Or

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

OR

For the transition period from to

(Commission file number)

(Exact name of registrant as specified in its charter)

__ | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | Accelerated filer | ☐ |

⌧ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

On November 1, 2023, approximately

FORM 10-Q

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

PROTALIX BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands)

(Unaudited)

| September 30, 2023 |

| December 31, 2022 | |||

ASSETS | ||||||

CURRENT ASSETS: | ||||||

Cash and cash equivalents | $ | | $ | | ||

Short-term bank deposits | | | ||||

Accounts receivable – Trade |

| |

| | ||

Other assets |

| |

| | ||

Inventories |

| |

| | ||

Total current assets | $ | | $ | | ||

NON-CURRENT ASSETS: | ||||||

Funds in respect of employee rights upon retirement | $ | | $ | | ||

Property and equipment, net |

| |

| | ||

Deferred income tax asset | | — | ||||

Operating lease right of use assets |

| |

| | ||

Total assets | $ | | $ | | ||

LIABILITIES AND STOCKHOLDERS' EQUITY (NET OF CAPITAL DEFICIENCY) |

|

|

| |||

CURRENT LIABILITIES: |

|

|

| |||

Accounts payable and accruals: |

|

|

| |||

Trade | $ | | $ | | ||

Other |

| |

| | ||

Operating lease liabilities |

| |

| | ||

Contracts liability |

| — |

| | ||

Convertible notes | | — | ||||

Total current liabilities | $ | | $ | | ||

LONG TERM LIABILITIES: |

|

|

| |||

Convertible notes | $ | | ||||

Liability for employee rights upon retirement | $ | |

| | ||

Operating lease liabilities |

| |

| | ||

Total long term liabilities | $ | | $ | | ||

Total liabilities | $ | | $ | | ||

COMMITMENTS | ||||||

STOCKHOLDERS' EQUITY (CAPITAL DEFICIENCY) | | ( | ||||

Total liabilities and stockholders' equity (net of capital deficiency) | $ | | $ | | ||

The accompanying notes are an integral part of the condensed consolidated financial statements.

2

PROTALIX BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per share data)

(Unaudited)

Nine Months Ended | Three Months Ended | |||||||||||||

| September 30, 2023 |

| September 30, 2022 |

| September 30, 2023 |

| September 30, 2022 | |||||||

REVENUES FROM SELLING GOODS | $ | | $ | | $ | | $ | | ||||||

REVENUES FROM LICENSE AND R&D SERVICES |

| |

| |

| |

| | ||||||

TOTAL REVENUE | | | | | ||||||||||

COST OF GOODS SOLD (1) |

| ( |

| ( |

| ( |

| ( | ||||||

RESEARCH AND DEVELOPMENT EXPENSES (2) |

| ( |

| ( |

| ( |

| ( | ||||||

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES (3) |

| ( |

| ( |

| ( |

| ( | ||||||

OPERATING INCOME (LOSS) |

| |

| ( |

| ( |

| ( | ||||||

FINANCIAL EXPENSES |

| ( |

| ( |

| ( |

| ( | ||||||

FINANCIAL INCOME |

| |

| |

| |

| | ||||||

FINANCIAL INCOME (EXPENSES), NET |

| ( |

| ( |

| |

| ( | ||||||

INCOME (LOSS) BEFORE TAXES ON INCOME | | ( | ( | ( | ||||||||||

TAXES ON INCOME | ( | - | ( | - | ||||||||||

NET INCOME (LOSS) FOR THE PERIOD | $ | | $ | ( | $ | ( | $ | ( | ||||||

EARNINGS (LOSS) PER SHARE OF COMMON STOCK: | ||||||||||||||

BASIC | $ | | $ | ( | $ | ( | $ | ( | ||||||

DILUTED | $ | | $ | ( | $ | ( | $ | ( | ||||||

WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK | ||||||||||||||

USED IN COMPUTING EARNINGS (LOSS) PER SHARE: | ||||||||||||||

BASIC |

| |

| |

| |

| | ||||||

DILUTED |

| |

| |

| |

| | ||||||

$ | | $ | | $ | | $ | | |||||||

$ | | $ | | $ | | $ | | |||||||

$ | | $ | | $ | | $ | | |||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

3

PROTALIX BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

STOCKHOLDERS’ EQUITY (CAPITAL DEFICIENCY)

(U.S. dollars in thousands, except share data)

(Unaudited)

|

|

| Additional |

|

|

| ||||||||

Common | Common | Paid-In | Accumulated | |||||||||||

Stock (1) | Stock | Capital | Deficit | Total | ||||||||||

Number of | ||||||||||||||

| Shares | Amount | ||||||||||||

Balance at January 1, 2022 |

| | $ | | $ | | $ | ( | $ | ( | ||||

Changes during the nine-month period ended September 30, 2022: |

|

|

|

|

|

|

|

|

| |||||

Issuance of common stock under the Sales Agreement, net |

| | | | | |||||||||

Share-based compensation related to stock options | | | ||||||||||||

Share-based compensation related to restricted stock awards | | * | | | ||||||||||

Exercise of warrants | | * | | | ||||||||||

Net loss for the period |

|

|

|

| ( |

| ( | |||||||

Balance at September 30, 2022 |

| | $ | | $ | | $ | ( | $ | ( | ||||

Balance at January 1, 2023 |

| | $ | | $ | | $ | ( | $ | ( | ||||

Changes during the nine-month period ended September 30, 2023: |

|

|

|

|

|

|

|

|

|

| ||||

Issuance of common stock under the Sales Agreement, net |

| | | | | |||||||||

Convertible notes conversions | | | | | ||||||||||

Share-based compensation related to stock options |

|

|

| |

|

| | |||||||

Share-based compensation related to restricted stock awards |

| | | | ||||||||||

Exercise of warrants |

| | * | | | |||||||||

Net income for the period |

|

|

| | | |||||||||

Balance at September 30, 2023 |

| | $ | | $ | | $ | ( | $ | | ||||

Balance at June 30, 2022 | | $ | | $ | | $ | ( | $ | ( | |||||

Changes during the three-month period ended September 30, 2022: | ||||||||||||||

Issuance of common stock under the Sales Agreement, net | | | | |||||||||||

Share-based compensation related to stock options | | | ||||||||||||

Share-based compensation related to restricted stock awards | | | ||||||||||||

Net loss for the period | ( | ( | ||||||||||||

Balance at September 30, 2022 | | $ | | $ | | $ | ( | $ | ( | |||||

Balance at June 30, 2023 | | $ | | $ | | $ | ( | $ | | |||||

Changes during the three-month period ended September 30, 2023: | ||||||||||||||

Share-based compensation related to stock options | | | ||||||||||||

Share-based compensation related to restricted stock awards | | | | |||||||||||

Net loss for the period | ( | ( | ||||||||||||

Balance at September 30, 2023 | | $ | | $ | | $ | ( | $ | | |||||

*Represents an amount equal to less than $1.

(1)

The accompanying notes are an integral part of the condensed consolidated financial statements.

4

PROTALIX BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

(Unaudited)

Nine Months Ended | |||||||

| September 30, 2023 |

| September 30, 2022 | ||||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| |||

Net income (loss) | $ | | $ | ( | |||

Adjustments required to reconcile net income (loss) to net cash used in operating activities: |

|

| |||||

Share-based compensation |

| |

| | |||

Depreciation |

| |

| | |||

Financial income, net (mainly exchange differences) |

| ( |

| ( | |||

Changes in accrued liability for employee rights upon retirement |

| ( |

| ( | |||

Changes in deferred tax asset | ( | — | |||||

Loss (gain) on amounts funded in respect of employee rights upon retirement |

| ( |

| | |||

Gain on conversions of convertible notes | ( | — | |||||

Amortization of debt issuance costs and debt discount | | | |||||

Changes in operating assets and liabilities: |

|

| |||||

Decrease in contracts liability |

| ( |

| ( | |||

Increase in accounts receivable-trade and other assets |

| ( |

| ( | |||

Changes in operating lease right of use assets, net |

| |

| ( | |||

Decrease (increase) in inventories |

| ( |

| | |||

Increase (decrease) in accounts payable and accruals |

| |

| ( | |||

Net cash used in operating activities | $ | ( | $ | ( | |||

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

| |||||

Investment in bank deposits | $ | ( | $ | ( | |||

Proceeds from sale of short-term deposits | | | |||||

Purchase of property and equipment | ( | ( | |||||

Amounts paid (funded) in respect of employee rights upon retirement, net |

| ( |

| | |||

Net cash used in investing activities | $ | ( | $ | ( | |||

CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||

Proceeds from issuance of common stock under the Sales Agreement, net | $ | | $ | | |||

Exercise of warrants | | | |||||

Net cash provided by financing activities | $ | | $ | | |||

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | $ | ( | $ | ( | |||

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS |

| |

| ( | |||

BALANCE OF CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD |

| |

| | |||

BALANCE OF CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | | $ | | |||

The accompanying notes are an integral part of the condensed consolidated financial statements.

5

PROTALIX BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

(Unaudited)

(Continued) – 2

Nine Months Ended | |||||||

| September 30, 2023 |

| September 30, 2022 | ||||

SUPPLEMENTARY INFORMATION ON INVESTING AND FINANCING ACTIVITIES NOT INVOLVING CASH FLOWS: | |||||||

Purchase of property and equipment | $ | | $ | | |||

Operating lease right of use assets obtained in exchange for new operating lease liabilities | $ | | $ | | |||

Convertible notes conversions | $ | | $ | — | |||

SUPPLEMENTARY DISCLOSURE ON CASH FLOWS |

|

| |||||

Interest paid | $ | | $ | | |||

Interest received | $ | | $ | | |||

The accompanying notes are an integral part of the condensed consolidated financial statements.

6

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

a. | General |

Protalix BioTherapeutics, Inc. (collectively with its subsidiaries, the “Company”) and its wholly-owned subsidiaries, Protalix Ltd. and Protalix B.V. (collectively, the “Subsidiaries”), are biopharmaceutical companies focused on the development and commercialization of recombinant therapeutic proteins based on the Company’s proprietary ProCellEx® protein expression system (“ProCellEx”). The Company’s current focus is to facilitate the commercialization efforts of Chiesi Farmaceutici S.p.A. (“Chiesi”), the Company’s development and commercialization partner for pegunigalsidase alfa, or Elfabrio® (which the Company referred to as PRX-102 during its development stage), for the treatment of Fabry disease, a rare, genetic lysosomal disorder. To date, the Company has successfully developed taliglucerase alfa (marketed under the name Elelyso® except in Brazil where it is marketed as BioManguinhos alfataliglicerase), an enzyme replacement therapy for the treatment of Gaucher disease that has been approved for marketing in the United States, Brazil, Israel and other markets.

The Company’s strategy is to develop proprietary recombinant proteins designed to address high, unmet needs in the rare disease space that are therapeutically superior to existing recombinant proteins currently marketed for the same indications. Consistent with this strategy, the Company has a number of product candidates in varying stages of the clinical development process.

On May 5, 2023, the European Commission (“EC”) announced that it had approved the Marketing Authorization Application (“MAA”) for Elfabrio and on May 9, 2023, the U.S. Food and Drug Administration (“FDA”) announced that it had approved the Biologics License Application (“BLA”) for Elfabrio, each for adult patients with Fabry disease. Both approvals cover the 1 mg/kg every two weeks dosage. The European Medicines Agency (“EMA”) approval followed the February 2023 adoption of a positive opinion and recommendation of marketing authorization for Elfabrio by the EMA’s Committee for Medicinal Products for Human Use the (“CHMP”). Elfabrio was approved by the FDA with a boxed warning for hypersensitivity reactions/anaphylaxis, consistent with Enzyme Replacement Therapy (ERT) class labeling, and Warnings/Precautions providing guidance on the signs and symptoms of hypersensitivity and infusion-associated reactions seen in the clinical studies as well as treatments to manage such events should they occur. The Warnings/Precautions for membranoproliferative glomerulonephritis (MPGN) alert prescribers to the possibility of MPGN and provide guidance for appropriate patient management. Overall, the FDA review team concluded that in the context of Fabry disease as a rare, serious disease with limited therapeutic options that may not be suitable to all individual patients, the benefit-risk of Elfabrio is favorable for the treatment of adults with confirmed Fabry disease.

In August and September of 2023, Elfabrio was approved in Great Britain and Switzerland, respectively, for long-term enzyme replacement therapy in adult patients with a confirmed diagnosis of Fabry disease.

The Company has entered into

Elfabrio, an enzyme replacement therapy, or ERT, was the subject of a phase III clinical program studying the drug as a treatment of patients with Fabry disease, a rare, genetic lysosomal disorder. The phase III clinical program included three separate studies, which are referred to as the BALANCE study, the BRIDGE study and the BRIGHT study. The phase III clinical program analyzed two potential dosing regimens: 1 mg/kg every two weeks and 2 mg/kg every four weeks. In addition, the phase III clinical program included two extension studies in which subjects that participated in our phase I/II clinical trials and phase III clinical trials had the opportunity to enroll and continue to be treated with PRX-102. As of March 1, 2023, sponsorship of the two open-label extension studies was transferred to Chiesi, which is now administering the extension studies. Over time, and as Elfabrio is approved for marketing in different jurisdictions,

7

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

participants withdraw from the open-label extension studies. Some of the withdrawals transfer to a commercial setting, others withdraw for other reasons.

The BLA for Elfabrio for the treatment of adult patients with Fabry disease was resubmitted to the FDA on November 9, 2022. An initial BLA for Elfabrio was submitted to the FDA on May 27, 2020 under the FDA’s Accelerated Approval pathway, but resulted in a Complete Response Letter (“CRL”).

The MAA was submitted to the EMA on February 7, 2022, after the October 8, 2021 meeting we held, together with Chiesi, with the Rapporteur and Co-Rapporteur of the EMA regarding PRX-102.

The FDA publicly released the internal review documents for Elfabrio (pegunigalsidase alfa-iwxj) injection BLA 761161. These documents provide previously unavailable additional information regarding the basis for the FDA’s May 2023 approval decision. In particular, the FDA determined that substantial evidence of effectiveness for Elfabrio in Fabry patients was established with one adequate and well-controlled study (Study PB-102-F01/02) with confirmatory evidence provided by the BALANCE study (also referred to as Study PB-102-F20). The FDA review team also concluded that the BALANCE study met its primary efficacy endpoint, which assessed the annualized rate of change in eGFR (estimated glomerular filtration rate) over 104 weeks. However, the FDA also determined that the results from the BALANCE study did not support a non-inferiority claim to the comparator product due to the lack of data to support a non-inferiority margin.

The Company has licensed the rights to commercialize taliglucerase alfa worldwide (other than Brazil) to Pfizer Inc. (“Pfizer”), and in Brazil to Fundação Oswaldo Cruz (“Fiocruz”), an arm of the Brazilian Ministry of Health (the “Brazilian MoH”). Otherwise, except with respect to taliglucerase alfa and Elfabrio, the Company holds the worldwide commercialization rights to its other proprietary development candidates. In addition, the Company continuously evaluates potential strategic marketing partnerships as well as collaboration programs with biotechnology and pharmaceutical companies and academic research institutions.

The Company’s product pipeline currently includes, among other candidates:

On March 21, 2023, the first patient was dosed in the Company’s phase I First-in-Human (“FIH”) clinical trial of PRX-115. As of September 30, 2023,

Obtaining marketing approval with respect to any product candidate in any country is dependent on the Company’s ability to implement the necessary regulatory steps required to obtain such approvals, and demonstrate the safety and efficacy of its product candidates. The Company cannot reasonably predict the outcome of these activities.

On July 2, 2021, the Company entered into an At The Market Offering Agreement (the “2021 Sales Agreement”) with H.C. Wainwright & Co., LLC, as the Company’s sales agent (the “Agent”) which was amended on May 2, 2022. Pursuant to the terms of the 2021 Sales Agreement, the Company was able to sell, from time to time through the Agent, shares of its common stock, par value $

During the term of the 2021 Sales Agreement which ended during the quarter ended March 31, 2023, the Company sold a total of

8

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On February 27, 2023, the Company entered into an At The Market Offering Agreement (the “2023 Sales Agreement”) with the Agent. Pursuant to the terms of the 2023 Sales Agreement, the Company may sell, from time to time through the Agent, ATM Shares having an aggregate offering price of up to $

Under each of the Chiesi Ex-US Agreement and the Chiesi US Agreement (collectively, the “Chiesi Agreements”), Chiesi made an upfront payment to Protalix Ltd. of $

Under the terms of both of the Chiesi Agreements, Protalix Ltd. is required to manufacture all of the Elfabrio drug substance needed under the agreements, subject to certain exceptions, and Chiesi will purchase Elfabrio drug product from Protalix, subject to certain terms and conditions. The consideration for Protalix Ltd. is based on the drug product supplied to Chiesi and the average selling price of the drug product in the relevant territory multiplied by tiered payments as described in the relevant agreement. Under the Chiesi Ex-US Agreement, Chiesi is required to make tiered payments for drug product purchased from Protalix of

On August 29, 2022, the Company entered into a Fill/Finish Agreement (the “F/F Agreement”) and a Letter Agreement (the “Letter Agreement”), in each case with Chiesi. The Company agreed to supply Chiesi with drug substance for PRX-102 and, following relevant technology and technical information transfer activities, Chiesi has agreed, among other things, to provide the Company with commercial fill/finish services for PRX-102, including to support the anticipated global launch of PRX-102. The F/F Agreement shall continue in force until December 31, 2025, unless terminated earlier in accordance with the terms of the F/F Agreement and the term may be extended by mutual agreement for an additional period of

On May 13, 2021, the Company signed a binding term sheet with Chiesi pursuant to which the Company and Chiesi amended the Chiesi Agreements in order to provide the Company with near-term capital. Chiesi agreed to make a $

Since its approval by the FDA, taliglucerase alfa has been marketed by Pfizer in accordance with the exclusive license and supply agreement entered into between Protalix Ltd. and Pfizer, which is referred to herein as the Pfizer Agreement. In October 2015, Protalix Ltd. and Pfizer entered into an amended exclusive license and supply agreement, which is referred to herein as the Amended Pfizer Agreement, pursuant to which the Company sold to Pfizer its share in the collaboration created under the Pfizer Agreement for the commercialization of Elelyso. As part of the sale, the Company agreed to transfer its rights to Elelyso in Israel to Pfizer while gaining full rights to it in Brazil. Under the Amended Pfizer Agreement, Pfizer is entitled to all of the revenues, and is responsible for

On June 18, 2013, the Company entered into a Supply and Technology Transfer Agreement with Fiocruz (the “Brazil Agreement”) for taliglucerase alfa. Fiocruz’s purchases of BioManguinhos alfataliglicerase to date have been significantly below certain agreed-upon purchase milestones and, accordingly, the Company has the right to terminate the Brazil Agreement. Notwithstanding the termination right, the Company is, at this time, continuing to supply

9

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

BioManguinhos alfataliglicerase to Fiocruz and patients continue to be treated with BioManguinhos alfataliglicerase in Brazil.

The Company expects to continue to incur significant expenditures in the near future due to research and developments efforts with respect to the product candidates. Under the terms of the Company’s outstanding

b. | Basis of presentation |

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) for interim financial information. Accordingly, they do not include all of the information and notes required by GAAP for annual financial statements. In the opinion of management, all adjustments (of a normal recurring nature) considered necessary for a fair statement of the results for the interim periods presented have been included. Operating results for the interim period are not necessarily indicative of the results that may be expected for the full year.

These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements in the Annual Report on Form 10-K for the year ended December 31, 2022, filed by the Company with the U.S. Securities and Exchange Commission (the “Commission”). The comparative balance sheet at December 31, 2022 has been derived from the audited financial statements at that date. There have been no material changes in our significant accounting policies as described in our consolidated financial statements for the year ended December 31, 2022.

c. | Revenue recognition |

The Company accounts for revenue pursuant to Accounting Standards Codification, Topic 606, Revenue from Contracts with Customers (“ASC 606”). Under ASC 606, a contract with a customer exists only when: the parties to the contract have approved it and are committed to perform their respective obligations, the Company can identify each party’s rights regarding the distinct goods or services to be transferred (“performance obligations”), the Company can determine the transaction price for the goods or services to be transferred, the contract has commercial substance and it is probable that the Company will collect the consideration to which it will be entitled in exchange for the goods or services that will be transferred to the customer.

Revenues are recorded in the amount of consideration to which the Company expects to be entitled in exchange for performance obligations upon transfer of control to the customer.

1. Revenues from selling products

The Company recognizes revenues from selling goods at a point in time when control over the product is transferred to customers (upon delivery), at the net selling price, which reflects reserves for variable consideration, potential discounts and allowances.

The transaction price is the consideration to which the Company expects to be entitled from the customer. The consideration promised in a contract with the Company’s customers may include fixed amounts and variable amounts. The Company estimates the variable consideration and includes it in the transaction price using the most likely outcome method, and only to the extent it is highly probable that a significant reversal of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. Prior to recognizing revenue from variable consideration, the Company uses significant judgment to determine the probability of significant reversal of such revenue.

10

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

2. | Revenues from Chiesi Agreements |

The Company has identified

The Company determined that the license together with the research and development services should be combined into single performance obligation since Chiesi cannot benefit from the license without the research and development services. The research and development services are highly specialized and are dependent on the supply of the drug.

The manufacturing was contingent on regulatory approvals of the drug and the Company deems these services to be separately identifiable from other performance obligations in the contract. Manufacturing services post-regulatory approval are not interdependent or interrelated with the license, research and development services. Following the regulatory approvals for Elfabrio received in May 2023, the Company started recognizing revenue from manufacturing, see also revenue from selling products above.

The transaction price was comprised of fixed consideration and variable consideration (capped research and development reimbursements). Under ASC 606, the consideration to which the Company would be entitled upon the achievement of contractual milestones, which are contingent upon the occurrence of future events, are a form of variable consideration. The Company estimates variable consideration using the most likely method. Amounts included in the transaction price are recognized only when it is probable that a significant reversal of cumulative revenues will not occur. Prior to recognizing revenue from variable consideration, the Company uses significant judgment to determine the probability of significant reversal of such revenue. Following the approval of Elfabrio by the FDA, the Company received a milestone payment equal to $

Since the customer benefits from the research and development services as the entity performs the service, revenue from granting the license and the research and development services was recognized over time using the cost-to-cost method.

Revenue from additional research and development services ordered by Chiesi is recognized over time using the cost-to-cost method.

3. | Revenue from R&D services |

Revenue from the research and development services was recognized over time using the cost-to-cost method since the customer benefits from the research and development services as the entity performs the services.

NOTE 2 - INVENTORIES

Inventories at September 30, 2023 and December 31, 2022 consisted of the following:

| September 30, |

| December 31, | ||||

(U.S. dollars in thousands) | 2023 | 2022 | |||||

Raw materials | $ | | $ | | |||

Work in progress |

| | | ||||

Finished goods |

| | | ||||

Total inventory | $ | | $ | | |||

NOTE 3 – FAIR VALUE MEASUREMENT

The Company measures fair value and discloses fair value measurements for financial assets and liabilities. Fair value is based on the price that would be received from the sale of an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date.

11

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The accounting standard establishes a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three broad levels, which are described below:

Level 1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for assets or liabilities. The fair value hierarchy gives the highest priority to Level 1 inputs.

Level 2: Observable prices that are based on inputs not quoted on active markets, but corroborated by market data.

Level 3: Unobservable inputs are used when little or no market data is available. The fair value hierarchy gives the lowest priority to Level 3 inputs.

In determining fair value, the Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible and considers counterparty credit risk in its assessment of fair value.

The fair value of the financial instruments included in the working capital of the Company is usually identical or close to their carrying value.

Based on a Level 3 measurement, as of September 30, 2023, the fair value of the $

| 2024 Notes | |||||

Stock price (USD) |

| | ||||

Expected term |

| | ||||

Risk free rate |

| | % | |||

Volatility |

| | % | |||

Yield |

| | % |

NOTE 4 – REVENUES

The following table summarizes the Company’s disaggregation of revenues:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

(U.S. dollars in thousands) |

| 2023 |

| 2022 | 2023 |

| 2022 | ||||||

Pfizer | $ | | $ | | $ | | $ | | |||||

Brazil | $ | | $ | | $ | | $ | | |||||

Chiesi | $ | | $ | | $ | | $ | | |||||

Total revenues from selling goods | $ | | $ | | $ | | $ | | |||||

Revenues from license and R&D services | $ | | $ | | $ | | $ | | |||||

NOTE 5 – STOCK TRANSACTIONS

| (a) | Authorized Capital |

On June 28, 2023, the Company held its 2023 Annual Meeting of Stockholders, which was adjourned and reconvened on July 13, 2023 (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders, among other matters, approved an amendment to the Company’s Certificate of Incorporation, as amended, to increase the number of shares of Common Stock authorized for issuance from

12

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| (b) | At-the-Market (ATM) Offering |

During the nine months ended September 30, 2023, the Company sold, in the aggregate,

(c)Exercise of Warrants

On May 8, 2023, the Company issued

On May 10, 2023, the Company issued

(d)Conversion of 2024 Notes

During the nine months ended September 30, 2023, the Company issued, in the aggregate,

(e)Stock based compensation

| 1) | On June 28, 2023, at the Annual Meeting, the Company’s stockholders, among other matters, adopted amendments to the Company’s Amended and Restated 2006 Employee Stock Incentive Plan, as amended (the “Plan”) to increase the number of shares of Common Stock available under Plan from |

| 2) | On August 15, 2023, the Company granted, with the approval of the Company’s compensation committee, |

3) | On August 15, 2023, the Company granted, with the approval of the Company’s compensation committee, |

13

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On September 14, 2023, the Company granted, with the approval of the Company’s compensation committee,

On September 29, 2023, the Company granted, with the approval of the Company’s compensation committee,

The fair value of each option granted during the three-month period ended September 30, 2023 is estimated at the date of grant using the Black-Scholes option-pricing model. The following weighted average assumptions were applied in determining the fair value of the options described in this Note 5(e)(3) on their respective grant dates:

Weighted average grants date fair value (USD) | | ||

Exercise price (USD) | | ||

Risk free rate | | % | |

Volatility | | % | |

Dividend yield | % | ||

Expected life (Years) |

NOTE 6 – EARNINGS (LOSS) PER SHARE

Basic earnings (loss) per share is calculated by dividing the net income (loss) by the weighted average number of shares of Common Stock outstanding during each period.

Diluted earnings per share is calculated by dividing the net income by the weighted-average number of shares of Common Stock outstanding during each period increased to include the number of additional shares of Common Stock that would have been outstanding if the potentially dilutive shares had been issued.

In computing diluted earnings per share, basic earnings per share are adjusted to take into account the potential dilution that could occur upon: (i) the exercise of options granted under employee stock compensation plans using the treasury stock method; (ii) the exercise of warrants using the treasury stock method; and (iii) the conversion of the convertible notes using the “if-converted” method.

14

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Basic and diluted net earnings (loss) per share attributable to common stockholders were calculated as follows:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

(In thousands, except share data) | 2023 | 2022 | 2023 | 2022 | ||||||||

Numerator: | ||||||||||||

Net income (loss) | $ | ( | $ | ( | $ | | $ | ( | ||||

Add: | ||||||||||||

Financial expenses of 2024 Notes* | $ | ( | — | $ | ( | — | ||||||

Net income (loss) for diluted calculation | $ | ( | $ | ( | $ | | $ | ( | ||||

Denominator: | ||||||||||||

Weighted average shares of Common Stock outstanding for basic calculation | | | | | ||||||||

Weighted average dilutive effect of 2024 Notes | | — | | — | ||||||||

Weighted average dilutive effect of stock options | — | — | | — | ||||||||

Weighted average shares of Common Stock outstanding for diluted calculation | | | | | ||||||||

* Financial expenses on 2024 Notes consists of add back of financial expense incurred during the period and inclusion of make-whole interest payments that will be incurred upon conversion.

Diluted earnings (loss) per share do not include

Diluted earnings (loss) per share do not include

NOTE 7 – TAXES ON INCOME

The following table summarizes the Company’s taxes on income:

| Three Months Ended |

| Nine Months Ended | |||

(U.S. dollars in thousands) | September 30, 2023 | September 30, 2023 | ||||

Current taxes on income | $ | | $ | | ||

Deferred taxes on income |

| | ( | |||

Total taxes on income | $ | | $ | | ||

The Company had an effective tax rate of

Following the regulatory approvals for Elfabrio in May 2023, the receipt of the $

15

PROTALIX BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Section 174 of the TCJA which requires the Company to capitalize and amortize its research and development expenses over 15 years; and (iii) its forecasted profits in the United States following the regulatory approvals of Elfabrio.

NOTE 8 – SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION

Balance sheets:

| September 30, |

| December 31, | |||

(U.S. dollars in thousands) | 2023 | 2022 | ||||

Accounts payable and accruals – other: | ||||||

Payroll and related expenses | $ | | $ | | ||

Interest Payable | | | ||||

Provision for vacation | | | ||||

Accrued expenses | | | ||||

Royalties payable | | | ||||

Income tax payable | | | ||||

Reserve for deductions from revenue |

| | — | |||

Property and equipment suppliers |

| | | |||

$ | | $ | | |||

NOTE 9 – SUBSEQUENT EVENTS

1) | On October 4, 2023 the Company collected approximately $ |

2) | On October 15, 2023, the Company granted, with the approval of the Company’s compensation committee, |

3) | Because the Company's operations are conducted in the State of Israel, the business and operations may be directly affected by economic, political, geopolitical and military conditions in Israel. In October 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets. Hamas also launched extensive rocket attacks on Israeli population and industrial centers located along Israel’s border with the Gaza Strip and in other areas within the State of Israel attacking a number of civilian and military targets while simultaneously launching extensive rocket attacks on the Israeli population and industrial centers. At the same time, clashes between Israel and Hezbollah in Lebanon have increased. In response, Israel’s security cabinet declared war against the Hamas and a military campaign against these terrorist organizations commenced in parallel to their continued rocket and terror attacks. Moreover, the attacks by Hamas and Hezbollah, and Israel’s defensive measures, may result in a greater regional conflict. It is currently not possible to predict the duration or severity of the ongoing conflict or its effects on our business, operations and financial conditions. The ongoing conflict is rapidly evolving and developing, and could disrupt certain of our business and operations, among others. |

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

AND RISK FACTORS SUMMARY

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and the consolidated financial statements and the related notes included elsewhere in this Form 10-Q and in our Annual Report on Form 10-K for the year ended December 31, 2022. Some of the information contained in this discussion and analysis, particularly with respect to our plans and strategy for our business and related financing, includes forward-looking statements within the meanings of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, including statements regarding expectations, beliefs, intentions or strategies for the future. When used in this report, the terms “anticipate,” “believe,” “estimate,” “expect,” “can,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and words or phrases of similar import, as they relate to our company or our management, are intended to identify forward-looking statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are only predictions and reflect our views as of the date they are made with respect to future events and financial performance, and we undertake no obligation to update or revise, nor do we have a policy of updating or revising, any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required under applicable law. Forward-looking statements are subject to many risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements as a result of several factors including those set forth under “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 and in this Quarterly Report on Form 10-Q.

Examples of the risks and uncertainties include, but are not limited to, the following:

17

Given these uncertainties, you should not place undue reliance on these forward-looking statements. Companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced or late-stage clinical trials, even after obtaining promising earlier trial results or preliminary findings for such clinical trials. Even if favorable testing data is generated from clinical trials of a drug product, the FDA or foreign regulatory authorities may not accept or approve a marketing application filed by a pharmaceutical or biotechnology company for the drug product.

Recent Company Developments

18

ProCellEx: Our Proprietary Protein Expression System

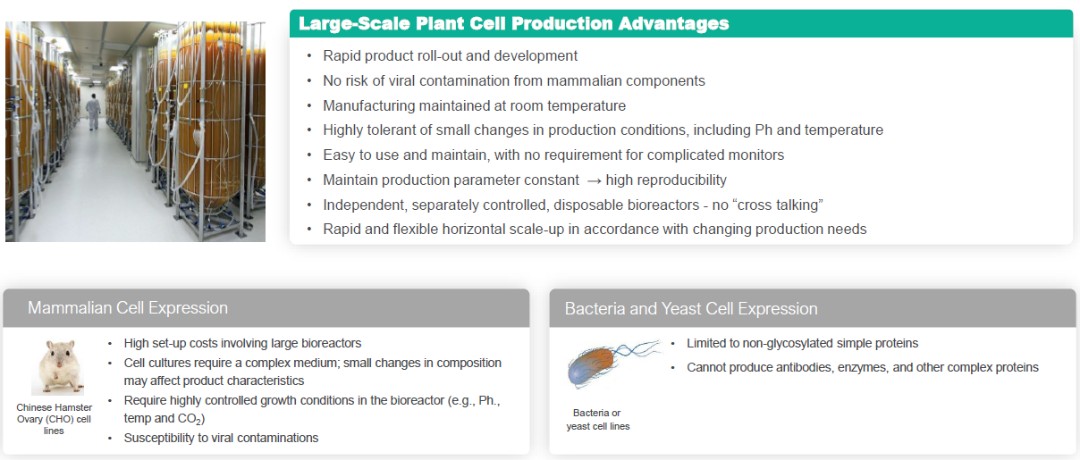

ProCellEx is our proprietary platform used to produce and manufacture recombinant proteins through plant cell-based expressions in suspension. ProCellEx consists of a comprehensive set of proprietary technologies and capabilities, including the use of advanced genetic engineering and plant cell culture technology, enabling us to produce complex, proprietary, and biologically equivalent proteins for a variety of human diseases. Our protein expression system facilitates the creation and selection of high-expressing, genetically-stable cell lines capable of expressing recombinant proteins.

Our ProCellEx technology allows for many unique advantages, including: biologic optimization; an ability to handle complex protein expressions; flexible manufacturing with improvements through efficiencies, enhancements and/or rapid horizontal scale-ups; a simplified production process; elimination of the risk of viral contaminations from mammalian components; and intellectual property advantages.

We are the first and only company to gain FDA approval of a protein produced through plant cell-based expression, and with the recent approval of Elfabrio, we now have two FDA approved proteins produced through our platform. Our ProCellEx platform uses flexible polyethylene disposable bioreactors and is optimized for plant cell cultures. As opposed to the large stainless-steel bioreactors commonly used for recombinant protein production, our ProCellEx bioreactors are easy to use and maintain and allow for the major advantage of rapid horizontal scale-up.

Plant Cell Production Advantages

19

ProCellEx®: Protalix’s Differentiated Plant Cell Protein Expression Platform

Products and Product Pipeline

Elfabrio (PRX-102) for the Treatment of Fabry Disease

On May 5, 2023, the EC announced that it had approved the MAA for Elfabrio and on May 9, 2023, the FDA announced that it had approved the BLA for Elfabrio, each for adult patients with Fabry disease. Both approvals cover the 1 mg/kg every two weeks dosage. The EMA approval followed the February 2023 adoption of a positive opinion and recommendation of marketing authorization for Elfabrio by the CHMP. Elfabrio was approved by the FDA with a boxed warning for hypersensitivity reactions/anaphylaxis, consistent with ERT class labeling, and Warnings/Precautions providing guidance on the signs and symptoms of hypersensitivity and infusion-associated reactions seen in the clinical studies as well as treatments to manage such events should they occur. The Warnings/Precautions for MPGN alert prescribers to the possibility of MPGN and provide guidance for appropriate patient management. Overall, the FDA review team concluded that in the context of Fabry disease as a rare, serious disease with limited therapeutic options that may not be suitable to all individual patients, the benefit-risk of Elfabrio is favorable for the treatment of adults with confirmed Fabry disease.

In August and September of 2023, Elfabrio was approved in Great Britain and Switzerland, respectively, for long-term enzyme replacement therapy in adult patients with a confirmed diagnosis of Fabry disease.

20

Elfabrio, an ERT, is our proprietary, plant cell culture expressed enzyme, and a chemically modified stabilized version of, the recombinant α-Galactosidase-A protein, a lysosomal enzyme. Fabry disease is a serious life-threatening rare genetic disorder. Fabry patients lack or have low levels of α-galactosidase-A resulting in the progressive accumulation of abnormal deposits of a fatty substance called globotriaosylceramide, or Gb3, in blood vessel walls throughout their body. The ultimate consequences of Gb3 deposition range from episodes of pain and impaired peripheral sensation to end-organ failure, particularly of the kidneys, but also of the heart and the cerebrovascular system. Fabry disease occurs in one person per 40,000 to 60,000 males.

The global market for Fabry disease, that includes Sanofi’s Fabrazyme®, Shire’s (acquired by Takeda Pharmaceutical Company Limited) Replagal®, and Amicus Therapeutics’ Galafold®, among others, was approximately $2.0 billion in 2022, is forecasted to be approximately $2.0 billion in 2023 and is forecasted to grow at a CAGR of approximately 10% from 2022-2029.

In preclinical studies, PRX-102 showed significantly longer half-life due to higher enzyme stability, enhanced activity in Fabry disease affected organs leading to reduction of the accumulated substrate and reduced immunogenicity, which together can potentially lead to improved efficacy through increased substrate clearance and significantly lower formation of anti-drug antibodies, or ADAs. In 2015, we completed a phase I/II clinical trial of PRX-102 (NCT01678898), which was a worldwide, multi-center, open-label, dose ranging study designed to evaluate the safety, tolerability, pharmacokinetics, immunogenicity and efficacy parameters of PRX-102 in adult patients with Fabry disease. Our phase III clinical program, which has now been completed, included the following three separate studies:

The BALANCE study (PB-102-F20, NCT02795676), a pivotal 24-month, randomized, double blind, active control study of PRX-102 in adult Fabry patients with deteriorating renal function that was designed to evaluate the safety and efficacy of 1 mg/kg of PRX-102 administered every two weeks compared to agalsidase beta;

The BRIDGE study (PB-102-F30, NCT03018730), a 12-month open-label, single arm switch-over study evaluating the safety and efficacy of PRX-102, 1 mg/kg infused every two weeks, in up to 22 Fabry patients previously treated with agalsidase alfa for at least two years and on a stable dose for at least six months; and

The BRIGHT study (PB-102-F50, NCT03180840), a multicenter, multinational open-label, switch-over study designed to evaluate the safety, efficacy and pharmacokinetics of treatment with 2 mg/kg of PRX-102 administered every four weeks for 52 weeks (a total of 14 infusions). The 2 mg/kg every four weeks dosage was not approved by the EMA, FDA or any other jurisdiction.

Patients who completed the BALANCE, BRIDGE and BRIGHT studies, and the extension of the phase I/II study, were offered the opportunity to continue PRX-102 treatment in one of two long-term open-label extension studies. Overall, 126 subjects who participated in our PRX-102 clinical program initially opted, with the advice of the treating physician, to enroll in one of our long-term, open label, extension studies of PRX-102: 97 patients in the 1 mg/kg every two weeks extension study (PB-102-F60, NCT03566017) (10 subjects who completed an extension study from the phase I/II study, 18 subjects who completed the BRIDGE study, 69 subjects who completed the BALANCE study); and 29 subjects who completed the BRIGHT study in the 2 mg/kg every four weeks extension study (PB-102-F51, NCT03614234). Two of the subjects in the PB-102-F51 study are being treated with 1 mg/kg every two weeks. As of March 1, 2023, sponsorship of the two extension studies was transferred to Chiesi, and Chiesi is now administering the open-label extension studies.

Over time, and as Elfabrio is approved for marketing in different jurisdictions, participants withdraw from the open-label extension studies. Some of the withdrawals transfer to a commercial setting, others withdraw for other reasons.

A BLA for Elfabrio for the treatment of adult patients with Fabry disease was first submitted to the FDA on May 27, 2020 under the FDA’s Accelerated Approval pathway, but resulted in a CRL. The BLA was resubmitted to the FDA on November 9, 2022.

The MAA was submitted to the EMA on February 7, 2022, after the October 8, 2021 meeting we held, together with Chiesi, with the Rapporteur and Co-Rapporteur of the EMA regarding PRX-102.

The FDA publicly released the internal review documents for Elfabrio (pegunigalsidase alfa-iwxj) injection BLA 761161. These documents provide previously unavailable additional information regarding the basis for the FDA’s May 2023 approval decision. In particular, the FDA determined that substantial evidence of effectiveness for Elfabrio in Fabry patients was established with one adequate and well-controlled study (Study PB-102-F01/02) with confirmatory evidence provided by the BALANCE study (also referred to as Study PB-102-F20). The FDA review team also concluded that the BALANCE study met its primary efficacy endpoint, which assessed the annualized rate of change in eGFR (estimated glomerular filtration rate) over 104 weeks (two years).

21

However, the FDA also determined that the results from the BALANCE study did not support a non-inferiority claim to the comparator product due to the lack of data to support a non-inferiority margin.

In February 2020, we, together with Chiesi, announced an agreement with the FDA for the Initial Pediatric Study Plan (iPSP) for PRX-102, which is intended to be initiated post-marketing approval. The joint announcement was made after completion of discussions with the FDA and receipt of confirmation from the FDA in an official “Agreement Letter” which outlines an agreed-upon approach to evaluate the safety and efficacy of PRX-102 in pediatric Fabry patients in a clinical trial to be performed by Chiesi with our collaborative efforts.

Chiesi, together with Protalix, participated in an Oral Explanation at a meeting of the EMA’s Committee for Orphan Medicinal Products (COMP) held on March 21, 2023, as part of the Orphan Drug Designation maintenance process. Following the meeting, Chiesi formally withdrew the application for Orphan Drug Designation for PRX-102. The EC first granted Orphan Drug Designation for PRX-102 for the treatment of Fabry disease in December 2017.

Phase III BALANCE Study

The Clinical Study Report for the BALANCE study was completed in July 2022. The final analysis confirmed the positive topline results (announced in April 2022) and favorable tolerability profile. A total of 78 patients who were previously treated with agalsidase beta for at least one year with an eGFR slope at screening worse than -2 mL/min/1.73 m2/year were enrolled in the study. Patients were randomized on a 2:1 ratio for switching to PRX-102 or continuing on agalsidase beta. A total of 77 patients were treated; 52 with PRX-102 and 25 with agalsidase beta. Approximately 40% of the enrolled patients were female.

The primary endpoint of the BALANCE study is the comparison in the annualized rate of decline of eGFR slope between the agalsidase beta and PRX-102 treatment arms. eGFR is considered a reliable and accepted test to measure kidney function and stage of kidney disease. Additional parameters evaluated include: cardiac assessment, lyso-Gb3 (a biomarker for monitoring Fabry patients during therapy), pain, quality of life, immunogenicity, Fabry Clinical Events, pharmacokinetics and other parameters.

Based on the original primary analysis (random intercept random slope (RIRS)), the estimated mean eGFR slopes were -2.4 mL/min/1.73 m2 /year and -2.3 mL/min/1.73 m2 /year in the PRX-102 and agalsidase beta arms, respectively, and the treatment difference was -0.1 (95% CI: -2.2, 2.1) mL/min/1.73 m2 /year. Based on the ANCOVA adjusted for continuous baseline proteinuria, the estimated mean eGFR slopes were -2.0 and -3.1 mL/min/1.73 m2 /year in the PRX-102 and agalsidase beta arms, respectively, and the treatment difference was 1.1 (95% CI: -0.8, 3.1) mL/min/1.73 m2 /year. Based on quantile regression model, the median of the eGFR slope in the PRX-102 arm was -2.514 mL/min/1.73 m2/year (95% CI:-3.788, -1.240) and -2.155 mL/min/1.73 m2/year (95% CI:-3.805, -0.505) in the agalsidase beta arm, demonstrating a large overlap in the confidence intervals of the two arms. The difference in medians (95% confidence interval) is -0.359 mL/min/1.73 m2/year (-2.444, 1.726). Additional sensitivity and supportive analyses investigated mean eGFR slopes using other statistical models. These models yielded results similar to the primary analysis and confirming the comparability between the treatment arms. These results supported the robustness of the methodology used for comparisons of treatment effects in the BALANCE study. The results of the analyses on eGFR slopes were further supported by the analysis of change from baseline in the average eGFR at the last two visits (100 and 104 weeks). The estimated mean changes were -3.0 and -3.8 mL/min/1.73 m2 in the PRX102 and agalsidase beta arms, respectively. The difference in mean change (PRX-102 – agalsidase beta) was 0.8 (95% CI: -3.0, 4.6) mL/min/1.73 m2 or annualized change of 0.4 (95% CI: -1.5, 2.3) mL/min/1.73 m2/year.

The study population (ITT analysis set) was composed of 47 males (61.0%) and 30 females (39.0%), with a mean (range) age of 44.3 (18-60) years. The mean duration of prior treatment with agalsidase beta was approximately six years. At baseline, mean (SD) eGFR was 73.69 ml/min/1.73 m2 (20.32) and median eGFR was 74.51 ml/min/1.73 m2; mean (SD) eGFR slope was -8.10 mL/min/1.73 m2/year (5.92) and median eGFR slope was -7.25 ml/min/1.73 m2/year.

A comparable efficacy response was also observed across biomarkers and functional systems relevant to Fabry disease, as demonstrated via secondary endpoints, where in some cases the trend was in favor of PRX-102 and in some in favor of agalsidase beta, but the actual difference between the two arms is always clinically small, supporting the comparability of the two treatments.

Key secondary endpoints included Urine protein creatinine ratio (UPCR) as indicator of proteinuria, plasma levels of lyso–Gb3, imaging marker of cardiac remodeling (Left Ventricular Mass Index, LVMI, by cardiac MRI), disease severity (by Mainz Severity Score Index, MSSI), pain severity (Short Form Brief Pain Inventory, BPI) and quality of life (EQ-5D-5L). Both treatments showed either a stabilization of clinical parameters (e.g., for eGFR, eGFR slope and UPCR) or prevention of further progression of Fabry disease (e.g., LVMI, MSSI).

22

For an overview of primary and secondary endpoints collected in the BALANCE study, please refer to the Table 1 below.

Table 1: Summary Table of Comparison of Treatment Benefit Data in the BALANCE Study, (Mean (SE) [median]), Efficacy Population

Parameter | PRX-102 (N = 52) | Agalsidase beta (N = 25) | |||

eGFR (ml/min/1.73 m2) | n | n | |||

Baseline | 52 | 73.46 (2.80) [73.45] | 25 | 74.16 (4.19) [74.85] | |

Month 24 | 47 | 70.53 (3.19) [69.35] | 24 | 72.05 (4.69) [74.48] | |

Change from Baseline | 47 | -3.60 (1.58) [-2.39] | 24 | -1.97 (1.51) [-3.20] | |

eGFR slope (ml/min/1.73 m2/yr) | Baseline | 52 | -8.03 (0.92) [-6.70] | 25 | -8.25 (0.85) [-7.84] |

Month 24 | 51 | -2.38 (1.25) [-2.51] | 25 | -2.31 (0.71) [-2.16] Q1; Q3: -4.6; -0.5 | |

Reaching kidney therapeutic goala | Month 24 | 52 | 41 patients (80.4%) | 25 | 20 patients (80.0%) |

UPCR | Baseline | 52 | 0.441 (0.084) | 25 | 0.284 (0.097) |

Month 24 | 45 | 0.480 (0.118) | 24 | 0.489 (0.162) | |

Change from Baseline | 45 | 0.088 (0.067) | 24 | 0.197 (0.085) | |

Plasma lyso-Gb3 (nM) | Baseline | 52 | 26.22 (3.78) [15.20] | 25 | 32.14 (7.08) [17.60] |

Month 24 | 46 | 29.22 (4.48) [18.80] | 22 | 19.65 (3.60) [15.30] | |

Change from Baseline | 46 | 3.30 (1.38) [1.15] | 22 | -8.74 (4.85) [-1.50] | |

LVMI (g/m2) | Baseline | 40 | 75.97 (5.13) | 22 | 82.22 (6.34) |

Month 24 | 35 | 71.56 (5.20) | 20 | 82.43 (8.39) | |

Change from Baseline | 28 | -0.64 (2.69) | 19 | 0.29 (3.73) | |

23

MSSI (overall score)a | Baseline | 49 | 23.18 (1.42) | 25 | 25.16 (2.14) |

Month 24 | 46 | 22.11 (1.80) | 23 | 27.09 (2.30) | |

Change from Baseline | 44 | -2.07 (0.77) | 23 | 2.04 (1.10) | |

BPI (score for pain at its worst)b | Baseline | 52 | 3.5 (0.4) | 25 | 2.6 (0.6) |

Month 24 | 45 | 3.3 (0.5) | 22 | 3.0 (0.7) | |

Change from Baseline | 45 | -0.1 (0.5) | 22 | 0.6 (0.6) |

BPI=brief pain inventory; eGFR=estimated glomerular filtration rate; lyso-Gb3=globotriaosylsphingosine; LVMI=Left Ventricular Mass Index; MSSI=Mainz Severity Score Index; UPCR=Urine Protein Creatinine Ratio.

a Wanner 2018; b Higher scores indicate higher symptom severity.

Forty-seven (90.4%) patients in the PRX-102 arm experienced at least one treatment-emergent adverse event (TEAE) compared to 24 (96.0%) in the agalsidase beta arm. The number of events adjusted to 100 years of exposure is 572.36 events for the PRX-102 arm and 816.85 events for the agalsidase beta arm.

Treatment-related adverse events were reported for 21 (40.4%) patients in the PRX-102 arm compared to 11 (44.0%) in the agalsidase beta arm. The number of treatment-related events adjusted to 100 years of exposure is 42.85 events for the PRX-102 arm and 152.91 events for the agalsidase beta arm.

Usage of infusion pre-medication was tapered down during the study, if possible, for all patients. At baseline, 21 (40.4%) patients in the PRX-102 arm used infusion premedication compared to 16 (64.0%) in the agalsidase beta arm. At the end of the study, only three out of 47 (6.4%) patients in the PRX-102 arm used infusion premedication compared to three out of 24 (12.5%) in the agalsidase beta arm. Even with this reduction in use of premedication, there were fewer reported infusion-related reactions with PRX-102: 11 (21.2%) patients in the PRX-102 arm experienced a total of 13 events compared to six (24.0%) patients experiencing a total of 51 events in the agalsidase beta arm. The number of infusion-related reactions adjusted to 100 infusions is 0.5 for the PRX-102 arm and 3.9 for the agalsidase beta arm.

Assessment of immunogenicity, that is, the existence and development of anti PRX-102 antibodies or anti-agalsidase beta antibodies, in the study indicated that for the PRX-102 arm, 18 (34.6%) patients were ADA positive at baseline, of which 17 (94.4%) had neutralizing antibody activity. For the agalsidase beta arm, eight (32.0%) patients were ADA positive at baseline, of which seven (87.5%) had neutralizing antibody activity. Only a small number of patients showed treatment-emergent ADA. At the end of the two-year study, 11 (23.4%) patients who received PRX-102 were ADA positive, of which seven (63.6%) had neutralizing antibody activity, while in the agalsidase beta arm six (26.1%) were ADA-positive and all six (100%) had neutralizing antibody activity. There was little change in the percentage of patients who were ADA positive, with a trend of reduction observed in the PRX-102 arm and stability in the agalsidase beta arm. The proportion of patients with neutralizing ADA decreased in the PRX-102 arm while it remained stable in the agalsidase beta arm.

Out of the 78 randomized patients, six patients discontinued the study: out of the five (9.4%) from the PRX-102 arm, one patient withdrew consent prior to the first infusion, two discontinued due to personal reasons, and two due to adverse events (one due to an unrelated adverse event and one due to a treatment related adverse event); one (4%) patient from the agalsidase beta arm discontinued for personal reasons. There were no deaths in this study.

Considering that in the trial, patients in the PRX-102 arm were exposed for the first time to the novel enzyme, tolerability data appear favorable for PRX-102 and in line with what was observed in the previous clinical studies of PRX-102.

Of the patients who completed the trial from both the PRX-102 and agalsidase beta treatment arms, 69 have opted, with the advice of the treating physician, to receive PRX-102 1 mg/kg every two weeks in the long-term open-label extension study which is now sponsored by Chiesi.

The results of the direct, blinded comparison of PRX-102 to agalsidase beta, for the primary efficacy renal endpoints (i.e., eGFR change, eGFR slope) and for the main secondary endpoints (e.g., urine protein to creatinine ratio [UPCR] LVMI, MSSI, BPI) strongly suggest comparability in treatment effects between the two treatments.

At the same time a potentially favorable safety profile was identified based on lower rates of IRR, lower ADA positivity, and less premedication use in the PRX-102 arm compared to agalsidase beta. Overall, a positive benefit-risk balance was confirmed.

24

Phase III BRIDGE Study

The BRIDGE study was completed in December 2019. In the study, patients were screened and evaluated over three months while continuing agalsidase alfa treatment.

Final results of the data generated in the BRIDGE study showed substantial improvement in renal function as measured by mean annualized eGFR slope in both male and female patients. Twenty of 22 patients completed the 12-month treatment duration. Eighteen of the patients who completed the study opted to roll over to a long-term extension study and continue to be treated with PRX-102. In the study, the mean annualized eGFR slope of the study participants improved from -5.90 mL/min/1.73 m2/year while on agalsidase alfa to -1.19 mL/min/1.73 m2/year on PRX-102 in all patients. Male patients improved from -6.36 mL/min/1.73 m2/year to -1.73 mL/min/1.73 m2/year and female patients improved from -5.03 mL/min/1.73 m2/year to -0.21 mL/min/1.73 m2/year. Following the switch to PRX-102, there was a decrease in patients with progressing or fast progressing kidney disease which is consistent with the therapeutic goals for Fabry disease, as identified by Christoph Wanner, et. al., in 2019, and most patients achieved a stable status post-switch.

PRX-102 was well-tolerated in the BRIDGE study, with all adverse events being transient in nature without sequelae. Of the 22 patients enrolled in the BRIDGE study, the majority of TEAEs were mild or moderate in severity, with two patients (9.1%) withdrawing from the therapy due to hypersensitivity reaction that was resolved. The most common moderate TEAEs were nasopharyngitis, headache and dyspnea.

An immunogenicity assessment indicated that four out of 20 patients (20%) developed persistent ADAs over the course of the study, of which two had neutralizing activity.

Baseline characteristics of the 20 patients who completed the study, ranging from ages 28 to 60 years, were as follows: mean eGFR 75.87 mL/min/1.73 m2 in males, and 86.14 mL/min/1.73 m2 in females and plasma lyso-Gb3 were 51.81 nM and 13.81 nM in males and females, respectively. While lyso-Gb3 levels remain slightly high, particularly within the male cohort, continuous reduction in lyso-Gb3 levels was observed of 19.55 nM (32.35%) in males and 4.57 nM (29.81%) in females.

Of the patients who completed the trial, 18 have opted, with the advice of the treating physician, to continue receiving PRX-102 1 mg/kg every two weeks in a long-term open-label extension study which now sponsored by Chiesi.

Phase III BRIGHT Study

The BRIGHT study, which studied the 2 mg/kg every four weeks dosage, was completed in June 2020. This dosage was not approved by the EMA or the FDA.

Enrollment in the study included 30 adult patients (24 males and 6 females) with mean (SD) age of 40.5 (11.3) years, ranging from 19 to 58 years previously treated with a commercially available ERT (agalsidase beta or agalsidase alfa), for at least three years and on a stable dose administered every two weeks. To determine eligibility for participation in the study, candidates were screened to identify and select Fabry patients with clinically stable kidney disease. The most common Fabry disease symptoms at baseline were acroparesthesia, heat intolerance, angiokeratomas and hypohydrosis. Patients who matched the criteria were enrolled in the study and switched from their current treatment of IV infusions every two weeks to 2 mg/kg of PRX-102 every four weeks for 12 months. Patients participating in the study were evaluated, among other disease parameters, to determine if their kidney disease had not further deteriorated while being treated with the four-week dosing regimen as measured by eGFR and for lyso-Gb3 levels as a Fabry biomarker, as well as other parameters. In addition, participating patients were evaluated to assess the safety and tolerability of PRX-102.

We announced final results from the BRIGHT study in March 2022. The results indicate that 2 mg/kg of PRX-102 administered by intravenous infusion every four weeks was well tolerated, and Fabry disease assessed by eGFR slope and plasma lyso-Gb3 was stable throughout PRX-102 treatment in adult Fabry patients. None of the patients without ADAs at screening developed treatment-induced ADAs following the switch to PRX-102 treatment.

All 30 patients received at least one dose of PRX-102, and 29 patients completed the one-year study. Of these 29 patients, 28 received the intended regimen of 2 mg/kg every four weeks throughout the entire study, while one patient was switched to 1 mg/kg PRX-102 every two weeks per protocol at the 11th infusion. One patient withdrew from the study after the first infusion due to a traffic accident.

First infusions of PRX-102 were administered under controlled conditions at the investigation site. Based on the protocol-specified criteria, patients were able to receive their PRX-102 infusions at a home care setup once the applicable Investigator and Sponsor

25

Medical Monitor agreed that it was safe to do so. Safety and efficacy exploratory endpoints were assessed throughout the 52-week study.

Overall, 33 of 183 total TEAEs reported in nine (30.0%) of the patients were considered treatment related; all were mild or moderate in severity and the majority were resolved at the end of the study. There were no serious or severe treatment-related TEAEs and no TEAEs led to death or study withdrawal. Of the treatment-related TEAEs, 27 were infusion-related reactions (IRRs) and the remainder were single events of diarrhea, erythema, fatigue, influenza-like illness, increases urine protein/creatinine ratio, and urine positive for white blood cells. The 27 IRRs were reported in five (16.7%) patients, all male. All IRRs occurred during the infusion or within two hours post-infusion; no events were recorded between two and 24 hours post-infusion.

Study outcome measures show that plasma lyso-Gb3 concentrations remained stable during the study with a mean change (±SE) of 3.01 nM (0.94) from baseline (19.36 nM ±3.35) to Week 52 (22.23 ±3.60 nM). Mean absolute eGFR values were stable during the 52-week treatment period, with a mean change from baseline of -1.27 mL/min/1.73 m2 (1.39). Mean (SE) eGFR slope, at the end of the study, for the overall population, was -2.92 (1.05) mL/min/1.73 m2/year indicating stability.

Following a survey of participants using the Quality of Life EQ-5D-5L questionnaire, responses indicate that patient perception of their own health remained high and stable throughout the 52-week study duration, with overall health mean (SE) scores of 78.3 (3.1) and 82.1 (2.9) at baseline and Week 52, respectively, in a 0 to 100 scale. Using the short-form Brief Pain Inventory, or questionnaire, approximately 75% of study participants had an improvement or no change in average pain severity at Week 52 (compared to baseline). The short-form BPI interference items also remained stable during the study. Pain-related results indicate that there was no increase and/or relapse in pain. No Fabry clinical events were reported during the study.

Phase I/II Study

Sixteen adult, naïve Fabry patients (9 male and 7 female) completed our phase I/II clinical trial of PRX-102, each in one of three dosing groups, 0.2 mg/kg, 1 mg/kg and 2 mg/kg. Each patient received IV infusions of PRX-102 every two weeks for 12 weeks, with efficacy follow-up after six-month and twelve-month periods. A majority of the patients who completed the trial opted to continue receiving PRX-102 in an open-label, 60-month extension study under which all patients were switched to receive 1 mg/kg of the drug, the selected dose for our BALANCE and BRIDGE studies.

The adult symptomatic, ERT-naïve Fabry disease patients enrolled in the phase I/II study were evaluated for Gb3 levels in kidney biopsies and for plasma lyso-Gb3 concentration by the quantitative BLISS methodology. Biopsies were available from 14 patients. The outcome of ≥ 50% reduction in the average number of Gb3 inclusions per kidney PTC from baseline to Month 6 was demonstrated in 11 of 14 (78.6%) of the patients treated with PRX-102. The overall results demonstrate that PRX-102 reaches the affected tissue and reduces kidney Gb3 inclusions burden and lyso-Gb3 in the circulation. A high correlation was found between the two Fabry disease biomarkers, reduction of kidney Gb3 inclusions and the reduction of plasma lyso-Gb3 over six months of treatment.

Data was recorded at 24 months from 11 patients who completed 12 months of the long-term open-label extension trial that succeeded the phase I/II study. Patients who did not continue in the extension trial included: female patients who became or planned to become pregnant and therefore were unable to continue in accordance with the study protocol; and patients who relocated to a location where treatment was not available under the clinical study.

Results show that lyso-Gb3 levels decreased approximately 90% from baseline. Renal function remained stable with mean eGFR levels of 108.02 and 107.20 at baseline and 24 months, respectively, with a modest annual eGFR slope of -2.1. An improvement across all the gastrointestinal symptoms evaluated, including severity and frequency of abdominal pain and frequency of diarrhea, was noted. Cardiac parameters, including LVM, LVMI and EF, remained stable with no cardiac fibrosis development detected. In conclusion, an improvement of over 40% in disease severity was shown as measured by the Mainz Severity Score Index, or MSSI, a score compiling the different elements of the disease severity including neurological, renal and cardiovascular parameters. In addition, an improvement was noted in each of the individual parameters of the MSSI.

The majority of adverse events were mild-to-moderate in severity, and transient in nature. During the first 12 months of treatment, only three of 16 patients (less than 19%) formed ADAs of which two of these patients (less than 13%) had neutralizing antibodies. Importantly, however, the ADAs turned negative for all three of these patients following 12 months of treatment. The ADA positivity effect had no observed impact on the safety, efficacy or continuous biomarker reduction of PRX-102.

Commercialization Agreements with Chiesi Farmaceutici

We have entered into two exclusive global licensing and supply agreements for PRX-102 for the treatment of Fabry disease with Chiesi. The agreements have significant revenue potential for Protalix. Under the agreements, Protalix Ltd. has received $50.0 million

26

in upfront payments and development cost reimbursements of $45.0 million, and is entitled to approximately $1.0 billion in potential milestone payments as well as additional payments as consideration for drug product supply. The additional payments for drug product supplied are based on the average selling price of the drug product in the relevant territory multiplied by tiered payments, as detailed below. During the quarter ended June 30, 2023, we received net proceeds of $20.0 million representing a milestone payment earned upon the FDA’s approval of Elfabrio for adult Fabry patients.

On October 19, 2017, Protalix Ltd. and Chiesi entered into the Chiesi Ex-US Agreement pursuant to which Chiesi was granted an exclusive license for all markets outside of the United States to commercialize PRX-102. Under the Chiesi Ex-US Agreement, Chiesi made an upfront payment to Protalix Ltd. of $25.0 million in connection with the execution of the agreement, and Protalix Ltd. was entitled to additional payments of up to $25.0 million in development costs in the aggregate, capped at $10.0 million per year. Protalix Ltd. is also eligible to receive additional payments of up to a maximum of $320.0 million in regulatory and commercial milestone payments. Protalix Ltd. agreed to manufacture all of the PRX-102 needed for all purposes under the agreement, subject to certain exceptions, and Chiesi will purchase PRX-102 from Protalix Ltd., subject to certain terms and conditions. Chiesi is required to make tiered payments for drug product purchased from Protalix based on the average selling price of the drug product in the relevant territory multiplied by 15% to 35%, depending on the amount of annual net sales outside of the United States.

On July 23, 2018, Protalix Ltd. entered into the Chiesi US Agreement with respect to the development and commercialization of PRX-102 in the United States. Protalix Ltd. received an upfront, non-refundable, non-creditable payment of $25.0 million from Chiesi and was entitled to additional payments of up to a maximum of $20.0 million to cover development costs for PRX-102, capped at $7.5 million per year. Protalix Ltd. is also eligible to receive additional payments of up to a maximum of $760.0 million, in the aggregate, in regulatory and commercial milestone payments. Chiesi agreed to make tiered payments for drug product purchased from Protalix based on the average selling price of the drug product in the United States multiplied by 15% to 40%, subject to certain terms and conditions, depending on the amount of annual net sales in the United States.

On May 13, 2021, we signed a binding term sheet with Chiesi amending the Chiesi Agreements in order to provide our company with near-term capital. Chiesi agreed to make a $10.0 million payment to us before the end of the second quarter of 2021 in exchange for a $25.0 million reduction in a longer term regulatory milestone payment provided in the Chiesi EX-US Agreement. All other regulatory and commercial milestone payments remain unchanged. We received the payment in June 2021. We also agreed to negotiate certain manufacturing related matters.