UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07589

THE HARTFORD MUTUAL FUNDS, INC.

(Exact name of registrant as specified in charter)

5 Radnor Corporate Center, Suite 300, 100 Matsonford Road, Radnor, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Edward P. Macdonald, Esquire

Hartford Funds Management Company, LLC

5 Radnor Corporate Center, Suite 300

100 Matsonford Road

Radnor, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: October 31

Date of reporting period: October 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HARTFORDFUNDS

|

THE HARTFORD BALANCED FUND

2014 Annual Report |

A MESSAGE FROM THE PRESIDENT

Dear Fellow Shareholders:

Thank you for investing in Hartford Funds.

Market Review

U.S. equities (as represented by the S&P 500 Index) rose steadily for the fiscal year ended October 31, 2014, with a return of 17.27% for the period. With the exception of short-lived geopolitical scares early in 2014 and concerns about continuing global growth near the end of the period, stocks generally rose on solid fundamentals and encouraging macroeconomic data during the year.

September 2014 marked the six-year anniversary of the start of the financial crisis. Within weeks of that anniversary, both the S&P 500 Index and the Dow Jones Industrial Average set new all-time highs, closing at 2,018 and 17,391, respectively, on October 31. Although the fallout of the crisis continues to influence investor behavior, stocks have recovered and risen dramatically, up 198% from their low in March 2009. Meanwhile, the domestic economy is notching strong growth, and the unemployment rate has reached its lowest level since August 2008.

While the U.S. economy appears to have stabilized and to have reverted to a solid growth path, the outlook for the global economy appears to have gotten cloudier. The U.S. Federal Reserve has ended quantitative easing, while Europe and Japan are pursuing stimulus options to avoid a double-dip recession and deflation, respectively. Diverging central-bank policies will likely continue to play an important role in market movements going forward as investors wait to see the reactions to their efforts and their impacts on global markets.

How have market movements impacted your portfolio throughout the last year? Are your investments still on track to provide the growth or income you need, and are you comfortable with their progress during times of volatility?

Your financial professional can help you navigate today’s markets with confidence, as well as assist you to achieve your investment goals by providing advice on the best options within our fund family to help you work toward overcoming today’s investing challenges. Meet with your financial advisor regularly to examine your portfolio and your investment strategy, and to determine if you’re still on track to meet your goals.

Thank you again for investing with Hartford Funds.

James Davey

President

Hartford Funds

1 The S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

2 The Dow Jones Industrial Average is an unmanaged, price-weighted index of 30 of the largest, most widely held stocks traded on the NYSE

The Hartford Balanced Fund

The views expressed in the Fund’s Manager Discussion under ‘‘Why did the Fund perform this way?’’ and ‘‘What is the outlook?’’ are views of the Fund’s sub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. The Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

| The Hartford Balanced Fund inception 07/22/1996 |

| (sub-advised by Wellington Management Company, LLP) |

| Investment objective – The Fund seeks long-term total return. |

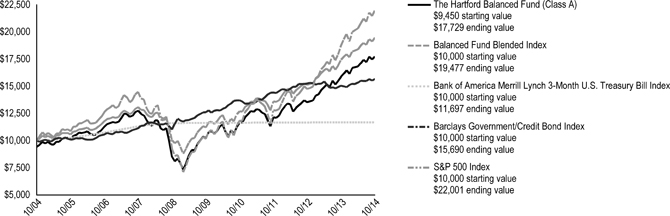

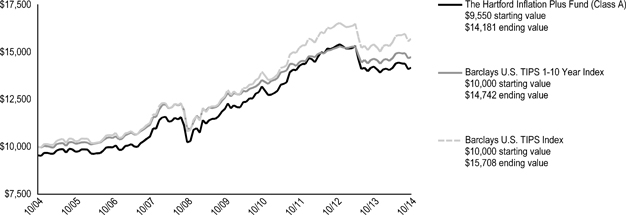

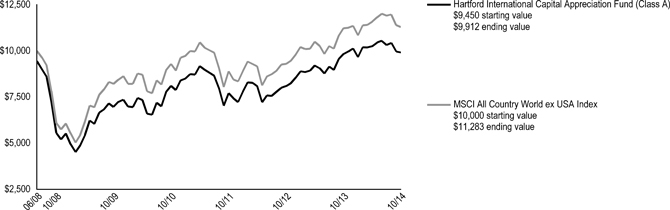

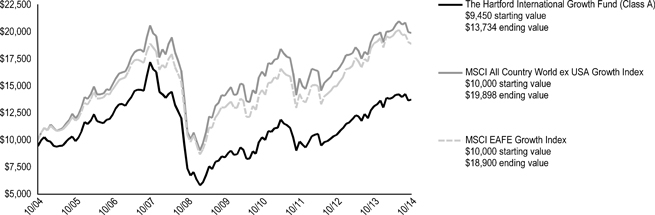

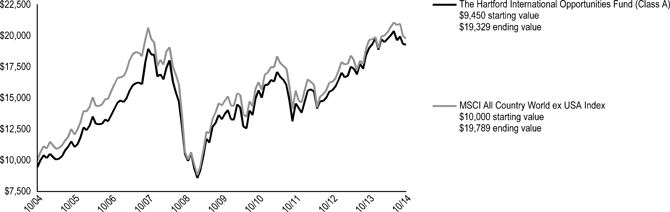

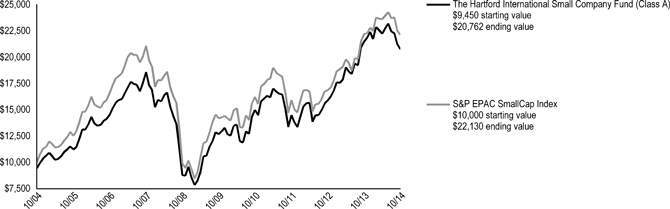

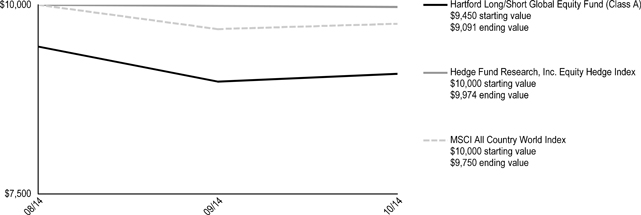

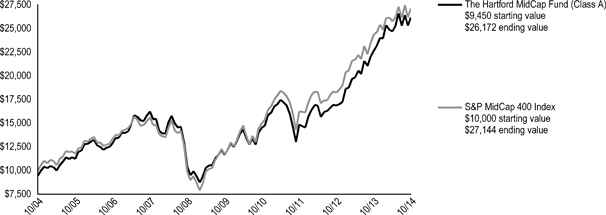

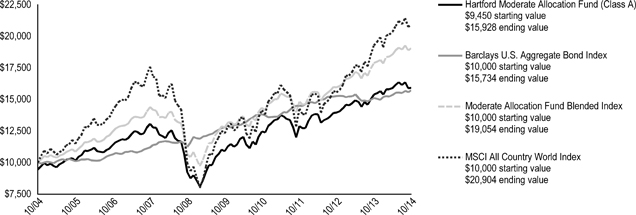

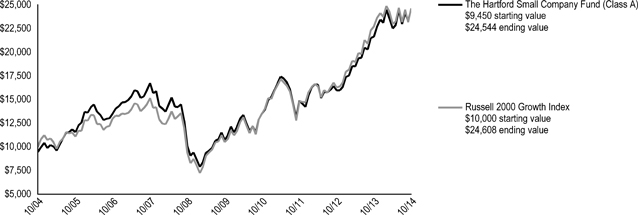

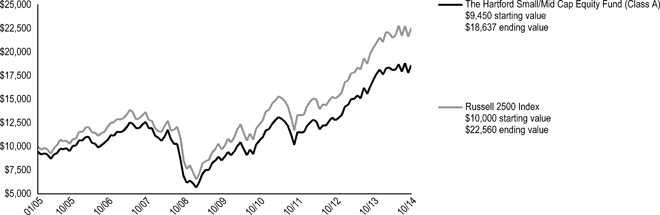

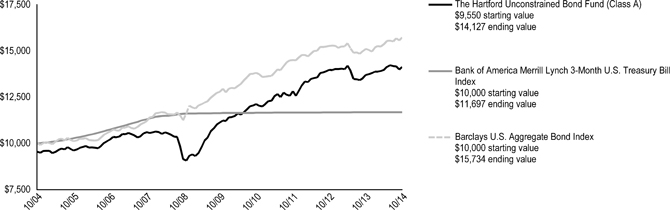

Performance Overview 10/31/04 - 10/31/14

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes a sales charge. Growth results in classes other than Class A will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns (as of 10/31/14)

| 1 Year | 5 Years | 10 Years | ||||||||||

| Balanced A# | 11.60 | % | 11.55 | % | 6.49 | % | ||||||

| Balanced A## | 5.46 | % | 10.29 | % | 5.89 | % | ||||||

| Balanced B# | 10.64 | % | 10.61 | % | 5.79 | %* | ||||||

| Balanced B## | 5.64 | % | 10.34 | % | 5.79 | %* | ||||||

| Balanced C# | 10.82 | % | 10.76 | % | 5.73 | % | ||||||

| Balanced C## | 9.82 | % | 10.76 | % | 5.73 | % | ||||||

| Balanced R3# | 11.32 | % | 11.29 | % | 6.40 | % | ||||||

| Balanced R4# | 11.67 | % | 11.63 | % | 6.64 | % | ||||||

| Balanced R5# | 12.02 | % | 11.97 | % | 6.90 | % | ||||||

| Balanced Y# | 12.08 | % | 12.04 | % | 6.97 | % | ||||||

| Balanced Fund Blended Index | 11.74 | % | 11.67 | % | 6.89 | % | ||||||

| Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.05 | % | 0.09 | % | 1.58 | % | ||||||

| Barclays Government/Credit Bond Index | 4.21 | % | 4.43 | % | 4.61 | % | ||||||

| S&P 500 Index | 17.27 | % | 16.69 | % | 8.20 | % | ||||||

| # | Without sales charge |

| ## | With sales charge |

| * | Class B shares convert to Class A shares after 8 years. The return shown reflects the conversion to Class A shares, which had different operating expenses, for the period after conversion. |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

The initial investment in Class A shares reflects the maximum sales charge of 5.50% and returns for Class B shares reflect a contingent deferred sales charge of up to 5.00% and declining to zero, depending on the period of time the shares are held. Returns for Class C shares reflect a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on October 31, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Effective 9/30/09, Class B shares of the Fund were closed to new investments.

Class R3, R4 and R5 shares commenced operations on 12/22/06. Performance prior to that date is that of the Fund's Class Y shares, which had different operating expenses.

Balanced Fund Blended Index is calculated by Hartford Funds Management Company, LLC and represents the weighted return of 60% S&P 500 Index, 35% Barclays Government/Credit Bond Index and 5% Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index that tracks the performance of U.S. dollar denominated U.S. Treasury bills publicly issued in the U.S. domestic markets with maturities of 90 days or less that assumes reinvestment of all income.

Barclays Government/Credit Bond Index is an unmanaged, market-value-weighted index of all debt obligations of the U.S. Treasury and U.S. Government agencies (excluding mortgaged-backed securities) and of all publicly-issued fixed-rate, nonconvertible, investment grade domestic corporate debt.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

You cannot invest directly in an index.

The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance information may reflect historical or current expense waivers/reimbursements from the investment adviser, without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| 2 |

| The Hartford Balanced Fund |

| Manager Discussion |

| October 31, 2014 (Unaudited) |

| Operating Expenses* | ||||||||

| Net | Gross | |||||||

| Balanced Class A | 1.18 | % | 1.21 | % | ||||

| Balanced Class B | 2.04 | % | 2.27 | % | ||||

| Balanced Class C | 1.89 | % | 1.89 | % | ||||

| Balanced Class R3 | 1.40 | % | 1.51 | % | ||||

| Balanced Class R4 | 1.10 | % | 1.15 | % | ||||

| Balanced Class R5 | 0.80 | % | 0.86 | % | ||||

| Balanced Class Y | 0.74 | % | 0.74 | % | ||||

| * | As shown in the Fund's current prospectus dated March 1, 2014. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the year ended October 31, 2014. |

Gross expenses are the Fund's total annual operating expenses shown in the Fund's most recent prospectus. Net expenses are the Fund's total annual operating expenses shown in the Fund's most recent prospectus and reflect contractual expense reimbursements in instances when these reductions reduce the Fund's gross expenses. Contractual reimbursements remain in effect until February 28, 2015, and automatically renew for one-year terms unless terminated.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

| Portfolio Managers | |

| Karen H. Grimes, CFA | John C. Keogh |

| Senior Vice President and Equity Portfolio Manager | Senior Vice President and Fixed Income Portfolio Manager |

How did the Fund perform?

The Class A shares of The Hartford Balanced Fund returned 11.60%, before sales charge, for the twelve-month period ended October 31, 2014, underperforming the Fund’s custom benchmark (60% S&P 500 Index, 35% Barclays Government/Credit Bond Index, and 5% Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index), which returned 11.74% for the same period. The Fund outperformed the 8.98% average return of the Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds that hold between 60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents. For the same period, the S&P 500 Index returned 17.27%, the Barclays Government/Credit Bond Index returned 4.21%, and the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index returned 0.05%.

Why did the Fund perform this way?

The S&P 500 Index surged during the period (+17%), despite bouts of significant volatility. After finishing its best year since 1997, the S&P 500 Index began 2014 with its worst month in nearly two years. Worries about an economic slowdown in China and general angst surrounding emerging markets overshadowed a fairly benign domestic environment. However, robust merger and acquisition activity and an uncontested increase in the debt ceiling from Congress helped stoke investors' risk appetites in February. The rally continued in May amid renewed signs of life in the housing market and the best payroll gain in more than two years. However, a pullback in July ended a streak of five consecutive monthly gains. Fear gripped the market as heightened geopolitical risks, a potential Portuguese banking crisis, and worries of U.S. Federal Reserve (Fed) tightening took center stage. Stocks rebounded in August as investors were emboldened by encouraging economic data, headlined by better-than-expected Gross Domestic Product (GDP) growth and signs that the housing recovery still had legs. In September, U.S. equities retreated for just the third month this year. Despite solid manufacturing and consumer confidence readings, the reality of quantitative easing ending and the prospect of higher federal funds rates in mid-2015 contributed to increased risk aversion levels. Stocks finished a volatile October at an all-time high on the heels of a positive earnings season and generally solid economic data. Returns varied noticeably by market-cap, as small- and mid-cap stocks underperformed large-cap stocks. Within the S&P 500 Index, Healthcare (+30%), Information Technology (+26%), and Utilities (+22%) posted the largest gains, while the Energy (+4%), Telecommunication Services (+5%), and Consumer Discretionary (+9%) sectors lagged on a relative basis.

The bond market, as measured by the Barclays Government/Credit Bond Index, returned 4.21% during the period. Fixed income markets gained throughout much of the period as expectations of prolonged easy monetary policy by major central banks and a supportive macroeconomic environment kept rates low and suppressed volatility. Early in the period emerging markets dominated headlines as economic and political developments sparked risk aversion across global markets, pushing bond prices higher and yields lower amid a flight to quality. Toward the end of the period, however, persistent geopolitical risks – tensions between Ukraine and Russia and violence in Iraq – and Chinese economic slowdown concerns raised questions about the global growth rate, keeping a lid on risk appetites overall.

The period was also highlighted by a divergence in central bank policies. The European Central Bank (ECB) cut its benchmark lending and deposit rates and announced a host of stimulus measures in an effort to encourage lending and fend off fears of deflation. China’s central bank joined the ECB in boosting liquidity by injecting funds into the nation’s largest banks in an attempt to combat weakening growth. The Bank of Japan pre-emptively announced incremental monetary easing to counter the risk of missing the country’s inflation and growth targets. In contrast, the Bank of England and the Fed leaned toward tighter policies. The Fed ended its quantitative easing program as U.S. data largely

| 3 |

| The Hartford Balanced Fund |

| Manager Discussion – (continued) |

| October 31, 2014 (Unaudited) |

suggested the economy was on a sustainable growth path. Second quarter GDP rebounded after the first quarter’s steep contraction. The labor market strengthened as the unemployment rate dropped to a six-year low. Housing regained some lost ground after a weak start to the year, though the pace of home price appreciation started to slow after a strong 2013. Inflation pressures were muted overall, alleviating pressure on the Fed to raise rates.

The U.S. Treasury curve flattened as markets contemplated bringing interest rates to normal levels; short-term yields rose while longer term rates declined. Most credit risk sectors posted positive absolute returns and outperformed duration-equivalent government bonds as credit spreads tightened.

The Fund has three primary levers to generate investment performance: equity investments, fixed income investments, and asset allocation among stocks, bonds, and cash. During the period, the equity portion of the Fund underperformed the S&P 500 Index, while the fixed income portion performed in line with the Barclays Government/Credit Bond Index. Asset allocation contributed positively to the custom benchmark-relative results as the Fund was overweight equities relative to this benchmark in an environment where equities outperformed.

Equity underperformance versus the S&P 500 Index was driven primarily by security selection within the Information Technology, Energy, and Consumer Discretionary sectors. An overweight to and security selection in Healthcare and an underweight to Telecommunications Services contributed to benchmark-relative performance.

During the period, stocks that detracted the most from relative returns in the equity portion of the Fund included Academy CoInvest (Consumer Discretionary), Apple (Information Technology) and BG Group (Energy). Our private placement position in Academy CoInvest, a U.S.-based apparel, fitness, and recreational products retailer, declined during the period driven by a change in the fair-value price derived from key comparable companies, a group that experienced declining earnings in aggregate. Academy CoInvest has been a positive absolute contributor since inception of the position. Shares of Apple, a maker of an interconnected ecosystem of computing and mobile devices, rose after the company posted better-than-expected quarterly earnings and gave solid guidance for the fourth quarter; our underweight relative to the benchmark detracted. Shares of BG Group, a UK-based natural gas company, fell short of consensus expectations as upstream operating profits fell as production declined due to a slide in crude oil prices which reverberated through the oil and gas industry. Academy, Ford Motor (Consumer Discretionary), and BG Group detracted most from absolute results during the period.

Top contributors to relative performance in the equity portion of the Fund during the period were Vertex Pharmaceuticals (Healthcare), Covidien (Healthcare) and Amazon.com (Consumer Discretionary). Shares of Vertex Pharmaceuticals, a biotechnology firm with a focus on cancer and neurodegenerative diseases, rose as the company launched its product to treat cystic fibrosis patients, which we believe puts the company in a good position to grow its platform in this treatment area. Covidien, a U.S.-based medical products, manufacturing and distribution company, outperformed over the period after medical device giant Medtronic agreed to acquire Covidien for a mix of cash and stock. Covidien also reported solid third quarter results as it continues to grow its key business segments. Not owning Amazon.com, a U.S.-based global e-commerce retailer, contributed to S&P 500 Index-relative results as the company has experienced three consecutive quarterly losses amid investor concerns that it is overstretched as it attempts to move into niche markets. The Fund’s holdings in Microsoft (Information Technology), and Wells Fargo (Financials) contributed on an absolute basis.

The fixed income portion of the Fund performed roughly in line with the Barclays Government/Credit Bond Index during the period. An out-of-benchmark allocation to agency pass-through mortgages contributed the most to benchmark-relative results. Security selection within investment grade corporates also contributed to relative results, particularly within industrials and financials. Non corporate investment grade credit detracted from relative results driven by sovereigns and local agencies.

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

What is the outlook?

We believe U.S. fundamentals remain supportive of moderate growth, but acknowledge some risks have increased since the start of the year including geopolitical risks, such as continued conflicts in the Middle East, tougher Russian sanctions, and the cyber-security attacks.

The Healthcare and Consumer Staples sectors represented our largest sector overweight and underweight, respectively, at the end of the period.

On the fixed income side, we ended the period with a moderately positive risk posture, continuing to favor financial issuers within investment grade credit. We continued to hold an out-of-benchmark allocation, relative to the Fund’s custom benchmark, to agency mortgage backed securities. At the end of the period, the Fund’s equity exposure was at 69% compared to 60% in the Fund’s custom benchmark and at the upper end of the Fund’s 50-70% range.

| 4 |

| The Hartford Balanced Fund |

| Manager Discussion – (continued) |

| October 31, 2014 (Unaudited) |

Credit Exposure

as of October 31, 2014

| Credit Rating * | Percentage of Net Assets | |||

| Aaa/ AAA | 2.9 | % | ||

| Aa/ AA | 15.1 | |||

| A | 4.4 | |||

| Baa/ BBB | 4.6 | |||

| Ba/ BB | 0.2 | |||

| Non-Debt Securities and Other Short-Term Instruments | 72.7 | |||

| Other Assets and Liabilities | 0.1 | |||

| Total | 100.0 | % | ||

| * | Credit exposure is the long-term credit ratings for the Fund's holdings, as of the date noted, as provided by Standard and Poor's (S&P) or Moody's Investors Service (Moody's) and typically range from AAA/Aaa (highest) to C/D (lowest). Presentation of S&P and Moody's credit ratings in this report have been selected for informational purposes for shareholders, as well as the Fund's consideration of industry practice. If Moody's and S&P assign different ratings, the lower rating is used. Fixed income securities that are not rated by either agency are listed as "Not Rated." Ratings do not apply to the Fund itself or to the Fund's shares. Ratings may change. |

Diversification by Security Type

as of October 31, 2014

| Category | Percentage of Net Assets | |||

| Equity Securities | ||||

| Common Stocks | 68.8 | % | ||

| Total | 68.8 | % | ||

| Fixed Income Securities | ||||

| Asset & Commercial Mortgage Backed Securities | 0.3 | % | ||

| Corporate Bonds | 9.7 | |||

| Foreign Government Obligations | 0.1 | |||

| Municipal Bonds | 0.9 | |||

| U.S. Government Agencies | 2.6 | |||

| U.S. Government Securities | 13.6 | |||

| Total | 27.2 | % | ||

| Short-Term Investments | 3.9 | |||

| Other Assets and Liabilities | 0.1 | |||

| Total | 100.0 | % | ||

| 5 |

| The Hartford Balanced Fund |

| Schedule of Investments |

| October 31, 2014 |

| (000’s Omitted) |

| Shares or Principal Amount | Market Value ╪ | |||||||

| Common Stocks - 68.8% | ||||||||

| Automobiles and Components - 0.5% | ||||||||

| 269 | Ford Motor Co. | $ | 3,787 | |||||

| Banks - 3.9% | ||||||||

| 107 | BB&T Corp. | 4,046 | ||||||

| 101 | PNC Financial Services Group, Inc. | 8,708 | ||||||

| 288 | Wells Fargo & Co. | 15,279 | ||||||

| 28,033 | ||||||||

| Capital Goods - 4.6% | ||||||||

| 62 | 3M Co. | 9,519 | ||||||

| 92 | Eaton Corp. plc | 6,285 | ||||||

| 92 | Fortune Brands Home & Security, Inc. | 3,970 | ||||||

| 93 | Ingersoll-Rand plc | 5,830 | ||||||

| 38 | PACCAR, Inc. | 2,495 | ||||||

| 46 | United Technologies Corp. | 4,890 | ||||||

| 32,989 | ||||||||

| Consumer Durables and Apparel - 0.5% | ||||||||

| 34 | PVH Corp. | 3,934 | ||||||

| Diversified Financials - 6.7% | ||||||||

| 36 | Ameriprise Financial, Inc. | 4,593 | ||||||

| 23 | BlackRock, Inc. | 7,709 | ||||||

| 165 | Citigroup, Inc. | 8,816 | ||||||

| 30 | Goldman Sachs Group, Inc. | 5,738 | ||||||

| 165 | Invesco Ltd. | 6,661 | ||||||

| 247 | JP Morgan Chase & Co. | 14,933 | ||||||

| 48,450 | ||||||||

| Energy - 6.0% | ||||||||

| 65 | Anadarko Petroleum Corp. | 5,938 | ||||||

| 230 | BG Group plc | 3,830 | ||||||

| 58 | Chevron Corp. | 6,969 | ||||||

| 45 | EOG Resources, Inc. | 4,277 | ||||||

| 97 | Exxon Mobil Corp. | 9,420 | ||||||

| 106 | Halliburton Co. | 5,834 | ||||||

| 53 | Occidental Petroleum Corp. | 4,704 | ||||||

| 69 | Southwestern Energy Co. ● | 2,240 | ||||||

| 43,212 | ||||||||

| Food and Staples Retailing - 1.1% | ||||||||

| 89 | CVS Health Corp. | 7,663 | ||||||

| Food, Beverage and Tobacco - 3.3% | ||||||||

| 32 | Anheuser-Busch InBev N.V. ADR | 3,585 | ||||||

| 35 | Diageo plc ADR | 4,176 | ||||||

| 62 | Kraft Foods Group, Inc. | 3,481 | ||||||

| 113 | Mondelez International, Inc. | 3,991 | ||||||

| 48 | Philip Morris International, Inc. | 4,273 | ||||||

| 119 | Unilever N.V. NY Shares ADR | 4,617 | ||||||

| 24,123 | ||||||||

| Health Care Equipment and Services - 3.3% | ||||||||

| 64 | Baxter International, Inc. | 4,503 | ||||||

| 99 | Covidien plc | 9,133 | ||||||

| 55 | Medtronic, Inc. | 3,742 | ||||||

| 68 | UnitedHealth Group, Inc. | 6,480 | ||||||

| 23,858 | ||||||||

| Insurance - 2.3% | ||||||||

| 107 | American International Group, Inc. | 5,705 | ||||||

| 162 | Marsh & McLennan Cos., Inc. | 8,797 | ||||||

| 74 | Unum Group | 2,465 | ||||||

| 16,967 | ||||||||

| Materials - 1.9% | ||||||||

| 119 | Dow Chemical Co. | 5,879 | ||||||

| 98 | International Paper Co. | 4,945 | ||||||

| 60 | Nucor Corp. | 3,238 | ||||||

| 14,062 | ||||||||

| Media - 2.9% | ||||||||

| 76 | CBS Corp. Class B | 4,131 | ||||||

| 107 | Comcast Corp. Class A | 5,945 | ||||||

| 112 | Thomson Reuters Corp. | 4,165 | ||||||

| 76 | Walt Disney Co. | 6,936 | ||||||

| 21,177 | ||||||||

| Pharmaceuticals, Biotechnology and Life Sciences - 10.6% | ||||||||

| 74 | Agilent Technologies, Inc. | 4,074 | ||||||

| 44 | Amgen, Inc. | 7,103 | ||||||

| 79 | AstraZeneca plc ADR | 5,755 | ||||||

| 155 | Bristol-Myers Squibb Co. | 8,996 | ||||||

| 61 | Celgene Corp. ● | 6,575 | ||||||

| 69 | Gilead Sciences, Inc. ● | 7,683 | ||||||

| 28 | Johnson & Johnson | 2,986 | ||||||

| 223 | Merck & Co., Inc. | 12,938 | ||||||

| 20 | Roche Holding AG | 6,036 | ||||||

| 90 | UCB S.A. | 7,220 | ||||||

| 50 | Vertex Pharmaceuticals, Inc. ● | 5,576 | ||||||

| 55 | Zoetis, Inc. | 2,055 | ||||||

| 76,997 | ||||||||

| Retailing - 3.0% | ||||||||

| 2,007 | Allstar Co. ⌂●† | 1,703 | ||||||

| 10 | AutoZone, Inc. ● | 5,369 | ||||||

| 75 | Home Depot, Inc. | 7,314 | ||||||

| 67 | Nordstrom, Inc. | 4,865 | ||||||

| 32 | Tory Burch LLC ⌂●† | 2,123 | ||||||

| 21,374 | ||||||||

| Semiconductors and Semiconductor Equipment - 3.6% | ||||||||

| 115 | Analog Devices, Inc. | 5,682 | ||||||

| 276 | Intel Corp. | 9,370 | ||||||

| 277 | Maxim Integrated Products, Inc. | 8,124 | ||||||

| 65 | Xilinx, Inc. | 2,882 | ||||||

| 26,058 | ||||||||

| Software and Services - 6.6% | ||||||||

| 78 | Accenture plc | 6,287 | ||||||

| 95 | eBay, Inc. ● | 4,993 | ||||||

| 18 | Google, Inc. Class C ● | 9,895 | ||||||

| 300 | Microsoft Corp. | 14,104 | ||||||

| 139 | Oracle Corp. | 5,428 | ||||||

| 282 | Symantec Corp. | 7,007 | ||||||

| 47,714 | ||||||||

| Technology Hardware and Equipment - 5.5% | ||||||||

| 145 | Apple, Inc. | 15,703 | ||||||

| 487 | Cisco Systems, Inc. | 11,912 | ||||||

| 281 | EMC Corp. | 8,085 | ||||||

| 50 | Qualcomm, Inc. | 3,957 | ||||||

| 39,657 | ||||||||

| Telecommunication Services - 0.4% | ||||||||

| 56 | Verizon Communications, Inc. | 2,820 | ||||||

| Transportation - 0.9% | ||||||||

| 41 | FedEx Corp. | 6,780 | ||||||

The accompanying notes are an integral part of these financial statements.

| 6 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

| Shares or Principal Amount | Market Value ╪ | |||||||

| Common Stocks - 68.8% - (continued) | ||||||||

| Utilities - 1.2% | ||||||||

| 85 | NextEra Energy, Inc. | $ | 8,489 | |||||

| Total Common Stocks | ||||||||

| (Cost $337,315) | $ | 498,144 | ||||||

Asset and Commercial Mortgage Backed Securities - 0.3% | ||||||||

| Finance and Insurance - 0.3% | ||||||||

| Ally Master Owner Trust | ||||||||

| $ | 900 | 1.54%, 09/15/2019 | $ | 900 | ||||

| Hilton USA Trust | ||||||||

| 345 | 2.66%, 11/05/2030 ■ | 347 | ||||||

| Santander Drive Automotive Receivables Trust | ||||||||

| 85 | 2.33%, 11/15/2019 | 85 | ||||||

| 140 | 2.57%, 03/15/2019 | 142 | ||||||

| SBA Tower Trust | ||||||||

| 310 | 2.90%, 10/15/2044 ■Δ | 311 | ||||||

| Westlake Automobile Receivables Trust | ||||||||

| 360 | 0.97%, 10/16/2017 ■ | 360 | ||||||

| 2,145 | ||||||||

| Total Asset and Commercial Mortgage Backed Securities | ||||||||

| (Cost $2,143) | $ | 2,145 | ||||||

Corporate Bonds - 9.7% | ||||||||

| Accommodation and Food Services - 0.0% | ||||||||

| Sysco Corp. | ||||||||

| $ | 85 | 3.00%, 10/02/2021 | $ | 86 | ||||

| 50 | 3.50%, 10/02/2024 | 51 | ||||||

| 137 | ||||||||

| Air Transportation - 0.2% | ||||||||

| Continental Airlines, Inc. | ||||||||

| 623 | 5.98%, 04/19/2022 | 689 | ||||||

| Southwest Airlines Co. | ||||||||

| 400 | 5.75%, 12/15/2016 | 436 | ||||||

| 514 | 6.15%, 08/01/2022 | 590 | ||||||

| 1,715 | ||||||||

| Arts, Entertainment and Recreation - 0.5% | ||||||||

| 21st Century Fox America | ||||||||

| 180 | 4.00%, 10/01/2023 | 188 | ||||||

| British Sky Broadcasting Group plc | ||||||||

| 220 | 3.75%, 09/16/2024 ■ | 221 | ||||||

| Comcast Corp. | ||||||||

| 1,000 | 5.90%, 03/15/2016 | 1,070 | ||||||

| 150 | 6.40%, 05/15/2038 | 192 | ||||||

| DirecTV Holdings LLC | ||||||||

| 545 | 4.45%, 04/01/2024 | 569 | ||||||

| Discovery Communications, Inc. | ||||||||

| 55 | 3.25%, 04/01/2023 | 54 | ||||||

| News America, Inc. | ||||||||

| 220 | 4.50%, 02/15/2021 | 240 | ||||||

| Time Warner Cable, Inc. | ||||||||

| 780 | 5.85%, 05/01/2017 | 862 | ||||||

| 80 | 6.55%, 05/01/2037 | 101 | ||||||

| 60 | 7.30%, 07/01/2038 | 82 | ||||||

| Viacom, Inc. | ||||||||

| 145 | 3.88%, 12/15/2021 | 150 | ||||||

| 3,729 | ||||||||

| Beverage and Tobacco Product Manufacturing - 0.4% | ||||||||

| Altria Group, Inc. | ||||||||

| 330 | 4.50%, 05/02/2043 | 320 | ||||||

| 420 | 4.75%, 05/05/2021 | 463 | ||||||

| Anheuser-Busch InBev Worldwide, Inc. | ||||||||

| 610 | 7.75%, 01/15/2019 | 740 | ||||||

| BAT International Finance plc | ||||||||

| 565 | 3.25%, 06/07/2022 ■ | 567 | ||||||

| Coca-Cola Femsa S.A.B. de C.V. | ||||||||

| 222 | 2.38%, 11/26/2018 | 224 | ||||||

| 250 | 3.88%, 11/26/2023 | 260 | ||||||

| Molson Coors Brewing Co. | ||||||||

| 12 | 2.00%, 05/01/2017 | 12 | ||||||

| 180 | 3.50%, 05/01/2022 | 181 | ||||||

| 85 | 5.00%, 05/01/2042 | 88 | ||||||

| Philip Morris International, Inc. | ||||||||

| 300 | 2.63%, 03/06/2023 | 291 | ||||||

| 3,146 | ||||||||

| Chemical Manufacturing - 0.0% | ||||||||

| Monsanto Co. | ||||||||

| 65 | 4.70%, 07/15/2064 | 67 | ||||||

| Computer and Electronic Product Manufacturing - 0.1% | ||||||||

| Apple, Inc. | ||||||||

| 300 | 2.85%, 05/06/2021 | 304 | ||||||

| 270 | 3.45%, 05/06/2024 | 278 | ||||||

| 35 | 4.45%, 05/06/2044 | 37 | ||||||

| EMC Corp. | ||||||||

| 366 | 1.88%, 06/01/2018 | 364 | ||||||

| 983 | ||||||||

| Couriers and Messengers - 0.1% | ||||||||

| FedEx Corp. | ||||||||

| 50 | 2.63%, 08/01/2022 | 49 | ||||||

| 80 | 2.70%, 04/15/2023 | 77 | ||||||

| 180 | 4.90%, 01/15/2034 | 197 | ||||||

| 300 | 5.10%, 01/15/2044 | 330 | ||||||

| 653 | ||||||||

| Finance and Insurance - 4.7% | ||||||||

| ACE INA Holdings, Inc. | ||||||||

| 185 | 3.35%, 05/15/2024 | 186 | ||||||

| American Express Centurion Bank | ||||||||

| 1,200 | 6.00%, 09/13/2017 | 1,348 | ||||||

| American International Group, Inc. | ||||||||

| 180 | 4.13%, 02/15/2024 | 190 | ||||||

| American Tower Corp. | ||||||||

| 225 | 3.45%, 09/15/2021 | 220 | ||||||

| AvalonBay Communities, Inc. | ||||||||

| 150 | 3.63%, 10/01/2020 | 156 | ||||||

| Bank of America Corp. | ||||||||

| 750 | 4.20%, 08/26/2024 | 756 | ||||||

| 560 | 5.00%, 05/13/2021 | 620 | ||||||

| 1,200 | 5.42%, 03/15/2017 | 1,299 | ||||||

| Barclays Bank plc | ||||||||

| 200 | 2.50%, 02/20/2019 | 202 | ||||||

| 350 | 3.75%, 05/15/2024 | 354 | ||||||

| 150 | 6.05%, 12/04/2017 ■ | 166 | ||||||

| BNP Paribas | ||||||||

| 425 | 2.40%, 12/12/2018 | 428 | ||||||

| 65 | 3.25%, 03/03/2023 | 65 | ||||||

The accompanying notes are an integral part of these financial statements.

| 7 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

| Shares or Principal Amount | Market Value ╪ | |||||||

| Corporate Bonds - 9.7% - (continued) | ||||||||

| Finance and Insurance - 4.7% - (continued) | ||||||||

| BP Capital Markets plc | ||||||||

| $ | 25 | 3.99%, 09/26/2023 | $ | 26 | ||||

| 575 | 4.75%, 03/10/2019 | 634 | ||||||

| BPCE S.A. | ||||||||

| 375 | 2.50%, 12/10/2018 | 377 | ||||||

| 250 | 4.00%, 04/15/2024 | 258 | ||||||

| 200 | 5.15%, 07/21/2024 ■ | 206 | ||||||

| Brandywine Operating Partnership L.P. | ||||||||

| 350 | 5.70%, 05/01/2017 | 381 | ||||||

| Capital One Bank | ||||||||

| 345 | 2.15%, 11/21/2018 | 344 | ||||||

| Capital One Financial Corp. | ||||||||

| 445 | 2.15%, 03/23/2015 | 448 | ||||||

| 615 | 3.75%, 04/24/2024 | 623 | ||||||

| Caterpillar Financial Services Corp. | ||||||||

| 400 | 3.30%, 06/09/2024 | 402 | ||||||

| CDP Financial, Inc. | ||||||||

| 575 | 4.40%, 11/25/2019 ■ | 636 | ||||||

| Citigroup, Inc. | ||||||||

| 255 | 2.50%, 07/29/2019 | 256 | ||||||

| 300 | 4.95%, 11/07/2043 | 328 | ||||||

| 140 | 5.30%, 05/06/2044 | 149 | ||||||

| 550 | 5.85%, 08/02/2016 | 593 | ||||||

| 300 | 6.13%, 05/15/2018 | 341 | ||||||

| 105 | 8.13%, 07/15/2039 | 158 | ||||||

| Credit Agricole S.A. | ||||||||

| 405 | 2.50%, 04/15/2019 ■ | 408 | ||||||

| Credit Suisse New York | ||||||||

| 250 | 2.30%, 05/28/2019 | 250 | ||||||

| 335 | 3.63%, 09/09/2024 | 336 | ||||||

| Discover Financial Services | ||||||||

| 645 | 6.45%, 06/12/2017 | 720 | ||||||

| Eaton Vance Corp. | ||||||||

| 99 | 6.50%, 10/02/2017 | 112 | ||||||

| Five Corners Funding Trust | ||||||||

| 315 | 4.42%, 11/15/2023 ■ | 333 | ||||||

| Ford Motor Credit Co. LLC | ||||||||

| 615 | 2.38%, 03/12/2019 | 614 | ||||||

| General Electric Capital Corp. | ||||||||

| 400 | 3.10%, 01/09/2023 | 401 | ||||||

| 800 | 4.63%, 01/07/2021 | 892 | ||||||

| 925 | 5.88%, 01/14/2038 | 1,135 | ||||||

| Goldman Sachs Group, Inc. | ||||||||

| 655 | 2.38%, 01/22/2018 | 661 | ||||||

| 275 | 3.63%, 01/22/2023 | 276 | ||||||

| 250 | 3.70%, 08/01/2015 | 256 | ||||||

| 595 | 5.63%, 01/15/2017 | 645 | ||||||

| 470 | 6.25%, 02/01/2041 | 582 | ||||||

| HCP, Inc. | ||||||||

| 335 | 6.00%, 01/30/2017 | 370 | ||||||

| HSBC Holdings plc | ||||||||

| 650 | 6.10%, 01/14/2042 | 841 | ||||||

| ING Bank N.V. | ||||||||

| 900 | 3.75%, 03/07/2017 ■ | 948 | ||||||

| JP Morgan Chase & Co. | ||||||||

| 650 | 3.25%, 09/23/2022 | 651 | ||||||

| 180 | 3.38%, 05/01/2023 | 176 | ||||||

| 475 | 3.70%, 01/20/2015 | 478 | ||||||

| 230 | 5.40%, 01/06/2042 | 267 | ||||||

| 100 | 6.30%, 04/23/2019 | 116 | ||||||

| Korea Development Bank | ||||||||

| 550 | 2.50%, 03/11/2020 | 548 | ||||||

| Liberty Mutual Group, Inc. | ||||||||

| 100 | 4.25%, 06/15/2023 ■ | 103 | ||||||

| Loews Corp. | ||||||||

| 165 | 2.63%, 05/15/2023 | 157 | ||||||

| Merrill Lynch & Co., Inc. | ||||||||

| 300 | 6.40%, 08/28/2017 | 338 | ||||||

| MetLife, Inc. | ||||||||

| 60 | 1.90%, 12/15/2017 | 61 | ||||||

| 525 | 3.60%, 04/10/2024 | 535 | ||||||

| 235 | 4.88%, 11/13/2043 | 255 | ||||||

| Morgan Stanley | ||||||||

| 425 | 2.50%, 01/24/2019 | 428 | ||||||

| 200 | 3.70%, 10/23/2024 | 200 | ||||||

| 550 | 5.75%, 01/25/2021 | 631 | ||||||

| National City Corp. | ||||||||

| 125 | 6.88%, 05/15/2019 | 148 | ||||||

| Nissan Motor Acceptance Corp. | ||||||||

| 700 | 1.80%, 03/15/2018 ■ | 700 | ||||||

| Nordea Bank AB | ||||||||

| 330 | 3.70%, 11/13/2014 ■ | 330 | ||||||

| Prudential Financial, Inc. | ||||||||

| 200 | 3.50%, 05/15/2024 | 201 | ||||||

| 300 | 4.50%, 11/15/2020 | 326 | ||||||

| Rabobank Nederland | ||||||||

| 750 | 3.20%, 03/11/2015 ■ | 757 | ||||||

| Republic New York Capital I | ||||||||

| 250 | 7.75%, 11/15/2026 | 252 | ||||||

| Scentre Group | ||||||||

| 345 | 2.38%, 11/05/2019 ■☼ | 344 | ||||||

| Sovereign Bancorp, Inc. | ||||||||

| 1,000 | 8.75%, 05/30/2018 | 1,210 | ||||||

| State Grid Overseas Investment | ||||||||

| 380 | 2.75%, 05/07/2019 ■ | 383 | ||||||

| Synchrony Financial | ||||||||

| 75 | 3.00%, 08/15/2019 | 76 | ||||||

| Teachers Insurance & Annuity Association of America | ||||||||

| 100 | 4.90%, 09/15/2044 ■ | 106 | ||||||

| U.S. Bancorp | ||||||||

| 165 | 3.70%, 01/30/2024 | 172 | ||||||

| Wachovia Corp. | ||||||||

| 100 | 5.75%, 06/15/2017 | 111 | ||||||

| Wellpoint, Inc. | ||||||||

| 81 | 3.30%, 01/15/2023 | 80 | ||||||

| Wells Fargo & Co. | ||||||||

| 1,794 | 4.48%, 01/16/2024 | 1,899 | ||||||

| 33,969 | ||||||||

| Food Manufacturing - 0.2% | ||||||||

| ConAgra Foods, Inc. | ||||||||

| 50 | 1.90%, 01/25/2018 | 50 | ||||||

| Kraft Foods Group, Inc. | ||||||||

| 145 | 2.25%, 06/05/2017 | 148 | ||||||

| 90 | 3.50%, 06/06/2022 | 92 | ||||||

| Mondelez International, Inc. | ||||||||

| 700 | 4.13%, 02/09/2016 | 728 | ||||||

| Tyson Foods, Inc. | ||||||||

| 65 | 2.65%, 08/15/2019 | 66 | ||||||

| 1,084 | ||||||||

The accompanying notes are an integral part of these financial statements.

| 8 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

| Shares or Principal Amount | Market Value ╪ | |||||||

| Corporate Bonds - 9.7% - (continued) | ||||||||

| Health Care and Social Assistance - 0.7% | ||||||||

| Actavis Funding SCS | ||||||||

| $ | 250 | 4.85%, 06/15/2044 ■ | $ | 236 | ||||

| Bayer Finance LLC | ||||||||

| 375 | 3.00%, 10/08/2021 ■ | 377 | ||||||

| Catholic Health Initiatives | ||||||||

| 155 | 2.60%, 08/01/2018 | 158 | ||||||

| Celgene Corp. | ||||||||

| 55 | 2.25%, 05/15/2019 | 55 | ||||||

| 125 | 3.63%, 05/15/2024 | 126 | ||||||

| CVS Caremark Corp. | ||||||||

| 470 | 4.00%, 12/05/2023 | 495 | ||||||

| Dignity Health | ||||||||

| 35 | 2.64%, 11/01/2019 | 35 | ||||||

| 80 | 3.81%, 11/01/2024 | 82 | ||||||

| Eli Lilly & Co. | ||||||||

| 215 | 4.65%, 06/15/2044 | 232 | ||||||

| Express Scripts Holding Co. | ||||||||

| 315 | 2.25%, 06/15/2019 | 313 | ||||||

| 460 | 3.50%, 06/15/2024 | 456 | ||||||

| Forest Laboratories, Inc. | ||||||||

| 60 | 4.88%, 02/15/2021 ■ | 64 | ||||||

| Gilead Sciences, Inc. | ||||||||

| 195 | 3.70%, 04/01/2024 | 200 | ||||||

| GlaxoSmithKline Capital, Inc. | ||||||||

| 460 | 2.80%, 03/18/2023 | 452 | ||||||

| Kaiser Foundation Hospitals | ||||||||

| 60 | 3.50%, 04/01/2022 | 61 | ||||||

| 115 | 4.88%, 04/01/2042 | 128 | ||||||

| McKesson Corp. | ||||||||

| 25 | 2.85%, 03/15/2023 | 24 | ||||||

| 205 | 3.80%, 03/15/2024 | 208 | ||||||

| Medtronic, Inc. | ||||||||

| 65 | 3.63%, 03/15/2024 | 66 | ||||||

| Merck & Co., Inc. | ||||||||

| 315 | 2.80%, 05/18/2023 | 312 | ||||||

| 125 | 4.15%, 05/18/2043 | 130 | ||||||

| Novartis Capital Corp. | ||||||||

| 550 | 3.40%, 05/06/2024 | 565 | ||||||

| Zoetis, Inc. | ||||||||

| 30 | 3.25%, 02/01/2023 | 30 | ||||||

| 35 | 4.70%, 02/01/2043 | 36 | ||||||

| 4,841 | ||||||||

| Information - 0.6% | ||||||||

| America Movil S.A.B. de C.V. | ||||||||

| 250 | 3.13%, 07/16/2022 | 246 | ||||||

| AT&T, Inc. | ||||||||

| 25 | 5.35%, 09/01/2040 | 27 | ||||||

| 105 | 5.55%, 08/15/2041 | 115 | ||||||

| 175 | 6.55%, 02/15/2039 | 217 | ||||||

| Orange S.A. | ||||||||

| 650 | 4.13%, 09/14/2021 | 687 | ||||||

| Verizon Communications, Inc. | ||||||||

| 45 | 3.45%, 03/15/2021 | 46 | ||||||

| 490 | 3.50%, 11/01/2021 | 500 | ||||||

| 880 | 4.50%, 09/15/2020 | 955 | ||||||

| 130 | 4.75%, 11/01/2041 | 131 | ||||||

| 1,180 | 6.40%, 09/15/2033 | 1,437 | ||||||

| 4,361 | ||||||||

| Machinery Manufacturing - 0.1% | ||||||||

| Caterpillar, Inc. | ||||||||

| 170 | 3.40%, 05/15/2024 | 174 | ||||||

| 100 | 4.30%, 05/15/2044 | 103 | ||||||

| Hutchison Whampoa International Ltd. | ||||||||

| 200 | 3.63%, 10/31/2024 ■ | 198 | ||||||

| 475 | ||||||||

| Mining - 0.1% | ||||||||

| BHP Billiton Finance USA Ltd. | ||||||||

| 335 | 3.85%, 09/30/2023 | 351 | ||||||

| Rio Tinto Finance USA Ltd. | ||||||||

| 365 | 3.75%, 09/20/2021 | 380 | ||||||

| 731 | ||||||||

| Miscellaneous Manufacturing - 0.0% | ||||||||

| United Technologies Corp. | ||||||||

| 65 | 3.10%, 06/01/2022 | 66 | ||||||

| Motor Vehicle and Parts Manufacturing - 0.1% | ||||||||

| Daimler Finance NA LLC | ||||||||

| 1,000 | 2.63%, 09/15/2016 ■ | 1,029 | ||||||

| Other Services - 0.0% | ||||||||

| Illinois Tool Works, Inc. | ||||||||

| 165 | 3.50%, 03/01/2024 | 170 | ||||||

| Petroleum and Coal Products Manufacturing - 0.4% | ||||||||

| Atmos Energy Corp. | ||||||||

| 1,160 | 6.35%, 06/15/2017 | 1,308 | ||||||

| Gazprom Neft OAO via GPN Capital S.A. | ||||||||

| 200 | 4.38%, 09/19/2022 ■ | 177 | ||||||

| Schlumberger Investment S.A. | ||||||||

| 330 | 3.65%, 12/01/2023 | 345 | ||||||

| Shell International Finance B.V. | ||||||||

| 200 | 4.38%, 03/25/2020 | 221 | ||||||

| Statoil ASA | ||||||||

| 310 | 2.90%, 11/08/2020 | 318 | ||||||

| Total Capital S.A. | ||||||||

| 325 | 2.70%, 01/25/2023 | 316 | ||||||

| 2,685 | ||||||||

| Pipeline Transportation - 0.2% | ||||||||

| Kinder Morgan Energy Partners L.P. | ||||||||

| 1,000 | 6.95%, 01/15/2038 | 1,167 | ||||||

| Real Estate, Rental and Leasing - 0.1% | ||||||||

| ERAC USA Finance Co. | ||||||||

| 140 | 2.35%, 10/15/2019 ■ | 139 | ||||||

| 70 | 2.75%, 03/15/2017 ■ | 72 | ||||||

| 510 | 4.50%, 08/16/2021 ■ | 555 | ||||||

| 250 | 5.63%, 03/15/2042 ■ | 285 | ||||||

| 1,051 | ||||||||

| Retail Trade - 0.3% | ||||||||

| Amazon.com, Inc. | ||||||||

| 285 | 2.50%, 11/29/2022 | 267 | ||||||

| AutoZone, Inc. | ||||||||

| 200 | 3.13%, 07/15/2023 | 195 | ||||||

| 355 | 3.70%, 04/15/2022 | 363 | ||||||

| Home Depot, Inc. | ||||||||

| 75 | 4.40%, 03/15/2045 | 79 | ||||||

| Kroger (The) Co. | ||||||||

| 125 | 3.30%, 01/15/2021 | 127 | ||||||

| 230 | 4.00%, 02/01/2024 | 239 | ||||||

The accompanying notes are an integral part of these financial statements.

| 9 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

| Shares or Principal Amount | Market Value ╪ | |||||||

| Corporate Bonds - 9.7% - (continued) | ||||||||

| Retail Trade - 0.3% - (continued) | ||||||||

| Lowe's Cos., Inc. | ||||||||

| $ | 600 | 4.63%, 04/15/2020 | $ | 668 | ||||

| 1,938 | ||||||||

| Soap, Cleaning Compound and Toilet Manufacturing - 0.3% | ||||||||

| Procter & Gamble Co. | ||||||||

| 1,457 | 9.36%, 01/01/2021 | 1,817 | ||||||

| Utilities - 0.6% | ||||||||

| Consolidated Edison Co. of NY | ||||||||

| 655 | 5.30%, 12/01/2016 | 714 | ||||||

| Electricitie De France | ||||||||

| 525 | 4.88%, 01/22/2044 ■ | 559 | ||||||

| 525 | 5.63%, 01/22/2024 ■♠ | 556 | ||||||

| Indianapolis Power and Light | ||||||||

| 750 | 6.60%, 06/01/2037 ■ | 1,024 | ||||||

| NiSource Finance Corp. | ||||||||

| 70 | 4.80%, 02/15/2044 | 74 | ||||||

| Pacific Gas & Electric Co. | ||||||||

| 135 | 3.85%, 11/15/2023 | 142 | ||||||

| 85 | 5.13%, 11/15/2043 | 96 | ||||||

| Southern California Edison Co. | ||||||||

| 750 | 5.55%, 01/15/2037 | 921 | ||||||

| 4,086 | ||||||||

| Wholesale Trade - 0.0% | ||||||||

| Heineken N.V. | ||||||||

| 245 | 2.75%, 04/01/2023 ■ | 234 | ||||||

| 10 | 4.00%, 10/01/2042 ■ | 9 | ||||||

| 243 | ||||||||

| Total Corporate Bonds | ||||||||

| (Cost $65,689) | $ | 70,143 | ||||||

Foreign Government Obligations - 0.1% | ||||||||

| Mexico - 0.1% | ||||||||

| Mexico (United Mexican States) | ||||||||

| $ | 372 | 3.50%, 01/21/2021 | $ | 383 | ||||

| Total Foreign Government Obligations | ||||||||

| (Cost $370) | $ | 383 | ||||||

Municipal Bonds - 0.9% | ||||||||

| General Obligations - 0.2% | ||||||||

| California State GO, Taxable, | ||||||||

| $ | 250 | 7.55%, 04/01/2039 | $ | 375 | ||||

| Chicago, IL, Metropolitan Water Reclamation GO, | ||||||||

| 130 | 5.72%, 12/01/2038 | 162 | ||||||

| Illinois State GO, | ||||||||

| 150 | 5.10%, 06/01/2033 | 147 | ||||||

| Los Angeles, CA, USD GO, | ||||||||

| 800 | 5.75%, 07/01/2034 | 987 | ||||||

| 1,671 | ||||||||

| Health Care/Services - 0.1% | ||||||||

| University of California, | ||||||||

| 100 | 6.55%, 05/15/2048 | 132 | ||||||

| University of California, Regents MedCenter Pooled Rev, | ||||||||

| 375 | 6.58%, 05/15/2049 | 494 | ||||||

| 626 | ||||||||

| Higher Education (Univ., Dorms, etc.) - 0.1% | ||||||||

| University of California, Build America Bonds Rev, | ||||||||

| 370 | 5.77%, 05/15/2043 | 454 | ||||||

| Tax Allocation - 0.1% | ||||||||

| Dallas, TX, Area Rapid Transit Sales Tax Rev, | ||||||||

| 425 | 6.00%, 12/01/2044 | 558 | ||||||

| Transportation - 0.4% | ||||||||

| Bay Area, CA, Toll Auth Bridge Rev, | ||||||||

| 650 | 6.26%, 04/01/2049 | 894 | ||||||

| Illinois State Toll Highway Auth, Taxable Rev, | ||||||||

| 350 | 6.18%, 01/01/2034 | 442 | ||||||

| Maryland State Transportation Auth, | ||||||||

| 255 | 5.89%, 07/01/2043 | 326 | ||||||

| New York & New Jersey PA, | ||||||||

| 185 | 5.86%, 12/01/2024 | 230 | ||||||

| 115 | 6.04%, 12/01/2029 | 145 | ||||||

| North Texas Tollway Auth Rev, | ||||||||

| 730 | 6.72%, 01/01/2049 | 1,015 | ||||||

| 3,052 | ||||||||

| Utilities - Combined - 0.0% | ||||||||

| Utility Debt Securitization Auth, New York, | ||||||||

| 100 | 3.44%, 12/15/2025 | 104 | ||||||

| Utilities - Electric - 0.0% | ||||||||

| Municipal Elec Auth Georgia, | ||||||||

| 150 | 6.64%, 04/01/2057 | 191 | ||||||

| Total Municipal Bonds | ||||||||

| (Cost $5,326) | $ | 6,656 | ||||||

| U.S. Government Agencies - 2.6% | ||||||||

| FHLMC - 0.4% | ||||||||

| $ | 68 | 4.00%, 03/01/2041 | $ | 73 | ||||

| 2,815 | 4.50%, 08/01/2033 - 11/01/2043 | 3,057 | ||||||

| 3,130 | ||||||||

| FNMA - 1.9% | ||||||||

| 12,387 | 4.50%, 04/01/2039 - 06/01/2044 | 13,448 | ||||||

| GNMA - 0.3% | ||||||||

| 436 | 6.00%, 11/20/2023 - 09/15/2034 | 494 | ||||||

| 591 | 6.50%, 04/15/2026 - 02/15/2035 | 675 | ||||||

| 628 | 7.00%, 11/15/2031 - 11/15/2033 | 743 | ||||||

| 137 | 8.00%, 12/15/2029 - 02/15/2031 | 149 | ||||||

| 2,061 | ||||||||

| Total U.S. Government Agencies | ||||||||

| (Cost $18,212) | $ | 18,639 | ||||||

| U.S. Government Securities - 13.6% | ||||||||

| Other Direct Federal Obligations - 0.9% | ||||||||

| FFC - 0.9% | ||||||||

| $ | 5,000 | 9.80%, 04/06/2018 | $ | 6,423 | ||||

The accompanying notes are an integral part of these financial statements.

| 10 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

| Shares or Principal Amount | Market Value ╪ | |||||||||||

| U.S. Government Securities - 13.6% - (continued) | ||||||||||||

| U.S. Treasury Securities - 12.7% | ||||||||||||

| U.S. Treasury Bonds - 1.9% | ||||||||||||

| $ | 865 | 2.75%, 11/15/2042 | $ | 813 | ||||||||

| 5,420 | 2.88%, 05/15/2043 | 5,218 | ||||||||||

| 3,988 | 3.13%, 02/15/2043 - 08/15/2044 | 4,035 | ||||||||||

| 1,850 | 3.38%, 05/15/2044 | 1,963 | ||||||||||

| 1,400 | 6.00%, 02/15/2026 ‡ | 1,890 | ||||||||||

| 13,919 | ||||||||||||

| U.S. Treasury Notes - 10.8% | ||||||||||||

| 490 | 0.25%, 11/30/2015 | 491 | ||||||||||

| 4,350 | 0.38%, 06/30/2015 - 05/31/2016 □ | 4,354 | ||||||||||

| 15,000 | 0.50%, 08/31/2016 | 15,021 | ||||||||||

| 1,500 | 0.63%, 05/31/2017 | 1,494 | ||||||||||

| 534 | 0.88%, 01/31/2017 | 537 | ||||||||||

| 9,300 | 1.00%, 09/30/2016 - 05/31/2018 | 9,321 | ||||||||||

| 1,525 | 1.25%, 11/30/2018 | 1,516 | ||||||||||

| 9,400 | 1.38%, 09/30/2018 | 9,413 | ||||||||||

| 5,000 | 1.50%, 06/30/2016 | 5,091 | ||||||||||

| 8,280 | 1.63%, 07/31/2019 | 8,300 | ||||||||||

| 9,745 | 1.75%, 09/30/2019 | 9,810 | ||||||||||

| 2,365 | 2.38%, 08/15/2024 | 2,374 | ||||||||||

| 1,850 | 2.75%, 02/15/2024 | 1,921 | ||||||||||

| 955 | 3.50%, 05/15/2020 | 1,043 | ||||||||||

| 1,950 | 3.88%, 05/15/2018 | 2,131 | ||||||||||

| 5,200 | 4.50%, 05/15/2017 | 5,688 | ||||||||||

| 78,505 | ||||||||||||

| 92,424 | ||||||||||||

| Total U.S. Government Securities | ||||||||||||

| (Cost $95,670) | $ | 98,847 | ||||||||||

| Total Long-Term Investments | ||||||||||||

| (Cost $524,725) | $ | 694,957 | ||||||||||

| Short-Term Investments - 3.9% | ||||||||||||

| Repurchase Agreements - 3.9% | ||||||||||||

| Bank of America Merrill Lynch TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $82, collateralized by U.S. Treasury Note 1.50%, 2019, value of $83) | ||||||||||||

| $ | 81 | 0.08%, 10/31/2014 | $ | 81 | ||||||||

| Bank of America Merrill Lynch TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $1,389, collateralized by GNMA 1.63% - 7.00%, 2031 - 2054, value of $1,417) | ||||||||||||

| 1,389 | 0.09%, 10/31/2014 | 1,389 | ||||||||||

| Bank of Montreal TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $373, collateralized by U.S. Treasury Bond 2.88% - 5.25%, 2029 - 2043, U.S. Treasury Note 0.38% - 4.50%, 2015 - 2022, value of $381) | ||||||||||||

| 373 | 0.08%, 10/31/2014 | 373 | ||||||||||

| Bank of Montreal TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $1,265, collateralized by FHLMC 2.00% - 5.50%, 2022 - 2034, FNMA 2.00% - 4.50%, 2024 - 2039, GNMA 3.00%, 2043, U.S. Treasury Note 4.63%, 2017, value of $1,290) | ||||||||||||

| 1,265 | 0.10%, 10/31/2014 | 1,265 | ||||||||||

| Barclays Capital TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $4,766, collateralized by U.S. Treasury Bond 4.50% - 6.25%, 2023 - 2036, U.S. Treasury Note 1.63% - 2.13%, 2015 - 2019, value of $4,861) | ||||||||||||

| 4,766 | 0.08%, 10/31/2014 | 4,766 | ||||||||||

| Citigroup Global Markets, Inc. TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $5,478, collateralized by U.S. Treasury Bill 0.02%, 2015, U.S. Treasury Bond 3.88% - 11.25%, 2015 - 2040, U.S. Treasury Note 2.00% - 3.38%, 2019 - 2021, value of $5,587) | ||||||||||||

| 5,478 | 0.09%, 10/31/2014 | 5,478 | ||||||||||

| Deutsche Bank Securities TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $316, collateralized by U.S. Treasury Note 0.88%, 2017, value of $323) | ||||||||||||

| 316 | 0.13%, 10/31/2014 | 316 | ||||||||||

| RBS Securities, Inc. TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $465, collateralized by U.S. Treasury Bond 3.63% - 5.00%, 2037 - 2043, U.S. Treasury Note 2.13%, 2020, value of $475) | ||||||||||||

| 465 | 0.07%, 10/31/2014 | 465 | ||||||||||

| Societe Generale TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $4,904, collateralized by U.S. Treasury Bill 0.02%, 2015, U.S. Treasury Bond 3.75% - 11.25%, 2015 - 2043, U.S. Treasury Note 1.38% - 4.25%, 2015 - 2022, value of $5,002) | ||||||||||||

| 4,904 | 0.08%, 10/31/2014 | 4,904 | ||||||||||

| TD Securities TriParty Repurchase Agreement (maturing on 11/03/2014 in the amount of $9,503, collateralized by FHLMC 3.00% - 4.00%, 2026 - 2044, FNMA 2.50% - 5.00%, 2025 - 2044, U.S. Treasury Bond 3.50% - 6.50%, 2026 - 2041, U.S. Treasury Note 1.75% - 2.88%, 2018 - 2019, value of $9,693) | ||||||||||||

| 9,503 | 0.10%, 10/31/2014 | 9,503 | ||||||||||

| 28,540 | ||||||||||||

| Total Short-Term Investments | ||||||||||||

| (Cost $28,540) | $ | 28,540 | ||||||||||

| Total Investments | ||||||||||||

| (Cost $553,265) ▲ | 99.9 | % | $ | 723,497 | ||||||||

| Other Assets and Liabilities | 0.1 | % | 811 | |||||||||

| Total Net Assets | 100.0 | % | $ | 724,308 | ||||||||

The accompanying notes are an integral part of these financial statements.

| 11 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

Prices of foreign equities that are principally traded on certain foreign markets may be adjusted daily pursuant to a fair value pricing service approved by the Board of Directors in order to reflect an adjustment for factors occurring after the close of certain foreign markets but before the close of the New York Stock Exchange.

The Fund may refer to any one or more of the industry classifications used by one or more widely recognized market indices, ratings group indices and/or as defined by Fund management. Industry classifications may not be identical across all security types.

Equity industry classifications used in this report are the Global Industry Classification Standard, which was developed by and is the exclusive property and service mark of MSCI, Inc. and Standard & Poor’s.

For Fund compliance purposes, the Fund may not use the same classification system shown in this report as these classifications are used for reporting ease.

| ▲ | At October 31, 2014, the cost of securities for federal income tax purposes was $556,241 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | $ | 172,827 | ||

| Unrealized Depreciation | (5,571 | ) | ||

| Net Unrealized Appreciation | $ | 167,256 |

| † | These securities were valued in good faith at fair value as determined under policies and procedures established by and under the supervision of the Board of Directors. At October 31, 2014, the aggregate fair value of these securities was $3,826, which represents 0.5% of total net assets. This amount excludes securities that are principally traded in certain foreign markets and whose prices are adjusted pursuant to a third party pricing service methodology approved by the Board of Directors. |

| ● | Non-income producing. |

| Δ | Variable rate securities; the rate reported is the coupon rate in effect at October 31, 2014. |

| ■ | Securities issued within terms of a private placement memorandum, exempt from registration under Rule 144A under the Securities Act of 1933, as amended, and may be sold only to qualified institutional buyers. Unless otherwise indicated, these holdings are determined to be liquid. At October 31, 2014, the aggregate value of these securities was $12,740, which represents 1.8% of total net assets. |

| ⌂ | The following securities are considered illiquid. Illiquid securities are often purchased in private placement transactions, are often not registered under the Securities Act of 1933, as amended, and may have contractual restrictions on resale. A security may also be considered illiquid if the security lacks a readily available market or if its valuation has not changed for a certain period of time. |

| Period Acquired | Shares/ Par | Security | Cost Basis | |||||||

| 08/2011 | 2,007 | Allstar Co. | $ | 873 | ||||||

| 11/2013 | 32 | Tory Burch LLC | 2,539 | |||||||

At October 31, 2014, the aggregate value of these securities was $3,826, which represents 0.5% of total net assets.

| ♠ | Perpetual maturity security. Maturity date shown is the next call date or final legal maturity date, whichever comes first. |

| ☼ | This security, or a portion of this security, was purchased on a when-issued or delayed-delivery basis. The cost of these securities was $343 at October 31, 2014. |

| ‡ | This security, or a portion of this security, has been segregated to cover funding requirements on investment transactions settling in the future. |

| □ | This security, or a portion of this security, has been pledged as collateral in connection with futures contracts. |

The accompanying notes are an integral part of these financial statements.

| 12 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

Futures Contracts Outstanding at October 31, 2014

| Number of | Expiration | Notional | Market | Unrealized Appreciation/(Depreciation) | Variation Margin | |||||||||||||||||||||||

| Description | Contracts* | Date | Amount | Value ╪ | Asset | Liability | Asset | Liability | ||||||||||||||||||||

| Long position contracts: | ||||||||||||||||||||||||||||

| U.S. Treasury 10-Year Note Future | 31 | 12/19/2014 | $ | 3,880 | $ | 3,917 | $ | 37 | $ | — | $ | — | $ | (8 | ) | |||||||||||||

| * | The number of contracts does not omit 000's. |

TBA Sale Commitments Outstanding at October 31, 2014

| Description | Principal Amount | Maturity Date | Market Value ╪ | Unrealized Appreciation/ Depreciation | ||||||||||

| FNMA, 4.50% | $ | 4,100 | 11/15/2044 | $ | 4,443 | $ | (11 | ) | ||||||

At October 31, 2014, the aggregate market value of these securities represents 0.6% of total net assets.

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

| GLOSSARY: (abbreviations used in preceding Schedule of Investments) | |

| Municipal Bond Abbreviations: | |

| GO | General Obligation |

| PA | Port Authority |

| Rev | Revenue |

| USD | United School District |

| Other Abbreviations: | |

| ADR | American Depositary Receipt |

| FFC | Federal Financing Corp. |

| FHLMC | Federal Home Loan Mortgage Corp. |

| FNMA | Federal National Mortgage Association |

| GNMA | Government National Mortgage Association |

| TBA | To Be Announced |

The accompanying notes are an integral part of these financial statements.

| 13 |

| The Hartford Balanced Fund |

| Schedule of Investments – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

| Investment Valuation Hierarchy Level Summary |

| October 31, 2014 |

| Total | Level 1 ♦ | Level 2 ♦ | Level 3 | |||||||||||||

| Assets: | ||||||||||||||||

| Asset and Commercial Mortgage Backed Securities | $ | 2,145 | $ | — | $ | 2,145 | $ | — | ||||||||

| Common Stocks ‡ | 498,144 | 477,232 | 17,086 | 3,826 | ||||||||||||

| Corporate Bonds | 70,143 | — | 68,864 | 1,279 | ||||||||||||

| Foreign Government Obligations | 383 | — | 383 | — | ||||||||||||

| Municipal Bonds | 6,656 | — | 6,656 | — | ||||||||||||

| U.S. Government Agencies | 18,639 | — | 18,639 | — | ||||||||||||

| U.S. Government Securities | 98,847 | 4,216 | 94,631 | — | ||||||||||||

| Short-Term Investments | 28,540 | — | 28,540 | — | ||||||||||||

| Total | $ | 723,497 | $ | 481,448 | $ | 236,944 | $ | 5,105 | ||||||||

| Futures * | $ | 37 | $ | 37 | $ | — | $ | — | ||||||||

| Total | $ | 37 | $ | 37 | $ | — | $ | — | ||||||||

| Liabilities: | ||||||||||||||||

| TBA Sale Commitments | $ | 4,443 | $ | — | $ | 4,443 | $ | — | ||||||||

| Total | $ | 4,443 | $ | — | $ | 4,443 | $ | — | ||||||||

| ♦ | For the year ended October 31, 2014, there were no transfers between Level 1 and Level 2. |

| ‡ | The Fund has all or primarily all of the equity securities categorized in a particular level. Refer to the Schedule of Investments for further industry breakout. |

| * | Derivative instruments (excluding purchased and written options, if applicable) are valued at the unrealized appreciation/depreciation on the investments. |

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| Balance as of October 31, 2013 | Realized Gain (Loss) | Change in Unrealized Appreciation (Depreciation) | Net Amortization | Purchases | Sales | Transfers Into Level 3 | Transfers Out of Level 3 | Balance as of October 31, 2014 | ||||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||||||

| Common Stocks | $ | 3,849 | $ | 140 | $ | (2,205 | )* | $ | — | $ | 2,539 | $ | (497 | ) | $ | — | $ | — | $ | 3,826 | ||||||||||||||||

| Corporate Bonds | 1,323 | — | 7 | † | — | — | (51 | ) | — | — | 1,279 | |||||||||||||||||||||||||

| Total | $ | 5,172 | $ | 140 | $ | (2,198 | ) | $ | — | $ | 2,539 | $ | (548 | ) | $ | — | $ | — | $ | 5,105 | ||||||||||||||||

| * | Change in unrealized appreciation (depreciation) in the current period relating to assets still held at October 31, 2014 was $(2,090). |

| † | Change in unrealized appreciation (depreciation) in the current period relating to assets still held at October 31, 2014 was $7. |

| Note: | For purposes of reporting transfers between different hierarchy levels, both transfers in and out of each level, as applicable, are shown as if they occurred at the beginning of the period. |

The accompanying notes are an integral part of these financial statements.

| 14 |

| The Hartford Balanced Fund |

| Statement of Assets and Liabilities |

| October 31, 2014 |

| (000’s Omitted) |

| Assets: | ||||

| Investments in securities, at market value (cost $553,265) | $ | 723,497 | ||

| Cash | 4 | |||

| Receivables: | ||||

| Investment securities sold | 16,215 | |||

| Fund shares sold | 623 | |||

| Dividends and interest | 2,017 | |||

| Other assets | 52 | |||

| Total assets | 742,408 | |||

| Liabilities: | ||||

| TBA sale commitments, at market value (proceeds $4,432) | 4,443 | |||

| Payables: | ||||

| Investment securities purchased | 12,696 | |||

| Fund shares redeemed | 651 | |||

| Investment management fees | 92 | |||

| Administrative fees | — | |||

| Distribution fees | 53 | |||

| Variation margin on financial derivative instruments | 8 | |||

| Accrued expenses | 155 | |||

| Other liabilities | 2 | |||

| Total liabilities | 18,100 | |||

| Net assets | $ | 724,308 | ||

| Summary of Net Assets: | ||||

| Capital stock and paid-in-capital | $ | 689,588 | ||

| Undistributed net investment income | 597 | |||

| Accumulated net realized loss | (136,127 | ) | ||

| Unrealized appreciation of investments and the translation of assets and liabilities denominated in foreign currency | 170,250 | |||

| Net assets | $ | 724,308 | ||

| Shares authorized | 910,000 | |||

| Par value | $ | 0.001 | ||

| Class A: Net asset value per share/Maximum offering price per share | $20.54/$21.74 | |||

| Shares outstanding | 28,489 | |||

| Net assets | $ | 585,217 | ||

| Class B: Net asset value per share | $ | 20.42 | ||

| Shares outstanding | 423 | |||

| Net assets | $ | 8,635 | ||

| Class C: Net asset value per share | $ | 20.54 | ||

| Shares outstanding | 6,171 | |||

| Net assets | $ | 126,773 | ||

| Class R3: Net asset value per share | $ | 20.75 | ||

| Shares outstanding | 29 | |||

| Net assets | $ | 593 | ||

| Class R4: Net asset value per share | $ | 20.78 | ||

| Shares outstanding | 38 | |||

| Net assets | $ | 786 | ||

| Class R5: Net asset value per share | $ | 20.80 | ||

| Shares outstanding | 8 | |||

| Net assets | $ | 157 | ||

| Class Y: Net asset value per share | $ | 20.82 | ||

| Shares outstanding | 103 | |||

| Net assets | $ | 2,147 |

The accompanying notes are an integral part of these financial statements.

| 15 |

| The Hartford Balanced Fund |

| Statement of Operations |

| For the Year Ended October 31, 2014 |

| (000’s Omitted) |

| Investment Income: | ||||

| Dividends | $ | 10,518 | ||

| Interest | 5,816 | |||

| Less: Foreign tax withheld | (135 | ) | ||

| Total investment income | 16,199 | |||

| Expenses: | ||||

| Investment management fees | 4,661 | |||

| Administrative services fees | ||||

| Class R3 | 1 | |||

| Class R4 | 1 | |||

| Class R5 | — | |||

| Transfer agent fees | ||||

| Class A | 1,039 | |||

| Class B | 55 | |||

| Class C | 138 | |||

| Class R3 | — | |||

| Class R4 | — | |||

| Class R5 | — | |||

| Class Y | — | |||

| Distribution fees | ||||

| Class A | 1,412 | |||

| Class B | 104 | |||

| Class C | 1,152 | |||

| Class R3 | 3 | |||

| Class R4 | 2 | |||

| Custodian fees | 7 | |||

| Accounting services fees | 125 | |||

| Registration and filing fees | 138 | |||

| Board of Directors' fees | 19 | |||

| Audit fees | 24 | |||

| Other expenses | 129 | |||

| Total expenses (before waivers and fees paid indirectly) | 9,010 | |||

| Expense waivers | (1 | ) | ||

| Transfer agent fee waivers | (24 | ) | ||

| Commission recapture | — | |||

| Total waivers and fees paid indirectly | (25 | ) | ||

| Total expenses, net | 8,985 | |||

| Net Investment Income | 7,214 | |||

| Net Realized Gain on Investments, Other Financial Instruments and Foreign Currency Transactions: | ||||

| Net realized gain on investments | 38,398 | |||

| Net realized loss on TBA sale transactions | (216 | ) | ||

| Net realized loss on futures contracts | (47 | ) | ||

| Net realized gain on swap contracts | 37 | |||

| Net realized gain on foreign currency contracts | 15 | |||

| Net realized loss on other foreign currency transactions | (6 | ) | ||

| Net Realized Gain on Investments, Other Financial Instruments and Foreign Currency Transactions | 38,181 | |||

| Net Changes in Unrealized Appreciation of Investments, Other Financial Instruments and Foreign Currency Transactions: | ||||

| Net unrealized appreciation of investments | 29,620 | |||

| Net unrealized depreciation of TBA sale commitments | (7 | ) | ||

| Net unrealized appreciation of futures contracts | 37 | |||

| Net unrealized depreciation of swap contracts | (9 | ) | ||

| Net unrealized depreciation of translation of other assets and liabilities in foreign currencies | (11 | ) | ||

| Net Changes in Unrealized Appreciation of Investments, Other Financial Instruments and Foreign Currency Transactions | 29,630 | |||

| Net Gain on Investments, Other Financial Instruments and Foreign Currency Transactions | 67,811 | |||

| Net Increase in Net Assets Resulting from Operations | $ | 75,025 |

The accompanying notes are an integral part of these financial statements.

| 16 |

| The Hartford Balanced Fund |

| Statement of Changes in Net Assets |

| (000’s Omitted) |

| For the Year Ended October 31, 2014 | For the Year Ended October 31, 2013 | |||||||

| Operations: | ||||||||

| Net investment income | $ | 7,214 | $ | 6,862 | ||||

| Net realized gain on investments, other financial instruments and foreign currency transactions | 38,181 | 25,722 | ||||||

| Net unrealized appreciation of investments, other financial instruments and foreign currency transactions | 29,630 | 64,392 | ||||||

| Net Increase in Net Assets Resulting from Operations | 75,025 | 96,976 | ||||||

| Distributions to Shareholders: | ||||||||

| From net investment income | ||||||||

| Class A | (6,596 | ) | (6,295 | ) | ||||

| Class B | (25 | ) | (45 | ) | ||||

| Class C | (590 | ) | (477 | ) | ||||

| Class R3 | (6 | ) | (5 | ) | ||||

| Class R4 | (8 | ) | (18 | ) | ||||

| Class R5 | (2 | ) | (2 | ) | ||||

| Class Y | (33 | ) | (31 | ) | ||||

| Total distributions | (7,260 | ) | (6,873 | ) | ||||

| Capital Share Transactions: | ||||||||

| Class A | (12,446 | ) | (15,316 | ) | ||||

| Class B | (4,619 | ) | (5,676 | ) | ||||

| Class C | 15,371 | 9,097 | ||||||

| Class R3 | (106 | ) | 192 | |||||

| Class R4 | 190 | (1,120 | ) | |||||

| Class R5 | 3 | — | ||||||

| Class Y | (29 | ) | (118 | ) | ||||

| Net decrease from capital share transactions | (1,636 | ) | (12,941 | ) | ||||

| Net Increase in Net Assets | 66,129 | 77,162 | ||||||

| Net Assets: | ||||||||

| Beginning of period | 658,179 | 581,017 | ||||||

| End of period | $ | 724,308 | $ | 658,179 | ||||

| Undistributed (distributions in excess of) net investment income | $ | 597 | $ | 430 | ||||

The accompanying notes are an integral part of these financial statements.

| 17 |

| The Hartford Balanced Fund |

| Notes to Financial Statements |

| October 31, 2014 |

| (000’s Omitted) |

Organization:

The Hartford Mutual Funds, Inc. (“Company”) is an open-end management investment company comprised of forty-two portfolios. Financial statements for The Hartford Balanced Fund (the "Fund"), a series of the Company, are included in this report.

The Company is organized under the laws of the State of Maryland and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (“1940 Act”). The Fund is a diversified open-end management investment company. The Fund is an investment company and applies specialized accounting and reporting under Accounting Standards Codification Topic 946, Financial Services - Investment Companies.

Class A shares are sold with a front-end sales charge of up to 5.50%. Class B shares were sold with a contingent deferred sales charge which is assessed on the lesser of the per share net asset value (“NAV”) of the shares at the time of redemption or the original purchase price, and declines from up to 5.00% to zero depending on the period of time the shares are held (see note below regarding the closing of Class B shares). Class C shares are sold with a contingent deferred sales charge of up to 1.00% on shares redeemed within twelve months of purchase. Class R3, R4 and R5 shares, which are offered to employer-sponsored retirement plans, and Class Y shares, which are sold to certain eligible institutional investors, are sold without a sales charge. All classes of shares have identical voting, redemption, dividend, liquidation and other rights and the same terms and conditions, with the exceptions that each class may have different expenses, which may affect performance, and that Class B shares automatically convert to Class A shares after 8 years.

No new or additional investments are allowed in Class B shares of the Fund (including investments through any systematic investment plan). Existing shareholders of Class B shares may continue to hold their Class B shares, exchange their Class B shares for Class B shares of another Hartford Fund (as permitted by existing exchange privileges), or redeem their Class B shares as described in the Fund’s prospectus. Reinstatement privileges with respect to Class B shares are set forth in the Fund's prospectus. For investors electing to reinvest capital gains and dividends, any such capital gains or dividends on Class B shares will continue to be reinvested in Class B shares of the Fund. All Class B share attributes, including the 12b-1 fee, contingent deferred sales charge schedule, and conversion to Class A shares, remain unchanged.

Significant Accounting Policies:

The following is a summary of significant accounting policies of the Fund in the preparation of its financial statements, which are in accordance with United States generally accepted accounting principles (“U.S. GAAP”). The preparation of financial statements in accordance with U.S. GAAP may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Determination of Net Asset Value – The NAV of each class of the Fund's shares is determined as of the close of regular trading (normally 4:00 p.m. Eastern Time) (the “NYSE Close”) on each day that the New York Stock Exchange (the “Exchange”) is open (“Valuation Date”). Information that becomes known to the Fund after the NAV has been calculated on a particular day will not generally be used to retroactively adjust the NAV determined earlier that day.

Investment Valuation and Fair Value Measurements – For purposes of calculating the NAV, portfolio investments and other assets held by the Fund's portfolio for which market quotes are readily available are valued at market value. Market value is generally determined on the basis of last reported sales prices or official close price. If no sales are reported, market value is based on quotes obtained from a quotation reporting system, established market makers, or independent pricing services. If market prices are not readily available or are deemed unreliable, the Fund will use the fair value of the investment as determined in good faith under policies and procedures established by and under the supervision of the Company's Board of Directors. Market quotes are considered not readily available where there is an absence of current or reliable market-based data (e.g., trade information or indicative market quotes), including where events occur after the close of the relevant market, but prior to the NYSE Close, that materially affect the values of the Fund's portfolio investments or assets. In addition, market quotes are considered not readily available when, due to extraordinary circumstances, the exchanges or markets on which the investments trade do not open for trading for the entire day and no other market prices are available. In addition, prices of foreign equities that are principally traded on certain foreign markets may be adjusted daily pursuant to a fair value pricing service approved by the Board of Directors in order to reflect an adjustment for the

| 18 |

| The Hartford Balanced Fund |

| Notes to Financial Statements – (continued) |

| October 31, 2014 |

| (000’s Omitted) |

factors occurring after the close of certain foreign markets but before the NYSE Close. Investments that are primarily traded on foreign markets may trade on days that are not business days of the Fund. The value of the foreign investments in which the Fund invests may change on days when a shareholder will not be able to purchase or redeem shares of the Fund. Fair value pricing is subjective in nature and the use of fair value pricing by the Fund may cause the NAV of its shares to differ significantly from the NAV that would have been calculated using market prices at the close of the exchange on which a portfolio investment is primarily traded. There can be no assurance that the Fund could obtain the fair market value assigned to an investment if the Fund were to sell the investment at approximately the time at which the Fund determines its NAV.