UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

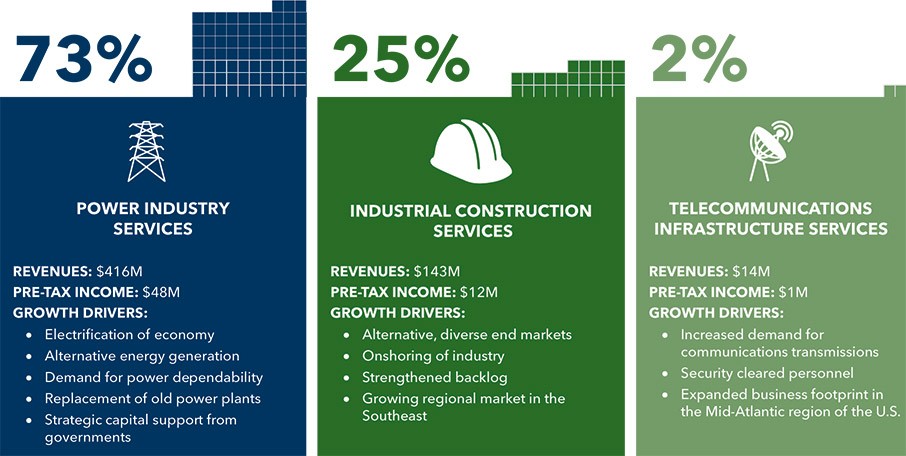

ARGAN AT-A-GLANCE | |||||

$573M | OUR MISSION IS TO SAFELY BUILD THE ENERGY AND INDUSTRIAL BASE OF TOMORROW ESSENTIAL TO ECONOMIC PROSPERITY WITH MOTIVATED, CREATIVE, HIGH-ENERGY AND CUSTOMER-DRIVEN TEAMS WHO ARE COMMITTED TO DELIVERING THE BEST POSSIBLE PROJECT RESULTS EACH AND EVERY TIME. | ||||

$2.39 | |||||

$412M | |||||

$245M | |||||

$757M | |||||

|

|

|

73% POWER Building innovative power solutions for the transition to low-carbon/zero carbon emissions: efficient gas-fired power plants, biomass projects, solar energy facilities, wind farms, waste-to energy facilities. | 25% INDUSTRIAL Servicing heavy and light industrial clients, particularly in new industries as well as agriculture, petrochemical, pulp & paper, water and power. | 2% TELECOMMUNICATIONS Constructing and connecting technology, telecommunications and power. |

| ||

www.arganinc.com | ||

“ We are dedicated to enhancing our capabilities to strengthen Argan’s position as a preferred partner in the power and industrial sectors. As we enter the new fiscal year, we remain competitive and driven, engaged in continuing the momentum of this past year, and we look forward to safely building the energy and industrial base of tomorrow. ” |

May 9, 2024 Dear Stockholders: You are cordially invited to attend our 2024 Annual Meeting of Stockholders to be held on Thursday, June 20, 2024, at 11:00 a.m., local time, in Room #104 of the building where our offices are located, One Church Street, Rockville, Maryland 20850. The matters to be acted upon at the meeting are described in detail in the accompanying notice of annual meeting of stockholders and proxy statement. As allowed by the Securities and Exchange Commission, we are furnishing proxy materials to our stockholders primarily over the Internet again this year. Since its introduction, we believe that this delivery method, referred to as "Notice and Access,” has been successful in providing stockholders with efficient access to proxy materials which has resulted in the accurate and timely tabulation of votes. Use of this method lowers the costs of our annual meeting considerably and significantly reduces the amount of paper used to print proxy materials. On or about May 9, 2024, we will begin to provide our stockholders with a Notice of Internet Availability of Proxy Materials (the "Notice”) containing instructions for accessing our 2024 Proxy Statement and 2024 Annual Report and for voting online. The Notice also includes instructions for requesting printed paper copies of the proxy materials, including the notice of annual meeting, the proxy statement, the annual report and the proxy card, should you desire to obtain paper copies. Even if you do not plan to attend the meeting, your vote is important and we encourage you to review our proxy materials and promptly cast your vote. For those stockholders who access the proxy materials over the Internet, we ask that you vote your shares over the Internet as well, by following the instructions that will be provided to you. Alternatively, if you requested or received a printed paper copy of the proxy materials by mail, you may vote your shares over the Internet, or you may sign, date and return the proxy card by mail in the envelope provided. Instructions regarding the two methods of voting are contained in the Notice and the proxy card. As described in the accompanying 2024 Proxy Statement, our Board of Directors has approved the matters included in the proposals presented there, and believes that they are fair to, and in the best interests of, our stockholders. Thank you for your continued support of Argan, Inc., and I look forward to seeing you on June 20th. By Order of the Board of Directors, /s/ William F. Leimkuhler William F. Leimkuhler Chairman of the Board of Directors |

NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS

To Be Held on THURSDAY, June 20, 2024

ITEMS OF BUSINESS | BOARD |

DATE & TIME Thursday, June 20, 2024,

PLACE One Church Street, Room #104,

WHO Stockholders of record | |||

1 | To elect ten directors to our Board of Directors, each to serve until our 2025 Annual Meeting of Stockholders and until his/her successor has been elected and qualified or until his/her earlier resignation, death or removal; |

| |||

2 | To hold a non-binding advisory vote on our executive compensation (the "say-on-pay” vote); and |

| |||

3 | To ratify the appointment of Grant Thornton LLP as our independent registered public accountants for the fiscal year ending January 31, 2025. |

| |||

These items of business are more fully described in the accompanying proxy statement. Only stockholders of record at the close of business on April 26, 2024 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. Your vote is important. Whether or not you plan to attend the Annual Meeting in person, please cast your vote via either the Internet or mail before the Annual Meeting so that your shares will be represented at the Annual Meeting. BY ORDER OF THE BOARD OF DIRECTORS, /s/ Richard H. Deily Richard H. Deily Corporate Secretary Rockville, Maryland May 9, 2024 | |||||

Table of contents

37 | |

40 | |

41 | Major Elements of Executive Compensation and Analysis of Compensation Decisions |

42 | |

42 | |

42 | |

43 | |

44 | |

44 | |

44 | |

45 | |

46 | |

46 | |

47 | |

48 | |

48 | |

50 | |

51 | |

51 | |

55 | |

55 | |

55 | |

56 | COMPLIANCE UNDER SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934 |

56 | |

57 | |

57 | |

58 |

Argan, Inc.

Proxy Statement

May 9, 2024

The accompanying proxy is solicited on behalf of the Board of Directors (or the “Board”) of Argan, Inc., a Delaware corporation (referred to herein as “Argan” or the “Company”), for use at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 20, 2024, at 11:00 a.m., local time, One Church Street, Room #104, Rockville, Maryland 20850. This proxy statement for the Annual Meeting (the “Proxy Statement”) and the accompanying proxy card will be available to stockholders of record on April 26, 2024, starting on or about May 9, 2024. Our Annual Report on Form 10-K for the fiscal year ended January 31, 2024 (the “Annual Report”) accompanies the Proxy Statement. At the Annual Meeting, stockholders will be asked to consider and vote upon the following three matters, and to transact any other business that may properly arise.

| 1. | The election of ten directors to our Board, each to serve until our 2025 Annual Meeting of Stockholders and until his/her successor has been elected and qualified or until his/her earlier resignation, death or removal; |

| 2. | The non-binding advisory approval of our executive compensation (the “say-on-pay” vote); and |

| 3. | The ratification of the appointment of Grant Thornton LLP as our independent registered public accountants for the fiscal year ending January 31, 2025 (“Fiscal 2025”). |

If a proxy is properly executed and returned to the Company via either the Internet or mail in time for the Annual Meeting and is not revoked prior to the time it is exercised, the shares represented by the proxy will be voted in accordance with the directions specified therein for the matters listed on the proxy card. Unless the proxy specifies that it is to be voted against or is an abstention on a listed matter, proxies will be voted “FOR” the election to our Board of each of the ten nominees identified in Proposal No. 1; “FOR” Proposals No. 2 and No. 3; and otherwise in the discretion of the proxy holders as to any other matter that may be properly brought before the Annual Meeting.

Argan, Inc. | 1

PROPOSAL NO. 1 –

ELECTION OF DIRECTORS

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR” THE ELECTION OF EACH OF THE NOMINATED DIRECTORS |

The members of our Board of Directors are elected annually and hold office until the next annual meeting of stockholders and until their successors have been elected and shall have been qualified. Vacancies and newly-created directorships resulting from any increase in the number of authorized directors may be filled by a majority vote of the directors then in office.

At the Annual Meeting, our stockholders are being asked to elect ten individuals to our Board of Directors, all of whom currently serve in that capacity, other than Karen A. Sweeney, who is a director nominee. Mano S. Koilpillai, who served as a director since 2019, is not standing for re-election. Unless a stockholder withholds authority, the holders of proxies representing shares of Common Stock will vote "FOR” the election of each of the nominees listed below.

Proxies cannot be voted for a greater number of persons than the number of nominees named. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder may determine. We are not aware of any nominee who will be unable to or for good cause will not serve as a member of our Board of Directors.

Board Skills and Qualifications

|

|

|

|

|

| |

ACCOUNTING | INDUSTRY | STRATEGIC | RISK | TALENT | CORPORATE | |

RAINER H. BOSSELMANN Director Since: 2003 | Age: 81 | · | · | · | · | ||

CYNTHIA A. FLANDERS IND Director Since: 2009 | Age: 69 | · | · | · | · | · | |

PETER W. GETSINGER IND Director Since: 2014 | Age: 72 | · | · | · | · | · | |

WILLIAM F. GRIFFIN, JR. Director Since: 2012 | Age: 69 | · | · | · | · | ||

JOHN R. JEFFREY, JR. IND Director Since: 2017 | Age: 70 | · | · | · | · | · | |

WILLIAM F. LEIMKUHLER IND Director Since: 2007 | Age: 72 | · | · | · | · | · | · |

W.G. CHAMPION MITCHELL IND Director Since: 2003 | Age: 77 | · | · | · | · | ||

JAMES W. QUINN IND Director Since: 2003 | Age: 66 | · | · | · | · | · | |

KAREN A. SWEENEY IND Director Nominee | Age: 66 | · | · | · | · | ||

DAVID H. WATSON Director Since: 2022 | Age: 48 | · | · | · | · | · | · |

· = Skill

2 | 2024 Proxy

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Directors/Nominees

The names of the nominees, their ages as of April 30, 2024, and certain other information about them are set forth below:

RAINER H. AGE: 81 DIRECTOR SINCE: 2003 COMMITTEES: ● Executive

|

| Mr. Bosselmann has been a director since May 2003 and served as Chairman of the Board of Directors of the Company from May 2003 to August 2022. He also served as the Company’s Chief Executive Officer from October 2003 until his retirement in August 2022. Mr. Bosselmann was chairman of the board, chief executive officer and a director of Arguss Communications, Inc. ("Arguss”), a telecommunications infrastructure company listed on the NYSE, from 1996 through 2002 and president of Arguss from 1997 through 2002. Mr. Bosselmann served as an independent director of The Roberts Company, Inc., formerly a privately owned firm, from 2008 until December 2015 when it was acquired by us. QUALIFICATIONS Mr. Bosselmann’s experience positions him to share his extensive knowledge of the Company with the Board during its deliberations, including its history and development, and to provide critical continuity. As chief executive officer of Arguss and then the Company, he developed substantial expertise in managing public companies with diverse and remotely-located business operations, and in identifying, executing and integrating acquisitions. |

CYNTHIA A. INDEPENDENT AGE: 69 DIRECTOR SINCE: 2009 COMMITTEES: ● Audit ● Compensation

|

| Ms. Flanders has been a member of our Board of Directors since April 2009. Ms. Flanders currently serves as Chairwoman of the Risk Committee and member of the Audit Committee on the board of directors of Forbright Bank (formerly known as Congressional Bank), a full service, privately-held bank in Chevy Chase, Maryland. Since October 2013, she has served as a senior advisor for Verit Advisors LLC, an independent investment bank advisory firm that specializes in ESOPs and other ownership transitions. In April 2021, Ms. Flanders co-founded The Profitable Idea, LLC, an online business workshop and educational space for entrepreneurs and business owners to learn how to make their businesses sustainably profitable. Ms. Flanders is also founder of Manage Fearlessly, an organization that provides business training and career coaching resources to a number of company executives, senior managers, and entrepreneurs. From 1975 through 2009, Ms. Flanders held a series of positions of increasing responsibility with Bank of America and its predecessor organizations (the "Bank”). Ultimately, she served as the Global Commercial Banking Executive for the Bank’s Mid-Atlantic region overseeing eight commercial banking markets and over 80 client teams delivering a full array of financial services to over 6,000 small, middle market and micro-cap clients in the region. Ms. Flanders served as our chief financial officer during the calendar year 2015. During the year ended January 31, 2019, the Board membership of Ms. Flanders was restored to "independent” pursuant to the requirements of the NYSE. QUALIFICATIONS With her long banking and management career, Ms. Flanders brings to the Board her considerable experience in executive management and strategic planning, as well as expertise in financial analysis, capital structuring and due diligence investigations. Her many years of lending to businesses in the Mid-Atlantic region of the United States (the "U.S.”) have provided her with a unique understanding of our business and the construction industry. In addition, she represents an important resource for consultation regarding commercial banking matters. |

Argan, Inc. | 3

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

PETER W. INDEPENDENT AGE: 72 DIRECTOR SINCE: 2014 COMMITTEES: ● Audit ● Responsible Business

|

| Mr. Getsinger has been a member of our Board of Directors since his appointment in November 2014. Mr. Getsinger retired in 2018 from Nexstar Capital Partners LLC (a SEC registered firm), a firm that he founded in 2004 as an alternative investment management firm focused on investing in emerging markets with a primary concentration in Latin America, where he was managing partner and chief investment officer. In 2005, his firm acquired an ownership interest in Electro Dunas S.A. ("Dunas,” an electricity distributor servicing the southwest of Peru and one of four privatized distribution companies in that country). Mr. Getsinger served as a board member of Dunas until 2016. From 2012 to 2014, he was chairman of its board of directors. Prior to forming Nexstar, Mr. Getsinger was head of global investment banking for Latin America at Deutsche Bank. He held the same role at Bankers Trust Company in addition to running the global project finance business. He previously served as the senior vice president and head of fixed income sales for the United Kingdom, continental Europe, and the Middle East at Lehman Brothers. Mr. Getsinger is also a former director and owner of GPU Argentina Holdings, Inc. QUALIFICATIONS Mr. Getsinger brings a significant amount of business experience to our Board along with deep financial and diverse banking expertise. Because of his experience with Dunas, he provides additional power industry knowledge. Mr. Getsinger has a strong background in international markets and his leadership in providing global investment banking services is valuable to us in matters relating to strategic planning and potential overseas expansion. |

WILLIAM F. AGE: 69 DIRECTOR SINCE: 2012 COMMITTEES: ● Executive

|

| Mr. Griffin was appointed to the Board of Directors in April 2012. He is a co-founder of Gemma Power Systems, LLC ("Gemma”) which was acquired by Argan in December 2006 along with its affiliated companies. Mr. Griffin is a veteran of power plant construction with over 40 years of related experience. He now holds the position of Non-Executive Chairman of Gemma. Mr. Griffin served as Vice Chairman of Gemma from November 2007 to November 2019 and as Chief Executive Officer of Gemma from September 2008 to November 2019. Under Mr. Griffin’s leadership, Gemma grew to become one of the nation’s leading providers of engineering, procurement and construction services to the power generation market. Over the past two years, Mr. Griffin has evolved into an important leadership mentor for the heads of both Gemma and our overseas energy project construction firm, Atlantic Projects Company Limited ("APC”). QUALIFICATIONS Mr. Griffin has significant senior executive experience in the energy-related construction sector. Based on his long length of service as the leader of our largest operating company, Mr. Griffin contributes an in-depth understanding of our business that may not be easily attainable by an outside member of our Board. Based on the extent of his experience, the Board of Directors benefits from Mr. Griffin making important contributions to its decision making regarding our strategic direction, our commitment to certain business development efforts, the identification of future construction project opportunities, contract negotiations and project execution. |

4 | 2024 Proxy

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

JOHN R. INDEPENDENT AGE: 70 DIRECTOR SINCE: 2017 COMMITTEES: ● Audit ● Responsible Business

|

| Mr. Jeffrey has been a member of our Board of Directors since June 2017. Mr. Jeffrey accumulated 40 years of experience with Deloitte & Touche LLP ("Deloitte”), which included 30 years as a partner serving several of Deloitte’s largest audit clients, before retiring in 2017. Mr. Jeffrey was Managing Partner of Deloitte’s Global Japanese Services Group from 2003 to 2015, and he was a member of Deloitte’s United States Chairman and CEO Nominating Committee in 2010. Currently, Mr. Jeffrey serves as a board member for two non-profit entities based in New York offering educational and enrichment programs dedicated to improving the education of children. In 2023, Mr. Jeffrey joined Clara Vista Fund I, LP, a media and emerging technology investment entity, as an advisory member of its Board of Directors. QUALIFICATIONS Mr. Jeffrey provides our Board with significant expertise in the areas of public accounting, risk management, mergers and acquisitions, and related regulatory matters, which he developed over a long career with Deloitte, a leading public accounting firm. He brings to the Board viable experience with operational and governance issues faced by complex organizations, including extensive international expertise. He also brings to our Board valuable experience in dealing with long-term construction projects. Mr. Jeffrey is a certified public accountant with an active license. |

WILLIAM F. INDEPENDENT AGE: 72 DIRECTOR SINCE: 2007 COMMITTEES: ● Executive ● Compensation ● Nominating/Corporate Governance

|

| Mr. Leimkuhler has been a member of our Board of Directors since June 2007 and he was appointed as Chairman of the Board in August 2022. Currently, Mr. Leimkuhler serves as a senior vice president of Mutualink, Inc. ("Mutualink”), a privately owned provider of communications interoperability solutions for public safety and critical infrastructure organizations. From November 2017 to January 31, 2021, Mr. Leimkuhler served as the chief financial officer of Mutualink. He has been the general counsel and director of business development to Paice Corporation, a privately held developer of hybrid electric powertrains, since 1999. He also advises a number of technology-based companies on business, financial and legal matters, including corporate and commercial transactions and intellectual property matters. From 1994 through 1999, he held various positions with Allen & Company LLC ("Allen”), a New York investment banking firm, initially serving as the firm’s general counsel. From 2012 to September 2019, Mr. Leimkuhler was a member of the board of directors of Northern Power Systems Corp., which designed, manufactured and serviced wind turbines. He served as chairman of the board from December 2013. He also served on the audit and compensation committees of this board. Mr. Leimkuhler also serves on the board of U.S. Neurosurgical Holdings, Inc. (OTC: USNU), which holds interests in radiological treatment facilities and is developing a managed care business. QUALIFICATIONS The leadership experience that Mr. Leimkuhler has developed as a legal executive with an investment banking firm, a securities law firm partner and a board and associated committee member for public companies makes him a valuable member of our Board. He is a respected source of legal guidance to the members of the executive management team and the members of our Board of Directors and provides special insight to them on matters relating to financial reporting and corporate governance requirements. |

Argan, Inc. | 5

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

W.G. CHAMPION INDEPENDENT AGE: 77 DIRECTOR SINCE: 2003 COMMITTEES: ● Executive ● Nominating/Corporate Governance

|

| Mr. Mitchell has been a member of our Board of Directors since October 2003. From January 2003 until March 2008, Mr. Mitchell was chairman of the board and chief executive officer of Network Solutions, Inc. which was engaged in the creation, marketing and management of digital identity and web presence products. Mr. Mitchell currently serves as a director of two privately-held companies, Direct Brands, Inc. and The 41st Parameter, Inc. He is also a member of the board of governors for RTI International, a leading independent, nonprofit research and development organization, and for the University of North Carolina system that controls all state-owned universities and operates the largest hospital system in the state. QUALIFICATIONS Mr. Mitchell possesses business leadership skills which were honed as a former chief executive officer for a series of companies. This background makes him a valuable source of advice and consultation for the management team and the other members of the Board as we address the contemporary issues facing public companies today. His many years of experience as a corporate executive and his length of service on our Board provide him with a unique capability to assess the needs of the Board and to evaluate the value of potential Board members, with substantial insight into management, operational and financial matters, and with knowledge of market conditions and trends. |

JAMES W. INDEPENDENT AGE: 66 DIRECTOR SINCE: 2003 COMMITTEES: ● Executive ● Compensation ● Nominating/Corporate Governance

|

| Mr. Quinn has been a member of our Board of Directors since May 2003. Mr. Quinn is currently a managing director of Allen & Company LLC. Since 1982, Mr. Quinn has served in various capacities at Allen and its affiliates, including head of the Corporate Syndicate Department and chief financial officer for approximately ten years. Mr. Quinn served as a director of Arguss from 1999 through 2002. He also serves as a director on the boards of several privately held companies in connection with Allen’s investment in the companies and of several charitable organizations. QUALIFICATIONS Mr. Quinn’s experience with financial and investment banking matters at Allen and his terms of service on the boards of the Company and Arguss make him a valued member of our Board and well-qualified to be the chair of the Board’s Compensation Committee. His many years of experience allow him to counsel the Board on matters such as executive compensation, mergers and acquisitions, capital structure, financings and strategic planning and to provide insightful views on public company reporting matters and general business trends. |

6 | 2024 Proxy

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

KAREN A. SWEENEY INDEPENDENT AGE: 66 DIRECTOR NOMINEE COMMITTEES: ● Responsible Business

|

| Ms. Sweeney is standing for election as a new member of Argan’s Board of Directors beginning in June 2024. Ms. Sweeney first joined Turner Construction Company (“Turner”), an international construction services company, in 1980 as a field engineer. Throughout her tenure, she worked in estimating and engineering, special projects, and project management on number commercial construction projects throughout the U.S. In 2000, she was appointed as vice president and general manager of the Cleveland business unit, taking on the responsibilities of overseeing both field and business development operations. She was the first woman to head a Turner office. In 2009, she was named Turner’s vice president of diversity and inclusion, and in 2014 was promoted to senior vice president, inclusion and community. She has served as a director of the Penn State Engineering Alumni Society since 2004 and served as its president from 2012 to 2014. Ms. Sweeney is also a founding member of In Counsel With Women, a professional network for women in Northeast Ohio, and a member of the Society of Women Engineers. QUALIFICATIONS Ms. Sweeney’s extensive 43-year career in construction engineering and operations will make her a valuable member of our Board, providing expertise in sales, contracts, field operations and client relationships. Her background in leading company initiatives focused on diversity and inclusion also make her a trusted resource to lead the Board’s Responsible Business Committee. |

DAVID H. AGE: 48 DIRECTOR SINCE: 2022 COMMITTEES: ● Executive ● Responsible Business

|

| Mr. Watson was appointed President and Chief Executive Officer of the Company and a member of the Board of Directors, effective August 2022. Previously, Mr. Watson served as our Senior Vice President, Chief Financial Officer, Treasurer and Corporate Secretary since he joined the Company in October 2015. Mr. Watson has held senior financial positions with public companies for over 15 years. Mr. Watson was the Chief Financial Officer of Gladstone Investment Corporation (NASDAQ: GAIN) from 2010 until 2015, and also served as its Treasurer from 2012 until 2015. In addition, Mr. Watson was the Chief Financial Officer of Gladstone Capital Corporation (NASDAQ: GLAD) from 2011 until 2013 and served as its Treasurer from 2012 until 2015. Gladstone Investment Corporation and Gladstone Capital Corporation are closed-end, non-diversified management investment companies. Prior to his Gladstone positions, Mr. Watson served as a director of Portfolio Accounting of the publicly-traded MCG Capital Corporation from 2007 until 2010. QUALIFICATIONS Mr. Watson has extensive knowledge and experience in our business and has obtained an in-depth knowledge of our employees, culture and competitors. As chief financial officer of the Company, he developed important relationships with the leaders now running our subsidiary operations, and he has a deep understanding of the financial accounting and risk management disciplines. He possesses the leadership skills, the energy and the problem-solving capabilities that are important to the Board and the Company. |

Composition of Board of Directors

The number of directors which shall constitute the whole Board of Directors shall be not less than four or more than ten. Nine of the current directors will stand for re-election at the Annual Meeting as described in this Proxy Statement in addition to one director nominee, Ms. Sweeney. Ms. Koilpillai, who served as a director since 2019, is not standing for re-election.

Director Attendance at the Annual Meeting

All of our directors attended last year’s annual meeting in person or by teleconference, and we expect that all ten of the nominated directors will attend this year’s Annual Meeting in person or by teleconference.

Argan, Inc. | 7

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Board of Directors Meetings and Committees

During the fiscal year ended January 31, 2024 (“Fiscal 2024”), the Board of Directors met five times and acted twice by unanimous written consent. All current Board members were present for the full Board and Committee meetings held during the year or participated by telephone conference, with the exception of one Board member, Mr. Bosselmann, who was unable to attend one Board meeting.

Currently, the Board has five standing committees: the Executive Committee, the Audit Committee, the Compensation Committee, the Nominating/Corporate Governance Committee and the Responsible Business Committee. The Responsible Business Committee was formerly named the Environmental, Social and Governance Committee and was subcommittee of the Nominating/Corporate Governance Committee. The Board designated it as a standing committee in April 2023. The functions of each of these committees and their members are specified below. The Audit Committee, the Compensation Committee, the Nominating/Corporate Governance Committee and the Responsible Business Committee each operate under written charters which were updated and affirmed by the Board in June 2023, in order to meet the requirements of the NYSE Listed Company Manual. These charters, as well as the Board’s Governance Guidelines, are available on our website at www.arganinc.com.

The current members of the five standing committees are identified in the following table.

COMMITTEES | ||||||||||

|

|

|

|

| ||||||

IND | AUDIT | COMPENSATION | NOMINATING/ | RESPONSIBLE BUSINESS | EXECUTIVE | |||||

RAINER H. BOSSELMANN | · | |||||||||

CYNTHIA A. FLANDERS | · | · | · | |||||||

PETER W. GETSINGER | · | · | · | |||||||

WILLIAM F. GRIFFIN, JR. | · | |||||||||

JOHN R. JEFFREY, JR. | · | C | · | |||||||

MANO S. KOILPILLAI | · | C | ||||||||

WILLIAM F. LEIMKUHLER* | · | · | · | C | ||||||

W.G. CHAMPION MITCHELL | · | C | · | |||||||

JAMES W. QUINN | · | C | · | · | ||||||

DAVID H. WATSON | · | · | ||||||||

* = Chairman of the Board C = Chair · = Member IND = Independent

The Board has determined that the following members of the Board are currently independent directors, as such term is defined in Section 303A of the NYSE Listed Company Manual: Messrs. Jeffrey, Getsinger, Leimkuhler, Mitchell and Quinn; Ms. Flanders; and Ms. Koilpillai. The independent directors meet from time to time in executive session without the other members. |

|

8 | 2024 Proxy

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

AUDIT COMMITTEE | |||

| MEMBERS: JOHN R. JEFFREY, JR. (Chair), CYNTHIA A. FLANDERS, PETER W. GETSINGER NUMBER OF MEETINGS IN 2024: 6 AVERAGE DIRECTOR ATTENDANCE IN 2024:100% | ||

During Fiscal 2024, the Audit Committee met six times by telephone conference. All elected members participated in each one of these meetings. The members of the Audit Committee are all independent directors under applicable SEC and stock exchange rules. In addition, the Board of Directors has determined that at least one of the independent directors serving on the Audit Committee, Mr. Jeffrey, is an audit committee financial expert, as that term has been defined by Item 407 of the Security and Exchange Commission’s Regulation S-K.

The original written charter of the Audit Committee was adopted in October 2003. As indicated above, the charter was most recently updated and approved by the Board in June 2023. The Audit Committee assists the full Board of Directors in its oversight responsibilities relating to the integrity of our published consolidated financial statements, our financial disclosure controls and our system of internal control over financial reporting. This group considers and approves the selection of, and approves the fee arrangements with, our independent registered public accountants.

The Audit Committee meets with members of management and representatives of our independent registered public accounting firm in order to review the overall plan for the annual independent audits including the scope of audit testing and any other factors that may impact the effectiveness of the audits. The Audit Committee discusses with management and the auditors our major financial and operating risks, the steps that management has taken to monitor and manage such exposures, the results of the quarterly reviews and annual audits and any other matters required to be communicated to the Audit Committee pursuant to the standards of the Public Company Accounting Oversight Board (United States).

At the end of each of the first three quarters and subsequent to year-end, the members of the Audit Committee meet with management and the independent auditors to review the adequacy and accuracy of the information included in the applicable SEC filing, including the disclosures made in the "Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of each filing.

The Audit Committee also meets with representatives of our internal auditing firm in order to review the scope of its annual audit plan and the results of its testing including the identification of any significant deficiencies or material weaknesses in the system of internal control over financial reporting and the discovery of any fraud regardless of materiality. The Audit Committee oversees and periodically reviews the Company’s cybersecurity and related policies, controls and effectiveness assessments. In addition, the Audit Committee reviews complaints referred to them that we receive regarding accounting, internal controls or auditing matters, and the confidential or anonymous submissions by employees expressing concerns regarding questionable accounting or auditing practices.

COMPENSATION COMMITTEE | |||

| MEMBERS: JAMES W. QUINN (Chair), CYNTHIA A. FLANDERS, WILLIAM F. LEIMKUHLER NUMBER OF MEETINGS IN 2024: 3 AVERAGE DIRECTOR ATTENDANCE IN 2024: 100% | ||

Each year, the Compensation Committee performs comprehensive stockholder outreach efforts. The overall purpose of this outreach is to improve our understanding of the perspectives that our stockholders have with respect to our compensation practices, and to evaluate and to address any concerns or feedback we receive, as described further in the "Executive Compensation Discussion and Analysis” section below.

Compensation Committee meetings are held primarily to determine the elements of cash compensation for our executive officers, including cash bonus and incentive awards, and to develop recommendations for the consideration of the Board of Directors regarding the award of options to purchase shares of our Common Stock and of restricted stock units.

During Fiscal 2024, the members of the Compensation Committee formally met three times by telephone conference and acted once by unanimous written consent. All members participated in these meetings. At the meetings that were held early

Argan, Inc. | 9

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

in the year, the members evaluated the performance of the Company for the fiscal year ended January 31, 2023 ("Fiscal 2023”) and the performance of each officer considered a Named Executive Officer (“NEO”) and other key employees for Fiscal 2023. Based on the evaluations, the Compensation Committee approved the cash bonus and incentive cash awards for the NEOs in the amounts discussed in our proxy statement provided to stockholders last year, approved the bonus pool amounts for Argan and each of the subsidiaries related to Fiscal 2023, and approved deferred compensation awards for senior management and other key employees at Gemma (awards currently exclude Charles E. Collins, IV, the Chief Executive Officer of Gemma). At the meeting of the Board of Directors held in April 2023, and based on the recommendations of the Compensation Committee, the independent members approved the awards of stock options and restricted stock units to NEOs and other key employees.

Members acted by unanimous written consent in September 2023 to permit outstanding Restricted Stock Agreements and Non-Qualified Stock Option Agreements of the Company to include a share netting provision, allowing participants or optionees the choice to receive a net number of shares, which number shall be reduced by the number of shares of common stock of the Company with an aggregate fair market value equal to (i) the estimated payroll tax withholding amount due and/or (ii) the option exercise price. At the meeting held later in the year, the members evaluated and approved an amended Clawback Policy to comply with the new compensation recovery standards established by the Securities and Exchange Commission (the “SEC”) for incentive compensation erroneously awarded subsequent to October 1, 2023.

Subsequent to the end of Fiscal 2024, the members of the Compensation Committee met two additional times to consider consolidated operating results for Fiscal 2024 and to understand the performance of each individual subsidiary operation for the year. As a result, the members 1) approved cash bonus pool amounts related to Fiscal 2024 for Gemma and the other companies comprising the Company’s consolidated group, 2) approved deferred compensation awards for certain senior management members and other key employees of Gemma (which did not include any award amounts for Mr. Collins), 3) approved the cash bonus and incentive cash awards described in the following paragraph for the NEOs in the amounts disclosed for Fiscal 2024 in the "Summary Compensation Table” included below, and 4) developed its recommendations for the stock awards that were approved by the independent members of the Board of Directors in April 2024.

The members of the Compensation Committee reviewed and approved the incentive compensation calculations for Fiscal 2024 that were made pursuant to the performance criteria established for Mr. Collins in his employment agreement which resulted in the payment of cash incentive compensation of $1,150,000. In addition, Mr. Collins was awarded a discretionary cash bonus of $350,000 for Fiscal 2024.

The review by the Compensation Committee of the consolidated Company’s performance for Fiscal 2024 and of individual performance and achievements during the year also resulted in the payment of cash bonuses to Mr. Watson, our Chief Executive Officer (our "CEO”), and Mr. Richard H. Deily, our Chief Financial Officer (our "CFO”), in the amounts of $575,000 and $300,000, respectively.

Based on recommendations received from the Compensation Committee, the independent members of the Board of Directors approved awards to 1) Mr. Watson of Time-Based Restricted Stock Units (TRSUs”), Performance-Based Restricted Stock Units ("PRSUs”) and EPS Performance-Based Restricted Stock Units ("EPRSUs”) covering 10,000 shares of Common Stock, a target of 4,000 shares of Common Stock and a target of 8,000 shares of Common Stock, respectively, and 2) awards to Mr. Collins of TRSUs, PRSUs and EPRSUs covering 4,000 shares of Common Stock, a target of 1,000 shares of Common Stock and a target of 2,000 shares of Common Stock, respectively. The independent members of the Board also approved the award of Renewable Performance-Based Restricted Stock Units ("RRSUs”) to Mr. Collins covering up to 5,000 shares of Common Stock. Descriptions of each type of restricted stock unit award identified above are included in the "Executive Compensation Discussion and Analysis” section of this 2024 Proxy Statement.

Finally, in April 2024, the independent members of the Board of Directors approved the awards to Mr. Watson and Mr. Collins of non-qualified options (all with three-year vesting plans) to purchase 3,000 shares and 1,500 shares of our Common Stock, respectively, as recommended by the Compensation Committee.

It should be noted that Mr. Deily did not receive equity awards in April 2024 (which are intended to incentivize future performance) as he plans to retire at the end of his employment agreement term in September 2024. He is 70 years old.

The written charter for the Compensation Committee, which was originally adopted in April 2004, was most recently reviewed and affirmed in June 2023. The Compensation Committee is responsible for implementing and reviewing executive compensation plans, policies and programs in an effort to ensure the attraction and retention of executive officers in a reasonable and cost-effective manner, to motivate their performance in the achievement of our business objectives and to align the interests of executive officers with the long-term interests of our stockholders. To that end, it is the responsibility of the Compensation Committee to develop and approve, periodically, a general compensation plan and salary structure for our

10 | 2024 Proxy

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

executive officers that also consider business and financial objectives, industry and market pay practices and/or such other information as may be deemed appropriate.

It is the responsibility of the Compensation Committee to review and approve the cash compensation (salary, bonus, and other incentive payments) of our CEO and the other NEOs, and to review and approve perquisites offered to our NEOs. The Compensation Committee shall also review and approve corporate goals and objectives relevant to the compensation of our NEOs, evaluate performance in light of the goals and objectives, and review and approve all employment, retention and severance agreements for our NEOs. As noted above, the Compensation Committee also makes recommendations to the Board of Directors regarding equity-based awards to the NEOs.

The Compensation Committee acts on behalf of the Board of Directors in administering compensation plans approved by the Board and/or the stockholders, including the 2020 Stock Plan, in a manner consistent with the terms of such plans; reviews and makes recommendations to the Board of Directors with respect to new compensation, incentive and equity-based plans; and reviews and makes recommendations to the Board on changes in major benefit programs for our NEOs.

The members of the Compensation Committee are independent directors under the applicable rules of the NYSE.

NOMINATING/CORPORATE GOVERNANCE COMMITTEE | |||

| MEMBERS: W.G. CHAMPION MITCHELL (Chair), WILLIAM F. LEIMKUHLER, JAMES W. QUINN NUMBER OF MEETINGS IN 2024: None AVERAGE DIRECTOR ATTENDANCE IN 2024: N/A | ||

The initial written charter of this committee now known as the Nominating/Corporate Governance Committee was adopted in April 2004, and was most recently reviewed and affirmed in June 2023. Pursuant to its expanded duties and responsibilities, the Nominating/Corporate Governance Committee provides oversight of our corporate governance affairs, including the consideration of risks, and assesses the full Board’s performance annually in accordance with established procedures.

It has been primarily responsible for identifying individuals qualified to become members of our Board of Directors, and for recommending the persons to be nominated by the Board for election as directors at the annual meeting of stockholders and the persons to be chosen by the Board of Directors to fill any vacancies on the Board that may arise.

In its evaluations, the Nominating/Corporate Governance Committee considers the following selection criteria as a guide in its selection process as well as the gender and ethnic diversity of the Board. Such selection criteria include the following: (i) nominees should have a reputation for integrity, honesty and adherence to high ethical standards; (ii) nominees should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to our current and long-term business objectives and should be willing and able to contribute positively to our decision-making process; (iii) nominees should have a commitment to understand the Company and its industry and to attend regularly and to participate meaningfully in meetings of the Board of Directors and its committees; (iv) nominees should have the willingness and ability to understand the sometimes conflicting interests of our various constituencies, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders; and (v) nominees should not have, or appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all of our stockholders and to fulfill the responsibilities of a director. Nominees shall not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law.

The Board is committed to having a diverse board of directors and to using new appointment opportunities to strengthen the Board’s diversity. Specifically, the Nominating/Corporate Governance Committee will consider the candidacy of women and racially/ethnically diverse candidates for all future vacancies on the Board. To that end, the Nominating/Corporate Governance Committee will continue to require that all prospective director candidate pools include a robust selection of women and racially/ethnically diverse candidates for serious consideration. Presently, two of our Board members are female and one of our Board members is ethnically/racially diverse.

The Nominating/Corporate Governance Committee is also responsible for reviewing the requisite skills and criteria for new members of the Board of Directors as well as the composition of the Board as a whole. The Board of Directors believes that its membership should include individuals representing a diverse range of experience that gives the Board both depth and breadth in the mix of its skills. To that end, the Board endeavors to include in its overall composition a variety of targeted skills that complement one another rather than requiring each director to possess the same skills, perspective and interests.

Argan, Inc. | 11

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Accordingly, the Nominating/Corporate Governance Committee and the other members of the Board of Directors consider the qualifications of directors and director nominees individually and also in the broader context of the Board’s overall composition and the Company’s current and future needs. The Nominating/Corporate Governance Committee continues to actively review potential candidates on an informal basis to ensure there exists a pipeline of qualified candidates as refreshment opportunities arise. Subsequent to Fiscal 2024, the committee met to officially recommend the nomination of Ms. Sweeney.

We will consider nominees for the Board who are recommended by stockholders. Nominations by stockholders must be in writing, must include the full name of the proposed nominee, a brief description of the proposed nominee’s business experience for at least the previous five years, and a representation that the nominating stockholder is a beneficial or record owner of our common stock. Any such submission must also be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. The Nominating/Corporate Governance Committee will review the qualifications and backgrounds of all directors and nominees (without regard to whether a nominee has been recommended by a stockholder), as well as the overall composition of the Board. Nominations must be delivered to the attention of the Nominating/Corporate Governance Committee at our headquarters address.

In April 2024, the members of this committee met formally one time, with all members in attendance, in order to agree on a recommendation that Ms. Sweeney be included in the slate of directors presented to the stockholders for election to the Board in June 2024. A vacancy on the Board will be created by the recent decision of Ms. Koilpillai not to stand for election to another term. Mr. Leimkuhler presented Ms. Sweeney to the committee for its consideration of her as a potential independent Board member. The majority of committee members interviewed Ms. Sweeney, as did other members of the Board, deliberated and agreed to recommend her for nomination to the full Board. The committee members considered Mr. Leimkuhler’s recommendation, Ms. Sweeney’s background and professional experience, the interview performance of Ms. Sweeney, and her potential fit with the other members of the Board in making their recommendation decision.

RESPONSIBLE BUSINESS COMMITTEE | |||

| MEMBERS: MANO S. KOILPILLAI (Chair), PETER W. GETSINGER, JOHN R. JEFFREY, JR., DAVID H. WATSON NUMBER OF MEETINGS IN 2024: 3 AVERAGE DIRECTOR ATTENDANCE IN 2024: 100% | ||

The Board understands that, increasingly, investors are making investment decisions pursuant to a strategy which considers both financial return and the commitment to favored social/environmental initiatives. Our on-going commitment to environmental, health and safety, corporate social responsibility, corporate governance, sustainability, and other public policy matters relevant to us is being supported by the Responsible Business Committee, which was formed initially as a subcommittee of the Nominating/Corporate Governance Committee in April 2020 and was elevated to full committee status in April 2023.

The Board tasked the Responsible Business Committee with formalizing the Company’s approach to understanding and responding to the environmental, social and governance concerns of the Company’s stockholders, with a focus on management’s practices and whether they encourage sustainability and community improvement. The charter of the Responsible Business Committee, which was approved by the full Board in September 2020 and updated in April 2024, formalized its mission to assist the Company’s senior management in: (a) setting the Company’s general strategy relating to responsible business matters, as well as developing, implementing, and monitoring initiatives and policies for the Company based on that strategy; (b) overseeing communications with employees, investors, and other of the Company’s stakeholders with respect to responsible business matters; and (c) monitoring and anticipating developments relating to, and improving management’s understanding of, responsible business matters.

The Responsible Business Committee held periodic meetings throughout the year. A summary of our Responsible Business accomplishments in various areas over the past three years is presented in Item 1, Business, of our Annual Report. In addition, more information about our sustainability accomplishments can be found in the sustainability section we recently added to our website.

We also report that for Fiscal 2024, Fiscal 2023 and Fiscal 2022, the amounts of revenues earned by us and associated with renewable energy projects were 6.9%, 9.6% and 13.4% of corresponding revenues, respectively. As of January 31, 2024, 83% of our project backlog of $757 million supports the low-carbon economy. We expect that revenues associated with the

12 | 2024 Proxy

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

performance of renewable energy projects will continue to contribute meaningfully to our power industry services segment and consolidated revenues over the coming years.

EXECUTIVE COMMITTEE | |||

| MEMBERS: WILLIAM F. LEIMKUHLER (Chair), RAINER H. BOSSELMANN, WILLIAM F. GRIFFIN, JR., W.G. NUMBER OF MEETINGS IN 2024: None AVERAGE DIRECTOR ATTENDANCE IN 2024: N/A | ||

This committee is authorized to exercise the general powers of the Board in managing the business and affairs of the Company between meetings of the full Board, if necessary. The Executive Committee did not meet during Fiscal 2024.

Board Leadership and Risk Oversight

Mr. Watson serves as the Company’s CEO. Mr. Griffin is also a member of management. Prior to his retirement from the Company in August 2022, Mr. Bosselmann served as our chief executive officer and chairman of the Board. Upon Mr. Bosselmann’s retirement, we appointed Mr. Leimkuhler as Chairman of the Board of Directors and the lead independent director role was eliminated. Seven of the ten members of the Board, Messrs. Getsinger, Jeffrey, Leimkuhler, Mitchell, Quinn; Ms. Flanders; and Ms. Koilpillai, are considered to be independent based on the Board’s consideration of our independence standards and the applicable independence standards of the NYSE as set forth in Section 303A.02(a)(ii) of the NYSE Listed Company Manual. Ms. Sweeney would also be considered to be independent.

The Board periodically reviews the structure of the Board of Directors. Our bylaws currently provide that the Company’s CEO shall preside at all meetings of the Board of Directors. The Board could amend that bylaw, but it believes that we have best corporate practices in place to ensure that the Company maintains a strong and independent Board, the highest standards of corporate governance and the continued accountability of our CEO to the Board. This structure is evidenced by the composition of the current Board of Directors and the membership of its various committees. Additionally, the CEO reports to the Chairman of the Board of Directors multiple times each month.

The members of the Audit Committee, the Compensation Committee and the Nominating/Corporate Governance Committee are all independent directors. Consequently, independent directors directly oversee critical matters such as the remuneration policy for executive officers; corporate governance guidelines, policies and practices; the director nomination process; our corporate finance strategies and initiatives; and the integrity of our consolidated financial statements and system of internal control over financial reporting.

One of the Board’s key responsibilities is the oversight of our assessment and management of risks that may adversely impact the Company. The standing Audit, Compensation and Nominating/Corporate Governance Committees address risks in their respective areas of oversight. Consequently, the Board monitors the design and effectiveness of our system of internal controls over financial reporting, the security of our computer information systems, the effectiveness of our corporate codes of conduct and ethics, including whether they are successful in preventing wrongful conduct, and risks associated with the independence of its members, potential conflicts of interest and succession planning.

Our Audit Committee considers and discusses our major financial risk exposures, including the risk that our sensitive and confidential data may not be adequately protected from unauthorized access, and the steps our management has taken to monitor and control these exposures, including guidelines and policies for the processes by which risk assessment, risk management and the structuring of our insurance programs are undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements. It oversees the performance of management’s assessments of our system of internal control over financial reporting and of the audits conducted by the independent registered public accountants of our consolidated financial statements and our internal controls over financial reporting.

The Compensation Committee oversees the administration of our equity compensation plans, and reviews and approves the salaries, bonuses and cash incentives paid to the NEOs while assessing whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. The independent directors of the Board approve all stock option and other stock awards. Senior management provides reports on enterprise risk issues, including operational, financial, legal and regulatory, and strategic and reputation risks, to the appropriate committee or to the full Board.

Argan, Inc. | 13

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

The entire Board and the committees receive reports on areas of material risk not only from senior management, but from our internal audit firm, our independent registered public accountants, outside counsel, and other members of management and professional advisors. When one of the committees receives any such report, the chairman of the committee reports to the full Board of Directors at the next Board meeting. This process enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

The Board of Directors adopted a set of governance guidelines which provide a framework within which the Board conducts its business. The guidelines describe the basic responsibilities of a member of our Board and the requirements for the conduct of Board and committee meetings. These governance guidelines are available on our website at www.arganinc.com.

Compensation of Directors

The following table summarizes the fees and other compensation for the non-employee members of our Board of Directors for Fiscal 2024. Each non-employee member of our Board of Directors received an annual fee of $35,000 and the Chairman of the Board received an additional annual fee of $65,000. The members of the Audit Committee received an additional annual fee of $5,000 and the Audit Committee Chair received an additional annual fee of $10,000. Directors were reimbursed for reasonable expenses actually incurred in connection with attending each formal meeting of the Board of Directors or the meeting of any committee thereof. Directors were also eligible to receive awards of options to purchase shares of our Common Stock and of restricted stock units.

Stock Option | Restricted Stock | All Other | Total | ||||||||||||

Name |

| Fees |

| Awards(1) |

| Unit Awards(1) |

| Compensation |

| Compensation | |||||

Cynthia A. Flanders | $ | 40,000 | $ | 13,727 | $ | 109,250 | $ | – | $ | 162,977 | |||||

Peter W. Getsinger |

| 40,000 |

| 13,727 |

| 109,250 |

| – |

| 162,977 | |||||

John R. Jeffrey, Jr. |

| 50,000 |

| 13,727 |

| 109,250 |

| – |

| 172,977 | |||||

Mano S. Koilpillai |

| 35,000 |

| 13,727 |

| 109,250 |

| – |

| 157,977 | |||||

William F. Leimkuhler |

| 100,000 |

| 13,727 |

| 109,250 |

| – |

| 222,977 | |||||

W.G. Champion Mitchell |

| 35,000 |

| 13,727 |

| 109,250 |

| – |

| 157,977 | |||||

James W. Quinn |

| 35,000 |

| 13,727 |

| 109,250 |

| – |

| 157,977 | |||||

| (1) | Amounts represent the aggregate award-date fair values computed for financial reporting purposes reflecting the assumptions discussed in the section “Share-Based Payments” of Note 1 – Description of the Business and Basis of Presentation and in Note 11 – Stock-Based Compensation of our consolidated financial statements that are included in Item 8 of our Annual Report on Form 10-K for the year ended January 31, 2024. |

Effective February 1, 2024, the Company revised the compensation structure for the independent Board members by increasing the annual fee to $40,000 and increasing the annual Audit Committee fee membership to $6,000.

14 | 2024 Proxy

PROPOSAL NO. 2

APPROVAL OF EXECUTIVE COMPENSATION (THE “SAY-ON-PAY” PROPOSAL)

| THE BOARD RECOMMENDS A VOTE "FOR” APPROVAL OF THE SAY-ON-PAY PROPOSAL |

We are seeking stockholder approval of the compensation of our NEOs as described in the “Executive Compensation Discussion and Analysis” section, the compensation tables and the other narrative compensation disclosures of this Proxy Statement, all of which are included below. This non-binding advisory proposal, commonly known as a “say-on-pay” proposal, is required under Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This vote represents our twelfth annual advisory say-on-pay vote. Last year, the stockholders approved our executive compensation with 74% of the vote in favor of our program.

Based on management’s recommendation and the results of voting by the stockholders at the 2019 Annual Meeting, the Board of Directors determined that we will hold an advisory vote on our executive compensation every year. Because this is an advisory vote, the results will not be binding on the Board of Directors and it will not directly affect or otherwise limit any existing compensation or award arrangement of any of our NEOs. However, our Compensation Committee does consider the outcome of the annual votes when determining executive compensation arrangements.

The Compensation Committee has conducted comprehensive stockholder outreach which commenced during our fiscal year ended January 31, 2018. During Fiscal 2024 and shortly thereafter, the members of the Compensation Committee continued to engage in meaningful contacts with certain stockholders, as we proactively contacted all of our top 25 stockholders, who collectively represented approximately 64% of our outstanding shares, as described further in the “Executive Compensation Discussion and Analysis” section below. The purpose of the outreach practice is to deepen our understanding of the perspectives of our stockholders with respect to our compensation practices, and to evaluate and to address any concerns or reactions we receive.

Based on feedback we have received in the past, we increased the vesting period for stock option awards, introduced the use of performance-based long-term incentive equity compensation, instituted a cap on annual cash incentive awards and committed to a policy prohibiting the future negotiation of single-trigger change-in-control provisions, among other changes. These changes led to enhancements of the disclosures regarding executive compensation, which are reflected in the discussion of our executive compensation included in our Proxy Statement for the current year.

The Board of Directors has adopted several other policies to improve accountability and further encourage an alignment of stockholder and executive officer interests. These policies, which are also described in further detail below in the “Executive Compensation Discussion and Analysis” section, include a stock ownership policy for NEOs and non-employee members of our Board, a no pledging policy, an anti-hedging policy, and a clawback policy, which we amended in October 2023. In April 2023, we introduced a new restricted stock award for certain executive officers in order to provide incentives for the growth of our diluted EPS over a three-year measurement period.

Consistent with past efforts to increase compensation transparency for our stockholders, we developed specific performance metrics for use in the determination of the amount of non-equity cash incentive compensation that may be earned each year by the CEO of Gemma. The metrics were used to confirm the amounts of such compensation earned by him for Fiscal 2024. In April 2021, we introduced the use of a new restricted stock award in order to provide incentives for the growth in the number and value of renewable energy construction projects awarded to Gemma over the ensuing three-year period.

In summary, our executive compensation program has been structured by the Compensation Committee to retain and incentivize our core management team through challenging business environments. Concurrently we provide incentives to drive profitable growth and to deliver value to our stockholders.

In considering how to vote on this advisory proposal, we urge our stockholders to study all the relevant information in the “Executive Compensation Discussion and Analysis” section below, and the compensation tables and the other narrative disclosures regarding our executive compensation program that are included herein.

Argan, Inc. | 15

PROPOSAL NO. 3

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

| THE BOARD RECOMMENDS A VOTE "FOR” RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR FISCAL 2025 |

The Audit Committee of our Board of Directors has selected Grant Thornton LLP (“Grant Thornton”) as the independent registered public accountants for the performance of the audits of our consolidated financial statements and our system of internal control over financial reporting for our fiscal year ending January 31, 2025.

Our stockholders are being asked to ratify the Audit Committee’s selection. Grant Thornton has served as our independent registered public accountants since 2006. A representative of Grant Thornton is expected to be present at the Annual Meeting and to be available to respond to appropriate questions. Although Grant Thornton has indicated that no statement will be made, the firm will be provided the opportunity to make a statement.

Audit Firm Independence

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accountants and it evaluates the selection of them each year. In addition, in order to promote continuing auditor independence, the Audit Committee considers the independence of Grant Thornton at least annually. Based on its most recent evaluation, including the firm’s past performance and an assessment of the firm’s qualifications and resources, the Audit Committee believes that the continued retention of Grant Thornton to serve as our independent registered public accountants is in the best interests of the Company and its stockholders.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has established a policy requiring the pre-approval of all audit and non-audit services to be performed by our independent registered public accountants, who may not render any audit or non-audit service unless the service is approved in advance by the Audit Committee pursuant to its pre-approval policy. The Audit Committee has delegated to its chairman the authority to pre-approve certain services. The chairman must report any pre-approval pursuant to such delegation of authority to the other members of the Audit Committee at its next scheduled meeting at which time the Audit Committee is then asked to approve and ratify the pre-approved service. The Audit Committee followed these guidelines in approving all services rendered by our independent registered public accountants during Fiscal 2024 and Fiscal 2023.

16 | 2024 Proxy

PROPOSAL NO. 3 — RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Fees

The following table below presents the amounts of fees billed to us by Grant Thornton for professional services rendered during and related to Fiscal 2024 and Fiscal 2023.

| 2024(1) |

| 2023 | |||

Audit Fees | $ | 1,461,794 | $ | 1,494,734 | ||

Audit-Related Fees |

| – |

| – | ||

Tax Fees |

| – |

| 288,431 | ||

All Other Fees |

| – |

| – | ||

Total Fees | $ | 1,461,794 | $ | 1,783,165 | ||

| (1) | Amount for 2024 includes estimated amounts for final billings. |

Audit Fees. This category consists of fees billed for professional services rendered for annual audits of our consolidated financial statements; for statutory audits of the separate financial statements of foreign subsidiaries; for reviews of quarterly condensed consolidated financial statements; and for the review of current reports and other documents filed with the SEC. Audit fees also include the costs associated with Grant Thornton’s audit of the effectiveness of our internal control over financial reporting. For Fiscal 2024 and Fiscal 2023, this amount also reflects the expanded audit procedures performed at APC as its growth has caused an increase in the materiality of its financial results and system of internal control over financial reporting.

Audit-Related Fees. This category includes fees billed for services provided by Grant Thornton related to consultations on accounting and reporting matters and to due diligence procedures performed during the investigations of potential acquisitions. No such fees were incurred during Fiscal 2024 or Fiscal 2023.

Tax Fees. This category consists of fees billed for professional tax services provided in the areas of compliance, research and development credits, research and planning. No such fees were incurred during Fiscal 2024.

All Other Fees. This category includes fees for other miscellaneous items. No such fees were incurred during Fiscal 2024 or Fiscal 2023.

Argan, Inc. | 17

AUDIT COMMITTEE REPORT

The Audit Committee of our Board operates pursuant to a written charter which was updated in June 2023. A copy can be found at www.arganinc.com. The Board of Directors has made a determination that the members of the Audit Committee satisfy the independence and other requirements of the NYSE and the applicable rules of the SEC. The Board has also made the determination that at least one member of the Audit Committee is a “financial expert” as that term is defined in Item 407 of the SEC’s Regulation S-K.

The responsibilities of the Audit Committee are set forth in its charter, and include the responsibilities for the appointment and supervision of our independent registered public accountants; the approval of the arranged fees for services; the evaluation of the firm’s qualifications and independence; the approval of all audit and non-audit services provided by them; and the review of our consolidated financial statements with our management and them. The Company’s independent registered public accountants are required to report directly to the Audit Committee. The Audit Committee also reviews our accounting policies, internal control procedures, material related party transactions, the security of our information systems (including cybersecurity), and compliance activities. Its members also review the Charter of the Audit Committee.

The following is a report on the Audit Committee’s activities for Fiscal 2024:

Audit of Financial Statements

The Audit Committee reviewed and discussed the Company’s condensed unaudited consolidated financial statements for the fiscal quarters ended April 30, July 31 and October 31, 2023, and the Company’s audited consolidated financial statements as of January 31, 2024 and for the year then ended with the management of the Company and with the engagement personnel of Grant Thornton, the Company’s independent registered public accountants. During the year, Grant Thornton also made a presentation to the Audit Committee that outlined the firm’s audit timeline and planned procedures based on its assessments of the significant financial statement and fraud risks.

The audit report issued by Grant Thornton relating to the Company’s consolidated financial statements as of January 31, 2024 and for the year then ended, including a discussion of one critical audit matter, expressed an unqualified opinion thereon.

The scope of the audit procedures performed by Grant Thornton for the year ended January 31, 2024 also included observations and tests of evidence with results sufficient for the accounting firm to report that the Company maintained, in all material respects, effective internal control over financial reporting as of January 31, 2024.

Review of Other Matters with the Independent Registered Public Accountants

The Audit Committee has also discussed with Grant Thornton the matters required to be communicated to the Company pursuant to applicable regulations of the Public Company Accounting Oversight Board (United States). The Audit Committee has received from Grant Thornton the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and has discussed with Grant Thornton matters relating to the firm’s independence from the Company. There have not been any matters brought to the attention of the Audit Committee which caused the Audit Committee to conclude that Grant Thornton is not independent.

The Audit Committee has also received from Grant Thornton the written communication required by the corporate governance rules of the NYSE that describes the firm’s quality control policies and procedures including its audit performance and independence monitoring systems. This communication also provides disclosure of material issues raised by inquiry or investigation by government or professional authorities over the last five years.

18 | 2024 Proxy

AUDIT COMMITTEE REPORT

Recommendation That Financial Statements Be Included in the Annual Report

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements described above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2024 for filing with the SEC.

Submitted by the Audit Committee of the Board of Directors: | |

John R. Jeffrey, Jr. (Chairman, Audit Committee) | |

Cynthia A. Flanders (Member, Audit Committee) | |

Peter W. Getsinger (Member, Audit Committee) |

Argan, Inc. | 19

PRINCIPAL STOCKHOLDERS

The following table presents the number of shares of Common Stock beneficially owned as of January 31, 2024 by each director; each executive officer named in the Summary Compensation Table below; all directors and executive officers as a group; and each person who, to our knowledge, owns beneficially more than 5% of our common stock (the “Common Stock”). Unless otherwise indicated, beneficial ownership is direct and the identified stockholder has sole voting and investment power.

| Shares |

| Beneficial | ||

Beneficially | Ownership | ||||

Name and Address | Owned(1) | Percentage(1) | |||

Rainer H. Bosselmann(2) |

| 583,302 | 4.31 | % | |

William F. Griffin, Jr.(3) |

| 203,430 | 1.54 | % | |

David H. Watson(4) |

| 176,823 | 1.32 | % | |

James W. Quinn(5) |

| 149,570 | 1.12 | % | |

William F. Leimkuhler(6) |

| 117,000 |

| * | |

Cynthia A. Flanders(7) |

| 91,500 |

| * | |

Peter W. Getsinger(8) |

| 74,400 |

| * | |

W.G. Champion Mitchell(9) |

| 72,500 |

| * | |

John R. Jeffrey, Jr.(10) |

| 63,000 |

| * | |

Richard H. Deily(11) |

| 60,339 |

| * | |

Charles E. Collins IV(12) |

| 58,549 |

| * | |

Mano S. Koilpillai(13) |

| 31,847 |

| * | |

Officers and Directors, as a group (12 persons)(14) |

| 1,682,260 |

| 11.85 | % |

BlackRock, Inc.(15) |

| 1,436,745 |

| 10.85 | % |

River Road Asset Management, LLC(16) |

| 1,109,515 |

| 8.38 | % |

Dimensional Fund Advisors LP(17) |

| 798,240 |

| 6.03 | % |

Vanguard Group, Inc.(18) |

| 714,009 |

| 5.39 | % |

| * | Less than 1%. |

| (1) | Each applicable percentage of ownership is based on 13,242,520 shares of Common Stock outstanding as of January 31, 2024, together with applicable stock options for each stockholder. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options that are currently exercisable or exercisable within 60 days of January 31, 2024 are deemed to be beneficially owned by the person holding such stock options for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise noted in the footnotes below, the address for each of the individuals listed in the table above is c/o Argan, Inc., One Church Street, Suite 201, Rockville, Maryland 20850. |

| (2) | Includes 298,560 shares owned by Mr. Bosselmann and 2,241 shares owned by Mr. Bosselmann and his wife, as joint tenants. Also includes options to purchase 282,501 shares of Common Stock which are held by Mr. Bosselmann and are fully vested. |

| (3) | Includes 174,280 shares owned by the William F. Griffin, Jr. Revocable Trust DTD 12/09/04; Mr. Griffin is a trustee of the trust. Also includes 29,150 shares owned by Peach Pit Foundation for which Sharon K. Griffin, wife of Mr. Griffin, is a trustee. |

| (4) | Includes options to purchase 143,999 shares of Common Stock which are fully vested. |

| (5) | Includes options to purchase 75,000 shares of Common Stock held by Mr. Quinn which are fully vested. Does not include 273,157 shares of Common Stock held by Allen & Company LLC and affiliates. Mr. Quinn disclaims beneficial ownership of the shares held by Allen & Company LLC and affiliates. |

| (6) | Includes options to purchase 75,000 shares of Common Stock which are fully vested. |

| (7) | Includes options to purchase 75,000 shares of Common Stock which are fully vested. |

| (8) | Includes options to purchase 62,000 shares of Common Stock which are fully vested. |

| (9) | Includes options to purchase 51,667 shares of Common Stock which are fully vested. |

| (10) | Includes options to purchase 55,000 shares of Common Stock which are fully vested. |

20 | 2024 Proxy

PRINCIPAL STOCKHOLDERS

| (11) | Includes options to purchase 53,501 shares of Common Stock which are fully vested. |

| (12) | Includes options to purchase 51,667 shares of Common Stock which are fully vested. |

| (13) | Includes options to purchase 31,667 shares of Common Stock which are fully vested. |

| (14) | Includes options to purchase 957,002 shares of Common Stock held by the executive officers and members of our Board of Directors which are fully vested. |