual reports, quarterly account statements, and a quarterly newsletter. Shareholders who have questions about their accounts may call a toll-free telephone number, 1.800.224.6312, may visit our website, www.turnerinvestments.com, or may write to Turner Funds, P.O. Box 219805, Kansas City, Missouri 64121-9805.

TURNER FUNDS 2013 ANNUAL REPORT 1

LETTER TO SHAREHOLDERS

Dear Shareholder;

Nearly 33 years ago, I was introduced to Dr. Henry Latane. He was a finance professor from the University of North Carolina whose research focused on earnings surprise. When many were arguing that the stock market was fully efficient, his research supported the conclusion that companies which reported earnings above what was expected (surprise) outperformed the market.

This made sense to me and with a natural bias to growth stocks, I adopted and adapted this approach to investing. Specifically, over the last three decades and for the entire history of Turner Investments, our philosophy has been "earnings expectations drive stock prices". We seek to buy those companies with improving earnings and sell those where we believe earnings are deteriorating.

Generally that worked pretty well. For most of the 1990s, earnings went up and stocks followed suit. As the tech bubble burst in 2000, earnings deteriorated, particularly in tech stocks, and the market went down. By 2003, tech had stabilized while the rest of the market marched forward driven by earnings growth fueled by credit expansion. Of course as we all know too well that ended badly with the credit bubble bursting bringing about the global financial crisis. Economic growth across the globe plummeted and so did earnings. Accordingly, the stock market went down.

With global economic calamity averted, stocks began to rally in 2009 and 2010. The early move off the bottom seemed to be a "dead cat bounce" from a severely oversold position. 2011 saw markets across the globe fluctuate up or down a bit as investors tried to assess whether the global financial crisis was over. By 2012, investors had tired of miniscule money market and treasury yields and began to seek yield from equity securities which at the time were offering a yield sharply higher than bonds (S&P 500 yielding nearly 3% while 10 year treasuries yielded less than 2%). As a result, stocks with modest growth but with a high yield performed best. Those stocks generally had lower volatility, or beta, than the market overall. This persisted into the first half of 2013.

Over the years, Turner's performance has been pretty predictable, i.e. market up, growth in favor, we outperform; market down, growth out of favor, we underperform. But we stick with our pure growth, earnings driven disciplines and bounce nicely off bottoms.

After bouncing nicely in 2009 and 2010, 2011 was a mixed year for performance in congruence with a mixed year for performance for the markets overall. However, in 2012 and the first half of 2013, as the market went up, we underperformed. In fact, the fastest growing stocks sharply underperformed the slower growing stocks. The same held true for high beta versus low beta. Was Dr. Latane wrong?

I don't think so. While at the time we were frustrated that the fast growers like Michael Kors and Salesforce.com were

underperforming Wal-Mart and Microsoft, in hindsight the focus on yield was very logical. For investors to dip their toes back in the investment pond, they required a yield better than they could find in treasuries from a company that wasn't going to "blow up".

Due to this investor preference and sentiment, the market was advancing but not in our type of stocks. Fortunately that changed about midyear this year as Fed Chairman Bernanke began to discuss tapering and interest rates rose.

With the prospects for improving global economies that bring about improving earnings, our type of stocks — pure growth stocks — once again began to outperform. Dr. Latane was vindicated!

So the question now is "is the return of pure growth stock out performance of the recent quarter here to stay or is yield still desirable". While you know our preference, my answer is "somewhere in between". With treasury rates still low and with the prospects that one can lose money in these if rates go up, stocks with above average dividend yields are still desirable. However, now that isn't the end all and be all for stock investing. History has shown that as interest rates rise, pure growth stocks lead by the technology, consumer and health care sectors tend to lead the market.

Adding to that within technology, mobility and cloud computing have become big drivers of growth. New cloud based companies are growing rapidly (and coming public) at the expense of legacy based companies. In the consumer sector, internet stocks continue to charge ahead as consumers use the internet longer and in more varied ways. Finally, in the health care sector, breakthroughs in drug discovery are driving many biotech stocks higher.

What was a pretty sharp headwind for a couple years for Turner recently became a pleasant tailwind. I think this continues.

Also, I have learned over the years that when one's style is out of favor, bad decisions are magnified and good decisions are muted. Certainly, while the headwinds were in place bad decisions were made, just as they will be made with the wind shifting to our back. The key is to minimize the mistakes, learn from them and move forward with the constant search for the next great growth stock.

As for the market in general, we feel the bias is upward. Since stocks began to advance in the Spring of 2009 any setback due to macro or geopolitical events has been met by renewed buying of stocks. That's because corporations have been generating a robust free cash flow with rising earnings. They are buying back their own shares, raising their dividends and recently have begun to buy the shares of other companies (takeovers). Following two recessions in eight years, the last being a "near death" experience, corporations have become very focused on the segments of their business where they have a competitive advantage

2 TURNER FUNDS 2013 ANNUAL REPORT

September 30, 2013

and are growing that. Segments of their business which are challenged, they are shedding. Corporations have embraced technology with factory automation, mobility and the cloud to sharply reduce the cost of doing business. Because of this, free cash flow has soared, debt levels have subsided, cash balances accumulate, shares are being bought back and dividends increased. With four years of this under their belts, corporations are now beginning to invest in their growth through capital expenditures and acquisitions. This has been the safety net beneath the market. While the headlines are often scary, the underlying fundamentals of global corporations are the best they have ever been.

Last year our 25 research analysts visited with over 2800 company management teams and engaged in extensive research within their global industry. Each of our analysts affirms that the productivity/profits growth is real and should continue as long as economic growth continues.

And continue it shall. For the most part, countries across the globe are united in their quantitative easing. They understand only too well the risk of deflation and are committed to do all they can do through both monetary and fiscal policy to avoid this.

Recessions or anticipations of recessions lead to the fall of stock prices. Recessions occur when excesses are building in the system that must be corrected. Because of the severity of the global financial crises, we are nowhere near exhibiting any sign of excesses. So until that happens, economies will grow, companies will prosper, earnings will rise and stock prices should follow suit. From our perspective, hopefully stocks are more in sync with their earnings with a little less emphasis on yield.

During this bull market of the last four years, the safest, most visible, most liquid, best governed market in the world, our home market USA has overall been the best performing market. While the US may not outperform other markets as much moving forward, we still see it near the front of the pack. All the positives I outlined from corporations a few paragraphs above, manifest themselves most vividly in US companies. After years and decades of underperformance, Japan should play catch-up and be a good relative performer due to its very aggressive QE program in place. Europe is showing some green shoots of growth and thus should perform reasonably well also. Finally, Emerging Markets stocks likely will continue to face headwinds, due to downward pressure on commodity prices, slower growth in China and country specific issues with inflation, elections, governance, etc.

But at the end of the day, it really boils down to earnings. Regardless of where a company is located or what it does, if its earnings go up, its stock price generally follows suit. Dr. Latane's research of nearly 40 years ago holds true today as it was then — announce a good quarter and your stock price goes up. Do that quarter after quarter

and your stock price really goes up. From its low price in the Spring of 2009, Salesforce.com , the poster child for new technology driven growth (cloud computing), has seen its stock increase nearly nine fold, due to the combination of sharply rising revenues and earnings.

Our goal is to find as many of these as we can for your portfolio. For our long/short portfolios, our team of analysts also seeks to find those companies that are seeing their earnings deteriorate because of competition from companies like Salesforce.com. Companies with a poor earnings growth profile make up the short side of our long/short portfolios.

As always, thank you for your support. The yield headwinds presented our team with some of its greatest challenges in our 23 year history, but fortunately that seems to have changed benefitting the performance of your fund over time.

Sincerely,

Bob Turner

Chairman and Chief Investment Officer

Turner Investments

Past performance is no guarantee of future results. The views expressed are those of Turner Investments as of September 30, 2013, and are not intended as a forecast or investment recommendations. The indexes mentioned are not available for investment.

Bob Turner

TURNER FUNDS 2013 ANNUAL REPORT 3

PERFORMANCE (Unaudited)

Total returns of the Turner Funds

Through September 30, 2013

Current performance may be lower or higher than the performance data quoted. Please call 1.800.224.6312 or visit our Web site at www.turnerinvestments.com for the most recent month-end performance information.

The performance data quoted represents past performance and the principal value and investment return will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown, unless otherwise indicated, are total returns, with dividends and income reinvested. Returns spanning more than one year are annualized. Fee waivers are in effect; if they had not been in effect, performance would have been lower. The indices mentioned are unmanaged statistical composites of stock-market performance. Investing in an index is not possible.

The holdings and sector weightings of the Funds are subject to change. Forward-earnings projections are not predictors of stock price or investment performance, and do not represent past performance. There is no guarantee that the forward-earnings projections will accurately predict the actual earnings experience of any of the companies involved, and there is no guarantee that owning securities of companies with relatively high price-to-earnings ratios will cause the portfolio to outperform its benchmark or index.

The Turner Funds are distributed by Foreside Fund Services, LLC, Portland, Maine. The investor should consider the investment objectives, risks, charges, and expenses carefully before investing. This and other information can be found in the prospectus. A free prospectus, which contains detailed information, including fees and expenses, and the risks associated with investing in these Funds, can be obtained by calling 1.800.224.6312. Read the prospectus carefully before investing.

|

Fund name/Index |

Six months* |

Year to date* |

One year |

Three years |

Five years |

10 years |

(Annualized) Since inception* |

Total net assets ($mil) |

|||||||||||||||||||||||||||

|

Turner Market Neutral Fund — Institutional Class Shares |

8.16 |

% |

3.55 |

% |

0.29 |

% |

n/a |

n/a |

n/a |

1.61 |

% |

$ |

3.30 |

||||||||||||||||||||||

|

Investor Class Shares |

7.99 |

3.26 |

0.10 |

n/a |

n/a |

n/a |

1.35 |

0.60 |

|||||||||||||||||||||||||||

|

Class C Shares |

7.68 |

2.79 |

-0.60 |

n/a |

n/a |

n/a |

0.63 |

0.07 |

|||||||||||||||||||||||||||

|

S&P 500 Index |

8.31 |

19.79 |

19.34 |

n/a |

n/a |

n/a |

12.05 |

||||||||||||||||||||||||||||

|

Barclays Capital U.S. Aggregate Bond Index |

-1.77 |

-1.89 |

-1.68 |

n/a |

n/a |

n/a |

4.09 |

||||||||||||||||||||||||||||

|

Lipper Equity Market-Neutral Funds Average |

-0.15 |

0.96 |

1.47 |

n/a |

n/a |

n/a |

1.43 |

||||||||||||||||||||||||||||

|

Inception date: 2/7/11 |

|||||||||||||||||||||||||||||||||||

|

Turner Medical Sciences Long/Short Fund — Institutional Class Shares |

10.75 |

15.63 |

13.25 |

n/a |

n/a |

n/a |

5.56 |

16.74 |

|||||||||||||||||||||||||||

|

Investor Class Shares |

10.60 |

15.49 |

12.99 |

n/a |

n/a |

n/a |

5.35 |

3.06 |

|||||||||||||||||||||||||||

|

Class C Shares |

10.18 |

14.90 |

12.15 |

n/a |

n/a |

n/a |

4.59 |

1.37 |

|||||||||||||||||||||||||||

|

S&P 500 Health Care Index |

10.91 |

28.45 |

28.55 |

n/a |

n/a |

n/a |

21.26 |

||||||||||||||||||||||||||||

|

Barclays Capital U.S. Aggregate Bond Index |

-1.77 |

-1.89 |

-1.68 |

n/a |

n/a |

n/a |

4.09 |

||||||||||||||||||||||||||||

|

Lipper Long/Short Equity Funds Average |

4.77 |

10.35 |

10.07 |

n/a |

n/a |

n/a |

3.37 |

||||||||||||||||||||||||||||

|

Inception date: 2/7/11 |

|||||||||||||||||||||||||||||||||||

|

Turner Spectrum Fund — Institutional Class Shares |

2.70 |

4.96 |

4.96 |

3.30 |

% |

n/a |

n/a |

4.24 |

481.85 |

||||||||||||||||||||||||||

|

Investor Class Shares |

2.54 |

4.73 |

4.63 |

3.04 |

n/a |

n/a |

3.98 |

44.14 |

|||||||||||||||||||||||||||

|

Class C Shares(1) |

2.14 |

4.17 |

3.88 |

2.27 |

n/a |

n/a |

3.51 |

5.57 |

|||||||||||||||||||||||||||

|

S&P 500 Index |

8.31 |

19.79 |

19.34 |

16.27 |

n/a |

n/a |

17.54 |

||||||||||||||||||||||||||||

|

Barclays Capital U.S. Aggregate Bond Index |

-1.77 |

-1.89 |

-1.68 |

2.86 |

n/a |

n/a |

4.94 |

||||||||||||||||||||||||||||

|

Lipper Long/Short Equity Funds Average |

4.77 |

10.35 |

10.07 |

6.58 |

n/a |

n/a |

8.33 |

||||||||||||||||||||||||||||

|

Inception date: 5/7/09 |

|||||||||||||||||||||||||||||||||||

4 TURNER FUNDS 2013 ANNUAL REPORT

PERFORMANCE (continued) (Unaudited)

|

Fund name/Index |

Six months* |

Year to date* |

One year |

Three years |

Five years |

10 years |

(Annualized) Since inception* |

Total net assets ($mil) |

|||||||||||||||||||||||||||

|

Turner Titan Fund — Institutional Class Shares |

5.00 |

% |

7.24 |

% |

3.43 |

% |

n/a |

n/a |

n/a |

2.54 |

% |

$ |

21.17 |

||||||||||||||||||||||

|

Investor Class Shares |

4.82 |

6.97 |

3.14 |

n/a |

n/a |

n/a |

2.28 |

0.39 |

|||||||||||||||||||||||||||

|

Class C Shares |

4.18 |

6.24 |

2.28 |

n/a |

n/a |

n/a |

1.47 |

0.03 |

|||||||||||||||||||||||||||

|

S&P 500 Index |

8.31 |

19.79 |

19.34 |

n/a |

n/a |

n/a |

12.05 |

||||||||||||||||||||||||||||

|

Barclays Capital U.S. Aggregate Bond Index |

-1.77 |

-1.89 |

-1.68 |

n/a |

n/a |

n/a |

4.09 |

||||||||||||||||||||||||||||

|

Lipper Long/Short Equity Funds Average |

4.77 |

10.35 |

10.07 |

n/a |

n/a |

n/a |

3.37 |

||||||||||||||||||||||||||||

|

Inception date: 2/7/11 |

|||||||||||||||||||||||||||||||||||

|

Turner All Cap Growth Fund(2) |

15.70 |

24.04 |

14.93 |

13.78 |

13.10 |

% |

9.09 |

% |

0.27 |

17.98 |

|||||||||||||||||||||||||

|

NASDAQ Composite Index |

15.42 |

24.90 |

21.03 |

16.77 |

12.51 |

7.76 |

-0.38 |

||||||||||||||||||||||||||||

|

Russell 3000® Growth Index |

10.86 |

21.75 |

20.30 |

17.18 |

12.16 |

7.99 |

0.73 |

||||||||||||||||||||||||||||

|

Inception date: 6/30/00 |

|||||||||||||||||||||||||||||||||||

|

Turner Emerging Growth Fund(2) — Institutional Class Shares(3) |

21.96 |

36.22 |

32.98 |

21.74 |

n/a |

n/a |

23.69 |

72.44 |

|||||||||||||||||||||||||||

|

Investor Class Shares |

21.82 |

35.97 |

32.63 |

21.45 |

11.16 |

11.44 |

18.81 |

180.29 |

|||||||||||||||||||||||||||

|

Russell 2000® Growth Index |

17.02 |

32.47 |

33.07 |

19.96 |

13.17 |

9.85 |

5.29 |

||||||||||||||||||||||||||||

|

Inception date: 2/27/98 |

|||||||||||||||||||||||||||||||||||

|

Turner Large Growth Fund — Institutional Class Shares |

11.81 |

17.44 |

14.87 |

11.91 |

7.52 |

6.50 |

3.32 |

53.97 |

|||||||||||||||||||||||||||

|

Investor Class Shares(4) |

11.58 |

17.15 |

14.50 |

11.62 |

7.24 |

n/a |

4.16 |

30.62 |

|||||||||||||||||||||||||||

|

Russell 1000® Growth Index |

10.34 |

20.87 |

19.27 |

16.94 |

12.07 |

7.82 |

3.88 |

||||||||||||||||||||||||||||

|

Inception date: 2/28/01 |

|||||||||||||||||||||||||||||||||||

|

Turner Midcap Growth Fund(2) — Institutional Class Shares(5) |

15.05 |

27.55 |

24.69 |

13.85 |

10.99 |

n/a |

4.66 |

205.68 |

|||||||||||||||||||||||||||

|

Investor Class Shares |

14.88 |

27.30 |

24.31 |

13.57 |

10.71 |

8.34 |

10.46 |

257.24 |

|||||||||||||||||||||||||||

|

Retirement Class Shares(6) |

14.72 |

27.07 |

24.11 |

13.31 |

10.46 |

7.99 |

7.61 |

4.24 |

|||||||||||||||||||||||||||

|

Russell Midcap® Growth Index |

12.48 |

25.42 |

27.54 |

17.65 |

13.92 |

10.16 |

8.29 |

||||||||||||||||||||||||||||

|

Inception date: 10/1/96 |

|||||||||||||||||||||||||||||||||||

|

Turner Small Cap Growth Fund(2) |

18.60 |

33.02 |

33.79 |

18.42 |

12.71 |

9.81 |

11.91 |

233.04 |

|||||||||||||||||||||||||||

|

Russell 2000® Growth Index |

17.02 |

32.47 |

33.07 |

19.96 |

13.17 |

9.85 |

7.08 |

||||||||||||||||||||||||||||

|

Inception date: 2/7/94 |

|||||||||||||||||||||||||||||||||||

|

Turner Emerging Markets Fund — Institutional Class Shares |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

7.80 |

0.51 |

|||||||||||||||||||||||||||

|

Investor Class Shares |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

7.80 |

0.04 |

|||||||||||||||||||||||||||

|

MSCI Emerging Markets Index |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

8.19 |

||||||||||||||||||||||||||||

|

Inception date: 8/27/13 |

|||||||||||||||||||||||||||||||||||

(1) Commenced operations on July 14, 2009.

(2) Investing in technology and science companies and small- and mid-capitalization companies may subject the Funds to specific inherent risks, including above-average price fluctuations.

(3) Commenced operations on February 1, 2009.

(4) Commenced operations on August 1, 2005.

(5) Commenced operations on June 16, 2008.

(6) Commenced operations on September 24, 2001.

* Returns of less than one year are cumulative, and not annualized.

TURNER FUNDS 2013 ANNUAL REPORT 5

(Unaudited)

Expense Ratio†

|

Gross expense ratio |

Net expense ratio* |

||||||||||

|

Turner Market Neutral Fund |

|||||||||||

|

Institutional Class Shares |

2.58 |

% |

1.95 |

% |

|||||||

|

Investor Class Shares |

2.83 |

% |

2.20 |

% |

|||||||

|

Class C Shares |

3.58 |

% |

2.95 |

% |

|||||||

|

Turner Medical Sciences Long/Short Fund |

|||||||||||

|

Institutional Class Shares |

2.17 |

% |

1.95 |

% |

|||||||

|

Investor Class Shares |

2.42 |

% |

2.20 |

% |

|||||||

|

Class C Shares |

3.17 |

% |

2.95 |

% |

|||||||

|

Turner Spectrum Fund |

|||||||||||

|

Institutional Class Shares |

2.40 |

% |

1.95 |

% |

|||||||

|

Investor Class Shares |

2.65 |

% |

2.20 |

% |

|||||||

|

Class C Shares |

3.40 |

% |

2.95 |

% |

|||||||

|

Turner Titan Fund |

|||||||||||

|

Institutional Class Shares |

2.44 |

% |

1.95 |

% |

|||||||

|

Investor Class Shares |

2.69 |

% |

2.20 |

% |

|||||||

|

Class C Shares |

3.44 |

% |

2.95 |

% |

|||||||

|

Gross expense ratio |

Net expense ratio* |

||||||||||

|

Turner All Cap Growth Fund |

|||||||||||

|

Investor Class Shares |

1.47 |

% |

1.24 |

% |

|||||||

|

Turner Emerging Growth Fund |

|||||||||||

|

Institutional Class Shares |

1.32 |

% |

1.17 |

% |

|||||||

|

Investor Class Shares |

1.57 |

% |

1.42 |

% |

|||||||

|

Turner Large Growth Fund |

|||||||||||

|

Institutional Class Shares |

0.91 |

% |

0.69 |

% |

|||||||

|

Investor Class Shares |

1.16 |

% |

0.94 |

% |

|||||||

|

Turner Midcap Growth Fund |

|||||||||||

|

Institutional Class Shares |

1.04 |

% |

0.93 |

% |

|||||||

|

Investor Class Shares |

1.29 |

% |

1.18 |

% |

|||||||

|

Retirement Class Shares |

1.54 |

% |

1.43 |

% |

|||||||

|

Turner Small Cap Growth Fund |

|||||||||||

|

Investor Class Shares |

1.53 |

% |

1.25 |

% |

|||||||

|

Turner Emerging Markets Fund |

|||||||||||

|

Institutional Class Shares |

1.91 |

% |

1.06 |

% |

|||||||

|

Investor Class Shares |

2.16 |

% |

1.31 |

% |

|||||||

† These expense ratios are based on the most recent prospectus and may differ from those shown in the financial highlights.

* Net expense ratio reflects contractual waivers of certain fees and/or expense reimbursements. Turner may discontinue this arrangement at any time after January 31, 2014 for all funds, except the Turner Emerging Markets Fund, which may discontinue the arrangement at any time after January 31, 2015.

6 TURNER FUNDS 2013 ANNUAL REPORT

INVESTMENT REVIEW (Unaudited)

Turner Market Neutral Fund

Fund profile

September 30, 2013

n Ticker symbol TMNFX

Investor Class Shares

n CUSIP #900297581

Investor Class Shares

n Top five holdings1

(1) Lekoil

(2) Harley-Davidson

(3) Louisiana-Pacific

(4) Pfizer

(5) TIBCO Software

n % in five largest holdings 27.9%1,2

n Number of holdings 601

n Net assets $0.60 million, Investor Class Shares

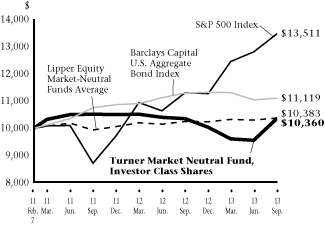

Growth of a $10,000 investment in the

Turner Market Neutral Fund, Investor Class Shares:

February 7, 2011-September 30, 20133,4

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Since inception4 |

||||||||||

|

Turner Market Neutral Fund, Institutional Class Shares5 |

0.29 |

% |

1.61 |

% |

|||||||

|

Turner Market Neutral Fund, Investor Class Shares5 |

0.10 |

% |

1.35 |

% |

|||||||

|

Turner Market Neutral Fund, Class C Shares5 |

-0.60 |

% |

0.63 |

% |

|||||||

|

S&P 500 Index6 |

19.34 |

% |

12.05 |

% |

|||||||

|

Barclays Capital U.S. Aggregate Bond Index7 |

-1.68 |

% |

4.09 |

% |

|||||||

|

Lipper Equity Market-Neutral Funds Average8 |

1.47 |

% |

1.43 |

% |

|||||||

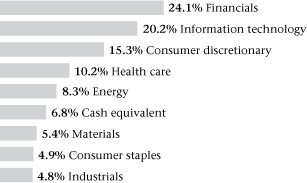

Sector weightings2:

Manager's discussion and analysis

The Turner Market Neutral Fund (Institutional Class and Investor Class) generated a positive absolute return during the 12-month period ended September 30, 2013. The Class C Shares generated a slightly negative return. During the reporting period, the Fund outperformed the Barclays Capital U.S. Aggregate Bond Index but underperformed both the S&P 500 Index and the Lipper Equity Market-Neutral Funds Average. The Turner Market Neutral Fund invests in stocks of companies with any capitalization range using a long/short strategy in seeking to capture alpha, reduce volatility, and preserve capital in declining markets.

During the reporting period, top contributors to performance were long and short positions in biotechnology, investment managers, apparel, and precious metals companies. Over the same period, top detractors to performance were long and short positions in computer hardware, precious metals, entertainment, and medical supplies companies.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. Top five holdings are based on long positions. The fund composition is subject to change.

2 Percentages based on total investments of long positions.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Market Neutral Fund was February 7, 2011.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

7 The Barclays Capital U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities.

8 The Lipper Equity Market-Neutral Funds Average represents the average annualized total return for all reporting funds in the Lipper Equity Market-Neutral Fund category.

The Turner Market Neutral Fund is subject to the risks associated with selling securities short. A short sale involves a finite opportunity for appreciation, but a theoretically unlimited risk of loss. The Fund may focus its investments from time to time on one or more economic sectors. To the extent that it does so, developments affecting companies in that sector or sectors will likely have a magnified effect on the Fund's net asset value and total return.

TURNER FUNDS 2013 ANNUAL REPORT 7

INVESTMENT REVIEW (Unaudited)

Turner Medical Sciences Long/Short Fund

Fund profile

September 30, 2013

n Ticker symbol TMSFX

Investor Class Shares

n CUSIP #900297557

Investor Class Shares

n Top five holdings1

(1) Pfizer

(2) McKesson

(3) Roche Holding AG ADR

(4) Bristol-Myers Squibb

(5) Cubist Pharmaceuticals

n % in five largest holdings 22.5%1,2

n Number of holdings 871

n Net assets $3.06 million, Investor Class Shares

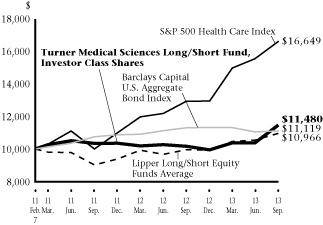

Growth of a $10,000 investment in the

Turner Medical Sciences Long/Short Fund,

Investor Class Shares:

February 7, 2011-September 30, 20133,4

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Since inception4 |

||||||||||

|

Turner Medical Sciences Long/Short Fund, Institutional Class Shares5 |

13.25 |

% |

5.56 |

% |

|||||||

|

Turner Medical Sciences Long/Short Fund, Investor Class Shares5 |

12.99 |

% |

5.35 |

% |

|||||||

|

Turner Medical Sciences Long/Short Fund, Class C Shares5 |

12.15 |

% |

4.59 |

% |

|||||||

|

S&P 500 Health Care Index6 |

28.55 |

% |

21.26 |

% |

|||||||

|

Barclays Capital U.S. Aggregate Bond Index7 |

-1.68 |

% |

4.09 |

% |

|||||||

|

Lipper Long/Short Equity Funds Average8 |

10.07 |

% |

3.37 |

% |

|||||||

Sector weightings2:

Manager's discussion and analysis

The Turner Medical Sciences Long/Short Fund produced a positive absolute return for the 12-month period ended September 30, 2013. During the reporting period, the Fund outperformed the Lipper Long/Short Equity Funds Average and the Barclays Capital U.S. Aggregate Bond Index but underperformed the S&P 500 Health Care Index. The Turner Medical Sciences Long/Short Fund invests primarily (at least 80% of its net assets) in stocks of companies engaged in the health care sector using a long/short growth strategy in seeking to capture alpha, reduce volatility, and preserve capital in declining markets.

During the reporting period, top contributors to performance were long and short positions in biotechnology, medical distributors, pharmaceuticals, and health care technology companies. Over the same period, top detractors to performance were long and short positions in pharmaceuticals, biotechnology, hospital management, and health care services companies.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. Top five holdings are based on long positions. The fund composition is subject to change.

2 Percentages based on total investments of long positions.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Medical Sciences Long/Short Fund was February 7, 2011.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The S&P 500 Health Care Index is an unmanaged index which includes the stocks in the health-care sector of the S&P 500 Index.

7 The Barclays Capital U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities.

8 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

ADR — American Depositary Receipt

The Turner Medical Sciences Long/Short Fund is subject to the risks associated with selling securities short. A short sale involves a finite opportunity for appreciation, but a theoretically unlimited risk of loss. The Fund is subject to the risks associated with health care-related companies. Many health care-related companies are smaller and less seasoned than companies in other sectors. Health care-related companies may also be strongly affected by scientific or technological developments and their products may quickly become obsolete. The Fund is subject to risks due to its foreign investments.

8 TURNER FUNDS 2013 ANNUAL REPORT

INVESTMENT REVIEW (Unaudited)

Turner Spectrum Fund

Fund profile

September 30, 2013

n Ticker symbol TSPEX

Institutional Class Shares

n CUSIP #900297664

Institutional Class Shares

n Top five holdings1

(1) Ocwen Financial

(2) Towers Watson, Cl A

(3) McKesson

(4) Anadarko Petroleum

(5) IntercontinentalExchange

n % in five largest holdings 6.5%1,2

n Number of holdings 3941

n Net assets $481.85 million, Institutional Class Shares

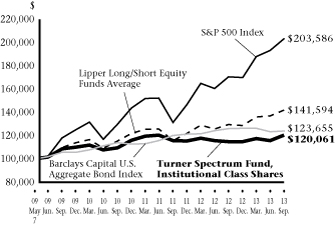

Growth of a $100,000 investment in the

Turner Spectrum Fund, Institutional Class Shares:

May 7, 2009-September 30, 20133,4

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Three years |

Since inception |

|||||||||||||

|

Turner Spectrum Fund, Institutional Class Shares5 |

4.96 |

% |

3.30 |

% |

4.24 |

%4 |

|||||||||

|

Turner Spectrum Fund, Investor Class Shares5 |

4.63 |

% |

3.04 |

% |

3.98 |

%4 |

|||||||||

|

Turner Spectrum Fund, Class C Shares5 |

3.88 |

% |

2.27 |

% |

3.51 |

%6 |

|||||||||

|

S&P 500 Index7 |

19.34 |

% |

16.27 |

% |

17.54 |

%4 |

|||||||||

|

Barclays Capital U.S. Aggregate Bond Index8 |

-1.68 |

% |

2.86 |

% |

4.94 |

%4 |

|||||||||

|

Lipper Long/Short Equity Funds Average9 |

10.07 |

% |

6.58 |

% |

8.33 |

%4 |

|||||||||

Sector weightings2:

Manager's discussion and analysis

The Turner Spectrum Fund produced a positive absolute return for the 12-month period ended September 30, 2013. During the reporting period, the Fund outperformed the Barclays Capital U.S. Aggregate Bond Index but underperformed both the S&P 500 Index and the Lipper Long/Short Equity Funds Average. The Turner Spectrum Fund is a multi-manager mutual fund that seeks long-term capital appreciation through investments in a number of long/short equity strategies offered by Turner Investments.

During the reporting period, top contributors to performance were long positions in biotechnology, internet, and consumer finance companies. Over the same period, top detractors to performance were long and short positions in entertainment, chemicals, and computer hardware companies.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. Top five holdings are based on long positions. The fund composition is subject to change.

2 Percentages based on total investments of long positions.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Spectrum Fund (Institutional Class Shares and Investor Class Shares) was May 7, 2009. Index returns are based on Institutional Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Spectrum Fund (Class C Shares) was July 14, 2009.

7 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

8 The Barclays Capital U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities.

9 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

Cl — Class

The Turner Spectrum Fund may focus its investments from time to time on one or more economic sectors. To the extent that it does so, developments affecting companies in that sector or sectors will likely have a magnified effect on the Fund's net asset value and total return. The Fund is subject to the risks associated with selling securities short. A short sale involves a finite opportunity for appreciation, but a theoretically unlimited risk of loss. The smaller capitalization companies the Fund invests in may be more vulnerable to adverse business or economic events than larger, more established companies.

TURNER FUNDS 2013 ANNUAL REPORT 9

INVESTMENT REVIEW (Unaudited)

Turner Titan Fund

Fund profile

September 30, 2013

n Ticker symbol TTLFX

Investor Class Shares

n CUSIP #900297524

Investor Class Shares

n Top five holdings1

(1) Salesforce.com

(2) IntercontinentalExchange

(3) eBay

(4) Apple

(5) Discover Financial Services

n % in five largest holdings 16.0%1,2

n Number of holdings 1071

n Net assets $0.39 million, Investor Class Shares

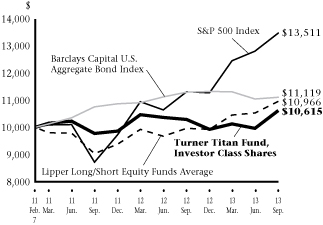

Growth of a $10,000 investment in the

Turner Titan Fund, Investor Class Shares:

February 7, 2011-September 30, 20133,4

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Since inception4 |

||||||||||

|

Turner Titan Fund, Institutional Class Shares5 |

3.43 |

% |

2.54 |

% |

|||||||

|

Turner Titan Fund, Investor Class Shares5 |

3.14 |

% |

2.28 |

% |

|||||||

|

Turner Titan Fund, Class C Shares5 |

2.28 |

% |

1.47 |

% |

|||||||

|

S&P 500 Index6 |

19.34 |

% |

12.05 |

% |

|||||||

|

Barclays Capital U.S. Aggregate Bond Index7 |

-1.68 |

% |

4.09 |

% |

|||||||

|

Lipper Long/Short Equity Funds Average8 |

10.07 |

% |

3.37 |

% |

|||||||

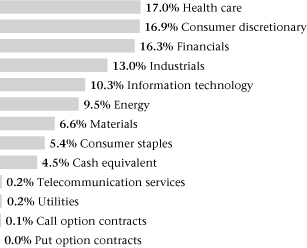

Sector weightings2:

Manager's discussion and analysis

The Turner Titan Fund generated a positive absolute return for the 12-month period ended September 30, 2013. During the reporting period, the Fund outperformed the Barclays Capital U.S. Aggregate Bond Index but underperformed both the S&P 500 Index and the Lipper Long/Short Equity Funds Average. The Turner Titan Fund invests in stocks of companies with primarily large capitalization ranges across all major industry sectors using a long/short strategy in seeking to capture alpha, reduce volatility, and preserve capital in declining markets.

During the reporting period, top contributors to performance were long positions in internet, biotechnology, and gaming companies. Over the same period, top detractors to performance were long and short positions in entertainment, apparel, software, and semiconductor companies.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. Top five holdings are based on long positions. The fund composition is subject to change.

2 Percentages based on total investments of long positions.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Titan Fund was February 7, 2011.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

7 The Barclays Capital U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities.

8 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

The Turner Titan Fund may focus its investments from time to time on one or more economic sectors. To the extent that it does so, developments affecting companies in that sector or sectors will likely have a magnified effect on the Fund's net asset value and total return. The Fund is subject to the risks associated with selling securities short. A short sale involves a finite opportunity for appreciation, but a theoretically unlimited risk of loss. The smaller capitalization companies the Fund invests in may be more vulnerable to adverse business or economic events than larger, more established companies.

10 TURNER FUNDS 2013 ANNUAL REPORT

INVESTMENT REVIEW (Unaudited)

Turner All Cap Growth Fund

Fund profile

September 30, 2013

n Ticker symbol TBTBX

n CUSIP #87252R797

n Top five holdings1

(1) LinkedIn, Cl A

(2) Avago Technologies

(3) Cavium

(4) NXP Semiconductors

(5) Apple

n % in five largest holdings 23.3%1,2

n Number of holdings 381

n Net assets $17.98 million

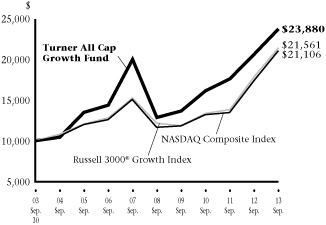

Growth of a $10,000 investment in the

Turner All Cap Growth Fund:

September 30, 2003-September 30, 20133

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Three years |

Five years |

10 years |

Since inception3 |

|||||||||||||||||||

|

Turner All Cap Growth Fund4 |

14.93 |

% |

13.78 |

% |

13.10 |

% |

9.09 |

% |

0.27 |

% |

|||||||||||||

|

NASDAQ Composite Index5 |

21.03 |

% |

16.77 |

% |

12.51 |

% |

7.76 |

% |

-0.38 |

% |

|||||||||||||

|

Russell 3000® Growth Index6 |

20.30 |

% |

17.18 |

% |

12.16 |

% |

7.99 |

% |

0.73 |

% |

|||||||||||||

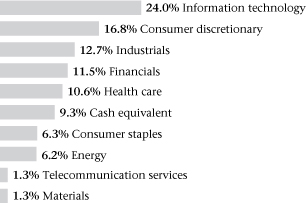

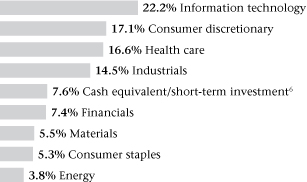

Sector weightings2:

Manager's discussion and analysis

Outperformance in internet software and services and capital markets holdings helped the Turner All Cap Growth Fund to gain a strong absolute return in the 12-month period ended September 30, 2013. However, the fund's return lagged that of both the Russell 3000® Growth Index and the NASDAQ Composite Index on a relative basis.

From an attribution standpoint, the two sectors with the strongest outperformance to their corresponding index sectors were financial and consumer discretionary sectors. Within the sectors discussed above, hotels, restaurants, and leisure contributed to returns. The two bottom sectors that detracted from relative returns compared to their corresponding index were information technology and energy, with holdings in computers, communication equipment, and oil gas and consumable fuels holdings recording poor returns.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. The inception date of the Turner All Cap Growth Fund was June 30, 2000.

4 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

5 The NASDAQ Composite Index includes more than 5,000 domestic and non-U.S. based common stocks listed on the NASDAQ stock market. The Index is market-value weighted. This means that each company's security affects the index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the index. Because it is so broad-based, the Index is one of the most widely followed and quoted major market indices.

6 The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values.

7 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

Cl — Class

The Turner All Cap Growth Fund may buy and sell securities frequently as part of its investment strategy. The medium capitalization companies in which the Fund invests may be more vulnerable to adverse business or economic events than larger, more established companies.

TURNER FUNDS 2013 ANNUAL REPORT 11

INVESTMENT REVIEW (Unaudited)

Turner Emerging Growth Fund

Fund profile

September 30, 2013

n Ticker symbol TMCGX

Investor Class Shares

n CUSIP #872524301

Investor Class Shares

n Top five holdings1

(1) Middleby

(2) Cracker Barrel Old Country Store

(3) Huron Consulting Group

(4) Tyler Technologies

(5) Rex Energy

n % in five largest holdings 12.1%1,2

n Number of holdings 1091

n Net assets $180.29 million, Investor Class Shares

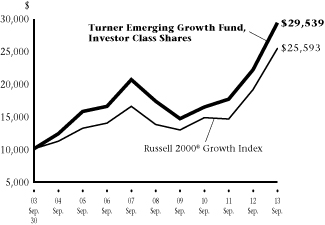

Growth of a $10,000 investment in the

Turner Emerging Growth Fund, Investor Class Shares:

September 30, 2003-September 30, 20133,4

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Three years |

Five years |

10 years |

Since inception |

|||||||||||||||||||

|

Turner Emerging Growth Fund, Institutional Class Shares5 |

32.98 |

% |

21.74 |

% |

— |

— |

23.69 |

%6 |

|||||||||||||||

|

Turner Emerging Growth Fund, Investor Class Shares5 |

32.63 |

% |

21.45 |

% |

11.16 |

% |

11.44 |

% |

18.81 |

%4 |

|||||||||||||

|

Russell 2000® Growth Index7 |

33.07 |

% |

19.96 |

% |

13.17 |

% |

9.85 |

% |

5.29 |

%4 |

|||||||||||||

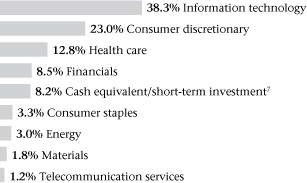

Sector weightings2:

Manager's discussion and analysis

During the 12-month period ended September 30, 2013, the Turner Emerging Growth Fund posted strong absolute returns; however, the fund slightly underperformed the Russell 2000® Growth Index on a relative basis.

The two strongest returning sectors were energy and materials with those sectors outperforming their corresponding index sectors. Within those sectors, shares in oil gas and consumable fuels, and paper and forest products, did best. The health care and financial sectors detracted the most from relative results. In those sectors, health care equipment and supplies, health care specialty retail, and capital markets shares proved disappointing.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional and Investor Class Shares will differ due to differences in fees.

4 The inception date of the Turner Emerging Growth Fund (Investor Class Shares) was February 27, 1998. Index returns are based on Investor Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Emerging Growth Fund (Institutional Class Shares) was February 1, 2009.

7 The Russell 2000® Growth Index is a widely-recognized, capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 2,000 smallest U.S. companies out of the 3,000 largest U.S. companies with higher growth rates and price-to-book ratios.

8 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

Amounts designated as "—" are not applicable.

The Turner Emerging Growth Fund is also subject to taxable income and realized capital gains. Shareholder redemptions may force the Fund to sell securities at an inappropriate time, also resulting in realized gains.

12 TURNER FUNDS 2013 ANNUAL REPORT

INVESTMENT REVIEW (Unaudited)

Turner Large Growth Fund

Fund profile

September 30, 2013

n Ticker symbol TTMEX

Institutional Class Shares

n CUSIP #900297847

Institutional Class Shares

n Top five holdings1

(1) Apple

(2) Google, Cl A

(3) Facebook, Cl A

(4) Visa, Cl A

(5) Gilead Sciences

n % in five largest holdings 19.7%1,2

n Number of holdings 551

n Net assets $53.97 million, Institutional Class Shares

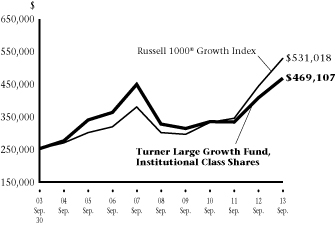

Growth of a $250,000 investment in the

Turner Large Growth Fund, Institutional Class Shares:

September 30, 2003-September 30, 20133,4

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Three years |

Five years |

10 years |

Since inception |

|||||||||||||||||||

|

Turner Large Growth Fund, Institutional Class Shares5 |

14.87 |

% |

11.91 |

% |

7.52 |

% |

6.50 |

% |

3.32 |

%4 |

|||||||||||||

|

Turner Large Growth Fund, Investor Class Shares5 |

14.50 |

% |

11.62 |

% |

7.24 |

% |

— |

4.16 |

%6 |

||||||||||||||

|

Russell 1000® Growth Index7 |

19.27 |

% |

16.94 |

% |

12.07 |

% |

7.82 |

% |

3.88 |

%4 |

|||||||||||||

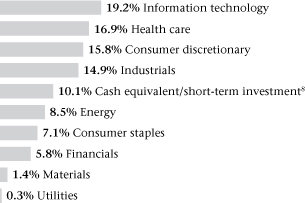

Sector weightings2:

Manager's discussion and analysis

The Turner Large Growth Fund gained a healthy absolute return for the 12-month period ended September 30, 2013. However, the fund underperformed its benchmark, the Russell 1000® Growth Index, on a relative basis.

Regarding sector attribution, the consumer discretionary and financial sectors contributed the most to positive performance. In those sectors, internet software and services, hotels restaurants and leisure, and capital markets shares boosted performance. Additionally, software holdings contributed positively. The technology and health care sectors overall detracted the most from performance. Shares of computers and peripherals, communications equipment, and pharmaceuticals produced unfavorable relative results.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional and Investor Class Shares will differ due to differences in fees.

4 The inception date of the Turner Large Growth Fund (Institutional Class Shares) was February 28, 2001. Index returns are based on Institutional Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Large Growth Fund (Investor Class Shares) was August 1, 2005.

7 The Russell 1000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values.

8 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

Amounts designated as "—" are not applicable.

Cl — Class

The Turner Large Growth Fund may buy and sell securities frequently as part of its investment strategy. The Fund is subject to the risk that large capitalization growth stocks may underperform other segments of the equity markets as a whole.

TURNER FUNDS 2013 ANNUAL REPORT 13

INVESTMENT REVIEW (Unaudited)

Turner Midcap Growth Fund

Fund profile

September 30, 2013

n Ticker symbol TMGFX

Investor Class Shares

n CUSIP #900297409

Investor Class Shares

n Top five holdings1

(1) Wynn Resorts

(2) LinkedIn, Cl A

(3) NXP Semiconductors

(4) IntercontinentalExchange

(5) Alliance Data Systems

n % in five largest holdings 10.3%1,2

n Number of holdings 771

n Net assets $257.24 million, Investor Class Shares

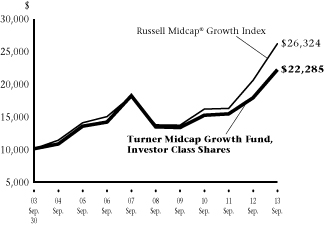

Growth of a $10,000 investment in the

Turner Midcap Growth Fund, Investor Class Shares:

September 30, 2003-September 30, 20133,4

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Three years |

Five years |

10 years |

Since inception |

|||||||||||||||||||

|

Turner Midcap Growth Fund, Institutional Class Shares5 |

24.69 |

% |

13.85 |

% |

10.99 |

% |

— |

4.66 |

%6 |

||||||||||||||

|

Turner Midcap Growth Fund, Investor Class Shares5 |

24.31 |

% |

13.57 |

% |

10.71 |

% |

8.34 |

% |

10.46 |

%4 |

|||||||||||||

|

Turner Midcap Growth Fund, Retirement Class Shares5 |

24.11 |

% |

13.31 |

% |

10.46 |

% |

7.99 |

% |

7.61 |

%7 |

|||||||||||||

|

Russell Midcap® Growth Index8 |

27.54 |

% |

17.65 |

% |

13.92 |

% |

10.16 |

% |

8.29 |

%4 |

|||||||||||||

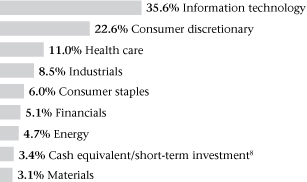

Sector weightings2:

Manager's discussion and analysis

In the 12-month period ended September 30, 2013, the Turner Midcap Growth Fund advanced to produce strong absolute returns while underperforming the Russell Midcap® Growth Index on a relative basis.

The financial and materials sectors provided the greatest contribution to the fund's performance. Real estate investment trusts (REITs) and financial IT services generated the best results within these sectors. In addition, specific holdings in biotechnology within the health care sector produced superior absolute returns. The major detractors from performance were the producer durable and information technology sectors. Subpar performers in those sectors included computers and peripherals, software, machinery, and household durables shares.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Retirement Class Shares will differ due to differences in fees.

4 The inception date of the Turner Midcap Growth Fund (Investor Class Shares) was October 1, 1996. Index returns are based on Investor Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Midcap Growth Fund (Institutional Class Shares) was June 16, 2008.

7 The inception date of the Turner Midcap Growth Fund (Retirement Class Shares) was September 24, 2001.

8 The Russell Midcap® Growth Index is a capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 800 smallest U.S. companies out of the 1,000 largest companies with higher growth rates and price-to-book ratios.

9 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

Amounts designated as "—" are not applicable.

Cl — Class

The Turner Midcap Growth Fund may buy and sell securities frequently as part of its investment strategy. The medium capitalization companies in which the Fund invests may be more vulnerable to adverse business or economic events than larger, more established companies.

14 TURNER FUNDS 2013 ANNUAL REPORT

INVESTMENT REVIEW (Unaudited)

Turner Small Cap Growth Fund

Fund profile

September 30, 2013

n Ticker symbol TSCEX

n CUSIP #900297300

n Top five holdings1

(1) ACADIA Pharmaceuticals

(2) NPS Pharmaceuticals

(3) QLIK Technologies

(4) Rosetta Resources

(5) Ciena

n % in five largest holdings 6.7%1,2

n Number of holdings 1061

n Net assets $233.04 million

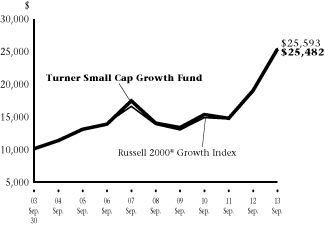

Growth of a $10,000 investment in the

Turner Small Cap Growth Fund:

September 30, 2003-September 30, 20133

Average annual total returns (Periods ended September 30, 2013)

|

One year |

Three years |

Five years |

10 years |

Since inception3 |

|||||||||||||||||||

|

Turner Small Cap Growth Fund4 |

33.79 |

% |

18.42 |

% |

12.71 |

% |

9.81 |

% |

11.91 |

% |

|||||||||||||

|

Russell 2000® Growth Index5 |

33.07 |

% |

19.96 |

% |

13.17 |

% |

9.85 |

% |

7.08 |

% |

|||||||||||||

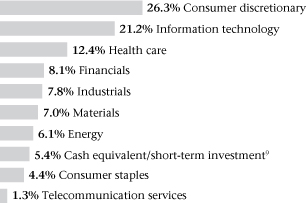

Sector weightings2:

Manager's discussion and analysis

The Turner Small Cap Growth Fund gain a solid absolute return during the 12-month period ended September 30, 2013 and the fund just slightly beat its benchmark, the Russell 2000® Growth Index, over the same time period on a relative basis.

Two of the strongest sectors were health care and materials. Specifically, holdings in biotechnology, health care equipment and supplies, and paper and forest products beat their index counterparts. But the information technology and the financials sector shares proved the biggest drag on performance. Software, computers and peripherals, computer equipment and a handful of financial industries stocks within the real estate investment trusts (REITs), trading companies and distributors, commercial bank industries recorded subpar results relative to the benchmark.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. The inception date of the Turner Small Cap Growth Fund was February 7, 1994.

4 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

5 The Russell 2000® Growth Index is a widely-recognized, capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 2,000 smallest U.S. companies out of the 3,000 largest U.S. companies with higher growth rates and price-to-book ratios.

6 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

The Turner Small Cap Growth Fund may buy and sell securities frequently as part of its investment strategy. The smaller capitalization companies the Fund invests in may be more vulnerable to adverse business or economic events than larger, more established companies.

TURNER FUNDS 2013 ANNUAL REPORT 15

INVESTMENT REVIEW (Unaudited)

Turner Emerging Markets Fund

Fund profile

September 30, 2013

n Ticker symbol TEEEX

Institutional Class Shares

n CUSIP #900297516

Institutional Class Shares

n Top five holdings1

(1) Samsung Electronics

(2) Taiwan Semiconductor Manufacturing ADR

(3) Industrial & Commerical Bank of China, H Shares

(4) Banco do Brasil

(5) Tencent Holdings

n % in five largest holdings 14.2%1,2

n Number of holdings 921

n Net assets $0.51 million, Institutional Class Shares

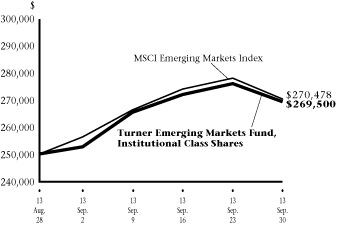

Growth of a $250,000 investment in the

Turner Emerging Markets, Institutional Class Shares:

August 28, 2013-September 30, 20133

Cumulative total returns (Period ended September 30, 2013)

|

Since inception4 |

|||||||

|

Turner Emerging Markets Fund, Institutional Class Shares5 |

7.80 |

% |

|||||

|

Turner Emerging Markets Fund, Investor Class Shares5 |

7.80 |

% |

|||||

|

MSCI Emerging Markets Index6 |

8.19 |

% |

|||||

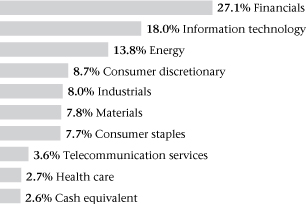

Sector weightings2:

Manager's discussion and analysis

The Turner Emerging Markets Fund generated a positive absolute return from its inception on August 28, 2013 through September 30, 2013. During that period, the Fund underperformed the MSCI Emerging Markets Index. The Turner Emerging Markets Fund is a diversified, actively managed portfolio of about 60 – 100 growth equity stocks that are economically tied to emerging markets. Emerging markets are defined as those markets included in the MSCI Emerging Markets Index.

The materials and energy sectors had a positive impact on the fund's performance during the period. Top contributors included holdings in metals and mining, pulp and paper, oil and gas production, and integrated oil companies. The fund's worst performing sectors were financials and technology. Notable detractors included commercial banks, real estate development and management, semiconductor, and information technology services companies.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional and Investor Class Shares will differ due to differences in fees.

4 The inception date of the Turner Emerging Markets Fund was August 28, 2013. Cumulative returns, not annualized.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The MSCI Emerging Markets Index captures large and mid cap representation, covering over 800 securities across 21 emerging market countries. The countries include: Brazil, Chile, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

ADR — American Depositary Receipt

The Turner Emerging Markets Fund is subject to risks due to its foreign investments and investments in emerging market countries.

16 TURNER FUNDS 2013 ANNUAL REPORT

Schedule of investments

Turner Market Neutral Fund

September 30, 2013

|

Shares |

Value (000) |

||||||||||

|

Common stock—75.6% |

|||||||||||

|

Consumer discretionary—12.4% |

|||||||||||

|

Harley-Davidson^ |

2,740 |

$ |

176 |

||||||||

|

Norwegian Cruise Line Holdings* |

2,650 |

82 |

|||||||||

|

Ralph Lauren^ |

940 |

155 |

|||||||||

|

Walt Disney |

1,230 |

79 |

|||||||||

|

Total Consumer discretionary |

492 |

||||||||||

|

Consumer staples—4.0% |

|||||||||||

|

Church & Dwight^ |

2,620 |

157 |

|||||||||

|

Total Consumer staples |

157 |

||||||||||

|

Energy—6.8% |

|||||||||||

|

Lekoil* |

324,724 |

224 |

|||||||||

|

PetroChina ADR^ |

400 |

44 |

|||||||||

|

Total Energy |

268 |

||||||||||

|

Financials—19.5% |

|||||||||||

|

Affiliated Managers Group*^ |

670 |

122 |

|||||||||

|

Allstate^ |

1,440 |

73 |

|||||||||

|

Concentradora Fibra Hotelera Mexicana |

42,790 |

71 |

|||||||||

|

Credicorp |

1,220 |

158 |

|||||||||

|

Hersha Hospitality Trust^ |

19,160 |

107 |

|||||||||

|

Ocwen Financial*^ |

1,470 |

82 |

|||||||||

|

OFG Bancorp |

4,960 |

80 |

|||||||||

|

Safeguard Scientifics*^ |

5,290 |

83 |

|||||||||

|

Total Financials |

776 |

||||||||||

|

Health care—8.3% |

|||||||||||

|

AstraZeneca ADR |

1,600 |

83 |

|||||||||

|

Cooper^ |

620 |

80 |

|||||||||

|

Pfizer |

5,720 |

165 |

|||||||||

|

Total Health care |

328 |

||||||||||

|

Industrials—3.9% |

|||||||||||

|

Eaton PLC^ |

2,250 |

155 |

|||||||||

|

Total Industrials |

155 |

||||||||||

|

Information technology—16.4% |

|||||||||||

|

Apple^ |

180 |

86 |

|||||||||

|

Cavium*^ |

2,420 |

100 |

|||||||||

|

Jabil Circuit^ |

3,510 |

76 |

|||||||||

|

NXP Semiconductors*^ |

2,740 |

102 |

|||||||||

|

Skyworks Solutions*^ |

1,790 |

44 |

|||||||||

|

Shares |

Value (000) |

||||||||||

|

Take-Two Interactive Software*^ |

4,350 |

$ |

79 |

||||||||

|

TIBCO Software*^ |

6,410 |

164 |

|||||||||

|

Total Information technology |

651 |

||||||||||

|

Materials—4.3% |

|||||||||||

|

Louisiana-Pacific*^ |

9,690 |

170 |

|||||||||

|

Total Materials |

170 |

||||||||||

|

Total Common stock (Cost $2,810)** |

2,997 |

||||||||||

|

Cash equivalent—5.5% |

|||||||||||

|

BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.060%‡ |

219,789 |

220 |

|||||||||

|

Total Cash equivalent (Cost $220)** |

220 |

||||||||||

|

Total Investments—81.1% (Cost $3,030)** |

3,217 |

||||||||||

|

Segregated cash with brokers—87.9% |

3,484 |

||||||||||

|

Securities sold short—(73.8)% (Proceeds $(2,882))** |

(2,925 |

) |

|||||||||

|

Net Other assets (liabilities)—4.8% |

189 |

||||||||||

|

Net Assets—100.0% |

$ |

3,965 |

|||||||||

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

‡ Rate shown is the 7-day effective yield as of September 30, 2013.

ADR — American Depositary Receipt

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2013 ANNUAL REPORT 17

FINANCIAL STATEMENTS

Schedule of securities sold short

Turner Market Neutral Fund

September 30, 2013

|

Shares |

Value (000) |

||||||||||

|

Common stock—73.8% |

|||||||||||

|

Consumer discretionary—10.3% |

|||||||||||

|

Hasbro |

1,790 |

$ |

84 |

||||||||

|

Kohl's |

1,520 |

79 |

|||||||||

|

Target |

1,170 |

75 |

|||||||||

|

Twenty-First Century Fox |

2,430 |

81 |

|||||||||

|

Under Armour, Cl A |

1,120 |

89 |

|||||||||

|