Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07455

Virtus Opportunities Trust

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9668

(Address of principal executive offices) (Zip code)

Kevin J. Carr, Esq.

Senior Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

100 Pearl Street

Hartford, CT 06103-4506

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 243-1574

Date of fiscal year end: September 30

Date of reporting period: September 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Table of Contents

ANNUAL REPORT

Virtus Bond Fund*

Virtus CA Tax-Exempt Bond Fund

Virtus Essential Resources Fund*

Virtus High Yield Fund*

Virtus Low Duration Income Fund

Virtus Low Volatility Equity Fund*

Virtus Multi-Sector Intermediate Bond Fund

Virtus Senior Floating Rate Fund*

Virtus Tax-Exempt Bond Fund

Virtus Wealth Masters Fund

| September 30, 2016 TRUST NAME: VIRTUS OPPORTUNITIES TRUST * Prospectus and Statement of Additional Information supplements applicable to these Funds |

|

Not FDIC Insured

No Bank Guarantee

May Lose Value

Table of Contents

| 1 | ||||||||

| 2 | ||||||||

| 4 | ||||||||

| Fund | Fund Summary |

Schedule of Investments |

||||||

| 7 | 31 | |||||||

| 9 | 38 | |||||||

| Virtus Essential Resources Fund (“Essential Resources Fund”) |

12 | 41 | ||||||

| 14 | 43 | |||||||

| Virtus Low Duration Income Fund (“Low Duration Income Fund”) |

17 | 49 | ||||||

| Virtus Low Volatility Equity Fund (“Low Volatility Equity Fund”) |

19 | 58 | ||||||

| Virtus Multi-Sector Intermediate Bond Fund (“Multi-Sector Intermediate Bond Fund”) |

21 | 59 | ||||||

| Virtus Senior Floating Rate Fund (“Senior Floating Rate Fund”) |

23 | 68 | ||||||

| 26 | 74 | |||||||

| 29 | 79 | |||||||

| 81 | ||||||||

| 84 | ||||||||

| 88 | ||||||||

| 95 | ||||||||

| 101 | ||||||||

| 116 | ||||||||

| 117 | ||||||||

| Consideration of Advisory and Subadvisory Agreements by the Board of Trustees |

118 | |||||||

| 120 | ||||||||

| 124 | ||||||||

Proxy Voting Procedures and Voting Record (Form N-PX)

The subadvisers vote proxies relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Trust (“Trustees,” or the “Board”). You may obtain a description of these procedures, along with information regarding how the Funds voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-243-1574. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

Form N-Q Information

The Trust files a complete schedule of portfolio holdings for each Fund with the SEC for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov. Form N-Q may be reviewed and copied at the SEC’s Public Reference Room. Information on the operation of the SEC’s Public Reference Room can be obtained by calling toll-free 1-800-SEC-0330.

This report is not authorized for distribution to prospective investors in the Funds presented in this book unless preceded or accompanied by an effective prospectus which includes information concerning the sales charge, each Fund’s record and other pertinent information.

Table of Contents

To My Fellow Shareholders of Virtus Mutual Funds:

|

I am pleased to present this annual report that reviews the performance of your fund for the 12 months ended September 30, 2016.

During the first half of the fiscal year, global equity markets were challenged by falling oil prices, China’s slowdown, and concerns over the Federal Reserve’s (“the Fed”) first rate hike in nine years, which occurred in December 2015. Equities plummeted in early 2016, but stabilizing oil prices and the Fed’s softened stance on further rate hikes for 2016 sparked a rally in mid-February that lasted until June. The U.K.’s June 23 “Brexit” decision to leave the European Union triggered a selloff that was largely | |

| short-lived. Calm was restored by better-than-expected corporate earnings, an improving global economic picture, and reassurance that the world’s central banks would continue to provide monetary stimulus. By the end of September, U.S. equity markets had recovered much of their losses, and the 12-month period was positive for many asset classes.

For the 12 months ended September 30, 2016, U.S. small-cap stocks kept pace with U.S. large-cap stocks, as measured by the 15.47% and 15.43% returns of the Russell 2000® Index and S&P 500® Index, respectively. Within international equities, emerging markets significantly outperformed their developed peers, with the MSCI Emerging Markets Index (net) up 16.78%, while the MSCI EAFE® Index (net) returned 6.52%.

Demand for U.S. Treasuries remained strong, driven by foreign investors seeking safe havens and yield in light of the negative interest rate environment in many international economies. On September 30, 2016, the benchmark 10-year U.S. Treasury yielded 1.60% compared with 2.06% one year earlier. For the 12 months ended September 30, 2016, the broader U.S. fixed income market, as represented by the Bloomberg Barclays U.S. Aggregate Bond Index, which tracks Treasuries and other investment-grade debt securities, gained 5.19%, while non-investment grade bonds rose 12.73%, as measured by the Bloomberg Barclays U.S. Corporate High Yield Bond Index.

The strength of the global economy will likely remain a leading concern for markets in the months ahead, and investors will watch with great interest the actions of the Fed and other major central banks. The U.S. economy’s continued growth, as evidenced by recent strong jobs, housing, and consumer spending data, should give investors reason for optimism, but future market direction will be determined largely by the ability of corporations to continue to produce robust earnings.

Market uncertainty is an ever-present reminder of the importance of portfolio diversification, including exposure to both traditional and alternative asset classes. While diversification cannot guarantee a profit or prevent a loss, owning a variety of asset classes may cushion your portfolio against inevitable market fluctuations. Your financial advisor can help you ensure that your portfolio is adequately diversified across asset classes and investment strategies.

As always, thank you for entrusting Virtus with your assets. Should you have questions about your account or require assistance, please visit our website at Virtus.com, or call our customer service team at 1-800-243-1574. We appreciate your business and remain committed to your long-term financial success.

Sincerely,

George R. Aylward President, Virtus Mutual Funds

October 2016 | ||

Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above.

1

Table of Contents

VIRTUS OPPORTUNITIES TRUST

Disclosure of Fund Expenses (Unaudited)

FOR THE SIX-MONTH PERIOD OF APRIL 1, 2016 TO SEPTEMBER 30, 2016

2

Table of Contents

VIRTUS OPPORTUNITIES TRUST

Disclosure of Fund Expenses (Unaudited) (Continued)

FOR THE SIX-MONTH PERIOD OF APRIL 1, 2016 TO SEPTEMBER 30, 2016

3

Table of Contents

VIRTUS OPPORTUNITIES TRUST

SEPTEMBER 30, 2016 (Unaudited)

American Depositary Receipt (ADR)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Bank of Japan (“BOJ”)

The Bank of Japan is the Japanese central bank.

Bloomberg Barclays California Municipal Bond Index

The Bloomberg Barclays California Municipal Bond Index measures long term investment grade, tax-exempt and fixed rate bonds issued in California. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg Barclays Municipal Bond Index

The Bloomberg Barclays Municipal Bond Index is a market capitalization-weighted index that measures the long-term tax-exempt bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Bloomberg Barclays U.S. Aggregate Bond Index

The Bloomberg Barclays U.S. Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg Barclays U.S. Corporate High Yield Bond Index

The Bloomberg Barclays U.S. Corporate High Yield Bond Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index

The Bloomberg Barclays High-Yield 2% Issuer Capped Bond Index is a market capitalization-weighted index that measures fixed rate non-investment grade debt securities of U.S. and non-U.S. corporations. No single issuer accounts for more than 2% of market cap. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index

The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index measures U.S. investment grade government and corporate debt securities with an average maturity of 4 to 5 years. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

BofA Merrill Lynch U.S. Municipal Securities Index

The BofA Merrill Lynch U.S. Municipal Securities Index tracks the performance of U.S. dollar denominated investment grade tax-exempt debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. domestic market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

BofA Merrill Lynch 1–22 Year U.S. Municipal Securities Index

The BofA Merrill Lynch 1–22 Year U.S. Municipal Securities Index is a a subset of the BofA Merrill Lynch U.S. Municipal Securities Index including all securities with a remaining term to final maturity less than 22 years, calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Chicago Board Options Exchange (CBOE) Volatility Index

The Chicago Board Options Exchange (CBOE) Volatility Index (“VIX®”) shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500® Index options. This volatility is meant to be forward looking and is calculated from both calls and puts. The VIX® is a widely used measure of market risk and is often referred to as the “investor fear gauge.” The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

4

Table of Contents

VIRTUS OPPORTUNITIES TRUST

KEY INVESTMENT TERMS (Continued)

SEPTEMBER 30, 2016 (Unaudited)

CBOE S&P 500 Buywrite Index

The CBOE S&P 500 Buywrite Index is a passive total return index based on buying an S&P 500® stock index portfolio and “writing” (or selling) the nearterm S&P 500® Index (SPXSM) “covered” call option. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Collateralized Loan Obligation (“CLO”)

A collateralized loan obligation is a type of security backed by a pool of debt, typically low-rated corporate loans, structured so that there are several classes of bondholders with varying maturities, called tranches.

European Central Bank (“ECB”)

The European Central Bank (ECB) is responsible for conducting monetary policy for the eurozone. The ECB was established as the core of the Eurosystem and the European System of Central Banks (ESCB). The ESCB comprises the ECB and the national central banks (NCBs) of all 17 European Union Member States whether they have adopted the Euro or not.

European Union (“EU”)

The European Union (“EU”) is a unique economic and political union of 28 European countries. The EU was created in the aftermath of the Second World War that has become a single market for goods and services and it created the single currency the euro.

Exchange-Traded Funds (ETF)

A Fund that is traded on a stock exchange. Most ETFs have a portfolio of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The Central Bank of the United States, responsible for controlling the money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches and all national and state banks that are part of the system.

Gross Domestic Product (“GDP”)

The market value of all officially recognized final goods and services produced within a country in a given period.

iShares®

Represents shares of an open-end exchange-traded fund.

London Interbank Offered Rate (LIBOR)

A benchmark rate that some of the world’s leading banks charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world.

Mergers and Acquisitions (M&A) Bond

An M&A bond is a type of corporate bond that is used to raise money for financing activities such as mergers and acquisitions.

MSCI EAFE® Index (net)

The MSCI EAFE® Index (net) is a free float-adjusted market capitalization-weighted index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

MSCI Emerging Markets Index (net)

The MSCI Emerging Markets Index (net) is a free float-adjusted market capitalization-weighted index designed to measure equity market performance in the global emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

MSCI World Index (net)

The MSCI World Index (net) is a free float-adjusted market capitalization-weighted index that measures developed global market equity performance. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

5

Table of Contents

VIRTUS OPPORTUNITIES TRUST

KEY INVESTMENT TERMS (Continued)

SEPTEMBER 30, 2016 (Unaudited)

Organization of the Petroleum Exporting Countries (OPEC)

The Organization of the Petroleum Exporting Countries was originally organized in September 1960 with 5 member countries and there are currently 12 member countries. The organization’s objective is to co-ordinate and unify petroleum policies among member countries, in order to secure fair and stable prices for petroleum producers; an efficient, economic and regular supply of petroleum to consuming nations; and a fair return on capital to those investing in the industry.

Payment-in-Kind Security (PIK)

A bond which pays interest in the form of additional bonds, or preferred stock which pays dividends in the form of additional preferred stock.

Real Estate Investment Trust (REIT)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Russell 2000® Index

The Russell 2000® Index is a market capitalization-weighted index of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

S&P 100® Index

The S&P 100® Index, a sub-set of the S&P 500®, measures the performance of large-cap U.S. companies, and comprises 100 major, blue chip companies across multiple industry groups.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

S&P Global Natural Resources Index (net)

The S&P Global Natural Resources Index (net) is a free-float market capitalization index calculated on a total return basis with net dividends reinvested. The index consists of 90 of the largest publicly traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified and investable equity exposure across three primary commodity-related sectors: agribusiness, energy, and metals and mining. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

S&P/LSTA Leveraged Loan Index

The S&P/LSTA Leveraged Loan Index is a daily total return index that uses LSTA/LPC Mark-to-Market Pricing (third-party research data on the price movements of senior secured floating rate loans in the secondary loan market) to calculate market value change. On a real-time basis, the Index tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included in the Index represent a broad cross section of leveraged loans syndicated in the United States, including dollar-denominated loans to overseas issuers. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges and it is not available for direct investment.

Tax-Exempt Bond Linked Benchmark

The Tax-Exempt Bond Linked Benchmark consists of the BofA Merrill Lynch 1-22 Year US Municipal Securities Index, a subset of the BofA Merrill Lynch US Municipal Securities Index including all securities with a remaining term to final maturity less than 22 years, calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. Performance of the Tax- Exempt Bond Linked Benchmark prior to 6/30/2012 is that of the Barclays Municipal Bond Index.

When-issued and Forward Commitments (Delayed Delivery)

Securities purchased on a when-issued or forward commitment basis are also known as delayed delivery transactions. Delayed delivery transactions involve a commitment by a Fund to purchase or sell a security at a future date, ordinarily up to 90 days later. When-issued or forward commitments enable a Fund to lock in what is believed to be an attractive price or yield on a particular security for a period of time, regardless of future changes in interest rates.

6

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: SAVAX Class B: SAVBX Class C: SAVCX Class I: SAVYX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

7

Table of Contents

Bond Fund (Continued)

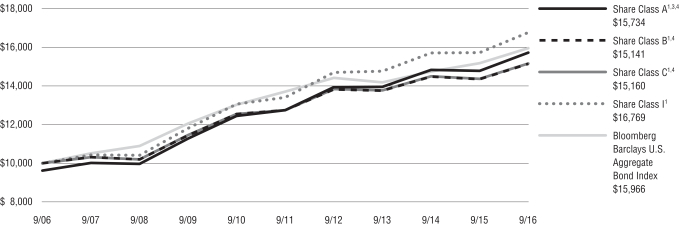

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||

| 1 year | 5 years | 10 years | ||||||||||

| Class A Shares at NAV2 | 6.38 | % | 4.29 | % | 5.04 | % | ||||||

| Class A Shares at POP3 | 2.39 | 3.50 | 4.64 | |||||||||

| Class B Shares at NAV2 | 5.47 | 3.50 | 4.24 | |||||||||

| Class B Shares with CDSC4 | 1.47 | 3.50 | 4.24 | |||||||||

| Class C Shares at NAV2 | 5.54 | 3.52 | 4.25 | |||||||||

| Class I Shares at NAV | 6.63 | 4.57 | 5.31 | |||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.19 | 3.08 | 4.79 | |||||||||

Fund Expense Ratios5: A Shares: Gross 1.13%, Net 0.86%; B Shares: Gross 1.88%, Net 1.61%; C Shares: Gross 1.88%, Net 1.61%; I Shares: Gross 0.88%, Net 0.61%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for B shares decline from 5% to 0% over a five-year period. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by contractual fee waiver in effect through January 31, 2017. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

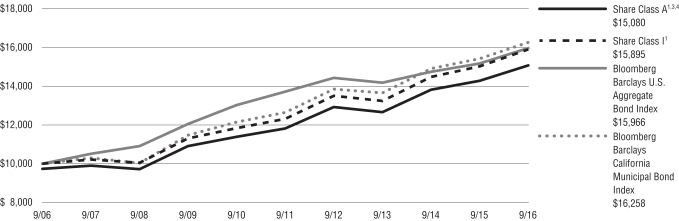

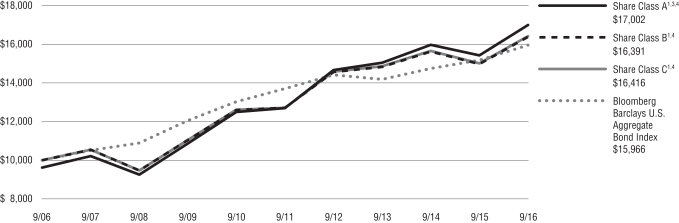

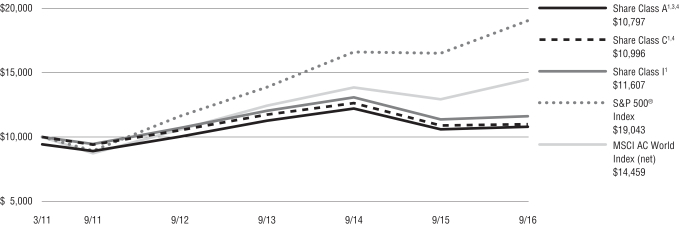

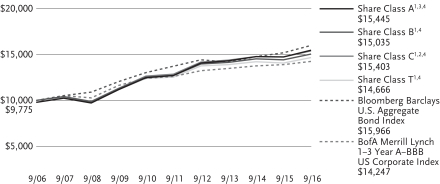

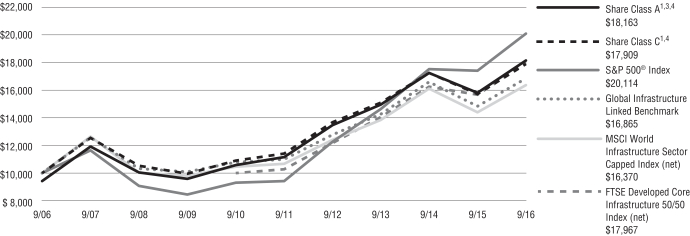

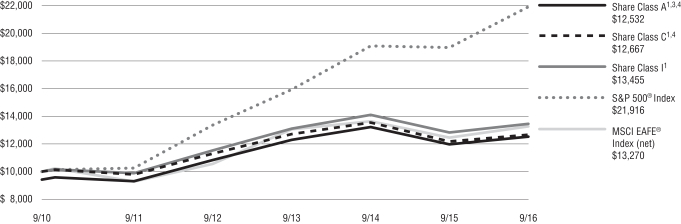

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2006, for Class A, Class B, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

8

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: CTESX Class I: CTXEX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

9

Table of Contents

| CA Tax-Exempt Bond Fund (Continued) |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

10

Table of Contents

CA Tax-Exempt Bond Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||

| 1 year | 5 years | 10 years | ||||||||||

| Class A Shares at NAV2 | 5.56 | % | 5.00 | % | 4.48 | % | ||||||

| Class A Shares at POP3,4 | 2.66 | 4.42 | 4.19 | |||||||||

| Class I Shares at NAV | 5.83 | 5.25 | 4.74 | |||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.19 | 3.08 | 4.79 | |||||||||

| Bloomberg Barclays California Municipal Bond Index | 5.45 | 5.17 | 4.98 | |||||||||

Fund Expense Ratios5: A Shares: Gross 1.18%, Net 0.85%; I Shares: Gross 0.93%, Net 0.60%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid are 1% and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by contractual fee waiver in effect through January 31, 2017. Gross Expense: Does not reflect the effect of the fee waiver. |

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2006 for Class A and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

11

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VERAX Class C: VERCX Class I: VERIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

12

Table of Contents

Essential Resources Fund (Continued)

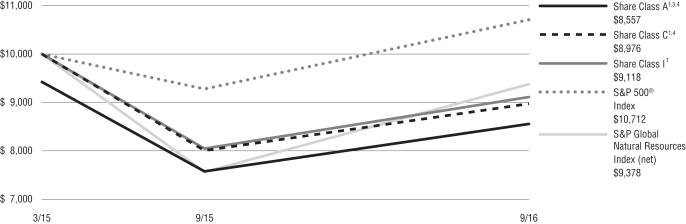

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||

| 1 year | Since Inception |

Inception Date |

||||||||||

| Class A Shares at NAV2 | 12.93 | % | -6.14 | % | 3/24/15 | |||||||

| Class A Shares at POP3,4 | 6.44 | -9.72 | 3/24/15 | |||||||||

| Class C Shares at NAV2 and with CDSC4 | 12.07 | -6.84 | 3/24/15 | |||||||||

| Class I Shares at NAV2 | 13.27 | -5.88 | 3/24/15 | |||||||||

| S&P 500® Index | 15.43 | 4.62 | 5 | — | ||||||||

| S&P Global Natural Resources Index (net) | 23.89 | -4.13 | 5 | — | ||||||||

Fund Expense Ratios6: A Shares: Gross 6.27%, Net 1.66%; C Shares: Gross 7.02%, Net 2.41%; I Shares: Gross 6.02%, Net 1.41%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through January 31, 2017. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

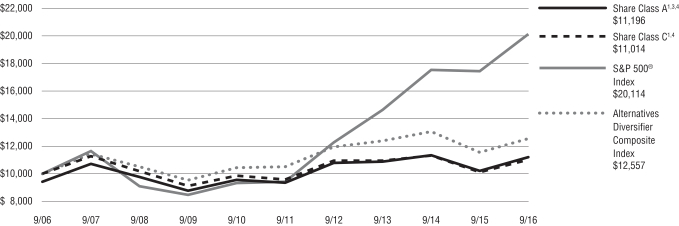

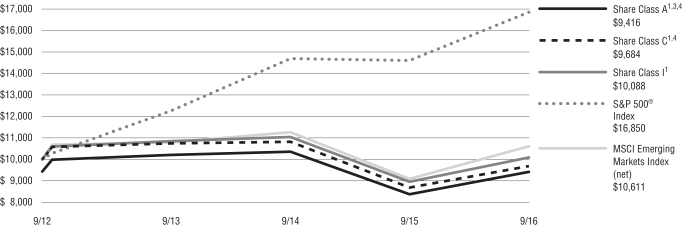

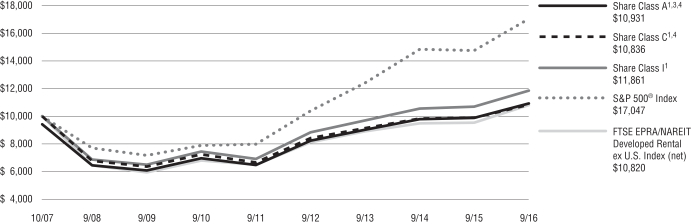

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on March 24, 2015 (inception date of the Fund) for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

13

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: PHCHX Class B: PHCCX Class C: PGHCX Class I: PHCIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

14

Table of Contents

| High Yield Fund (Continued) |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

15

Table of Contents

High Yield Fund (Continued)

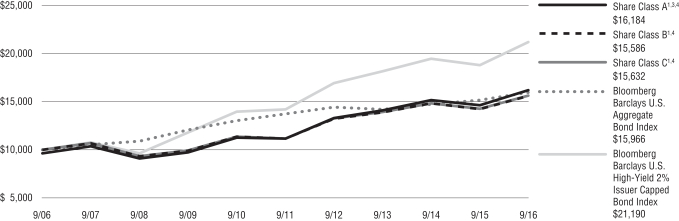

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||||||||||

| 1 year | 5 years | 10 years | Since Inception |

Inception Date |

||||||||||||||||

| Class A Shares at NAV2 | 10.59 | % | 7.73 | % | 5.33 | % | — | — | ||||||||||||

| Class A Shares at POP3,4 | 6.44 | 6.91 | 4.93 | — | — | |||||||||||||||

| Class B Shares at NAV2 | 9.52 | 6.91 | 4.54 | — | — | |||||||||||||||

| Class B Shares with CDSC4 | 5.52 | 6.91 | 4.54 | — | — | |||||||||||||||

| Class C Shares at NAV2 and with CDSC4 | 9.68 | 6.94 | 4.57 | — | — | |||||||||||||||

| Class I Shares at NAV2 | 10.86 | — | — | 5.71 | % | 8/8/12 | ||||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.19 | 3.08 | 4.79 | 2.64 | 5 | — | ||||||||||||||

| Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index | 12.74 | 8.34 | 7.80 | 6.02 | 5 | — | ||||||||||||||

Fund Expense Ratios6: A Shares: Gross 1.33%, Net 1.16% B Shares: Gross 2.08%, Net 1.91% C Shares: Gross 2.08%, Net 1.91% Class I: Gross 1.08% Net 0.91%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for B shares decline from 5% to 0% over a five-year period. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the inception date of Class I. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by contractual fee waiver in effect through January 31, 2017. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

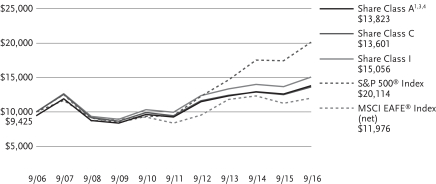

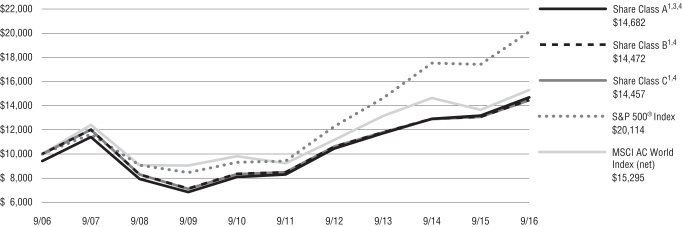

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2006, for Class A, Class B, and Class C shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

16

Table of Contents

|

Fund Summary |

Ticker Symbols: A Share: HIMZX C Share: PCMZX I Share: HIBIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

17

Table of Contents

Low Duration Income Fund (Continued)

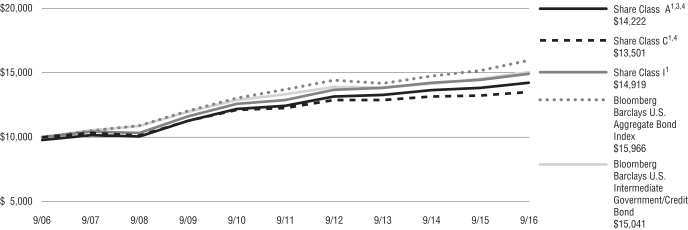

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||

| 1 year | 5 years | 10 years | ||||||||||

| Class A Shares at NAV2 | 2.78 | % | 2.71 | % | 3.82 | % | ||||||

| Class A Shares at POP3,4 | 0.47 | 2.24 | 3.58 | |||||||||

| Class C Shares at NAV2 and CDSC4 | 2.01 | 1.94 | 3.05 | |||||||||

| Class I Shares at NAV2 | 3.14 | 2.97 | 4.08 | |||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.19 | 3.08 | 4.79 | |||||||||

| Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | 3.52 | 2.45 | 4.17 | |||||||||

Fund Expense Ratios5: A Shares: Gross 1.12%, Net 0.75%; C Shares: Gross 1.872%, Net 1.50%; I Shares: Gross 0.872%, Net 0.50%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.25% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for C shares are 1% in the first year and 0% thereafter. CDSC charges for certain redemptions of Class A shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund, both net and gross, are set forth according to the prospectus for the Fund effective September 23, 2016, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expenses: Expenses reduced by a contractual fee waiver in effect through September 30, 2017. Gross Expenses: Do not reflect the effect of contractual fee waiver. |

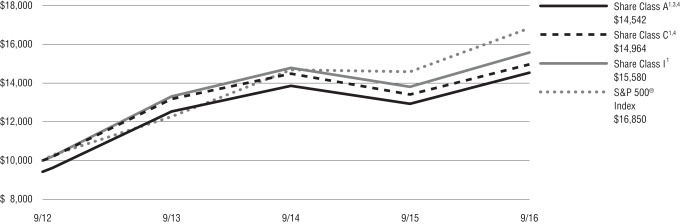

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2006, for Class A, Class C and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

18

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VLVAX Class C: VLVCX Class I: VLVIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

19

Table of Contents

Low Volatility Equity Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||

| 1 year | Since Inception |

Inception Date |

||||||||||

| Class A Shares at NAV2 | 2.82 | % | 5.41 | % | 6/11/13 | |||||||

| Class A Shares at POP3,4 | -3.09 | 3.54 | 6/11/13 | |||||||||

| Class C Shares at NAV2 and with CDSC4 | 2.05 | 4.63 | 6/11/13 | |||||||||

| Class I Shares at NAV2 | 3.08 | 5.69 | 6/11/13 | |||||||||

| CBOE S&P 500 Buywrite Index | 8.48 | 6.68 | 5 | — | ||||||||

| S&P 500® Index |

15.43 | 11.41 | 5 | — | ||||||||

Fund Expense Ratios6: A Shares: Gross 2.90%, Net 1.75%; C Shares: Gross 3.65%, Net 2.50%; I Shares: Gross 2.65%, Net 1.50%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through January 31, 2017. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios reflect fees and expenses associated with the underlying funds. |

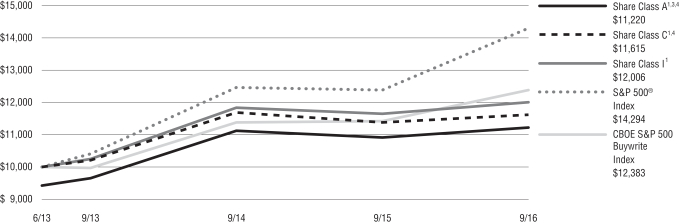

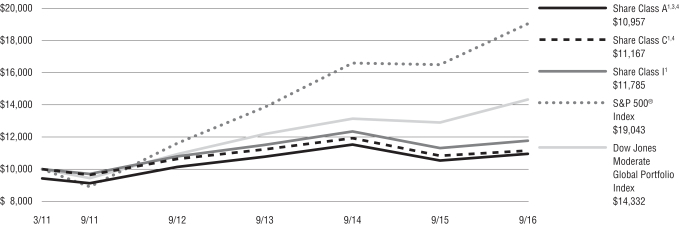

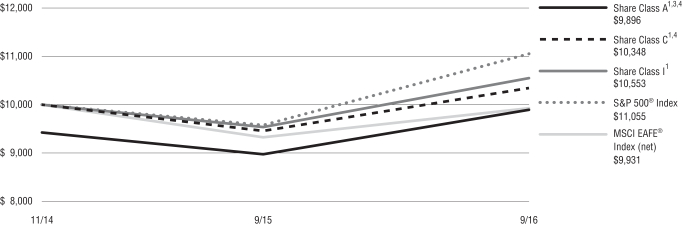

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on June 11, 2013 (inception date of the Fund), for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

20

Table of Contents

| Multi-Sector Intermediate Bond Fund

Fund Summary |

Ticker Symbols: Class A: NAMFX Class B: NBMFX Class C: NCMFX Class I: VMFIX Class R6: VMFRX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

21

Table of Contents

Multi-Sector Intermediate Bond Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||||||||||

| 1 year | 5 years | 10 years | Since Inception |

Inception Date |

||||||||||||||||

| Class A Shares at NAV2 | 10.15 | % | 6.01 | % | 5.85 | % | — | — | ||||||||||||

| Class A Shares at POP3,4 | 6.02 | 5.20 | 5.45 | — | — | |||||||||||||||

| Class B Shares at NAV2 | 9.36 | 5.21 | 5.07 | — | — | |||||||||||||||

| Class B Shares with CDSC4 | 5.36 | 5.21 | 5.07 | — | — | |||||||||||||||

| Class C Shares at NAV2 and with CDSC4 | 9.34 | 5.23 | 5.08 | — | — | |||||||||||||||

| Class I Shares at NAV | 10.42 | 6.29 | — | 6.90 | % | 10/1/09 | ||||||||||||||

| Class R6 Shares at NAV | 10.50 | — | — | 3.58 | 11/12/14 | |||||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.19 | 3.08 | 4.79 | — | 5 | — | ||||||||||||||

Fund Expense Ratios6: A Shares: 1.11%, B Shares: 1.86%, C Shares: 1.86%, I Shares: 0.86%, R6 Shares: 0.79%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for B shares decline from 5% to 0% over a five-year period. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The index returned 4.05 for Class I shares and 3.82% for Class R6 shares since the inception date of the respective share class. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Expense ratios include fees and expenses associated with underlying funds. |

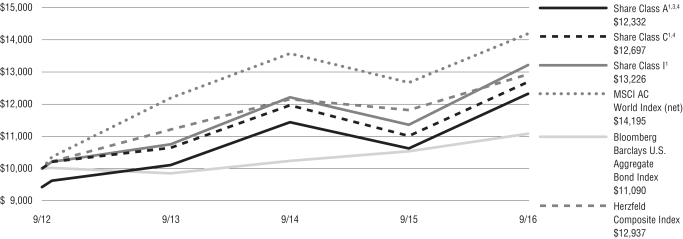

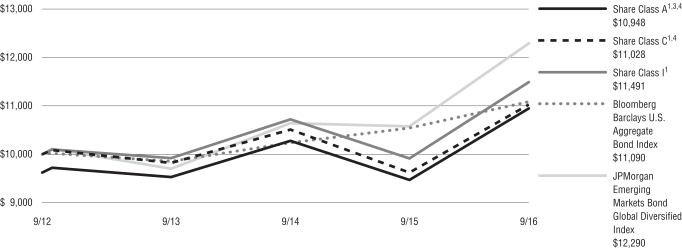

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2006, for Class A, Class B, and Class C shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

22

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: PSFRX Class C: PFSRX Class I: PSFIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

23

Table of Contents

| Senior Floating Rate Fund (Continued) |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

24

Table of Contents

Senior Floating Rate Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||||||

| 1 year | 5 years | Since Inception |

Inception Date |

|||||||||||||

| Class A Shares at NAV2 | 4.42 | % | 4.67 | % | 4.86 | % | 1/31/08 | |||||||||

| Class A Shares at POP3,4 | 1.55 | 4.09 | 4.52 | 1/31/08 | ||||||||||||

| Class C Shares at NAV2 and with CDSC4 | 3.63 | 3.89 | 4.09 | 1/31/08 | ||||||||||||

| Class I Shares at NAV | 4.69 | 4.94 | 5.12 | 1/31/08 | ||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.19 | 3.08 | 4.38 | 5 | — | |||||||||||

| S&P/LSTA Leveraged Loan Index | 5.46 | 5.25 | 5.25 | 5 | — | |||||||||||

Fund Expense Ratios6: A Shares: 1.20%, C Shares: 1.95%, I Shares: 0.95%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. |

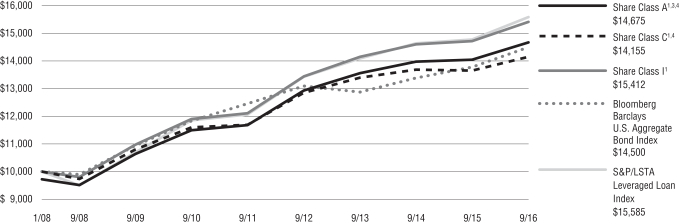

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on January 31, 2008 (inception date of the Fund), for Class A, Class C and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

25

Table of Contents

|

Fund Summary |

Ticker Symbols: A Share: HXBZX C Share: PXCZX I Share: HXBIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

26

Table of Contents

| Tax-Exempt Bond Fund (Continued) |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

27

Table of Contents

Tax-Exempt Bond Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||

| 1 year | 5 years | 10 years | ||||||||||

| Class A Shares at NAV2 | 4.13 | % | 3.82 | % | 4.47 | % | ||||||

| Class A Shares at POP3,4 | 1.27 | 3.24 | 4.17 | |||||||||

| Class C Shares at NAV2 and CDSC4 | 3.35 | 3.05 | 3.68 | |||||||||

| Class I Shares at NAV2 | 4.39 | 4.08 | 4.74 | |||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.19 | 3.08 | 4.79 | |||||||||

| Tax-Exempt Bond Linked Benchmark | 4.85 | 4.12 | 4.57 | |||||||||

Fund Expense Ratios5: A Shares: Gross 1.00%, Net 0.85%; C Shares: Gross 1.75%, Net 1.60%; I Shares: Gross 0.75%, Net 0.60%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares and all redemptions of Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund, both net and gross, are set forth according to the prospectus for the Fund effective September 23, 2016, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expenses: Expenses reduced by a contractual fee waiver in effect through September 30, 2017. Gross Expenses: Do not reflect the effect of contractual fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

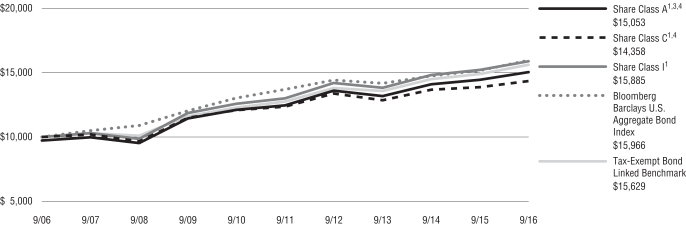

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2006 for Class A, Class C and Class I shares. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

28

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VWMAX Class C: VWMCX Class I: VWMIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

29

Table of Contents

Wealth Masters Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/16 | ||||||||||||

| 1 year | Since Inception |

Inception Date |

||||||||||

| Class A Shares at NAV2 | 12.44 | % | 11.24 | % | 9/5/12 | |||||||

| Class A Shares at POP3,4 | 5.98 | 9.63 | 9/5/12 | |||||||||

| Class C Shares at NAV2 and with CDSC4 | 11.56 | 10.41 | 9/5/12 | |||||||||

| Class I Shares at NAV | 12.75 | 11.51 | 9/5/12 | |||||||||

| S&P 500® Index | 15.43 | 13.67 | 5 | — | ||||||||

Fund Expense Ratios6: A Shares: Gross 1.46%, Net 1.45%; C Shares: Gross 2.21%, Net 2.20%; I Shares: Gross 1.21%, Net 1.20%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 28, 2016, as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by contractual fee waiver in effect through January 31, 2017. Gross Expense: Does not reflect the effect of the fee waiver. |

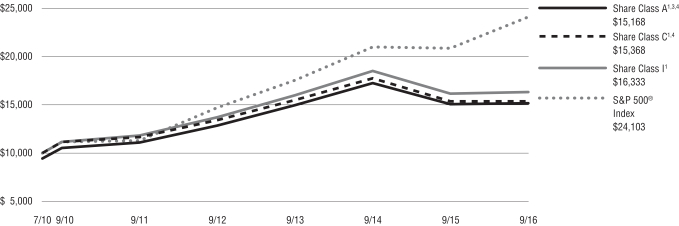

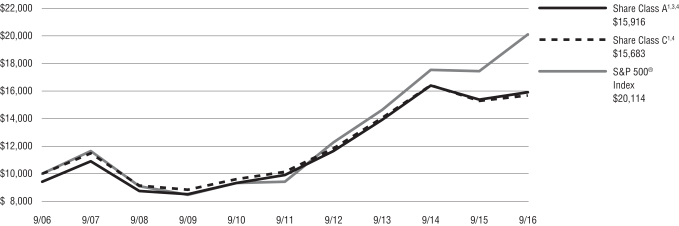

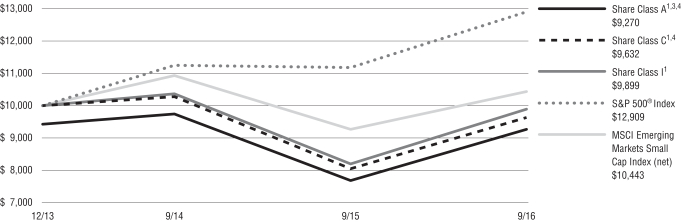

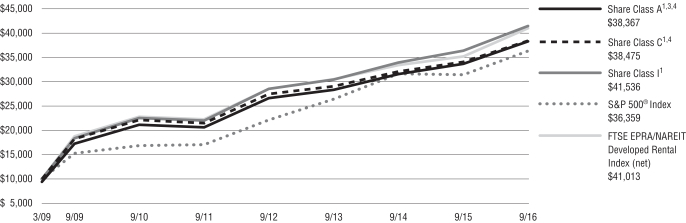

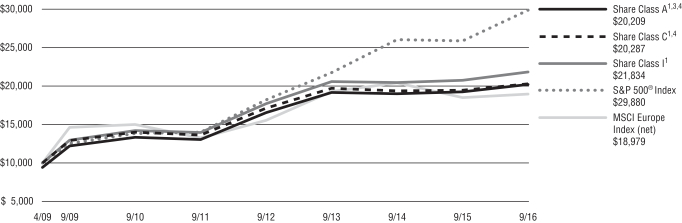

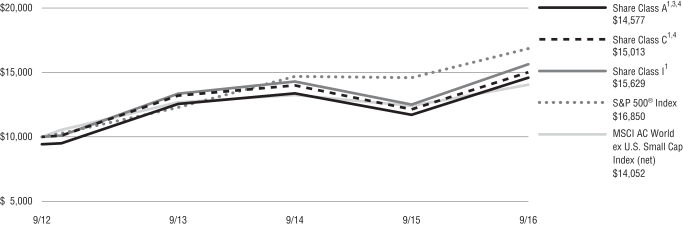

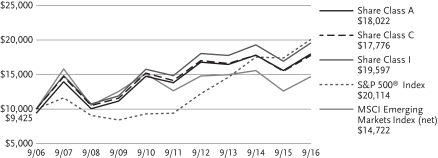

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 5, 2012 (inception date of the Fund), for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

30

Table of Contents

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

31

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

32

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

33

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

34

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

35

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

36

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

| Country Weightings† (Unaudited) | ||||

| United States |

86 | % | ||

| Canada |

1 | |||

| Chile |

1 | |||

| Mexico |

1 | |||

| Netherlands |

1 | |||

| Switzerland |

1 | |||

| United Kingdom |

1 | |||

| Other |

8 | |||

| Total |

100 | % | ||

| † % of total investments as of September 30, 2016 |

| |||

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2016 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2016 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Debt Securities: |

||||||||||||||||

| Asset-Backed Securities |

$ | 4,007 | $ | — | $ | 4,007 | $ | — | ||||||||

| Corporate Bonds And Notes |

36,447 | — | 36,207 | 240 | ||||||||||||

| Foreign Government Securities |

1,179 | — | 1,179 | — | ||||||||||||

| Loan Agreements |

3,249 | — | 3,249 | — | ||||||||||||

| Mortgage-Backed Securities |

20,872 | — | 20,872 | — | ||||||||||||

| Municipal Bonds |

1,133 | — | 1,133 | — | ||||||||||||

| U.S. Government Securities |

5,769 | — | 5,769 | — | ||||||||||||

| Equity Securities: |

||||||||||||||||

| Affiliated Mutual Fund |

1,159 | 1,159 | — | — | ||||||||||||

| Exchange-Traded Funds |

828 | 828 | — | — | ||||||||||||

| Preferred Stocks |

2,481 | 493 | 1,988 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 77,124 | $ | 2,480 | $ | 74,404 | $ | 240 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

There were no transfers from Level 1 to Level 2 related to securities held as of September 30, 2016.

Securities held by the Fund with an end of period value of $261 were transferred from Level 2 into Level 1 since starting to use an exchange price.

The following is a reconciliation of assets of the Fund for Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Corporate Bonds and Notes |

||||

| Investments in Securities |

||||

| Balance as of September 30, 2015: |

$ | — | ||

| Accrued discount/(premium) |

— | (c) | ||

| Realized gain (loss) |

— | (c) | ||

| Change in unrealized appreciation (depreciation) |

— | (c) | ||

| Purchases |

443 | |||

| Sales(b) |

(203 | ) | ||

| Transfers into Level 3(a) |

— | |||

| Transfers from Level 3(a) |

— | |||

|

|

|

|||

| Balance as of September 30, 2016 |

$ | 240 | (d) | |

|

|

|

|||

| (a) | “Transfers into and/or from” represent the ending value as of September 30, 2016, for any investment security where a change in the pricing level occurred from the beginning to the end of the period. |

| (b) | Includes paydown on securities. |

| (c) | Amount is less than $500. |

| (d) | The Fund’s investments that are categorized as Level 3 were valued utilizing third party pricing information without adjustment. Such valuations are based on unobservable inputs. A significant change in third party information could result in a significantly lower or higher value of Level 3 investments. |

None of the securities in this table are internally fair valued.

See Notes to Financial Statements

37

Table of Contents

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

38

Table of Contents

VIRTUS CA TAX-EXEMPT BOND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

39

Table of Contents

VIRTUS CA TAX-EXEMPT BOND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

40

Table of Contents

VIRTUS ESSENTIAL RESOURCES FUND

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

41

Table of Contents

VIRTUS ESSENTIAL RESOURCES FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2016 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2016 |

Level 1 Quoted Prices |

Level 2 Significant Observable lnputs |

||||||||||

| Equity Securities: |

||||||||||||

| Closed End Fund |

$ | 35 | $ | 35 | $ | — | ||||||

| Common Stocks |

4,693 | 4,248 | 445 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Investments |

$ | 4,728 | $ | 4,283 | $ | 445 | ||||||

|

|

|

|

|

|

|

|||||||

There are no Level 3 (significant unobservable inputs) priced securities.

There were no transfers between Level 1 and Level 2 related to securities held at September 30, 2016.

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

42

Table of Contents

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

43

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

44

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

45

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

46

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

47

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2016 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2016 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Debt Securities: |

||||||||||||||||

| Asset-Backed Securities |

$ | 978 | $ | — | $ | 723 | $ | 255 | ||||||||

| Corporate Bonds And Notes |

61,605 | — | 61,586 | 19 | ||||||||||||

| Foreign Government Securities |

1,002 | — | 1,002 | — | ||||||||||||

| Loan Agreements |

7,149 | — | 7,111 | 38 | ||||||||||||

| Mortgage-Backed Securities |

998 | — | 998 | — | ||||||||||||

| Equity Securities: |

||||||||||||||||

| Affiliated Mutual Fund |

352 | 352 | — | — | ||||||||||||

| Exchange-Traded Funds |

1,549 | 1,549 | — | — | ||||||||||||

| Preferred Stocks |

1,050 | — | 1,050 | — | ||||||||||||

| Short-Term Investment |

227 | 227 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 74,910 | $ | 2,128 | $ | 72,470 | $ | 312 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

There were no transfers between Level 1 and Level 2 related to securities held as of September 30, 2016.

The following is a reconciliation of assets of the Fund for Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Total | Asset-Backed Securities |

Corporate Bonds And Notes |

Loan Agreements |

|||||||||||||

| Investments in Securities |

||||||||||||||||

| Balance as of September 30, 2015: |

$ | 444 | $ | 250 | $ | — | $ | 194 | ||||||||

| Accrued discount/(premium) |

1 | — | — | 1 | ||||||||||||

| Realized gain (loss) |

— | — | — | — | ||||||||||||

| Change in unrealized appreciation (depreciation)(c) |

(162 | ) | 5 | — | (167 | ) | ||||||||||

| Purchases |

— | — | — | — | ||||||||||||

| Sales(b) |

— | — | — | — | ||||||||||||

| Transfers into Level 3(a) |

29 | (d) | — | 19 | (d) | 10 | (d) | |||||||||

| Transfers from Level 3(a) |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance as of September 30, 2016 |

$ | 312 | $ | 255 | (e) | $ | 19 | (e) | $ | 38 | (e) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | “Transfers into and/or from” represent the ending value as of September 30, 2016, for any investment security where a change in the pricing level occurred from the beginning to the end of the period. |

| (b) | Includes paydown on securities. |

| (c) | Included in the related net change in unrealized appreciation/(depreciation) in the Statements of Operations. The change in unrealized appreciation/(depreciation) on investments still held on September 30, 2016 was ($222) |

| (d) | The transfers into Level 3 are due to a decrease in trading activities at period end. |

| (e) | The Fund’s investments that are categorized as Level 3 were valued utilizing third party pricing information without adjustment. Such valuations are based on unobservable inputs. A significant change in third party information could result in a significantly lower or higher value of Level 3 investments. |

None of the securities in this table are internally fair valued.

See Notes to Financial Statements

48

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

49

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

50

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

51

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

52

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

53

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

54

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

55

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

56

Table of Contents

VIRTUS LOW DURATION INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2016 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2016 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

||||||||||

| Debt Securities: |

||||||||||||

| Asset-Backed Securities |

$ | 94,928 | $ | — | $ | 94,928 | ||||||

| Corporate Bonds And Notes |

73,193 | — | 73,193 | |||||||||

| Foreign Government Securities |

445 | — | 445 | |||||||||

| Loan Agreements |

15,743 | — | 15,743 | |||||||||

| Mortgage-Backed Securities |

164,885 | — | 164,885 | |||||||||

| Municipal Bonds |

201 | — | 201 | |||||||||

| U.S. Government Securities |

40,585 | — | 40,585 | |||||||||

| Equity Securities: |

||||||||||||

| Preferred Stocks |

1,500 | — | 1,500 | |||||||||

| Exchange-Traded Funds |

7,333 | 7,333 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Investments |

$ | 398,813 | $ | 7,333 | $ | 391,480 | ||||||

|

|

|

|

|

|

|

|||||||

There are no Level 3 (significant unobservable inputs) priced securities.

There were no transfers between Level 1 and Level 2 related to securities held as of September 30, 2016.

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

57

Table of Contents

VIRTUS LOW VOLATILITY EQUITY FUND

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

58

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

59

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

60

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

61

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

62

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

63

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

64

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

See Notes to Financial Statements

65

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2016 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2016 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Debt Securities: |

||||||||||||||||

| Asset-Backed Securities |

$ | 12,480 | $ | — | $ | 11,924 | $ | 556 | ||||||||

| Corporate Bonds And Notes |

160,918 | — | 159,925 | 993 | ||||||||||||

| Foreign Government Securities |

33,004 | — | 33,004 | — | ||||||||||||

| Loan Agreements |

29,794 | — | 29,742 | 52 | ||||||||||||

| Mortgage-Backed Securities |

44,912 | — | 44,912 | — | ||||||||||||

| Municipal Bonds |

422 | — | 422 | — | ||||||||||||

| Equity Securities: |

||||||||||||||||

| Affiliated Mutual Fund |

9,186 | 9,186 | — | — | ||||||||||||

| Common Stocks |

13 | — | — | 13 | ||||||||||||

| Preferred Stocks |

9,474 | 2,493 | 6,981 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 300,203 | $ | 11,679 | $ | 286,910 | $ | 1,614 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

There were no transfers from Level 1 to Level 2 related to securities held as of September 30, 2016.

Securities held by the Fund with an end of period value of $1,143 were transferred from Level 2 into Level 1 since starting to use an exchange price.

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

66

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2016

($ reported in thousands)

The following is a reconciliation of assets of the Fund for Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Total | Asset-Backed Securities |

Common Stocks |

Corporate Bonds And Notes |

Loan Agreements |

||||||||||||||||

| Investments in Securities |

||||||||||||||||||||

| Balance as of September 30, 2015: |

$ | 929 | $ | 544 | $ | 16 | $ | — | $ | 369 | ||||||||||

| Accrued discount/(premium) |

1 | — | — | — | 1 | |||||||||||||||

| Realized gain (loss) |

— | — | — | — | — | |||||||||||||||

| Change in unrealized appreciation /(depreciation)(c) |

(309 | ) | 12 | (3 | ) | — | (318 | ) | ||||||||||||

| Purchases |

1,618 | — | — | 1,618 | ||||||||||||||||

| Sales(b) |

(743 | ) | — | — | (743 | ) | — | |||||||||||||

| Transfers into Level 3(a) |

118 | — | — | 118 | (d) | — | ||||||||||||||

| Transfers from Level 3(a) |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance as of September 30, 2016 |

$ | 1,614 | $ | 556 | (e) | $ | 13 | (e) | $ | 993 | (e) | $ | 52 | (e) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||