UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended May 26, 2013, or

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period for _________ to _________.

Commission file number: 0-27446

LANDEC CORPORATION

(Exact name of registrant as specified in its charter)

Delaware 94-3025618 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification Number)

3603 Haven Avenue

Menlo Park, California 94025

(Address of principal executive offices)

Registrant's telephone number, including area code:

(650) 306-1650

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered Common Stock The NASDAQ Global Select Stock Market

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ___ No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ___ No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No ___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X No ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. __

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ___ |

Accelerated Filer X |

|

Non Accelerated Filer ___ |

Smaller Reporting Company ___ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ___ No X

The aggregate market value of voting stock held by non-affiliates of the Registrant was approximately $233,854,000 as of November 25, 2012, the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sales price on The NASDAQ Global Select Market reported for such date. Shares of Common Stock held by each officer and director and by each person who owns 10% or more of the outstanding Common Stock have been excluded from such calculation in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of July 19, 2013, there were 26,464,518 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its October 2013 Annual Meeting of Stockholders which statement will be filed not later than 120 days after the end of the fiscal year covered by this report, are incorporated by reference in Part III hereof.

LANDEC CORPORATION

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

Item No. |

Description |

Page |

|

Part I |

||

|

1. |

Business |

4 |

|

1A. |

Risk Factors |

17 |

|

1B. |

Unresolved Staff Comments |

24 |

|

2. |

Properties |

25 |

|

3. |

Legal Proceedings |

25 |

|

4. |

Mine Safety Disclosures |

25 |

|

Part II |

||

|

5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

26 |

|

6. |

Selected Financial Data |

26 |

|

7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

27 |

|

7A. |

Quantitative and Qualitative Disclosures about Market Risk |

46 |

|

8. |

Financial Statements and Supplementary Data |

46 |

|

9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

46 |

|

9A. |

Controls and Procedures |

46 |

|

9B. |

Other Information |

47 |

|

Part III |

||

|

10. |

Directors, Executive Officers and Corporate Governance |

48 |

|

11. |

Executive Compensation |

48 |

|

12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

48 |

|

13. |

Certain Relationships and Related Transactions, and Director Independence |

48 |

|

14. |

Principal Accountant Fees and Services |

48 |

|

Part IV |

||

|

15. |

Exhibits and Financial Statement Schedules |

49 |

PART I

Item 1. Business

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Words such as “projected,” “expects,” “believes,” “intends,” “assumes” and similar expressions are used to identify forward-looking statements. These statements are made based upon current expectations and projections about our business and assumptions made by our management and are not guarantees of future performance, nor do we assume any obligation to update such forward-looking statements after the date this report is filed. Our actual results could differ materially from those projected in the forward-looking statements for many reasons, including the risk factors listed in Item 1A. “Risk Factors” and the factors discussed below.

Corporate Overview

Landec Corporation and its subsidiaries (“Landec” or the “Company”) design, develop, manufacture and market differentiated products in food and biomedical materials markets and license technology applications to partners. The Company has two proprietary polymer technology platforms: 1) Intelimer® polymers, and 2) hyaluronan (“HA”) biopolymers. The Company’s materials are generally proprietary in that they are specially formulated for specific customers to meet specific commercial applications and in some cases, specific regulatory requirements. The Company’s polymer technologies, along with its customer relationships and trade names, are the foundation and a key differentiating advantage on which Landec has built its business.

Landec has three core businesses – Food Products Technology, Food Export and HA-based Biomaterials, each of which is described below. Financial information concerning the industry segments for which the Company reported its operations during fiscal years 2011, 2012 and 2013 is summarized in Note 14 to the Consolidated Financial Statements.

Landec’s wholly-owned subsidiary, Apio, Inc. (“Apio”), operates our Food Products Technology business, which combines our proprietary BreatheWay® food packaging technology with the capabilities of a large national food supplier and value-added produce processor which sells products under the Eat Smart® and GreenLine® brands. In Apio’s value-added operations, produce is processed by trimming, washing, mixing, and packaging into bags and trays that in most cases incorporate Landec’s BreatheWay® membrane technology. The BreatheWay membrane increases shelf life and reduces shrink (waste) for retailers and, for certain products, eliminates the need for ice during the distribution cycle and helps to ensure that consumers receive fresh produce by the time the product makes its way through the supply chain. Apio also licenses the BreatheWay technology to partners such as Chiquita Brands International, Inc. (“Chiquita”) for packaging and distribution of bananas and to Windset Holding 2010 Ltd., a Canadian corporation (“Windset”), for packaging of greenhouse grown cucumbers, peppers and tomatoes.

Apio also operates the Food Export business through its subsidiary, Cal Ex Trading Company (“Cal-Ex”). The Export business purchases and sells whole fruit and vegetable products predominantly to Asian markets.

Landec’s wholly-owned subsidiary, Lifecore Biomedical, Inc. (“Lifecore”), operates our HA-based Biomaterials business and is principally involved in the development and manufacture of products utilizing hyaluronan, a naturally occurring polysaccharide that is widely distributed in the extracellular matrix of connective tissues in animals including humans. Lifecore’s products are primarily sold for use in three medical areas: (1) Ophthalmic, (2) Orthopedic and (3) Veterinary. Lifecore also supplies limited quantities of HA to customers pursuing other medical applications, such as aesthetic surgery, medical device coatings, tissue engineering and pharmaceuticals. Lifecore leverages its fermentation process to manufacture premium, pharmaceutical-grade HA, and uses its aseptic filling capabilities to also deliver private-labeled HA finished goods to its customers. In addition, Lifecore manufactures and sells it own HA-based finished goods in several foreign markets. Lifecore is known as a premium supplier of HA. Its name recognition allows Lifecore to attract new customers and sell new products and offer its services with a minimal marketing and sales infrastructure.

Landec was incorporated in California on October 31, 1986 and reincorporated as a Delaware corporation on November 6, 2008. Our common stock is listed on The NASDAQ Global Select Market under the symbol “LNDC”.

Technology Overview

Landec has two polymer technology platforms. The first platform is its Intelimer polymer and the second is Lifecore’s HA.

A) Intelimer Polymers

Intelimer polymers are crystalline, hydrophobic polymers that have unique properties and benefits.

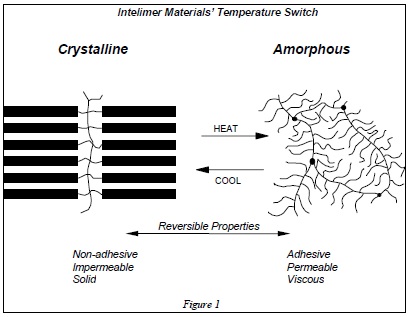

The first unique feature of the Intelimer polymer system is the way that it uses a temperature switch to control and modulate properties such as viscosity, permeability and adhesion when varying the materials’ temperature above and below the temperature switch. The sharp temperature switch is adjustable at relatively low temperatures (0°C to 100°C) and the changes resulting from the temperature switch are relatively easy to maintain in industrial and commercial environments. For instance, Intelimer polymers can change within the range of one or two degrees Celsius from a non-adhesive state to a highly tacky, adhesive state; from an impermeable state to a highly permeable state; or from a solid state to a viscous liquid state.

A second unique feature of Intelimer polymer materials is its controlled release properties. The polymer is able to deliver active ingredients with low or no burst, with a sustained release over periods of time. Finally, Intelimer polymers can be designed to contain up to 80% renewable materials from components of natural raw materials such as rapeseed oil, palm oil or coconut oil, and can be supplied in biocompatible and bioerodible forms.

Landec's proprietary polymer technology is based on the structure and phase behavior of Intelimer materials. The abrupt thermal transitions of specific Intelimer materials are achieved through the controlled use of hydrocarbon side chains that are attached to a polymer backbone. Below a pre-determined switch temperature, the polymer's side chains align through weak hydrophobic interactions resulting in a crystalline structure. When this side chain crystallizable polymer is heated to, or above, this switch temperature, these interactions are disrupted and the polymer is transformed into an amorphous, viscous state. Because this transformation involves a physical and not a chemical change, this process can be repeatedly reversible. Landec can set the polymer switch temperature anywhere between 0°C to 100°C by varying the average length of the side chains. The reversible transitions between crystalline and amorphous states are illustrated in Figure 1 below.

This chemical structure provides an additional benefit. Spatially distinct regions of the Intelimer polymer confer different physical properties on the material. Each part can be tuned independently to meet the needs of a given application. For example, the switching temperature (which arises from one part of the chain) can be adjusted independently of adhesive properties (which arise from another part of the chain).

Landec's Intelimer materials are readily available and are generally synthesized from long side-chain acrylic monomers that are derived primarily from natural materials such as coconut and palm oils that are highly purified and designed to be manufactured economically through known synthetic processes. These acrylic-monomer raw materials are then polymerized by Landec leading to many different side-chain crystallizable polymers whose properties vary depending upon the initial materials and the synthetic process. Intelimer materials can be made into many different forms, including films, coatings, microcapsules and discrete forms.

B) Hyaluronan Biopolymers

Hyaluronan is a non-crystalline, hydrophilic polymer that exists naturally within the human body, most notably within the aqueous humor of the eye, synovial fluid, skin and umbilical cord. The viscoelastic properties and water solubility of HA make it ideal for medical applications where lubrication and protection are critical. Because of its widespread presence in tissues, its critical role in normal physiology, and its high degree of biocompatibility, the Company believes that hyaluronan will continue to be used for an increasing variety of medical applications.

Hyaluronan can be produced in two ways, either through bacterial fermentation or through extraction from rooster combs. Lifecore produces HA only from fermentation, using an extremely efficient microbial fermentation process and a highly effective purification operation.

Hyaluronan was first demonstrated to have commercial medical utility as a viscoelastic solution in cataract surgery. In this application, it is used for maintaining the shape of the anterior chamber and protecting corneal tissue during the removal and implantation of intraocular lenses. The first ophthalmic hyaluronan product, produced by extraction from rooster comb tissue, became commercially available in the United States in 1981. Hyaluronan-based products, produced either by rooster comb extraction or by fermentation processes such as Lifecore’s, have since gained widespread acceptance in ophthalmology and are currently used in the majority of cataract extraction procedures in the world. Lifecore’s hyaluronan is also used as an orthopedic carrier vehicle for allogeneic freeze-dried demineralized bone as the active component of devices to treat the symptoms of osteoarthritis, and as a formulation component to provide increased lubricity to medical devices. Lifecore’s hyaluronan has also been utilized in veterinary drug applications to treat traumatic arthritis.

Trademarks/Trade names

Intelimer®, Landec®, Apio™, Eat Smart®, BreatheWay®, GreenLine®, Clearly Fresh™, Lifecore®, LUROCOAT® and Ortholure™ are some of the trademarks or registered trademarks and trade names of the Company in the United States and other countries. This Annual Report on Form 10-K also refers to the trademarks of other companies.

Description of Core Business

Landec participates in three core business segments: Apio with the Food Products Technology and Food Export businesses and Lifecore with the HA Biomaterials business.

A) Food Products Technology Business

The Company began marketing its proprietary Intelimer-based BreatheWay membranes in 1996 for use in the fresh-cut produce packaging market, historically one of the fastest growing segments in the food industry. Landec’s proprietary BreatheWay packaging technology is used to package Eat Smart and GreenLine branded and private label fresh-cut or whole produce, resulting in a convenient, ready-to-eat finished product that achieves increased shelf life and reduced shrink (waste) without the need for ice during the distribution cycle. These products are referred to as “value-added” products. In 1999, the Company acquired Apio, its then largest customer in the Food Products Technology business and one of the nation’s leading marketers and packers of produce and specialty packaged fresh-cut vegetables. Apio utilizes state-of-the-art fresh-cut processing facilities and year-round access to quality vegetable sourcing to produce products which Apio distributes to top U.S. retail grocery chains, major club stores and foodservice customers. The Company’s proprietary BreatheWay packaging business has been combined with Apio into a subsidiary that retains the Apio name. This vertical integration within the Food Products Technology business gives Landec direct access to the large and growing fresh-cut and whole produce market. In April 2012, Apio acquired GreenLine Holding Company (“GreenLine”), the number one processor and marketer of value-added, fresh-cut green beans in the U.S. GreenLine’s financial results are included in Apio’s Food Products Technology business (see Note 2 to the Consolidated Financial Statements). The acquisition of GreenLine provides Apio with new customers, new processing locations and new distribution centers which will allow Apio greater access to new and existing customers. In addition, because of GreenLine’s retail market share for fresh-cut green beans, Apio sees an opportunity to cross sell its Eat Smart® line of fresh-cut vegetables to existing GreenLine customers who are currently not carrying the Eat Smart line of products and to cross sell GreenLine® products to Eat Smart customers currently not carrying the GreenLine line of products.

The Technology: BreatheWay Membrane Packaging

Certain types of fresh-cut and whole produce can spoil or discolor rapidly when packaged in conventional packaging materials and, therefore, are limited in their ability to be distributed broadly to markets. The Company’s proprietary BreatheWay packaging technology extends the shelf life and quality of fresh-cut and whole produce.

Fresh-cut produce is cut, washed, and packaged in a form that is ready to use by the consumer and is thus typically sold at premium price levels compared to unpackaged produce. The total U.S. fresh produce market is estimated to be $100 billion to $120 billion. Of this, U.S. retail sales of fresh-cut produce are estimated to comprise 10% of the fresh produce market.

After harvesting, vegetables and fruit continue to respire, consuming oxygen and releasing carbon dioxide. Too much or too little oxygen can result in premature spoilage and decay. The respiration rate of produce varies from vegetable to vegetable and from fruit to fruit. Conventional packaging films used today, such as polyethylene and polypropylene, can be made with modest permeability to oxygen and carbon dioxide, but often do not provide the optimal atmosphere for the packaged produce. Shortcomings of conventional packaging materials have not significantly hindered the growth in the fresh-cut salad market because lettuce, unlike many vegetables and fruit, has low respiration requirements. To achieve optimal product performance, each fruit or vegetable requires its own unique package atmosphere conditions. The challenge facing the industry is to develop packaging that meets the highly variable needs that each product requires in order to achieve value creating performance. The Company believes that its BreatheWay packaging technology possesses all of the critical functionalities required to serve this diverse market. In creating a product package, a BreatheWay membrane is applied over a small cutout section or an aperture of a flexible film bag or plastic tray. This highly permeable “window” acts as the mechanism to provide the majority of the gas transmission requirements for the entire package. These membranes are designed to provide three principal benefits:

High Permeability. Landec's BreatheWay packaging technology is designed to permit transmission of oxygen and carbon dioxide at 300 to 1,000 times the rate of conventional packaging films. The Company thinks that these higher permeability levels will facilitate the packaging diversity required to market many types of fresh-cut and whole produce in many package sizes and configurations.

Ability to Adjust Oxygen and Carbon Dioxide Permeability. BreatheWay packaging can be tailored with carbon dioxide to oxygen transfer ratios ranging from 1.0 to 12.0 to selectively transmit oxygen and carbon dioxide at optimum rates to sustain the quality and shelf life of packaged produce. Other high permeability packaging materials, such as micro-perforated films cannot differentially control carbon dioxide permeability resulting in sub-optimal package atmosphere conditions for many produce products.

Temperature Responsiveness. Landec has developed breathable membranes that can be designed to increase or decrease permeability in response to environmental temperature changes. The Company has developed packaging that responds to higher oxygen requirements at elevated temperatures but is also reversible, and returns to its original state as temperatures decline. As the respiration rate of fresh produce also increases with temperature, the BreatheWay membrane’s temperature responsiveness allows packages to compensate for the change in produce respiration by automatically adjusting gas permeation rates. By doing so, detrimental package atmosphere conditions are avoided and improved quality is maintained through the distribution chain.

The Company has demonstrated that the growth of the fresh-cut produce market has been driven by consumer demand and the willingness to pay for convenience, freshness, uniform quality, and safety delivered to the point of sale. Landec believes that growth of the overall produce market will be driven by the increasing demand for the convenience and nutrition of fresh-cut produce as nearly 10% of Americans are diabetic and over a third of American adults are considered obese. In addition, with recent regulations requiring more visibility into the calories in what we eat, demand for healthy foods is increasing. This increasing demand will in turn require packaging that provides for high quality produce and technology that extends the shelf life of produce that is transported to fresh-cut distributors in bulk and pallet quantities. The Company thinks that in the future its BreatheWay packaging technology will be useful for packaging a diverse variety of fresh-cut and whole produce products.

Landec is working with leaders in club stores, retail grocery chains and with the recent acquisition of GreenLine, food service customers. The Company thinks it will have growth opportunities for the next several years through new customers and innovative products in the United States, expansion of its existing customer relationships, and through export and shipments of specialty packaged produce.

Landec manufactures its BreatheWay packaging through selected qualified contract manufacturers. In addition to using BreatheWay packaging for its value-added produce business, the Company markets and sells BreatheWay packaging directly to select partner food distributors.

The Business: Food Products Technology

The Food Products Technology business, which operates through our Apio subsidiary, had revenues of approximately $320 million for the fiscal year ended May 26, 2013, $208 million for the fiscal year ended May 27, 2012 and $176 million for the fiscal year ended May 29, 2011.

Based in Guadalupe, California, Apio’s primary business is fresh-cut and whole value-added products primarily packaged in our proprietary BreatheWay packaging. The fresh-cut value-added products business markets a variety of fresh-cut and whole vegetables to the top retail grocery chains, club stores and food service operators. During the fiscal year ended May 26, 2013, Apio shipped approximately twenty-eight million cartons of produce to its customers throughout North America, primarily in the United States.

There are five major distinguishing characteristics of Apio that provide competitive advantages in the Food Products Technology market:

Value-Added Supplier: Apio has structured its business as a marketer and seller of branded and private label fresh-cut and whole value-added produce. It is focused on selling products under its Eat Smart and GreenLine brands and private label brands for its fresh-cut and whole value-added products. As retail grocery chains, club stores and food service operators consolidate, Apio is well positioned as a single source of a broad range of products.

Reduced Farming Risks: Apio reduces its farming risk by not taking ownership of farmland, and instead, contracts with growers for produce and during certain times of the year enters into joint ventures with growers for produce. The year-round sourcing of produce is a key component to the fresh-cut and whole value-added processing business.

Access to Customer Base: Apio has strategically invested in the rapidly growing fresh-cut and whole value-added business. Apio’s value-added processing plant in Guadalupe, CA, is automated with state-of-the-art vegetable processing equipment. Apio operates one large central processing facility in one of the lowest cost growing regions in California, the Santa Maria Valley, and for the majority of its non-green bean vegetable business, use its packaging technology for nationwide delivery. With the acquisition of GreenLine, Apio now has three East Coast processing facilities and five East Coast distribution centers for nationwide delivery of green beans and recently Apio began processing non-green bean products in one of our East Coast processing facilities to meet the next day delivery needs of customers.

Expanded Product Line Using Technology and Unique Blends: Apio, through the use of its BreatheWay packaging technology, is introducing new value-added products each year. These new product offerings range from various sizes of fresh-cut bagged products, to vegetable trays, to whole produce, to vegetable salads and snack packs. During the last twelve months,, Apio has introduced four new unique products.

Products Currently in 80% of U.S. Retail Grocery Stores: With the acquisition of GreenLine, Apio now has products in approximately 80% of all U.S. retail grocery stores. This gives Apio the opportunity to cross sell Eat Smart value-added products to GreenLine customers and GreenLine value-added products to Eat Smart customers.

Apio established its Apio Packaging division in 2005 to advance the sales of BreatheWay packaging technology for shelf-life sensitive vegetables and fruit to third party partners outside of Apio’s core value-added business. The Company’s specialty packaging for case liner products extends the shelf life of certain produce commodities up to 50%. This shelf life extension can enable the utilization of alternative distribution strategies to gain efficiencies or reach new markets while maintaining product quality to the end customer.

Apio Packaging’s first program has concentrated on bananas and was formally consummated when Apio entered into an agreement to supply Chiquita with its proprietary banana packaging technology. This global agreement applies to the ripening, conservation and shelf-life extension of bananas. The BreatheWay packaging technology extends the shelf-life of bananas by approximately ten days.

In June 2008, Apio entered into a collaboration agreement with Seminis Vegetable Seeds, Inc., a wholly-owned subsidiary of Monsanto Company (“Monsanto”), to develop novel broccoli and cauliflower products for the exclusive sale by Apio in the North American market. These novel products are packaged in Landec’s proprietary BreatheWay packaging and commercial sales started in 2012 under Monsanto’s Beneforte® brand to retail grocery and club store chains.

In June 2010, Apio entered into an exclusive license agreement with Windset for Windset to utilize Landec’s proprietary breathable packaging to extend the shelf life of greenhouse grown cucumbers, peppers and tomatoes. Commercial sales of Windset peppers in BreatheWay packaging have recently begun.

On February 15, 2011, Apio entered into a share purchase agreement (the “Purchase Agreement”) with Windset. Pursuant to the Purchase Agreement, Apio purchased 150,000 senior preferred shares for $15 million and 201 common shares for $201 (the “Purchased Shares”). The Company’s common shares represent a 20.1% interest in Windset. The non-voting senior preferred shares yield a cash dividend of 7.5% annually. The dividend is payable within 90 days of each anniversary of the execution of the Purchase Agreement. The Purchase Agreement includes a put and call option, which can be exercised on the sixth anniversary of the Purchase Agreement whereby Apio can exercise the put to sell its Purchased Shares to Windset, or Windset can exercise the call to purchase the Purchased Shares from Apio, in either case, at a price equal to 20.1% of the appreciation in the fair market value of Windset from the date of the Company’s investment through the put/call date, plus the purchase price of the Purchased Shares. Under the terms of the arrangement with Windset, the Company is entitled to designate one of five members on the Board of Directors of Windset.

The Company thinks that hydroponically grown produce using Windset’s know how and growing practices will result in higher yields with competitive growing costs that will provide dependable year round supply to Windset’s customers. In addition, the produce grown in Windset’s greenhouses has a very high safety profile as no soil is used in the growing process. Windset owns and operates greenhouses in British Columbia, Canada and in Nevada and California. Windset currently has three million square feet of greenhouses in California with plans to double that capacity by December 2013. In addition to growing produce in their own greenhouses, Windset has numerous marketing arrangements with other greenhouse growers and utilizes buy/sell arrangements to meet fluctuation in demand from their customers.

B) Food Export Business

Food Export revenues consist of revenues generated from the purchase and sale of primarily whole commodity fruit and vegetable products to Asia through Apio’s export company, Cal-Ex. The Food Export business is a buy/sell business that realizes a commission-based margin on average in the 5-8% range.

The Food Export business had revenues of approximately $79 million for the fiscal year ended May 26, 2013, $71 million for the fiscal year ended May 27, 2012 and $62 million for the fiscal year ended May 29, 2011.

Apio is strategically positioned to benefit from the growth in export sales to Asia and other parts of the world over the next decade with Cal-Ex. Through Cal-Ex, Apio is currently one of the largest U.S. exporters of broccoli to Asia. Other large export items include apples, grapes, stonefruit and citrus.

C) Hyaluronan-based Biomaterials Business

Our HA Biomaterials business operates through our Lifecore subsidiary, which Landec acquired in April 2010. Lifecore had revenues of approximately $41 million for the fiscal year ended May 26, 2013, $34 million for the fiscal year ended May 27, 2012 and $33 million for the fiscal year ended May 29, 2011.

The Technology: Hyaluronan-based Biomaterials

Lifecore uses its fermentation process and aseptic formulation and filling expertise to become a leader in the development of HA-based products for multiple applications and to take advantage of non-HA device and drug opportunities which leverage its expertise in manufacturing and aseptic syringe filling capabilities. Elements of Lifecore’s strategy include the following:

• Establish strategic relationships with market leaders. Lifecore will continue to develop applications for products with partners who have strong marketing, sales and distribution capabilities to end-user markets. Through its strong reputation and history of providing premium HA products, Lifecore has been able to establish long-term relationships with the market leading ophthalmology and orthopedics companies.

• Expand medical applications for HA. Due to the growing knowledge of the unique characteristics of HA, and the role it plays in normal physiology, Lifecore continues to identify and pursue further uses for HA in other medical applications, such as wound care, aesthetic surgery, drug delivery, device coatings and pharmaceuticals. Further applications may involve expanding process development activity and/or additional licensing of technology.

• Utilize manufacturing infrastructure to pursue contract aseptic filling and fermentation opportunities. Lifecore is currently utilizing its manufacturing capabilities to provide contract services for customers related to aseptic filling equipment, fermentation and purification and continues to seek new opportunities for contract services.

• Maintain flexibility in product development and supply relationships. Lifecore’s vertically integrated development and manufacturing capabilities allow it to establish a variety of contractual relationships with global corporate partners. Lifecore’s role in these relationships extends from supplying HA raw materials to manufacturing of aseptically-packaged, finished sterile products to developing and manufacturing its own proprietary products.

Ophthalmic Applications

Cataract Surgery. A primary commercial application for Lifecore’s HA is in cataract surgery. HA, in the form of a viscoelastic solution, is used to maintain a deep chamber during anterior segment surgeries (including cataract extraction and intraocular lens implantation) and to protect the corneal endothelium and other ocular tissue. These solutions have been shown to reduce surgical trauma and thereby contribute to more rapid recovery with fewer complications than were experienced prior to the use of viscoelastics. HA-based products are used in the majority of cataract surgeries in the world.

Lifecore currently sells HA for this application to leading producers of ophthalmic surgical products in the world for inclusion in their proprietary viscoelastic solutions.

Lifecore has developed its own viscoelastic solution, LUROCOAT Ophthalmic Viscoelastic. Lifecore received CE marking for LUROCOAT Ophthalmic Viscoelastic in 1997, allowing LUROCOAT Ophthalmic Viscoelastic to be marketed and sold outside the United States. Lifecore has distribution agreements with multiple companies to supply its HA-based LUROCOAT Ophthalmic Viscoelastic under private label.

Lifecore estimates that its HA products have been used in over 50 million ophthalmic patients globally since 1983.

Orthopedic Applications

Lifecore supplies an aseptic HA solution to a customer which utilizes the solution as a carrier vehicle for its allogeneic demineralized, freeze-dried bone in a final putty composition trademarked as “DBX Demineralized Bone Matrix”. This bone putty is provided to orthopedic surgeons through the distribution channels established and managed by their customers.

Lifecore also supplies a private-labeled finished orthopedic viscosupplement to another customer and HA raw material to yet another customer for formulation in their proprietary viscosupplement.

Veterinary Applications

Lifecore manufactures an aseptically processed, private-labeled HA solution for use as a veterinary viscosupplement in an equine injectable drug for a customer.

Lifecore estimates that its veterinary HA product has been used in over 700,000 equine procedures worldwide.

Product Development

In conjunction with partners, Lifecore pursues product development activities for HA-based applications with certain clients. The majority of the projects are intended to demonstrate that Lifecore’s HA is suitable for a particular medical application. Suitability is often measured by detailed specifications for product characteristics such as purity, stability, viscosity and molecular weight, as well as the primary efficacy for a particular medical application in a clinical setting.

Other Non-Core Businesses

Seeds Business – Intellicoat® Seed Coatings

Landec developed Intellicoat seed coating applications are designed to control seed germination timing, increase crop yields, reduce risks and extend crop-planting windows. Pollinator Plus® coatings, commercialized by Landec over a decade ago, are currently available on male inbred corn used by seed companies as a method for spreading pollination to increase yields and reduce risk in the production of hybrid seed corn. This business was sold to INCOTEC Holding North America, Inc. (“INCOTEC”) in June 2012 (see Note 3 to the Consolidated Financial Statements).

Industrial Materials and Adhesives

Landec’s industrial product development strategy focuses on coatings, catalysts, resins, additives and adhesives in the polymer materials market. During the product development stage, the Company identifies corporate partners to support the ongoing development and testing of these products, with the ultimate goal of licensing the applications at the appropriate time. The Company licensed it proprietary pressure sensitive adhesives to Nitta Corporation (“Nitta”) for use in the manufacturing of electronic components by their customers and the Company has licensed its latent thermoset catalysts technology to Air Products and Chemicals, Inc. for use in thermoset chemistries such as epoxy, polyurethane, and unsaturated polyester.

Personal Care and Cosmetic Applications

Landec’s personal care and cosmetic applications strategy is focused on supplying Intelimer materials to industry leaders for use in lotions and creams, as well as color cosmetics, lipsticks and hair care. The Company's exclusive marketing partner, Air Products and Chemicals, Inc. (“Air Products”), is currently shipping products to L’Oreal, Mentholatum, Louis Widmer, Aris Cosmetics and other companies for use in lotions and creams. The rights to develop and sell Landec’s polymers for personal care products were licensed to Air Products in March 2006 along with the latent catalyst rights. The Company’s Intelimer polymers are currently in over 50 personal care products worldwide.

Sales and Marketing

Apio is supported by dedicated sales and marketing resources. Lifecore primarily sells products to customers under established supply agreements and also through distribution agreements. Lifecore does not sell to the end user, and, therefore, has no dedicated sales and marketing employees. The Company intends to expand its internal sales capacity as more products progress toward commercialization and as business volume expands geographically. Apio has 36 sales and marketing employees, located in central California and throughout the U.S., supporting the Food Products Technology business and the Food Export business. During fiscal years 2013, 2012 and 2011, sales to the Company’s top five customers accounted for approximately 40%, 45% and 44%, respectively, of its revenues, with the top two customers from the Food Products Technology segment accounting for approximately 16% and 13%, 17% and 11% and 16% and 10%, respectively, of the Company’s revenues.

Seasonality

The Company’s sales are moderately seasonal. The Food Products Technology business can be affected by seasonal weather factors which have impacted quarterly results, such as the high cost of sourcing product due to a shortage of essential value-added produce items. The Food Export business also typically recognizes a much higher percentage of its revenues and profit during the first half of Landec’s fiscal year compared to the second half. Lifecore’s business is not significantly affected by seasonality.

Manufacturing and Processing

Food Products Technology Business

The manufacturing process for the Company's proprietary BreatheWay packaging products is comprised of polymer manufacturing, membrane manufacturing and label package conversion. A third party toll manufacturer currently makes virtually all of the polymers for the BreatheWay packaging system. Select outside contractors currently manufacture the breathable membranes, and Landec has transitioned virtually all of the label package conversion to Apio’s Guadalupe facility to meet the increasing product demand and to provide additional developmental capabilities.

Apio processes virtually all of its fresh-cut, value-added non-green bean products in its processing facility located in Guadalupe, California. Cooling of produce is done through third parties and Apio Cooling LP, a separate consolidated subsidiary in which Apio has a 60% ownership interest and is the general partner.

Apio processes its fresh-cut, value-added green bean products, acquired with the acquisition of GreenLine in April 2012, in four processing plants located in Bowling Green, Ohio; Hanover, Pennsylvania; Vero Beach, Florida and Pico Rivera, California.

Hyaluronan-based Biomaterials Business

The commercial production of HA by Lifecore requires fermentation, separation and purification capabilities. Products are supplied in a variety of bulk and single dose configurations.

Lifecore produces its HA through a bacterial fermentation process. In the early 1980s, Lifecore introduced the bacterial fermentation process to manufacture premium pharmaceutical-grade HA, and received patent protection in 1985. Lifecore’s fermentation process patent expired in 2002. Previously, medical grade HA was commercially available through an extraction process from rooster combs. Lifecore believes that the fermentation manufacturing approach is superior to rooster comb extraction because of greater efficiency and flexibility, a more favorable long-term regulatory environment, and better economies of scale in producing large commercial quantities.

Lifecore’s 114,000 square foot facility in Chaska, Minnesota is used primarily for the HA manufacturing process, formulation and aseptic syringe and bulk filling. The Company considers that the current inventory on-hand, together with its manufacturing capacity, will be sufficient to allow it to meet the needs of its current customers for the foreseeable future.

Lifecore provides versatility in the manufacturing of various types of finished products. Currently, it supplies several different forms of HA in a variety of molecular weight fractions as powders, solutions and gels, and in a variety of bulk and single-use finished packages. Lifecore continues to conduct development work designed to improve production efficiencies and expand its capabilities to achieve a wider range of HA product specifications in order to address the broadening opportunities for using HA in medical applications.

The FDA inspects the Company’s manufacturing systems periodically and requires compliance with the FDA’s Quality System Regulation (“QSR”). In addition, Lifecore’s corporate partners conduct intensive quality audits of the facility and its operations. Lifecore also periodically contracts with independent regulatory consultants to conduct audits of its operations. As a result, similar to other manufacturers subject to regulatory and customer specific requirements, Lifecore’s facility was designed to meet applicable regulatory requirements and has been cleared for the manufacturing of both device and pharmaceutical products. The Company maintains a Quality System which complies with applicable standards and regulations (21 CFR 820, 21 CFR 210-211, EudraLex Volume 4, ISO 13485, European Medical Device Directive, Canadian Medical Device Regulations ICH Q7, and Australian Therapeutic Goods Regulations). Compliance with these international standards of quality greatly assists in the marketing of Lifecore’s products globally.

General

Several of the raw materials used in manufacturing certain of the Company’s products are currently purchased from a single source. Although to date the Company has not experienced difficulty acquiring materials for the manufacture of its products, no assurance can be given that interruptions in supplies will not occur in the future, that the Company will be able to obtain substitute vendors, or that the Company will be able to procure comparable materials at similar prices and terms within a reasonable time. Any such interruption of supply could have a material adverse effect on the Company’s ability to manufacture and distribute its products and, consequently, could materially and adversely affect the Company’s business, operating results and financial condition.

Research and Development

Landec is focusing its research and development resources on both existing and new product applications. Expenditures for research and development for the fiscal years ended May 26, 2013, May 27, 2012 and May 29, 2011 were $9.3 million, $9.6 million and $9.3 million, respectively. Research and development expenditures funded by corporate or governmental partners were $2.1 million during fiscal year 2013 and none in fiscal years 2012 and 2011. The Company may seek funds for applied materials research programs from U.S. government agencies as well as from commercial entities. The Company anticipates that it will continue to have significant research and development expenditures in order to maintain its competitive position with a continuing flow of innovative, high-quality products and services. As of May 26, 2013, Landec had 65 employees engaged in research and development with experience in polymer and analytical chemistry, product application, product formulation, mechanical and chemical engineering.

Competition

The Company operates in highly competitive and rapidly evolving fields, and new developments are expected to continue at a rapid pace. Competition from large food processors, packaging companies, medical and pharmaceutical companies is intense. In addition, the nature of the Company's collaborative arrangements may result in its corporate partners and licensees becoming competitors of the Company. Many of these competitors have substantially greater financial and technical resources and production and marketing capabilities than the Company, and many have substantially greater experience in conducting field trials, obtaining regulatory approvals and manufacturing and marketing commercial products. There can be no assurance that these competitors will not succeed in developing alternative technologies and products that are more effective, easier to use or less expensive than those which have been or are being developed by the Company or that would render the Company's technology and products obsolete and non-competitive.

Patents and Proprietary Rights

The Company's success depends in large part on its ability to obtain patents, maintain trade secret protection and operate without infringing on the proprietary rights of third parties. The Company has had 41 U.S. patents issued of which 27 remain active as of May 26, 2013 with expiration dates ranging from 2014 to 2028. The Company's issued and pending patents include claims relating to compositions, devices and use of a class of temperature and time sensitive polymers that exhibit distinctive properties of permeability, adhesion and viscosity control. There can be no assurance that any of the pending patent applications will be approved, that the Company will develop additional proprietary products that are patentable, that any patents issued to the Company will provide the Company with competitive advantages or will not be challenged by any third parties or that the patents of others will not prevent the commercialization of products incorporating the Company's technology. Furthermore, there can be no assurance that others will not independently develop similar products, duplicate any of the Company's products or design around the Company's patents. Any of the foregoing results could have a material adverse effect on the Company's business, operating results and financial condition.

The commercial success of the Company will also depend, in part, on its ability to avoid infringing patents issued to others. If the Company were determined to be infringing any third party patent, the Company could be required to pay damages, alter its products or processes, obtain licenses or cease certain activities. In addition, if patents are issued to others which contain claims that compete or conflict with those of the Company and such competing or conflicting claims are ultimately determined to be valid, the Company may be required to pay damages, to obtain licenses to these patents, to develop or obtain alternative technology or to cease using such technology. If the Company is required to obtain any licenses, there can be no assurance that the Company will be able to do so on commercially favorable terms, if at all. The Company's failure to obtain a license to any technology that it may require to commercialize its products could have a material adverse impact on the Company's business, operating results and financial condition.

Litigation, which could result in substantial costs to the Company, may also be necessary to enforce any patents issued or licensed to the Company or to determine the scope and validity of third party proprietary rights. If competitors of the Company prepare and file patent applications in the United States that claim technology also claimed by the Company, the Company may have to participate in interference proceedings declared by the U.S. Patent and Trademark Office to determine priority of invention, which could result in substantial cost to and diversion of effort by the Company, even if the eventual outcome is favorable to the Company. Any such litigation or interference proceeding, regardless of outcome, could be expensive and time consuming and could subject the Company to significant liabilities to third parties, require disputed rights to be licensed from third parties or require the Company to cease using such technology and consequently, could have a material adverse effect on the Company's business, operating results and financial condition.

In addition to patent protection, the Company relies on trade secrets, proprietary know-how, technological advances and customer relationships which the Company seeks to protect, in part, by confidentiality agreements with its collaborators, employees and consultants. There can be no assurance that these agreements will not be breached, that the Company will have adequate remedies for any breach, or that the Company's trade secrets and proprietary know-how will not otherwise become known or be independently discovered by others.

Government Regulation

Government regulation in the United States and other countries is a significant factor in the marketing of certain of the Company’s products and in the Company’s ongoing research and development activities. Some of the Company’s products are subject to extensive and rigorous regulation by the FDA, which regulates some of the products as medical devices and which, in some cases, requires Pre-Market Approval (“PMA”), and by foreign countries, which regulate some of the products as medical devices or drugs. Under the Federal Food, Drug, and Cosmetic Act (“FDC Act”), the FDA regulates the clinical testing, manufacturing, labeling, distribution, sale and promotion of medical devices in the United States.

Following the enactment of the Medical Device Amendments of 1976 to the FDC Act, the FDA classified medical devices in commercial distribution at the time of enactment (“pre-Amendment devices”) into one of three classes - Class I, II or III. This classification is based on the controls necessary to reasonably assure the safety and effectiveness of medical devices. Class I devices are those whose safety and effectiveness can reasonably be assured through general controls, such as establishment registration and labeling, and adherence to FDA mandated current QSR requirements for devices. Most Class I devices are exempt from FDA premarket review, but some require premarket notification (“510(k) Notification”). Class II devices are those whose safety and effectiveness can reasonably be assured through the use of special controls, such as performance standards, post market surveillance, patient registries and FDA guidelines. Class III devices are devices that require a PMA from the FDA to assure their safety and effectiveness. A PMA ordinarily must contain data from a multi-center clinical study demonstrating the device’s safety and effectiveness for the intended use and patient population. Class III devices are generally life sustaining, life supporting or implantable devices, and also include most devices that were not on the market before May 28, 1976 (“new devices”) and for which the FDA has not made a finding of substantial equivalence based upon a 510(k) Notification. A pre-Amendment Class III device does not require a PMA unless and until the FDA issues a regulation requiring submission of a PMA application for the device.

The FDA requires clinical data for a PMA application and has the authority to require such data for a 510(k) Notification. If clinical data are necessary, the company that sponsors the study must follow the FDA’s Investigational Device Exemption (“IDE”) regulations governing the conduct of human studies. The FDA’s regulations require institutional review board approval of the study and the informed consent of the study subjects. In addition, for a “significant risk” device, the FDA must approve an IDE application before the study can begin. Non-significant risk devices do not require FDA approval of an IDE application, and are conducted under the “abbreviated IDE” requirements. Once in effect, an IDE or abbreviated IDE permits evaluation of devices under controlled clinical conditions. After a clinical evaluation process, the resulting data may be included in a PMA application or a 510(k) Notification. The PMA may be approved or the 510(k) Notification may be cleared by the FDA only after a review process that may include FDA requests for additional data, sometimes requiring further studies.

If a manufacturer or distributor of medical devices can establish to the FDA’s satisfaction through a 510(k) Notification that a new device is substantially equivalent to what is called a “predicate device,” i.e., a legally marketed Class I or Class II medical device or a legally marketed pre-Amendment Class III device for which the FDA has not required a PMA, the manufacturer or distributor may market the new device. In the 510(k) Notification, a manufacturer or distributor makes a claim of substantial equivalence, which the FDA may require to be supported by various types of information, including data from clinical studies, showing that the new device is as safe and effective for its intended use as the predicate device.

Following submission of the 510(k) Notification, the manufacturer or distributor may not place the new device into commercial distribution until the FDA issues a “substantial equivalence” determination finding the new device to be substantially equivalent to a predicate device. The FDA has a 90 day period in which to respond to a 510(k) Notification (30 days for a Special 510(k)). Depending on the specific submission and subsequent agency information requests, the 510(k) Notification process can take significantly longer to complete. The FDA may agree with the manufacturer or distributor that the new device is substantially equivalent to a predicate device and allow the new device to be marketed in the United States. The FDA may, however, determine that the new device is not substantially equivalent and require the manufacturer or distributor to submit a PMA or require further information, such as additional test data, including data from clinical studies, before it is able to make a determination regarding substantial equivalence. Although the PMA process is significantly more complex, time-consuming and expensive than the 510(k) Notification process, the latter process can also be expensive and substantially delay the market introduction of a product. Modifications to a device that is marketed under a 510(k) Notification might require submission of a new 510(k) prior to their implementation, although some modifications can be made through a “note to file” procedure described in FDA guidance.

For devices that cannot be found “substantially equivalent” to a predicate device, the manufacturer must submit a PMA application, petition for reclassification, or submit a PMA application via the de novo process. A PMA must contain information on the materials and manufacturing process for the device, results of preclinical testing, clinical data, and labeling for the device. The FDA has 180 days to review a PMA application, but may request additional information, which could include additional studies. The FDA might refer a PMA to an advisory committee of outside experts to review and make recommendation on whether a device should be approved. After considering the data in the PMA application and the recommendations of an advisory committee, the FDA can approve the device, approve the device with conditions or refuse approval. Devices approved by the FDA are subject to periodic reporting requirements, and may be subject to restrictions on sale, distribution or use.

Hyaluronan products are generally Class III devices. In cases where the Company is supplying hyaluronan to a corporate partner as a raw material or producing a finished product under a license for the partner, the corporate partner is responsible for obtaining the appropriate FDA clearance or approval. Export of the Company’s hyaluronan products generally requires approval of the importing country and compliance with the export provisions of the FDC Act.

Other regulatory requirements are placed on the manufacture, processing, packaging, labeling, distribution, recordkeeping and reporting of a medical device and on the quality control procedures, such as the FDA’s device QSR regulations. Manufacturing facilities are subject to periodic inspections by the FDA to assure compliance with device QSR requirements. Lifecore’s facility is subject to inspections as both a device and a drug manufacturing operation. For PMA devices, the Company is required to submit an annual report and to obtain approval of a PMA supplement for modifications to the device or its labeling. Other applicable FDA requirements include the medical device reporting (“MDR”) regulation, which requires that the Company provide information to the FDA regarding deaths or serious injuries alleged to have been associated with the use of its devices, as well as product malfunctions that would likely cause or contribute to death or serious injury if the malfunction were to recur. The FDA also requires reporting regarding notices of correction and the removal of a medical device.

If the Company is not in compliance with FDA requirements, the FDA or the federal government can order a recall, detain the Company’s devices, refuse to grant 510(k) Notification clearances or PMA approvals, withdraw or limit product approvals, institute proceedings to seize the Company’s devices, seek injunctions to control or prohibit marketing and sales of the Company’s devices, assess civil money penalties and impose criminal sanctions against the Company, its officers or its employees.

There can be no assurance that any of the Company’s clinical studies will show safety or effectiveness; that 510(k) Notifications or PMA applications or supplemental applications will be submitted or, if submitted, accepted for filing; that any of the Company’s products that require clearance of a 510(k) Notification or approval of a PMA application or PMA supplement will obtain such clearance or approval on a timely basis, on terms acceptable to the Company for the purpose of actually marketing the products, or at all; or that following any such clearance or approval previously unknown problems will not result in restrictions on the marketing of the products or withdrawal of clearance or approval.

Product Liability

Product liability claims may be asserted with respect to the Company’s products. The Company maintains product liability insurance coverage in amounts the Company deems to be adequate. There can be no assurance that the Company will have sufficient resources to satisfy product claims if they exceed available insurance coverage.

Employees

As of May 26, 2013, Landec had 526 full-time employees, of whom 431 were dedicated to research, development, manufacturing, quality control and regulatory affairs and 95 were dedicated to sales, marketing and administrative activities. Landec intends to recruit additional personnel in connection with the development, manufacturing and marketing of its products. None of Landec's employees is represented by a union, and Landec considers its relationship with its employees to be good.

Available Information

Landec’s website is http://www.landec.com. Landec makes available free of charge its annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the SEC. Information contained on our website is not part of this Report.

Item 1A. Risk Factors

Landec desires to take advantage of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995 and of Section 21E and Rule 3b-6 under the Securities Exchange Act of 1934. Specifically, Landec wishes to alert readers that the following important factors could in the future affect, and in the past have affected, Landec’s actual results and could cause Landec’s results for future periods to differ materially from those expressed in any forward-looking statements made by or on behalf of Landec. Landec assumes no obligation to update such forward-looking statements.

Lapses in disclosure controls and procedures or internal control over financial reporting could materially and adversely affect the Company’s operations, profitability or reputation.

We are committed to maintaining high standards of internal control over financial reporting and disclosure controls and procedures. Nevertheless, lapses or deficiencies in disclosure controls and procedures or in our internal control over financial reporting may occur from time to time. On January 2, 2013, we reported that our audit committee reached a determination to restate our previously-filed interim financial statements for the first fiscal quarter of 2013 and that our previously-filed interim financial statements for the first fiscal quarter of 2013 should not be relied upon. We also reported management’s determination that a material weakness existed in our internal control over financial reporting at August 26, 2012. As a result of the material weakness, management also concluded that our disclosure controls and procedures were not effective at August 26, 2012.

There can be no assurance that our disclosure controls and procedures will be effective in preventing a material weakness or significant deficiency in internal control over financial reporting from occurring in the future. Any such lapses or deficiencies may materially and adversely affect our business and results of operations or financial condition, restrict our ability to access the capital markets, require us to expend resources to correct the lapses or deficiencies, expose us to regulatory or legal proceedings, harm our reputation, or otherwise cause a decline in investor confidence.

Adverse Weather Conditions and Other Acts of God May Cause Substantial Decreases in Our Sales and/or Increases in Our Costs

Our Food Products Technology business is subject to weather conditions that affect commodity prices, crop quality and yields, and decisions by growers regarding crops to be planted. Crop diseases and severe conditions, particularly weather conditions such as unexpected or excessive rain or other precipitation, unseasonable temperature fluctuations, floods, droughts, frosts, windstorms, earthquakes and hurricanes, may adversely affect the supply of vegetables and fruits used in our business, which could reduce the sales volumes and/or increase the unit production costs. In fiscal year 2013, the Company’s operating income was negatively impacted by approximately $5.0 million because of weather-related produce sourcing issues in the Food Products Technology business. Because a significant portion of the costs are fixed and contracted in advance of each operating year, volume declines reflecting production interruptions or other factors could result in increases in unit production costs which could result in substantial losses and weaken our financial condition.

The Global Economy is Experiencing Continued Volatility Following the Recent Economic Downturn, Which May Have an Adverse Effect on Our Business

In recent years, the U.S. and international economy and financial markets experienced a significant slowdown and volatility due to uncertainties related to the availability of credit, energy prices, difficulties in the banking and financial services sectors, softness in the housing market, severely diminished market liquidity, geopolitical conflicts, falling consumer confidence and high unemployment rates beginning in 2008. Ongoing volatility in the economy and financial markets could further lead to reduced demand for our products, which in turn, would reduce our revenues and adversely affect our business, financial condition and results of operations. In particular, volatility in the global markets have resulted in softer demand and more conservative purchasing decisions by customers, including a tendency toward lower-priced products, which could negatively impact our revenues, gross margins and results of operations. In addition to a reduction in sales, our profitability may decrease because we may not be able to reduce costs at the same rate as our sales decline. We cannot predict the ultimate severity or length of the current period of volatility, whether the recent signs of economic recovery will prove sustainable or the timing or severity of future economic or industry downturns.

Given the current uncertain economic environment, our customers, suppliers, and partners may have difficulties obtaining capital at adequate or historical levels to finance their ongoing business and operations, which could impair their ability to make timely payments to us. This may result in lower sales and/or inventory that may not be saleable or bad debt expense for Landec. In addition to the impact of the current market uncertainty on our customers, some of our vendors and growers may experience a reduction in their availability of funds and cash flows, which could negatively impact their business as well as ours. A further worsening of the economic environment or continued or increased volatility of the U.S. economy, including increased volatility in the credit markets, could adversely impact our customers’ and vendors’ ability or willingness to conduct business with us on the same terms or at the same levels as they have historically. Further, this economic volatility and uncertainty about future economic conditions makes it challenging for Landec to forecast its operating results, make business decisions, and identify the risks that may affect its business, sources and uses of cash, financial condition and results of operations.

Our Future Operating Results Are Likely to Fluctuate Which May Cause Our Stock Price to Decline

In the past, our results of operations have fluctuated significantly from quarter to quarter and are expected to continue to fluctuate in the future. Apio can be affected by seasonal and weather factors which have impacted our financial results due to a shortage of essential value-added produce items, including the approximate $5.0 million negative impact on operating income which occurred in fiscal year 2013 due to weather-related produce sourcing issues. Our earnings may also fluctuate based on our ability to collect accounts receivable from customers and notes receivable from growers and on price fluctuations in the fresh vegetables and fruits markets. Other factors that affect our operations include:

the seasonality and availability of our supplies,

our ability to process produce during critical harvest periods,

the timing and effects of ripening,

the degree of perishability,

the effectiveness of worldwide distribution systems,

total worldwide industry volumes,

the seasonality and timing of consumer demand,

foreign currency fluctuations, and

foreign importation restrictions and foreign political risks.

As a result of these and other factors, we expect to continue to experience fluctuations in quarterly operating results.

Uncertainty Relating To Integration Of New Business Acquisitions.

The successful integration of new business acquisitions, including the GreenLine acquisition, may require substantial effort from the Company's management. The diversion of the attention of management and any difficulties encountered in the transition process could have a material adverse effect on the Company's ability to realize the anticipated benefits of the acquisitions. The successful combination of new businesses also requires coordination of research and development activities, manufacturing, and sales and marketing efforts. In addition, the process of combining organizations located in different regions of the United States could cause the interruption of, or a loss of momentum in, the Company's activities. There can be no assurance that the Company will be able to retain key management, technical, sales and customer support personnel, or that the Company will realize the anticipated benefits of any acquisitions, and the failure to do so would have a material adverse effect on the Company's business, results of operations and financial condition.

We May Not Be Able to Achieve Acceptance of Our New Products in the Marketplace

Our success in generating significant sales of our products depends in part on our ability and our partners and licensees to achieve market acceptance of our new products and technology. The extent to which, and rate at which, we achieve market acceptance and penetration of our current and future products is a function of many variables including, but not limited to:

price,

safety,

efficacy,

reliability,

conversion costs,

regulatory approvals,

marketing and sales efforts, and

general economic conditions affecting purchasing patterns.

We may not be able to develop and introduce new products and technologies in a timely manner or new products and technologies may not gain market acceptance. We or our partners/customers are in the early stage of product commercialization of certain Intelimer-based specialty packaging, HA-based products and other Intelimer polymer products and many of our potential products are in development. We expect that our future growth will depend in large part on our or our partners/customers ability to develop and market new products in our target markets and in new markets. In particular, we expect that our ability to compete effectively with existing food products, industrial, medical and pharmaceutical companies will depend substantially on developing, commercializing, achieving market acceptance of and reducing the cost of producing our products. In addition, commercial applications of our temperature switch polymer technology are relatively new and evolving. Our failure to develop new products or the failure of our new products to achieve market acceptance would have a material adverse effect on our business, results of operations and financial condition.

We Face Strong Competition in the Marketplace

Competitors may succeed in developing alternative technologies and products that are more effective, easier to use or less expensive than those which have been or are being developed by us or that would render our technology and products obsolete and non-competitive. We operate in highly competitive and rapidly evolving fields, and new developments are expected to continue at a rapid pace. Competition from large food products, industrial, medical and pharmaceutical companies is expected to be intense. In addition, the nature of our collaborative arrangements may result in our corporate partners and licensees becoming our competitors. Many of these competitors have substantially greater financial and technical resources and production and marketing capabilities than we do, and may have substantially greater experience in conducting clinical and field trials, obtaining regulatory approvals and manufacturing and marketing commercial products.

We Have a Concentration of Manufacturing for Apio and Lifecore and May Have to Depend on Third Parties to Manufacture Our Products

Any disruptions in our primary manufacturing operation at Apio’s facility in Guadalupe, California or Lifecore’s facility in Chaska, Minnesota would reduce our ability to sell our products and would have a material adverse effect on our financial results. Additionally, we may need to consider seeking collaborative arrangements with other companies to manufacture our products. If we become dependent upon third parties for the manufacture of our products, our profit margins and our ability to develop and deliver those products on a timely basis may be adversely affected. Failures by third parties may impair our ability to deliver products on a timely basis and impair our competitive position. We may not be able to continue to successfully operate our manufacturing operations at acceptable costs, with acceptable yields, and retain adequately trained personnel.

Our Dependence on Single-Source Suppliers and Service Providers May Cause Disruption in Our Operations Should Any Supplier Fail to Deliver Materials

We may experience difficulty acquiring materials or services for the manufacture of our products or we may not be able to obtain substitute vendors. We may not be able to procure comparable materials at similar prices and terms within a reasonable time. Several services that are provided to Apio are obtained from a single provider. Several of the raw materials we use to manufacture our products are currently purchased from a single source, including some monomers used to synthesize Intelimer polymers, substrate materials for our breathable membrane products and raw materials for our HA products. Any interruption of our relationship with single-source suppliers or service providers could delay product shipments and materially harm our business.

We May Be Unable to Adequately Protect Our Intellectual Property Rights

We may receive notices from third parties, including some of our competitors, claiming infringement by our products of patent and other proprietary rights. Regardless of their merit, responding to any such claim could be time-consuming, result in costly litigation and require us to enter royalty and licensing agreements which may not be offered or available on terms acceptable to us. If a successful claim is made against us and we fail to develop or license a substitute technology, we could be required to alter our products or processes and our business, results of operations or financial position could be materially adversely affected. Our success depends in large part on our ability to obtain patents, maintain trade secret protection and operate without infringing on the proprietary rights of third parties. Any pending patent applications we file may not be approved and we may not be able to develop additional proprietary products that are patentable. Any patents issued to us may not provide us with competitive advantages or may be challenged by third parties. Patents held by others may prevent the commercialization of products incorporating our technology. Furthermore, others may independently develop similar products, duplicate our products or design around our patents.

Our Operations Are Subject to Regulations that Directly Impact Our Business

Our products and operations are subject to governmental regulation in the United States and foreign countries. The manufacture of our products is subject to periodic inspection by regulatory authorities. We may not be able to obtain necessary regulatory approvals on a timely basis or at all. Delays in receipt of or failure to receive approvals or loss of previously received approvals would have a material adverse effect on our business, financial condition and results of operations. Although we have no reason to believe that we will not be able to comply with all applicable regulations regarding the manufacture and sale of our products and polymer materials, regulations are always subject to change and depend heavily on administrative interpretations and the country in which the products are sold. Future changes in regulations or interpretations relating to matters such as safe working conditions, laboratory and manufacturing practices, environmental controls, and disposal of hazardous or potentially hazardous substances may adversely affect our business.

We are subject to FDA rules and regulations concerning the safety of the food products handled and sold by Apio, and the facilities in which they are packed and processed. Failure to comply with the applicable regulatory requirements can, among other things, result in:

fines, injunctions, civil penalties, and suspensions,

withdrawal of regulatory approvals,

product recalls and product seizures, including cessation of manufacturing and sales,

operating restrictions, and

criminal prosecution.