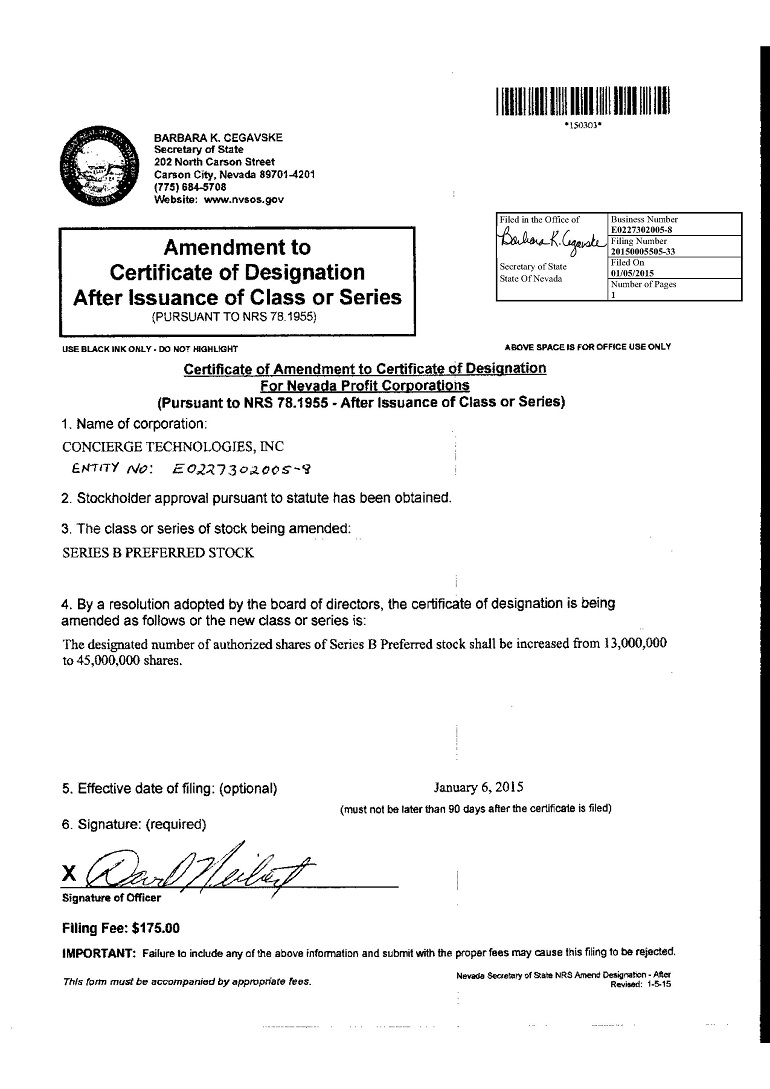

Exhibit 3.3

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended

OR

| | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . |

Commission File Number:

CONCIERGE TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

120 Calle Iglesia

Unit B

Fax: 888.312.0124

(Address and telephone number of registrant's principal

executive offices and principal place of business)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class of Security | Trading Symbol | Name of Exchange on Which Registered |

| None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| | ☐ | Smaller reporting company | | |

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The registrant had

CONCIERGE TECHNOLOGIES, INC.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “would,” “shall,” “might,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Forward-looking statements contained in this Quarterly Report on Form 10-Q include, but are not limited to, statements about:

| • |

the outcome of the class action litigation; |

|

| • | recent resolutions with the Securities Exchange Commission (the “SEC”) and the Commodity Futures Trading Commission (the “CFTC”) against United States Oil Fund, L.P., United States Commodity Funds, LLC, a subsidiary of our subsidiary, Wainwright Holdings, and other related parties, as disclosed under “Item 1. Legal Proceedings”; | |

| • |

our future financial performance, including our revenue, cost of revenue, gross profit, gross margin, operating expenses, ability to generate positive cash flow, and ability to achieve and maintain profitability; and the impact of the COVID-19 pandemic thereon; |

|

| • |

the sufficiency of our cash and cash equivalents to meet our working capital, capital expenditure, and liquidity needs; and the impact of the COVID-19 pandemic thereon; |

|

| • |

our operating subsidiaries' ability to attract and retain customers to use our products, to optimize the pricing for our products, to expand our sales to our customers, and to convince our existing customers to renew subscriptions; |

|

| • |

the evolution of technologies affecting our operating subsidiaries' products and markets; |

|

| • |

our operating subsidiaries' ability to innovate and provide a superior user experience and our intentions and strategy with respect thereto; |

|

| • |

our operating subsidiaries' ability to successfully penetrate enterprise markets; and the impact of the COVID-19 pandemic thereon; |

|

| • |

our operating subsidiaries' ability to successfully expand in our existing markets and into new markets, including international markets; and the impact of the COVID-19 pandemic thereon; |

|

| • |

the attraction and retention of key personnel; |

|

| • |

our ability to effectively manage our growth and future expenses; |

|

| • |

worldwide economic conditions, including the economic disruption imposed by the COVID-19 pandemic, and their impact on spending; and |

|

| • |

and our operating subsidiaries' ability to comply with modified or new laws and regulations applying to our business, including privacy and data security regulations. |

We caution you that the foregoing list does not contain all of the forward-looking statements made in this Quarterly Report on Form 10-Q.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, operating results, and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors described in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended June 30, 2021 and this Quarterly Report on Form 10-Q. Moreover, we and our subsidiaries operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report on Form 10-Q. We cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Quarterly Report on Form 10-Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q or to reflect new information or the occurrence of unanticipated events, except as required by law. We and our subsidiaries may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make.

PART I – FINANCIAL INFORMATION

| Item 1. Financial Statements. |

CONCIERGE TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| September 30, 2021 | June 30, 2021 (1) | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable, net | ||||||||

| Accounts receivable - related parties | ||||||||

| Inventories | ||||||||

| Prepaid income tax and tax receivable | ||||||||

| Investments | ||||||||

| Other current assets | ||||||||

| Total current assets | ||||||||

| Restricted cash | ||||||||

| Property, plant and equipment, net | ||||||||

| Operating lease right-of-use asset | ||||||||

| Goodwill | ||||||||

| Intangible assets, net | ||||||||

| Deferred tax assets, net-U.S. | ||||||||

| Other assets, long - term | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable, accrued expenses and legal settlement | $ | $ | ||||||

| Expense waivers – related parties | ||||||||

| Operating lease liabilities, current portion | ||||||||

| Notes payable - related parties | ||||||||

| Loans - property and equipment, current portion | ||||||||

| Total current liabilities | ||||||||

| LONG-TERM LIABILITIES | ||||||||

| Loans - property and equipment, net of current portion | ||||||||

| Operating lease liabilities, net of current portion | ||||||||

| Deferred tax liabilities, net-foreign | ||||||||

| Total long-term liabilities | ||||||||

| Total liabilities | ||||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Preferred stock, $ par value; authorized | ||||||||

| Series B: issued and outstanding at September 30, 2021 and at June 30, 2021 | ||||||||

| Common stock, $ par value; shares authorized; shares issued and outstanding at September 30, 2021 and at June 30, 2021 | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated other comprehensive income | ||||||||

| Retained earnings | ||||||||

| Total stockholders' equity | ||||||||

| Total liabilities and stockholders' equity | $ | $ | ||||||

(1) Derived from audited financial statements

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CONCIERGE TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF (LOSS) INCOME

(UNAUDITED)

| Three Months Ended September 30, 2021 | Three Months Ended September 30, 2020 | |||||||

| Net revenue | ||||||||

| Fund management - related party | $ | $ | ||||||

| Food products | ||||||||

| Security systems | ||||||||

| Beauty products | ||||||||

| Net revenue | ||||||||

| Cost of revenue | ||||||||

| Gross profit | ||||||||

| Operating expense | ||||||||

| General and administrative expense | ||||||||

| Fund operations | ||||||||

| Marketing and advertising | ||||||||

| Depreciation and amortization | ||||||||

| Salaries and compensation | ||||||||

| Legal settlement | ||||||||

| Total operating expenses | ||||||||

| (Loss) income from operations | ( | ) | ||||||

| Other income: | ||||||||

| Interest and dividend income | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Other income | ||||||||

| Total other income, net | ||||||||

| (Loss) income before income taxes | ( | ) | ||||||

| Provision of income taxes | ( | ) | ( | ) | ||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Weighted average shares of common stock | ||||||||

| Basic and diluted | ||||||||

| Net (loss) income per common share | ||||||||

| Basic and diluted | $ | ( | ) | $ | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CONCIERGE TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

| Three Months Ended September 30, 2021 | Three Months Ended September 30, 2020 | |||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Other comprehensive income: | ||||||||

| Foreign currency translation (loss) gain | ( | ) | ||||||

| Comprehensive (loss) income | $ | ( | ) | $ | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CONCIERGE TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

FOR THE THREE MONTH PERIODS ENDING SEPTEMBER 30, 2021 AND SEPTEMBER 30, 2020

(UNAUDITED)

| Period Ending September 30, 2021 | Preferred Stock (Series B) | Common Stock | ||||||||||||||||||||||||||||||

| Number of Shares | Amount | Number of Shares | Par Value | Additional Paid - in Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Total Stockholders' Equity | |||||||||||||||||||||||||

| Balance at July 1, 2021 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

| Loss on currency translation | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balance at September 30, 2021 | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| Period Ending September 30, 2020 | Preferred Stock (Series B) | Common Stock | ||||||||||||||||||||||||||||||

| Number of Shares | Amount | Number of Shares | Par Value | Additional Paid - in Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Total Stockholders' Equity | |||||||||||||||||||||||||

| Balance at July 1, 2020 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

| Gain on currency translation | - | - | ||||||||||||||||||||||||||||||

| Net income | - | - | ||||||||||||||||||||||||||||||

| Balance at September 30, 2020 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONCIERGE TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Three Month Period Ended | ||||||||

| September 30, | ||||||||

| 2021 | 2020 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities | ||||||||

| Depreciation and amortization | ||||||||

| Bad debt expense | ||||||||

| Unrealized loss (gain) on investments | ( | ) | ||||||

| Loss (gain) on disposal of equipment | ( | ) | ||||||

| Operating lease right-of-use asset - non-cash lease cost | ||||||||

| Decrease (increase) in current assets: | ||||||||

| Accounts receivable | ( | ) | ( | ) | ||||

| Accounts receivable - related party | ||||||||

| Prepaid income taxes and tax receivable | ( | ) | ||||||

| Inventories | ( | ) | ( | ) | ||||

| Other current assets | ||||||||

| Decrease (increase) in current liabilities: | ||||||||

| Accounts payable, accrued expenses and legal settlement | ( | ) | ||||||

| Operating lease liabilities | ( | ) | ( | ) | ||||

| Expense waivers - related party | ||||||||

| Net cash provided by operating activities | ||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Cash paid for acquisition of assets | ( | ) | ||||||

| Purchase of real estate and equipment | ( | ) | ( | ) | ||||

| Sale of investments | ||||||||

| Purchase of investments | ( | ) | ( | ) | ||||

| Net cash provided by (used in) investing activities | ( | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Repayment of property and equipment loans | ( | ) | ( | ) | ||||

| Net cash (used in) financing activities | ( | ) | ( | ) | ||||

| Effect of exchange rate change on cash and cash equivalents | ( | ) | ||||||

| NET INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | ||||||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING BALANCE | ||||||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, ENDING BALANCE | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | ||||||||

| Cash paid during the period for: | ||||||||

| Interest paid | $ | $ | ||||||

| Income taxes paid (refunded) | $ | $ | ( | ) | ||||

| Non-cash financing and investing activities: | ||||||||

| Reclassification of acquisition deposit | $ | $ | ||||||

| Purchase price payable | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONCIERGE TECHNOLOGIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIALS STATEMENTS

(UNAUDITED)

| NOTE 1. | ORGANIZATION AND DESCRIPTION OF BUSINESS |

Concierge Technologies, Inc., (the “Company” or “Concierge”), a Nevada corporation, operates through its wholly owned subsidiaries who are engaged in varied business activities. The operations of the Company’s wholly owned subsidiaries are more particularly described herein but are summarized as follows:

| ● | Wainwright Holdings, Inc. (“Wainwright”), a U.S. based company, is the sole member of two investment services limited liability company subsidiaries, United States Commodity Funds LLC (“USCF”), and USCF Advisers LLC (“USCF Advisers”), each of which manages, operates or is an investment advisor to exchange traded funds organized as limited partnerships or investment trusts that issue shares which trade on the NYSE Arca stock exchange. | |

| ● | Gourmet Foods, Ltd., a New Zealand based company, manufactures and distributes New Zealand meat pies on a commercial scale and its wholly owned New Zealand subsidiary company, Printstock Products Limited ("Printstock"), prints specialty wrappers for the food industry in New Zealand and Australia (collectively "Gourmet Foods"). | |

| ● | Brigadier Security Systems (2000) Ltd. (“Brigadier”), a Canadian based company, sells and installs commercial and residential alarm monitoring systems under the names Brigadier Security Systems and Elite Security in the province of Saskatchewan. | |

| ● | Kahnalytics, Inc. dba/Original Sprout (“Original Sprout”), a U.S. based company, is engaged in the wholesale distribution of hair and skin care products under the brand name Original Sprout on a global scale. | |

| ● | Marygold & Co., a newly formed U.S. based company, together with its wholly owned limited liability company, Marygold & Co. Advisory Services, LLC, (collectively "Marygold") was established by Concierge to explore opportunities in the financial technology ("Fintech") space, is still in the development stage as of September 30, 2021, and is estimated to launch commercial services in the current fiscal year. Through September 30, 2021, expenditures have been limited to developing the business model and the associated application development. | |

| ● | Marygold & Co. (UK) Limited, a newly formed U.K. limited company (“Marygold UK”), was established to act as a holding company for acquisitions to be made in the U.K. As of September 30, 2021, there have been no acquisitions completed and no operations. The expenses of Marygold UK have been included with those of Concierge. |

Concierge manages its operating businesses on a decentralized basis. There are no centralized or integrated operational functions such as marketing, sales, legal or other professional services and there is little involvement by Concierge’s management in the day-to-day business affairs of its operating subsidiary businesses apart from oversight. Concierge’s corporate management is responsible for capital allocation decisions, investment activities and selection and retention of the Chief Executive to head each of the operating subsidiaries. Concierge's corporate management is also responsible for corporate governance practices, monitoring regulatory affairs, including those of its operating businesses and involvement in governance-related issues of its subsidiaries as needed. Across Concierge and its subsidiaries the Company employs

As more fully detailed in the Company’s Definitive Information Statement on Schedule 14C, filed with the U.S. Securities and Exchange Commission on September 13, 2021, on August 24, 2021, the Board of Directors of the Company approved, by unanimous written consent in lieu of a meeting, to effect a name change of the Company to "The Marygold Companies, Inc." As of November 12, 2021, no action has been taken with respect to the name change and no definitive date has been set.

| NOTE 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation and Accounting Principles

The Company has prepared the accompanying unaudited financial statements on a consolidated basis. In the opinion of management, the accompanying consolidated balance sheets, related statements of income and comprehensive income, and cash flows include all adjustments, consisting only of normal recurring items, necessary for their fair presentation, prepared on an accrual basis, in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The information included in this Form 10-Q should be read in conjunction with information included in the Company’s Annual Report on Form 10-K for year ended June 30, 2021 and filed with the U.S. Securities and Exchange Commission on September 22, 2021.

Principles of Consolidation

The accompanying unaudited consolidated financial statements, which are referred to herein as the “Financial Statements” include the accounts of Concierge and its wholly owned subsidiaries, Wainwright, Gourmet Foods, Brigadier, Original Sprout, Marygold and Marygold UK.

All inter-company transactions and accounts have been eliminated in consolidation.

Use of Estimates

The preparation of the Financial Statements are in conformity with U.S. GAAP which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Financial Statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents include all highly liquid debt instruments with original maturities of three months or less on the date of purchase. The Company maintains its cash and cash equivalents in financial institutions in the United States, Canada, and New Zealand. Accounts in the United States are insured by the Federal Deposit Insurance Corporation up to $250,000 per depositor, and accounts in Canada are insured by the Canada Deposit Insurance Corporation up to CD$100,000 per depositor. Accounts in New Zealand are uninsured. The Company has, at times, held deposits in excess of insured amounts, but the Company does not expect any losses in such accounts.

Accounts Receivable, net and Accounts Receivable - Related Parties

Accounts receivable, net consist of receivables related to the Brigadier, Gourmet Foods and Original Sprout businesses. Management regularly reviews the composition of accounts receivable and analyzes customer credit worthiness, customer concentrations, current economic trends and changes in customer payment patterns to determine whether or not an account should be deemed uncollectible. Reserves, if any, are recorded on a specific identification basis. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. As of September 30, 2021 and June 30, 2021, the Company had $

Accounts receivable - related parties consist of fund asset management fees receivable from the Wainwright business. Management fees receivable generally consist of one month of management fees which are collected in the month after they are earned. As of September 30, 2021 and June 30, 2021, there is

Major Customers and Suppliers – Concentration of Credit Risk

Concierge, as a holding company, operates through its wholly owned subsidiaries and has no concentration of risk either from customers or suppliers as a stand-alone entity. Marygold and Marygold UK, as newly formed development stage entities, had no revenues and no significant transactions for the three months ended September 30, 2021. Any transactions that did occur were included with those of Concierge.

For our subsidiary, Wainwright, the concentration of risk and the relative reliance on major customers are found within the various funds it manages and the associated three-month revenues as of September 30, 2021 compared with those at September 30, 2020 along with the accounts receivable – related parties as of September 30, 2021 and June 30, 2021 as depicted below.

| For the Three Months Ended | For the Three Months Ended | |||||||||||||||

| September 30, 2021 | September 30, 2020 | |||||||||||||||

| Revenue | Revenue | |||||||||||||||

| Fund | ||||||||||||||||

| USO | $ | % | $ | % | ||||||||||||

| BNO | % | % | ||||||||||||||

| UNG | % | % | ||||||||||||||

| USCI | % | % | ||||||||||||||

| All Others | % | % | ||||||||||||||

| Total | $ | % | $ | % | ||||||||||||

| As of September 30, 2021 | As of June 30, 2021 | |||||||||||||||

| Accounts Receivable | Accounts Receivable | |||||||||||||||

| Fund | ||||||||||||||||

| USO | $ | % | $ | % | ||||||||||||

| BNO | % | % | ||||||||||||||

| UNG | % | % | ||||||||||||||

| USCI | % | % | ||||||||||||||

| All Others | % | % | ||||||||||||||

| Total | $ | % | $ | % | ||||||||||||

Concierge, through Gourmet Foods and following the acquisition of Printstock Products Limited on July 1, 2020, has two major customer groups comprising gross revenues: 1) baking, and 2) printing. For the purpose of segment reporting (Note 15) both revenue streams are considered part of the same "food industry" segment as they are evaluated as one segment by the Company's Chief Operating Decision Maker.

Baking: Within the baking sector there are three major customer groups; 1) grocery, 2) gasoline convenience stores, and 3) independent retailers. The grocery industry is dominated by several large chain operations, which are customers of Gourmet Foods, and there are no long-term guarantees that these major customers will continue to purchase products from Gourmet Foods, however, many of the existing relationships have been in place for sufficient time to give management reasonable confidence in their continuing business. For the three months ended September 30, 2021, Gourmet Foods’ largest customer in the grocery industry, who operates through a number of independently branded stores, accounted for approximately

In the gasoline convenience store market customer group, Gourmet Foods supplies two major channels. The largest is a marketing consortium of gasoline dealers operating under the same brand who, for the three month periods ended September 30, 2021 and September 30, 2020 accounted for approximately

The third major customer group is independent retailers and cafes, which collectively accounted for the balance of baking sales revenue, however no single customer in this group was a significant contributor of baking sales revenues for the three month periods ended September 30, 2021 or September 30, 2020, nor a significant contributor to baking accounts receivable as of September 30, 2021 and June 30, 2021.

Printing: The printing sector of Gourmet Foods' gross revenues is comprised of many customers, some large and some small, with one customer accounting for

Consolidated: With respect to Gourmet Foods’ consolidated risk, the largest

Gourmet Foods, including Printstock, is not dependent upon any one major supplier as many alternative sources are available in the local marketplace should the need arise. However, the unavailability of, or increase in price in, any of the ingredients on which Gourmet Foods relies to produce its products could harm its operating results for such period.

Concierge, through Brigadier, is partially dependent upon its contractual relationship with the alarm monitoring company who provides monitoring services to Brigadier’s customers. In the event this contract is terminated, Brigadier would be compelled to find an alternate source of alarm monitoring, or establish such a facility itself. Management believes that the contractual relationship is sustainable, and has been for many years, with alternate solutions available should the need arise. Sales to the largest customer, which includes contracts and recurring monthly support fees, totaled

Brigadier purchases alarm panels, digital and analog cameras, mounting hardware and accessory items needed to complete security installations from a variety of sources. The manufacture of electronic items such as those sought by Brigadier has expanded to a global scale thus providing Brigadier with a broad choice of suppliers. Brigadier bases its vendor selection on several criteria including: price, availability, shipping costs, quality, suitability for purpose and the technical support of the manufacturer. Brigadier is not reliant on any one supplier.

Concierge, through Original Sprout, has thousands of customers and, from time to time, certain customers become significant during specific reporting periods, but may not be significant during other periods. Original Sprout had

Concierge, through Original Sprout, is dependent upon its relationship with a product packaging company who, at the direction of Original Sprout, produces the products in accordance with proprietary formulas, packages them in appropriate containers, and delivers the finished goods to Original Sprout for distribution to its customers. All of Original Sprout’s products are currently produced by this packaging company, although if this relationship were to fail there are other similar packaging companies available to Original Sprout at competitive pricing. Because of the nature of the Original Sprout product ingredients, some of the ingredients may, at times, be difficult to source in timely fashion or at the expected price point. To safeguard against this possibility Original Sprout endeavors to maintain at least a 90-day supply of all products in stock. Estimating and maintaining a reserve stock account is not a guarantee that a shortage of ingredient supplies will not affect production such that Original Sprout will not exhaust its reserves or be unable to fulfill customer orders.

Inventories

Inventories, consisting primarily of; (i) food products, printing supplies, and packaging in New Zealand, (ii) hair and skin care finished products and components in the U.S. and, (iii) security system hardware in Canada, are valued at the lower of cost or net realizable value. Inventories in Canada and New Zealand are maintained on the first-in, first-out method, while inventory in the U.S is maintained using the average cost method. Inventories include product cost, inbound freight and warehousing costs where applicable. Management compares the cost of inventories with the net realizable value and an allowance is made for writing down the inventories to their net realizable value, if lower. An assessment is made at the end of each fiscal quarter to determine what slow-moving inventory items, if any, should be deemed obsolete and written down to their estimated net realizable value. For the three months ended September 30, 2021 and September 30, 2020, the expense for slow-moving or obsolete inventory was $

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Expenditures for maintenance and repairs are charged to operating expense as incurred; additions and improvements are capitalized. Office furniture and equipment include office fixtures, computers, printers and other office equipment plus software and applicable packaging designs. Leasehold improvements, which are included in plant and equipment, are depreciated over the shorter of the useful life of the improvement and the length of the lease. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation is computed using the straight line method over the estimated useful life of the asset (see Note 5 to the Consolidated Financial Statements).

| Category | Estimated Useful Life (in years) | |||

| Building | ||||

| Plant and equipment: | ||||

| Furniture and office equipment | ||||

| Vehicles | ||||

Intangible Assets

Intangible assets consist of brand names, domain names, recipes, non-compete agreements and customer lists along with the internally developed software in process for the business applications of Marygold to be launched in the coming fiscal year. Intangible assets with finite lives are amortized over the estimated useful life and are evaluated for impairment at least on an annual basis and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. The Company assesses recoverability by determining whether the carrying value of such assets will be recovered through the discounted expected future cash flows. If the future discounted cash flows are less than the carrying amount of these assets, the Company recognizes an impairment loss based on the excess of the carrying amount over the fair value of the assets. There was

Goodwill

Goodwill represents the excess of the aggregate purchase price over the fair value of the net assets acquired in a business combination transaction. Goodwill is tested for impairment on an annual basis during the fourth quarter of the Company's fiscal year, or more frequently if events or changes in circumstances indicate that the carrying amount of goodwill may be impaired. The Company first performs a qualitative test to determine if goodwill is impaired at a reporting unit. In performing this test, the Company evaluates macroeconomic factors, industry and market considerations, cost factors such as the increase in the cost of materials or labor or other costs, overall financial performance, changes in key personnel or customers or strategy, and other entity-specific events or trends that could indicate impairment, among other items. If the results of this test indicate that it is more likely than not that the fair value of the reporting is below its carrying value, a quantitative test is then performed to determine the amount of the impairment. When impaired, the carrying value of goodwill is written down to fair value. There was

Impairment of Long-Lived Assets

The Company tests long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable through the estimated undiscounted cash flows expected to result from the use and eventual disposition of the assets. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value. There was

Investments and Fair Value of Financial Instruments

Short-term investments are classified as available-for-sale securities. The Company measures the investments at fair value at period end with any changes in fair value reflected as unrealized gains or (losses) which is included as part of other (expense) income. The Company values its investments in accordance with Accounting Standards Codification ("ASC") 820 – Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurement. ASC 820 establishes a fair value hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Company (observable inputs) and (2) The Company’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the ASC 820 hierarchy are as follows:

Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 assets include the following: quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market-corroborated inputs).

Level 3 – Unobservable pricing input at the measurement date for the asset or liability. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available.

In some instances, the inputs used to measure fair value might fall within different levels of the fair value hierarchy. The level in the fair value hierarchy within which the fair value measurement in its entirety falls shall be determined based on the lowest input level that is significant to the fair value measurement in its entirety.

Revenue Recognition

Revenue consists of fees earned through management of investment funds, sale of gourmet meat pies and printing of food wrappers in New Zealand, security alarm system installation and maintenance services in Canada, and sales of hair and skin care products internationally. Revenue is accounted for net of sales taxes, sales returns, and trade discounts. The performance obligation is satisfied when the product has been shipped and title, risk of loss and rewards of ownership have been transferred. For most of the Company’s product sales or services, these criteria are met at the time the product is shipped, the subscription period commences, or the management fees earned each month. For our Brigadier subsidiary in Canada, the Company operates under contract with an alarm monitoring company that pays a percentage of its recurring monitoring fee to Brigadier in exchange for continued customer service and support functions with respect to each customer maintained under contract by the monitoring company. The Company has no costs of contracts which require capitalization.

The Company generates revenue, in part, through contractual monthly recurring fees received for providing ongoing customer support services to monitoring company clientele. The five-step process governing contract revenue reporting includes:

| 1. Identifying the contract(s) with customers |

| 2. Identifying the performance obligations in the contract |

| 3. Determining the transaction price |

| 4. Allocating the transaction price to the performance obligations in the contract |

| 5. Recognizing revenue when or as the performance obligation is satisfied |

Transactions involve security systems that are sold outright to the customer where the Company's performance obligations include customer support services and the sale and installation of the security systems. For such arrangements, the Company allocates a portion of the transaction price to each performance obligation based on a relative stand-alone selling price. Revenue associated with the sale and installation of security systems is recognized once installation is complete, and is reflected as security system revenue in the Consolidated Statements of Income. Revenue associated with customer support services is recognized as those services are provided, and is included as a component of security system revenue in the Condensed Consolidated Statements of (Loss) Income, which for the three months ended September 30, 2021, were approximately $

Because the Company has no contract with the end user, and the monthly payments for customer support services are made to the Company by the monitoring company who has a contract with the end user, and end user customers are subject to cancellation through no control of the Company, no deferred revenues or contingent liability reserves have been established with respect to these contracts. The services are deemed delivered as the obligation is acknowledged on a monthly basis.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date. A valuation allowance is provided for deferred tax assets if it is more likely than not that these items will either expire before the Company is able to realize their benefits or if future deductibility is uncertain.

When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Applicable interest and penalties associated with unrecognized tax benefits are classified as additional income taxes in the statements of Income.

Advertising Costs

The Company expenses the cost of advertising as incurred. Marketing and advertising costs for the three months ended September 30, 2021 and September 30, 2020 were $

Other Comprehensive Income (Loss)

Foreign Currency Translation

We record foreign currency translation adjustments and transaction gains and losses in accordance with ASC 830-30, Foreign Currency Translation. The accounts of Gourmet Foods use the New Zealand dollar as the functional currency. The accounts of Brigadier Security Systems use the Canadian dollar as the functional currency. Assets and liabilities are translated at the exchange rate on the balance sheet date, and operating results are translated at the weighted average exchange rate throughout the period. Foreign currency transaction gains and (losses) can also occur if a transaction is settled in a currency other than the entity's functional currency. Accumulated currency translation gains and (losses) are classified as an item of accumulated other comprehensive income (loss) in the stockholders’ equity section of the consolidated balance sheet.

Segment Reporting

The Company defines operating segments as components for which separate financial information is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performances. The Company allocates its resources and assesses the performance of its sales activities based on these segments (Refer to Note 16 of the Condensed Consolidated Financial Statements).

Business Combinations

We allocate the fair value of purchase consideration to the tangible assets acquired, liabilities assumed and intangible assets acquired based on their estimated fair values. The excess of the fair value of purchase consideration over the fair values of these identifiable assets and liabilities is recorded as goodwill. Such valuations require management to make significant estimates and assumptions, especially with respect to intangible assets. Significant estimates in valuing certain intangible assets include, but are not limited to, future expected cash flows from acquired users, acquired trade names from a market participant perspective, useful lives and discount rates. Management’s estimates of fair value are based upon assumptions believed to be reasonable, but which are inherently uncertain and unpredictable and, as a result, actual results may differ from estimates. During the measurement period, which is one year from the acquisition date, we may record adjustments to the assets acquired and liabilities assumed. For the three months ended September 30, 2021 and September 30, 2020 a determination was made that no adjustments were necessary.

Recent Accounting Pronouncements

In June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Board Update (“ASU”) 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, and also issued subsequent amendments to the initial guidance: ASU 2018-19, ASU 2019-04, ASU 2019-05, ASU 2019-10, and ASU 2019-11, which replace the existing incurred loss impairment model with an expected credit loss model and require a financial asset measured at amortized cost to be presented at the net amount expected to be collected. The new guidance will be effective for annual reporting periods beginning after December 15, 2022 (as amended by ASU 2019-10), including interim periods within that annual period. The Company anticipates the adoption of the standard will lead to changes in disclosures as well as insignificant changes related to the period of recognition of losses on its receivables.

In August 2020, the FASB issued ASU No. 2020-06, Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40). The amendment is meant to simplify the accounting for convertible instruments by removing certain separation models in subtopic 470-20 for convertible instruments. The amendment also changed the method used to calculate diluted earnings per share ("EPS") for convertible instruments and for instruments that may be settled in cash. The amendment is effective for years beginning after December 15, 2023, including interim periods for those fiscal years. Early adoption is permitted for periods beginning after December 15, 2020, including interim periods within those fiscal years. The Company anticipates the adoption of the standard will not have a material impact on its consolidated financial statements and related disclosures given its current and anticipated operations.

| NOTE 3. | BASIC AND DILUTED NET INCOME PER SHARE |

Basic net income per share is based upon the weighted average number of common shares outstanding. This calculation also includes the weighted average number of Series B Convertible Preferred shares outstanding as they are deemed to be substantially similar to the common shares and shareholders are entitled to the same liquidation and dividend rights. Diluted net income per share is based on the assumption that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period. The Company does not have any options or warrants or other dilutive financial instruments. As such, basic and diluted earnings per share are the same.

On August 25, 2021 the Company adopted the Concierge Technologies, Inc. 2021 Omnibus Equity Incentive Plan (the "Plan") and had not issued any awards under the Plan as of September 30, 2021. The Company has also authorized a reverse stock split of its Common Stock by a ratio of not less than 1-for-

Basic and diluted net income per share reflects the effects of shares actually potentially issuable upon conversion of convertible preferred stock.

The components of basic and diluted earnings per share were as follows:

| For the Three Months Ended September 30, 2021 | ||||||||||||

| Net Loss | Shares | Per Share | ||||||||||

| Basic net loss per share: | ||||||||||||

| Net loss available to common shareholders | $ | ( | ) | $ | ( | ) | ||||||

| Net loss available to preferred shareholders | ( | ) | $ | ( | ) | |||||||

| Basic and diluted net loss per share | $ | ( | ) | $ | ( | ) | ||||||

| For the Three Months Ended September 30, 2020 | ||||||||||||

| Net Income | Shares | Per Share | ||||||||||

| Basic net income per share: | ||||||||||||

| Net income available to common shareholders | $ | $ | ||||||||||

| Net income available to preferred shareholders | $ | |||||||||||

| Basic and diluted net income per share | $ | 2,219,434 | 38,473,159 | $ | 0.06 | |||||||

| NOTE 4. | INVENTORIES |

Inventories for Gourmet Foods, Brigadier, Original Sprout and Marygold consisted of the following totals as of September 30, 2021 and June 30, 2021:

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Raw materials | $ | $ | ||||||

| Supplies and packing materials | ||||||||

| Finished goods | ||||||||

| Total inventories | $ | $ | ||||||

| NOTE 5. | PROPERTY, PLANT AND EQUIPMENT |

Property, plant and equipment consisted of the following as of September 30, 2021 and June 30, 2021:

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Plant and equipment | $ | $ | ||||||

| Furniture and office equipment | ||||||||

| Vehicles | ||||||||

| Land and building | ||||||||

| Total property, plant and equipment, gross | ||||||||

| Accumulated depreciation | ( | ) | ( | ) | ||||

| Total property, plant and equipment, net | $ | $ | ||||||

For the three months ended September 30, 2021 and September 30, 2020, depreciation expense for property, plant and equipment totaled $

| NOTE 6. | INTANGIBLE ASSETS |

Intangible assets consisted of the following as of September 30, 2021 and June 30, 2021:

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Customer relationships | $ | $ | ||||||

| Brand name | ||||||||

| Domain name | ||||||||

| Recipes | ||||||||

| Non-compete agreement | ||||||||

| Internally developed software | ||||||||

| Total | ||||||||

| Less : accumulated amortization | ( | ) | ( | ) | ||||

| Net intangibles | $ | $ | ||||||

CUSTOMER RELATIONSHIPS

On August 11, 2015, the Company acquired Gourmet Foods, Ltd. The fair value on the acquired customer relationships was estimated to be $

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Customer relationships | $ | |||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total customer relationships, net | $ | |||||||

BRAND NAME

On August 11, 2015, the Company acquired Gourmet Foods, Ltd. The fair value on the acquired brand name was estimated to be $

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Brand name | $ | $ | ||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total brand name, net | $ | $ | ||||||

DOMAIN NAME

On August 11, 2015, the Company acquired Gourmet Foods, Ltd. The fair value on the acquired domain name was estimated to be $

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Domain name | $ | $ | ||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total brand name, net | $ | $ | ||||||

RECIPES AND FORMULAS

On August 11, 2015, the Company acquired Gourmet Foods, Ltd. The fair value on the recipes was estimated to be $

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Recipes and formulas | $ | $ | ||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total recipes and formulas, net | $ | $ | ||||||

NON-COMPETE AGREEMENT

On June 2, 2016, the Company acquired Brigadier. The fair value on the acquired non-compete agreement was estimated to be $

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Non-compete agreement | $ | $ | ||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total non-compete agreement, net | $ | $ | ||||||

INTERNALLY DEVELOPED SOFTWARE

During the quarter ended September 30, 2020, Marygold began incurring expenses in connection with the internal development of software applications that are planned for eventual integration to its consumer Fintech offering. Certain of these expenses, totaling as of September 30, 2021, have been capitalized as intangible assets. Once development has been completed and the product is commercially viable, these capitalized costs will be amortized over their useful lives. As of September 30, 2021,

AMORTIZATION EXPENSE

The total amortization expense for intangible assets for the three months ended September 30, 2021 and September 30, 2020 was $

Estimated remaining amortization expenses of intangible assets for the next five fiscal years, are as follows:

| Years Ending June 30, | Expense | |||

| 2022 | $ | |||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total | $ | |||

| NOTE 7. | OTHER ASSETS |

Other Current Assets

Other current assets totaling $

| As of September 30, 2021 | As of June 30, 2021 | |||||||

| Prepaid expenses | $ | $ | ||||||

| Other current assets | ||||||||

| Total | $ | $ | ||||||

Investments

Wainwright, from time to time, provides initial investment in the creation of ETP funds that Wainwright manages. Wainwright classifies these investments as current assets as these investments are generally sold within one year of the balance sheet date. Investments in which no controlling financial interest or significant influence exists are recorded at fair value with the change included in earnings on the Consolidated Statements of Income. Investments in which no controlling financial interest exists, but significant influence exists are recorded per the equity method of investment accounting. As of September 30, 2021 and June 30, 2021, there were no investments in its ETP funds or investments requiring equity method investment accounting. The Company also invests in marketable securities. As of September 30, 2021 and June 30, 2021, such investments were approximately $

Investments measured at estimated fair value consist of the following as of September 30, 2021 and June 30, 2021:

| September 30, 2021 | ||||||||||||||||

| Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | |||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| Other short-term investments | ||||||||||||||||

| Other equities | ( | ) | ||||||||||||||

| Total short-term investments | $ | $ | $ | ( | ) | $ | ||||||||||

| June 30, 2021 | ||||||||||||||||

| Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | |||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| Other short term investments | ||||||||||||||||

| Other equities | ( | ) | ||||||||||||||

| Total short-term investments | $ | $ | $ | ( | ) | $ | ||||||||||

All of the Company's short-term investments are Level 1 as of September 30, 2021 and June 30, 2021. During the three months ended September 30, 2021 and September 30, 2020, there were no transfers between Level 1 and Level 2.

Restricted Cash

At September 30, 2021 and June 30, 2021, Gourmet Foods had on deposit approximately NZ$

Long Term Assets

Other long-term assets totaling $

| (i) | $ | |

| (ii) | and $ |

| NOTE 8. | GOODWILL |

Goodwill represents the excess of the aggregate purchase price over the fair value of the net assets acquired in business combinations. The amount recorded in goodwill for September 30, 2021 and June 30, 2021 was $

Goodwill is comprised of the following amounts as of September 30, 2021 and June 30, 2021:

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Goodwill – Original Sprout | ||||||||

| Goodwill – Gourmet Foods | ||||||||

| Goodwill – Brigadier | ||||||||

| Total | $ | $ | ||||||

The Company tests for goodwill impairment at each reporting unit. There was

| NOTE 9. | ACCOUNTS PAYABLE, ACCRUED EXPENSES AND LEGAL SETTLEMENT |

Accounts payable and accrued expenses consisted of the following as of September 30, 2021 and June 30, 2021:

| September 30, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Accounts payable | $ | $ | ||||||

| Accrued interest | ||||||||

| Taxes payable | ||||||||

| Accrued payroll, vacation and bonus payable | ||||||||

| Accrued operating expenses and legal settlement | ||||||||

| Total | $ | $ | ||||||

| NOTE 10. | RELATED PARTY TRANSACTIONS |

Notes Payable - Related Parties

Current related party notes payable consist of the following as of September 30, 2021 and June 30, 2021:

| September 30, | June 30, | |||||||

|

|

| |||||||

| Notes payable to shareholder, interest rate of 8%, unsecured and payable on December 31, 2012 (past due) | $ | $ | ||||||

| Notes payable to shareholder, interest rate of 4%, unsecured and payable on May 25, 2022 | ||||||||

| Notes payable to shareholder, interest rate of 4%, unsecured and payable on April 8, 2022 | ||||||||

| $ | $ | |||||||

Interest expense for all related party notes for the three months ended September 30, 2021 and September 30, 2020 was $

Wainwright - Related Party Transactions

The Funds managed by USCF and USCF Advisers are deemed by management to be related parties. The Company’s Wainwright revenues, totaling $

| NOTE 11. | LOANS - PROPERTY AND EQUIPMENT |

As of September 30, 2021, Brigadier had an outstanding principal balance of CD$

| NOTE 12. | STOCKHOLDERS' EQUITY |

Convertible Preferred Stock

Each issued Series B Convertible Preferred Stock is convertible into

| NOTE 13. | BUSINESS COMBINATIONS |

On March 11, 2020 our wholly owned subsidiary Gourmet Foods, Ltd. entered into a Stock Purchase Agreement to acquire all the issued and outstanding shares of Printstock, a New Zealand private company located in Napier, New Zealand. Printstock is a printer of wrappers distributed to food manufacturers primarily within New Zealand and limited export to Australia. The company will be operated as a subsidiary of Gourmet Foods and is expected to incrementally reduce the cost of goods sold through reduction in the cost of wrappers purchased by Gourmet Foods by elimination of inter-company profit while increasing overall revenues and profits to Gourmet Foods on a consolidated basis through inclusion of Printstock operations. The purchase price was agreed to be million subject to adjustment within 90 days of the closing date. The transaction closed on July 1, 2020 with a payment of and an estimated final payment due of on September 30, 2020. Included in the below purchase price allocation are estimated deferred income tax liabilities of pertaining to the increase in the value of fixed assets above their book value and the acquired intangible assets. The amounts have been translated to US currency as of the acquisition date, July 1, 2020.

| Item | Amount | |||

| Cash in bank | $ | |||

| Accounts receivable | ||||

| Prepayments/deposits | ||||

| Inventories | ||||

| Operating lease right of use asset | ||||

| Plant, property and equipment | ||||

| Intangible assets | ||||

| Goodwill | ||||

| Deferred tax liability | ( | ) | ||

| Assumed lease liabilities | ( | ) | ||

| Accounts payable and accrued expenses | ( | ) | ||

| Total Purchase Price | $ | |||

On August 13, 2021, Marygold UK entered into a Share Purchase Agreement that, when consummated, would result in the acquisition of all the outstanding and issued shares of Tiger Financial and Asset Management Limited, a U.K. limited company, ("Tiger") in exchange for GBP

| NOTE 14. | INCOME TAXES |

The Company accounts for income taxes under the asset and liability method, which recognizes deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the tax bases of assets and liabilities and their financial statement reported amounts, and for net operating losses and tax credit carryforwards. Deferred income tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The Company records a valuation allowance against deferred tax assets when it is more likely than not that such asset will not be realized. The Company continues to monitor the likelihood that it will be able to recover its deferred tax assets. If recovery is not likely, the Company must increase its provision for income taxes by recording a valuation allowance against the deferred tax assets.

The Company accounts for uncertain tax positions in accordance with the authoritative guidance on income taxes under which the Company may only recognize or continue to recognize tax positions that meet a "more likely than not" threshold. The Company recognizes accrued interest and penalties related to unrecognized tax benefits as a component of the provision for income taxes.

As of September 30, 2021, the Company's total unrecognized tax benefits were approximately $

The Company is required to make its best estimate of the annual effective tax rate for the full fiscal year and use that rate to provide for income taxes on a current year-to-date basis. The Company recorded tax expense of $

The Company is subject to income taxes in the U.S. federal, various states, Canada and New Zealand tax jurisdictions. Tax regulations within each jurisdiction are subject to the interpretation of the related tax laws and regulations and require significant judgment to apply. The Company’s U.S. tax years 2017 through 2020 will remain open for examination by the federal and state authorities which is three and four years, respectively. The Company’s tax years from 2017 through remain open for examination by Canada and New Zealand authorities. As of September 30, 2021, there were no active taxing authority examinations.

| NOTE 15. | COMMITMENTS AND CONTINGENCIES |

Lease Commitments

The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use assets, accrued expenses, and long-term operating lease liabilities in the Consolidated Balance Sheets. Right-of-use assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. Operating lease right-of-use assets and liabilities are recognized at the lease commencement date based on the present value of lease payments over the lease term. In determining the present value of lease payments, the Company uses its incremental borrowing rate based on the information available at the lease commencement date. The operating lease right-of-use assets also include any lease payments made at or before the commencement date and are reduced by any lease incentives received. The Company’s lease terms may include options to extend or not terminate the lease when it is reasonably certain that it will exercise any such options. For the majority of its leases, the Company concluded that it is not reasonably certain that any renewal options would be exercised, and, therefore, the amounts are not recognized as part of operating lease right-of-use assets nor operating lease liabilities. Leases with an initial term of 12 months or less, and certain office equipment leases which are deemed insignificant, are not recorded on the balance sheet and expensed as incurred and included within rent expense under general and administrative expense. Lease expense is recognized on a straight-line basis over the expected lease term.

The Company’s most significant leases are real estate leases of office, warehouse and production facilities. The remaining operating leases are primarily comprised of leases of printers and other equipment which are deemed insignificant. For all operating leases, the Company has elected the practical expedient permitted under Topic 842 to combine lease and non-lease components. As a result, non-lease components, such as common area or equipment maintenance charges, are accounted for as a single lease element. The Company does not have any finance leases.

Fixed lease expense payments are recognized on a straight-line basis over the lease term. Variable lease payments vary because of changes in facts or circumstances occurring after the commencement date, other than the passage of time. Certain of the Company’s operating lease agreements include variable payments that are passed through by the landlord, such as insurance, taxes, and common area maintenance. Variable payments are deemed immaterial, expensed as incurred, and included within rent expense under general and administrative expense.

The Company leases various facilities and offices throughout the world including the following subsidiary locations:

Gourmet Foods has operating leases for its office, factory and warehouse facilities located in Tauranga, New Zealand, and facilities leased by its subsidiary, Printstock, in Napier, New Zealand, as well as for certain equipment including printers and copiers. These leases are generally for -year terms, with some options to renew for an additional term. The leases mature between October 2021 and September 2024, and require monthly rental payments of approximately US$

For the three month periods ended September 30, 2021 and September 30, 2020, the combined lease payments of the Company and its subsidiaries totaled $

Future minimum consolidated lease payments for Concierge and its subsidiaries are as follows:

| Year Ended June 30, | Lease Amount | |||

| 2022 | $ | |||

| 2023 | ||||

| 2024 | ||||

| Total minimum lease payments | ||||

| Less: present value discount | ( | ) | ||

| Total operating lease liabilities | $ | |||

The weighted average remaining lease term for the Company's operating leases was

Additionally, Gourmet Foods, Ltd. entered into a General Security Agreement in favor of the Gerald O’Leary Family Trust and registered on the Personal Property Securities Register for a priority sum of (approximately US$

Other Agreements and Commitments

USCF manages four Funds (BNO, CPER, UGA, UNL) which had expense waiver provisions during the prior fiscal year, whereby USCF reimburses funds when fund expenditure levels exceed certain threshold amounts. Effective May 1, 2021 USCF discontinued expense waiver reimbursements for BNO, CPER and UGA with only UNL continuing. As of September 30, 2021 and June 30, 2021 the expense waiver payable was $

As Marygold builds out its application it enters into agreements with various service providers. As of September 30, 2021, Marygold has future payment commitments with its primary service vendors totaling $

Litigation

From time to time, the Company and its subsidiaries may be involved in legal proceedings arising primarily from the ordinary course of their respective businesses. Except as described below there are no pending legal proceedings against the Company. USCF, is an indirect wholly owned subsidiary of the Company. USCF, as the general partner of USO and the general partner and sponsor of the related public funds may, from time to time, be involved in litigation arising out of its operations in the ordinary course of business. Except as described herein, (refer to Part II, Item 1. Legal Proceedings) neither the Company or its subsidiaries are currently party to any material legal proceedings.

SEC and CFTC Wells Notices

On November 8, 2021, one of Concierge Technologies, Inc.'s (the "Company") indirect subsidiaries, the United States Commodity Funds LLC (“USCF”), together with United States Oil Fund, LP (“USO”), for which USCF is the general partner, announced a resolution with each of the U.S. Securities and Exchange Commission (the “SEC”) and the U.S. Commodity Futures Trading Commission (the “CFTC”) relating to matters set forth in certain Wells Notices issued by the staffs of each of the SEC and CFTC, as detailed below.

On August 17, 2020, USCF, USO, and John Love received a “Wells Notice” from the staff of the SEC (the “SEC Wells Notice”). The SEC Wells Notice relates to USO's disclosures in late April 2020 and early May 2020 regarding constraints imposed on USO's ability to invest in Oil Futures Contracts. The SEC Wells Notice states that the SEC staff has made a preliminary determination to recommend that the SEC file an enforcement action against USCF, USO, and Mr. Love alleging violations of Sections 17(a)(1) and 17(a)(3) of the 1933 Act and Section 10(b) of the 1934 Act and Rule 10b-5 thereunder, in each case with respect to its disclosures and USO’s actions.

Subsequently, on August 19, 2020, USCF, USO, and Mr. Love received a Wells Notice from the staff of the CFTC (the “CFTC Wells Notice”). The CFTC Wells Notice states that the CFTC staff has made a preliminary determination to recommend that the CFTC file an enforcement action against USCF, USO, and Mr. Love alleging violations of Sections 4o(1)(A) and (B) and 6(c)(1) of the CEA, 7 U.S.C. §§ 6o(1)(A), (B), 9(1) (2018), and CFTC Regulations 4.26, 4.41, and 180.1(a), 17 C.F.R. §§ 4.26, 4.41, 180.1(a) (2019), in each case with respect to its disclosures and USO’s actions.

On November 8, 2021, acting pursuant to an offer of settlement submitted by USCF and USO, the SEC issued an order instituting cease-and-desist proceedings, making findings, and imposing a cease-and-desist order pursuant to Section 8A of the 1933 Act, directing USCF and USO to cease and desist from committing or causing any violations of Section 17(a)(3) of the 1933 Act, 15 U.S.C. § 77q(a)(3) (the “SEC Order”). In the SEC Order, the SEC made findings that, from April 24, 2020 to May 21, 2020, USCF and USO violated Section 17(a)(3) of 1933 Act, which provides that it is “unlawful for any person in the offer or sale of any securities . . . to engage in any transaction, practice, or course of business which operates or would operate as a fraud or deceit upon the purchaser.” USCF and USO consented to entry of the SEC Order without admitting or denying the findings contained therein, except as to jurisdiction.

Separately, on November 8, 2021, acting pursuant to an offer of settlement submitted by USCF, the CFTC issued an order instituting cease-and-desist proceedings, making findings, and imposing a cease-and-desist order pursuant to Section 6(c) and (d) of the CEA, directing USCF to cease and desist from committing or causing any violations of Section 4o(1)(B) of the CEA, 7 U.S.C. § 6o(1)(B), and CFTC Regulation 4.41(a)(2), 17 C.F.R. § 4.41(a)(2) (the “CFTC Order”). In the CFTC Order, the CFTC made findings that, from on or about April 22, 2020 to June 12, 2020, USCF violated Section 4o(1)(B) of the CEA and CFTC Regulation 4.41(a)(2), which make it unlawful for any commodity pool operator (“CPO”) to engage in “any transaction, practice, or course of business which operates as a fraud or deceit upon any client or participant or prospective client or participant” and prohibit a CPO from advertising in a manner which “operates as a fraud or deceit upon any client or participant or prospective client or participant,” respectively. USCF consented to entry of the CFTC Order without admitting or denying the findings contained therein, except as to jurisdiction.

Pursuant to the SEC Order and the CFTC Order, in addition to the command to cease and desist from committing or causing any violations of Section 17(a)(3) of the 1933 Act, Section 4o(1)(B) of the CEA, and CFTC Regulation 4.14(a)(2), civil monetary penalties totaling two million five hundred thousand dollars ($2,500,000) in the aggregate must be paid to the SEC and CFTC, of which one million two hundred fifty thousand dollars ($1,250,000) will be paid by USCF to each of the SEC and the CFTC, respectively, pursuant to the offsets permitted under the orders. The SEC Order can be accessed at www.sec.gov and the CFTC Order can be accessed at www.cftc.gov.

In re: United States Oil Fund, LP Securities Litigation

On June 19, 2020, USCF, USO, John P. Love, and Stuart P. Crumbaugh were named as defendants in a putative class action filed by purported shareholder Robert Lucas (the “Lucas Class Action”). The Court thereafter consolidated the Lucas Class Action with two related putative class actions filed on July 31, 2020 and August 13, 2020, and appointed a lead plaintiff. The consolidated class action is pending in the U.S. District Court for the Southern District of New York under the caption In re: United States Oil Fund, LP Securities Litigation, Civil Action No. 1:20-cv-04740.

On November 30, 2020, the lead plaintiff filed an amended complaint (the “Amended Lucas Class Complaint”). The Amended Lucas Class Complaint asserts claims under the 1933 Act, the 1934 Act, and Rule 10b-5. The Amended Lucas Class Complaint challenges statements in registration statements that became effective on February 25, 2020 and March 23, 2020 as well as subsequent public statements through April 2020 concerning certain extraordinary market conditions and the attendant risks that caused the demand for oil to fall precipitously, including the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. The Amended Lucas Class Complaint purports to have been brought by an investor in USO on behalf of a class of similarly-situated shareholders who purchased USO securities between February 25, 2020 and April 28, 2020 and pursuant to the challenged registration statements. The Amended Lucas Class Complaint seeks to certify a class and to award the class compensatory damages at an amount to be determined at trial as well as costs and attorney’s fees. The Amended Lucas Class Complaint named as defendants USCF, USO, John P. Love, Stuart P. Crumbaugh, Nicholas D. Gerber, Andrew F Ngim, Robert L. Nguyen, Peter M. Robinson, Gordon L. Ellis, and Malcolm R. Fobes III, as well as the marketing agent, ALPS Distributors, Inc., and the Authorized Participants: ABN Amro, BNP Paribas Securities Corporation, Citadel Securities LLC, Citigroup Global Markets, Inc., Credit Suisse Securities USA LLC, Deutsche Bank Securities Inc., Goldman Sachs & Company, J.P. Morgan Securities Inc., Merrill Lynch Professional Clearing Corporation, Morgan Stanley & Company Inc., Nomura Securities International Inc., RBC Capital Markets LLC, SG Americas Securities LLC, UBS Securities LLC, and Virtu Financial BD LLC.

The lead plaintiff has filed a notice of voluntary dismissal of its claims against BNP Paribas Securities Corporation, Citadel Securities LLC, Citigroup Global Markets Inc., Credit Suisse Securities USA LLC, Deutsche Bank Securities Inc., Morgan Stanley & Company, Inc., Nomura Securities International, Inc., RBC Capital Markets, LLC, SG Americas Securities LLC, and UBS Securities LLC.

USCF, USO, and the individual defendants in In re: United States Oil Fund, LP Securities Litigation intend to vigorously contest such claims and has moved for their dismissal.

Mehan Action

On August 10, 2020, purported shareholder Darshan Mehan filed a derivative action on behalf of nominal defendant USO, against defendants USCF, John P. Love, Stuart P. Crumbaugh, Nicholas D. Gerber, Andrew F Ngim, Robert L. Nguyen, Peter M. Robinson, Gordon L. Ellis, and Malcolm R. Fobes, III (the “Mehan Action”). The action is pending in the Superior Court of the State of California for the County of Alameda as Case No. RG20070732.

The Mehan Action alleges that the defendants breached their fiduciary duties to USO and failed to act in good faith in connection with a March 19, 2020 registration statement and offering and disclosures regarding certain extraordinary market conditions that caused demand for oil to fall precipitously, including the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. The complaint seeks, on behalf of USO, compensatory damages, restitution, equitable relief, attorney’s fees, and costs. All proceedings in the Mehan Action are stayed pending disposition of the motion(s) to dismiss in In re: United States Oil Fund, LP Securities Litigation.

USCF, USO, and the other defendants intend to vigorously contest such claims.

In re United States Oil Fund, LP Derivative Litigation