UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Protalix BioTherapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

, 2022

Dear Stockholder,

We cordially invite you to attend the 2022 Annual Meeting of Stockholders of Protalix BioTherapeutics, Inc. to be held at 6:00 p.m. Israel Daylight Time on June 30, 2022 at the offices of our Israeli counsel, Horn & Co., Law Offices, Amot Investments Tower, 2 Weizmann Street, 24th Floor, Tel Aviv 6423902, Israel.

The attached notice of annual meeting and proxy statement describe the business we will conduct at the meeting and provide information about us that you should consider when you vote your shares. As set forth in the attached proxy statement, the meeting will be held to:

| · | consider the election of directors; |

| · | approve an advisory vote on executive compensation; |

| · | to adopt amendments to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended, to increase the number of shares of common stock available under the plan from 5,725,171 shares to 8,475,171 shares and to amend certain other terms of said plan; |

| · | approve an amendment to our Certificate of Incorporation, as amended, to increase the number of shares of our common stock, par value $0.001 per share, authorized for issuance from 120,000,000 to 144,000,000; and |

| · | ratify the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2022. |

Please take the time to carefully read each of the proposals stockholders are being asked to consider and vote on.

Please promptly vote your shares either via the Internet, by telephone or by marking, signing, dating and returning the proxy card in the enclosed envelope. Your vote is important, whether or not you attend the meeting in person. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting. If you decide to attend the meeting and vote in person, your proxy may be revoked at your request.

We appreciate your support and look forward to your attending the meeting.

Sincerely,

Eyal Rubin

Sr. Vice President and Chief Financial Officer

2 University Plaza, Suite 100, Hackensack, NJ 07601

Tel: 1-201-696-9435 | Web: www.protalix.com

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 30, 2022

To the Stockholders of Protalix BioTherapeutics, Inc.:

The 2022 Annual Meeting of Stockholders of Protalix BioTherapeutics, Inc. (the “Company”) will be held at the following time, date and place for the following purposes:

| TIME: | 6:00 p.m., Israel Daylight Time |

| DATE: | June 30, 2022 |

| PLACE: | Horn & Co., Law Offices, Amot Investments Tower, 2 Weizmann Street, 24th Floor, Tel Aviv 6423902, Israel |

PURPOSES:

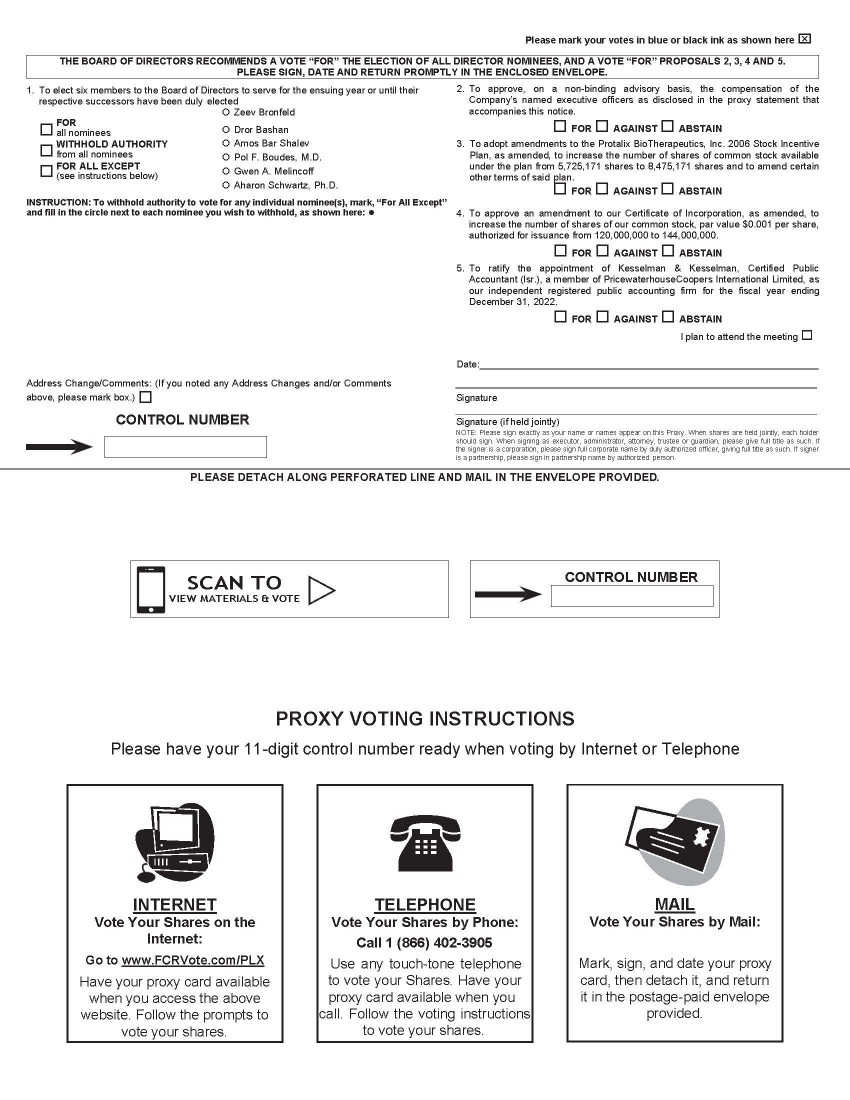

1. To elect six members to the Board of Directors to serve for the ensuing year or until their respective successors have been duly elected.

2. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the proxy statement that accompanies this notice.

3. To adopt amendments to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended, to increase the number of shares of common stock available under the plan from 5,725,171 shares to 8,475,171 shares and to amend certain other terms of said plan;

4. To approve an amendment to our Certificate of Incorporation, as amended, to increase the number of shares of our common stock, par value $0.001 per share, authorized for issuance from 120,000,000 to 144,000,000; and

5. To ratify the appointment of Kesselman & Kesselman, Certified Public Accountant (lsr.), a member of PricewaterhouseCoopers International Limited, as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

6. To transact such other business that is properly presented at the meeting or any adjournment.

All of these proposals are more fully described in the proxy statement that follows. You may vote at the meeting and any adjournments if you were the record owner of the Company’s common stock at the close of business on May 2, 2022. A list of stockholders of record will be available at the meeting and, during the 10 days prior to the meeting, at the office of the Company’s Corporate Secretary at 2 University Plaza, Suite 100, Hackensack, NJ 07601.

Please sign, date and promptly return the enclosed proxy card in the enclosed envelope, or vote by telephone or Internet (instructions are on your proxy card), so that your shares will be represented whether or not you attend the annual meeting.

| BY ORDER OF THE BOARD OF DIRECTORS | |

|

| |

| Eyal Rubin | |

| Carmiel, Israel , 2022 |

Sr. Vice President and Chief Financial Officer and Corporate Secretary |

Protalix BioTherapeutics, Inc.

2 University Plaza, Suite 100

Hackensack, NJ 07601

201-696-9345

PROXY STATEMENT FOR PROTALIX BIOTHERAPEUTICS, INC.

2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 30, 2022

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

Why Did You Send Me This Proxy Statement?

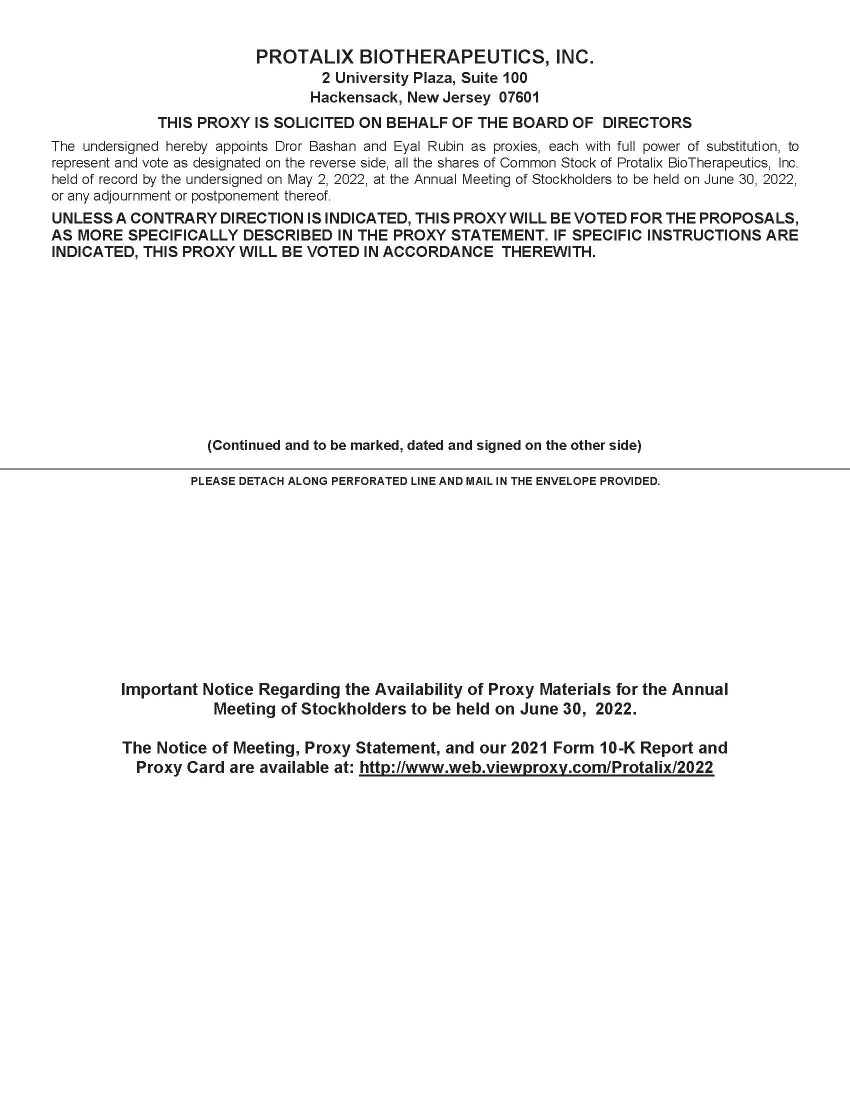

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Protalix BioTherapeutics, Inc. is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments of the meeting to be held at 6:00 p.m., Israel Daylight Time, on June 30, 2022 at the offices of our Israeli counsel, Horn & Co., Law Offices, Amot Investments Tower, 2 Weizmann Street, 24th Floor, Tel Aviv 6423902, Israel. This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting.

We anticipate that on or about May 13, 2022, we will begin sending this proxy statement, the attached Notice of Annual Meeting and the form of proxy enclosed to all stockholders entitled to vote at the meeting. Although not part of this proxy statement, we are also sending along with this proxy statement our Annual Report on Form 10-K which includes financial statements for the fiscal year ended December 31, 2021. You can also find a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 on the Internet through the electronic data system called EDGAR provided by the Securities and Exchange Commission, or the SEC, at http://www.sec.gov or through the Investor Relations section of our website at http://www.protalix.com. In addition, since we are also listed on the Tel Aviv Stock Exchange (the “TASE”), we submit copies of all our filings with the SEC to the Israeli Securities Authority and the TASE. Such copies can be retrieved electronically through the TASE’s Internet messaging system (www.maya.tase.co.il) and through the MAGNA distribution site of the Israeli Securities Authority (www.magna.isc.gov.il). Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and information on the website other than the proxy statement are not part of our proxy soliciting materials. Additional copies of the Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available upon request.

Who Can Vote?

Only holders of record of our common stock, par value $0.001 per share, on May 2, 2022 (the “Record Date”), are entitled to vote at the annual meeting. On the Record Date, there were 46,365,832 shares of common stock outstanding and entitled to vote. The common stock is currently our only outstanding class of voting stock.

You do not need to attend the annual meeting to vote your shares. Shares represented by valid proxies, received in time for the meeting and not revoked prior to the meeting, will be voted at the meeting.

How Many Votes Do I Have?

Each share of common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the annual meeting or not, we urge you to vote by proxy. Voting by proxy will not affect your right to attend the annual meeting. If your shares are registered directly in your name through our stock transfer agent, American Stock Transfer & Trust Company, or you have stock certificates, you may vote:

| · | By mail. Complete, date, sign and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. |

| · | By Internet or by telephone. Follow the instructions attached to the proxy card to vote by Internet or telephone. |

| · | In person at the meeting. If you attend the meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting. |

If your shares are held in “street name” (held in the name of a bank, broker or other nominee), but not including shares held through a Tel Aviv Stock Exchange Clearing House Ltd. (the “TASE Clearing House”) member, you must provide the bank, broker or other nominee with instructions on how to vote your shares and can generally do so as follows:

| · | By mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. |

| · | By Internet or by telephone. Follow the instructions you receive from your broker to vote by Internet or telephone. |

| · | In person at the meeting. Contact the broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the meeting. You will not be able to vote at the meeting unless you have a proxy card from your broker. |

If you own shares that are traded through the TASE, you may vote your shares in one of the following two ways:

| · | By mail. Complete, sign and date the proxy card and attach to it an ownership certificate from the TASE Clearing House member through which your shares are registered (i.e., your broker, bank or other nominee) indicating that you were the beneficial owner of the shares on May 2, 2022, the Record Date, and return the proxy card or voting instruction form, along with the ownership certificate, to our designated address for that purpose in Israel, 2 Snunit Street, Science Park, P.O. Box 455, Carmiel 2161401, Israel. If the TASE member holding your shares is not a TASE Clearing House member, please make sure to include an ownership certificate from the TASE Clearing House member in which name your shares are registered. |

| · | In person at the meeting. Attend the meeting, where ballots will be provided. If you choose to vote in person at the meeting, you need to bring an ownership certificate from the TASE Clearing House member through which your shares are registered (i.e., your broker, bank or other nominee) indicating that you were the beneficial owner of the shares on May 2, 2022, the Record Date for voting. If the TASE member holding your shares is not a TASE Clearing House member, please make sure to include an ownership certificate from the TASE Clearing House member in which name your shares are registered. |

If you need assistance in voting by telephone or over the Internet or completing your proxy card or have questions regarding the meeting, please contact our proxy advisor:

Alliance Advisors, LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

+1 (833) 757-0740 (toll free in the United States)

2

What Am I Voting On?

You are voting on:

| · | The election of six members to our Board of Directors to serve for the ensuing year or until their respective successors have been duly elected (Zeev Bronfeld, Dror Bashan, Amos Bar Shalev, Pol F. Boudes, M.D., Gwen A. Melincoff and Aharon Schwartz, Ph.D.). |

| · | To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. |

| · | To adopt amendments to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended, to increase the number of shares of common stock available under the plan from 5,725,171 shares to 8,475,171 shares and to amend certain other terms of said plan. |

| · | To approve an amendment to our Certificate of Incorporation, as amended, to increase the number of shares of our common stock, par value $0.001 per share, authorized for issuance from 120,000,000 to 144,000,000. |

| · | The ratification of the appointment of Kesselman and Kesselman, Certified Public Accountant (Isr.), a member of PricewaterhouseCoopers International Limited, as our independent registered public accounting firm for the fiscal year ending December 31, 2022. |

How Does The Board Of Directors Recommend That I Vote At The Meeting?

The Board of Directors recommends that you vote as follows:

| · | “FOR” the re-election of all director nominees named in “Proposal 1: Election of Directors” of this proxy statement. |

| · | “FOR” the approval, on a non-binding advisory basis, of our executive compensation as disclosed in the proxy statement that accompanies this notice and as described in “Proposal 2: Advisory Vote on Executive Compensation” of this proxy statement. |

| · | “FOR” the adoption of amendments to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended, to increase the number of shares of common stock available under the plan from 5,725,171 shares to 8,475,171 shares and to amend certain other terms of said plan as disclosed in the proxy statement that accompanies this notice and as described in “Proposal 3: Advisory Vote on Executive Compensation” of this proxy statement. |

| · | “FOR” the approval of an amendment to our Certificate of Incorporation, as amended, to increase the number of shares of our common stock, par value $0.001 per share, authorized for issuance from 120,000,000 to 144,000,000, as disclosed in the proxy statement that accompanies this notice and as described in “Proposal 4: Advisory Vote on Executive Compensation” of this proxy statement; and |

| · | “FOR” the ratification of Kesselman and Kesselman as our independent registered public accounting firm for the 2022 fiscal year, as named in “Proposal 5: Ratification of Independent Registered Public Accounting Firm” of this proxy statement. |

If any other matter is properly presented at the meeting or any adjournment, the proxy card provides that your shares will be voted by the proxy holder listed on the proxy card in accordance with his or her best judgment. At the time this proxy statement was printed, we knew of no matters that needed to be acted on at the annual meeting, other than those discussed in this proxy statement.

3

What Constitutes A Quorum For The Meeting?

Of the 46,365,832 shares of common stock outstanding as of the Record Date, the holders of at least one-third (1/3) of those shares, or at least 15,455,278 shares, must be present at the meeting in person or represented by proxy to hold the meeting and conduct business. Once a quorum is established at a meeting, it shall not be broken by the withdrawal of enough votes to leave less than a quorum. Shares held by stockholders of record who are present at the meeting in person or by proxy are counted for purposes of determining whether a quorum exists. Abstentions and “broker non-votes” are also counted as present and entitled to vote for purposes of determining whether a quorum exists. If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

What Are The Voting Requirements To Approve A Proposal?

Election of directors

Director nominees will be elected by a plurality of votes cast, which means that the director nominees receiving the highest number of votes will be elected. In voting to elect nominees to the Board of Directors, stockholders may vote in favor of all the nominees or any individual nominee or withhold their votes as to all the nominees or any individual nominee. Only “FOR” and “WITHHOLD” votes will affect the outcome. Abstentions and broker non-votes will have no effect on Proposal 1.

Approval of non-binding advisory resolution on executive compensation

You may vote “FOR,” “AGAINST” or “ABSTAIN” on the advisory vote to approve executive compensation. Approval requires the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the resolution. The outcome of this vote is not binding; however, the Board of Directors and the Compensation Committee will consider the outcome of the vote when developing and reviewing the future executive compensation plans. Abstentions and broker non-votes will have no effect on Proposal 2.

Adoption of amendments to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended, to increase the number of authorized shares of common stock reserved for issuance under the plan and to amend certain other terms of the plan

You may vote “FOR,” “AGAINST” or “ABSTAIN” on the adoption of an amendment to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended, to increase the number of authorized shares of common stock reserved for issuance under the plan. If a quorum is present, adoption of the amendment requires that the number of votes cast at the annual meeting in favor of adoption exceeds the number of votes cast opposing adoption. Abstentions and broker non-votes will have no effect on Proposal 3.

Amendment to Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock

You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to amend our Certificate of Incorporation, as amended, to increase the number of shares of our common stock authorized for issuance from 120,000,000 to 144,000,000. The affirmative vote of a majority of the shares of our common stock outstanding and entitled to vote at the annual meeting is required to approve the amendment to our Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock from 120,000,000 to 144,000,000. Abstentions will have the same effect as an “against” vote on Proposal 4.

Ratification of the selection of Kesselman & Kesselman as our independent auditor

You may vote “FOR,” “AGAINST” or “ABSTAIN” on the ratification of the selection of Kesselman & Kesselman to serve as our principal independent registered public accounting firm for the fiscal year ending December 31, 2022. Ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the. Abstentions will have no effect on Proposal 5.

4

How Are My Votes Cast When I Sign And Return A Proxy Card?

When you sign the proxy card or submit your proxy by telephone or over the Internet, you appoint Dror Bashan, our President and Chief Executive Officer, and Eyal Rubin, our Sr. Vice President and Chief Financial Officer, as your representatives at the meeting. Either Dror Bashan or Eyal Rubin will vote your shares at the meeting as you have instructed them on the proxy card. Each such person may appoint a substitute for himself.

Even if you plan to attend the meeting, it is a good idea to complete, sign and return your proxy card or submit your proxy by telephone or over the Internet in advance of the meeting in case your plans change. This way, your shares will be voted by you whether or not you actually attend the meeting.

May I Revoke My Proxy?

If you give us your proxy, you may revoke it at any time before it is voted at the meeting. There will be no double counting of votes. You may revoke your proxy in any one of the following ways:

| · | entering a new vote or by granting a new proxy card or new voting instruction bearing a later date (which automatically revokes the earlier instructions); |

| · | if your shares are held in street name, re-voting by Internet or by telephone as instructed above (only your latest Internet or telephone vote will be counted); |

| · | notifying our Corporate Secretary, Eyal Rubin, in writing before the annual meeting that you have revoked your proxy; or |

| · | attending the meeting in person and voting in person. Attending the meeting in person will not in and of itself revoke a previously submitted proxy unless you specifically request it. |

Can My Broker Vote My Shares For Me?

A broker “non-vote” occurs when a broker or nominee holding shares for a beneficial owner does not vote on a particular matter because the matter is not routine and such broker or nominee does not have the discretionary voting authority to vote the shares for which it is the holder of record with respect to a particular matter at the annual meeting and such broker or nominee has not received instructions from the beneficial owner. Broker “non-votes,” and shares as to which proxy authority has been withheld with respect to any matter, are generally not deemed to be entitled to vote for purposes of determining whether stockholders’ approval of that matter has been obtained. Pursuant to New York Stock Exchange (“NYSE”) Rule 452, the uncontested election of directors (Proposal No. 1), the approval of a non-binding advisory resolution on executive compensation (Proposal No. 2), the adoption of amendments to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan which increase the number of shares of common stock authorized for issuance under the plan and amend certain other terms of the plan (Proposal No. 3) and the amendment to Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock (Proposal No. 4) are non-routine matters and, therefore, may not be voted upon by brokers without instructions from beneficial owners. Consequently, proxies submitted by brokers for shares beneficially owned by other persons may not, in the absence of specific instructions from such beneficial owners, vote the shares in favor of or withhold votes from such proposals at the brokers’ discretion. The ratification of the selection of Kesselman & Kesselman to serve as our principal independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 5) is a routine matter. Please complete your proxy and return it as instructed so your vote can be counted.

What If I Receive More Than One Proxy Card?

You may receive more than one proxy card or voting instruction form if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described under “How Do I Vote?” for each account to ensure that all of your shares are voted.

5

What If I Do Not Vote For Some Of The Matters Listed On My Proxy Card?

If you return your proxy card without indicating your vote, your shares will be voted for the nominees listed on the card; for the approval, on an advisory basis, of the executive compensation; for the adoption of amendments to the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan which increase the number of shares of common stock authorized for issuance under the plan and amend certain other terms of the plan; for the amendment to Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock; and for the ratification of the appointment of Kesselman & Kesselman.

Will My Shares Be Voted If I Do Not Return My Proxy Card And Do Not Attend The Annual Meeting?

If your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy card by mail or vote at the meeting as described above under “How Do I Vote?”.

If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above under “How Do I Vote?,” the bank, broker or other nominee has the authority to vote your shares on certain routine matters scheduled to come before the meeting even if it does not receive instructions from you. We encourage you to provide voting instructions. This ensures your shares will be voted at the meeting in the manner you desire.

Is Voting Confidential?

Yes. Only the inspector of elections and our employees who have been assigned the responsibility for overseeing the legal aspects of the annual meeting and our proxy solicitors will have access to your proxy card. The inspector of elections will tabulate and certify the vote. Any comments written on the proxy card will remain confidential unless you ask that your name be disclosed.

What Are The Costs Of Soliciting These Proxies?

We will pay all of the costs of soliciting these proxies. Our officers, directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these officers, employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. We have engaged Alliance Advisors LLC to assist us in soliciting proxies for the annual meeting. We will pay Alliance Advisors a base fee of $10,000, plus reasonable out-of-pocket expenses, plus an additional fee based upon the number of contacts with stockholders made and work performed. We estimate the total amount payable to Alliance Advisors will be approximately $100,000.

Could Other Matters Be Decided At The Annual Meeting?

We do not know of any other matters that will be considered at the annual meeting. If any other matters arise at the annual meeting at or by the direction of the Board of Directors, the proxies will be voted at the discretion of the proxy holders.

What Happens If The Annual Meeting Is Postponed Or Adjourned?

Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted.

Do I Need A Ticket To Attend The Annual Meeting?

Yes, you will need an admission ticket or proof of ownership of common stock to enter the annual meeting. If you are a stockholder of record, your admission ticket is the bottom half of the proxy card sent to you. If you plan to attend the Annual Meeting, please so indicate when you vote and bring the ticket with you to the annual meeting. If your shares are held in the name of a bank, broker or other holder of record, your admission ticket is the left side of your voting information form. If you do not bring your admission ticket, you will need proof of ownership to be admitted to the annual meeting. A recent brokerage statement or letter from a bank or broker is an example of proof of ownership. If you arrive at the annual meeting without an admission ticket, we will admit you only if we are able to verify that you are a stockholder of our Company.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of May 2, 2022, regarding beneficial ownership of our common stock:

· each person who is known by us to own beneficially more than 5% of our common stock;

· each director;

· each of our executive officers; and

· all of our directors and executive officers collectively.

Unless otherwise noted, we believe that all persons named in the table have sole voting and investment power with respect to all shares of our common stock beneficially owned by each of them. For purposes of this table, a person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days from May 2, 2022 upon exercise of options, warrants and convertible securities. Each beneficial owner’s percentage ownership is determined by assuming that options, warrants and convertible securities that are held by such person (but not those held by any other person) and that are exercisable within such 60 days from such date have been exercised. The information set forth below is based upon information obtained from the beneficial owners, upon information in our possession regarding their respective holdings and upon information filed by the holders with the SEC. The percentages of beneficial ownership are based on 46,365,832 shares of our common stock outstanding as of April 15, 2022.

The address for all directors and officers is c/o Protalix BioTherapeutics, Inc., 2 Snunit Street, Science Park, P.O. Box 455, Carmiel 2161401, Israel.

| Amount and Nature of | Percentage of | |||||||

| Name and Address of Beneficial Owner | Beneficial Ownership | Class (%) | ||||||

| Board of Directors and Executive Officers | ||||||||

| Zeev Bronfeld(1) | 567,283 | 1.21 | ||||||

| Dror Bashan(2) | 1,273,458 | 2.74 | ||||||

| Amos Bar Shalev(3) | 22,668 | * | ||||||

| Pol F. Boudes, M.D.(4) | 22,540 | * | ||||||

| David Granot(5) | 22,500 | * | ||||||

| Gwen A. Melincoff(6) | 22,500 | * | ||||||

| Aharon Schwartz, Ph.D.(7) | 86,500 | * | ||||||

| Einat Brill Almon, Ph.D.(8) | 207,622 | * | ||||||

| Yaron Naos(9) | 134,867 | * | ||||||

| Eyal Rubin(10) | 423,097 | * | ||||||

| Yael Hayon(11) | 56,774 | * | ||||||

| All executive officers and directors as a group (11 persons)(12) | 2,839,809 | 6.00 | ||||||

| 5% Holders | ||||||||

| Alfred Akirov(13) | 4,525,687 | 9.35 | ||||||

| Angels Investments in Hi-Tech Ltd.(14) | 2,816,901 | 5.73 | ||||||

| Highbridge Capital Management LLC(16) | 5,146,036 | 9.99 | ||||||

| HIR Investments Ltd.(17) | 4,411,305 | 9.12 | ||||||

| Psagot Provident Funds and Pension Ltd.(18) | 2,816,901 | 5.73 | ||||||

| UBS O’Connor(19) | 3,057,715 | 6.19 | ||||||

| Whitebox Advisors LP(20) | 2,816,108 | 5.73 | ||||||

| (1) | Consists of 216,247 outstanding shares of our common stock held by EBC Holdings Ltd., an investment company wholly-owned by Mr. Bronfeld, 216,036 shares of our common stock issuable upon exercise of an outstanding warrant held by Mr. Bronfeld and 135,000 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 105,000 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

7

| (2) | Consists of 1,085,458 outstanding restricted shares of our common stock that are subject to forfeiture, 68,000 outstanding shares of our common stock and 120,000 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 40,000 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (3) | Consists of 168 outstanding shares of our common stock and 22,500 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 17,500 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (4) | Consists of 40 outstanding shares of our common stock and 22,500 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 17,500 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (5) | Consists of 22,500 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 17,500 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (6) | Consists of 22,500 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 17,500 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (7) | Consists of 64,000 outstanding shares of our common stock and 22,500 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 17,500 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (8) | Consists of 18,500 outstanding shares of our common stock and 189,122 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 102,873 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (9) | Consists of 19,955 outstanding shares of our common stock and 114,912 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 72,744 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (10) | Consists of 368,097 outstanding restricted shares of our common stock that are subject to forfeiture and 55,000 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 25,000 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (11) | Consists of 56,774 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 72,997 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (12) | Consists of 1,840,465 outstanding shares of our common stock, 216,036 shares of our common stock issuable upon exercise of an outstanding warrant and 783,308 shares of our common stock issuable upon exercise of outstanding options within 60 days of May 2, 2022. Does not include 506,114 shares of our common stock underlying options that will not vest within 60 days of May 2, 2022. |

| (13) | Based on a Schedule 13G filed by Alfred Akirov on March 30, 2020 for March 12, 2020. Consists of 2,513,615 outstanding shares of our common stock and 2,012,072 shares of our common stock issuable upon exercise of outstanding warrants within 60 days of May 2, 2022, in the aggregate, held by Alrov Properties & Lodgings Ltd., or Alrov Properties, Technorov Holdings (1993) Ltd., or Technorov, and Alrov Holdings Technologies Ltd., or Alrov Technologies. Mr. Akirov is the majority shareholder, and Chairman of the Board of each of Alrov Properties, which is listed on the Tel Aviv Stock Exchange, and the subsidiaries of Alrov Properties, Technorov and Alrov Technologies, and, accordingly, in the normal course of business has the power to direct the voting and disposition decisions of such entities, all subject to the Israeli law provision in regards to a public company. Mr. Akirov’s principal business office is at The Alrov Tower, 46 Rothschild Boulevard, Tel Aviv 66883, Israel. |

8

| (14) | Based on a Schedule 13G filed by Angels Investments on January 31, 2022 for December 31, 2021. Consists of 2,816,901 shares of our common stock issuable upon exercise of outstanding warrants within 60 days of May 2, 2022 held by Angels Investments. Marius Nacht is the sole shareholder and director of Angel Investments, and, accordingly, may be deemed to have beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act) of such shares held by Angels Investments. The principal business office of Angels Investments is 42 Brendeis Street, Tel Aviv 6200157, Israel. |

| (16) | Based on a Schedule 13F-HR filed on February 11, 2022 for December 31, 2021 and a Schedule 13G\A filed on February 14, 2022 for December 31, 2021, both by Highbridge Capital Management LLC, or Highbridge. Consists of 5,146,036 shares of our common stock issuable upon conversion of convertible notes and exercise of outstanding warrants within 60 days of May 2, 2022, held by Highbridge Tactical Credit Master Fund, L.P. (the “Highbridge Fund”). Highbridge, as the trading manager of the Highbridge Fund, and the Highbridge Fund may each be deemed to be the beneficial owner of such shares. The convertible notes and the warrants are subject to blocker provisions pursuant to which the holders thereof cannot convert the notes or exercise the warrants to the extent that the reporting persons would beneficially own, after any such exercise, more than 9.99% of the outstanding shares of our common stock. The disclosed holdings do not include all of the shares issuable upon exercise of all of the notes and the warrants held due to the blocker provision. The principal business office of Highbridge is 40 West 57th Street, 32nd Floor, New York, New York 10019. |

| (17) | Consists of 2,362,783 outstanding shares of our common stock and 2,012,072 shares of our common stock issuable upon exercise of outstanding warrants within 60 days of May 2, 2022, in the aggregate, held by HIR Investments Ltd., or HIR, and 36,450 outstanding shares of our common stock held directly or indirectly by Chinar Shah. Mr. Shah has the power to direct the voting and disposition decisions of, and thus may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act) of, all such shares and warrants. The principal business office of HIR is Flat No. 303, Al-Shamal Building, Al-Khor Street, Goldsuq, Deira, Dubai, UAE. |

| (18) | Consists of 2,816,901 shares of our common stock issuable upon exercise of outstanding warrants within 60 days of May 2, 2022, in the aggregate, held collectively by a number of funds managed by Psagot Provident Funds and Pension Ltd., or Psagot. The principal business office of Psagot is Ehad Ha’Am Street 14, Tel Aviv-Yafo, Israel. |

| (19) | Based on a Schedule 13F-HR for December 31, 2021 filed by UBS O’Connor LLC (“UBS O’Connor”), on February 14, 2022. UBS O’Connor serves as the investment manager to Nineteen77 Global Multi-Strategy Alpha Master Limited (“GLEA”). In such capacity, UBS O’Connor exercises voting and investment power over the shares of common stock held for the account of GLEA. Consists of shares of our common stock issuable upon conversion of convertible notes and the exercise of outstanding warrants held by GLEA within 60 days of May 2, 2022. The principal business office of UBS O’Connor is One North Wacker Drive, 32nd Floor, Chicago, Illinois 60606. |

| (20) | Based on a Schedule 13F-HR for December 31, 2021 filed by Whitebox Advisors LLC (“Whitebox”), on February 14, 2022. Consists of shares of our common stock issuable upon conversion of convertible notes held by certain funds managed by Whitebox. The principal business office of Whitebox is 3033 Excelsior Boulevard, Suite 500, Minneapolis, MN 55416. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and holders of more than 10% of our common stock to file with the SEC reports regarding their ownership and changes in ownership of our equity securities. We believe that all Section 16 filings requirements were met by our officers and directors during 2021. In making this statement, we have relied solely upon examination of the copies of Forms 3, 4 and 5, and written representations of our former and current officers and directors.

9

PROPOSAL 1: ELECTION OF DIRECTORS

At the annual meeting, our stockholders will be asked to elect six directors for a one-year term expiring at the next annual meeting of stockholders. Each director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal.

Our Board of Directors recommends that the persons named below be elected as directors of our Company and it is intended that the accompanying proxy will be voted for their election as directors, unless the proxy contains contrary instructions. Shares of common stock represented by all proxies received by the Board of Directors and not so marked as to withhold authority to vote for any individual nominee or for all nominees will be voted (unless one or more nominees are unable to serve) for the election of the nominees named below. The Board of Directors knows of no reason why any such nominee should be unable or unwilling to serve, but if such should be the case, proxies will be voted for the election of some other person or the size of the Board of Directors will be fixed at a lower number.

Each of the nominees currently serves as a member of our Board of Directors. The directors are elected by a plurality of the votes cast by the stockholders present or represented by proxy and entitled to vote at the annual meeting.

Nominees for Election to the Board of Directors

The names of the nominees for election to the Board of Directors and certain information about such nominees are set forth below. For information concerning the number of shares of common stock beneficially owned by each nominee, see “Security Ownership of Certain Beneficial Owners and Management” above.

| Name | Age | Position | |||

| Zeev Bronfeld | 70 | Chairman of the Board | |||

| Dror Bashan | 55 | President and Chief Executive Officer, Director | |||

| Amos Bar Shalev | 69 | Director | |||

| Pol F. Boudes, M.D. | 65 | Director | |||

| Gwen A. Melincoff | 70 | Director | |||

| Aharon Schwartz, Ph.D. | 79 | Director |

Zeev Bronfeld. Mr. Bronfeld has served as the Chairman of our Board of Directors since August 2019. He has served as a director of Protalix Ltd., our wholly-owned subsidiary and sole operating unit, since 1996 and as our director since December 2006. Mr. Bronfeld brings to us vast experience in management and value building of biotechnology companies. He is an experienced businessman who is involved in a number of biotechnology companies. He was a co-founder of Bio-cell Ltd., a former Israeli publicly-traded holding company that specialized in biotechnology companies and served as its Chief Executive Officer from 1986 through 2015. Mr. Bronfeld currently serves as a director of The Trendlines Group (SGX:42T) and Electreon Wireless Ltd. (TASE:ELWS) (formerly, Biomedix Incubator Ltd.), both of which are public companies. Mr. Bronfeld is also a director of a number of privately-held companies, most of which are involved in the life sciences industry, such as Contipi Medical Ltd. From August 2010 through April 2021, Mr. Bronfeld served as a director of Entera Bio Ltd. (NASDAQ: ENTX), from November 2009 through February 2021, he served as a director of D.N.A. Biomedical Solutions Ltd. (TASE:DNA) and from January 2008 through January 2017, he served as a director of Macrocure Ltd., a Nasdaq-listed company that merged into Leap Therapeutics, Inc. (NASDAQ:LPTX). Mr. Bronfeld received a B.A. in Economics from the Hebrew University in 1975. We believe Mr. Bronfeld’s qualifications to serve on our Board of Directors include his years of experience in the management of private and public Israeli companies, including life science companies.

Dror Bashan. Mr. Bashan has served as our President and Chief Executive Officer and as our director since June 2019. He has over 20 years of experience in the pharmaceutical industry with roles ranging from business development, marketing, sales and finance providing him with both cross regional and cross discipline experience and a deep knowledge of the global pharmaceutical and health industries. From 1998 through 2018, he served in a number of senior positions at Teva Pharmaceutical Industries Ltd (“Teva”). (NYSE:TEVA; TASE:TEVA). Most recently, he served as Teva’s Senior Vice President, Global Business Development, and was involved in strategic alliances, cross-company strategic projects and the acquisition and divestiture of assets. Mr. Bashan holds a BA in Economics and Business Management from the Tel Aviv University and an MBA from the Tel Aviv University.

10

Amos Bar Shalev. Mr. Bar Shalev has served as our director since July 2008. Previously, Mr. Bar Shalev served as a director of Protalix Ltd. from 2005 through January 2008, and as our director from 2006 through January 2008. Mr. Bar Shalev brings to us extensive experience in managing technology companies. Currently, Mr. Bar Shalev serves on the Board of Directors of the following privately-held Israeli companies: Aposense Ltd., Steam CC Ltd. and Sirvir Ltd. From 2004 through 2012, Mr. Bar Shalev served as a director of Technorov Holdings (1993) Ltd. and managed its portfolio. From 1997 through 2004, he was a Managing Director of TDA Capital Partners, a management company of the TGF (Templeton Tadiran) Fund. From 2004 through 2007, he was the President of Win Buyer Ltd. He has served on the Board of Directors of a number of Israeli publicly traded and privately-held Israeli companies including, among others, Velox Ltd., NESS Ltd. (acquired by BioNess Inc.), Idanit (acquired by Scitex Corporation Ltd.), Objet Geometrix (merged with Stratasys, Inc. (NASDAQ:SSYS)), Verisity, Scitex Vision (acquired by Hewlett Packard), Golden Wings Investment Company Ltd., the venture capital fund of the Israeli Air Force Veterans Business Club, Win Buyer Ltd. and Sun Light Ltd. He received his B.Sc. in Electrical Engineering from the Technion, Israel in 1978 and M.B.A. from the Tel Aviv University in 1981. He holds the highest award from the Israeli Air Force for technological achievements. We believe Mr. Bar Shalev’s qualifications to serve on our Board of Directors include his years of experience in the management of Israeli businesses.

Pol F. Boudes, M.D. Dr. Boudes joined our Board of Directors in January 2020. He is a senior physician and chief medical officer with more than 25 years of experience in research and development, with a special emphasis on orphan drugs and translational medicine. In March 2020, Dr. Boudes was appointed Chief Medical Officer of Galectin Therapeutics Inc. (NASDAQ:GALT). He also serves as a research and development consultant. From April 2014 through October 2019, he served as the Chief Medical Officer of CymaBay Therapeutics, Inc. (Nasdaq:CBAY) where he led the development of treatments for rare liver diseases. Dr. Boudes was also Chief Medical Officer at Amicus Therapeutics Inc. (Nasdaq:FOLD) from 2009 to 2013 where he was instrumental in the development of migalastat (Galafold®) for the treatment of Fabry disease, as well as treatments for Pompe disease and Gaucher disease. He has served in various roles at Berlex Laboratories (acquired by Bayer HealthCare Pharmaceuticals), Wyeth-Ayerst Research, Hoffmann-La Roche and Pasteur-Merieux Serums & Vaccines. Dr. Boudes holds an M.D. from the University of Aix-Marseilles, France and has specialized in Endocrinology and Metabolic Diseases, Internal Medicine, and Geriatric diseases. We believe Dr. Boudes’ qualifications to serve on our Board of Directors include his vast experience and knowledge of the research and development of pharmaceuticals.

Gwen A. Melincoff. Ms. Melincoff joined our Board of Directors in January 2020. She is a seasoned business development and venture professional with over 25 years of deal-making and management experience in the biotechnology and pharmaceutical industries. Her experience has spanned public and private company boards, venture financing, business development, licensing, mergers and acquisitions, research operations, marketing, product management and project management. Ms. Melincoff currently serves on the Board of Directors of Gain Therapeutics, Inc. ((NASDAQ:GANX), Soleno Therapeutics, Inc. (NASDAQ:SOLN) and Collegium Pharmaceutical, Inc. (NASDAQ:COLL) and. She also serves in an advisory capacity at a number of pharmaceutical companies. From April 2017 through June 2020, she served on the Board of Directors of Photocure ASA, from January 2017 through January 2019, she served on the Board of Directors of Kamada Ltd. (NASDAQ:KMDA, TASE:KMDA), and from June 2014 through November 2016, she served on the Board of Directors of Tobira Therapeutics Inc. (acquired by Allergan plc). From August 2014 through September 2016, Ms. Melincoff served as Vice President of Business Development at BTG International Inc. Prior to that, she was Senior Vice President of Corporate Development at Shire Plc. Additionally, she led the Shire Strategic Investment Group, the venture capital arm of Shire Plc. Ms. Melincoff was Vice President of Business Development at Adolor Corporation and held executive positions at Eastman Kodak for over ten years in a number of their health care companies. She holds a B.S. in Biology from The George Washington University and an M.S. in Management and Health Care Administration from Pennsylvania State University. Ms. Melincoff has also attained the designation of Certified Licensing Professional (CLP™). Ms. Melincoff was named to the “Top Women in Biotech 2013” by Fierce Biotech and to the Powerlist 100 of Corporate Venture Capital in 2012 and 2013. We believe Ms. Melincoff’s qualifications to serve on our Board of Directors include her years of experience at pharmaceutical companies, particularly with respect to business development.

Aharon Schwartz, Ph.D. Dr. Schwartz has served as our director since November 2014. He retired from Teva in 2011 where he served in a number of positions from 1975 through 2011, the most recent being Vice President, Head of Teva Innovative Ventures from 2008. Dr. Schwartz is currently chairman of the Board of Directors of BiolineRx Ltd. (NASDAQ:BLRX, TASE:BLRX) and a member of the Board of Directors of Barcode Ltd. He also serves as the Head of the Advisory Board of Oncohost Ltd. and works as an independent consultant. From May 2015 through March 2020, he served as a member of the Board of Directors of Foamix Pharmaceuticals Ltd., (Nasdaq: FOMX) which was acquired by Menlo Therapeutics Inc. (Nasdaq: MNLO), and from January 2013 through November 2017, he served as a member of the Board of Directors of Alcobra Ltd., which is now called Arcturus Therapeutics Ltd. Dr. Schwartz received his Ph.D. in organic chemistry in 1978 from the Weizmann Institute of Science, his M.Sc. in organic chemistry from the Technion and a B.Sc. in chemistry and physics from the Hebrew University of Jerusalem. Dr. Schwartz received a second Ph.D. in 2014 from the Hebrew University of Jerusalem in the history and philosophy of science. We believe Dr. Schwartz’s qualifications to serve on our Board of Directors include his years of experience at life science companies.

11

Our Board of Directors recommends that stockholders vote “FOR” the election or re-election of all director nominees named in this “Proposal 1: Election of Directors.”

Corporate Governance and Independent Directors

In compliance with the listing requirements of the NYSE American, we have a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. We currently regularly monitor developments in the area of corporate governance to ensure we are in compliance with the standards and regulations required by the NYSE American. A summary of our corporate governance measures follows.

Independent Directors

We believe a majority of the members of our Board of Directors are independent from management. When making determinations from time to time regarding independence, the Board of Directors will reference the listing standards adopted by the NYSE American as well as the independence standards set forth in the Sarbanes-Oxley Act of 2002, or the SOX, and the rules and regulations promulgated by the SEC under that Act, as well as other factors which could assist our Board of Directors and its committees in determining that a director will have no material relationship with us that could compromise that director’s independence.

Our Board of Directors has determined that Mr. Bronfeld, Mr. Bar Shalev, Mr. Granot, Ms. Melincoff, Dr. Boudes and Dr. Schwartz are “independent” pursuant to the rules of the NYSE American.

The position of Chairman of the Board is not held by our chief executive officer at this time. The Board of Directors does not have a policy mandating the separation of these functions. We believe it is in our best interest that Mr. Bronfeld serve as the chairman of our Board of Directors. This decision was based on Mr. Bronfeld’s experience in the healthcare industry in Israel and globally and his years of experience serving on the Board of Directors of public and private companies. Our non-management directors hold formal meetings, separate from management, at least twice per year.

The Board’s Role in Risk Oversight

Our Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of business objectives, including organizational and strategic objectives, to improve long-term organizational performance and enhance stockholder value. The involvement of our Board of Directors in setting our business strategy is a key part of its assessment of management’s plans for risk management and its determination of what constitutes an appropriate level of risk for the Company. The participation of our Board of Directors in our risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, and strategic and reputational risks. While the full Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board of Directors also have responsibility for risk management. For example, financial risks, including internal controls, are overseen by the Audit and Finance Committee and risks that may be implicated by our executive compensation programs are overseen by the Compensation Committee. Upon identification of a risk, the assigned committee or our full Board of Directors discuss or review risk management and risk mitigation strategies. Additional review or reporting on enterprise risks is conducted as needed or as requested by our Board of Directors or a committee thereof.

12

Board and Committee Meetings

Our Board of Directors has an Audit and Finance Committee, Compensation Committee and Nominating Committee. The membership of each committee is as follows:

| Committee | Chairman | Membership | ||

| Audit and Finance Committee | David Granot | David Granot, Amos Bar Shalev and Aharon Schwartz, Ph.D. | ||

| Compensation Committee | Amos Bar Shalev | Amos Bar Shalev, David Granot and Aharon Schwartz, Ph.D. | ||

| Nominating Committee | Amos Bar Shalev | Amos Bar Shalev, Zeev Bronfeld and Aharon Schwartz, Ph.D. |

The primary functions of each committee are as follows:

Audit and Finance Committee

Our Board of Directors has determined that Mr. Granot, Mr. Bar Shalev and Dr. Schwartz are “independent” for purposes of membership on the Audit and Finance Committee pursuant to Section 803B(2) of the NYSE American Company Guide and Section 10A(m)(3) of the Exchange Act. We require that all Audit and Finance Committee members possess the required level of financial literacy and at least one member of the Audit and Finance Committee meet the current standard of requisite financial management expertise as required by the NYSE American and applicable rules and regulations of the SEC.

Our Audit and Finance Committee operates under a formal charter that governs its duties and conduct. A current copy of the Audit and Finance Committee Charter is available on our website at http://www.protalix.com.

All members of the Audit and Finance Committee are independent from our executive officers and management.

Our independent registered public accounting firm reports directly to the Audit and Finance Committee.

Our Audit and Finance Committee meets with management and representatives of our registered public accounting firm prior to the filing of officers’ certifications with the SEC to receive information concerning, among other things, effectiveness of the design or operation of our internal controls over financial reporting, as required by Section 404 of SOX.

Our Audit and Finance Committee has adopted a Policy for Reporting Questionable Accounting and Auditing Practices and Policy Prohibiting Retaliation against Reporting employees to enable confidential and anonymous reporting of improper activities to the Audit and Finance Committee.

Mr. Granot, Mr. Bar Shalev and Dr. Schwartz each qualify as “audit committee financial experts” under the applicable rules of the SEC. In making the determination as to these individuals’ status as audit committee financial experts, our Board of Directors determined they have accounting and related financial management expertise within the meaning of the aforementioned rules, as well as the listing standards of the NYSE American.

Compensation Committee

Our Board of Directors has determined that Mr. Bar Shalev, Mr. Granot, and Dr. Schwartz are “independent” for purposes of membership on the Compensation Committee pursuant to Section 805(c) of the NYSE American Company Guide. The Compensation Committee reviews and approves the compensation of executive officers and key employees and administers our stock incentive plan. A current copy of the Compensation Committee Charter is available on our website at http://www.protalix.com.

13

Nominating Committee

The Nominating Committee is responsible for assisting our Board of Directors in selecting nominees for election to the Board of Directors and monitoring the composition of the Board of Directors. A current copy of the Nominating Committee Charter is available on our website at http://www.protalix.com. Although our Board of Directors does not have a formal policy requiring the Nominating Committee to consider the diversity of directors in its nomination process, in considering potential new directors, the Nominating Committee will review individuals from various disciplines and backgrounds, and consider the following qualifications: broad experience in business, finance or administration; familiarity with national business matters; familiarity with our industry; independence; and prominence and reputation. The committee seeks nominees with a broad diversity of experience, professions, education, skills and backgrounds with a view to having a Board of Directors that represents a diversity of views, experiences, and backgrounds. After making such a review, the Nominating Committee submits the nomination to the full Board of Directors for approval.

The Nominating Committee will consider any nominees submitted by stockholders of record at the time of any such nomination in compliance with applicable rules of the SEC and our By-Laws. The Nominating Committee will determine whether any stockholder nominee meets the qualifications for candidacy described above and in the Nominating Committee Charter. Stockholders’ nominations for election at the 2023 Annual Meeting of Stockholders must be submitted in writing to Eyal Rubin, Corporate Secretary, not less than 45 days nor more than 75 days prior to the date on which we first mailed this proxy statement. Such written notice must include the following information: (i) name, age, business address and residence address of the nominee; (ii) the principal occupation or employment of the nominee; (iii) the class and number of shares of our Company beneficially owned by the nominee; and (iv) any other information relating to the nominee that would be required to be disclosed in solicitations for proxies for elections of directors pursuant to Regulation 14A of the Exchange Act. The written notice must also include the following information with respect to each stockholder delivering such notice: (i) the name and record address of such stockholder; and (ii) the class and number of shares of our Company beneficially owned by the stockholder. Lastly, the written notice must include certain information relating to any derivative or hedging transactions by the stockholder delivering such notice and its Stockholder Associated Persons, as defined in our By-Laws, and other arrangements with other parties regarding our securities, as presented in detail in our By-Laws. Stockholders can mail any such recommendations, including the criteria outlined above, to Eyal Rubin, Corporate Secretary, Protalix BioTherapeutics, Inc., 2 University Plaza, Suite 100, Hackensack, NJ 07601.

Under the rules of the NYSE American, a director of our Company will only qualify as an “independent director” if, among other things, in the opinion of our Board of Directors, that person does not have a material relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board of Directors has determined that none of the non-employee directors has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of the non-employee directors is an “independent director” as defined under rules of the NYSE American. In addition, the Board of Directors has determined that all members of the Audit and Finance Committee meet the independence requirements set forth in Section 803B(2) of the NYSE American Company Guide and Section 10A(m)(3) of the Exchange Act, and that all members of the Compensation Committee meet the independence requirements set forth in Rule 805(c) of the NYSE American Listed Company Guide.

Contacting the Board of Directors

Stockholders who wish to communicate with the Board of Directors may do so by mailing any such communications to Eyal Rubin, Corporate Secretary, Protalix BioTherapeutics, Inc., 2 University Plaza, Suite 100, Hackensack, NJ 07601. All communications are distributed to the Board of Directors, as appropriate, depending upon the facts and circumstances outlined in the communications received. For example, if any complaints regarding accounting and/or auditing matters are received, they may be forwarded by our Corporate Secretary to the Audit and Finance Committee for review.

14

Policy Governing Director Attendance at Annual Meetings of Stockholders

We have no formal policy regarding attendance by our directors at annual stockholders meetings, although we encourage such attendance and anticipate most of our directors will attend these meetings. Our directors did not attend our 2021 annual meeting of stockholders due to the COVID-19 pandemic.

During the year ended December 31, 2021, there were 13 meetings of our Board of Directors, four meetings of the Audit and Finance Committee, one meeting of the Compensation Committee and one meeting of the Nominating Committee. Our non-management directors hold meetings separate from management at least twice per year. All of our current directors that served on our Board of Directors during the year ended December 31, 2021 attended at least 75% of the aggregate number of meetings of the Board of Directors and the committees of the Board of Directors on which they served.

Compensation of Directors

The following table sets forth information with respect to compensation of our non-employee directors during fiscal year 2021.

| Fees Earned or | Option | |||||||||||

| Name | Paid in Cash ($) | Award(s) ($) | Total ($) | |||||||||

| Zeev Bronfeld | 152,543 | 152,543 | ||||||||||

| Amos Bar Shalev | 40,000 | 24,436 | 64,436 | |||||||||

| David Granot | 40,000 | 24,436 | 64,436 | |||||||||

| Aharon Schwartz, Ph.D. | 40,000 | 24,436 | 64,436 | |||||||||

| Pol F. Boudes, M.D. | 40,000 | 24,436 | 64,436 | |||||||||

| Gwen A. Melincoff | 40,000 | 24,436 | 64,436 | |||||||||

The Board of Directors approved a new compensation program for our non-employee directors, commencing as of January 1, 2020. Directors are entitled to a cash payment equal to $40,000 per year, payable quarterly, and were granted options to purchase 40,000 shares of our common stock. The options vest quarterly in 16 equal increments over a four-year period. We granted to the Chairman of the Board an option to purchase 240,000 shares of our common stock, which option vests quarterly in 16 equal increments over a four-year period. As part of the compensation program, the Chairman of the Board of Directors is not entitled to cash compensation. His compensation is limited to equity compensation.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee or any executive officer of the Company or of Protalix Ltd. has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity. No Compensation Committee member is or was an officer or employee of ours or of Protalix Ltd. or had any relationship that constituted a related party transaction. Further, none of our executive officers serves on the Board of Directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics includes provisions ranging from restrictions on gifts to conflicts of interest. All of our employees and directors are bound by this Code of Business Conduct and Ethics. Violations of our Code of Business Conduct and Ethics may be reported to the Audit and Finance Committee.

The Code of Business Conduct and Ethics includes provisions applicable to all of our employees, including senior financial officers and members of our Board of Directors and is posted on our website (www.protalix.com). We intend to post amendments to or waivers from any such Code of Business Conduct and Ethics.

15

Insider Trading, Prohibition on Short-term, Speculative Transactions

Our Insider Trading and Blackout Policy includes restrictions regarding the timing and types of transactions in our securities by our directors, officers, including our Named Executive officers, and other employees. Our directors, officers and certain other designated other employees are prohibited from trading during blackout periods (during the period from and including the close of business on the seventh day prior to the end of the third month of each quarter and ends on the opening of the second business day following our filing with the SEC of the Company’s quarterly or annual financial reports or earlier public release of quarterly or annual financial information) and without the clearance of our Compliance Officer. In addition, the policy provides that none of our directors, officers or other employees may engage in the following transactions: (i) purchasing our securities on margin; (ii) pledging our securities; (iii) short sales; (d) buying or selling puts or calls in connection with our securities; and (v) engaging in derivative transactions relating to our securities (e.g., exchange traded options, etc.).

MANAGEMENT

Our 2021 Named Executive Officers consist of the following individuals:

| Name | Age | Position | |||

| Dror Bashan | 55 | President and Chief Executive Officer | |||

| Einat Brill Almon, Ph.D. (1) | 63 | Senior Vice President, Chief Development Officer | |||

| Eyal Rubin | 46 | Sr. Vice President, Chief Financial Officer, Treasurer and Secretary |

Einat Brill Almon, Ph.D. Dr. Almon joined Protalix Ltd. in December 2004, originally as a Senior Director and later as a Vice President and became our Senior Vice President, Product Development in 2006 and our Chief Development Officer in 2020. Dr. Almon has many years of experience in the management of life science projects and companies, including biotechnology and agrobiotech, with direct experience in clinical, device and scientific software development, as well as a strong background and work experience in intellectual property. Prior to joining Protalix Ltd., from 2001 to 2004, she served as Director of R&D and IP of Medgenics Medical (Israel) Ltd. (formerly, Biogenics Ltd.), a company that developed an autologous platform for tissue-based protein drug delivery. Medgenics Medical, based in Israel, is a wholly-owned subsidiary of Aevi Genomic Medicine, Inc. (NASDAQ:GNMX) (formerly, Medgenics Inc.). Dr. Almon has trained as a biotechnology patent agent at leading IP firms in Israel. Dr. Almon holds a Ph.D. and an M.Sc. in molecular biology of cancer research from the Weizmann Institute of Science, a B.Sc. from the Hebrew University and has carried out Post- Doctoral research at the Hebrew University in molecular biology of plant genetic engineering.

Eyal Rubin. Mr. Rubin has served as our Senior Vice President and Chief Financial Officer since September 2019. He brings more than 20 years of finance and capital markets experience, an extensive background in financial planning and operations, management and strategy and a deep knowledge of the biotechnology and pharmaceutical industries. Prior to joining Protalix, he served as Executive Vice President and Chief Financial Officer of BrainStorm Cell Therapeutics Inc. (NASDAQ:BCLI), a publicly traded biotechnology company, where he was responsible for all corporate finance, accounting and investor relations activities. Prior to his role at BrainStorm, Mr. Rubin served at Teva (NYSE:TEVA; TASE:TEVA) in several roles, most recently as Vice President, Head of Corporate Treasury. In this role, Mr. Rubin was responsible for Teva’s cash operations and cash management, as well as Teva’s equity and debt capital markets transactions. Mr. Rubin holds a BA in Financing and IT Systems from the College of Management, Israel, where he graduated Summa Cum Laude with a specialization in Financing and IT Systems, and an MBA from Bar-Ilan University, Israel, where he graduated Summa Cum Laude with a specialization in Finance.

(1) On March 31, 2022, Einat Brill Almon, Ph.D., having reached retirement age, retired from her position as our Sr. Vice President & Chief Development Officer. Dr. Almon will continue her service to our company on a consultancy basis, taking a facilitating role in the continued progress of our clinical development program, as well as assisting in the identification of her replacement.

The biographical information for Mr. Bashan is set forth above under “Proposal 1: Election of Directors.”

16

Family Relationships

There are no family relationships among directors or executive officers of our Company.

Executive Compensation

The primary goals of the Compensation Committee of our Board of Directors with respect to executive compensation are to attract and retain the most talented and dedicated executives possible, to tie annual and long-term cash and stock incentives to achievement of specified performance objectives, and to align executives’ incentives with stockholder value creation. To achieve these goals, the Compensation Committee implements and maintains compensation plans that tie a portion of executives’ overall compensation to key strategic goals such as developments in our clinical path, the establishment of key strategic collaborations, the build-up of our pipeline and the strengthening of our financial position. The Compensation Committee evaluates individual executive performance with a goal of setting compensation at levels the committee believes are comparable with executives in other companies of similar size and stage of development operating in the biotechnology industry while taking into account our relative performance and our own strategic goals.

Elements of Compensation

Executive compensation consists of following elements:

Base Salary. Base salaries for our executive officers are established based on the scope of their responsibilities taking into account competitive market compensation paid by other companies for similar positions. Generally, we believe that executive base salaries should be targeted near the median of the range of salaries for executives in similar positions with similar responsibilities at comparable companies. The Compensation Committee convenes from time to time to evaluate present and future executive compensation, which evaluation generally includes an evaluation of the peer group considered in analyzing executive compensation. The Compensation Committee intends to continue reviewing and revising the peer group periodically to ensure that it continues to reflect companies similar to the Company in size and development stage. The Compensation Committee also reviews executive compensation reports and an analysis of publicly-traded biotechnology companies prepared by third party experts from a well-known consulting firm for additional data and other information regarding executive compensation for comparative purposes.

Base salaries are usually reviewed annually, and adjusted from time to time to realign salaries with market levels after taking into account individual responsibilities, performance and experience. The base salaries of each of our President and Chief Executive Officer, our Senior Vice President, Chief Development Officer, and our Senior Vice President and Chief Financial Officer, who we refer to collectively as the “Named Executive Officers,” are discussed herein.

Annual Bonus. The Compensation Committee has the authority to award discretionary annual bonuses to our executive officers. The discretionary annual bonus awards were intended to compensate officers for achieving financial, clinical, regulatory and operational goals and for achieving individual annual performance objectives. For any given year, the compensation objectives vary, but relate generally to strategic factors such as developments in our clinical path, the execution of a license agreement for the commercialization of product candidates, the establishment of key strategic collaborations, the build-up of our pipeline and financial factors such as capital raising. Bonuses are awarded generally based on corporate performance, with adjustments made within a range for individual performance, at the discretion of the Compensation Committee. The Compensation Committee determines, on a discretionary basis, the size of the entire bonus pool and the amount of the actual award to each Named Executive Officer.

The Compensation Committee selects, in its discretion, the executive officers of the Company or our subsidiary who are eligible to receive bonuses for any given year. Any bonus granted by the Compensation Committee will generally be paid upon the achievement of a specific milestone, subject to certain terms and conditions. The Compensation Committee has not fixed a minimum or maximum award for any executive officer’s annual discretionary bonus. Each of our executive officers is eligible for a discretionary annual bonus under his or her employment agreement.

Options and Share-Based Compensation. Our Amended and Restated 2006 Stock Incentive Plan authorizes us to grant options to purchase shares of common stock, restricted stock and other securities to our employees, directors and consultants. Our Compensation Committee is the administrator of the stock incentive plan. Stock option or other grants are generally made at the commencement of employment and following a significant change in job responsibilities or to meet other special retention or performance objectives. The Compensation Committee reviews and approves stock option and other awards to executive officers based upon a review of competitive compensation data, its assessment of individual performance, a review of each executive’s existing long-term incentives, and retention considerations. The exercise price of stock options granted under our Amended and Restated 2006 Stock Incentive Plan, as amended, must be equal to at least 100% of the fair market value of our common stock on the date of grant; however, in certain circumstances, grants may be made at a lower price to Israeli grantees who are residents of the State of Israel.

17

Severance and Change in Control Benefits. The Compensation Committee granted the following payments that would be payable in connection with a change of control: $1.0 million to the President and Chief Executive Officer and $400,000 to each of the other executive Vice Presidents. Such payments are subject to certain terms and conditions. In addition to the foregoing, pursuant to the employment agreements entered into with each of our executive officers, the executive officer is entitled to be insured by Protalix Ltd. under a Manager’s Policy in lieu of severance. The intention of such Manager’s Policies is to provide the Israel-based officers with severance protection of one month’s salary for each year of employment. In addition, the stock options and restricted stock granted to each of our Named Executive Officers provide that all of such instruments are subject to accelerated vesting immediately upon a change in control of the Company.