UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended May 25, 2014, or

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period for _________ to _________.

Commission file number: 0-27446

LANDEC CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

94-3025618 |

|

(State or other jurisdiction of |

|

(IRS Employer |

|

incorporation or organization) |

|

Identification Number) |

3603 Haven Avenue

Menlo Park, California 94025

(Address of principal executive offices)

Registrant's telephone number, including area code:

(650) 306-1650

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock |

|

The NASDAQ Global Select Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ___ No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ___ No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No ___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X No ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. __

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ___ Accelerated Filer X

Non Accelerated Filer ___ Smaller Reporting Company ___

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ___ No X

The aggregate market value of voting stock held by non-affiliates of the Registrant was approximately $294,141,000 as of November 24, 2013, the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sales price on The NASDAQ Global Select Market reported for such date. Shares of Common Stock held by each officer and director and by each person who owns 10% or more of the outstanding Common Stock have been excluded from such calculation in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of July 18, 2014, there were 26,839,725 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its October 2014 Annual Meeting of Stockholders which statement will be filed not later than 120 days after the end of the fiscal year covered by this report, are incorporated by reference in Part III hereof.

LANDEC CORPORATION

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

Item No. |

Description |

Page |

|

Part I |

||

|

1. |

Business |

4 |

|

1A. |

Risk Factors |

13 |

|

1B. |

Unresolved Staff Comments |

20 |

|

2. |

Properties |

21 |

|

3. |

Legal Proceedings |

21 |

|

4. |

Mine Safety Disclosures |

21 |

|

Part II |

||

|

5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

22 |

|

6. |

Selected Financial Data |

22 |

|

7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

7A. |

Quantitative and Qualitative Disclosures about Market Risk |

42 |

|

8. |

Financial Statements and Supplementary Data |

42 |

|

9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

42 |

|

9A. |

Controls and Procedures |

42 |

|

9B. |

Other Information |

44 |

|

Part III |

||

|

10. |

Directors, Executive Officers and Corporate Governance |

45 |

|

11. |

Executive Compensation |

45 |

|

12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

45 |

|

13. |

Certain Relationships and Related Transactions, and Director Independence |

45 |

|

14. |

Principal Accountant Fees and Services |

45 |

|

Part IV |

||

|

15. |

Exhibits and Financial Statement Schedules |

46 |

PART I

Item 1. Business

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Words such as “projected,” “expects,” “believes,” “intends,” “assumes” and similar expressions are used to identify forward-looking statements. These statements are made based upon current expectations and projections about our business and assumptions made by our management and are not guarantees of future performance, nor do we assume any obligation to update such forward-looking statements after the date this report is filed. Our actual results could differ materially from those projected in the forward-looking statements for many reasons, including the risk factors listed in Item 1A. “Risk Factors” and the factors discussed below.

Corporate Overview

Landec Corporation and its subsidiaries (“Landec” or the “Company”) design, develop, manufacture and market differentiated products in food and biomedical materials markets and license technology applications to partners. The Company is focused on health and wellness solutions and applications within the packaged food and biomaterial markets. In our Apio, Inc. (“Apio”) food business, we are committed to offering healthy, fresh produce products conveniently packaged to consumers. Apio also exports whole fruit and vegetables, predominantly to Asia through its subsidiary, Cal Ex Trading Company (“Cal-Ex”). In our Lifecore Biomedical, Inc. (“Lifecore”) biomedical materials business, we commercialize products that enable people to stay more active as they grow older.

Landec’s food and biomedical materials businesses utilize polymer chemistry technology, a key differentiating factor. Both core businesses focus on business-to-business selling such as selling directly to retail grocery store chains and club stores for Apio and directly to large ophthalmic suppliers for Lifecore. Both core businesses also benefit from the momentum that underlies consumer interest in healthy living - eating better and staying active.

Within our two core businesses, Landec has three operating segments – Food Products Technology, Food Export and HA-based Biomaterials, each of which is described below. Financial information concerning each of these segments for fiscal years 2014, 2013 and 2012 is summarized in Note 14 to the Consolidated Financial Statements.

Apio operates our Food Products Technology business, which combines our proprietary BreatheWay® food packaging technology with the capabilities of a large national food supplier and value-added produce processor which sells products under the Eat Smart® and GreenLine® brands. In Apio’s value-added operations, produce is processed by trimming, washing, mixing, and packaging in bags and trays that in most cases incorporate Landec’s BreatheWay membrane technology. The BreatheWay membrane increases shelf life and reduces shrink (waste) for retailers and helps ensure that consumers receive fresh produce by the time the product makes its way through the supply chain. Apio also licenses the BreatheWay technology to partners such as Chiquita Brands International, Inc. (“Chiquita”) for packaging and distribution of bananas and to Windset Holding 2010 Ltd., a Canadian corporation (“Windset”), for packaging of greenhouse grown cucumbers and peppers.

Apio also operates the Food Export business. The Food Export business purchases and sells whole fruit and vegetable products predominantly to Asian markets.

Lifecore operates our Biomaterials business and is principally involved in the manufacture of pharmaceutical-grade sodium hyaluronate (“HA”) products. Sodium hyaluronate is a naturally occurring polysaccharide that is widely distributed in the extracellular matrix in animals and humans. Based upon Lifecore’s expertise working with highly viscous HA, the Company also specializes in aseptic filling services, as a contract development and manufacturing organization (CDMO), for difficult to handle (viscous) medicines filled in finished dose syringes.

Landec was incorporated in California on October 31, 1986 and reincorporated as a Delaware corporation on November 6, 2008. Our common stock is listed on The NASDAQ Global Select Market under the symbol “LNDC”.

Technology Overview

The Company has two proprietary polymer technology platforms: 1) Intelimer® materials which are the key technology behind our BreatheWay membrane technology, and 2) hyaluronan biopolymers. The Company’s materials are generally proprietary as a result of being patented or due to being specially formulated for specific customers to meet specific commercial applications and/or specific regulatory requirements. The Company’s polymer technologies, its customer relationships and trade names and its strong channels of distribution, are the foundation and key differentiating advantages on which Landec has built its business.

A) Intelimer Polymers

Intelimer polymers are crystalline, hydrophobic polymers that use a temperature switch to control and modulate properties such as viscosity, permeability and adhesion when varying the materials’ temperature above and below the temperature switch. The sharp temperature switch is adjustable at relatively low temperatures (0°C to 100°C) and the changes resulting from the temperature switch are relatively easy to maintain in industrial and commercial environments. For instance, Intelimer polymers can change within the range of one or two degrees Celsius from a non-adhesive state to a highly tacky, adhesive state; from an impermeable state to a highly permeable state; or from a solid state to a viscous liquid state.

Landec's proprietary polymer technology is based on the structure and phase behavior of Intelimer materials. The abrupt thermal transitions of specific Intelimer materials are achieved through the controlled use of hydrocarbon side chains that are attached to a polymer backbone. Below a pre-determined switch temperature, the polymer's side chains align through weak hydrophobic interactions resulting in a crystalline structure. When this side chain crystallizable polymer is heated to, or above, this switch temperature, these interactions are disrupted and the polymer is transformed into an amorphous, viscous state. Because this transformation involves a physical and not a chemical change, this process can be repeatedly reversible. Landec can set the polymer switch temperature anywhere between 0°C to 100°C by varying the average length of the side chains.

Landec's Intelimer materials are readily available and are generally synthesized from long side-chain acrylic monomers that are derived primarily from natural materials such as coconut and palm oils that are highly purified and designed to be manufactured economically through known synthetic processes. These acrylic-monomer raw materials are then polymerized by Landec leading to many different side-chain crystallizable polymers whose properties vary depending upon the initial materials and the synthetic process. Intelimer materials can be made into many different forms, including films, coatings, microcapsules and discrete forms. Intelimer polymers are the coatings on the substrate used to form our BreatheWay membranes.

BreatheWay Membrane Packaging

Certain types of fresh-cut and whole produce can spoil or discolor rapidly when packaged in conventional packaging materials and, therefore, are limited in their ability to be distributed broadly to markets. The Company’s proprietary BreatheWay packaging technology utilizes Landec’s Intelimer polymer technology to naturally extend the shelf life and quality of fresh-cut and whole produce.

After harvesting, vegetables and fruit continue to respire, consuming oxygen and releasing carbon dioxide. Too much or too little oxygen can result in premature spoilage and decay. The respiration rate of produce varies for each fruit and vegetable. Conventional packaging films used today, such as polyethylene and polypropylene, can be made with modest permeability to oxygen and carbon dioxide, but often do not provide the optimal atmosphere for the packaged produce. To achieve optimal product performance, each fruit or vegetable requires its own unique package atmosphere conditions. The challenge facing the industry is to develop packaging that meets the highly variable needs that each product requires in order to achieve value-creating performance. The Company believes that its BreatheWay packaging technology possesses all of the critical functionalities required to serve this diverse market. In creating a product package, a BreatheWay membrane is applied over a small cutout section or an aperture of a flexible film bag or plastic tray. This highly permeable “window” acts as the mechanism to provide the majority of the gas transmission requirements for the entire package. These membranes are designed to provide three principal benefits:

High Permeability. Landec's BreatheWay packaging technology is designed to permit transmission of oxygen and carbon dioxide at 300 to 1,000 times the rate of conventional packaging films. The Company thinks that these higher permeability levels will facilitate the packaging diversity required to market many types of fresh-cut and whole produce in many package sizes and configurations.

Ability to Adjust Oxygen and Carbon Dioxide Ratios. BreatheWay packaging can be tailored with carbon dioxide to oxygen transfer ratios ranging from 1.0 to 12.0 to selectively transmit oxygen and carbon dioxide at optimum rates to sustain the quality and shelf life of packaged produce. Other high permeability packaging materials, such as micro-perforated films cannot differentially control carbon dioxide permeability resulting in sub-optimal package atmosphere conditions for many produce products.

Temperature Responsiveness. Landec has developed breathable membranes that can be designed to increase or decrease permeability in response to environmental temperature changes. The Company has developed packaging that responds to higher oxygen requirements at elevated temperatures but is also reversible, and returns to its original state as temperatures decline. As the respiration rate of fresh produce also increases with temperature, the BreatheWay membrane’s temperature responsiveness allows packages to compensate for the change in produce respiration by automatically adjusting gas permeation rates. By doing so, detrimental package atmosphere conditions are avoided and improved quality is maintained through the distribution chain.

B) Sodium Hyaluronate (HA)

Sodium hyaluronate is a non-crystalline, hydrophilic polymer that exists naturally as part of the extracellular matrix in many tissues within the human body, most notably within the aqueous humor of the eye, synovial fluid, skin and umbilical cord. The viscoelastic properties and water solubility of HA make it ideal for medical applications where space maintenance, lubricity or tissue protection are critical. Because of its widespread presence in tissues, its critical role in normal physiology, and its high degree of biocompatibility, the Company believes that hyaluronan will continue to be used in existing applications and for an increasing variety of other medical applications.

Sodium hyaluronate can primarily be produced in two ways, either through bacterial fermentation or through extraction from rooster combs. Lifecore produces HA only from fermentation, using an extremely efficient microbial fermentation process and a highly effective purification operation.

Sodium hyaluronate was first demonstrated to have commercial medical utility as a viscoelastic solution in cataract surgery. In this application, it is used for maintaining the space in the anterior chamber and protecting corneal tissue during the removal and implantation of intraocular lenses. The first ophthalmic HA product, produced by extraction from rooster comb tissue, became commercially available in the United States in 1981. In 1985, Lifecore introduced the bacterial fermentation process to manufacture premium HA and received patent protection until 2002. HA-based products, produced either by rooster comb extraction or by fermentation processes such as Lifecore’s, have since gained widespread acceptance in ophthalmology and are currently used in the majority of cataract extraction procedures in the world. HA has also become a significant component in several products used in orthopedics. Lifecore’s HA is used as a viscous carrier for allogeneic freeze-dried demineralized bone used in spinal surgery, and as the active component of devices to treat the symptoms of osteoarthritis, and as a component to provide increased lubricity to medical devices. Lifecore’s HA has also been utilized in veterinary drug applications to treat traumatic arthritis.

Description of Business Segments

In this Description of Business Segments section, “Apio” and the “Food Products Technology business” will be used interchangeably; however, when describing Apio’s export business it will be referred to as the “Food Export business”.

A) Food Products Technology Business

The Food Products Technology business had revenues of $361 million for the fiscal year ended May 25, 2014, $320 million for the fiscal year ended May 26, 2013 and $208 million for the fiscal year ended May 27, 2012.

Based in Guadalupe, California, Apio’s primary business is fresh-cut and whole value-added products typically packaged in our proprietary BreatheWay packaging. Apio’s fresh-cut value-added products business markets a variety of fresh-cut and whole vegetables to the top retail grocery chains, club stores and food service operators. During the fiscal year ended May 25, 2014, Apio shipped approximately twenty-nine million cartons of produce to its customers throughout North America, primarily in the United States.

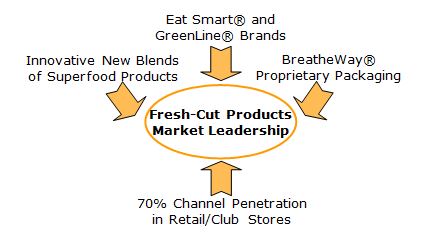

Most vegetable products packaged in our BreatheWay packaging have 17 to 20 days of shelf life. In addition to packaging innovation, Landec’s Apio food business develops innovative blends and combinations of vegetables that are sold in flexible film bags or rigid trays. More recently, the Company has launched a family of salad kits that are comprised of “superfood” mixtures of vegetables with healthy toppings/dressings. The launch of the first of these products called Sweet Kale Salad has broken all of Apio’s records for speed of adoption with weekly sales of well over $1 million as of May 2014. Additionally, we have launched several other superfood salad kits including Ginger Bok Choy, Apple Fennel, Kale and Chard Stir Fry and Shanghai Stir Fry, as examples. The Company’s expertise includes accessing leading culinary experts and nutritionists nationally to help in the new product development process. We believe that our new products are “on trend” and strong market acceptance supports this belief. Recent statistics show that 39% of Americans are obese and 23% of Americans have diabetes. More and more consumers are beginning to make better food choices in their schools, homes and in restaurants and that is where our superfood products can fit into consumers daily healthy food choices.

In addition to proprietary packaging technology and a strong new product development pipeline, the Company has strong channels of distribution throughout North America with retail grocery store chains and club stores. Landec has one or more of its products in over 70% of all retail and club store sites in North America giving us a strong platform for introducing new products.

The Company sells its products under the nationally-known brands EatSmart® and GreenLine®. The Company also periodically licenses its BreatheWay packaging technology to partners such as Chiquita for packaging bananas and to Windset for packaging peppers and cucumbers that are grown hydroponically in greenhouses. The Company is engaged in the testing and development of other BreatheWay products. These packaging license relationships generate revenues either from product sales or royalties once commercialized.

Apio Business Model

Landec is working with leaders in club stores, retail grocery chains and food service customers. The Company thinks it will have growth opportunities for the next several years through new customers and the introduction of innovative products in the United States, expansion of its existing customer relationships, and export and shipment of specialty packaged produce.

Landec manufactures its BreatheWay packaging through selected qualified contract manufacturers. In addition to using BreatheWay packaging for its value-added produce business, the Company markets and sells BreatheWay packaging directly to select partner food distributors.

There are five major distinguishing characteristics of Apio that provide competitive advantages in the Food Products Technology market:

Value-Added Supplier: Apio has structured its business as a marketer and seller of branded and private label fresh-cut and whole value-added produce. It is focused on selling products under its Eat Smart and GreenLine brands and private label brands for its fresh-cut and whole value-added products. As retail grocery chains, club stores and food service operators consolidate, Apio is well positioned as a single source of a broad range of products.

Reduced Farming Risks: Apio reduces its farming risk by not taking ownership of farmland, and instead, contracts with growers for produce and during certain times of the year, enters into joint ventures with growers for produce. The year-round sourcing of produce is a key component to the fresh-cut and whole value-added processing business.

Access to Customer Base: Apio has strategically invested in the rapidly growing fresh-cut and whole value-added business. Apio’s value-added processing plant in Guadalupe, CA, is automated with state-of-the-art vegetable processing equipment. Apio operates one large central processing facility in one of the lowest cost growing regions in California, the Santa Maria Valley, and for the majority of its non-green bean vegetable business, uses its packaging technology for nationwide delivery. With the acquisition of GreenLine, Apio now has three East Coast processing facilities and five East Coast distribution centers for nationwide delivery of green beans and recently Apio began processing non-green bean products in one of our East Coast processing facilities to meet the next-day delivery needs of customers.

Expanded Product Line Using Technology and Unique Blends: Apio, through the use of its BreatheWay packaging technology, is introducing new value-added products each year. These new product offerings range from various sizes of fresh-cut bagged products, to vegetable trays, to whole produce, to vegetable salads and to snack packs. During the last twelve months, Apio has introduced eleven new unique products.

Products Currently in Over 70% of U.S. Retail Grocery Stores: With the acquisition of GreenLine, Apio now has products in over 70% of all U.S. retail grocery stores. This gives Apio the opportunity to cross sell Eat Smart value-added products to GreenLine customers and GreenLine value-added products to Eat Smart customers.

Windset

On February 15, 2011, Apio entered into a share purchase agreement (the “Purchase Agreement”) with Windset. Pursuant to the Purchase Agreement, Apio purchased 150,000 senior preferred shares for $15 million and 201 common shares for $201 (the “Purchased Shares”). The Company’s common shares represent a 20.1% interest in Windset. The non-voting senior preferred shares yield a cash dividend of 7.5% annually. The dividend is payable within 90 days of each anniversary of the execution of the Purchase Agreement. The Purchase Agreement includes a put and call option, which can be exercised on the sixth anniversary of the Purchase Agreement whereby Apio can exercise the put to sell its Purchased Shares to Windset, or Windset can exercise the call to purchase the Purchased Shares from Apio, in either case, at a price equal to 20.1% of the appreciation in the fair market value of Windset from the date of the Company’s investment through the put/call date, plus the purchase price of the Purchased Shares. Under the terms of the arrangement with Windset, the Company is entitled to designate one of five members on the Board of Directors of Windset. On July 15, 2014, the Company purchased an additional 6.8% of Windset common stock and 8.5% of Windset’s outstanding junior preferred stock for an aggregate price of $11.0 million increasing its ownership to 26.9% of Windset’s common stock.

The Company thinks that hydroponically grown produce using Windset’s know-how and growing practices will result in higher yields with competitive growing costs that will provide dependable year round supply to Windset’s customers. In addition, the produce grown in Windset’s greenhouses has a very high safety profile as no soil is used in the growing process. Windset owns and operates greenhouses in British Columbia, Canada and in Nevada and California. In addition to growing produce in their own greenhouses, Windset has numerous marketing arrangements with other greenhouse growers and utilizes buy/sell arrangements to meet fluctuation in demand from their customers.

B) Food Export Business

Food Export revenues consist of revenues generated from the purchase and sale of primarily whole commodity fruit and vegetable products to Asia through Apio’s export company, Cal-Ex. The Food Export business is a commission-based buy/sell business that realizes a gross margin in the 5-8% range.

The Food Export business had revenues of $70 million for the fiscal year ended May 25, 2014, $79 million for the fiscal year ended May 26, 2013 and $71 million for the fiscal year ended May 27, 2012.

Apio is strategically positioned with Cal-Ex to benefit from the growing population and wealth in Asia and other parts of the world over the next decade. Through Cal-Ex, Apio is currently one of the largest U.S. exporters of broccoli to Asia. Other large export items include apples, grapes, stonefruit and citrus.

C) HA-based Biomaterials

Our HA-based Biomaterials business operates through our Lifecore subsidiary. Lifecore had revenues of $46 million for the fiscal year ended May 25, 2014, $41 million for the fiscal year ended May 26, 2013 and $34 million for the fiscal year ended May 27, 2012.

Lifecore operates our medical materials business and is principally involved in the manufacture of pharmaceutical-grade sodium hyaluronate products in the form of injectable products for ophthalmologic and orthopedic applications. There is now a greater percentage of Americans age 65 and older than at any other time in U.S. history and currently over 40 million Americans are 65 years of age or older and this trend is going to accelerate dramatically over the upcoming years. As our population ages, eye surgeries such as cataract surgeries, are going to increase. Additionally, patients will seek joint therapy as cartilage and soft tissue deteriorates. HA injections are a primary course of treatment and Lifecore has built a leadership position in the markets it serves. It is estimated that there will be 22 million cataract surgeries in 2014 worldwide. Lifecore’s expertise includes its ability to ferment, separate, purify, and aseptically fill HA for injectable product use. In addition to ophthalmic and orthopedic uses, veterinary medicine is another application for Lifecore’s HA. Lifecore leverages its fermentation process to manufacture premium, pharmaceutical-grade HA and uses its aseptic filling capabilities to also deliver private-labeled HA finished products to its customers. Lifecore sells its products through partners in the U.S., Europe and South America. Lifecore has built its reputation as a premium supplier of HA.

Lifecore’s products are primarily sold to strategic marketing partners for use in three medical areas: (1) Ophthalmic, (2) Orthopedic and (3) Veterinary. In addition, Lifecore provides product development services to its partners for HA-based, as well as non-HA based, fermented products and aseptically formulated products. These services include activities such as tech transfer, material component changes, analytical method development, pilot studies, stability studies, process validation, and clinical production.

By leveraging its fermentation process and aseptic formulation and filling expertise, Lifecore has become a leader in the supply of HA-based products for multiple applications, and has taken advantage of non-HA device and drug opportunities by leveraging its expertise in manufacturing and aseptic syringe filling capabilities. Elements of Lifecore’s strategy include the following:

• Establish strategic relationships with market leaders. Lifecore will continue to develop applications for products with partners who have strong marketing, sales and distribution capabilities to end-user markets. Through its strong reputation and history of providing pharmaceutical grade HA and products, Lifecore has been able to establish long-term relationships with the market leading ophthalmic surgical companies, and leverages those partnerships to attract new relationships in other medical markets.

• Expand medical applications for HA. Due to the growing knowledge of the unique characteristics of HA, and the role it plays in normal physiology, Lifecore continues to identify and pursue opportunities for the use of HA in other medical applications, such as wound care, aesthetic surgery, drug delivery, device coatings and through pharmaceutical sales to academic and corporate research customers. As part of this effort, Lifecore continues to explore applications for its Corgel® Biohydrogel technology licensed from the Cleveland Clinic Foundation. Further applications may involve expanding process development activity and/or additional licensing of technology.

• Utilize manufacturing infrastructure to pursue contract aseptic filling and fermentation opportunities. Lifecore has made strategic capital investments in its contract manufacturing and development business focusing on extending its aseptic filling capacity and capabilities. It is investing in this segment to meet increasing partner demand and attract new contract filling opportunities. Lifecore is using its manufacturing capabilities to provide contract manufacturing and development services to its partners in the area of sterile pre-filled syringes and fermentation and purification requirements.

• Maintain flexibility in product development and supply relationships. Lifecore’s vertically integrated development and manufacturing capabilities allow it to establish a variety of contractual relationships with global corporate partners. Lifecore’s role in these relationships extends from supplying HA raw materials to providing tech transfer and development services to manufacturing aseptically-packaged, finished sterile products and to assuming full supply chain responsibilities.

Trademarks/Trade names

Intelimer®, Landec®, Apio™, Eat Smart®, BreatheWay®, GreenLine®, Clearly Fresh™, Lifecore®, LUROCOAT® and Ortholure™ are some of the trademarks or registered trademarks and trade names of the Company in the United States and other countries. This Annual Report on Form 10-K also refers to the trademarks of other companies.

Sales and Marketing

Apio is supported by dedicated sales and marketing resources. Apio has 36 sales and marketing employees, located in central California and throughout the U.S., supporting the Food Products Technology business and the Food Export business. During fiscal years 2014, 2013 and 2012, sales to the Company’s top five customers accounted for approximately 42%, 40% and 45%, respectively, of its revenues, with the top two customers, both from the Food Products Technology segment, Costco Wholesale Corporation which accounted for approximately 21%, 16%, and 17%, respectively, and Wal-mart, Inc. which accounted for approximately 11%, 13%, and 11%, respectively, of the Company’s revenues. A loss of either of these customers would have a material adverse effect on the Company’s business.

Lifecore sells products to partners under supply agreements and also through distribution agreements. Excluding research sales, Lifecore does not sell to end users and, therefore, does not have the traditional infrastructure of a dedicated sales force and marketing employees and its name recognition allows Lifecore to attract new customers and offer its services with a minimal marketing and sales infrastructure.

Seasonality

Apio’s sales are seasonal. The Food Products Technology business can be affected by seasonal weather factors, such as the high cost of sourcing product due to a shortage of essential value-added produce items, which have impacted quarterly results in the past. The Food Export business also typically recognizes a much higher percentage of its revenues and profit during the first half of Landec’s fiscal year compared to the second half. Lifecore’s business is not significantly affected by seasonality.

Manufacturing and Processing

Food Products Technology Business

The manufacturing process for the Company's proprietary BreatheWay packaging products is comprised of polymer manufacturing, membrane manufacturing and label package conversion. A third party toll manufacturer currently makes virtually all of the polymers for the BreatheWay packaging system. Select outside contractors currently manufacture the breathable membranes, and Landec has transitioned virtually all of the label package conversion to Apio’s Guadalupe facility to meet the increasing product demand and to provide additional developmental capabilities.

Apio processes virtually all of its fresh-cut, value-added non-green bean products in its processing facility located in Guadalupe, California. Cooling of produce is done through third parties and Apio Cooling LP, a separate consolidated subsidiary in which Apio has a 60% ownership interest and is the general partner.

Apio processes its fresh-cut, value-added green bean products, acquired with the acquisition of GreenLine in April 2012, in four processing plants located in Guadalupe, California; Bowling Green, Ohio; Hanover, Pennsylvania; and Vero Beach, Florida.

Hyaluronan-based Biomaterials Business

The commercial production of HA by Lifecore requires fermentation, separation and purification capabilities. Products are supplied in a variety of bulk and single dose configurations.

Lifecore produces its HA through a bacterial fermentation process. Medical grade HA was initially commercially available only through an extraction process from rooster combs. Lifecore believes that the fermentation manufacturing approach is superior to rooster comb extraction because of greater efficiency and flexibility, a more favorable long-term regulatory environment, and better economies of scale in producing large commercial quantities. Today’s HA competitors are primarily utilizing a fermentation process.

Lifecore’s 114,000 square foot facility in Chaska, Minnesota is used primarily for the HA manufacturing process, formulation and aseptic syringe and bulk filling. The Company considers that the current inventory on-hand, together with its manufacturing capacity, will be sufficient to allow it to meet the needs of its current customers for the foreseeable future.

Lifecore provides versatility in the manufacturing of various types of finished products. It supplies several different forms of HA in a variety of molecular weight fractions as powders, solutions and gels, and in a variety of bulk and single-use finished packages. Lifecore continues to conduct development work designed to improve production efficiencies and expand its capabilities to achieve a wider range of HA product specifications in order to address the broadening opportunities for using HA in medical applications.

The FDA inspects the Company’s manufacturing systems periodically and requires compliance with the FDA’s Quality System Regulation (“QSR”). In addition, Lifecore’s customers conduct intensive quality audits of the facility and its operations. Lifecore also periodically contracts with independent regulatory consultants to conduct audits of its operations. Similar to other manufacturers subject to regulatory and customer specific requirements, Lifecore’s facility was designed to meet applicable regulatory requirements and has been cleared for the manufacturing of both device and pharmaceutical products. The Company maintains a Quality System which complies with applicable standards and regulations: FDA Medical Device Quality System requirements (21 CFR 820); FDA Drug Good Manufacturing Practices (21 CFR 210-211); European Union Good Manufacturing Practices (EudraLex Volume 4); Medical Device Quality Management System (ISO 13485); European Medical Device Directive; Canadian Medical Device Regulations; International Guide for Active Pharmaceutical Ingredients (ICH Q7), and Australian Therapeutic Goods Regulations). Compliance with these international standards of quality greatly assists in the marketing of Lifecore’s products globally.

General

Several of the raw materials used in manufacturing certain of the Company’s products are currently purchased from a single source. Although to date the Company has not experienced difficulty acquiring materials for the manufacture of its products, no assurance can be given that interruptions in supplies will not occur in the future, that the Company will be able to obtain substitute vendors, or that the Company will be able to procure comparable materials at similar prices and terms within a reasonable time. Any such interruption of supply could have a material adverse effect on the Company’s ability to manufacture and distribute its products and, consequently, could materially and adversely affect the Company’s business, operating results and financial condition.

Research and Development

Landec is focusing its research and development resources on both existing and new product applications. Expenditures for research and development for the fiscal years ended May 25, 2014, May 26, 2013 and May 27, 2012 were $7.2 million, $9.3 million and $9.6 million, respectively. Research and development expenditures funded by corporate or governmental partners were zero during fiscal year 2014, $688,000 during fiscal year 2013 and zero in fiscal year 2012. The Company may seek funds for applied materials research programs from U.S. government agencies as well as from commercial entities. The Company anticipates that it will continue to incur significant research and development expenditures in order to maintain its competitive position with a continuing flow of innovative, high-quality products and services. As of May 25, 2014, Landec had 61 employees engaged in research and development with experience in polymer and analytical chemistry, product application, product formulation, and mechanical and chemical engineering.

Competition

The Company operates in highly competitive and rapidly evolving fields, and new developments are expected to continue at a rapid pace. Competition from large food processors, packaging companies, and medical and pharmaceutical companies is intense. Many of these competitors have substantially greater financial and technical resources and production and marketing capabilities than the Company, and many have substantially greater experience in conducting field trials, obtaining regulatory approvals and manufacturing and marketing commercial products. There can be no assurance that these competitors will not succeed in developing alternative technologies and products that are more effective, easier to use or less expensive than those which have been or are being developed by the Company or that would render the Company's technology and products obsolete and non-competitive.

Patents and Proprietary Rights

The Company's success depends in large part on its ability to obtain patents, maintain trade secret protection and operate without infringing on the proprietary rights of third parties. The Company has had 43 U.S. patents issued of which 28 remain active as of May 25, 2014 with expiration dates ranging from 2014 to 2028. There can be no assurance that any of the pending patent applications will be approved, that the Company will develop additional proprietary products that are patentable, that any patents issued to the Company will provide the Company with competitive advantages or will not be challenged by any third parties or that the patents of others will not prevent the commercialization of products incorporating the Company's technology. Furthermore, there can be no assurance that others will not independently develop similar products, duplicate any of the Company's products or design around the Company's patents. Any of the foregoing results could have a material adverse effect on the Company's business, operating results and financial condition.

The commercial success of the Company will also depend, in part, on its ability to avoid infringing patents issued to others. If the Company were determined to be infringing any third party patent, the Company could be required to pay damages, alter its products or processes, obtain licenses or cease certain activities. In addition, if patents are issued to others which contain claims that compete or conflict with those of the Company and such competing or conflicting claims are ultimately determined to be valid, the Company may be required to pay damages, to obtain licenses to these patents, to develop or obtain alternative technology or to cease using such technology. If the Company is required to obtain any licenses, there can be no assurance that the Company will be able to do so on commercially favorable terms, if at all. The Company's failure to obtain a license to any technology that it may require to commercialize its products could have a material adverse impact on the Company's business, operating results and financial condition.

Government Regulation

Government regulation in the United States and other countries is a significant factor in the marketing of certain of the Company’s products and in the Company’s ongoing research and development activities. Some of the Company’s products are subject to extensive and rigorous regulation by the FDA, which regulates some of the products as medical devices and which, in some cases, requires Pre-Market Approval (“PMA”), and by foreign countries, which regulate some of the products as medical devices or drugs. Under the Federal Food, Drug, and Cosmetic Act (“FDC Act”), the FDA regulates the clinical testing, manufacturing, labeling, distribution, sale and promotion of medical devices in the United States.

Other regulatory requirements are placed on the manufacture, processing, packaging, labeling, distribution, recordkeeping and reporting of a medical device and on the quality control procedures, such as the FDA’s device QSR regulations. Manufacturing facilities are subject to periodic inspections by the FDA to assure compliance with device QSR requirements, along with pre-approval inspection (PAI) for PMA product introduction. Lifecore’s facility is subject to inspections as both a device and a drug manufacturing operation. For PMA devices, the Company that owns the product submission is required to submit an annual report and to obtain approval of a PMA supplement for modifications to the device or its labeling. Other applicable FDA requirements include the medical device reporting (“MDR”) regulation, which requires that the Company provide information to the FDA regarding deaths or serious injuries alleged to have been associated with the use of its devices, as well as product malfunctions that would likely cause or contribute to death or serious injury if the malfunction were to recur.

Employees

As of May 25, 2014, Landec had 531 full-time employees, of whom 432 were dedicated to research, development, manufacturing, quality control and regulatory affairs and 99 were dedicated to sales, marketing and administrative activities. Landec intends to recruit additional personnel in connection with the development, manufacturing and marketing of its products. None of Landec's employees is represented by a union, and Landec considers its relationship with its employees to be good.

Available Information

Landec’s website is http://www.landec.com. Landec makes available free of charge its annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the SEC. Information contained on our website is not part of this Report.

Item 1A. Risk Factors

Landec desires to take advantage of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995 and of Section 21E and Rule 3b-6 under the Securities Exchange Act of 1934. Specifically, Landec wishes to alert readers that the following important factors could in the future affect, and in the past have affected, Landec’s actual results and could cause Landec’s results for future periods to differ materially from those expressed in any forward-looking statements made by or on behalf of Landec. Landec assumes no obligation to update such forward-looking statements.

Lapses in disclosure controls and procedures or internal control over financial reporting could materially and adversely affect the Company’s operations, profitability or reputation.

We are committed to maintaining high standards of internal control over financial reporting and disclosure controls and procedures. Nevertheless, lapses or deficiencies in disclosure controls and procedures or in our internal control over financial reporting may occur from time to time. On January 2, 2013, we reported that our audit committee reached a determination to restate our previously-filed interim financial statements for the quarter ended August 26, 2012 and that our previously-filed interim financial statements for the quarter ended August 26, 2012 should not be relied upon. We also reported management’s determination that a material weakness existed in our internal control over financial reporting at August 26, 2012. As a result of the material weakness, management also concluded that our disclosure controls and procedures were not effective at August 26, 2012.

There can be no assurance that our disclosure controls and procedures will be effective in preventing a material weakness or significant deficiency in internal control over financial reporting from occurring in the future. Any such lapses or deficiencies may materially and adversely affect our business and results of operations or financial condition, restrict our ability to access the capital markets, require us to expend resources to correct the lapses or deficiencies, expose us to regulatory or legal proceedings, harm our reputation, or otherwise cause a decline in investor confidence.

Adverse Weather Conditions and Other Acts of God May Cause Substantial Decreases in Our Sales and/or Increases in Our Costs

Our Food Products Technology business is subject to weather conditions that affect commodity prices, crop quality and yields, and decisions by growers regarding crops to be planted. Crop diseases and severe conditions, particularly weather conditions such as unexpected or excessive rain or other precipitation, unseasonable temperature fluctuations, floods, droughts, frosts, windstorms, earthquakes and hurricanes, may adversely affect the supply of vegetables and fruits used in our business, which could reduce the sales volumes and/or increase the unit production costs. In fiscal year 2014, the Company’s operating income was negatively impacted by approximately $9.3 million in operational variances driven from produce quality and yield issues, higher labor costs and lower processing yields in the Food Products Technology business. Because a significant portion of the costs are fixed and contracted in advance of each operating year, volume declines reflecting production interruptions or other factors could result in increases in unit production costs which could result in substantial losses and weaken our financial condition.

The Global Economy is Experiencing Continued Volatility, Which May Have an Adverse Effect on Our Business

In recent years, the U.S. and international economy and financial markets experienced a significant slowdown and volatility due to uncertainties related to the availability of credit, energy prices, difficulties in the banking and financial services sectors, softness in the housing market, diminished market liquidity, geopolitical conflicts, falling consumer confidence and high unemployment rates. Ongoing volatility in the economy and financial markets could further lead to reduced demand for our products, which in turn, would reduce our revenues and adversely affect our business, financial condition and results of operations. In particular, volatility in the global markets have resulted in softer demand and more conservative purchasing decisions by customers, including a tendency toward lower-priced products, which could negatively impact our revenues, gross margins and results of operations. In addition to a reduction in sales, our profitability may decrease because we may not be able to reduce costs at the same rate as our sales decline. We cannot predict the ultimate severity or length of the current period of volatility, whether the recent signs of economic recovery will prove sustainable, or the timing or severity of future economic or industry downturns.

Given the current uncertain economic environment, our customers, suppliers and partners may have difficulties obtaining capital at adequate or historical levels to finance their ongoing business and operations, which could impair their ability to make timely payments to us. This may result in lower sales and/or inventory that may not be saleable or bad debt expense for Landec. In addition to the impact of the current market uncertainty on our customers, some of our vendors and growers may experience a reduction in their availability of funds and cash flows, which could negatively impact their business as well as ours. A further worsening of the economic environment or continued or increased volatility of the U.S. economy, including increased volatility in the credit markets, could adversely impact our customers’ and vendors’ ability or willingness to conduct business with us on the same terms or at the same levels as they have historically. Further, this economic volatility and uncertainty about future economic conditions makes it challenging for Landec to forecast its operating results, make business decisions, and identify the risks that may affect its business, sources and uses of cash, financial condition and results of operations.

Our Future Operating Results Are Likely to Fluctuate Which May Cause Our Stock Price to Decline

In the past, our results of operations have fluctuated significantly from quarter to quarter and are expected to continue to fluctuate in the future. Apio can be affected by seasonal and weather factors which have impacted our financial results due to a shortage of essential value-added produce items. In fiscal year 2014, operational variances driven from produce quality and yield issues, higher labor costs and lower processing yields in the Food Products Technology business had an approximate $9.3 million negative impact on our operating income. Our earnings may also fluctuate based on our ability to collect accounts receivable from customers and notes receivable from growers and on price fluctuations in the fresh vegetable and fruit markets. Other factors that affect our operations include:

the seasonality and availability of our supplies,

our ability to process produce during critical harvest periods,

the timing and effects of ripening,

the degree of perishability,

the effectiveness of worldwide distribution systems,

total worldwide industry volumes,

the seasonality and timing of consumer demand,

foreign currency fluctuations, and

foreign importation restrictions and foreign political risks.

As a result of these and other factors, we expect to continue to experience fluctuations in quarterly operating results.

Uncertainty Relating To Integration Of New Business Acquisitions.

The successful integration of new business acquisitions, including the GreenLine acquisition, may require substantial effort from the Company's management. The diversion of the attention of management and any difficulties encountered in the transition process could have a material adverse effect on the Company's ability to realize the anticipated benefits of the acquisitions. The successful combination of new businesses also requires coordination of research and development activities, manufacturing, and sales and marketing efforts. In addition, the process of combining organizations located in different regions of the United States could cause the interruption of, or a loss of momentum in, the Company's activities. There can be no assurance that the Company will be able to retain key management, technical, sales and customer support personnel, or that the Company will realize the anticipated benefits of any acquisitions, and the failure to do so would have a material adverse effect on the Company's business, results of operations and financial condition.

We May Not Be Able to Achieve Acceptance of Our New Products in the Marketplace

Our success in generating significant sales of our products depends in part on our ability and our partners and licensees to achieve market acceptance of our new products and technology. The extent to which, and rate at which, we achieve market acceptance and penetration of our current and future products is a function of many variables including, but not limited to:

price,

safety,

efficacy,

reliability,

conversion costs,

regulatory approvals,

marketing and sales efforts, and

general economic conditions affecting purchasing patterns.

We may not be able to develop and introduce new products and technologies in a timely manner or new products and technologies may not gain market acceptance. We or our partners/customers are in the early stage of product commercialization of certain Intelimer-based specialty packaging, HA-based products and other Intelimer polymer products. We expect that our future growth will depend in large part on our or our partners/customers ability to develop and market new products in our target markets and in new markets. In particular, we expect that our ability to compete effectively with existing food products companies will depend substantially on developing, commercializing, achieving market acceptance of and reducing the cost of producing our products. In addition, commercial applications of our temperature switch polymer technology are relatively new and evolving. Our failure to develop new products or the failure of our new products to achieve market acceptance would have a material adverse effect on our business, results of operations and financial condition.

We Face Strong Competition in the Marketplace

Competitors may succeed in developing alternative technologies and products that are more effective, easier to use or less expensive than those which have been or are being developed by us or that would render our technology and products obsolete and non-competitive. We operate in highly competitive and rapidly evolving fields, and new developments are expected to continue at a rapid pace. Competition from large food products, industrial, medical and pharmaceutical companies is expected to be intense. In addition, the nature of our collaborative arrangements may result in our corporate partners and licensees becoming our competitors. Many of these competitors have substantially greater financial and technical resources and production and marketing capabilities than we do, and may have substantially greater experience in conducting clinical and field trials, obtaining regulatory approvals and manufacturing and marketing commercial products.

We Have a Concentration of Manufacturing for Apio and Lifecore and May Have to Depend on Third Parties to Manufacture Our Products

Any disruptions in our primary manufacturing operation at Apio’s facilities in Guadalupe, California or Bowling Green, Ohio or Lifecore’s facility in Chaska, Minnesota would reduce our ability to sell our products and would have a material adverse effect on our financial results. Additionally, we may need to consider seeking collaborative arrangements with other companies to manufacture our products. If we become dependent upon third parties for the manufacture of our products, our profit margins and our ability to develop and deliver those products on a timely basis may be adversely affected. Failures by third parties may impair our ability to deliver products on a timely basis and impair our competitive position. We may not be able to continue to successfully operate our manufacturing operations at acceptable costs, with acceptable yields, and retain adequately trained personnel.

Our Dependence on Single-Source Suppliers and Service Providers May Cause Disruption in Our Operations Should Any Supplier Fail to Deliver Materials

We may experience difficulty acquiring materials or services for the manufacture of our products or we may not be able to obtain substitute vendors. In addition, we may not be able to procure comparable materials at similar prices and terms within a reasonable time. Several services that are provided to Apio are obtained from a single provider. Several of the raw materials we use to manufacture our products are currently purchased from a single source, including some monomers used to synthesize Intelimer polymers, substrate materials for our breathable membrane products and raw materials for our HA products. Any interruption of our relationship with single-source suppliers or service providers could delay product shipments and materially harm our business.

We May Be Unable to Adequately Protect Our Intellectual Property Rights

We may receive notices from third parties, including some of our competitors, claiming infringement by our products of their patent and other proprietary rights. Regardless of their merit, responding to any such claim could be time-consuming, result in costly litigation and require us to enter royalty and licensing agreements which may not be offered or available on terms acceptable to us. If a successful claim is made against us and we fail to develop or license a substitute technology, we could be required to alter our products or processes and our business, results of operations or financial position could be materially adversely affected. Our success depends in large part on our ability to obtain patents, maintain trade secret protection and operate without infringing on the proprietary rights of third parties. Any pending patent applications we file may not be approved and we may not be able to develop additional proprietary products that are patentable. Any patents issued to us may not provide us with competitive advantages or may be challenged by third parties. Patents held by others may prevent the commercialization of products incorporating our technology. Furthermore, others may independently develop similar products, duplicate our products or design around our patents.

Our Operations Are Subject to Regulations that Directly Impact Our Business

Our products and operations are subject to governmental regulation in the United States and foreign countries. The manufacture of our products is subject to periodic inspection by regulatory authorities. We may not be able to obtain necessary regulatory approvals on a timely basis or at all. Delays in receipt of or failure to receive approvals or loss of previously received approvals would have a material adverse effect on our business, financial condition and results of operations. Although we have no reason to believe that we will not be able to comply with all applicable regulations regarding the manufacture and sale of our products and polymer materials, regulations are always subject to change and depend heavily on administrative interpretations and the country in which the products are sold. Future changes in regulations or interpretations relating to matters such as safe working conditions, laboratory and manufacturing practices, environmental controls, and disposal of hazardous or potentially hazardous substances may adversely affect our business.

We are subject to FDA rules and regulations concerning the safety of the food products handled and sold by Apio, and the facilities in which they are packed and processed. Failure to comply with the applicable regulatory requirements can, among other things, result in:

fines, injunctions, civil penalties, and suspensions,

withdrawal of regulatory approvals,

product recalls and product seizures, including cessation of manufacturing and sales,

operating restrictions, and

criminal prosecution.

We may be required to incur significant costs to comply with the laws and regulations in the future which may have a material adverse effect on our business, operating results and financial condition.

Our food packaging products are subject to regulation under the Food, Drug and Cosmetic Act (the “FDC Act”). Under the FDC Act, any substance that when used as intended may reasonably be expected to become, directly or indirectly, a component or otherwise affect the characteristics of any food may be regulated as a food additive unless the substance is generally recognized as safe. Food packaging materials are generally not considered food additives by the FDA because these products are not expected to become components of food under their expected conditions of use. We consider our breathable membrane product to be a food packaging material not subject to regulation or approval by the FDA. We have not received any communication from the FDA concerning our breathable membrane product. If the FDA were to determine that our breathable membrane products are food additives, we may be required to submit a food additive petition for approval by the FDA. The food additive petition process is lengthy, expensive and uncertain. A determination by the FDA that a food additive petition is necessary would have a material adverse effect on our business, operating results and financial condition.

Our Food Products Technology business is subject to the Perishable Agricultural Commodities Act (“PACA”). PACA regulates fair trade standards in the fresh produce industry and governs all the products sold by Apio. Our failure to comply with the PACA requirements could among other things, result in civil penalties, suspension or revocation of a license to sell produce, and in the most egregious cases, criminal prosecution, which could have a material adverse effect on our business.

Lifecore’s existing products and its products under development are considered to be medical devices and therefore, require clearance or approval by the FDA before commercial sales can be made in the United States. The products also require the approval of foreign government agencies before sales may be made in many other countries. The process of obtaining these clearances or approvals varies according to the nature and use of the product. It can involve lengthy and detailed safety, efficacy and clinical studies, as well as extensive site inspections and lengthy regulatory agency reviews. There can be no assurance that any of the Company’s clinical studies will show safety or effectiveness; that any of the Company’s products that require FDA clearance or appoval will obtain such clearance or approval on a timely basis, on terms acceptable to the Company for the purpose of actually marketing the products, or at all; or that following any such clearance or approval previously unknown problems will not result in restrictions on the marketing of the products or withdrawal of clearance or approval.

In addition, most of the existing products being sold by Lifecore and its customers are subject to continued regulation by the FDA, various state agencies and foreign regulatory agencies which regulate manufacturing, labeling and record keeping procedures for such products. Marketing clearances or approvals by these agencies can be withdrawn due to failure to comply with regulatory standards or the occurrence of unforeseen problems following initial clearance or approval. These agencies can also limit or prevent the manufacture or distribution of Lifecore’s products. A determination that Lifecore is in violation of such regulations could lead to the imposition of civil penalties, including fines, product recalls or product seizures, injunctions, and, in extreme cases, criminal sanctions.

Federal, state and local regulations impose various environmental controls on the use, storage, discharge or disposal of toxic, volatile or otherwise hazardous chemicals and gases used in some of the manufacturing processes. Our failure to control the use of, or to restrict adequately the discharge of, hazardous substances under present or future regulations could subject us to substantial liability or could cause our manufacturing operations to be suspended and changes in environmental regulations may impose the need for additional capital equipment or other requirements.

We Depend on Strategic Partners and Licenses for Future Development

Our strategy for development, clinical and field testing, manufacture, commercialization and marketing for some of our current and future products includes entering into various collaborations with corporate partners, licensees and others. We are dependent on our corporate partners to develop, test, manufacture and/or market some of our products. Although we believe that our partners in these collaborations have an economic motivation to succeed in performing their contractual responsibilities, the amount and timing of resources to be devoted to these activities are not within our control. Our partners may not perform their obligations as expected or we may not derive any additional revenue from the arrangements. Our partners may not pay any additional option or license fees to us or may not develop, market or pay any royalty fees related to products under such agreements. Moreover, some of the collaborative agreements provide that they may be terminated at the discretion of the corporate partner, and some of the collaborative agreements provide for termination under other circumstances. Our partners may pursue existing or alternative technologies in preference to our technology. Furthermore, we may not be able to negotiate additional collaborative arrangements in the future on acceptable terms, if at all, and our collaborative arrangements may not be successful.

Our International Sales May Expose Our Business to Additional Risks

For fiscal year 2014, approximately 29% of our total revenues were derived from product sales to international customers. A number of risks are inherent in international transactions. International sales and operations may be limited or disrupted by any of the following:

regulatory approval process,

government controls,

export license requirements,

political instability,

price controls,

trade restrictions,

changes in tariffs, or

difficulties in staffing and managing international operations.

Foreign regulatory agencies have or may establish product standards different from those in the United States, and any inability to obtain foreign regulatory approvals on a timely basis could have a material adverse effect on our international business, and our financial condition and results of operations. While our foreign sales are currently priced in dollars, fluctuations in currency exchange rates may reduce the demand for our products by increasing the price of our products in the currency of the countries in which the products are sold. Regulatory, geopolitical and other factors may adversely impact our operations in the future or require us to modify our current business practices.

Cancellations or Delays of Orders by Our Customers May Adversely Affect Our Business

During fiscal year 2014, sales to our top five customers accounted for approximately 42% of our revenues, with our two largest customers from our Food Products Technology segment, Costco Wholesale Corporation and Wal-mart, Inc. accounting for approximately 21% and 11%, respectively, of our revenues. We expect that, for the foreseeable future, a limited number of customers may continue to account for a substantial portion of our revenues. We may experience changes in the composition of our customer base as we have experienced in the past. The reduction, delay or cancellation of orders from one or more major customers for any reason or the loss of one or more of our major customers could materially and adversely affect our business, operating results and financial condition. In addition, since some of the products processed by Apio and Lifecore are sole sourced to customers, our operating results could be adversely affected if one or more of our major customers were to develop other sources of supply. Our current customers may not continue to place orders, orders by existing customers may be canceled or may not continue at the levels of previous periods or we may not be able to obtain orders from new customers.

Our Sale of Some Products May Increase Our Exposure to Product Liability Claims

The testing, manufacturing, marketing, and sale of the products we develop involve an inherent risk of allegations of product liability. If any of our products were determined or alleged to be contaminated or defective or to have caused a harmful accident to an end-customer, we could incur substantial costs in responding to complaints or litigation regarding our products and our product brand image could be materially damaged. Such events may have a material adverse effect on our business, operating results and financial condition. Although we have taken and intend to continue to take what we consider to be appropriate precautions to minimize exposure to product liability claims, we may not be able to avoid significant liability. We currently maintain product liability insurance. While we think the coverage and limits are consistent with industry standards, our coverage may not be adequate or may not continue to be available at an acceptable cost, if at all. A product liability claim, product recall or other claim with respect to uninsured liabilities or in excess of insured liabilities could have a material adverse effect on our business, operating results and financial condition.

Our Stock Price May Fluctuate in Accordance with Market Conditions

The following events may cause the market price of our common stock to fluctuate significantly:

technological innovations applicable to our products,

our attainment of (or failure to attain) milestones in the commercialization of our technology,

our development of new products or the development of new products by our competitors,

new patents or changes in existing patents applicable to our products,

our acquisition of new businesses or the sale or disposal of a part of our businesses,

development of new collaborative arrangements by us, our competitors or other parties,

changes in government regulations applicable to our business,

changes in investor perception of our business,

fluctuations in our operating results, and

changes in the general market conditions in our industry.

These broad fluctuations may adversely affect the market price of our common stock.

We May Be Exposed to Employment Related Claims and Costs that Could Materially Adversely Affect Our Business

We have been subject in the past, and may be in the future, to claims by employees based on allegations of discrimination, negligence, harassment and inadvertent employment of undocumented workers or unlicensed personnel, and we may be subject to payment of workers' compensation claims and other similar claims. We could incur substantial costs and our management could spend a significant amount of time responding to such complaints or litigation regarding employee claims, which may have a material adverse effect on our business, operating results and financial condition.

We Are Dependent on Our Key Employees and if One or More of Them Were to Leave, We Could Experience Difficulties in Replacing Them and Our Operating Results Could Suffer

The success of our business depends to a significant extent on the continued service and performance of a relatively small number of key senior management, technical, sales, and marketing personnel. The loss of any of our key personnel for an extended period would likely harm our business. In addition, competition for senior level personnel with knowledge and experience in our different lines of business is intense. If any of our key personnel were to leave, we would need to devote substantial resources and management attention to replace them. As a result, management attention may be diverted from managing our business, and we may need to pay higher compensation to replace these employees.

We May Issue Preferred Stock with Preferential Rights that Could Affect Your Rights

The issuance of shares of preferred stock could have the effect of making it more difficult for a third party to acquire a majority of our outstanding stock, and the holders of such preferred stock could have voting, dividend, liquidation and other rights superior to those of holders of our Common Stock.

We Have Never Paid any Dividends on Our Common Stock

We have not paid any dividends on our Common Stock since inception and do not expect to in the foreseeable future. Any dividends may be subject to preferential dividends payable on any preferred stock we may issue.

Our Profitability Could Be Materially and Adversely Affected if it Is Determined that the Book Value of Goodwill is Higher than Fair Value

Our balance sheet includes an amount designated as “goodwill” that represents a portion of our assets and our stockholders’ equity. Goodwill arises when an acquirer pays more for a business than the fair value of the tangible and separately measurable intangible net assets. In accordance with accounting guidance, the amortization of goodwill has been replaced with an “impairment test” which requires that we compare the fair value of goodwill to its book value at least annually and more frequently if circumstances indicate a possible impairment. If we determine at any time in the future that the book value of goodwill is higher than fair value then the difference must be written-off, which could materially and adversely affect our reported profitability.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of May 25, 2014, the Company owned or leased properties in Menlo Park and Arroyo Grande, Guadalupe California; Chaska, Minnesota; Bowling Green, Perrysburg and McClure, Ohio; Hanover, Pennsylvania; Vero Beach, Florida; Rock Hill, South Carolina and Rock Tavern, New York.

These properties are described below:

| Acres | ||||||||||

|

|

Business Segment |

|

|

of Land |

Lease Expiration | |||||

|

Menlo Park, CA |

Corporate |

Leased |

14,600 square feet of office and laboratory space |

— |

12/31/16 | |||||

|

Chaska, MN |

HA-based Biomaterials |

Owned |

114,000 square feet of office, laboratory and manufacturing space |

27.5 |

— | |||||

|

Guadalupe, CA |

Food Products Technology |

Owned |

199,000 square feet of office space, manufacturing and cold storage |

17.7 |

— | |||||

|

Bowling Green, OH |

Food Products Technology |

Owned |

55,900 square feet of office space, manufacturing and cold storage |

7.7 |

— | |||||

|

Hanover, PA |

Food Products Technology |

Owned |

18,700 square feet of office space, manufacturing and cold storage |

15.3 |

— | |||||

|

Vero Beach, FL |

Food Products Technology |

Leased |

9,200 square feet of office space, manufacturing and cold storage |

— |

12/31/14 | |||||

|

Rock Hill, SC |

Food Products Technology |

Owned |

16,400 square feet of cold storage and office space |

3.6 |

— | |||||

|

Rock Tavern, NY |

Food Products Technology |

Leased |