United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[X] |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Quarter Ended August 25, 2013, or

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _________.

Commission file number: 0-27446

LANDEC CORPORATION

(Exact name of registrant as specified in its charter)

Delaware 94-3025618 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification Number)

3603 Haven Avenue

Menlo Park, California 94025

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code:

(650) 306-1650

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days.

Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X No ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

|

Accelerated Filer |

X |

|

|

Non Accelerated Filer |

|

Smaller Reporting Company |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes No X

As of September 20, 2013, there were 26,488,209 shares of Common Stock outstanding.

LANDEC CORPORATION

FORM 10-Q For the Fiscal Quarter Ended August 25, 2013

INDEX

|

Page | |||

|

Facing sheet |

1 | ||

|

Index |

2 | ||

|

Part I. |

Financial Information |

||

|

Item 1. |

Financial Statements |

||

| a) |

Consolidated Balance Sheets as of August 25, 2013 and May 26, 2013 |

3 | |

| b) |

Consolidated Statements of Comprehensive Income for the Three Months Ended August 25, 2013 and August 26, 2012 |

4 | |

| c) |

Consolidated Statements of Cash Flows for the Three Months Ended August 25, 2013 and August 26, 2012 |

5 | |

| d) |

Notes to Consolidated Financial Statements |

6 | |

|

Item 2. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

18 | |

|

Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

27 | |

|

Item 4 |

Controls and Procedures |

28 | |

|

Part II. |

Other Information |

29 | |

|

Item 1. |

Legal Proceedings |

29 | |

|

Item 1A. |

Risk Factors |

29 | |

|

Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

29 | |

|

Item 3. |

Defaults Upon Senior Securities |

29 | |

|

Item 4. |

Mine Safety Disclosures |

29 | |

|

Item 5. |

Other Information |

29 | |

|

Item 6. |

Exhibits |

29 | |

|

Signatures |

30 | ||

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

LANDEC CORPORATION

CONSOLIDATED BALANCE SHEETS

(In thousands except shares and per share amounts)

|

August 25, 2013 |

May 26, 2013 |

|||||||

| (unaudited) | (1) | |||||||

|

ASSETS |

||||||||

|

Current Assets: |

||||||||

|

Cash and cash equivalents |

$ | 8,897 | $ | 13,718 | ||||

|

Marketable securities |

1,297 | 1,545 | ||||||

|

Accounts receivable, less allowance for doubtful accounts of $451 and $583 at August 25, 2013 and May 26, 2013, respectively |

32,973 | 36,072 | ||||||

|

Accounts receivable, related party |

205 | 671 | ||||||

|

Income taxes receivable |

4,942 | 5,103 | ||||||

|

Inventories, net |

24,589 | 24,113 | ||||||

|

Deferred taxes |

2,006 | 1,582 | ||||||

|

Prepaid expenses and other current assets |

2,816 | 2,856 | ||||||

|

Total Current Assets |

77,725 | 85,660 | ||||||

|

Investment in non-public company, non-fair value |

793 | 793 | ||||||

|

Investment in non-public company, fair value |

35,000 | 29,600 | ||||||

|

Property and equipment, net |

68,489 | 65,811 | ||||||

|

Goodwill, net |

49,620 | 49,620 | ||||||

|

Trademarks/tradenames, net |

48,428 | 48,428 | ||||||

|

Customer relationships, net |

9,384 | 9,606 | ||||||

|

Other assets |

1,394 | 1,424 | ||||||

|

Total Assets |

$ | 290,833 | $ | 290,942 | ||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

|

Current Liabilities: |

||||||||

|

Accounts payable |

$ | 29,083 | $ | 31,470 | ||||

|

Accounts payable, related party |

297 | 786 | ||||||

|

Accrued compensation |

3,929 | 4,984 | ||||||

|

Other accrued liabilities |

3,219 | 2,332 | ||||||

|

Deferred revenue |

628 | 1,248 | ||||||

|

Lines of credit |

1,050 | 4,000 | ||||||

|

Current portion of long-term debt |

5,961 | 5,933 | ||||||

|

Total Current Liabilities |

44,167 | 50,753 | ||||||

|

Long-term debt, less current portion |

32,961 | 34,372 | ||||||

|

Deferred taxes |

26,781 | 24,054 | ||||||

|

Other non-current liabilities |

1,455 | 1,349 | ||||||

|

Total Liabilities |

105,364 | 110,528 | ||||||

|

Stockholders’ Equity: |

||||||||

|

Common stock, $0.001 par value; 50,000,000 shares authorized; 26,478,809 and 26,402,247 shares issued and outstanding at August 25, 2013 and May 26, 2013, respectively |

26 | 26 | ||||||

|

Additional paid-in capital |

126,502 | 126,258 | ||||||

|

Retained earnings |

57,161 | 52,409 | ||||||

|

Total Stockholders’ Equity |

183,689 | 178,693 | ||||||

|

Non-controlling interest |

1,780 | 1,721 | ||||||

|

Total Equity |

185,469 | 180,414 | ||||||

|

Total Liabilities and Stockholders’ Equity |

$ | 290,833 | $ | 290,942 | ||||

(1) Derived from audited financial statements.

See accompanying notes.

LANDEC CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(In thousands, except per share amounts)

|

Three Months Ended |

||||||||

|

August 25, 2013 |

August 26, 2012 |

|||||||

|

Revenues: |

||||||||

|

Product sales |

$ | 108,929 | $ | 101,303 | ||||

|

Services revenue, related party |

550 | 771 | ||||||

|

Total revenues |

109,479 | 102,074 | ||||||

|

Cost of revenue: |

||||||||

|

Cost of product sales |

96,430 | 87,664 | ||||||

|

Cost of services revenue |

517 | 647 | ||||||

|

Total cost of revenue |

96,947 | 88,311 | ||||||

|

Gross profit |

12,532 | 13,763 | ||||||

|

Operating costs and expenses: |

||||||||

|

Research and development |

1,926 | 2,204 | ||||||

|

Selling, general and administrative |

8,630 | 8,556 | ||||||

|

Total operating costs and expenses |

10,556 | 10,760 | ||||||

|

Operating income |

1,976 | 3,003 | ||||||

|

Dividend income |

281 | 281 | ||||||

|

Interest income |

60 | 26 | ||||||

|

Interest expense |

(431 | ) | (541 | ) | ||||

|

Other income |

5,400 | 4,259 | ||||||

|

Net income before taxes |

7,286 | 7,028 | ||||||

|

Income tax expense |

(2,475 | ) | (2,565 | ) | ||||

|

Consolidated net income |

4,811 | 4,463 | ||||||

|

Non-controlling interest |

(59 | ) | (97 | ) | ||||

|

Net income and comprehensive income applicable to common stockholders |

$ | 4,752 | $ | 4,366 | ||||

|

Basic net income per share |

$ | 0.18 | $ | 0.17 | ||||

|

Diluted net income per share |

$ | 0.18 | $ | 0.17 | ||||

|

Shares used in per share computation |

||||||||

|

Basic |

26,452 | 25,670 | ||||||

|

Diluted |

27,081 | 26,212 | ||||||

See accompanying notes.

LANDEC CORPORATION

Consolidated StatementS of Cash Flows

(Unaudited)

(In thousands)

|

Three Months Ended |

||||||||

|

August 25, 2013 |

August 26, 2012 |

|||||||

|

Cash flows from operating activities: |

||||||||

|

Consolidated net income |

$ | 4,811 | $ | 4,463 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

|

Depreciation and amortization |

1,842 | 1,856 | ||||||

|

Stock-based compensation expense |

278 | 348 | ||||||

|

Tax benefit from stock-based compensation expense |

— | (505 | ) | |||||

|

Net loss on disposal of property and equipment |

46 | 180 | ||||||

|

Deferred taxes |

2,303 | 1,942 | ||||||

|

Change in investment in non-public company (fair market value) |

(5,400 | ) | (4,296 | ) | ||||

|

Changes in current assets and current liabilities: |

||||||||

|

Accounts receivable, net |

3,099 | 1,656 | ||||||

|

Accounts receivable, related party |

466 | 55 | ||||||

|

Income taxes receivable |

161 | 236 | ||||||

|

Inventories, net |

(476 | ) | (1,532 | ) | ||||

|

Prepaid expenses and other current assets |

40 | (260 | ) | |||||

|

Accounts payable |

(2,387 | ) | 4,080 | |||||

|

Accounts payable, related party |

(489 | ) | (243 | ) | ||||

|

Accrued compensation |

(129 | ) | (1,824 | ) | ||||

|

Other accrued liabilities |

993 | (1,435 | ) | |||||

|

Deferred revenue |

(620 | ) | 364 | |||||

|

Net cash provided by operating activities |

4,538 | 5,085 | ||||||

|

Cash flows from investing activities: |

||||||||

|

Purchases of property and equipment |

(4,345 | ) | (2,029 | ) | ||||

|

Purchase of marketable securities |

(1,417 | ) | (756 | ) | ||||

|

Proceeds from maturities of marketable securities |

1,665 | — | ||||||

|

Net cash used in investing activities |

(4,097 | ) | (2,785 | ) | ||||

|

Cash flows from financing activities: |

||||||||

|

Proceeds from sale of common stock |

250 | 202 | ||||||

|

Taxes paid by Company for stock swaps and RSUs |

(1,210 | ) | (49 | ) | ||||

|

Tax benefit from stock-based compensation expense |

— | 505 | ||||||

|

Earn out payment from Lifecore acquisition |

— | (9,650 | ) | |||||

|

Payments on long-term debt |

(1,383 | ) | (1,369 | ) | ||||

|

Payments on lines of credit |

(2,950 | ) | (4,166 | ) | ||||

|

Decrease in other assets |

31 | 99 | ||||||

|

Net cash used in financing activities |

(5,262 | ) | (14,428 | ) | ||||

|

Net decrease in cash and cash equivalents |

(4,821 | ) | (12,128 | ) | ||||

|

Cash and cash equivalents at beginning of period |

13,718 | 22,177 | ||||||

|

Cash and cash equivalents at end of period |

$ | 8,897 | $ | 10,049 | ||||

See accompanying notes.

LANDEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Organization, Basis of Presentation and Summary of Significant Accounting Policies

Organization

Landec Corporation and its subsidiaries (“Landec” or the “Company”) design, develop, manufacture and sell differentiated products for food and biomaterials markets and license technology applications to partners. The Company has two proprietary polymer technology platforms: 1) Intelimer® polymers, and 2) hyaluronan (“HA”) biopolymers. The Company sells specialty packaged branded Eat Smart® and GreenLine® and private label fresh-cut vegetables and whole produce to retailers, club stores and foodservice operators, primarily in the United States, Canada and Asia through its Apio, Inc. (“Apio”) subsidiary and sells HA-based biomaterials through its Lifecore Biomedical, Inc. (“Lifecore”) subsidiary. The Company’s HA biopolymers are proprietary in that they are specially formulated for specific customers to meet strict regulatory requirements. The Company’s polymer technologies, along with its customer relationships and trade names, are the foundation, and a key differentiating advantage upon which Landec has built its business.

Basis of Presentation

The accompanying unaudited consolidated financial statements of Landec have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and with the instructions for Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, all adjustments (consisting of normal recurring accruals) have been made which are necessary to present fairly the financial position at August 25, 2013 and the results of operations and cash flows for all periods presented. Although Landec believes that the disclosures in these financial statements are adequate to make the information presented not misleading, certain information normally included in financial statements and related footnotes prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted in accordance with the rules and regulations of the Securities and Exchange Commission. The accompanying financial data should be reviewed in conjunction with the audited financial statements and accompanying notes included in Landec's Annual Report on Form 10-K for the fiscal year ended May 26, 2013.

The results of operations for the three months ended August 25, 2013 are not necessarily indicative of the results that may be expected for an entire fiscal year because there is some seasonality in Apio’s food business, particularly, Apio’s Food Export business and the order patterns of Lifecore’s customers which may lead to significant fluctuations in Landec’s quarterly results of operations.

Basis of Consolidation

The consolidated financial statements are presented on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles and include the accounts of Landec Corporation and its subsidiaries, Apio and Lifecore. All material inter-company transactions and balances have been eliminated.

Arrangements that are not controlled through voting or similar rights are reviewed under the guidance for variable interest entities (“VIEs”). A company is required to consolidate the assets, liabilities and operations of a VIE if it is determined to be the primary beneficiary of the VIE.

An entity is a VIE and subject to consolidation, if by design: a) the total equity investment at risk is not sufficient to permit the entity to finance its activities without additional subordinated financial support provided by any parties, including equity holders or b) as a group the holders of the equity investment at risk lack any one of the following three characteristics: (i) the power, through voting rights or similar rights to direct the activities of an entity that most significantly impact the entity’s economic performance, (ii) the obligation to absorb the expected losses of the entity, or (iii) the right to receive the expected residual returns of the entity. The Company reviewed the consolidation guidance and concluded that its partnership interest in Apio Cooling and its equity investments in non-public companies are not VIEs.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make certain estimates and judgments that affect the amounts reported in the financial statements and accompanying notes. The accounting estimates that require management’s most significant and subjective judgments include revenue recognition; sales returns and allowances; recognition and measurement of current and deferred income tax assets and liabilities; the assessment of recoverability of long-lived assets; the valuation of intangible assets and inventory; the valuation of investments; and the valuation and recognition of stock-based compensation.

These estimates involve the consideration of complex factors and require management to make judgments. The analysis of historical and future trends can require extended periods of time to resolve and is subject to change from period to period. The actual results may differ from management’s estimates.

Cash and Cash Equivalents

The Company records all highly liquid securities with three months or less from date of purchase to maturity as cash equivalents. Cash equivalents consist mainly of certificate of deposits (CDs), money market funds and U.S. Treasuries. The market value of cash equivalents approximates their historical cost given their short-term nature.

Marketable Securities

Short-term marketable securities consist of CDs that are FDIC insured and single A or better rated corporate and municipal bonds with original maturities of more than three months at the date of purchase regardless of the maturity date. The Company classifies all debt securities with readily determined market values as “available for sale.” The aggregate amount of CDs included in marketable securities at August 25, 2013 and May 26, 2013 was $854,000 and $701,000, respectively. The contractual maturities of the Company’s marketable securities that are due in less than one year represented $1.0 million and $1.3 million of its marketable securities as of August 25, 2013 and May 26, 2013, respectively. The contractual maturities of the Company’s marketable securities that are due in one to two years represented $251,000 and $251,000 of its marketable securities as of August 25, 2013 and May 26, 2013, respectively. Investments in marketable securities are carried at fair market value with unrealized gains and losses reported as other income. The cost of debt securities is adjusted for amortization of premiums and discounts to maturity. This amortization is recorded to interest income. Realized gains and losses on the sale of available-for-sale securities are also recorded to interest income. During the three months ended August 25, 2013 and August 26, 2012, the Company did not sell any marketable securities. The cost of securities sold is based on the specific identification method.

Financial Instruments

The Company’s financial instruments are primarily composed of marketable securities, commercial-term trade payables, grower advances, notes receivable and debt instruments. For short-term instruments, the historical carrying amount approximates the fair value of the instrument. The fair value of long-term debt and lines of credit approximates their carrying value. Fair values for long-term financial instruments not readily marketable are estimated based upon discounted future cash flows at prevailing market interest rates. Based on these assumptions, management believes the fair market values of the Company’s financial instruments are not materially different from their recorded amounts as of August 25, 2013 and May 26, 2013.

Investments in Non-Public Companies

The Company’s investment in Aesthetic Sciences Corporation (“Aesthetic Sciences”), which is reported as an investment in non-public company, non-fair value, in the accompanying Consolidated Balance Sheets, is carried at cost and adjusted for impairment losses. Since there is no readily available market value information, the Company periodically reviews this investment to determine if any other than temporary declines in value have occurred based on the financial stability and viability of Aesthetic Sciences.

On February 15, 2011, the Company made an investment in Windset Holdings 2010 Ltd., a Canadian corporation (“Windset”), which is reported as an investment in non-public company, fair value, in the accompanying Consolidated Balance Sheets as of August 25, 2013 and May 26, 2013. The Company has elected to account for its investment in Windset under the fair value option (see Note 4).

Intangible Assets

The Company’s intangible assets are comprised of customer relationships with a finite estimated useful life of twelve to thirteen years and trademarks, trade names and goodwill with indefinite lives.

Finite-lived intangible assets are reviewed for possible impairment whenever events or changes in circumstances occur that indicate that the carrying amount of an asset (or asset group) may not be recoverable. Indefinite lived intangible assets are reviewed for impairment at least annually, in accordance with accounting guidance. For non-goodwill indefinite-lived intangible assets, the Company performs a qualitative analysis in accordance with ASC 350-30-35. For goodwill, the Company performs a quantitative analysis in accordance with ASC 350-20-35.

Partial Self-Insurance on Employee Health Plan

The Company provides health insurance benefits to eligible employees under a self-insured plan whereby the Company pays actual medical claims subject to certain stop loss limits. We record self-insurance liabilities based on actual claims filed and an estimate of those claims incurred but not reported. Any projection of losses concerning the Company's liability is subject to a high degree of variability. Among the causes of this variability are unpredictable external factors such as inflation rates, changes in severity, benefit level changes, medical costs, and claims settlement patterns. This self-insurance liability is included in accrued liabilities and represents management's best estimate of the amounts that have not been paid as of August 25, 2013. It is reasonably possible that the expense the Company ultimately incurs could differ and we may need to adjust our future reserves.

Fair Value Measurements

The Company uses fair value measurement accounting for financial assets and liabilities and for financial instruments and certain other items measured at fair value. The Company has elected the fair value option for its investment in a non-public company (see Note 4). The Company has not elected the fair value option for any of its other eligible financial assets or liabilities.

The accounting guidance established a three-tier hierarchy for fair value measurements, which prioritizes the inputs used in measuring fair value as follows:

Level 1 – observable inputs such as quoted prices for identical instruments in active markets.

Level 2 – inputs other than quoted prices in active markets that are observable either directly or indirectly through corroboration with observable market data.

Level 3 – unobservable inputs in which there is little or no market data, which would require the Company to develop its own assumptions.

As of August 25, 2013, the Company held certain assets and liabilities that are required to be measured at fair value on a recurring basis, including marketable securities, interest rate swap and a minority interest investment in Windset.

The fair value of the Company’s marketable securities is determined based on observable inputs that are readily available in public markets or can be derived from information available in publicly quoted markets. Therefore, the Company has categorized its marketable securities as a Level 1 measurement.

The fair value of the Company’s interest rate swap is determined based on model inputs that can be observed in a liquid market, including yield curves, and is categorized as a Level 2 measurement.

The Company has elected the fair value option of accounting for its investment in Windset. The calculation of fair value utilizes significant unobservable inputs in the discounted cash flow models, including projected cash flows, growth rates and discount rates. As a result, the Company’s investment in Windset is considered to be a Level 3 measurement investment. The change in the fair market value of the Company’s investment in Windset for the three months ended August 25, 2013 was due to the Company’s 20.1% minority interest in the change in the fair market value of Windset during the period. In determining the fair value of the investment in Windset, the Company utilizes the following significant unobservable inputs in the discounted cash flow models:

|

At August 25, 2013 |

At May 26, 2013 | |||||||||

|

Revenue growth rates |

3% | to | 6% | 3% | to | 9% | ||||

|

Expense growth rates |

3% | to | 25% | 3% | to | 8% | ||||

|

Income tax rates |

15% | 15% | ||||||||

|

Discount rates |

16% | to | 22% | 18% | to | 28% | ||||

The revenue growth, expense growth and income tax rate assumptions, consider the Company's best estimate of the trends in those items over the discount period. The discount rate assumption takes into account the risk-free rate of return, the market equity risk premium and the company’s specific risk premium and then applies an additional discount for lack of liquidity of the underlying securities. The discounted cash flow valuation model used by the Company has the following sensitivity to changes in inputs and assumptions (in thousands):

|

Impact on value of Windset investment as of August 25, 2013 |

||||

|

10% increase in revenue growth rates |

$ | 1,700 | ||

|

10% increase in expense growth rates |

$ | (1,500 | ) | |

|

10% increase in income tax rates |

$ | (100 | ) | |

|

10% increase in discount rates |

$ | (1,500 | ) | |

Imprecision in estimating unobservable market inputs can affect the amount of gain or loss recorded for a particular position. The use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different estimate of fair value at the reporting date.

The following table summarizes the fair value of the Company’s assets and liabilities that are measured at fair value on a recurring basis, as of August 25, 2013 and May 26, 2013 (in thousands):

|

Fair Value at August 25, 2013 |

Fair Value at May 26, 2013 |

|||||||||||||||||||||||

|

Assets: |

Level 1 |

Level 2 |

Level 3 |

Level 1 |

Level 2 |

Level 3 |

||||||||||||||||||

|

Marketable securities |

$ | 1,297 | $ | - | $ | - | $ | 1,545 | $ | - | $ | - | ||||||||||||

|

Investment in private company |

- | - | 35,000 | - | - | 29,600 | ||||||||||||||||||

|

Total |

$ | 1,297 | $ | - | $ | 35,000 | $ | 1,545 | $ | - | $ | 29,600 | ||||||||||||

|

Liabilities: |

||||||||||||||||||||||||

|

Interest rate swap |

- | 123 | - | - | 163 | - | ||||||||||||||||||

|

Total |

$ | - | $ | 123 | $ | - | $ | - | $ | 163 | $ | - | ||||||||||||

Revenue Recognition

The Company recognizes revenue when the earnings process is complete, as evidenced by an agreement with the customer, transfer of title, and acceptance, if applicable, as well as fixed pricing and probable collectibility. The Company records pricing allowances, including discounts based on arrangements with customers, as a reduction to both accounts receivable and net revenue.

When a sales arrangement contains multiple elements, the Company allocates revenue to each element based on a selling price hierarchy. The relative selling price for a deliverable is based on its vendor-specific objective evidence (VSOE), if available, third-party evidence (TPE), if VSOE is not available, or estimated selling price, if neither VSOE nor TPE is available. The Company then recognizes revenue on each deliverable in accordance with its policies for product and service revenue recognition. The Company is not typically able to determine VSOE or TPE, and therefore, uses estimated selling prices to allocate revenue between the elements of the arrangement.

The Company limits the amount of revenue recognition for delivered elements to the amount that is not contingent on the future delivery of products or services or future performance obligations or subject to customer-specific cancellation rights. The Company evaluates each deliverable in an arrangement to determine whether they represent separate units of accounting. A deliverable constitutes a separate unit of accounting when it has stand-alone value, and for an arrangement that includes a general right of return relative to the delivered products or services, delivery or performance of the undelivered product or service is considered probable and is substantially controlled by the Company. The Company considers a deliverable to have stand-alone value if the product or service is sold separately by the Company or another vendor or could be resold by the customer. Further, the revenue arrangements generally do not include a general right of return relative to the delivered products. Where the aforementioned criteria for a separate unit of accounting are not met, the deliverable is combined with the undelivered element(s) and treated as a single unit of accounting for the purposes of allocation of the arrangement consideration and revenue recognition. The Company allocates the total arrangement consideration to each separable element of an arrangement based upon the relative selling price of each element. Allocation of the consideration is determined at arrangement inception on the basis of each unit’s relative selling price. In instances where the Company has not established fair value for any undelivered element, revenue for all elements is deferred until delivery of the final element is completed and all recognition criteria are met.

New Accounting Pronouncements

Unrecognized Tax Benefit

In July 2013, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update No. 2013-11, Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (a consensus of the FASB Emerging Issues Task Force) ("ASU 2013-11"), which provides that a liability related to an unrecognized tax benefit would be offset against a deferred tax asset for a net operating loss carryforward, a similar tax loss or a tax credit carryforward if such settlement is required or expected in the event the uncertain tax position is disallowed. In situations in which a net operating loss carryforward, a similar tax loss or a tax credit carryforward is not available at the reporting date under the tax law of the jurisdiction or the tax law of the jurisdiction does not require, and the entity does not intend to use, the deferred tax asset for such purpose, the unrecognized tax benefit will be presented in the financial statements as a liability and will not be combined with deferred tax assets. The amendments should be applied prospectively to all unrecognized tax benefits that exist at the effective date. Retrospective application is permitted. ASU 2013-11 is effective for fiscal years and interim periods beginning after December 15, 2013, with early adoption permitted. The Company has early adopted this standard and such adoption did not have a significant impact on the Company’s financial position or results of operations.

2. Acquisition of GreenLine Holding Company

On April 23, 2012 (the “GreenLine Acquisition Date”), Apio acquired all of the outstanding equity of GreenLine Holding Company (“GreenLine”) pursuant to a Stock Purchase Agreement (the “GreenLine Purchase Agreement”) in order to expand its product offerings and enter into new markets such as foodservice. GreenLine, headquartered in Bowling Green, Ohio, was a privately-held company and is the leading processor and marketer of value-added, fresh-cut green beans in North America. GreenLine has four processing plants one each in Ohio, Pennsylvania, Florida and California and distribution centers in New York and South Carolina.

Under the GreenLine Purchase Agreement, the aggregate consideration paid at closing consisted of $62.9 million in cash, including $4.7 million that is held in an escrow account until October 22, 2013 to secure Landec’s indemnification rights with respect to certain matters, including breaches of representations, warranties and covenants.

The acquisition date fair value of the total consideration transferred was $66.8 million, which consisted of the following (in thousands):

|

Cash |

$ | 62,900 | ||

|

Contingent consideration |

3,933 | |||

|

Total |

$ | 66,833 |

The assets and liabilities of GreenLine were recorded at their respective estimated fair values as of the date of the acquisition using generally accepted accounting principles for business combinations. The excess of the purchase price over the fair value of the net identifiable assets acquired has been allocated to goodwill. Goodwill represents a substantial portion of the acquisition proceeds because of the workforce in-place at acquisition and because of GreenLine’s long history and future prospects. Management believes that there is further growth potential by extending GreenLine’s product lines into new channels, such as club stores.

The following table summarizes the estimated fair values of GreenLine’s assets acquired and liabilities assumed and related deferred income taxes, effective April 23, 2012, the date the Company obtained control of GreenLine (in thousands).

|

Accounts receivable, net |

$ | 7,057 | ||

|

Inventories, net |

1,409 | |||

|

Property and equipment |

11,669 | |||

|

Other tangible assets |

306 | |||

|

Intangible assets |

43,500 | |||

|

Total identifiable assets acquired |

63,941 | |||

|

Accounts payable and other liabilities |

(8,391 | ) | ||

|

Deferred taxes |

(1,875 | ) | ||

|

Total liabilities assumed |

(10,266 | ) | ||

|

Net identifiable assets acquired |

53,675 | |||

|

Goodwill |

13,158 | |||

|

Net assets acquired |

$ | 66,833 |

The Company used a combination of the market and cost approaches to estimate the fair values of the GreenLine assets acquired and liabilities assumed.

Intangible Assets

The fair value of indefinite and finite-lived intangible assets was determined using a DCF model, under an income valuation methodology, based on management’s five-year projections of revenues, gross profits and operating profits by fiscal year and assumed a 40% effective tax rate for each year. Management took into account the historical trends of GreenLine and the industry categories in which GreenLine operates along with inflationary factors, current economic conditions, new product introductions, cost of sales, operating expenses, capital requirements and other relevant data when developing its projection. The Company believes that the level and timing of cash flows appropriately reflect market participant assumptions. The projected cash flows from these intangibles were based on key assumptions such as estimates of revenues and operating profits related to the intangibles over their respective forecast periods. The resultant cash flows were then discounted using a rate the Company believes is appropriate given the inherent risks associated with each intangible asset and reflect market participant assumptions.

The Company identified two intangible assets in connection with the GreenLine acquisition: trade names and trademarks valued at $36.0 million, which are considered to be indefinite life assets and therefore, will not be amortized; and customer base valued at $7.5 million with a thirteen year useful life. The trade name/trademark intangible asset was valued using the relief from royalty valuation method and the customer relationship intangible asset was valued using the distributor method.

Goodwill

The excess of the consideration transferred over the fair values assigned to the assets acquired and liabilities assumed was $13.2 million on the closing date, which represents the goodwill amount resulting from the acquisition which can be attributable to GreenLine’s long history, future prospects and the expected operating synergies from combining GreenLine with Apio’s fresh-cut, value-added vegetable business. None of the goodwill is expected to be deductible for income tax purposes. The Company will test goodwill for impairment on an annual basis or sooner, if indicators of impairment are present.

Deferred Tax Liabilities

The $1.9 million of net deferred tax liabilities resulting from the acquisition was primarily related to the difference between the book basis and tax basis of the intangible assets and net operating losses that were assumed by the Company in the acquisition.

“

3. Sale of Landec Ag

On June 24, 2012, Landec entered into a stock purchase agreement and two licensing agreements (see Note 5) with INCOTEC® Coating and Seed Technology Companies (“INCOTEC”), a leading provider of seed and coating technology products and services to the seed industry.

In the stock purchase agreement, Landec sold its equity interest in its seed subsidiary, Landec Ag LLC, to INCOTEC for $600,000, which resulted in a gain of $400,000. Under accounting guidance, because the stock purchase agreement was entered into at the same time the license agreements were consummated (a multiple element agreement), a portion of the gain, or $300,000, has been deferred and will be recognized as revenue monthly from the sale date over the seven year life of the Pollinator Plus® license agreement (see Note 5). The remaining $100,000 of the gain was recognized during the first quarter of fiscal year 2013.

4. Investments in non-public companies

In December 2005, Landec entered into a licensing agreement with Aesthetic Sciences for the exclusive rights to use Landec's Intelimer® materials technology for the development of dermal fillers worldwide under the agreement. The Company received shares of preferred stock in exchange for the license with a valuation of $1.8 million. Aesthetic Sciences sold the rights to its Smartfil™ Injector System on July 16, 2010. Landec has evaluated its investment in Aesthetic Sciences for impairment, utilizing a discounted cash flow analysis under the terms of the purchase agreement. Based on the terms of the sale, the Company determined that its investment was other than temporarily impaired and therefore, recorded an impairment charge of $1.0 million as of May 30, 2010. The Company’s carrying value of its investment in Aesthetic Sciences is $793,000 as of August 25, 2013 and May 26, 2013. No additional impairment has been determined for the Company’s investment in Aesthetic Sciences.

On February 15, 2011, Apio entered into a share purchase agreement (the “Windset Purchase Agreement”) with Windset. Pursuant to the Windset Purchase Agreement, Apio purchased 150,000 senior preferred shares for $15 million and 201 common shares for $201 that were issued by Windset (the “Purchased Shares”). The Company’s common shares represent a 20.1% interest in Windset. The non-voting senior preferred shares yield a cash dividend of 7.5% annually. The dividend is payable within 90 days of each anniversary of the execution of the Windset Purchase Agreement and the first two dividend payments of $1.1 million were made in May 2012 and May 2013. The Windset Purchase Agreement includes a put and call option, which can be exercised on the sixth anniversary of the Windset Purchase Agreement whereby Apio can exercise the put to sell its Purchased Shares to Windset, or Windset can exercise the call to purchase the Purchased Shares from Apio, in either case, at a price equal to 20.1% of the appreciation in the fair market value of Windset from the date of the Company’s investment through the put and call date, plus the purchase price of the Purchased Shares. Under the terms of the arrangement with Windset, the Company is entitled to designate one of five members on the Board of Directors of Windset.

The investment in Windset does not qualify for equity method accounting as the investment does not meet the criteria of in-substance common stock due to returns through the annual dividend on the non-voting senior preferred shares that are not available to the common stock holders. As the put and call options require the Purchased Shares to be put or called in equal proportions, the Company has deemed that the investment, in substance, should be treated as a single security for purposes of accounting. The Company has adopted fair value option in the accounting for its investment in Windset effective on the acquisition date. The fair value of the Company’s investment in Windset utilizes significant unobservable inputs in the discounted cash flow models, including projected cash flows, revenue/expense growth rates and discount rates (see Note 1) and is therefore considered a Level 3 investment for fair value measurement purposes. The Company believes that reporting its investment at fair value provides its investors with useful information on the performance of the Company’s investment and the anticipated appreciation in value as Windset expands its business.

The fair value of the Company’s investment in Windset was determined utilizing a discounted cash flow model based on projections developed by Windset, and considers the put and call conversion options. These features impact the duration of the cash flow utilized to derive the estimated fair value of the investment. Assumptions included in the discounted cash flow model will be evaluated quarterly based on Windset’s actual and projected operating results to determine the change in fair value.

During both the three months ended August 25, 2013 and August 26, 2012, the Company recorded $281,000 in dividend income. The change in the fair market value of the Company’s investment in Windset for the three months ended August 25, 2013 and August 26, 2012 was $5.4 million and $4.3 million, respectively, and is included in other income in the Consolidated Statements of Comprehensive Income.

The Company also entered into an exclusive license agreement with Windset, which was executed in June 2010, prior to contemplation of Apio’s investment in Windset (see Note 5).

5. Collaborative Agreements

INCOTEC

In connection with the sale of Landec Ag to INCOTEC on June 24, 2012 (see Note 3), Landec entered into a seven-year exclusive technology license and polymer supply agreement with INCOTEC for the use of Landec’s Intellicoat® polymer seed coating technology for male inbred corn which is sold under the Pollinator Plus label. This license does not include the use of Intellicoat for the controlled release of an active ingredient for agricultural applications which was retained by Landec. Landec will be the exclusive supplier of Pollinator Plus polymer to INCOTEC during the term of the license agreement. Landec will receive a royalty equal to 20% of the revenues realized by INCOTEC from the sale of or sublicense of Pollinator Plus coatings during the first four years of the agreement and 10% for the last three years of the agreement.

On June 24, 2012, Landec also entered into a five-year exclusive technology license and polymer supply agreement with INCOTEC for the joint development of new polymer and unique coatings for use in seed treatment formulations. In this agreement, Landec will receive a value share which will be mutually agreed to by both parties prior to each application being developed.

Air Products

In March 2006, Landec entered into an exclusive license and research and development agreement with Air Products and Chemicals, Inc. (“Air Products”). In accordance with the agreement, Landec receives 40% of the direct profit generated from the sale of products by Air Products occurring after April 1, 2007, that incorporate Landec’s Intelimer materials.

Chiquita

The agreement with Chiquita has been renewed through December 2016 and requires Chiquita to pay annual gross profit minimums to Landec in order for Chiquita to maintain its exclusive license for bananas. Under the terms of the agreement, Chiquita must notify Landec before December 1st of each year whether it is going to maintain its exclusive license for the following calendar year and thus agree to pay the minimums for that year. Landec was notified in November 2012 of Chiquita’s desire to not maintain its exclusive license for calendar year 2013 and thus will not be required to pay the minimum gross profit for calendar year 2013. As a result, the agreement has reverted to a non-exclusive agreement in which Chiquita will pay the Company for membranes purchased and the Company is now entitled to sell its BreatheWay packaging technology for bananas to others.

Windset

In June 2010, Apio entered into an exclusive license agreement with Windset to allow for the use of Landec’s proprietary breathable packaging to extend the shelf life of greenhouse grown cucumbers, peppers and tomatoes (“Exclusive Products”). In accordance with the agreement, Apio received and recorded a one-time upfront research and development fee of $100,000 and will receive license fees equal to 3% of net revenue of the Exclusive Products utilizing the proprietary breathable packaging technology, with or without the BreatheWay® trademark. The ongoing license fees are subject to annual minimums of $150,000 for each of the three types of exclusive product as each is added to the agreement. As of August 25, 2013, two products have been added to the agreement.

6. Stock-Based Compensation

In the three months ended August 25, 2013, the Company recognized stock-based compensation expense of $278,000 or $0.01 per basic and diluted share, which included $170,000 for restricted stock unit awards and $108,000 for stock option grants. In the three months ended August 26, 2012, the Company recognized stock-based compensation expense of $348,000 or $0.01 per basic and diluted share, which included $157,000 for restricted stock unit awards and $191,000 for stock option grants.

The following table summarizes the stock-based compensation by income statement line item:

|

Three Months Ended August 25, 2013 |

Three Months Ended August 26, 2012 |

|||||||

|

Research and development |

$ | 14,000 | $ | 110,000 | ||||

|

Sales, general and administrative |

264,000 | 238,000 | ||||||

|

Total stock-based compensation |

$ | 278,000 | $ | 348,000 | ||||

As of August 25, 2013, there was $3.1 million of total unrecognized compensation expense related to unvested equity compensation awards granted under the Landec incentive stock plans. Total expense is expected to be recognized over the weighted-average period of 2.7 years for stock options and 2.3 years for restricted stock unit awards.

7. Diluted Net Income Per Share

The following table sets forth the computation of diluted net income per share (in thousands, except per share amounts):

|

Three Months Ended August 25, 2013 |

Three Months Ended August 26, 2012 |

|||||||

|

Numerator: |

||||||||

|

Net income applicable to Common Stockholders |

$ | 4,752 | $ | 4,366 | ||||

|

Denominator: |

||||||||

|

Weighted average shares for basic net income per share |

26,452 | 25,670 | ||||||

|

Effect of dilutive securities: |

||||||||

|

Stock options and restricted stock units |

629 | 542 | ||||||

|

Weighted average shares for diluted net income per share |

27,081 | 26,212 | ||||||

|

Diluted net income per share |

$ | 0.18 | $ | 0.17 | ||||

For the three months ended August 25, 2013 and August 26, 2012, the computation of the diluted net income per share excludes the impact of options to purchase 256,264 shares and 277,489 shares of Common Stock, respectively, as such impacts would be antidilutive for these periods.

8. Income Taxes

The provision for income taxes for the three months ended August 25, 2013 was $2.5 million. The effective tax rate for the three months ended August 25, 2013 was 34%, compared to 37% for the first quarter of fiscal year 2013. The effective tax rate for the three months ended August 25, 2013 differs from the statutory federal income tax rate of 35% as a result of several factors, including state taxes, domestic manufacturing deductions, non-deductible stock-based compensation expense and the benefit of federal and state research and development credits.

As of August 25, 2013 and May 26, 2013, the Company had unrecognized tax benefits of approximately $1.0 million. Included in the balance of unrecognized tax benefits as of August 25, 2013 and May 26, 2013 is approximately $819,000 and $807,000, respectively, of tax benefits that, if recognized, would result in an adjustment to the Company’s effective tax rate. The Company does not expect its unrecognized tax benefits to change significantly within the next twelve months.

The Company has decided to classify interest and penalties related to uncertain tax positions as a component of its provision for income taxes. The Company has accrued an insignificant amount of interest and penalties relating to the income tax on the unrecognized tax benefits as of August 25, 2013 and May 26, 2013.

Due to tax attribute carryforwards, the Company is subject to examination for tax years 1997 forward for U.S. tax purposes. The Company is also subject to examination in various state jurisdictions for tax years 1998 forward, none of which were individually material.

9. Inventories

Inventories are stated at the lower of cost (first-in, first-out method) or market and consisted of the following (in thousands):

|

August 25, 2013 |

May 26, 2013 |

|||||||

|

Finished goods |

$ | 12,825 | $ | 11,297 | ||||

|

Raw materials |

8,778 | 9,290 | ||||||

|

Work in progress |

2,986 | 3,526 | ||||||

|

Total |

$ | 24,589 | $ | 24,113 |

10. Debt

Long-term debt consists of the following (in thousands):

|

August 25, 2013 |

May 26, 2013 |

|||||||

|

Real estate loan agreement with General Electric Capital Corporation (“GE Capital”); due in monthly principal and interest payments of $133,060 through May 1, 2022 with interest based on a fixed rate of 4.02% per annum |

$ | 16,837 | $ | 17,065 | ||||

|

Capital equipment loan with GE Capital; due in monthly principal and interest payments of $175,356 through May 1, 2019 with interest based on a fixed rate of 4.39% per annum |

10,675 | 11,080 | ||||||

|

Term note with BMO Harris Bank N.A. (“BMO Harris”); due in monthly payments of $250,000 through May 23, 2016 with interest payable monthly at LIBOR plus 2% per annum |

8,250 | 9,000 | ||||||

|

Industrial revenue bonds (“IRBs”) issued by Lifecore; due in annual payments through 2020 with interest at a variable rate set weekly by the bond remarketing agent (0.26% and 0.38% at August 25, 2013 and May 26, 2013, respectively) |

3,160 | 3,160 | ||||||

|

Total |

38,922 | 40,305 | ||||||

|

Less current portion |

(5,961 | ) | (5,933 | ) | ||||

|

Long-term portion |

$ | 32,961 | $ | 34,372 | ||||

In addition to entering into the GE Capital real estate and equipment loans mentioned above, on April 23, 2012 in connection with the acquisition of GreenLine, Apio also entered into a five-year, $25.0 million asset-based working capital revolving line of credit, with an interest rate of LIBOR plus 2%, with availability based on the combination of the eligible accounts receivable and eligible inventory (availability was $14.4 million at August 25, 2013). Apio’s revolving line of credit has an unused fee of 0.375% per annum. At August 25, 2013 and May 26, 2013, Apio had $1.1 million and $4.0 million, respectively, outstanding under its revolving line of credit.

The GE Capital real estate, equipment and line of credit agreements (collectively the “GE Debt Agreements”) are secured by liens on all of the property of Apio and its subsidiaries. The GE Debt Agreements contain customary events of default under which obligations could be accelerated or increased. The GE Debt Agreements are guaranteed by Landec and Landec has pledged its equity interest in Apio as collateral under the agreements. The GE Debt Agreements contain customary covenants, such as limitations on the ability to (1) incur indebtedness or grant liens or negative pledges on Apio’s assets; (2) make loans or other investments; (3) pay dividends, sell stock or repurchase stock or other securities; (4) sell assets; (5) engage in mergers; (6) enter into sale and leaseback transactions; and (7) make changes in Apio’s corporate structure. In addition, Apio must maintain a minimum fixed charge coverage ratio of not less than 1.10 to 1.0. Apio was in compliance with all financial covenants as of August 25, 2013. Unamortized loan origination fees for the GE Debt Agreements were $1.1 million and $1.2 million at August 25, 2013 and May 26, 2013, respectively, and are included in other assets in the Consolidated Balance Sheets. Amortization of loan origination fees recorded to interest expense for the three months ended August 25, 2013 and August 26, 2012 were $47,000 and $46,000, respectively.

On May 23, 2012, Lifecore entered into two financing agreements with BMO Harris and/or its affiliates, collectively (the “Lifecore Loan Agreements”):

|

1) |

A Credit and Security Agreement (the “Credit Agreement”) which includes (a) a one-year, $10.0 million asset-based working capital revolving line of credit, with an interest rate of LIBOR plus 1.85%, with availability based on the combination of Lifecore’s eligible accounts receivable and inventory balances (availability was $8.0 million at August 25, 2013) and with no unused fee (at August 25, 2013 and May 26, 2013, no amounts were outstanding under the line of credit) and (b) a $12.0 million term loan which matures in four years due in monthly payments of $250,000 with interest payable monthly based on a variable interest rate of LIBOR plus 2% (the “Term Loan”). |

|

2) |

A Reimbursement Agreement pursuant to which BMO Harris caused its affiliate Bank of Montreal to issue an irrevocable letter of credit in the amount of $3.5 million (the “Letter of Credit”) which is securing the IRB described below. |

The obligations of Lifecore under the Lifecore Loan Agreements are secured by liens on all of the property of Lifecore. The Lifecore Loan Agreements contain customary covenants, such as limitations on the ability to (1) incur indebtedness or grant liens or negative pledges on Lifecore’s assets; (2) make loans or other investments; (3) pay dividends or repurchase stock or other securities; (4) sell assets; (5) engage in mergers; (6) enter into sale and leaseback transactions; (7) adopt certain benefit plans; and (8) make changes in Lifecore’s corporate structure. In addition, under the Credit Agreement, Lifecore must maintain (a) a minimum fixed charge coverage ratio of 1.10 to 1.0 and a minimum quick ratio of 1.25 to 1.00, both of which must be satisfied as of the end of each fiscal quarter commencing with the fiscal quarter ending August 26, 2012 and (b) a minimum tangible net worth of $29,000,000, measured as of May 26, 2013, and as of the end of each fiscal year thereafter. Lifecore was in compliance with all financial covenants as of August 25, 2013. Unamortized loan origination fees for the Lifecore Loan Agreements were $136,000 and $149,000 at August 25, 2013 and May 26, 2013, respectively, and are included in other assets in the Consolidated Balance Sheets. Amortization of loan origination fees recorded to interest expense for both three months ended August 25, 2013 and August 26, 2012 was $13,000.

The market value of the Company’s debt approximates its recorded value as the interest rate on each debt instrument approximates current market rates.

The Term Loan was used to repay Lifecore’s former credit facility with Wells Fargo Bank, N.A. (“Wells Fargo”). The Letter of Credit (which replaces a letter of credit previously provided by Wells Fargo) provides liquidity

and credit support for the IRBs.

On August 19, 2004, Lifecore issued variable rate industrial revenue bonds (“IRBs”) which were assumed by Landec in the acquisition of Lifecore. The IRBs are collateralized by a bank letter of credit which is secured by a first mortgage on the Company’s facility in Chaska, Minnesota. In addition, the Company pays an annual remarketing fee equal to 0.125% and an annual letter of credit fee of 0.75%. The maturities on the IRBs are held in a sinking fund account, recorded in other assets in the accompanying Consolidated Balance Sheets, and are paid out each year on September 1st.

11. Derivative Financial Instruments

In May 2010, the Company entered into a five-year interest rate swap agreement under its prior credit agreement with Wells Fargo, which expires on April 30, 2015. The interest rate swap was originally designated as a cash flow hedge of future interest payments of LIBOR and had a notional amount of $20 million. As a result of the interest rate swap transaction, the Company fixed for a five-year period the interest rate at 4.24% subject to market based interest rate risk on $20 million of borrowings under the credit agreement with Wells Fargo. The Company’s obligations under the interest rate swap transaction as to the scheduled payments were guaranteed and secured on the same basis as its obligations under the credit agreement with Wells Fargo at the time the agreement was consummated. Upon entering into the new Term Loan with BMO Harris, the Company used the proceeds from that loan to pay off the Wells Fargo credit facility. The swap with Wells Fargo was not terminated upon the extinguishment of the debt with Wells Fargo. As a result of extinguishing the debt with Wells Fargo as of May 23, 2012, the swap was no longer an effective hedge and therefore, the fair value of the swap at the time the debt was extinguished of $347,000 was reversed from other comprehensive income and recorded in other expense during fiscal year 2012. The fair value of the swap arrangement as of August 25, 2013 and May 26, 2013 was $123,000 and $163,000, respectively, and is included in other accrued liabilities in the accompanying Consolidated Balance Sheets.

12. Related Party

The Company provides cooling and distribution services to both a farm and Beachside Produce LLC ("Beachside"), a commodity produce distributor, in which the Chairman of Apio has a farming and ownership interest, respectively. During the three months ended August 25, 2013 and August 26, 2012, the Company recognized revenues of $580,000 and $953,000, respectively, which have been included in product sales and in service revenues in the accompanying Consolidated Statements of Comprehensive Income, from the sale of products and providing cooling services to these parties. The related receivable balances of $205,000 and $671,000 are included in accounts receivable in the accompanying Consolidated Balance Sheets as of August 25, 2013 and May 26, 2013, respectively.

Additionally, unrelated to the revenue transactions above, the Company purchases produce from Beachside, a farm in which the Chairman of Apio has an ownership interest, and Windset for sale to third parties. During the three months ended August 25, 2013 and August 26, 2012, the Company recognized cost of product sales of $1.9 million and $2.2 million, respectively, which have been included in cost of product sales in the accompanying Consolidated Statements of Comprehensive Income, from the sale of products purchased from these parties. The related accounts payable of $297,000 and $786,000 are included in related party accounts payable in the accompanying Consolidated Balance Sheets as of August 25, 2013 and May 26, 2013, respectively.

All related party transactions are monitored quarterly by the Company and approved by the Audit Committee of the Board of Directors.

13. Stockholders’ Equity

During the three months ended August 25, 2013, the Company granted options to purchase 291,500 shares of common stock and 128,631 of restricted stock unit awards.

As of August 25, 2013 the Company has reserved 1.7 million shares of Common Stock for future issuance under its current and former equity plans.

On July 14, 2010, the Company announced that the Board of Directors of the Company had approved the establishment of a stock repurchase plan authorizing the repurchase of up to $10 million of the Company’s Common Stock. The Company may repurchase its common stock from time to time in open market purchases or in privately negotiated transactions. The timing and actual number of shares repurchased is at the discretion of management of the Company and will depend on a variety of factors, including stock price, corporate and regulatory requirements, market conditions, the relative attractiveness of other capital deployment opportunities and other corporate priorities. The stock repurchase program does not obligate Landec to acquire any amount of its common stock and the program may be modified, suspended or terminated at any time at the Company's discretion without prior notice. During the three months ended August 25, 2013, the Company did not purchase any shares on the open market.

Consolidated Statements of Changes in Stockholders’ Equity (in thousands, except share amounts):

|

August 25, 2013 |

||||

|

Common Stock Shares |

||||

|

Balance at May 26, 2013 |

26,402,247 | |||

|

Stock options exercised, net of shares tendered |

36,836 | |||

|

Vested restricted stock units, net of shares tendered |

39,726 | |||

|

Balance at August 25, 2013 |

26,478,809 | |||

|

Common Stock |

||||

|

Balance at May 26, 2013 |

$ | 26 | ||

|

Stock options exercised, net of shares tendered |

— | |||

|

Vested restricted stock units, net of shares tendered |

— | |||

|

Balance at August 25, 2013 |

$ | 26 | ||

|

Additional Paid-in Capital |

||||

|

Balance at May 26, 2013 |

$ | 126,258 | ||

|

Stock options exercised, net of shares tendered |

250 | |||

|

Vested restricted stock units, net of shares tendered |

— | |||

|

Taxes incurred by Company for RSUs vested |

(284 | ) | ||

|

Stock-based compensation expense |

278 | |||

|

Tax-benefit from stock based compensation expense |

— | |||

|

Balance at August 25, 2013 |

$ | 126,502 | ||

|

Retained Earnings |

||||

|

Balance at May 26, 2013 |

$ | 52,409 | ||

|

Net income |

4,752 | |||

|

Balance at August 25, 2013 |

$ | 57,161 | ||

|

Non controlling Interest |

||||

|

Balance at May 26, 2013 |

$ | 1,721 | ||

|

Non controlling interest in net income |

59 | |||

|

Distributions to non controlling interest |

— | |||

|

Balance at August 25, 2013 |

$ | 1,780 | ||

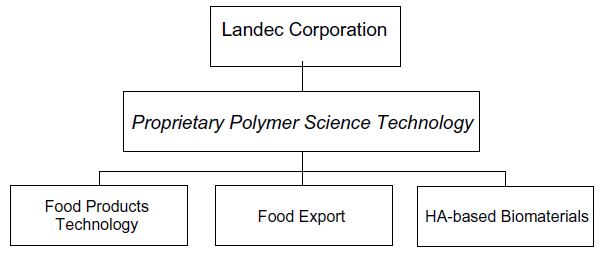

14. Business Segment Reporting

The Company manages its business operations through three strategic business units. Based upon the information reported to the chief operating decision maker, who is the Chief Executive Officer, the Company has the following reportable segments: the Food Products Technology segment, the Food Export segment and the Hyaluronan-based Biomaterials segment.

The Food Products Technology segment markets and packs specialty packaged whole and fresh-cut fruit and vegetables, the majority of which incorporate the BreatheWay specialty packaging for the retail grocery, club store and food services industry. In addition, the Food Products Technology segment sells BreatheWay packaging to partners for non-vegetable products. The Food Export segment consists of revenues generated from the purchase and sale of primarily whole commodity fruit and vegetable products to Asia and domestically. The HA-based Biomaterials segment sells products utilizing hyaluronan, a naturally occurring polysaccharide that is widely distributed in the extracellular matrix of connective tissues in both animals and humans, for medical use primarily in the Ophthalmic, Orthopedic and Veterinary markets. Corporate licenses Landec’s patented Intellicoat® seed coatings to the farming industry and licenses the Company’s Intelimer polymers for personal care products and other industrial products. The Corporate segment also includes general and administrative expenses, non-Food Products Technology and non HA-based Biomaterials interest income and income tax expenses. Beginning in fiscal year 2013, the Food Products Technology, the Food Export and the Hyaluronan-based Biomaterials segments include charges for corporate services and tax sharing allocated from the Corporate segment. All of the assets of the Company are located within the United States of America. The Company’s international sales were as follows (in millions):

|

Three Months Ended |

||||||||

|

August 25, 2013 |

August 26, 2012 |

|||||||

|

Taiwan |

$ | 12.0 | $ | 12.9 | ||||

|

Canada |

$ | 9.4 | $ | 6.2 | ||||

|

Japan |

$ | 3.2 | $ | 3.1 | ||||

|

Indonesia |

$ | 2.5 | $ | 6.1 | ||||

|

Belgium |

$ | 1.2 | $ | 3.0 | ||||

|

All Other Countries |

$ | 6.9 | $ | 5.0 | ||||

Operations and identifiable assets by business segment consisted of the following (in thousands):

|

Three Months Ended August 25, 2013 |

Food Products Technology |

Food Export |

HA-based Biomaterials |

Corporate |

TOTAL |

|||||||||||||||

|

Net sales |

$ | 79,436 | $ | 21,398 | $ | 8,587 | $ | 58 | $ | 109,479 | ||||||||||

|

International sales |

$ | 9,478 | $ | 21,389 | $ | 4,377 | $ | — | $ | 35,244 | ||||||||||

|

Gross profit |

$ | 8,881 | $ | 1,205 | $ | 2,388 | $ | 58 | $ | 12,532 | ||||||||||

|

Net income (loss) |

$ | 7,266 | $ | 276 | $ | (376 | ) | $ | (2,414 | ) | $ | 4,752 | ||||||||

|

Depreciation and amortization |

$ | 1,222 | $ | 1 | $ | 584 | $ | 35 | $ | 1,842 | ||||||||||

|

Dividend Income |

$ | 281 | $ | — | $ | — | $ | — | $ | 281 | ||||||||||

|

Interest income |

$ | 4 | $ | — | $ | 56 | $ | — | $ | 60 | ||||||||||

|

Interest expense |

$ | 376 | $ | — | $ | 55 | $ | — | $ | 431 | ||||||||||

|

Income tax expense |

$ | 505 | $ | 78 | $ | (106 | ) | $ | 1,998 | $ | 2,475 | |||||||||

|

Three Months Ended August 26, 2012 |

||||||||||||||||||||

|

Net sales |

$ | 68,631 | $ | 25,358 | $ | 7,973 | $ | 112 | $ | 102,074 | ||||||||||

|

International sales |

$ | 6,223 | $ | 25,311 | $ | 4,802 | $ | — | $ | 36,336 | ||||||||||

|

Gross profit |

$ | 9,942 | $ | 1,343 | $ | 2,366 | $ | 112 | $ | 13,763 | ||||||||||

|

Net income (loss) |

$ | 5,916 | $ | 309 | $ | (312 | ) | $ | (1,547 | ) | $ | 4,366 | ||||||||

|

Depreciation and amortization |

$ | 1,236 | $ | 1 | $ | 583 | $ | 36 | $ | 1,856 | ||||||||||

|

Dividend Income |

$ | 281 | $ | — | $ | — | $ | — | $ | 281 | ||||||||||

|

Interest income |

$ | 1 | $ | — | $ | 25 | $ | — | $ | 26 | ||||||||||

|

Interest expense |

$ | 455 | $ | — | $ | 86 | $ | — | $ | 541 | ||||||||||

|

Income tax expense |

$ | 1,972 | $ | 103 | $ | (104 | ) | $ | 594 | $ | 2,565 | |||||||||

During the three months ended August 25, 2013 and August 26, 2012, sales to the Company’s top five customers accounted for 44% and 36%, respectively, of revenues with the Company’s top two customers from the Food Products Technology segment accounting for 20% and 12% for the three months ended August 25, 2013 and 12% and 12% for the three months ended August 26, 2012, respectively. The Company expects that, for the foreseeable future, a limited number of customers may continue to account for a significant portion of its net revenues.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the unaudited consolidated financial statements and accompanying notes included in Part I-Item 1 of this Form 10-Q and the audited consolidated financial statements and accompanying notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in Landec’s Annual Report on Form 10-K for the fiscal year ended May 26, 2013.

Except for the historical information contained herein, the matters discussed in this report are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties include, without limitation, those mentioned in this Form 10-Q and those mentioned in Landec’s Annual Report on Form 10-K for the fiscal year ended May 26, 2013. Landec undertakes no obligation to update or revise any forward-looking statements in order to reflect events or circumstances that may arise after the date of this report.

Critical Accounting Policies and Use of Estimates

There have been no material changes to the Company's critical accounting policies which are included and described in the Form 10-K for the fiscal year ended May 26, 2013 filed with the Securities and Exchange Commission on August 6, 2013.

The Company

Landec Corporation and its subsidiaries (“Landec” or the “Company”) design, develop, manufacture and sell differentiated products for food and biomaterials markets and license technology applications to partners. The Company has two proprietary polymer technology platforms: 1) Intelimer® polymers, and 2) hyaluronan (“HA”) biopolymers. The Company’s HA biopolymers are proprietary in that they are specially formulated for specific customers to meet strict regulatory requirements. The Company’s polymer technologies, along with its customer relationships and trade names, are the foundation, and a key differentiating advantage upon which Landec has built its business. The Company sells specialty packaged branded Eat Smart and GreenLine and private label fresh-cut vegetables and whole produce to retailers, club stores and foodservice operators, primarily in the United States, Canada and Asia through its Apio, Inc. (“Apio”) subsidiary and sells HA-based biomaterials through its Lifecore Biomedical, Inc. (“Lifecore”) subsidiary.

Landec has three core businesses – Food Products Technology, Food Export and HA-based Biomaterials – each of which is described below.

Landec’s wholly-owned subsidiary, Apio, Inc. (“Apio”), operates our Food Products Technology business, which combines our proprietary BreatheWay® food packaging technology with the capabilities of a large national food supplier and value-added produce processor which sells products under the Eat Smart® and GreenLine® brands. In Apio’s value-added operations, produce is processed by trimming, washing, mixing, and packaging into bags and trays that in most cases incorporate Landec’s BreatheWay membrane technology. The BreatheWay membrane increases shelf life and reduces shrink (waste) for retailers and, for certain products, eliminates the need for ice during the distribution cycle and helps to ensure that consumers receive fresh produce by the time the product makes its way through the supply chain. Apio also licenses the BreatheWay technology to partners such as Chiquita Brands International, Inc. (“Chiquita”) for packaging and distribution of bananas and to Windset Holding 2010 Ltd., a Canadian corporation (“Windset”), for packaging of greenhouse grown cucumbers, peppers and tomatoes.

Apio also operates the Food Export business through its subsidiary, Cal Ex Trading Company (“Cal-Ex”). The Export business purchases and sells whole fruit and vegetable products predominantly to Asian markets.

Landec’s wholly-owned subsidiary, Lifecore Biomedical, Inc. (“Lifecore”), operates our HA-based Biomaterials business and is principally involved in the development and manufacture of products utilizing hyaluronan, a naturally occurring polysaccharide that is widely distributed in the extracellular matrix of connective tissues in animals including humans. Lifecore’s products are sold worldwide for use primarily in three medical areas: (1) Ophthalmic, (2) Orthopedic and (3) Veterinary. In addition, Lifecore provides specialized aseptic fill and finish services in a cGMO validated manufacturing facility for supplying commercial, clinical and pre-clinical products. Lifecore also supplies limited quantities of HA, and raw materials to customers pursuing other medical applications, such as aesthetic surgery, medical device coatings, tissue engineering and pharmaceuticals. Lifecore leverages its fermentation process to manufacture premium, pharmaceutical-grade HA, and uses its aseptic filling capabilities to provide private-labeled HA finished goods to its customers. Furthermore, Lifecore manufactures and sells it own HA-based finished goods in several foreign markets. Lifecore is known as a premium supplier of HA with expertise in formulation and filling of difficult to handle products. Its name recognition allows Lifecore to attract new customers and sell new products and offer its services with a minimal marketing and sales infrastructure.

Landec also develops proprietary polymer technologies and applies them in a wide range of applications including seed coatings and treatments, controlled release systems, personal care products and pressure sensitive adhesives. These applications are commercialized through partnerships with third parties resulting in licensing and royalty revenues. For example, INCOTEC Holding North America, Inc. (“INCOTEC”) has an exclusive license to our Intellicoat® seed coating and treatments technology, Air Products and Chemicals, Inc. (“Air Products”) has an exclusive license to our Intelimer polymers for personal care products and Nitta Corporation (“Nitta”) licenses Landec’s proprietary pressure sensitive adhesives for use in the manufacture of electronic components by their customers.

Landec was incorporated on October 31, 1986. We completed our initial public offering in 1996 and our Common Stock is listed on The NASDAQ Global Select Market under the symbol “LNDC.” Our principal executive offices are located at 3603 Haven Avenue, Menlo Park, California 94025 and our telephone number is (650) 306-1650.

Description of Core Business

Landec participates in three core business segments: Food Products Technology, Food Export and Hyaluronan-based Biomaterials.

Food Products Technology Business

Based in Guadalupe, California, Apio’s primary business is fresh-cut and whole value-added products primarily packaged in our proprietary BreatheWay packaging. The fresh-cut value-added products business markets a variety of fresh-cut and whole vegetables to the top retail grocery chains, club stores and food service operators. During the fiscal year ended May 26, 2013, Apio shipped approximately twenty-eight million cartons of produce to its customers throughout North America, primarily in the United States.

There are five major distinguishing characteristics of Apio that provide competitive advantages in the Food Products Technology market:

Value-Added Supplier: Apio has structured its business as a marketer and seller of branded and private label fresh-cut and whole value-added produce. It is focused on selling products under its Eat Smart and GreenLine brands and private label brands for its fresh-cut and whole value-added products. As retail grocery chains, club stores and food service operators consolidate, Apio is well positioned as a single source of a broad range of products.

Reduced Farming Risks: Apio reduces its farming risk by not taking ownership of farmland, and instead, contracts with growers for produce and during certain times of the year enters into joint ventures with growers for produce. The year-round sourcing of produce is a key component to the fresh-cut and whole value-added processing business.