Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07455

Virtus Opportunities Trust

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9668

(Address of principal executive offices) (Zip code)

Kevin J. Carr, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

100 Pearl Street

Hartford, CT 06103-4506

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 243-1574

Date of fiscal year end: September 30

Date of reporting period: September 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Table of Contents

ANNUAL REPORT

Virtus Bond Fund

Virtus CA Tax-Exempt Bond Fund

Virtus Disciplined Equity Style Fund

Virtus Disciplined Select Bond Fund

Virtus Disciplined Select Country Fund

Virtus Herzfeld Fund

Virtus High Yield Fund

Virtus Low Volatility Equity Fund

Virtus Multi-Sector Intermediate Bond Fund

Virtus Senior Floating Rate Fund

Virtus Wealth Masters Fund

| September 30, 2013 TRUST NAME: VIRTUS OPPORTUNITIES TRUST |

|

Not FDIC Insured

No Bank Guarantee

May Lose Value

Table of Contents

| 1 | ||||||||

| 2 | ||||||||

| 4 | ||||||||

| Fund | Fund Summary |

Schedule of Investments |

||||||

| 6 | 29 | |||||||

| 8 | 36 | |||||||

| Virtus Disciplined Equity Style Fund (“Disciplined Equity Style Fund”) |

10 | 39 | ||||||

| Virtus Disciplined Select Bond Fund (“Disciplined Select Bond Fund”) |

12 | 40 | ||||||

| Virtus Disciplined Select Country Fund (“Disciplined Select Country Fund”) |

14 | 41 | ||||||

| 16 | 42 | |||||||

| 19 | 43 | |||||||

| 21 | 48 | |||||||

| 23 | 49 | |||||||

| Virtus Senior Floating Rate Fund (“Senior Floating Rate Fund”) |

25 | 58 | ||||||

| 27 | 67 | |||||||

| 69 | ||||||||

| 72 | ||||||||

| 75 | ||||||||

| 80 | ||||||||

| 85 | ||||||||

| 98 | ||||||||

| 99 | ||||||||

| Consideration of Advisory and Subadvisory Agreements by the Board of Trustees |

100 | |||||||

| 102 | ||||||||

Proxy Voting Procedures and Voting Record (Form N-PX)

The subadvisers vote proxies relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Trust (“Trustees,” the “Board”). You may obtain a description of these procedures, along with information regarding how the Funds voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-243-1574. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

Form N-Q Information

The Trust files a complete schedule of portfolio holdings for each Fund with the SEC for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov. Form N-Q may be reviewed and copied at the SEC’s Public Reference Room. Information on the operation of the SEC’s Public Reference Room can be obtained by calling toll-free 1-800-SEC-0330.

This report is not authorized for distribution to prospective investors in the Funds presented in this book unless preceded or accompanied by an effective prospectus which includes information concerning the sales charge, each Fund’s record and other pertinent information.

Table of Contents

Dear Fellow Shareholders of Virtus Mutual Funds:

|

The financial markets experienced significant volatility during the 12-month period that ended September 30, 2013. The S&P 500® Index, a benchmark for U.S. equities, gained 19.3% while the Barclays U.S. Aggregate Bond Index, which tracks the U.S. fixed income market, declined 1.7%, and the MSCI All Country World Index (net), a measure of international equities, rose 17.7%.

The bond markets were particularly volatile during the second half of this period. U.S. Treasury yields climbed over the last few months as the market prepared for the Federal Reserve’s tapering of its bond purchases, which never occurred. The 10-year Treasury yield was at 2.6% as of September 30, 2013, | |

| compared with 1.7% a year earlier, and, as rates rose, most bond sectors suffered losses.

Despite this recent market unpredictability, there is reason for investors to be cautiously optimistic about the economy. The U.S. economy is showing signs of growth in hiring, consumer spending, and housing and, although China’s recovery remains tenuous, Europe appears to be coming out of its recession. The onus remains on the U.S. government to keep the country on strong fiscal footing and on corporations to produce robust earnings, which will play a pivotal role in determining future market direction.

Market uncertainty is a timely reminder of the importance of portfolio diversification. While diversification cannot guarantee a profit or prevent loss, owning a variety of asset classes may cushion your portfolio against inevitable market fluctuations. Your financial advisor can help you ensure that your portfolio is adequately diversified.

Thank you for entrusting Virtus with your assets. Should you have any questions or require support, the Virtus customer service team is ready to assist you at 1-866-270-7788. We appreciate your business and remain committed to your long-term financial success.

Sincerely,

George R. Aylward President, Virtus Mutual Funds

October 2013 | ||

Whenever you have questions about your account, or require additional information, please visit us on the Web at www.virtus.com or call our shareowner service group toll-free at 1-800-243-1574.

Performance data quoted represents past results. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

1

Table of Contents

VIRTUS OPPORTUNITIES TRUST

Disclosure of Fund Expenses (Unaudited)

For the six-month period of April 1, 2013 to September 30, 2013

2

Table of Contents

VIRTUS OPPORTUNITIES TRUST

Disclosure of Fund Expenses (Unaudited) (Continued)

For the six-month period of April 1, 2013 to September 30, 2013

3

Table of Contents

ADR (American Depositary Receipt)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Barclays California Municipal Bond Index

The Barclays California Municipal Bond Index measures long term investment grade, tax-exempt and fixed rate bonds issued in California. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses or sales charges and is not available for direct investment.

Barclays U.S. High Yield 2% Issuer Capped Bond Index

The Barclays U.S. High Yield 2% Issuer Capped Bond Index is a market capitalization-weighted index that measures fixed rate non-investment grade debt securities of U.S. and non-U.S. corporations. No single issuer accounts for more than 2% of market cap. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses or sales charges and is not available for direct investment.

Barclays U.S. Aggregate Bond Index

The Barclays U.S. Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses or sales charges and is not available for direct investment.

Exchange-Traded Funds (ETF)

Portfolios of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The central bank of the United States, responsible for controlling the money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches and all national and state banks that are part of the system.

Herzfeld Composite Index (60% MSCI AC World Index (net)/40% Barclays U.S. Aggregate Bond Index)

The composite index consists of 60% MSCI AC World Index (net) and 40% Barclays U.S. Aggregate Bond Index. The MSCI AC World Index (net) is a free float-adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The index is calculated on a total return basis with net dividends reinvested. The Barclays U.S. Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis. The indexes are unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

iShares®

Represents shares of an open-end exchange-traded fund.

MSCI AC World Index (net)

The MSCI AC World Index (net) is a free float-adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses or sales charges and is not available for direct investment.

MSCI EAFE® Index (net)

The MSCI EAFE® Index (net) is a free float-adjusted market capitalization-weighted index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

PIK (Payment-in-Kind Security)

A bond which pays interest in the form of additional bonds, or preferred stock which pays dividends in the form of additional preferred stock.

4

Table of Contents

KEY INVESTMENT TERMS (Continued)

Quantitative Easing

A government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

REIT (Real Estate Investment Trust)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Russell 3000® Index

The Russell 3000® Index is a market capitalization-weighted index that measures the performance of the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses or sales charges and is not available for direct investment.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses or sales charges and is not available for direct investment.

S&P/LSTA U.S. Leveraged Loan Index

The S&P/LSTA Leveraged Loan Index is a daily total return index that uses LSTA/LPC Mark-to-Market Pricing to calculate market value change. On a real-time basis, the Index tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included in the Index represent a broad cross section of leveraged loans syndicated in the United States, including dollar-denominated loans to overseas issuers. The index is unmanaged, its returns do not reflect any fees, expenses or sales charges and is not available for direct investment.

Sponsored ADR (American Depositary Receipt)

An ADR which is issued with the cooperation of the company whose stock will underlie the ADR. Sponsored ADRs generally carry the same rights normally given to stockholders, such as voting rights. ADRs must be sponsored to be able to trade on a major U.S. exchange such as the New York Stock Exchange (NYSE).

When-issued and Forward Commitments (Delayed Delivery)

Securities purchased on a when-issued or forward commitment basis are also known as delayed delivery transactions. Delayed delivery transactions involve a commitment by a Fund to purchase or sell a security at a future date, ordinarily up to 90 days later. When-issued or forward commitments enable a Fund to lock in what is believed to be an attractive price or yield on a particular security for a period of time, regardless of future changes in interest rates.

5

Table of Contents

| Bond Fund

Fund Summary |

Ticker Symbols: Class A: SAVAX Class B: SAVBX Class C: SAVCX Class I: SAVYX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

6

Table of Contents

Bond Fund (Continued)

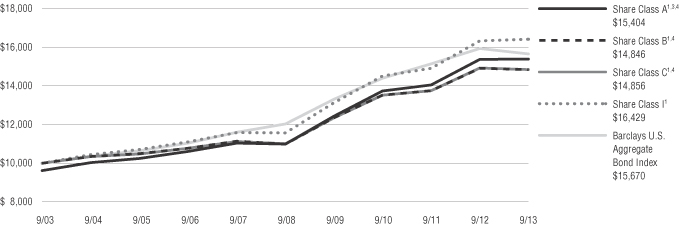

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||||||

| 1 year | 5 years | 10 years | ||||||||||

| Class A Shares at NAV2 | 0.17 | % | 6.97 | % | 4.81 | % | ||||||

| Class A Shares at POP3 | -3.59 | 6.16 | 4.41 | |||||||||

| Class B Shares at NAV2 | -0.50 | 6.18 | 4.03 | |||||||||

| Class B Shares with CDSC4 | -4.37 | 6.18 | 4.03 | |||||||||

| Class C Shares at NAV2 and with CDSC4 | -0.51 | 6.17 | 4.04 | |||||||||

| Class I Shares at NAV | 0.49 | 7.24 | 5.09 | |||||||||

| Barclays U.S. Aggregate Bond Index | -1.68 | 5.41 | 4.59 | |||||||||

Fund Expense Ratios5: A Shares: Gross 1.03%, Net 0.85%; B Shares: Gross 1.78%, Net 1.60%; C Shares: Gross 1.78%, Net 1.60%; I Shares: Gross 0.78%, Net 0.60%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for B shares decline from 5% to 0% over a five year period. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013, as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by voluntary fee waiver which may be discontinued at any time. Gross Expense: Does not reflect the effect of the voluntary fee waiver. |

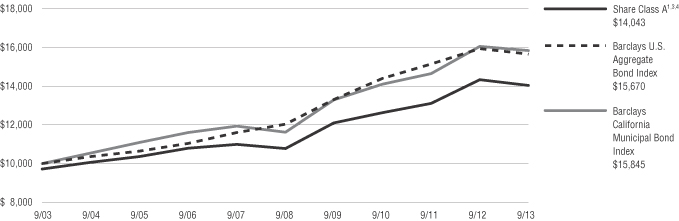

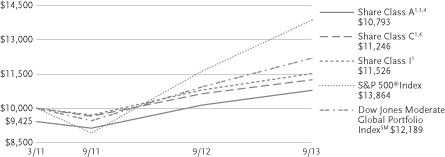

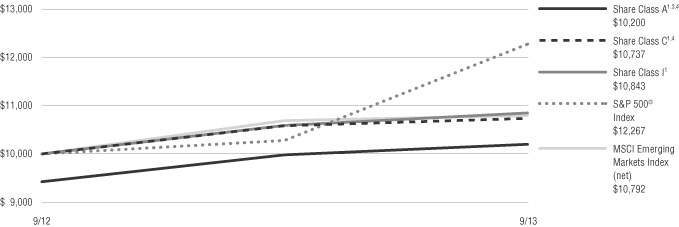

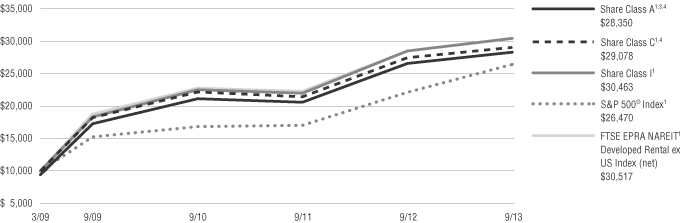

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2003, for Class A, Class B, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

7

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: CTESX Class I: CTXEX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

8

Table of Contents

CA Tax-Exempt Bond Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||||||||||||||

| 1 year | 5 years | 10 years | Since Inception |

Inception Date |

||||||||||||||||

| Class A Shares at NAV2 | -2.12 | % | 5.43 | % | 3.74 | % | — | — | ||||||||||||

| Class A Shares at POP3,4 | -4.81 | 4.85 | 3.45 | — | — | |||||||||||||||

| Class I Shares at NAV | -1.88 | 5.68 | — | 4.09 | % | 9/29/06 | ||||||||||||||

| Barclays U.S. Aggregate Bond Index | -1.68 | 5.41 | 4.59 | 4.55 | 5 | — | ||||||||||||||

| Barclays California Municipal Bond Index | -1.37 | 6.38 | 4.71 | 5.11 | 5 | — | ||||||||||||||

Fund Expense Ratios6: A Shares: Gross 1.05%, Net 0.85%; I Shares: Gross 0.80%, Net 0.60%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the inception date of Class I. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013, as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by voluntary fee waiver which may be discontinued at any time. Gross Expense: Does not reflect the effect of the voluntary fee waiver. |

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2003 for Class A shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

--

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

9

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VDEAX Class C: VDECX Class I: VDEIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

10

Table of Contents

Disciplined Equity Style Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||

| Since Inception |

Inception Date |

|||||||

| Class A Shares at NAV2 | 25.75 | % | 12/18/12 | |||||

| Class A Shares at POP3,4 | 18.52 | 12/18/12 | ||||||

| Class C Shares at NAV2 | 25.02 | 12/18/12 | ||||||

| Class C Shares with CDSC4 | 24.02 | 12/18/12 | ||||||

| Class I Shares at NAV | 25.96 | 12/18/12 | ||||||

| S&P 500® Index |

18.185 | — | ||||||

| Russell 3000® Index |

19.945 | — | ||||||

Fund Expense Ratios6: A Shares: Gross 2.09%, Net 1.83%; C Shares: Gross 2.84%, Net 2.58%; I Shares: Gross 1.84%, Net 1.58%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013 and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by the contractual fee waiver in effect through January 31, 2014. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios do reflect fees and expenses associated with the underlying funds. |

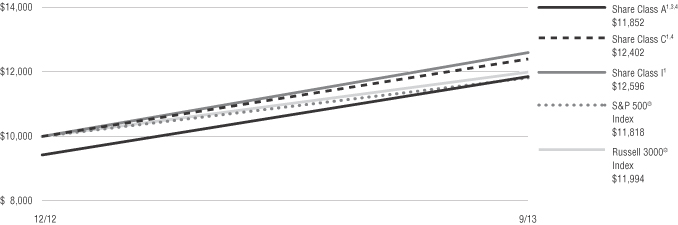

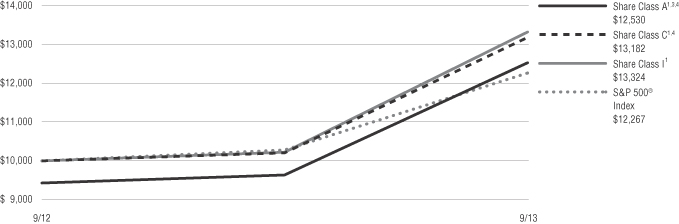

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on December 18, 2013 (inception date of the Fund), for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

11

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VDBAX Class C: VDBCX Class I: VDBIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

12

Table of Contents

Disciplined Select Bond Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||

| Since Inception |

Inception Date |

|||||||

| Class A Shares at NAV2 | -4.53 | % | 12/18/12 | |||||

| Class A Shares at POP3,4 | -8.11 | 12/18/12 | ||||||

| Class C Shares at NAV2 | -4.95 | 12/18/12 | ||||||

| Class C Shares with CDSC4 | -5.90 | 12/18/12 | ||||||

| Class I Shares at NAV | -4.28 | 12/18/12 | ||||||

| Barclays U.S. Aggregate Bond Index | -1.47 | — | 5 | |||||

Fund Expense Ratios6: A Shares: Gross 1.81%, Net 1.59%; C Shares: Gross 2.56%, Net 2.34%; I Shares: Gross 1.56%, Net 1.34%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013 and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by the contractual fee waiver in effect through January 31, 2014. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios do reflect fees and expenses associated with the underlying funds. |

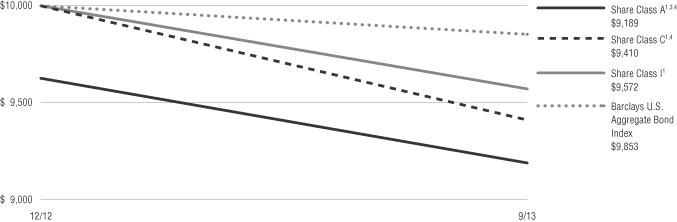

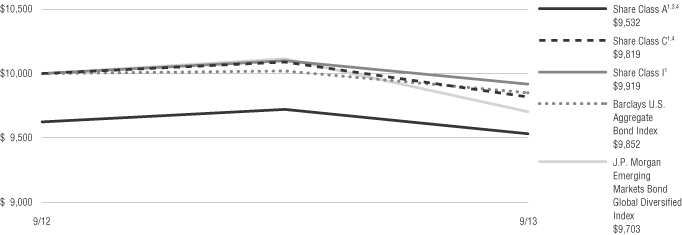

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on December 18, 2012 (inception date of the Fund), for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

13

Table of Contents

| Disciplined Select Country Fund

Fund Summary |

Ticker Symbols: Class A: VDCAX Class C: VDCCX Class I: VDCIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

14

Table of Contents

Disciplined Select Country Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||

| Since Inception |

Inception Date |

|||||||

| Class A Shares at NAV2 | 13.40 | % | 12/18/12 | |||||

| Class A Shares at POP3,4 | 6.88 | 12/18/12 | ||||||

| Class C Shares at NAV2 | 12.80 | 12/18/12 | ||||||

| Class C Shares with CDSC4 | 11.80 | 12/18/12 | ||||||

| Class I Shares at NAV | 13.70 | 12/18/12 | ||||||

| S&P 500® Index |

18.18 | 5 | — | |||||

| MSCI EAFE® Index (net) | 16.31 | 5 | — | |||||

Fund Expense Ratios6: A Shares: Gross 2.50%, Net 2.21%; C Shares: Gross 3.25%, Net 2.96%; I Shares: Gross 2.25%, Net 1.96%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013 and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by the contractual fee waiver in effect through January 31, 2014. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios do reflect fees and expenses associated with the underlying funds. |

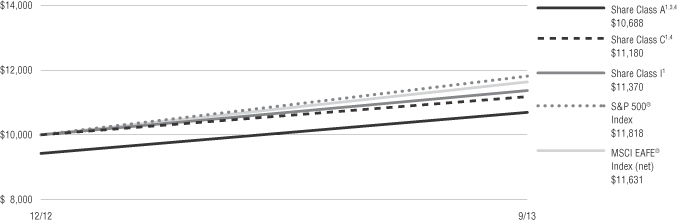

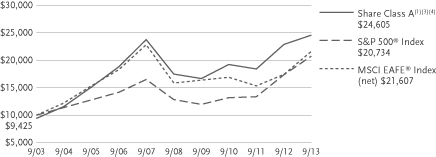

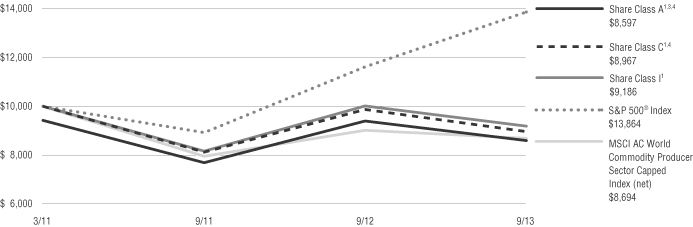

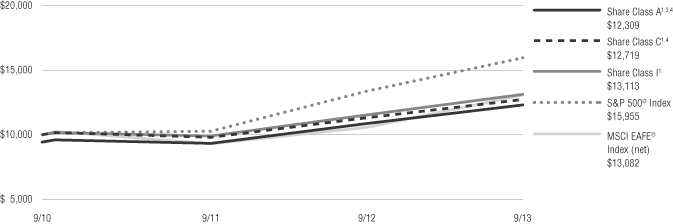

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on December 18, 2012 (inception date of the Fund), for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

15

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VHFAX Class C: VHFCX Class I: VHFIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

16

Table of Contents

| Herzfeld Fund (Continued) |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

17

Table of Contents

Herzfeld Fund (Continued)

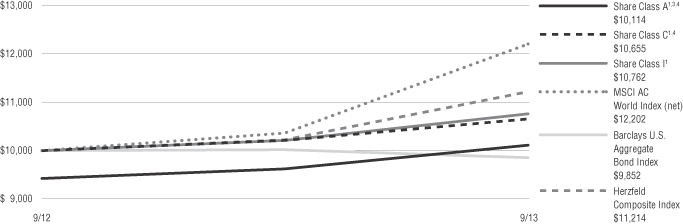

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||||||

| 1 year | Since Inception |

Inception Date |

||||||||||

| Class A Shares at NAV2 | 5.10 | % | 6.82 | % | 9/5/12 | |||||||

| Class A Shares at POP3,4 | -0.94 | 1.06 | 9/5/12 | |||||||||

| Class C Shares at NAV2 and with CDSC4 | 4.36 | 6.12 | 9/5/12 | |||||||||

| Class I Shares at NAV2 | 5.41 | 7.12 | 9/5/12 | |||||||||

| MSCI AC World Index (net) |

17.73 | 20.47 | 5 | — | ||||||||

| Barclays U.S. Aggregate Bond Index | -1.68 | -1.39 | 5 | — | ||||||||

| Herzfeld Composite Index | 9.66 | 11.32 | 5 | — | ||||||||

Fund Expense Ratios6: A Shares: Gross 2.84%, Net 2.58%; C Shares: Gross 3.59%, Net 3.33%; I Shares: Gross 2.59%, Net 2.33%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception indexes returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013 and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by the contractual fee waiver in effect through January 31, 2014. Gross Expense: Does not reflect the effect of the fee waiver. |

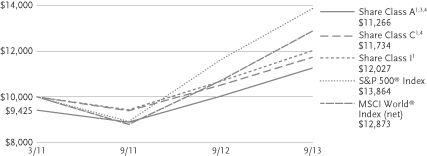

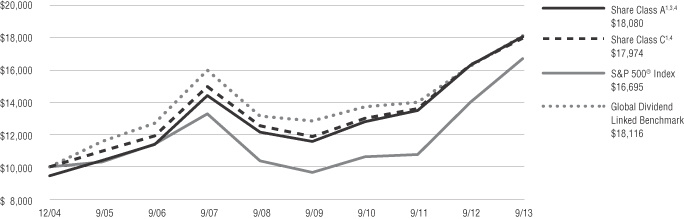

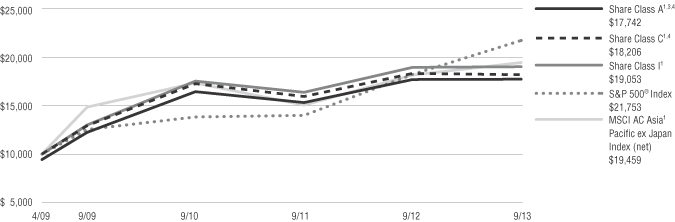

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 5, 2012 (inception date of the Fund), for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

18

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: PHCHX Class B: PHCCX Class C: PGHCX Class I: PHCIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

19

Table of Contents

High Yield Fund (Continued)

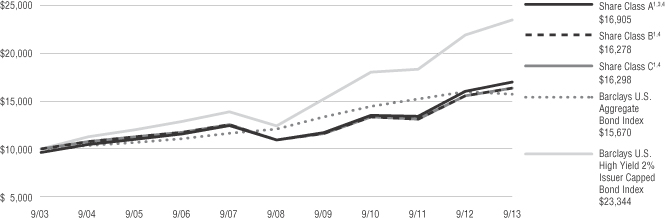

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||||||||||||||

| 1 year | 5 years | 10 years | Since Inception |

Inception Date |

||||||||||||||||

| Class A Shares at NAV2 | 5.98 | % | 9.13 | % | 5.79 | % | — | — | ||||||||||||

| Class A Shares at POP3,4 | 2.00 | 8.30 | 5.39 | — | — | |||||||||||||||

| Class B Shares at NAV2 | 5.06 | 8.29 | 4.99 | — | — | |||||||||||||||

| Class B Shares with CDSC4 | 1.08 | 8.29 | 4.99 | — | — | |||||||||||||||

| Class C Shares at NAV2 and with CDSC4 | 5.00 | 8.33 | 5.01 | — | — | |||||||||||||||

| Class I Shares at NAV2 | 6.25 | — | — | 7.62 | % | 8/8/12 | ||||||||||||||

| Barclays U.S. Aggregate Bond Index | -1.68 | 5.41 | 4.59 | -0.88 | 5 | — | ||||||||||||||

| Barclays U.S. High Yield 2% Issuer Capped Bond Index | 7.14 | 13.51 | 8.85 | 7.95 | 5 | — | ||||||||||||||

Fund Expense Ratios6: A Shares: Gross 1.31%, Net 1.15% B Shares: Gross 2.06%, Net 1.90% C Shares: Gross 2.06%, Net 1.90% Class I: Gross 1.06% Net 0.90%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for B shares decline from 5% to 0% over a five year period. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the inception date of Class I. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013 as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by voluntary fee waiver which may be discontinued at any time. Gross Expense: Does not reflect the effect of the voluntary fee waiver. |

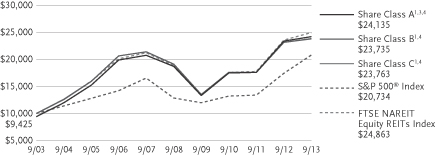

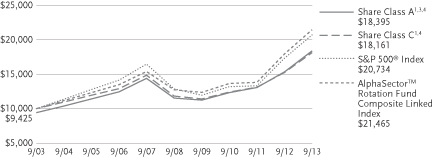

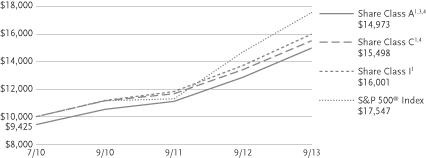

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2003, for Class A, Class B, and Class C shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

20

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VLVAX Class C: VLVIX Class I: VLVCX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

21

Table of Contents

THIS PAGE INTENTIONALLY BLANK.

Table of Contents

| Multi-Sector Intermediate Bond Fund

Fund Summary |

Ticker Symbols: Class A: NAMFX Class B: NBMFX Class C: NCMFX Class I: VMFIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

23

Table of Contents

Multi-Sector Intermediate Bond Fund (Continued)

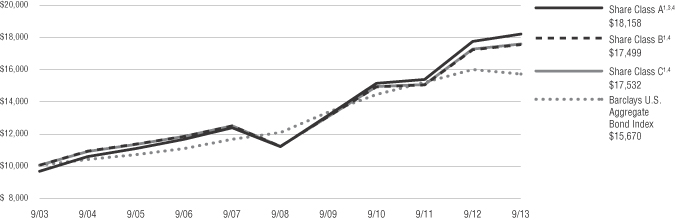

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||||||||||||||

| 1 year | 5 years | 10 years | Since Inception |

Inception Date |

||||||||||||||||

| Class A Shares at NAV2 | 2.59 | % | 10.21 | % | 6.55 | % | — | — | ||||||||||||

| Class A Shares at POP3,4 | -1.26 | 9.38 | 6.15 | — | — | |||||||||||||||

| Class B Shares at NAV2 | 1.83 | 9.37 | 5.75 | — | — | |||||||||||||||

| Class B Shares with CDSC4 | -2.03 | 9.37 | 5.75 | — | — | |||||||||||||||

| Class C Shares at NAV2 and with CDSC4 | 1.90 | 9.43 | 5.78 | — | — | |||||||||||||||

| Class I Shares at NAV | 2.85 | — | — | 8.80 | % | 10/1/09 | ||||||||||||||

| Barclays U.S. Aggregate Bond Index | -1.68 | 5.41 | 4.59 | 4.07 | 5 | — | ||||||||||||||

Fund Expense Ratios6: A Shares: 1.13%, B Shares: 1.88%, C Shares: 1.88%, I Shares: 0.88%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for B shares decline from 5% to 0% over a five year period. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the inception date of Class I Shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013, as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. |

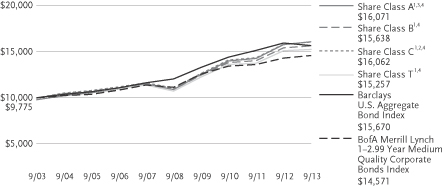

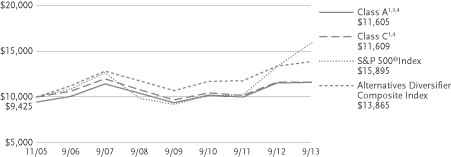

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 30, 2003, for Class A, Class B, and Class C shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

24

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: PSFRX Class C: PFSRX Class I: PSFIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

25

Table of Contents

Senior Floating Rate Fund (Continued)

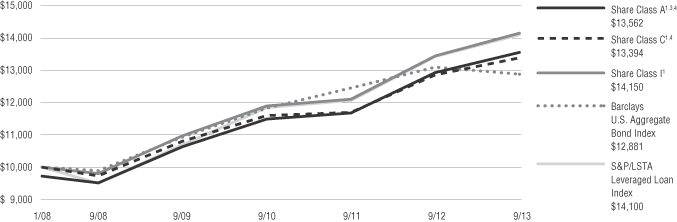

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||||||||||

| 1 year | 5 years | Since Inception |

Inception Date |

|||||||||||||

| Class A Shares at NAV2 | 4.84 | % | 7.34 | % | 6.04 | % | 1/31/08 | |||||||||

| Class A Shares at POP3,4 | 1.96 | 6.74 | 5.52 | 1/31/08 | ||||||||||||

| Class C Shares at NAV2 and with CDSC4 | 4.15 | 6.58 | 5.29 | 1/31/08 | ||||||||||||

| Class I Shares at NAV | 5.21 | 7.61 | 6.32 | 1/31/08 | ||||||||||||

| Barclays U.S. Aggregate Bond Index | -1.68 | 5.41 | 4.57 | 5 | — | |||||||||||

| S&P/LSTA Leveraged Loan Index | 5.00 | 8.20 | 6.25 | 5 | — | |||||||||||

Fund Expense Ratios6: A Shares: Gross 1.24%, Net 1.20%; C Shares: Gross 1.99%, Net 1.95%; I Shares: Gross 0.99%, Net 0.95%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013, as supplemented and revised and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by voluntary fee waiver which may be discontinued at any time. Gross Expense: Does not reflect the effect of the voluntary fee waiver. |

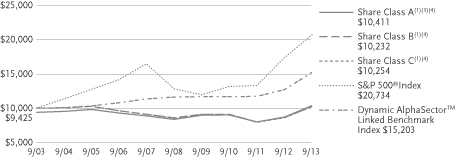

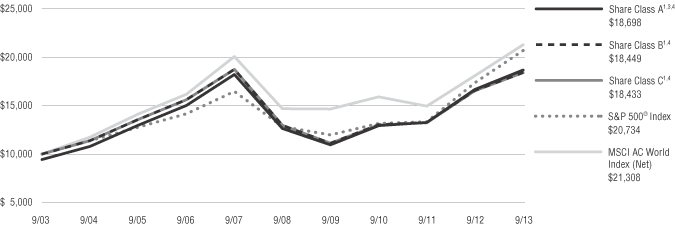

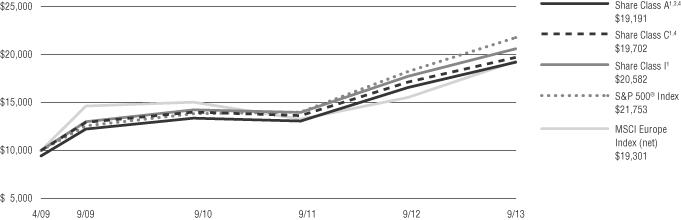

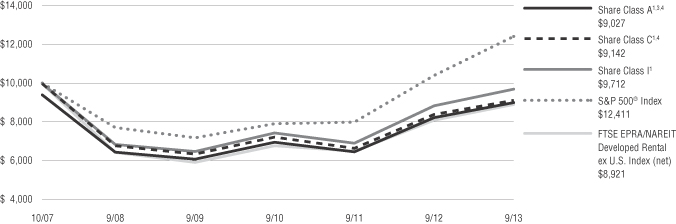

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on January 31, 2008 (inception date of the Fund), for Class A, Class C and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

26

Table of Contents

|

Fund Summary |

Ticker Symbols: Class A: VWMAX Class C: VWMCX Class I: VWMIX |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

27

Table of Contents

Wealth Masters Fund (Continued)

| Average Annual Total Returns1 for periods ended 9/30/13 | ||||||||||||

| 1 year | Since Inception |

Inception Date |

||||||||||

| Class A Shares at NAV2 | 30.09 | % | 30.54 | % | 9/5/12 | |||||||

| Class A Shares at POP3,4 | 22.61 | 23.51 | 9/5/12 | |||||||||

| Class C Shares at NAV2 and with CDSC4 | 29.11 | 29.51 | 9/5/12 | |||||||||

| Class I Shares at NAV2 | 30.37 | 30.81 | 9/5/12 | |||||||||

| S&P 500® Index | 19.34 | 21.07 | —5 | |||||||||

Fund Expense Ratios6: A Shares: Gross 1.68%, Net 1.45%; C Shares: Gross 2.43%, Net 2.20%; I Shares: Gross 1.43%, Net 1.20%.

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.75% sales charge. |

| 4 | “CDSC” (Contingent Deferred Sales Charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of purchase in which a finder’s fee was paid and all redemptions of Class C shares within the first year are 1% and 0% thereafter. |

| 5 | The since inception index returns are from the Fund’s inception date. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 31, 2013 and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by the contractual fee waiver in effect through January 31, 2014. Gross Expense: Does not reflect the effect of the fee waiver. |

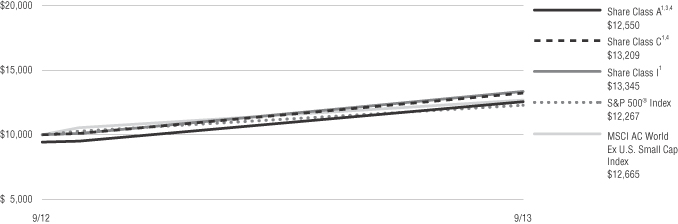

Growth of $10,000 For periods ended 9/30

This chart assumes an initial investment of $10,000 made on September 5, 2012 (inception date of the Fund), for Class A, Class C, and Class I shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain distributions.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

28

Table of Contents

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

29

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

30

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

31

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

32

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

33

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

34

Table of Contents

VIRTUS BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2013 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2013 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Debt Securities: |

||||||||||||||||

| Asset-Backed Securities |

$ | 3,837 | $ | — | $ | 3,837 | $ | — | ||||||||

| Convertible Bonds |

315 | — | 315 | — | ||||||||||||

| Corporate Bonds and Notes |

47,951 | — | 47,941 | 10 | ||||||||||||

| Foreign Government Securities |

4,577 | — | 4,577 | — | ||||||||||||

| Loan Agreements |

7,556 | — | 7,556 | — | ||||||||||||

| Mortgage-Backed Securities |

18,759 | — | 18,759 | — | ||||||||||||

| Municipal Bonds |

306 | — | 306 | — | ||||||||||||

| Equity Securities: |

||||||||||||||||

| Preferred Stock |

2,294 | 669 | 1,625 | — | ||||||||||||

| Short-Term Investments |

641 | 641 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 86,236 | $ | 1,310 | $ | 84,916 | $ | 10 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Securities held by the Fund with an end of period market value of $445 was transferred from level 2 into level 1 since starting to use an exchange price.

The following is a reconciliation of assets of the Fund for Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Corporate Bonds and Notes |

||||

| Investments in Securities |

||||

| Balance as of September 30, 2012: |

$ | 14 | ||

| Accrued discount/(premium) |

— | |||

| Realized gain (loss) |

— | |||

| Change in unrealized appreciation (depreciation) |

— | (c) | ||

| Purchases |

— | |||

| Sales(b) |

(4 | ) | ||

| Transfers into Level 3(a) |

— | |||

| Transfers from Level 3(a) |

— | |||

|

|

|

|||

| Balance as of September 30, 2013 |

$ | 10 | (d) | |

|

|

|

|||

| (a) | “Transfers into and/or from” represent the ending value as of September 30, 2013, for any investment security where a change in the pricing level occurred from the beginning to the end of the period. |

| (b) | Includes paydowns on securities. |

| (c) | Amount less than $500. |

| (d) | Includes internally fair valued security. See the last paragraph under “Note 2A Security Valuation” for a description of the valuation process in place and a qualitative discussion about sensitive inputs used in Level 3 internally fair valued measurements. |

See Notes to Financial Statements

35

Table of Contents

VIRTUS CA TAX-EXEMPT BOND FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

36

Table of Contents

VIRTUS CA TAX-EXEMPT BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

37

Table of Contents

VIRTUS CA TAX-EXEMPT BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

38

Table of Contents

VIRTUS DISCIPLINED EQUITY STYLE FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

39

Table of Contents

VIRTUS DISCIPLINED SELECT BOND FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

40

Table of Contents

VIRTUS DISCIPLINED SELECT COUNTRY FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

41

Table of Contents

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

42

Table of Contents

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

43

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

44

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

45

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

46

Table of Contents

VIRTUS HIGH YIELD FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2013 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2013 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Debt Securities: |

||||||||||||||||

| Asset-Backed Securities |

$ | 544 | $ | — | $ | 544 | $ | — | ||||||||

| Corporate Bonds and Notes |

71,943 | — | 71,700 | 243 | (c) | |||||||||||

| Loan Agreements |

11,954 | — | 11,954 | — | ||||||||||||

| Mortgage-Backed Securities |

1,236 | — | 1,236 | — | ||||||||||||

| Equity Securities: |

||||||||||||||||

| Preferred Stock |

1,002 | 556 | 446 | — | ||||||||||||

| Short-Term Investments |

3,224 | 3,224 | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 89,903 | $ | 3,780 | $ | 85,880 | $ | 243 | (c) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

Securities with an end of period market value of $556 were transferred from level 2 into level 1 since starting to use an exchange price.

The following is a reconciliation of assets of the Fund for Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Corporate Bonds and Notes |

||||

| Investments in Securities |

||||

| Balance as of September 30, 2012: |

$ | 347 | ||

| Accrued discount/(premium) |

3 | |||

| Realized gain (loss) |

— | |||

| Change in unrealized appreciation (depreciation) |

(3 | ) | ||

| Purchases |

— | |||

| Sales(b) |

(104 | ) | ||

| Transfers into Level 3 (a) |

— | |||

| Transfers from Level 3(a) |

— | |||

|

|

|

|||

| Balance as of September 30, 2013 |

$ | 243 | (c) | |

|

|

|

|||

| (a) | “Transfers into and/or from” represent the ending value as of September 30, 2013, for any investment security where a change in the pricing level occurred from the beginning to the end of the period. |

| (b) | Includes paydowns on securities. |

| (c) | Includes internally fair valued security. See the last paragraph under “Note 2A Security Valuation” for a description of the valuation process in place and a qualitative discussion about sensitive inputs used in Level 3 internally fair valued measurements. |

See Notes to Financial Statements

47

Table of Contents

VIRTUS LOW VOLATILITY EQUITY FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

48

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

49

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

50

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

51

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

52

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

53

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

54

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

55

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

56

Table of Contents

VIRTUS MULTI-SECTOR INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2013 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2013 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Debt Securities: |

||||||||||||||||

| Asset-Backed Securities |

$ | 14,804 | $ | — | $ | 14,131 | $ | 673 | ||||||||

| Corporate Bonds and Notes |

229,221 | — | 229,221 | — | ||||||||||||

| Foreign Government Securities |

42,313 | — | 42,313 | — | ||||||||||||

| Loan Agreements |

46,194 | — | 46,194 | — | ||||||||||||

| Mortgage-Backed Securities |

32,117 | — | 32,117 | — | ||||||||||||

| Municipal Bonds |

776 | — | 776 | — | ||||||||||||

| Equity Securities: |

||||||||||||||||

| Preferred Stock |

12,944 | 4,081 | 8,863 | — | ||||||||||||

| Common Stocks |

18 | — | — | 18 | ||||||||||||

| Short-Term Investments |

573 | 573 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 378,960 | $ | 4,654 | $ | 373,615 | $ | 691 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Securities with an end of period market value of $1,948 were transferred from level 2 into level 1 since starting to use an exchange price.

The following is a reconciliation of assets of the Fund for Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Total | Asset-Backed Securities |

Corporate Bonds and Notes |

Loan Agreements |

Common Stocks |

||||||||||||||||

| Investments in Securities |

||||||||||||||||||||

| Balance as of September 30, 2012: |

$ | 76 | $ | — | $ | 13 | (c) | $ | 51 | $ | 12 | |||||||||

| Accrued discount/(premium) |

— | — | — | — | — | |||||||||||||||

| Realized gain (loss) |

(2 | ) | — | — | (2 | ) | — | |||||||||||||

| Change in unrealized appreciation (depreciation) |

558 | (5 | ) | 608 | (51 | ) | 6 | |||||||||||||

| Purchases |

744 | 703 | — | 40 | — | |||||||||||||||

| Sales(b) |

(685 | ) | (25 | ) | (621 | ) | (38 | ) | — | |||||||||||

| Transfers into Level 3(a) |

— | — | — | — | — | |||||||||||||||

| Transfers from Level 3(a) |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance as of September 30, 2013 |

$ | 691 | $ | 673 | $ | — | $ | — | $ | 18 | (c) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | “Transfers into and/or from” represent the ending value as of September 30, 2013, for any investment security where a change in the pricing level occurred from the beginning to the end of the period. |

| (b) | Includes paydowns on securities. |

| (c) | Includes internally fair valued security currently priced at zero $0. See the last paragraph under “Note 2A Security Valuation” for a description of the valuation process in place and qualitative discussion about sensitive inputs used in Level 3 internally fair valued measurements. |

See Notes to Financial Statements

57

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

58

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

59

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

60

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

61

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

62

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

63

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

64

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

65

Table of Contents

VIRTUS SENIOR FLOATING RATE FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2013 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2013 |

Level 1 Quoted Prices |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Debt Securities: |

||||||||||||||||

| Asset-Backed Securities |

$ | 4,070 | $ | — | $ | 3,277 | $ | 793 | ||||||||

| Corporate Bonds And Notes |

80,472 | — | 80,472 | — | ||||||||||||

| Foreign Government Securities |

475 | — | 475 | — | ||||||||||||

| Loan Agreements |

886,474 | — | 886,474 | — | ||||||||||||

| Mortgage-Backed Securities |

3,665 | — | 3,665 | — | ||||||||||||

| Equity Securities: |

||||||||||||||||

| Common Stocks |

0 | — | — | 0 | (c) | |||||||||||

| Short-Term Investments |

59,828 | 59,828 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 1,034,984 | $ | 59,828 | $ | 974,363 | $ | 793 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following is a reconciliation of assets of the Fund for Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Total | Asset-Backed Securities |

Corporate Bonds and Notes |

Loan Agreements |

Common Stocks |

||||||||||||||||

| Investments in Securities |

||||||||||||||||||||

| Balance as of September 30, 2012: |

$ | 292 | $ | — | $ | 6 | $ | 286 | $ | — | (c) | |||||||||

| Accrued discount/(premium) |

— | — | — | — | — | |||||||||||||||

| Realized gain (loss) |

(379 | ) | — | — | (379 | ) | — | |||||||||||||

| Change in unrealized appreciation (depreciation) |

642 | (6 | ) | 243 | 405 | — | ||||||||||||||

| Purchases |

829 | 829 | — | — | — | |||||||||||||||

| Sales(b) |

(591 | ) | (30 | ) | (249 | ) | (312 | ) | — | |||||||||||

| Transfers into Level 3 (a) |

— | — | — | — | ||||||||||||||||

| Transfers from Level 3(a) |

— | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance as of September 30, 2013 |

$ | 793 | $ | 793 | $ | — | $ | — | $ | — | (c) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | “Transfers into and/or from” represent the ending value as of September 30, 2013, for any investment security where a change in the pricing level occurred from the beginning to the end of the period. |

| (b) | Includes paydowns on securities. |

| (c) | Includes internally fair valued security currently priced at zero $0. See the last paragraph under “Note 2A Security Valuation” for a description of valuation process in place and qualitative discussion about sensitive inputs used in Level 3 internally fair valued measurements. |

See Notes to Financial Statements

66

Table of Contents

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2013

($ reported in thousands)

See Notes to Financial Statements

67

Table of Contents

VIRTUS WEALTH MASTERS FUND

SCHEDULE OF INVESTMENTS (Continued)

SEPTEMBER 30, 2013

($ reported in thousands)

The following table provides a summary of inputs used to value the Fund’s investments as of September 30, 2013 (See Security Valuation Note 2A in the Notes to Financial Statements):

| Total Value at September 30, 2013 |

Level 1 Quoted Prices |

|||||||

| Equity Securities: |

||||||||

| Common Stocks |

$ | 51,549 | $ | 51,549 | ||||

| Securities Lending Collateral |

42 | 42 | ||||||

| Short-Term Investments |

73 | 73 | ||||||

|

|

|

|

|

|||||

| Total Investments |

$ | 51,664 | $ | 51,664 | ||||

|

|

|

|

|

|||||

There are no Level 2 (significant observable inputs) or Level 3 (significant unobservable inputs) priced securities.

Security abbreviation definitions are located under the Key Investment Terms starting on page 4.

See Notes to Financial Statements

68

Table of Contents

VIRTUS OPPORTUNITIES TRUST

STATEMENTS OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2013

(Reported in thousands except shares and per share amounts)

|

|

|

|

|

|

|

|

|

|||||||||

| Bond Fund |

CA Tax-Exempt Bond Fund |

Disciplined Equity Style Fund |

Disciplined Select Bond Fund |

|||||||||||||

| Assets | ||||||||||||||||

| Investment in securities at value(1)(3) |

$ | 86,236 | $ | 47,172 | $ | 1,586 | $ | 1,052 | ||||||||

| Cash |

55 | 983 | — | — | ||||||||||||

| Receivables |

||||||||||||||||

| Investment securities sold |

566 | — | — | — | ||||||||||||

| Fund shares sold |

96 | 1 | 6 | — | ||||||||||||

| Receivable from adviser |

— | — | 4 | 5 | ||||||||||||

| Dividends and interest receivable |

914 | 677 | — | — | ||||||||||||

| Prepaid expenses |

25 | 13 | — | — | ||||||||||||

| Prepaid trustee retainer |

— | (2) | — | (2) | — | (2) | — | (2) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

87,892 | 48,846 | 1,596 | 1,057 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities | ||||||||||||||||

| Payables |

||||||||||||||||

| Fund shares repurchased |

68 | 77 | — | — | ||||||||||||

| Investment securities purchased |

1,126 | — | — | — | ||||||||||||

| Dividend distributions |

51 | 73 | — | — | ||||||||||||

| Investment advisory fee |

10 | 10 | — | — | ||||||||||||

| Distribution and service fees |

18 | 5 | — | (2) | — | (2) | ||||||||||

| Administration fee |

9 | 5 | — | (2) | — | (2) | ||||||||||

| Transfer agent fees and expenses |

21 | 4 | — | (2) | — | (2) | ||||||||||

| Trustees’ fees and expenses |

— | (2) | — | (2) | — | (2) | — | (2) | ||||||||

| Professional fees |

32 | 31 | 18 | 18 | ||||||||||||

| Other accrued expenses |

8 | 3 | 3 | 2 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

1,343 | 208 | 21 | 20 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets | $ | 86,549 | $ | 48,638 | $ | 1,575 | $ | 1,037 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets Consist of: | ||||||||||||||||

| Capital paid in on shares of beneficial interest |

$ | 90,909 | $ | 46,573 | $ | 1,298 | $ | 1,096 | ||||||||

| Accumulated undistributed net investment income (loss) |

51 | 25 | — | — | (2) | |||||||||||

| Accumulated undistributed net realized gain (loss) |

(3,647 | ) | 943 | 99 | (38 | ) | ||||||||||

| Net unrealized appreciation (depreciation) on investments |

(764 | ) | 1,097 | 178 | (21 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets | $ | 86,549 | $ | 48,638 | $ | 1,575 | $ | 1,037 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Class A | ||||||||||||||||

| Net asset value (net assets/shares outstanding) per share |

$ | 11.21 | $ | 12.10 | $ | 12.47 | $ | 9.44 | ||||||||

| Maximum offering price per share NAV/(1–2.75%) |

$ | — | $ | 12.70 | $ | — | — | |||||||||

| Maximum offering price per share NAV/(1–3.75%) |

$ | 11.77 | $ | — | $ | — | $ | — | ||||||||

| Maximum offering price per share NAV/(1–5.75%) |

$ | — | $ | — | $ | 13.23 | $ | 10.02 | ||||||||

| Shares of beneficial interest outstanding, no par value(3), unlimited authorization |

5,109,588 | 1,868,190 | 26,111 | 16,668 | ||||||||||||

| Net Assets |

$ | 57,286 | $ | 22,612 | $ | 326 | $ | 157 | ||||||||

| Class B | ||||||||||||||||

| Net asset value (net assets/shares outstanding) and offering price per share |

$ | 10.95 | $ | — | $ | — | $ | — | ||||||||

| Shares of beneficial interest outstanding, no par value(3), unlimited authorization |

36,613 | — | — | — | ||||||||||||

| Net Assets |

$ | 401 | $ | — | $ | — | $ | — | ||||||||

| Class C | ||||||||||||||||

| Net asset value (net assets/shares outstanding) and offering price per share |

$ | 10.99 | $ | — | $ | 12.40 | $ | 9.44 | ||||||||

| Shares of beneficial interest outstanding, no par value(3), unlimited authorization |

621,281 | — | 19,112 | 12,093 | ||||||||||||

| Net Assets |

$ | 6,825 | $ | — | $ | 237 | $ | 114 | ||||||||

| Class I | ||||||||||||||||

| Net asset value (net assets/shares outstanding) and offering price per share |

$ | 11.37 | $ | 12.09 | $ | 12.49 | $ | 9.45 | ||||||||

| Shares of beneficial interest outstanding, no par value(3), unlimited authorization |

1,938,665 | 2,151,960 | 81,095 | 81,031 | ||||||||||||

| Net Assets |

$ | 22,037 | $ | 26,026 | $ | 1,012 | $ | 766 | ||||||||

| (1) Investment in securities at cost |

$ | 87,000 | $ | 46,075 | $ | 1,408 | $ | 1,073 | ||||||||

| (2) Amount is less than $500. |

||||||||||||||||

| (3) All Funds with exception of Bond Fund have no par value. Bond Fund has a par value of $1.00. |

|

|||||||||||||||

See Notes to Financial Statements

69

Table of Contents

VIRTUS OPPORTUNITIES TRUST

STATEMENTS OF ASSETS AND LIABILITIES (Continued)

SEPTEMBER 30, 2013

(Reported in thousands except shares and per share amounts)

|

|

|

|

|

|

|

|

|

|||||||||

| Disciplined Select Country Fund |

Herzfeld Fund |

High Yield Fund |

Low Volatility Equity Fund |

|||||||||||||

| Assets | ||||||||||||||||

| Investment in securities at value(1) |

$ | 1,208 | $ | 9,626 | $ | 89,903 | $ | 1,600 | ||||||||

| Cash |

— | — | 88 | 3 | ||||||||||||

| Deposits with prime broker for options |

— | — | — | 1 | ||||||||||||

| Receivables |

||||||||||||||||

| Investment securities sold |

— | — | 464 | — | ||||||||||||

| Fund shares sold |

— | — | 13 | — | ||||||||||||

| Receivable from adviser |

4 | — | — | 7 | ||||||||||||

| Dividends and interest receivable |

— | (2) | 27 | 1,515 | — | |||||||||||

| Prepaid expenses |

— | 27 | 23 | 1 | ||||||||||||

| Prepaid trustee retainer |

— | (2) | — | (2) | — | (2) | — | (2) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

1,212 | 9,680 | 92,006 | 1,612 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities | ||||||||||||||||

| Written options at value(3) |

— | — | — | — | (2) | |||||||||||

| Payables |

||||||||||||||||

| Fund shares repurchased |