UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended |

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to |

(Commission file number)

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) | (Zip Code) |

(

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting common stock held by non-affiliates of the Registrant as of June 30, 2023 was approximately $

On March 1, 2024, approximately

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement related to its 2024 Annual Stockholders’ Meeting to be filed subsequently are incorporated by reference into Part III of this Annual Report on Form 10-K. Except as expressly incorporated by reference, the registrant’s proxy statement shall not be deemed to be part of this report.

PROTALIX BIOTHERAPEUTICS, INC.

2023 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

PART I

Except where the context otherwise requires, the terms “we,” “us,” “our” or “the Company,” refer to the business of Protalix BioTherapeutics, Inc. and its consolidated subsidiaries, and “Protalix” or “Protalix Ltd.” refers to the business of Protalix Ltd., our wholly-owned subsidiary and sole operating unit.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements set forth under the sections entitled “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” and other statements included elsewhere in this Annual Report on Form 10-K, particularly with respect to our plans and strategy for our business and related financing, include forward-looking statements within the meanings of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, including statements regarding expectations, beliefs, intentions or strategies for the future. When used in this report, the terms “anticipate,” “believe,” “estimate,” “expect,” “can,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and other words or phrases of similar import, as they relate to our company, our subsidiaries or our management, are intended to identify forward-looking statements. We intend that all forward-looking statements be subject to the safe-harbor provisions under the Private Securities Litigation Reform Act of 1995. These forward-looking statements are only predictions and reflect our views as of the date they are made with respect to future events and financial performance, and we undertake no obligation to update or revise, nor do we have a policy of updating or revising, any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required under applicable law. Forward-looking statements are subject to many risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements.

Examples of the risks and uncertainties include, but are not limited to, the following:

Given these uncertainties, you should not place undue reliance on these forward-looking statements. Companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced or late-stage clinical trials, even after obtaining promising earlier trial results or preliminary findings for such clinical trials. Even if favorable testing data is generated from clinical trials of a drug product, the FDA or foreign regulatory authorities may not accept or approve a marketing application filed by a pharmaceutical or biotechnology company for the drug product.

2

These and other risks and uncertainties are detailed under the “Risk Factors” section of this Annual Report and are described from time to time in the reports we file with the U.S. Securities and Exchange Commission, or the Commission.

Item 1.Business

We are a commercial stage biopharmaceutical company focused on the development, production and commercialization of recombinant therapeutic proteins produced via our proprietary ProCellEx® plant cell-based protein expression system. We are the first and only company to gain FDA approval of a protein produced through plant cell-based expression in suspension. Our unique expression system represents a new method for developing recombinant proteins in an industrial-scale manner.

To date, we have successfully developed two commercial products. On May 5, 2023, the European Commission, or EC, announced that it had approved the Marketing Authorization Application, or MAA, for Elfabrio and on May 9, 2023, the FDA announced that it had approved the Biologics License Application, or BLA, for Elfabrio (pegunigalsidase alfa-iwxj) injection BLA 761161, each for adult patients with a confirmed diagnosis of Fabry disease. Both approvals cover the 1 mg/kg every two weeks dosage. Elfabrio was approved by the FDA with a boxed warning for hypersensitivity reactions/anaphylaxis, consistent with Enzyme Replacement Therapy (ERT) class labeling, and Warnings/Precautions providing guidance on the signs and symptoms of hypersensitivity and infusion-associated reactions seen in the clinical studies as well as treatments to manage such events should they occur. The Warnings/Precautions for membranoproliferative glomerulonephritis (MPGN) alert prescribers to the possibility of MPGN and provide guidance for appropriate patient management. Overall, the FDA review team concluded that in the context of Fabry disease as a rare, serious disease with limited therapeutic options that may not be suitable to all individual patients, the benefit-risk of Elfabrio is favorable for the treatment of adults with confirmed Fabry disease. According to the EMA, overall, the benefit/risk balance of Elfabrio is positive in the claimed indication (Fabry disease). Elfabrio has also been approved for marketing in Great Britain, Switzerland and Israel.

The FDA publicly released the internal review documents for Elfabrio. These documents provide previously unavailable additional information regarding the basis for the FDA’s May 2023 approval decision. In particular, the FDA determined that substantial evidence of effectiveness for Elfabrio in Fabry patients was established with one adequate and well-controlled study (our phase I\II clinical trial of Fabry Disease, Study PB-102-F01/02) with confirmatory evidence provided by our phase III BALANCE clinical trial of PRX-102 for the treatment of Fabry disease, or the BALANCE study (also referred to as Study PB-102-F20). The FDA review team also concluded that the BALANCE study met its primary efficacy endpoint, which assessed the annualized rate of change in eGFR (estimated glomerular filtration rate) over 104 weeks. However, the FDA also determined that the results from the BALANCE study did not support a non-inferiority claim to the comparator product due to the lack of data to support a non-inferiority margin.

Our first product, Elelyso® (taliglucerase alfa, except in Brazil where it is marketed as BioManguinhos alfataliglicerase), an ERT for the treatment of patients with Gaucher disease was first approved by the FDA in May 2012 and is now approved for marketing in 23 markets including Brazil, Israel and others.

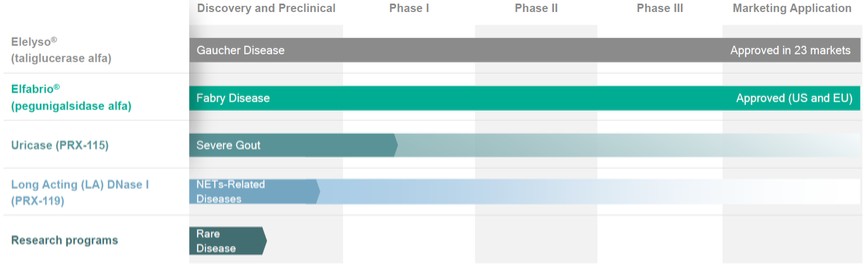

In addition, we are developing PEGylated uricase, or PRX-115, for the treatment of severe gout, Long Acting (LA) DNase I, or PRX-119, for the treatment of NETs-related diseases, and a number of other technologies and preclinical assets.

Our proprietary ProCellEx platform is being used to manufacture both of our approved and marketed products as well as PRX-115 and PRX-119.

Our strategy moving forward is to develop proprietary recombinant proteins designed to address high, unmet needs in the genetic and non-genetic rare disease space that are therapeutically superior to existing recombinant proteins currently marketed for the same indications. Consistent with this strategy, we have a number of product candidates in varying stages of the clinical development process.

3

Product Pipeline

ProCellEx: Our Proprietary Protein Expression System

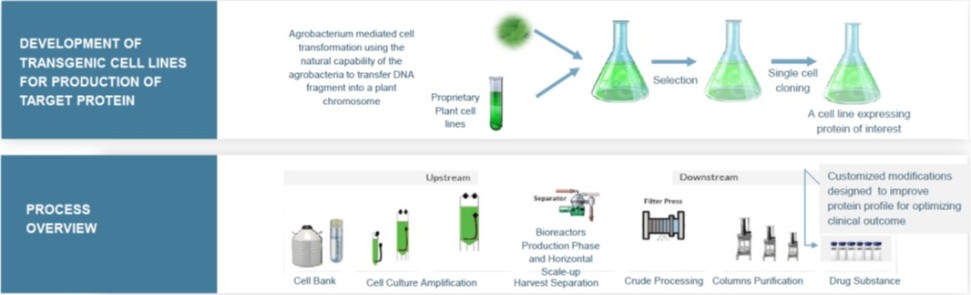

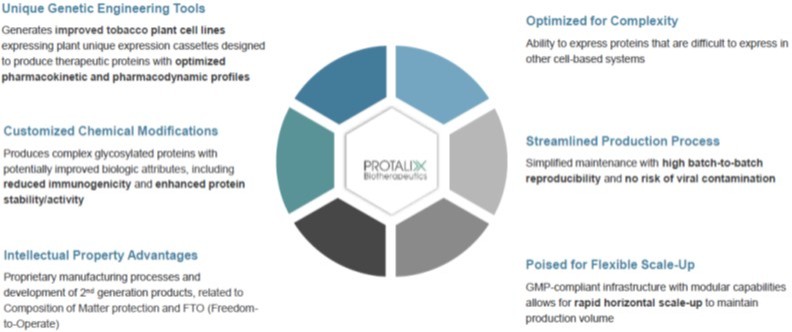

ProCellEx is our proprietary platform used to produce and manufacture recombinant proteins through plant cell-based expression in suspension. ProCellEx consists of a comprehensive set of proprietary technologies and capabilities, including the use of advanced genetic engineering and plant cell culture technology, enabling us to produce complex, proprietary and biologically equivalent proteins for a variety of human diseases. Our protein expression system facilitates the creation and selection of high-expressing, genetically-stable cell lines capable of expressing recombinant proteins. We plan to execute on our strategy by developing tailored complex recombinant therapeutic proteins primarily produced through ProCellEx while genetically engineering and/or chemically modifying the proteins pre- and/or post-production. We intend such engineering and modifications to provide added clinical benefits by improving the biological characteristics (e.g., glycosylation, half-life, immunogenicity) of the therapeutic proteins.

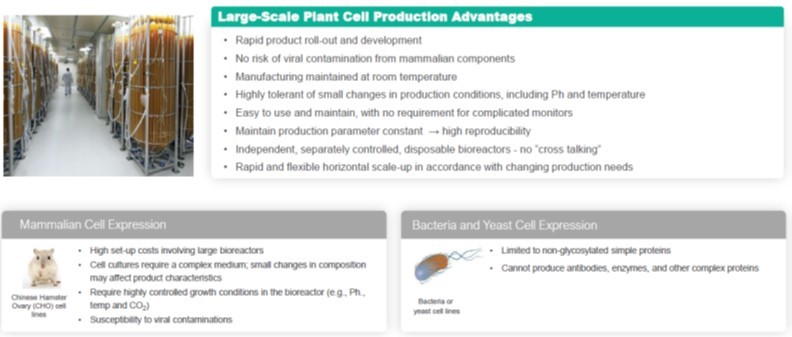

Our ProCellEx technology allows for many unique advantages, including: biologic optimization; an ability to handle complex protein expressions; flexible manufacturing with improvements through efficiencies, enhancements and/or rapid horizontal scale-ups; a simplified production process; elimination of the risk of viral contaminations from mammalian components; and intellectual property advantages.

We developed ProCellEx based on our plant cell culture technology for the development, expression and manufacture of recombinant proteins which are the essential foundation of modern biotechnology. We develop new, recombinant therapeutic proteins by using the natural capability of agrobacterium to transfer a DNA fragment into the plant chromosome, allowing the genome of the plant cell to code for specific proteins of interest. The agrobacterium-mediated transformed cells are then able to produce specific proteins, which are extracted and purified and can be used as therapies to treat a variety of diseases. We are the first and only company to gain FDA approval of a protein produced through plant cell-based expression, and with the recent approval of Elfabrio, we now have two commercial proteins produced through our platform.

4

Our ProCellEx technology can be utilized to express complex therapeutic proteins belonging to different drug classes, such as enzymes, hormones, monoclonal antibodies, cytokines and vaccines. The entire protein expression process, from initial nucleotide cloning to large-scale production of the protein product, occurs under Current Good Manufacturing Practice-, or cGMP-, compliant, controlled processes. Our plant cell culture technology uses cells, such as carrot and tobacco (BY-2) cells, which undergo advanced genetic engineering and/or chemical modifications, and are grown on an industrial scale in a disposable, flexible bioreactor system. Our system does not involve mammalian or animal-derived components or transgenic field-grown or whole plants at any point in the production process.

Cell growth, from initiating scale-up steps from a cell-bank through large-scale production takes place in a clean-room environment in flexible, sterile, custom-designed polyethylene bioreactors, and does not require the use of large stainless-steel bioreactors commonly used in mammalian-based systems for recombinant protein production. The ProCellEx reactors are easy to use and maintain, allow for rapid horizontal scale-up and do not involve the risk of mammalian viral contamination. Our bioreactors are well-suited for plant cell growth using a simple, inexpensive, chemically defined growth medium. The reactors, which are custom-designed and optimized for plant cell cultures, require low initial capital investment and are rapidly scalable at a low cost.

Plant Cell Production Advantages

ProCellEx®: Protalix’s Differentiated Plant Cell Protein Expression Platform

5

Business Highlights

We have two commercial products, each of which is an ERT; Elelyso and Elfabrio. Our pipeline of product candidates includes PEGylated uricase for the treatment of severe gout, Long Acting (LA) DNase I for the treatment of NETs and other technologies and preclinical assets.

Elelyso® (taliglucerase alfa)

Elelyso for the treatment of Gaucher disease is currently approved and marketed in 23 countries including the United States, Australia, Canada, Israel, Brazil, Russia and Turkey. In June 2012, the EMA’s Committee for Medicinal Products for Human Use, or the CHMP, issued a positive opinion regarding the benefit of Elelyso but did not immediately grant marketing authorization because of the ten-year market exclusivity granted to Vpriv® (Takeda Shire) in August 2010 for the same condition, which was extended for an additional two years, and expired in August 2022. We have granted the marketing rights to Elelyso globally, excluding Brazil, to Pfizer through an exclusive licensing agreement. We maintain the distribution rights to Elelyso in Brazil, where it is currently marketed as BioManguinhos alfataliglicerase, through the Supply and Technology Transfer Agreement, or the Brazil Agreement, we entered into on June 18, 2013, with Fiocruz, an arm of the Brazilian MoH. In 2023, we generated $12.5 million from sales of Elelyso to Pfizer and $10.4 million from sales of BioManguinhos alfataliglicerase to the Brazilian MoH.

Elfabrio® (pegunigalsidase alfa orPRX-102)

Elfabrio for the treatment of adult patients with Fabry disease, is our proprietary, plant cell culture expressed enzyme, and a chemically modified stabilized version of, the recombinant α-Galactosidase-A protein, a lysosomal enzyme. Elfabrio has been approved by the FDA for marketing in the United States, the European Union, Great Britain, Switzerland and Israel. In 2023, we generated $17.5 million from sales of Elfabrio to Chiesi.

Protalix Ltd., our wholly-owned subsidiary, has entered into two exclusive licensing and supply agreements with Chiesi for Elfabrio, one global excluding the United States and the second for the United States.

Uricase (PRX-115)

PEGylated Uricase (PRX-115)

PRX-115 is our plant cell-expressed recombinant PEGylated Uricase (urate oxidase) – a chemically modified enzyme under development for the potential treatment of severe gout. Gout is the most common inflammatory arthritis, affecting an estimated 14.0 million adults in the United States, 2.0 million in France, 2.0 million in United Kingdom, 0.7 million in Italy, 1.5 million in Germany, 0.7 million in Spain and over 190.0 million in China. An estimated approximately 5% of the gout population is considered to have chronic refractory disease. Gout results from sustained elevation of serum urate levels (hyperuricaemia). Urate levels may increase due to diet, genetic predisposition and environmental factors leading to the deposition of monosodium urate crystals, tophi, in joints, tendons and other tissues, which triggers recurrent episodes of pronounced acute inflammation, known as gout flares. Gout leads to substantial morbidity, severe pain, reduced quality of life, decreased physical function, increased healthcare costs, and lost economic productivity. Furthermore, gout is strongly associated with a number of comorbidities, including hypertension, cardiovascular disease, renal impairment, diabetes, obesity, hyperlipidaemia and frequently in a combination known as the metabolic syndrome.

PRX-119

PRX-119 is our plant cell-expressed PEGylated recombinant human DNase I product candidate which we are designing to have an elongated half-life in the circulation for the potential treatment of NETs-related diseases. NETs, or Neutrophil extracellular traps, are web-like structures released by activated neutrophils that trap and kill a variety of microorganisms. NETs are composed of DNA, histones, antimicrobial and pro-inflammatory proteins. Excessive formation or ineffective clearance of NETs can cause different pathological effects. NETs formation has been observed in various autoimmune, inflammatory and fibrotic conditions, diverse forms of thrombosis, cancer and metastasis. According to scientific literature, animal studies have demonstrated that DNase I treatment reduce NETs toxicity. Our proprietary modified DNase I may potentially enable effective treatment for these conditions.

6

2023 and Recent Company Developments

Recent Developments

2023 Developments

7

Our Marketed Products

Elelyso for the Treatment of Gaucher Disease

Elelyso (taliglucerase alfa), our first commercial product, was approved by the FDA in 2012 for injection as an ERT for the long-term treatment of adult patients with a confirmed diagnosis of type 1 Gaucher disease. In August 2014, the FDA approved Elelyso for injection for pediatric patients. Elelyso is the first plant cell derived recombinant protein to be approved by the FDA for the treatment of Gaucher disease and is now approved in 23 markets including the United States, Brazil, Israel and others.

Gaucher disease, also known as glucocerebrosidase, or GCD, deficiency, is a rare genetic autosomal recessive disorder and one of the most common Lysosomal Storage Disorders, or LSDs, in the world. It is one of a group of disorders that affect specific enzymes that normally break down fatty substances for reuse in the cells. If the enzymes are missing or do not work properly, the substances can build up and become toxic. Gaucher disease occurs when a lipid called glucosylceramide accumulates in the cells of the bone marrow, lungs, spleen, liver, and sometimes the brain. Gaucher disease symptoms can include fatigue, anemia, easy bruising and bleeding, severe bone pain and easily broken bones, and distended stomach due to an enlarged spleen and thrombocytopenia. Epidemiology of Gaucher disease varies; Recent literature provides that prevalence of Gaucher disease ranges from 0.70 to 1.75 per 100,000 in the general population. In people of Ashkenazi Jewish heritage, estimates of occurrence vary from approximately 1 in 400 to 1 in 850 people.

The global market for Gaucher disease, that includes Sanofi’s Cerezyme®, Shire’s Vpriv® and Sanofi’s Cerdelga®, among others, was $1.6 billion in 2023, is forecasted to be approximately $1.6 billion in 2024 and is forecasted to grow at a CAGR of approximately 1% from 2023-2029.

The current standard of care for Gaucher disease is ERT, which is a medical treatment where recombinant enzymes are injected into patients to replace the lacking or dysfunctional enzyme. In Gaucher disease, recombinant GCD is infused to replace the mutated or deficient natural GCD enzyme. Elelyso is the only alternative ERT treatment of Gaucher disease to Sanofi Genzyme’s Cerezyme® and Takeda’s (Shire) Vpriv.

Elfabrio for the Treatment of Fabry Disease

Elfabrio, our second commercial product, was approved by the EC for marketing in the EU and by the FDA for marketing in the United States in May 2023 for adult patients with Fabry disease. Both approvals cover the 1 mg/kg every two weeks dosage. Overall, the FDA review team concluded that in the context of Fabry disease as a rare, serious disease with limited therapeutic options that may not be suitable to all individual patients, the benefit-risk of Elfabrio is favorable for the treatment of adults with confirmed Fabry disease. According to the EMA, overall, the benefit/risk balance of Elfabrio is positive in the claimed indication (Fabry disease). The FDA publicly released the internal review documents for Elfabrio. These documents provide previously unavailable additional information regarding the basis for the FDA’s May 2023 approval decision. In particular, the FDA determined that substantial evidence of effectiveness for Elfabrio in Fabry patients was established with one adequate and well-controlled study, our phase I\II clinical trial of Fabry disease, with confirmatory evidence provided by the BALANCE study. The FDA review team also concluded that the BALANCE study met its primary efficacy endpoint, which assessed the annualized rate of change in eGFR (estimated glomerular filtration rate) over 104 weeks. However, the FDA also determined that the results from the BALANCE study did not support a non-inferiority claim to the comparator product due to the lack of data to support the non-inferiority margin.

In August and September of 2023, Elfabrio was approved in Great Britain and Switzerland, respectively, and by the Israeli Ministry of Health in January 2024, for long-term enzyme replacement therapy in adult patients with a confirmed diagnosis of Fabry disease.

Fabry disease is a serious life-threatening rare genetic disorder. Fabry patients lack or have low levels of α-galactosidase-A resulting in the progressive accumulation of abnormal deposits of a fatty substance called globotriaosylceramide, or Gb3, in blood vessel walls throughout their body. The ultimate consequences of Gb3 deposition

8

range from episodes of pain and impaired peripheral sensation to end-organ failure, particularly of the kidneys, but also of the heart and the cerebrovascular system. Fabry disease occurs in one person per 40,000 to 60,000 males.

The standard of care for Fabry disease is ERT. Currently, the ERTs for Fabry disease are agalsidase alfa, agalsidase beta, and now Elfabrio. Through an ERT, the missing α-galactosidase-A is replaced with a recombinant form of the protein via intravenous, or IV, infusion once every two weeks. Fabry disease, if left untreated, will progress from a less severe condition to a more serious one. It can have a significant impact on quality of life due to presence of serious, chronic and debilitating complications, including cardiovascular and renal complications, and comorbid conditions such as pain can have a significant impact on the psychological well-being of Fabry patients and their social functioning. Fabry disease involves substantial reduction in life expectancy. Causes of death are most often cardiovascular disease and, to a lesser extent, cerebrovascular disease and renal disease. The life expectancy of Fabry patients is significantly shorter compared to the general population. Untreated male Fabry patients may experience shortened lifespans to approximately 50 years, and 70 years for untreated female patients with Fabry disease. This represents a 20- and 10-year reduction of their respective lifespans.

The global market for Fabry disease, that includes agalsidase beta, Sanofi’s Fabrazyme®, agalsidase alfa, Shire’s (acquired by Takeda Pharmaceutical Company Limited) Replagal® and Amicus Therapeutics’ Galafold®, among others, is forecasted to be approximately $2.0 billion in 2023 and is forecasted to grow at a CAGR of 6.8% from 2023-2029 reaching approximately $3.1 billion in annual sales at the end of the decade.

Regulatory Background

On November 9, 2022, we, together with Chiesi, resubmitted to the FDA a BLA for PRX-102, the name we assigned to Elfabrio internally prior to its approvals, for the potential treatment of adult patients with Fabry disease. The initial BLA for PRX-102 was submitted to the FDA on May 27, 2020 under the FDA’s Accelerated Approval pathway, and the submission was subsequently accepted by the FDA and granted Priority Review designation. However, in April 2021, the FDA issued a complete response letter, or CRL, in response to the initial BLA. In preparation for the BLA resubmission, we and Chiesi participated in a Type A (End of Review) meeting with the FDA on September 9, 2021. As part of the meeting minutes provided by the FDA, which included the preliminary comments and meeting discussion, the FDA, in principle, agreed that the data package proposed to the FDA for a BLA resubmission had the potential to support a traditional approval of PRX-102 for the treatment of Fabry disease. The data package in the BLA resubmission, given the change in the regulatory landscape in the United States, included the final two-year analyses of our BALANCE study, which were completed in July 2022, and long-term data from our open-label extension study of PRX-102 in adult patients treated with a 2 mg/kg every four weeks dosage of PRX-102. The initial BLA included a comprehensive set of preclinical, clinical and manufacturing data compiled from our completed phase I/II clinical trial of PRX-102, including the related extension study, interim clinical data from our phase III BRIDGE clinical trial of PRX-102 for the treatment of Fabry disease, or the BRIDGE study, and safety data from our then on-going clinical studies of PRX-102 in adult patients receiving 1 mg/kg every two weeks.

The CRL did not report any concerns relating to the potential safety or efficacy of PRX-102 in the submitted data package. In the CRL, the FDA noted that an inspection of our manufacturing facility in Carmiel, Israel, including the FDA’s subsequent assessment of any related FDA findings, is required before the FDA can approve a new drug. Due to travel restrictions during the COVID-19 pandemic, the FDA was unable to conduct the required pre-approval inspection during the review cycle. In addition to the foregoing, the FDA noted that agalsidase beta had recently been converted to full approval, a change in regulatory circumstances which had to be addressed in the resubmitted BLA for PRX-102.

On February 7, 2022, the PRX-102 MAA was submitted to, and subsequently validated by, the EMA. The submission was made after the October 8, 2021 meeting we held, together with Chiesi, with the Rapporteur and Co-Rapporteur of the EMA regarding PRX-102. At the meeting, we and Chiesi discussed the scope of the anticipated MAA submission for the European Union, and the Rapporteur and Co-Rapporteur were generally supportive of the planned MAA submission. The MAA submission included a comprehensive set of preclinical, clinical and manufacturing data compiled from our completed and ongoing clinical studies evaluating PRX-102 as a potential alternative treatment for adult patients with Fabry disease. The submission was supported by the 12–month interim data analysis generated from our BALANCE study, which was released in June 2021. Data generated from the completed BRIDGE study, the phase I/II clinical trial in naive or untreated patients, and from the extension studies with 1 mg/kg every two weeks were also included in the

9

submission. In addition, the MAA included data from the completed 12–month switch–over phase III BRIGHT clinical trial of PRX-102 for the treatment of Fabry disease for adult patients with Fabry disease treated with the 2 mg/kg every four weeks dosage, or the BRIGHT study. As part of the EMA review process, we and Chiesi received the Day 120 list of questions in June 2022, and the full response package thereto was submitted to the EMA in September 2022 (following a 3-month clock-stop period). An essential portion of the response included the submission of the final analysis of the two-year BALANCE study (the final Clinical Study Report), and an interim analysis of the long-term, open-label extension study of PRX-102 in adult patients with Fabry disease treated with the 2 mg/kg every four weeks dosage.

On February 24, 2023, we, together with Chiesi, announced that the CHMP had adopted a positive opinion, recommending marketing authorization for PRX-102. The CHMP opinion was then referred for final action to the EC. As disclosed above, Elfabrio was subsequently approved by the EC for marketing in the EU and in the United States in May 2023 for adult patients with Fabry disease. Both approvals cover the 1 mg/kg every two weeks dosage.

Key Trials and Design

Our PRX-102 clinical development program was designed to show that PRX-102 has a potential clinical benefit in all adult Fabry patient populations when compared to the then marketed Fabry disease enzymes, agalsidase beta and agalsidase alfa. In preclinical studies, PRX-102 showed significantly longer half-life due to higher enzyme stability, enhanced activity in Fabry disease affected organs leading to reduction of the accumulated substrate and reduced immunogenicity, which together can potentially lead to improved efficacy through increased substrate clearance and significantly lower formation of anti-drug antibodies, or ADAs.

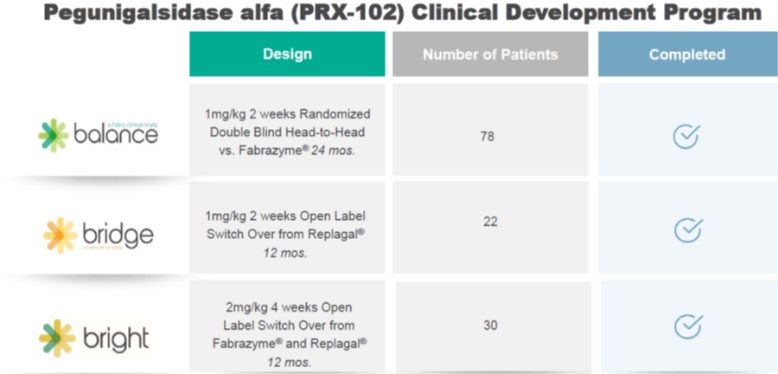

The phase III clinical program included three individual studies; the BALANCE study, the BRIDGE study the BRIGHT study, all of which have been completed. In the phase III clinical program overall, two potential dosing regimens for PRX-102 were analyzed; 1 mg/kg every two weeks, with the potential for improved efficacy and safety offering a potential alternative to existing enzyme replacement therapies, and 2 mg/kg every four weeks. The phase III program was preceded by the phase I/II clinical trial, a dose range finding study in ERT-naïve adult patients with Fabry disease, which was completed in 2016.

Phase III BALANCE Study

The BALANCE study (PB-102-F20, NCT02795676) was a pivotal 24-month, randomized, double blind, active control study of PRX-102 in adult Fabry patients with deteriorating renal function designed to evaluate the safety and efficacy of 1 mg/kg of PRX-102 administered every two weeks compared to agalsidase beta. The Clinical Study Report for the BALANCE study was completed in July 2022. The final analysis confirmed the positive top-line results (announced in April 2022) and favorable tolerability profile. A total of 78 patients who were previously treated with agalsidase beta for at least one year with an eGFR slope at screening worse than -2 mL/min/1.73 m2/year were enrolled in the study.

10

Patients were randomized on a 2:1 ratio for switching to PRX-102 or continuing on agalsidase beta. A total of 77 patients were treated; 52 with PRX-102 and 25 with agalsidase beta. Approximately 40% of the enrolled patients were female.

Forty-seven (90.4%) patients in the PRX-102 arm experienced at least one treatment-emergent adverse event (TEAE) compared to 24 (96.0%) in the agalsidase beta arm. The number of events adjusted to 100 years of exposure is 572.36 events for the PRX-102 arm and 816.85 events for the agalsidase beta arm.

TEAEs were reported for 21 (40.4%) patients in the PRX-102 arm compared to 11 (44.0%) in the agalsidase beta arm. The number of treatment-related events adjusted to 100 years of exposure is 42.85 events for the PRX-102 arm and 152.91 events for the agalsidase beta arm.

Usage of infusion pre-medication was tapered down during the study, if possible, for all patients. At baseline, 21 (40.4%) patients in the PRX-102 arm used infusion premedication compared to 16 (64.0%) in the agalsidase beta arm. At the end of the study, only three out of 47 (6.4%) patients in the PRX-102 arm used infusion premedication compared to three out of 24 (12.5%) in the agalsidase beta arm. Even with this reduction in use of premedication, there were fewer reported infusion-related reactions with PRX-102: 11 (21.2%) patients in the PRX-102 arm experienced a total of 13 events compared to six (24.0%) patients experiencing a total of 51 events in the agalsidase beta arm. The number of infusion-related reactions adjusted to 100 infusions is 0.5 for the PRX-102 arm and 3.9 for agalsidase beta arm.

Assessment of immunogenicity, that is, the existence and development of anti PRX-102 antibodies or anti-agalsidase beta antibodies, in the study indicated that for the PRX-102 arm, 18 (34.6%) patients were ADA positive at baseline, of which 17 (94.4%) had neutralizing antibody activity. For the agalsidase beta arm, eight (32.0%) patients were ADA positive at baseline, of which seven (87.5%) had neutralizing antibody activity. Only a small number of patients showed treatment-emergent ADA. At the end of the two-year study, 11 (23.4%) patients that received PRX-102 were ADA positive, of which seven (63.6%) had neutralizing antibody activity, while in the agalsidase beta arm six (26.1%) were ADA-positive and all six (100%) had neutralizing antibody activity. There was little change in the percentage of patients who were ADA positive, with a trend of reduction observed in the PRX-102 arm and stability in the agalsidase beta arm. The proportion of patients with neutralizing ADA decreased in the PRX-102 arm while it remained stable in the agalsidase beta arm.

Out of the 78 randomized patients, six patients discontinued the study: out of the five (9.4%) from the PRX-102 arm, one patient withdrew consent prior to the first infusion, two discontinued due to personal reasons, and two due to adverse events (one due to an unrelated adverse event and one due to a treatment related adverse event); one (4%) patient from the agalsidase beta arm discontinued for personal reasons. There were no deaths in this study.

Considering that in the trial patients in the PRX-102 arm were exposed for the first time to the novel enzyme, tolerability data appear favorable for PRX-102 and in-line with what was observed in the previous clinical studies of PRX-102.

Of the patients that completed the trial from both the PRX-102 and agalsidase beta treatment arms, 69 opted, with the advice of the treating physician, to receive PRX-102 1 mg/kg every two weeks in the long-term open-label extension study which is now sponsored by Chiesi.

The results of the direct, blinded comparison of PRX-102 to agalsidase beta, for the primary efficacy renal endpoints (i.e., eGFR change, eGFR slope) and for the main secondary endpoints (e.g., urine protein to creatinine ratio [UPCR] LVMI, MSSI, BPI) strongly suggest comparability in treatment effects between the two treatments.

At the same time a potentially favorable safety profile was identified based on lower rates of IRR, lower ADA positivity, and less premedication use in the PRX-102 arm compared to agalsidase beta. Overall, a positive benefit-risk balance was confirmed.

Phase III BRIDGE Study

The BRIDGE study (PB-102-F30, NCT03018730) was a 12-month open-label, single arm switch-over study evaluating the safety and efficacy of PRX-102, 1 mg/kg infused every two weeks, in up to 22 Fabry patients previously treated with

11

agalsidase alfa for at least two years and on a stable dose for at least six months. In the study, patients were screened and evaluated over three months while continuing agalsidase alfa treatment. The study was completed in December 2019.

Final results of the data generated in the BRIDGE study showed substantial improvement in renal function as measured by mean annualized eGFR slope in both male and female patients. Twenty of 22 patients completed the 12-month treatment duration. Eighteen of the patients who completed the study opted to roll over to a long-term extension study and continue to be treated with PRX-102. In the study, the mean annualized eGFR slope of the study participants improved from -5.90 mL/min/1.73m2/year while on agalsidase alfa to -1.19 mL/min/1.73m2/year on PRX-102 in all patients. Male patients improved from -6.36 mL/min/1.73m2/year to -1.73mL/min/1.73m2/year and female patients improved from -5.03 mL/min/1.73m2/year to -0.21 mL/min/1.73m2/year. Following the switch to PRX-102, there was a decrease in patients with progressing or fast progressing kidney disease which is consistent with the therapeutic goals for Fabry disease, as identified by Christoph Wanner, et. al., in 2019, and most patients achieved a stable status post-switch.

PRX-102 was well-tolerated in the BRIDGE study, with all adverse events being transient in nature without sequelae. Of the 22 patients enrolled in the BRIDGE study, the majority of TEAEs were mild or moderate in severity, with two patients (9.1%) withdrawing from the therapy due to hypersensitivity reaction that was resolved. The most common moderate TEAEs were nasopharyngitis, headache and dyspnea. An immunogenicity assessment indicated that four out of 20 patients (20%) developed persistent ADAs over the course of the study, of which two had neutralizing activity.

Of the patients that completed the trial, 18 opted, with the advice of the treating physician, to continue receiving PRX-102 1 mg/kg every two weeks in a long-term open-label extension study which is now sponsored by Chiesi.

Phase III BRIGHT Study

The BRIGHT study (PB-102-F50, NCT03180840) was a multicenter, multinational open-label, switch-over study designed to evaluate the safety, efficacy and pharmacokinetics of treatment with 2 mg/kg of PRX-102 administered every four weeks for 52 weeks (a total of 14 infusions). The study was completed in June 2020. The 2 mg/kg every four weeks dosage has not been approved by the EMA, FDA or any other jurisdiction.

Enrollment in the study included 30 adult patients (24 males and 6 females) with mean (SD) age of 40.5 (11.3) years, ranging from 19 to 58 years previously treated with a commercially available ERT (agalsidase beta or agalsidase alfa), for at least three years and on a stable dose administered every two weeks. To determine eligibility for participation in the study, candidates were screened to identify and select Fabry patients with clinically stable kidney disease. The most common Fabry disease symptoms at baseline were acroparesthesia, heat intolerance, angiokeratomas and hypohydrosis. Patients who matched the criteria were enrolled in the study and switched from their current treatment of IV infusions every two weeks to 2 mg/kg of PRX-102 every four weeks for 12 months. Patients participating in the study were evaluated, among other disease parameters, to determine if their kidney disease had not further deteriorated while being treated with the four-week dosing regimen as measured by eGFR and for lyso-Gb3 levels as a Fabry biomarker, as well as other parameters. In addition, participating patients were evaluated to assess the safety and tolerability of PRX-102.

The final results from the BRIGHT study indicate that 2 mg/kg of PRX-102 administered by intravenous infusion every four weeks was well tolerated, and Fabry disease assessed by eGFR slope and plasma lyso-Gb3 was stable throughout PRX-102 treatment in adult Fabry patients. None of the patients without ADAs at screening developed treatment-induced ADAs following the switch to PRX-102 treatment.

All 30 patients received at least one dose of PRX-102, and 29 patients completed the one-year study. Of these 29 patients, 28 received the intended regimen of 2 mg/kg every four weeks throughout the entire study, while one patient was switched to 1 mg/kg PRX-102 every two weeks per protocol at the 11th infusion. One patient withdrew from the study after the first infusion due to a traffic accident.

First infusions of PRX-102 were administered under controlled conditions at the investigation site. Based on the protocol-specified criteria, patients were able to receive their PRX-102 infusions at a home care setup once the applicable Investigator and Sponsor Medical Monitor agreed that it was safe to do so. Safety and efficacy exploratory endpoints were assessed throughout the 52-week study.

12

Overall, 33 of 183 total TEAEs reported in nine (30.0%) of the patients were considered treatment related; all were mild or moderate in severity and the majority were resolved at the end of the study. There were no serious or severe treatment-related TEAEs and no TEAEs led to death or study withdrawal. Of the treatment-related TEAEs, 27 were infusion-related reactions (IRRs) and the remainder were single events of diarrhea, erythema, fatigue, influenza-like illness, increases urine protein/creatinine ratio, and urine positive for white blood cells. The 27 IRRs were reported in five (16.7%) patients, all male. All IRRs occurred during the infusion or within two hours post-infusion; no events were recorded between two and 24 hours post-infusion.

The study suggests that Fabry patients who are currently receiving ERT every two weeks may be successfully transitioned to PRX-102 2 mg/kg every four weeks as an effective and tolerable alternative treatment option. Additional long term data is being collected as part of the ongoing long term extension study (PB-102-F51, NCT03614234) of the 2 mg/kg PRX-102 every four weeks dose.

Following a survey of participants using the Quality of Life EQ-5D-5L questionnaire, responses indicate that patient perception of their own health remained high and stable throughout the 52-week study duration, with overall health mean (SE) scores of 78.3 (3.1) and 82.1 (2.9) at baseline and Week 52, respectively, in a 0 to 100 scale. Using the short-form Brief Pain Inventory, or, questionnaire, approximately 75% of study participants had an improvement or no change in average pain severity at Week 52 (compared to baseline). The short-form BPI interference items also remained stable during the study. Pain-related results indicate that there was no increase and/or relapse in pain. No Fabry clinical events were reported during the study.

Of the patients that completed the trial, 29 opted, with the advice of the treating physician, to continue receiving PRX-102 2 mg/kg every four weeks in a long-term open-label extension study which is now sponsored by Chiesi. Two of such patients are being treated with 1 mg/kg every two weeks dosage.

Phase I/II Study

The phase I/II clinical trial of PRX-102 (NCT01678898) was a worldwide, multi-center, open-label, dose ranging study designed to evaluate the safety, tolerability, pharmacokinetics, immunogenicity and efficacy parameters of PRX-102 in adult patients with Fabry disease. It was completed in 2015.

We initiated the phase I\II study after PRX-102, in preclinical studies, showed significantly longer half-life due to higher enzyme stability, enhanced activity in Fabry disease affected organs leading to reduction of the accumulated substrate and reduced immunogenicity, which together can potentially lead to improved efficacy through increased substrate clearance and significantly lower formation of ADAs.

Sixteen adult, naïve Fabry patients (9 male and 7 female) completed the phase I/II study, each in one of three dosing groups, 0.2 mg/kg, 1 mg/kg and 2 mg/kg. Each patient received IV infusions of PRX-102 every two weeks for 12 weeks, with efficacy follow-up after six-month and twelve-month periods. The overall results demonstrate that PRX-102 reaches the affected tissue and reduces kidney Gb3 inclusions burden and lyso-Gb3 in the circulation. A high correlation was found between the two Fabry disease biomarkers, reduction of kidney Gb3 inclusions and the reduction of plasma lyso-Gb3 over six months of treatment.

Data was recorded at 24 months from 11 patients who completed 12 months of the long-term open-label extension trial that succeeded the phase I/II study. Patients who did not continue in the extension trial included female patients who became or planned to become pregnant and therefore were unable to continue in accordance with the study protocol and patients who relocated to a location where treatment was not available under the clinical study.

Results show that lyso-Gb3 levels decreased approximately 90% from baseline. Renal function remained stable with mean eGFR levels of 108.02 and 107.20 at baseline and 24 months, respectively, with a modest annual eGFR slope of -2.1. An improvement across all the gastrointestinal symptoms evaluated, including severity and frequency of abdominal pain and frequency of diarrhea, was noted. Cardiac parameters, including LVM, LVMI and EF, remained stable with no cardiac fibrosis development detected. In conclusion, an improvement of over 40% in disease severity was shown as measured by the Mainz Severity Score Index, or MSSI, a score compiling the different elements of the disease severity

13

including neurological, renal and cardiovascular parameters. In addition, an improvement was noted in each of the individual parameters of the MSSI.

The majority of adverse events were mild-to-moderate in severity, and transient in nature. During the first 12 months of treatment, only three of 16 patients (less than 19%) formed ADAs of which two of these patients (less than 13%) had neutralizing antibodies. Importantly, however, the ADAs turned negative for all three of these patients following 12 months of treatment. The ADA positivity effect had no observed impact on the safety, efficacy or continuous biomarker reduction of PRX-102.

Of the patients who completed the trial, 10 patients opted to continue receiving PRX-102 in an open-label, 60-month extension study under which all patients were switched to receive 1 mg/kg of the drug, the selected dose for our BALANCE and BRIDGE studies.

Extension Studies

Patients who completed the BALANCE, BRIDGE and BRIGHT studies, and the extension of the phase I/II study, were offered the opportunity to continue PRX-102 treatment in one of two long-term open-label extension studies. Overall, 126 subjects who participated in our PRX-102 clinical program initially opted, with the advice of the treating physician, to enroll in one of our long-term, open label, extension studies of PRX-102: 97 patients in the 1 mg/kg every two weeks extension study (PB-102-F60, NCT03566017) (10 subjects who completed an extension study from the phase I/II study, 18 subjects who completed the BRIDGE study; 69 subjects who completed the BALANCE study), and 29 subjects who completed the BRIGHT study in the 2 mg/kg every four weeks extension study (PB-102-F51, NCT03614234). Two of the subjects in the PB-102-F51 study are being treated with 1 mg/kg every two weeks. As of March 1, 2023, sponsorship of the two extension studies was transferred to Chiesi, and Chiesi is now administering the open-label extension studies.

Over time, and as Elfabrio is approved for marketing in different jurisdictions, participants switch-out of the open-label extension studies. Most of them have transferred to a commercial setting; others withdraw for other reasons.

Pediatric FLY Study

The pediatric FLY study, to be sponsored by Chiesi with our collaborative efforts, is currently in the start-up phase. The study is planned to be a multi-center, open-label trial to assess the safety, pharmacodynamics, efficacy and pharmacokinetics of Elfabrio in patients from two years to less than 18 years of age with confirmed Fabry disease. The design of the study is based on the Initial Pediatric Study Plan (iPSP) agreed to with the FDA and the paediatric investigation plan (PIP) for Elfabrio, which has been accepted, as amended, by the Paediatric Committee (PDCO) of the EMA.

Japanese RISE Study

Chiesi is currently enrolling patients in its Japanese RISE clinical trial of PRX-102 for the treatment of Fabry disease in Japan.

PEGylated Uricase (PRX-115)

PRX-115 is our recombinant PEGylated uricase (urate oxidase) – a chemically modified enzyme under development for the potential treatment of severe gout patients. The uricase enzyme converts uric acid to allantoin, which is easily eliminated through urine and does not exist naturally in humans. This recombinant enzyme, expressed via our ProCellEx system, is designed to lower uric acid levels and improve clinical manifestation of the disease while having low immunogenicity and increased half-life of the drug in the blood. Pre-clinical data demonstrates long half-life, reduced immunogenic risk and high specific activity which supports the potential of PRX-115 to be a safe and effective treatment for patients with gout. One-month multiple dosing toxicity studies in two species and 6-month multiple dosing toxicity study in one species were conducted to support single and multiple dose studies is humans.

A phase I First in Human (FIH) single ascending dose (SAD) double-blind, placebo-controlled study designed to evaluate the safety, pharmacokinetics, pharmacodynamics (reduction of uric acid) and immunogenicity of PRX-115 in patients with elevated uric acid levels (NCT05745727) was commenced in March 2023. The study is being conducted at

14

New Zealand Clinical Research (NZCR) under the New Zealand Medicines and Medical Devices Safety Authority (MedSafe) and the Health and Disability Ethics Committee (HDEC) guidelines. Fifty-six patients with no previous exposure to PEGylated uricase have been enrolled in the study. We anticipate announcing preliminary results in the second quarter of 2024.

Gout is the most common inflammatory arthritis, affecting an estimated 14.0 million adults in the United States, 2.0 million in France, 2.0 million in United Kingdom, 0.7 million in Italy, 1.5 million in Germany, 0.7 million in Spain and over 190.0 million in China. An estimated approximately 5% of the gout population is considered to have chronic refractory disease. The risk of gout increases with age, and it is thus more common in ageing populations. Gout results from sustained elevation of serum urate levels (hyperuricaemia). Urate levels may increase due to diet, genetic predisposition and environmental factors leading to the deposition of monosodium urate crystals and\or tophi in joints, tendons and other tissues, which triggers recurrent episodes of pronounced acute inflammation, known as gout flares. Gout leads to substantial morbidity, severe pain, reduced quality of life, decreased physical function, increased healthcare costs, and lost economic productivity. Furthermore, gout is strongly associated with a number of comorbidities, including hypertension, cardiovascular disease, renal impairment, diabetes, obesity, hyperlipidaemia and frequently in a combination known as the metabolic syndrome.

Severe gout is generally described as a state of gout in which there is a presence of monosodium urate crystals with any of the following: frequent recurrent gout flares, chronic gouty arthritis, subcutaneous tophi or disease elements of gout seen via imaging. Currently available urate-lowering therapies, can be effective in treating gout. However, low adherence, under dosing and disease progression that cause high patient burden require new, effective and safe therapies to treat these severe, underserved gout patients.

To date, two variants of recombinant uricases are approved for marketing: (i) Krystexxa® (pegloticase) for treatment of chronic gout refractory to conventional therapy (gout patients who have contraindication/failure of other lowering uric acid treatments) and (ii) Elitek®, indicated for the treatment of tumor lysis syndrome but not gout. Both have a black box warning for anaphylaxis and other major side-effects. In particular, 89% of patients treated with Krystexxa developed an immunogenic response associated with a failure to maintain normalization of serum uric acid levels over a 6-month therapy cycle. The FDA label of krystexxa was amended in 2022 to include co-treatment of metrotrexate to prolong efficacy and increases tolerability in patients with refractory gout. Krystexxa is no longer marketed in the European Union. The EC withdrew the marketing authorization for Krystexxa in 2016 at the request of the marketing authorization holder which notified the EC of its decision not to market the product in the European Union for commercial reasons. We believe that new effective, safe therapies are needed to treat severe gout, chronic refractory and uncontrolled gout, regardless of treatment history.

PRX-119

PRX-119 is our plant cell-expressed PEGylated recombinant human DNase I product candidate being designed to elongate half-life in the circulation for NETs-related diseases. NETs, Neutrophil extracellular traps, are web-like structures, released by activated neutrophils that trap and kill a variety of microorganisms. NETs are composed of DNA, histones, antimicrobial and pro-inflammatory proteins. Excessive formation or ineffective clearance of NETs can cause different pathological effects. NETs formation has been observed in various autoimmune, inflammatory and fibrotic conditions, diverse forms of thrombosis, cancer and metastasis. According to scientific literature, animal studies have demonstrated that DNase treatment reduces NETs toxicity. Our proprietary modified DNase I design for long and customized systemically circulating in the bloodstream, may potentially enable effective treatment of these conditions.

The administration of PRX-119 resulted in a decrease in circulating of DNA levels and significantly enhanced the survival of mice in both a CLP-induced sepsis model and an ARDS model.

Intellectual Property

We have a robust patent portfolio, which is a key element of our overall strategy. We work to continually enhance, strengthen, and protect our intellectual property and now hold a broad portfolio of approximately 90 patents globally, including in Europe, the United States, Israel and additional countries worldwide. Our patents are designed to protect our

15

proprietary technology, proprietary products and product candidates, and their methods of use. Additionally, we have approximately 50 pending patent applications.

During the year ended December 31, 2023, we received the following:

| ● | New patents in each of New Zealand and the Russian Federation for the patent family named “Therapeutic Regimen For The Treatment of Fabry Using Stabilized Alpha-galactosidase, adding to the single previously granted patent in such family. |

| ● | A new patent in Brazil for the patent family named “DNase I Polypeptides, Polynucleotides Encoding Same, Methods of Producing DNase I and uses thereof in Therapy, adding to the two previously granted patents in such family. |

| ● | A new patent in Brazil for the patent family named “Nucleic Acid Construct for Expression of Alpha-Galactosidase in Plants and Plant Cells,” adding to the nine previously granted patents in such family. |

| ● | New patents in each of the USA, New Zealand, Israel and South Africa for the patent family named “Modified DNase and uses thereof,” adding to the three previously granted patents in such family. |

Our competitive position and future success depend, in part, on our ability, and that of our licensees, to obtain and leverage the intellectual property rights covering our product candidates, know-how, methods, processes and other technologies, to protect our trade secrets, to prevent others from using our intellectual property and to operate without infringing on the intellectual property rights of third parties. We seek to protect our competitive position by filing United States, European Union, Israeli and other foreign patent applications covering our technology, including both new technology and improvements to existing technology. Our patent strategy includes obtaining patents on methods of production, compositions of matter and methods of use. We also rely on know-how, continuing technological innovation, licensing and partnership opportunities to develop and maintain our competitive position.

Our outstanding 7.50% Senior Secured Convertible Notes due 2024, or the 2024 Notes, are guaranteed by our subsidiaries and secured by perfected liens on all of our material assets, primarily consisting of our intellectual property assets, including a stock pledge of our foreign subsidiaries in favor of the holders of outstanding 2024 Notes.

As of December 31, 2023, our patent portfolio consisted of several patent families (consisting of patents and/or patent applications) covering our technology, protein expression methodologies and system and product candidates, as follows:

Production of High Mannose Proteins in Plant Culture/PCT/ Il2004 000181 | N/A | Japan, Israel, Canada, Russian Federation, Mexico, India, Australia, South Africa, Republic of Korea, Singapore, Europe, Hong Kong, Ukraine, China, USA, Brazil | 2024(1) |

Plant Cell/Tissue Culturing Device, System and Method/PCT/Il2005/ 000228 | N/A | Israel | 2025 |

Large Scale Disposable Bioreactor/PCT/Il2008/000614 | N/A | Australia, Canada, China, Europe, Hong Kong, India, Israel, Republic of Korea, Russian Federation, Singapore, South Africa, USA, Brazil | 2028(2) |

Stabilized Alpha-galactosidase and uses thereof/PCT/Il2011/ 000209 | Brazil | Canada, South Africa, Russian Federation, Singapore, Israel, India, New Zealand, | 2031(3) |

16

China, Japan, USA, Europe, | |||

Nucleic Acid Construct for Expression of Alpha-galactosidase in Plants and Plant Cells/PCT/ Il2011/000719 | N/A | India, China, Republic of Korea, Japan, Israel, Europe, Hong Kong, USA, Brazil | 2024(2) |

Therapeutic Regimen For The Treatment of Fabry Using Stabilized Alpha-galactosidase/ PCT/Il2018/050018 | USA, Europe, Brazil, Japan, Canada, Australia, Chile, Israel, Republic of Korea, China, Mexico, Hong Kong | South Africa, New Zealand, Russian Federation | 2038 |

Dry Powder Formulations of DNase 1/PCT/Il2013/050094 | N/A | Israel, USA | 2033 |

DNase I Polypeptides, Polynucleotides Encoding Same, Methods of Producing DNase I and uses thereof in Therapy/PCT/ Il2013/050097 | N/A | Europe, Israel, Brazil | 2033 |

Inhalable Liquid Formulations of DNase I/PCT/Il2013/050096 | N/A | Israel, USA | 2033 |

Modified DNase and uses thereof/ PCT/Il2016/050003 | Europe, Canada, China, | USA, Australia, Mexico, Israel, | 2036 |

Use of Plant Cells Expressing a TNF Alpha Polypeptide Inhibitor in Therapy/PCT/IL2014/050231 | N/A | Israel | 2034 |

Removal of Constructs from Transformed Cells/PCT/IL2019/ 051266 | USA, Israel, Japan, New Zealand, Australia | N/A | N/A |

Long-Acting DNase/PCT/IL2021/051207 | Canada, Israel, USA, Japan, Europe, Hong Kong, Republic of Korea, China | N/A | N/A |

Dicer-Like Knock-Out Plant Cells/ PCT/IL2021/051194 | Israel, USA, Japan, Europe, Hong Kong, Republic of Korea, China | N/A | N/A |

Modified Uricase and Uses Thereof/PCT/IL2021/051305 | Japan, Canada, Brazil, USA, Israel, Mexico, Europe, Republic of Korea, China | N/A | N/A |

Methods of treating diseases associated with elevated uric acid | N/A | N/A | N/A |

| (1) | Patent granted in Australia expires in 2029. |

| (2) | Patent granted in the United States expires in 2032. |

| (3) | PTE/SPC applications were submitted for some of the patents. |

We are aware of U.S. patents, and corresponding international counterparts of such patents, owned by third parties that contain claims covering methods of producing glucocerebrosidase. We do not believe that, if any claim of infringement were to be asserted against us based upon such patents, taliglucerase alfa would be found to infringe any valid claim under such patents. However, there can be no assurance that a court would find in our favor or that, if we choose or are required to seek a license to any one or more of such patents, a license would be available to us on acceptable terms or at all.

In April 2005, Protalix Ltd. entered into a license agreement with Icon Genetics AG, or Icon, pursuant to which we received an exclusive worldwide license to develop, test, use and commercialize Icon’s technology to express certain proteins in our ProCellEx protein expression system. We are also entitled to a non-exclusive worldwide license to make and have made other proteins expressed by using Icon’s technology. As consideration for the license, we are obligated to make royalty payments equal to varying low, single-digit percentages of net sales of products by us, our affiliates, or any

17

sublicensees under the agreement. In addition, we are obligated to make milestone payments equal to $350,000, in the aggregate, for each product developed under the license, upon the achievement of certain milestones.

Our license agreement with Icon remains in effect until the earlier of the expiration of the last patent under the agreement or, if all of the patents under the agreement expire, 20 years after the first commercial sale of any product under the agreement. Icon may terminate the agreement upon written notice to us that we are in material breach of our obligations under the agreement and we are unable to remedy such material breach within 30 days after we receive such notice. Further, Icon may terminate the agreement in connection with certain events relating to a wind up or bankruptcy, if we make a general assignment for the benefit of our creditors, or if we cease to conduct operations for a certain period. Icon may also terminate the exclusivity granted to us by written notice if we fail to reach certain milestones within a designated period of time. Notwithstanding the termination date of the agreement, our obligation to pay royalties to Icon under the agreement may expire prior to the termination of the agreement, subject to certain conditions.

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly evolving technology and significant competition. Competition from numerous existing companies and others entering the fields in which we operate is intense and expected to increase. Most of these companies have substantially greater research and development, manufacturing, marketing, financial, technological personnel and managerial resources than we do. In addition, many specialized biotechnology companies have formed collaborations with large, established companies to support research, development and commercialization of products that may be competitive with our current and future product candidates and technologies. Acquisitions of competing companies by large pharmaceutical or biotechnology companies could further enhance such competitors’ financial, marketing and other resources. Academic institutions, governmental agencies and other public and private research organizations are also conducting research activities and seeking patent protection and may commercialize competitive products or technologies on their own through collaborations with pharmaceutical and biotechnology companies.

With respect to Gaucher disease, we face competition primarily from two ERTs, Sanofi Genzyme’s Cerezyme and Takeda’s (Shire) Vpriv. In addition, Actelion markets a small molecule drug for the treatment of mild to moderate Type 1 Gaucher disease (Zavesca or miglustat), an oral treatment approved by the FDA only for patients for whom ERT is not a therapeutic option. In addition, Sanofi Genzyme markets a small molecule oral drug, Cerdelga®, approved for Gaucher patients with certain CYP2D6 metabolizer status. We are aware of other treatments and gene therapies in early clinical development and later stage clinical development for the treatment of Gaucher disease.

With respect to Fabry disease, we face competition primarily from Sanofi Genzyme (Fabrazyme), Takeda (Replagal) and Amicus (Galafold®). In addition, we are aware of other late clinical stage, early clinical stage and experimental drugs that are being developed by other companies for the treatment of Fabry disease.

With respect to severe gout, we face competition from Horizon Therapeutics Public Limited Company (Krsytexxa), which is indicated for treatment of chronic gout in adult patients refractory to conventional therapy. In addition, we are aware of other clinical stage, early clinical stage and experimental refractory or chronic gout treatments. For example, we are aware of a product candidate for chronic refractory gout that recently completed a phase III clinical trial and has met the primary endpoints of the trial, and of another product candidate that is the subject of a phase II clinical trial for hyperuricemia in gout patients with advanced CKD.

We also face potential competition to our ProCellEx system from companies that are developing other platforms for the expression of recombinant therapeutic pharmaceuticals. We are aware of companies that are developing alternative technologies to develop and produce therapeutic proteins in anticipation of the expiration of certain patent claims covering marketed proteins. A number of companies have developed or are developing alternative expression technologies. Examples include Crucell N.V.’s (acquired by Johnson & Johnson) expression system based on human-cell technology, Dyadic International Inc.’s expression system based on a fungus, Pfenex Inc.’s (acquired by Ligand Pharmaceuticals Incorporated) bacteria-based expression system, and others. Companies developing alternate plant-based technologies include iBio, Inc., Medicago, Inc., and eleva. Unlike ProCellEx, these alternate technologies are not cell-based. These companies base their product development on transgenic plants or whole plants.

18

Agreements and Partnerships

Elelyso – Pfizer

We have licensed to Pfizer the global rights to Elelyso in all markets, excluding Brazil, pursuant to an Amended and Restated Exclusive License and Supply Agreement, or the Amended Pfizer Agreement, which we entered into with Pfizer in October 2015 to amend and restate our initial Exclusive License and Supply Agreement with Pfizer, or the Pfizer Agreement. Pursuant to the Amended Pfizer Agreement, Pfizer retains 100% of revenue and reimburses 100% of direct costs. For the first 10-year period after the execution of the Amended Pfizer Agreement, we have agreed to sell drug substance to Pfizer for the production of Elelyso, subject to certain terms and conditions, and Pfizer maintains the right to extend the supply period for up to two additional 30-month periods, subject to certain terms and conditions. In a subsequent amendment, we agreed that after the completion of the first 10-year supply period, the supply term would automatically extend for a five-year period. Any failure to comply with our supply commitments may subject us to substantial financial penalties. The Amended Pfizer Agreement includes customary provisions regarding cooperation for regulatory matters, patent enforcement, termination, indemnification and insurance requirements. We retain distribution rights to taliglucerase alfa in Brazil.

Elelyso – Fundação Oswaldo Cruz (Fiocruz)

Elelyso, marketed as BioManguinhos alfataliglicerase in Brazil, is commercialized in Brazil through the Brazil Agreement with Fiocruz, which became effective in January 2014. Gaucher patients in Brazil are entitled to receive ERT paid for by the Brazilian MoH. The Brazilian MoH clinical treatment guidelines (PCDT) state that BioManguinhos alfataliglicerase is the therapy of choice for newly diagnosed patients. BioManguinhos alfataliglicerase is currently estimated to be used by approximately 25% of Gaucher patients in Brazil.

The Brazil Agreement provides for a staged technology transfer which is intended to transfer to Fiocruz the capacity and skills required for the Brazilian government to construct its own manufacturing facility, at its sole expense, and to produce a sustainable, high-quality, and cost-effective supply of BioManguinhos alfataliglicerase. Fiocruz has not satisfied certain purchase commitments under the Brazil Agreement. Accordingly, we and Fiocruz discuss on a continuous basis, potential steps to maximize sales of BioManguinhos alfataliglicerase sales to the Brazilian MoH.

Elfabrio (pegunigalsidase alfa\PRX-102) – Chiesi Farmaceutici

We have entered into two exclusive global licensing and supply agreements for PRX-102 for the treatment of Fabry disease with Chiesi; the Exclusive License and Supply Agreement dated as of October 17, 2017, made by and between Protalix Ltd. and Chiesi, or the Chiesi Ex-US Agreement, and the Exclusive License and Supply Agreement dated as of July 23, 2018, made by and between Protalix Ltd. and Chiesi, or the Chiesi US Agreement. The Chiesi Ex-US Agreement and the Chiesi US Agreement are referred to herein collectively as the Chiesi Agreements. Under the agreements, Protalix Ltd. has received $50.0 million in upfront payments and development cost reimbursements of $45 million, and is entitled to more than $1.0 billion in potential milestone payments tiered payments for drug product purchased from Protalix Ltd. equal to 15% - 35% (ex-US) and 15% - 40% (US), depending on the amount of annual net sales in the applicable territories.

Under the Chiesi Ex-US Agreement, we granted to Chiesi an exclusive license for all markets outside of the United States to commercialize PRX-102. Chiesi made an upfront payment to Protalix Ltd. of $25.0 million in connection with the execution of the agreement, and Protalix Ltd. was entitled to additional payments of up to $25.0 million in development costs in the aggregate, capped at $10.0 million per year. Protalix Ltd. is also eligible to receive additional payments of up to a maximum of $320.0 million, in the aggregate, in regulatory and commercial milestone payments. Protalix Ltd. agreed to manufacture all of the PRX-102 needed for all purposes under the agreement, subject to certain exceptions, and Chiesi will purchase PRX-102 from Protalix Ltd., subject to certain terms and conditions. Chiesi is required to make tiered payments of 15% to 35% of its net sales, depending on the amount of annual sales, as consideration for the supply of PRX-102.

The exclusive license to develop and commercialize PRX-102 in the United States were granted to Chiesi under the Chiesi US Agreement. Protalix Ltd. received an upfront, non-refundable, non-creditable payment of $25.0 million from

19

Chiesi and was entitled to additional payments of up to a maximum of $20.0 million to cover development costs for PRX-102, capped at $7.5 million per year. Protalix Ltd. is also eligible to receive additional payments of up to a maximum of $760.0 million, in the aggregate, in regulatory and commercial milestone payments. Chiesi agreed to make tiered payments of 15% to 40% of its net sales under the Chiesi US Agreement to Protalix Ltd., depending on the amount of annual sales, subject to certain terms and conditions, as consideration for product supply.

On May 13, 2021, we signed a binding term sheet with Chiesi amending the Chiesi Agreements in order to provide our company with near-term capital. Chiesi agreed to make a $10.0 million payment to us before the end of the second quarter of 2021 in exchange for a $25.0 million reduction in a longer term regulatory milestone payment provided in the Chiesi EX-US Agreement. All other regulatory and commercial milestone payments remain unchanged. We received the payment in June 2021. We also agreed to negotiate certain manufacturing related matters.

On August 29, 2022, we entered into the F/F Agreement and the Letter Agreement. Under the F/F Agreement, we agreed to supply Chiesi with drug substance for PRX-102 and, following relevant technology and technical information transfer activities, Chiesi has agreed, among other things, to provide us with commercial fill/finish services for PRX-102, including to support the anticipated global launch of PRX-102. The F/F Agreement will expire December 31, 2025, unless terminated earlier in accordance with its terms and may be extended by mutual agreement in writing for an additional period of seven years. The Letter Agreement changed the obligations of both us and Chiesi under the Chiesi Agreements with respect to, among other things, the evaluation, selection and establishment of an initial alternate source of commercial fill/finish services for PRX-102. In addition, the Letter Agreement amended certain provisions of the Chiesi Agreements to reflect the appointment of Chiesi as a supplier to our company of commercial fill/finish services and the potential establishment of an initial alternate source of commercial fill/finish services.

Manufacturing

We use our current manufacturing facility in Carmiel, Israel, which has approximately 14,700 sq/ft of clean rooms built according to industry standards, to manufacture drug substance for Elfabrio and Elelyso for commercial purposes and, with respect to Elfabrio, in connection with clinical trials. We maintain an approximately 3,400 sq/ft pilot plant for protein development and to manufacture supplies for clinical trials (phase I and phase II). Elelyso, Elfabrio and our drug product candidates must be manufactured in a clean environment and in compliance with cGMPs set by the FDA and other relevant foreign regulatory authorities. We intend to use our manufacturing space to produce all of the drug substance needed in connection with the clinical trials for our other product candidates.

In 2017, the FDA approved the supplemental New Drug Application (sNDA) we submitted to allow us to convert our manufacturing facility from a single dedicated product facility to a multi-product facility. This conversion allows us to realize potentially significant operational savings. Our facility’s current capacity can serve all of our current and expected commercial and clinical needs.

Our manufacturing facilities are subject to inspections by various regulatory authorities from time to time. We have undergone successful inspections by the FDA, the Irish Medicines Board (under the EMA’s centralized marketing authorization procedure), the Brazilian National Health Surveillance Agency (ANVISA), the Israeli Ministry of Health, the Turkish Ministry of Health, the Australian Therapeutic Goods Administration (TGA) and Health Canada.

Our current facility in Israel was granted “Approved Enterprise” status, and we have elected to participate in the alternative benefits program. Our facility is located in a top priority location, or “Zone A,” location, and, therefore, our income from the Approved Enterprise will be tax exempt in Israel for a 10-year period, commencing with the year in which we first generate taxable income from the relevant Approved Enterprise and after we use our net operating loss carryforwards, or NOLs. We expect to be entitled to similar tax benefits for a number of years thereafter. To remain eligible for these tax benefits, we must continue to meet certain conditions, and if we increase our activities outside of Israel, for example, by future acquisitions, such increased activities generally may not be eligible for inclusion in Israeli tax benefit programs. In addition, our technology is subject to certain restrictions with respect to the transfer of technology and manufacturing rights.

20

Raw Materials and Suppliers

We believe that the raw materials that we require throughout the manufacturing process of Elfabrio and Elelyso, and our current and potential drug product candidates, are widely available from numerous suppliers and are generally considered to be generic industrial biological supplies. We rely on a single, approved supplier for certain materials relating to the current expression of our proprietary biotherapeutic proteins through ProCellEx. We have identified additional suppliers for most of the materials required for the production of our product candidates.